PFI.pptx

- Количество слайдов: 11

Portfolio of financial investments Completed by the 3 d year student of “Finance” specialization F 1002 Aimanova A. 1

CONTENT Introduction I Chapter Theoretical bases of formation of financial investments 2 portfolio 1. 1 Definition and forms of financial investments 1. 2 Concept and principles of investment portfolio II Chapter Assessment and formation of the investment portfolio 2. 1 Assessment of the financial assets 2. 2 Formation of the investment portfolio of the company (on the example of JSC Accumulative Pension Fund "Ular Umіt“) III Chapter The problem of formation and management of investment portfolio 3. 1 Formation of an optimal investment portfolio 3. 2 The problems of portfolio investment in the conditions of the Republic of Kazakhstan’s market Conclusion List of references Appendix

Introduction Object -> portfolio of financial investments Subject -> operational management of an 3 investment portfolio Tasks: -> to explore theoretical basis of the portfolio of financial investment; -> to consider the principles and outline the steps of forming an investment portfolio; - >to research a strategy for investment portfolio management; - >to analyze the choice of the optimal investment portfolio.

Portfolio of financial investments A major condition for the development of the enterprise according to the chosen economic and financial strategy is its high level of investment activity. The portfolio of financial investments is purposefully shaped set of objects of the real and financial investment intended for realization investment policy of the company in the forthcoming period (in other words - set of stock instruments formed by investor). 4

The main purposes: selecting 5 the most profitable and safe investment objects; providing of high rate of capital growth in the forthcoming term; ensuring a high level of income for the current period; provision of investment risks minimization; providing of sufficient liquidity of the investment portfolio.

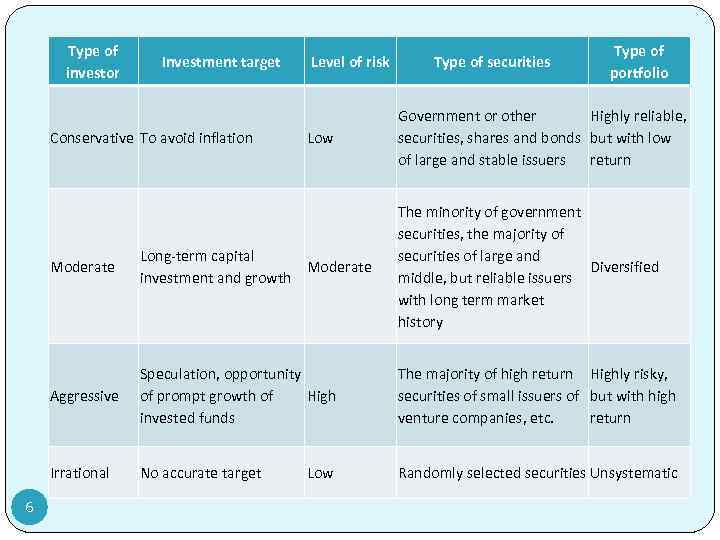

Type of investor Investment target Conservative To avoid inflation Level of risk Low Type of securities Type of portfolio Government or other Highly reliable, securities, shares and bonds but with low of large and stable issuers return Moderate Aggressive Speculation, opportunity of prompt growth of High invested funds The majority of high return Highly risky, securities of small issuers of but with high venture companies, etc. return Irrational 6 Long-term capital Moderate investment and growth The minority of government securities, the majority of securities of large and Diversified middle, but reliable issuers with long term market history No accurate target Randomly selected securities Unsystematic Low

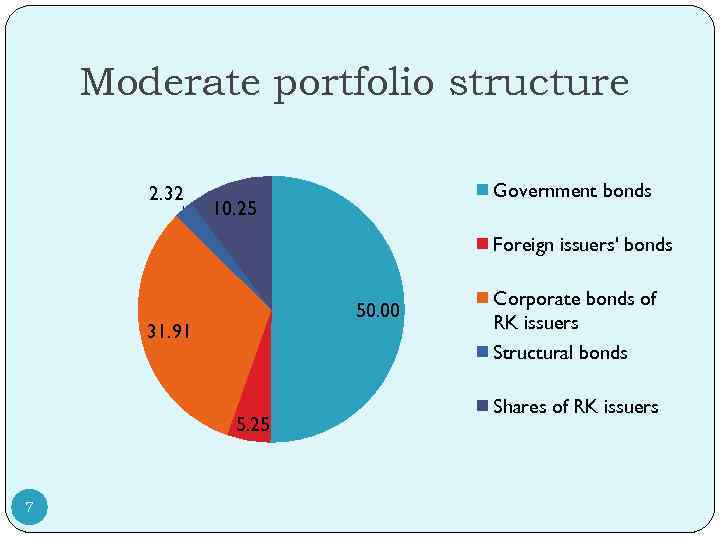

Moderate portfolio structure 2. 32 Government bonds 10. 25 Foreign issuers' bonds 50. 00 31. 91 5. 25 7 Corporate bonds of RK issuers Structural bonds Shares of RK issuers

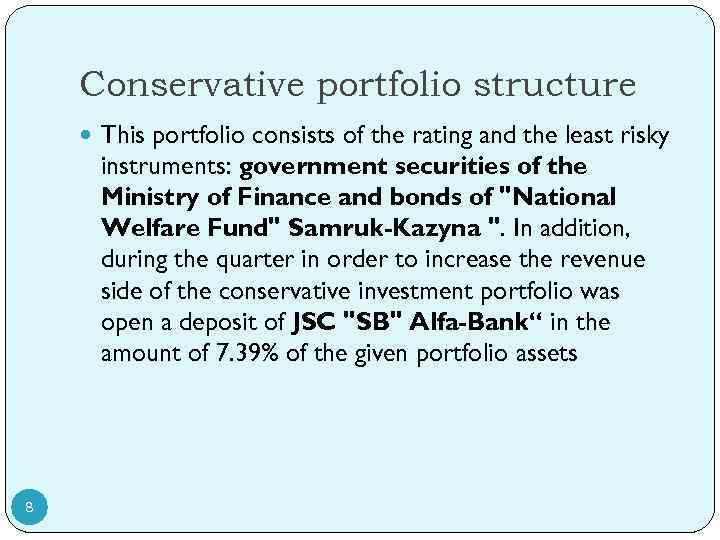

Conservative portfolio structure This portfolio consists of the rating and the least risky instruments: government securities of the Ministry of Finance and bonds of "National Welfare Fund" Samruk-Kazyna ". In addition, during the quarter in order to increase the revenue side of the conservative investment portfolio was open a deposit of JSC "SB" Alfa-Bank“ in the amount of 7. 39% of the given portfolio assets 8

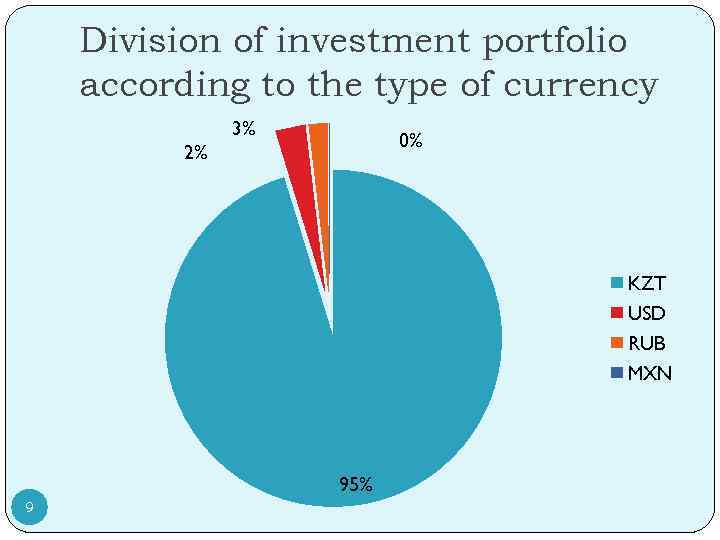

Division of investment portfolio according to the type of currency 3% 0% 2% KZT USD RUB MXN 95% 9

The main problems of portfolio investments: Problems of general character Problems of modeling and forecasting Problems of optimal achieving of investment target Problem of task statement of portfolio management 10

Thank you for attention! 11

PFI.pptx