0aa7f5dbe655927ce6d2f0013d8fc859.ppt

- Количество слайдов: 40

Portfolio and Investment Strategy: Targeting the Opportunities a Tough Market Presents Leandra Knes President and Chief Executive Officer Chief Investment Officer PPM America

Portfolio and Investment Strategy: Targeting the Opportunities a Tough Market Presents Leandra Knes President and Chief Executive Officer Chief Investment Officer PPM America

The North American Investment Arm of Prudential Plc ▲ ▲ Founded in 1990, headquartered in Chicago Manages approximately $62. 3 billion in assets – – ▲ Jackson National Prudential UK and Prudential Asia Institutional Collateralized Bond Obligation clients Other clients 175 total employees in Chicago and New York City

The North American Investment Arm of Prudential Plc ▲ ▲ Founded in 1990, headquartered in Chicago Manages approximately $62. 3 billion in assets – – ▲ Jackson National Prudential UK and Prudential Asia Institutional Collateralized Bond Obligation clients Other clients 175 total employees in Chicago and New York City

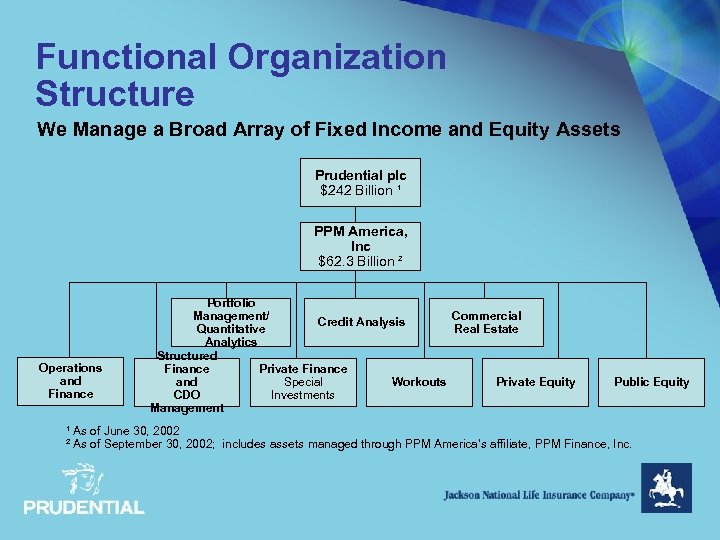

Functional Organization Structure We Manage a Broad Array of Fixed Income and Equity Assets Prudential plc $242 Billion ¹ PPM America, Inc. $62. 3 Billion ² Operations and Finance Portfolio Management/ Commercial Credit Analysis Quantitative Real Estate Analytics Structured Private Finance Workouts Private Equity and Special CDO Investments Management Public Equity ¹ As of June 30, 2002 ² As of September 30, 2002; includes assets managed through PPM America’s affiliate, PPM Finance, Inc.

Functional Organization Structure We Manage a Broad Array of Fixed Income and Equity Assets Prudential plc $242 Billion ¹ PPM America, Inc. $62. 3 Billion ² Operations and Finance Portfolio Management/ Commercial Credit Analysis Quantitative Real Estate Analytics Structured Private Finance Workouts Private Equity and Special CDO Investments Management Public Equity ¹ As of June 30, 2002 ² As of September 30, 2002; includes assets managed through PPM America’s affiliate, PPM Finance, Inc.

Overwhelming Majority of PPMA’s Clients are Internal Assets Under Management as of September 30, 2002 Billions Jackson National Life $ 42. 8 Prudential 14. 4 Collateralized Bond Obligations Prudential Asia 0. 7 Other 0. 3 $ 62. 3 4. 1

Overwhelming Majority of PPMA’s Clients are Internal Assets Under Management as of September 30, 2002 Billions Jackson National Life $ 42. 8 Prudential 14. 4 Collateralized Bond Obligations Prudential Asia 0. 7 Other 0. 3 $ 62. 3 4. 1

Centralized Credit and Portfolio Management Functions ▲ Background – ▲ Historically organized in “self sufficient” asset class silos, with little overlap Reorganized September 2001 – – Leverage analytical competitive advantage Centralize systems Checks and balances Expandable

Centralized Credit and Portfolio Management Functions ▲ Background – ▲ Historically organized in “self sufficient” asset class silos, with little overlap Reorganized September 2001 – – Leverage analytical competitive advantage Centralize systems Checks and balances Expandable

Investment Portfolio Update

Investment Portfolio Update

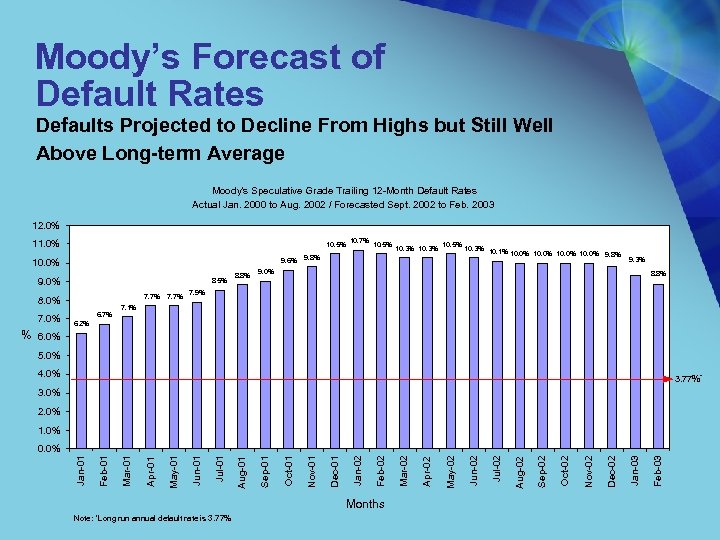

Moody’s Forecast of Default Rates Defaults Projected to Decline From Highs but Still Well Above Long-term Average Moody's Speculative Grade Trailing 12 -Month Default Rates Actual Jan. 2000 to Aug. 2002 / Forecasted Sept. 2002 to Feb. 2003 12. 0% 11. 0% 10. 5% 9. 6% 10. 0% 9. 0% 8. 5% 7. 7% 8. 0% 7. 0% 6. 7% 7. 7% 8. 8% 10. 7% 10. 5% 10. 3% 9. 8% 10. 1% 10. 0% 9. 8% 9. 3% 9. 0% 8. 8% 7. 9% 7. 1% 6. 2% % 6. 0% 5. 0% 4. 0% 3. 77%* 3. 0% 2. 0% 1. 0% Months Note: *Long run annual default rate is 3. 77% Feb-03 Jan-03 Dec-02 Nov-02 Oct-02 Sep-02 Aug-02 Jul-02 Jun-02 May-02 Apr-02 Mar-02 Feb-02 Jan-02 Dec-01 Nov-01 Oct-01 Sep-01 Aug-01 Jul-01 Jun-01 May-01 Apr-01 Mar-01 Feb-01 Jan-01 0. 0%

Moody’s Forecast of Default Rates Defaults Projected to Decline From Highs but Still Well Above Long-term Average Moody's Speculative Grade Trailing 12 -Month Default Rates Actual Jan. 2000 to Aug. 2002 / Forecasted Sept. 2002 to Feb. 2003 12. 0% 11. 0% 10. 5% 9. 6% 10. 0% 9. 0% 8. 5% 7. 7% 8. 0% 7. 0% 6. 7% 7. 7% 8. 8% 10. 7% 10. 5% 10. 3% 9. 8% 10. 1% 10. 0% 9. 8% 9. 3% 9. 0% 8. 8% 7. 9% 7. 1% 6. 2% % 6. 0% 5. 0% 4. 0% 3. 77%* 3. 0% 2. 0% 1. 0% Months Note: *Long run annual default rate is 3. 77% Feb-03 Jan-03 Dec-02 Nov-02 Oct-02 Sep-02 Aug-02 Jul-02 Jun-02 May-02 Apr-02 Mar-02 Feb-02 Jan-02 Dec-01 Nov-01 Oct-01 Sep-01 Aug-01 Jul-01 Jun-01 May-01 Apr-01 Mar-01 Feb-01 Jan-01 0. 0%

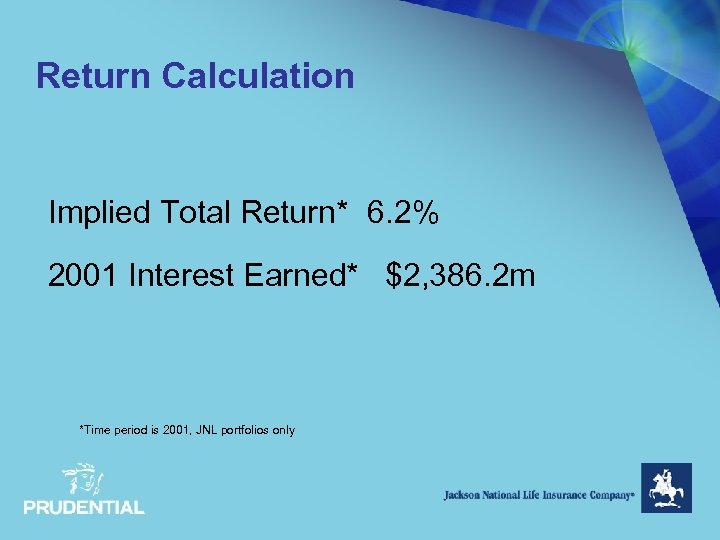

Return Calculation Implied Total Return* 6. 2% 2001 Interest Earned* $2, 386. 2 m *Time period is 2001, JNL portfolios only

Return Calculation Implied Total Return* 6. 2% 2001 Interest Earned* $2, 386. 2 m *Time period is 2001, JNL portfolios only

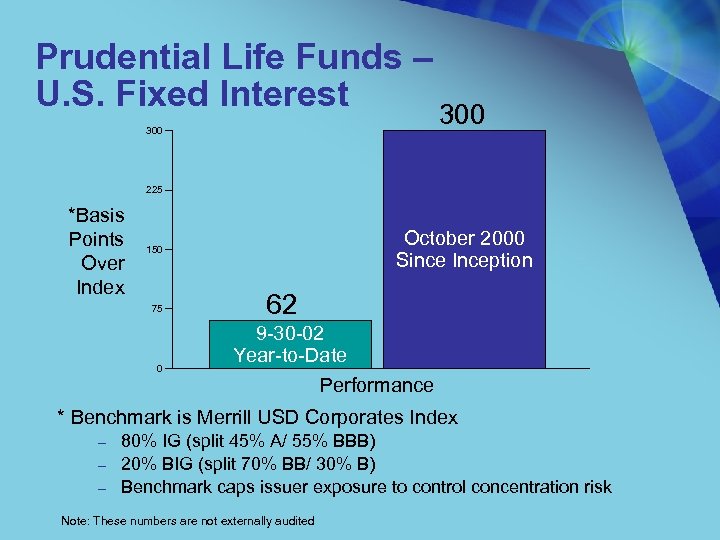

Prudential Life Funds – U. S. Fixed Interest 300 225 *Basis Points Over Index October 2000 Since Inception 150 75 0 62 9 -30 -02 Year-to-Date Performance * Benchmark is Merrill USD Corporates Index – – – 80% IG (split 45% A/ 55% BBB) 20% BIG (split 70% BB/ 30% B) Benchmark caps issuer exposure to control concentration risk Note: These numbers are not externally audited

Prudential Life Funds – U. S. Fixed Interest 300 225 *Basis Points Over Index October 2000 Since Inception 150 75 0 62 9 -30 -02 Year-to-Date Performance * Benchmark is Merrill USD Corporates Index – – – 80% IG (split 45% A/ 55% BBB) 20% BIG (split 70% BB/ 30% B) Benchmark caps issuer exposure to control concentration risk Note: These numbers are not externally audited

Portfolio Management Brion Johnson Executive Vice President Head of Public Fixed Income PPM America

Portfolio Management Brion Johnson Executive Vice President Head of Public Fixed Income PPM America

Portfolio Management Structured to Deliver Superior Investment Performance ▲ ▲ ▲ Manage multiple accounts using total return, “buy and manage” and other client specific President, CEO & CIO strategies Leandra Knes Client Portfolio Managers manage relationships, articulate client objectives and Portfolio Management Brion Johnson optimize portfolios Asset Portfolio Managers make Client Asset sector and individual credit decisions Portfolio Managers for public fixed income securities Quantitative specialists support Quantitative these functions Research Trading transmits market information and centralizes our interactions with Wall Street Trading

Portfolio Management Structured to Deliver Superior Investment Performance ▲ ▲ ▲ Manage multiple accounts using total return, “buy and manage” and other client specific President, CEO & CIO strategies Leandra Knes Client Portfolio Managers manage relationships, articulate client objectives and Portfolio Management Brion Johnson optimize portfolios Asset Portfolio Managers make Client Asset sector and individual credit decisions Portfolio Managers for public fixed income securities Quantitative specialists support Quantitative these functions Research Trading transmits market information and centralizes our interactions with Wall Street Trading

Investment Strategy Seeking Diversified Portfolio That Funds Liabilities Without Mismatch Risk ▲ Increase the universe of investable asset categories – – – ▲ Continue to migrate away from residential MBS investments – ▲ Greater diversification of risks Higher option- and risk-adjusted spreads Replacement of interest rate risk with diversifiable risks Less attractive from a return on capital perspective Emphasis on “value-added” investments when relative values are attractive – – – Commercial mortgages Investment grade private placements ABS and CMBS

Investment Strategy Seeking Diversified Portfolio That Funds Liabilities Without Mismatch Risk ▲ Increase the universe of investable asset categories – – – ▲ Continue to migrate away from residential MBS investments – ▲ Greater diversification of risks Higher option- and risk-adjusted spreads Replacement of interest rate risk with diversifiable risks Less attractive from a return on capital perspective Emphasis on “value-added” investments when relative values are attractive – – – Commercial mortgages Investment grade private placements ABS and CMBS

Investment Strategy Seeking Value Added Investments Won’t Take “Bet the Company” Risks ▲ ▲ Maintain tight restrictions on duration, convexity and liquidity Refinement of the investment policy implies – – ▲ A more precise articulation of risk and return Quantification of out of index exposures More active portfolio management Better articulated sales criteria Migrate high yield investments to more private high yield investments – – – Better historical default/recovery experience Better covenants/monitoring ability Maintain 8% exposure for non-investment grade investments

Investment Strategy Seeking Value Added Investments Won’t Take “Bet the Company” Risks ▲ ▲ Maintain tight restrictions on duration, convexity and liquidity Refinement of the investment policy implies – – ▲ A more precise articulation of risk and return Quantification of out of index exposures More active portfolio management Better articulated sales criteria Migrate high yield investments to more private high yield investments – – – Better historical default/recovery experience Better covenants/monitoring ability Maintain 8% exposure for non-investment grade investments

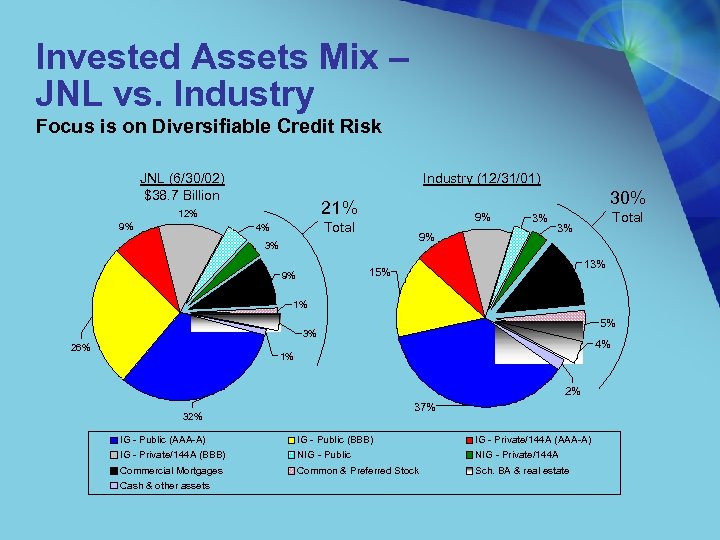

Invested Assets Mix – JNL vs. Industry Focus is on Diversifiable Credit Risk JNL (6/30/02) $38. 7 Billion Industry (12/31/01) 9% 30% 21% 12% 9% Total 4% 9% 3% 3% 15% 9% Total 3% 1% 5% 3% 26% 4% 1% 2% 37% 32% IG - Public (AAA-A) IG - Private/144 A (BBB) IG - Public (BBB) NIG - Public IG - Private/144 A (AAA-A) NIG - Private/144 A Commercial Mortgages Cash & other assets Common & Preferred Stock Sch. BA & real estate

Invested Assets Mix – JNL vs. Industry Focus is on Diversifiable Credit Risk JNL (6/30/02) $38. 7 Billion Industry (12/31/01) 9% 30% 21% 12% 9% Total 4% 9% 3% 3% 15% 9% Total 3% 1% 5% 3% 26% 4% 1% 2% 37% 32% IG - Public (AAA-A) IG - Private/144 A (BBB) IG - Public (BBB) NIG - Public IG - Private/144 A (AAA-A) NIG - Private/144 A Commercial Mortgages Cash & other assets Common & Preferred Stock Sch. BA & real estate

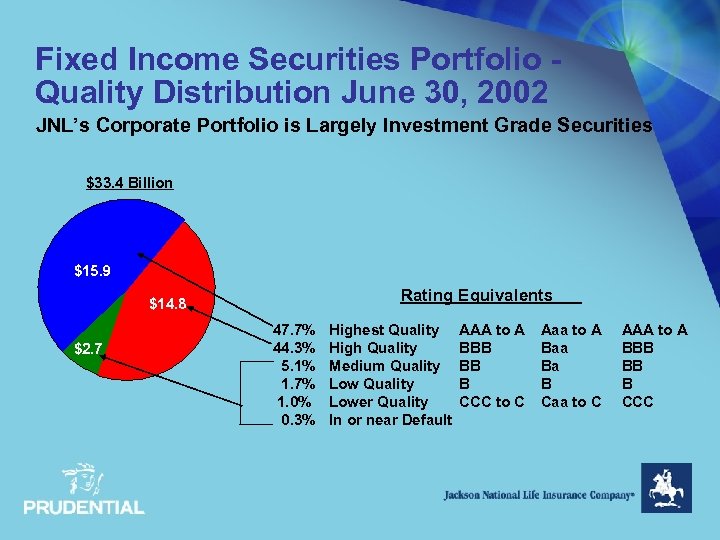

Fixed Income Securities Portfolio Quality Distribution June 30, 2002 JNL’s Corporate Portfolio is Largely Investment Grade Securities $33. 4 Billion $15. 9 Rating Equivalents $14. 8 $2. 7 47. 7% 44. 3% 5. 1% 1. 7% 1. 0% 0. 3% Highest Quality High Quality Medium Quality Lower Quality In or near Default AAA to A BBB BB B CCC to C Aaa to A Baa Ba B Caa to C AAA to A BBB BB B CCC

Fixed Income Securities Portfolio Quality Distribution June 30, 2002 JNL’s Corporate Portfolio is Largely Investment Grade Securities $33. 4 Billion $15. 9 Rating Equivalents $14. 8 $2. 7 47. 7% 44. 3% 5. 1% 1. 7% 1. 0% 0. 3% Highest Quality High Quality Medium Quality Lower Quality In or near Default AAA to A BBB BB B CCC to C Aaa to A Baa Ba B Caa to C AAA to A BBB BB B CCC

Fixed Income Securities Portfolio - Sector Distribution JNL’s Corporate Portfolio is Diversified by Sector As of June 30, 2002 $33. 4 Billion CMBS 5. 0% Public/144 a ABS 6. 6% Private Corp. 11. 8% Private ABS 1. 9% Foreign government 0. 1% MBS 21. 5% Public/144 a Corp. 53. 1%

Fixed Income Securities Portfolio - Sector Distribution JNL’s Corporate Portfolio is Diversified by Sector As of June 30, 2002 $33. 4 Billion CMBS 5. 0% Public/144 a ABS 6. 6% Private Corp. 11. 8% Private ABS 1. 9% Foreign government 0. 1% MBS 21. 5% Public/144 a Corp. 53. 1%

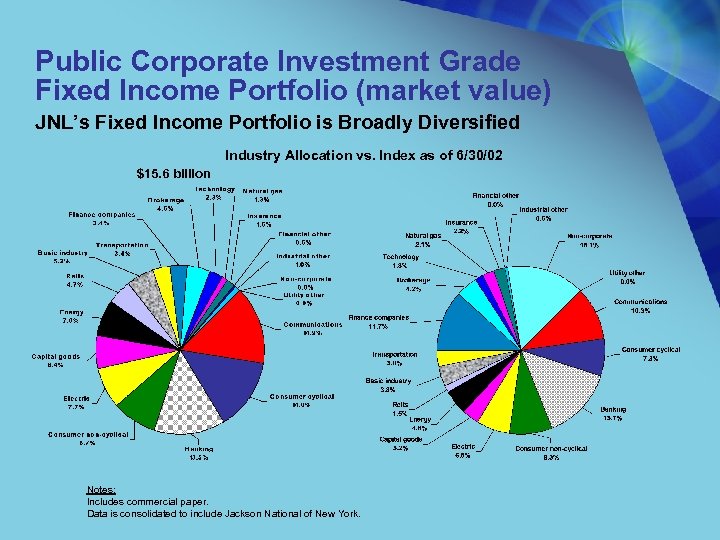

Public Corporate Investment Grade Fixed Income Portfolio (market value) JNL’s Fixed Income Portfolio is Broadly Diversified Industry Allocation vs. Index as of 6/30/02 $15. 6 billion Notes: Includes commercial paper. Data is consolidated to include Jackson National of New York.

Public Corporate Investment Grade Fixed Income Portfolio (market value) JNL’s Fixed Income Portfolio is Broadly Diversified Industry Allocation vs. Index as of 6/30/02 $15. 6 billion Notes: Includes commercial paper. Data is consolidated to include Jackson National of New York.

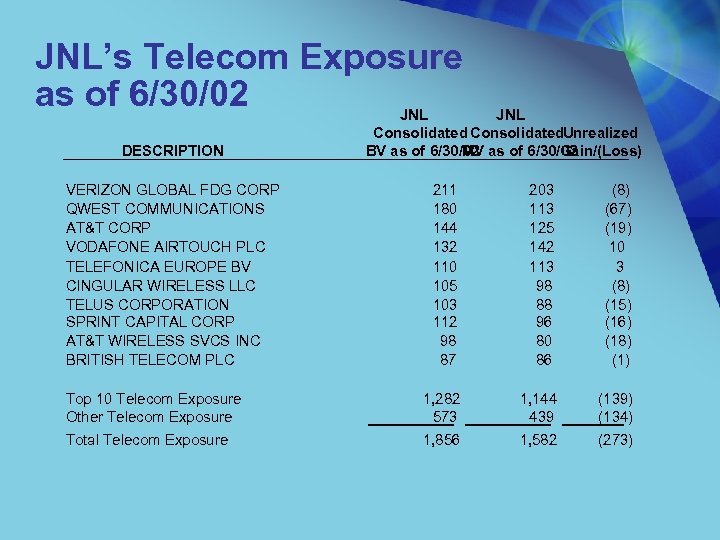

JNL’s Telecom Exposure as of 6/30/02 JNL DESCRIPTION VERIZON GLOBAL FDG CORP QWEST COMMUNICATIONS AT&T CORP VODAFONE AIRTOUCH PLC TELEFONICA EUROPE BV CINGULAR WIRELESS LLC TELUS CORPORATION SPRINT CAPITAL CORP AT&T WIRELESS SVCS INC BRITISH TELECOM PLC Top 10 Telecom Exposure Other Telecom Exposure Total Telecom Exposure JNL Consolidated. Unrealized BV as of 6/30/02 MV Gain/(Loss) 211 180 144 132 110 105 103 112 98 87 203 113 125 142 113 98 88 96 80 86 (8) (67) (19) 10 3 (8) (15) (16) (18) (1) 1, 282 573 1, 856 1, 144 439 1, 582 (139) (134) (273)

JNL’s Telecom Exposure as of 6/30/02 JNL DESCRIPTION VERIZON GLOBAL FDG CORP QWEST COMMUNICATIONS AT&T CORP VODAFONE AIRTOUCH PLC TELEFONICA EUROPE BV CINGULAR WIRELESS LLC TELUS CORPORATION SPRINT CAPITAL CORP AT&T WIRELESS SVCS INC BRITISH TELECOM PLC Top 10 Telecom Exposure Other Telecom Exposure Total Telecom Exposure JNL Consolidated. Unrealized BV as of 6/30/02 MV Gain/(Loss) 211 180 144 132 110 105 103 112 98 87 203 113 125 142 113 98 88 96 80 86 (8) (67) (19) 10 3 (8) (15) (16) (18) (1) 1, 282 573 1, 856 1, 144 439 1, 582 (139) (134) (273)

Credit Analysis Jim Young Executive Vice President Chief Credit Officer PPM America

Credit Analysis Jim Young Executive Vice President Chief Credit Officer PPM America

Credit Analysis Credit Team Organized by Industry ▲ Responsible for corporate credit analysis – – – ▲ Specialized industry analysts – – ▲ Investment grade High yield Public and private credits Covering all industry classifications Across credit spectrum Analysts, on average, follow 40 credits – – Fewer if issuers in an industry are primarily high yield Greater if primarily investment grade

Credit Analysis Credit Team Organized by Industry ▲ Responsible for corporate credit analysis – – – ▲ Specialized industry analysts – – ▲ Investment grade High yield Public and private credits Covering all industry classifications Across credit spectrum Analysts, on average, follow 40 credits – – Fewer if issuers in an industry are primarily high yield Greater if primarily investment grade

Approval Process for New Deals Rigorous Approval Process Prior to Purchase ▲ ▲ Full underwriting Approval by Credit Committee – ▲ Credit Opinion: Buy Above, Buy At, Buy Below, Sell Goal is to give Portfolio Managers information to guide purchase decision

Approval Process for New Deals Rigorous Approval Process Prior to Purchase ▲ ▲ Full underwriting Approval by Credit Committee – ▲ Credit Opinion: Buy Above, Buy At, Buy Below, Sell Goal is to give Portfolio Managers information to guide purchase decision

Ongoing Portfolio Monitoring Analysts Expected to Know Credits on “Real Time” Basis ▲ Expected to know credits “real time” ▲ Semi-annual portfolio reviews ▲ Constant communication with portfolio managers and traders

Ongoing Portfolio Monitoring Analysts Expected to Know Credits on “Real Time” Basis ▲ Expected to know credits “real time” ▲ Semi-annual portfolio reviews ▲ Constant communication with portfolio managers and traders

Fifteen Largest Bankruptcies From 1/1/01 to 6/30/02 JNL has largely avoided many of the largest bankruptcies ▲ Names held – – ▲ Adelphia: sold out prior to bankruptcy at price well above prices today Global Crossing Mc. Leod Williams Communications Names avoided (less than $5 MM exposure) – – – NTL Communications Enron Finova Pacific Gas and Electric XO Communications Southern California Edison PSINET Comdisco Exodus Communications KMart Metromedia Fiber Notes: World. Com filed in July, 2002

Fifteen Largest Bankruptcies From 1/1/01 to 6/30/02 JNL has largely avoided many of the largest bankruptcies ▲ Names held – – ▲ Adelphia: sold out prior to bankruptcy at price well above prices today Global Crossing Mc. Leod Williams Communications Names avoided (less than $5 MM exposure) – – – NTL Communications Enron Finova Pacific Gas and Electric XO Communications Southern California Edison PSINET Comdisco Exodus Communications KMart Metromedia Fiber Notes: World. Com filed in July, 2002

Competitor Information Evidence Would Suggest We are Doing as Well or Better Than Competition ▲ Schedule D ▲ Holdings in stressed names ▲ Underweight power generation, airlines

Competitor Information Evidence Would Suggest We are Doing as Well or Better Than Competition ▲ Schedule D ▲ Holdings in stressed names ▲ Underweight power generation, airlines

2002 First Half Writedowns and Realized Losses (Gross) Writedowns and Losses Higher Than Expected Due to World. Com Fraud Further Writedowns on High Yield Telecom ABS Writedowns Other Total $ 80 MM 30 MM 40 MM $150 MM World. Com (Fraud) Adelphia (Fraud) Total Fraud-Related $120 MM 11 MM $131 MM Total $281 MM

2002 First Half Writedowns and Realized Losses (Gross) Writedowns and Losses Higher Than Expected Due to World. Com Fraud Further Writedowns on High Yield Telecom ABS Writedowns Other Total $ 80 MM 30 MM 40 MM $150 MM World. Com (Fraud) Adelphia (Fraud) Total Fraud-Related $120 MM 11 MM $131 MM Total $281 MM

Summary Credit Intensive Approach a Benefit in Today’s Market ▲ ▲ ▲ Weak U. S. economy and bond market in 2002 Many significant bankruptcies JNL’s credit approach is paying dividends – – – Avoided 11 of 15 bankruptcies Severe underweight in power generation sector 2002 performance as good, or better, than competition Holdings in stressed names in line with competition Solid total return performance

Summary Credit Intensive Approach a Benefit in Today’s Market ▲ ▲ ▲ Weak U. S. economy and bond market in 2002 Many significant bankruptcies JNL’s credit approach is paying dividends – – – Avoided 11 of 15 bankruptcies Severe underweight in power generation sector 2002 performance as good, or better, than competition Holdings in stressed names in line with competition Solid total return performance

Commercial Mortgage Loans and Real Estate Securities David Zachar Executive Vice President Commercial Real Estate PPM America

Commercial Mortgage Loans and Real Estate Securities David Zachar Executive Vice President Commercial Real Estate PPM America

Commercial Mortgage Loans and Real Estate Securities PPM’s Commercial Real Estate Group Real estate securities ▲ Commercial mortgage lending ▲ Real estate joint ventures ▲ ▲ CMBS and REIT Securities Commercial Mortgage Loans $2. 6 billion $3. 3 billion Focus is on – – High quality real estate Well sponsored Well located Well diversified both in terms of property types and geography Real Estate Joint Ventures $60 million

Commercial Mortgage Loans and Real Estate Securities PPM’s Commercial Real Estate Group Real estate securities ▲ Commercial mortgage lending ▲ Real estate joint ventures ▲ ▲ CMBS and REIT Securities Commercial Mortgage Loans $2. 6 billion $3. 3 billion Focus is on – – High quality real estate Well sponsored Well located Well diversified both in terms of property types and geography Real Estate Joint Ventures $60 million

Real Estate Securities ▲ CMBS: - $1. 6 billion - 4. 26% of JNL’s Invested Assets – – ▲ U. S. CMBS market is $500 billion in size Value added to Corporate Bonds of similar ratings Unlike MBS, excellent call protection via the individual loans and the sequential structure of CMBS JNL portfolio consists primarily BBB+ to A- securities REITs: - $732 million - 1. 89% of JNL’s Invested Assets – – – Total public debt outstanding in REIT-debt market is $50 billion Also value added to Corporate Bonds of similar ratings All REIT-debt in JNL’s portfolio is public, investment grade securities

Real Estate Securities ▲ CMBS: - $1. 6 billion - 4. 26% of JNL’s Invested Assets – – ▲ U. S. CMBS market is $500 billion in size Value added to Corporate Bonds of similar ratings Unlike MBS, excellent call protection via the individual loans and the sequential structure of CMBS JNL portfolio consists primarily BBB+ to A- securities REITs: - $732 million - 1. 89% of JNL’s Invested Assets – – – Total public debt outstanding in REIT-debt market is $50 billion Also value added to Corporate Bonds of similar ratings All REIT-debt in JNL’s portfolio is public, investment grade securities

Commercial Mortgage Loans A Description of the Attributes of a Commercial Mortgage Loan ▲ Compelling Attributes of a Commercial Mortgage: – – – ▲ Fixed Income Asset based on real estate assets Yield Maintenance Favorable capital treatment by regulators JNL’s Commercial Mortgage Portfolio 9% of Invested Assets – – Totals $3. 2 billion with an average loan size of $8. 7 million Minimum loan size of $5 million, maximum loan size of $30 million Excellent experience Well-diversified in property types 40 West Office Building St. Louis, Missouri $22. 5 million loan

Commercial Mortgage Loans A Description of the Attributes of a Commercial Mortgage Loan ▲ Compelling Attributes of a Commercial Mortgage: – – – ▲ Fixed Income Asset based on real estate assets Yield Maintenance Favorable capital treatment by regulators JNL’s Commercial Mortgage Portfolio 9% of Invested Assets – – Totals $3. 2 billion with an average loan size of $8. 7 million Minimum loan size of $5 million, maximum loan size of $30 million Excellent experience Well-diversified in property types 40 West Office Building St. Louis, Missouri $22. 5 million loan

Commercial Mortgage Lending Strategy PPM’s Origination Strategy and Preferred Property Types Strategy ▲ Value Added Lending – – – ▲ Sourced and serviced by correspondents – ▲ Responsive Creative Mid Point documents Process oriented Borrower oriented Local knowledge of borrowers and submarkets Loans underwritten by PPM – PPM orders the appraisal and third party reviews JNL’s Commercial Mortgage Loan Portfolio

Commercial Mortgage Lending Strategy PPM’s Origination Strategy and Preferred Property Types Strategy ▲ Value Added Lending – – – ▲ Sourced and serviced by correspondents – ▲ Responsive Creative Mid Point documents Process oriented Borrower oriented Local knowledge of borrowers and submarkets Loans underwritten by PPM – PPM orders the appraisal and third party reviews JNL’s Commercial Mortgage Loan Portfolio

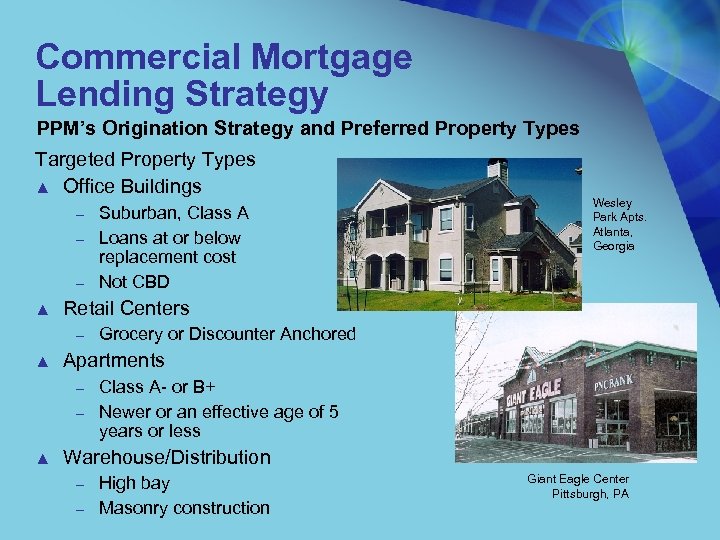

Commercial Mortgage Lending Strategy PPM’s Origination Strategy and Preferred Property Types Targeted Property Types ▲ Office Buildings – – – ▲ Grocery or Discounter Anchored Apartments – – ▲ Wesley Park Apts. Atlanta, Georgia Retail Centers – ▲ Suburban, Class A Loans at or below replacement cost Not CBD Class A- or B+ Newer or an effective age of 5 years or less Warehouse/Distribution – – High bay Masonry construction Giant Eagle Center Pittsburgh, PA

Commercial Mortgage Lending Strategy PPM’s Origination Strategy and Preferred Property Types Targeted Property Types ▲ Office Buildings – – – ▲ Grocery or Discounter Anchored Apartments – – ▲ Wesley Park Apts. Atlanta, Georgia Retail Centers – ▲ Suburban, Class A Loans at or below replacement cost Not CBD Class A- or B+ Newer or an effective age of 5 years or less Warehouse/Distribution – – High bay Masonry construction Giant Eagle Center Pittsburgh, PA

Private Placement Investments

Private Placement Investments

Private Placement Advantages ▲ Private placement investments have several advantages over public investments – – – ▲ Better and more consistent information Better structure Better documents Better covenants and control Better pricing JNL is willing to trade some liquidity for these advantages

Private Placement Advantages ▲ Private placement investments have several advantages over public investments – – – ▲ Better and more consistent information Better structure Better documents Better covenants and control Better pricing JNL is willing to trade some liquidity for these advantages

Private Placement Pricing Advantage

Private Placement Pricing Advantage

Summary

Summary

Summary ▲ ▲ Significant, multiple asset class investment capabilities Historically difficult investing environment Value added research capabilities Management response to current environment – – ▲ Monitor constantly Reposition within constraints Execute risk mitigation trades when practical Transition with evolving investment policies PPM is well-positioned to be proactive on the opportunities that a tough market can present

Summary ▲ ▲ Significant, multiple asset class investment capabilities Historically difficult investing environment Value added research capabilities Management response to current environment – – ▲ Monitor constantly Reposition within constraints Execute risk mitigation trades when practical Transition with evolving investment policies PPM is well-positioned to be proactive on the opportunities that a tough market can present

Appendix

Appendix

Appendix: A 2001 Return Calculations Comments 12/31/00 Total assets $36, 067. 9 438. 0 Accrued investment income $36, 505. 9 Capital contribution-dividends (32. 8) $36, 473. 1 Take out CMLs (4, 660. 2) Take out Policy Lns (687. 2) PPM Assets ex CMLs $31, 125. 7 Deposits W'drawals Decr (incr) in CMLs Net transfer to sep accts Net $6, 876. 6 (4, 858. 7) 468. 8 (468. 9) $2, 017. 8 12/31/01 $39, 733. 1 480. 6 $40, 213. 7 (168. 6) $40, 045. 1 (4, 191. 4) (700. 4) $35, 153. 3 Assumptions/Methodology ▲ Using the balance sheet we calculate the beginning and ending market value of JNL’s portfolio, which reflects both realized and unrealized losses. We adjust for capital movement; for commercial mortgage loans, where the performance is clearly excellent; and for policy loans, which PPMA does not manage. ▲ We calculate net flows as sales minus surrenders and reflect the inflow from the reduction in the commercial mortgage loan portfolio. These numbers are from the GAAP statement of cash flows and from the balance sheet. ▲ Treating this as a mid-period flow, 6. 2% is the real time weighted rated of return that these numbers suggest is the total return for the portfolio.

Appendix: A 2001 Return Calculations Comments 12/31/00 Total assets $36, 067. 9 438. 0 Accrued investment income $36, 505. 9 Capital contribution-dividends (32. 8) $36, 473. 1 Take out CMLs (4, 660. 2) Take out Policy Lns (687. 2) PPM Assets ex CMLs $31, 125. 7 Deposits W'drawals Decr (incr) in CMLs Net transfer to sep accts Net $6, 876. 6 (4, 858. 7) 468. 8 (468. 9) $2, 017. 8 12/31/01 $39, 733. 1 480. 6 $40, 213. 7 (168. 6) $40, 045. 1 (4, 191. 4) (700. 4) $35, 153. 3 Assumptions/Methodology ▲ Using the balance sheet we calculate the beginning and ending market value of JNL’s portfolio, which reflects both realized and unrealized losses. We adjust for capital movement; for commercial mortgage loans, where the performance is clearly excellent; and for policy loans, which PPMA does not manage. ▲ We calculate net flows as sales minus surrenders and reflect the inflow from the reduction in the commercial mortgage loan portfolio. These numbers are from the GAAP statement of cash flows and from the balance sheet. ▲ Treating this as a mid-period flow, 6. 2% is the real time weighted rated of return that these numbers suggest is the total return for the portfolio.