0e7c369376a6a9543eff2f3c7206694c.ppt

- Количество слайдов: 36

PORTFOLIO ADVISORY SERVICE for NRI Clients 1

PORTFOLIO ADVISORY SERVICE for NRI Clients 1

CONTENTS § Portfolio Management Service • PNVF Credentials • Portfolio Advisory Products 2

CONTENTS § Portfolio Management Service • PNVF Credentials • Portfolio Advisory Products 2

ABOUT US § Promoted in May 1990, PN Vijay Financial Services (P) Ltd (PNVF) is a SEBI-Authorized Portfolio Manager. § P N Vijay, the promoter of PNVF is a well known Investment Analyst with an experience of over 30 years in the financial sector. § Started career at SBI, moved on to ANZ Grindlays, and served as VP and Country Head, Merchant Banking at Citibank. 3

ABOUT US § Promoted in May 1990, PN Vijay Financial Services (P) Ltd (PNVF) is a SEBI-Authorized Portfolio Manager. § P N Vijay, the promoter of PNVF is a well known Investment Analyst with an experience of over 30 years in the financial sector. § Started career at SBI, moved on to ANZ Grindlays, and served as VP and Country Head, Merchant Banking at Citibank. 3

PNVF Credentials § Corporate Office in New Delhi and a network of three branches at Noida, Greater Kailash II and Gurgaon. § Qualified professionals well versed in latest techniques of investment analysis. § Latest communication and automation systems with access to real time data. § Close links with Corporates and leading market players. 4

PNVF Credentials § Corporate Office in New Delhi and a network of three branches at Noida, Greater Kailash II and Gurgaon. § Qualified professionals well versed in latest techniques of investment analysis. § Latest communication and automation systems with access to real time data. § Close links with Corporates and leading market players. 4

Our Wealth Advisory Service We provide advisory on the client’s overall wealth portfolio • Portfolio Advisory Service – Equity • Portfolio Advisory Service – Mutual Funds 5

Our Wealth Advisory Service We provide advisory on the client’s overall wealth portfolio • Portfolio Advisory Service – Equity • Portfolio Advisory Service – Mutual Funds 5

Portfolio Advisory Service Equity § § § Discretionary Portfolio Advisory Service For Corporates and High Net-worth Individuals Investment in Stocks Minimum Investible funds (stock/cash): Rs. 25 lacs Customized Portfolio designed after ascertaining the risk return profile of the client § Investment horizon of one year and above 6

Portfolio Advisory Service Equity § § § Discretionary Portfolio Advisory Service For Corporates and High Net-worth Individuals Investment in Stocks Minimum Investible funds (stock/cash): Rs. 25 lacs Customized Portfolio designed after ascertaining the risk return profile of the client § Investment horizon of one year and above 6

Procedure for PAS-Equity § § § A Client enters into Portfolio Advisory Agreement With PNVF Authorizes PNVF to manage his broking account with the broker Opens Broking Account With the broker Opens NRE Account and NRE PIS with Reporting Bank. Authorizes bank to honor claims raised by the broker and credit the account with cheques received from the broker 7

Procedure for PAS-Equity § § § A Client enters into Portfolio Advisory Agreement With PNVF Authorizes PNVF to manage his broking account with the broker Opens Broking Account With the broker Opens NRE Account and NRE PIS with Reporting Bank. Authorizes bank to honor claims raised by the broker and credit the account with cheques received from the broker 7

Our Designated Broker - India Infoline Securities § India Infoline Securities is a ten years old firm started by a group of Finance Professionals § Full service brokerage house with NSE , BSE membership, depository service with NSDL and commodity broking. § The company recently came out with its public issue and is listed on NSE § (www. indiainfoline. com) 8

Our Designated Broker - India Infoline Securities § India Infoline Securities is a ten years old firm started by a group of Finance Professionals § Full service brokerage house with NSE , BSE membership, depository service with NSDL and commodity broking. § The company recently came out with its public issue and is listed on NSE § (www. indiainfoline. com) 8

Reporting Bank - UTI Bank Ltd. § UTI Bank was the first of the new private banks to have begun operations in 1994, after the India allowed new private banks to be established. § The Bank was promoted by Unit Trust of India § The Bank today is capitalized to the extent of Rs. 278. 12 Crores with the public holding (other than promoters) at 56. 18 % § Bank has necessary license to enable NRI to invest and disinvest in shares of Companies in India, on repatriation or non-repatriation basis through its wide network of branches throughout the country. (www. utibank. com) 9

Reporting Bank - UTI Bank Ltd. § UTI Bank was the first of the new private banks to have begun operations in 1994, after the India allowed new private banks to be established. § The Bank was promoted by Unit Trust of India § The Bank today is capitalized to the extent of Rs. 278. 12 Crores with the public holding (other than promoters) at 56. 18 % § Bank has necessary license to enable NRI to invest and disinvest in shares of Companies in India, on repatriation or non-repatriation basis through its wide network of branches throughout the country. (www. utibank. com) 9

Documentation P N Vijay Financial Services § Client will enter into Portfolio Advisory Agreement with us. § Client will provide his personal details and his investment objectives w. r. t risk and return. § Client will provide his identity proof as well as his address proof. § Client will sign authority letter to execute trade in his broking account maintained with our designated broker. 10

Documentation P N Vijay Financial Services § Client will enter into Portfolio Advisory Agreement with us. § Client will provide his personal details and his investment objectives w. r. t risk and return. § Client will provide his identity proof as well as his address proof. § Client will sign authority letter to execute trade in his broking account maintained with our designated broker. 10

Continued………. . Indiainfoline Securities Ltd. – Client will fill Broker Client Agreement Form – Client will provide following documents; copy of RBI approval (to be provided by UTI Bank), Permanent Account Number (PAN), his Indian Address and Foreign Address with proof, Copy of passport, Bank verification letter indicating type of accounts as NRI/NRE/NRO, Po. A duly notarised. 11

Continued………. . Indiainfoline Securities Ltd. – Client will fill Broker Client Agreement Form – Client will provide following documents; copy of RBI approval (to be provided by UTI Bank), Permanent Account Number (PAN), his Indian Address and Foreign Address with proof, Copy of passport, Bank verification letter indicating type of accounts as NRI/NRE/NRO, Po. A duly notarised. 11

Continues………. . UTI Bank § Client opens Normal NRE SB A/C and NRE PIS. . § Client will provide attested copy of passport /visa. § Client will give authority to honor claims raised by the broker and credit the account with payment form the broker provided such debits and credits are supported by the contract note duly signed by the authorized signatory. 12

Continues………. . UTI Bank § Client opens Normal NRE SB A/C and NRE PIS. . § Client will provide attested copy of passport /visa. § Client will give authority to honor claims raised by the broker and credit the account with payment form the broker provided such debits and credits are supported by the contract note duly signed by the authorized signatory. 12

Continues………. . UTI Bank § Bank will provide broker a copy of PIS permission granted by RBI. § Bank will issue bank verification letter indicating NRE account held with them. 13

Continues………. . UTI Bank § Bank will provide broker a copy of PIS permission granted by RBI. § Bank will issue bank verification letter indicating NRE account held with them. 13

Working of Scheme § NRE SB A/C and NRE account is opened with reporting bank. § Bank issues PIS permission to client on behalf of RBI. § Broking account is opened with the our designated broker. § Client remits the corpus to be invested in his NRE account. 14

Working of Scheme § NRE SB A/C and NRE account is opened with reporting bank. § Bank issues PIS permission to client on behalf of RBI. § Broking account is opened with the our designated broker. § Client remits the corpus to be invested in his NRE account. 14

Continued…. § PNVF constructs customized portfolio for client. § PNVF invest on client’s behalf through the designated broker. § Broker will provide duly signed contract note to the reporting bank at the end of the day. 15

Continued…. § PNVF constructs customized portfolio for client. § PNVF invest on client’s behalf through the designated broker. § Broker will provide duly signed contract note to the reporting bank at the end of the day. 15

Continued…. § Bank will report NRI investment to RBI. § Bank will manage transfer of funds for buy/sale transaction. § Bank will compute capital gain @ 10. 2% and issue TDS certificate to investor at the end of the financial year. 16

Continued…. § Bank will report NRI investment to RBI. § Bank will manage transfer of funds for buy/sale transaction. § Bank will compute capital gain @ 10. 2% and issue TDS certificate to investor at the end of the financial year. 16

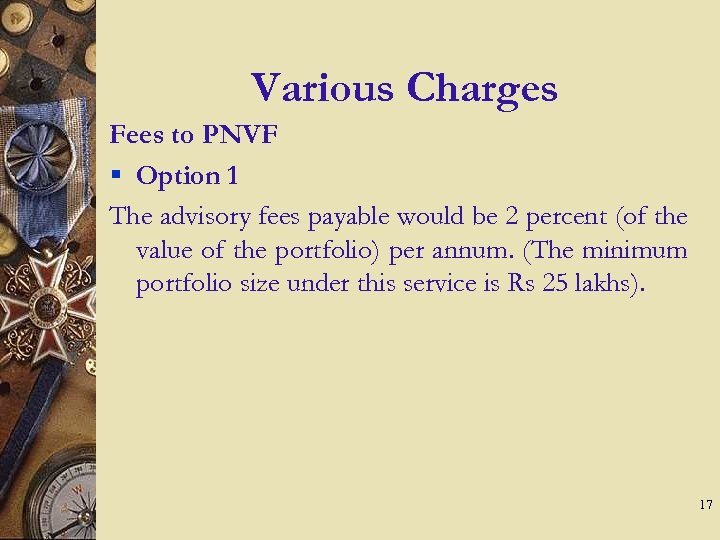

Various Charges Fees to PNVF § Option 1 The advisory fees payable would be 2 percent (of the value of the portfolio) per annum. (The minimum portfolio size under this service is Rs 25 lakhs). 17

Various Charges Fees to PNVF § Option 1 The advisory fees payable would be 2 percent (of the value of the portfolio) per annum. (The minimum portfolio size under this service is Rs 25 lakhs). 17

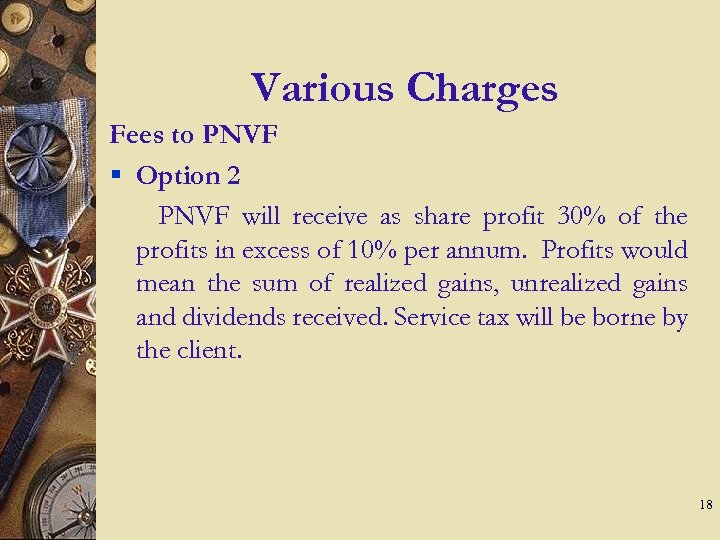

Various Charges Fees to PNVF § Option 2 PNVF will receive as share profit 30% of the profits in excess of 10% per annum. Profits would mean the sum of realized gains, unrealized gains and dividends received. Service tax will be borne by the client. 18

Various Charges Fees to PNVF § Option 2 PNVF will receive as share profit 30% of the profits in excess of 10% per annum. Profits would mean the sum of realized gains, unrealized gains and dividends received. Service tax will be borne by the client. 18

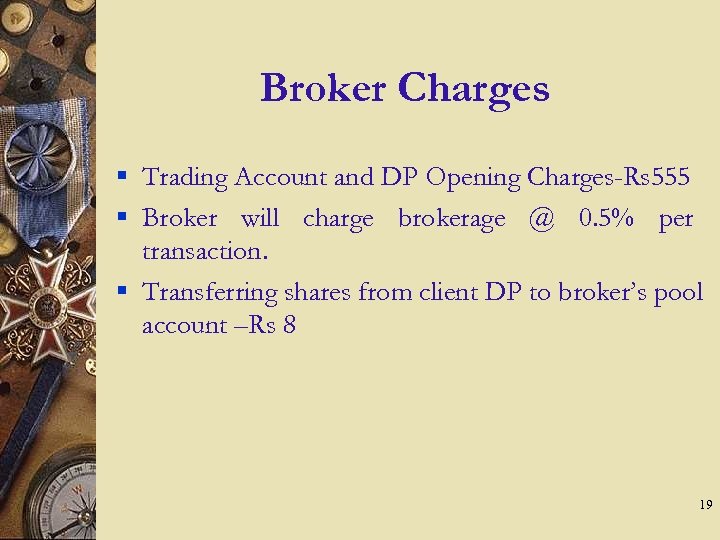

Broker Charges § Trading Account and DP Opening Charges-Rs 555 § Broker will charge brokerage @ 0. 5% per transaction. § Transferring shares from client DP to broker’s pool account –Rs 8 19

Broker Charges § Trading Account and DP Opening Charges-Rs 555 § Broker will charge brokerage @ 0. 5% per transaction. § Transferring shares from client DP to broker’s pool account –Rs 8 19

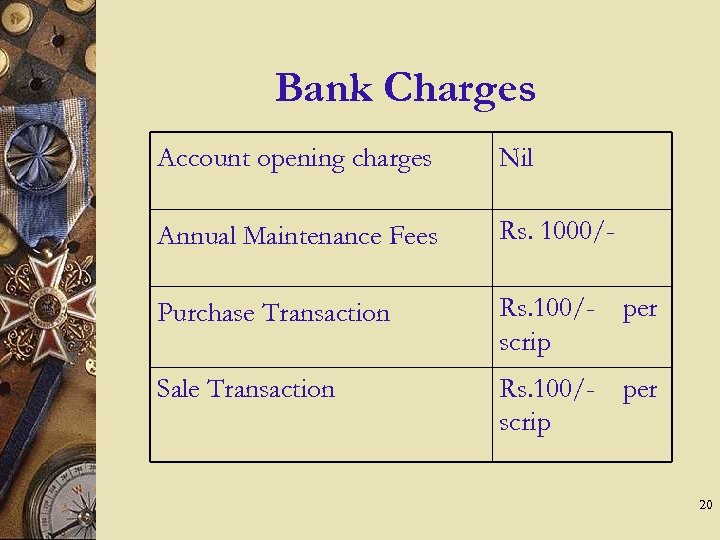

Bank Charges Account opening charges Nil Annual Maintenance Fees Rs. 1000/- Purchase Transaction Rs. 100/- per scrip Sale Transaction Rs. 100/- per scrip 20

Bank Charges Account opening charges Nil Annual Maintenance Fees Rs. 1000/- Purchase Transaction Rs. 100/- per scrip Sale Transaction Rs. 100/- per scrip 20

Client Reporting PNVF has got a very effective and prompt system of reporting in place. Our monthly report contains: § Account performance summarizing returns generated in the client’s portfolio. § Composition and the value of the portfolio. Description of security, number of securities, value of each security held in the portfolio. § Realised and unrealised income. § Transaction statement. Our Relationship Manager are constantly in touch with the clients to understand their needs and get their 21 feedback.

Client Reporting PNVF has got a very effective and prompt system of reporting in place. Our monthly report contains: § Account performance summarizing returns generated in the client’s portfolio. § Composition and the value of the portfolio. Description of security, number of securities, value of each security held in the portfolio. § Realised and unrealised income. § Transaction statement. Our Relationship Manager are constantly in touch with the clients to understand their needs and get their 21 feedback.

Continued…… – Client will receive all confirmation of the trades done in his broking account through email. – Client can view and monitor his holdings and broking account through our broker’s website. 22

Continued…… – Client will receive all confirmation of the trades done in his broking account through email. – Client can view and monitor his holdings and broking account through our broker’s website. 22

Taxation- Equity § Dividend income is tax free in the hands of investor. § Short term capital gains is taxed at 10%. § Long term capital gains attract no tax. 23

Taxation- Equity § Dividend income is tax free in the hands of investor. § Short term capital gains is taxed at 10%. § Long term capital gains attract no tax. 23

Portfolio Advisory Services Mutual Funds 24

Portfolio Advisory Services Mutual Funds 24

Mutual Fund Environment § Mutual Funds have been a popular investment choice for individuals and institutions in the last decade. 25

Mutual Fund Environment § Mutual Funds have been a popular investment choice for individuals and institutions in the last decade. 25

Mutual Fund Choices Wide range of products to choose from including § Equity Mutual Funds-Diversified, Sector specific, Tax saving and Index. § Debt Mutual Funds-Income , Short term, Medium term , Floating rate, Gilt fund. § Hybrid Funds -Equity oriented- Balanced fund. -Debt oriented -Monthly Income plan. 26

Mutual Fund Choices Wide range of products to choose from including § Equity Mutual Funds-Diversified, Sector specific, Tax saving and Index. § Debt Mutual Funds-Income , Short term, Medium term , Floating rate, Gilt fund. § Hybrid Funds -Equity oriented- Balanced fund. -Debt oriented -Monthly Income plan. 26

Risk In Mutual Funds § Equity Funds - uncertainty in the stock market - competence of fund managers § Debt Funds -movements in interest rates -inflation and the state of the economy 27

Risk In Mutual Funds § Equity Funds - uncertainty in the stock market - competence of fund managers § Debt Funds -movements in interest rates -inflation and the state of the economy 27

Our Mutual Fund Product PNVF now offers a product that will manage and monitor your mutual fund portfolio minimizing risk and maximizing returns. 28

Our Mutual Fund Product PNVF now offers a product that will manage and monitor your mutual fund portfolio minimizing risk and maximizing returns. 28

How It Works-Initial Stage § You define your investment goals § We will design a mutual fund portfolio based on your investment objectives. § We will implement the agreed upon strategy to optimize your portfolio returns. 29

How It Works-Initial Stage § You define your investment goals § We will design a mutual fund portfolio based on your investment objectives. § We will implement the agreed upon strategy to optimize your portfolio returns. 29

How It Works-Continuous basis § Continuous monitoring of the performance and progress of portfolio. § Regular monthly reporting. § Refine strategy if required and portfolio rebalancing. § Prompt implementation of the strategy so your money does not stay idle. 30

How It Works-Continuous basis § Continuous monitoring of the performance and progress of portfolio. § Regular monthly reporting. § Refine strategy if required and portfolio rebalancing. § Prompt implementation of the strategy so your money does not stay idle. 30

Procedures § NRI will open an NRE account with the funds repatriated into India. § These funds will be utilized for mutual fund investment in India. § P. N. Vijay Financial Services will decide the strategy for investments. 31

Procedures § NRI will open an NRE account with the funds repatriated into India. § These funds will be utilized for mutual fund investment in India. § P. N. Vijay Financial Services will decide the strategy for investments. 31

Continued…. Two options available -Client can give mandate letter making Mr P. N. Vijay mandate holder to implement strategy without the loss of time and client intervention. - Client can make one of his known person mandate holder who can execute documents and sign cheques on his behalf. 32

Continued…. Two options available -Client can give mandate letter making Mr P. N. Vijay mandate holder to implement strategy without the loss of time and client intervention. - Client can make one of his known person mandate holder who can execute documents and sign cheques on his behalf. 32

Tax Implications § § Debt Mutual Funds The dividend is fully tax exempt in the hands of investor. Dividend distribution tax at the rate of 14. 02% is deducted by Mutual Fund Houses. Lower Tax Regime From 2003 -04 - TDS applicable on Long term Capital Gain is 22. 44%. TDS applicable on Short term Capital Gain is 33. 44%. 33

Tax Implications § § Debt Mutual Funds The dividend is fully tax exempt in the hands of investor. Dividend distribution tax at the rate of 14. 02% is deducted by Mutual Fund Houses. Lower Tax Regime From 2003 -04 - TDS applicable on Long term Capital Gain is 22. 44%. TDS applicable on Short term Capital Gain is 33. 44%. 33

Tax Implications § § Equity Mutual Funds In equity oriented schemes the benefits are higher. The dividend is fully tax exempt in the hands of investor. So are the long term capital gains. No TDS Only short term capital gains tax is applicable at 11. 22% as TDS. 34

Tax Implications § § Equity Mutual Funds In equity oriented schemes the benefits are higher. The dividend is fully tax exempt in the hands of investor. So are the long term capital gains. No TDS Only short term capital gains tax is applicable at 11. 22% as TDS. 34

We understand that your money matters to you, It does for us too. We are committed to do our utmost so that you get the best out of it. 35

We understand that your money matters to you, It does for us too. We are committed to do our utmost so that you get the best out of it. 35

THANK YOU 36

THANK YOU 36