POOL4TOOL - Sellside Pitch .pptx

- Количество слайдов: 48

POOL 4 TOOL AG Strategic considerations for an optimized exit

POOL 4 TOOL AG Strategic considerations for an optimized exit

Agenda 1 Introduction • • 2 Investment case • 3 Potential buyers universe and preliminary valuation considerations 4 Process considerations • 5 Mandate proposal • 6 Appendix • 2

Agenda 1 Introduction • • 2 Investment case • 3 Potential buyers universe and preliminary valuation considerations 4 Process considerations • 5 Mandate proposal • 6 Appendix • 2

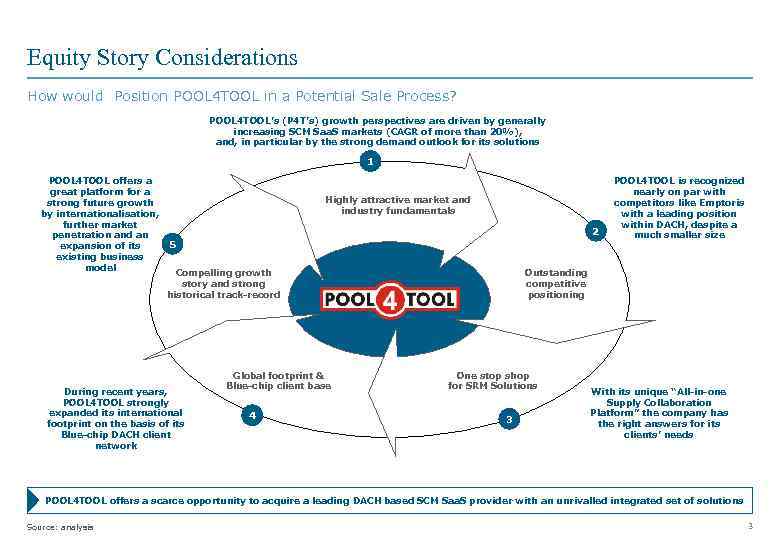

Equity Story Considerations How would Position POOL 4 TOOL in a Potential Sale Process? POOL 4 TOOL’s (P 4 T’s) growth perspectives are driven by generally increasing SCM Saa. S markets (CAGR of more than 20%), and, in particular by the strong demand outlook for its solutions 1 POOL 4 TOOL offers a great platform for a strong future growth by internationalisation, further market penetration and an expansion of its existing business model Highly attractive market and industry fundamentals 2 5 Compelling growth story and strong historical track-record During recent years, POOL 4 TOOL strongly expanded its international footprint on the basis of its Blue-chip DACH client network Global footprint & Blue-chip client base 4 POOL 4 TOOL is recognized nearly on par with competitors like Emptoris with a leading position within DACH, despite a much smaller size Outstanding competitive positioning One stop shop for SRM Solutions 3 With its unique “All-in-one Supply Collaboration Platform” the company has the right answers for its clients’ needs POOL 4 TOOL offers a scarce opportunity to acquire a leading DACH based SCM Saa. S provider with an unrivalled integrated set of solutions Source: analysis 3

Equity Story Considerations How would Position POOL 4 TOOL in a Potential Sale Process? POOL 4 TOOL’s (P 4 T’s) growth perspectives are driven by generally increasing SCM Saa. S markets (CAGR of more than 20%), and, in particular by the strong demand outlook for its solutions 1 POOL 4 TOOL offers a great platform for a strong future growth by internationalisation, further market penetration and an expansion of its existing business model Highly attractive market and industry fundamentals 2 5 Compelling growth story and strong historical track-record During recent years, POOL 4 TOOL strongly expanded its international footprint on the basis of its Blue-chip DACH client network Global footprint & Blue-chip client base 4 POOL 4 TOOL is recognized nearly on par with competitors like Emptoris with a leading position within DACH, despite a much smaller size Outstanding competitive positioning One stop shop for SRM Solutions 3 With its unique “All-in-one Supply Collaboration Platform” the company has the right answers for its clients’ needs POOL 4 TOOL offers a scarce opportunity to acquire a leading DACH based SCM Saa. S provider with an unrivalled integrated set of solutions Source: analysis 3

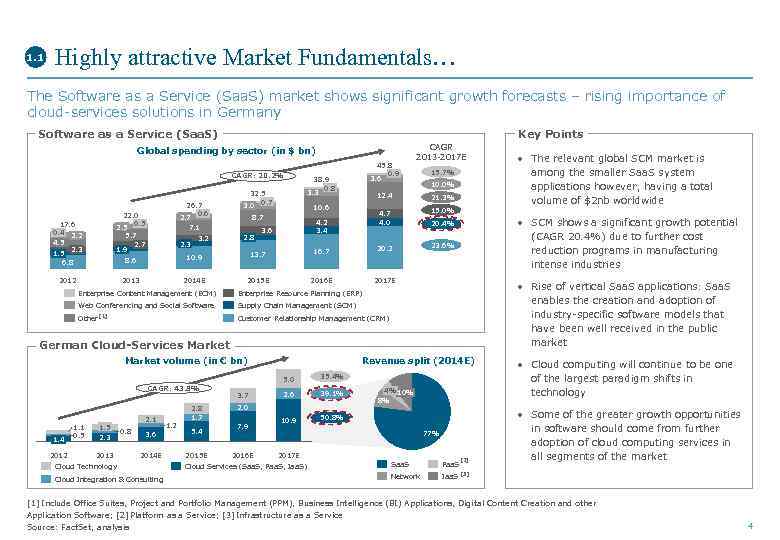

1. 1 Highly attractive Market Fundamentals… The Software as a Service (Saa. S) market shows significant growth forecasts – rising importance of cloud-services solutions in Germany Software as a Service (Saa. S) Key Points Global spending by sector (in $ bn) CAGR: 20. 2% 26. 7 2. 7 0. 6 22. 0 2. 5 0. 5 17. 6 0. 4 2. 2 4. 5 2. 3 1. 5 6. 8 2. 3 3. 2 8. 6 2013 2012 2014 E 13. 7 Enterprise Content Management (ECM) 2015 E 2016 E 21. 3% 23. 6% • SCM shows a significant growth potential (CAGR 20. 4%) due to further cost reduction programs in manufacturing intense industries 20. 4% 2017 E • Rise of vertical Saa. S applications: Saa. S enables the creation and adoption of industry-specific software models that have been well received in the public market Enterprise Resource Planning (ERP) Web Conferencing and Social Software Supply Chain Management (SCM) Other [1] Customer Relationship Management (CRM) German Cloud-Services Market volume (in € bn) Revenue split (2014 E) 5. 0 CAGR: 43. 8% 1. 4 2012 1. 1 0. 5 1. 5 2. 3 2013 2. 1 0. 8 3. 6 2014 E Cloud Technology Cloud Integration & Consulting 1. 2 2. 8 1. 7 5. 4 2015 E 3. 7 35. 4% 2. 6 39. 1% 10. 9 50. 8% 2. 0 7. 9 2016 E 4% 10% 8% 77% 2017 E Cloud Services (Saa. S, Paa. S, Iaa. S) • The relevant global SCM market is among the smaller Saa. S system applications however, having a total volume of $2 nb worldwide 15. 0% 20. 2 16. 7 10. 9 10. 0% 4. 7 4. 0 4. 2 3. 4 3. 6 15. 7% 12. 4 10. 6 8. 7 2. 8 38. 9 0. 8 3. 3 32. 5 0. 7 3. 0 7. 1 5. 7 2. 7 1. 9 45. 8 0. 9 3. 6 CAGR 2013 -2017 E Saa. S Paa. S Network Iaa. S [2] • Cloud computing will continue to be one of the largest paradigm shifts in technology • Some of the greater growth opportunities in software should come from further adoption of cloud computing services in all segments of the market [3] [1] Include Office Suites, Project and Portfolio Management (PPM), Business Intelligence (BI) Applications, Digital Content Creation and other Application Software; [2] Platform as a Service; [3] Infrastructure as a Service Source: Fact. Set, analysis 4

1. 1 Highly attractive Market Fundamentals… The Software as a Service (Saa. S) market shows significant growth forecasts – rising importance of cloud-services solutions in Germany Software as a Service (Saa. S) Key Points Global spending by sector (in $ bn) CAGR: 20. 2% 26. 7 2. 7 0. 6 22. 0 2. 5 0. 5 17. 6 0. 4 2. 2 4. 5 2. 3 1. 5 6. 8 2. 3 3. 2 8. 6 2013 2012 2014 E 13. 7 Enterprise Content Management (ECM) 2015 E 2016 E 21. 3% 23. 6% • SCM shows a significant growth potential (CAGR 20. 4%) due to further cost reduction programs in manufacturing intense industries 20. 4% 2017 E • Rise of vertical Saa. S applications: Saa. S enables the creation and adoption of industry-specific software models that have been well received in the public market Enterprise Resource Planning (ERP) Web Conferencing and Social Software Supply Chain Management (SCM) Other [1] Customer Relationship Management (CRM) German Cloud-Services Market volume (in € bn) Revenue split (2014 E) 5. 0 CAGR: 43. 8% 1. 4 2012 1. 1 0. 5 1. 5 2. 3 2013 2. 1 0. 8 3. 6 2014 E Cloud Technology Cloud Integration & Consulting 1. 2 2. 8 1. 7 5. 4 2015 E 3. 7 35. 4% 2. 6 39. 1% 10. 9 50. 8% 2. 0 7. 9 2016 E 4% 10% 8% 77% 2017 E Cloud Services (Saa. S, Paa. S, Iaa. S) • The relevant global SCM market is among the smaller Saa. S system applications however, having a total volume of $2 nb worldwide 15. 0% 20. 2 16. 7 10. 9 10. 0% 4. 7 4. 0 4. 2 3. 4 3. 6 15. 7% 12. 4 10. 6 8. 7 2. 8 38. 9 0. 8 3. 3 32. 5 0. 7 3. 0 7. 1 5. 7 2. 7 1. 9 45. 8 0. 9 3. 6 CAGR 2013 -2017 E Saa. S Paa. S Network Iaa. S [2] • Cloud computing will continue to be one of the largest paradigm shifts in technology • Some of the greater growth opportunities in software should come from further adoption of cloud computing services in all segments of the market [3] [1] Include Office Suites, Project and Portfolio Management (PPM), Business Intelligence (BI) Applications, Digital Content Creation and other Application Software; [2] Platform as a Service; [3] Infrastructure as a Service Source: Fact. Set, analysis 4

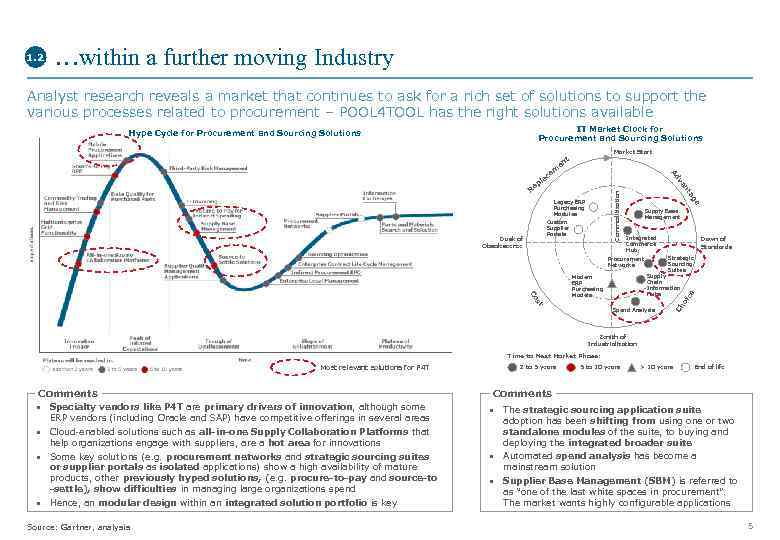

1. 2 …within a further moving Industry Analyst research reveals a market that continues to ask for a rich set of solutions to support the various processes related to procurement – POOL 4 TOOL has the right solutions available IT Market Clock for Procurement and Sourcing Solutions Market Start t en em Supply Base Management Integrated Commerce Hub Dawn of Standards Strategic Sourcing Suites Procurement Networks oi st Co Supply Chain Information Hubs Modern ERP Purchasing Models ce Commoditization Dusk of Obsolescence e Custom Supplier Portals ag Legacy ERP Purchasing Modules nt va R Ad ac l ep Spend Analysis Ch Hype Cycle for Procurement and Sourcing Solutions Zenith of Industrialization Time to Next Market Phase: Most relevant solutions for P 4 T Comments • Specialty vendors like P 4 T are primary drivers of innovation, although some ERP vendors (including Oracle and SAP) have competitive offerings in several areas • Cloud-enabled solutions such as all-in-one Supply Collaboration Platforms that help organizations engage with suppliers, are a hot area for innovations • Some key solutions (e. g. procurement networks and strategic sourcing suites or supplier portals as isolated applications) show a high availability of mature products, other previously hyped solutions, (e. g. procure-to-pay and source-to -settle), show difficulties in managing large organizations spend • Hence, an modular design within an integrated solution portfolio is key Source: Gartner, analysis 2 to 5 years 5 to 10 years > 10 years End of life Comments • The strategic sourcing application suite adoption has been shifting from using one or two standalone modules of the suite, to buying and deploying the integrated broader suite • Automated spend analysis has become a mainstream solution • Supplier Base Management (SBM) is referred to as “one of the last white spaces in procurement”. The market wants highly configurable applications 5

1. 2 …within a further moving Industry Analyst research reveals a market that continues to ask for a rich set of solutions to support the various processes related to procurement – POOL 4 TOOL has the right solutions available IT Market Clock for Procurement and Sourcing Solutions Market Start t en em Supply Base Management Integrated Commerce Hub Dawn of Standards Strategic Sourcing Suites Procurement Networks oi st Co Supply Chain Information Hubs Modern ERP Purchasing Models ce Commoditization Dusk of Obsolescence e Custom Supplier Portals ag Legacy ERP Purchasing Modules nt va R Ad ac l ep Spend Analysis Ch Hype Cycle for Procurement and Sourcing Solutions Zenith of Industrialization Time to Next Market Phase: Most relevant solutions for P 4 T Comments • Specialty vendors like P 4 T are primary drivers of innovation, although some ERP vendors (including Oracle and SAP) have competitive offerings in several areas • Cloud-enabled solutions such as all-in-one Supply Collaboration Platforms that help organizations engage with suppliers, are a hot area for innovations • Some key solutions (e. g. procurement networks and strategic sourcing suites or supplier portals as isolated applications) show a high availability of mature products, other previously hyped solutions, (e. g. procure-to-pay and source-to -settle), show difficulties in managing large organizations spend • Hence, an modular design within an integrated solution portfolio is key Source: Gartner, analysis 2 to 5 years 5 to 10 years > 10 years End of life Comments • The strategic sourcing application suite adoption has been shifting from using one or two standalone modules of the suite, to buying and deploying the integrated broader suite • Automated spend analysis has become a mainstream solution • Supplier Base Management (SBM) is referred to as “one of the last white spaces in procurement”. The market wants highly configurable applications 5

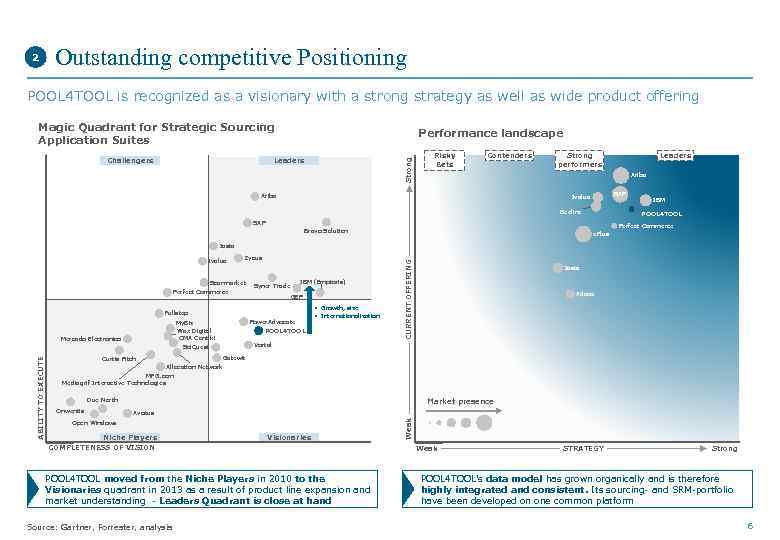

2 Outstanding competitive Positioning POOL 4 TOOL is recognized as a visionary with a strong strategy as well as wide product offering Magic Quadrant for Strategic Sourcing Application Suites Leaders Strong Challengers Performance landscape Risky Bets Contenders Strong performers Leaders Ariba SAP Ivalua Beeline IBM POOL 4 TOOL SAP Perfect Commerce Bravo Solution e. Plus Ivalua Zycus Scanmarket Perfect Commerce Syner Trade IBM (Emptoris) GEP Fullstep Power. Advocate POOL 4 TOOL My. Biz Wax Digital CMA Contiki Mercado Electronico Adaco Gatewit Allocation Network MFG. com Mediagrif Interactive Technologies Market presence Due North Onwentis Avotus Open Windows Niche Players COMPLETENESS OF VISION Visionaries POOL 4 TOOL moved from the Niche Players in 2010 to the Visionaries quadrant in 2013 as a result of product line expansion and market understanding - Leaders Quadrant is close at hand Source: Gartner, Forrester, analysis Weak ABILITY TO EXECUTE Iasta Vortal Sci. Quest Curtis Fitch • Growth, size • Internationalization CURRENT OFFERING Iasta Weak STRATEGY Strong POOL 4 TOOL’s data model has grown organically and is therefore highly integrated and consistent. Its sourcing- and SRM-portfolio have been developed on one common platform 6

2 Outstanding competitive Positioning POOL 4 TOOL is recognized as a visionary with a strong strategy as well as wide product offering Magic Quadrant for Strategic Sourcing Application Suites Leaders Strong Challengers Performance landscape Risky Bets Contenders Strong performers Leaders Ariba SAP Ivalua Beeline IBM POOL 4 TOOL SAP Perfect Commerce Bravo Solution e. Plus Ivalua Zycus Scanmarket Perfect Commerce Syner Trade IBM (Emptoris) GEP Fullstep Power. Advocate POOL 4 TOOL My. Biz Wax Digital CMA Contiki Mercado Electronico Adaco Gatewit Allocation Network MFG. com Mediagrif Interactive Technologies Market presence Due North Onwentis Avotus Open Windows Niche Players COMPLETENESS OF VISION Visionaries POOL 4 TOOL moved from the Niche Players in 2010 to the Visionaries quadrant in 2013 as a result of product line expansion and market understanding - Leaders Quadrant is close at hand Source: Gartner, Forrester, analysis Weak ABILITY TO EXECUTE Iasta Vortal Sci. Quest Curtis Fitch • Growth, size • Internationalization CURRENT OFFERING Iasta Weak STRATEGY Strong POOL 4 TOOL’s data model has grown organically and is therefore highly integrated and consistent. Its sourcing- and SRM-portfolio have been developed on one common platform 6

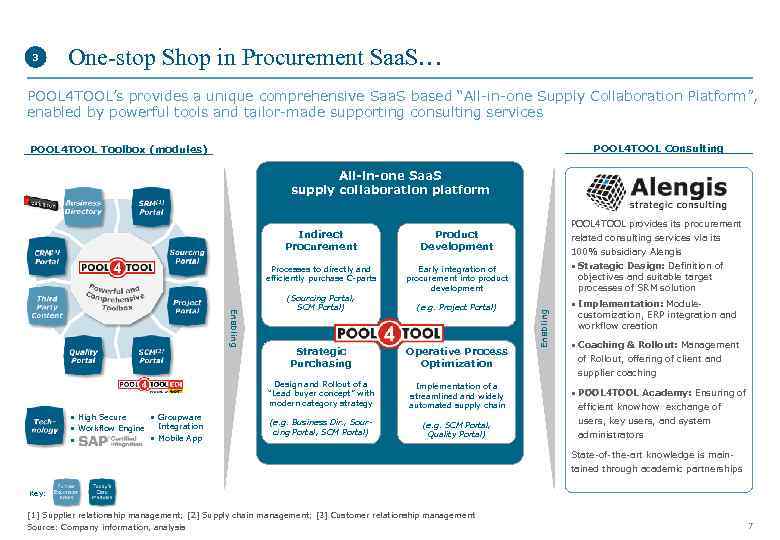

3 One-stop Shop in Procurement Saa. S… POOL 4 TOOL’s provides a unique comprehensive Saa. S based “All-in-one Supply Collaboration Platform”, enabled by powerful tools and tailor-made supporting consulting services POOL 4 TOOL Consulting POOL 4 TOOL Toolbox (modules) All-in-one Saa. S supply collaboration platform Processes to directly and efficiently purchase C-parts Early integration of procurement into product development Enabling (Sourcing Portal, SCM Portal) (e. g. Project Portal) Strategic Purchasing Operative Process Optimization Design and Rollout of a “Lead buyer concept” with modern category strategy • High Secure • Groupware Integration • Workflow Engine • Mobile App • POOL 4 TOOL provides its procurement Product Development Implementation of a streamlined and widely automated supply chain (e. g. Business Dir. , Sourcing Portal, SCM Portal) (e. g. SCM Portal, Quality Portal) related consulting services via its 100% subsidiary Alengis • Strategic Design: Definition of objectives and suitable target processes of SRM solution Enabling Indirect Procurement • Implementation: Module- customization, ERP integration and workflow creation • Coaching & Rollout: Management of Rollout, offering of client and supplier coaching • POOL 4 TOOL Academy: Ensuring of efficient knowhow exchange of users, key users, and system administrators State-of-the-art knowledge is maintained through academic partnerships Key: [1] Supplier relationship management; [2] Supply chain management; [3] Customer relationship management Source: Company information, analysis 7

3 One-stop Shop in Procurement Saa. S… POOL 4 TOOL’s provides a unique comprehensive Saa. S based “All-in-one Supply Collaboration Platform”, enabled by powerful tools and tailor-made supporting consulting services POOL 4 TOOL Consulting POOL 4 TOOL Toolbox (modules) All-in-one Saa. S supply collaboration platform Processes to directly and efficiently purchase C-parts Early integration of procurement into product development Enabling (Sourcing Portal, SCM Portal) (e. g. Project Portal) Strategic Purchasing Operative Process Optimization Design and Rollout of a “Lead buyer concept” with modern category strategy • High Secure • Groupware Integration • Workflow Engine • Mobile App • POOL 4 TOOL provides its procurement Product Development Implementation of a streamlined and widely automated supply chain (e. g. Business Dir. , Sourcing Portal, SCM Portal) (e. g. SCM Portal, Quality Portal) related consulting services via its 100% subsidiary Alengis • Strategic Design: Definition of objectives and suitable target processes of SRM solution Enabling Indirect Procurement • Implementation: Module- customization, ERP integration and workflow creation • Coaching & Rollout: Management of Rollout, offering of client and supplier coaching • POOL 4 TOOL Academy: Ensuring of efficient knowhow exchange of users, key users, and system administrators State-of-the-art knowledge is maintained through academic partnerships Key: [1] Supplier relationship management; [2] Supply chain management; [3] Customer relationship management Source: Company information, analysis 7

4 …for a global Blue-chip Client Network With its global reach, POOL 4 TOOL will be able to participate in the prospected growth of cloud services Overview of POOL 4 TOOL’s Global Footprint and Key Customers Worldwide Comments • Overall, POOL 4 TOOL serves more than 200 customers worldwide • The company has a leading position in its target market, mostly addressing: Stuttgart Farmington Hills - DACH based Munich - manufacturers Paris - with revenues from € 200 m Vienna up to € 10 bn Belgrade • Initial historical steps of Singapore Headquarter • Additionally the international Business location footprint enables P 4 T to “think gobally, but act locally” Countries with high POOL 4 TOOL user frequency Countries with POOL 4 TOOL users European Customers Source: Company information, analysis internationalization were based on a “follow-yourcustomer approach” however, meanwhile the company developed its own international client network • POOL 4 TOOL’s Top-10 customers account for 40. 1% of revenues Germany Austria Switzerland Belgium 8

4 …for a global Blue-chip Client Network With its global reach, POOL 4 TOOL will be able to participate in the prospected growth of cloud services Overview of POOL 4 TOOL’s Global Footprint and Key Customers Worldwide Comments • Overall, POOL 4 TOOL serves more than 200 customers worldwide • The company has a leading position in its target market, mostly addressing: Stuttgart Farmington Hills - DACH based Munich - manufacturers Paris - with revenues from € 200 m Vienna up to € 10 bn Belgrade • Initial historical steps of Singapore Headquarter • Additionally the international Business location footprint enables P 4 T to “think gobally, but act locally” Countries with high POOL 4 TOOL user frequency Countries with POOL 4 TOOL users European Customers Source: Company information, analysis internationalization were based on a “follow-yourcustomer approach” however, meanwhile the company developed its own international client network • POOL 4 TOOL’s Top-10 customers account for 40. 1% of revenues Germany Austria Switzerland Belgium 8

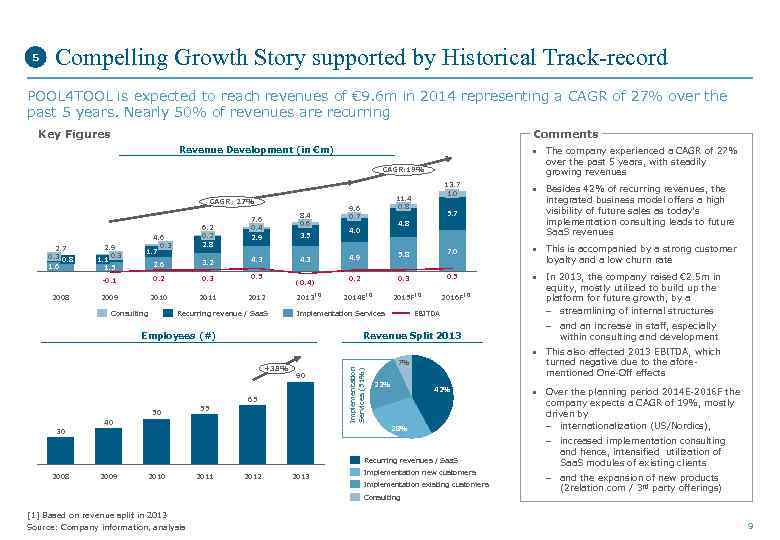

5 Compelling Growth Story supported by Historical Track-record POOL 4 TOOL is expected to reach revenues of € 9. 6 m in 2014 representing a CAGR of 27% over the past 5 years. Nearly 50% of revenues are recurring Key Figures Comments Revenue Development (in €m) • The company experienced a CAGR of 27% over the past 5 years, with steadily growing revenues CAGR: 19% CAGR: 27% 2. 7 0. 3 0. 8 1. 6 2. 9 0. 3 1. 1 1. 5 6. 2 0. 2 2. 8 4. 6 0. 3 1. 7 4. 3 -0. 1 2008 3. 2 0. 3 0. 5 2009 2010 2011 2012 Consulting [1] 5. 8 7. 0 • This is accompanied by a strong customer 0. 2 (0. 4) Recurring revenue / Saa. S 0. 3 0. 5 • In 2013, the company raised € 2. 5 m in 2014 E [1] 2015 F Implementation Services Employees (#) 5. 7 integrated business model offers a high visibility of future sales as today’s implementation consulting leads to future Saa. S revenues 4. 9 4. 3 2013 • Besides 42% of recurring revenues, the 4. 8 4. 0 3. 5 2. 6 11. 4 0. 8 9. 6 0. 7 8. 4 0. 6 7. 6 0. 4 2. 9 13. 7 1. 0 [1] 2016 F loyalty and a low churn rate [1] EBITDA Revenue Split 2013 equity, mostly utilized to build up the platform for future growth, by a - streamlining of internal structures - and an increase in staff, especially within consulting and development • This also affected 2013 EBITDA, which 90 65 50 55 40 Implementation Services (51%) +38% turned negative due to the aforementioned One-Off effects 7% 23% 42% 28% 30 company expects a CAGR of 19%, mostly driven by - internationalization (US/Nordics), - increased implementation consulting Recurring revenues / Saa. S 2008 • Over the planning period 2014 E-2016 F the 2009 2010 2011 2012 2013 Implementation new customers Implementation existing customers Consulting [1] Based on revenue split in 2013 Source: Company information, analysis and hence, intensified utilization of Saa. S modules of existing clients - and the expansion of new products (2 relation. com / 3 rd party offerings) 9

5 Compelling Growth Story supported by Historical Track-record POOL 4 TOOL is expected to reach revenues of € 9. 6 m in 2014 representing a CAGR of 27% over the past 5 years. Nearly 50% of revenues are recurring Key Figures Comments Revenue Development (in €m) • The company experienced a CAGR of 27% over the past 5 years, with steadily growing revenues CAGR: 19% CAGR: 27% 2. 7 0. 3 0. 8 1. 6 2. 9 0. 3 1. 1 1. 5 6. 2 0. 2 2. 8 4. 6 0. 3 1. 7 4. 3 -0. 1 2008 3. 2 0. 3 0. 5 2009 2010 2011 2012 Consulting [1] 5. 8 7. 0 • This is accompanied by a strong customer 0. 2 (0. 4) Recurring revenue / Saa. S 0. 3 0. 5 • In 2013, the company raised € 2. 5 m in 2014 E [1] 2015 F Implementation Services Employees (#) 5. 7 integrated business model offers a high visibility of future sales as today’s implementation consulting leads to future Saa. S revenues 4. 9 4. 3 2013 • Besides 42% of recurring revenues, the 4. 8 4. 0 3. 5 2. 6 11. 4 0. 8 9. 6 0. 7 8. 4 0. 6 7. 6 0. 4 2. 9 13. 7 1. 0 [1] 2016 F loyalty and a low churn rate [1] EBITDA Revenue Split 2013 equity, mostly utilized to build up the platform for future growth, by a - streamlining of internal structures - and an increase in staff, especially within consulting and development • This also affected 2013 EBITDA, which 90 65 50 55 40 Implementation Services (51%) +38% turned negative due to the aforementioned One-Off effects 7% 23% 42% 28% 30 company expects a CAGR of 19%, mostly driven by - internationalization (US/Nordics), - increased implementation consulting Recurring revenues / Saa. S 2008 • Over the planning period 2014 E-2016 F the 2009 2010 2011 2012 2013 Implementation new customers Implementation existing customers Consulting [1] Based on revenue split in 2013 Source: Company information, analysis and hence, intensified utilization of Saa. S modules of existing clients - and the expansion of new products (2 relation. com / 3 rd party offerings) 9

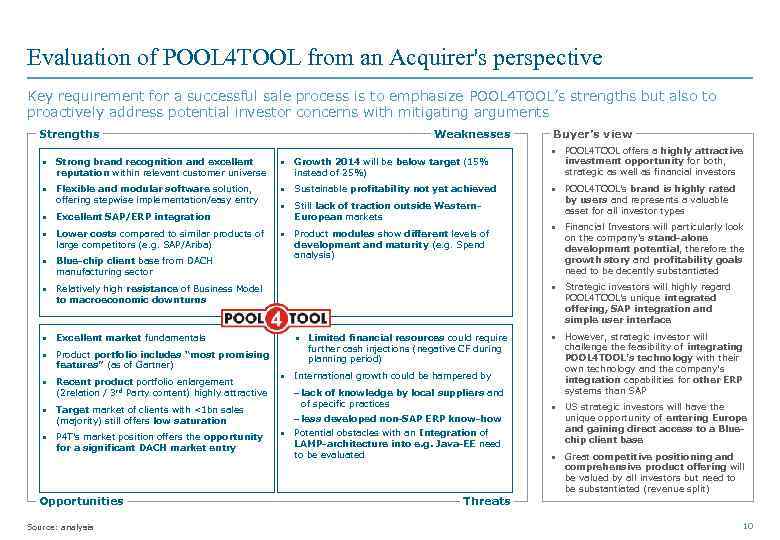

Evaluation of POOL 4 TOOL from an Acquirer's perspective Key requirement for a successful sale process is to emphasize POOL 4 TOOL’s strengths but also to proactively address potential investor concerns with mitigating arguments Strengths Weaknesses • Strong brand recognition and excellent • Growth 2014 will be below target (15% • Flexible and modular software solution, • Sustainable profitability not yet achieved reputation within relevant customer universe offering stepwise implementation/easy entry • Excellent SAP/ERP integration • Lower costs compared to similar products of large competitors (e. g. SAP/Ariba) • Blue-chip client base from DACH instead of 25%) • Still lack of traction outside Western. European markets • Product modules show different levels of development and maturity (e. g. Spend analysis) manufacturing sector features” (as of Gartner) • Recent product portfolio enlargement (2 relation / 3 rd Party content) highly attractive • Target market of clients with <1 bn sales (majority) still offers low saturation • P 4 T’s market position offers the opportunity for a significant DACH market entry Opportunities Source: analysis investment opportunity for both, strategic as well as financial investors • POOL 4 TOOL’s brand is highly rated by users and represents a valuable asset for all investor types • Financial Investors will particularly look on the company’s stand-alone development potential, therefore the growth story and profitability goals need to be decently substantiated POOL 4 TOOL’s unique integrated offering, SAP integration and simple user interface to macroeconomic downturns • Product portfolio includes “most promising • POOL 4 TOOL offers a highly attractive • Strategic investors will highly regard • Relatively high resistance of Business Model • Excellent market fundamentals Buyer’s view • Limited financial resources could require further cash injections (negative CF during planning period) • International growth could be hampered by - lack of knowledge by local suppliers and of specific practices - less developed non-SAP ERP know-how • Potential obstacles with an Integration of LAMP-architecture into e. g. Java-EE need to be evaluated Threats • However, strategic investor will challenge the feasibility of integrating POOL 4 TOOL’s technology with their own technology and the company’s integration capabilities for other ERP systems than SAP • US strategic investors will have the unique opportunity of entering Europe and gaining direct access to a Bluechip client base • Great competitive positioning and comprehensive product offering will be valued by all investors but need to be substantiated (revenue split) 10

Evaluation of POOL 4 TOOL from an Acquirer's perspective Key requirement for a successful sale process is to emphasize POOL 4 TOOL’s strengths but also to proactively address potential investor concerns with mitigating arguments Strengths Weaknesses • Strong brand recognition and excellent • Growth 2014 will be below target (15% • Flexible and modular software solution, • Sustainable profitability not yet achieved reputation within relevant customer universe offering stepwise implementation/easy entry • Excellent SAP/ERP integration • Lower costs compared to similar products of large competitors (e. g. SAP/Ariba) • Blue-chip client base from DACH instead of 25%) • Still lack of traction outside Western. European markets • Product modules show different levels of development and maturity (e. g. Spend analysis) manufacturing sector features” (as of Gartner) • Recent product portfolio enlargement (2 relation / 3 rd Party content) highly attractive • Target market of clients with <1 bn sales (majority) still offers low saturation • P 4 T’s market position offers the opportunity for a significant DACH market entry Opportunities Source: analysis investment opportunity for both, strategic as well as financial investors • POOL 4 TOOL’s brand is highly rated by users and represents a valuable asset for all investor types • Financial Investors will particularly look on the company’s stand-alone development potential, therefore the growth story and profitability goals need to be decently substantiated POOL 4 TOOL’s unique integrated offering, SAP integration and simple user interface to macroeconomic downturns • Product portfolio includes “most promising • POOL 4 TOOL offers a highly attractive • Strategic investors will highly regard • Relatively high resistance of Business Model • Excellent market fundamentals Buyer’s view • Limited financial resources could require further cash injections (negative CF during planning period) • International growth could be hampered by - lack of knowledge by local suppliers and of specific practices - less developed non-SAP ERP know-how • Potential obstacles with an Integration of LAMP-architecture into e. g. Java-EE need to be evaluated Threats • However, strategic investor will challenge the feasibility of integrating POOL 4 TOOL’s technology with their own technology and the company’s integration capabilities for other ERP systems than SAP • US strategic investors will have the unique opportunity of entering Europe and gaining direct access to a Bluechip client base • Great competitive positioning and comprehensive product offering will be valued by all investors but need to be substantiated (revenue split) 10

Agenda 1 Introduction • • 2 Investment case • 3 Potential buyers universe and preliminary valuation considerations 4 Process considerations • 5 Mandate proposal • 6 Appendix • 11

Agenda 1 Introduction • • 2 Investment case • 3 Potential buyers universe and preliminary valuation considerations 4 Process considerations • 5 Mandate proposal • 6 Appendix • 11

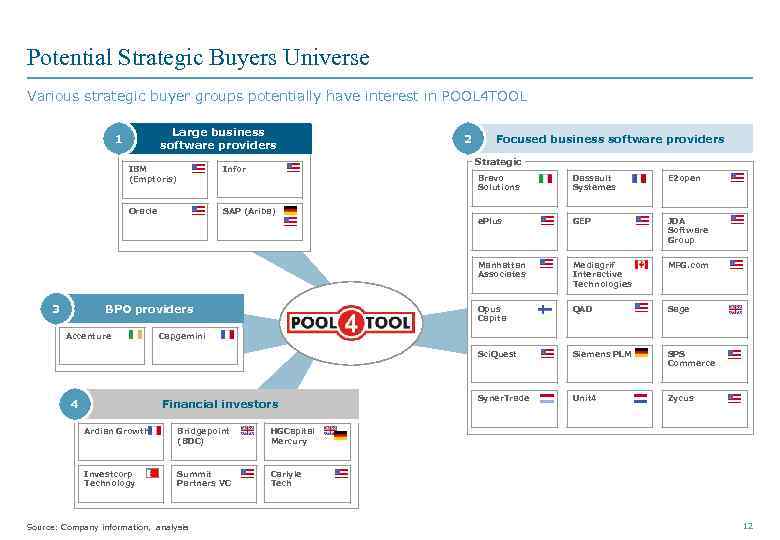

Potential Strategic Buyers Universe Various strategic buyer groups potentially have interest in POOL 4 TOOL Large business software providers 1 2 Focused business software providers Strategic IBM (Emptoris) Infor Oracle SAP (Ariba) 4 GEP JDA Software Group Mediagrif Interactive Technologies MFG. com Opus Capita QAD Sage Sci. Quest Accenture E 2 open Manhattan Associates BPO providers Dassault Systemes e. Plus 3 Bravo Solutions Siemens PLM SPS Commerce Syner. Trade Unit 4 Zycus Capgemini Financial investors Ardian Growth Bridgepoint (BDC) HGCapital Mercury Investcorp Technology Summit Partners VC Carlyle Tech Source: Company information, analysis 12

Potential Strategic Buyers Universe Various strategic buyer groups potentially have interest in POOL 4 TOOL Large business software providers 1 2 Focused business software providers Strategic IBM (Emptoris) Infor Oracle SAP (Ariba) 4 GEP JDA Software Group Mediagrif Interactive Technologies MFG. com Opus Capita QAD Sage Sci. Quest Accenture E 2 open Manhattan Associates BPO providers Dassault Systemes e. Plus 3 Bravo Solutions Siemens PLM SPS Commerce Syner. Trade Unit 4 Zycus Capgemini Financial investors Ardian Growth Bridgepoint (BDC) HGCapital Mercury Investcorp Technology Summit Partners VC Carlyle Tech Source: Company information, analysis 12

![Potential Strategic Buyers Universe (1/6) - Large business software providers Company Country Available KPIs[1] Potential Strategic Buyers Universe (1/6) - Large business software providers Company Country Available KPIs[1]](https://present5.com/presentation/92062072_416917759/image-13.jpg) Potential Strategic Buyers Universe (1/6) - Large business software providers Company Country Available KPIs[1] • Revenues: € 410 m Descriptions • • Employees: 3, 000 • EBITDA: € 35 m • EBITDA margin: 8% • • • Revenues: ~€ 80 m • Employees: ~750 • • • Revenues: € 2, 041 m • Employees: 12, 920 • • • EBITDA: € 566 m • EBITDA margin: 28% • Revenues: € 28, 320 m • Employees: 122, 000 • EBITDA: € 13, 223 m • EBITDA margin: 47% • Market Cap: € 146, 028 m Strong potential buyer • • Offers a complete industry-agnostic S 2 S solution, global supplier network for discovery, e-invoicing and e-catalogs Java EE-architected multitenant Saa. S SAP is positioning Ariba Saa. S solutions as its cloud procurement product line Specialty procurement solution vendor Offers strategic supply, category spend and contract management solutions Java EE-architected solutions; IBM DB 2 and Oracle Databases are supported Innovative virtual supply master solution and global client database Vendor of cloud-based ERP software Beside ERP, business solutions include CRM, SCM, PLM and enterprise asset, financial and performance management SAP integration opportunity Provider of enterprise software, computer hardware products and cloud solutions Java EE-architected multitenant Saa. S for running the entire Web. Logic Server cluster Offering complete technology stack Similar products/recent Saa. S transactions [1] Latest available figures Source: Company information, Gartner, Fact. Set, analysis • • • Fit SAP acquired Concur (travel and expense mgt. ) in Sep 2014 for € 7. 6 bn Ariba acquired by SAP in Oct 2012 for € 3. 5 bn Ariba acquired French b-process (einvoice network) in Oct 2011 and entered into strategic partnership with US based Med. Assets in Apr 2013 • • Acquired by IBM in Feb 2012 Acquired Xcitec (SRM Solutions, Munich based) in May 2011 • • > 20 acquisitions in the last 8 years Interested in adjacent sectors to ERP e. g. sales, procurement, TDC and acquisitions for cloud based sales portals • 1 Large business software providers • • Relevant Transactions Acquired MICROS Systems (enterprise information solutions) in Sep 2014 for € 4, 505 m Acquired Responsys (marketing solutions) in Feb 2014 for € 1, 386 m Acquired Right. Now (CRM Saa. S) in Oct 2011 • • Saa. S solutions/recent sector transactions Outside the box 13

Potential Strategic Buyers Universe (1/6) - Large business software providers Company Country Available KPIs[1] • Revenues: € 410 m Descriptions • • Employees: 3, 000 • EBITDA: € 35 m • EBITDA margin: 8% • • • Revenues: ~€ 80 m • Employees: ~750 • • • Revenues: € 2, 041 m • Employees: 12, 920 • • • EBITDA: € 566 m • EBITDA margin: 28% • Revenues: € 28, 320 m • Employees: 122, 000 • EBITDA: € 13, 223 m • EBITDA margin: 47% • Market Cap: € 146, 028 m Strong potential buyer • • Offers a complete industry-agnostic S 2 S solution, global supplier network for discovery, e-invoicing and e-catalogs Java EE-architected multitenant Saa. S SAP is positioning Ariba Saa. S solutions as its cloud procurement product line Specialty procurement solution vendor Offers strategic supply, category spend and contract management solutions Java EE-architected solutions; IBM DB 2 and Oracle Databases are supported Innovative virtual supply master solution and global client database Vendor of cloud-based ERP software Beside ERP, business solutions include CRM, SCM, PLM and enterprise asset, financial and performance management SAP integration opportunity Provider of enterprise software, computer hardware products and cloud solutions Java EE-architected multitenant Saa. S for running the entire Web. Logic Server cluster Offering complete technology stack Similar products/recent Saa. S transactions [1] Latest available figures Source: Company information, Gartner, Fact. Set, analysis • • • Fit SAP acquired Concur (travel and expense mgt. ) in Sep 2014 for € 7. 6 bn Ariba acquired by SAP in Oct 2012 for € 3. 5 bn Ariba acquired French b-process (einvoice network) in Oct 2011 and entered into strategic partnership with US based Med. Assets in Apr 2013 • • Acquired by IBM in Feb 2012 Acquired Xcitec (SRM Solutions, Munich based) in May 2011 • • > 20 acquisitions in the last 8 years Interested in adjacent sectors to ERP e. g. sales, procurement, TDC and acquisitions for cloud based sales portals • 1 Large business software providers • • Relevant Transactions Acquired MICROS Systems (enterprise information solutions) in Sep 2014 for € 4, 505 m Acquired Responsys (marketing solutions) in Feb 2014 for € 1, 386 m Acquired Right. Now (CRM Saa. S) in Oct 2011 • • Saa. S solutions/recent sector transactions Outside the box 13

![Potential Strategic Buyers Universe (2/6) - Focused business software providers Company Country Available KPIs[1] Potential Strategic Buyers Universe (2/6) - Focused business software providers Company Country Available KPIs[1]](https://present5.com/presentation/92062072_416917759/image-14.jpg) Potential Strategic Buyers Universe (2/6) - Focused business software providers Company Country Available KPIs[1] Descriptions • • Revenues: € 65 m • • • Employees: 500 • EBITDA: € 8 m • • Revenues: € 2, 187 m • • Employees: 10, 654 • EBITDA: € 631 m • • EBITDA margin: 29% • Market Cap: € 12, 486 m • Revenues: € 56 m • Employees: 444 • • • EBITDA: €-16 m • EBITDA margin: -30% • • Market Cap: € 152 m • Revenues: € 793 m • • Employees: 934 • EBITDA: € 63 m • EBITDA margin: 8% • Market Cap: € 417 m Strong potential buyer • Specialised strategic sourcing application suite and services vendor Java EE-architected multitenant Saa. S • Spend analysis, e-sourcing, SBM and contract management Top 5 player in spend analysis, top 3 for public sector sourcing and optimisation Provider of product development software • solutions and consulting services End-to-end software applications and services based on 3 DEXPERIENCE platform for 3 D • construction, engineering, 3 D CAD, modelling, simulation, data and process management Acquired Quintiq (Netherlands based SCM and workforce management Saa. S) in Jul 2014 Intends to internationalize within Europe Provider of cloud-based and on-demand software solutions B 2 B integration capabilities in a Saa. S model Seamless integration with existing planning, execution, and other internal systems Acquired Serus Corp. (inventory, order and contract compliance and SCM) in Jun 2014 for € 26 m Acquired icon-scm (supply chain planning software and Saa. S) in Jul 2013 for € 27 m 2 Acquired Verticalnet (sourcing and supply management) in Oct 2007 for € 11 m Provider of internet-based business-tobusiness supply chain management solutions, technology products and flexible leasing solutions Two business segments: Technology and financing Similar products/recent Saa. S transactions [1] Latest available figures Source: Company information, Gartner, Fact. Set, analysis Fit • • • Focused business software providers • EBITDA margin: 12% Relevant Transactions Acquired Granite Business solutions (data, voice and video communication) in Aug 2014 for € 13 m Saa. S solutions/recent sector transactions Outside the box 14

Potential Strategic Buyers Universe (2/6) - Focused business software providers Company Country Available KPIs[1] Descriptions • • Revenues: € 65 m • • • Employees: 500 • EBITDA: € 8 m • • Revenues: € 2, 187 m • • Employees: 10, 654 • EBITDA: € 631 m • • EBITDA margin: 29% • Market Cap: € 12, 486 m • Revenues: € 56 m • Employees: 444 • • • EBITDA: €-16 m • EBITDA margin: -30% • • Market Cap: € 152 m • Revenues: € 793 m • • Employees: 934 • EBITDA: € 63 m • EBITDA margin: 8% • Market Cap: € 417 m Strong potential buyer • Specialised strategic sourcing application suite and services vendor Java EE-architected multitenant Saa. S • Spend analysis, e-sourcing, SBM and contract management Top 5 player in spend analysis, top 3 for public sector sourcing and optimisation Provider of product development software • solutions and consulting services End-to-end software applications and services based on 3 DEXPERIENCE platform for 3 D • construction, engineering, 3 D CAD, modelling, simulation, data and process management Acquired Quintiq (Netherlands based SCM and workforce management Saa. S) in Jul 2014 Intends to internationalize within Europe Provider of cloud-based and on-demand software solutions B 2 B integration capabilities in a Saa. S model Seamless integration with existing planning, execution, and other internal systems Acquired Serus Corp. (inventory, order and contract compliance and SCM) in Jun 2014 for € 26 m Acquired icon-scm (supply chain planning software and Saa. S) in Jul 2013 for € 27 m 2 Acquired Verticalnet (sourcing and supply management) in Oct 2007 for € 11 m Provider of internet-based business-tobusiness supply chain management solutions, technology products and flexible leasing solutions Two business segments: Technology and financing Similar products/recent Saa. S transactions [1] Latest available figures Source: Company information, Gartner, Fact. Set, analysis Fit • • • Focused business software providers • EBITDA margin: 12% Relevant Transactions Acquired Granite Business solutions (data, voice and video communication) in Aug 2014 for € 13 m Saa. S solutions/recent sector transactions Outside the box 14

![Potential Strategic Buyers Universe (3/6) - Focused business software providers Company Country Available KPIs[1] Potential Strategic Buyers Universe (3/6) - Focused business software providers Company Country Available KPIs[1]](https://present5.com/presentation/92062072_416917759/image-15.jpg) Potential Strategic Buyers Universe (3/6) - Focused business software providers Company Country Available KPIs[1] • Revenues: ~€ 100 m • Employees: 850 Descriptions • • • Employees: 3, 100 • • • EBITDA: € 135 m • • • Revenues: € 346 m • • Employees: 2, 530 • • EBITDA: € 94 m • EBITDA margin: 27% • • Market Cap: € 2, 128 m • Revenues: € 47 m • • Employees: 360 • • EBITDA: € 17 m • EBITDA margin: 36% • Market Cap: € 200 m Strong potential buyer • S 2 S technology and services provider. NET-architected solution Spend analysis, e-sourcing, SBM, CLM, supplier directory and risk management Large service organisation and BPO offering Provider of SCM software solutions Cloud-based Saa. S solutions covering the entire supply chain Offer pricing, yield and demand management Deep industry knowledge and comprehensive service offering • • Acquired by New Mountain Capital (warehouse, inventory and logistics mgmt. ) in Nov 2012 for € 1, 468 m and merged with Red. Prairie Acquired i 2 Technologies (supply chain) in Nov 2009 for € 351 m • Provider of e-commerce solutions to • businesses Java EE-architected multitenant Saa. S, • including e-sourcing, SBM and supplier directory • In the top 5 for SBM and ease of use, no spend analysis and contract repository offered [1] Latest available figures [2] WMS = Warehouse Management System Source: Company information, Gartner, Fact. Set, analysis 2 Acquired Enporion (SCM Saa. S) in Jan 2012 Provider of supply chain commerce solutions Built either on open-source technology or. NET platform Services consist of inventory optimisation, order lifecycle, transportation lifecycle, and warehouse & distribution management Similar products/recent Saa. S transactions Fit no relevant transactions Focused business software providers • Revenues: € 497 m Relevant Transactions Acquired Quebecor Media (online services) in May 2013 for € 63 m Acquired Les. PAC (advertising services) in Nov 2011 for € 72 m Acquired Inter. Trade Systems (SCM collaboration) in Dec 2010 for € 8 m Saa. S solutions/recent sector transactions Outside the box 15

Potential Strategic Buyers Universe (3/6) - Focused business software providers Company Country Available KPIs[1] • Revenues: ~€ 100 m • Employees: 850 Descriptions • • • Employees: 3, 100 • • • EBITDA: € 135 m • • • Revenues: € 346 m • • Employees: 2, 530 • • EBITDA: € 94 m • EBITDA margin: 27% • • Market Cap: € 2, 128 m • Revenues: € 47 m • • Employees: 360 • • EBITDA: € 17 m • EBITDA margin: 36% • Market Cap: € 200 m Strong potential buyer • S 2 S technology and services provider. NET-architected solution Spend analysis, e-sourcing, SBM, CLM, supplier directory and risk management Large service organisation and BPO offering Provider of SCM software solutions Cloud-based Saa. S solutions covering the entire supply chain Offer pricing, yield and demand management Deep industry knowledge and comprehensive service offering • • Acquired by New Mountain Capital (warehouse, inventory and logistics mgmt. ) in Nov 2012 for € 1, 468 m and merged with Red. Prairie Acquired i 2 Technologies (supply chain) in Nov 2009 for € 351 m • Provider of e-commerce solutions to • businesses Java EE-architected multitenant Saa. S, • including e-sourcing, SBM and supplier directory • In the top 5 for SBM and ease of use, no spend analysis and contract repository offered [1] Latest available figures [2] WMS = Warehouse Management System Source: Company information, Gartner, Fact. Set, analysis 2 Acquired Enporion (SCM Saa. S) in Jan 2012 Provider of supply chain commerce solutions Built either on open-source technology or. NET platform Services consist of inventory optimisation, order lifecycle, transportation lifecycle, and warehouse & distribution management Similar products/recent Saa. S transactions Fit no relevant transactions Focused business software providers • Revenues: € 497 m Relevant Transactions Acquired Quebecor Media (online services) in May 2013 for € 63 m Acquired Les. PAC (advertising services) in Nov 2011 for € 72 m Acquired Inter. Trade Systems (SCM collaboration) in Dec 2010 for € 8 m Saa. S solutions/recent sector transactions Outside the box 15

![Potential Strategic Buyers Universe (4/6) - Focused business software providers Company Country Available KPIs[1] Potential Strategic Buyers Universe (4/6) - Focused business software providers Company Country Available KPIs[1]](https://present5.com/presentation/92062072_416917759/image-16.jpg) Potential Strategic Buyers Universe (4/6) - Focused business software providers Company Country Available KPIs[1] Descriptions • • Revenues: € 15 m • Employees: 200 • • Revenues: € 265 m • • Employees: 2100 • Revenues: € 200 m • • Employees: 1, 570 • • EBITDA: € 12 m • EBITDA margin: 6% • Market Cap: € 159 m • Revenues: € 1, 637 m • Employees: 13, 242 • • EBITDA: € 483 m • EBITDA margin: 30% • Market Cap: € 3, 382 m Strong potential buyer • Specialised in direct material sourcing and supplier management for manufacturing and defence industries Java EE-architected Saa. S solution Bid analysis, team scoring, auctions, RFI, excel integration and supplier management Top player in product sourcing functionality 2 Backed by Fidelity Ventures / Jeff Bezos since 2006/2007 Provider of finance process automation software solutions and e-invoicing • Automation solutions include finance & accounting outsourcing, process optimisation and order-to-cash or purchaseto-pay outsourcing offered via BPO or Saa. S Highly acquisitive, but so far only alongside its existing portfolio however, explicitly expressed interest in SCM Saa. S acquisitions Provider of software applications and services to global manufacturing companies Services include ERP, MRP, CRM, supply chain and lean manufacturing business software Two deployment models: On-Premise (Licensed) and On-Demand (Non-licensed) • Acquired Dyna. Sys (supply chain planning and forecasting) in Jun 2012 for € 6 m • >30 transactions in payroll, accounting, distribution software Up to now, not in procurement Business management solutions for small and medium sized businesses Services include accounting, resource planning and payroll software as well as payment processing and CRM Honoured with the European Contact Centre of the Year 2011 award for its customer service Similar products/recent Saa. S transactions [1] Latest available figures Source: Company information, Gartner, Fact. Set, analysis • Fit Focused business software providers • Relevant Transactions • Saa. S solutions/recent sector transactions Outside the box 16

Potential Strategic Buyers Universe (4/6) - Focused business software providers Company Country Available KPIs[1] Descriptions • • Revenues: € 15 m • Employees: 200 • • Revenues: € 265 m • • Employees: 2100 • Revenues: € 200 m • • Employees: 1, 570 • • EBITDA: € 12 m • EBITDA margin: 6% • Market Cap: € 159 m • Revenues: € 1, 637 m • Employees: 13, 242 • • EBITDA: € 483 m • EBITDA margin: 30% • Market Cap: € 3, 382 m Strong potential buyer • Specialised in direct material sourcing and supplier management for manufacturing and defence industries Java EE-architected Saa. S solution Bid analysis, team scoring, auctions, RFI, excel integration and supplier management Top player in product sourcing functionality 2 Backed by Fidelity Ventures / Jeff Bezos since 2006/2007 Provider of finance process automation software solutions and e-invoicing • Automation solutions include finance & accounting outsourcing, process optimisation and order-to-cash or purchaseto-pay outsourcing offered via BPO or Saa. S Highly acquisitive, but so far only alongside its existing portfolio however, explicitly expressed interest in SCM Saa. S acquisitions Provider of software applications and services to global manufacturing companies Services include ERP, MRP, CRM, supply chain and lean manufacturing business software Two deployment models: On-Premise (Licensed) and On-Demand (Non-licensed) • Acquired Dyna. Sys (supply chain planning and forecasting) in Jun 2012 for € 6 m • >30 transactions in payroll, accounting, distribution software Up to now, not in procurement Business management solutions for small and medium sized businesses Services include accounting, resource planning and payroll software as well as payment processing and CRM Honoured with the European Contact Centre of the Year 2011 award for its customer service Similar products/recent Saa. S transactions [1] Latest available figures Source: Company information, Gartner, Fact. Set, analysis • Fit Focused business software providers • Relevant Transactions • Saa. S solutions/recent sector transactions Outside the box 16

![Potential Strategic Buyers Universe (5/6) - Focused business software providers Company Country Available KPIs[1] Potential Strategic Buyers Universe (5/6) - Focused business software providers Company Country Available KPIs[1]](https://present5.com/presentation/92062072_416917759/image-17.jpg) Potential Strategic Buyers Universe (5/6) - Focused business software providers Company Country Available KPIs[1] • Revenues: € 73 m • Employees: 538 • EBITDA: € 5 m • EBITDA margin: 7% Descriptions • • • Acquired Combine. Net (bid analysis and procurement Saa. S) in Sep 2013 for € 33 m Acquired Spend Radar (spend data analytics) in Sep 2012 for € 8 m Acquired Upside Software (contract management) in Aug 2012 for € 18 m • • Revenues: n/a Business unit of Siemens industry automation • segment, offering product lifecycle management and related services Acquired Camstar Systems (manufacturing execution systems) in Oct 2014 for € 126 m • Provides cloud-based SCM to retailers, suppliers, third-party logistics providers and partners Services include order and warehouse management, ERP, packing, shipping and accounting Acquired Leadtec (SCM, EDI software and Saa. S) in Oct 2014 for € 12 m Acquired Edifice Information Management (supply chain Po. S analytics) in Aug 2012 for € 30 m • Employees: n/a • Revenues: € 85 m • Employees: 771 • EBITDA: € 8 m • EBITDA margin: 10% • • Market Cap: € 591 m • • Revenues: € 47 m • Employees: 123 Strong potential buyer Comprehensive procure-to-pay solutions. NET architected sourcing application suite has been built through acquisitions Good support, but customers concern over acquisition-related changes; lack of brand awareness outside the U. S. market Fit • • Offers spend analytics, e-sourcing, SBM, CLM, supplier directory and commodity risk Management Java EE-architected Main focus in the retail, pharmaceutical and consumer packaged goods verticals Similar products/recent Saa. S transactions [1] Latest available figures Source: Company information, Gartner, Fact. Set, analysis • • • 2 Focused business software providers • Market Cap: € 214 m Relevant Transactions Syner. Trade and Nipendo (procure-topay-automation) announce strategic partnership to provide a complete sourcing-to-payment solution in Mar 2014 Saa. S solutions/recent sector transactions Outside the box 17

Potential Strategic Buyers Universe (5/6) - Focused business software providers Company Country Available KPIs[1] • Revenues: € 73 m • Employees: 538 • EBITDA: € 5 m • EBITDA margin: 7% Descriptions • • • Acquired Combine. Net (bid analysis and procurement Saa. S) in Sep 2013 for € 33 m Acquired Spend Radar (spend data analytics) in Sep 2012 for € 8 m Acquired Upside Software (contract management) in Aug 2012 for € 18 m • • Revenues: n/a Business unit of Siemens industry automation • segment, offering product lifecycle management and related services Acquired Camstar Systems (manufacturing execution systems) in Oct 2014 for € 126 m • Provides cloud-based SCM to retailers, suppliers, third-party logistics providers and partners Services include order and warehouse management, ERP, packing, shipping and accounting Acquired Leadtec (SCM, EDI software and Saa. S) in Oct 2014 for € 12 m Acquired Edifice Information Management (supply chain Po. S analytics) in Aug 2012 for € 30 m • Employees: n/a • Revenues: € 85 m • Employees: 771 • EBITDA: € 8 m • EBITDA margin: 10% • • Market Cap: € 591 m • • Revenues: € 47 m • Employees: 123 Strong potential buyer Comprehensive procure-to-pay solutions. NET architected sourcing application suite has been built through acquisitions Good support, but customers concern over acquisition-related changes; lack of brand awareness outside the U. S. market Fit • • Offers spend analytics, e-sourcing, SBM, CLM, supplier directory and commodity risk Management Java EE-architected Main focus in the retail, pharmaceutical and consumer packaged goods verticals Similar products/recent Saa. S transactions [1] Latest available figures Source: Company information, Gartner, Fact. Set, analysis • • • 2 Focused business software providers • Market Cap: € 214 m Relevant Transactions Syner. Trade and Nipendo (procure-topay-automation) announce strategic partnership to provide a complete sourcing-to-payment solution in Mar 2014 Saa. S solutions/recent sector transactions Outside the box 17

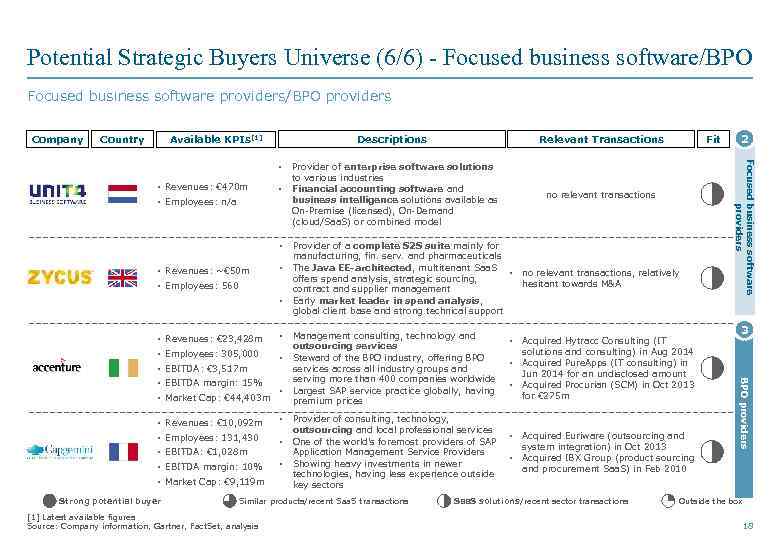

Potential Strategic Buyers Universe (6/6) - Focused business software/BPO Focused business software providers/BPO providers Company Country Available KPIs[1] Descriptions • Revenues: € 470 m • • Employees: n/a • • Revenues: ~€ 50 m • • Employees: 560 • • Revenues: € 23, 428 m • • Employees: 305, 000 • • EBITDA: € 3, 517 m • Market Cap: € 44, 403 m • • Revenues: € 10, 092 m • • Employees: 131, 430 • • EBITDA: € 1, 028 m • EBITDA margin: 10% • Market Cap: € 9, 119 m Strong potential buyer • Provider of a complete S 2 S suite mainly for manufacturing, fin. serv. and pharmaceuticals The Java EE-architected, multitenant Saa. S • offers spend analysis, strategic sourcing, contract and supplier management Early market leader in spend analysis, global client base and strong technical support no relevant transactions, relatively hesitant towards M&A Management consulting, technology and outsourcing services Steward of the BPO industry, offering BPO services across all industry groups and serving more than 400 companies worldwide Largest SAP service practice globally, having premium prices Acquired Hytracc Consulting (IT solutions and consulting) in Aug 2014 Acquired Pure. Apps (IT consulting) in Jun 2014 for an undisclosed amount Acquired Procurian (SCM) in Oct 2013 for € 275 m Provider of consulting, technology, outsourcing and local professional services One of the world’s foremost providers of SAP Application Management Service Providers Showing heavy investments in newer technologies, having less experience outside key sectors Similar products/recent Saa. S transactions [1] Latest available figures Source: Company information, Gartner, Fact. Set, analysis no relevant transactions • • • Acquired Euriware (outsourcing and system integration) in Oct 2013 Acquired IBX Group (product sourcing and procurement Saa. S) in Feb 2010 Saa. S solutions/recent sector transactions 2 3 BPO providers • EBITDA margin: 15% Provider of enterprise software solutions to various industries Financial accounting software and business intelligence solutions available as On-Premise (licensed), On-Demand (cloud/Saa. S) or combined model Fit Focused business software providers • Relevant Transactions Outside the box 18

Potential Strategic Buyers Universe (6/6) - Focused business software/BPO Focused business software providers/BPO providers Company Country Available KPIs[1] Descriptions • Revenues: € 470 m • • Employees: n/a • • Revenues: ~€ 50 m • • Employees: 560 • • Revenues: € 23, 428 m • • Employees: 305, 000 • • EBITDA: € 3, 517 m • Market Cap: € 44, 403 m • • Revenues: € 10, 092 m • • Employees: 131, 430 • • EBITDA: € 1, 028 m • EBITDA margin: 10% • Market Cap: € 9, 119 m Strong potential buyer • Provider of a complete S 2 S suite mainly for manufacturing, fin. serv. and pharmaceuticals The Java EE-architected, multitenant Saa. S • offers spend analysis, strategic sourcing, contract and supplier management Early market leader in spend analysis, global client base and strong technical support no relevant transactions, relatively hesitant towards M&A Management consulting, technology and outsourcing services Steward of the BPO industry, offering BPO services across all industry groups and serving more than 400 companies worldwide Largest SAP service practice globally, having premium prices Acquired Hytracc Consulting (IT solutions and consulting) in Aug 2014 Acquired Pure. Apps (IT consulting) in Jun 2014 for an undisclosed amount Acquired Procurian (SCM) in Oct 2013 for € 275 m Provider of consulting, technology, outsourcing and local professional services One of the world’s foremost providers of SAP Application Management Service Providers Showing heavy investments in newer technologies, having less experience outside key sectors Similar products/recent Saa. S transactions [1] Latest available figures Source: Company information, Gartner, Fact. Set, analysis no relevant transactions • • • Acquired Euriware (outsourcing and system integration) in Oct 2013 Acquired IBX Group (product sourcing and procurement Saa. S) in Feb 2010 Saa. S solutions/recent sector transactions 2 3 BPO providers • EBITDA margin: 15% Provider of enterprise software solutions to various industries Financial accounting software and business intelligence solutions available as On-Premise (licensed), On-Demand (cloud/Saa. S) or combined model Fit Focused business software providers • Relevant Transactions Outside the box 18

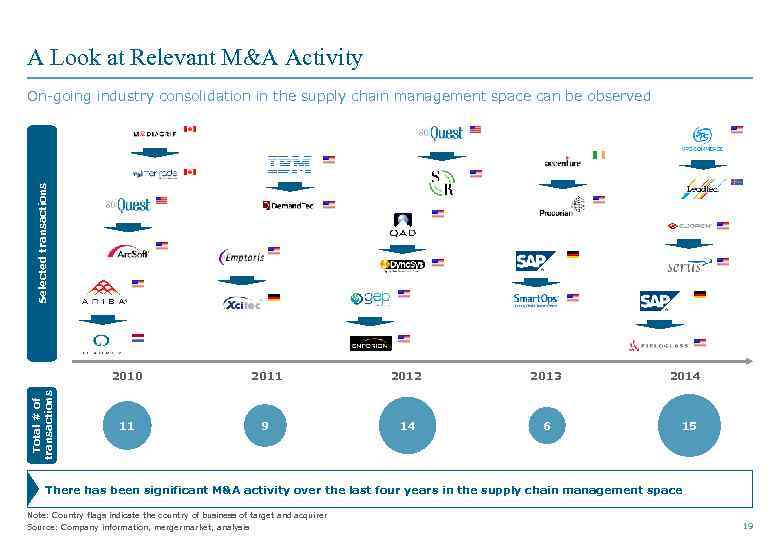

A Look at Relevant M&A Activity Selected transactions On-going industry consolidation in the supply chain management space can be observed Total # of transactions 2010 2011 2012 2013 11 9 14 6 2014 15 There has been significant M&A activity over the last four years in the supply chain management space Note: Country flags indicate the country of business of target and acquirer Source: Company information, mergermarket, analysis 19

A Look at Relevant M&A Activity Selected transactions On-going industry consolidation in the supply chain management space can be observed Total # of transactions 2010 2011 2012 2013 11 9 14 6 2014 15 There has been significant M&A activity over the last four years in the supply chain management space Note: Country flags indicate the country of business of target and acquirer Source: Company information, mergermarket, analysis 19

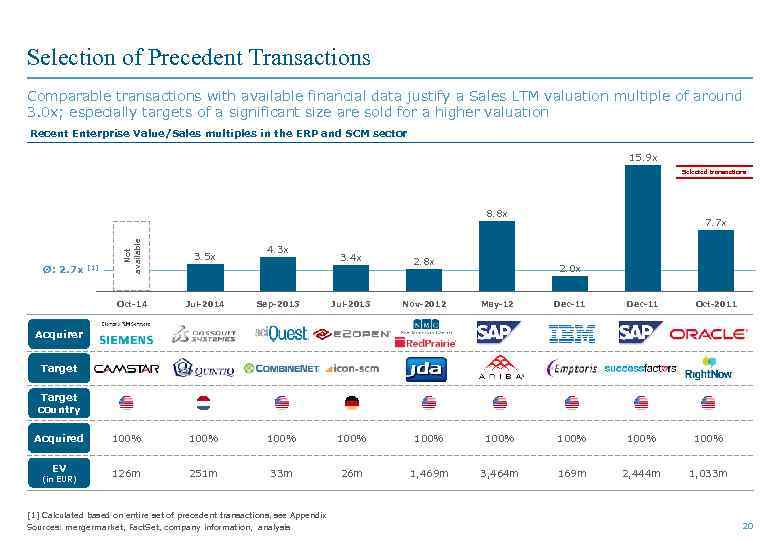

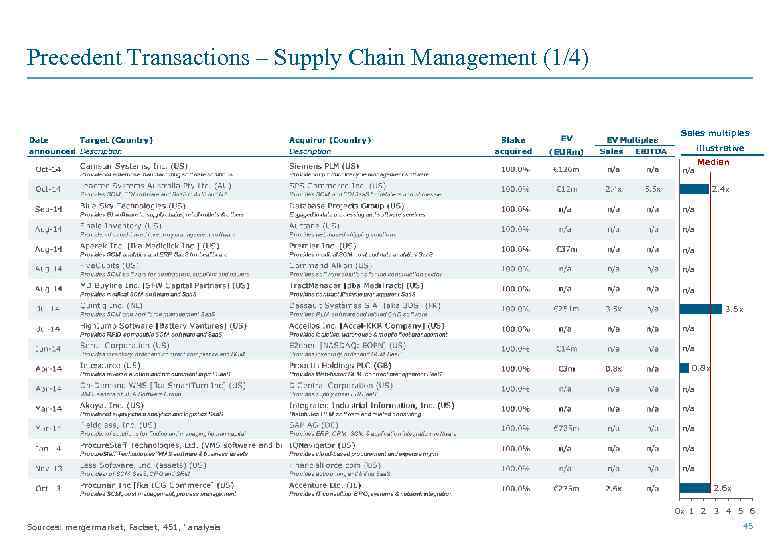

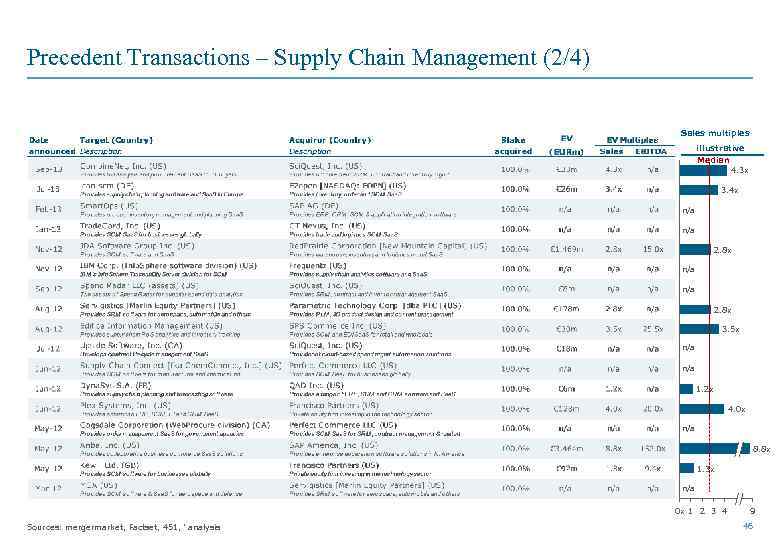

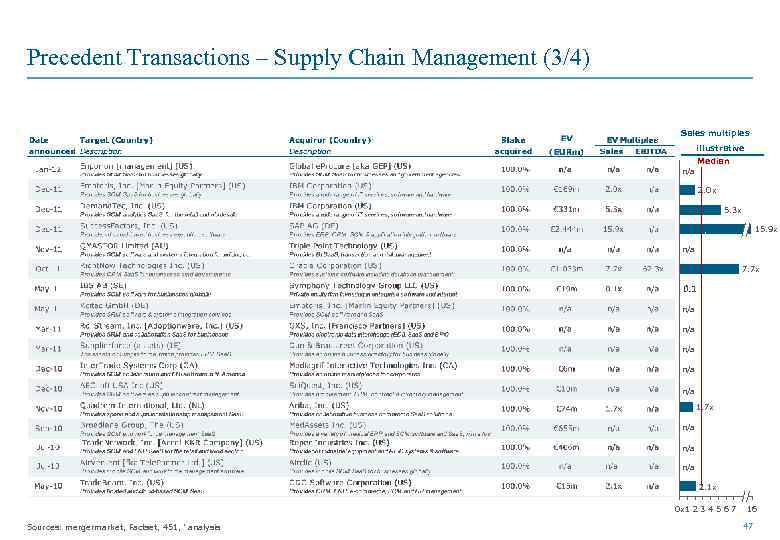

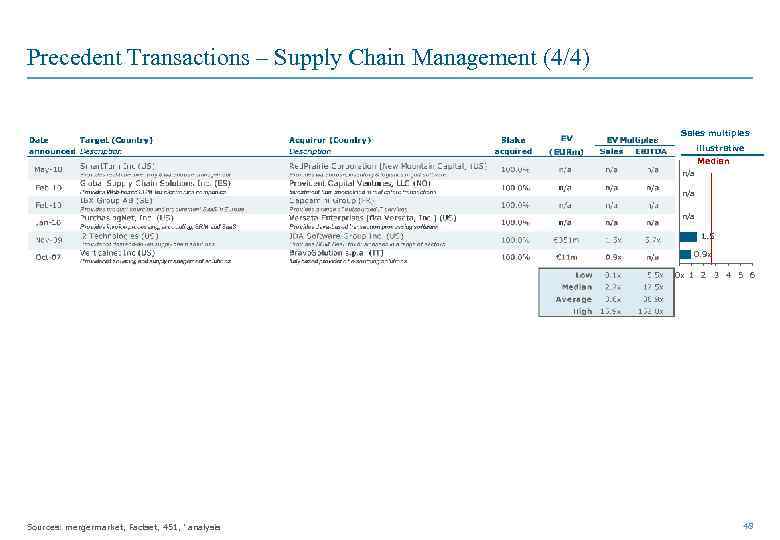

Selection of Precedent Transactions Comparable transactions with available financial data justify a Sales LTM valuation multiple of around 3. 0 x; especially targets of a significant size are sold for a higher valuation Recent Enterprise Value/Sales multiples in the ERP and SCM sector 15. 9 x Selected transactions [1] 3. 5 x Oct-14 Ø: 2. 7 x Not available 8. 8 x Jul-2014 4. 3 x Sep-2013 3. 4 x Jul-2013 2. 8 x 7. 7 x 2. 0 x Nov-2012 May-12 Dec-11 Oct-2011 Acquirer Target country Acquired 100% 100% 100% EV 126 m 251 m 33 m 26 m 1, 469 m 3, 464 m 169 m 2, 444 m 1, 033 m (in EUR) [1] Calculated based on entire set of precedent transactions, see Appendix Sources: mergermarket, Fact. Set, company information, analysis 20

Selection of Precedent Transactions Comparable transactions with available financial data justify a Sales LTM valuation multiple of around 3. 0 x; especially targets of a significant size are sold for a higher valuation Recent Enterprise Value/Sales multiples in the ERP and SCM sector 15. 9 x Selected transactions [1] 3. 5 x Oct-14 Ø: 2. 7 x Not available 8. 8 x Jul-2014 4. 3 x Sep-2013 3. 4 x Jul-2013 2. 8 x 7. 7 x 2. 0 x Nov-2012 May-12 Dec-11 Oct-2011 Acquirer Target country Acquired 100% 100% 100% EV 126 m 251 m 33 m 26 m 1, 469 m 3, 464 m 169 m 2, 444 m 1, 033 m (in EUR) [1] Calculated based on entire set of precedent transactions, see Appendix Sources: mergermarket, Fact. Set, company information, analysis 20

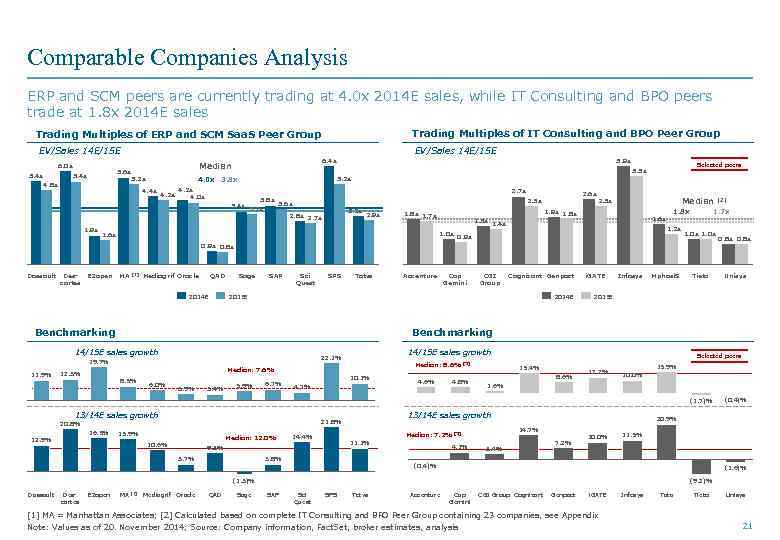

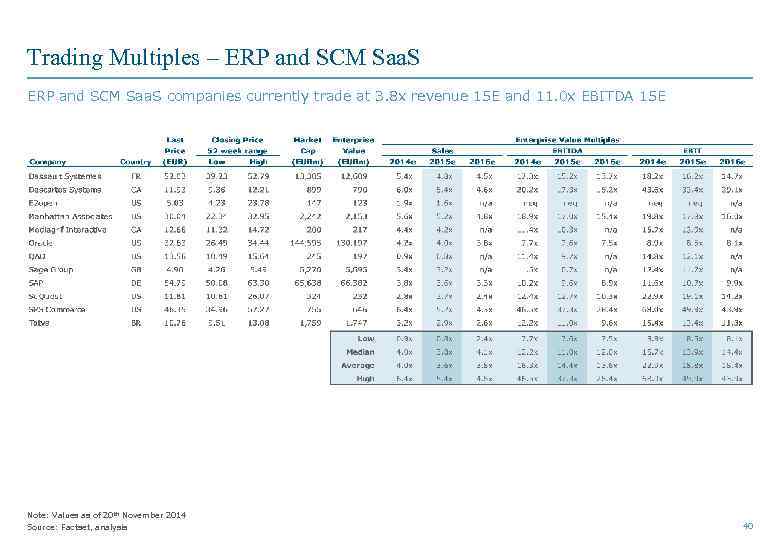

Comparable Companies Analysis ERP and SCM peers are currently trading at 4. 0 x 2014 E sales, while IT Consulting and BPO peers trade at 1. 8 x 2014 E sales Trading Multiples of IT Consulting and BPO Peer Group Trading Multiples of ERP and SCM Saa. S Peer Group EV/Sales 14 E/15 E 6. 0 x 5. 4 x 4. 8 x EV/Sales 14 E/15 E Median 5. 6 x 5. 2 x 5. 4 x 4. 2 x 4. 0 x 3. 9 x Selected peers 3. 5 x 5. 2 x 4. 0 x 3. 8 x 4. 4 x 1. 9 x 6. 4 x 2. 7 x 3. 8 x 3. 6 x 3. 4 x 3. 2 x 2. 8 x 2. 7 x 2. 6 x 2. 3 x 3. 2 x 2. 9 x Median 2. 3 x 1. 9 x 1. 8 x 1. 7 x 1. 6 x 1. 5 x 1. 4 x 1. 2 x 1. 0 x 0. 9 x 1. 6 x 1. 8 x 1. 0 x 0. 9 x 0. 8 x Dassault Descartes E 2 open MA [1] Mediagrif Oracle QAD 2014 E Sage SAP Sci Quest SPS Totvs CGI Group Cognizant Genpact 2014 E i. GATE Infosys Mphasi. S Tieto Median: 8. 6% Median: 7. 6% 8. 5% 6. 0% 3. 9% 3. 4% 5. 9% 6. 7% 10. 1% 4. 7% 4. 6% [2] 4. 8% Selected peers 15. 4% 8. 6% 12. 2% 15. 9% 10. 0% 1. 6% (1. 7)% 13/14 E sales growth 21. 8% 20. 8% 12. 9% 15. 9% Median: 12. 0% 10. 6% Median: 7. 2% 14. 4% 11. 1% 9. 3% 3. 7% 3. 8% 4. 1% Descartes E 2 open MA [1] Mediagrif Oracle QAD Sage (0. 4)% 20. 9% 14. 7% [2] 3. 4% 7. 2% 10. 0% 11. 5% (0. 4)% (1. 6)% (1. 3)% Dassault Unisys 2015 E 14/15 E sales growth 22. 1% 19. 7% 16. 5% 0. 8 x Benchmarking 14/15 E sales growth 12. 3% Cap Gemini 2015 E Benchmarking 11. 9% Accenture [2] 1. 7 x (9. 2)% SAP Sci Quest SPS Totvs Accenture Cap Gemini CGI Group Cognizant Genpact i. GATE [1] MA = Manhattan Associates; [2] Calculated based on complete IT Consulting and BPO Peer Group containing 23 companies, see Appendix Note: Values as of 20. November 2014; Source: Company information, Fact. Set, broker estimates, analysis Infosys Tata Tieto Unisys 21

Comparable Companies Analysis ERP and SCM peers are currently trading at 4. 0 x 2014 E sales, while IT Consulting and BPO peers trade at 1. 8 x 2014 E sales Trading Multiples of IT Consulting and BPO Peer Group Trading Multiples of ERP and SCM Saa. S Peer Group EV/Sales 14 E/15 E 6. 0 x 5. 4 x 4. 8 x EV/Sales 14 E/15 E Median 5. 6 x 5. 2 x 5. 4 x 4. 2 x 4. 0 x 3. 9 x Selected peers 3. 5 x 5. 2 x 4. 0 x 3. 8 x 4. 4 x 1. 9 x 6. 4 x 2. 7 x 3. 8 x 3. 6 x 3. 4 x 3. 2 x 2. 8 x 2. 7 x 2. 6 x 2. 3 x 3. 2 x 2. 9 x Median 2. 3 x 1. 9 x 1. 8 x 1. 7 x 1. 6 x 1. 5 x 1. 4 x 1. 2 x 1. 0 x 0. 9 x 1. 6 x 1. 8 x 1. 0 x 0. 9 x 0. 8 x Dassault Descartes E 2 open MA [1] Mediagrif Oracle QAD 2014 E Sage SAP Sci Quest SPS Totvs CGI Group Cognizant Genpact 2014 E i. GATE Infosys Mphasi. S Tieto Median: 8. 6% Median: 7. 6% 8. 5% 6. 0% 3. 9% 3. 4% 5. 9% 6. 7% 10. 1% 4. 7% 4. 6% [2] 4. 8% Selected peers 15. 4% 8. 6% 12. 2% 15. 9% 10. 0% 1. 6% (1. 7)% 13/14 E sales growth 21. 8% 20. 8% 12. 9% 15. 9% Median: 12. 0% 10. 6% Median: 7. 2% 14. 4% 11. 1% 9. 3% 3. 7% 3. 8% 4. 1% Descartes E 2 open MA [1] Mediagrif Oracle QAD Sage (0. 4)% 20. 9% 14. 7% [2] 3. 4% 7. 2% 10. 0% 11. 5% (0. 4)% (1. 6)% (1. 3)% Dassault Unisys 2015 E 14/15 E sales growth 22. 1% 19. 7% 16. 5% 0. 8 x Benchmarking 14/15 E sales growth 12. 3% Cap Gemini 2015 E Benchmarking 11. 9% Accenture [2] 1. 7 x (9. 2)% SAP Sci Quest SPS Totvs Accenture Cap Gemini CGI Group Cognizant Genpact i. GATE [1] MA = Manhattan Associates; [2] Calculated based on complete IT Consulting and BPO Peer Group containing 23 companies, see Appendix Note: Values as of 20. November 2014; Source: Company information, Fact. Set, broker estimates, analysis Infosys Tata Tieto Unisys 21

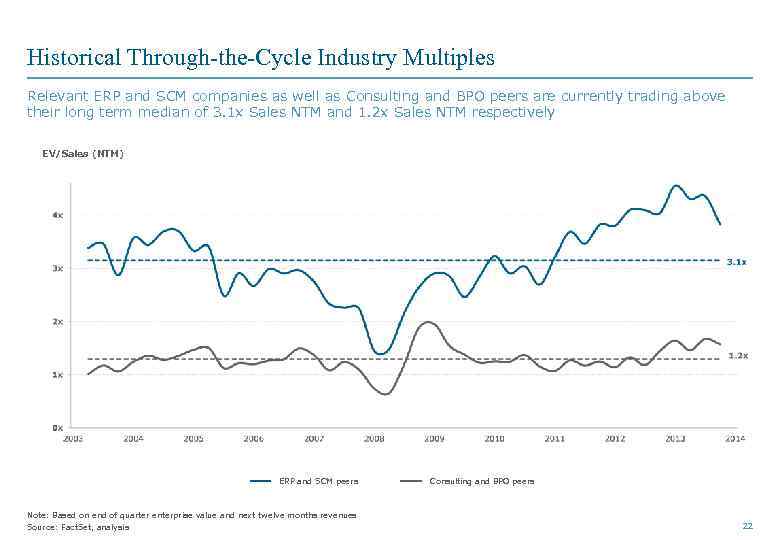

Historical Through-the-Cycle Industry Multiples Relevant ERP and SCM companies as well as Consulting and BPO peers are currently trading above their long term median of 3. 1 x Sales NTM and 1. 2 x Sales NTM respectively EV/Sales (NTM) ERP and SCM peers Note: Based on end of quarter enterprise value and next twelve months revenues Source: Fact. Set, analysis Consulting and BPO peers 22

Historical Through-the-Cycle Industry Multiples Relevant ERP and SCM companies as well as Consulting and BPO peers are currently trading above their long term median of 3. 1 x Sales NTM and 1. 2 x Sales NTM respectively EV/Sales (NTM) ERP and SCM peers Note: Based on end of quarter enterprise value and next twelve months revenues Source: Fact. Set, analysis Consulting and BPO peers 22

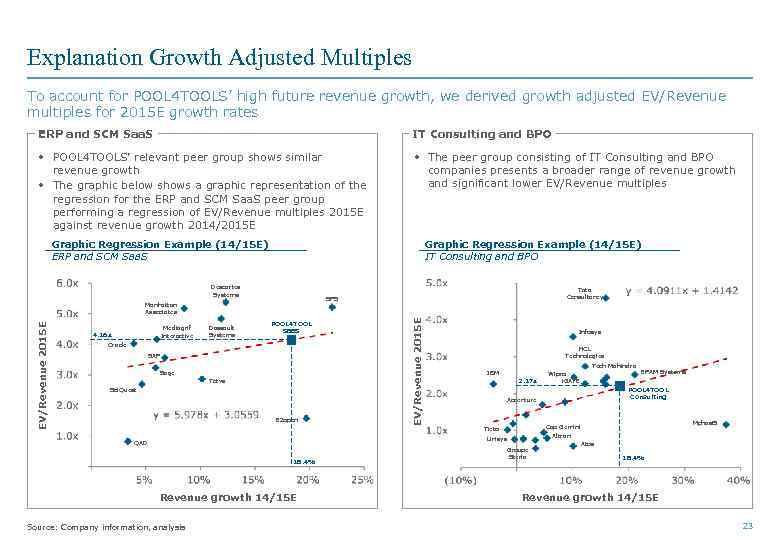

Explanation Growth Adjusted Multiples To account for POOL 4 TOOLS’ high future revenue growth, we derived growth adjusted EV/Revenue multiples for 2015 E growth rates ERP and SCM Saa. S IT Consulting and BPO • POOL 4 TOOLS’ relevant peer group shows similar revenue growth • The graphic below shows a graphic representation of the regression for the ERP and SCM Saa. S peer group performing a regression of EV/Revenue multiples 2015 E against revenue growth 2014/2015 E • The peer group consisting of IT Consulting and BPO companies presents a broader range of revenue growth and significant lower EV/Revenue multiples Graphic Regression Example (14/15 E) ERP and SCM Saa. S Graphic Regression Example (14/15 E) IT Consulting and BPO Descartes Systems Dassault Systems POOL 4 TOOL Saa. S Oracle SAP Sage Totvs Sci. Quest E 2 open EV/Revenue 2015 E Mediagrif Interactive 4. 16 x Tata Consultancy SPS Manhattan Associates Infosys HCL Technologies Tech Mahindra IBM 2. 17 x 18. 4% Revenue growth 14/15 E Source: Company information, analysis EPAM Systems POOL 4 TOOL Consulting Accenture Mphasi. S Cap Gemini Tieto Altran Unisys QAD Wipro i. GATE Groupe Steria Atos 18. 4% Revenue growth 14/15 E 23

Explanation Growth Adjusted Multiples To account for POOL 4 TOOLS’ high future revenue growth, we derived growth adjusted EV/Revenue multiples for 2015 E growth rates ERP and SCM Saa. S IT Consulting and BPO • POOL 4 TOOLS’ relevant peer group shows similar revenue growth • The graphic below shows a graphic representation of the regression for the ERP and SCM Saa. S peer group performing a regression of EV/Revenue multiples 2015 E against revenue growth 2014/2015 E • The peer group consisting of IT Consulting and BPO companies presents a broader range of revenue growth and significant lower EV/Revenue multiples Graphic Regression Example (14/15 E) ERP and SCM Saa. S Graphic Regression Example (14/15 E) IT Consulting and BPO Descartes Systems Dassault Systems POOL 4 TOOL Saa. S Oracle SAP Sage Totvs Sci. Quest E 2 open EV/Revenue 2015 E Mediagrif Interactive 4. 16 x Tata Consultancy SPS Manhattan Associates Infosys HCL Technologies Tech Mahindra IBM 2. 17 x 18. 4% Revenue growth 14/15 E Source: Company information, analysis EPAM Systems POOL 4 TOOL Consulting Accenture Mphasi. S Cap Gemini Tieto Altran Unisys QAD Wipro i. GATE Groupe Steria Atos 18. 4% Revenue growth 14/15 E 23

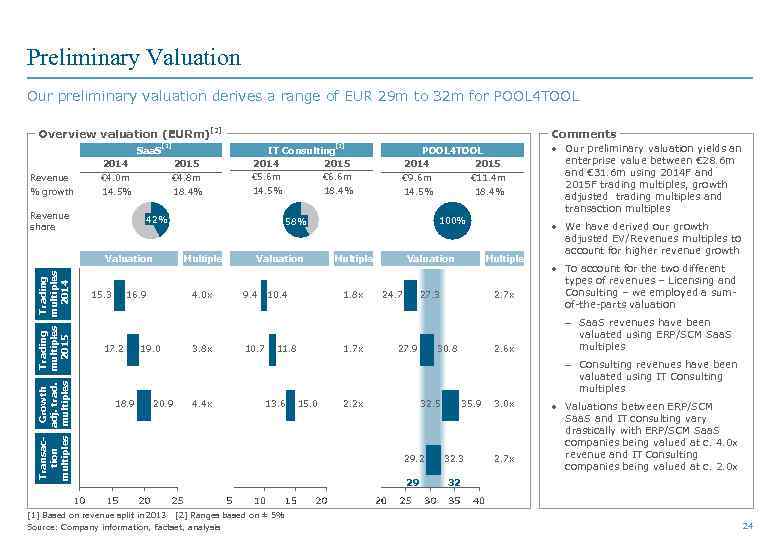

Preliminary Valuation Our preliminary valuation derives a range of EUR 29 m to 32 m for POOL 4 TOOL Overview valuation (EURm)[2] Saa. S [1] IT Consulting 2014 2015 € 4. 8 m € 9. 6 m € 11. 4 m 18. 4% 14. 5% 18. 4% Revenue € 4. 0 m % growth 14. 5% 42% Transac. Growth Trading tion adj. trad. multiples 2015 2014 Valuation 4. 0 x 19. 0 100% 58% Multiple 16. 9 17. 2 POOL 4 TOOL 2015 € 6. 6 m 2015 15. 3 Comments • Our preliminary valuation yields an 2014 € 5. 6 m 2014 Revenue share [1] 3. 8 x Valuation 9. 4 10. 7 10. 4 Multiple 1. 8 x 11. 8 1. 7 x Valuation Multiple 27. 3 2. 7 x 24. 7 27. 9 30. 8 2. 6 x enterprise value between € 28. 6 m and € 31. 6 m using 2014 F and 2015 F trading multiples, growth adjusted trading multiples and transaction multiples • We have derived our growth adjusted EV/Revenues multiples to account for higher revenue growth • To account for the two different types of revenues – Licensing and Consulting – we employed a sumof-the-parts valuation - Saa. S revenues have been valuated using ERP/SCM Saa. S multiples - Consulting revenues have been valuated using IT Consulting multiples 18. 9 20. 9 4. 4 x 13. 6 [1] Based on revenue split in 2013 [2] Ranges based on ± 5% Source: Company information, Factset, analysis 15. 0 2. 2 x 32. 5 35. 9 29. 2 32. 3 29 3. 0 x • Valuations between ERP/SCM Saa. S and IT consulting vary drastically with ERP/SCM Saa. S companies being valued at c. 4. 0 x revenue and IT Consulting companies being valued at c. 2. 0 x 32 2. 7 x 24

Preliminary Valuation Our preliminary valuation derives a range of EUR 29 m to 32 m for POOL 4 TOOL Overview valuation (EURm)[2] Saa. S [1] IT Consulting 2014 2015 € 4. 8 m € 9. 6 m € 11. 4 m 18. 4% 14. 5% 18. 4% Revenue € 4. 0 m % growth 14. 5% 42% Transac. Growth Trading tion adj. trad. multiples 2015 2014 Valuation 4. 0 x 19. 0 100% 58% Multiple 16. 9 17. 2 POOL 4 TOOL 2015 € 6. 6 m 2015 15. 3 Comments • Our preliminary valuation yields an 2014 € 5. 6 m 2014 Revenue share [1] 3. 8 x Valuation 9. 4 10. 7 10. 4 Multiple 1. 8 x 11. 8 1. 7 x Valuation Multiple 27. 3 2. 7 x 24. 7 27. 9 30. 8 2. 6 x enterprise value between € 28. 6 m and € 31. 6 m using 2014 F and 2015 F trading multiples, growth adjusted trading multiples and transaction multiples • We have derived our growth adjusted EV/Revenues multiples to account for higher revenue growth • To account for the two different types of revenues – Licensing and Consulting – we employed a sumof-the-parts valuation - Saa. S revenues have been valuated using ERP/SCM Saa. S multiples - Consulting revenues have been valuated using IT Consulting multiples 18. 9 20. 9 4. 4 x 13. 6 [1] Based on revenue split in 2013 [2] Ranges based on ± 5% Source: Company information, Factset, analysis 15. 0 2. 2 x 32. 5 35. 9 29. 2 32. 3 29 3. 0 x • Valuations between ERP/SCM Saa. S and IT consulting vary drastically with ERP/SCM Saa. S companies being valued at c. 4. 0 x revenue and IT Consulting companies being valued at c. 2. 0 x 32 2. 7 x 24

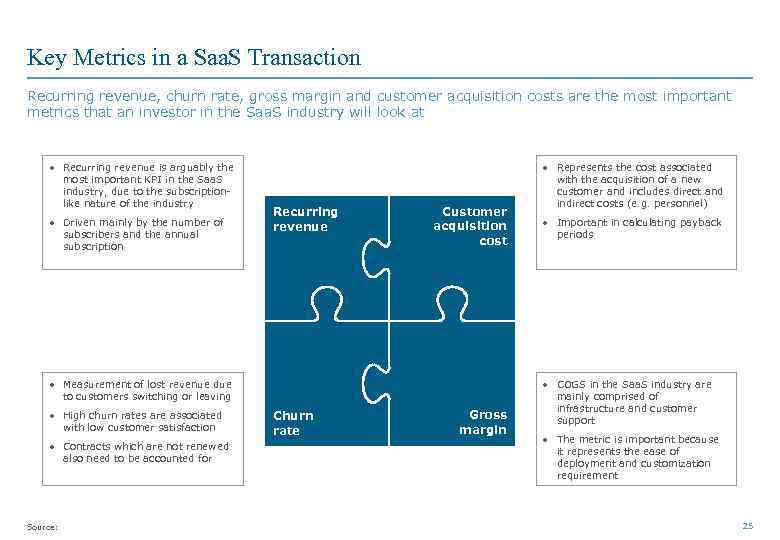

Key Metrics in a Saa. S Transaction Recurring revenue, churn rate, gross margin and customer acquisition costs are the most important metrics that an investor in the Saa. S industry will look at • Recurring revenue is arguably the most important KPI in the Saa. S industry, due to the subscriptionlike nature of the industry • Driven mainly by the number of subscribers and the annual subscription Recurring revenue Customer acquisition cost • Measurement of lost revenue due to customers switching or leaving • High churn rates are associated with low customer satisfaction • Contracts which are not renewed also need to be accounted for Source: Churn rate Gross margin • Represents the cost associated with the acquisition of a new customer and includes direct and indirect costs (e. g. personnel) • Important in calculating payback periods • COGS in the Saa. S industry are mainly comprised of infrastructure and customer support • The metric is important because it represents the ease of deployment and customization requirement 25

Key Metrics in a Saa. S Transaction Recurring revenue, churn rate, gross margin and customer acquisition costs are the most important metrics that an investor in the Saa. S industry will look at • Recurring revenue is arguably the most important KPI in the Saa. S industry, due to the subscriptionlike nature of the industry • Driven mainly by the number of subscribers and the annual subscription Recurring revenue Customer acquisition cost • Measurement of lost revenue due to customers switching or leaving • High churn rates are associated with low customer satisfaction • Contracts which are not renewed also need to be accounted for Source: Churn rate Gross margin • Represents the cost associated with the acquisition of a new customer and includes direct and indirect costs (e. g. personnel) • Important in calculating payback periods • COGS in the Saa. S industry are mainly comprised of infrastructure and customer support • The metric is important because it represents the ease of deployment and customization requirement 25

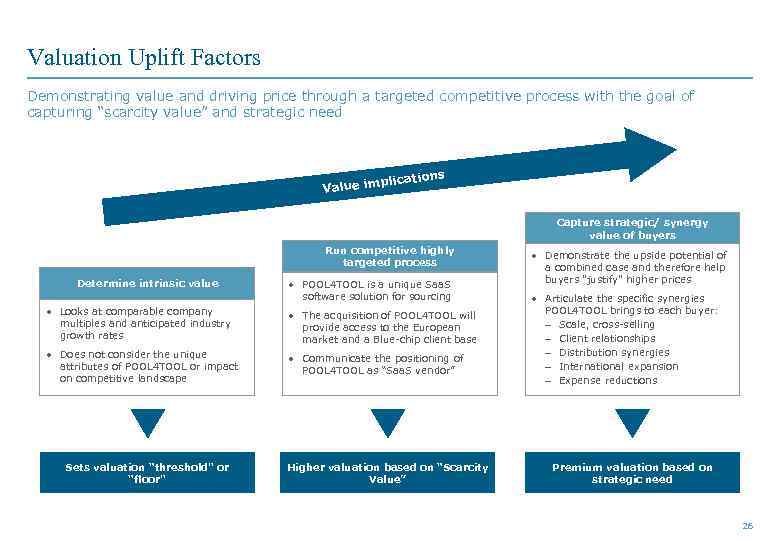

Valuation Uplift Factors Demonstrating value and driving price through a targeted competitive process with the goal of capturing “scarcity value” and strategic need ions plicat Value im Capture strategic/ synergy value of buyers Run competitive highly targeted process Determine intrinsic value • POOL 4 TOOL is a unique Saa. S software solution for sourcing • Looks at comparable company multiples and anticipated industry growth rates • The acquisition of POOL 4 TOOL will provide access to the European market and a Blue-chip client base • Does not consider the unique attributes of POOL 4 TOOL or impact on competitive landscape • Communicate the positioning of POOL 4 TOOL as “Saa. S vendor” Sets valuation “threshold" or “floor" Higher valuation based on “Scarcity Value” • Demonstrate the upside potential of a combined case and therefore help buyers "justify" higher prices • Articulate the specific synergies POOL 4 TOOL brings to each buyer: - Scale, cross-selling - Client relationships - Distribution synergies - International expansion - Expense reductions Premium valuation based on strategic need 26

Valuation Uplift Factors Demonstrating value and driving price through a targeted competitive process with the goal of capturing “scarcity value” and strategic need ions plicat Value im Capture strategic/ synergy value of buyers Run competitive highly targeted process Determine intrinsic value • POOL 4 TOOL is a unique Saa. S software solution for sourcing • Looks at comparable company multiples and anticipated industry growth rates • The acquisition of POOL 4 TOOL will provide access to the European market and a Blue-chip client base • Does not consider the unique attributes of POOL 4 TOOL or impact on competitive landscape • Communicate the positioning of POOL 4 TOOL as “Saa. S vendor” Sets valuation “threshold" or “floor" Higher valuation based on “Scarcity Value” • Demonstrate the upside potential of a combined case and therefore help buyers "justify" higher prices • Articulate the specific synergies POOL 4 TOOL brings to each buyer: - Scale, cross-selling - Client relationships - Distribution synergies - International expansion - Expense reductions Premium valuation based on strategic need 26

Agenda 1 Introduction • • 2 Investment case • 3 Potential buyers universe and preliminary valuation considerations 4 Process considerations • 5 Mandate proposal • 6 Appendix • 27

Agenda 1 Introduction • • 2 Investment case • 3 Potential buyers universe and preliminary valuation considerations 4 Process considerations • 5 Mandate proposal • 6 Appendix • 27

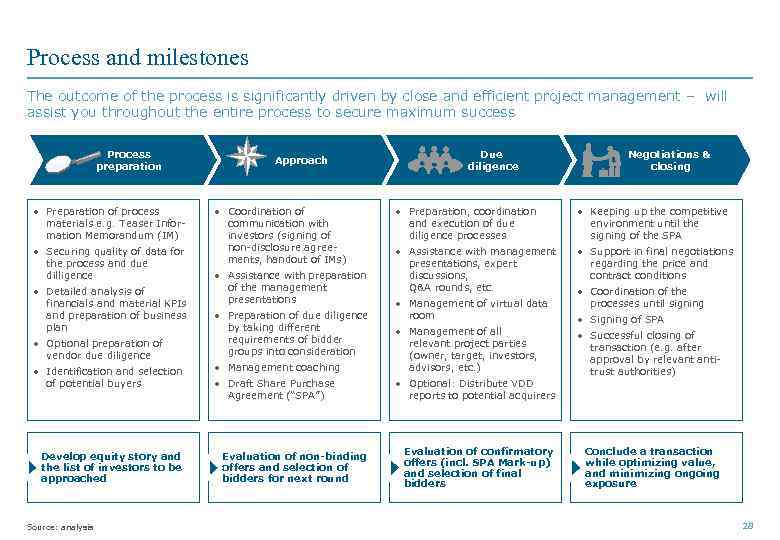

Process and milestones The outcome of the process is significantly driven by close and efficient project management – will assist you throughout the entire process to secure maximum success Process preparation • Preparation of process materials e. g. Teaser Information Memorandum (IM) • Securing quality of data for the process and due dilligence • Detailed analysis of financials and material KPIs and preparation of business plan • Optional preparation of vendor due diligence • Identification and selection of potential buyers Develop equity story and the list of investors to be approached Source: analysis Approach • Coordination of communication with investors (signing of non-disclosure agreements, handout of IMs) • Assistance with preparation of the management presentations • Preparation of due diligence by taking different requirements of bidder groups into consideration Due diligence • Preparation, coordination and execution of due diligence processes • Keeping up the competitive environment until the signing of the SPA • Assistance with management presentations, expert discussions, Q&A rounds, etc. • Support in final negotiations regarding the price and contract conditions • Management of virtual data room • Management coaching • Management of all relevant project parties (owner, target, investors, advisors, etc. ) • Draft Share Purchase Agreement (“SPA”) • Optional: Distribute VDD reports to potential acquirers Evaluation of non-binding offers and selection of bidders for next round Negotiations & closing Evaluation of confirmatory offers (incl. SPA Mark-up) and selection of final bidders • Coordination of the processes until signing • Signing of SPA • Successful closing of transaction (e. g. after approval by relevant antitrust authorities) Conclude a transaction while optimizing value, and minimizing ongoing exposure 28

Process and milestones The outcome of the process is significantly driven by close and efficient project management – will assist you throughout the entire process to secure maximum success Process preparation • Preparation of process materials e. g. Teaser Information Memorandum (IM) • Securing quality of data for the process and due dilligence • Detailed analysis of financials and material KPIs and preparation of business plan • Optional preparation of vendor due diligence • Identification and selection of potential buyers Develop equity story and the list of investors to be approached Source: analysis Approach • Coordination of communication with investors (signing of non-disclosure agreements, handout of IMs) • Assistance with preparation of the management presentations • Preparation of due diligence by taking different requirements of bidder groups into consideration Due diligence • Preparation, coordination and execution of due diligence processes • Keeping up the competitive environment until the signing of the SPA • Assistance with management presentations, expert discussions, Q&A rounds, etc. • Support in final negotiations regarding the price and contract conditions • Management of virtual data room • Management coaching • Management of all relevant project parties (owner, target, investors, advisors, etc. ) • Draft Share Purchase Agreement (“SPA”) • Optional: Distribute VDD reports to potential acquirers Evaluation of non-binding offers and selection of bidders for next round Negotiations & closing Evaluation of confirmatory offers (incl. SPA Mark-up) and selection of final bidders • Coordination of the processes until signing • Signing of SPA • Successful closing of transaction (e. g. after approval by relevant antitrust authorities) Conclude a transaction while optimizing value, and minimizing ongoing exposure 28

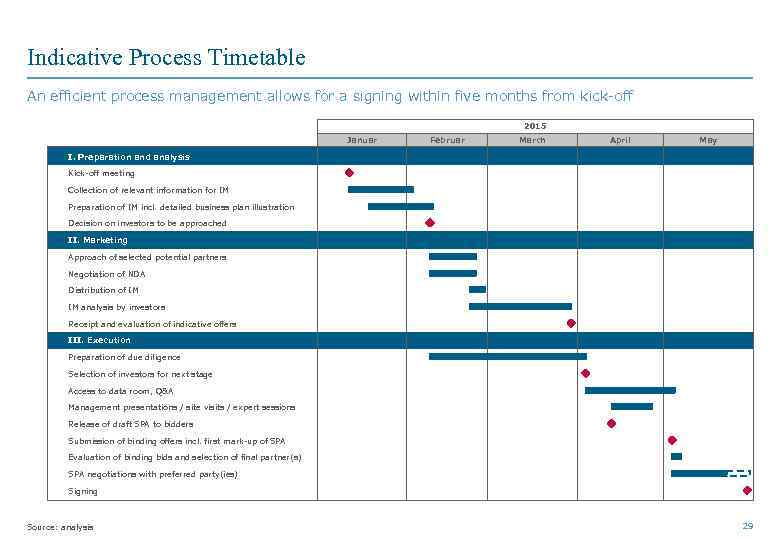

Indicative Process Timetable An efficient process management allows for a signing within five months from kick-off 2015 Januar Februar March April May I. Preparation and analysis Kick-off meeting Collection of relevant information for IM Preparation of IM incl. detailed business plan illustration Decision on investors to be approached II. Marketing Approach of selected potential partners Negotiation of NDA Distribution of IM IM analysis by investors Receipt and evaluation of indicative offers III. Execution Preparation of due diligence Selection of investors for next stage Access to data room, Q&A Management presentations / site visits / expert sessions Release of draft SPA to bidders Submission of binding offers incl. first mark-up of SPA Evaluation of binding bids and selection of final partner(s) SPA negotiations with preferred party(ies) Signing Source: analysis 29

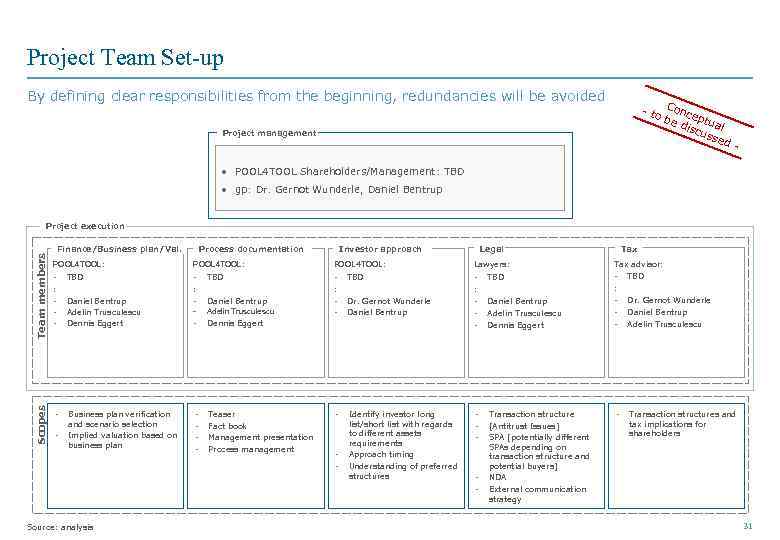

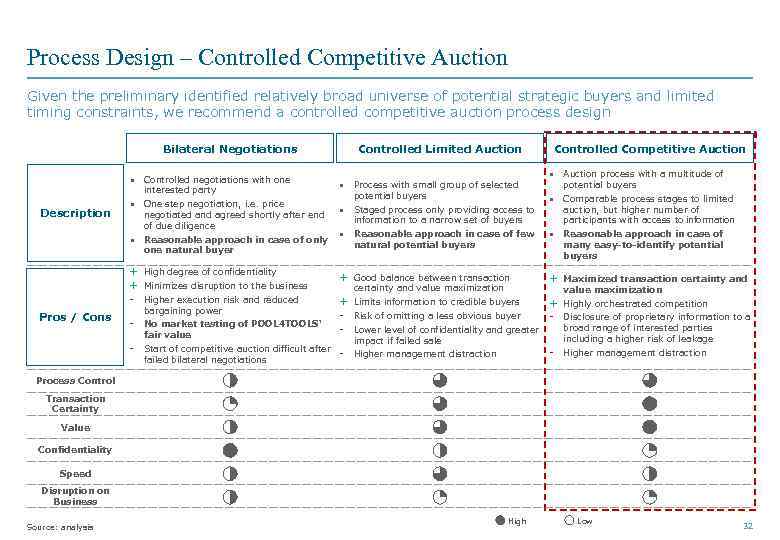

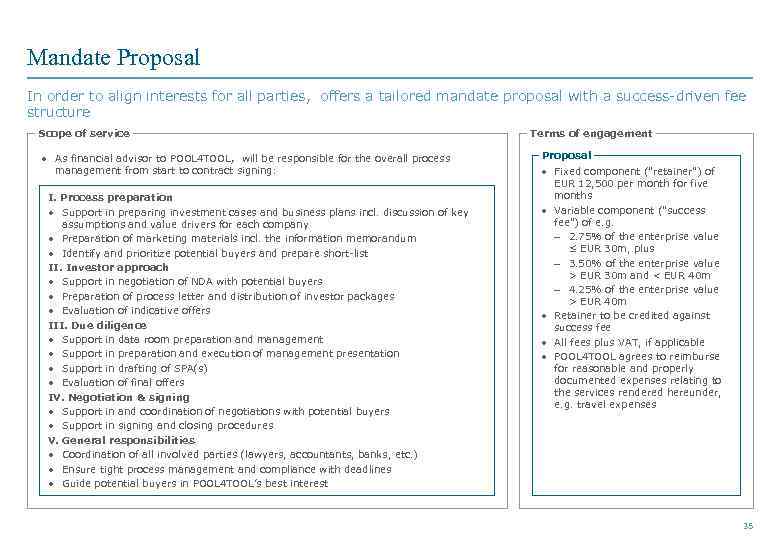

Indicative Process Timetable An efficient process management allows for a signing within five months from kick-off 2015 Januar Februar March April May I. Preparation and analysis Kick-off meeting Collection of relevant information for IM Preparation of IM incl. detailed business plan illustration Decision on investors to be approached II. Marketing Approach of selected potential partners Negotiation of NDA Distribution of IM IM analysis by investors Receipt and evaluation of indicative offers III. Execution Preparation of due diligence Selection of investors for next stage Access to data room, Q&A Management presentations / site visits / expert sessions Release of draft SPA to bidders Submission of binding offers incl. first mark-up of SPA Evaluation of binding bids and selection of final partner(s) SPA negotiations with preferred party(ies) Signing Source: analysis 29