353801ee96f0b6090705c0923937dc4d.ppt

- Количество слайдов: 39

Political Economy of Taxation Prof. Fabio Padovano

Reference Text n Hettich, W. and Winer, S. L. (1997), « The Political Economy of Taxation » , in Dennis C. Mueller (ed. ) Perspectives on Public Choice. A Handbook, Cambridge, Cambridge University Press, pp. 481 -505.

Introduction - 1 n n n Taxation gives government resources → without it no effective political power Schumpeter (1918) connects the establishment of the power to tax to the birth of modern state → contemporary administrative state, welfare state possible with expansion of power to tax (income tax) Positive knowledge of how government employs tax instruments to pursue its ends necessary to understanding the functioning of public economy

Introduction - 2 n 3 sources of systematic differences ¨ ¨ ¨ n n n Normative public finance offers little guidance in explaining such differences → public choice can, by highlighting incentives and constraints of public agents Empirical data are available Analysis so far focuses on ¨ ¨ n Cross country differences in tax instruments Differences related to different stages of economic development Differences related to short term economic and political shocks Structure of tax systems Use of public debt Analysis neglects other substitutes ¨ Economics of regulation

Models of political economy n Positive explanations of tax structures require Multidimensional choices ¨ Stable equilibria → comparative empirical analysis ¨ n 3 models used to explain tax structures Expected vote maximization (probabilistic voting models) ¨ Median voter ¨ Leviathan model ¨ n n Models 1 and 2 assume democratic institutions (voting process) Leviathan disregards democratic control of government by citizens/taxpayers

Expected vote maximization n n Candidates maximize expected votes being uncertain about how voters respond to their platforms Competition for offices pushes candidates to search for policies that ensure political success Also standing government affected by competition → must ensure victory in next election Tax structures are equilibrium outcome of a competitive political process Expected vote maximization produces stable equilibria and can treat multidimensional choices

Median voter - 1 n n Voters presented with competing alternatives and support the one that yields highest utility Equilibrium exists if choices are one-dimensional and voters preferences are single peaked → preferences of voter in median position prevail under majority voting by virtue of the median Single dimension hypothesis restrict model to the study of single aspects of tax systems Incapable to examine broader aspects of tax structures that are inherently multidimensional

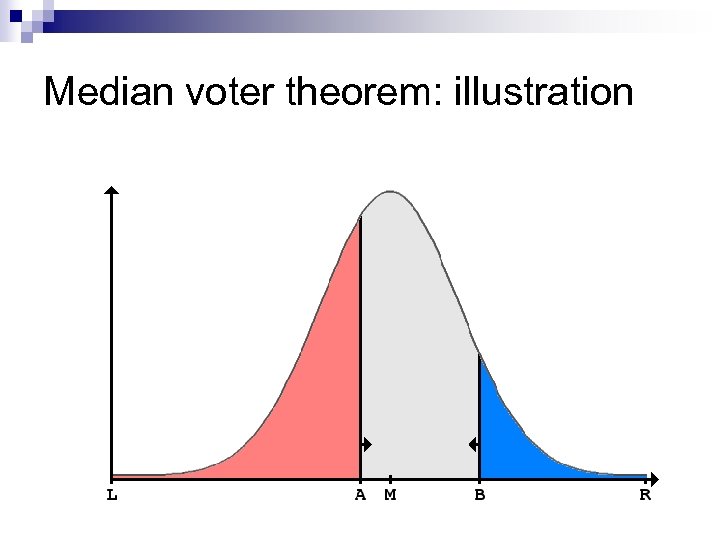

Median voter theorem: illustration

Median voter - 2 n n n When more than one dimension (and voting strategy is discrete instead than probabilistic) → cycling → instable equilibria Shepsle and Weingast (1981) impute to the working of given institutions (e. g. , rules of the game in parliaments, committees) the absence of observed instability Problem is how to relate the features of observed equilibria to the structure of decision making institutions → so far not solved

Leviathan model n n n Disregards voting procedures as effective constraints on political action → government ability to act unbounded → Leviathan Government uses taxes to maximize revenues from private sector Laffer curve (choices to work/leisure and tax evasion) is the only limit to the state’s ability to tax Model does not explain who joins the “government group” → no prediction about what features the tax structure should have so to benefit Leviathan group Predictions about the structure of tax system can de derived from the monopoly structure of government Possible comparisons with tax structures of democratic/competitive governments

Expected vote maximization and tax structures n n The creation of tax systems fits within the broader question of how governments choose policy instruments and outcomes In competitive electoral systems, fiscal choices are the equilibrium result of the interaction between Governing party who seek to remain in power and shape tax instruments to do so ¨ Opposing parties who design fiscal platforms so to win elections (generally neglected side of the process) ¨ Voters who have heterogeneous tastes and interests and vote so to maximize their utility ¨

Model structure - 1 n Basic structure of the model Government provides 1 public good (expenditure side of the budget) ¨ Imposes N proportional tax rates t ¨ One tax rate per voter ¨ Each voter has one tax base B ¨ n n Probability to receive support π depends on difference I between voter’s evaluation of public services b and loss of utility from taxation c, due to both the level of taxation T and the excess burden d (distortion of individual choices) Government problem is to choose tax rates t and level of public good G to maximize total expected support

Equilibrium n Equilibrium characterized by 2 conditions 1. 2. For every level of public spending G, government adjusts tax rates among voters until the reduction of expected votes (Marginal Political Costs MPC) is the same across taxpayers → optimal tax structure minimizes total political costs for any level of tax revenues collected Government sets public spending so that the marginal political benefit of spending equals the MPC

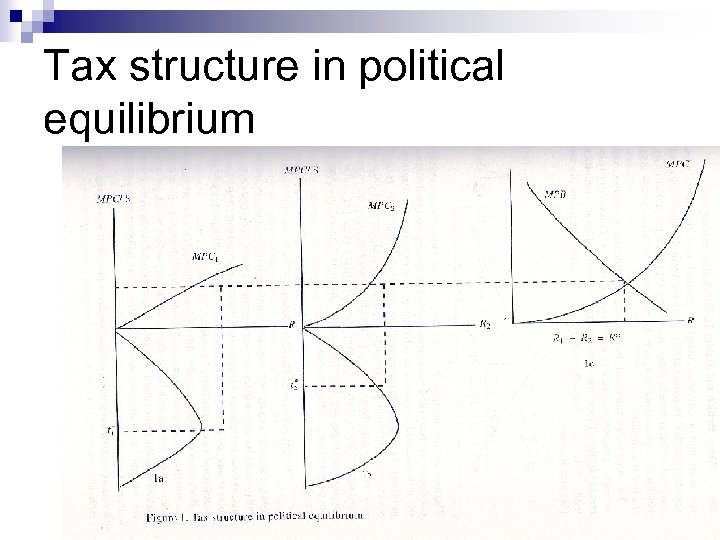

Diagram n n n In fig. 1, 2 taxpayers a and b Tax base is income from work Taxpayers differ in their Tastes for work → ability to trade off labor for leisure → different shapes of Laffer curves (lower part of panels 1 a and 1 b) ¨ Political tastes → intensity of reaction (in terms of reduced political support) to a loss of income due to taxation ¨ n n Government expected to know all functions Panel 1 c represents MPB and MPC of budget ¨ ¨ ¨ MPC is horizontal sum of individual MPC Budget size R must be raised from two taxpayers MPB from spending downward sloped → diminishing utility

Tax structure in political equilibrium

Complexity n n Analysis predicts that tax structures will be complex, with potentially as many tax rates as individuals Complexity even greater if each taxpayer has more than one taxable activitiy In this case, fig. 1 represents the tax treatments of each tax base of a given individual Government raises a given amount of tax revenues by equalizing the MPC of revenue, imposing different rates on each taxable activity → similar to Ramsey rule

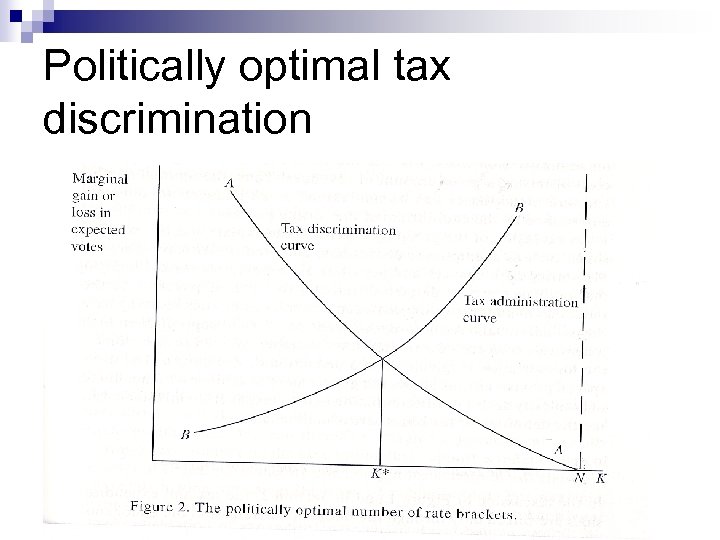

Administrative costs - 1 n n A tax treatment specific to every single activity of every single individual very costly to implement → this cost reduces government’s ability to spend on the public good → government tries to economize on administration costs of tax system Administrative costs increase with number of tax rates → savings can be made by sorting individuals into tax brackets where all individuals are treated similarly (same tax rate) The drawback is that MPC of revenues will vary among individuals belonging to same group → higher costs per any budget Government must find optimal number of tax brackets K (fig. 2) and allocate optimally individuals among them

Administrative costs – 2 n n n As K increases, number of groups increases, sorting decreases, total loss of support decreases by differentiating the tax treatment more among individuals (downward sloping curve D) As K increases, complexity of the tax structure grows, and administrative costs as well (upward sloping curve A) K* is equilibrium → intersection of the 2 curves

Politically optimal tax discrimination

Extensions n Same logic applies to creation of tax bases ¨ Grouping bases saves on administrative costs → liberates resources to spend ¨ Discriminating bases reduces the costs of raising a given amount of revenues n Creation of more deductions and exemptions counterbalances the loss of support due to grouping tax bases → increases differential tax treatment

Tax and expenditure structure n n Results obtained so far under the hypothesis that expenditure and tax side of the budget not related If cost of raising revenues are function of type of expenditure → MPC are lower in the case of PG complementary to private activities on which taxes are imposed ¨ MPC are lower on lower demanders of PG ¨ Government trades off at the margin lower support by imperfect sorting with higher support due to lower administrative costs on the spending side ¨ n Information about ind characteristics on the tax side are easier to obtain for government than on the spending side → government first creates a tax structure independent of G , then introduces on discrimination on expenditure side by menas of special provisions

Redistribution and median voter n n n MV limited to one-dimensional issues → cannot deal with complexity Roemer and Rosenthal (1977) assume a linear progressive income tax rate, a predetermined level of PG, ind discriminated by ability → look at marginal tax rate If AY>MY, voter with median ability demands and receives a positive marginal tax rate → redistribution Amount of redistribution depends on government size G → as G increases, higher marginal rates generate larger excess burdens, which will be higher the larger the elasticity of labor supply (Laffer curve) → this will reduce the demand for redistribution Meltzer and Richard (1981) model applies the same logic to growth of government → growth depends on position of AY wrt MY → if AY>MY and vote franchise expanded to encompass voters with lower income levels → government grows

Rate structure and median voter n n MV cannot deal with complex issues such as the presence of nonlinear rate structures → cycling results Structure induced equilibrium Example Inman and Fitts (1990) who look at universalism to overcome political instability → each legislator supports allocations preferred by every other legislators If benefits allocated on particular districts and taxes spread over larger constituencies → larger budgets and more tax special provisions than in the case of no decision externalities

Leviathan model n n Choice of tax structure driven by logic of price discrimination, limited only by Laffer curves Leviathan chooses Broad tax bases to limit tax evasion Levies high tax rates on less elastic tax bases to maximize revenues ¨ Special provision can expand tax discrimination ¨ ¨ n n Tax structures chosen by Leviathan models multidimensional, just like those observed Problem of observational equivalence with PV models might arise → one must still specify the source of Leviathan power and of the stability of dictatorial equilibrium

Taxing the future n Time profile of taxation involves 2 other sources of complexity ¨ Intertemporal preferences of voters and politicians ¨ Time consistency of tax policies of successive governments n n Usual simplification is choice between debt (with intertemporal profile) and taxes (limited to present) → taxes linked to debt via intertemporal budget constraint Various strands of literature

Deficit finance and excess burden Barro (1979) predicts that government issues debt to smooth current tax rates over business cycle n Excess burden rises with square of tax rate → Increase debt when tax revenues temporarily decline and viceversa lowers overall excess burden n

Strategic use of deficit n Voters cannot be sure that future majorities share their preferences for PG ¨ Future government are committed to policies chosen in the present ¨ n n Voters in majority today who prefer e. g. a small public sector and anticipate that next majority will increase spending may favor issuing debt today to constrain the ability to spend of the future government (Alesina and Tabellini, 1990) The larger the disagreement between current and future MV → the larger the debt issue

Intergenerational conflict n n Voters who do not plan to leave positive bequest may support deficit financing Assuming that debt obligations are honored, bequest constrained voters may favor issuing debt to increase their own consumption If not bequest constrained, debt finance allows current voters to appropriate resources from future generations Key assumption is that governments always honor debt obligations inherited from the past → if they do not, no intergenerational redistribution through debt

Wars of attrition and democracies in deficit n n When fragmented government are affected by negative economic shocks, they find it difficult to increase current taxation to prevent large deficits → stabilization is delayed, debt rises The larger fragmentation and ideological polarization, the larger deficit response Buchanan and Wagner (1977) argue that deficit spending involves short run political benefits, while rising taxes to retire debt short run political costs → democracies are inherently deficit prone Why do people do not recognize future tax liabilities in current debt is the problem inherent in “Democracy in deficit” tradition

Empirical analysis n Empirical analyses of tax structures fall within 5 theoretical strands 1. 2. 3. 4. 5. n Vote maximization Median voter Leviathan Structure induced equilibrium Welfare maximization/Excess burden minimization Extremely wide scope of application, for tax systems, tax types, levels of government etc (Hettich and Winer, 1997)

Problems of regression analyses n n n Difficult to distinguish the implication of vote maximization from MV → some measure of heterogeneity of voters’ preferences identifies vote maximization → variables that describe interest groups Variables defining interest groups are not very precise (number? wealth? size? expected gains/losses? ) Qualitative and historical analyses highlight better the role of interest groups

Stable results n n 3 types of regressors of PV and MV always come out significant Revenue composition positively depends on ¨ size and rate of growth of tax bases ¨ Possibility to shift tax burdens to other jurisdictions ¨ Interjurisdictional tax competition (yardstick or Tiebout type)

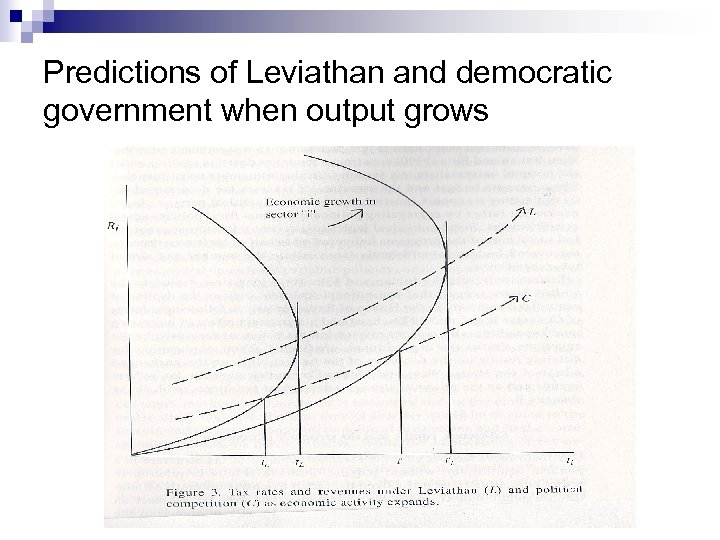

Vote maximization and Leviathan n n Leviathan and PV models have similar implications (complexity) Theoretical difference is that Leviathan taxes more → how to distinguish more revenues due to economic growth and to more repressive taxation? A significant impact of democratic institutions and of interest groups on tax structure equation should distinguish vote maximization from Leviathan (under Leviathan they should not be relevant) In many countries (AUS, Schneider and Pommerehne, 1980; USA, Holcombe and Mills, 1995). In Italy they are weakly significant (Galli and Profeta, 2007)

Predictions of Leviathan and democratic government when output grows

Structure induced equilibrium n n Very little empirical research in this field Inman and Fitts (1990) test universalism → legislators of all parties design tax structures and size of budget to accommodate all interests LR analysis In US, decline of centralized role of House appears to Explain growth of public spending ¨ Insignificant for tax structure → possibly due to unchanged power of House Ways and Means Committee on tax reform agenda ¨

Normative empirical analyses n Most of public finance literature has normative tone → need to verify whether tax structures respond to normative goals, such as ¨ Economic efficiency ¨ Equity

Economic efficiency n n n Some positive evidence that political equilibria (tax structures) found by PV models are economically efficient? Link is political competition → individual voters care only about personal welfare, but parties who would ignore policy changes that could make some better off without making others worse off would do more poorly in the polls than the opposition Look at efficiency of political systems → how they facilitate flow of info, elimination of rents → how these properties affect their shaping of tax structures

Equity n 2 concepts of equity Vertical equity → influence of taxation on the distribution of income ¨ Horizontal equity → are similar taxpayers treated equally? ¨ n n In PV models the question is whether equity criteria are political equilibria → normative evaluations apply one step backwards to political institutions that determine such equilibria PV models suggest that tax structures depend on Laffer curves, tax shifting and administrative costs, not on Simons criteria (broad based taxes, comprehensive taxation etc. )

Normative concerns with Leviathan governments Normative implications of Leviathan model are constitutional limitations on government n Constitutional reforms are different type of political equilibrium → require quasiunanimous agreements n Veil of ignorance hypothesis often misleading for empirical analysis n

353801ee96f0b6090705c0923937dc4d.ppt