7138c72dff0070b26a2f4366c44ecb7b.ppt

- Количество слайдов: 24

Poland – the EU front runner in terms of growth performance BRE - BRE Bank – best – in - class financial services’ provider in Poland Przemysław Gdański BRE Bank Management Board Member Head of Corporate Banking Tel Aviv, Dec 12, 2010

Poland – the EU front runner in terms of growth performance BRE - BRE Bank – best – in - class financial services’ provider in Poland Przemysław Gdański BRE Bank Management Board Member Head of Corporate Banking Tel Aviv, Dec 12, 2010

Poland – the EU front runner in terms of growth performance 2

Poland – the EU front runner in terms of growth performance 2

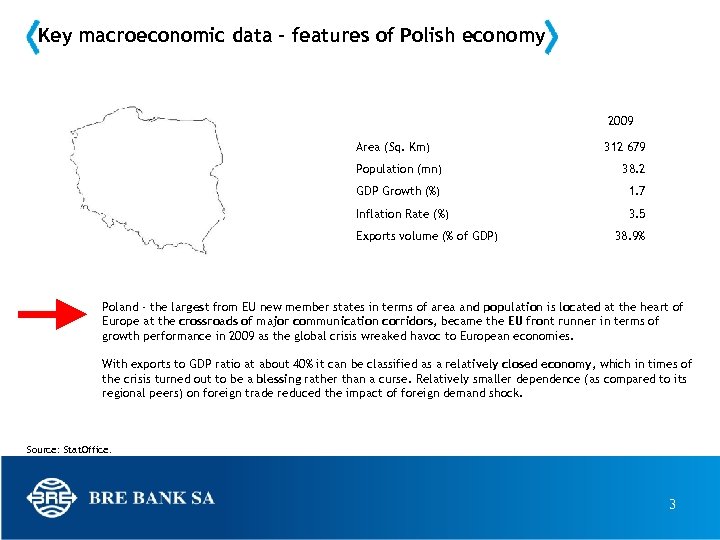

Key macroeconomic data – features of Polish economy 2009 Area (Sq. Km) 312 679 Population (mn) 38. 2 GDP Growth (%) 1. 7 Inflation Rate (%) 3. 5 Exports volume (% of GDP) 38. 9% Poland - the largest from EU new member states in terms of area and population is located at the heart of Europe at the crossroads of major communication corridors, became the EU front runner in terms of growth performance in 2009 as the global crisis wreaked havoc to European economies. With exports to GDP ratio at about 40% it can be classified as a relatively closed economy, which in times of the crisis turned out to be a blessing rather than a curse. Relatively smaller dependence (as compared to its regional peers) on foreign trade reduced the impact of foreign demand shock. Source: Stat. Office. 3

Key macroeconomic data – features of Polish economy 2009 Area (Sq. Km) 312 679 Population (mn) 38. 2 GDP Growth (%) 1. 7 Inflation Rate (%) 3. 5 Exports volume (% of GDP) 38. 9% Poland - the largest from EU new member states in terms of area and population is located at the heart of Europe at the crossroads of major communication corridors, became the EU front runner in terms of growth performance in 2009 as the global crisis wreaked havoc to European economies. With exports to GDP ratio at about 40% it can be classified as a relatively closed economy, which in times of the crisis turned out to be a blessing rather than a curse. Relatively smaller dependence (as compared to its regional peers) on foreign trade reduced the impact of foreign demand shock. Source: Stat. Office. 3

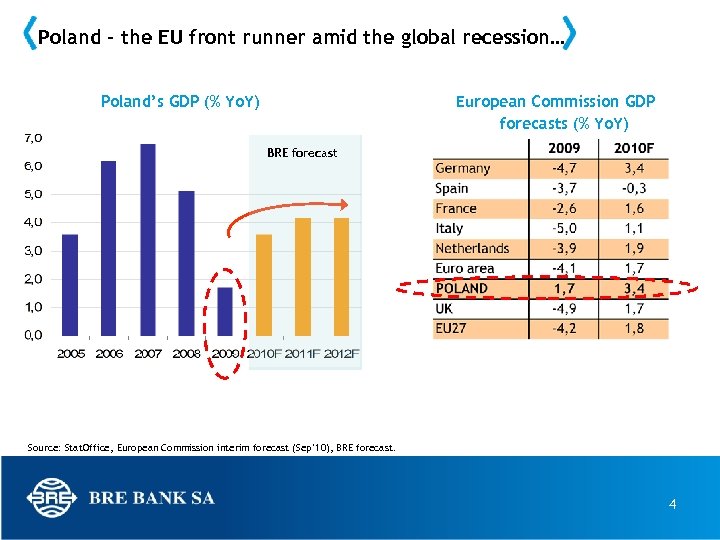

Poland – the EU front runner amid the global recession… Poland’s GDP (% Yo. Y) European Commission GDP forecasts (% Yo. Y) BRE forecast Source: Stat. Office, European Commission interim forecast (Sep’ 10), BRE forecast. 4

Poland – the EU front runner amid the global recession… Poland’s GDP (% Yo. Y) European Commission GDP forecasts (% Yo. Y) BRE forecast Source: Stat. Office, European Commission interim forecast (Sep’ 10), BRE forecast. 4

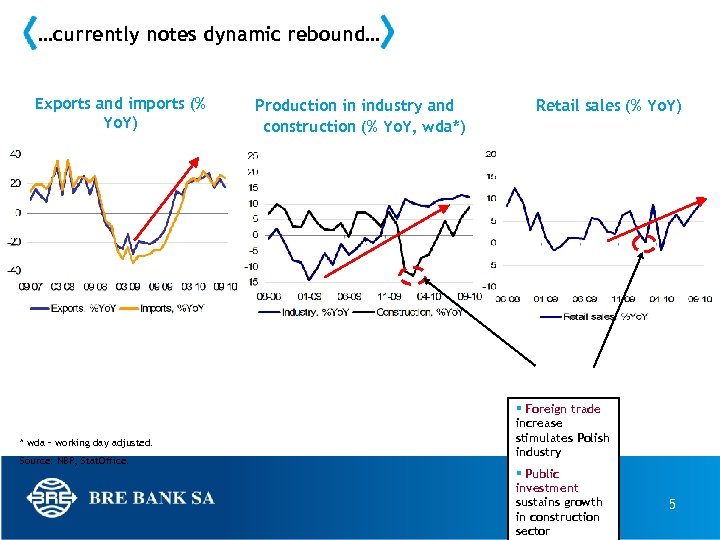

…currently notes dynamic rebound… Exports and imports (% Yo. Y) * wda – working day adjusted. Source: NBP, Stat. Office. Production in industry and construction (% Yo. Y, wda*) Retail sales (% Yo. Y) One-off effects of Foreign trade harsh increasewinter stimulates Polish industry Public investment sustains growth in construction sector 5

…currently notes dynamic rebound… Exports and imports (% Yo. Y) * wda – working day adjusted. Source: NBP, Stat. Office. Production in industry and construction (% Yo. Y, wda*) Retail sales (% Yo. Y) One-off effects of Foreign trade harsh increasewinter stimulates Polish industry Public investment sustains growth in construction sector 5

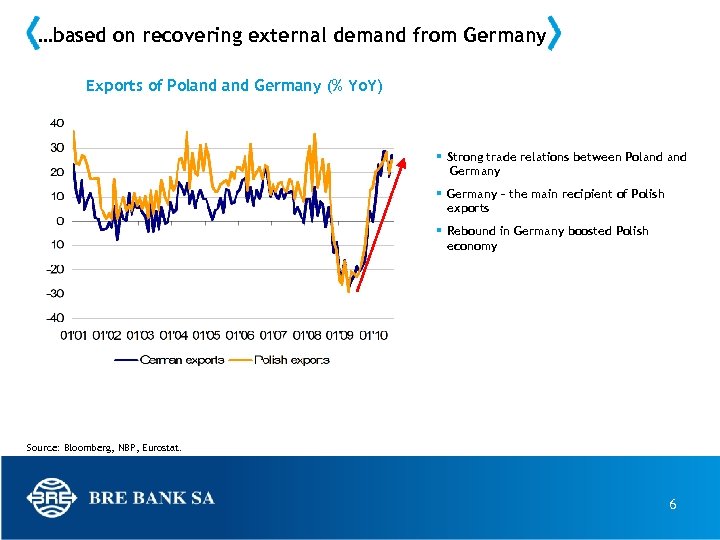

…based on recovering external demand from Germany Exports of Poland Germany (% Yo. Y) Strong trade relations between Poland Germany – the main recipient of Polish exports Rebound in Germany boosted Polish economy Source: Bloomberg, NBP, Eurostat. 6

…based on recovering external demand from Germany Exports of Poland Germany (% Yo. Y) Strong trade relations between Poland Germany – the main recipient of Polish exports Rebound in Germany boosted Polish economy Source: Bloomberg, NBP, Eurostat. 6

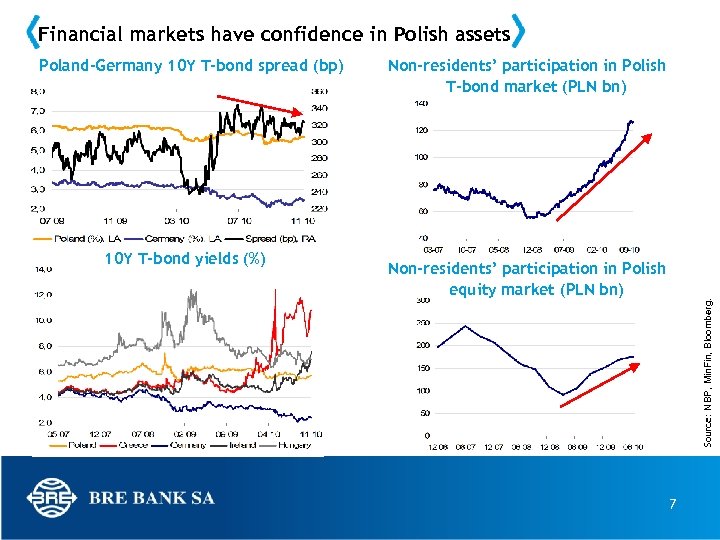

Financial markets have confidence in Polish assets 10 Y T-bond yields (%) Non-residents’ participation in Polish T-bond market (PLN bn) Non-residents’ participation in Polish equity market (PLN bn) Source: NBP, Min. Fin, Bloomberg. Poland-Germany 10 Y T-bond spread (bp) 7

Financial markets have confidence in Polish assets 10 Y T-bond yields (%) Non-residents’ participation in Polish T-bond market (PLN bn) Non-residents’ participation in Polish equity market (PLN bn) Source: NBP, Min. Fin, Bloomberg. Poland-Germany 10 Y T-bond spread (bp) 7

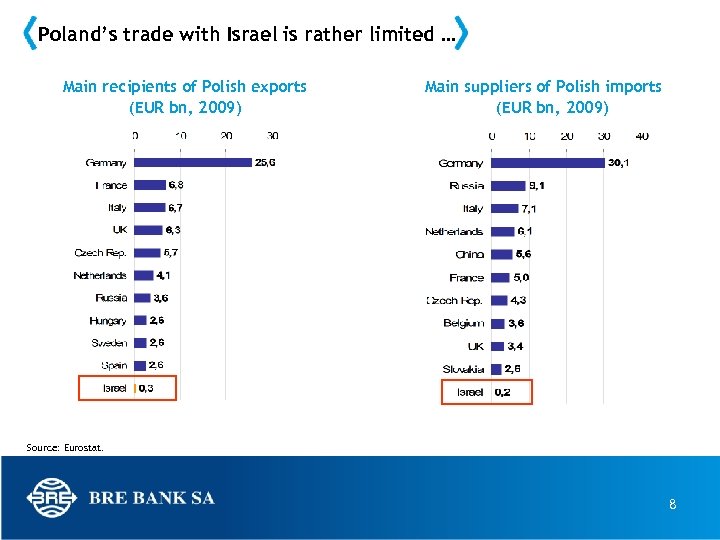

Poland’s trade with Israel is rather limited … Main recipients of Polish exports (EUR bn, 2009) Main suppliers of Polish imports (EUR bn, 2009) Source: Eurostat. 8

Poland’s trade with Israel is rather limited … Main recipients of Polish exports (EUR bn, 2009) Main suppliers of Polish imports (EUR bn, 2009) Source: Eurostat. 8

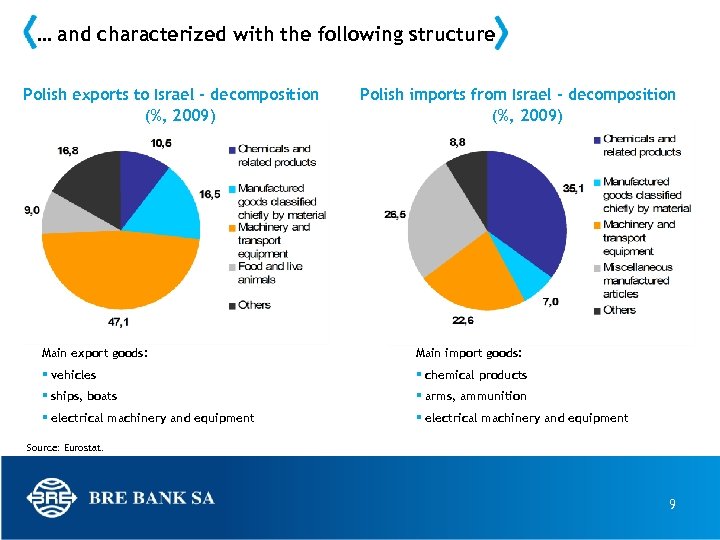

… and characterized with the following structure Polish exports to Israel - decomposition (%, 2009) Polish imports from Israel - decomposition (%, 2009) Main export goods: Main import goods: vehicles chemical products ships, boats arms, ammunition electrical machinery and equipment Source: Eurostat. 9

… and characterized with the following structure Polish exports to Israel - decomposition (%, 2009) Polish imports from Israel - decomposition (%, 2009) Main export goods: Main import goods: vehicles chemical products ships, boats arms, ammunition electrical machinery and equipment Source: Eurostat. 9

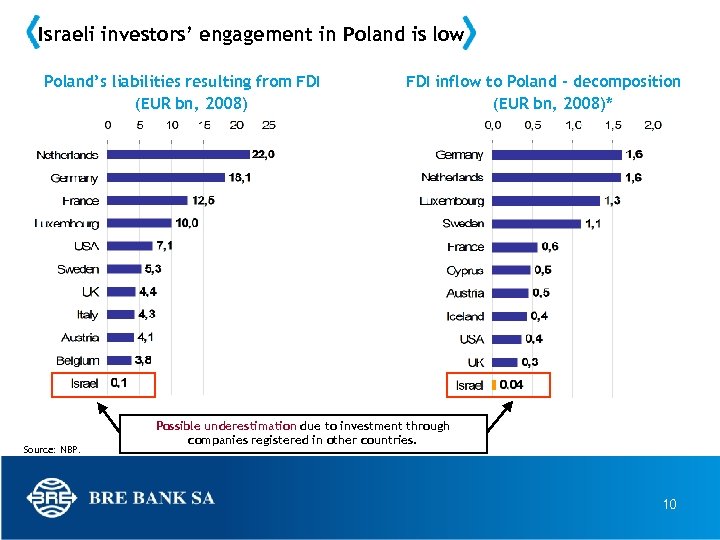

Israeli investors’ engagement in Poland is low Poland’s liabilities resulting from FDI (EUR bn, 2008) Source: NBP. FDI inflow to Poland - decomposition (EUR bn, 2008)* Possible underestimation due to investment through companies registered in other countries. 10

Israeli investors’ engagement in Poland is low Poland’s liabilities resulting from FDI (EUR bn, 2008) Source: NBP. FDI inflow to Poland - decomposition (EUR bn, 2008)* Possible underestimation due to investment through companies registered in other countries. 10

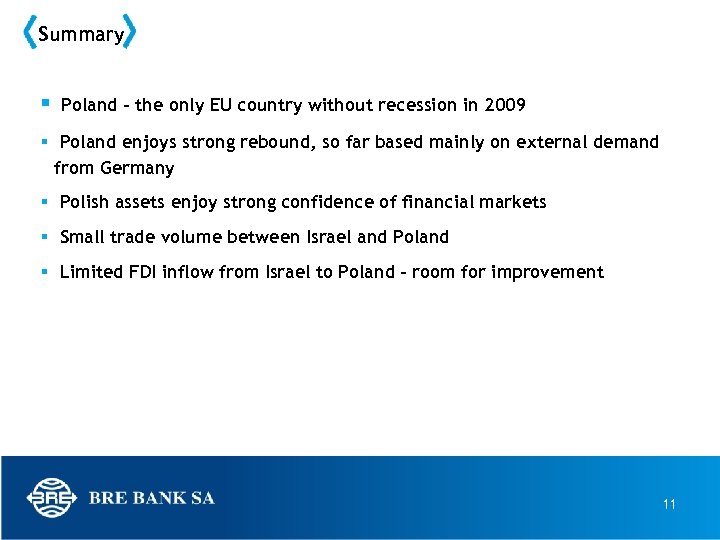

Summary Poland – the only EU country without recession in 2009 Poland enjoys strong rebound, so far based mainly on external demand from Germany Polish assets enjoy strong confidence of financial markets Small trade volume between Israel and Poland Limited FDI inflow from Israel to Poland – room for improvement 11

Summary Poland – the only EU country without recession in 2009 Poland enjoys strong rebound, so far based mainly on external demand from Germany Polish assets enjoy strong confidence of financial markets Small trade volume between Israel and Poland Limited FDI inflow from Israel to Poland – room for improvement 11

BRE Bank – best – in - class financial services’ provider in Poland 12

BRE Bank – best – in - class financial services’ provider in Poland 12

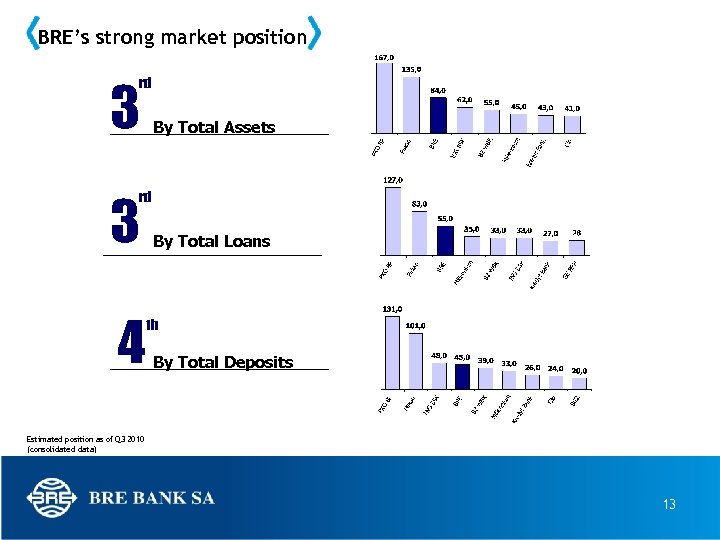

BRE’s strong market position 3 By Total Assets 3 By Total Loans rd rd 4 th By Total Deposits Estimated position as of Q 3 2010 (consolidated data) 13

BRE’s strong market position 3 By Total Assets 3 By Total Loans rd rd 4 th By Total Deposits Estimated position as of Q 3 2010 (consolidated data) 13

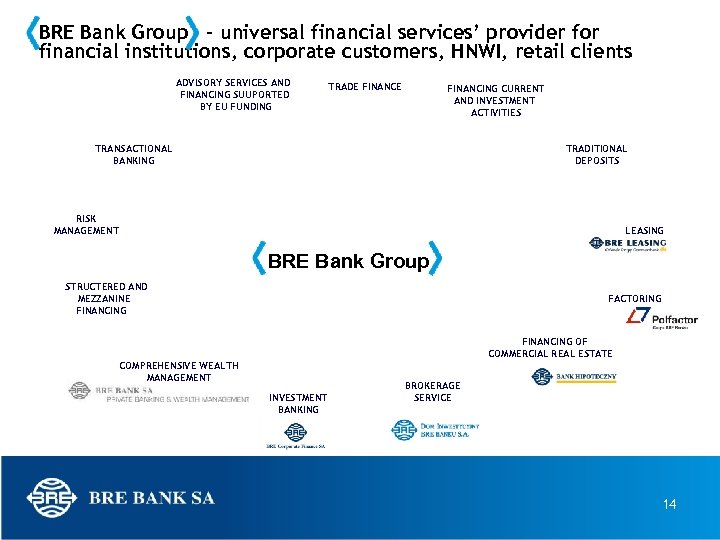

BRE Bank Group – universal financial services’ provider for financial institutions, corporate customers, HNWI, retail clients ADVISORY SERVICES AND FINANCING SUUPORTED BY EU FUNDING TRADE FINANCING CURRENT AND INVESTMENT ACTIVITIES TRADITIONAL DEPOSITS TRANSACTIONAL BANKING RISK MANAGEMENT LEASING BRE Bank Group STRUCTERED AND MEZZANINE FINANCING FACTORING FINANCING OF COMMERCIAL REAL ESTATE COMPREHENSIVE WEALTH MANAGEMENT INVESTMENT BANKING BROKERAGE SERVICE 14

BRE Bank Group – universal financial services’ provider for financial institutions, corporate customers, HNWI, retail clients ADVISORY SERVICES AND FINANCING SUUPORTED BY EU FUNDING TRADE FINANCING CURRENT AND INVESTMENT ACTIVITIES TRADITIONAL DEPOSITS TRANSACTIONAL BANKING RISK MANAGEMENT LEASING BRE Bank Group STRUCTERED AND MEZZANINE FINANCING FACTORING FINANCING OF COMMERCIAL REAL ESTATE COMPREHENSIVE WEALTH MANAGEMENT INVESTMENT BANKING BROKERAGE SERVICE 14

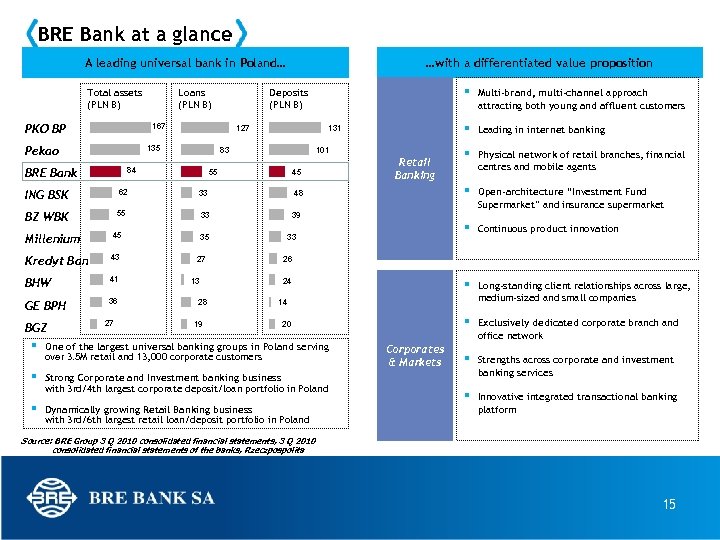

BRE Bank at a glance A leading universal bank in Poland… Total assets (PLN B) PKO BP Loans (PLN B) 127 135 BRE Bank 55 ING BSK 62 33 BZ WBK 55 45 33 Millenium 45 Kredyt Bank 43 BHW 41 GE BPH 36 BGZ 27 33 35 27 13 28 19 Open-architecture “Investment Fund Supermarket” and insurance supermarket Continuous product innovation Long-standing client relationships across large, medium-sized and small companies 39 Physical network of retail branches, financial centres and mobile agents 48 Retail Banking Leading in internet banking 101 Multi-brand, multi-channel approach attracting both young and affluent customers 131 83 84 Deposits (PLN B) 167 Pekao …with a differentiated value proposition Exclusively dedicated corporate branch and office network Strengths across corporate and investment banking services Innovative integrated transactional banking platform 26 24 14 20 One of the largest universal banking groups in Poland serving over 3. 5 M retail and 13, 000 corporate customers Strong Corporate and Investment banking business with 3 rd/4 th largest corporate deposit/loan portfolio in Poland Dynamically growing Retail Banking business with 3 rd/6 th largest retail loan/deposit portfolio in Poland Corporates & Markets Source: BRE Group 3 Q 2010 consolidated financial statements, 3 Q 2010 consolidated financial statements of the banks, Rzeczpospolita 15

BRE Bank at a glance A leading universal bank in Poland… Total assets (PLN B) PKO BP Loans (PLN B) 127 135 BRE Bank 55 ING BSK 62 33 BZ WBK 55 45 33 Millenium 45 Kredyt Bank 43 BHW 41 GE BPH 36 BGZ 27 33 35 27 13 28 19 Open-architecture “Investment Fund Supermarket” and insurance supermarket Continuous product innovation Long-standing client relationships across large, medium-sized and small companies 39 Physical network of retail branches, financial centres and mobile agents 48 Retail Banking Leading in internet banking 101 Multi-brand, multi-channel approach attracting both young and affluent customers 131 83 84 Deposits (PLN B) 167 Pekao …with a differentiated value proposition Exclusively dedicated corporate branch and office network Strengths across corporate and investment banking services Innovative integrated transactional banking platform 26 24 14 20 One of the largest universal banking groups in Poland serving over 3. 5 M retail and 13, 000 corporate customers Strong Corporate and Investment banking business with 3 rd/4 th largest corporate deposit/loan portfolio in Poland Dynamically growing Retail Banking business with 3 rd/6 th largest retail loan/deposit portfolio in Poland Corporates & Markets Source: BRE Group 3 Q 2010 consolidated financial statements, 3 Q 2010 consolidated financial statements of the banks, Rzeczpospolita 15

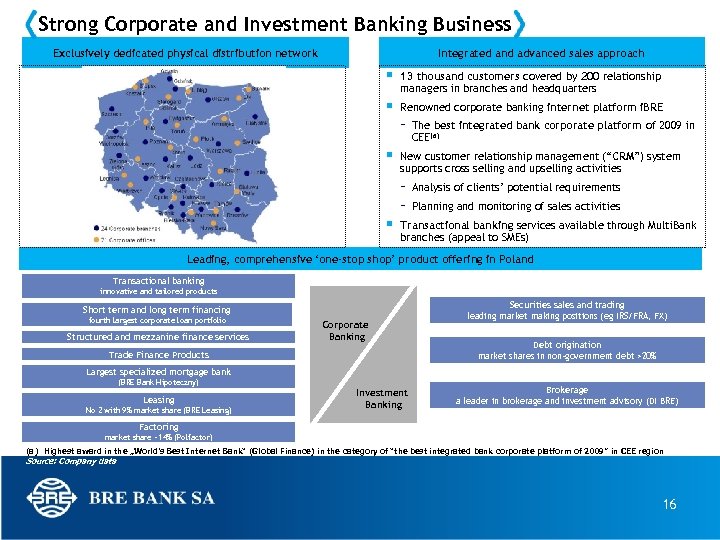

Strong Corporate and Investment Banking Business Exclusively dedicated physical distribution network Integrated and advanced sales approach 13 thousand customers covered by 200 relationship managers in branches and headquarters Renowned corporate banking internet platform i. BRE New customer relationship management (“CRM”) system supports cross selling and upselling activities The best integrated bank corporate platform of 2009 in CEE(a) Analysis of clients’ potential requirements Planning and monitoring of sales activities Transactional banking services available through Multi. Bank branches (appeal to SMEs) Leading, comprehensive ‘one-stop shop’ product offering in Poland Transactional banking innovative and tailored products Short term and long term financing fourth largest corporate loan portfolio Structured and mezzanine finance services Corporate Banking Trade Finance Products Securities sales and trading leading market making positions (eg IRS/FRA, FX) Debt origination market shares in non-government debt >20% Largest specialized mortgage bank (BRE Bank Hipoteczny) Leasing No 2 with 9% market share (BRE Leasing) Investment Banking Brokerage a leader in brokerage and investment advisory (DI BRE) Factoring market share ~14% (Polfactor) (a) Highest award in the „World’s Best Internet Bank“ (Global Finance) in the category of “the best integrated bank corporate platform of 2009” in CEE region Source: Company data 16

Strong Corporate and Investment Banking Business Exclusively dedicated physical distribution network Integrated and advanced sales approach 13 thousand customers covered by 200 relationship managers in branches and headquarters Renowned corporate banking internet platform i. BRE New customer relationship management (“CRM”) system supports cross selling and upselling activities The best integrated bank corporate platform of 2009 in CEE(a) Analysis of clients’ potential requirements Planning and monitoring of sales activities Transactional banking services available through Multi. Bank branches (appeal to SMEs) Leading, comprehensive ‘one-stop shop’ product offering in Poland Transactional banking innovative and tailored products Short term and long term financing fourth largest corporate loan portfolio Structured and mezzanine finance services Corporate Banking Trade Finance Products Securities sales and trading leading market making positions (eg IRS/FRA, FX) Debt origination market shares in non-government debt >20% Largest specialized mortgage bank (BRE Bank Hipoteczny) Leasing No 2 with 9% market share (BRE Leasing) Investment Banking Brokerage a leader in brokerage and investment advisory (DI BRE) Factoring market share ~14% (Polfactor) (a) Highest award in the „World’s Best Internet Bank“ (Global Finance) in the category of “the best integrated bank corporate platform of 2009” in CEE region Source: Company data 16

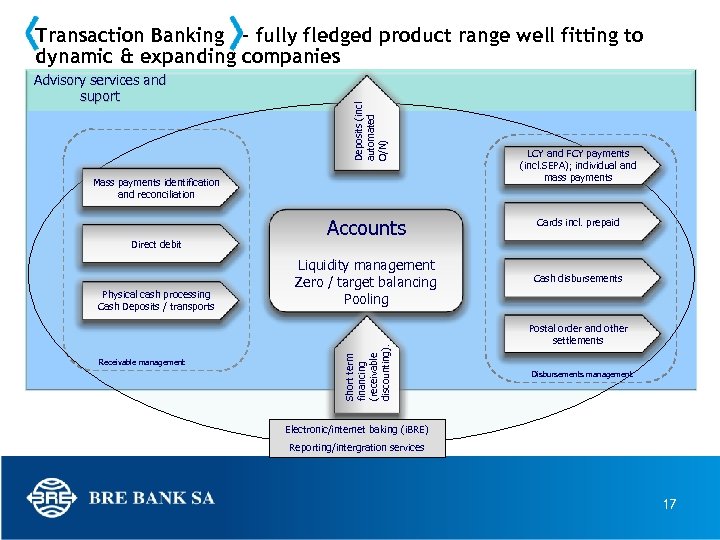

Advisory services and suport Deposits (incl automated O/N) Transaction Banking - fully fledged product range well fitting to dynamic & expanding companies Mass payments identification and reconciliation Physical cash processing Cash Deposits / transports Receivable management Liquidity management Zero / target balancing Pooling Short term financing (receivable discounting). Direct debit Accounts LCY and FCY payments (incl. SEPA); individual and mass payments Cards incl. prepaid Cash disbursements Postal order and other settlements Disbursements management Electronic/internet baking (i. BRE) Reporting/intergration services 17

Advisory services and suport Deposits (incl automated O/N) Transaction Banking - fully fledged product range well fitting to dynamic & expanding companies Mass payments identification and reconciliation Physical cash processing Cash Deposits / transports Receivable management Liquidity management Zero / target balancing Pooling Short term financing (receivable discounting). Direct debit Accounts LCY and FCY payments (incl. SEPA); individual and mass payments Cards incl. prepaid Cash disbursements Postal order and other settlements Disbursements management Electronic/internet baking (i. BRE) Reporting/intergration services 17

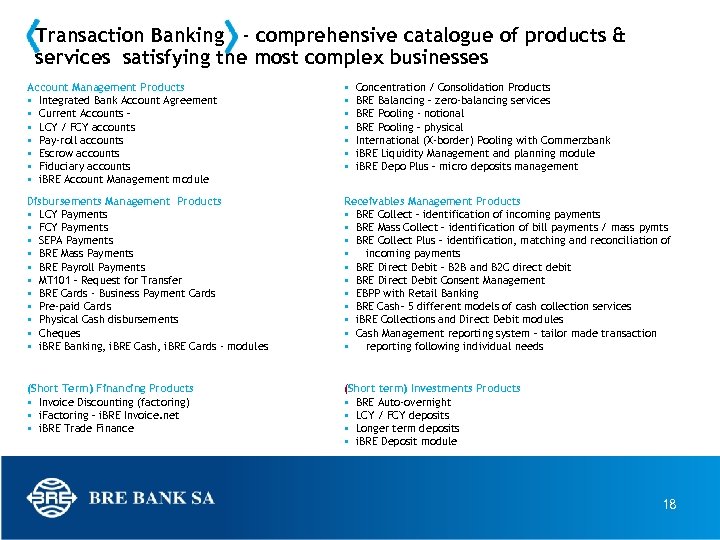

Transaction Banking - comprehensive catalogue of products & services satisfying the most complex businesses Account Management Products Integrated Bank Account Agreement Current Accounts – LCY / FCY accounts Pay-roll accounts Escrow accounts Fiduciary accounts i. BRE Account Management module Disbursements Management Products LCY Payments FCY Payments SEPA Payments BRE Mass Payments BRE Payroll Payments MT 101 – Request for Transfer BRE Cards - Business Payment Cards Pre-paid Cards Physical Cash disbursements Cheques i. BRE Banking, i. BRE Cash, i. BRE Cards - modules Receivables Management Products BRE Collect – identification of incoming payments BRE Mass Collect – identification of bill payments / mass pymts BRE Collect Plus – identification, matching and reconciliation of incoming payments BRE Direct Debit – B 2 B and B 2 C direct debit BRE Direct Debit Consent Management EBPP with Retail Banking BRE Cash– 5 different models of cash collection services i. BRE Collections and Direct Debit modules Cash Management reporting system – tailor made transaction reporting following individual needs (Short Term) Financing Products Invoice Discounting (factoring) i. Factoring – i. BRE Invoice. net i. BRE Trade Finance (Short term) Investments Products BRE Auto-overnight LCY / FCY deposits Longer term deposits i. BRE Deposit module Concentration / Consolidation Products BRE Balancing – zero-balancing services BRE Pooling - notional BRE Pooling – physical International (X-border) Pooling with Commerzbank i. BRE Liquidity Management and planning module i. BRE Depo Plus – micro deposits management 18

Transaction Banking - comprehensive catalogue of products & services satisfying the most complex businesses Account Management Products Integrated Bank Account Agreement Current Accounts – LCY / FCY accounts Pay-roll accounts Escrow accounts Fiduciary accounts i. BRE Account Management module Disbursements Management Products LCY Payments FCY Payments SEPA Payments BRE Mass Payments BRE Payroll Payments MT 101 – Request for Transfer BRE Cards - Business Payment Cards Pre-paid Cards Physical Cash disbursements Cheques i. BRE Banking, i. BRE Cash, i. BRE Cards - modules Receivables Management Products BRE Collect – identification of incoming payments BRE Mass Collect – identification of bill payments / mass pymts BRE Collect Plus – identification, matching and reconciliation of incoming payments BRE Direct Debit – B 2 B and B 2 C direct debit BRE Direct Debit Consent Management EBPP with Retail Banking BRE Cash– 5 different models of cash collection services i. BRE Collections and Direct Debit modules Cash Management reporting system – tailor made transaction reporting following individual needs (Short Term) Financing Products Invoice Discounting (factoring) i. Factoring – i. BRE Invoice. net i. BRE Trade Finance (Short term) Investments Products BRE Auto-overnight LCY / FCY deposits Longer term deposits i. BRE Deposit module Concentration / Consolidation Products BRE Balancing – zero-balancing services BRE Pooling - notional BRE Pooling – physical International (X-border) Pooling with Commerzbank i. BRE Liquidity Management and planning module i. BRE Depo Plus – micro deposits management 18

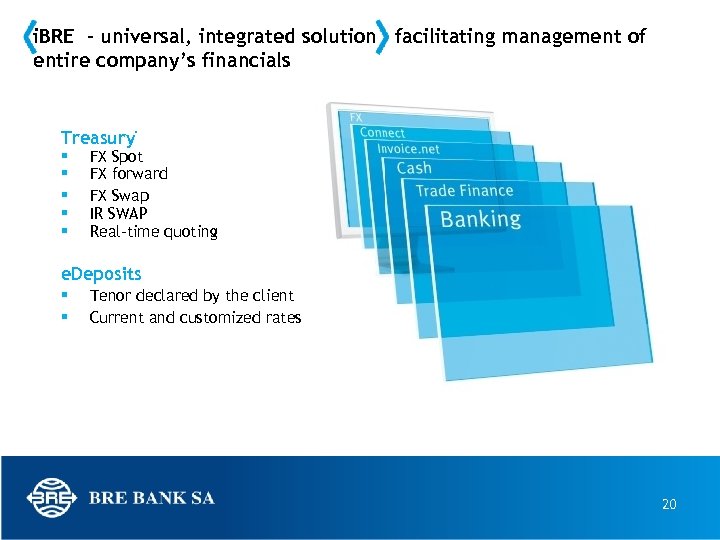

i. BRE – universal, integrated solution facilitating management of entire company’s financials i. BRE – Internet financial platform aggregating all financial services, within one access channel Transactional Banking Services Account management LCY and FCY payment management Cash Management orders management Other Banking Services Letters of credit, bank guarantees, collections Treasury Custody services Information management Customized reporting & analyses Electronic invoices and debt discount 19

i. BRE – universal, integrated solution facilitating management of entire company’s financials i. BRE – Internet financial platform aggregating all financial services, within one access channel Transactional Banking Services Account management LCY and FCY payment management Cash Management orders management Other Banking Services Letters of credit, bank guarantees, collections Treasury Custody services Information management Customized reporting & analyses Electronic invoices and debt discount 19

i. BRE – universal, integrated solution facilitating management of entire company’s financials Treasury * FX Spot FX forward FX Swap IR SWAP Real-time quoting e. Deposits Tenor declared by the client Current and customized rates 20

i. BRE – universal, integrated solution facilitating management of entire company’s financials Treasury * FX Spot FX forward FX Swap IR SWAP Real-time quoting e. Deposits Tenor declared by the client Current and customized rates 20

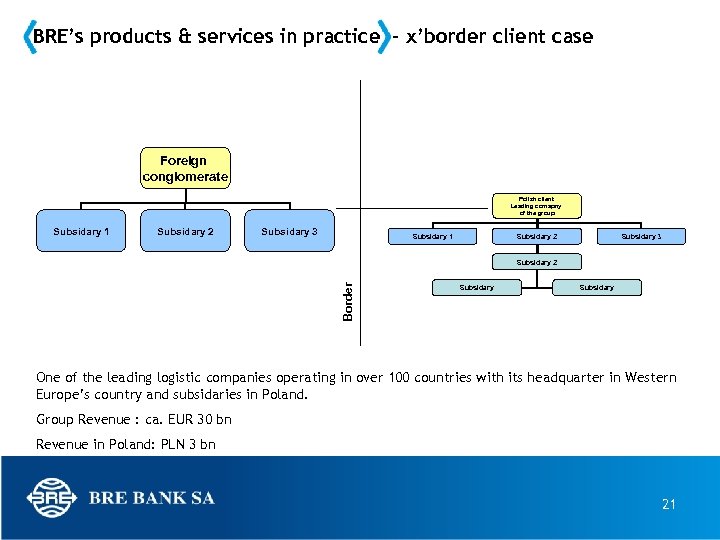

BRE’s products & services in practice – x’border client case Foreign conglomerate Polish client Leading comapny of the group Subsidary 1 Subsidary 2 Subsidary 3 Border Subsidary 2 Subsidary One of the leading logistic companies operating in over 100 countries with its headquarter in Western Europe’s country and subsidaries in Poland. Group Revenue : ca. EUR 30 bn Revenue in Poland: PLN 3 bn 21

BRE’s products & services in practice – x’border client case Foreign conglomerate Polish client Leading comapny of the group Subsidary 1 Subsidary 2 Subsidary 3 Border Subsidary 2 Subsidary One of the leading logistic companies operating in over 100 countries with its headquarter in Western Europe’s country and subsidaries in Poland. Group Revenue : ca. EUR 30 bn Revenue in Poland: PLN 3 bn 21

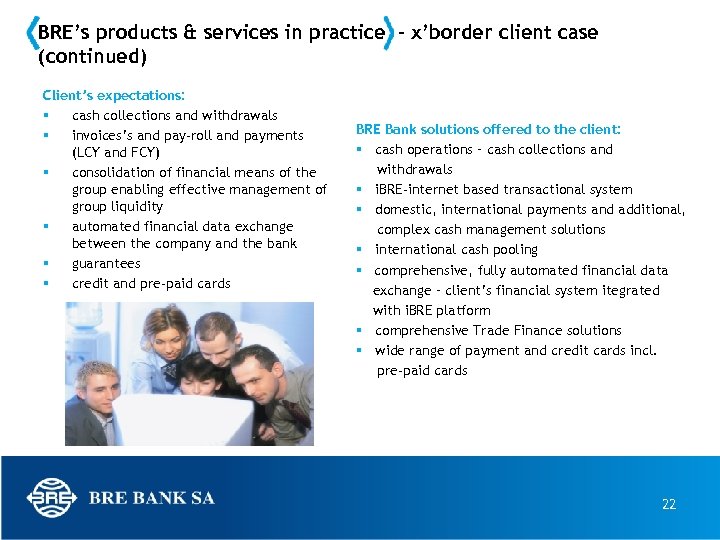

BRE’s products & services in practice – x’border client case (continued) Client’s expectations: cash collections and withdrawals invoices’s and pay-roll and payments (LCY and FCY) consolidation of financial means of the group enabling effective management of group liquidity automated financial data exchange between the company and the bank guarantees credit and pre-paid cards BRE Bank solutions offered to the client: cash operations – cash collections and withdrawals i. BRE-internet based transactional system domestic, international payments and additional, complex cash management solutions international cash pooling comprehensive, fully automated financial data exchange – client’s financial system itegrated with i. BRE platform comprehensive Trade Finance solutions wide range of payment and credit cards incl. pre-paid cards 22

BRE’s products & services in practice – x’border client case (continued) Client’s expectations: cash collections and withdrawals invoices’s and pay-roll and payments (LCY and FCY) consolidation of financial means of the group enabling effective management of group liquidity automated financial data exchange between the company and the bank guarantees credit and pre-paid cards BRE Bank solutions offered to the client: cash operations – cash collections and withdrawals i. BRE-internet based transactional system domestic, international payments and additional, complex cash management solutions international cash pooling comprehensive, fully automated financial data exchange – client’s financial system itegrated with i. BRE platform comprehensive Trade Finance solutions wide range of payment and credit cards incl. pre-paid cards 22

Selection of awards and distinctions 2010 i. BRE platform - the winner in five categories of prestigious international contest „World Best Internet Banks 2010” run by Global Finance magazine: Best Corporate/Institutional Internet Bank Central & Eastern Europe Best Corporate/Institutional Internet Bank Poland Best Integrated Corporate Bank Site Central & Eastern Europe Best Consumer Internet Bank - m. Bank Czech Republic Best Integrated Consumer Bank Site – m. Bank and Multibank Central & Eastern Europe 23

Selection of awards and distinctions 2010 i. BRE platform - the winner in five categories of prestigious international contest „World Best Internet Banks 2010” run by Global Finance magazine: Best Corporate/Institutional Internet Bank Central & Eastern Europe Best Corporate/Institutional Internet Bank Poland Best Integrated Corporate Bank Site Central & Eastern Europe Best Consumer Internet Bank - m. Bank Czech Republic Best Integrated Consumer Bank Site – m. Bank and Multibank Central & Eastern Europe 23

Selection of awards and distinctions 2010 Award of Euromoney Magazine 2010: The Management Board won the second place in the category „Bank with most accessible Senior Management” 24

Selection of awards and distinctions 2010 Award of Euromoney Magazine 2010: The Management Board won the second place in the category „Bank with most accessible Senior Management” 24