45f1977758b2ed35a0bd5d29ba1f7fe0.ppt

- Количество слайдов: 21

Pointers of a Keynote Speech to be delivered by Minister of Finance at an International Conference on Budgeting for Performances – Modernizing Public Financial Management in Indonesia Jakarta, May 26, 2008

BACKGROUND v To achieve the nation goals of increasing people’s welfare, it is necessary to establish a sound and stable economy; v The most essential effort in setting up a robust economy is by implementing credible budget. v Credible budget needs suitable planning that guide budget policy to achieve the national goals. v Thus, planning and budgeting system plays significant role in determining the success of government policy performance; v However, the existing planning and budgeting system has been out of date and incapable of ruling the whole aspects of public finance management as expected by constitution; v Budget reform is a must.

WHAT CIRCUMSTANCES GENERATE BUDGET REFORM ? 1) The willingness to change the Indonesian Public Finance Law inherited from Colonial Administration; • • 2) The existing Indonesian Treasury Law has been out of date and incapable of ruling the whole aspects of public finance management The changing of the old Public Finance law to the new one, can strengthen the implementation of checks and balances budget preparation process. The awareness of having dual budget classification causes inefficiency. § Dual budget classification creates ambiguity and eventually causes duplication and distortion on activity resource allocation—needs unification; § GFS system which provides single table of account prevents the creation of ambiguous activity resulting from distortion on resource allocation as well as duplication on budget allocation. 3) Strong demand to implement good governance • Demand to implement good governance necessitates reform on budget management. • To assure the implementation of good governance in the budget operation, the budget should be managed in discipline, sustainable, transparent, efficient, and accountable manner.

LEGAL ASPECT OF THE BUDGET REFORM v The reform has now been underway. . . v The new laws and regulations on public finance, treasury, and planning which have been ratified and performed as legal basic for implementing new budget system include: • • • Law No 17 / 2003 on Public Finance Law No 1 / 2004 on Treasury Law No 15 / 2004 on Auditing of Public Finance Account Law No 25 / 2004 on National Development Planning Regulation No 20 / 2004 on Government Work Plan Regulation No 21 / 2004 on Line Ministry and Agency Budget Work Plan.

WHAT ARE THE OBJECTIVES OF THE REFORM ? 1. To assure checks and balances in the budget process § The principle of checks and balances in the budget process implies equal role between the government and the parliament in determining the budget. § The present of Law No 17/2003 which regulates the rule above gives the assurance on the implementation of checks and balances in budget preparation. 2. To raise self confidence by replacing traditional Indonesian Treasury Law with new Public Finance Laws • Long lasting implementation of traditional Indonesian Treasury Law may delegitimate national confidence and dignity. • The ratification of Public Finance Law Year 2003, therefore, becomes the starting point to raise self confidence and national dignity. 3. To improve the quality of decision making process on budget allocation and hold budget users accountable for outputs /outcomes through the utilization of performance information 4. In broad sense, the objective of reform is to establish credible and sustainable budget, which apparently determines the performance of the economy

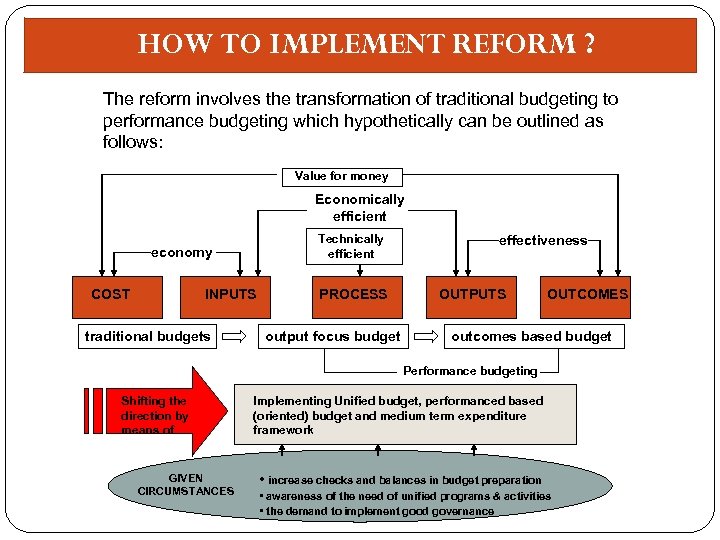

HOW TO IMPLEMENT REFORM ? The reform involves the transformation of traditional budgeting to performance budgeting which hypothetically can be outlined as follows: Value for money Economically efficient Technically efficient economy COST INPUTS traditional budgets PROCESS output focus budget effectiveness OUTPUTS OUTCOMES outcomes based budget Performance budgeting Shifting the direction by means of GIVEN CIRCUMSTANCES Implementing Unified budget, performanced based (oriented) budget and medium term expenditure framework • increase checks and balances in budget preparation • awareness of the need of unified programs & activities • the demand to implement good governance

THREE KEY ELEMENTS OF THE BUDGET REFORM 1. Unified Budget Approach 2. Performanced Oriented Budget Approach 3. Medium Term Expenditure Framework Approach

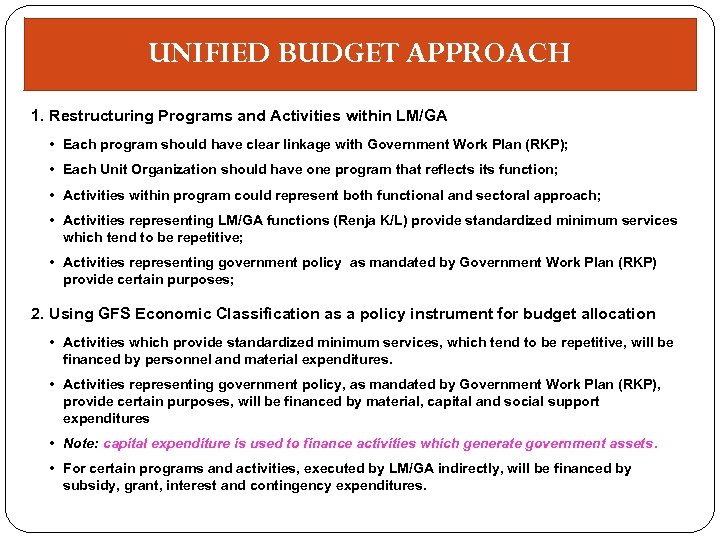

UNIFIED BUDGET APPROACH 1. Restructuring Programs and Activities within LM/GA • Each program should have clear linkage with Government Work Plan (RKP); • Each Unit Organization should have one program that reflects its function; • Activities within program could represent both functional and sectoral approach; • Activities representing LM/GA functions (Renja K/L) provide standardized minimum services which tend to be repetitive; • Activities representing government policy as mandated by Government Work Plan (RKP) provide certain purposes; 2. Using GFS Economic Classification as a policy instrument for budget allocation • Activities which provide standardized minimum services, which tend to be repetitive, will be financed by personnel and material expenditures. • Activities representing government policy, as mandated by Government Work Plan (RKP), provide certain purposes, will be financed by material, capital and social support expenditures • Note: capital expenditure is used to finance activities which generate government assets. • For certain programs and activities, executed by LM/GA indirectly, will be financed by subsidy, grant, interest and contingency expenditures.

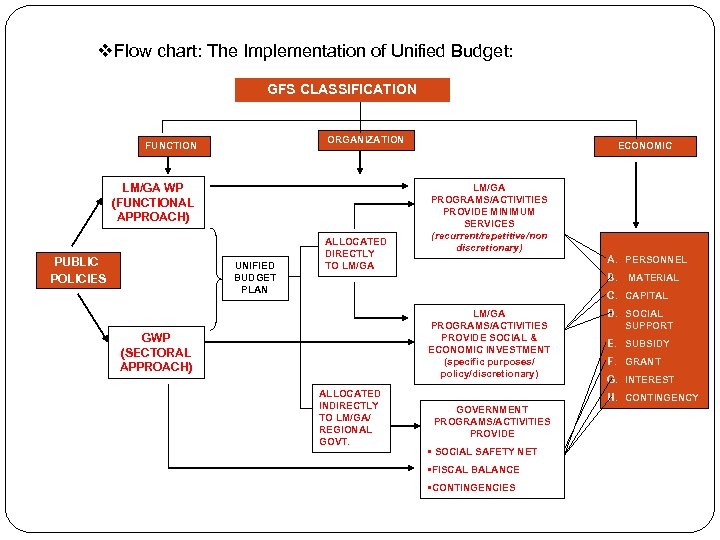

v. Flow chart: The Implementation of Unified Budget: GFS CLASSIFICATION ORGANIZATION FUNCTION LM/GA WP (FUNCTIONAL APPROACH) PUBLIC POLICIES UNIFIED BUDGET PLAN ALLOCATED DIRECTLY TO LM/GA ECONOMIC LM/GA PROGRAMS/ACTIVITIES PROVIDE MINIMUM SERVICES (recurrent/repetitive/non discretionary) A. PERSONNEL B. MATERIAL C. CAPITAL LM/GA PROGRAMS/ACTIVITIES PROVIDE SOCIAL & ECONOMIC INVESTMENT (specific purposes/ policy/discretionary) GWP (SECTORAL APPROACH) ALLOCATED INDIRECTLY TO LM/GA/ REGIONAL GOVT. D. SOCIAL SUPPORT E. SUBSIDY F. GRANT G. INTEREST H. CONTINGENCY GOVERNMENT PROGRAMS/ACTIVITIES PROVIDE § SOCIAL SAFETY NET §FISCAL BALANCE §CONTINGENCIES

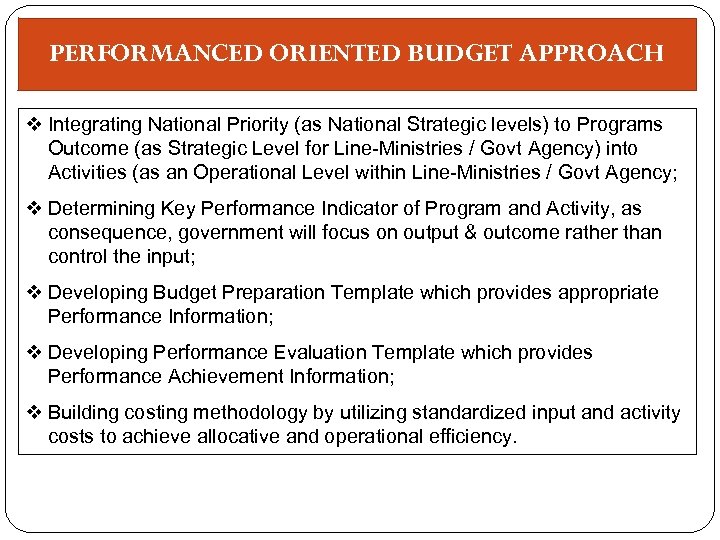

PERFORMANCED ORIENTED BUDGET APPROACH v Integrating National Priority (as National Strategic levels) to Programs Outcome (as Strategic Level for Line-Ministries / Govt Agency) into Activities (as an Operational Level within Line-Ministries / Govt Agency; v Determining Key Performance Indicator of Program and Activity, as consequence, government will focus on output & outcome rather than control the input; v Developing Budget Preparation Template which provides appropriate Performance Information; v Developing Performance Evaluation Template which provides Performance Achievement Information; v Building costing methodology by utilizing standardized input and activity costs to achieve allocative and operational efficiency.

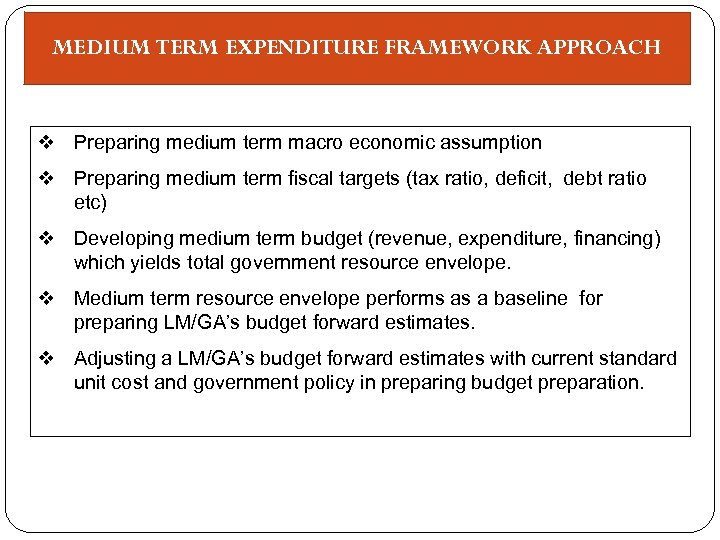

MEDIUM TERM EXPENDITURE FRAMEWORK APPROACH v Preparing medium term macro economic assumption v Preparing medium term fiscal targets (tax ratio, deficit, debt ratio etc) v Developing medium term budget (revenue, expenditure, financing) which yields total government resource envelope. v Medium term resource envelope performs as a baseline for preparing LM/GA’s budget forward estimates. v Adjusting a LM/GA’s budget forward estimates with current standard unit cost and government policy in preparing budget preparation.

CHALLENGES v Legal Aspect § Revised the Government Regulation to accommodate proposed budgeting system reform; § Harmonized all existing regulation related to public finance management, to avoid both overlapping and conflicting rules; v Paradigm—shifting the government control paradigm From tight input cost to performance based budget; § From “compliance and stewardess” to “let the managers manage, but keep them accountable” § v Dealing with the Parliament § Too deep intervention of the Parliament § Lengthy and detail deliberation process; § Costly decision making process

Thank You

ATTACHMENTS

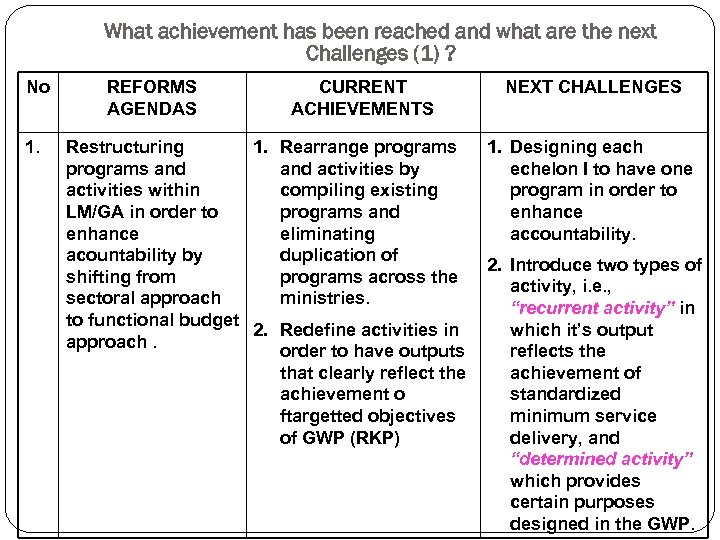

What achievement has been reached and what are the next Challenges (1) ? No 1. REFORMS AGENDAS CURRENT ACHIEVEMENTS Restructuring 1. Rearrange programs and activities by activities within compiling existing LM/GA in order to programs and enhance eliminating acountability by duplication of shifting from programs across the sectoral approach ministries. to functional budget 2. Redefine activities in approach. order to have outputs that clearly reflect the achievement o ftargetted objectives of GWP (RKP) NEXT CHALLENGES 1. Designing each echelon I to have one program in order to enhance accountability. 2. Introduce two types of activity, i. e. , “recurrent activity” in which it’s output reflects the achievement of standardized minimum service delivery, and “determined activity” which provides certain purposes designed in the GWP.

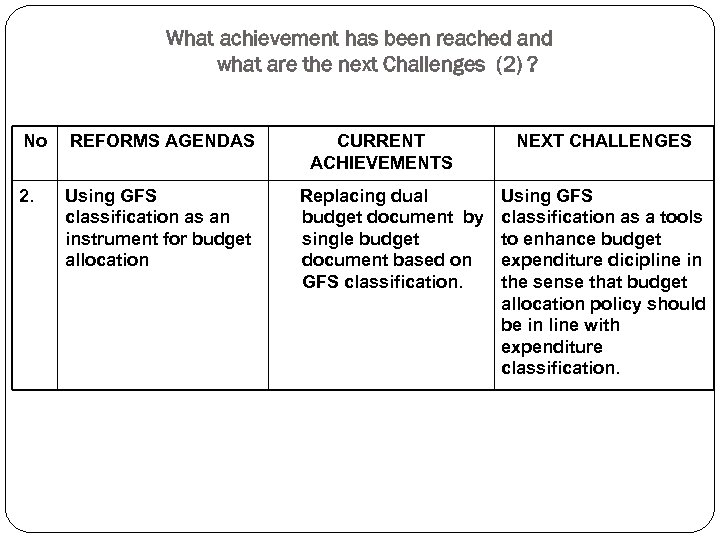

What achievement has been reached and what are the next Challenges (2) ? No 2. REFORMS AGENDAS Using GFS classification as an instrument for budget allocation CURRENT ACHIEVEMENTS Replacing dual budget document by single budget document based on GFS classification. NEXT CHALLENGES Using GFS classification as a tools to enhance budget expenditure dicipline in the sense that budget allocation policy should be in line with expenditure classification.

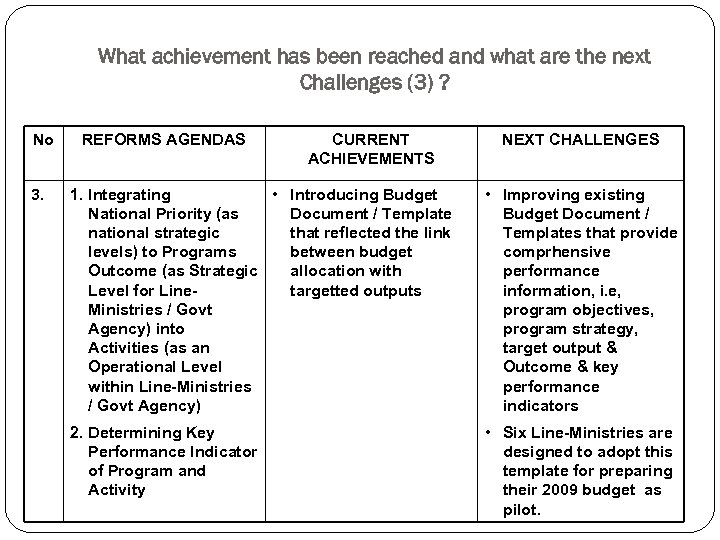

What achievement has been reached and what are the next Challenges (3) ? No 3. REFORMS AGENDAS CURRENT ACHIEVEMENTS NEXT CHALLENGES 1. Integrating • Introducing Budget National Priority (as Document / Template national strategic that reflected the link levels) to Programs between budget Outcome (as Strategic allocation with Level for Linetargetted outputs Ministries / Govt Agency) into Activities (as an Operational Level within Line-Ministries / Govt Agency) • Improving existing Budget Document / Templates that provide comprhensive performance information, i. e, program objectives, program strategy, target output & Outcome & key performance indicators 2. Determining Key Performance Indicator of Program and Activity • Six Line-Ministries are designed to adopt this template for preparing their 2009 budget as pilot.

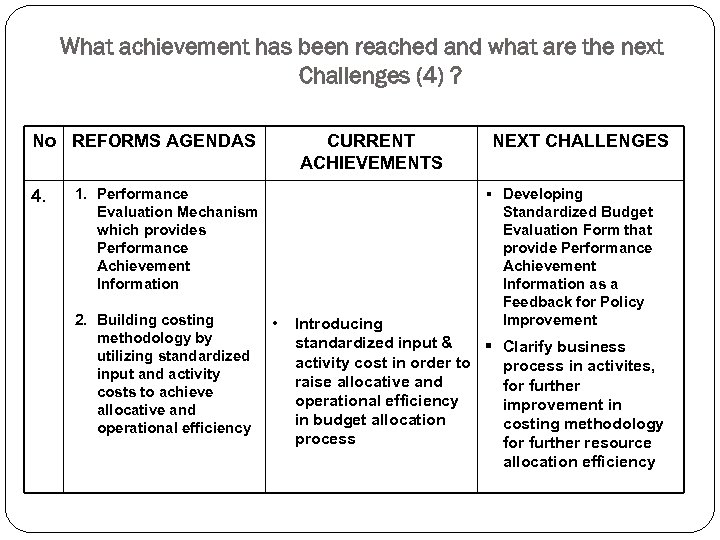

What achievement has been reached and what are the next Challenges (4) ? No REFORMS AGENDAS 4. CURRENT ACHIEVEMENTS 1. Performance Evaluation Mechanism which provides Performance Achievement Information 2. Building costing methodology by utilizing standardized input and activity costs to achieve allocative and operational efficiency • NEXT CHALLENGES § Developing Standardized Budget Evaluation Form that provide Performance Achievement Information as a Feedback for Policy Improvement Introducing standardized input & § Clarify business activity cost in order to process in activites, raise allocative and for further operational efficiency improvement in in budget allocation costing methodology process for further resource allocation efficiency

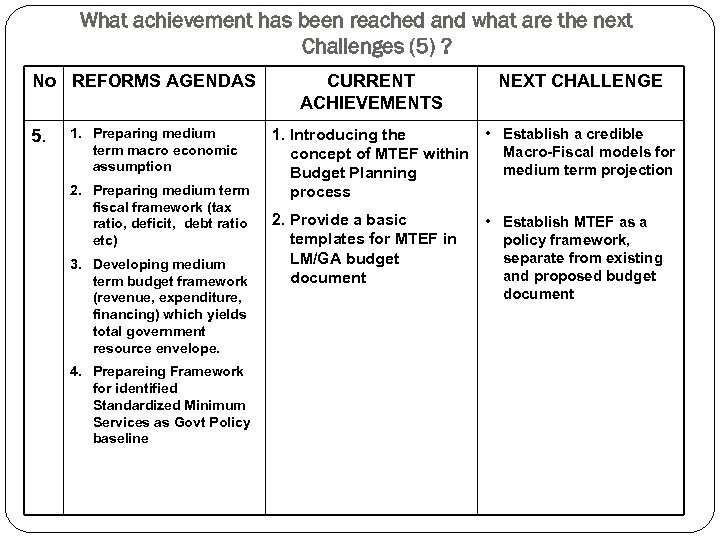

What achievement has been reached and what are the next Challenges (5) ? No REFORMS AGENDAS 5. 1. Preparing medium term macro economic assumption 2. Preparing medium term fiscal framework (tax ratio, deficit, debt ratio etc) 3. Developing medium term budget framework (revenue, expenditure, financing) which yields total government resource envelope. 4. Prepareing Framework for identified Standardized Minimum Services as Govt Policy baseline CURRENT ACHIEVEMENTS NEXT CHALLENGE • Establish a credible 1. Introducing the Macro-Fiscal models for concept of MTEF within medium term projection Budget Planning process 2. Provide a basic templates for MTEF in LM/GA budget document • Establish MTEF as a policy framework, separate from existing and proposed budget document

What achievement has been reached and what are the next Challenges (6) ? No REFORMS AGENDAS 6. 5. Medium term resource envelope performs as a budget baseline for preparing LM/GA’s budget forward estimates. 6. Adjusting a LM/GA’s budget forward estimates with current cost and government policy in preparing budget preparation. CURRENT ACHIEVEMENTS NEXT CHALLENGE

45f1977758b2ed35a0bd5d29ba1f7fe0.ppt