254bd8c11ba149ac7141ae157823bbc3.ppt

- Количество слайдов: 26

Point & Figure Technical Analysis Enron: The Anatomy of A Collapse The Case For Technical Analysis

Point & Figure Technical Analysis Enron: The Anatomy of A Collapse The Case For Technical Analysis

Point & Figure Technical Analysis www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis Our Basic Philosophy Ø Fundamental analysis plays an Ø Ø important role. It tells us WHAT to buy. Technical analysis is just as important, however. It tells us WHEN to buy. Using only one without the other is like playing the piano with just one hand; you can make much better music with both hands on the piano. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis Our Basic Philosophy Ø Fundamental analysis plays an Ø Ø important role. It tells us WHAT to buy. Technical analysis is just as important, however. It tells us WHEN to buy. Using only one without the other is like playing the piano with just one hand; you can make much better music with both hands on the piano. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis Enron‘s Credentials Ø The world‘s foremost power and gas trader. Ø Ranked 7 th in the Fortune 500. Ø Ranked 16 th in the Fortune Global 500. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis Enron‘s Credentials Ø The world‘s foremost power and gas trader. Ø Ranked 7 th in the Fortune 500. Ø Ranked 16 th in the Fortune Global 500. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis Enron‘s Fundamentals Then. . . Ø Revenues: $100. 8 billion. Ø Profits: $979 million. Ø Assets: $65. 6 billion. Ø Stockholders‘ Equity: $11. 5 billion. Ø Market Value March 15, 2001: $49. 7 billion. Ø EPS (year 2000): $1. 12. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis Enron‘s Fundamentals Then. . . Ø Revenues: $100. 8 billion. Ø Profits: $979 million. Ø Assets: $65. 6 billion. Ø Stockholders‘ Equity: $11. 5 billion. Ø Market Value March 15, 2001: $49. 7 billion. Ø EPS (year 2000): $1. 12. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis . . . And Now Ø Close, Dec. 3, 2001: $0. 26 Ø 52 -week Range: $0. 12 - $81. 78 Ø Earnings Per Share: $0. 21 Ø Market cap: $220 million www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis . . . And Now Ø Close, Dec. 3, 2001: $0. 26 Ø 52 -week Range: $0. 12 - $81. 78 Ø Earnings Per Share: $0. 21 Ø Market cap: $220 million www. dorseywright. com © Dorsey, Wright & Associates 2001

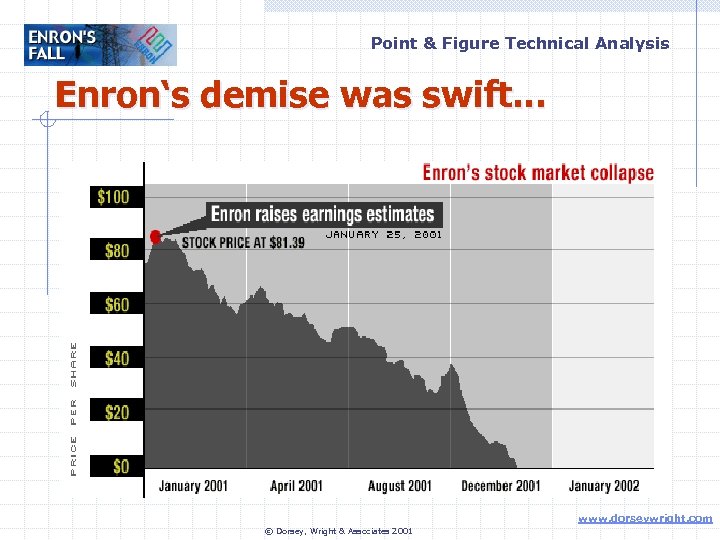

Point & Figure Technical Analysis Enron‘s demise was swift. . . www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis Enron‘s demise was swift. . . www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis And though trouble was looming. . . Ø August 14, 2001, CEO Jeffrey Skilling resigns. Ø October 12, 2001 Andersen‘s Enron Chief Auditor begins two-week document destruction effort. Ø October 16, 2001 Enron reports first quarterly loss in more than four years. Ø October 22, 2001 SEC opens investigation into Enron partnerships. Ø November 8, 2001 Enron restates earnings dating back to 1997 by $600 million. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis And though trouble was looming. . . Ø August 14, 2001, CEO Jeffrey Skilling resigns. Ø October 12, 2001 Andersen‘s Enron Chief Auditor begins two-week document destruction effort. Ø October 16, 2001 Enron reports first quarterly loss in more than four years. Ø October 22, 2001 SEC opens investigation into Enron partnerships. Ø November 8, 2001 Enron restates earnings dating back to 1997 by $600 million. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis Analysts were slow to react. . . Ø On November 25, 2001 more than half of the fundamental analysts following Enron rated it a Buy. Six rated it a Strong Buy, and two rated it a Buy. Ø Now, let‘s take a look at what the fundamentals AND the technicals showed as Enron stock fell from its 52 -week high of $84. 87, to a low of $4. 14 on November 27, 2001. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis Analysts were slow to react. . . Ø On November 25, 2001 more than half of the fundamental analysts following Enron rated it a Buy. Six rated it a Strong Buy, and two rated it a Buy. Ø Now, let‘s take a look at what the fundamentals AND the technicals showed as Enron stock fell from its 52 -week high of $84. 87, to a low of $4. 14 on November 27, 2001. www. dorseywright. com © Dorsey, Wright & Associates 2001

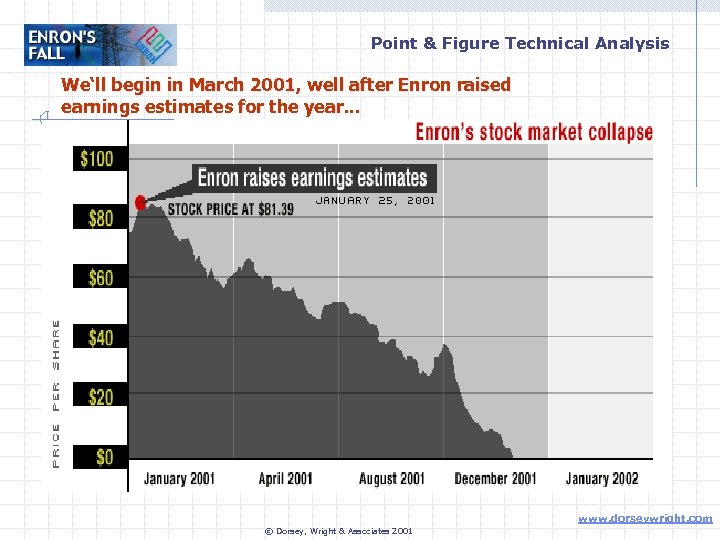

Point & Figure Technical Analysis We‘ll begin in March 2001, well after Enron raised earnings estimates for the year. . . www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis We‘ll begin in March 2001, well after Enron raised earnings estimates for the year. . . www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis Fundamentally, things looked ok. . . Ø March 12, 2001 $61. 27: Price Target cut at Prudential. Ø March 12, 2001 $61. 27: Reiterated Strong Buy at Lehman. Ø March 14, 2001 $62. 75: Raised to Accumulate at Commerzbank. Ø March 21, 2001 $55. 89: Reiterated Near-term Buy at Merrill Lynch. Ø March 22, 2001 $55. 02: Reiterated Accumulate at Commerzbank. Ø March 26, 2001 $55. 02: Let‘s go to the chart. . . www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis Fundamentally, things looked ok. . . Ø March 12, 2001 $61. 27: Price Target cut at Prudential. Ø March 12, 2001 $61. 27: Reiterated Strong Buy at Lehman. Ø March 14, 2001 $62. 75: Raised to Accumulate at Commerzbank. Ø March 21, 2001 $55. 89: Reiterated Near-term Buy at Merrill Lynch. Ø March 22, 2001 $55. 02: Reiterated Accumulate at Commerzbank. Ø March 26, 2001 $55. 02: Let‘s go to the chart. . . www. dorseywright. com © Dorsey, Wright & Associates 2001

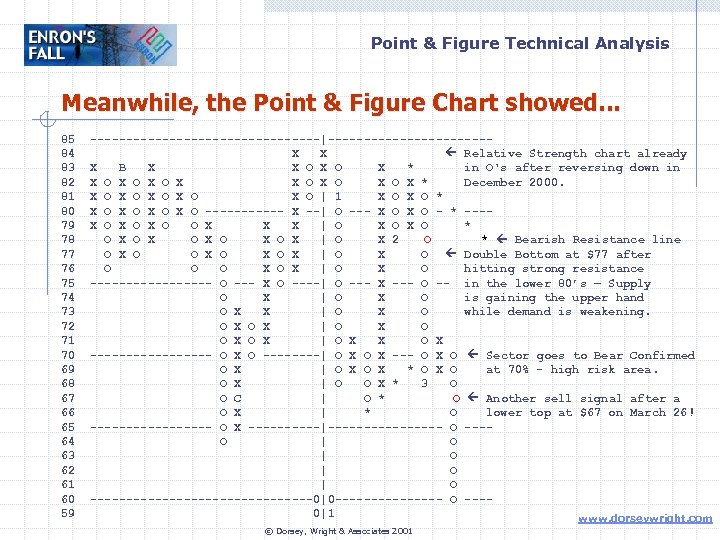

Point & Figure Technical Analysis Meanwhile, the Point & Figure Chart showed. . . 85 84 83 82 81 80 79 78 77 76 75 74 73 72 71 70 69 68 67 66 65 64 63 62 61 60 59 ----------------|-----------X X Relative Strength chart already X B X X O X * in O‘s after reversing down in X O X O X O X * December 2000. X O X O X O | 1 X O * X O X O ------ X --| O --- X O - * ---X O X O O X X X | O X O * O X O X O X | O X 2 O * Bearish Resistance line O X O X O X | O X O Double Bottom at $77 after O O O X | O X O hitting strong resistance --------- O --- X O ----| O --- X --- O -- in the lower 80’s – Supply O X | O X O is gaining the upper hand O X X | O X O while demand is weakening. O X | O X X O X --------- O X O ----| O X --- O X O Sector goes to Bear Confirmed O X | O X * O X O at 70% - high risk area. O X | O O X * 3 O O C | O * O Another sell signal after a O X | * O lower top at $67 on March 26! --------- O X -----|-------- O ---O | O | O ----------------0|0 -------- O ---0|1 www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis Meanwhile, the Point & Figure Chart showed. . . 85 84 83 82 81 80 79 78 77 76 75 74 73 72 71 70 69 68 67 66 65 64 63 62 61 60 59 ----------------|-----------X X Relative Strength chart already X B X X O X * in O‘s after reversing down in X O X O X O X * December 2000. X O X O X O | 1 X O * X O X O ------ X --| O --- X O - * ---X O X O O X X X | O X O * O X O X O X | O X 2 O * Bearish Resistance line O X O X O X | O X O Double Bottom at $77 after O O O X | O X O hitting strong resistance --------- O --- X O ----| O --- X --- O -- in the lower 80’s – Supply O X | O X O is gaining the upper hand O X X | O X O while demand is weakening. O X | O X X O X --------- O X O ----| O X --- O X O Sector goes to Bear Confirmed O X | O X * O X O at 70% - high risk area. O X | O O X * 3 O O C | O * O Another sell signal after a O X | * O lower top at $67 on March 26! --------- O X -----|-------- O ---O | O | O ----------------0|0 -------- O ---0|1 www. dorseywright. com © Dorsey, Wright & Associates 2001

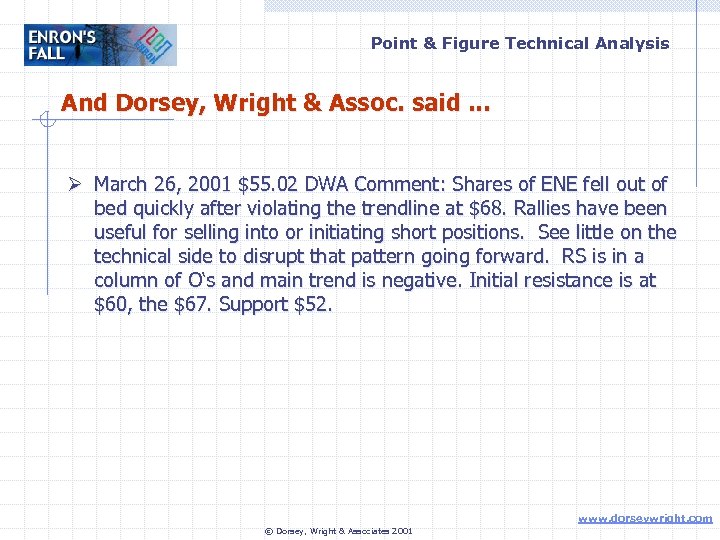

Point & Figure Technical Analysis And Dorsey, Wright & Assoc. said. . . Ø March 26, 2001 $55. 02 DWA Comment: Shares of ENE fell out of bed quickly after violating the trendline at $68. Rallies have been useful for selling into or initiating short positions. See little on the technical side to disrupt that pattern going forward. RS is in a column of O‘s and main trend is negative. Initial resistance is at $60, the $67. Support $52. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis And Dorsey, Wright & Assoc. said. . . Ø March 26, 2001 $55. 02 DWA Comment: Shares of ENE fell out of bed quickly after violating the trendline at $68. Rallies have been useful for selling into or initiating short positions. See little on the technical side to disrupt that pattern going forward. RS is in a column of O‘s and main trend is negative. Initial resistance is at $60, the $67. Support $52. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis Still, the fundamentals were slow to develop. . . Ø April 16, 2001 $59. 44: Reiterated Recommend List at Goldman Sachs. Ø April 17, 2001 $60. 00: Reiterated Near-term Buy at Merrill Lynch. Ø April 18, 2001 $61. 62: Reiterated Recommend List at Goldman Sachs. Reiterated Accumulate at Commerzbank. Ø May 21, 2001 $54. 99: Price Target cut at Prudential. Ø June 8, 2001 $51. 13: Reiterated Attractive at Bear Stearns Ø Let‘s go back to the chart. . . www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis Still, the fundamentals were slow to develop. . . Ø April 16, 2001 $59. 44: Reiterated Recommend List at Goldman Sachs. Ø April 17, 2001 $60. 00: Reiterated Near-term Buy at Merrill Lynch. Ø April 18, 2001 $61. 62: Reiterated Recommend List at Goldman Sachs. Reiterated Accumulate at Commerzbank. Ø May 21, 2001 $54. 99: Price Target cut at Prudential. Ø June 8, 2001 $51. 13: Reiterated Attractive at Bear Stearns Ø Let‘s go back to the chart. . . www. dorseywright. com © Dorsey, Wright & Associates 2001

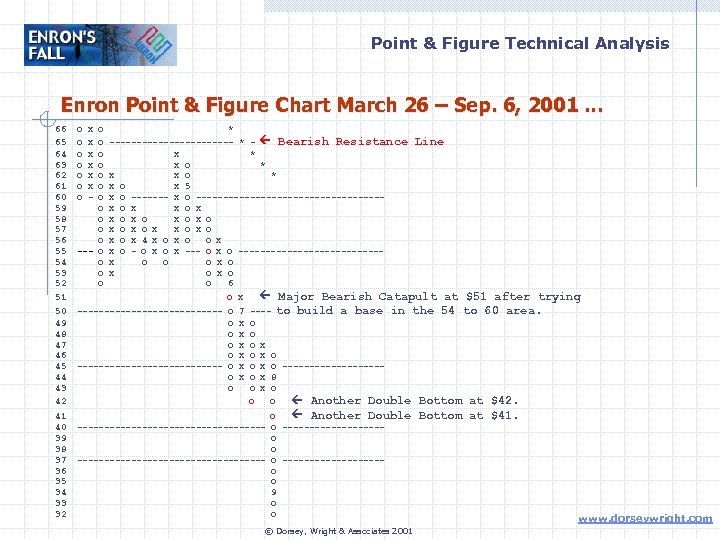

Point & Figure Technical Analysis Enron Point & Figure Chart March 26 – Sep. 6, 2001. . . 66 65 64 63 62 61 60 59 58 57 56 55 54 53 52 51 O O O O X X X - O O O --- O O * ------------ * - Bearish Resistance Line X * X O X 5 X O ---------------------X O X X O X O X 4 X O O X X O - O X --- O X O -------------X O O O X O X O O 6 O X Major Bearish Catapult at 50 49 48 47 46 45 44 43 42 -------------- O O O 41 40 39 38 37 36 35 34 33 32 O Another Double ----------------------------------- O ------------------O O 9 O O 7 X X X $51 after trying to build a base in the 54 to 60 area. ---O O O X O ---------O X 8 O X O O O Another Double © Dorsey, Wright & Associates 2001 Bottom at $42. Bottom at $41. www. dorseywright. com

Point & Figure Technical Analysis Enron Point & Figure Chart March 26 – Sep. 6, 2001. . . 66 65 64 63 62 61 60 59 58 57 56 55 54 53 52 51 O O O O X X X - O O O --- O O * ------------ * - Bearish Resistance Line X * X O X 5 X O ---------------------X O X X O X O X 4 X O O X X O - O X --- O X O -------------X O O O X O X O O 6 O X Major Bearish Catapult at 50 49 48 47 46 45 44 43 42 -------------- O O O 41 40 39 38 37 36 35 34 33 32 O Another Double ----------------------------------- O ------------------O O 9 O O 7 X X X $51 after trying to build a base in the 54 to 60 area. ---O O O X O ---------O X 8 O X O O O Another Double © Dorsey, Wright & Associates 2001 Bottom at $42. Bottom at $41. www. dorseywright. com

Point & Figure Technical Analysis And Dorsey, Wright & Assoc. said. . . Ø April 4, 2001 $56. 57 DWA Comment: Remains below the Bearish Resistance Line and well into oversold territory at present price ranges. Still, recent action has formed a consolidation pattern on the trend chart, whcih can be broken on a move to $54. That move would break a double bottom and complete a Bearish Triangle pattern. RS is in O‘s here and we would continue to avoid ENE here. Those looking for a tight trade to the downside may initiate a short position on the breakdown at $54, but keep in mind that we are already oversold. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis And Dorsey, Wright & Assoc. said. . . Ø April 4, 2001 $56. 57 DWA Comment: Remains below the Bearish Resistance Line and well into oversold territory at present price ranges. Still, recent action has formed a consolidation pattern on the trend chart, whcih can be broken on a move to $54. That move would break a double bottom and complete a Bearish Triangle pattern. RS is in O‘s here and we would continue to avoid ENE here. Those looking for a tight trade to the downside may initiate a short position on the breakdown at $54, but keep in mind that we are already oversold. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis And. . . Ø June 8, 2001 $51. 13 DWA Comment: ENE broke a spread triple bottom at $51 and remains below the Bearish Resistance Line. This stock has underperformed while the utilities sector rallied, and now that the group is beginning to look suspect, this stock is one to fear. Continue to avoid positions in ENE until we can see some clear signs of a bottom near-term. The bottom of the trading band is $45. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis And. . . Ø June 8, 2001 $51. 13 DWA Comment: ENE broke a spread triple bottom at $51 and remains below the Bearish Resistance Line. This stock has underperformed while the utilities sector rallied, and now that the group is beginning to look suspect, this stock is one to fear. Continue to avoid positions in ENE until we can see some clear signs of a bottom near-term. The bottom of the trading band is $45. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis And. . . Ø August 13, 2001 $46. 56 DWA Comment: Stock is making lower tops and lower bottoms. The move to $42 in July took ENE below its March lows though the market remains above those lows. This divergence is typically negative. Also negative is the trend and ENE is underperforming the market. Avoid this one. Ø August 16, 2001 $38. 93 DWA Comment: Shares of ENE have fallen well below the initial bearish price objective of $44 and are now trading a point shy of the bottom of the 10 -week trading band. Still no convincing sign of a bottom here. . . www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis And. . . Ø August 13, 2001 $46. 56 DWA Comment: Stock is making lower tops and lower bottoms. The move to $42 in July took ENE below its March lows though the market remains above those lows. This divergence is typically negative. Also negative is the trend and ENE is underperforming the market. Avoid this one. Ø August 16, 2001 $38. 93 DWA Comment: Shares of ENE have fallen well below the initial bearish price objective of $44 and are now trading a point shy of the bottom of the 10 -week trading band. Still no convincing sign of a bottom here. . . www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis But still the fundamentals lagged the technicals. . . Ø Sep. 6, 2001 $30. 49: Raised to Buy at Sanders Morris Harris. Ø Sep. 26, 2001 $25. 15: Upgraded from Accumulate to Buy at A. G. Edwards. Ø Oct. 3, 2001 $33. 49: Reiterated Recommend List at Goldman Sachs. Ø Oct. 4, 2001 $33. 10: Downgraded from Strong Buy to Buy at A. G. Edwards; price target $40. Ø Oct. 9, 2001 $33. 39: Raised to Long-term Buy at Merrill Lynch. Ø Oct. 19, 2001 $26. 05: Cut to Hold at A. G. Edwards. Ø Oct. 22, 2001 $20. 65: Downgraded from Buy to Hold at Prudential. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis But still the fundamentals lagged the technicals. . . Ø Sep. 6, 2001 $30. 49: Raised to Buy at Sanders Morris Harris. Ø Sep. 26, 2001 $25. 15: Upgraded from Accumulate to Buy at A. G. Edwards. Ø Oct. 3, 2001 $33. 49: Reiterated Recommend List at Goldman Sachs. Ø Oct. 4, 2001 $33. 10: Downgraded from Strong Buy to Buy at A. G. Edwards; price target $40. Ø Oct. 9, 2001 $33. 39: Raised to Long-term Buy at Merrill Lynch. Ø Oct. 19, 2001 $26. 05: Cut to Hold at A. G. Edwards. Ø Oct. 22, 2001 $20. 65: Downgraded from Buy to Hold at Prudential. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis Meanwhile, the technical picture was unchanged. . . Ø October 23, 2001 $19. 79 DWA Comment: ENE falls amid SEC inquiries, the chart breaks yet another bottom at $24 and moves to new chart lows. Best to let this dog sleep outside until some sign of a bottom is shown. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis Meanwhile, the technical picture was unchanged. . . Ø October 23, 2001 $19. 79 DWA Comment: ENE falls amid SEC inquiries, the chart breaks yet another bottom at $24 and moves to new chart lows. Best to let this dog sleep outside until some sign of a bottom is shown. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis And finally, some on Wall Street capitulated. . . Ø Oct. 24, 2001 $16. 41: Cut to Sell at Prudential. Cut to Long-term Buy at JP Morgan. Reiterated Strong Buy at Lehman. Ø Oct. 25, 2001 $16. 35: Cut to Market Perform at Banc of America. Reiterated Buy at Salomon Smith Barney. S&P changes Enron outlook to Negative. Ø Nov. 1, 2001 $11. 99: Cut to Near-term Neutral at Merrill Lynch. Ø Nov. 7, 2001 $ 9. 05: Cut to Sell at A. G. Edwards. Ø Nov. 9, 2001 $8. 63: Cut to Hold at Commerzbank. Ø Nov. 12, 2001 $9. 24: Raised to Hold at Prudential. Ø Nov. 13, 2001 $9. 98: Raised to Maintain Position at Edward Jones. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis And finally, some on Wall Street capitulated. . . Ø Oct. 24, 2001 $16. 41: Cut to Sell at Prudential. Cut to Long-term Buy at JP Morgan. Reiterated Strong Buy at Lehman. Ø Oct. 25, 2001 $16. 35: Cut to Market Perform at Banc of America. Reiterated Buy at Salomon Smith Barney. S&P changes Enron outlook to Negative. Ø Nov. 1, 2001 $11. 99: Cut to Near-term Neutral at Merrill Lynch. Ø Nov. 7, 2001 $ 9. 05: Cut to Sell at A. G. Edwards. Ø Nov. 9, 2001 $8. 63: Cut to Hold at Commerzbank. Ø Nov. 12, 2001 $9. 24: Raised to Hold at Prudential. Ø Nov. 13, 2001 $9. 98: Raised to Maintain Position at Edward Jones. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis While some held out until the bitter end. . . Ø Nov. 21, 2001 $5. 01: Cut to Market Perform at Goldman Sachs. Cut to Hold at CIBC. Cut to Sell at Edward Jones. Ø Nov. 28, 2001 $0. 61: Estimates reduced at Prudential. Cut to Hold at UBS Painewebber. Cut to Sell at Commerzbank. Ø Nov. 29, 2001 $0. 36: Cut to Hold at CSFB. Cut to Underperform at RBC Capital Markets. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis While some held out until the bitter end. . . Ø Nov. 21, 2001 $5. 01: Cut to Market Perform at Goldman Sachs. Cut to Hold at CIBC. Cut to Sell at Edward Jones. Ø Nov. 28, 2001 $0. 61: Estimates reduced at Prudential. Cut to Hold at UBS Painewebber. Cut to Sell at Commerzbank. Ø Nov. 29, 2001 $0. 36: Cut to Hold at CSFB. Cut to Underperform at RBC Capital Markets. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis What We‘ve Learned. . . Ø Sometimes the technicals collapse well in advance of the fundamentals. Ø Fundamental analysis is necessary to tell us What to buy, but it can only do so much when companies hide their fundamental problems, or give analysts bad information. Ø Technical analysis tells us When to buy, and can help us manage the risk of stock ownership. www. dorseywright. com © Dorsey, Wright & Associates 2001

Point & Figure Technical Analysis What We‘ve Learned. . . Ø Sometimes the technicals collapse well in advance of the fundamentals. Ø Fundamental analysis is necessary to tell us What to buy, but it can only do so much when companies hide their fundamental problems, or give analysts bad information. Ø Technical analysis tells us When to buy, and can help us manage the risk of stock ownership. www. dorseywright. com © Dorsey, Wright & Associates 2001

Copyright © 2001 Dorsey, Wright & Associates, Inc. Keep in mind that there is no assurance that this or any strategy will ultimately be successful or profitable. © Dorsey, Wright & Assoc.

Copyright © 2001 Dorsey, Wright & Associates, Inc. Keep in mind that there is no assurance that this or any strategy will ultimately be successful or profitable. © Dorsey, Wright & Assoc.