060dcca46b09920183d0164a3242c14a.ppt

- Количество слайдов: 52

Point & Figure Analysis A Disciplined Approach to Selecting Stocks and Managing Risk The Company fundamentals look great. All the analysts love it. So why is the stock going down?

Point & Figure Analysis A Disciplined Approach to Selecting Stocks and Managing Risk The Company fundamentals look great. All the analysts love it. So why is the stock going down?

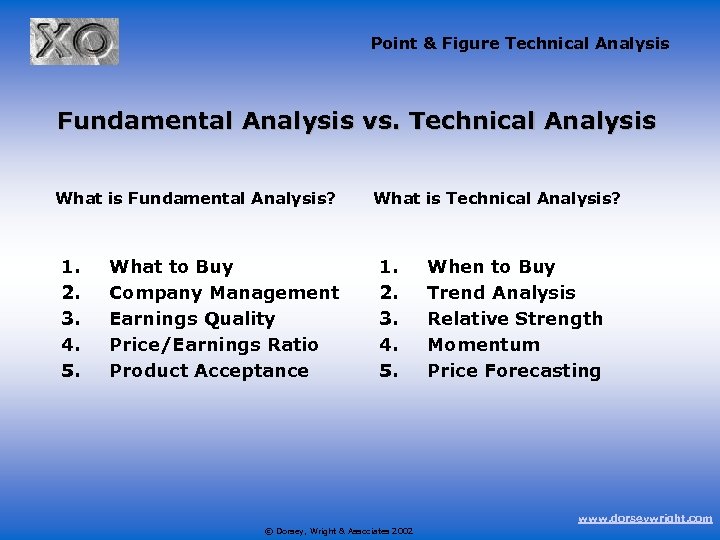

Point & Figure Technical Analysis Fundamental Analysis vs. Technical Analysis What is Fundamental Analysis? 1. 2. 3. 4. 5. What to Buy Company Management Earnings Quality Price/Earnings Ratio Product Acceptance What is Technical Analysis? 1. 2. 3. 4. 5. When to Buy Trend Analysis Relative Strength Momentum Price Forecasting www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Fundamental Analysis vs. Technical Analysis What is Fundamental Analysis? 1. 2. 3. 4. 5. What to Buy Company Management Earnings Quality Price/Earnings Ratio Product Acceptance What is Technical Analysis? 1. 2. 3. 4. 5. When to Buy Trend Analysis Relative Strength Momentum Price Forecasting www. dorseywright. com © Dorsey, Wright & Associates 2002

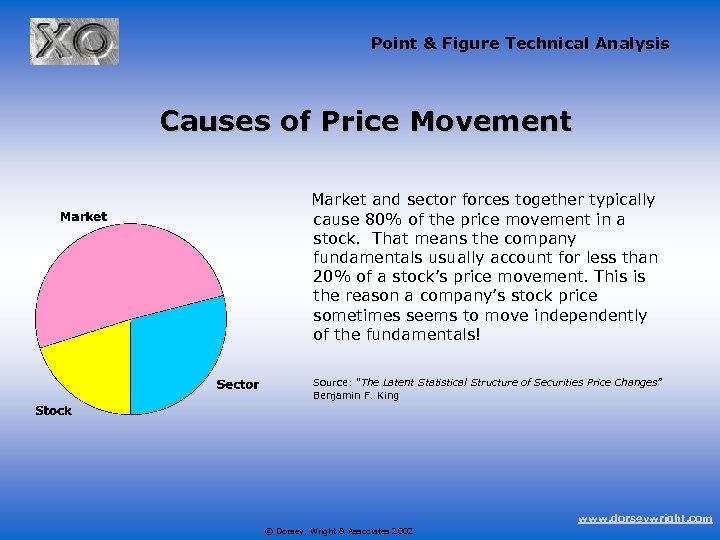

Point & Figure Technical Analysis Causes of Price Movement Market and sector forces together typically cause 80% of the price movement in a stock. That means the company fundamentals usually account for less than 20% of a stock’s price movement. This is the reason a company’s stock price sometimes seems to move independently of the fundamentals! Source: “The Latent Statistical Structure of Securities Price Changes” Benjamin F. King www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Causes of Price Movement Market and sector forces together typically cause 80% of the price movement in a stock. That means the company fundamentals usually account for less than 20% of a stock’s price movement. This is the reason a company’s stock price sometimes seems to move independently of the fundamentals! Source: “The Latent Statistical Structure of Securities Price Changes” Benjamin F. King www. dorseywright. com © Dorsey, Wright & Associates 2002

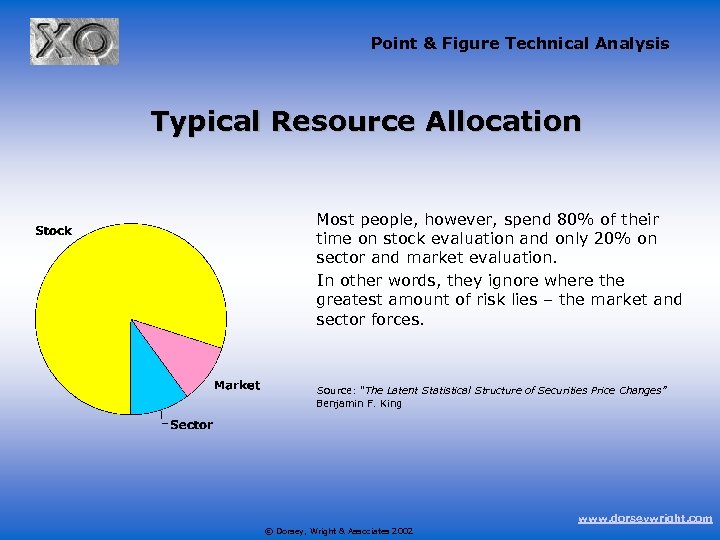

Point & Figure Technical Analysis Typical Resource Allocation Most people, however, spend 80% of their time on stock evaluation and only 20% on sector and market evaluation. In other words, they ignore where the greatest amount of risk lies – the market and sector forces. Source: “The Latent Statistical Structure of Securities Price Changes” Benjamin F. King www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Typical Resource Allocation Most people, however, spend 80% of their time on stock evaluation and only 20% on sector and market evaluation. In other words, they ignore where the greatest amount of risk lies – the market and sector forces. Source: “The Latent Statistical Structure of Securities Price Changes” Benjamin F. King www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis The Five-Step Game Plan Ø Step 1: Market Analysis Ø Step 2: Sector Analysis Ø Step 3: Fundamental Research Ø Step 4: Technical Research Ø Step 5: Risk management and Follow-up www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis The Five-Step Game Plan Ø Step 1: Market Analysis Ø Step 2: Sector Analysis Ø Step 3: Fundamental Research Ø Step 4: Technical Research Ø Step 5: Risk management and Follow-up www. dorseywright. com © Dorsey, Wright & Associates 2002

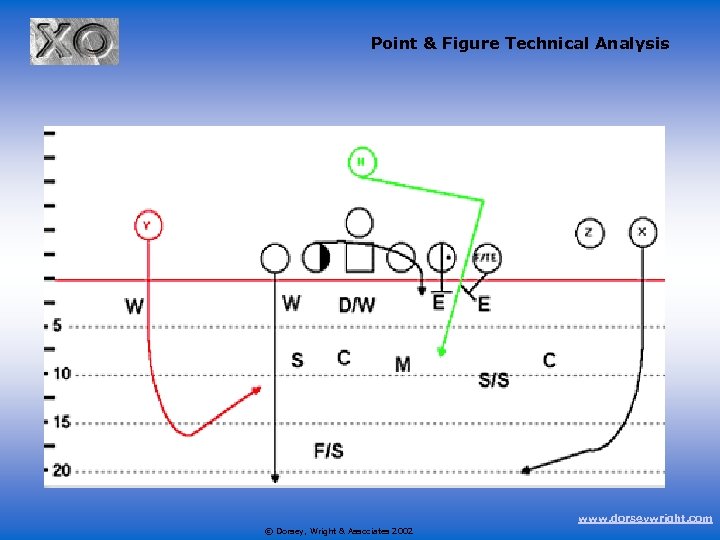

Point & Figure Technical Analysis The Five-Step Game Plan Ø Keep It Simple!!! Ø Stack as many factors in our favor as possible. Ø What are the general market conditions? Ø Are prices rising or falling? Ø What sectors are best positioned? Ø Combine the fundamentals with the technicals. Ø If we wanted to visualize our game plan, it would look something like this. . . www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis The Five-Step Game Plan Ø Keep It Simple!!! Ø Stack as many factors in our favor as possible. Ø What are the general market conditions? Ø Are prices rising or falling? Ø What sectors are best positioned? Ø Combine the fundamentals with the technicals. Ø If we wanted to visualize our game plan, it would look something like this. . . www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Our Basic Philosophy Ø Fundamental analysis plays an important role. Ø It tells us WHAT to buy. Ø Technical analysis is just as important, however. Ø It tells us WHEN to buy. Ø Using only one without the other is like playing the piano with just one hand; you can make much better music with both hands on the piano. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Our Basic Philosophy Ø Fundamental analysis plays an important role. Ø It tells us WHAT to buy. Ø Technical analysis is just as important, however. Ø It tells us WHEN to buy. Ø Using only one without the other is like playing the piano with just one hand; you can make much better music with both hands on the piano. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Point & Figure Analysis History Ø Charles Dow created the Point & Figure in the late 1800‘s. Ø Charles Dow was a fundamentalist at heart, but he appreciated the need for understanding the supply and demand relationship of any stock he was going to own. Ø Point & figure technical analysis is based on the simplest, most basic law of economics. . . Ø Supply and Demand. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Point & Figure Analysis History Ø Charles Dow created the Point & Figure in the late 1800‘s. Ø Charles Dow was a fundamentalist at heart, but he appreciated the need for understanding the supply and demand relationship of any stock he was going to own. Ø Point & figure technical analysis is based on the simplest, most basic law of economics. . . Ø Supply and Demand. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Supply and Demand Ø We all understand the basic forces of supply and demand. Ø The same forces that affect prices in the supermarket also affect prices in the stock market. Ø Stocks and sectors move in and out of favor just like produce in the supermarket. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Supply and Demand Ø We all understand the basic forces of supply and demand. Ø The same forces that affect prices in the supermarket also affect prices in the stock market. Ø Stocks and sectors move in and out of favor just like produce in the supermarket. www. dorseywright. com © Dorsey, Wright & Associates 2002

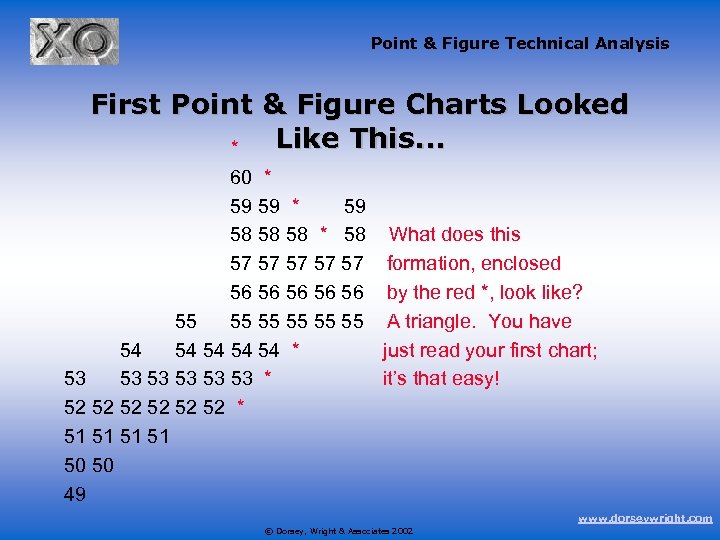

Point & Figure Technical Analysis First Point & Figure Charts Looked Like This. . . * 60 * 59 59 * 59 58 58 58 * 58 What does this 57 57 57 formation, enclosed 56 56 56 by the red *, look like? 55 55 55 A triangle. You have 54 54 54 * just read your first chart; 53 53 53 * it’s that easy! 52 52 52 * 51 51 50 50 49 www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis First Point & Figure Charts Looked Like This. . . * 60 * 59 59 * 59 58 58 58 * 58 What does this 57 57 57 formation, enclosed 56 56 56 by the red *, look like? 55 55 55 A triangle. You have 54 54 54 * just read your first chart; 53 53 53 * it’s that easy! 52 52 52 * 51 51 50 50 49 www. dorseywright. com © Dorsey, Wright & Associates 2002

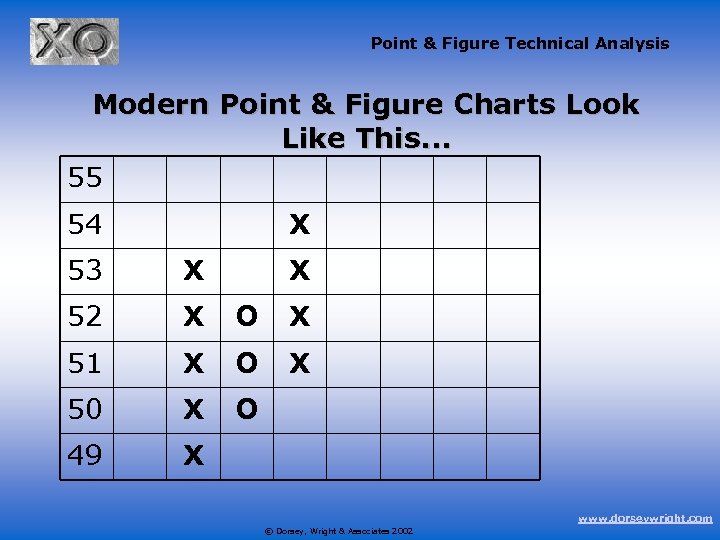

Point & Figure Technical Analysis Modern Point & Figure Charts Look Like This. . . 55 54 X 53 X X 52 X O X 51 X O X 50 X O 49 X www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Modern Point & Figure Charts Look Like This. . . 55 54 X 53 X X 52 X O X 51 X O X 50 X O 49 X www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Point & Figure Chart Basics Ø X = Demand Ø O = Supply Ø These symbols represent the battle between supply and demand. Ø It‘s similar to a tennis match. Ø Each side may win a game here and there, but we want to know who‘s going to win the ultimate set. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Point & Figure Chart Basics Ø X = Demand Ø O = Supply Ø These symbols represent the battle between supply and demand. Ø It‘s similar to a tennis match. Ø Each side may win a game here and there, but we want to know who‘s going to win the ultimate set. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Point & Figure Chart Basics Ø X = Demand, the stock is rising. Ø O = Supply, the stock is falling. Ø Always alternate columns of X‘s and O‘s. Ø Never will you see an X in a column of O‘s, or an O in a column of X‘s. Ø Each column must have three X‘s or three O‘s. Ø The first action of the month is designated by a number or A, B, and C for Oct, Nov, and Dec. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Point & Figure Chart Basics Ø X = Demand, the stock is rising. Ø O = Supply, the stock is falling. Ø Always alternate columns of X‘s and O‘s. Ø Never will you see an X in a column of O‘s, or an O in a column of X‘s. Ø Each column must have three X‘s or three O‘s. Ø The first action of the month is designated by a number or A, B, and C for Oct, Nov, and Dec. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Point & Figure Chart Basics Ø It takes three boxes to move from one column to another. Ø For example, if a stock were in a column of X‘s at 45, a move to 42 would be required to reverse to a column of O‘s. Ø If a stock were in a column of O‘s at 45, a move to 48 would be required to reverse to a column of X‘s. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Point & Figure Chart Basics Ø It takes three boxes to move from one column to another. Ø For example, if a stock were in a column of X‘s at 45, a move to 42 would be required to reverse to a column of O‘s. Ø If a stock were in a column of O‘s at 45, a move to 48 would be required to reverse to a column of X‘s. www. dorseywright. com © Dorsey, Wright & Associates 2002

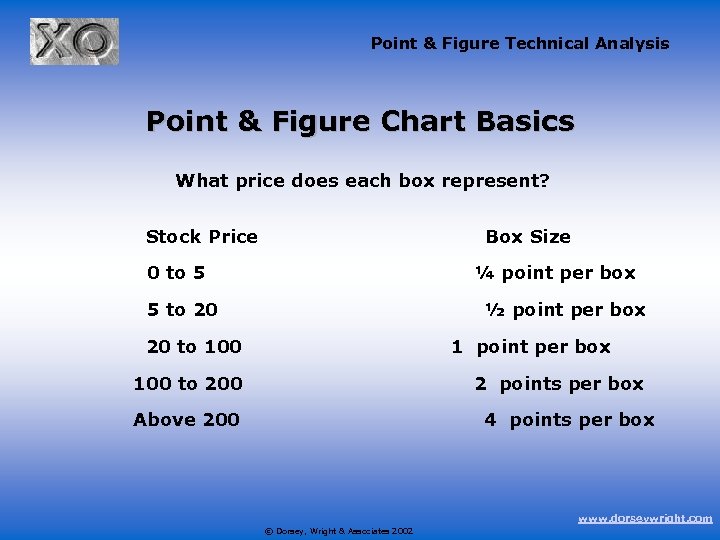

Point & Figure Technical Analysis Point & Figure Chart Basics What price does each box represent? Stock Price Box Size 0 to 5 ¼ point per box 5 to 20 ½ point per box 20 to 100 1 point per box 100 to 200 2 points per box Above 200 4 points per box www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Point & Figure Chart Basics What price does each box represent? Stock Price Box Size 0 to 5 ¼ point per box 5 to 20 ½ point per box 20 to 100 1 point per box 100 to 200 2 points per box Above 200 4 points per box www. dorseywright. com © Dorsey, Wright & Associates 2002

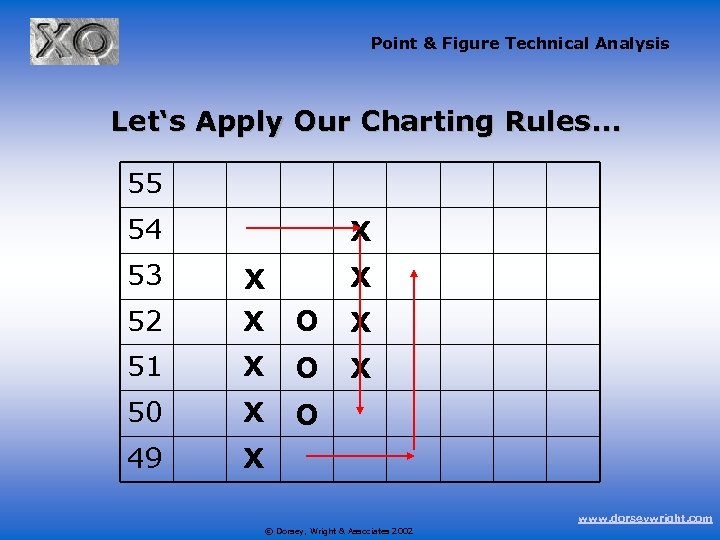

Point & Figure Technical Analysis Let‘s Apply Our Charting Rules. . . 55 54 53 X X 52 X X O X 51 X O X 50 X O 49 X www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Let‘s Apply Our Charting Rules. . . 55 54 53 X X 52 X X O X 51 X O X 50 X O 49 X www. dorseywright. com © Dorsey, Wright & Associates 2002

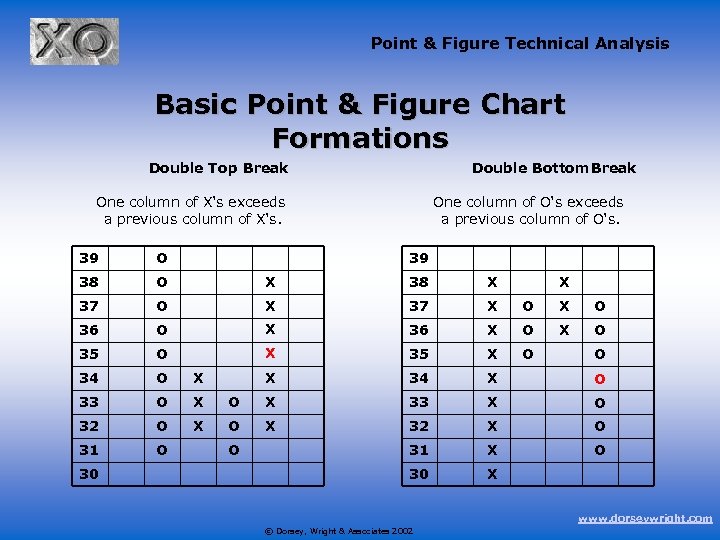

Point & Figure Technical Analysis Basic Point & Figure Chart Formations Double Top Break Double Bottom Break One column of X‘s exceeds a previous column of X‘s. One column of O‘s exceeds a previous column of O‘s. 39 O 38 O X 38 X 37 O X 37 X O 36 O X 36 X O 35 O X 35 X O 34 O X X 34 X O 33 O X 33 X O 32 O X 32 X O 31 X O 30 X 30 39 O X O www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Basic Point & Figure Chart Formations Double Top Break Double Bottom Break One column of X‘s exceeds a previous column of X‘s. One column of O‘s exceeds a previous column of O‘s. 39 O 38 O X 38 X 37 O X 37 X O 36 O X 36 X O 35 O X 35 X O 34 O X X 34 X O 33 O X 33 X O 32 O X 32 X O 31 X O 30 X 30 39 O X O www. dorseywright. com © Dorsey, Wright & Associates 2002

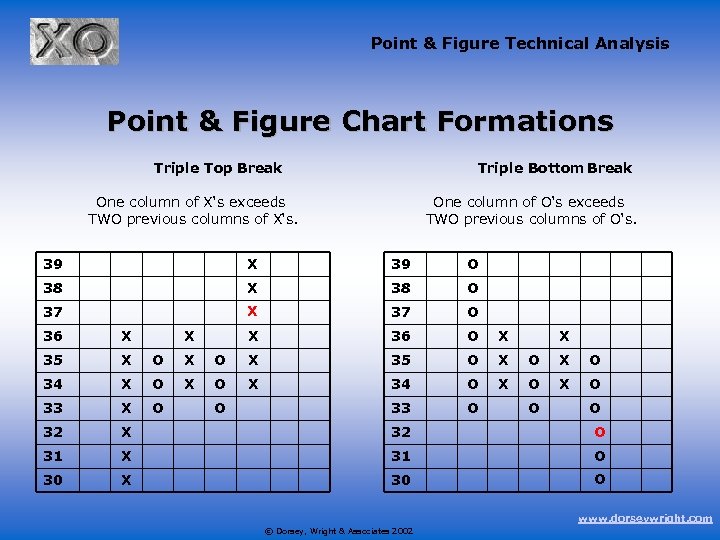

Point & Figure Technical Analysis Point & Figure Chart Formations Triple Top Break Triple Bottom Break One column of X‘s exceeds TWO previous columns of X‘s. One column of O‘s exceeds TWO previous columns of O‘s. 39 X 39 O 38 X 38 O 37 X 37 O X 36 X X 35 X O X 35 O X O 34 X O X 34 O X O 33 O 32 X 32 O 31 X 31 O 30 X 30 O O X O O www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Point & Figure Chart Formations Triple Top Break Triple Bottom Break One column of X‘s exceeds TWO previous columns of X‘s. One column of O‘s exceeds TWO previous columns of O‘s. 39 X 39 O 38 X 38 O 37 X 37 O X 36 X X 35 X O X 35 O X O 34 X O X 34 O X O 33 O 32 X 32 O 31 X 31 O 30 X 30 O O X O O www. dorseywright. com © Dorsey, Wright & Associates 2002

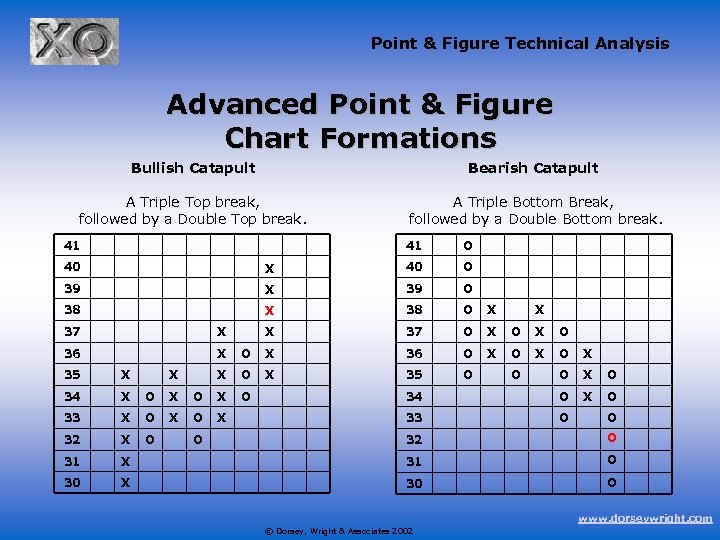

Point & Figure Technical Analysis Advanced Point & Figure Chart Formations Bullish Catapult Bearish Catapult A Triple Top break, followed by a Double Top break. A Triple Bottom Break, followed by a Double Bottom break. 41 41 O 40 X 40 O 39 X 39 O 38 X 38 O X X 37 O X O X O X O 34 O X O 33 O 37 X 36 X O X 36 O X 35 O O 35 X X 34 X O X 33 X O X 32 X O 31 30 X O O 32 O X 31 O X 30 O O www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Advanced Point & Figure Chart Formations Bullish Catapult Bearish Catapult A Triple Top break, followed by a Double Top break. A Triple Bottom Break, followed by a Double Bottom break. 41 41 O 40 X 40 O 39 X 39 O 38 X 38 O X X 37 O X O X O X O 34 O X O 33 O 37 X 36 X O X 36 O X 35 O O 35 X X 34 X O X 33 X O X 32 X O 31 30 X O O 32 O X 31 O X 30 O O www. dorseywright. com © Dorsey, Wright & Associates 2002

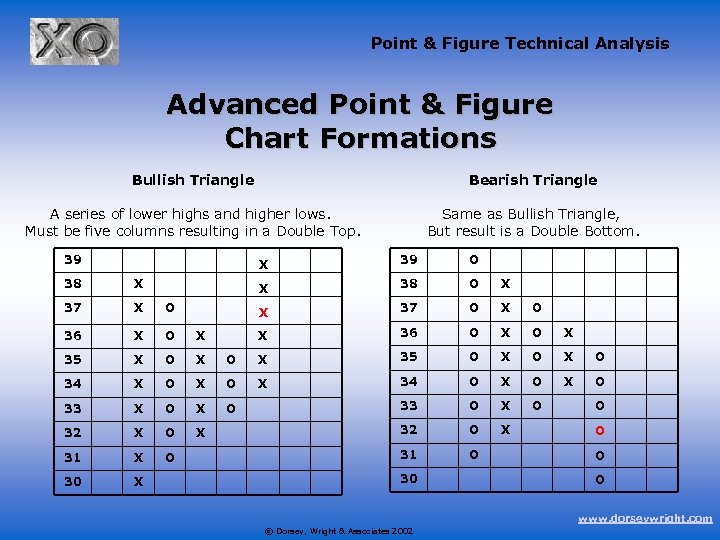

Point & Figure Technical Analysis Advanced Point & Figure Chart Formations Bullish Triangle Bearish Triangle A series of lower highs and higher lows. Must be five columns resulting in a Double Top. Same as Bullish Triangle, But result is a Double Bottom. 39 X 39 O X 38 O X X 37 O X 36 O X 38 X 37 X O 36 X O X 35 O X O 34 X O X 34 O X O 33 O X O 32 X O X 32 O X 31 X O 31 O 30 X 30 O O www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Advanced Point & Figure Chart Formations Bullish Triangle Bearish Triangle A series of lower highs and higher lows. Must be five columns resulting in a Double Top. Same as Bullish Triangle, But result is a Double Bottom. 39 X 39 O X 38 O X X 37 O X 36 O X 38 X 37 X O 36 X O X 35 O X O 34 X O X 34 O X O 33 O X O 32 X O X 32 O X 31 X O 31 O 30 X 30 O O www. dorseywright. com © Dorsey, Wright & Associates 2002

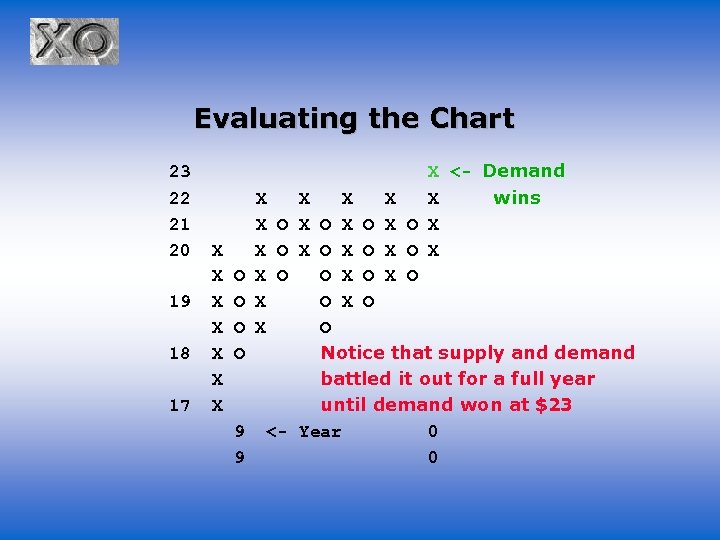

Evaluating the Chart 23 22 21 20 19 18 17 X X O X O X O X X 9 <9 X <- Demand X X wins X O X O X O O Notice that supply and demand battled it out for a full year until demand won at $23 Year 0 0

Evaluating the Chart 23 22 21 20 19 18 17 X X O X O X O X X 9 <9 X <- Demand X X wins X O X O X O O Notice that supply and demand battled it out for a full year until demand won at $23 Year 0 0

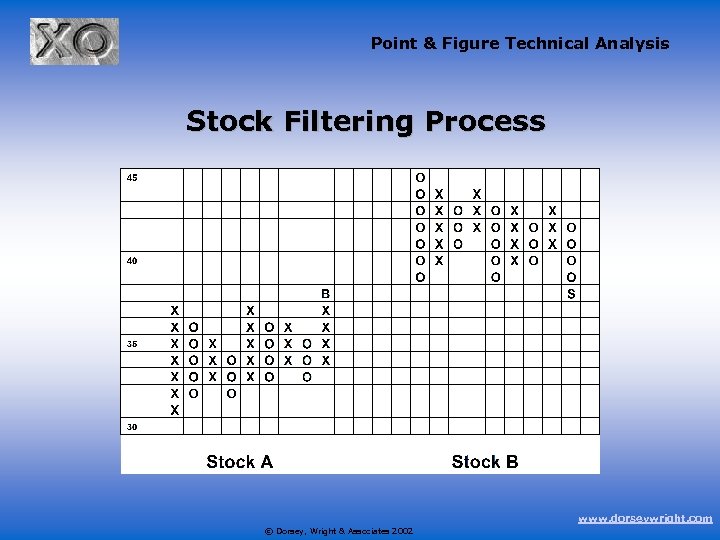

Point & Figure Technical Analysis Stock Filtering Process www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Stock Filtering Process www. dorseywright. com © Dorsey, Wright & Associates 2002

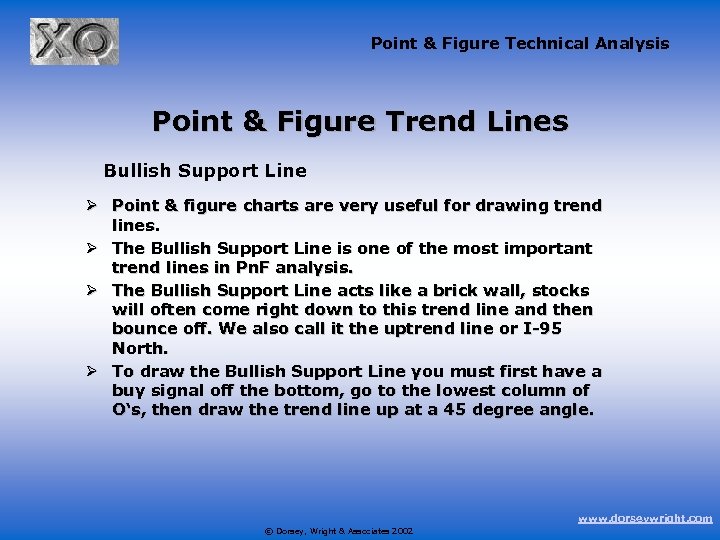

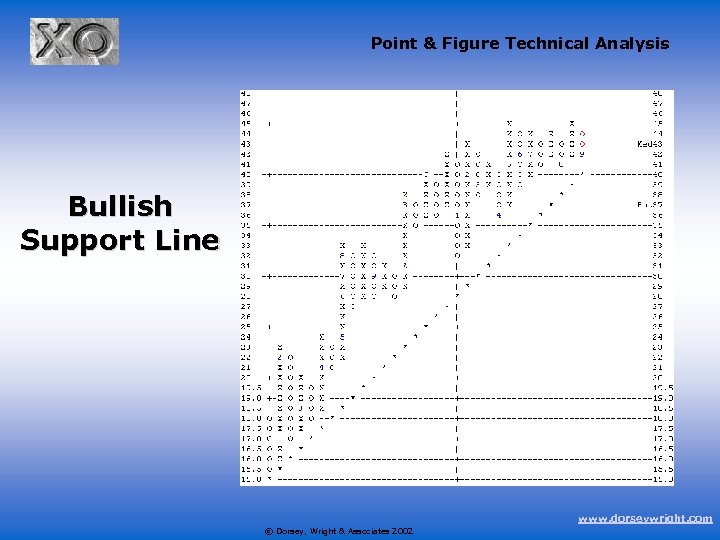

Point & Figure Technical Analysis Point & Figure Trend Lines Bullish Support Line Ø Point & figure charts are very useful for drawing trend lines. Ø The Bullish Support Line is one of the most important trend lines in Pn. F analysis. Ø The Bullish Support Line acts like a brick wall, stocks will often come right down to this trend line and then bounce off. We also call it the uptrend line or I-95 North. Ø To draw the Bullish Support Line you must first have a buy signal off the bottom, go to the lowest column of O‘s, then draw the trend line up at a 45 degree angle. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Point & Figure Trend Lines Bullish Support Line Ø Point & figure charts are very useful for drawing trend lines. Ø The Bullish Support Line is one of the most important trend lines in Pn. F analysis. Ø The Bullish Support Line acts like a brick wall, stocks will often come right down to this trend line and then bounce off. We also call it the uptrend line or I-95 North. Ø To draw the Bullish Support Line you must first have a buy signal off the bottom, go to the lowest column of O‘s, then draw the trend line up at a 45 degree angle. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Bullish Support Line www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Bullish Support Line www. dorseywright. com © Dorsey, Wright & Associates 2002

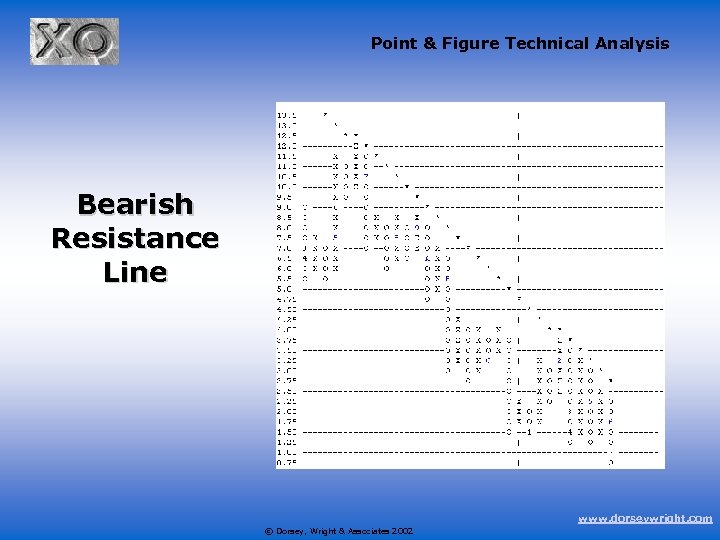

Point & Figure Technical Analysis Point & Figure Trend Lines Bearish Resistance Line Ø Exact opposite of the Bullish Support Line. Ø Acts like a brick wall, stocks will often rally right up to the Bearish Resistance Line and then bounce off. This line acts as I-95 South and is also called the downtrend line. Ø To draw the Bearish Resistance Line you must first have a sell signal from the top, go to the highest column of X‘s, then draw the trend line down at a 135 degree angle. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Point & Figure Trend Lines Bearish Resistance Line Ø Exact opposite of the Bullish Support Line. Ø Acts like a brick wall, stocks will often rally right up to the Bearish Resistance Line and then bounce off. This line acts as I-95 South and is also called the downtrend line. Ø To draw the Bearish Resistance Line you must first have a sell signal from the top, go to the highest column of X‘s, then draw the trend line down at a 135 degree angle. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Bearish Resistance Line www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Bearish Resistance Line www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Our Primary Indicator Now that you understand Point & Figure charting basics, we can move on to our most important indicator, the NYSE Bullish Percent. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Our Primary Indicator Now that you understand Point & Figure charting basics, we can move on to our most important indicator, the NYSE Bullish Percent. www. dorseywright. com © Dorsey, Wright & Associates 2002

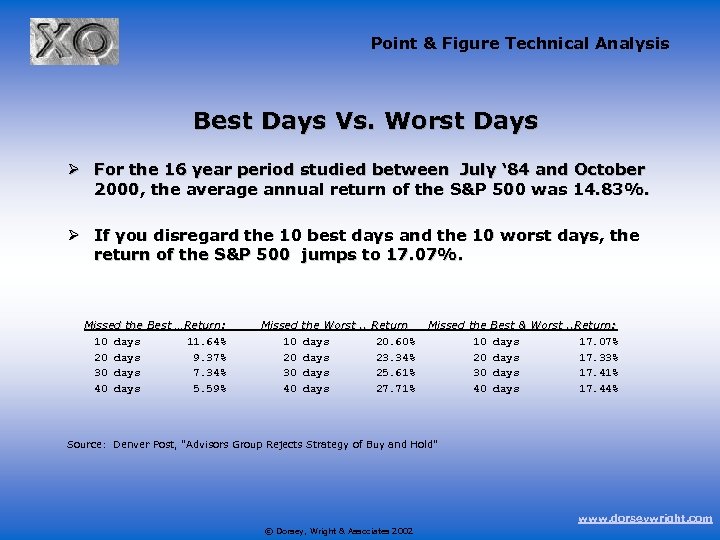

Point & Figure Technical Analysis Best Days Vs. Worst Days Ø For the 16 year period studied between July ‘ 84 and October 2000, the average annual return of the S&P 500 was 14. 83%. Ø If you disregard the 10 best days and the 10 worst days, the return of the S&P 500 jumps to 17. 07%. Missed the Best …Return: 10 days 11. 64% 20 days 9. 37% 30 days 7. 34% 40 days 5. 59% Missed 10 20 30 40 the Worst. . Return days 20. 60% days 23. 34% days 25. 61% days 27. 71% Missed the 10 20 30 40 Best & Worst. . Return: days 17. 07% days 17. 33% days 17. 41% days 17. 44% Source: Denver Post, "Advisors Group Rejects Strategy of Buy and Hold" www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Best Days Vs. Worst Days Ø For the 16 year period studied between July ‘ 84 and October 2000, the average annual return of the S&P 500 was 14. 83%. Ø If you disregard the 10 best days and the 10 worst days, the return of the S&P 500 jumps to 17. 07%. Missed the Best …Return: 10 days 11. 64% 20 days 9. 37% 30 days 7. 34% 40 days 5. 59% Missed 10 20 30 40 the Worst. . Return days 20. 60% days 23. 34% days 25. 61% days 27. 71% Missed the 10 20 30 40 Best & Worst. . Return: days 17. 07% days 17. 33% days 17. 41% days 17. 44% Source: Denver Post, "Advisors Group Rejects Strategy of Buy and Hold" www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Game Plan Ø There is a time to play offense and a time to play defense. Ø The problem most investors have is they don’t know which team to put on the field! Ø Let‘s look at why this is so important to investment success. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Game Plan Ø There is a time to play offense and a time to play defense. Ø The problem most investors have is they don’t know which team to put on the field! Ø Let‘s look at why this is so important to investment success. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis The Buy-and-Hold Myth Ø Ø Ø Ø • Buy the “Market“ in 1929. . . It took 25 years to get back to even. Buy it 1973. . . It took 7. 6 years to get back to even. Starting in 1987 IBM went down 74%. . . It took 10 years to recover. Using the same assumptions, it could take CSCO 13 years to get back to its high of 82 from its April 2001 low at a return of 15% a year. Note: Past performance is no guarantee of future success. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis The Buy-and-Hold Myth Ø Ø Ø Ø • Buy the “Market“ in 1929. . . It took 25 years to get back to even. Buy it 1973. . . It took 7. 6 years to get back to even. Starting in 1987 IBM went down 74%. . . It took 10 years to recover. Using the same assumptions, it could take CSCO 13 years to get back to its high of 82 from its April 2001 low at a return of 15% a year. Note: Past performance is no guarantee of future success. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Managing Stock Market Risk “In order to be a successful risk management investment strategy, market timing does not have to be perfect. Despite belief to the contrary, market timing does not target getting in and out of the market at the absolute bottoms or tops. It does, however, strive to get an investor’s funds out of the market before a major bear market devastates the portfolio. Market timing’s first and foremost priority is the preservation of capital. ” How can I manage risk to preserve capital? Source: “Lasting Wealth is a Matter of Timing” by George Sosnowy www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Managing Stock Market Risk “In order to be a successful risk management investment strategy, market timing does not have to be perfect. Despite belief to the contrary, market timing does not target getting in and out of the market at the absolute bottoms or tops. It does, however, strive to get an investor’s funds out of the market before a major bear market devastates the portfolio. Market timing’s first and foremost priority is the preservation of capital. ” How can I manage risk to preserve capital? Source: “Lasting Wealth is a Matter of Timing” by George Sosnowy www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis NYSE Bullish Percent Ø Our Primary Market Indicator. Ø Tells us whether to have the offense or defense on the field. Ø The concept began with Earnest Staby in the 1940‘s. Ø Staby wanted an indicator that was bullish at the bottom and bearish at the top. Ø It is calculated by taking the number of stocks in the NYSE on a buy signal and dividing by the total number of stocks in the NYSE resulting in a percentage. Ø For example, if there were only 1, 000 stocks on the NYSE and 500 were on buy signals, the resulting NYSE Bullish Percent would be 50%, which we would then plot on a Point & Figure chart. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis NYSE Bullish Percent Ø Our Primary Market Indicator. Ø Tells us whether to have the offense or defense on the field. Ø The concept began with Earnest Staby in the 1940‘s. Ø Staby wanted an indicator that was bullish at the bottom and bearish at the top. Ø It is calculated by taking the number of stocks in the NYSE on a buy signal and dividing by the total number of stocks in the NYSE resulting in a percentage. Ø For example, if there were only 1, 000 stocks on the NYSE and 500 were on buy signals, the resulting NYSE Bullish Percent would be 50%, which we would then plot on a Point & Figure chart. www. dorseywright. com © Dorsey, Wright & Associates 2002

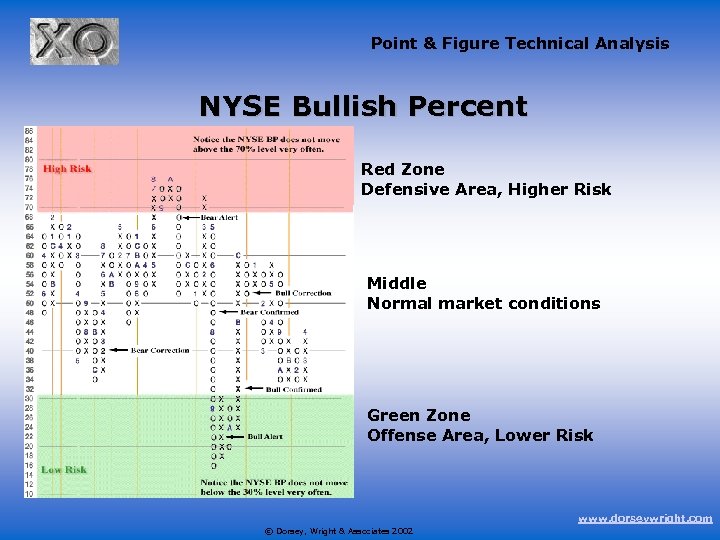

Point & Figure Technical Analysis NYSE Bullish Percent Red Zone Defensive Area, Higher Risk Middle Normal market conditions Green Zone Offense Area, Lower Risk www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis NYSE Bullish Percent Red Zone Defensive Area, Higher Risk Middle Normal market conditions Green Zone Offense Area, Lower Risk www. dorseywright. com © Dorsey, Wright & Associates 2002

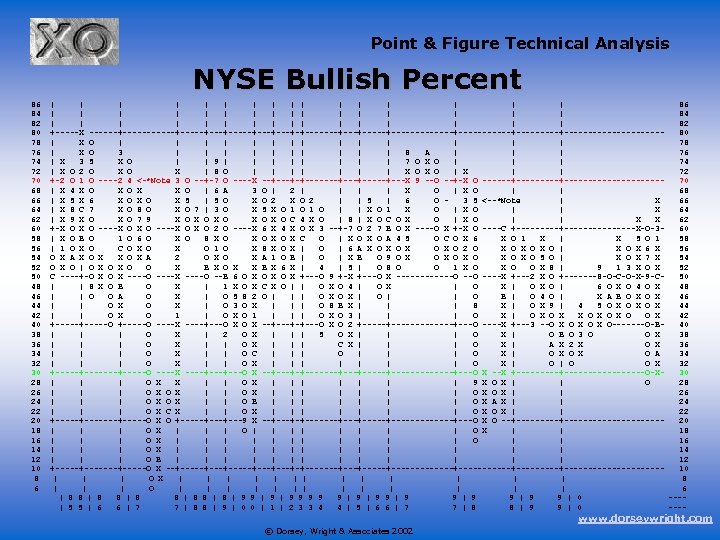

Point & Figure Technical Analysis NYSE Bullish Percent 86 84 82 80 78 76 74 72 70 68 66 64 62 60 58 56 54 52 50 48 46 44 42 40 38 36 34 32 30 28 26 24 22 20 18 16 14 12 10 8 6 | | | | | | | | 84 | | | | 82 +-----X ------+-----+-----+---+-+-------+-----+-----------+-------------80 | X O | | | | 78 | X O 3 | | | | | 8 A | | | 76 | X 3 5 X O | | 9 | | | | 7 O X O | | | 74 | X O 2 O X | 8 O | | | | X O | X | | 72 +-2 O 1 O ----2 4 <-*Note 3 O --+-7 O ----X --+-+-------+-----+---X 9 --O --+-X O ------+------------70 | X 4 X O X X O | 6 A 3 O | 2 | | X O | | 68 | X 5 X 6 X O X 5 | 5 O X O 2 | | 5 | 6 O 3 5 <--*Note | X 66 | X 8 C 7 X O 8 O X O 7 | 3 O X 5 X O 1 O | | X O 1 X O | | X 64 | X 9 X O 7 9 X O X O X O C 4 X O | 8 | X O C O X O | | X X 62 +-X O X O ----X O 2 O ----X 6 X 4 X O X 3 --+-7 O 2 7 B O X ----O X +-X O ----C +---------------X-O-360 | X O B O 1 O 6 O X O 8 X O X O X C O | X O A 4 5 O C O X 6 X O 1 X | X 5 O 1 58 | 1 O X O C O X O 1 O X 8 X O X | O | 6 A X O X O 2 O X O X O | X O X 6 X 56 O X A X O X A 2 O X A 1 O B | O | X B O 9 O X O X O X O 5 O | X O X 7 X 54 O X O | O X O O X B X O X X B X 6 X | 4 | 5 | O 8 O O 1 X O O X 8 | 9 1 3 X O X 52 C ----+-O X ----O ----X ----O --B 6 O X O X +---O 9 +-X +---O X ------O ----X +---2 X O +-------8 -O-C-O-X-9 -C 50 | | 8 X O B O X | 1 X O X C X O | | O X O 4 | O X O | 6 O X O 4 O X 48 | | O O A O X | O 5 8 2 O | | | O X | O | | O B | O 4 O | X A B O X 46 | | O X | O 3 O X | | | O 8 B X | | | 8 X | O X 9 | 4 5 O X O X 44 | | O X O 1 | | | O X O 3 | | | O X O X O O X 42 +-----O ----X ----+---O X --+-+---O X O 2 +---------+---O ----X +---3 --O X O X O-------O-B 40 | | | O X | 2 O X | | | 5 O X | | | O X | O B O 3 O O X 38 | | | O X | | | C X | | | O X | A X 2 X O X 36 | | | O X | | O C | | | O X O A 34 | | | O X | O O X 32 +-------+-----O ----X ----+---O X --+-+-------+-----+-------+---O X --X +-------------O-X 30 | | | O X X | | O X | | | | 9 X O X | | O 28 | | | O X | | | | O X | | 26 | | | O X | | O B | | | | O X A X | | 24 | | | O X C X | | O X | | 22 +-------+-----O X O +-----+---9 X --+-+-------+-----+-------+---O X O --+--------------20 | | | O X | | | O | | | | O X | | 18 | | | O X | | | O | | 16 | | | O X | | | | 14 | | | O B | | | | 12 +-------+-----O X --+-----+---+-+-------+-----+-----------+-------------10 | | | O X | | | | 8 | | | O | | | | 6 | 8 8 | 8 | 9 9 9 | 9 9 | 0 ---| 5 5 | 6 6 | 7 7 | 8 8 | 9 | 0 0 | 1 | 2 3 3 4 4 | 5 | 6 6 | 7 7 | 8 8 | 9 9 | 0 ---- www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis NYSE Bullish Percent 86 84 82 80 78 76 74 72 70 68 66 64 62 60 58 56 54 52 50 48 46 44 42 40 38 36 34 32 30 28 26 24 22 20 18 16 14 12 10 8 6 | | | | | | | | 84 | | | | 82 +-----X ------+-----+-----+---+-+-------+-----+-----------+-------------80 | X O | | | | 78 | X O 3 | | | | | 8 A | | | 76 | X 3 5 X O | | 9 | | | | 7 O X O | | | 74 | X O 2 O X | 8 O | | | | X O | X | | 72 +-2 O 1 O ----2 4 <-*Note 3 O --+-7 O ----X --+-+-------+-----+---X 9 --O --+-X O ------+------------70 | X 4 X O X X O | 6 A 3 O | 2 | | X O | | 68 | X 5 X 6 X O X 5 | 5 O X O 2 | | 5 | 6 O 3 5 <--*Note | X 66 | X 8 C 7 X O 8 O X O 7 | 3 O X 5 X O 1 O | | X O 1 X O | | X 64 | X 9 X O 7 9 X O X O X O C 4 X O | 8 | X O C O X O | | X X 62 +-X O X O ----X O 2 O ----X 6 X 4 X O X 3 --+-7 O 2 7 B O X ----O X +-X O ----C +---------------X-O-360 | X O B O 1 O 6 O X O 8 X O X O X C O | X O A 4 5 O C O X 6 X O 1 X | X 5 O 1 58 | 1 O X O C O X O 1 O X 8 X O X | O | 6 A X O X O 2 O X O X O | X O X 6 X 56 O X A X O X A 2 O X A 1 O B | O | X B O 9 O X O X O X O 5 O | X O X 7 X 54 O X O | O X O O X B X O X X B X 6 X | 4 | 5 | O 8 O O 1 X O O X 8 | 9 1 3 X O X 52 C ----+-O X ----O ----X ----O --B 6 O X O X +---O 9 +-X +---O X ------O ----X +---2 X O +-------8 -O-C-O-X-9 -C 50 | | 8 X O B O X | 1 X O X C X O | | O X O 4 | O X O | 6 O X O 4 O X 48 | | O O A O X | O 5 8 2 O | | | O X | O | | O B | O 4 O | X A B O X 46 | | O X | O 3 O X | | | O 8 B X | | | 8 X | O X 9 | 4 5 O X O X 44 | | O X O 1 | | | O X O 3 | | | O X O X O O X 42 +-----O ----X ----+---O X --+-+---O X O 2 +---------+---O ----X +---3 --O X O X O-------O-B 40 | | | O X | 2 O X | | | 5 O X | | | O X | O B O 3 O O X 38 | | | O X | | | C X | | | O X | A X 2 X O X 36 | | | O X | | O C | | | O X O A 34 | | | O X | O O X 32 +-------+-----O ----X ----+---O X --+-+-------+-----+-------+---O X --X +-------------O-X 30 | | | O X X | | O X | | | | 9 X O X | | O 28 | | | O X | | | | O X | | 26 | | | O X | | O B | | | | O X A X | | 24 | | | O X C X | | O X | | 22 +-------+-----O X O +-----+---9 X --+-+-------+-----+-------+---O X O --+--------------20 | | | O X | | | O | | | | O X | | 18 | | | O X | | | O | | 16 | | | O X | | | | 14 | | | O B | | | | 12 +-------+-----O X --+-----+---+-+-------+-----+-----------+-------------10 | | | O X | | | | 8 | | | O | | | | 6 | 8 8 | 8 | 9 9 9 | 9 9 | 0 ---| 5 5 | 6 6 | 7 7 | 8 8 | 9 | 0 0 | 1 | 2 3 3 4 4 | 5 | 6 6 | 7 7 | 8 8 | 9 9 | 0 ---- www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis NYSE Bullish Percent Ø The NYSE Bullish Percent measures risk. Ø It DOES NOT tell us where the Dow or S&P 500 will go. Ø The Dow only measures 30 stocks and is price weighted. Ø The S&P 500 only measures 500 stocks and is capitalization weighted. Ø The NYSE Bullish Percent measures ALL stocks on the NYSE and behaves more like an investors portfolio since most of us neither price weight or capitalization weight our portfolios. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis NYSE Bullish Percent Ø The NYSE Bullish Percent measures risk. Ø It DOES NOT tell us where the Dow or S&P 500 will go. Ø The Dow only measures 30 stocks and is price weighted. Ø The S&P 500 only measures 500 stocks and is capitalization weighted. Ø The NYSE Bullish Percent measures ALL stocks on the NYSE and behaves more like an investors portfolio since most of us neither price weight or capitalization weight our portfolios. www. dorseywright. com © Dorsey, Wright & Associates 2002

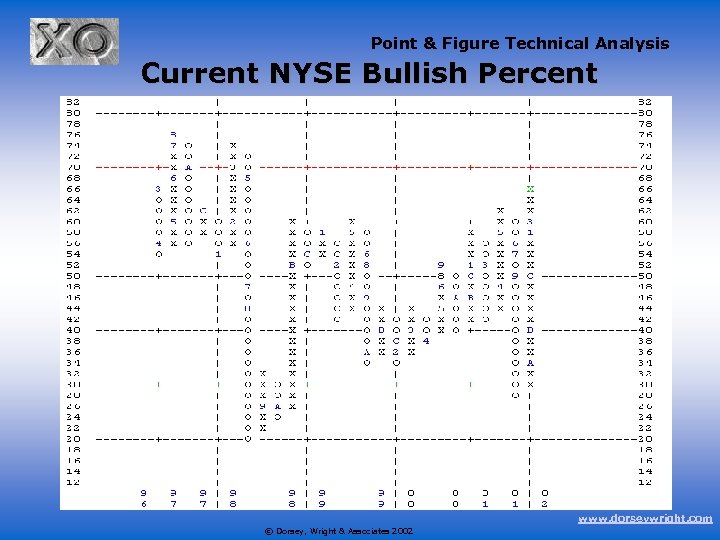

Point & Figure Technical Analysis Current NYSE Bullish Percent www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Current NYSE Bullish Percent www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis The OTC Bullish Percent Ø Just like the NYSE Bullish Percent except it is our primary indicator for the Nasdaq, or over-the-counter market. Ø It measures risk in the OTC market. Ø Tells us whether to have the offense or the defense on the field with respect to the OTC. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis The OTC Bullish Percent Ø Just like the NYSE Bullish Percent except it is our primary indicator for the Nasdaq, or over-the-counter market. Ø It measures risk in the OTC market. Ø Tells us whether to have the offense or the defense on the field with respect to the OTC. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Sector Bullish Percents Ø Calculated like the NYSE Bullish Percent and measures percent of buy signals in a sector. Ø More than 40 different sectors. Ø 30% and 70% are the lines of demarcation for the sector as well. Ø Tells us when to play offense or defense in particular sectors. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Sector Bullish Percents Ø Calculated like the NYSE Bullish Percent and measures percent of buy signals in a sector. Ø More than 40 different sectors. Ø 30% and 70% are the lines of demarcation for the sector as well. Ø Tells us when to play offense or defense in particular sectors. www. dorseywright. com © Dorsey, Wright & Associates 2002

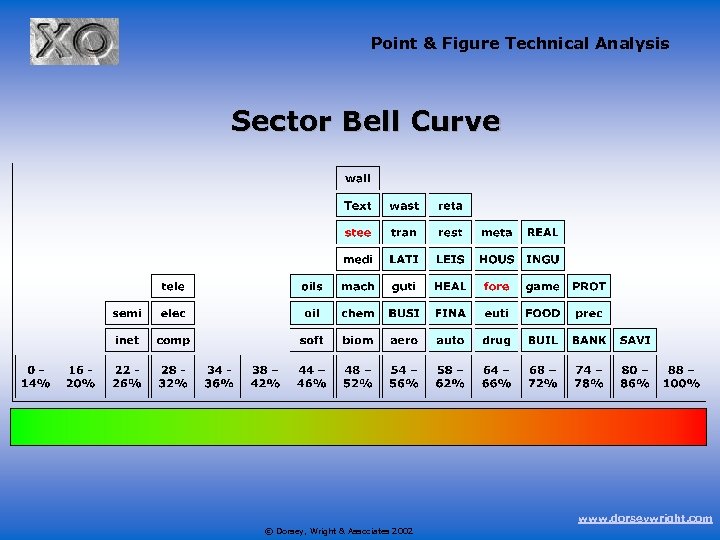

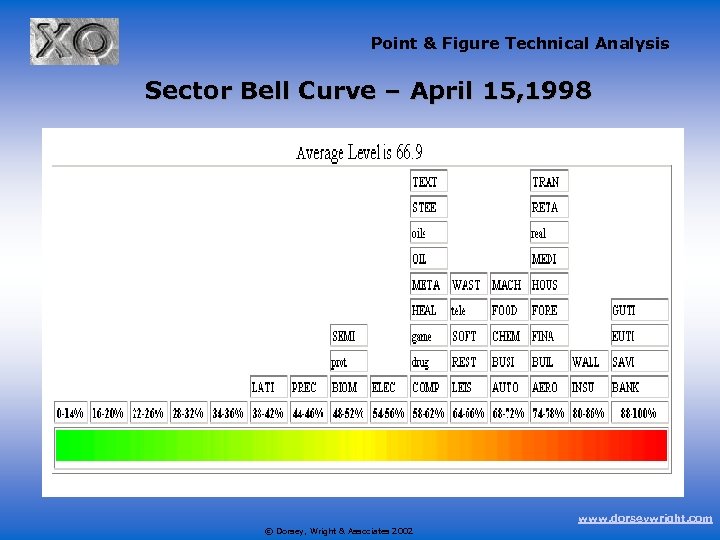

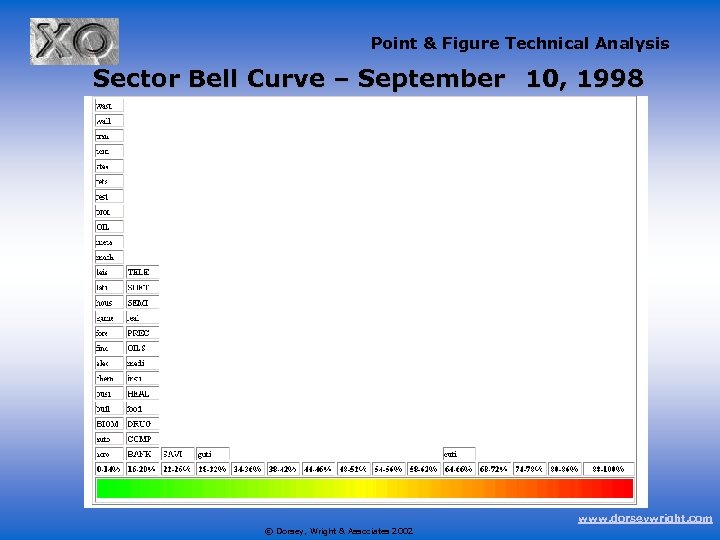

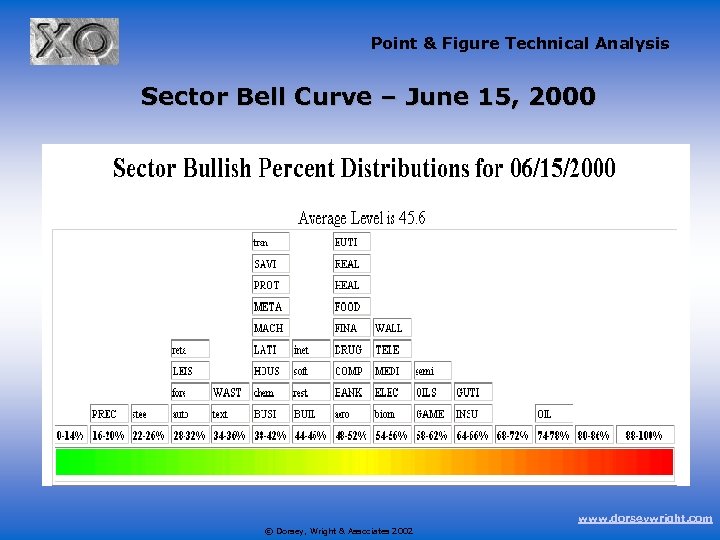

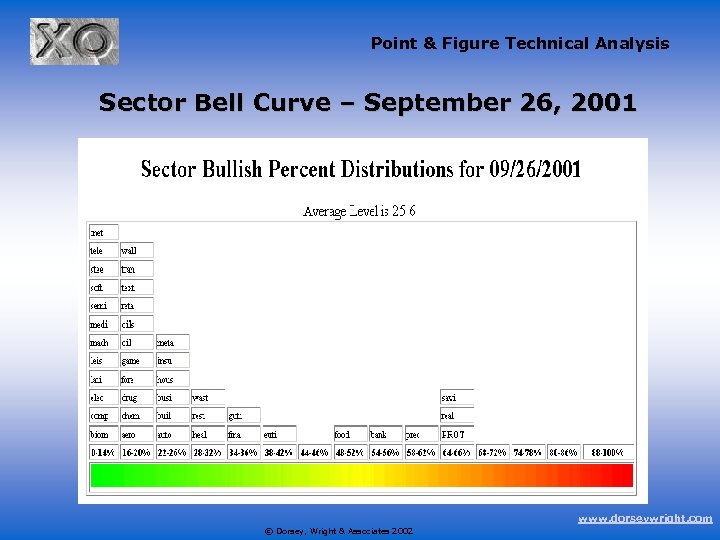

Point & Figure Technical Analysis Sector Bell Curve Ø Remember the bell curve from Statistics 101? Ø The sector bell curve allows us to get a visual picture of the current market. Ø Most of the time the sector bell curve looks fairly normal with some sectors overbought, some sectors oversold, but most sectors in between. Ø We often hear market commentators talk about the market being oversold or overbought, so let’s look at some of the historic sector bell curves to see what a true overbought or oversold market looks like. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Sector Bell Curve Ø Remember the bell curve from Statistics 101? Ø The sector bell curve allows us to get a visual picture of the current market. Ø Most of the time the sector bell curve looks fairly normal with some sectors overbought, some sectors oversold, but most sectors in between. Ø We often hear market commentators talk about the market being oversold or overbought, so let’s look at some of the historic sector bell curves to see what a true overbought or oversold market looks like. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Sector Bell Curve www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Sector Bell Curve www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Sector Bell Curve – April 15, 1998 www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Sector Bell Curve – April 15, 1998 www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Sector Bell Curve – September 10, 1998 www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Sector Bell Curve – September 10, 1998 www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Sector Bell Curve – June 15, 2000 www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Sector Bell Curve – June 15, 2000 www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Sector Bell Curve – September 26, 2001 www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Sector Bell Curve – September 26, 2001 www. dorseywright. com © Dorsey, Wright & Associates 2002

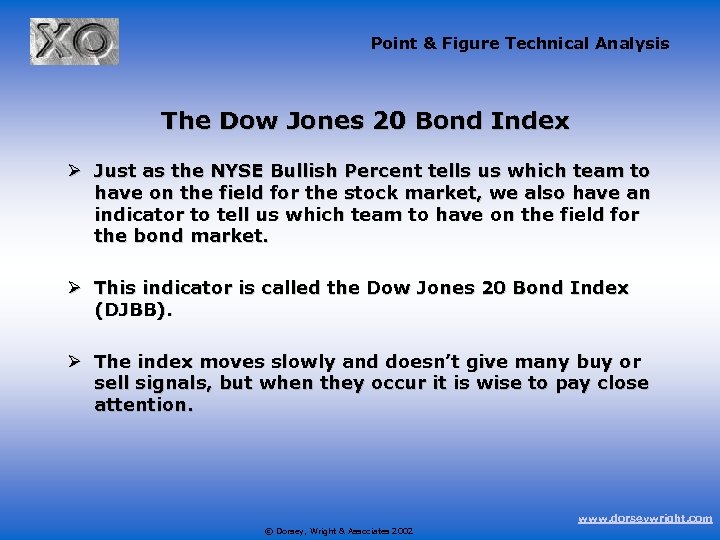

Point & Figure Technical Analysis The Dow Jones 20 Bond Index Ø Just as the NYSE Bullish Percent tells us which team to have on the field for the stock market, we also have an indicator to tell us which team to have on the field for the bond market. Ø This indicator is called the Dow Jones 20 Bond Index (DJBB). Ø The index moves slowly and doesn’t give many buy or sell signals, but when they occur it is wise to pay close attention. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis The Dow Jones 20 Bond Index Ø Just as the NYSE Bullish Percent tells us which team to have on the field for the stock market, we also have an indicator to tell us which team to have on the field for the bond market. Ø This indicator is called the Dow Jones 20 Bond Index (DJBB). Ø The index moves slowly and doesn’t give many buy or sell signals, but when they occur it is wise to pay close attention. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Recap of the Five-Step Game Plan Ø Step 1: Market Analysis using the NYSE Bullish Percent. Ø Step 2: Sector Analysis using the sector Bullish Percents. Ø Step 3: Fundamental research. Ø Step 4: Technical Research. Once we evaluate the market and each sector, the individual stock charts tell us whether supply or demand is in control. Ø Step 5: Risk management and follow-up. www. dorseywright. com © Dorsey, Wright & Associates 2002

Point & Figure Technical Analysis Recap of the Five-Step Game Plan Ø Step 1: Market Analysis using the NYSE Bullish Percent. Ø Step 2: Sector Analysis using the sector Bullish Percents. Ø Step 3: Fundamental research. Ø Step 4: Technical Research. Once we evaluate the market and each sector, the individual stock charts tell us whether supply or demand is in control. Ø Step 5: Risk management and follow-up. www. dorseywright. com © Dorsey, Wright & Associates 2002

Copyright © 2002 Dorsey, Wright & Associates, Inc. Keep in mind that there is no assurance that this or any strategy will ultimately be successful or profitable.

Copyright © 2002 Dorsey, Wright & Associates, Inc. Keep in mind that there is no assurance that this or any strategy will ultimately be successful or profitable.