45258f667237fe5cf292a9ca07a7b278.ppt

- Количество слайдов: 16

Po. A Experiences Joint Implementation Supervisory committee Roundtable Consultations Bonn, 16 June 2009 Klaus Oppermann, Kf. W

Source of Kf. W’s Po. A Experience: Po. A Support Center Germany l Since October 2008 Kf. W runs Po. A support program on behalf of German Environmental Ministry: l Enable public and private entities to identify Po. As. l Develop concrete and realizable Po. A proposals. l Prepare for Po. A implementation and operation. l Facilitate Po. A financing and marketing of carbon credits. l Po. A Blueprint Book → www. kfw. de/carbonfund 2

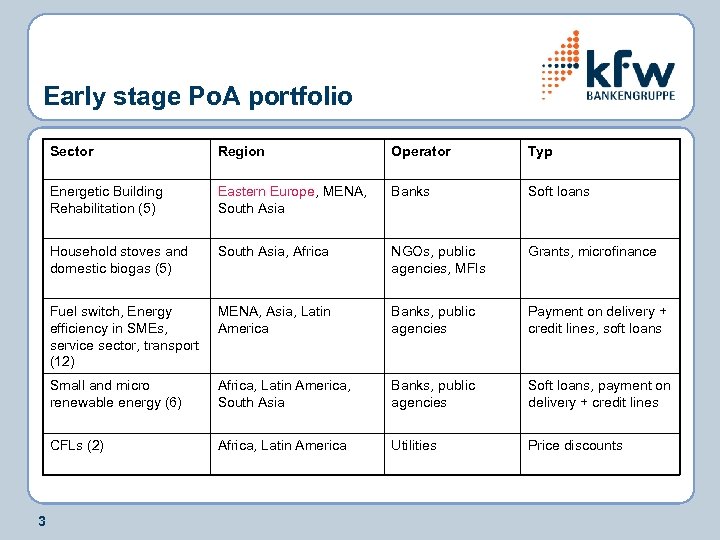

Early stage Po. A portfolio Sector Operator Typ Energetic Building Rehabilitation (5) Eastern Europe, MENA, South Asia Banks Soft loans Household stoves and domestic biogas (5) South Asia, Africa NGOs, public agencies, MFIs Grants, microfinance Fuel switch, Energy efficiency in SMEs, service sector, transport (12) MENA, Asia, Latin America Banks, public agencies Payment on delivery + credit lines, soft loans Small and micro renewable energy (6) Africa, Latin America, South Asia Banks, public agencies Soft loans, payment on delivery + credit lines CFLs (2) 3 Region Africa, Latin America Utilities Price discounts

Looking deeper into four cases Energetic building rehabilitation – Eastern Europe (EU): l Insulation, windows, heating (EE & FS); l 20 CERs/building/p. a. , investment costs 25, 000 EUR/building on average; l Soft loans, carbon impact 8%*, entering renovation cycle, building typology approach for monitoring. l Energy Efficiency in public buildings – MENA: l Lighting, cooling, intelligent control technology; l 120 CERs/Building/p. a. , investment costs 30, 000 EUR/building on average; l Payment-on-delivery, carbon impact 36%, each building monitored. l Residential Biogas – South Asia: l 2. 5 CERs/unit/p. a. , investment costs 180 EUR/unit; l Grants + payment on delivery (maintenance), 140% carbon impact. l Residential Solar Water Heating – Africa: l 2 CERs/unit, investment costs 1, 000 EUR/unit; l Grants, carbon impact 10%, monitoring through sampling. l * 10 year’s carbon revenues undiscounted at 10 EUR/t relative to initial costs 4

Example German programmatic JI l l 2 Po. As: Energy efficient heating & steam boilers (Northwest and South Germany): l Po. A operators: public energy agency & utility; l Payment-on-delivery programs: 80 kt. p. a. expected (for both programs together); l Example: Modernization 10 MW oil-fired steam boiler: 270 TEUR, 30 TEUR JI revenues per year. l 5 German DNA has approved 3 regional energy efficiency/fuel switching Po. As. 1 Po. A: Climate Bonus Program heat pumps (Northwest Germany): l Po. A operator: utility; l Conversion conventional heating to electric heat pumps (zero emissions because coverage of power sector within ETS); l Grant program (frontloading of carbon revenues): 50 kt. p. a. expected; l CO 2 reductions per heat pump: around 2 t p. a.

Efficient lighting - CFL program l Economics (example of an Indian give-away for free project): l Procurement/distribution costs for high quality CFL: 5 EUR/unit; l Carbon revenues: 0, 8 EUR/unit/a (0. 1 MWh savings; 0. 8 t. CO 2/MWh; 10 EUR/t. CO 2); l Fixed costs (development, CDM process): 300 TEUR; l Operational costs (including monitoring): 50 TEUR; l Break even requires > 1. 000, 000 CFLs. l Utility as Po. A operator: l Interest in peak load reduction; l Competence with demand side EE measures; l Customer database; l Synergies meter reading – monitoring on a sample basis. 6

Programmatic carbon crediting l Po. A - Incentive or policy implementation program as CDM project: l Program operator receives CDM revenues; l Program participants receive incentive payment; l Incentives are provided against carbon ownership; l Market based private sector driven and bottom-up approach to sustainable sectoral transformation (difference to sectoral crediting); l Addressing small and micro activities; l Core target group: households, SMEs, municipalities. l Economics and Finance: l Appropriate type and dimension of incentive (grant, soft loan. . ); l Core deal: incentive against carbon ownership (appropriate contracts); l Funding of the programme (in particular seed funding). 7

Specific interest of Po. As for JI l Po. A could have long term potential to boost JI. l Public sector – private sector asset distribution issue: l Approving a JI project means a wealth transfer public → private sector; l Po. A allows for implementation of public sector programs under JI. l JI in EU-ETS countries: l Big emitters covered by ETS: few opportunities for stand-alone projects; l Considerable potential for micro-activities including buildings and small industrial boilers → Po. A approach. 8

Po. A operators – interests and requirements l Required: institutional capacity; program experience. l Not necessarily required: carbon market experience. l Potential Po. A operators include (core interest/policy): l Financial institutions: attractive loan conditions. l Utilities: demand side energy efficiency measures. l Producers of climate friendly technology: marketing. l Public agencies: funding of policies. l NGOs: funding of sustainable development activities. l Substantial synergy effects: l Ex. 1: Microfinance loan monitoring and CDM/JI monitoring. l Ex. 2: Utility customer database/billing and quality control. l Ex. 3: Bank’s loan contracts and CER/ERU ownership transfer. 9

Po. A operator – responsibilities Running the program (core): l Develop Po. A concept and business plan; l Implement and operate Po. A; l Do core deal: carbon credits against incentive payment; l Sell carbon credits and refinance Po. A; l Handle all involved financial flows. Po. A procedures (potential for outsourcing): l Organize validation and registration of Po. A; l Check whether submitted CPAs fulfill the Po. A eligibility criteria; l Operate record keeping system for each CPA; l Submit CPA Design Documents (CPA-DDs) to validator; l Communicate with DOE regarding monitoring reports; l Organize revalidation of Po. A after revision of baseline methodology. 10

Po. A Funding l Situation for Po. A operator: l Costs: development, implementation, operation; l Revenues: carbon credits are only source of income. l Funding requirements: l Development (concept, business plan, capacity, PDD); l Seed Funding first generations of activities/incentives. l Risk profile seed funding: l Performance risk of Po. A operator; l Risk - : often stable consumption activities; low transfer risk (international carbon accounts); step wise implementation. l Risk +: complete reliance on monitoring; often no recourse to program participants (micro activities). l Banks have no experience with Po. A funding. 11

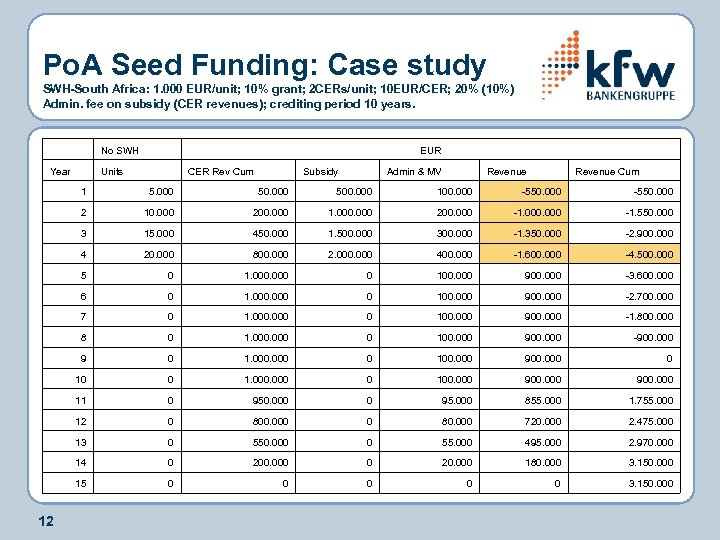

Po. A Seed Funding: Case study SWH-South Africa: 1. 000 EUR/unit; 10% grant; 2 CERs/unit; 10 EUR/CER; 20% (10%) Admin. fee on subsidy (CER revenues); crediting period 10 years. No SWH Year EUR Units CER Rev Cum Subsidy Admin & MV Revenue Cum 1 50. 000 500. 000 100. 000 -550. 000 2 10. 000 200. 000 1. 000 200. 000 -1. 550. 000 3 15. 000 450. 000 1. 500. 000 300. 000 -1. 350. 000 -2. 900. 000 4 20. 000 800. 000 2. 000 400. 000 -1. 600. 000 -4. 500. 000 5 0 1. 000 0 100. 000 900. 000 -3. 600. 000 6 0 1. 000 0 100. 000 900. 000 -2. 700. 000 7 0 1. 000 0 100. 000 900. 000 -1. 800. 000 8 0 1. 000 0 100. 000 900. 000 -900. 000 9 0 1. 000 0 100. 000 900. 000 11 0 950. 000 0 95. 000 855. 000 1. 755. 000 12 0 800. 000 0 80. 000 720. 000 2. 475. 000 13 0 550. 000 0 55. 000 495. 000 2. 970. 000 14 0 200. 000 0 20. 000 180. 000 3. 150. 000 15 12 5. 000 0 0 3. 150. 000

Summary of Experiences l Development: program (project) needs to be developed not only l l 13 carbon component; Institutional requirements: experienced program implementers (in general not yet well integrated into carbon market – major bottleneck in Po. A deployment); Economics: Minimum program size required for reaching break even; Finance: Risk of Po. A Seed Funding mainly rely on post registration regulatory risk (monitoring and verification, revisions of methodologies); Very limited pre-2012 Po. A carbon delivery expectation despite huge potential.

Comments on Po. A procedures l Po. As are very similar to ‚standard JI-projects‘ from a regulatory perspective: l Po. As are a project by project approach; l Deployment of measures/activities over time associated with quantitative uncertainty on ERUs also in ‚standard projects‘: (e. g. MWh windpower p. a. ; number of fly-ash bricks p. a. …); l Po. As face major market entry barriers and are much more difficult to develop than , standard projects‘; l → Guiding principles: l As simple as possible; l As close to procedures for , standard projects‘ as possible. l Most simple ruling would be a pure definition: Po. As are projects with ex post determination of included project activities – all JI (CDM) rules and procedures apply mutatis mutandis. 14

Comments on proposed JI-Po. A guidance l No. 6: JPA = single measure or set of ( interrelated ) measures: l l 15 clarification that CE defines in its own deliberation JPA (in practice optimization calculus); No. 7: JPAs within the same Po. A can use different methodology combinations: relevant e. g. for biogas – with or without methan component; No. 11: Avoidance of double counting – either CE procedure in determination or on JPA level in verification: specification required; No. 13/15: , Crediting period’ of JI Po. A versus crediting period of JPAs is not defined (in CDM: 28 ys. Po. A lifetime + CPA crediting periods); No 13: No AIE involvement in the JPA inclusion process (unnecessary as there is no consistency check as under CDMPo. A).

Thank you for your attention Dr. Klaus Oppermann Kf. W Bankengruppe Klaus. oppermann@kfw. de

45258f667237fe5cf292a9ca07a7b278.ppt