a78d55d060f2699856a872ae3c7b88f4.ppt

- Количество слайдов: 58

Play Listen Watch Learn Communicate Discover Create Share Network Service Turbo-Charge Plan April 20, 2010

Play Listen Watch Learn Communicate Discover Create Share Network Service Turbo-Charge Plan April 20, 2010

AGENDA n Trends in the Consumption of Entertainment Content n Sony Network Service Summary – Proposed Offering and Value Proposition – Target Markets & Customer Segments n Operational and Implementation Summary – Content Acquisition – Hardware/Device Integration – Marketing & Sales Strategy n Financial Plan – Projected Financial Impact n Next Steps Transformation Management Office 2

AGENDA n Trends in the Consumption of Entertainment Content n Sony Network Service Summary – Proposed Offering and Value Proposition – Target Markets & Customer Segments n Operational and Implementation Summary – Content Acquisition – Hardware/Device Integration – Marketing & Sales Strategy n Financial Plan – Projected Financial Impact n Next Steps Transformation Management Office 2

AGENDA We will discuss… 1. Shifts in how entertainment is consumed 2. How industry incumbents are adjusting to these shifts 3. Why these shifts create opportunities for Sony Transformation Management Office 3

AGENDA We will discuss… 1. Shifts in how entertainment is consumed 2. How industry incumbents are adjusting to these shifts 3. Why these shifts create opportunities for Sony Transformation Management Office 3

KEY TRENDS IN THE CONSUMPTION OF ENTERTAINMENT CONTENT Transformation Management Office 4

KEY TRENDS IN THE CONSUMPTION OF ENTERTAINMENT CONTENT Transformation Management Office 4

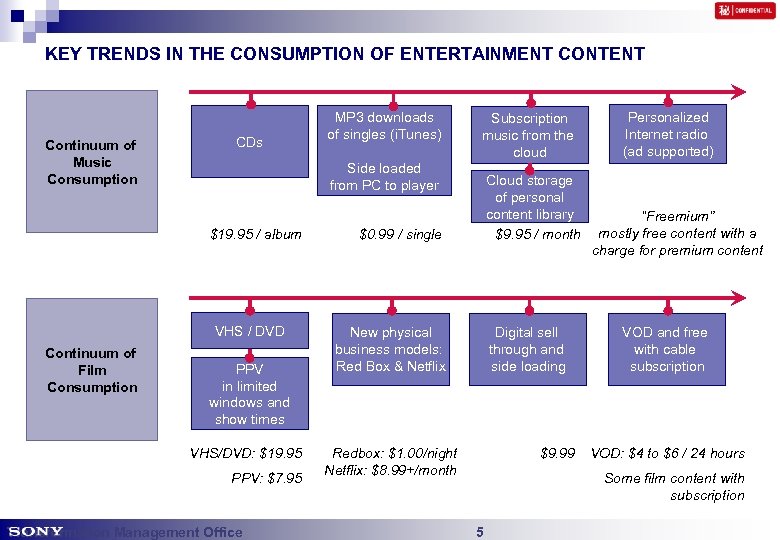

KEY TRENDS IN THE CONSUMPTION OF ENTERTAINMENT CONTENT Continuum of Music Consumption CDs Subscription music from the cloud Side loaded from PC to player $19. 95 / album VHS / DVD Continuum of Film Consumption MP 3 downloads of singles (i. Tunes) PPV in limited windows and show times VHS/DVD: $19. 95 PPV: $7. 95 Transformation Management Office Cloud storage of personal content library $9. 95 / month $0. 99 / single New physical business models: Red Box & Netflix Digital sell through and side loading Redbox: $1. 00/night Netflix: $8. 99+/month $9. 99 Personalized Internet radio (ad supported) “Freemium” mostly free content with a charge for premium content VOD and free with cable subscription VOD: $4 to $6 / 24 hours Some film content with subscription 5

KEY TRENDS IN THE CONSUMPTION OF ENTERTAINMENT CONTENT Continuum of Music Consumption CDs Subscription music from the cloud Side loaded from PC to player $19. 95 / album VHS / DVD Continuum of Film Consumption MP 3 downloads of singles (i. Tunes) PPV in limited windows and show times VHS/DVD: $19. 95 PPV: $7. 95 Transformation Management Office Cloud storage of personal content library $9. 95 / month $0. 99 / single New physical business models: Red Box & Netflix Digital sell through and side loading Redbox: $1. 00/night Netflix: $8. 99+/month $9. 99 Personalized Internet radio (ad supported) “Freemium” mostly free content with a charge for premium content VOD and free with cable subscription VOD: $4 to $6 / 24 hours Some film content with subscription 5

KEY TRENDS IN THE CONSUMPTION OF ENTERTAINMENT CONTENT Changing patterns in content consumption are weakening economics for content providers and distributors, but improving consumer experiences n Consumer preferences: – Unbundling of film and music content in favor of an à la carte approach – Escaping the frustrations of maintaining libraries in multiple formats and managing them via side loading – Accessing content anywhere (cloud-based services are a solution) – Flexibility in content access across all film “windows” n Ability to enjoy film content earlier and on more devices – Paying for purchase of content only once for use on multiple devices – Higher quality experiences should no longer be sacrificed for convenience n Examples: consumer preferences for higher bit rates for music, HD for video, and 3 D for video, as well as strong sales of higher quality headphones Transformation Management Office 6

KEY TRENDS IN THE CONSUMPTION OF ENTERTAINMENT CONTENT Changing patterns in content consumption are weakening economics for content providers and distributors, but improving consumer experiences n Consumer preferences: – Unbundling of film and music content in favor of an à la carte approach – Escaping the frustrations of maintaining libraries in multiple formats and managing them via side loading – Accessing content anywhere (cloud-based services are a solution) – Flexibility in content access across all film “windows” n Ability to enjoy film content earlier and on more devices – Paying for purchase of content only once for use on multiple devices – Higher quality experiences should no longer be sacrificed for convenience n Examples: consumer preferences for higher bit rates for music, HD for video, and 3 D for video, as well as strong sales of higher quality headphones Transformation Management Office 6

INDUSTRY INCUMBENTS HAVE YET TO DEVELOP HOLISTIC SOLUTIONS Transformation Management Office 7

INDUSTRY INCUMBENTS HAVE YET TO DEVELOP HOLISTIC SOLUTIONS Transformation Management Office 7

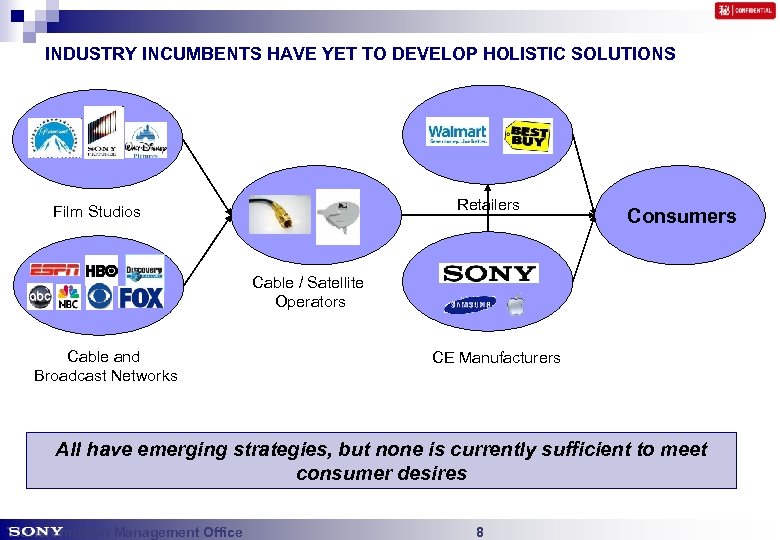

INDUSTRY INCUMBENTS HAVE YET TO DEVELOP HOLISTIC SOLUTIONS Retailers Film Studios Consumers Cable / Satellite Operators Cable and Broadcast Networks CE Manufacturers All have emerging strategies, but none is currently sufficient to meet consumer desires Transformation Management Office 8

INDUSTRY INCUMBENTS HAVE YET TO DEVELOP HOLISTIC SOLUTIONS Retailers Film Studios Consumers Cable / Satellite Operators Cable and Broadcast Networks CE Manufacturers All have emerging strategies, but none is currently sufficient to meet consumer desires Transformation Management Office 8

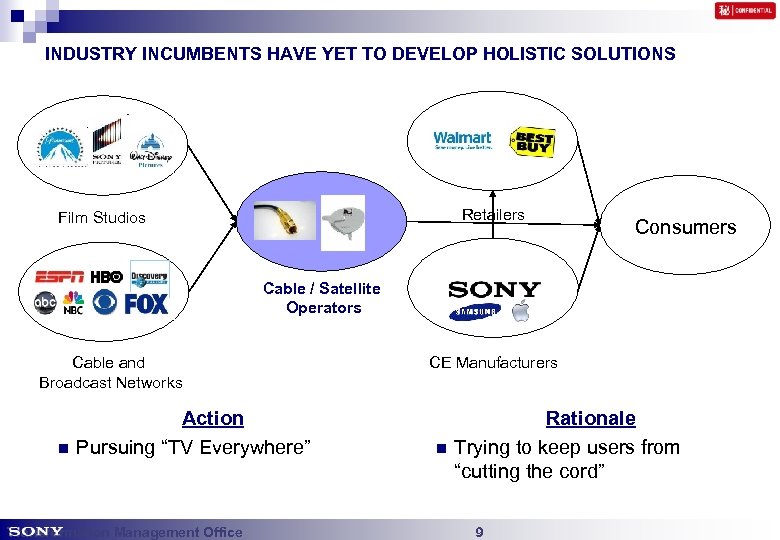

INDUSTRY INCUMBENTS HAVE YET TO DEVELOP HOLISTIC SOLUTIONS Retailers Film Studios Consumers Cable / Satellite Operators Cable and Broadcast Networks n Action Pursuing “TV Everywhere” Transformation Management Office CE Manufacturers n Rationale Trying to keep users from “cutting the cord” 9

INDUSTRY INCUMBENTS HAVE YET TO DEVELOP HOLISTIC SOLUTIONS Retailers Film Studios Consumers Cable / Satellite Operators Cable and Broadcast Networks n Action Pursuing “TV Everywhere” Transformation Management Office CE Manufacturers n Rationale Trying to keep users from “cutting the cord” 9

REACTIONS TO KEY TRENDS: CABLE OPERATORS n Cable companies, through a project called “TV Everywhere”, are beginning to experiment with offering subscribers access to their cable content on devices other than televisions – Comcast has begun operating Fancast XFinity TV, a program that allows subscribers to access 24 channels of TV shows and movies on up to 3 computers n Comcast is planning to extend these privileges beyond computers, to smart phones and tablets n Time Warner Cable is planning on launching a similar service to its subscribers n “TV Everywhere” is an “interim” solution, as what consumers truly want is content without having to purchase a full cable subscription n These cable operator solutions do not address consumers’ desires for unbundling content n Consumers are increasingly able to replicate (via the internet) much of the video content of the traditional cable operators Implications: n n Reduced overall revenue for cable operators over the long term Revenue mix will shift from traditional cable programming to data services Transformation Management Office 10

REACTIONS TO KEY TRENDS: CABLE OPERATORS n Cable companies, through a project called “TV Everywhere”, are beginning to experiment with offering subscribers access to their cable content on devices other than televisions – Comcast has begun operating Fancast XFinity TV, a program that allows subscribers to access 24 channels of TV shows and movies on up to 3 computers n Comcast is planning to extend these privileges beyond computers, to smart phones and tablets n Time Warner Cable is planning on launching a similar service to its subscribers n “TV Everywhere” is an “interim” solution, as what consumers truly want is content without having to purchase a full cable subscription n These cable operator solutions do not address consumers’ desires for unbundling content n Consumers are increasingly able to replicate (via the internet) much of the video content of the traditional cable operators Implications: n n Reduced overall revenue for cable operators over the long term Revenue mix will shift from traditional cable programming to data services Transformation Management Office 10

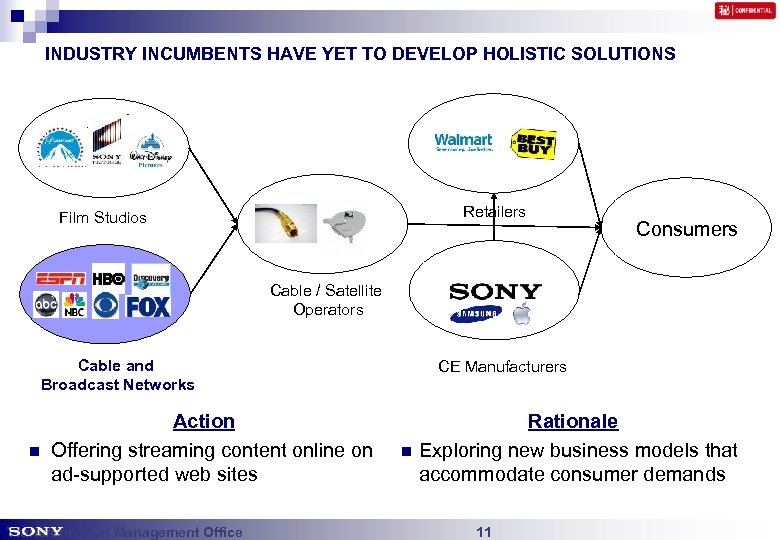

INDUSTRY INCUMBENTS HAVE YET TO DEVELOP HOLISTIC SOLUTIONS Retailers Film Studios Consumers Cable / Satellite Operators Cable and Broadcast Networks n Action Offering streaming content online on ad-supported web sites Transformation Management Office CE Manufacturers n Rationale Exploring new business models that accommodate consumer demands 11

INDUSTRY INCUMBENTS HAVE YET TO DEVELOP HOLISTIC SOLUTIONS Retailers Film Studios Consumers Cable / Satellite Operators Cable and Broadcast Networks n Action Offering streaming content online on ad-supported web sites Transformation Management Office CE Manufacturers n Rationale Exploring new business models that accommodate consumer demands 11

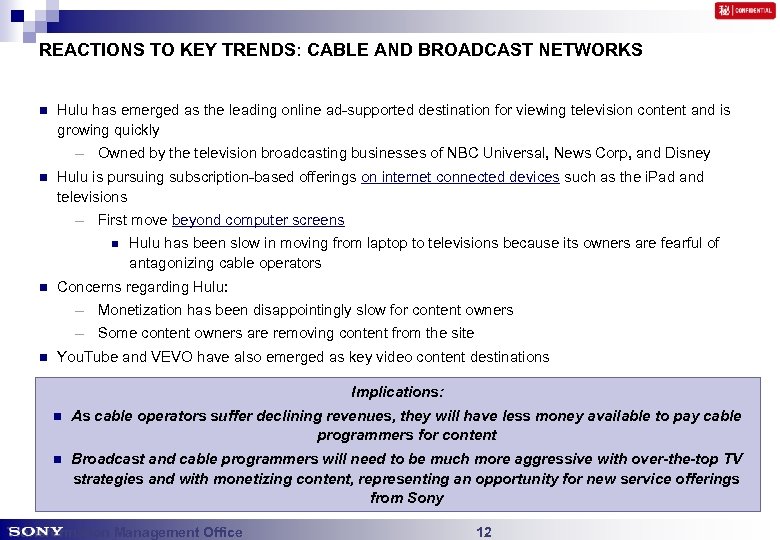

REACTIONS TO KEY TRENDS: CABLE AND BROADCAST NETWORKS n Hulu has emerged as the leading online ad-supported destination for viewing television content and is growing quickly – Owned by the television broadcasting businesses of NBC Universal, News Corp, and Disney n Hulu is pursuing subscription-based offerings on internet connected devices such as the i. Pad and televisions – First move beyond computer screens n n Hulu has been slow in moving from laptop to televisions because its owners are fearful of antagonizing cable operators Concerns regarding Hulu: – Monetization has been disappointingly slow for content owners – Some content owners are removing content from the site n You. Tube and VEVO have also emerged as key video content destinations Implications: n As cable operators suffer declining revenues, they will have less money available to pay cable programmers for content n Broadcast and cable programmers will need to be much more aggressive with over-the-top TV strategies and with monetizing content, representing an opportunity for new service offerings from Sony Transformation Management Office 12

REACTIONS TO KEY TRENDS: CABLE AND BROADCAST NETWORKS n Hulu has emerged as the leading online ad-supported destination for viewing television content and is growing quickly – Owned by the television broadcasting businesses of NBC Universal, News Corp, and Disney n Hulu is pursuing subscription-based offerings on internet connected devices such as the i. Pad and televisions – First move beyond computer screens n n Hulu has been slow in moving from laptop to televisions because its owners are fearful of antagonizing cable operators Concerns regarding Hulu: – Monetization has been disappointingly slow for content owners – Some content owners are removing content from the site n You. Tube and VEVO have also emerged as key video content destinations Implications: n As cable operators suffer declining revenues, they will have less money available to pay cable programmers for content n Broadcast and cable programmers will need to be much more aggressive with over-the-top TV strategies and with monetizing content, representing an opportunity for new service offerings from Sony Transformation Management Office 12

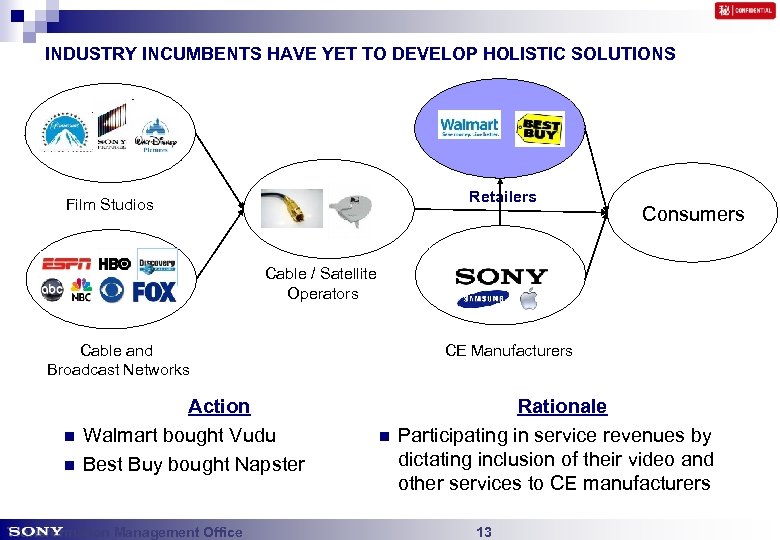

INDUSTRY INCUMBENTS HAVE YET TO DEVELOP HOLISTIC SOLUTIONS Retailers Film Studios Consumers Cable / Satellite Operators Cable and Broadcast Networks n n Action Walmart bought Vudu Best Buy bought Napster Transformation Management Office CE Manufacturers n Rationale Participating in service revenues by dictating inclusion of their video and other services to CE manufacturers 13

INDUSTRY INCUMBENTS HAVE YET TO DEVELOP HOLISTIC SOLUTIONS Retailers Film Studios Consumers Cable / Satellite Operators Cable and Broadcast Networks n n Action Walmart bought Vudu Best Buy bought Napster Transformation Management Office CE Manufacturers n Rationale Participating in service revenues by dictating inclusion of their video and other services to CE manufacturers 13

REACTIONS TO KEY TRENDS: RETAILERS n Retailers that participate heavily in sale of physical forms of entertainment content, have begun acquiring digital delivery platforms – Wal-Mart purchased movie streaming company Vudu – Best Buy purchased music streaming company Napster n Because major retailers have considerable power over CE manufacturers, they can compel these companies to include the retailers’ services on their devices, resulting in increased revenues to the retailers Implications: n n Retailers have historically not been successful service providers and content aggregators As a result, these retailer strategies are not expected to have a large impact on the value chain Transformation Management Office 14

REACTIONS TO KEY TRENDS: RETAILERS n Retailers that participate heavily in sale of physical forms of entertainment content, have begun acquiring digital delivery platforms – Wal-Mart purchased movie streaming company Vudu – Best Buy purchased music streaming company Napster n Because major retailers have considerable power over CE manufacturers, they can compel these companies to include the retailers’ services on their devices, resulting in increased revenues to the retailers Implications: n n Retailers have historically not been successful service providers and content aggregators As a result, these retailer strategies are not expected to have a large impact on the value chain Transformation Management Office 14

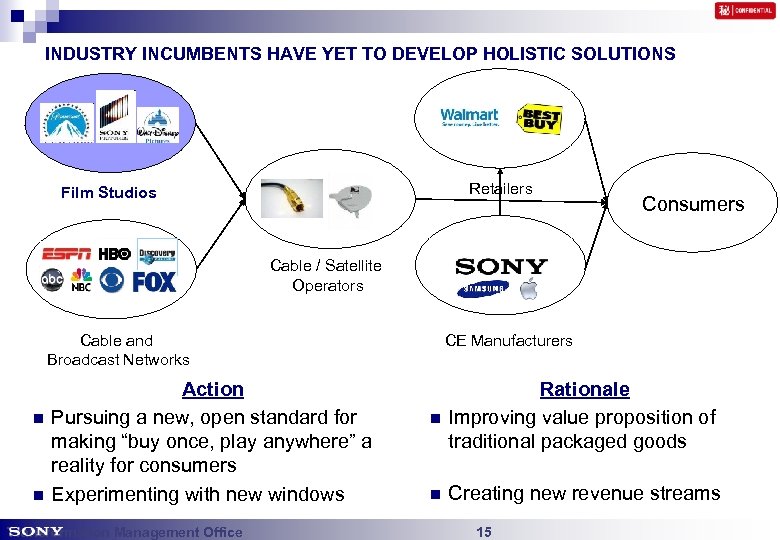

INDUSTRY INCUMBENTS HAVE YET TO DEVELOP HOLISTIC SOLUTIONS Retailers Film Studios Consumers Cable / Satellite Operators Cable and Broadcast Networks n n CE Manufacturers Action Pursuing a new, open standard for making “buy once, play anywhere” a reality for consumers Experimenting with new windows n Rationale Improving value proposition of traditional packaged goods n Creating new revenue streams Transformation Management Office 15

INDUSTRY INCUMBENTS HAVE YET TO DEVELOP HOLISTIC SOLUTIONS Retailers Film Studios Consumers Cable / Satellite Operators Cable and Broadcast Networks n n CE Manufacturers Action Pursuing a new, open standard for making “buy once, play anywhere” a reality for consumers Experimenting with new windows n Rationale Improving value proposition of traditional packaged goods n Creating new revenue streams Transformation Management Office 15

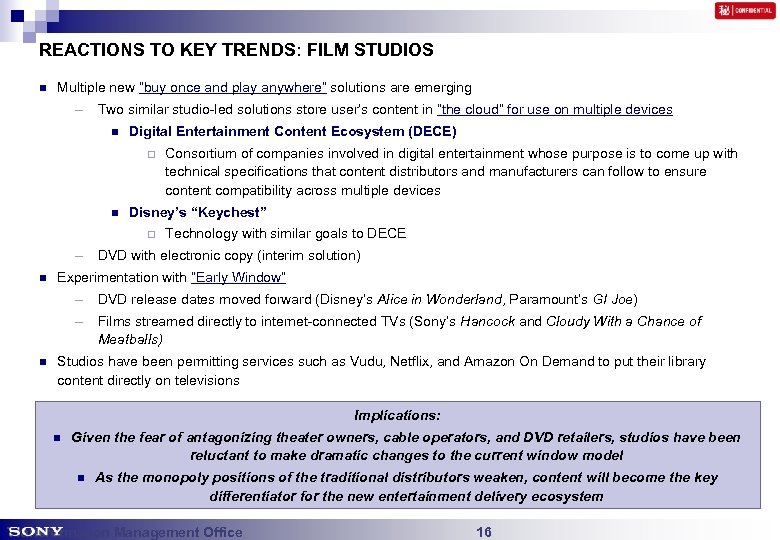

REACTIONS TO KEY TRENDS: FILM STUDIOS n Multiple new “buy once and play anywhere” solutions are emerging – Two similar studio-led solutions store user’s content in “the cloud” for use on multiple devices n Digital Entertainment Content Ecosystem (DECE) ¨ n Consortium of companies involved in digital entertainment whose purpose is to come up with technical specifications that content distributors and manufacturers can follow to ensure content compatibility across multiple devices Disney’s “Keychest” ¨ Technology with similar goals to DECE – DVD with electronic copy (interim solution) n Experimentation with “Early Window” – DVD release dates moved forward (Disney’s Alice in Wonderland, Paramount’s GI Joe) – Films streamed directly to internet-connected TVs (Sony’s Hancock and Cloudy With a Chance of Meatballs) n Studios have been permitting services such as Vudu, Netflix, and Amazon On Demand to put their library content directly on televisions Implications: n Given the fear of antagonizing theater owners, cable operators, and DVD retailers, studios have been reluctant to make dramatic changes to the current window model n As the monopoly positions of the traditional distributors weaken, content will become the key differentiator for the new entertainment delivery ecosystem Transformation Management Office 16

REACTIONS TO KEY TRENDS: FILM STUDIOS n Multiple new “buy once and play anywhere” solutions are emerging – Two similar studio-led solutions store user’s content in “the cloud” for use on multiple devices n Digital Entertainment Content Ecosystem (DECE) ¨ n Consortium of companies involved in digital entertainment whose purpose is to come up with technical specifications that content distributors and manufacturers can follow to ensure content compatibility across multiple devices Disney’s “Keychest” ¨ Technology with similar goals to DECE – DVD with electronic copy (interim solution) n Experimentation with “Early Window” – DVD release dates moved forward (Disney’s Alice in Wonderland, Paramount’s GI Joe) – Films streamed directly to internet-connected TVs (Sony’s Hancock and Cloudy With a Chance of Meatballs) n Studios have been permitting services such as Vudu, Netflix, and Amazon On Demand to put their library content directly on televisions Implications: n Given the fear of antagonizing theater owners, cable operators, and DVD retailers, studios have been reluctant to make dramatic changes to the current window model n As the monopoly positions of the traditional distributors weaken, content will become the key differentiator for the new entertainment delivery ecosystem Transformation Management Office 16

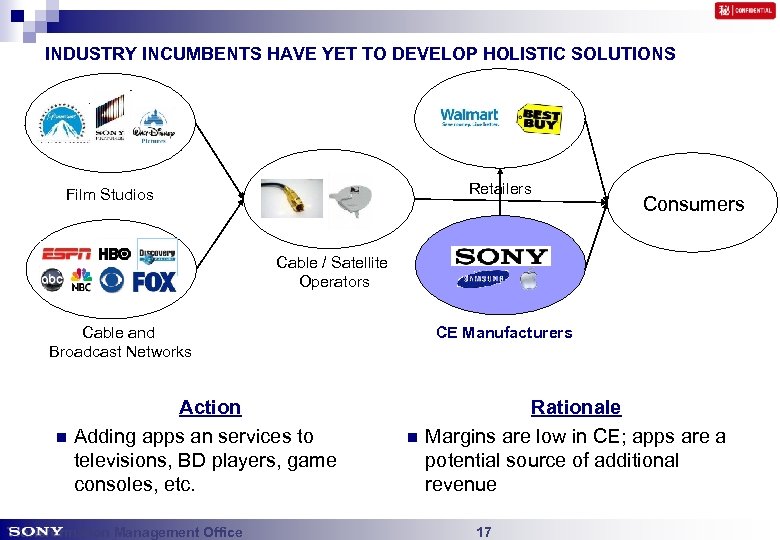

INDUSTRY INCUMBENTS HAVE YET TO DEVELOP HOLISTIC SOLUTIONS Retailers Film Studios Consumers Cable / Satellite Operators Cable and Broadcast Networks n Action Adding apps an services to televisions, BD players, game consoles, etc. Transformation Management Office CE Manufacturers n Rationale Margins are low in CE; apps are a potential source of additional revenue 17

INDUSTRY INCUMBENTS HAVE YET TO DEVELOP HOLISTIC SOLUTIONS Retailers Film Studios Consumers Cable / Satellite Operators Cable and Broadcast Networks n Action Adding apps an services to televisions, BD players, game consoles, etc. Transformation Management Office CE Manufacturers n Rationale Margins are low in CE; apps are a potential source of additional revenue 17

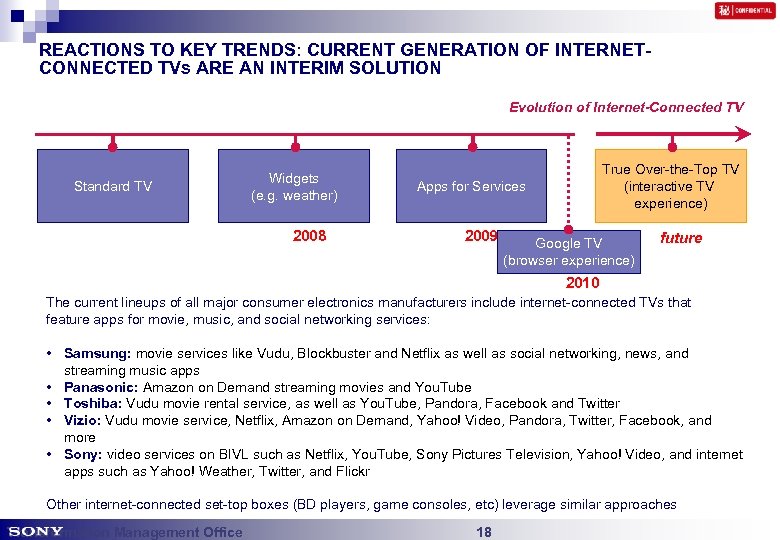

REACTIONS TO KEY TRENDS: CURRENT GENERATION OF INTERNETCONNECTED TVs ARE AN INTERIM SOLUTION Evolution of Internet-Connected TV Standard TV Widgets (e. g. weather) 2008 True Over-the-Top TV (interactive TV experience) Apps for Services 2009 Google TV (browser experience) future 2010 The current lineups of all major consumer electronics manufacturers include internet-connected TVs that feature apps for movie, music, and social networking services: • Samsung: movie services like Vudu, Blockbuster and Netflix as well as social networking, news, and streaming music apps • Panasonic: Amazon on Demand streaming movies and You. Tube • Toshiba: Vudu movie rental service, as well as You. Tube, Pandora, Facebook and Twitter • Vizio: Vudu movie service, Netflix, Amazon on Demand, Yahoo! Video, Pandora, Twitter, Facebook, and more • Sony: video services on BIVL such as Netflix, You. Tube, Sony Pictures Television, Yahoo! Video, and internet apps such as Yahoo! Weather, Twitter, and Flickr Other internet-connected set-top boxes (BD players, game consoles, etc) leverage similar approaches Transformation Management Office 18

REACTIONS TO KEY TRENDS: CURRENT GENERATION OF INTERNETCONNECTED TVs ARE AN INTERIM SOLUTION Evolution of Internet-Connected TV Standard TV Widgets (e. g. weather) 2008 True Over-the-Top TV (interactive TV experience) Apps for Services 2009 Google TV (browser experience) future 2010 The current lineups of all major consumer electronics manufacturers include internet-connected TVs that feature apps for movie, music, and social networking services: • Samsung: movie services like Vudu, Blockbuster and Netflix as well as social networking, news, and streaming music apps • Panasonic: Amazon on Demand streaming movies and You. Tube • Toshiba: Vudu movie rental service, as well as You. Tube, Pandora, Facebook and Twitter • Vizio: Vudu movie service, Netflix, Amazon on Demand, Yahoo! Video, Pandora, Twitter, Facebook, and more • Sony: video services on BIVL such as Netflix, You. Tube, Sony Pictures Television, Yahoo! Video, and internet apps such as Yahoo! Weather, Twitter, and Flickr Other internet-connected set-top boxes (BD players, game consoles, etc) leverage similar approaches Transformation Management Office 18

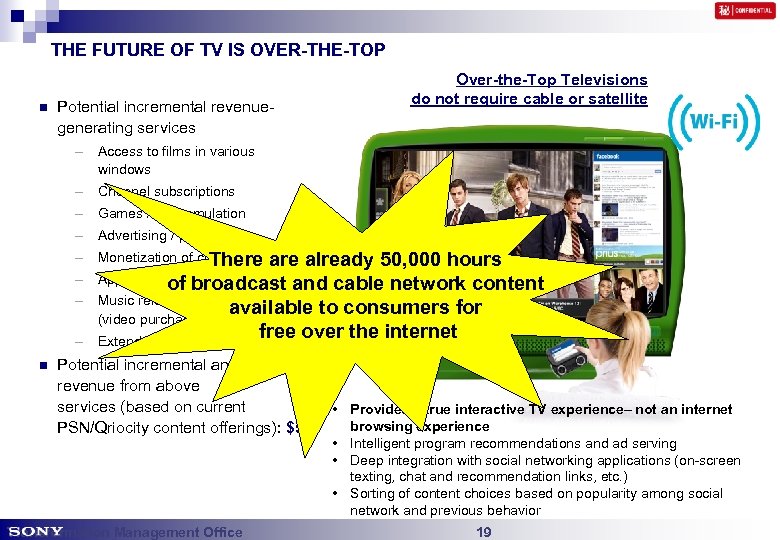

THE FUTURE OF TV IS OVER-THE-TOP n Potential incremental revenuegenerating services Over-the-Top Televisions do not require cable or satellite – Access to films in various windows – Channel subscriptions – Games / PS 2 emulation – Advertising / placement – Monetization of consumer data There are – – – n already 50, 000 hours Applications / e-retail / peripherals of broadcast and cable network content Music related purchases available to consumers for (video purchasing, concerts) free over the internet Extended warranty Potential incremental annual revenue from above services (based on current PSN/Qriocity content offerings): $50 Transformation Management Office • Provides a true interactive TV experience– not an internet browsing experience • Intelligent program recommendations and ad serving • Deep integration with social networking applications (on-screen texting, chat and recommendation links, etc. ) • Sorting of content choices based on popularity among social network and previous behavior 19

THE FUTURE OF TV IS OVER-THE-TOP n Potential incremental revenuegenerating services Over-the-Top Televisions do not require cable or satellite – Access to films in various windows – Channel subscriptions – Games / PS 2 emulation – Advertising / placement – Monetization of consumer data There are – – – n already 50, 000 hours Applications / e-retail / peripherals of broadcast and cable network content Music related purchases available to consumers for (video purchasing, concerts) free over the internet Extended warranty Potential incremental annual revenue from above services (based on current PSN/Qriocity content offerings): $50 Transformation Management Office • Provides a true interactive TV experience– not an internet browsing experience • Intelligent program recommendations and ad serving • Deep integration with social networking applications (on-screen texting, chat and recommendation links, etc. ) • Sorting of content choices based on popularity among social network and previous behavior 19

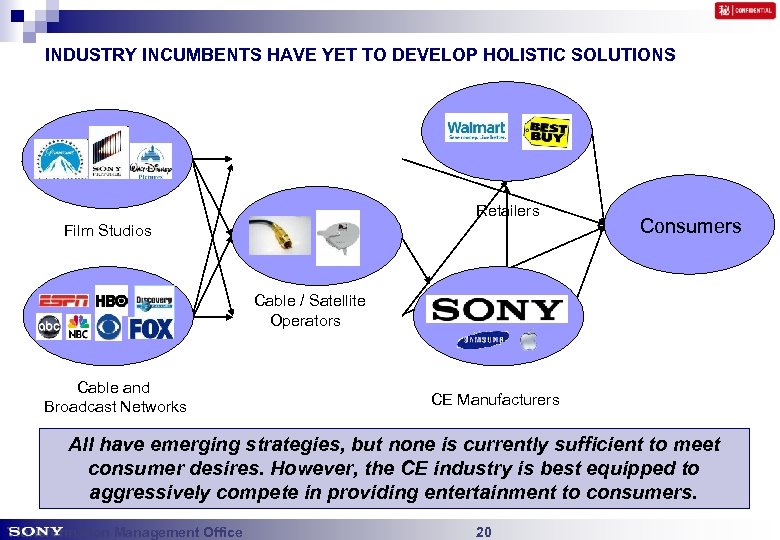

INDUSTRY INCUMBENTS HAVE YET TO DEVELOP HOLISTIC SOLUTIONS Retailers Film Studios Consumers Cable / Satellite Operators Cable and Broadcast Networks CE Manufacturers All have emerging strategies, but none is currently sufficient to meet consumer desires. However, the CE industry is best equipped to aggressively compete in providing entertainment to consumers. Transformation Management Office 20

INDUSTRY INCUMBENTS HAVE YET TO DEVELOP HOLISTIC SOLUTIONS Retailers Film Studios Consumers Cable / Satellite Operators Cable and Broadcast Networks CE Manufacturers All have emerging strategies, but none is currently sufficient to meet consumer desires. However, the CE industry is best equipped to aggressively compete in providing entertainment to consumers. Transformation Management Office 20

RECAP n n Shifting consumer desires require changes in how CE companies, cable/satellite companies, cable networks, and content companies deliver entertainment experiences to consumers These industry incumbents are not taking aggressive enough action in this regard – Fear of traditional distributors limits their aggressiveness – Traditional distributors are losing their monopoly status due the ubiquity of the high speed I/P Network CE manufacturers are best positioned to be aggressive in addressing consumer desires – CE manufacturers are not captive to cable and satellite operators or other incumbents Within the CE industry, Sony is the best positioned to take advantage of this opportunity to provide a holistic approach that will attract consumers – Sony has a large network of users across a broad range of connected products – Sony Pictures and Sony Music are two of the world’s largest content companies Transformation Management Office 21

RECAP n n Shifting consumer desires require changes in how CE companies, cable/satellite companies, cable networks, and content companies deliver entertainment experiences to consumers These industry incumbents are not taking aggressive enough action in this regard – Fear of traditional distributors limits their aggressiveness – Traditional distributors are losing their monopoly status due the ubiquity of the high speed I/P Network CE manufacturers are best positioned to be aggressive in addressing consumer desires – CE manufacturers are not captive to cable and satellite operators or other incumbents Within the CE industry, Sony is the best positioned to take advantage of this opportunity to provide a holistic approach that will attract consumers – Sony has a large network of users across a broad range of connected products – Sony Pictures and Sony Music are two of the world’s largest content companies Transformation Management Office 21

SONY’S OPPORTUNITY Sony needs to start treating its consumer base as a connected network of addressable users Across our consumers’ network of enabled devices, Sony maintains relationships with more than 40 MM connected users worldwide If we provide superior entertainment experiences that are unique to Sony devices, we will deliver a strong value proposition to our consumers and enhance our hardware margins Transformation Management Office 22

SONY’S OPPORTUNITY Sony needs to start treating its consumer base as a connected network of addressable users Across our consumers’ network of enabled devices, Sony maintains relationships with more than 40 MM connected users worldwide If we provide superior entertainment experiences that are unique to Sony devices, we will deliver a strong value proposition to our consumers and enhance our hardware margins Transformation Management Office 22

AGENDA n Trends in the Consumption of Entertainment Content n Sony Network Service Summary – Proposed Offering and Value Proposition – Target Markets & Customer Segments n Operational and Implementation Summary – Content Acquisition – Hardware/Device Integration – Marketing & Sales Strategy n Financial Plan – Projected Financial Impact n Next Steps Transformation Management Office 23

AGENDA n Trends in the Consumption of Entertainment Content n Sony Network Service Summary – Proposed Offering and Value Proposition – Target Markets & Customer Segments n Operational and Implementation Summary – Content Acquisition – Hardware/Device Integration – Marketing & Sales Strategy n Financial Plan – Projected Financial Impact n Next Steps Transformation Management Office 23

THERE IS A LOT OF EXPERIMENTATION AROUND BUSINESS MODELS AND CONTENT RIGHTS, BUT NO ONE HAS FIGURED IT OUT § With improvements in broadband technology and changes in customer buying behavior for digital content, market readiness for network services is high now § Our competitors are not standing still; the market is becoming increasingly crowded as many players try to enter this market § However, no competitor has figured out the “winning play” Sony can take a leadership position and WIN if we move FAST and go BIG Transformation Management Office 24

THERE IS A LOT OF EXPERIMENTATION AROUND BUSINESS MODELS AND CONTENT RIGHTS, BUT NO ONE HAS FIGURED IT OUT § With improvements in broadband technology and changes in customer buying behavior for digital content, market readiness for network services is high now § Our competitors are not standing still; the market is becoming increasingly crowded as many players try to enter this market § However, no competitor has figured out the “winning play” Sony can take a leadership position and WIN if we move FAST and go BIG Transformation Management Office 24

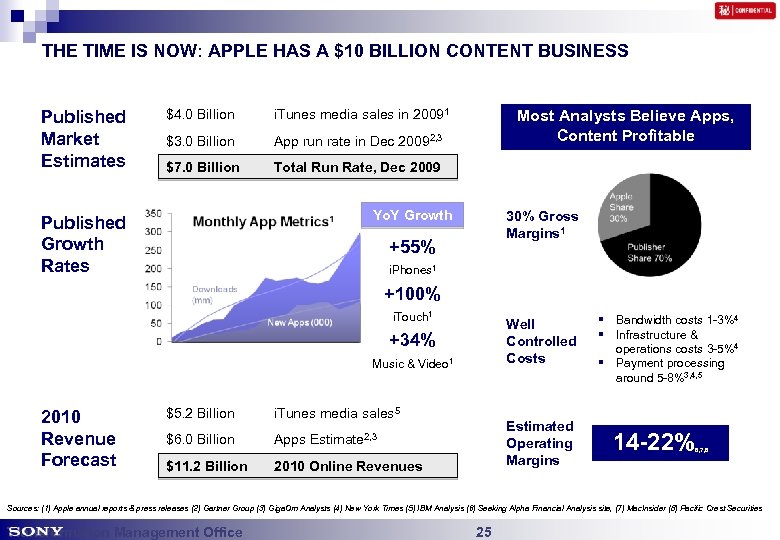

THE TIME IS NOW: APPLE HAS A $10 BILLION CONTENT BUSINESS Published Market Estimates $4. 0 Billion i. Tunes media sales in 20091 $3. 0 Billion App run rate in Dec 20092, 3 $7. 0 Billion Total Run Rate, Dec 2009 Most Analysts Believe Apps, Content Profitable Yo. Y Growth Published Growth Rates 30% Gross Margins 1 +55% i. Phones 1 +100% i. Touch 1 Well Controlled Costs +34% Music & Video 1 2010 Revenue Forecast $5. 2 Billion i. Tunes media sales 5 $6. 0 Billion Apps $11. 2 Billion Estimated Operating Margins Estimate 2, 3 2010 Online Revenues § Bandwidth costs 1 -3%4 § Infrastructure & operations costs 3 -5%4 § Payment processing around 5 -8%3, 4, 5 14 -22% 6, 7, 8 Sources: (1) Apple annual reports & press releases (2) Gartner Group (3) Giga. Om Analysts (4) New York Times (5) IBM Analysis (6) Seeking Alpha Financial Analysis site, (7) Mac. Insider (8) Pacific Crest Securities Transformation Management Office 25

THE TIME IS NOW: APPLE HAS A $10 BILLION CONTENT BUSINESS Published Market Estimates $4. 0 Billion i. Tunes media sales in 20091 $3. 0 Billion App run rate in Dec 20092, 3 $7. 0 Billion Total Run Rate, Dec 2009 Most Analysts Believe Apps, Content Profitable Yo. Y Growth Published Growth Rates 30% Gross Margins 1 +55% i. Phones 1 +100% i. Touch 1 Well Controlled Costs +34% Music & Video 1 2010 Revenue Forecast $5. 2 Billion i. Tunes media sales 5 $6. 0 Billion Apps $11. 2 Billion Estimated Operating Margins Estimate 2, 3 2010 Online Revenues § Bandwidth costs 1 -3%4 § Infrastructure & operations costs 3 -5%4 § Payment processing around 5 -8%3, 4, 5 14 -22% 6, 7, 8 Sources: (1) Apple annual reports & press releases (2) Gartner Group (3) Giga. Om Analysts (4) New York Times (5) IBM Analysis (6) Seeking Alpha Financial Analysis site, (7) Mac. Insider (8) Pacific Crest Securities Transformation Management Office 25

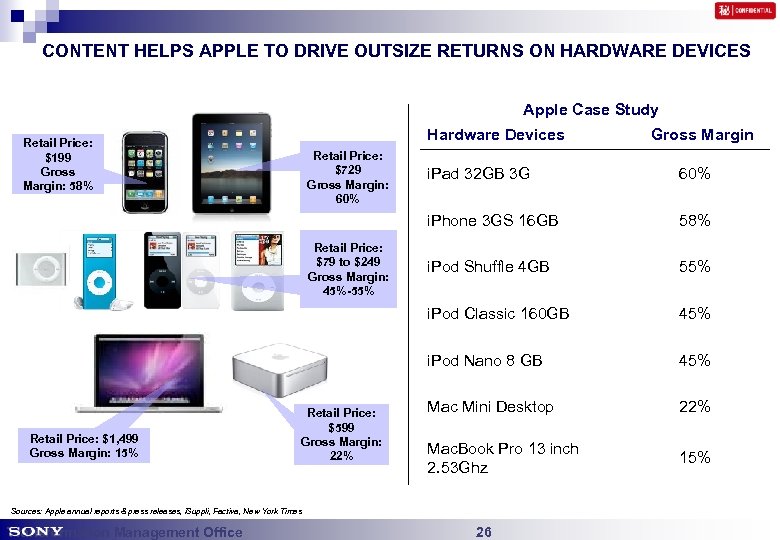

CONTENT HELPS APPLE TO DRIVE OUTSIZE RETURNS ON HARDWARE DEVICES Apple Case Study Hardware Devices Retail Price: $199 Gross Margin: 58% Retail Price: $729 Gross Margin: 60% Gross Margin i. Pod Shuffle 4 GB 55% 45% i. Pod Nano 8 GB Retail Price: $1, 499 Gross Margin: 15% 58% i. Pod Classic 160 GB Retail Price: $599 Gross Margin: 22% 60% i. Phone 3 GS 16 GB Retail Price: $79 to $249 Gross Margin: 45%-55% i. Pad 32 GB 3 G 45% Mac Mini Desktop 22% Mac. Book Pro 13 inch 2. 53 Ghz 15% Sources: Apple annual reports & press releases, i. Suppli, Factiva, New York Times Transformation Management Office 26

CONTENT HELPS APPLE TO DRIVE OUTSIZE RETURNS ON HARDWARE DEVICES Apple Case Study Hardware Devices Retail Price: $199 Gross Margin: 58% Retail Price: $729 Gross Margin: 60% Gross Margin i. Pod Shuffle 4 GB 55% 45% i. Pod Nano 8 GB Retail Price: $1, 499 Gross Margin: 15% 58% i. Pod Classic 160 GB Retail Price: $599 Gross Margin: 22% 60% i. Phone 3 GS 16 GB Retail Price: $79 to $249 Gross Margin: 45%-55% i. Pad 32 GB 3 G 45% Mac Mini Desktop 22% Mac. Book Pro 13 inch 2. 53 Ghz 15% Sources: Apple annual reports & press releases, i. Suppli, Factiva, New York Times Transformation Management Office 26

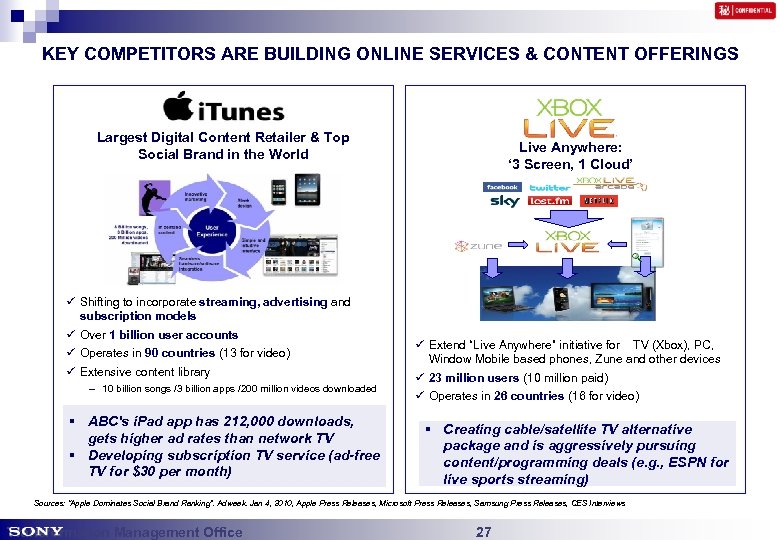

KEY COMPETITORS ARE BUILDING ONLINE SERVICES & CONTENT OFFERINGS Apple Largest digital content Retailer & Top ‘Mega Digital Content Social aggregator’ Brand in the World ü Shifting to incorporate streaming, advertising and subscription models ü Over 1 billion user accounts ü Operates in 90 countries (13 for video) ü Extensive content library – 10 billion songs /3 billion apps /200 million videos downloaded § ABC's i. Pad app has 212, 000 downloads, gets higher ad rates than network TV § Developing subscription TV service (ad-free TV for $30 per month) Microsoft’s future play Live Anywhere: ‘Xbox become altenarive to cable’ ‘ 3 Screen, 1 Cloud’ ü Extend “Live Anywhere” initiative for TV (Xbox), PC, Window Mobile based phones, Zune and other devices ü 23 million users (10 million paid) ü Operates in 26 countries (16 for video) § Creating cable/satellite TV alternative package and is aggressively pursuing content/programming deals (e. g. , ESPN for live sports streaming) Sources: “Apple Dominates Social Brand Ranking”. Adweek. Jan 4, 2010, Apple Press Releases, Microsoft Press Releases, Samsung Press Releases, CES Interviews Transformation Management Office 27

KEY COMPETITORS ARE BUILDING ONLINE SERVICES & CONTENT OFFERINGS Apple Largest digital content Retailer & Top ‘Mega Digital Content Social aggregator’ Brand in the World ü Shifting to incorporate streaming, advertising and subscription models ü Over 1 billion user accounts ü Operates in 90 countries (13 for video) ü Extensive content library – 10 billion songs /3 billion apps /200 million videos downloaded § ABC's i. Pad app has 212, 000 downloads, gets higher ad rates than network TV § Developing subscription TV service (ad-free TV for $30 per month) Microsoft’s future play Live Anywhere: ‘Xbox become altenarive to cable’ ‘ 3 Screen, 1 Cloud’ ü Extend “Live Anywhere” initiative for TV (Xbox), PC, Window Mobile based phones, Zune and other devices ü 23 million users (10 million paid) ü Operates in 26 countries (16 for video) § Creating cable/satellite TV alternative package and is aggressively pursuing content/programming deals (e. g. , ESPN for live sports streaming) Sources: “Apple Dominates Social Brand Ranking”. Adweek. Jan 4, 2010, Apple Press Releases, Microsoft Press Releases, Samsung Press Releases, CES Interviews Transformation Management Office 27

KEY COMPETITORS ARE BUILDING ONLINE SERVICES & CONTENT OFFERINGS Apple ‘Mega digital content Scale & Device Dominance With Integrated Content aggregator’ TV Everywhere: Multi-Screen Strategy (TV, PC, Mobile Phone) ü Launched Samsung Apps Store for mobile phones and PCs in September 2009 ü Launched Fancast Xfinity TV service for online content access in Dec. 2009 for existing pay TV/cable subscribers ü Partnerships with online content providers (e. g. , Pandora, Vudu, Netflix, Blockbuster, etc. ) ü Programming from 30 content providers, including major cable channels HBO, Starz and Cinemax ü Plans to launch premium apps for purchase with Internet@TV feature on select HDTVs, Blu-ray players and home theater systems in July 2010 ü Utilizes Move Networks’ adaptive streaming technology to deliver service Global content team (600 resources) for securing content for emerging markets & HW integration Acquired NBC Universal Sources: “Apple Dominates Social Brand Ranking”. Adweek. Jan 4, 2010, Apple Press Releases, Microsoft Press Releases, Samsung Press Releases, CES Interviews Transformation Management Office 28

KEY COMPETITORS ARE BUILDING ONLINE SERVICES & CONTENT OFFERINGS Apple ‘Mega digital content Scale & Device Dominance With Integrated Content aggregator’ TV Everywhere: Multi-Screen Strategy (TV, PC, Mobile Phone) ü Launched Samsung Apps Store for mobile phones and PCs in September 2009 ü Launched Fancast Xfinity TV service for online content access in Dec. 2009 for existing pay TV/cable subscribers ü Partnerships with online content providers (e. g. , Pandora, Vudu, Netflix, Blockbuster, etc. ) ü Programming from 30 content providers, including major cable channels HBO, Starz and Cinemax ü Plans to launch premium apps for purchase with Internet@TV feature on select HDTVs, Blu-ray players and home theater systems in July 2010 ü Utilizes Move Networks’ adaptive streaming technology to deliver service Global content team (600 resources) for securing content for emerging markets & HW integration Acquired NBC Universal Sources: “Apple Dominates Social Brand Ranking”. Adweek. Jan 4, 2010, Apple Press Releases, Microsoft Press Releases, Samsung Press Releases, CES Interviews Transformation Management Office 28

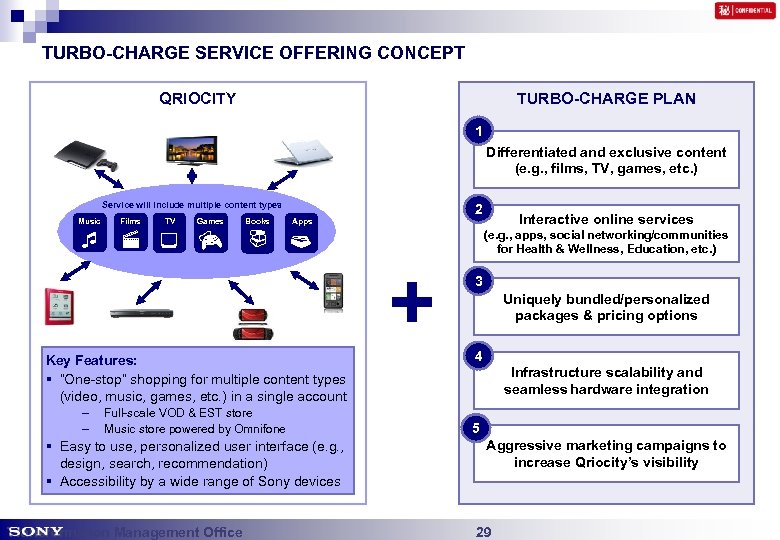

TURBO-CHARGE SERVICE OFFERING CONCEPT QRIOCITY TURBO-CHARGE PLAN 1 Differentiated and exclusive content (e. g. , films, TV, games, etc. ) Service will include multiple content types Music Films TV Games Books 2 Apps + Key Features: § “One-stop” shopping for multiple content types (video, music, games, etc. ) in a single account – – Full-scale VOD & EST store Music store powered by Omnifone § Easy to use, personalized user interface (e. g. , design, search, recommendation) § Accessibility by a wide range of Sony devices Transformation Management Office Interactive online services (e. g. , apps, social networking/communities for Health & Wellness, Education, etc. ) 3 Uniquely bundled/personalized packages & pricing options 4 Infrastructure scalability and seamless hardware integration 5 Aggressive marketing campaigns to increase Qriocity’s visibility 29

TURBO-CHARGE SERVICE OFFERING CONCEPT QRIOCITY TURBO-CHARGE PLAN 1 Differentiated and exclusive content (e. g. , films, TV, games, etc. ) Service will include multiple content types Music Films TV Games Books 2 Apps + Key Features: § “One-stop” shopping for multiple content types (video, music, games, etc. ) in a single account – – Full-scale VOD & EST store Music store powered by Omnifone § Easy to use, personalized user interface (e. g. , design, search, recommendation) § Accessibility by a wide range of Sony devices Transformation Management Office Interactive online services (e. g. , apps, social networking/communities for Health & Wellness, Education, etc. ) 3 Uniquely bundled/personalized packages & pricing options 4 Infrastructure scalability and seamless hardware integration 5 Aggressive marketing campaigns to increase Qriocity’s visibility 29

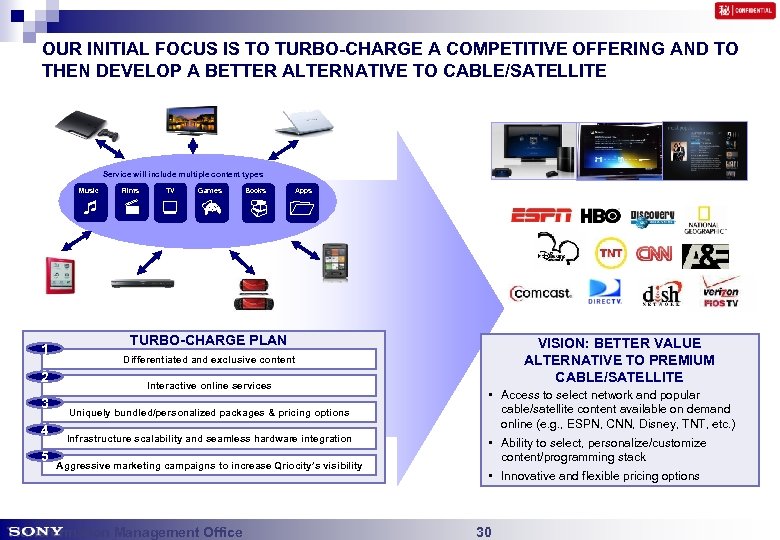

OUR INITIAL FOCUS IS TO TURBO-CHARGE A COMPETITIVE OFFERING AND TO THEN DEVELOP A BETTER ALTERNATIVE TO CABLE/SATELLITE Service will include multiple content types Music 1 2 3 4 5 Films TV Games Books Apps TURBO-CHARGE PLAN VISION: BETTER VALUE ALTERNATIVE TO PREMIUM CABLE/SATELLITE Differentiated and exclusive content Interactive online services Uniquely bundled/personalized packages & pricing options Infrastructure scalability and seamless hardware integration Aggressive marketing campaigns to increase Qriocity’s visibility Transformation Management Office • Access to select network and popular cable/satellite content available on demand online (e. g. , ESPN, CNN, Disney, TNT, etc. ) • Ability to select, personalize/customize content/programming stack • Innovative and flexible pricing options 30

OUR INITIAL FOCUS IS TO TURBO-CHARGE A COMPETITIVE OFFERING AND TO THEN DEVELOP A BETTER ALTERNATIVE TO CABLE/SATELLITE Service will include multiple content types Music 1 2 3 4 5 Films TV Games Books Apps TURBO-CHARGE PLAN VISION: BETTER VALUE ALTERNATIVE TO PREMIUM CABLE/SATELLITE Differentiated and exclusive content Interactive online services Uniquely bundled/personalized packages & pricing options Infrastructure scalability and seamless hardware integration Aggressive marketing campaigns to increase Qriocity’s visibility Transformation Management Office • Access to select network and popular cable/satellite content available on demand online (e. g. , ESPN, CNN, Disney, TNT, etc. ) • Ability to select, personalize/customize content/programming stack • Innovative and flexible pricing options 30

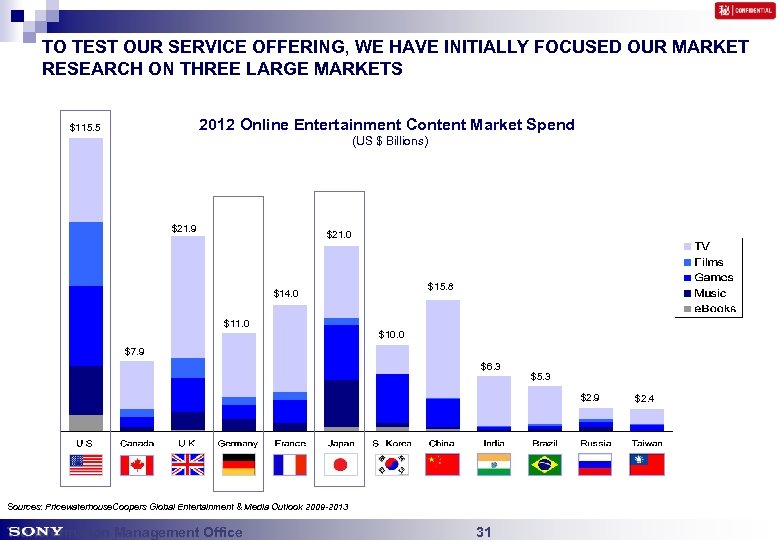

TO TEST OUR SERVICE OFFERING, WE HAVE INITIALLY FOCUSED OUR MARKET RESEARCH ON THREE LARGE MARKETS 2012 Online Entertainment Content Market Spend $115. 5 (US $ Billions) $21. 9 $21. 0 $15. 8 $14. 0 $11. 0 $10. 0 $7. 9 $6. 3 $5. 3 $2. 9 Sources: Pricewaterhouse. Coopers Global Entertainment & Media Outlook 2009 -2013 Transformation Management Office 31 $2. 4

TO TEST OUR SERVICE OFFERING, WE HAVE INITIALLY FOCUSED OUR MARKET RESEARCH ON THREE LARGE MARKETS 2012 Online Entertainment Content Market Spend $115. 5 (US $ Billions) $21. 9 $21. 0 $15. 8 $14. 0 $11. 0 $10. 0 $7. 9 $6. 3 $5. 3 $2. 9 Sources: Pricewaterhouse. Coopers Global Entertainment & Media Outlook 2009 -2013 Transformation Management Office 31 $2. 4

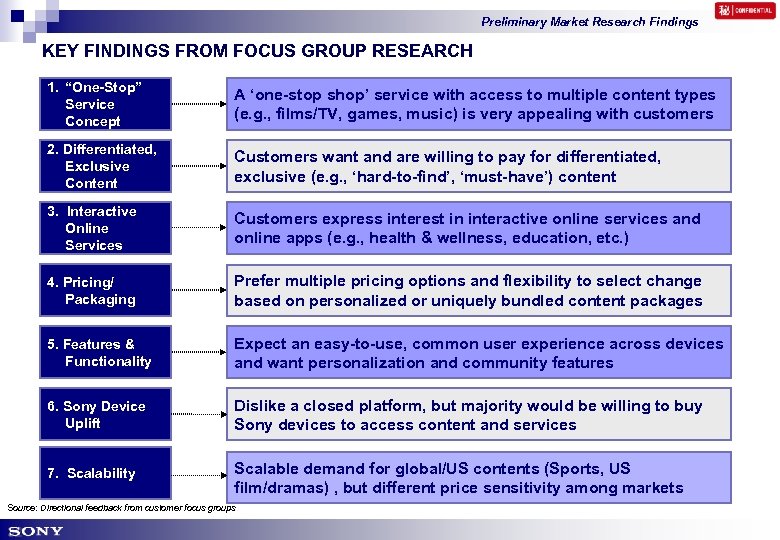

Preliminary Market Research Findings KEY FINDINGS FROM FOCUS GROUP RESEARCH 1. “One-Stop” Service Concept A ‘one-stop shop’ service with access to multiple content types (e. g. , films/TV, games, music) is very appealing with customers 2. Differentiated, Exclusive Content Customers want and are willing to pay for differentiated, exclusive (e. g. , ‘hard-to-find’, ‘must-have’) content 3. Interactive Online Services Customers express interest in interactive online services and online apps (e. g. , health & wellness, education, etc. ) 4. Pricing/ Packaging Prefer multiple pricing options and flexibility to select change based on personalized or uniquely bundled content packages 5. Features & Functionality Expect an easy-to-use, common user experience across devices and want personalization and community features 6. Sony Device Uplift Dislike a closed platform, but majority would be willing to buy Sony devices to access content and services 7. Scalability Scalable demand for global/US contents (Sports, US film/dramas) , but different price sensitivity among markets Source: Directional feedback from customer focus groups 32

Preliminary Market Research Findings KEY FINDINGS FROM FOCUS GROUP RESEARCH 1. “One-Stop” Service Concept A ‘one-stop shop’ service with access to multiple content types (e. g. , films/TV, games, music) is very appealing with customers 2. Differentiated, Exclusive Content Customers want and are willing to pay for differentiated, exclusive (e. g. , ‘hard-to-find’, ‘must-have’) content 3. Interactive Online Services Customers express interest in interactive online services and online apps (e. g. , health & wellness, education, etc. ) 4. Pricing/ Packaging Prefer multiple pricing options and flexibility to select change based on personalized or uniquely bundled content packages 5. Features & Functionality Expect an easy-to-use, common user experience across devices and want personalization and community features 6. Sony Device Uplift Dislike a closed platform, but majority would be willing to buy Sony devices to access content and services 7. Scalability Scalable demand for global/US contents (Sports, US film/dramas) , but different price sensitivity among markets Source: Directional feedback from customer focus groups 32

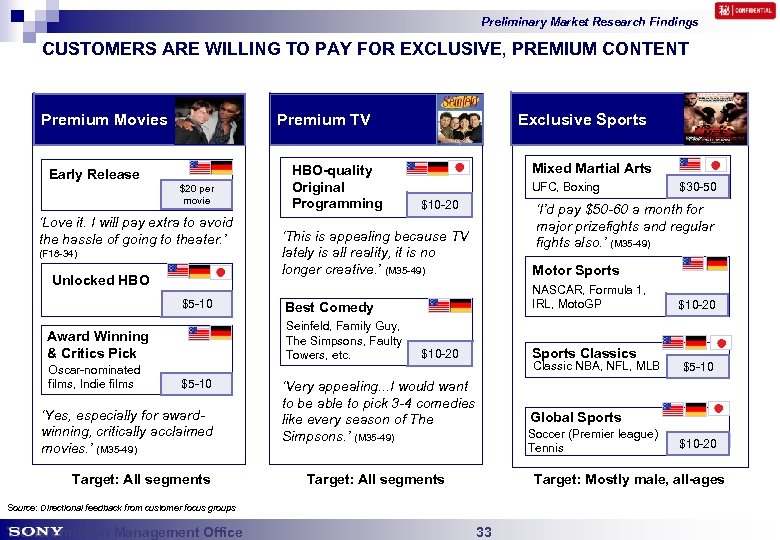

Preliminary Market Research Findings CUSTOMERS ARE WILLING TO PAY FOR EXCLUSIVE, PREMIUM CONTENT Premium Movies Early Release $20 per movie ‘Love it. I will pay extra to avoid the hassle of going to theater. ’ (F 18 -34) Unlocked HBO $5 -10 HBO-quality Original Programming $5 -10 ‘Yes, especially for awardwinning, critically acclaimed movies. ’ (M 35 -49) Target: All segments Mixed Martial Arts UFC, Boxing $10 -20 Motor Sports Best Comedy NASCAR, Formula 1, IRL, Moto. GP Sports Classics $10 -20 Classic NBA, NFL, MLB ‘Very appealing. . . I would want to be able to pick 3 -4 comedies like every season of The Simpsons. ’ (M 35 -49) $10 -20 $5 -10 Global Sports Soccer (Premier league) Tennis Target: All segments $10 -20 Target: Mostly male, all-ages Source: Directional feedback from customer focus groups Transformation Management Office $30 -50 ‘I’d pay $50 -60 a month for major prizefights and regular fights also. ’ (M 35 -49) ‘This is appealing because TV lately is all reality, it is no longer creative. ’ (M 35 -49) Seinfeld, Family Guy, The Simpsons, Faulty Towers, etc. Award Winning & Critics Pick Oscar-nominated films, Indie films Exclusive Sports Premium TV 33

Preliminary Market Research Findings CUSTOMERS ARE WILLING TO PAY FOR EXCLUSIVE, PREMIUM CONTENT Premium Movies Early Release $20 per movie ‘Love it. I will pay extra to avoid the hassle of going to theater. ’ (F 18 -34) Unlocked HBO $5 -10 HBO-quality Original Programming $5 -10 ‘Yes, especially for awardwinning, critically acclaimed movies. ’ (M 35 -49) Target: All segments Mixed Martial Arts UFC, Boxing $10 -20 Motor Sports Best Comedy NASCAR, Formula 1, IRL, Moto. GP Sports Classics $10 -20 Classic NBA, NFL, MLB ‘Very appealing. . . I would want to be able to pick 3 -4 comedies like every season of The Simpsons. ’ (M 35 -49) $10 -20 $5 -10 Global Sports Soccer (Premier league) Tennis Target: All segments $10 -20 Target: Mostly male, all-ages Source: Directional feedback from customer focus groups Transformation Management Office $30 -50 ‘I’d pay $50 -60 a month for major prizefights and regular fights also. ’ (M 35 -49) ‘This is appealing because TV lately is all reality, it is no longer creative. ’ (M 35 -49) Seinfeld, Family Guy, The Simpsons, Faulty Towers, etc. Award Winning & Critics Pick Oscar-nominated films, Indie films Exclusive Sports Premium TV 33

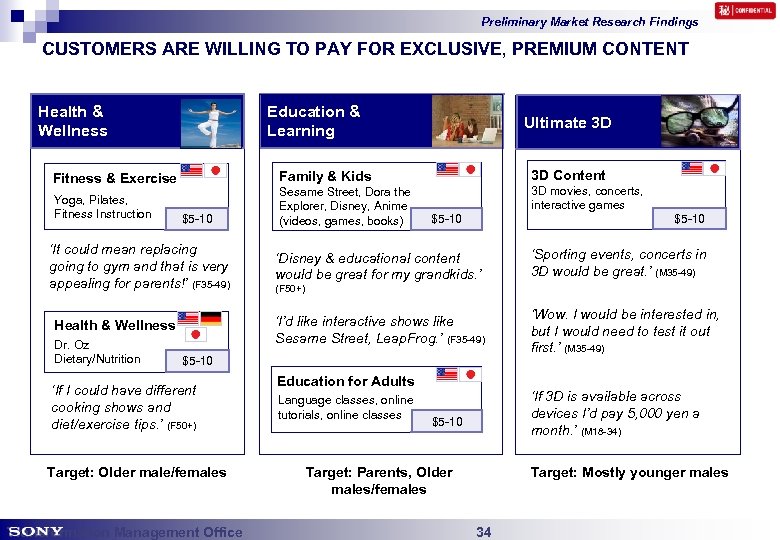

Preliminary Market Research Findings CUSTOMERS ARE WILLING TO PAY FOR EXCLUSIVE, PREMIUM CONTENT Health & Wellness Education & Learning Family & Kids Fitness & Exercise Yoga, Pilates, Fitness Instruction $5 -10 ‘It could mean replacing going to gym and that is very appealing for parents!’ (F 35 -49) 3 D Content Sesame Street, Dora the Explorer, Disney, Anime (videos, games, books) 3 D movies, concerts, interactive games $5 -10 ‘Disney & educational content would be great for my grandkids. ’ $5 -10 ‘If I could have different cooking shows and diet/exercise tips. ’ (F 50+) Target: Older male/females Transformation Management Office $5 -10 ‘Sporting events, concerts in 3 D would be great. ’ (M 35 -49) (F 50+) ‘I’d like interactive shows like Sesame Street, Leap. Frog. ’ (F 35 -49) Health & Wellness Dr. Oz Dietary/Nutrition Ultimate 3 D Education for Adults Language classes, online tutorials, online classes ‘Wow. I would be interested in, but I would need to test it out first. ’ (M 35 -49) ‘If 3 D is available across devices I’d pay 5, 000 yen a month. ’ (M 18 -34) $5 -10 Target: Parents, Older males/females Target: Mostly younger males 34

Preliminary Market Research Findings CUSTOMERS ARE WILLING TO PAY FOR EXCLUSIVE, PREMIUM CONTENT Health & Wellness Education & Learning Family & Kids Fitness & Exercise Yoga, Pilates, Fitness Instruction $5 -10 ‘It could mean replacing going to gym and that is very appealing for parents!’ (F 35 -49) 3 D Content Sesame Street, Dora the Explorer, Disney, Anime (videos, games, books) 3 D movies, concerts, interactive games $5 -10 ‘Disney & educational content would be great for my grandkids. ’ $5 -10 ‘If I could have different cooking shows and diet/exercise tips. ’ (F 50+) Target: Older male/females Transformation Management Office $5 -10 ‘Sporting events, concerts in 3 D would be great. ’ (M 35 -49) (F 50+) ‘I’d like interactive shows like Sesame Street, Leap. Frog. ’ (F 35 -49) Health & Wellness Dr. Oz Dietary/Nutrition Ultimate 3 D Education for Adults Language classes, online tutorials, online classes ‘Wow. I would be interested in, but I would need to test it out first. ’ (M 35 -49) ‘If 3 D is available across devices I’d pay 5, 000 yen a month. ’ (M 18 -34) $5 -10 Target: Parents, Older males/females Target: Mostly younger males 34

Preliminary Market Research Findings CUSTOMERS EXPECT A WORLD-CLASS EXPERIENCE AND WANT PORTABLE DEVICE ACCESSIBILITY Features/Functionality § Easy-to-use, easy-to-navigate § Personalized recommendation § Advanced search capabilities § Ability to customize experience Device Integration § Ability to access service and view content from multiple devices - Stream from digital locker (cloud) § Fast, reliable performance § Very strong interest in portable, mobile devices especially smartphone access ‘I like it , it’s easy to navigate. I’d like to get recommendations tailored to my interests. ’ (M 35 -49) ‘I would want to be able access this service from all my devices. Portability is important…. ’ (M 18 -34) Transformation Management Office 35

Preliminary Market Research Findings CUSTOMERS EXPECT A WORLD-CLASS EXPERIENCE AND WANT PORTABLE DEVICE ACCESSIBILITY Features/Functionality § Easy-to-use, easy-to-navigate § Personalized recommendation § Advanced search capabilities § Ability to customize experience Device Integration § Ability to access service and view content from multiple devices - Stream from digital locker (cloud) § Fast, reliable performance § Very strong interest in portable, mobile devices especially smartphone access ‘I like it , it’s easy to navigate. I’d like to get recommendations tailored to my interests. ’ (M 35 -49) ‘I would want to be able access this service from all my devices. Portability is important…. ’ (M 18 -34) Transformation Management Office 35

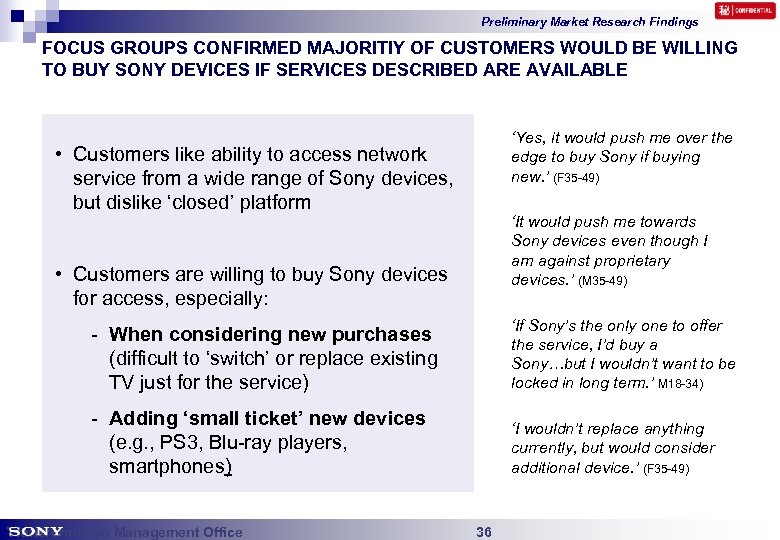

Preliminary Market Research Findings FOCUS GROUPS CONFIRMED MAJORITIY OF CUSTOMERS WOULD BE WILLING TO BUY SONY DEVICES IF SERVICES DESCRIBED ARE AVAILABLE ‘Yes, it would push me over the edge to buy Sony if buying new. ’ (F 35 -49) • Customers like ability to access network service from a wide range of Sony devices, but dislike ‘closed’ platform ‘It would push me towards Sony devices even though I am against proprietary devices. ’ (M 35 -49) • Customers are willing to buy Sony devices for access, especially: - When considering new purchases (difficult to ‘switch’ or replace existing TV just for the service) ‘If Sony’s the only one to offer the service, I’d buy a Sony…but I wouldn’t want to be locked in long term. ’ M 18 -34) - Adding ‘small ticket’ new devices (e. g. , PS 3, Blu-ray players, smartphones) ‘I wouldn’t replace anything currently, but would consider additional device. ’ (F 35 -49) Transformation Management Office 36

Preliminary Market Research Findings FOCUS GROUPS CONFIRMED MAJORITIY OF CUSTOMERS WOULD BE WILLING TO BUY SONY DEVICES IF SERVICES DESCRIBED ARE AVAILABLE ‘Yes, it would push me over the edge to buy Sony if buying new. ’ (F 35 -49) • Customers like ability to access network service from a wide range of Sony devices, but dislike ‘closed’ platform ‘It would push me towards Sony devices even though I am against proprietary devices. ’ (M 35 -49) • Customers are willing to buy Sony devices for access, especially: - When considering new purchases (difficult to ‘switch’ or replace existing TV just for the service) ‘If Sony’s the only one to offer the service, I’d buy a Sony…but I wouldn’t want to be locked in long term. ’ M 18 -34) - Adding ‘small ticket’ new devices (e. g. , PS 3, Blu-ray players, smartphones) ‘I wouldn’t replace anything currently, but would consider additional device. ’ (F 35 -49) Transformation Management Office 36

AGENDA n Trends in the Consumption of Entertainment Content n Sony Network Service Summary – Proposed Offering and Value Proposition – Target Markets & Customer Segments n Operational and Implementation Summary – Content Acquisition – Hardware/Device Integration – Marketing & Sales Strategy n Financial Plan – Projected Financial Impact n Next Steps Transformation Management Office 37

AGENDA n Trends in the Consumption of Entertainment Content n Sony Network Service Summary – Proposed Offering and Value Proposition – Target Markets & Customer Segments n Operational and Implementation Summary – Content Acquisition – Hardware/Device Integration – Marketing & Sales Strategy n Financial Plan – Projected Financial Impact n Next Steps Transformation Management Office 37

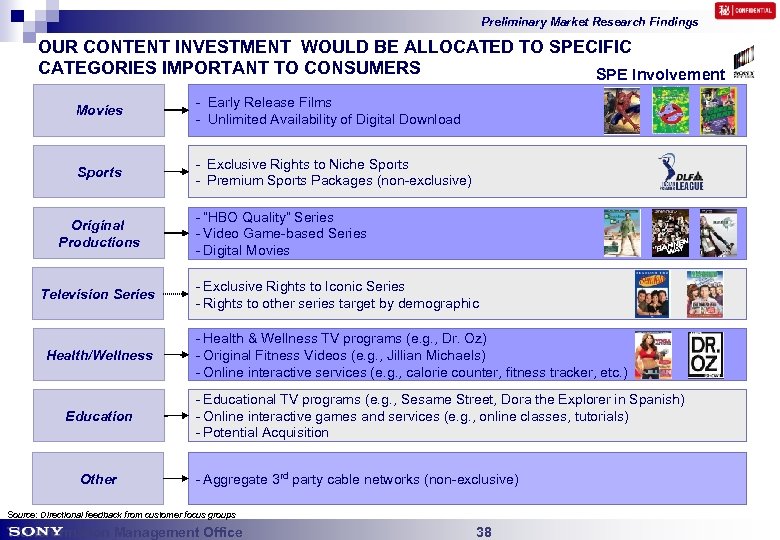

Preliminary Market Research Findings OUR CONTENT INVESTMENT WOULD BE ALLOCATED TO SPECIFIC CATEGORIES IMPORTANT TO CONSUMERS SPE Involvement Movies - Early Release Films - Unlimited Availability of Digital Download Sports - Exclusive Rights to Niche Sports - Premium Sports Packages (non-exclusive) Original Productions Television Series Health/Wellness Education Other - “HBO Quality” Series - Video Game-based Series - Digital Movies - Exclusive Rights to Iconic Series - Rights to other series target by demographic - Health & Wellness TV programs (e. g. , Dr. Oz) - Original Fitness Videos (e. g. , Jillian Michaels) - Online interactive services (e. g. , calorie counter, fitness tracker, etc. ) - Educational TV programs (e. g. , Sesame Street, Dora the Explorer in Spanish) - Online interactive games and services (e. g. , online classes, tutorials) - Potential Acquisition - Aggregate 3 rd party cable networks (non-exclusive) Source: Directional feedback from customer focus groups Transformation Management Office 38

Preliminary Market Research Findings OUR CONTENT INVESTMENT WOULD BE ALLOCATED TO SPECIFIC CATEGORIES IMPORTANT TO CONSUMERS SPE Involvement Movies - Early Release Films - Unlimited Availability of Digital Download Sports - Exclusive Rights to Niche Sports - Premium Sports Packages (non-exclusive) Original Productions Television Series Health/Wellness Education Other - “HBO Quality” Series - Video Game-based Series - Digital Movies - Exclusive Rights to Iconic Series - Rights to other series target by demographic - Health & Wellness TV programs (e. g. , Dr. Oz) - Original Fitness Videos (e. g. , Jillian Michaels) - Online interactive services (e. g. , calorie counter, fitness tracker, etc. ) - Educational TV programs (e. g. , Sesame Street, Dora the Explorer in Spanish) - Online interactive games and services (e. g. , online classes, tutorials) - Potential Acquisition - Aggregate 3 rd party cable networks (non-exclusive) Source: Directional feedback from customer focus groups Transformation Management Office 38

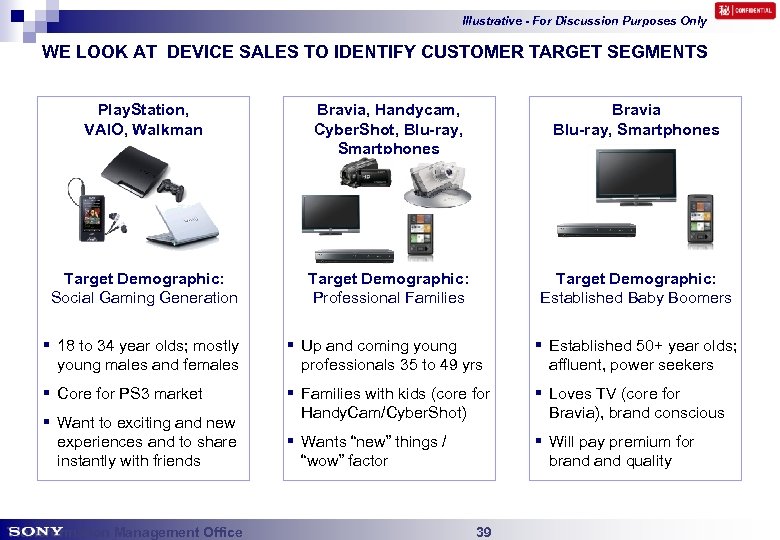

Illustrative - For Discussion Purposes Only WE LOOK AT DEVICE SALES TO IDENTIFY CUSTOMER TARGET SEGMENTS Play. Station, VAIO, Walkman Bravia, Handycam, Cyber. Shot, Blu-ray, Smartphones Bravia Blu-ray, Smartphones Target Demographic: Social Gaming Generation Target Demographic: Professional Families Target Demographic: Established Baby Boomers § 18 to 34 year olds; mostly young males and females § Up and coming young professionals 35 to 49 yrs § Established 50+ year olds; affluent, power seekers § Core for PS 3 market § Families with kids (core for Handy. Cam/Cyber. Shot) § Loves TV (core for Bravia), brand conscious § Wants “new” things / “wow” factor § Will pay premium for brand quality § Want to exciting and new experiences and to share instantly with friends Transformation Management Office 39

Illustrative - For Discussion Purposes Only WE LOOK AT DEVICE SALES TO IDENTIFY CUSTOMER TARGET SEGMENTS Play. Station, VAIO, Walkman Bravia, Handycam, Cyber. Shot, Blu-ray, Smartphones Bravia Blu-ray, Smartphones Target Demographic: Social Gaming Generation Target Demographic: Professional Families Target Demographic: Established Baby Boomers § 18 to 34 year olds; mostly young males and females § Up and coming young professionals 35 to 49 yrs § Established 50+ year olds; affluent, power seekers § Core for PS 3 market § Families with kids (core for Handy. Cam/Cyber. Shot) § Loves TV (core for Bravia), brand conscious § Wants “new” things / “wow” factor § Will pay premium for brand quality § Want to exciting and new experiences and to share instantly with friends Transformation Management Office 39

Illustrative - For Discussion Purposes Only AND TARGET OUR CONTENT PROGRAMS TO SATISFY UNMET DEMANDS Play. Station, VAIO, Walkman Bravia, Handycam, Cyber. Shot, Blu-ray, Smartphones Bravia Blu-ray, Smartphones Target Demographic: Social Gaming Generation Target Demographic: Professional Families Target Demographic: Established Baby Boomers Multiple Early Release Movies Per Month Unlimited Availability of Studio Films for Digital Download Movies Ultimate Fighting Championship Formula 1 Tour de France Original Video Game Based Series Original Digital Movies “HBO Quality” Series Other Premium Sports Packages (Non-exclusive) Education Service Key Networks (non-exclusive) Health/Wellness Key Networks (non-exclusive) Sports Transformation Management Office 40

Illustrative - For Discussion Purposes Only AND TARGET OUR CONTENT PROGRAMS TO SATISFY UNMET DEMANDS Play. Station, VAIO, Walkman Bravia, Handycam, Cyber. Shot, Blu-ray, Smartphones Bravia Blu-ray, Smartphones Target Demographic: Social Gaming Generation Target Demographic: Professional Families Target Demographic: Established Baby Boomers Multiple Early Release Movies Per Month Unlimited Availability of Studio Films for Digital Download Movies Ultimate Fighting Championship Formula 1 Tour de France Original Video Game Based Series Original Digital Movies “HBO Quality” Series Other Premium Sports Packages (Non-exclusive) Education Service Key Networks (non-exclusive) Health/Wellness Key Networks (non-exclusive) Sports Transformation Management Office 40

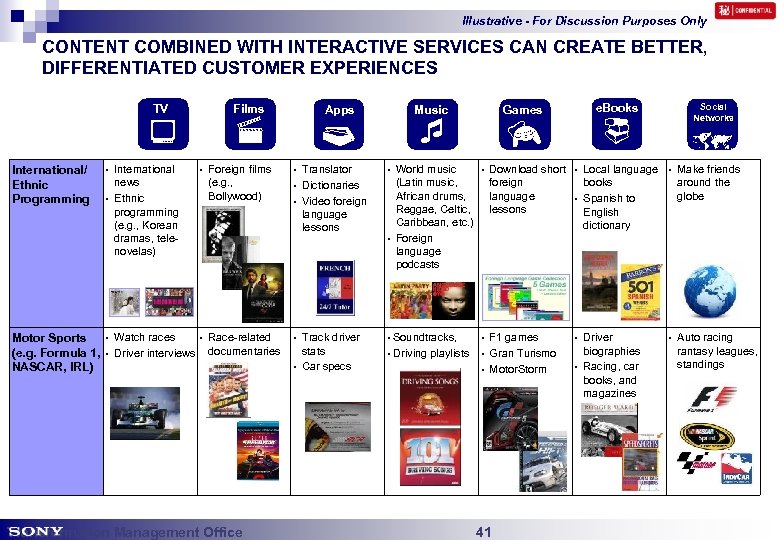

Illustrative - For Discussion Purposes Only CONTENT COMBINED WITH INTERACTIVE SERVICES CAN CREATE BETTER, DIFFERENTIATED CUSTOMER EXPERIENCES Films TV International/ Ethnic Programming Motor Sports (e. g. Formula 1, NASCAR, IRL) • • International news Ethnic programming (e. g. , Korean dramas, telenovelas) • Watch races Driver interviews • Foreign films (e. g. , Bollywood) Music Apps • • • Translator Dictionaries Video foreign language lessons • • Race-related documentaries Transformation Management Office • • Track driver stats Car specs World music (Latin music, African drums, Reggae, Celtic, Caribbean, etc. ) Foreign language podcasts Soundtracks, • Driving playlists • e. Books Games • • Download short foreign language lessons • F 1 games Gran Turismo Motor. Storm • 41 Social Networks • • Local language books Spanish to English dictionary • Make friends around the globe Driver biographies Racing, car books, and magazines • Auto racing rantasy leagues, standings

Illustrative - For Discussion Purposes Only CONTENT COMBINED WITH INTERACTIVE SERVICES CAN CREATE BETTER, DIFFERENTIATED CUSTOMER EXPERIENCES Films TV International/ Ethnic Programming Motor Sports (e. g. Formula 1, NASCAR, IRL) • • International news Ethnic programming (e. g. , Korean dramas, telenovelas) • Watch races Driver interviews • Foreign films (e. g. , Bollywood) Music Apps • • • Translator Dictionaries Video foreign language lessons • • Race-related documentaries Transformation Management Office • • Track driver stats Car specs World music (Latin music, African drums, Reggae, Celtic, Caribbean, etc. ) Foreign language podcasts Soundtracks, • Driving playlists • e. Books Games • • Download short foreign language lessons • F 1 games Gran Turismo Motor. Storm • 41 Social Networks • • Local language books Spanish to English dictionary • Make friends around the globe Driver biographies Racing, car books, and magazines • Auto racing rantasy leagues, standings

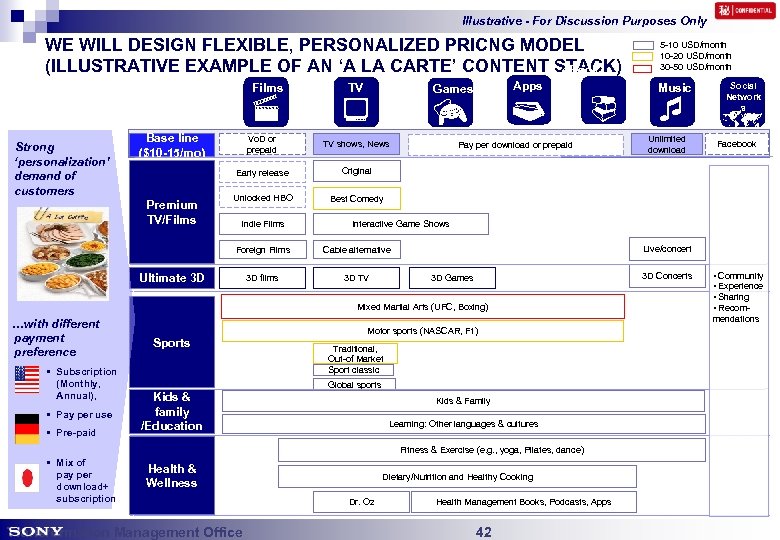

Illustrative - For Discussion Purposes Only WE WILL DESIGN FLEXIBLE, PERSONALIZED PRICNG MODEL (ILLUSTRATIVE EXAMPLE OF AN ‘A LA CARTE’ CONTENT STACK) e. Book Films Strong ‘personalization’ demand of customers Base line ($10 -15/mo) TV Vo. D or prepaid TV shows, News Indie Films Pay per download or prepaid • Pre-paid 3 D films 3 D TV 3 D Concerts 3 D Games Facebook • Community • Experience • Sharing • Recommendations Sports Motor sports (NASCAR, F 1) Traditional, Out-of Market Sport classic Global sports Kids & family /Education Kids & Family Learning: Other languages & cultures Fitness & Exercise (e. g. , yoga, Pilates, dance) • Mix of pay per download+ subscription Unlimited download Live/concert Mixed Martial Arts (UFC, Boxing) • Pay per use Interactive Game Shows Cable alternative Ultimate 3 D • Subscription (Monthly, Annual), Social Network s Best Comedy Foreign Films …with different payment preference Music Original Unlocked HBO s Early release Premium TV/Films Apps Games 5 -10 USD/month 10 -20 USD/month 30 -50 USD/month Health & Wellness Transformation Management Office Dietary/Nutrition and Healthy Cooking Dr. Oz Health Management Books, Podcasts, Apps 42

Illustrative - For Discussion Purposes Only WE WILL DESIGN FLEXIBLE, PERSONALIZED PRICNG MODEL (ILLUSTRATIVE EXAMPLE OF AN ‘A LA CARTE’ CONTENT STACK) e. Book Films Strong ‘personalization’ demand of customers Base line ($10 -15/mo) TV Vo. D or prepaid TV shows, News Indie Films Pay per download or prepaid • Pre-paid 3 D films 3 D TV 3 D Concerts 3 D Games Facebook • Community • Experience • Sharing • Recommendations Sports Motor sports (NASCAR, F 1) Traditional, Out-of Market Sport classic Global sports Kids & family /Education Kids & Family Learning: Other languages & cultures Fitness & Exercise (e. g. , yoga, Pilates, dance) • Mix of pay per download+ subscription Unlimited download Live/concert Mixed Martial Arts (UFC, Boxing) • Pay per use Interactive Game Shows Cable alternative Ultimate 3 D • Subscription (Monthly, Annual), Social Network s Best Comedy Foreign Films …with different payment preference Music Original Unlocked HBO s Early release Premium TV/Films Apps Games 5 -10 USD/month 10 -20 USD/month 30 -50 USD/month Health & Wellness Transformation Management Office Dietary/Nutrition and Healthy Cooking Dr. Oz Health Management Books, Podcasts, Apps 42

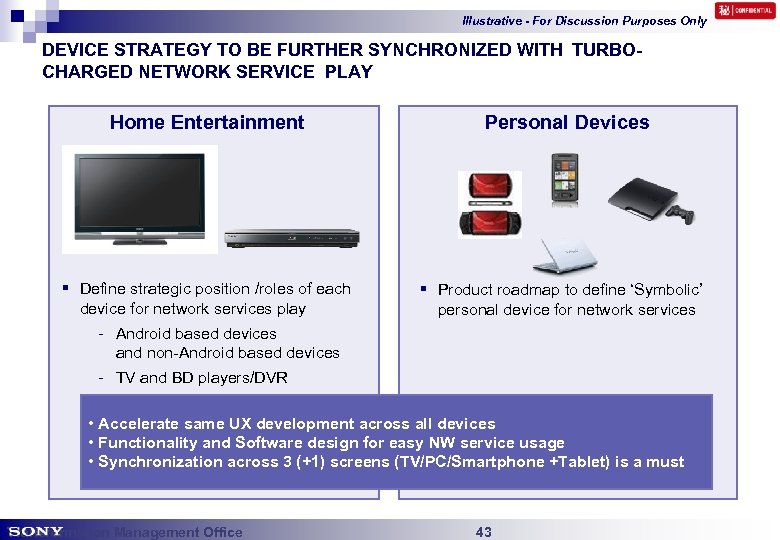

Illustrative - For Discussion Purposes Only DEVICE STRATEGY TO BE FURTHER SYNCHRONIZED WITH TURBOCHARGED NETWORK SERVICE PLAY Home Entertainment § Define strategic position /roles of each device for network services play Personal Devices § Product roadmap to define ‘Symbolic’ personal device for network services - Android based devices and non-Android based devices - TV and BD players/DVR • Accelerate same UX development across all devices • Functionality and Software design for easy NW service usage • Synchronization across 3 (+1) screens (TV/PC/Smartphone +Tablet) is a must Transformation Management Office 43

Illustrative - For Discussion Purposes Only DEVICE STRATEGY TO BE FURTHER SYNCHRONIZED WITH TURBOCHARGED NETWORK SERVICE PLAY Home Entertainment § Define strategic position /roles of each device for network services play Personal Devices § Product roadmap to define ‘Symbolic’ personal device for network services - Android based devices and non-Android based devices - TV and BD players/DVR • Accelerate same UX development across all devices • Functionality and Software design for easy NW service usage • Synchronization across 3 (+1) screens (TV/PC/Smartphone +Tablet) is a must Transformation Management Office 43

Illustrative - For Discussion Purposes Only COMPELLING CUSTOMER ACQUISITION / MARKETING STRATEGY TO BE DEVELOPED AND EXECUTED AS ‘ALL SONY EFFORT’ § ‘Killer feature’ to drag sizable customers (i. e. early film Attract with releases) Strong § Exclusive contents appealing to each segment ‘Hook’ § Cool and stylish ‘symbolic ’ device Activate § All Sony synchronized activation campaign § Subsidy for new device/free trial period with § Sony Electronics/SCE/SPE/SME ‘All Sony’ effort § Affiliation, Group discount, 3 rd party partnership etc. Retain/ Expand § Uniquely designed, cross medium programs that ties to personalization and community § Flexible pricing/subscription § Continuous content renewal / events arrangement Transformation Management Office 44

Illustrative - For Discussion Purposes Only COMPELLING CUSTOMER ACQUISITION / MARKETING STRATEGY TO BE DEVELOPED AND EXECUTED AS ‘ALL SONY EFFORT’ § ‘Killer feature’ to drag sizable customers (i. e. early film Attract with releases) Strong § Exclusive contents appealing to each segment ‘Hook’ § Cool and stylish ‘symbolic ’ device Activate § All Sony synchronized activation campaign § Subsidy for new device/free trial period with § Sony Electronics/SCE/SPE/SME ‘All Sony’ effort § Affiliation, Group discount, 3 rd party partnership etc. Retain/ Expand § Uniquely designed, cross medium programs that ties to personalization and community § Flexible pricing/subscription § Continuous content renewal / events arrangement Transformation Management Office 44

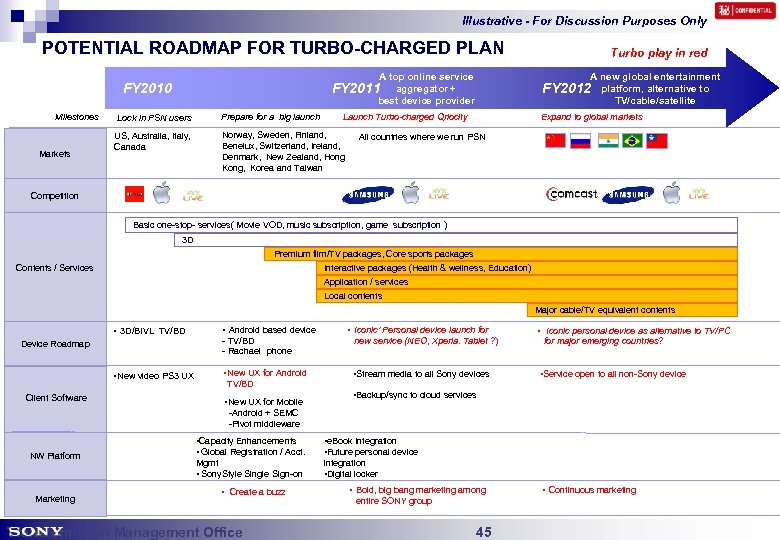

Illustrative - For Discussion Purposes Only POTENTIAL ROADMAP FOR TURBO-CHARGED PLAN A top online service FY 2011 aggregator + best device provider FY 2010 Milestones Markets Lock in PSN users US, Australia, Italy, Canada Prepare for a big launch A new global entertainment FY 2012 platform, alternative to TV/cable/satellite Expand to global markets Launch Turbo-charged Qriocity Norway, Sweden, Finland, Benelux, Switzerland, Ireland, Denmark, New Zealand, Hong Kong, Korea and Taiwan Turbo play in red All countries where we run PSN Competition Basic one-stop- services( Movie VOD, music subscription, game subscription ) 3 D Premium film/TV packages, Core sports packages Contents / Services Interactive packages (Health & wellness, Education) Application / services Local contents Major cable/TV equivalent contents • 3 D/BIVL TV/BD Device Roadmap • New video PS 3 UX Client Software • Android based device • Iconic’ Personal device launch for - TV/BD - Rachael phone new service (NEO, Xperia. Tablet ? ) • New UX for Android • Stream media to all Sony devices TV/BD • New UX for Mobile • Iconic personal device as alternative to TV/PC for major emerging countries? • Service open to all non-Sony device • Backup/sync to cloud services -Android + SEMC -Pivot middleware Server NW Platform infrastructure Marketing • Capacity Enhancements • Global Registration / Acct. • e. Book Integration • Future personal device Mgmt • Sony. Style Single Sign-on integration • Digital locker • Create a buzz Transformation Management Office • Bold, big bang marketing among entire SONY group 45 • Continuous marketing

Illustrative - For Discussion Purposes Only POTENTIAL ROADMAP FOR TURBO-CHARGED PLAN A top online service FY 2011 aggregator + best device provider FY 2010 Milestones Markets Lock in PSN users US, Australia, Italy, Canada Prepare for a big launch A new global entertainment FY 2012 platform, alternative to TV/cable/satellite Expand to global markets Launch Turbo-charged Qriocity Norway, Sweden, Finland, Benelux, Switzerland, Ireland, Denmark, New Zealand, Hong Kong, Korea and Taiwan Turbo play in red All countries where we run PSN Competition Basic one-stop- services( Movie VOD, music subscription, game subscription ) 3 D Premium film/TV packages, Core sports packages Contents / Services Interactive packages (Health & wellness, Education) Application / services Local contents Major cable/TV equivalent contents • 3 D/BIVL TV/BD Device Roadmap • New video PS 3 UX Client Software • Android based device • Iconic’ Personal device launch for - TV/BD - Rachael phone new service (NEO, Xperia. Tablet ? ) • New UX for Android • Stream media to all Sony devices TV/BD • New UX for Mobile • Iconic personal device as alternative to TV/PC for major emerging countries? • Service open to all non-Sony device • Backup/sync to cloud services -Android + SEMC -Pivot middleware Server NW Platform infrastructure Marketing • Capacity Enhancements • Global Registration / Acct. • e. Book Integration • Future personal device Mgmt • Sony. Style Single Sign-on integration • Digital locker • Create a buzz Transformation Management Office • Bold, big bang marketing among entire SONY group 45 • Continuous marketing

AGENDA n Trends in the Consumption of Entertainment Content n Sony Network Service Summary – Proposed Offering and Value Proposition – Target Markets & Customer Segments n Operational and Implementation Summary – Content Acquisition – Hardware/Device Integration – Marketing & Sales Strategy n Financial Plan – Projected Financial Impact n Next Steps Transformation Management Office 46

AGENDA n Trends in the Consumption of Entertainment Content n Sony Network Service Summary – Proposed Offering and Value Proposition – Target Markets & Customer Segments n Operational and Implementation Summary – Content Acquisition – Hardware/Device Integration – Marketing & Sales Strategy n Financial Plan – Projected Financial Impact n Next Steps Transformation Management Office 46

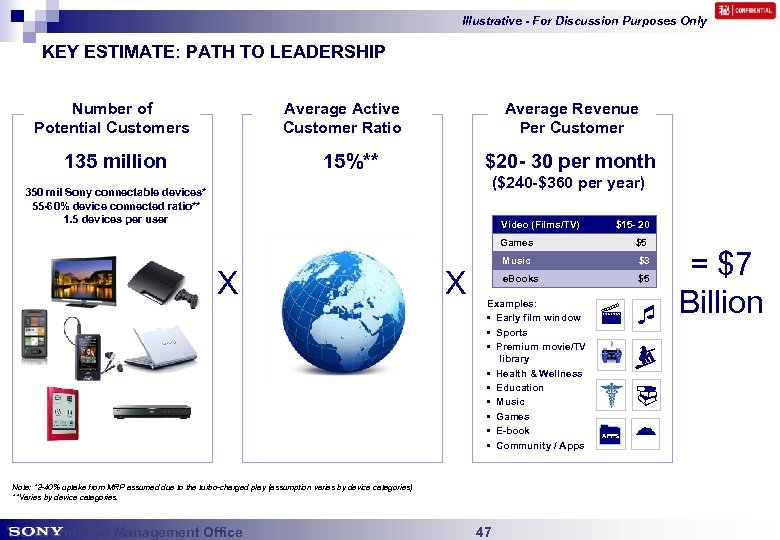

Illustrative - For Discussion Purposes Only KEY ESTIMATE: PATH TO LEADERSHIP Number of Potential Customers Average Active Customer Ratio 135 million Average Revenue Per Customer 15%** $20 - 30 per month ($240 -$360 per year) 350 mil Sony connectable devices* 55 -60% device connected ratio** 1. 5 devices per user Video (Films/TV) Games X X Music e. Books Examples: • Early film window • Sports • Premium movie/TV library • Health & Wellness • Education • Music • Games • E-book • Community / Apps Note: *2 -40% uptake from MRP assumed due to the turbo-charged play (assumption varies by device categories) **Varies by device categories. Transformation Management Office 47 $15 - 20 $5 = $7 Billion $3 $5 APPS

Illustrative - For Discussion Purposes Only KEY ESTIMATE: PATH TO LEADERSHIP Number of Potential Customers Average Active Customer Ratio 135 million Average Revenue Per Customer 15%** $20 - 30 per month ($240 -$360 per year) 350 mil Sony connectable devices* 55 -60% device connected ratio** 1. 5 devices per user Video (Films/TV) Games X X Music e. Books Examples: • Early film window • Sports • Premium movie/TV library • Health & Wellness • Education • Music • Games • E-book • Community / Apps Note: *2 -40% uptake from MRP assumed due to the turbo-charged play (assumption varies by device categories) **Varies by device categories. Transformation Management Office 47 $15 - 20 $5 = $7 Billion $3 $5 APPS

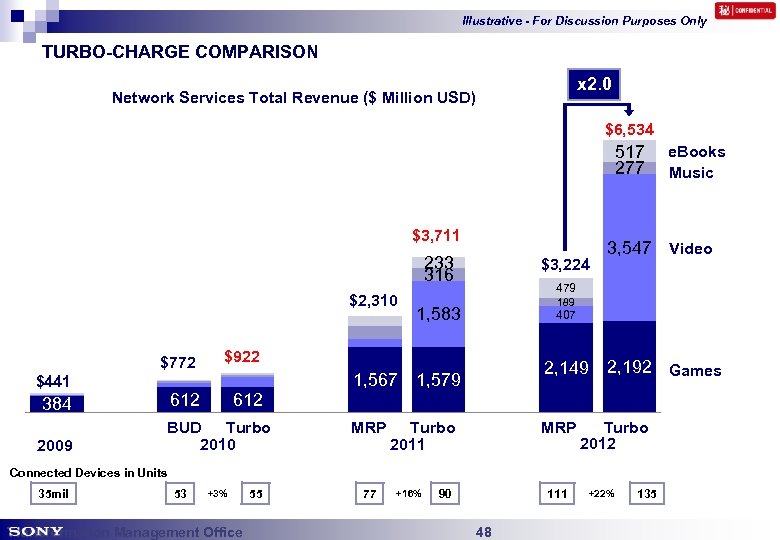

Illustrative - For Discussion Purposes Only TURBO-CHARGE COMPARISON x 2. 0 Network Services Total Revenue ($ Million USD) $6, 534 517 277 $3, 711 233 316 $2, 310 $772 612 $441 384 2009 1, 583 BUD Turbo 2010 1, 567 MRP 3, 547 Video 407 479 189 $922 612 $3, 224 2, 149 1, 579 Turbo 2011 MRP 2, 192 Games Turbo 2012 Connected Devices in Units 35 mil 53 +3% Transformation Management Office 55 77 e. Books Music +16% 90 111 48 +22% 135

Illustrative - For Discussion Purposes Only TURBO-CHARGE COMPARISON x 2. 0 Network Services Total Revenue ($ Million USD) $6, 534 517 277 $3, 711 233 316 $2, 310 $772 612 $441 384 2009 1, 583 BUD Turbo 2010 1, 567 MRP 3, 547 Video 407 479 189 $922 612 $3, 224 2, 149 1, 579 Turbo 2011 MRP 2, 192 Games Turbo 2012 Connected Devices in Units 35 mil 53 +3% Transformation Management Office 55 77 e. Books Music +16% 90 111 48 +22% 135

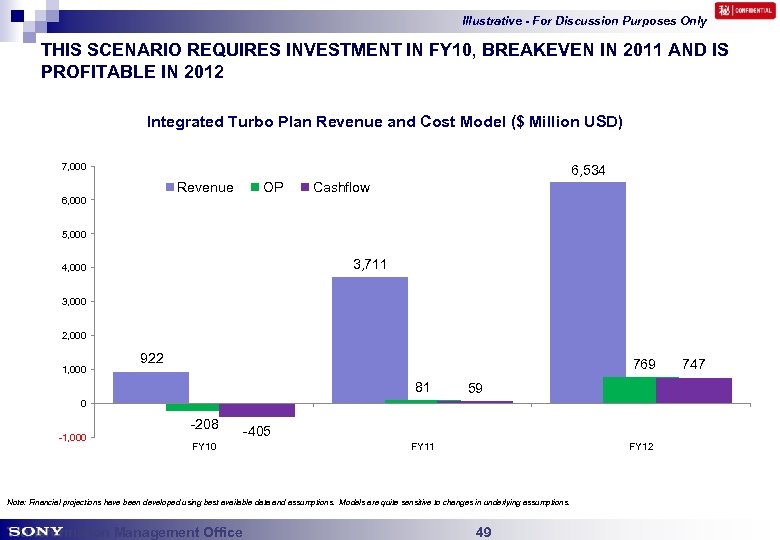

Illustrative - For Discussion Purposes Only THIS SCENARIO REQUIRES INVESTMENT IN FY 10, BREAKEVEN IN 2011 AND IS PROFITABLE IN 2012 Integrated Turbo Plan Revenue and Cost Model ($ Million USD) 7, 000 6, 534 Revenue 6, 000 OP Cashflow 5, 000 3, 711 4, 000 3, 000 2, 000 1, 000 922 769 81 59 0 -1, 000 -208 FY 10 -405 FY 11 FY 12 Note: Financial projections have been developed using best available data and assumptions. Models are quite sensitive to changes in underlying assumptions. Transformation Management Office 49 747

Illustrative - For Discussion Purposes Only THIS SCENARIO REQUIRES INVESTMENT IN FY 10, BREAKEVEN IN 2011 AND IS PROFITABLE IN 2012 Integrated Turbo Plan Revenue and Cost Model ($ Million USD) 7, 000 6, 534 Revenue 6, 000 OP Cashflow 5, 000 3, 711 4, 000 3, 000 2, 000 1, 000 922 769 81 59 0 -1, 000 -208 FY 10 -405 FY 11 FY 12 Note: Financial projections have been developed using best available data and assumptions. Models are quite sensitive to changes in underlying assumptions. Transformation Management Office 49 747

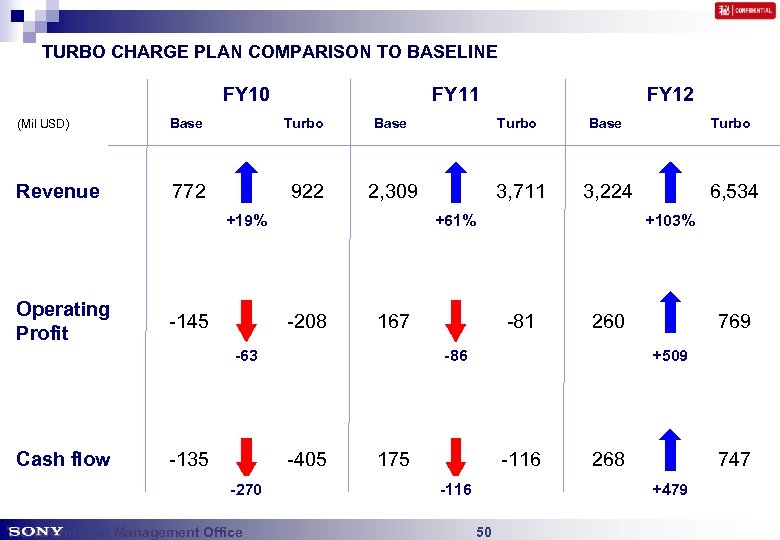

TURBO CHARGE PLAN COMPARISON TO BASELINE FY 10 FY 11 FY 12 (Mil USD) Base Turbo Revenue 772 922 2, 309 3, 711 3, 224 6, 534 +19% Operating Profit -145 +61% -208 167 -63 Cash flow -135 Transformation Management Office -81 260 769 +509 -86 -405 -270 +103% 175 -116 268 747 +479 50

TURBO CHARGE PLAN COMPARISON TO BASELINE FY 10 FY 11 FY 12 (Mil USD) Base Turbo Revenue 772 922 2, 309 3, 711 3, 224 6, 534 +19% Operating Profit -145 +61% -208 167 -63 Cash flow -135 Transformation Management Office -81 260 769 +509 -86 -405 -270 +103% 175 -116 268 747 +479 50

AGENDA n Trends in the Consumption of Entertainment Content n Sony Network Service Summary – Proposed Offering and Value Proposition – Target Markets & Customer Segments n Operational and Implementation Summary – Content Acquisition – Hardware/Device Integration – Marketing & Sales Strategy n Financial Plan – Projected Financial Impact n Next Steps Transformation Management Office 51

AGENDA n Trends in the Consumption of Entertainment Content n Sony Network Service Summary – Proposed Offering and Value Proposition – Target Markets & Customer Segments n Operational and Implementation Summary – Content Acquisition – Hardware/Device Integration – Marketing & Sales Strategy n Financial Plan – Projected Financial Impact n Next Steps Transformation Management Office 51

EXECUTION ISSUES § Ongoing Management Structure § Human Resources Issues § Device Roadmap § Marketing Capability § Technical Execution § Alliances Strategy Transformation Management Office 52

EXECUTION ISSUES § Ongoing Management Structure § Human Resources Issues § Device Roadmap § Marketing Capability § Technical Execution § Alliances Strategy Transformation Management Office 52

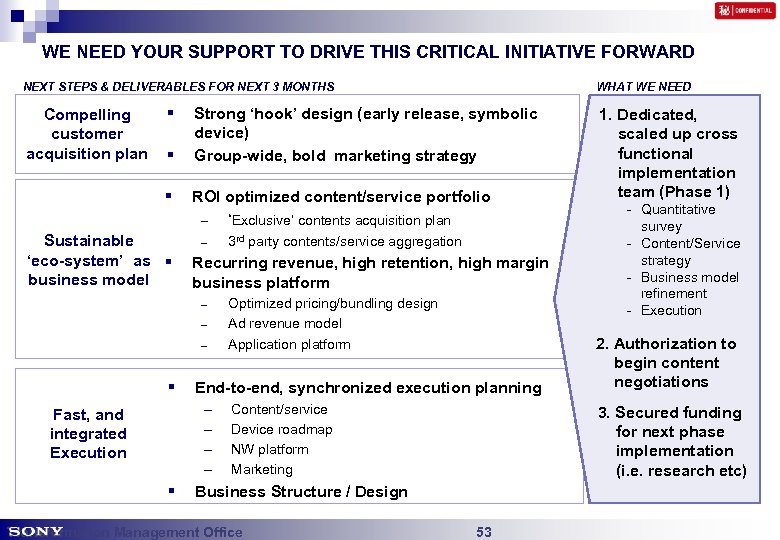

WE NEED YOUR SUPPORT TO DRIVE THIS CRITICAL INITIATIVE FORWARD WHAT WE NEED NEXT STEPS & DELIVERABLES FOR NEXT 3 MONTHS Compelling customer acquisition plan § § § Sustainable ‘eco-system’ as § business model Strong ‘hook’ design (early release, symbolic device) Group-wide, bold marketing strategy ROI optimized content/service portfolio – ‘Exclusive’ contents acquisition plan – Recurring revenue, high retention, high margin business platform – – – § § Optimized pricing/bundling design Ad revenue model Application platform End-to-end, synchronized execution planning – – Fast, and integrated Execution 3 rd party contents/service aggregation Content/service Device roadmap NW platform Marketing - Quantitative survey - Content/Service strategy - Business model refinement - Execution 2. Authorization to begin content negotiations 3. Secured funding for next phase implementation (i. e. research etc) Business Structure / Design Transformation Management Office 1. Dedicated, scaled up cross functional implementation team (Phase 1) 53

WE NEED YOUR SUPPORT TO DRIVE THIS CRITICAL INITIATIVE FORWARD WHAT WE NEED NEXT STEPS & DELIVERABLES FOR NEXT 3 MONTHS Compelling customer acquisition plan § § § Sustainable ‘eco-system’ as § business model Strong ‘hook’ design (early release, symbolic device) Group-wide, bold marketing strategy ROI optimized content/service portfolio – ‘Exclusive’ contents acquisition plan – Recurring revenue, high retention, high margin business platform – – – § § Optimized pricing/bundling design Ad revenue model Application platform End-to-end, synchronized execution planning – – Fast, and integrated Execution 3 rd party contents/service aggregation Content/service Device roadmap NW platform Marketing - Quantitative survey - Content/Service strategy - Business model refinement - Execution 2. Authorization to begin content negotiations 3. Secured funding for next phase implementation (i. e. research etc) Business Structure / Design Transformation Management Office 1. Dedicated, scaled up cross functional implementation team (Phase 1) 53

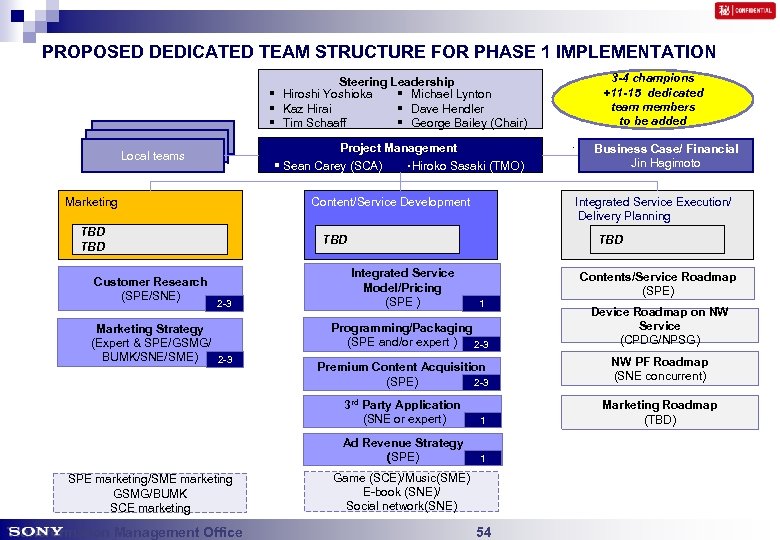

PROPOSED DEDICATED TEAM STRUCTURE FOR PHASE 1 IMPLEMENTATION Steering Leadership § Hiroshi Yoshioka § Michael Lynton § Kaz Hirai § Dave Hendler § Tim Schaaff § George Bailey (Chair) Local teams Project Management § Sean Carey (SCA) ・Hiroko Sasaki (TMO) Marketing Customer Research (SPE/SNE) TBD 2 -3 Marketing Strategy (Expert & SPE/GSMG/ BUMK/SNE/SME) 2 -3 Business Case/ Financial Jin Hagimoto § Hiroko Sasaki (TMO) Integrated Service Execution/ Delivery Planning Content/Service Development TBD 3 -4 champions +11 -15 dedicated team members to be added Integrated Service Model/Pricing (SPE ) Contents/Service Roadmap (SPE) 1 Programming/Packaging (SPE and/or expert ) 2 -3 Device Roadmap on NW Service (CPDG/NPSG) 1 Marketing Roadmap (TBD) Ad Revenue Strategy (SPE) Transformation Management Office NW PF Roadmap (SNE concurrent) 3 rd Party Application (SNE or expert) SPE marketing/SME marketing GSMG/BUMK SCE marketing Premium Content Acquisition (SPE) 2 -3 1 Game (SCE)/Music(SME) E-book (SNE)/ Social network(SNE) 54

PROPOSED DEDICATED TEAM STRUCTURE FOR PHASE 1 IMPLEMENTATION Steering Leadership § Hiroshi Yoshioka § Michael Lynton § Kaz Hirai § Dave Hendler § Tim Schaaff § George Bailey (Chair) Local teams Project Management § Sean Carey (SCA) ・Hiroko Sasaki (TMO) Marketing Customer Research (SPE/SNE) TBD 2 -3 Marketing Strategy (Expert & SPE/GSMG/ BUMK/SNE/SME) 2 -3 Business Case/ Financial Jin Hagimoto § Hiroko Sasaki (TMO) Integrated Service Execution/ Delivery Planning Content/Service Development TBD 3 -4 champions +11 -15 dedicated team members to be added Integrated Service Model/Pricing (SPE ) Contents/Service Roadmap (SPE) 1 Programming/Packaging (SPE and/or expert ) 2 -3 Device Roadmap on NW Service (CPDG/NPSG) 1 Marketing Roadmap (TBD) Ad Revenue Strategy (SPE) Transformation Management Office NW PF Roadmap (SNE concurrent) 3 rd Party Application (SNE or expert) SPE marketing/SME marketing GSMG/BUMK SCE marketing Premium Content Acquisition (SPE) 2 -3 1 Game (SCE)/Music(SME) E-book (SNE)/ Social network(SNE) 54

CONCLUSION § Competitive market dynamics are changing dramatically – Customers are increasingly consuming more digital content and online content availability is more widespread – Consumers want entertainment solutions and quality experiences that combine both anywhere access to content and device form factor § Sony is the best positioned to take advantage of this opportunity to provide a holistic approach that will attract consumers § We can leverage our content assets/knowledge to acquire and manage exclusive, “must-have content” to develop differentiated offerings § The industry is moving fast and our competitors are not standing still – we need to accelerate investment in order to win § Sony can take a leadership position if we move fast and go big! Transformation Management Office 55

CONCLUSION § Competitive market dynamics are changing dramatically – Customers are increasingly consuming more digital content and online content availability is more widespread – Consumers want entertainment solutions and quality experiences that combine both anywhere access to content and device form factor § Sony is the best positioned to take advantage of this opportunity to provide a holistic approach that will attract consumers § We can leverage our content assets/knowledge to acquire and manage exclusive, “must-have content” to develop differentiated offerings § The industry is moving fast and our competitors are not standing still – we need to accelerate investment in order to win § Sony can take a leadership position if we move fast and go big! Transformation Management Office 55

Play Listen Watch Learn Communicate Discover Create Share Transformation Management Office Network Service Turbo-Charge Plan APPENDIX April 20, 2010 56

Play Listen Watch Learn Communicate Discover Create Share Transformation Management Office Network Service Turbo-Charge Plan APPENDIX April 20, 2010 56

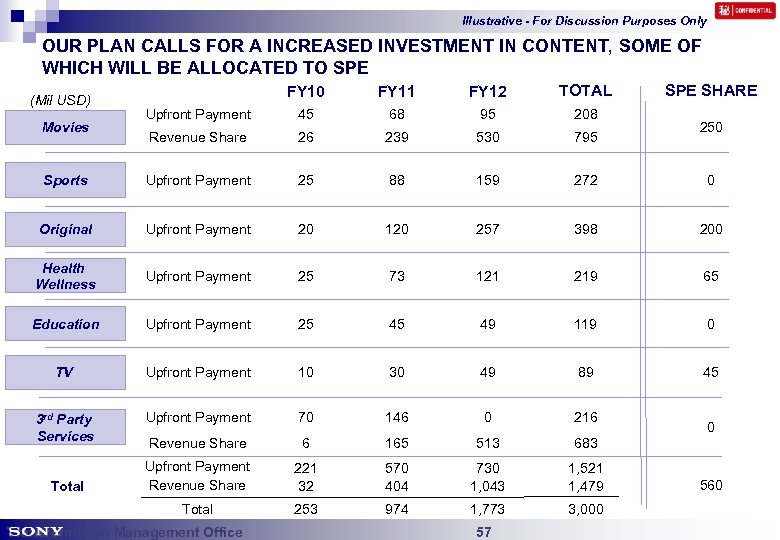

Illustrative - For Discussion Purposes Only OUR PLAN CALLS FOR A INCREASED INVESTMENT IN CONTENT, SOME OF WHICH WILL BE ALLOCATED TO SPE SHARE FY 10 FY 11 FY 12 TOTAL Upfront Payment 45 68 95 208 Revenue Share 26 239 530 795 Sports Upfront Payment 25 88 159 272 0 Original Upfront Payment 20 120 257 398 200 Health Wellness Upfront Payment 25 73 121 219 65 Education Upfront Payment 25 45 49 119 0 TV Upfront Payment 10 30 49 89 45 3 rd Party Services Upfront Payment 70 146 0 216 Revenue Share 6 165 513 683 Upfront Payment Revenue Share 221 32 570 404 730 1, 043 1, 521 1, 479 Total 253 974 1, 773 3, 000 (Mil USD) Movies Total Transformation Management Office 57 250 0 560

Illustrative - For Discussion Purposes Only OUR PLAN CALLS FOR A INCREASED INVESTMENT IN CONTENT, SOME OF WHICH WILL BE ALLOCATED TO SPE SHARE FY 10 FY 11 FY 12 TOTAL Upfront Payment 45 68 95 208 Revenue Share 26 239 530 795 Sports Upfront Payment 25 88 159 272 0 Original Upfront Payment 20 120 257 398 200 Health Wellness Upfront Payment 25 73 121 219 65 Education Upfront Payment 25 45 49 119 0 TV Upfront Payment 10 30 49 89 45 3 rd Party Services Upfront Payment 70 146 0 216 Revenue Share 6 165 513 683 Upfront Payment Revenue Share 221 32 570 404 730 1, 043 1, 521 1, 479 Total 253 974 1, 773 3, 000 (Mil USD) Movies Total Transformation Management Office 57 250 0 560