a4c28fd8e1adc296bc9955cb94230d8e.ppt

- Количество слайдов: 29

Planning Your Retirement Presentation to ALOC & OCAA Tuesday April 30 th, 2013 1

Planning Your Retirement Presentation to ALOC & OCAA Tuesday April 30 th, 2013 1

Agenda § What to expect § Benefits § Retirement timelines § Planning §Q& A 2

Agenda § What to expect § Benefits § Retirement timelines § Planning §Q& A 2

What to Expect: Benefits § PSPP Pension - Entitlement - Survivor pension - Formula - Buyback § CPP Pension - Eligibility - Maximum Benefit § OAS Pension - Eligibility - Maximum Benefit 3

What to Expect: Benefits § PSPP Pension - Entitlement - Survivor pension - Formula - Buyback § CPP Pension - Eligibility - Maximum Benefit § OAS Pension - Eligibility - Maximum Benefit 3

PSPP: When Can I Retire? § Unreduced Pension - 60/20 Rule - age 65 - 90 Factor § Reduced Pension - starting at age 55 - 5% reduction per year from age 65 4

PSPP: When Can I Retire? § Unreduced Pension - 60/20 Rule - age 65 - 90 Factor § Reduced Pension - starting at age 55 - 5% reduction per year from age 65 4

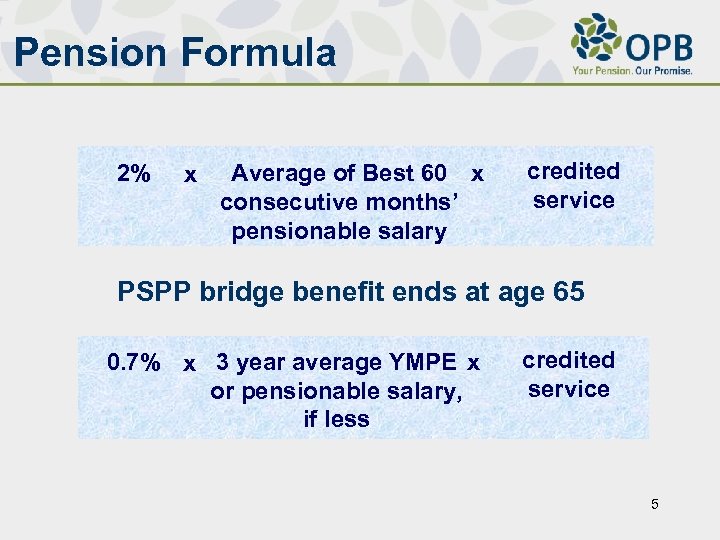

Pension Formula 2% x Average of Best 60 x consecutive months’ pensionable salary credited service PSPP bridge benefit ends at age 65 0. 7% x 3 year average YMPE x or pensionable salary, if less credited service 5

Pension Formula 2% x Average of Best 60 x consecutive months’ pensionable salary credited service PSPP bridge benefit ends at age 65 0. 7% x 3 year average YMPE x or pensionable salary, if less credited service 5

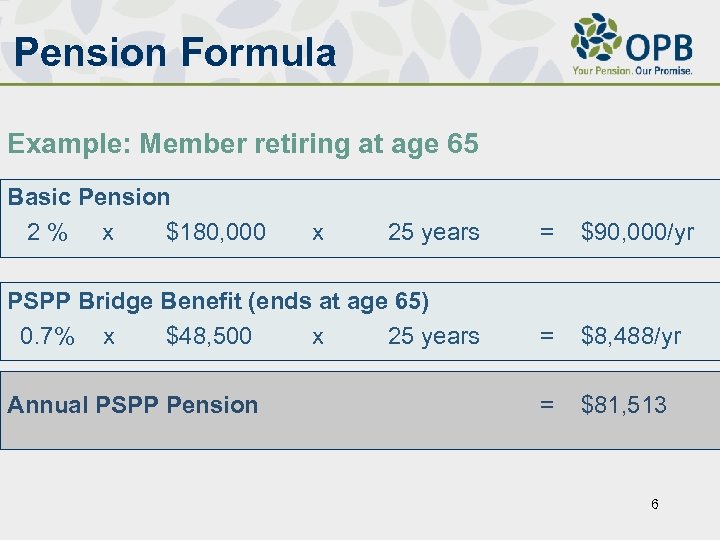

Pension Formula Example: Member retiring at age 65 Basic Pension 2% x $180, 000 x 25 years = $90, 000/yr PSPP Bridge Benefit (ends at age 65) 0. 7% x $48, 500 x 25 years = $8, 488/yr Annual PSPP Pension = $81, 513 6

Pension Formula Example: Member retiring at age 65 Basic Pension 2% x $180, 000 x 25 years = $90, 000/yr PSPP Bridge Benefit (ends at age 65) 0. 7% x $48, 500 x 25 years = $8, 488/yr Annual PSPP Pension = $81, 513 6

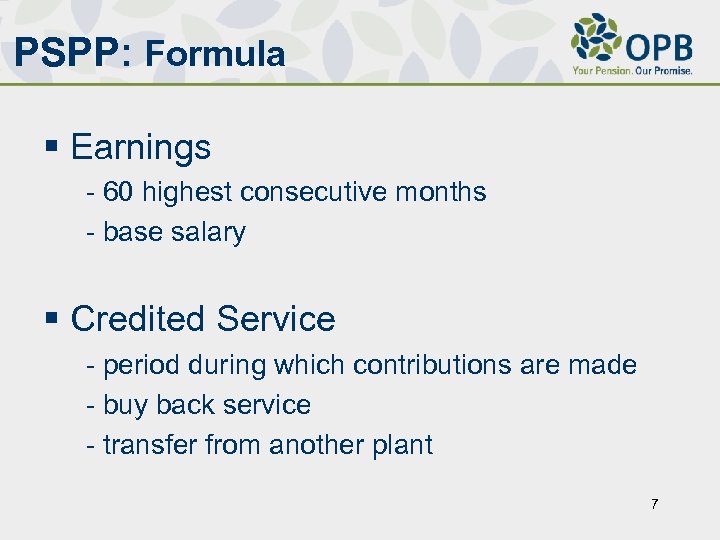

PSPP: Formula § Earnings - 60 highest consecutive months - base salary § Credited Service - period during which contributions are made - buy back service - transfer from another plant 7

PSPP: Formula § Earnings - 60 highest consecutive months - base salary § Credited Service - period during which contributions are made - buy back service - transfer from another plant 7

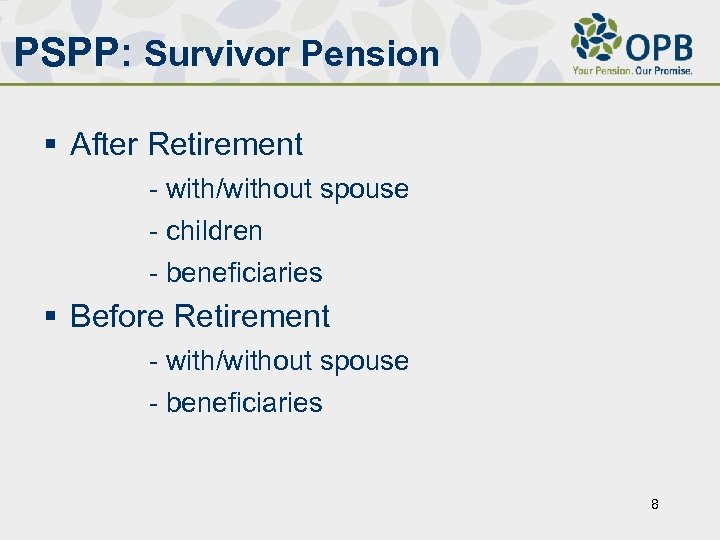

PSPP: Survivor Pension § After Retirement - with/without spouse - children - beneficiaries § Before Retirement - with/without spouse - beneficiaries 8

PSPP: Survivor Pension § After Retirement - with/without spouse - children - beneficiaries § Before Retirement - with/without spouse - beneficiaries 8

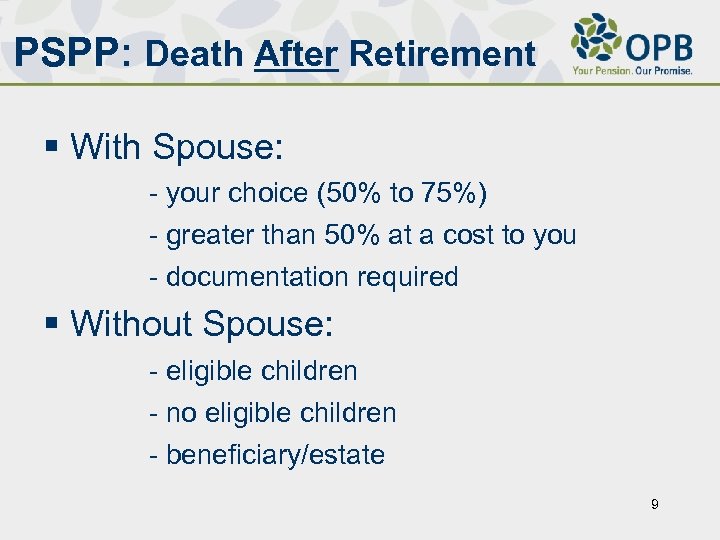

PSPP: Death After Retirement § With Spouse: - your choice (50% to 75%) - greater than 50% at a cost to you - documentation required § Without Spouse: - eligible children - no eligible children - beneficiary/estate 9

PSPP: Death After Retirement § With Spouse: - your choice (50% to 75%) - greater than 50% at a cost to you - documentation required § Without Spouse: - eligible children - no eligible children - beneficiary/estate 9

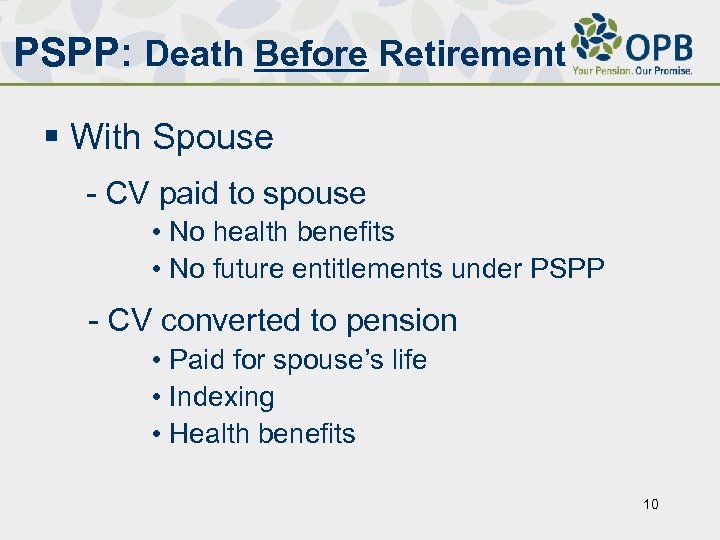

PSPP: Death Before Retirement § With Spouse - CV paid to spouse • No health benefits • No future entitlements under PSPP - CV converted to pension • Paid for spouse’s life • Indexing • Health benefits 10

PSPP: Death Before Retirement § With Spouse - CV paid to spouse • No health benefits • No future entitlements under PSPP - CV converted to pension • Paid for spouse’s life • Indexing • Health benefits 10

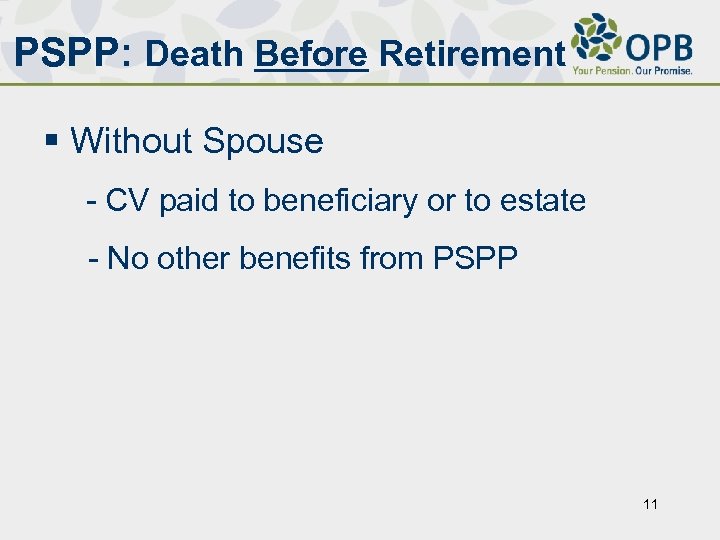

PSPP: Death Before Retirement § Without Spouse - CV paid to beneficiary or to estate - No other benefits from PSPP 11

PSPP: Death Before Retirement § Without Spouse - CV paid to beneficiary or to estate - No other benefits from PSPP 11

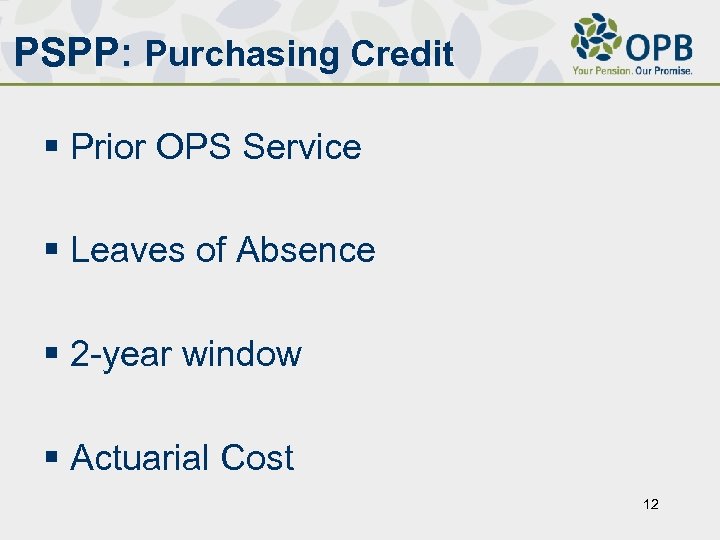

PSPP: Purchasing Credit § Prior OPS Service § Leaves of Absence § 2 -year window § Actuarial Cost 12

PSPP: Purchasing Credit § Prior OPS Service § Leaves of Absence § 2 -year window § Actuarial Cost 12

PSPP: Purchasing Credit § Non-OPS Service - Buy Back - Transfer § Check with OPB for: - Eligibility - Cost Method 13

PSPP: Purchasing Credit § Non-OPS Service - Buy Back - Transfer § Check with OPB for: - Eligibility - Cost Method 13

PSPP: Re-employment § Working in OPS - rejoin PSPP - receive pension with earnings test § Outside OPS - no limits 14

PSPP: Re-employment § Working in OPS - rejoin PSPP - receive pension with earnings test § Outside OPS - no limits 14

PSPP: Health Benefits § Standard Insured Benefits § Must be receiving pension to be eligible § Spousal coverage if survivor pension paid 15

PSPP: Health Benefits § Standard Insured Benefits § Must be receiving pension to be eligible § Spousal coverage if survivor pension paid 15

PSPP: Timelines § Review survivor pension options a minimum of 2 – 3 years before retirement § Notify OSS/OPB of your retirement plans a minimum of 6 months prior - check information - set date - complete forms 16

PSPP: Timelines § Review survivor pension options a minimum of 2 – 3 years before retirement § Notify OSS/OPB of your retirement plans a minimum of 6 months prior - check information - set date - complete forms 16

PSPP: Timelines § Retirement package will arrive 2 – 3 months before retirement - information package - request for missing documents - return signed forms 17

PSPP: Timelines § Retirement package will arrive 2 – 3 months before retirement - information package - request for missing documents - return signed forms 17

Retirement Income: Other § CPP – age 60 or 65 § OAS – age 65 § RRSP’s – you decide § Savings – you decide 18

Retirement Income: Other § CPP – age 60 or 65 § OAS – age 65 § RRSP’s – you decide § Savings – you decide 18

Retirement Income: CPP § Full CPP from age 65 § Maximum benefit: $1, 012. 15/month § Reduced from age 60 § Reduction depends on year of commencement 19

Retirement Income: CPP § Full CPP from age 65 § Maximum benefit: $1, 012. 15/month § Reduced from age 60 § Reduction depends on year of commencement 19

Retirement Income: OAS § Eligibility based on residency in Canada § OAS maximum benefit $546. 07 § Clawed-back based on income test 20

Retirement Income: OAS § Eligibility based on residency in Canada § OAS maximum benefit $546. 07 § Clawed-back based on income test 20

Retirement Income: Personal § RRSPs - can convert to life annuity - income stream you manage - lump sum withdrawals § Savings - can convert to life annuity - income stream you manage - lump sum withdrawals § House - downsize 21

Retirement Income: Personal § RRSPs - can convert to life annuity - income stream you manage - lump sum withdrawals § Savings - can convert to life annuity - income stream you manage - lump sum withdrawals § House - downsize 21

Planning: Online tools § Pension estimator - projections based on earnings, service, date - comparisons § Retirement Planner - retirement income sources - understand expenses in retirement - understand taxes in retirement - income splitting 22

Planning: Online tools § Pension estimator - projections based on earnings, service, date - comparisons § Retirement Planner - retirement income sources - understand expenses in retirement - understand taxes in retirement - income splitting 22

Planning: Online tools § Buyback cost calculator - return on investment § Change personal information - pension estimate - understand total § Initiate retirement process - inform OPB of retirement plans 23

Planning: Online tools § Buyback cost calculator - return on investment § Change personal information - pension estimate - understand total § Initiate retirement process - inform OPB of retirement plans 23

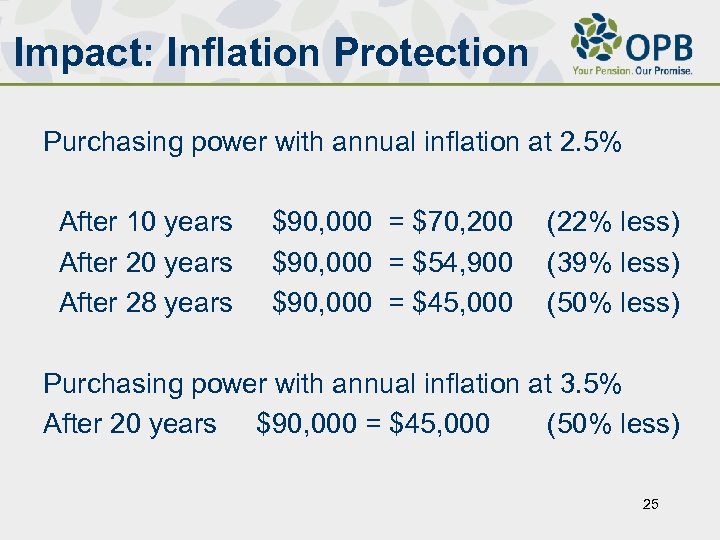

Plan Benefits § Inflation Protection: - Guaranteed indexing in retirement § Health Benefits: - Must have 10 years service in PSPP 24

Plan Benefits § Inflation Protection: - Guaranteed indexing in retirement § Health Benefits: - Must have 10 years service in PSPP 24

Impact: Inflation Protection Purchasing power with annual inflation at 2. 5% After 10 years After 28 years $90, 000 = $70, 200 $90, 000 = $54, 900 $90, 000 = $45, 000 (22% less) (39% less) (50% less) Purchasing power with annual inflation at 3. 5% After 20 years $90, 000 = $45, 000 (50% less) 25

Impact: Inflation Protection Purchasing power with annual inflation at 2. 5% After 10 years After 28 years $90, 000 = $70, 200 $90, 000 = $54, 900 $90, 000 = $45, 000 (22% less) (39% less) (50% less) Purchasing power with annual inflation at 3. 5% After 20 years $90, 000 = $45, 000 (50% less) 25

Value of Your Plan § Lump Sum worth of your pension: $$ need to = PSPP retirement benefits § Benefit of forced retirement savings and impact of late start § Value of 100% inflation protection § Based on caution, conservative assumptions about the future 26

Value of Your Plan § Lump Sum worth of your pension: $$ need to = PSPP retirement benefits § Benefit of forced retirement savings and impact of late start § Value of 100% inflation protection § Based on caution, conservative assumptions about the future 26

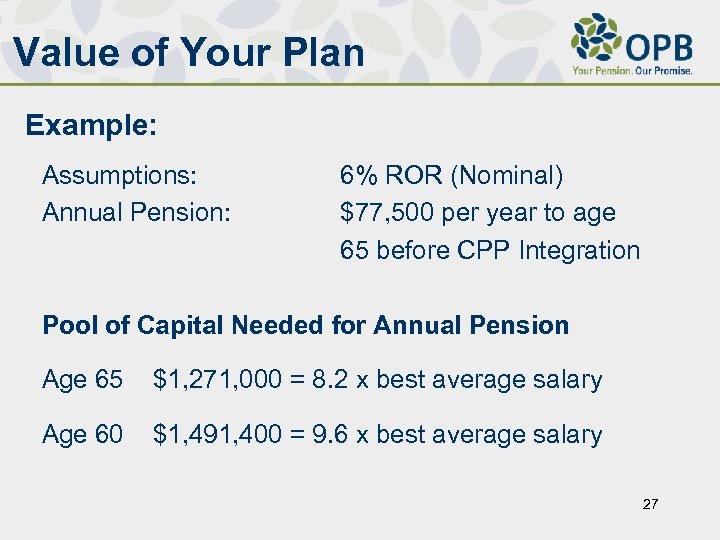

Value of Your Plan Example: Assumptions: Annual Pension: 6% ROR (Nominal) $77, 500 per year to age 65 before CPP Integration Pool of Capital Needed for Annual Pension Age 65 $1, 271, 000 = 8. 2 x best average salary Age 60 $1, 491, 400 = 9. 6 x best average salary 27

Value of Your Plan Example: Assumptions: Annual Pension: 6% ROR (Nominal) $77, 500 per year to age 65 before CPP Integration Pool of Capital Needed for Annual Pension Age 65 $1, 271, 000 = 8. 2 x best average salary Age 60 $1, 491, 400 = 9. 6 x best average salary 27

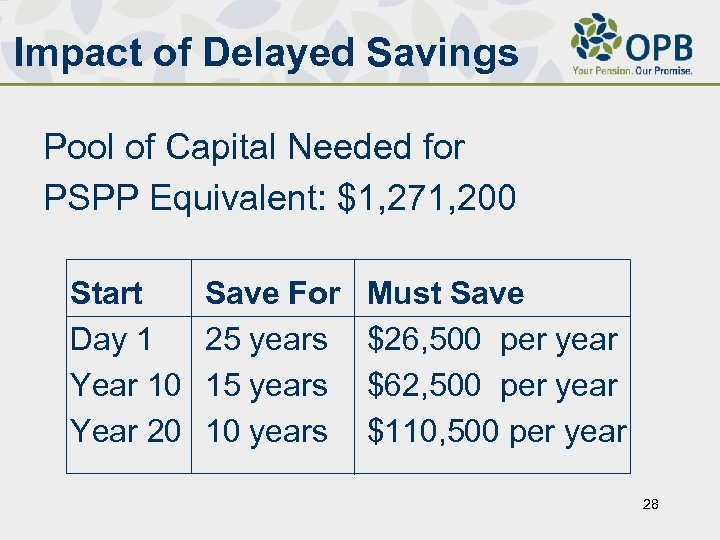

Impact of Delayed Savings Pool of Capital Needed for PSPP Equivalent: $1, 271, 200 Start Day 1 Year 10 Year 20 Save For 25 years 10 years Must Save $26, 500 per year $62, 500 per year $110, 500 per year 28

Impact of Delayed Savings Pool of Capital Needed for PSPP Equivalent: $1, 271, 200 Start Day 1 Year 10 Year 20 Save For 25 years 10 years Must Save $26, 500 per year $62, 500 per year $110, 500 per year 28

Contact Information Client Services: 416. 364. 5035 or 1. 800. 668. 6203 Website: www. opb. ca Email: clientservice@opb. ca Document Accessibility: PSPP documents are available in other formats upon request. 29

Contact Information Client Services: 416. 364. 5035 or 1. 800. 668. 6203 Website: www. opb. ca Email: clientservice@opb. ca Document Accessibility: PSPP documents are available in other formats upon request. 29