e640163f6e93d1113582f599a916c644.ppt

- Количество слайдов: 46

Planning for the Future “Life after Graduation”

Planning for the Future “Life after Graduation”

Introductions • • • John Mc. Millan- Lawyer Darren Farwell - Scotia Mcleod Maria Tsiaousidis – Manager Personal Banking. Jim Blair – Snr Manager Toronto Region BNS Graham Flanagan – Centre Manager Q& M

Introductions • • • John Mc. Millan- Lawyer Darren Farwell - Scotia Mcleod Maria Tsiaousidis – Manager Personal Banking. Jim Blair – Snr Manager Toronto Region BNS Graham Flanagan – Centre Manager Q& M

Agenda • • • Dealing with student debt. Incorporation of a business ( Accounting) Negotiating employment contracts. Incorporation of a business (Legal) Buying vs Leasing a vehicle. Financing a Real Estate purchase. Other forms of financing. Protection Building for the future. Helping you throughout your career.

Agenda • • • Dealing with student debt. Incorporation of a business ( Accounting) Negotiating employment contracts. Incorporation of a business (Legal) Buying vs Leasing a vehicle. Financing a Real Estate purchase. Other forms of financing. Protection Building for the future. Helping you throughout your career.

Dealing with Student Debt • • Profile: Maximum SPSP $48, 000 ( 4 x$12, 000) Pharmacy resident $10, 000 OSAP average$36, 000 (4 x $9, 000) – Prime +1. 5% Osap – Prime +2. 5% Federal • Credit cards and undergrad debt.

Dealing with Student Debt • • Profile: Maximum SPSP $48, 000 ( 4 x$12, 000) Pharmacy resident $10, 000 OSAP average$36, 000 (4 x $9, 000) – Prime +1. 5% Osap – Prime +2. 5% Federal • Credit cards and undergrad debt.

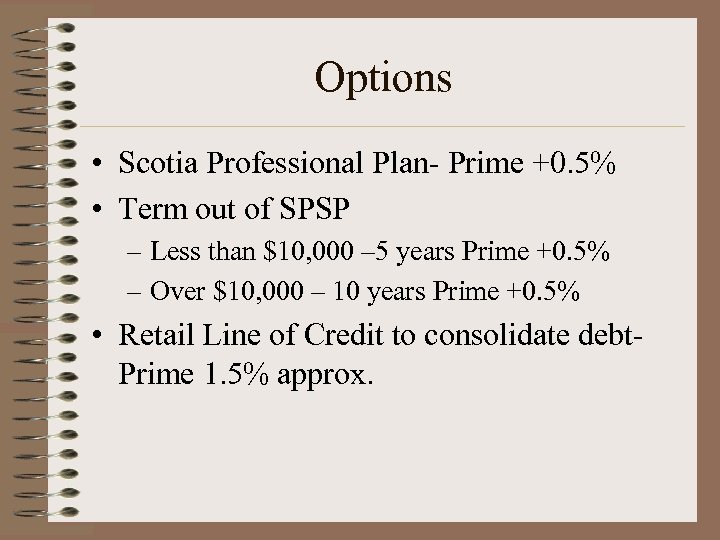

Options • Scotia Professional Plan- Prime +0. 5% • Term out of SPSP – Less than $10, 000 – 5 years Prime +0. 5% – Over $10, 000 – 10 years Prime +0. 5% • Retail Line of Credit to consolidate debt. Prime 1. 5% approx.

Options • Scotia Professional Plan- Prime +0. 5% • Term out of SPSP – Less than $10, 000 – 5 years Prime +0. 5% – Over $10, 000 – 10 years Prime +0. 5% • Retail Line of Credit to consolidate debt. Prime 1. 5% approx.

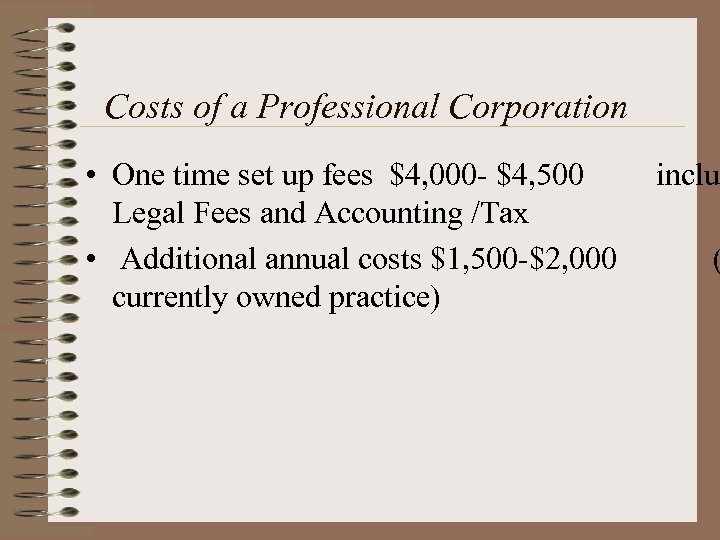

Costs of a Professional Corporation • One time set up fees $4, 000 - $4, 500 Legal Fees and Accounting /Tax • Additional annual costs $1, 500 -$2, 000 currently owned practice) inclu (

Costs of a Professional Corporation • One time set up fees $4, 000 - $4, 500 Legal Fees and Accounting /Tax • Additional annual costs $1, 500 -$2, 000 currently owned practice) inclu (

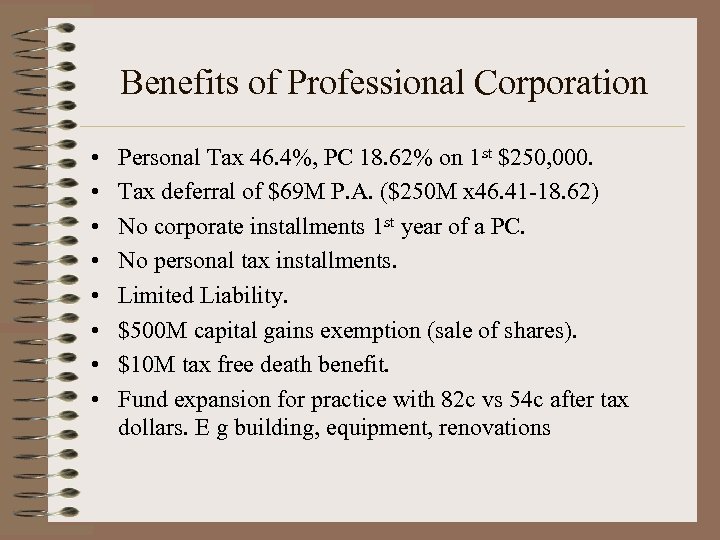

Benefits of Professional Corporation • • Personal Tax 46. 4%, PC 18. 62% on 1 st $250, 000. Tax deferral of $69 M P. A. ($250 M x 46. 41 -18. 62) No corporate installments 1 st year of a PC. No personal tax installments. Limited Liability. $500 M capital gains exemption (sale of shares). $10 M tax free death benefit. Fund expansion for practice with 82 c vs 54 c after tax dollars. E g building, equipment, renovations

Benefits of Professional Corporation • • Personal Tax 46. 4%, PC 18. 62% on 1 st $250, 000. Tax deferral of $69 M P. A. ($250 M x 46. 41 -18. 62) No corporate installments 1 st year of a PC. No personal tax installments. Limited Liability. $500 M capital gains exemption (sale of shares). $10 M tax free death benefit. Fund expansion for practice with 82 c vs 54 c after tax dollars. E g building, equipment, renovations

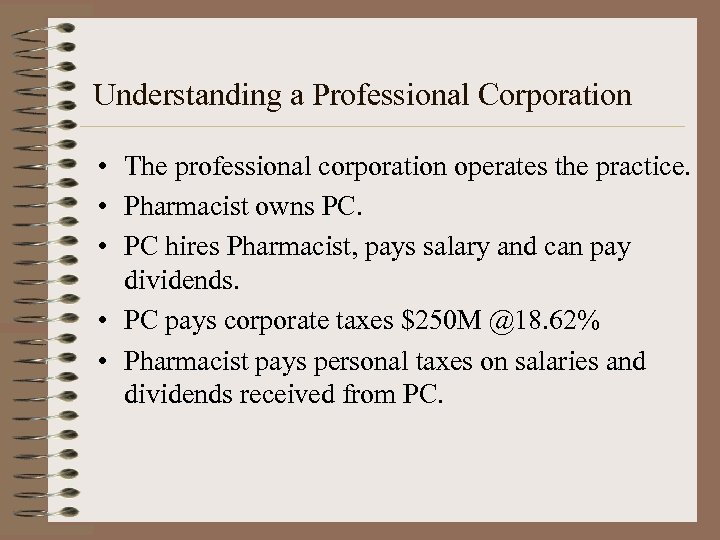

Understanding a Professional Corporation • The professional corporation operates the practice. • Pharmacist owns PC. • PC hires Pharmacist, pays salary and can pay dividends. • PC pays corporate taxes $250 M @18. 62% • Pharmacist pays personal taxes on salaries and dividends received from PC.

Understanding a Professional Corporation • The professional corporation operates the practice. • Pharmacist owns PC. • PC hires Pharmacist, pays salary and can pay dividends. • PC pays corporate taxes $250 M @18. 62% • Pharmacist pays personal taxes on salaries and dividends received from PC.

Who should incorporate their practice • Taxable Income > $103 M + $14. 5 M RRSP = $117. 5 M. • Pay off all significant personal debts (mortgage) • Must be able to leave surplus profits in PC • Will you be purchasing equipment, building etc.

Who should incorporate their practice • Taxable Income > $103 M + $14. 5 M RRSP = $117. 5 M. • Pay off all significant personal debts (mortgage) • Must be able to leave surplus profits in PC • Will you be purchasing equipment, building etc.

LEGAL ISSUES FOR PHARMACISTS John Mc. Millan, LL. B. 416 364 4771 johnmcmillan@bellnet. ca

LEGAL ISSUES FOR PHARMACISTS John Mc. Millan, LL. B. 416 364 4771 johnmcmillan@bellnet. ca

RETAIL Ø Large Chains ØEmployment Ø“Associate Owner” (Shoppers Drug Mart) ØFranchise ØEmployment Agreements largely uniform

RETAIL Ø Large Chains ØEmployment Ø“Associate Owner” (Shoppers Drug Mart) ØFranchise ØEmployment Agreements largely uniform

POST-GRADUATION PATHS Ø Public Health (Hospitals etc. ) ØCollective Agreements (OPSEU / CUPE) Ø Private ØCorporate (R&D, pharmaceutical sales, regulatory) ØChains ØBanner stores ØIndependent Ø Start-Up

POST-GRADUATION PATHS Ø Public Health (Hospitals etc. ) ØCollective Agreements (OPSEU / CUPE) Ø Private ØCorporate (R&D, pharmaceutical sales, regulatory) ØChains ØBanner stores ØIndependent Ø Start-Up

RETAIL CONT… Ø Small Chains and Independents ØEmployment agreements may be informal (verbal) or written ØBe prepared for a wide range of scenarios

RETAIL CONT… Ø Small Chains and Independents ØEmployment agreements may be informal (verbal) or written ØBe prepared for a wide range of scenarios

EMPLOYMENT AGREEMENTS Ø Most common arrangement for new graduates Ø Written agreements on the increase ØHeavy competition between employers ØWritten Agreements instrumental in communicating incentives to potential employees ØWritten Agreement also used to secure certain terms for the benefit of the employer

EMPLOYMENT AGREEMENTS Ø Most common arrangement for new graduates Ø Written agreements on the increase ØHeavy competition between employers ØWritten Agreements instrumental in communicating incentives to potential employees ØWritten Agreement also used to secure certain terms for the benefit of the employer

WRITTEN EMPLOYMENT AGREEMENTS Ø Basic Elements: ØTerm ØJob Description ØCompensation, bonuses ØBenefits ØHours and days of work ØRestrictive Covenants ØVacation, sick days, parental leave ØTermination ØAssignment

WRITTEN EMPLOYMENT AGREEMENTS Ø Basic Elements: ØTerm ØJob Description ØCompensation, bonuses ØBenefits ØHours and days of work ØRestrictive Covenants ØVacation, sick days, parental leave ØTermination ØAssignment

WRITTEN EMPLOYMENT AGREEMENTS CONT… Ø Benefits to Employee ØDocumentation of incentives Øsigning bonuses, milestone bonuses, benefits, covered expenses (fees, licenses, continuing education etc. , moving expenses) Ø Defines job description ØClarifies other terms and conditions ØVacations, sick days, parental benefits, hours and days of work, compensation etc.

WRITTEN EMPLOYMENT AGREEMENTS CONT… Ø Benefits to Employee ØDocumentation of incentives Øsigning bonuses, milestone bonuses, benefits, covered expenses (fees, licenses, continuing education etc. , moving expenses) Ø Defines job description ØClarifies other terms and conditions ØVacations, sick days, parental benefits, hours and days of work, compensation etc.

WRITTEN EMPLOYMENT AGREEMENTS CONT… Ø Benefits to Employer Ø Defines term of employment (“lock in”) ØDefines job description ØTermination provisions (including definition of termination for “cause”) ØNon-competition provisions ØRe-location provisions ØClarifies other terms and conditions ØVacations, sick days, hours and days of work, compensation, probation periods, termination

WRITTEN EMPLOYMENT AGREEMENTS CONT… Ø Benefits to Employer Ø Defines term of employment (“lock in”) ØDefines job description ØTermination provisions (including definition of termination for “cause”) ØNon-competition provisions ØRe-location provisions ØClarifies other terms and conditions ØVacations, sick days, hours and days of work, compensation, probation periods, termination

WRITTEN EMPLOYMENT AGREEMENTS CONT… Ø Things to Watch For (Employees) ØMilestone Bonuses ØBonuses may be payable by employer after employee has been continuously employed for a certain period of time (e. g. 2 years) ØIf employee terminates (or is terminated for cause) prior to milestone, bonus may not be paid.

WRITTEN EMPLOYMENT AGREEMENTS CONT… Ø Things to Watch For (Employees) ØMilestone Bonuses ØBonuses may be payable by employer after employee has been continuously employed for a certain period of time (e. g. 2 years) ØIf employee terminates (or is terminated for cause) prior to milestone, bonus may not be paid.

WRITTEN EMPLOYMENT AGREEMENTS CONT… Ø Things to watch for Cont…. ØRelocation Clause (Chain Stores) ØAgreement may provide that employee agrees to relocate to other locations, if required ØDecide first if you are willing to relocate ØIf yes, negotiate for moving expenses and moving bonus, in advance ØAlso negotiate that relocation must be on sufficient notice (120 days minimum)

WRITTEN EMPLOYMENT AGREEMENTS CONT… Ø Things to watch for Cont…. ØRelocation Clause (Chain Stores) ØAgreement may provide that employee agrees to relocate to other locations, if required ØDecide first if you are willing to relocate ØIf yes, negotiate for moving expenses and moving bonus, in advance ØAlso negotiate that relocation must be on sufficient notice (120 days minimum)

WRITTEN EMPLOYMENT AGREEMENTS CONT… Ø Things to watch for Cont…. ØFixed term agreements ØProtections contained in Employment Standards Act and the common law principle of “reasonable notice” do not apply if there is clear and explicit language to establish a fixed term contract (Ontario Court of Appeal) ØNote: Employment without written agreement governed by Employment Standards Act and common law Ø Prescribes notice periods for termination

WRITTEN EMPLOYMENT AGREEMENTS CONT… Ø Things to watch for Cont…. ØFixed term agreements ØProtections contained in Employment Standards Act and the common law principle of “reasonable notice” do not apply if there is clear and explicit language to establish a fixed term contract (Ontario Court of Appeal) ØNote: Employment without written agreement governed by Employment Standards Act and common law Ø Prescribes notice periods for termination

WRITTEN EMPLOYMENT AGREEMENTS CONT… Ø Things to watch for Cont…. Ø Independent Contractor Provision Ø May not be employment Ø Example: “The parties hereby acknowledge and agree that the relationship between them is not an employment relationship…. [The pharmacist] agrees that s/he shall be responsible for and will remit to all relevant government authorities all taxes, CPP etc. ” Ø May prevent (or hinder) wrongful dismissal claim under Employment Standards Act (but, if relationship displays “hallmarks” of employment, tribunal or court may find employment relationship to exist)

WRITTEN EMPLOYMENT AGREEMENTS CONT… Ø Things to watch for Cont…. Ø Independent Contractor Provision Ø May not be employment Ø Example: “The parties hereby acknowledge and agree that the relationship between them is not an employment relationship…. [The pharmacist] agrees that s/he shall be responsible for and will remit to all relevant government authorities all taxes, CPP etc. ” Ø May prevent (or hinder) wrongful dismissal claim under Employment Standards Act (but, if relationship displays “hallmarks” of employment, tribunal or court may find employment relationship to exist)

OTHER ARRANGEMENTS Ø “Associate Owners” (Shoppers Drug Mart) Ø Qualify after 2 years pharmacy experience Ø Licensing of retail operation to “Associate Owner” pharmacist (also “designated manager” under DPRA) Ø Associate Owner, through wholly-owned corporation, enters into licensing agreement with wholly owned subsidiary of SDM Ø Licensing Agreement requires Owner Associate to devote full time and attention to the operation and management of the location Ø Owner Associate receives base income, plus profit sharing (site-specific) Ø SDM receives “service fee” from Owner Associate

OTHER ARRANGEMENTS Ø “Associate Owners” (Shoppers Drug Mart) Ø Qualify after 2 years pharmacy experience Ø Licensing of retail operation to “Associate Owner” pharmacist (also “designated manager” under DPRA) Ø Associate Owner, through wholly-owned corporation, enters into licensing agreement with wholly owned subsidiary of SDM Ø Licensing Agreement requires Owner Associate to devote full time and attention to the operation and management of the location Ø Owner Associate receives base income, plus profit sharing (site-specific) Ø SDM receives “service fee” from Owner Associate

INCORPORATION Ø Why? ØTo enable shareholders (pharmacists) to gain tax relief ØTrade creditor protection (but not protection from professional liability or accountability to the College)

INCORPORATION Ø Why? ØTo enable shareholders (pharmacists) to gain tax relief ØTrade creditor protection (but not protection from professional liability or accountability to the College)

INCORPORATION CONT… Ø When? ØTax driven consideration ØConsult your accountant

INCORPORATION CONT… Ø When? ØTax driven consideration ØConsult your accountant

INCORPORATION CONT… Ø Compliant Ownership Structure (Regular Corporation) Ø 51% (or more) held directly by pharmacist or by “J. Smith Pharmacist Professional Corporation” Ø 49% (or less) held by nonpharmacist, family member or holding company Ø Non-Compliant Ownership Structure (Regular Corporation) Ø 51% held by #’ed corporation wholly owned by pharmacist Ø 49% held by nonpharmacist, family member or holding company

INCORPORATION CONT… Ø Compliant Ownership Structure (Regular Corporation) Ø 51% (or more) held directly by pharmacist or by “J. Smith Pharmacist Professional Corporation” Ø 49% (or less) held by nonpharmacist, family member or holding company Ø Non-Compliant Ownership Structure (Regular Corporation) Ø 51% held by #’ed corporation wholly owned by pharmacist Ø 49% held by nonpharmacist, family member or holding company

INCORPORATION CONT… Ø Why Not? ØAdvantages may be limited ØPharmacists already permitted to operate under regular corporation, with ownership of 51% of shares by pharmacist ØConsult your accountant ØMay not perfectly fit with “Associate Owner” program (Shoppers Drugs), as activities of the corporation would include non-pharmacy retail ØRevenue streams may need to be split (consult your accountant)

INCORPORATION CONT… Ø Why Not? ØAdvantages may be limited ØPharmacists already permitted to operate under regular corporation, with ownership of 51% of shares by pharmacist ØConsult your accountant ØMay not perfectly fit with “Associate Owner” program (Shoppers Drugs), as activities of the corporation would include non-pharmacy retail ØRevenue streams may need to be split (consult your accountant)

INCORPORATION CONT… Ø Why Not? Cont… ØIf operating through professional corporation, but not a pharmacy owner, you may be deemed to be an employee by the Canada Revenue Agency ØEmployer (pharmacy) would then have to deduct tax at source and issue T 4 (tax benefits could be lost)

INCORPORATION CONT… Ø Why Not? Cont… ØIf operating through professional corporation, but not a pharmacy owner, you may be deemed to be an employee by the Canada Revenue Agency ØEmployer (pharmacy) would then have to deduct tax at source and issue T 4 (tax benefits could be lost)

Leasing (How to ensure the rate you are paying) • • • Know the cash price of the vehicle. How much are the payments, & how many. What is the Purchase option. Is the lease rate fixed or floating. Simple interest vs compound interest. Obtain one or two quotes.

Leasing (How to ensure the rate you are paying) • • • Know the cash price of the vehicle. How much are the payments, & how many. What is the Purchase option. Is the lease rate fixed or floating. Simple interest vs compound interest. Obtain one or two quotes.

Tax benefits of Leases • No tax advantages in leasing vs buying • Assets acquired must depreciate faster than the assigned CCA rate (Computers & Leaseholds • Professional Business must be profitable. • The Lease structure meets the CRCA requirements.

Tax benefits of Leases • No tax advantages in leasing vs buying • Assets acquired must depreciate faster than the assigned CCA rate (Computers & Leaseholds • Professional Business must be profitable. • The Lease structure meets the CRCA requirements.

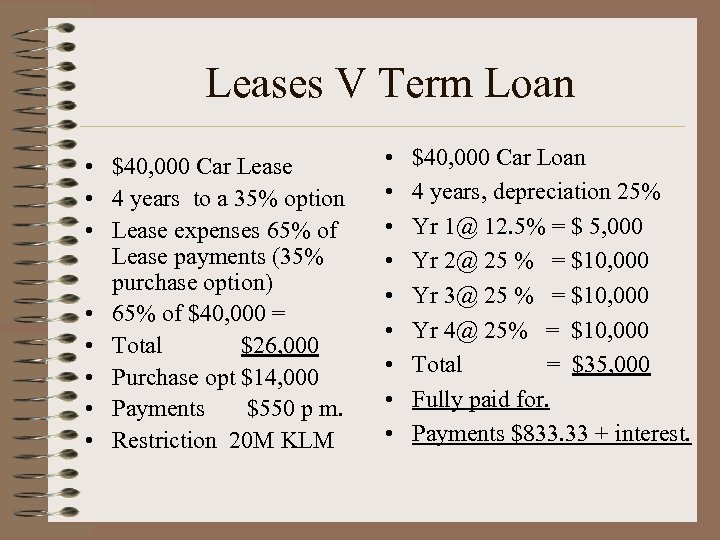

Leases V Term Loan • $40, 000 Car Lease • 4 years to a 35% option • Lease expenses 65% of Lease payments (35% purchase option) • 65% of $40, 000 = • Total $26, 000 • Purchase opt $14, 000 • Payments $550 p m. • Restriction 20 M KLM • • • $40, 000 Car Loan 4 years, depreciation 25% Yr 1@ 12. 5% = $ 5, 000 Yr 2@ 25 % = $10, 000 Yr 3@ 25 % = $10, 000 Yr 4@ 25% = $10, 000 Total = $35, 000 Fully paid for. Payments $833. 33 + interest.

Leases V Term Loan • $40, 000 Car Lease • 4 years to a 35% option • Lease expenses 65% of Lease payments (35% purchase option) • 65% of $40, 000 = • Total $26, 000 • Purchase opt $14, 000 • Payments $550 p m. • Restriction 20 M KLM • • • $40, 000 Car Loan 4 years, depreciation 25% Yr 1@ 12. 5% = $ 5, 000 Yr 2@ 25 % = $10, 000 Yr 3@ 25 % = $10, 000 Yr 4@ 25% = $10, 000 Total = $35, 000 Fully paid for. Payments $833. 33 + interest.

Mortgages • • • Application requirements CMHC 1 st time Homebuyers Mortgage products Closing costs New construction vs Resale homes.

Mortgages • • • Application requirements CMHC 1 st time Homebuyers Mortgage products Closing costs New construction vs Resale homes.

Other Credit Products • Scotialine & Scotialine Visa • Visa – Value – Classic – Gold

Other Credit Products • Scotialine & Scotialine Visa • Visa – Value – Classic – Gold

Darren Farwell, Director, Senior Investment Advisor & Leslie Mc. Cormick, Investment Executive Planning for the Future “Living With A Surplus”

Darren Farwell, Director, Senior Investment Advisor & Leslie Mc. Cormick, Investment Executive Planning for the Future “Living With A Surplus”

Three Cornerstones of Financial Management for Professionals § Protect Yourself and Your Family § Protect Your Practice § Save for Tomorrow

Three Cornerstones of Financial Management for Professionals § Protect Yourself and Your Family § Protect Your Practice § Save for Tomorrow

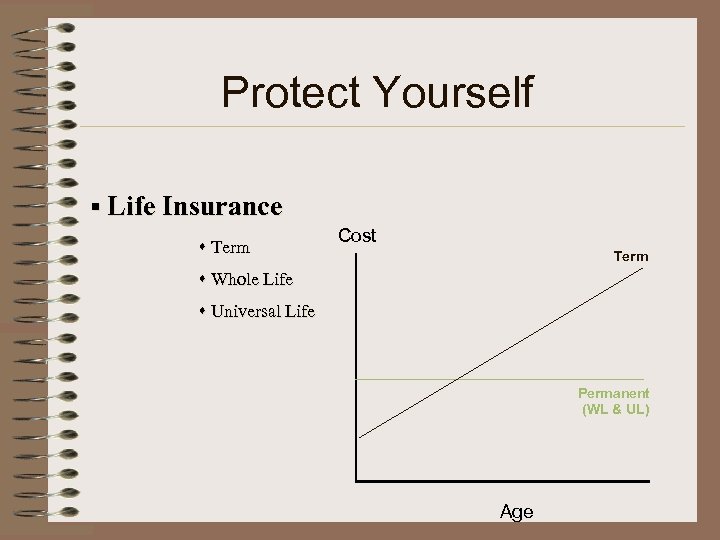

Protect Yourself § Life Insurance s Term Cost Term s Whole Life s Universal Life Permanent (WL & UL) Age

Protect Yourself § Life Insurance s Term Cost Term s Whole Life s Universal Life Permanent (WL & UL) Age

Protect Yourself § Disability Insurance s What is the Definition!!

Protect Yourself § Disability Insurance s What is the Definition!!

Protect Your Practice § Professional Liability Insurance

Protect Your Practice § Professional Liability Insurance

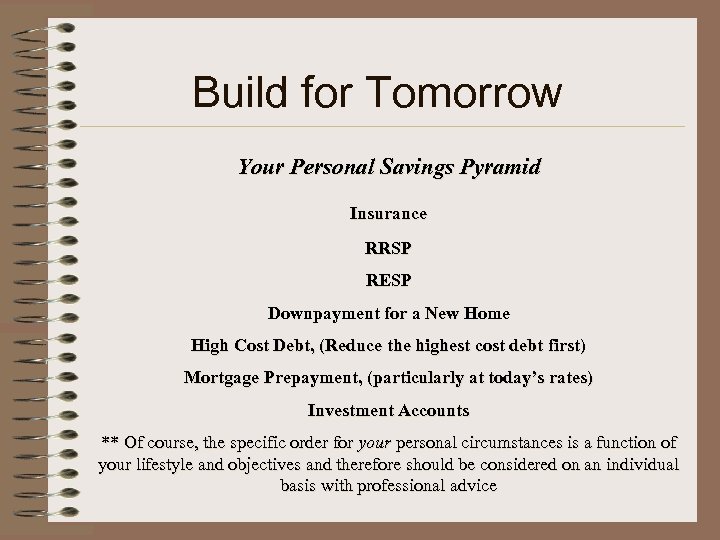

Build for Tomorrow Your Personal Savings Pyramid Insurance RRSP RESP Downpayment for a New Home High Cost Debt, (Reduce the highest cost debt first) Mortgage Prepayment, (particularly at today’s rates) Investment Accounts ** Of course, the specific order for your personal circumstances is a function of your lifestyle and objectives and therefore should be considered on an individual basis with professional advice

Build for Tomorrow Your Personal Savings Pyramid Insurance RRSP RESP Downpayment for a New Home High Cost Debt, (Reduce the highest cost debt first) Mortgage Prepayment, (particularly at today’s rates) Investment Accounts ** Of course, the specific order for your personal circumstances is a function of your lifestyle and objectives and therefore should be considered on an individual basis with professional advice

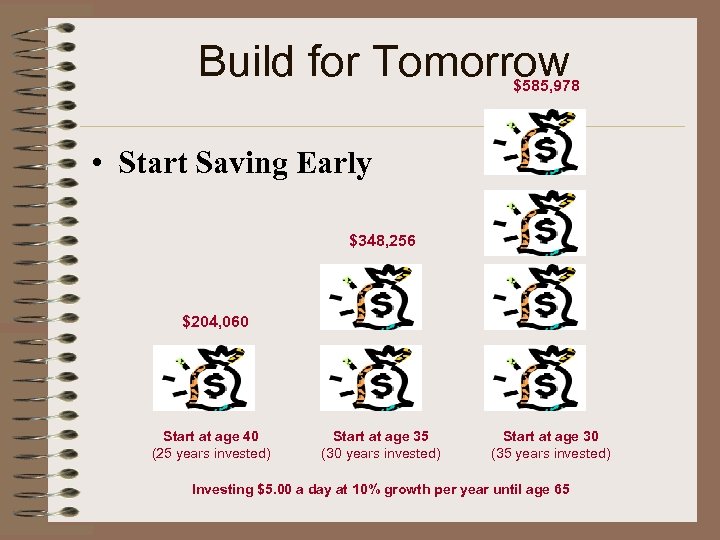

Build for Tomorrow $585, 978 • Start Saving Early $348, 256 $204, 060 Start at age 40 (25 years invested) Start at age 35 (30 years invested) Start at age 30 (35 years invested) Investing $5. 00 a day at 10% growth per year until age 65

Build for Tomorrow $585, 978 • Start Saving Early $348, 256 $204, 060 Start at age 40 (25 years invested) Start at age 35 (30 years invested) Start at age 30 (35 years invested) Investing $5. 00 a day at 10% growth per year until age 65

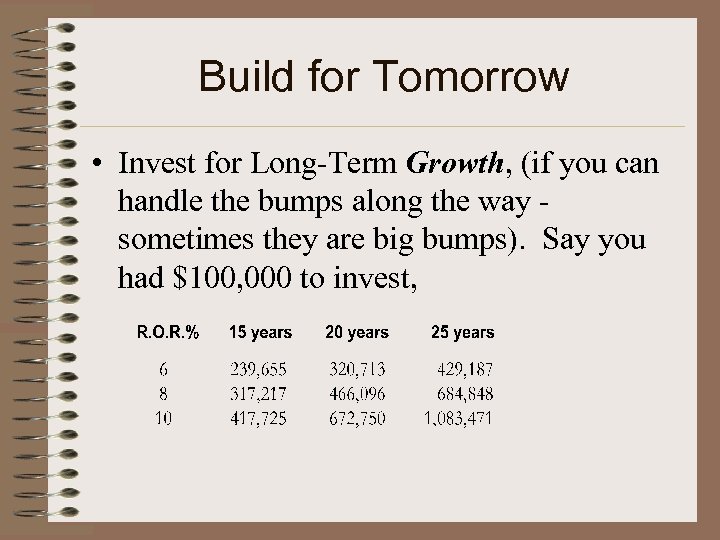

Build for Tomorrow • Invest for Long-Term Growth, (if you can handle the bumps along the way sometimes they are big bumps). Say you had $100, 000 to invest,

Build for Tomorrow • Invest for Long-Term Growth, (if you can handle the bumps along the way sometimes they are big bumps). Say you had $100, 000 to invest,

Build for Tomorrow • “If You Don’t Know Where You’re Going, You’ll End Up Somewhere Else” Yogi Berra

Build for Tomorrow • “If You Don’t Know Where You’re Going, You’ll End Up Somewhere Else” Yogi Berra

Building Relationships for Life

Building Relationships for Life

History of Scotiabank’s involvement in your Profession • Tenure in the Professional field ( 13 years) – We are not about to buy market share. • Meeting future needs for Students and Professionals. – Focus Groups – Customers Expectations • Team of Experts ( Queen & Mc. Caul) • Heart surgery vs General Practitioner • Accessibility – Association Endorsement – Specialty Classification for Professionals

History of Scotiabank’s involvement in your Profession • Tenure in the Professional field ( 13 years) – We are not about to buy market share. • Meeting future needs for Students and Professionals. – Focus Groups – Customers Expectations • Team of Experts ( Queen & Mc. Caul) • Heart surgery vs General Practitioner • Accessibility – Association Endorsement – Specialty Classification for Professionals

My Role • Conduit to the health care profession. • Keeping abreast of changes in your industry i. e. incorporation, P. I. PE. D. A. tax issues etc. • Provide Guidance Throughout your career – Introductions to industry experts i. e. C. A’s, Lawyers, Insurance Experts and Brokers. – Advising which “Centre of Influence” will be best suited to your needs: – Location, Profession, Complexity

My Role • Conduit to the health care profession. • Keeping abreast of changes in your industry i. e. incorporation, P. I. PE. D. A. tax issues etc. • Provide Guidance Throughout your career – Introductions to industry experts i. e. C. A’s, Lawyers, Insurance Experts and Brokers. – Advising which “Centre of Influence” will be best suited to your needs: – Location, Profession, Complexity

My Role (cont’d) • Support Continuing Education: – University Involvement. – Professional Faculty • Training & Development of “Centre of Influence”. to meet the ever changing industry and meet your future expectations of a financial institutions.

My Role (cont’d) • Support Continuing Education: – University Involvement. – Professional Faculty • Training & Development of “Centre of Influence”. to meet the ever changing industry and meet your future expectations of a financial institutions.

Any Questions ?

Any Questions ?