870ba38916ee71ec7d5094c05076ee06.ppt

- Количество слайдов: 38

Planning for the Future How you spend and invest your money can have an impact on your lifestyle at a later time. What might you want to start saving for in the near future?

Planning for the Future How you spend and invest your money can have an impact on your lifestyle at a later time. What might you want to start saving for in the near future?

Lesson Objective Use tables or a formula to compute interest on certificates of deposit. Content Vocabulary certificate of deposit (CD) A kind of savings account that requires a specific amount deposited for a specified period of time, and which earns a higher interest rate that a regular savings account.

Lesson Objective Use tables or a formula to compute interest on certificates of deposit. Content Vocabulary certificate of deposit (CD) A kind of savings account that requires a specific amount deposited for a specified period of time, and which earns a higher interest rate that a regular savings account.

Lesson Objective Determine the annual percentage yield. Content Vocabulary annual percentage yield (APY) The rate of return on your investment for a one-year period.

Lesson Objective Determine the annual percentage yield. Content Vocabulary annual percentage yield (APY) The rate of return on your investment for a one-year period.

Lesson Objective Calculate the total cost of a stock investment. Content Vocabulary stocks stock certificate Proof of ownership in Shareof ownership in a corporation.

Lesson Objective Calculate the total cost of a stock investment. Content Vocabulary stocks stock certificate Proof of ownership in Shareof ownership in a corporation.

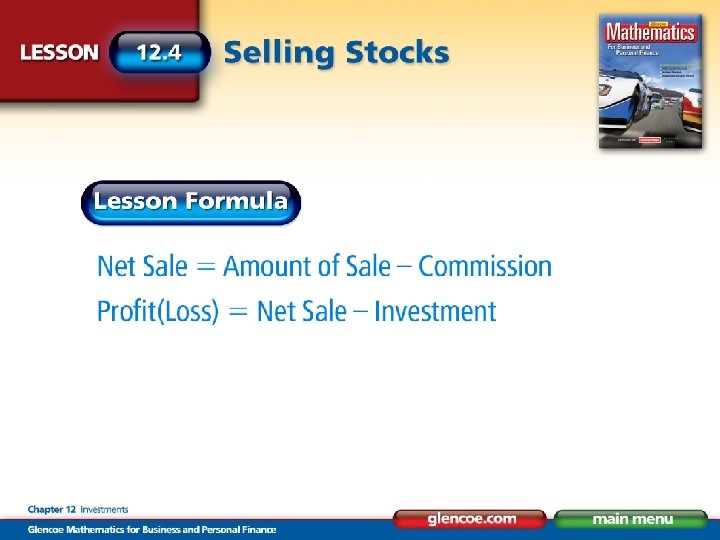

Lesson Objective Calculate the profit or loss from a stock sale. Content Vocabulary profit loss When the amount of money The amount of money made on a received from the sale of over and product or an investment product of stock is less amount invested. above the initialthan the amount initially invested.

Lesson Objective Calculate the profit or loss from a stock sale. Content Vocabulary profit loss When the amount of money The amount of money made on a received from the sale of over and product or an investment product of stock is less amount invested. above the initialthan the amount initially invested.

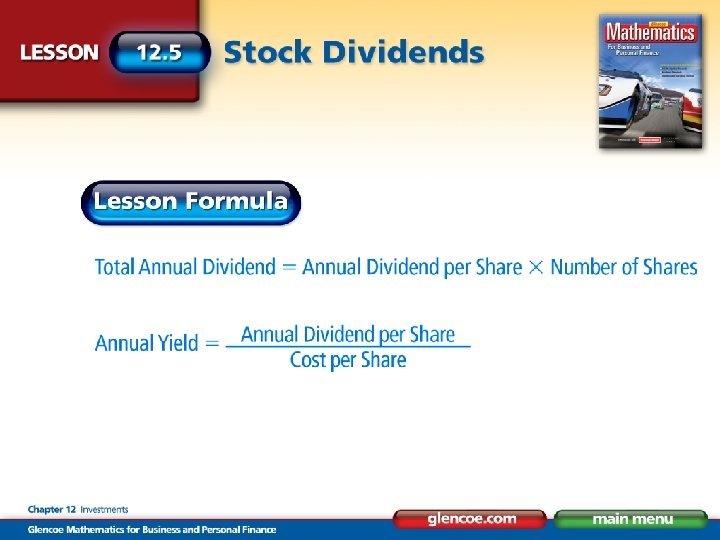

Lesson Objective Compute the annual dividend annual yield of a stock investment. Content Vocabulary dividend Money earned as a shareholder of a corporation.

Lesson Objective Compute the annual dividend annual yield of a stock investment. Content Vocabulary dividend Money earned as a shareholder of a corporation.

Lesson Objective Compute the loading charge, number of shares purchased, and profit or loss when you sell a mutual fund. Content Vocabulary mutual fund net asset value (NAV) loading charge net asset value (NAV) mutual fund The worth to an investment by an A kindpaid of a share offeredcompany fee of investment of a mutual fund, either when purchasing shares market determined by dividing the total of a investment company, which mutual fund the saving of many value by the number of shares accumulatesor when selling shares, based on a percent of them in a outstanding. individuals and investsthe amount invested. portfolio of stocks, bonds, or both.

Lesson Objective Compute the loading charge, number of shares purchased, and profit or loss when you sell a mutual fund. Content Vocabulary mutual fund net asset value (NAV) loading charge net asset value (NAV) mutual fund The worth to an investment by an A kindpaid of a share offeredcompany fee of investment of a mutual fund, either when purchasing shares market determined by dividing the total of a investment company, which mutual fund the saving of many value by the number of shares accumulatesor when selling shares, based on a percent of them in a outstanding. individuals and investsthe amount invested. portfolio of stocks, bonds, or both.

Lesson Objective Compute the annual interest and annual yield of a bond investment. Content Vocabulary mutual fund A kind of investment offered by an investment company, which accumulates the saving of many individuals and invests them in a portfolio of stocks, bond, or both.

Lesson Objective Compute the annual interest and annual yield of a bond investment. Content Vocabulary mutual fund A kind of investment offered by an investment company, which accumulates the saving of many individuals and invests them in a portfolio of stocks, bond, or both.

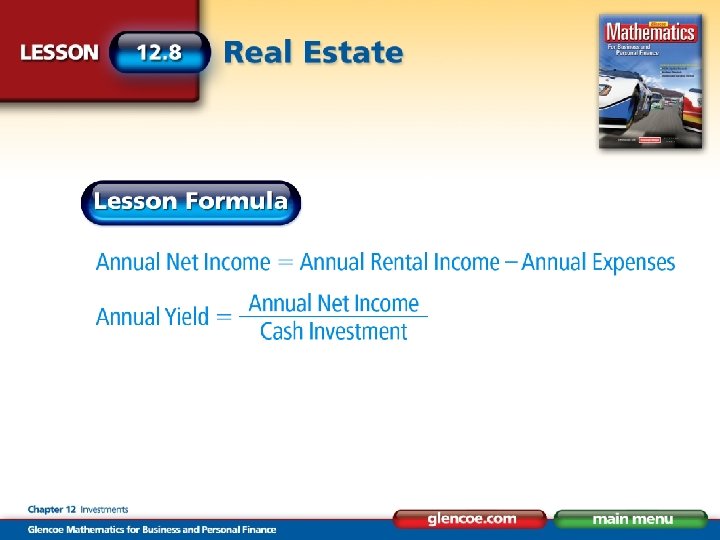

Lesson Objective Compute the annual net income, the annual yield, and monthly rent to charge on an investment in real estate rental property. Content Vocabulary rental property rental property Agreeing to pay a set fee for the Real estate available for or being use of and an alternative rented property, such as ato vehicle or building, often investment opportunities on a daily, weekly, or monthly basis. available at financial institutions.

Lesson Objective Compute the annual net income, the annual yield, and monthly rent to charge on an investment in real estate rental property. Content Vocabulary rental property rental property Agreeing to pay a set fee for the Real estate available for or being use of and an alternative rented property, such as ato vehicle or building, often investment opportunities on a daily, weekly, or monthly basis. available at financial institutions.

Lesson Objective Compute the required minimum distribution (RMD) and the penalty for early withdrawal from an individual retirement account (IRA). Content Vocabulary individual retirement account (IRA) Roth IRA required minimum distribution (RMD) required Roth IRAminimum distribution individual retirement account (RMD) (IRA) Individual retirement accounts, The amount you are required to which mature retirement being tax A tax-deferredwith interestaccount withdraw from a free. for an individual. traditional IRA once you reach retirement age, based on life expectancy.

Lesson Objective Compute the required minimum distribution (RMD) and the penalty for early withdrawal from an individual retirement account (IRA). Content Vocabulary individual retirement account (IRA) Roth IRA required minimum distribution (RMD) required Roth IRAminimum distribution individual retirement account (RMD) (IRA) Individual retirement accounts, The amount you are required to which mature retirement being tax A tax-deferredwith interestaccount withdraw from a free. for an individual. traditional IRA once you reach retirement age, based on life expectancy.

Summary Money Grows Investing your money can make it grow faster. Investments • Buying stocks (with stock dividends) • Selling stocks • Mutual funds • Bonds • Real estate Ways to Grow Money Interest • Certificates of deposit (CD) • Annual percentage yield (APY)

Summary Money Grows Investing your money can make it grow faster. Investments • Buying stocks (with stock dividends) • Selling stocks • Mutual funds • Bonds • Real estate Ways to Grow Money Interest • Certificates of deposit (CD) • Annual percentage yield (APY)

1. Lindsey Mc. Coy invests $5, 000 in a 1 -year certificate of deposit that earns interest at an annual rate of 4. 25% compounded monthly. The amount per $1. 00 is 1. 04338. How much interest will she earn at the end of one year? A. B. C. D. $203. 71 $216. 90 $310. 90 $411. 47

1. Lindsey Mc. Coy invests $5, 000 in a 1 -year certificate of deposit that earns interest at an annual rate of 4. 25% compounded monthly. The amount per $1. 00 is 1. 04338. How much interest will she earn at the end of one year? A. B. C. D. $203. 71 $216. 90 $310. 90 $411. 47

2. ALGEBRA Lloyd Mishra invests $8, 000 in a 1 -year CD that pays 5% compounded quarterly. Use the formula A = P(1. 00 + r)n to calculate the amount of interest Lloyd earns. A. B. C. D. $100. 00 $407. 56 $428. 52 $1, 724. 05

2. ALGEBRA Lloyd Mishra invests $8, 000 in a 1 -year CD that pays 5% compounded quarterly. Use the formula A = P(1. 00 + r)n to calculate the amount of interest Lloyd earns. A. B. C. D. $100. 00 $407. 56 $428. 52 $1, 724. 05

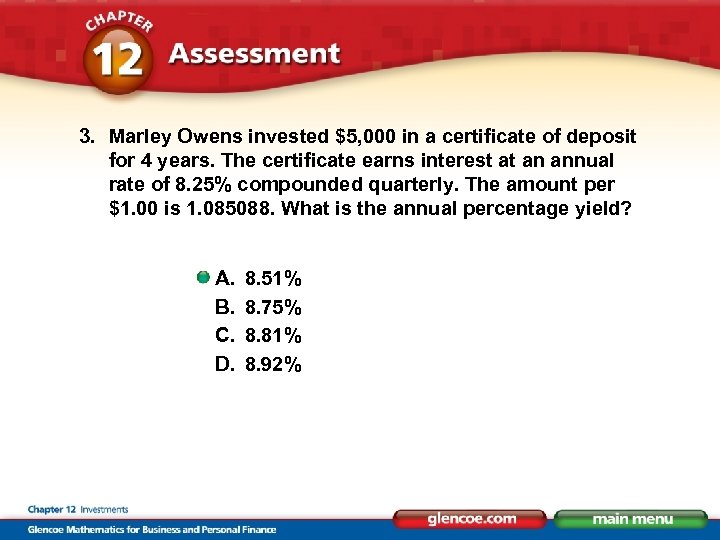

3. Marley Owens invested $5, 000 in a certificate of deposit for 4 years. The certificate earns interest at an annual rate of 8. 25% compounded quarterly. The amount per $1. 00 is 1. 085088. What is the annual percentage yield? A. B. C. D. 8. 51% 8. 75% 8. 81% 8. 92%

3. Marley Owens invested $5, 000 in a certificate of deposit for 4 years. The certificate earns interest at an annual rate of 8. 25% compounded quarterly. The amount per $1. 00 is 1. 085088. What is the annual percentage yield? A. B. C. D. 8. 51% 8. 75% 8. 81% 8. 92%

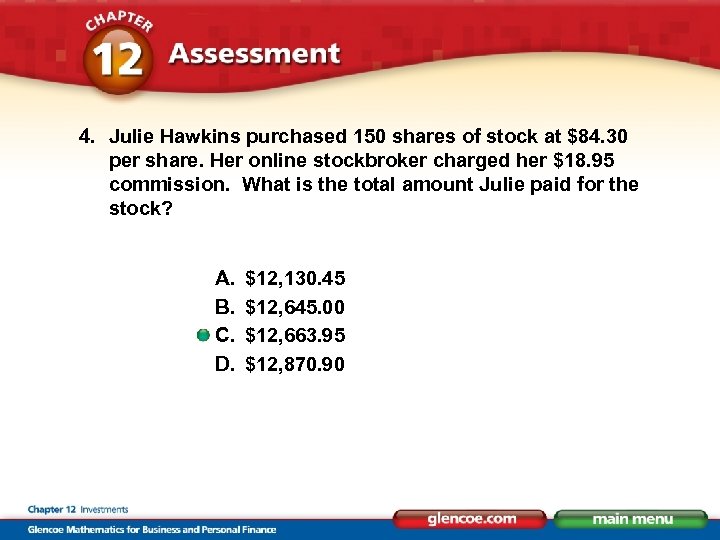

4. Julie Hawkins purchased 150 shares of stock at $84. 30 per share. Her online stockbroker charged her $18. 95 commission. What is the total amount Julie paid for the stock? A. B. C. D. $12, 130. 45 $12, 645. 00 $12, 663. 95 $12, 870. 90

4. Julie Hawkins purchased 150 shares of stock at $84. 30 per share. Her online stockbroker charged her $18. 95 commission. What is the total amount Julie paid for the stock? A. B. C. D. $12, 130. 45 $12, 645. 00 $12, 663. 95 $12, 870. 90

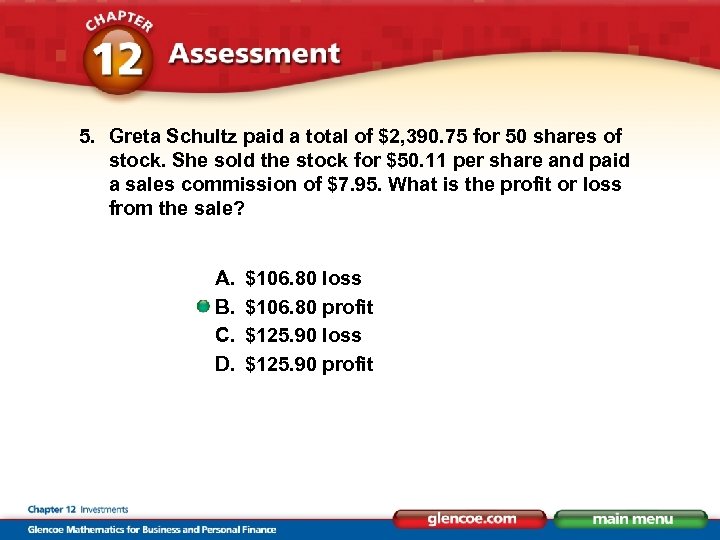

5. Greta Schultz paid a total of $2, 390. 75 for 50 shares of stock. She sold the stock for $50. 11 per share and paid a sales commission of $7. 95. What is the profit or loss from the sale? A. B. C. D. $106. 80 loss $106. 80 profit $125. 90 loss $125. 90 profit

5. Greta Schultz paid a total of $2, 390. 75 for 50 shares of stock. She sold the stock for $50. 11 per share and paid a sales commission of $7. 95. What is the profit or loss from the sale? A. B. C. D. $106. 80 loss $106. 80 profit $125. 90 loss $125. 90 profit

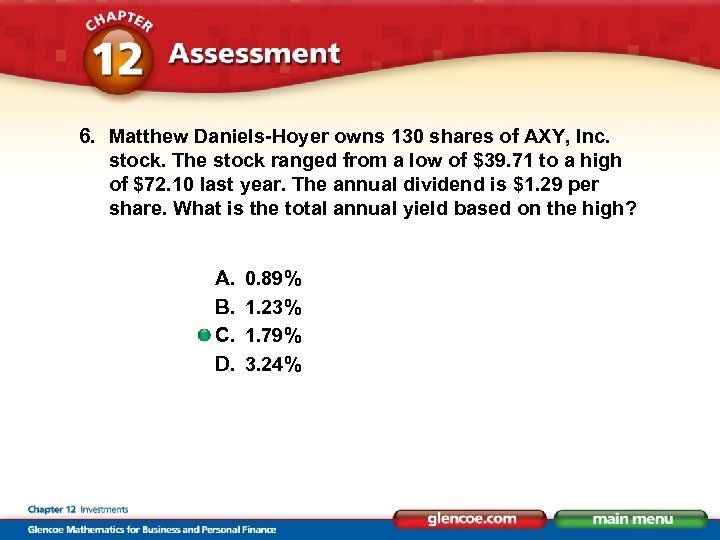

6. Matthew Daniels-Hoyer owns 130 shares of AXY, Inc. stock. The stock ranged from a low of $39. 71 to a high of $72. 10 last year. The annual dividend is $1. 29 per share. What is the total annual yield based on the high? A. B. C. D. 0. 89% 1. 23% 1. 79% 3. 24%

6. Matthew Daniels-Hoyer owns 130 shares of AXY, Inc. stock. The stock ranged from a low of $39. 71 to a high of $72. 10 last year. The annual dividend is $1. 29 per share. What is the total annual yield based on the high? A. B. C. D. 0. 89% 1. 23% 1. 79% 3. 24%

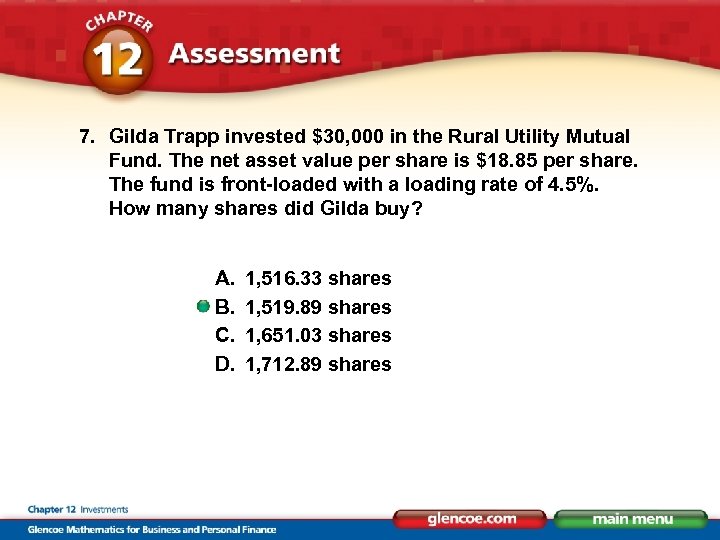

7. Gilda Trapp invested $30, 000 in the Rural Utility Mutual Fund. The net asset value per share is $18. 85 per share. The fund is front-loaded with a loading rate of 4. 5%. How many shares did Gilda buy? A. B. C. D. 1, 516. 33 shares 1, 519. 89 shares 1, 651. 03 shares 1, 712. 89 shares

7. Gilda Trapp invested $30, 000 in the Rural Utility Mutual Fund. The net asset value per share is $18. 85 per share. The fund is front-loaded with a loading rate of 4. 5%. How many shares did Gilda buy? A. B. C. D. 1, 516. 33 shares 1, 519. 89 shares 1, 651. 03 shares 1, 712. 89 shares

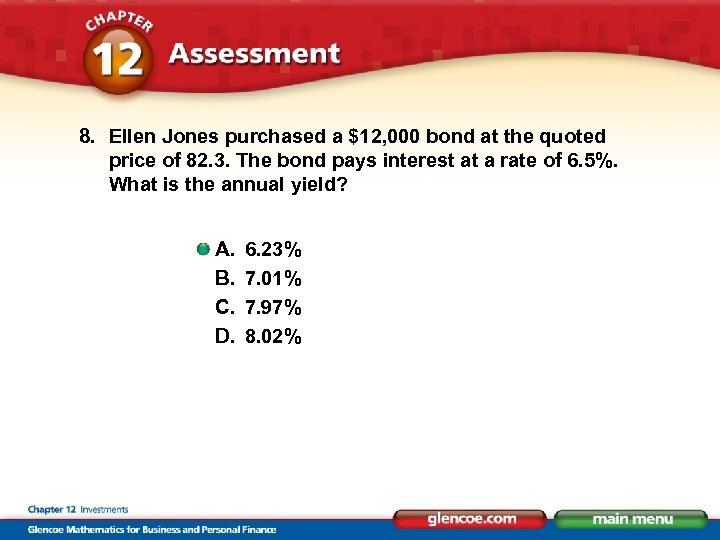

8. Ellen Jones purchased a $12, 000 bond at the quoted price of 82. 3. The bond pays interest at a rate of 6. 5%. What is the annual yield? A. B. C. D. 6. 23% 7. 01% 7. 97% 8. 02%

8. Ellen Jones purchased a $12, 000 bond at the quoted price of 82. 3. The bond pays interest at a rate of 6. 5%. What is the annual yield? A. B. C. D. 6. 23% 7. 01% 7. 97% 8. 02%

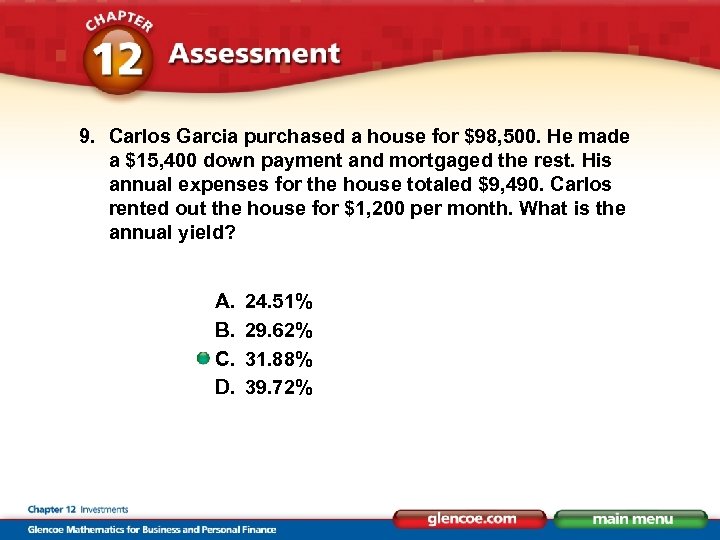

9. Carlos Garcia purchased a house for $98, 500. He made a $15, 400 down payment and mortgaged the rest. His annual expenses for the house totaled $9, 490. Carlos rented out the house for $1, 200 per month. What is the annual yield? A. B. C. D. 24. 51% 29. 62% 31. 88% 39. 72%

9. Carlos Garcia purchased a house for $98, 500. He made a $15, 400 down payment and mortgaged the rest. His annual expenses for the house totaled $9, 490. Carlos rented out the house for $1, 200 per month. What is the annual yield? A. B. C. D. 24. 51% 29. 62% 31. 88% 39. 72%

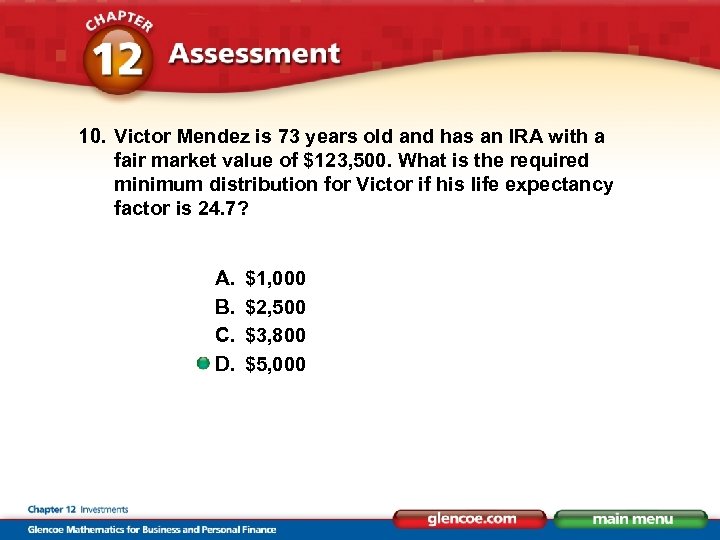

10. Victor Mendez is 73 years old and has an IRA with a fair market value of $123, 500. What is the required minimum distribution for Victor if his life expectancy factor is 24. 7? A. B. C. D. $1, 000 $2, 500 $3, 800 $5, 000

10. Victor Mendez is 73 years old and has an IRA with a fair market value of $123, 500. What is the required minimum distribution for Victor if his life expectancy factor is 24. 7? A. B. C. D. $1, 000 $2, 500 $3, 800 $5, 000

New Investors In this project you will track the performance of three different stocks over a three-month period.

New Investors In this project you will track the performance of three different stocks over a three-month period.

Step 1 Do Your Research ü Choose three companies that are located in your community or offer products or services that interest you. ü Research the performance of each company’s stock over the last three months.

Step 1 Do Your Research ü Choose three companies that are located in your community or offer products or services that interest you. ü Research the performance of each company’s stock over the last three months.

Step 2 Explore Your Community Interview two corporate professionals in your community. Do they keep track of their corporation’s stock performance? Do they consider it wise to invest in their own company’s stocks or bonds?

Step 2 Explore Your Community Interview two corporate professionals in your community. Do they keep track of their corporation’s stock performance? Do they consider it wise to invest in their own company’s stocks or bonds?

Step 3 Determine Your Stock Performance ü If you had invested $500 in each company’s stock three months ago, how many shares could you have purchased then? ü With that initial investment, currently what would be your profit or loss for each stock?

Step 3 Determine Your Stock Performance ü If you had invested $500 in each company’s stock three months ago, how many shares could you have purchased then? ü With that initial investment, currently what would be your profit or loss for each stock?

Step 4 Develop Your Presentation ü Prepare a report of your findings. ü With spreadsheet software, create a chart that shows the profit or loss over the past three months had you invested $500 in each company’s stock. ü Print your completed report and chart to present to your class.

Step 4 Develop Your Presentation ü Prepare a report of your findings. ü With spreadsheet software, create a chart that shows the profit or loss over the past three months had you invested $500 in each company’s stock. ü Print your completed report and chart to present to your class.

Step 5 Evaluate Go to glencoe. com for an evaluation rubric.

Step 5 Evaluate Go to glencoe. com for an evaluation rubric.

End of Chapter 12 Investments

End of Chapter 12 Investments