bc0d8b86a5c4bdaf96f276c3fbb85ec7.ppt

- Количество слайдов: 15

Planning for early stage financing in Estonia CONNECT ESTONIA Tarvo Tamm

Planning for early stage financing in Estonia CONNECT ESTONIA Tarvo Tamm

Planning for early stage financing in Estonia Presentation outline Planning multi-level Funding measures Market Study lessonsinvestment professionals June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonia Presentation outline Planning multi-level Funding measures Market Study lessonsinvestment professionals June 24, 2005 PAxis workshop, Salamanca

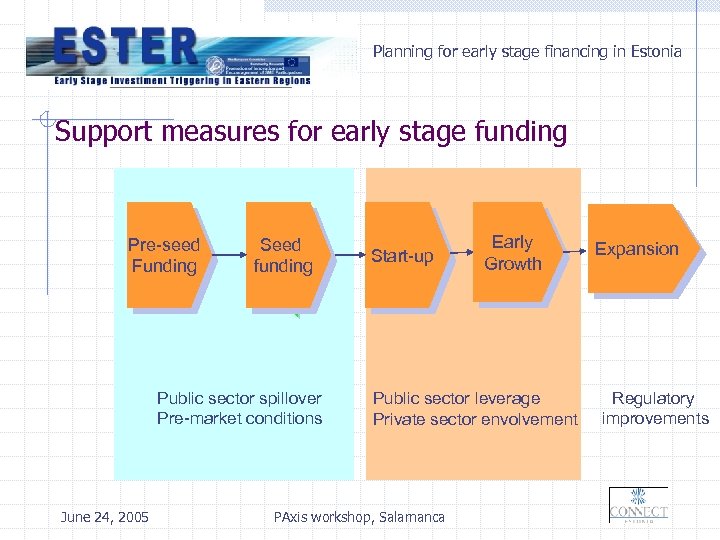

Planning for early stage financing in Estonia Support measures for early stage funding Pre-seed Funding Seed funding Public sector spillover Pre-market conditions June 24, 2005 Start-up Early Growth Public sector leverage Private sector envolvement PAxis workshop, Salamanca Expansion Regulatory improvements

Planning for early stage financing in Estonia Support measures for early stage funding Pre-seed Funding Seed funding Public sector spillover Pre-market conditions June 24, 2005 Start-up Early Growth Public sector leverage Private sector envolvement PAxis workshop, Salamanca Expansion Regulatory improvements

Planning for early stage financing in Estonia Pre-seed Funding, Seed Funding Technology Grant System Development n n n Development Centre funding Project funding 2, 7 MEUR for Technology Development Centres (2005) 6, 5 MEUR for Technology Development projects (2005) Variation of funding levels Variation of funding applicants: universities, start-up companies and SMEs June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonia Pre-seed Funding, Seed Funding Technology Grant System Development n n n Development Centre funding Project funding 2, 7 MEUR for Technology Development Centres (2005) 6, 5 MEUR for Technology Development projects (2005) Variation of funding levels Variation of funding applicants: universities, start-up companies and SMEs June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonia Pre-seed Funding There is need to improve linkages between industry and academia There is a pre-seed funding gap which is restricting the flow of technology from the laboratories to the market place SOLUTION n n There is possible to improve the level and quality of commercialization through the provision proof-of concept funding and/or widening technology grant funding Need for cluster support June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonia Pre-seed Funding There is need to improve linkages between industry and academia There is a pre-seed funding gap which is restricting the flow of technology from the laboratories to the market place SOLUTION n n There is possible to improve the level and quality of commercialization through the provision proof-of concept funding and/or widening technology grant funding Need for cluster support June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonia Start-up Funding Equity Gap – virtually no investors in the start-up , precash flow situation Under-developed private equity/venture capital market Consensus about the need for a public venture fund n Direct investments to companies w 100% publicly owned fund w Private co-investment on project basis, public fund invests up to 50% cash-to-cash w Prospective co-investor in the fund EIF or other EU sources as well as similar funds in neighbouring countries w Minimum investment EUR 0. 1 m, maximum investment EUR 1. 5 m June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonia Start-up Funding Equity Gap – virtually no investors in the start-up , precash flow situation Under-developed private equity/venture capital market Consensus about the need for a public venture fund n Direct investments to companies w 100% publicly owned fund w Private co-investment on project basis, public fund invests up to 50% cash-to-cash w Prospective co-investor in the fund EIF or other EU sources as well as similar funds in neighbouring countries w Minimum investment EUR 0. 1 m, maximum investment EUR 1. 5 m June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonia Start-up Funding n Why direct investments (matched project by project) w Limited dealflow, limited number of feasible projects w Growing informal investment community n Mobilizing private investor community to invest in early stage w Strong signal to private sector- partner is available w Competence building for industry (like SITRA in Finland) w Support actions—awareness building, business development, competence building, business internationalization– private fund management companies engage on limited scale in these actions June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonia Start-up Funding n Why direct investments (matched project by project) w Limited dealflow, limited number of feasible projects w Growing informal investment community n Mobilizing private investor community to invest in early stage w Strong signal to private sector- partner is available w Competence building for industry (like SITRA in Finland) w Support actions—awareness building, business development, competence building, business internationalization– private fund management companies engage on limited scale in these actions June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonia Early Growth and Expansion Funding n Public Venture Fund -- Fund Investments w Fund-of-funds w Investments into private venture capital funds w Under planning, but favored structure with strong upside incentives to trigger equity market development n Why investments into private venture capital funds w Need for local cornerstone investors in private funds w Triggering private/equity venture capital development w Support for institutional professional investment development into non-listed equities w Competition between funds is essential June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonia Early Growth and Expansion Funding n Public Venture Fund -- Fund Investments w Fund-of-funds w Investments into private venture capital funds w Under planning, but favored structure with strong upside incentives to trigger equity market development n Why investments into private venture capital funds w Need for local cornerstone investors in private funds w Triggering private/equity venture capital development w Support for institutional professional investment development into non-listed equities w Competition between funds is essential June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonia Seed Capital Funding - point for discussion Separate seed capital funding vehicle n Minimum Investments 0, 03 -0, 1 MEUR n Strong links with universities and technology incubators w Incubator/University Seed Fund n n n Early project incorporation No need for private sector co-finacing in the seed round Filling the gap between pre-seed and start-up June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonia Seed Capital Funding - point for discussion Separate seed capital funding vehicle n Minimum Investments 0, 03 -0, 1 MEUR n Strong links with universities and technology incubators w Incubator/University Seed Fund n n n Early project incorporation No need for private sector co-finacing in the seed round Filling the gap between pre-seed and start-up June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonian Private Equity/VC Landscape Small Estonian market Part of a bigger market(Baltics, Baltics and Scandinavia, CEEC countries, EU) 5 fund management companies managing institutional funds Big role of private (informal) investor capital, but without well-defined fund management companies Only one VC-type company (who is raising funds currently) is targeting start-ups, others growth investments n Three have closed their investment activities June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonian Private Equity/VC Landscape Small Estonian market Part of a bigger market(Baltics, Baltics and Scandinavia, CEEC countries, EU) 5 fund management companies managing institutional funds Big role of private (informal) investor capital, but without well-defined fund management companies Only one VC-type company (who is raising funds currently) is targeting start-ups, others growth investments n Three have closed their investment activities June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonia Interviews with private equity/venture capital investment company professionals in Estonia 10 interviews n 3 GPs in private equity/VC companies n 7 investment company professionals n 284 MEUR under management n Representative investment community sample June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonia Interviews with private equity/venture capital investment company professionals in Estonia 10 interviews n 3 GPs in private equity/VC companies n 7 investment company professionals n 284 MEUR under management n Representative investment community sample June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonia Interviews with investment professionals. Results 1. Problems in tax system 2. Incentive system favored by investment professionals June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonia Interviews with investment professionals. Results 1. Problems in tax system 2. Incentive system favored by investment professionals June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonia Problems in tax system No possibility for legal domicile for VC fund Taxing stock options as salary costs Net assets are less than 50% of share capital– it is possible to liquidate the venture by public auhority Convertible debt is limited Taxing dividends within the holding company June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonia Problems in tax system No possibility for legal domicile for VC fund Taxing stock options as salary costs Net assets are less than 50% of share capital– it is possible to liquidate the venture by public auhority Convertible debt is limited Taxing dividends within the holding company June 24, 2005 PAxis workshop, Salamanca

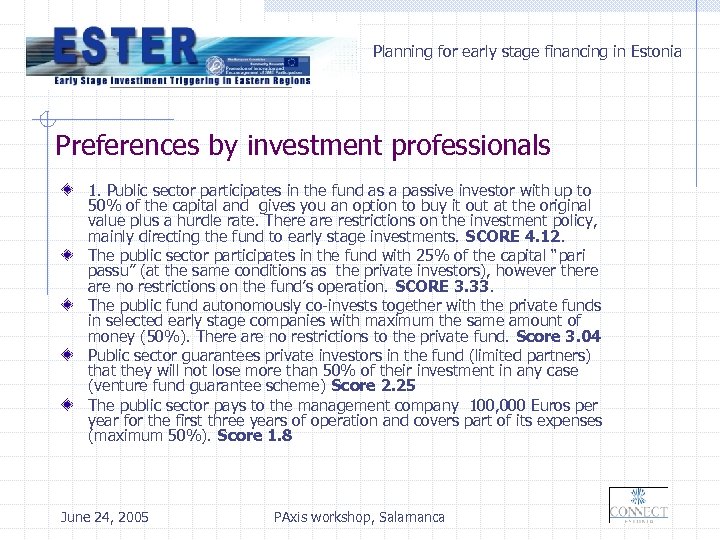

Planning for early stage financing in Estonia Preferences by investment professionals 1. Public sector participates in the fund as a passive investor with up to 50% of the capital and gives you an option to buy it out at the original value plus a hurdle rate. There are restrictions on the investment policy, mainly directing the fund to early stage investments. SCORE 4. 12. The public sector participates in the fund with 25% of the capital “pari passu” (at the same conditions as the private investors), however there are no restrictions on the fund’s operation. SCORE 3. 33. The public fund autonomously co-invests together with the private funds in selected early stage companies with maximum the same amount of money (50%). There are no restrictions to the private fund. Score 3. 04 Public sector guarantees private investors in the fund (limited partners) that they will not lose more than 50% of their investment in any case (venture fund guarantee scheme) Score 2. 25 The public sector pays to the management company 100, 000 Euros per year for the first three years of operation and covers part of its expenses (maximum 50%). Score 1. 8 June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonia Preferences by investment professionals 1. Public sector participates in the fund as a passive investor with up to 50% of the capital and gives you an option to buy it out at the original value plus a hurdle rate. There are restrictions on the investment policy, mainly directing the fund to early stage investments. SCORE 4. 12. The public sector participates in the fund with 25% of the capital “pari passu” (at the same conditions as the private investors), however there are no restrictions on the fund’s operation. SCORE 3. 33. The public fund autonomously co-invests together with the private funds in selected early stage companies with maximum the same amount of money (50%). There are no restrictions to the private fund. Score 3. 04 Public sector guarantees private investors in the fund (limited partners) that they will not lose more than 50% of their investment in any case (venture fund guarantee scheme) Score 2. 25 The public sector pays to the management company 100, 000 Euros per year for the first three years of operation and covers part of its expenses (maximum 50%). Score 1. 8 June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonia CONTACT Connect Estonia www. connectestonia. net Tarvo Tamm tarvo. tamm@connectestonia. net Kristjan Kalda kristjan. kalda@microlink. ee June 24, 2005 PAxis workshop, Salamanca

Planning for early stage financing in Estonia CONTACT Connect Estonia www. connectestonia. net Tarvo Tamm tarvo. tamm@connectestonia. net Kristjan Kalda kristjan. kalda@microlink. ee June 24, 2005 PAxis workshop, Salamanca