c5fad46c8ed5d155248e6cff3c083a42.ppt

- Количество слайдов: 14

Planning Demand Supply in a Supply Chain Manipulating the Demand Chapter 9 1 utdallas. edu/~metin

Planning Demand Supply in a Supply Chain Manipulating the Demand Chapter 9 1 utdallas. edu/~metin

Matching Demand Supply u Supply = Demand u Supply < Demand => Lost revenue opportunity u Supply > Demand => Inventory u Manage Supply – Productions Management u Manage Demand – Marketing 2 utdallas. edu/~metin

Matching Demand Supply u Supply = Demand u Supply < Demand => Lost revenue opportunity u Supply > Demand => Inventory u Manage Supply – Productions Management u Manage Demand – Marketing 2 utdallas. edu/~metin

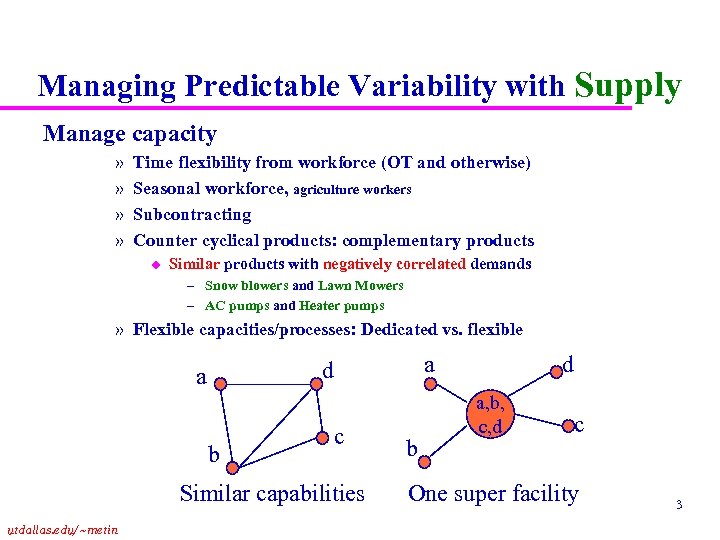

Managing Predictable Variability with Supply Manage capacity » » Time flexibility from workforce (OT and otherwise) Seasonal workforce, agriculture workers Subcontracting Counter cyclical products: complementary products u Similar products with negatively correlated demands – Snow blowers and Lawn Mowers – AC pumps and Heater pumps » Flexible capacities/processes: Dedicated vs. flexible a d a b c Similar capabilities utdallas. edu/~metin b d a, b, c, d c One super facility 3

Managing Predictable Variability with Supply Manage capacity » » Time flexibility from workforce (OT and otherwise) Seasonal workforce, agriculture workers Subcontracting Counter cyclical products: complementary products u Similar products with negatively correlated demands – Snow blowers and Lawn Mowers – AC pumps and Heater pumps » Flexible capacities/processes: Dedicated vs. flexible a d a b c Similar capabilities utdallas. edu/~metin b d a, b, c, d c One super facility 3

Managing Predictable Variability with Inventory u Component commonality – Remember fast food restaurant menus – Component commonality increase the benefit of postponement. » More on this later u Build seasonal inventory of predictable products in preseason – Nothing can be learnt by procrastinating u Keep inventory of predictable products in the downstream supply chain 4 utdallas. edu/~metin

Managing Predictable Variability with Inventory u Component commonality – Remember fast food restaurant menus – Component commonality increase the benefit of postponement. » More on this later u Build seasonal inventory of predictable products in preseason – Nothing can be learnt by procrastinating u Keep inventory of predictable products in the downstream supply chain 4 utdallas. edu/~metin

Managing Predictable Variability with Pricing Revisit Red Tomato Tools u Manage demand with pricing – Original pricing: » Cost = $422, 275, Revenue = $640, 000, Profit=$217, 725 u Demand increases from discounting – Market growth – Stealing market share from competitors – Forward buying » stealing your own market share from the future Discount of $1 in a period increases that period’s demand by 10% (market and market share growth) and moves 20% of next two months demand forward Can you gather this information –price sensitivity of the demand- easily? Does your company have this information? 5 utdallas. edu/~metin

Managing Predictable Variability with Pricing Revisit Red Tomato Tools u Manage demand with pricing – Original pricing: » Cost = $422, 275, Revenue = $640, 000, Profit=$217, 725 u Demand increases from discounting – Market growth – Stealing market share from competitors – Forward buying » stealing your own market share from the future Discount of $1 in a period increases that period’s demand by 10% (market and market share growth) and moves 20% of next two months demand forward Can you gather this information –price sensitivity of the demand- easily? Does your company have this information? 5 utdallas. edu/~metin

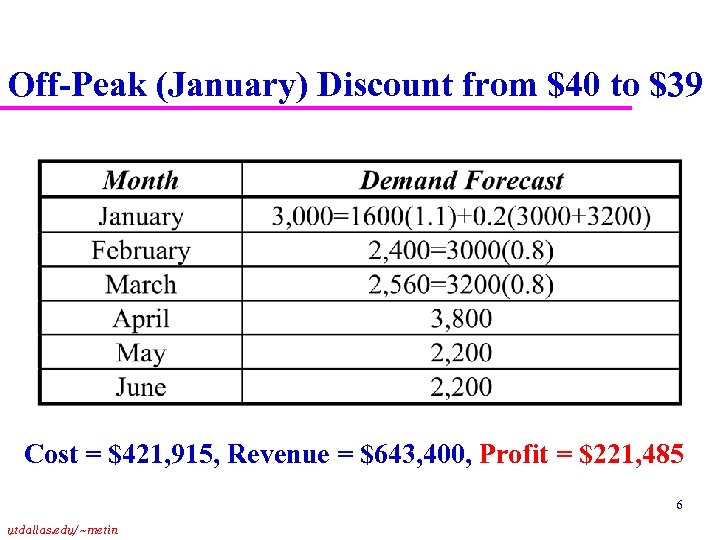

Off-Peak (January) Discount from $40 to $39 Cost = $421, 915, Revenue = $643, 400, Profit = $221, 485 6 utdallas. edu/~metin

Off-Peak (January) Discount from $40 to $39 Cost = $421, 915, Revenue = $643, 400, Profit = $221, 485 6 utdallas. edu/~metin

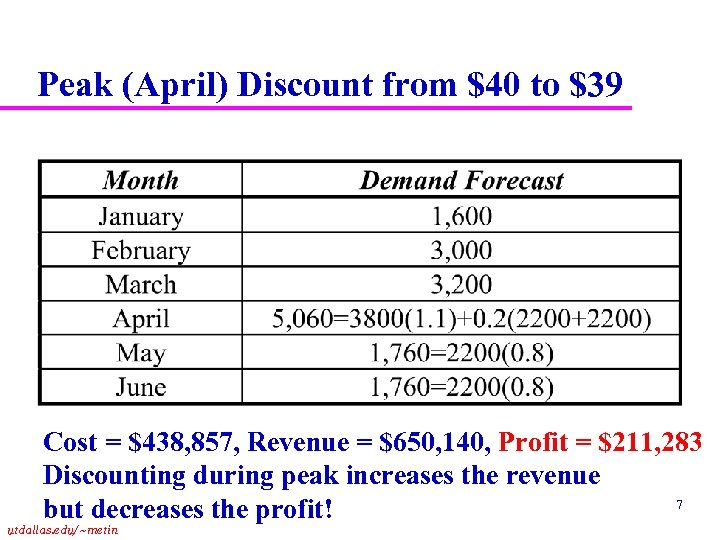

Peak (April) Discount from $40 to $39 Cost = $438, 857, Revenue = $650, 140, Profit = $211, 283 Discounting during peak increases the revenue 7 but decreases the profit! utdallas. edu/~metin

Peak (April) Discount from $40 to $39 Cost = $438, 857, Revenue = $650, 140, Profit = $211, 283 Discounting during peak increases the revenue 7 but decreases the profit! utdallas. edu/~metin

Demand Management u Pricing and Aggregate Planning must be done jointly u Factors affecting discount timing and their new values – Consumption: 100% increase in consumption instead of 10% increase – Forward buy, still 20% of the next two months – Product Margin: Impact of higher margin. What if discount from $31 to $30 instead of from $40 to $39. ) 8 utdallas. edu/~metin

Demand Management u Pricing and Aggregate Planning must be done jointly u Factors affecting discount timing and their new values – Consumption: 100% increase in consumption instead of 10% increase – Forward buy, still 20% of the next two months – Product Margin: Impact of higher margin. What if discount from $31 to $30 instead of from $40 to $39. ) 8 utdallas. edu/~metin

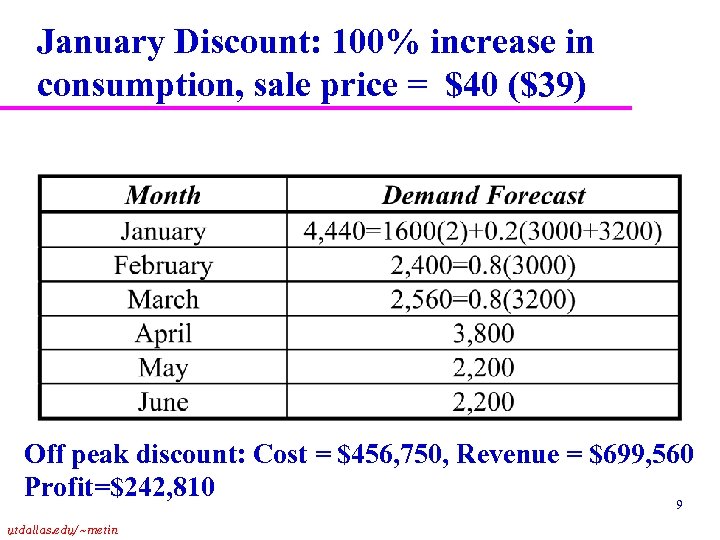

January Discount: 100% increase in consumption, sale price = $40 ($39) Off peak discount: Cost = $456, 750, Revenue = $699, 560 Profit=$242, 810 9 utdallas. edu/~metin

January Discount: 100% increase in consumption, sale price = $40 ($39) Off peak discount: Cost = $456, 750, Revenue = $699, 560 Profit=$242, 810 9 utdallas. edu/~metin

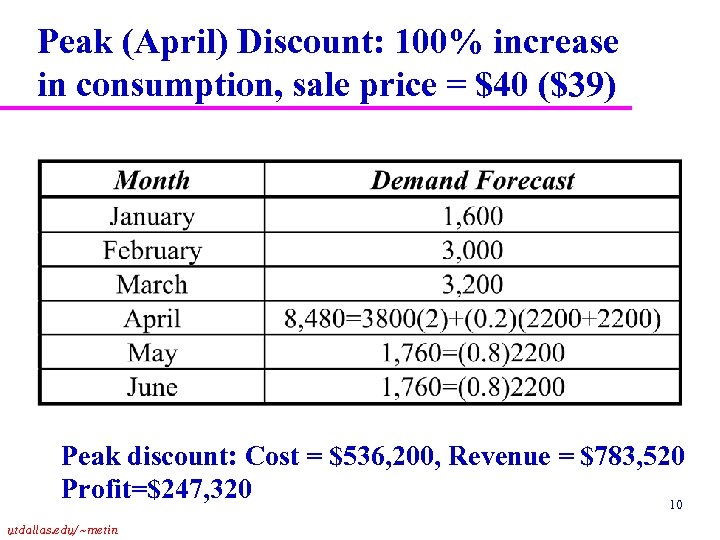

Peak (April) Discount: 100% increase in consumption, sale price = $40 ($39) Peak discount: Cost = $536, 200, Revenue = $783, 520 Profit=$247, 320 10 utdallas. edu/~metin

Peak (April) Discount: 100% increase in consumption, sale price = $40 ($39) Peak discount: Cost = $536, 200, Revenue = $783, 520 Profit=$247, 320 10 utdallas. edu/~metin

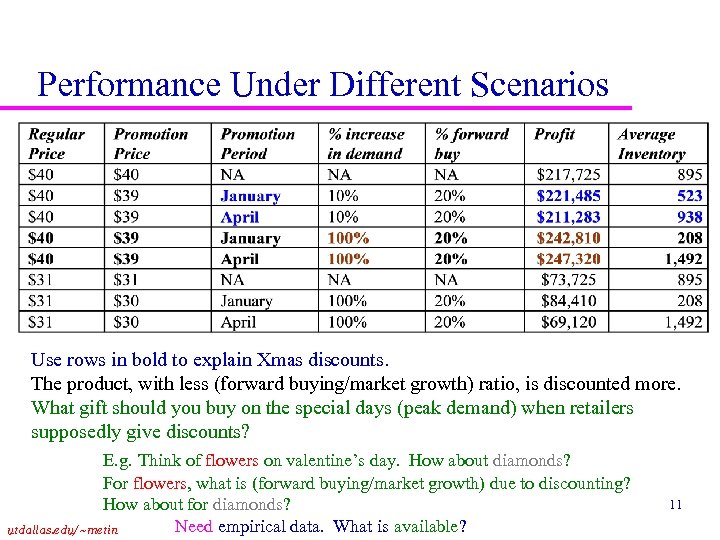

Performance Under Different Scenarios Use rows in bold to explain Xmas discounts. The product, with less (forward buying/market growth) ratio, is discounted more. What gift should you buy on the special days (peak demand) when retailers supposedly give discounts? E. g. Think of flowers on valentine’s day. How about diamonds? For flowers, what is (forward buying/market growth) due to discounting? How about for diamonds? Need empirical data. What is available? utdallas. edu/~metin 11

Performance Under Different Scenarios Use rows in bold to explain Xmas discounts. The product, with less (forward buying/market growth) ratio, is discounted more. What gift should you buy on the special days (peak demand) when retailers supposedly give discounts? E. g. Think of flowers on valentine’s day. How about diamonds? For flowers, what is (forward buying/market growth) due to discounting? How about for diamonds? Need empirical data. What is available? utdallas. edu/~metin 11

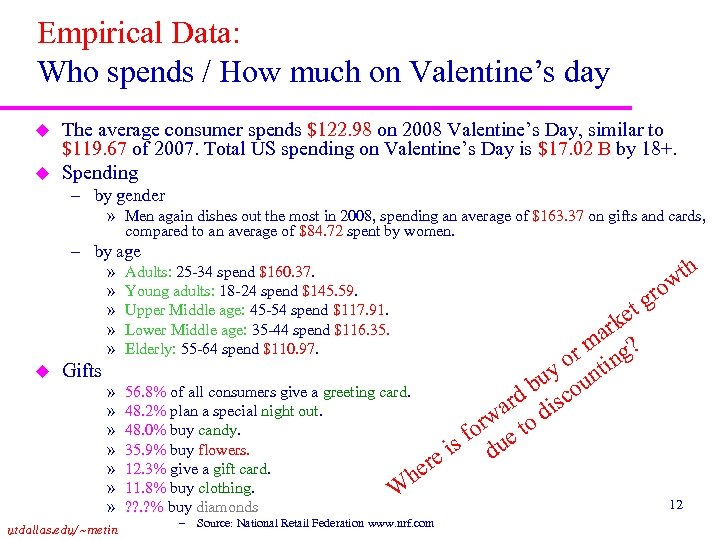

Empirical Data: Who spends / How much on Valentine’s day u u The average consumer spends $122. 98 on 2008 Valentine’s Day, similar to $119. 67 of 2007. Total US spending on Valentine’s Day is $17. 02 B by 18+. Spending – by gender » Men again dishes out the most in 2008, spending an average of $163. 37 on gifts and cards, compared to an average of $84. 72 spent by women. – by age » » » » u Adults: 25 -34 spend $160. 37. Young adults: 18 -24 spend $145. 59. Upper Middle age: 45 -54 spend $117. 91. Lower Middle age: 35 -44 spend $116. 35. Elderly: 55 -64 spend $110. 97. th w » » » 56. 8% of all consumers give a greeting card. 48. 2% plan a special night out. 48. 0% buy candy. 35. 9% buy flowers. 12. 3% give a gift card. he 11. 8% buy clothing. W ? ? . ? % buy diamonds e rk ma g? or tin uy oun d b isc ar d w or e to f is du re Gifts utdallas. edu/~metin o gr t – Source: National Retail Federation www. nrf. com 12

Empirical Data: Who spends / How much on Valentine’s day u u The average consumer spends $122. 98 on 2008 Valentine’s Day, similar to $119. 67 of 2007. Total US spending on Valentine’s Day is $17. 02 B by 18+. Spending – by gender » Men again dishes out the most in 2008, spending an average of $163. 37 on gifts and cards, compared to an average of $84. 72 spent by women. – by age » » » » u Adults: 25 -34 spend $160. 37. Young adults: 18 -24 spend $145. 59. Upper Middle age: 45 -54 spend $117. 91. Lower Middle age: 35 -44 spend $116. 35. Elderly: 55 -64 spend $110. 97. th w » » » 56. 8% of all consumers give a greeting card. 48. 2% plan a special night out. 48. 0% buy candy. 35. 9% buy flowers. 12. 3% give a gift card. he 11. 8% buy clothing. W ? ? . ? % buy diamonds e rk ma g? or tin uy oun d b isc ar d w or e to f is du re Gifts utdallas. edu/~metin o gr t – Source: National Retail Federation www. nrf. com 12

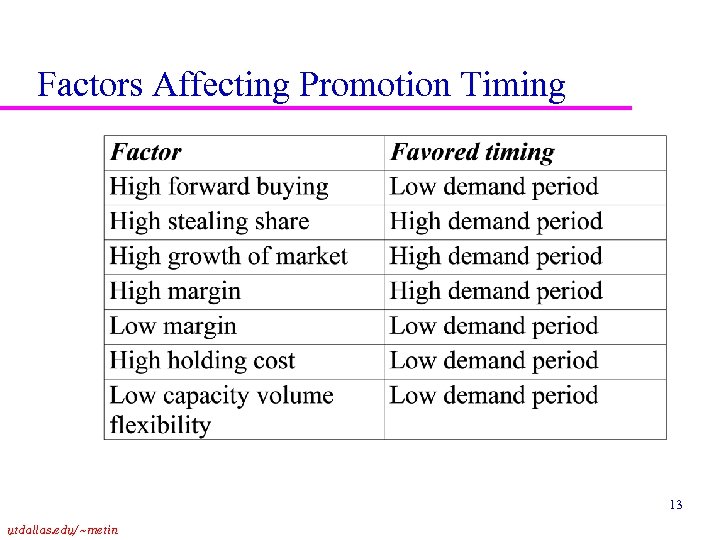

Factors Affecting Promotion Timing 13 utdallas. edu/~metin

Factors Affecting Promotion Timing 13 utdallas. edu/~metin

Summary u Optimality of peak vs. off-peak discounting depends on – Forward buy vs. Market growth 14 utdallas. edu/~metin

Summary u Optimality of peak vs. off-peak discounting depends on – Forward buy vs. Market growth 14 utdallas. edu/~metin