54d55f4799cb383531b1bcf45882c790.ppt

- Количество слайдов: 37

Improving Coverage and Access: An Overview of State Activities W. David Helms, President & CEO Academy. Health November 18, 2006

Improving Coverage and Access: An Overview of State Activities W. David Helms, President & CEO Academy. Health November 18, 2006

Drivers of State Health Reform Efforts l l Increasing numbers of uninsured Health insurance becoming increasingly unaffordable for working families Some states beginning to emerge from fiscal crisis Lack of national consensus 2

Drivers of State Health Reform Efforts l l Increasing numbers of uninsured Health insurance becoming increasingly unaffordable for working families Some states beginning to emerge from fiscal crisis Lack of national consensus 2

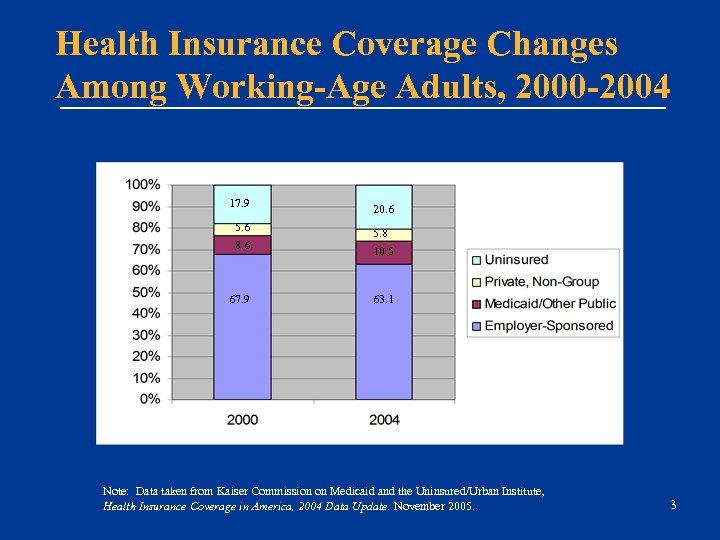

Health Insurance Coverage Changes Among Working-Age Adults, 2000 -2004 17. 9 20. 6 5. 6 8. 6 5. 8 10. 5 67. 9 63. 1 Note: Data taken from Kaiser Commission on Medicaid and the Uninsured/Urban Institute, Health Insurance Coverage in America, 2004 Data Update. November 2005. 3

Health Insurance Coverage Changes Among Working-Age Adults, 2000 -2004 17. 9 20. 6 5. 6 8. 6 5. 8 10. 5 67. 9 63. 1 Note: Data taken from Kaiser Commission on Medicaid and the Uninsured/Urban Institute, Health Insurance Coverage in America, 2004 Data Update. November 2005. 3

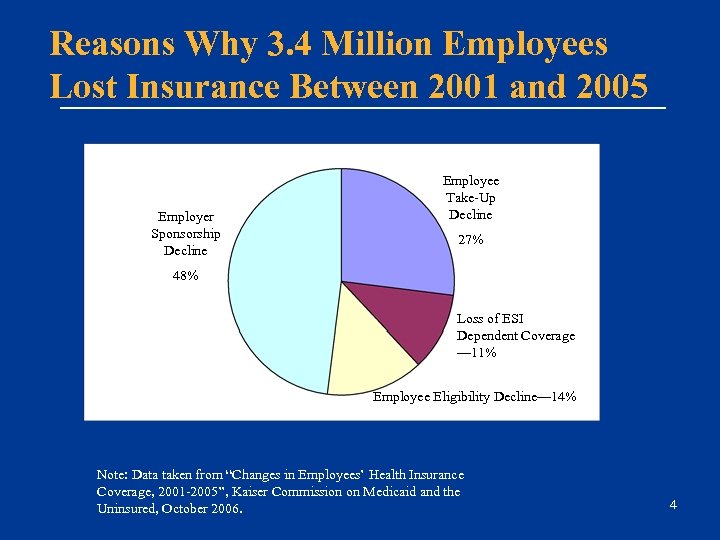

Reasons Why 3. 4 Million Employees Lost Insurance Between 2001 and 2005 Employer Sponsorship Decline Employee Take-Up Decline 27% 48% Loss of ESI Dependent Coverage — 11% Employee Eligibility Decline— 14% Note: Data taken from “Changes in Employees’ Health Insurance Coverage, 2001 -2005”, Kaiser Commission on Medicaid and the Uninsured, October 2006. 4

Reasons Why 3. 4 Million Employees Lost Insurance Between 2001 and 2005 Employer Sponsorship Decline Employee Take-Up Decline 27% 48% Loss of ESI Dependent Coverage — 11% Employee Eligibility Decline— 14% Note: Data taken from “Changes in Employees’ Health Insurance Coverage, 2001 -2005”, Kaiser Commission on Medicaid and the Uninsured, October 2006. 4

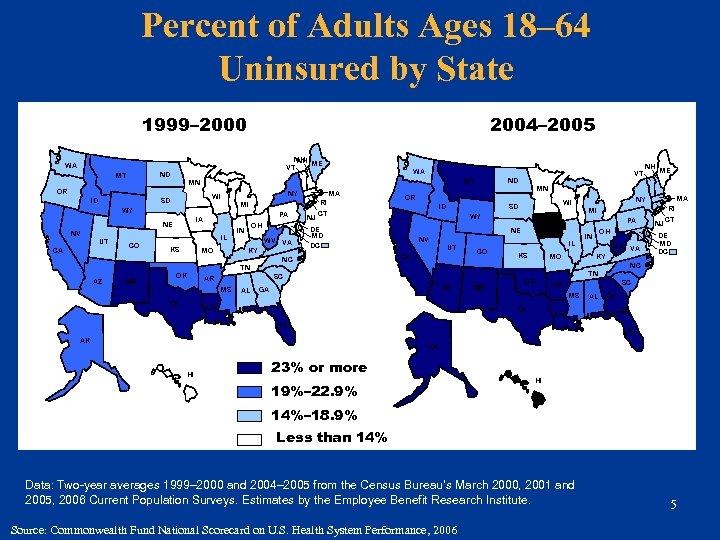

Percent of Adults Ages 18– 64 Uninsured by State 1999– 2000 2004– 2005 NH NH ME VT WA ND MT ID NY WI SD MI WY PA IA NE NV CA IL CO KS MO OH IN WV VA KY NM OK ID AL MI PA IA NE NV UT CA IL CO KS MO AZ LA NM OK IN WV VA KY NJ RI CT DE MD DC NC SC AR MS TX AL GA LA FL AK OH TN GA MA NY WI SD WY DE MD DC NH ME MN OR SC AR MS TX NJ RI CT NC TN AZ MA VT ND MT MN OR UT WA FL AK HI 23% or more 19%– 22. 9% HI 14%– 18. 9% Less than 14% Data: Two-year averages 1999– 2000 and 2004– 2005 from the Census Bureau’s March 2000, 2001 and 2005, 2006 Current Population Surveys. Estimates by the Employee Benefit Research Institute. Source: Commonwealth Fund National Scorecard on U. S. Health System Performance, 2006 5

Percent of Adults Ages 18– 64 Uninsured by State 1999– 2000 2004– 2005 NH NH ME VT WA ND MT ID NY WI SD MI WY PA IA NE NV CA IL CO KS MO OH IN WV VA KY NM OK ID AL MI PA IA NE NV UT CA IL CO KS MO AZ LA NM OK IN WV VA KY NJ RI CT DE MD DC NC SC AR MS TX AL GA LA FL AK OH TN GA MA NY WI SD WY DE MD DC NH ME MN OR SC AR MS TX NJ RI CT NC TN AZ MA VT ND MT MN OR UT WA FL AK HI 23% or more 19%– 22. 9% HI 14%– 18. 9% Less than 14% Data: Two-year averages 1999– 2000 and 2004– 2005 from the Census Bureau’s March 2000, 2001 and 2005, 2006 Current Population Surveys. Estimates by the Employee Benefit Research Institute. Source: Commonwealth Fund National Scorecard on U. S. Health System Performance, 2006 5

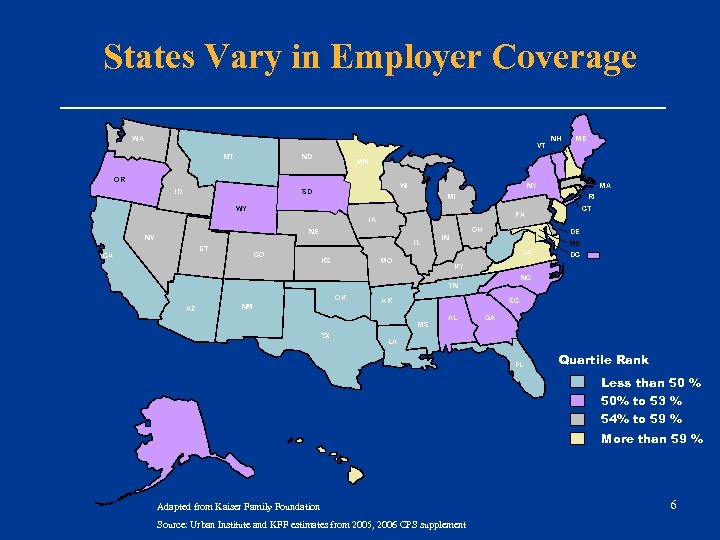

States Vary in Employer Coverage WA VT MT ND WI SD NY RI NE IL UT CO KS OH IN DE MD VA MO OK NM NC AR SC MS TX DC KY TN AZ CT PA IA CA MA MI WY NV ME MN OR ID NH AL GA LA FL Quartile Rank Less than 50 % 50% to 53 % 54% to 59 % More than 59 % Adapted from Kaiser Family Foundation Source: Urban Institute and KFF estimates from 2005, 2006 CPS supplement 6

States Vary in Employer Coverage WA VT MT ND WI SD NY RI NE IL UT CO KS OH IN DE MD VA MO OK NM NC AR SC MS TX DC KY TN AZ CT PA IA CA MA MI WY NV ME MN OR ID NH AL GA LA FL Quartile Rank Less than 50 % 50% to 53 % 54% to 59 % More than 59 % Adapted from Kaiser Family Foundation Source: Urban Institute and KFF estimates from 2005, 2006 CPS supplement 6

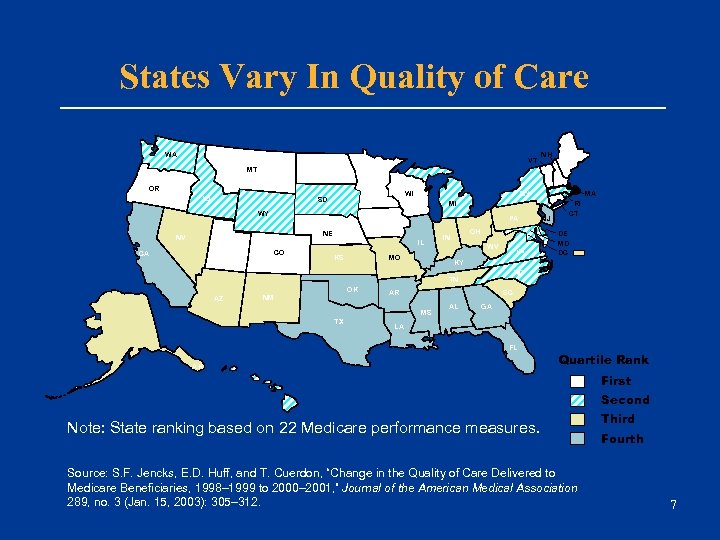

States Vary In Quality of Care WA VT MT ND WI SD NY PA IA NE IL UT CA CO KS MO OH IN WV VA OK NM NJ DE MD DC NC AR SC MS TX RI CT KY TN AZ MA MI WY NV ME MN OR ID NH AL GA LA FL AK Quartile Rank First Second Note: State ranking based on 22 Medicare performance measures. Source: S. F. Jencks, E. D. Huff, and T. Cuerdon, “Change in the Quality of Care Delivered to Medicare Beneficiaries, 1998– 1999 to 2000– 2001, ” Journal of the American Medical Association 289, no. 3 (Jan. 15, 2003): 305– 312. Third Fourth 7

States Vary In Quality of Care WA VT MT ND WI SD NY PA IA NE IL UT CA CO KS MO OH IN WV VA OK NM NJ DE MD DC NC AR SC MS TX RI CT KY TN AZ MA MI WY NV ME MN OR ID NH AL GA LA FL AK Quartile Rank First Second Note: State ranking based on 22 Medicare performance measures. Source: S. F. Jencks, E. D. Huff, and T. Cuerdon, “Change in the Quality of Care Delivered to Medicare Beneficiaries, 1998– 1999 to 2000– 2001, ” Journal of the American Medical Association 289, no. 3 (Jan. 15, 2003): 305– 312. Third Fourth 7

Different Strategies to Improve Coverage and Access l Comprehensive approaches l l Massachusetts, Maine and Vermont Incremental l Covering children Making new insurance options more affordable for low-income working uninsured Improve access through safety net 8

Different Strategies to Improve Coverage and Access l Comprehensive approaches l l Massachusetts, Maine and Vermont Incremental l Covering children Making new insurance options more affordable for low-income working uninsured Improve access through safety net 8

Reactions to Recent State Reforms l l l New approach presents excitement about what is possible– states want to “avoid being left behind” This works for that State, but we are different New idea sparks new creative approaches Fear of over-reaching – sustainability of initiatives Importance of on-going coalition of support 9

Reactions to Recent State Reforms l l l New approach presents excitement about what is possible– states want to “avoid being left behind” This works for that State, but we are different New idea sparks new creative approaches Fear of over-reaching – sustainability of initiatives Importance of on-going coalition of support 9

Comprehensive Efforts Massachusetts Maine Vermont 10

Comprehensive Efforts Massachusetts Maine Vermont 10

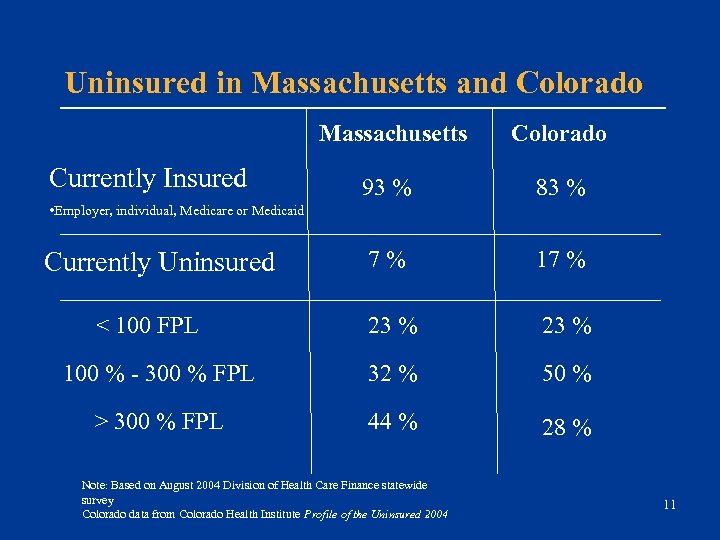

Uninsured in Massachusetts and Colorado Massachusetts Colorado 93 % 83 % 7% 17 % 23 % 100 % - 300 % FPL 32 % 50 % > 300 % FPL 44 % 28 % Currently Insured • Employer, individual, Medicare or Medicaid Currently Uninsured < 100 FPL Note: Based on August 2004 Division of Health Care Finance statewide survey Colorado data from Colorado Health Institute Profile of the Uninsured 2004 11

Uninsured in Massachusetts and Colorado Massachusetts Colorado 93 % 83 % 7% 17 % 23 % 100 % - 300 % FPL 32 % 50 % > 300 % FPL 44 % 28 % Currently Insured • Employer, individual, Medicare or Medicaid Currently Uninsured < 100 FPL Note: Based on August 2004 Division of Health Care Finance statewide survey Colorado data from Colorado Health Institute Profile of the Uninsured 2004 11

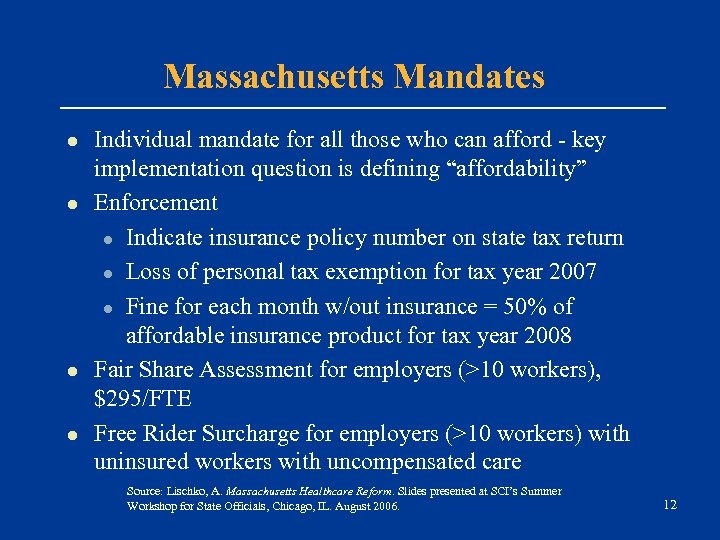

Massachusetts Mandates l l Individual mandate for all those who can afford - key implementation question is defining “affordability” Enforcement l Indicate insurance policy number on state tax return l Loss of personal tax exemption for tax year 2007 l Fine for each month w/out insurance = 50% of affordable insurance product for tax year 2008 Fair Share Assessment for employers (>10 workers), $295/FTE Free Rider Surcharge for employers (>10 workers) with uninsured workers with uncompensated care Source: Lischko, A. Massachusetts Healthcare Reform. Slides presented at SCI’s Summer Workshop for State Officials, Chicago, IL. August 2006. 12

Massachusetts Mandates l l Individual mandate for all those who can afford - key implementation question is defining “affordability” Enforcement l Indicate insurance policy number on state tax return l Loss of personal tax exemption for tax year 2007 l Fine for each month w/out insurance = 50% of affordable insurance product for tax year 2008 Fair Share Assessment for employers (>10 workers), $295/FTE Free Rider Surcharge for employers (>10 workers) with uninsured workers with uncompensated care Source: Lischko, A. Massachusetts Healthcare Reform. Slides presented at SCI’s Summer Workshop for State Officials, Chicago, IL. August 2006. 12

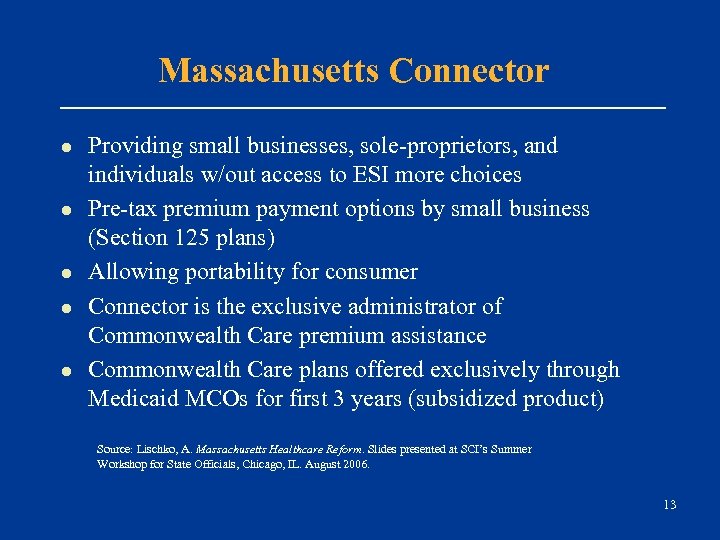

Massachusetts Connector l l l Providing small businesses, sole-proprietors, and individuals w/out access to ESI more choices Pre-tax premium payment options by small business (Section 125 plans) Allowing portability for consumer Connector is the exclusive administrator of Commonwealth Care premium assistance Commonwealth Care plans offered exclusively through Medicaid MCOs for first 3 years (subsidized product) Source: Lischko, A. Massachusetts Healthcare Reform. Slides presented at SCI’s Summer Workshop for State Officials, Chicago, IL. August 2006. 13

Massachusetts Connector l l l Providing small businesses, sole-proprietors, and individuals w/out access to ESI more choices Pre-tax premium payment options by small business (Section 125 plans) Allowing portability for consumer Connector is the exclusive administrator of Commonwealth Care premium assistance Commonwealth Care plans offered exclusively through Medicaid MCOs for first 3 years (subsidized product) Source: Lischko, A. Massachusetts Healthcare Reform. Slides presented at SCI’s Summer Workshop for State Officials, Chicago, IL. August 2006. 13

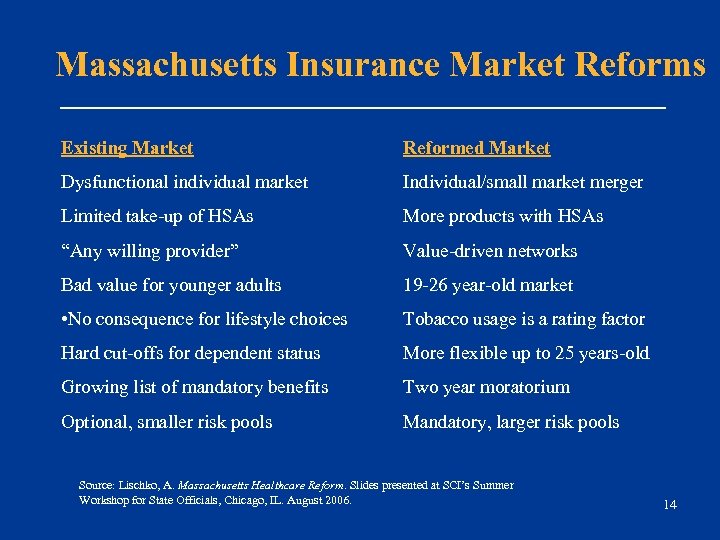

Massachusetts Insurance Market Reforms Existing Market Reformed Market Dysfunctional individual market Individual/small market merger Limited take-up of HSAs More products with HSAs “Any willing provider” Value-driven networks Bad value for younger adults 19 -26 year-old market • No consequence for lifestyle choices Tobacco usage is a rating factor Hard cut-offs for dependent status More flexible up to 25 years-old Growing list of mandatory benefits Two year moratorium Optional, smaller risk pools Mandatory, larger risk pools Source: Lischko, A. Massachusetts Healthcare Reform. Slides presented at SCI’s Summer Workshop for State Officials, Chicago, IL. August 2006. 14

Massachusetts Insurance Market Reforms Existing Market Reformed Market Dysfunctional individual market Individual/small market merger Limited take-up of HSAs More products with HSAs “Any willing provider” Value-driven networks Bad value for younger adults 19 -26 year-old market • No consequence for lifestyle choices Tobacco usage is a rating factor Hard cut-offs for dependent status More flexible up to 25 years-old Growing list of mandatory benefits Two year moratorium Optional, smaller risk pools Mandatory, larger risk pools Source: Lischko, A. Massachusetts Healthcare Reform. Slides presented at SCI’s Summer Workshop for State Officials, Chicago, IL. August 2006. 14

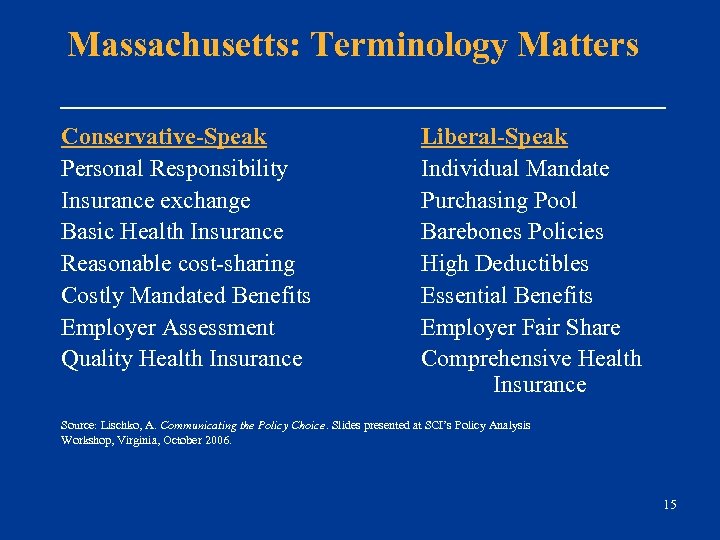

Massachusetts: Terminology Matters Conservative-Speak Personal Responsibility Insurance exchange Basic Health Insurance Reasonable cost-sharing Costly Mandated Benefits Employer Assessment Quality Health Insurance Liberal-Speak Individual Mandate Purchasing Pool Barebones Policies High Deductibles Essential Benefits Employer Fair Share Comprehensive Health Insurance Source: Lischko, A. Communicating the Policy Choice. Slides presented at SCI’s Policy Analysis Workshop, Virginia, October 2006. 15

Massachusetts: Terminology Matters Conservative-Speak Personal Responsibility Insurance exchange Basic Health Insurance Reasonable cost-sharing Costly Mandated Benefits Employer Assessment Quality Health Insurance Liberal-Speak Individual Mandate Purchasing Pool Barebones Policies High Deductibles Essential Benefits Employer Fair Share Comprehensive Health Insurance Source: Lischko, A. Communicating the Policy Choice. Slides presented at SCI’s Policy Analysis Workshop, Virginia, October 2006. 15

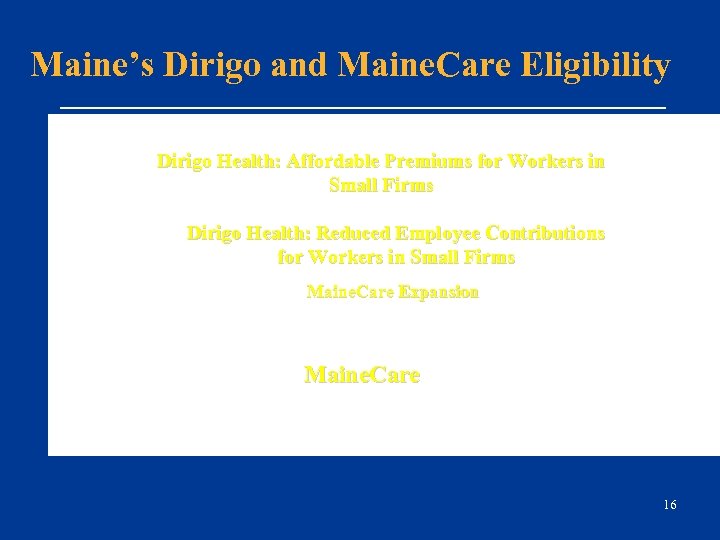

Maine’s Dirigo and Maine. Care Eligibility Dirigo Health: Affordable Premiums for Workers in Small Firms Dirigo Health: Reduced Employee Contributions for Workers in Small Firms Maine. Care Expansion Maine. Care 16

Maine’s Dirigo and Maine. Care Eligibility Dirigo Health: Affordable Premiums for Workers in Small Firms Dirigo Health: Reduced Employee Contributions for Workers in Small Firms Maine. Care Expansion Maine. Care 16

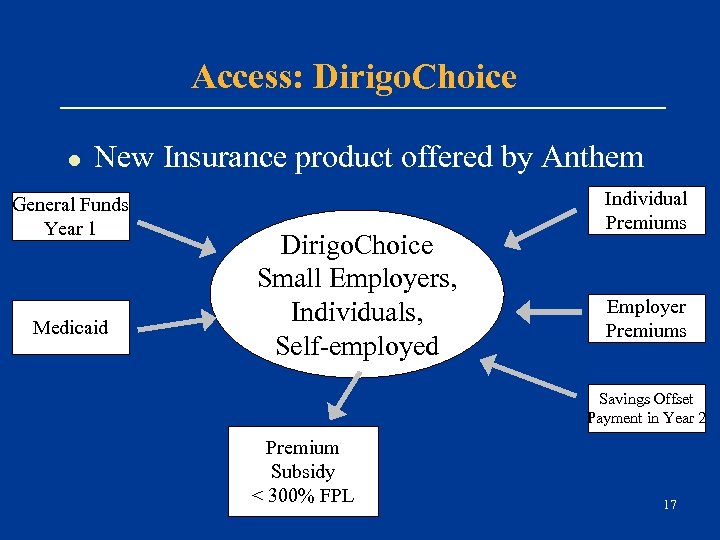

Access: Dirigo. Choice l New Insurance product offered by Anthem General Funds Year 1 Medicaid Dirigo. Choice Small Employers, Individuals, Self-employed Individual Premiums Employer Premiums Savings Offset Payment in Year 2 Premium Subsidy < 300% FPL 17

Access: Dirigo. Choice l New Insurance product offered by Anthem General Funds Year 1 Medicaid Dirigo. Choice Small Employers, Individuals, Self-employed Individual Premiums Employer Premiums Savings Offset Payment in Year 2 Premium Subsidy < 300% FPL 17

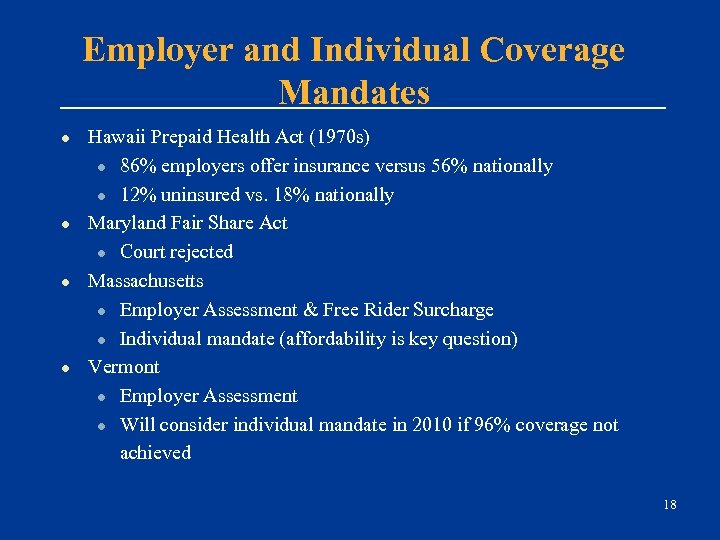

Employer and Individual Coverage Mandates l l Hawaii Prepaid Health Act (1970 s) l 86% employers offer insurance versus 56% nationally l 12% uninsured vs. 18% nationally Maryland Fair Share Act l Court rejected Massachusetts l Employer Assessment & Free Rider Surcharge l Individual mandate (affordability is key question) Vermont l Employer Assessment l Will consider individual mandate in 2010 if 96% coverage not achieved 18

Employer and Individual Coverage Mandates l l Hawaii Prepaid Health Act (1970 s) l 86% employers offer insurance versus 56% nationally l 12% uninsured vs. 18% nationally Maryland Fair Share Act l Court rejected Massachusetts l Employer Assessment & Free Rider Surcharge l Individual mandate (affordability is key question) Vermont l Employer Assessment l Will consider individual mandate in 2010 if 96% coverage not achieved 18

Incremental Approaches Children Purchasing Pools Limited Benefits Reinsurance Creative Uses of Medicaid Safety Net 19

Incremental Approaches Children Purchasing Pools Limited Benefits Reinsurance Creative Uses of Medicaid Safety Net 19

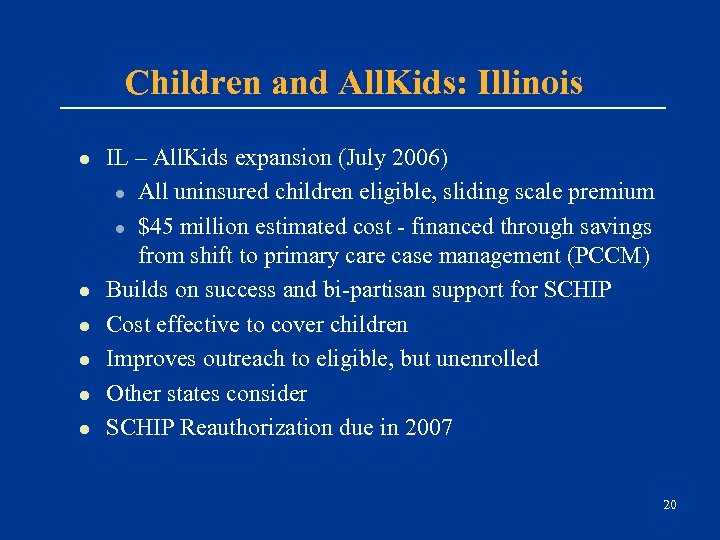

Children and All. Kids: Illinois l l l IL – All. Kids expansion (July 2006) l All uninsured children eligible, sliding scale premium l $45 million estimated cost - financed through savings from shift to primary care case management (PCCM) Builds on success and bi-partisan support for SCHIP Cost effective to cover children Improves outreach to eligible, but unenrolled Other states consider SCHIP Reauthorization due in 2007 20

Children and All. Kids: Illinois l l l IL – All. Kids expansion (July 2006) l All uninsured children eligible, sliding scale premium l $45 million estimated cost - financed through savings from shift to primary care case management (PCCM) Builds on success and bi-partisan support for SCHIP Cost effective to cover children Improves outreach to eligible, but unenrolled Other states consider SCHIP Reauthorization due in 2007 20

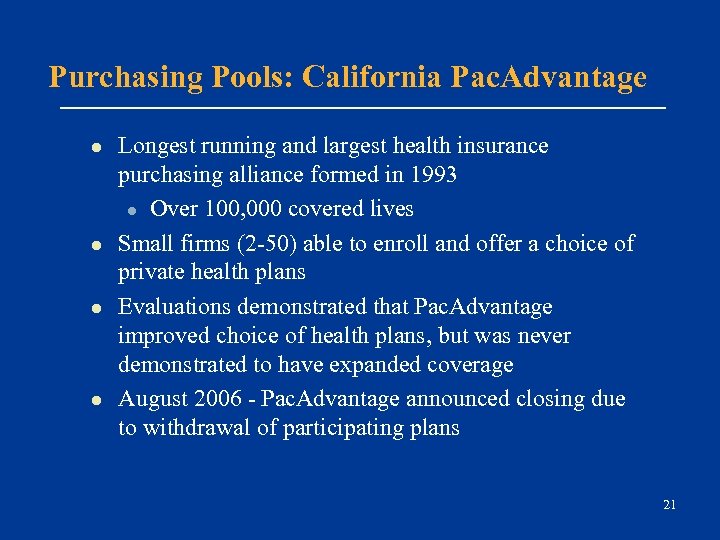

Purchasing Pools: California Pac. Advantage l l Longest running and largest health insurance purchasing alliance formed in 1993 l Over 100, 000 covered lives Small firms (2 -50) able to enroll and offer a choice of private health plans Evaluations demonstrated that Pac. Advantage improved choice of health plans, but was never demonstrated to have expanded coverage August 2006 - Pac. Advantage announced closing due to withdrawal of participating plans 21

Purchasing Pools: California Pac. Advantage l l Longest running and largest health insurance purchasing alliance formed in 1993 l Over 100, 000 covered lives Small firms (2 -50) able to enroll and offer a choice of private health plans Evaluations demonstrated that Pac. Advantage improved choice of health plans, but was never demonstrated to have expanded coverage August 2006 - Pac. Advantage announced closing due to withdrawal of participating plans 21

Purchasing Pools: Insure Montana l l $10 million coverage initiative funded through tobacco tax l Tax Credits l 40% of overall funding is for tax credits for small business that provide health insurance (tax credit provided on a “first come first serve basis”) l Purchasing Pool – l 60% of overall funding is for subsidies for small businesses that were previously unable to offer coverage on a “first come first serve basis” to assist both employer and employee pay portion of health insurance premium. Enrollment (Fall 2006) = 360 firms, 2200 lives 22

Purchasing Pools: Insure Montana l l $10 million coverage initiative funded through tobacco tax l Tax Credits l 40% of overall funding is for tax credits for small business that provide health insurance (tax credit provided on a “first come first serve basis”) l Purchasing Pool – l 60% of overall funding is for subsidies for small businesses that were previously unable to offer coverage on a “first come first serve basis” to assist both employer and employee pay portion of health insurance premium. Enrollment (Fall 2006) = 360 firms, 2200 lives 22

Lessons Learned: Purchasing Pools l l l Strategy has generally not expanded coverage to the uninsured Has improved plan choice for small firms Has not generated significant administrative savings or price discounts Unless designed carefully, pools can create adverse risk selection To be effective, need to combine pool with other strategies such as subsidy or individual mandate 23

Lessons Learned: Purchasing Pools l l l Strategy has generally not expanded coverage to the uninsured Has improved plan choice for small firms Has not generated significant administrative savings or price discounts Unless designed carefully, pools can create adverse risk selection To be effective, need to combine pool with other strategies such as subsidy or individual mandate 23

Limited Benefit Plans have had Marginal Impact l l At Least 13 states have passed limited benefit legislation, 2 states have passed new legislation in 2005 Barebones and other limited benefit plans have had low take-up rates May lead to currently insured to scale back benefits May contribute to increased uncompensated care 24

Limited Benefit Plans have had Marginal Impact l l At Least 13 states have passed limited benefit legislation, 2 states have passed new legislation in 2005 Barebones and other limited benefit plans have had low take-up rates May lead to currently insured to scale back benefits May contribute to increased uncompensated care 24

Reinsurance: Healthy New York l l l 20% of people account for 80% of health spending State subsidizes costs for high cost enrollees with the goal of lowering premiums for all State requires all HMOs to offer product Some benefits excluded (MH/SA) Small firms w/ low-wage workers, low income selfemployed, uninsured workers w/o access to employer sponsored insurance may enroll 25

Reinsurance: Healthy New York l l l 20% of people account for 80% of health spending State subsidizes costs for high cost enrollees with the goal of lowering premiums for all State requires all HMOs to offer product Some benefits excluded (MH/SA) Small firms w/ low-wage workers, low income selfemployed, uninsured workers w/o access to employer sponsored insurance may enroll 25

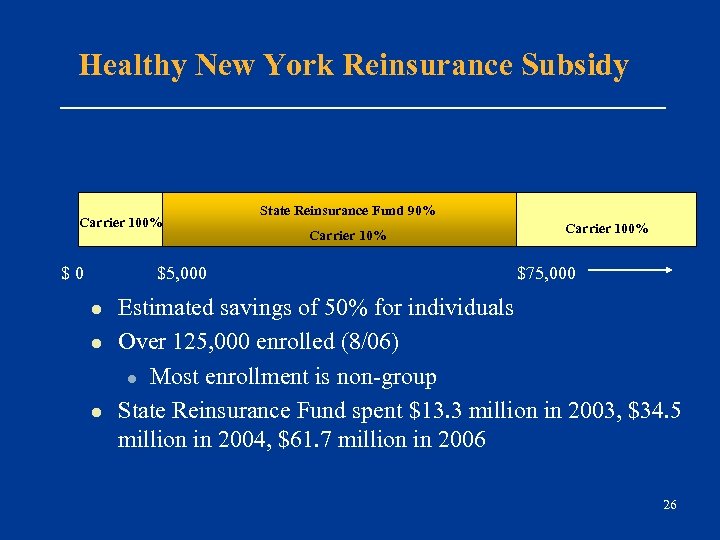

Healthy New York Reinsurance Subsidy Carrier 100% $0 $5, 000 l l l State Reinsurance Fund 90% Carrier 100% $75, 000 Estimated savings of 50% for individuals Over 125, 000 enrolled (8/06) l Most enrollment is non-group State Reinsurance Fund spent $13. 3 million in 2003, $34. 5 million in 2004, $61. 7 million in 2006 26

Healthy New York Reinsurance Subsidy Carrier 100% $0 $5, 000 l l l State Reinsurance Fund 90% Carrier 100% $75, 000 Estimated savings of 50% for individuals Over 125, 000 enrolled (8/06) l Most enrollment is non-group State Reinsurance Fund spent $13. 3 million in 2003, $34. 5 million in 2004, $61. 7 million in 2006 26

Early Lessons on Reinsurance: Healthy NY l l l Requiring HMOs to offer Healthy New York product is less expensive than establishing new program Perceived efficiency and value of program Getting participation requires long-term partnership to build trust that coverage will continue to be there While targeting small groups, product has enrolled mainly individuals and self-employed Must have market oversight to assure lower premiums 27

Early Lessons on Reinsurance: Healthy NY l l l Requiring HMOs to offer Healthy New York product is less expensive than establishing new program Perceived efficiency and value of program Getting participation requires long-term partnership to build trust that coverage will continue to be there While targeting small groups, product has enrolled mainly individuals and self-employed Must have market oversight to assure lower premiums 27

Creative Uses of Medicaid l l Premium Assistance: 15 states l Medicaid/SCHIP pays for employee portion of existing private insurance Medicaid Buy-In l All-Kids = sliding scale subsidy subsidized by SCHIP l New Insurance Product with a subsidy l Subsidy for low income individuals, and small firms 28

Creative Uses of Medicaid l l Premium Assistance: 15 states l Medicaid/SCHIP pays for employee portion of existing private insurance Medicaid Buy-In l All-Kids = sliding scale subsidy subsidized by SCHIP l New Insurance Product with a subsidy l Subsidy for low income individuals, and small firms 28

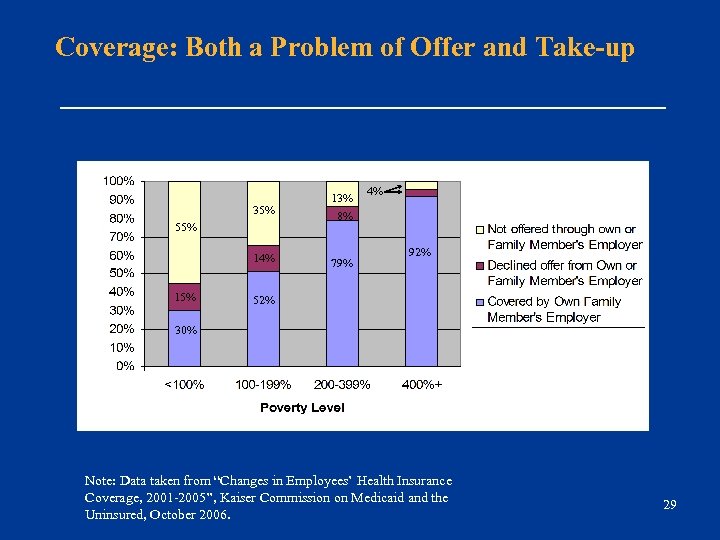

Coverage: Both a Problem of Offer and Take-up 35% 13% 8% 14% 79% 55% 15% 4% 92% 52% 30% Note: Data taken from “Changes in Employees’ Health Insurance Coverage, 2001 -2005”, Kaiser Commission on Medicaid and the Uninsured, October 2006. 29

Coverage: Both a Problem of Offer and Take-up 35% 13% 8% 14% 79% 55% 15% 4% 92% 52% 30% Note: Data taken from “Changes in Employees’ Health Insurance Coverage, 2001 -2005”, Kaiser Commission on Medicaid and the Uninsured, October 2006. 29

New Medicaid Strategies Address Low Offer Rates l l New insurance products for small firms with low-wage workers Employers, individual and Medicaid pay premium l New Mexico – open to uninsured adults <200% FPL, individuals may pay employer contribution l Oklahoma covers workers and spouses <185% FPL who work for small firms; program begins with voucher; safety-net option will be provided for workers with employers unwilling to participate l Arkansas recently received waiver to offer limited benefit product to small firms, Medicaid funding will be available for low-wage workers (<200% FPL) 30

New Medicaid Strategies Address Low Offer Rates l l New insurance products for small firms with low-wage workers Employers, individual and Medicaid pay premium l New Mexico – open to uninsured adults <200% FPL, individuals may pay employer contribution l Oklahoma covers workers and spouses <185% FPL who work for small firms; program begins with voucher; safety-net option will be provided for workers with employers unwilling to participate l Arkansas recently received waiver to offer limited benefit product to small firms, Medicaid funding will be available for low-wage workers (<200% FPL) 30

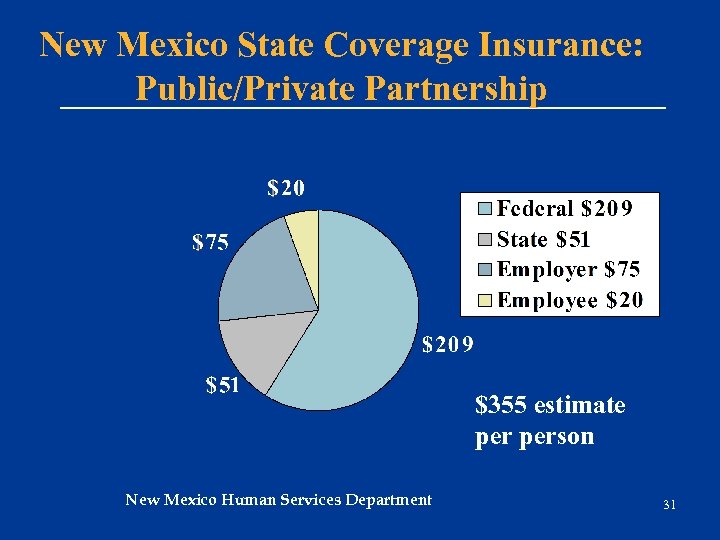

New Mexico State Coverage Insurance: Public/Private Partnership $355 estimate person New Mexico Human Services Department 31

New Mexico State Coverage Insurance: Public/Private Partnership $355 estimate person New Mexico Human Services Department 31

Medicaid’s Changing Role l l l Use in expanding coverage to the uninsured Covering different populations, sometimes higher income groups Increased cost-sharing Changing benefit designs Consumer Responsibility 32

Medicaid’s Changing Role l l l Use in expanding coverage to the uninsured Covering different populations, sometimes higher income groups Increased cost-sharing Changing benefit designs Consumer Responsibility 32

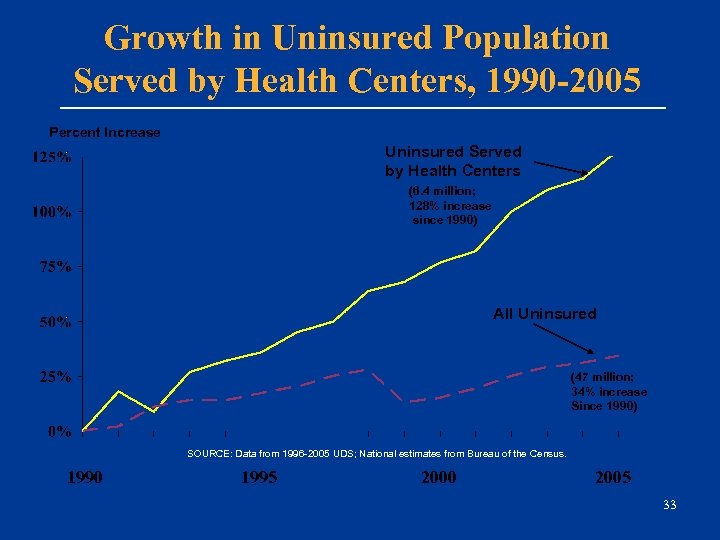

Growth in Uninsured Population Served by Health Centers, 1990 -2005 Percent Increase Uninsured Served by Health Centers (6. 4 million; 128% increase since 1990) All Uninsured (47 million; 34% increase Since 1990) SOURCE: Data from 1996 -2005 UDS; National estimates from Bureau of the Census. 1990 1995 2000 2005 33

Growth in Uninsured Population Served by Health Centers, 1990 -2005 Percent Increase Uninsured Served by Health Centers (6. 4 million; 128% increase since 1990) All Uninsured (47 million; 34% increase Since 1990) SOURCE: Data from 1996 -2005 UDS; National estimates from Bureau of the Census. 1990 1995 2000 2005 33

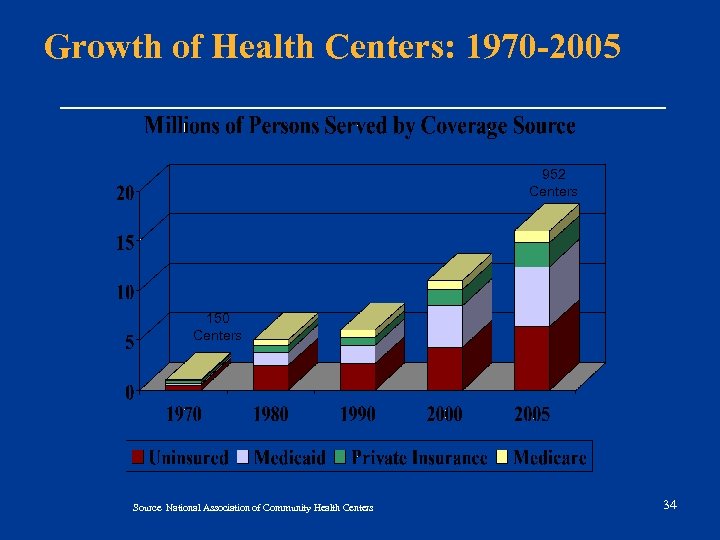

Growth of Health Centers: 1970 -2005 952 Centers 150 Centers Source National Association of Community Health Centers 34

Growth of Health Centers: 1970 -2005 952 Centers 150 Centers Source National Association of Community Health Centers 34

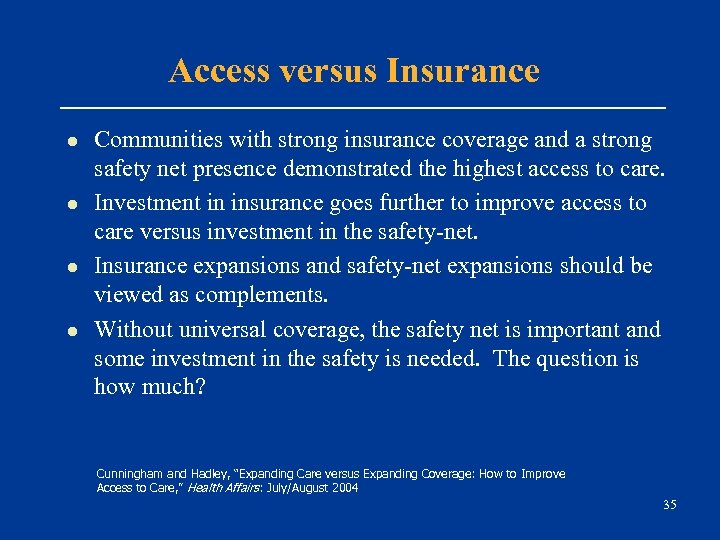

Access versus Insurance l l Communities with strong insurance coverage and a strong safety net presence demonstrated the highest access to care. Investment in insurance goes further to improve access to care versus investment in the safety-net. Insurance expansions and safety-net expansions should be viewed as complements. Without universal coverage, the safety net is important and some investment in the safety is needed. The question is how much? Cunningham and Hadley, “Expanding Care versus Expanding Coverage: How to Improve Access to Care, ” Health Affairs : July/August 2004 35

Access versus Insurance l l Communities with strong insurance coverage and a strong safety net presence demonstrated the highest access to care. Investment in insurance goes further to improve access to care versus investment in the safety-net. Insurance expansions and safety-net expansions should be viewed as complements. Without universal coverage, the safety net is important and some investment in the safety is needed. The question is how much? Cunningham and Hadley, “Expanding Care versus Expanding Coverage: How to Improve Access to Care, ” Health Affairs : July/August 2004 35

Challenges of Community-Based Models l l Assuring long-term, sustainable funding Need to address both access and insurance l l The safety-net is a delivery system while insurance is a financing strategy Difficult to design a program to fill gaps in complex health system 36

Challenges of Community-Based Models l l Assuring long-term, sustainable funding Need to address both access and insurance l l The safety-net is a delivery system while insurance is a financing strategy Difficult to design a program to fill gaps in complex health system 36

Concluding Thoughts l l States play critical role in moving the conversations about coverage expansions l Testing new ideas (politically and practically) l Creating momentum for national policy solution Catch 22: Often need ambiguous goal to sell new initiatives but need to be realistic about what states can do l Given overall fiscal picture, how far can states go? Comprehensive versus Incremental l Sequential = incremental plus a vision Few states can even approach universal coverage without a federal framework and funding 37

Concluding Thoughts l l States play critical role in moving the conversations about coverage expansions l Testing new ideas (politically and practically) l Creating momentum for national policy solution Catch 22: Often need ambiguous goal to sell new initiatives but need to be realistic about what states can do l Given overall fiscal picture, how far can states go? Comprehensive versus Incremental l Sequential = incremental plus a vision Few states can even approach universal coverage without a federal framework and funding 37