b40720e09bc78f5df6e7d9630799bc35.ppt

- Количество слайдов: 62

PHILIPPINE ECONOMIC ZONE AUTHORITY

PHILIPPINE ECONOMIC ZONE AUTHORITY

THE PHILIPPINES – YOUR BUSINESS PARTNER IN ASIA “OPPORTUNITIES FOR GERMAN INVESTORS IN PHILIPPINE ECONOMIC ZONES” A presentation by: DR. LILIA B. DE LIMA PEZA Director General Undersecretary, Department of Trade and Industry Pricewaterhouse. Coopers AG Potsdamer Platz 11, 17. OG, 10785 Berlin 28. 09. 2012, 14. 30 Uhr,

THE PHILIPPINES – YOUR BUSINESS PARTNER IN ASIA “OPPORTUNITIES FOR GERMAN INVESTORS IN PHILIPPINE ECONOMIC ZONES” A presentation by: DR. LILIA B. DE LIMA PEZA Director General Undersecretary, Department of Trade and Industry Pricewaterhouse. Coopers AG Potsdamer Platz 11, 17. OG, 10785 Berlin 28. 09. 2012, 14. 30 Uhr,

Philippine Economic Zone Authority An investment promotion and incentive granting agency attached to the Department of Trade and Industry. Reinforce Government’s efforts to: • • • Promote Investments Create Employment Generate Exports

Philippine Economic Zone Authority An investment promotion and incentive granting agency attached to the Department of Trade and Industry. Reinforce Government’s efforts to: • • • Promote Investments Create Employment Generate Exports

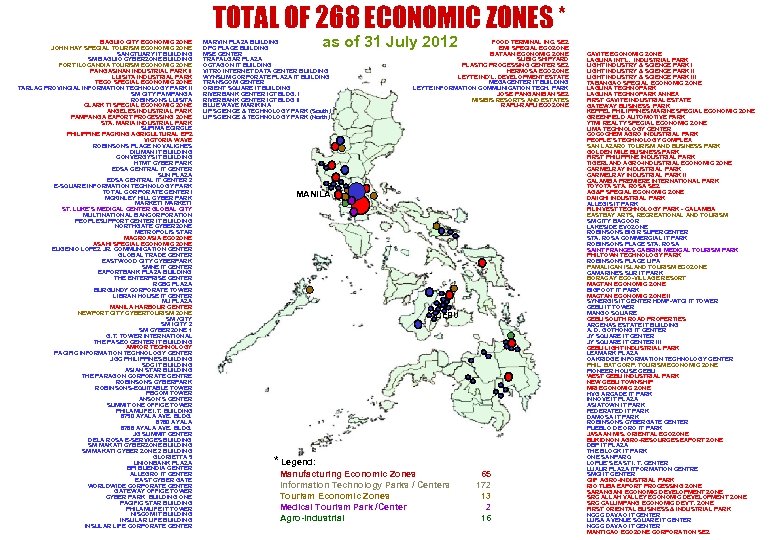

TOTAL OF 268 ECONOMIC ZONES * BAGUIO CITY ECONOMIC ZONE JOHN HAY SPECIAL TOURISM ECONOMIC ZONE SANCTUARY IT BUILDING SM BAGUIO CYBERZONE BUILDING FORT ILOCANDIA TOURISM ECONOMIC ZONE PANGASINAN INDUSTRIAL PARK II LUISITA INDUSTRIAL PARK TECO SPECIAL ECONOMIC ZONE TARLAC PROVINCIAL INFORMATION TECHNOLOGY PARK II SM CITY PAMPANGA ROBINSONS LUISITA CLARK TI SPECIAL ECONOMIC ZONE ANGELES INDUSTRIAL PARK PAMPANGA EXPORT PROCESSING ZONE STA. MARIA INDUSTRIAL PARK SUPIMA ECIRCLE PHILIPPINE PACKING AGRICULTURAL EPZ VICTORIA WAVE ROBINSONS PLACE NOVALICHES DILIMAN IT BUILDING CONVERGYS IT BUILDING HTMT CYBER PARK EDSA CENTRAL IT CENTER SUN PLAZA EDSA CENTRAL IT CENTER 2 E-SQUARE INFORMATION TECHNOLOGY PARK TOTAL CORPORATE CENTER I MCKINLEY HILL CYBER PARK MARKET! ST. LUKE’S MEDICAL CENTER GLOBAL CITY MULTINATIONAL BANCORPORATION PEOPLESUPPORT CENTER IT BUILDING NORTHGATE CYBERZONE METROPOLIS STAR MACROASIA ECOZONE ASAHI SPECIAL ECONOMIC ZONE EUGENIO LOPEZ JR. COMMUNICATION CENTER GLOBAL TRADE CENTER EASTWOOD CITY CYBERPARK SMNE IT CENTER EXPORTBANK PLAZA BUILDING THE ENTERPRISE CENTER RCBC PLAZA BURGUNDY CORPORATE TOWER LIBRAN HOUSE IT CENTER MJ PLAZA MANILA HARBOUR CENTER NEWPORT CITY CYBERTOURISM ZONE SM ICITY 2 SM CYBERZONE 1 G. T. TOWER INTERNATIONAL THE PASEO CENTER IT BUILDING AMKOR TECHNOLOGY PACIFIC INFORMATION TECHNOLOGY CENTER JGC PHILIPPINES BUILDING SDC IT BUILDING ASIAN STAR BUILDING THE PARAGON CORPORATE CENTRE ROBINSONS CYBERPARK ROBINSONS-EQUITABLE TOWER PBCOM TOWER ANSON’S CENTER SUMMIT ONE OFFICE TOWER PHILAMLIFE I. T. BUILDING 6750 AYALA AVE. BLDG. 6780 AYALA 6788 AYALA AVE. BLDG. JG SUMMIT CENTER DELA ROSA E-SERVICES BUILDING SM MAKATI CYBERZONE BUILDING SM MAKATI CYBER ZONE 2 BUILDING GLORIETTA 5 UNIONBANK PLAZA BPI BUENDIA CENTER ALLEGRO IT CENTER EAST CYBER GATE WORLDWIDE CORPORATE CENTER GATEWAY OFFICE TOWER CYBER PARK BUILDING ONE PACIFIC STAR BUILDING PHILAMLIFE IT TOWER NISCOM IT BUILDING INSULAR LIFE CORPORATE CENTER as of 31 July 2012 MARVIN PLAZA BUILDING DPC PLACE BUILDING MSE CENTER TRAFALGAR PLAZA OCTAGON IT BUILDING VITRO INTERNET DATA CENTER BUILDING WYNSUM CORPORATE PLAZA IT BUILDING TRANSCOM CENTER ORIENT SQUARE IT BUILDING RIVERBANK CENTER ICT BLDG. I RIVERBANK CENTER ICT BLDG II BLUE WAVE MARIKINA UP SCIENCE & TECHNOLOGY PARK (South) UP SCIENCE & TECHNOLOGY PARK (North) FOOD TERMINAL INC. SEZ EMI SPECIAL ECOZONE BATAAN ECONOMIC ZONE SUBIC SHIPYARD PLASTIC PROCESSING CENTER SEZ HERMOSA ECOZONE LEYTE IND’L. DEVELOPMENT ESTATE MEGACENTER IT BUILDING LEYTE INFORMATION COMMUNICATION TECH. PARK JOSE PANGANIBAN SEZ MISIBIS RESORTS AND ESTATES RAPU-RAPU ECOZONE MANILA CEBU * Legend: Manufacturing Economic Zones Information Technology Parks / Centers Tourism Economic Zones Medical Tourism Park /Center Agro-Industrial 65 172 13 2 16 CAVITE ECONOMIC ZONE LAGUNA INT’L. INDUSTRIAL PARK LIGHT INDUSTRY & SCIENCE PARK III TABANGAO SPECIAL ECONOMIC ZONE LAGUNA TECHNOPARK ANNEX FIRST CAVITE INDUSTRIAL ESTATE GATEWAY BUSINESS PARK KEPPEL PHILIPPINES MARINE SPECIAL ECONOMIC ZONE GREENFIELD AUTOMOTIVE PARK YTMI REALTY SPECIAL ECONOMIC ZONE LIMA TECHNOLOGY CENTER COCOCHEM AGRO INDUSTRIAL PARK PEOPLE’S TECHNOLOGY COMPLEX SAN LAZARO TOURISM AND BUSINESS PARK GOLDEN MILE BUSINESS PARK FIRST PHILIPPINE INDUSTRIAL PARK TIGERLAND AGRO-INDUSTRIAL ECONOMIC ZONE CARMELRAY INDUSTRIAL PARK II CALAMBA PREMIERE INTERNATIONAL PARK TOYOTA STA. ROSA SEZ AG&P SPECIAL ECONOMIC ZONE DAIICHI INDUSTRIAL PARK ALLEGIS IT PARK FILINVEST TECHNOLOGY PARK - CALAMBA EASTBAY ARTS, RECREATIONAL AND TOURISM SM CITY BACOOR LAKESIDE EVOZONE ROBINSONS BIG R SUPERCENTER STA. ROSA COMMERCIAL IT PARK ROBINSONS PLACE STA. ROSA SAINT FRANCES CABRINI MEDICAL TOURISM PARK PHILTOWN TECHNOLOGY PARK ROBINSONS PLACE LIPA PAMALICAN ISLAND TOURISM ECOZONE CAMARINES SUR IT PARK BORACAY ECO-VILLAGE RESORT MACTAN ECONOMIC ZONE BIGFOOT IT PARK MACTAN ECONOMIC ZONE II SYNERGIS IT CENTER HDMF-WTCI IT TOWER CEBU IT TOWER MANGO SQUARE CEBU SOUTH ROAD PROPERTIES ARCENAS ESTATE IT BUILDING A. D. GOTHONG IT CENTER JY SQUARE IT CENTER III CEBU LIGHT INDUSTRIAL PARK LEXMARK PLAZA OAKRIDGE INFORMATION TECHNOLOGY CENTER PHIL. BXT CORP. TOURISM ECONOMIC ZONE PIONEER HOUSE CEBU WEST CEBU INDUSTRIAL PARK NEW CEBU TOWNSHIP MRI ECONOMIC ZONE HVG ARCADE IT PARK INNOVE IT PLAZA ASIATOWN IT PARK FEDERATED IT PARK DAMOSA IT PARK ROBINSONS CYBERGATE CENTER PUEBLO DE ORO IT PARK JASAAN MIS. ORIENTAL ECOZONE BUKIDNON AGRO-RESOURCES EXPORT ZONE DBP IT PLAZA THE BLOCK IT PARK ONE SANPARQ LOPUE'S EAST I. T. CENTER LUXUR PLAZA ITFORMATION CENTRE SMCI IT CENTER CIIF AGRO-INDUSTRIAL PARK RIO TUBA EXPORT PROCESSING ZONE SARANGANI ECONOMIC DEVELOPMENT ZONE SRC ALLAH VALLEY ECONOMIC DEVELOPMENT ZONE SRC CALUMPANG ECONOMIC DEV’T. ZONE FIRST ORIENTAL BUSINESS & INDUSTRIAL PARK NCCC DAVAO IT CENTER LUISA AVENUE SQUARE IT CENTER NCCC DAVAO IT CENTER MANTICAO ECOZONE CORPORATION SEZ

TOTAL OF 268 ECONOMIC ZONES * BAGUIO CITY ECONOMIC ZONE JOHN HAY SPECIAL TOURISM ECONOMIC ZONE SANCTUARY IT BUILDING SM BAGUIO CYBERZONE BUILDING FORT ILOCANDIA TOURISM ECONOMIC ZONE PANGASINAN INDUSTRIAL PARK II LUISITA INDUSTRIAL PARK TECO SPECIAL ECONOMIC ZONE TARLAC PROVINCIAL INFORMATION TECHNOLOGY PARK II SM CITY PAMPANGA ROBINSONS LUISITA CLARK TI SPECIAL ECONOMIC ZONE ANGELES INDUSTRIAL PARK PAMPANGA EXPORT PROCESSING ZONE STA. MARIA INDUSTRIAL PARK SUPIMA ECIRCLE PHILIPPINE PACKING AGRICULTURAL EPZ VICTORIA WAVE ROBINSONS PLACE NOVALICHES DILIMAN IT BUILDING CONVERGYS IT BUILDING HTMT CYBER PARK EDSA CENTRAL IT CENTER SUN PLAZA EDSA CENTRAL IT CENTER 2 E-SQUARE INFORMATION TECHNOLOGY PARK TOTAL CORPORATE CENTER I MCKINLEY HILL CYBER PARK MARKET! ST. LUKE’S MEDICAL CENTER GLOBAL CITY MULTINATIONAL BANCORPORATION PEOPLESUPPORT CENTER IT BUILDING NORTHGATE CYBERZONE METROPOLIS STAR MACROASIA ECOZONE ASAHI SPECIAL ECONOMIC ZONE EUGENIO LOPEZ JR. COMMUNICATION CENTER GLOBAL TRADE CENTER EASTWOOD CITY CYBERPARK SMNE IT CENTER EXPORTBANK PLAZA BUILDING THE ENTERPRISE CENTER RCBC PLAZA BURGUNDY CORPORATE TOWER LIBRAN HOUSE IT CENTER MJ PLAZA MANILA HARBOUR CENTER NEWPORT CITY CYBERTOURISM ZONE SM ICITY 2 SM CYBERZONE 1 G. T. TOWER INTERNATIONAL THE PASEO CENTER IT BUILDING AMKOR TECHNOLOGY PACIFIC INFORMATION TECHNOLOGY CENTER JGC PHILIPPINES BUILDING SDC IT BUILDING ASIAN STAR BUILDING THE PARAGON CORPORATE CENTRE ROBINSONS CYBERPARK ROBINSONS-EQUITABLE TOWER PBCOM TOWER ANSON’S CENTER SUMMIT ONE OFFICE TOWER PHILAMLIFE I. T. BUILDING 6750 AYALA AVE. BLDG. 6780 AYALA 6788 AYALA AVE. BLDG. JG SUMMIT CENTER DELA ROSA E-SERVICES BUILDING SM MAKATI CYBERZONE BUILDING SM MAKATI CYBER ZONE 2 BUILDING GLORIETTA 5 UNIONBANK PLAZA BPI BUENDIA CENTER ALLEGRO IT CENTER EAST CYBER GATE WORLDWIDE CORPORATE CENTER GATEWAY OFFICE TOWER CYBER PARK BUILDING ONE PACIFIC STAR BUILDING PHILAMLIFE IT TOWER NISCOM IT BUILDING INSULAR LIFE CORPORATE CENTER as of 31 July 2012 MARVIN PLAZA BUILDING DPC PLACE BUILDING MSE CENTER TRAFALGAR PLAZA OCTAGON IT BUILDING VITRO INTERNET DATA CENTER BUILDING WYNSUM CORPORATE PLAZA IT BUILDING TRANSCOM CENTER ORIENT SQUARE IT BUILDING RIVERBANK CENTER ICT BLDG. I RIVERBANK CENTER ICT BLDG II BLUE WAVE MARIKINA UP SCIENCE & TECHNOLOGY PARK (South) UP SCIENCE & TECHNOLOGY PARK (North) FOOD TERMINAL INC. SEZ EMI SPECIAL ECOZONE BATAAN ECONOMIC ZONE SUBIC SHIPYARD PLASTIC PROCESSING CENTER SEZ HERMOSA ECOZONE LEYTE IND’L. DEVELOPMENT ESTATE MEGACENTER IT BUILDING LEYTE INFORMATION COMMUNICATION TECH. PARK JOSE PANGANIBAN SEZ MISIBIS RESORTS AND ESTATES RAPU-RAPU ECOZONE MANILA CEBU * Legend: Manufacturing Economic Zones Information Technology Parks / Centers Tourism Economic Zones Medical Tourism Park /Center Agro-Industrial 65 172 13 2 16 CAVITE ECONOMIC ZONE LAGUNA INT’L. INDUSTRIAL PARK LIGHT INDUSTRY & SCIENCE PARK III TABANGAO SPECIAL ECONOMIC ZONE LAGUNA TECHNOPARK ANNEX FIRST CAVITE INDUSTRIAL ESTATE GATEWAY BUSINESS PARK KEPPEL PHILIPPINES MARINE SPECIAL ECONOMIC ZONE GREENFIELD AUTOMOTIVE PARK YTMI REALTY SPECIAL ECONOMIC ZONE LIMA TECHNOLOGY CENTER COCOCHEM AGRO INDUSTRIAL PARK PEOPLE’S TECHNOLOGY COMPLEX SAN LAZARO TOURISM AND BUSINESS PARK GOLDEN MILE BUSINESS PARK FIRST PHILIPPINE INDUSTRIAL PARK TIGERLAND AGRO-INDUSTRIAL ECONOMIC ZONE CARMELRAY INDUSTRIAL PARK II CALAMBA PREMIERE INTERNATIONAL PARK TOYOTA STA. ROSA SEZ AG&P SPECIAL ECONOMIC ZONE DAIICHI INDUSTRIAL PARK ALLEGIS IT PARK FILINVEST TECHNOLOGY PARK - CALAMBA EASTBAY ARTS, RECREATIONAL AND TOURISM SM CITY BACOOR LAKESIDE EVOZONE ROBINSONS BIG R SUPERCENTER STA. ROSA COMMERCIAL IT PARK ROBINSONS PLACE STA. ROSA SAINT FRANCES CABRINI MEDICAL TOURISM PARK PHILTOWN TECHNOLOGY PARK ROBINSONS PLACE LIPA PAMALICAN ISLAND TOURISM ECOZONE CAMARINES SUR IT PARK BORACAY ECO-VILLAGE RESORT MACTAN ECONOMIC ZONE BIGFOOT IT PARK MACTAN ECONOMIC ZONE II SYNERGIS IT CENTER HDMF-WTCI IT TOWER CEBU IT TOWER MANGO SQUARE CEBU SOUTH ROAD PROPERTIES ARCENAS ESTATE IT BUILDING A. D. GOTHONG IT CENTER JY SQUARE IT CENTER III CEBU LIGHT INDUSTRIAL PARK LEXMARK PLAZA OAKRIDGE INFORMATION TECHNOLOGY CENTER PHIL. BXT CORP. TOURISM ECONOMIC ZONE PIONEER HOUSE CEBU WEST CEBU INDUSTRIAL PARK NEW CEBU TOWNSHIP MRI ECONOMIC ZONE HVG ARCADE IT PARK INNOVE IT PLAZA ASIATOWN IT PARK FEDERATED IT PARK DAMOSA IT PARK ROBINSONS CYBERGATE CENTER PUEBLO DE ORO IT PARK JASAAN MIS. ORIENTAL ECOZONE BUKIDNON AGRO-RESOURCES EXPORT ZONE DBP IT PLAZA THE BLOCK IT PARK ONE SANPARQ LOPUE'S EAST I. T. CENTER LUXUR PLAZA ITFORMATION CENTRE SMCI IT CENTER CIIF AGRO-INDUSTRIAL PARK RIO TUBA EXPORT PROCESSING ZONE SARANGANI ECONOMIC DEVELOPMENT ZONE SRC ALLAH VALLEY ECONOMIC DEVELOPMENT ZONE SRC CALUMPANG ECONOMIC DEV’T. ZONE FIRST ORIENTAL BUSINESS & INDUSTRIAL PARK NCCC DAVAO IT CENTER LUISA AVENUE SQUARE IT CENTER NCCC DAVAO IT CENTER MANTICAO ECOZONE CORPORATION SEZ

65 Manufacturing 172 IT Parks (38) and IT Centers (134) 13 Tourism Ecozones 2 Medical Tourism Park / Center 16 Agro-Industrial Parks

65 Manufacturing 172 IT Parks (38) and IT Centers (134) 13 Tourism Ecozones 2 Medical Tourism Park / Center 16 Agro-Industrial Parks

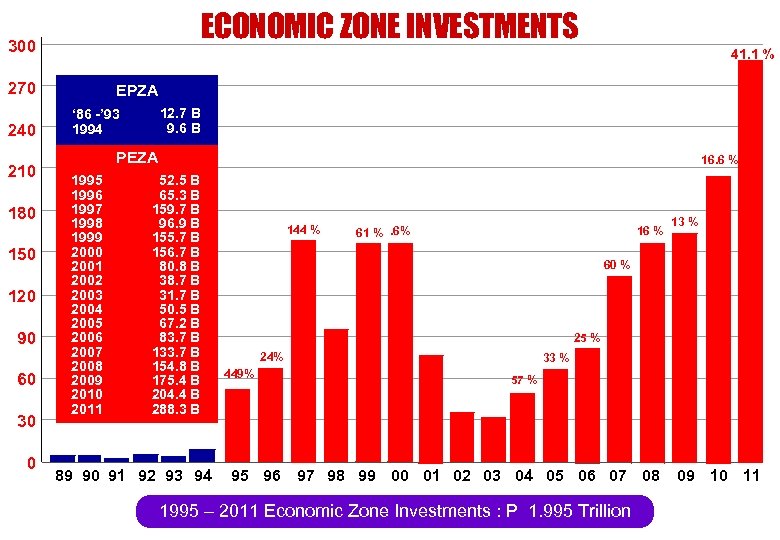

ECONOMIC ZONE INVESTMENTS 300 41. 1 % 270 240 210 180 150 120 90 60 30 0 EPZA 12. 7 B 9. 6 B ‘ 86 -’ 93 1994 PEZA 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 16. 6 % 52. 5 B 65. 3 B 159. 7 B 96. 9 B 155. 7 B 156. 7 B 80. 8 B 38. 7 B 31. 7 B 50. 5 B 67. 2 B 83. 7 B 133. 7 B 154. 8 B 175. 4 B 204. 4 B 288. 3 B 89 90 91 92 93 94 144 % 16 % 61 % . 6% 13 % 60 % 25 % 24% 449% 33 % 57 % 95 96 97 98 99 00 01 02 03 04 05 06 07 08 1995 – 2011 Economic Zone Investments : P 1. 995 Trillion 09 10 11

ECONOMIC ZONE INVESTMENTS 300 41. 1 % 270 240 210 180 150 120 90 60 30 0 EPZA 12. 7 B 9. 6 B ‘ 86 -’ 93 1994 PEZA 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 16. 6 % 52. 5 B 65. 3 B 159. 7 B 96. 9 B 155. 7 B 156. 7 B 80. 8 B 38. 7 B 31. 7 B 50. 5 B 67. 2 B 83. 7 B 133. 7 B 154. 8 B 175. 4 B 204. 4 B 288. 3 B 89 90 91 92 93 94 144 % 16 % 61 % . 6% 13 % 60 % 25 % 24% 449% 33 % 57 % 95 96 97 98 99 00 01 02 03 04 05 06 07 08 1995 – 2011 Economic Zone Investments : P 1. 995 Trillion 09 10 11

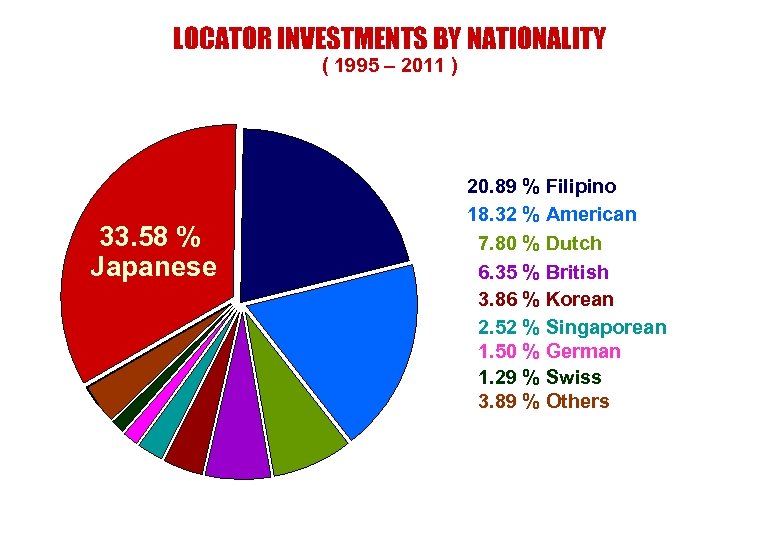

LOCATOR INVESTMENTS BY NATIONALITY ( 1995 – 2011 ) 33. 58 % Japanese 20. 89 % Filipino 18. 32 % American 7. 80 % Dutch 6. 35 % British 3. 86 % Korean 2. 52 % Singaporean 1. 50 % German 1. 29 % Swiss 3. 89 % Others

LOCATOR INVESTMENTS BY NATIONALITY ( 1995 – 2011 ) 33. 58 % Japanese 20. 89 % Filipino 18. 32 % American 7. 80 % Dutch 6. 35 % British 3. 86 % Korean 2. 52 % Singaporean 1. 50 % German 1. 29 % Swiss 3. 89 % Others

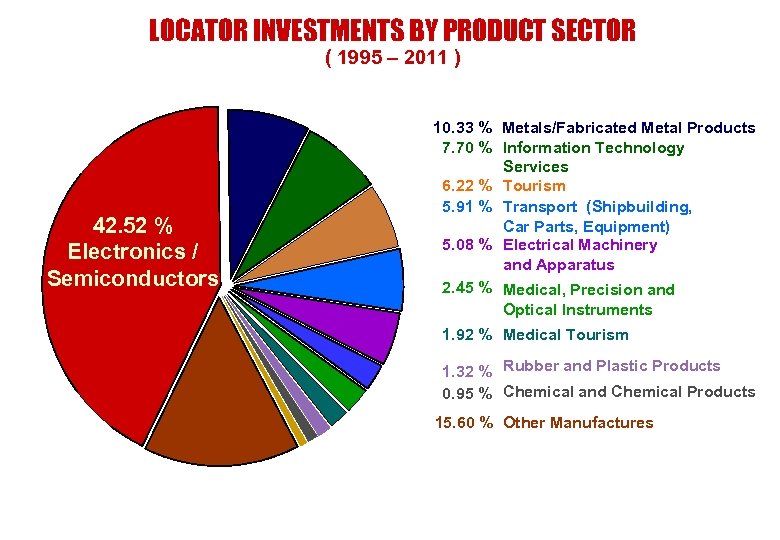

LOCATOR INVESTMENTS BY PRODUCT SECTOR ( 1995 – 2011 ) 42. 52 % Electronics / Semiconductors 10. 33 % Metals/Fabricated Metal Products 7. 70 % Information Technology Services 6. 22 % Tourism 5. 91 % Transport (Shipbuilding, Car Parts, Equipment) 5. 08 % Electrical Machinery and Apparatus 2. 45 % Medical, Precision and Optical Instruments 1. 92 % Medical Tourism 1. 32 % Rubber and Plastic Products 0. 95 % Chemical and Chemical Products 15. 60 % Other Manufactures

LOCATOR INVESTMENTS BY PRODUCT SECTOR ( 1995 – 2011 ) 42. 52 % Electronics / Semiconductors 10. 33 % Metals/Fabricated Metal Products 7. 70 % Information Technology Services 6. 22 % Tourism 5. 91 % Transport (Shipbuilding, Car Parts, Equipment) 5. 08 % Electrical Machinery and Apparatus 2. 45 % Medical, Precision and Optical Instruments 1. 92 % Medical Tourism 1. 32 % Rubber and Plastic Products 0. 95 % Chemical and Chemical Products 15. 60 % Other Manufactures

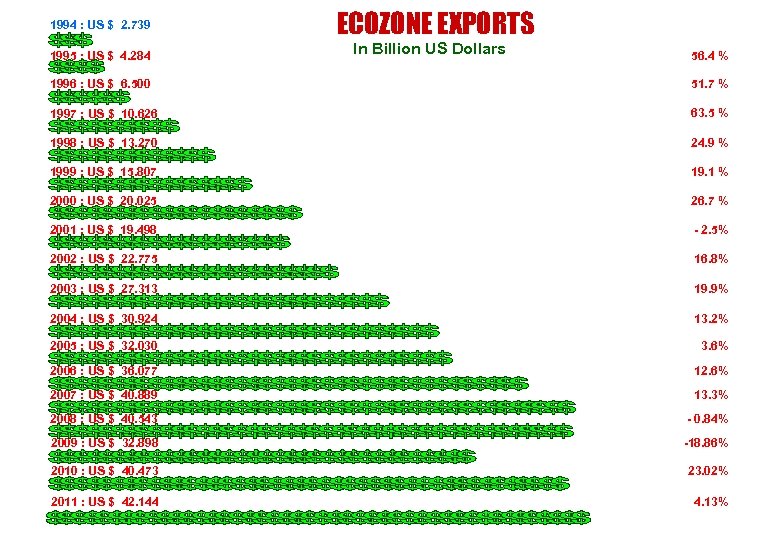

1994 : US $ 2. 739 1995 : US $ 4. 284 ECOZONE EXPORTS In Billion US Dollars 56. 4 % 1996 : US $ 6. 500 51. 7 % 1997 : US $ 10. 626 63. 5 % 1998 : US $ 13. 270 24. 9 % 1999 : US $ 15. 807 19. 1 % 2000 : US $ 20. 025 26. 7 % 2001 : US $ 19. 498 - 2. 5% 2002 : US $ 22. 775 16. 8% 2003 : US $ 27. 313 19. 9% 2004 : US $ 30. 924 13. 2% 2005 : US $ 32. 030 3. 6% 2006 : US $ 36. 077 12. 6% 2007 : US $ 40. 889 13. 3% 2008 : US $ 40. 543 - 0. 84% 2009 : US $ 32. 898 -18. 86% 2010 : US $ 40. 473 23. 02% 2011 : US $ 42. 144 4. 13%

1994 : US $ 2. 739 1995 : US $ 4. 284 ECOZONE EXPORTS In Billion US Dollars 56. 4 % 1996 : US $ 6. 500 51. 7 % 1997 : US $ 10. 626 63. 5 % 1998 : US $ 13. 270 24. 9 % 1999 : US $ 15. 807 19. 1 % 2000 : US $ 20. 025 26. 7 % 2001 : US $ 19. 498 - 2. 5% 2002 : US $ 22. 775 16. 8% 2003 : US $ 27. 313 19. 9% 2004 : US $ 30. 924 13. 2% 2005 : US $ 32. 030 3. 6% 2006 : US $ 36. 077 12. 6% 2007 : US $ 40. 889 13. 3% 2008 : US $ 40. 543 - 0. 84% 2009 : US $ 32. 898 -18. 86% 2010 : US $ 40. 473 23. 02% 2011 : US $ 42. 144 4. 13%

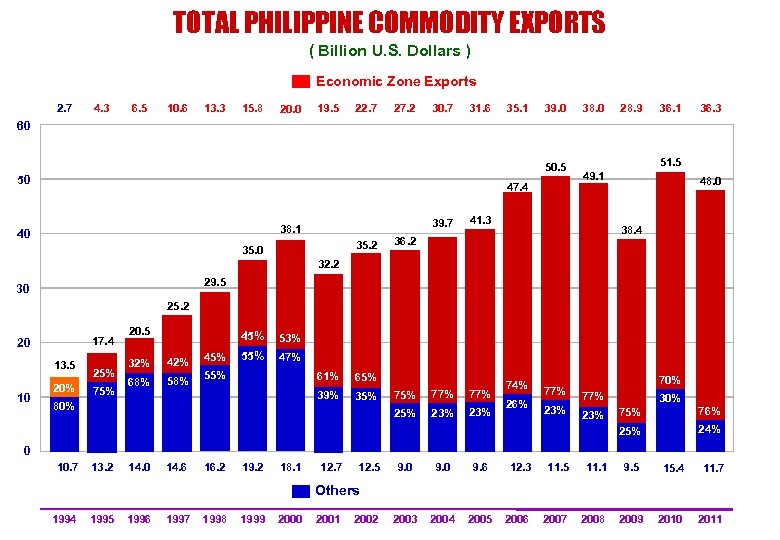

TOTAL PHILIPPINE COMMODITY EXPORTS ( Billion U. S. Dollars ) Economic Zone Exports 2. 7 4. 3 6. 5 10. 6 13. 3 15. 8 20. 0 19. 5 22. 7 27. 2 30. 7 31. 6 35. 1 39. 0 38. 0 28. 9 36. 1 36. 3 60 50. 5 50 47. 4 39. 7 38. 1 40 35. 2 35. 0 51. 5 49. 1 41. 3 48. 0 38. 4 36. 2 32. 2 29. 5 30 25. 2 17. 4 20 13. 5 10 20% 25% 75% 20. 5 45% 32% 42% 68% 58% 45% 53% 55% 47% 55% 61% 39% 80% 65% 35% 77% 74% 26% 70% 77% 23% 30% 23% 75% 76% 25% 24% 0 10. 7 13. 2 14. 0 14. 6 16. 2 19. 2 18. 1 12. 7 12. 5 9. 0 9. 6 12. 3 11. 5 11. 1 9. 5 15. 4 11. 7 2003 2004 2005 2006 2007 2008 2009 2010 2011 Others 1994 1995 1996 1997 1998 1999 2000 2001 2002

TOTAL PHILIPPINE COMMODITY EXPORTS ( Billion U. S. Dollars ) Economic Zone Exports 2. 7 4. 3 6. 5 10. 6 13. 3 15. 8 20. 0 19. 5 22. 7 27. 2 30. 7 31. 6 35. 1 39. 0 38. 0 28. 9 36. 1 36. 3 60 50. 5 50 47. 4 39. 7 38. 1 40 35. 2 35. 0 51. 5 49. 1 41. 3 48. 0 38. 4 36. 2 32. 2 29. 5 30 25. 2 17. 4 20 13. 5 10 20% 25% 75% 20. 5 45% 32% 42% 68% 58% 45% 53% 55% 47% 55% 61% 39% 80% 65% 35% 77% 74% 26% 70% 77% 23% 30% 23% 75% 76% 25% 24% 0 10. 7 13. 2 14. 0 14. 6 16. 2 19. 2 18. 1 12. 7 12. 5 9. 0 9. 6 12. 3 11. 5 11. 1 9. 5 15. 4 11. 7 2003 2004 2005 2006 2007 2008 2009 2010 2011 Others 1994 1995 1996 1997 1998 1999 2000 2001 2002

ECOZONE DIRECT EMPLOYMENT 1994 91, 860 1995 121, 823 1996 152, 250 1997 183, 709 1998 219, 791 1999 247, 076 2000 278, 407 2001 289, 548 2002 328, 384 2003 362, 851 2004 406, 752 2005 451, 279 2006 545, 025 2007 593, 108 2008 608, 387 2009 611, 058 2010 735, 672 2011 840, 945 14. 31%

ECOZONE DIRECT EMPLOYMENT 1994 91, 860 1995 121, 823 1996 152, 250 1997 183, 709 1998 219, 791 1999 247, 076 2000 278, 407 2001 289, 548 2002 328, 384 2003 362, 851 2004 406, 752 2005 451, 279 2006 545, 025 2007 593, 108 2008 608, 387 2009 611, 058 2010 735, 672 2011 840, 945 14. 31%

TOP ECONOMIC ZONE INVESTORS TI (Philippines), Inc. Electronics American Toshiba Information Electronics Japanese Sunpower Philippines Solar Cells Brit. Cayman Amkor Technology Electronics Singaporean NXP Semiconductors Electronics Dutch Ibiden Philippines Electronics Japanese Hoya Glass Disk Electronics Japanese Epson Precision Taganito Hpal Nickel Corp. Basic Metals Japanese Travellers International Tourism Filipino Coral Bay Nickel Corp. Basic Metals Japanese

TOP ECONOMIC ZONE INVESTORS TI (Philippines), Inc. Electronics American Toshiba Information Electronics Japanese Sunpower Philippines Solar Cells Brit. Cayman Amkor Technology Electronics Singaporean NXP Semiconductors Electronics Dutch Ibiden Philippines Electronics Japanese Hoya Glass Disk Electronics Japanese Epson Precision Taganito Hpal Nickel Corp. Basic Metals Japanese Travellers International Tourism Filipino Coral Bay Nickel Corp. Basic Metals Japanese

TOP ECONOMIC ZONE INVESTORS Hitachi Global Storage Electronics Dutch Samsung Electro-Mech Electronics Korean Rohm Electronics Singaporean St. Luke’s Medical City Medical Tourism Filipino Tsuneishi Heavy Ind Shipbuilding Japanese STMicroelectronics, Inc. Electronics Swiss Integrated Micro Electronics British Panasonic Precision Electronics Dutch Sureste Properties, Inc. Tourism Filipino Toyota Autoparts Automotive Japanese

TOP ECONOMIC ZONE INVESTORS Hitachi Global Storage Electronics Dutch Samsung Electro-Mech Electronics Korean Rohm Electronics Singaporean St. Luke’s Medical City Medical Tourism Filipino Tsuneishi Heavy Ind Shipbuilding Japanese STMicroelectronics, Inc. Electronics Swiss Integrated Micro Electronics British Panasonic Precision Electronics Dutch Sureste Properties, Inc. Tourism Filipino Toyota Autoparts Automotive Japanese

TOP ECONOMIC ZONE INVESTORS Convergys IT American Lufthansa Technik Air Transport German Nidec Phil Electronics Japanese TDK Phils. Electronics Pilipinas Kao, Inc. Chemical Products Japanese Analog Devices Electronics Dutch Green Future Innovation Agro-Industrial Filipino JP Morgan Chase Bank IT American Continental Temic Electronics German Schweitzer-Mauduit RTL Tobacco Products American On Semiconductor Electronics Terumo Phil Medical Instrm’t Japanese American

TOP ECONOMIC ZONE INVESTORS Convergys IT American Lufthansa Technik Air Transport German Nidec Phil Electronics Japanese TDK Phils. Electronics Pilipinas Kao, Inc. Chemical Products Japanese Analog Devices Electronics Dutch Green Future Innovation Agro-Industrial Filipino JP Morgan Chase Bank IT American Continental Temic Electronics German Schweitzer-Mauduit RTL Tobacco Products American On Semiconductor Electronics Terumo Phil Medical Instrm’t Japanese American

TOP ECONOMIC ZONE INVESTORS Lexmark Int’l Office Eqpmt. Swiss Electronics Japanese Teletech IT American House Technology Plastic Products Samsung Electronics Korean Accenture IT Taiyo Yuden Singaporean Dutch PASAR Basic Metals Filipino PV Tech Electrical Mach Singaporean Electronics American Automotive American Moog Electronics American First Philec Electronics Filipino Cypress Ford Motor

TOP ECONOMIC ZONE INVESTORS Lexmark Int’l Office Eqpmt. Swiss Electronics Japanese Teletech IT American House Technology Plastic Products Samsung Electronics Korean Accenture IT Taiyo Yuden Singaporean Dutch PASAR Basic Metals Filipino PV Tech Electrical Mach Singaporean Electronics American Automotive American Moog Electronics American First Philec Electronics Filipino Cypress Ford Motor

308 European Companies in PEZA. 281 are from EU Countries

308 European Companies in PEZA. 281 are from EU Countries

36 German Companies in PEZA Economic Zones

36 German Companies in PEZA Economic Zones

GERMAN ELECTRONICS AND SEMICON COMPANIES Continental Temic Electronics (Philippines), Inc. Nobile, Inc. Temic Automotive (Phils. ), Inc. Temic Semiconductor Test, Inc. TSPIC Corporation Vishay (Phils), Inc. GERMAN TRANSPORT AND TRAINING COMPANIES Lufthansa Technik Philippines, Inc. Lufthansa Technical Training Phils. , Inc. GERMAN ELECTRICITY AND GAS COMPANIES Linde Philippines (South) Linde Philippines, Inc.

GERMAN ELECTRONICS AND SEMICON COMPANIES Continental Temic Electronics (Philippines), Inc. Nobile, Inc. Temic Automotive (Phils. ), Inc. Temic Semiconductor Test, Inc. TSPIC Corporation Vishay (Phils), Inc. GERMAN TRANSPORT AND TRAINING COMPANIES Lufthansa Technik Philippines, Inc. Lufthansa Technical Training Phils. , Inc. GERMAN ELECTRICITY AND GAS COMPANIES Linde Philippines (South) Linde Philippines, Inc.

GERMAN GARMENTS AND TEXTILES COMPANIES CS Garment, Inc. Freshtex Philippines, Inc. JMMV Creations Manufacturing, Inc. Newtech Pulp, Inc. Philippine Light-Leather, Inc. Christ Philippines, Inc. GERMAN FABRICATED METALS COMPANIES Aionio, Inc. Zentes Unitex Asia, Inc. GERMAN MEDICAL PRECISION COMPANY Empress Dental Laboratories, Inc. GERMAN OTHER MANUFACTURING COMPANIES High End Fashion Jewelry Production Philippines, Inc. SHS Perforated Materials, Inc.

GERMAN GARMENTS AND TEXTILES COMPANIES CS Garment, Inc. Freshtex Philippines, Inc. JMMV Creations Manufacturing, Inc. Newtech Pulp, Inc. Philippine Light-Leather, Inc. Christ Philippines, Inc. GERMAN FABRICATED METALS COMPANIES Aionio, Inc. Zentes Unitex Asia, Inc. GERMAN MEDICAL PRECISION COMPANY Empress Dental Laboratories, Inc. GERMAN OTHER MANUFACTURING COMPANIES High End Fashion Jewelry Production Philippines, Inc. SHS Perforated Materials, Inc.

GERMAN ELECTRICAL APPARATUS COMPANY Bay-Sports Mfg. , Inc. GERMAN WAREHOUSING AND REAL ESTATES COMPANIES First Choice Properties, Inc. Vishay (Phils. ) Inc. – Warehousing Division Plastic and Tools, Inc. Cavite Socks, Inc.

GERMAN ELECTRICAL APPARATUS COMPANY Bay-Sports Mfg. , Inc. GERMAN WAREHOUSING AND REAL ESTATES COMPANIES First Choice Properties, Inc. Vishay (Phils. ) Inc. – Warehousing Division Plastic and Tools, Inc. Cavite Socks, Inc.

GERMAN I. T. COMPANIES CALL CENTERS Arvato Corp. Atos Information Technology Inc. Vishay (Phils. ) Inc. 1 & 1 Internet (Philippines), Inc. BPO NON-VOICE SERVICES Bombardier Transportation (Shared Services) Philippines, Inc. Daimler Group Services Philippines, Inc. MULTI-MEDIA GRAPHICS, ANIMATION, AND OTHER SERVICES Bigfoot Studios, Inc.

GERMAN I. T. COMPANIES CALL CENTERS Arvato Corp. Atos Information Technology Inc. Vishay (Phils. ) Inc. 1 & 1 Internet (Philippines), Inc. BPO NON-VOICE SERVICES Bombardier Transportation (Shared Services) Philippines, Inc. Daimler Group Services Philippines, Inc. MULTI-MEDIA GRAPHICS, ANIMATION, AND OTHER SERVICES Bigfoot Studios, Inc.

GERMAN I. T. COMPANIES SOFTWARE DEVELOPMENT Fritz & Macziol Asia Inc. ENGINEERING, ARCHITECTURAL AND OTHER DESIGN Temic Automotive (Phils. ) Inc. DATA ENCODING, TRANSCRIBING AND RELATED SERVICES Payment Processing Corporation

GERMAN I. T. COMPANIES SOFTWARE DEVELOPMENT Fritz & Macziol Asia Inc. ENGINEERING, ARCHITECTURAL AND OTHER DESIGN Temic Automotive (Phils. ) Inc. DATA ENCODING, TRANSCRIBING AND RELATED SERVICES Payment Processing Corporation

WHY INVEST IN THE PHILIPPINES

WHY INVEST IN THE PHILIPPINES

FILIPINO WORKERS Among the Best in the World THE COUNTRY’S COMPETITIVE EDGE Literate, English – speaking, easy to train, hardworking and very friendly In the IT Service Sector Filipino Workers are considered the new breed of world-class service professionals and are referred to as Global Knowledge Workers because they are intelligent and able to compete at the highest levels among the best in the world.

FILIPINO WORKERS Among the Best in the World THE COUNTRY’S COMPETITIVE EDGE Literate, English – speaking, easy to train, hardworking and very friendly In the IT Service Sector Filipino Workers are considered the new breed of world-class service professionals and are referred to as Global Knowledge Workers because they are intelligent and able to compete at the highest levels among the best in the world.

VERY FAST LEARNING CURVE OF FILIPINO WORKERS • 8 weeks (2 months) to train Filipino workers • Compared to 16 to 24 weeks (4 to 6 months) to train others

VERY FAST LEARNING CURVE OF FILIPINO WORKERS • 8 weeks (2 months) to train Filipino workers • Compared to 16 to 24 weeks (4 to 6 months) to train others

BUSINESS-FRIENDLY POLICIES • 100% Foreign Ownership of Companies; • Basic rights of Investors are guaranteed (right to remit profits and pay foreign obligations, right to repatriate investments) • Simplified investments procedures

BUSINESS-FRIENDLY POLICIES • 100% Foreign Ownership of Companies; • Basic rights of Investors are guaranteed (right to remit profits and pay foreign obligations, right to repatriate investments) • Simplified investments procedures

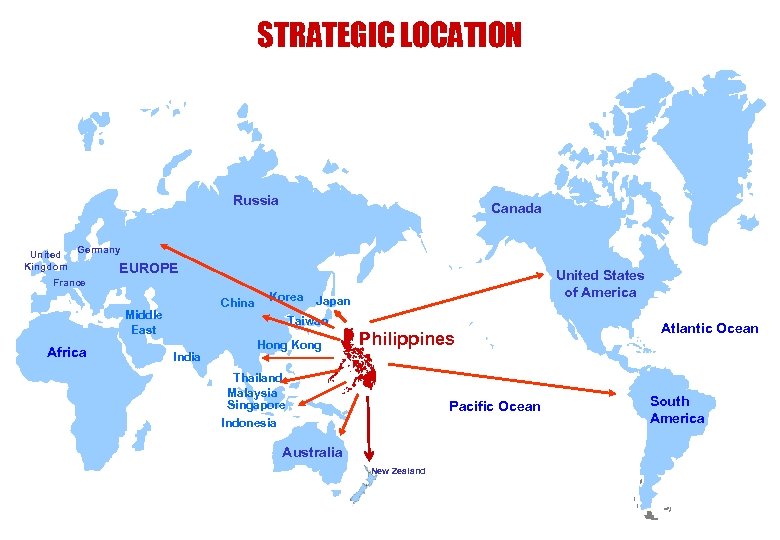

STRATEGIC LOCATION Russia Canada Germany United Kingdom EUROPE United States of America France China Middle East Africa Korea Japan Taiwan India Hong Kong Philippines Thailand Malaysia Singapore Indonesia Pacific Ocean Australia New Zealand Atlantic Ocean South America

STRATEGIC LOCATION Russia Canada Germany United Kingdom EUROPE United States of America France China Middle East Africa Korea Japan Taiwan India Hong Kong Philippines Thailand Malaysia Singapore Indonesia Pacific Ocean Australia New Zealand Atlantic Ocean South America

VERY HOSPITABLE and COMFORTABLE SECOND HOME to EXPATRIATES • Very friendly attitude of Filipinos towards foreigners • Availability of quality primary and secondary education Presence of International Schools • Housing closest to meeting western standards at very reasonable rental rates • Best sporting and recreational facilities Many world-class golf courses. • World class health care services (Result of a survey conducted on expatriates in Asia)

VERY HOSPITABLE and COMFORTABLE SECOND HOME to EXPATRIATES • Very friendly attitude of Filipinos towards foreigners • Availability of quality primary and secondary education Presence of International Schools • Housing closest to meeting western standards at very reasonable rental rates • Best sporting and recreational facilities Many world-class golf courses. • World class health care services (Result of a survey conducted on expatriates in Asia)

Philippines’ Competitive Advantage on Business Environment in Comparison to other Asian Countries January 2012 Japan External Trade Organization (JETRO) Manila

Philippines’ Competitive Advantage on Business Environment in Comparison to other Asian Countries January 2012 Japan External Trade Organization (JETRO) Manila

1. Moderate Cost

1. Moderate Cost

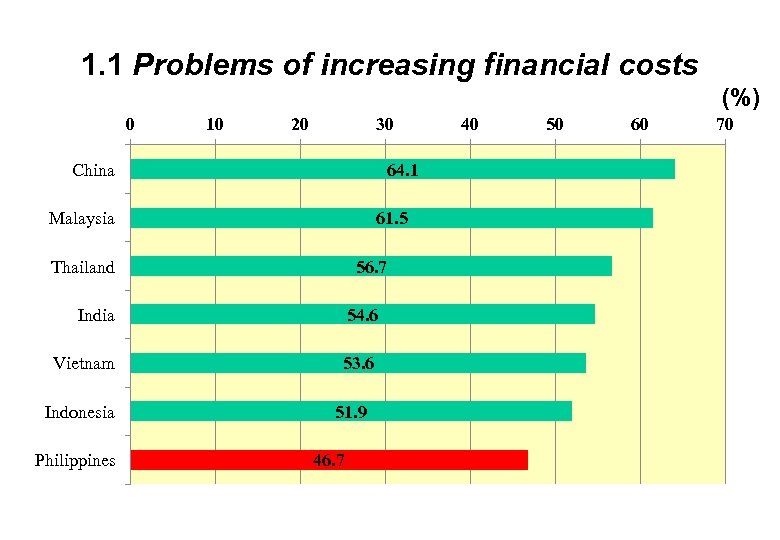

1. 1 Problems of increasing financial costs (%) 0 10 20 30 China 64. 1 Malaysia 61. 5 Thailand 56. 7 India 54. 6 Vietnam 53. 6 Indonesia Philippines 51. 9 46. 7 40 50 60 70

1. 1 Problems of increasing financial costs (%) 0 10 20 30 China 64. 1 Malaysia 61. 5 Thailand 56. 7 India 54. 6 Vietnam 53. 6 Indonesia Philippines 51. 9 46. 7 40 50 60 70

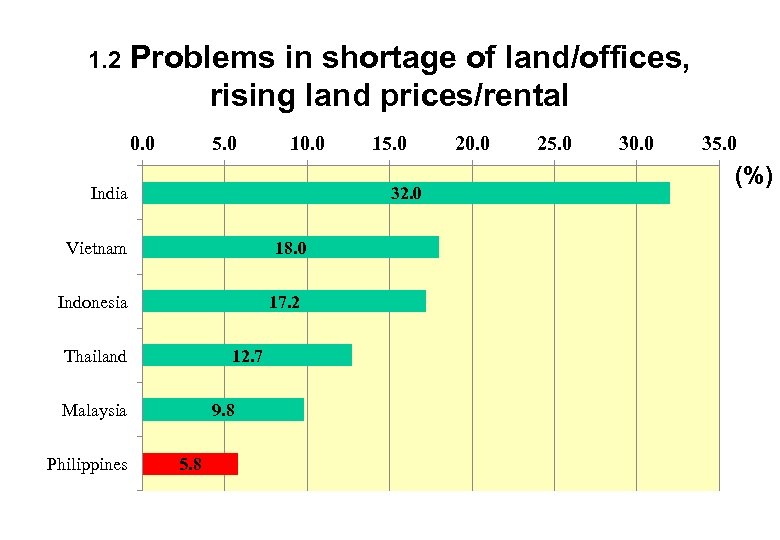

1. 2 Problems in shortage of land/offices, rising land prices/rental 0. 0 5. 0 10. 0 India 32. 0 Vietnam 18. 0 Indonesia 17. 2 Thailand 12. 7 Malaysia Philippines 15. 0 9. 8 5. 8 20. 0 25. 0 30. 0 35. 0 (%)

1. 2 Problems in shortage of land/offices, rising land prices/rental 0. 0 5. 0 10. 0 India 32. 0 Vietnam 18. 0 Indonesia 17. 2 Thailand 12. 7 Malaysia Philippines 15. 0 9. 8 5. 8 20. 0 25. 0 30. 0 35. 0 (%)

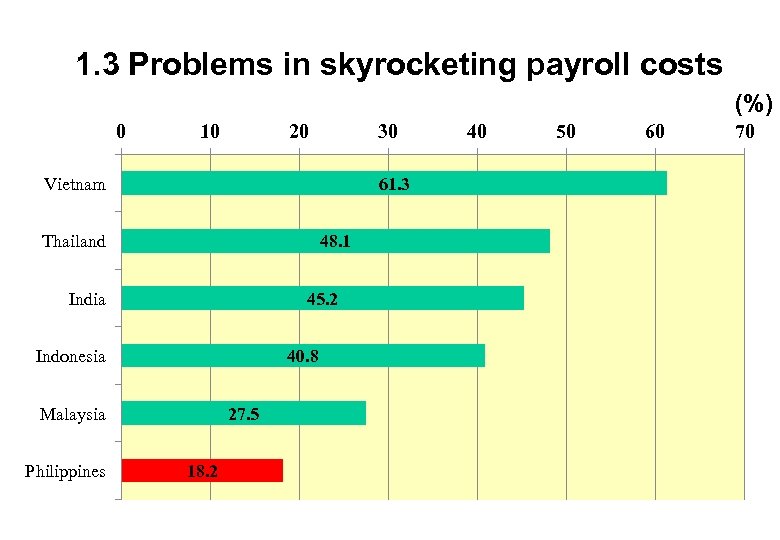

1. 3 Problems in skyrocketing payroll costs (%) 0 10 20 30 Vietnam 61. 3 Thailand 48. 1 45. 2 India Indonesia 40. 8 Malaysia Philippines 27. 5 18. 2 40 50 60 70

1. 3 Problems in skyrocketing payroll costs (%) 0 10 20 30 Vietnam 61. 3 Thailand 48. 1 45. 2 India Indonesia 40. 8 Malaysia Philippines 27. 5 18. 2 40 50 60 70

2. Sufficient Labor Supply

2. Sufficient Labor Supply

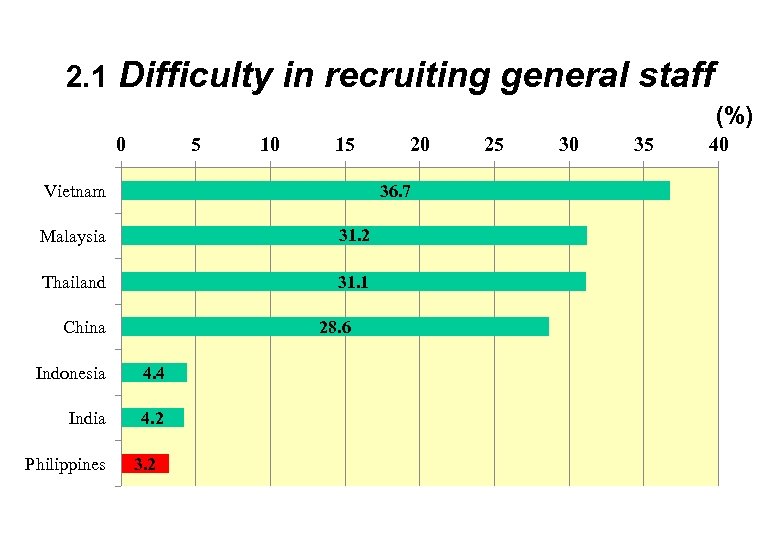

2. 1 Difficulty in recruiting general staff (%) 0 5 10 15 Vietnam 36. 7 Malaysia 31. 2 Thailand 31. 1 China 28. 6 Indonesia 4. 4 India 4. 2 Philippines 20 3. 2 25 30 35 40

2. 1 Difficulty in recruiting general staff (%) 0 5 10 15 Vietnam 36. 7 Malaysia 31. 2 Thailand 31. 1 China 28. 6 Indonesia 4. 4 India 4. 2 Philippines 20 3. 2 25 30 35 40

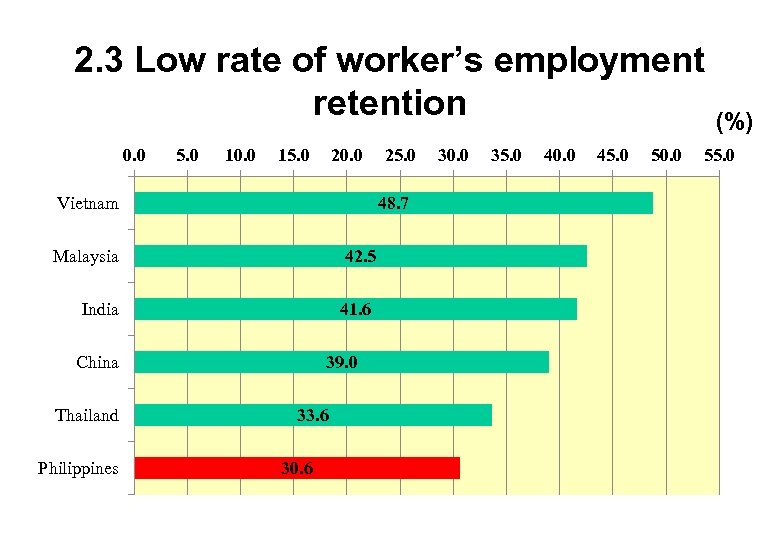

2. 3 Low rate of worker’s employment retention (%) 0. 0 5. 0 10. 0 15. 0 20. 0 Vietnam 48. 7 Malaysia 42. 5 India 41. 6 China Thailand Philippines 25. 0 39. 0 33. 6 30. 0 35. 0 40. 0 45. 0 50. 0 55. 0

2. 3 Low rate of worker’s employment retention (%) 0. 0 5. 0 10. 0 15. 0 20. 0 Vietnam 48. 7 Malaysia 42. 5 India 41. 6 China Thailand Philippines 25. 0 39. 0 33. 6 30. 0 35. 0 40. 0 45. 0 50. 0 55. 0

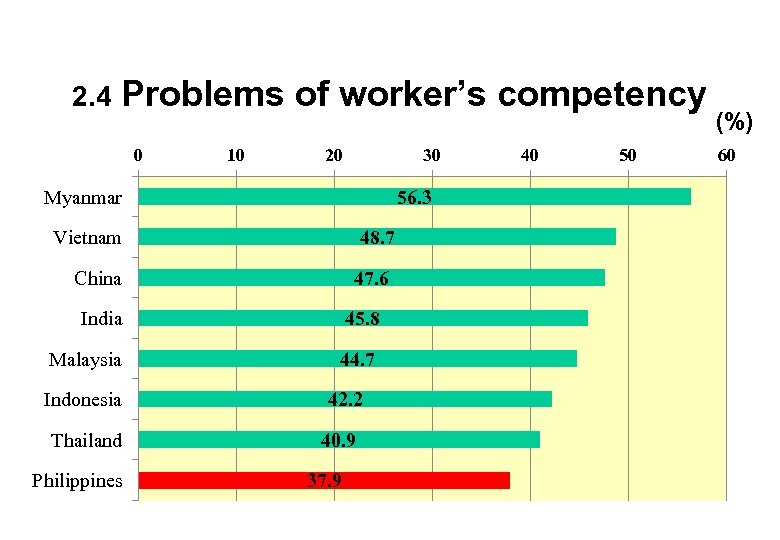

2. 4 Problems of worker’s competency 0 10 20 30 Myanmar 56. 3 Vietnam 48. 7 China 47. 6 India 45. 8 Malaysia 44. 7 Indonesia Thailand Philippines 42. 2 40. 9 37. 9 40 50 (%) 60

2. 4 Problems of worker’s competency 0 10 20 30 Myanmar 56. 3 Vietnam 48. 7 China 47. 6 India 45. 8 Malaysia 44. 7 Indonesia Thailand Philippines 42. 2 40. 9 37. 9 40 50 (%) 60

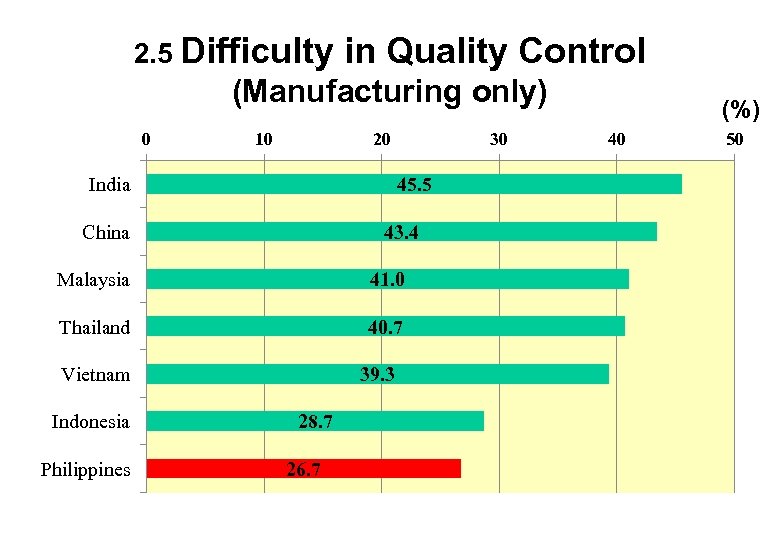

2. 5 Difficulty in Quality Control (Manufacturing only) 0 10 20 India 30 45. 5 China 43. 4 Malaysia 41. 0 Thailand 40. 7 Vietnam Indonesia Philippines 39. 3 28. 7 26. 7 (%) 40 50

2. 5 Difficulty in Quality Control (Manufacturing only) 0 10 20 India 30 45. 5 China 43. 4 Malaysia 41. 0 Thailand 40. 7 Vietnam Indonesia Philippines 39. 3 28. 7 26. 7 (%) 40 50

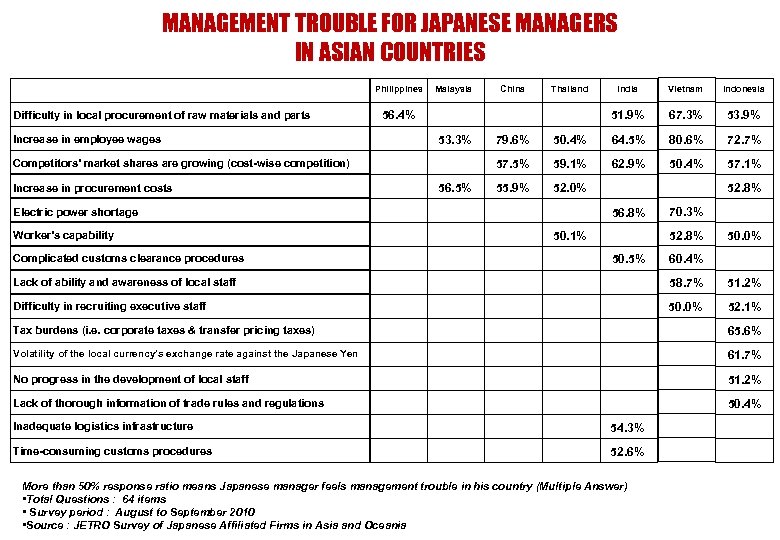

MANAGEMENT TROUBLE FOR JAPANESE MANAGERS IN ASIAN COUNTRIES Philippines Difficulty in local procurement of raw materials and parts Increase in employee wages Thailand 56. 4% Complicated customs clearance procedures Indonesia 67. 3% 53. 9% 56. 5% 79. 6% 50. 4% 64. 5% 80. 6% 72. 7% 59. 1% 62. 9% 50. 4% 57. 1% 55. 9% 52. 0% Electric power shortage Worker’s capability Vietnam 57. 5% 53. 3% Competitors’ market shares are growing (cost-wise competition) Increase in procurement costs China India 51. 9% Malaysia 52. 8% 56. 8% 70. 3% 52. 8% 50. 1% 50. 5% 50. 0% 60. 4% Lack of ability and awareness of local staff 58. 7% 51. 2% Difficulty in recruiting executive staff 50. 0% 52. 1% Tax burdens (i. e. corporate taxes & transfer pricing taxes) 65. 6% Volatility of the local currency’s exchange rate against the Japanese Yen 61. 7% No progress in the development of local staff 51. 2% Lack of thorough information of trade rules and regulations 50. 4% Inadequate logistics infrastructure 54. 3% Time-consuming customs procedures 52. 6% More than 50% response ratio means Japanese manager feels management trouble in his country (Multiple Answer) • Total Questions : 64 items • Survey period : August to September 2010 • Source : JETRO Survey of Japanese Affiliated Firms in Asia and Oceania

MANAGEMENT TROUBLE FOR JAPANESE MANAGERS IN ASIAN COUNTRIES Philippines Difficulty in local procurement of raw materials and parts Increase in employee wages Thailand 56. 4% Complicated customs clearance procedures Indonesia 67. 3% 53. 9% 56. 5% 79. 6% 50. 4% 64. 5% 80. 6% 72. 7% 59. 1% 62. 9% 50. 4% 57. 1% 55. 9% 52. 0% Electric power shortage Worker’s capability Vietnam 57. 5% 53. 3% Competitors’ market shares are growing (cost-wise competition) Increase in procurement costs China India 51. 9% Malaysia 52. 8% 56. 8% 70. 3% 52. 8% 50. 1% 50. 5% 50. 0% 60. 4% Lack of ability and awareness of local staff 58. 7% 51. 2% Difficulty in recruiting executive staff 50. 0% 52. 1% Tax burdens (i. e. corporate taxes & transfer pricing taxes) 65. 6% Volatility of the local currency’s exchange rate against the Japanese Yen 61. 7% No progress in the development of local staff 51. 2% Lack of thorough information of trade rules and regulations 50. 4% Inadequate logistics infrastructure 54. 3% Time-consuming customs procedures 52. 6% More than 50% response ratio means Japanese manager feels management trouble in his country (Multiple Answer) • Total Questions : 64 items • Survey period : August to September 2010 • Source : JETRO Survey of Japanese Affiliated Firms in Asia and Oceania

TOP CHIPMAKER 8 OUT OF THE WORLD’S TOP 20 CHIPMAKERS ARE OPERATING IN THE PHILIPPINES TIPI Analog Philips Sanyo Fairchild On Semi Samsung Rohm Source: SEIPI

TOP CHIPMAKER 8 OUT OF THE WORLD’S TOP 20 CHIPMAKERS ARE OPERATING IN THE PHILIPPINES TIPI Analog Philips Sanyo Fairchild On Semi Samsung Rohm Source: SEIPI

TOP HDD PRODUCER FOUR OF THE LARGEST HDD PRODUCERS IN THE WORLD ARE IN THE PHILIPPINES Hitachi Toshiba Fujitsu NEC Source: SEIPI

TOP HDD PRODUCER FOUR OF THE LARGEST HDD PRODUCERS IN THE WORLD ARE IN THE PHILIPPINES Hitachi Toshiba Fujitsu NEC Source: SEIPI

THE WORLD’S TOP ELECTRONICS FIRMS § CEBU MITSUMI –manufactures computer peripherals and components such as CD-R, CD-RW, optical pick up § AMKOR – manufactures IC packaging with 400 formats, from leadframe to BGA solutions § EPSON – one of the top 3 terminal printer production base of global Epson group, producing its 10 millionth printer § LEXMARK – produces 40 million printheads/year § CONTINENTAL – produces ABS, sensors § SUNPOWER – produces solar panels Source: SEIPI

THE WORLD’S TOP ELECTRONICS FIRMS § CEBU MITSUMI –manufactures computer peripherals and components such as CD-R, CD-RW, optical pick up § AMKOR – manufactures IC packaging with 400 formats, from leadframe to BGA solutions § EPSON – one of the top 3 terminal printer production base of global Epson group, producing its 10 millionth printer § LEXMARK – produces 40 million printheads/year § CONTINENTAL – produces ABS, sensors § SUNPOWER – produces solar panels Source: SEIPI

WITH HOMEGROWN SMS & EMS FIRMS IMI Ionics PSI Fastech Team … and a cluster of homegrown ODMs time recorder, AVR, power supplies, alarm systems, electronic ballasts, testers, GPS tracking, automated toll collection, others Notes: SMS – Semiconductor Manufacturing Services EMS – Electronics Manufacturing Services ODM – Original Design Manufacturing AVR – Automatic Voltage Regulator GPS – Global Positioning System Source: SEIPI

WITH HOMEGROWN SMS & EMS FIRMS IMI Ionics PSI Fastech Team … and a cluster of homegrown ODMs time recorder, AVR, power supplies, alarm systems, electronic ballasts, testers, GPS tracking, automated toll collection, others Notes: SMS – Semiconductor Manufacturing Services EMS – Electronics Manufacturing Services ODM – Original Design Manufacturing AVR – Automatic Voltage Regulator GPS – Global Positioning System Source: SEIPI

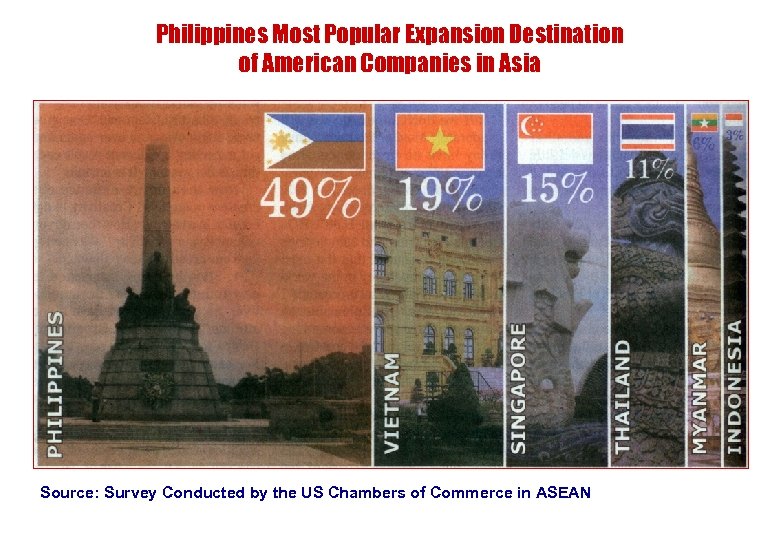

Philippines Most Popular Expansion Destination of American Companies in Asia Source: Survey Conducted by the US Chambers of Commerce in ASEAN

Philippines Most Popular Expansion Destination of American Companies in Asia Source: Survey Conducted by the US Chambers of Commerce in ASEAN

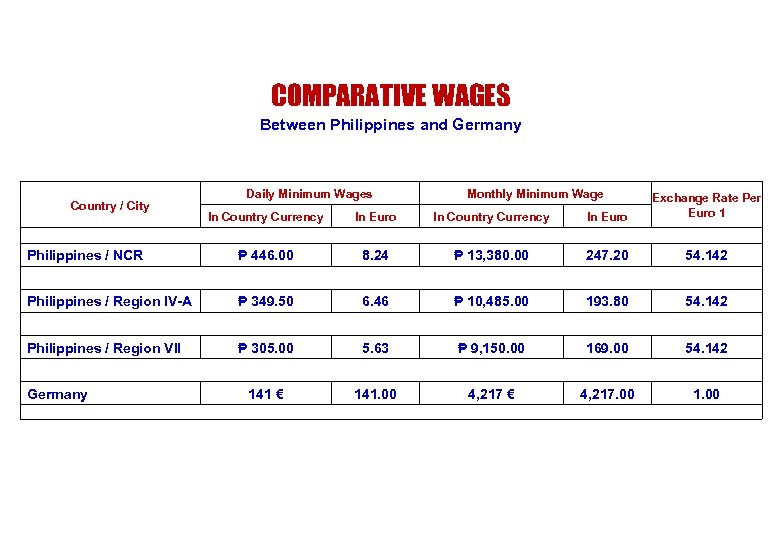

COMPARATIVE WAGES Between Philippines and Germany Country / City Daily Minimum Wages In Country Currency Monthly Minimum Wage In Euro In Country Currency In Euro Philippines / NCR Exchange Rate Per Euro 1 ₱ 446. 00 8. 24 ₱ 13, 380. 00 247. 20 54. 142 Philippines / Region IV-A ₱ 349. 50 6. 46 ₱ 10, 485. 00 193. 80 54. 142 Philippines / Region VII ₱ 305. 00 5. 63 ₱ 9, 150. 00 169. 00 54. 142 Germany 141 € 141. 00 4, 217 € 4, 217. 00 1. 00

COMPARATIVE WAGES Between Philippines and Germany Country / City Daily Minimum Wages In Country Currency Monthly Minimum Wage In Euro In Country Currency In Euro Philippines / NCR Exchange Rate Per Euro 1 ₱ 446. 00 8. 24 ₱ 13, 380. 00 247. 20 54. 142 Philippines / Region IV-A ₱ 349. 50 6. 46 ₱ 10, 485. 00 193. 80 54. 142 Philippines / Region VII ₱ 305. 00 5. 63 ₱ 9, 150. 00 169. 00 54. 142 Germany 141 € 141. 00 4, 217 € 4, 217. 00 1. 00

WHY INVEST IN PEZA ECONOMIC ZONES A. FISCAL INCENTIVES B. NON-FISCAL INCENTIVES

WHY INVEST IN PEZA ECONOMIC ZONES A. FISCAL INCENTIVES B. NON-FISCAL INCENTIVES

FISCAL INCENTIVES for EXPORT COMPANIES • Income Tax Holiday (ITH) or Exemption from Corporate Income Tax for four years, extendable to a maximum of eight years; • After the ITH period, payment of the special 5% Tax on Gross Income, in lieu of all national and local taxes; • Exemption from duties and taxes on imported capital equipment, spare parts, supplies, and raw materials; • Domestic sales allowance of up to 30% of total sales; • Zero Value-Added Tax (VAT) Rate on local purchases to include telecommunications, power, and water bills; • Exemption from payment of local government taxes and fees.

FISCAL INCENTIVES for EXPORT COMPANIES • Income Tax Holiday (ITH) or Exemption from Corporate Income Tax for four years, extendable to a maximum of eight years; • After the ITH period, payment of the special 5% Tax on Gross Income, in lieu of all national and local taxes; • Exemption from duties and taxes on imported capital equipment, spare parts, supplies, and raw materials; • Domestic sales allowance of up to 30% of total sales; • Zero Value-Added Tax (VAT) Rate on local purchases to include telecommunications, power, and water bills; • Exemption from payment of local government taxes and fees.

NON-FISCAL INCENTIVES for EXPORT COMPANIES • Employment of foreign nationals; • Special visa foreign investors and immediate family members; • Unequalled service by PEZA.

NON-FISCAL INCENTIVES for EXPORT COMPANIES • Employment of foreign nationals; • Special visa foreign investors and immediate family members; • Unequalled service by PEZA.

PEZA IS A ONE-STOP SHOP • Building and Occupancy Permits are issued by PEZA. • Import and Export Permits are issued by PEZA. • Automated and web-based Import & Export Procedures and e. Payment System (Paperless Transactions). • Special multiple-entry non-immigrant visa processed in PEZA. • Environment Clearance processed thru PEZA. • • Exemption from Local Government Permits and Fees. Registration requirements simplified, registration forms downloadable from website and uncomplicated, approval made easy.

PEZA IS A ONE-STOP SHOP • Building and Occupancy Permits are issued by PEZA. • Import and Export Permits are issued by PEZA. • Automated and web-based Import & Export Procedures and e. Payment System (Paperless Transactions). • Special multiple-entry non-immigrant visa processed in PEZA. • Environment Clearance processed thru PEZA. • • Exemption from Local Government Permits and Fees. Registration requirements simplified, registration forms downloadable from website and uncomplicated, approval made easy.

PEZA IS A “NON-STOP SHOP” • At the zones, PEZA provides 24 hours a day, 7 days a week of continuous service to locator companies. • The Director General herself and other PEZA officials are on call 24 hours a day, 7 days a week.

PEZA IS A “NON-STOP SHOP” • At the zones, PEZA provides 24 hours a day, 7 days a week of continuous service to locator companies. • The Director General herself and other PEZA officials are on call 24 hours a day, 7 days a week.

In PEZA, • NO RED TAPE • ONLY RED CARPET TREATMENT

In PEZA, • NO RED TAPE • ONLY RED CARPET TREATMENT

In PEZA, there is NO GRAFT NO CORRUPTION

In PEZA, there is NO GRAFT NO CORRUPTION

ISO 9001: 2008 PEZA’s Quality Management System is certified ISO 9001: 2008. PEZA is certified ISO 9001: 2008 for all its processes, at all levels, in all sites, nationwide.

ISO 9001: 2008 PEZA’s Quality Management System is certified ISO 9001: 2008. PEZA is certified ISO 9001: 2008 for all its processes, at all levels, in all sites, nationwide.

ONLY PEZA CITED FOR BEST PRACTICE AMONG ECONOMIC ZONES WORLDWIDE “Under PEZA, the Philippines has shown dramatic improvements in Investment Climate. End Result – PEZA is a shining example of successful regulatory reform improving overall investment climate in the country” Study of Gohan Akinci Foreign Investment Advisory Services (FIAS), International Finance Corporation of the World Bank (IFC-WB)

ONLY PEZA CITED FOR BEST PRACTICE AMONG ECONOMIC ZONES WORLDWIDE “Under PEZA, the Philippines has shown dramatic improvements in Investment Climate. End Result – PEZA is a shining example of successful regulatory reform improving overall investment climate in the country” Study of Gohan Akinci Foreign Investment Advisory Services (FIAS), International Finance Corporation of the World Bank (IFC-WB)

We now have a Reformist Government that is open for business. President Aquino’s Policy Thrusts: 1. 2. 3. 4. Good Governance Level Playing Field Transparency No Corruption

We now have a Reformist Government that is open for business. President Aquino’s Policy Thrusts: 1. 2. 3. 4. Good Governance Level Playing Field Transparency No Corruption

OTHER PEZA ECOZONE PROGRAMS

OTHER PEZA ECOZONE PROGRAMS

INFORMATION TECHNOLOGY PROGRAM

INFORMATION TECHNOLOGY PROGRAM

TOURISM ECONOMIC ZONES

TOURISM ECONOMIC ZONES

MEDICAL TOURISM ECONOMIC ZONES

MEDICAL TOURISM ECONOMIC ZONES

AGRO-INDUSTRIAL ECONOMIC ZONES

AGRO-INDUSTRIAL ECONOMIC ZONES

AWAITING YOUR INVESTMENTS !

AWAITING YOUR INVESTMENTS !