1d92d317a64cd98b00c08db561581a5d.ppt

- Количество слайдов: 20

Pharmaceuticals e. Q

Pharmaceuticals e. Q

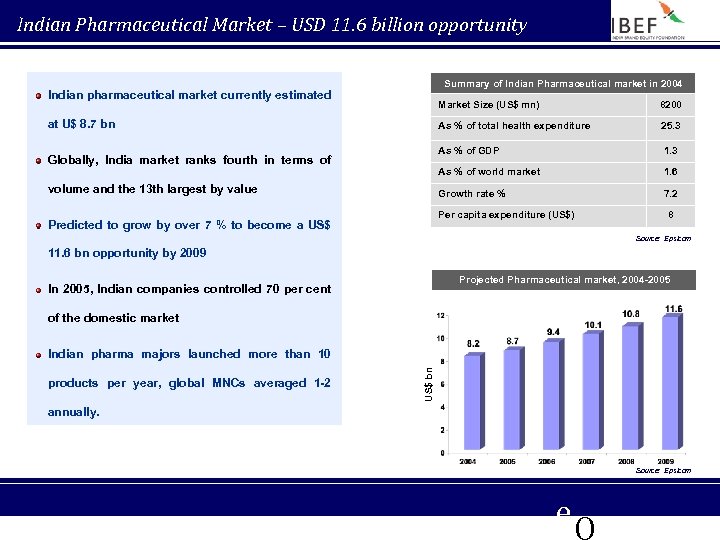

Indian Pharmaceutical Market – USD 11. 6 billion opportunity Summary of Indian Pharmaceutical market in 2004 Indian pharmaceutical market currently estimated Market Size (US$ mn) As % of total health expenditure 1. 6 Growth rate % volume and the 13 th largest by value 1. 3 As % of world market Globally, India market ranks fourth in terms of 25. 3 As % of GDP at U$ 8. 7 bn 8200 7. 2 Per capita expenditure (US$) Predicted to grow by over 7 % to become a US$ 8 Source: Epsicom 11. 6 bn opportunity by 2009 Projected Pharmaceutical market, 2004 -2005 In 2005, Indian companies controlled 70 per cent of the domestic market products per year, global MNCs averaged 1 -2 US$ bn Indian pharma majors launched more than 10 annually. Source: Epsicom e. Q

Indian Pharmaceutical Market – USD 11. 6 billion opportunity Summary of Indian Pharmaceutical market in 2004 Indian pharmaceutical market currently estimated Market Size (US$ mn) As % of total health expenditure 1. 6 Growth rate % volume and the 13 th largest by value 1. 3 As % of world market Globally, India market ranks fourth in terms of 25. 3 As % of GDP at U$ 8. 7 bn 8200 7. 2 Per capita expenditure (US$) Predicted to grow by over 7 % to become a US$ 8 Source: Epsicom 11. 6 bn opportunity by 2009 Projected Pharmaceutical market, 2004 -2005 In 2005, Indian companies controlled 70 per cent of the domestic market products per year, global MNCs averaged 1 -2 US$ bn Indian pharma majors launched more than 10 annually. Source: Epsicom e. Q

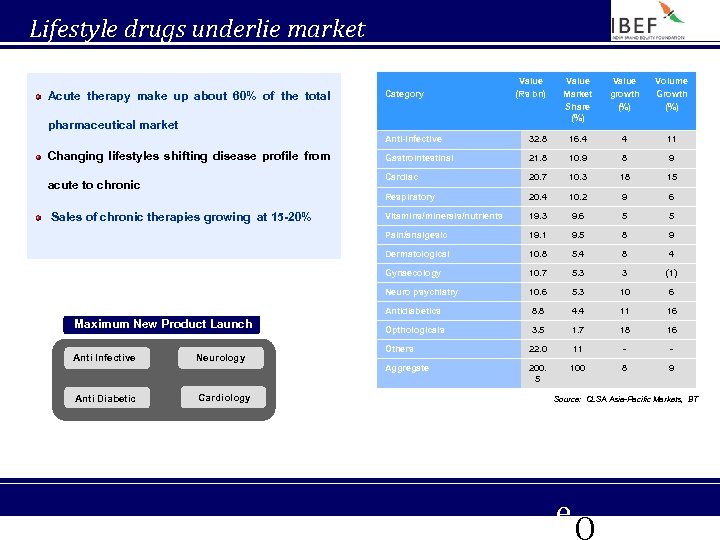

Lifestyle drugs underlie market growth Acute therapy make up about 60% of the total Category Value (Rs bn) pharmaceutical market Value Market Share (%) Value growth (%) Volume Growth (%) Anti-infective Cardiology 8 9 20. 7 10. 3 18 15 20. 4 10. 2 9 6 Vitamins/minerals/nutrients 19. 3 9. 6 5 5 19. 1 9. 5 8 9 10. 8 5. 4 8 4 10. 7 5. 3 3 (1) 10. 6 5. 3 10 6 Antidiabetics Anti Diabetic 10. 9 Neuro psychiatry Neurology 21. 8 Gynaecology Anti Infective Gastrointestinal Dermatological Maximum New Product Launch 11 Pain/analgesic Sales of chronic therapies growing at 15 -20% 4 Respiratory acute to chronic 16. 4 Cardiac Changing lifestyles shifting disease profile from 32. 8 8. 8 4. 4 11 16 Opthologicals 3. 5 1. 7 18 16 Others 22. 0 11 - - Aggregate 200. 5 100 8 9 Source: CLSA Asia-Pacific Markets, BT e. Q

Lifestyle drugs underlie market growth Acute therapy make up about 60% of the total Category Value (Rs bn) pharmaceutical market Value Market Share (%) Value growth (%) Volume Growth (%) Anti-infective Cardiology 8 9 20. 7 10. 3 18 15 20. 4 10. 2 9 6 Vitamins/minerals/nutrients 19. 3 9. 6 5 5 19. 1 9. 5 8 9 10. 8 5. 4 8 4 10. 7 5. 3 3 (1) 10. 6 5. 3 10 6 Antidiabetics Anti Diabetic 10. 9 Neuro psychiatry Neurology 21. 8 Gynaecology Anti Infective Gastrointestinal Dermatological Maximum New Product Launch 11 Pain/analgesic Sales of chronic therapies growing at 15 -20% 4 Respiratory acute to chronic 16. 4 Cardiac Changing lifestyles shifting disease profile from 32. 8 8. 8 4. 4 11 16 Opthologicals 3. 5 1. 7 18 16 Others 22. 0 11 - - Aggregate 200. 5 100 8 9 Source: CLSA Asia-Pacific Markets, BT e. Q

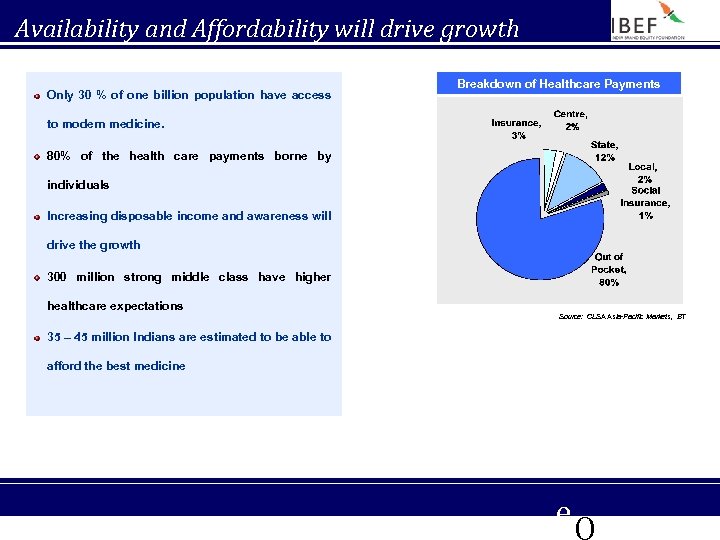

Availability and Affordability will drive growth Only 30 % of one billion population have access Breakdown of Healthcare Payments to modern medicine. 80% of the health care payments borne by individuals Increasing disposable income and awareness will drive the growth 300 million strong middle class have higher healthcare expectations Source: CLSA Asia-Pacific Markets, BT 35 – 45 million Indians are estimated to be able to afford the best medicine e. Q

Availability and Affordability will drive growth Only 30 % of one billion population have access Breakdown of Healthcare Payments to modern medicine. 80% of the health care payments borne by individuals Increasing disposable income and awareness will drive the growth 300 million strong middle class have higher healthcare expectations Source: CLSA Asia-Pacific Markets, BT 35 – 45 million Indians are estimated to be able to afford the best medicine e. Q

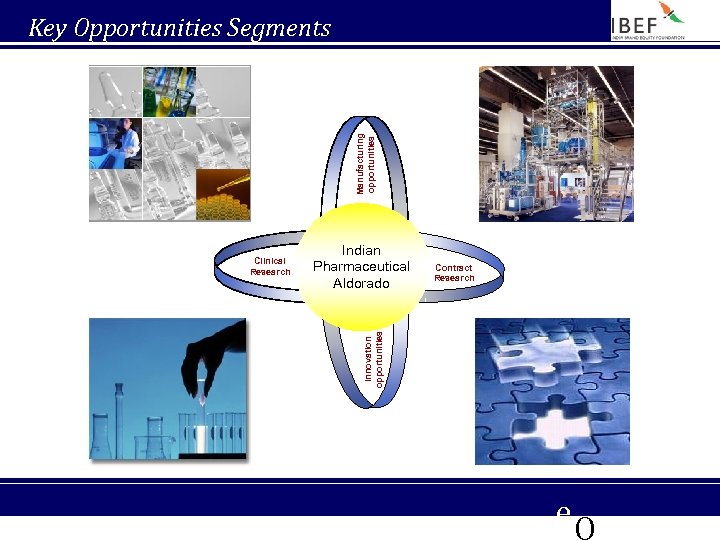

Manufacturing opportunities Key Opportunities Segments Indian Pharmaceutical Aldorado Contract Research Innovation opportunities Clinical Research e. Q

Manufacturing opportunities Key Opportunities Segments Indian Pharmaceutical Aldorado Contract Research Innovation opportunities Clinical Research e. Q

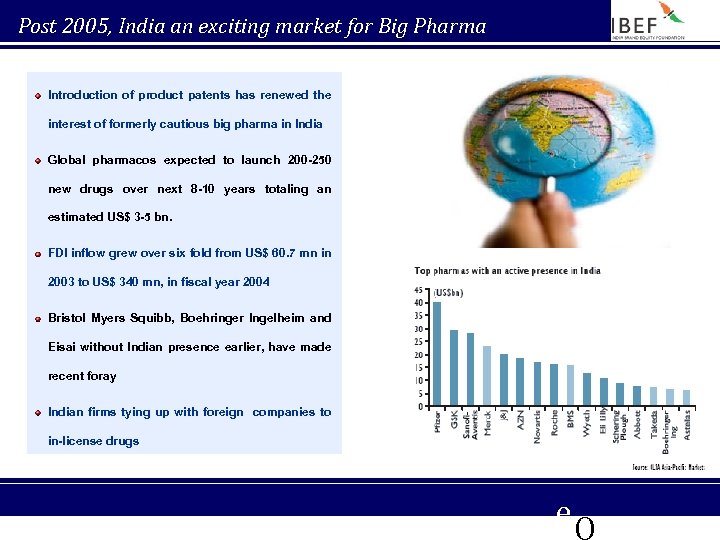

Post 2005, India an exciting market for Big Pharma Introduction of product patents has renewed the interest of formerly cautious big pharma in India Global pharmacos expected to launch 200 -250 new drugs over next 8 -10 years totaling an estimated US$ 3 -5 bn. FDI inflow grew over six fold from US$ 60. 7 mn in 2003 to US$ 340 mn, in fiscal year 2004 Bristol Myers Squibb, Boehringer Ingelheim and Eisai without Indian presence earlier, have made recent foray Indian firms tying up with foreign companies to in-license drugs e. Q

Post 2005, India an exciting market for Big Pharma Introduction of product patents has renewed the interest of formerly cautious big pharma in India Global pharmacos expected to launch 200 -250 new drugs over next 8 -10 years totaling an estimated US$ 3 -5 bn. FDI inflow grew over six fold from US$ 60. 7 mn in 2003 to US$ 340 mn, in fiscal year 2004 Bristol Myers Squibb, Boehringer Ingelheim and Eisai without Indian presence earlier, have made recent foray Indian firms tying up with foreign companies to in-license drugs e. Q

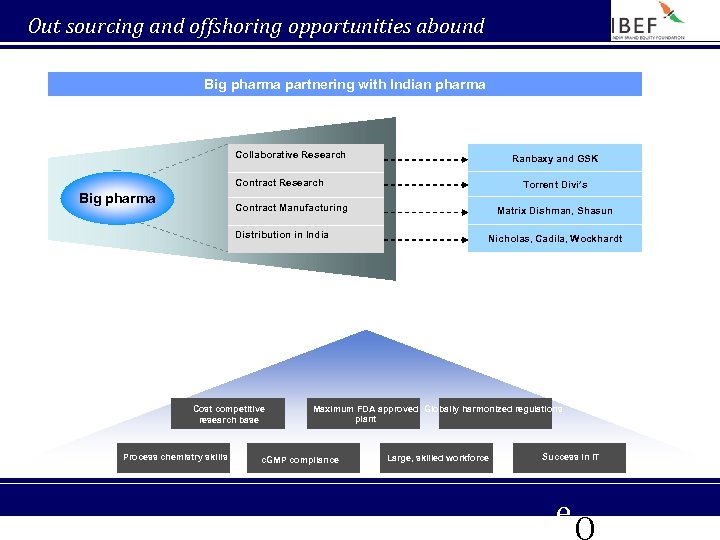

Out sourcing and offshoring opportunities abound Big pharma partnering with Indian pharma Collaborative Research Ranbaxy and GSK Contract Research Big pharma Torrent Divi’s Contract Manufacturing Distribution in India Cost competitive research base Process chemistry skills Matrix Dishman, Shasun Nicholas, Cadila, Wockhardt Maximum FDA approved Globally harmonized regulations plant c. GMP compliance Large, skilled workforce Success in IT e. Q

Out sourcing and offshoring opportunities abound Big pharma partnering with Indian pharma Collaborative Research Ranbaxy and GSK Contract Research Big pharma Torrent Divi’s Contract Manufacturing Distribution in India Cost competitive research base Process chemistry skills Matrix Dishman, Shasun Nicholas, Cadila, Wockhardt Maximum FDA approved Globally harmonized regulations plant c. GMP compliance Large, skilled workforce Success in IT e. Q

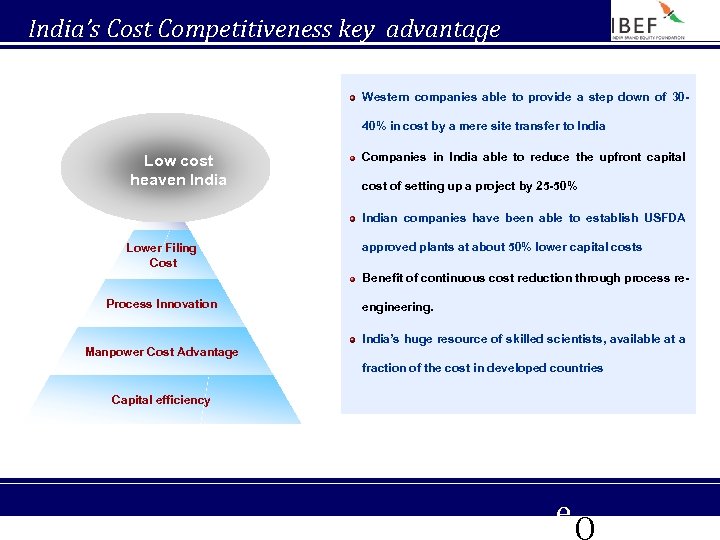

India’s Cost Competitiveness key advantage Western companies able to provide a step down of 3040% in cost by a mere site transfer to India Low cost heaven India Companies in India able to reduce the upfront capital cost of setting up a project by 25 -50% Indian companies have been able to establish USFDA Lower Filing Cost approved plants at about 50% lower capital costs Benefit of continuous cost reduction through process re- Process Innovation Manpower Cost Advantage engineering. India’s huge resource of skilled scientists, available at a fraction of the cost in developed countries Capital efficiency e. Q

India’s Cost Competitiveness key advantage Western companies able to provide a step down of 3040% in cost by a mere site transfer to India Low cost heaven India Companies in India able to reduce the upfront capital cost of setting up a project by 25 -50% Indian companies have been able to establish USFDA Lower Filing Cost approved plants at about 50% lower capital costs Benefit of continuous cost reduction through process re- Process Innovation Manpower Cost Advantage engineering. India’s huge resource of skilled scientists, available at a fraction of the cost in developed countries Capital efficiency e. Q

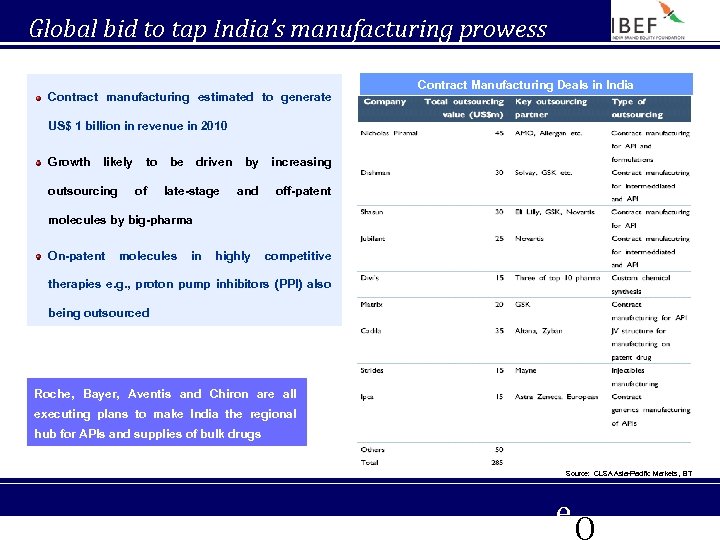

Global bid to tap India’s manufacturing prowess Contract manufacturing estimated to generate Contract Manufacturing Deals in India US$ 1 billion in revenue in 2010 Growth likely outsourcing to of be driven late-stage by increasing and off-patent molecules by big-pharma On-patent molecules in highly competitive therapies e. g. , proton pump inhibitors (PPI) also being outsourced Roche, Bayer, Aventis and Chiron are all executing plans to make India the regional hub for APIs and supplies of bulk drugs Source: CLSA Asia-Pacific Markets, BT e. Q

Global bid to tap India’s manufacturing prowess Contract manufacturing estimated to generate Contract Manufacturing Deals in India US$ 1 billion in revenue in 2010 Growth likely outsourcing to of be driven late-stage by increasing and off-patent molecules by big-pharma On-patent molecules in highly competitive therapies e. g. , proton pump inhibitors (PPI) also being outsourced Roche, Bayer, Aventis and Chiron are all executing plans to make India the regional hub for APIs and supplies of bulk drugs Source: CLSA Asia-Pacific Markets, BT e. Q

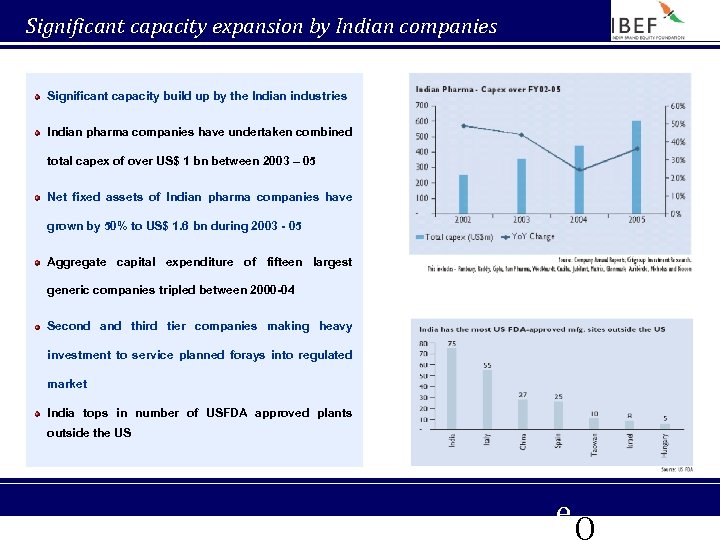

Significant capacity expansion by Indian companies Significant capacity build up by the Indian industries Indian pharma companies have undertaken combined total capex of over US$ 1 bn between 2003 – 05 Net fixed assets of Indian pharma companies have grown by 50% to US$ 1. 6 bn during 2003 - 05 Aggregate capital expenditure of fifteen largest generic companies tripled between 2000 -04 Second and third tier companies making heavy investment to service planned forays into regulated market India tops in number of USFDA approved plants outside the US e. Q

Significant capacity expansion by Indian companies Significant capacity build up by the Indian industries Indian pharma companies have undertaken combined total capex of over US$ 1 bn between 2003 – 05 Net fixed assets of Indian pharma companies have grown by 50% to US$ 1. 6 bn during 2003 - 05 Aggregate capital expenditure of fifteen largest generic companies tripled between 2000 -04 Second and third tier companies making heavy investment to service planned forays into regulated market India tops in number of USFDA approved plants outside the US e. Q

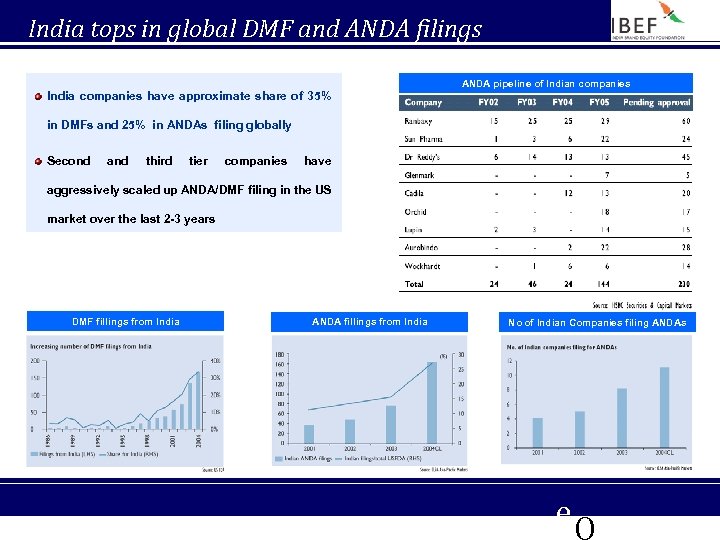

India tops in global DMF and ANDA filings ANDA pipeline of Indian companies India companies have approximate share of 35% in DMFs and 25% in ANDAs filing globally Second and third tier companies have aggressively scaled up ANDA/DMF filing in the US market over the last 2 -3 years DMF fillings from India ANDA fillings from India No of Indian Companies filing ANDAs e. Q

India tops in global DMF and ANDA filings ANDA pipeline of Indian companies India companies have approximate share of 35% in DMFs and 25% in ANDAs filing globally Second and third tier companies have aggressively scaled up ANDA/DMF filing in the US market over the last 2 -3 years DMF fillings from India ANDA fillings from India No of Indian Companies filing ANDAs e. Q

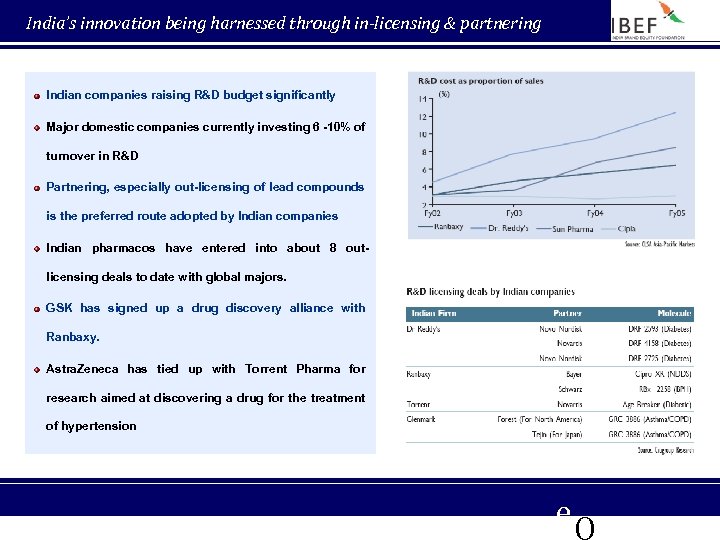

India’s innovation being harnessed through in-licensing & partnering Indian companies raising R&D budget significantly Major domestic companies currently investing 6 -10% of turnover in R&D Partnering, especially out-licensing of lead compounds is the preferred route adopted by Indian companies Indian pharmacos have entered into about 8 outlicensing deals to date with global majors. GSK has signed up a drug discovery alliance with Ranbaxy. Astra. Zeneca has tied up with Torrent Pharma for research aimed at discovering a drug for the treatment of hypertension e. Q

India’s innovation being harnessed through in-licensing & partnering Indian companies raising R&D budget significantly Major domestic companies currently investing 6 -10% of turnover in R&D Partnering, especially out-licensing of lead compounds is the preferred route adopted by Indian companies Indian pharmacos have entered into about 8 outlicensing deals to date with global majors. GSK has signed up a drug discovery alliance with Ranbaxy. Astra. Zeneca has tied up with Torrent Pharma for research aimed at discovering a drug for the treatment of hypertension e. Q

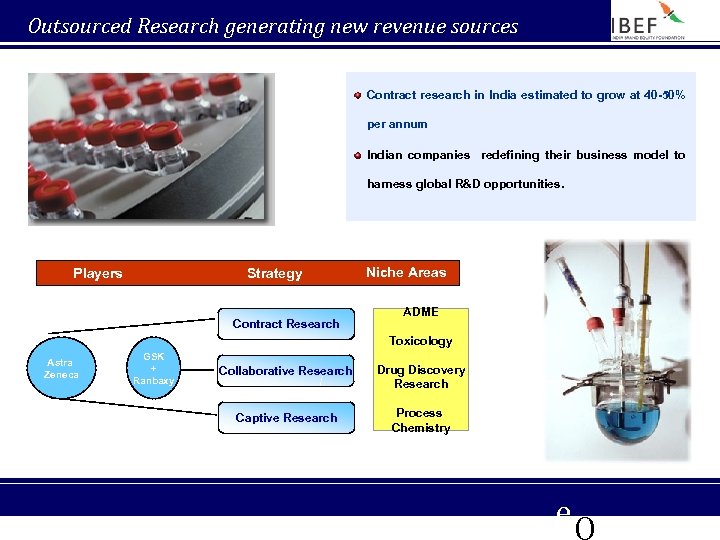

Outsourced Research generating new revenue sources Contract research in India estimated to grow at 40 -50% per annum Indian companies redefining their business model to harness global R&D opportunities. Players Strategy Contract Research Niche Areas ADME Toxicology Astra Zeneca GSK + Ranbaxy Collaborative Research Drug Discovery Research Captive Research Process Chemistry e. Q

Outsourced Research generating new revenue sources Contract research in India estimated to grow at 40 -50% per annum Indian companies redefining their business model to harness global R&D opportunities. Players Strategy Contract Research Niche Areas ADME Toxicology Astra Zeneca GSK + Ranbaxy Collaborative Research Drug Discovery Research Captive Research Process Chemistry e. Q

Preclinical R&D – India’s chemistry skills in demand Indian chemists, highly skilled in activities such as organic synthesis, medicinal chemistry, process chemistry and analytical chemistry in demand ADME/Toxicology, Drug discovery research and Process chemistry being increasingly outsourced Indian companies strength lies in low cost of operation, competent scientific workforce and experience in IT Collaboration with Indian CRO helps to Cover gaps in capacity, optimization of cost, widened skill base and enhancement of drug development pipeline Pfizer, Novartis, Astra Zeneca and GSK have established own R&D infrastructure to conduct Offshore research in India e. Q

Preclinical R&D – India’s chemistry skills in demand Indian chemists, highly skilled in activities such as organic synthesis, medicinal chemistry, process chemistry and analytical chemistry in demand ADME/Toxicology, Drug discovery research and Process chemistry being increasingly outsourced Indian companies strength lies in low cost of operation, competent scientific workforce and experience in IT Collaboration with Indian CRO helps to Cover gaps in capacity, optimization of cost, widened skill base and enhancement of drug development pipeline Pfizer, Novartis, Astra Zeneca and GSK have established own R&D infrastructure to conduct Offshore research in India e. Q

Toxicology services – US$ 20 -22 mn opportunity Need to conduct pre-clinical studies driving companies to India to set up captive facilities or form alliances with Indian CROs Enhanced biomedical infrastructure and competitive costs are key growth drivers Range of services Indian CROs capable of offering complete pre-clinical Dossier preparation solutions at one place Laboratories and facilities at par with international standard Regulatory summaries Product registration Product defence Capability to undertake studies in line with international regulatory guidelines e. g. OECD, EC, EU etc. Most players affiliated to Independent Institutional animal ethics committee e. Q

Toxicology services – US$ 20 -22 mn opportunity Need to conduct pre-clinical studies driving companies to India to set up captive facilities or form alliances with Indian CROs Enhanced biomedical infrastructure and competitive costs are key growth drivers Range of services Indian CROs capable of offering complete pre-clinical Dossier preparation solutions at one place Laboratories and facilities at par with international standard Regulatory summaries Product registration Product defence Capability to undertake studies in line with international regulatory guidelines e. g. OECD, EC, EU etc. Most players affiliated to Independent Institutional animal ethics committee e. Q

Government support for pre-clinical research Indian Council of Medical Research Primate Research Facility, Mumbai technical and financial assistance from NIH, USA International Animal Research Facility, Hyderabad Govt. of Andhra Pradesh has allotted 100 acres On 25 acres of land with an Investment of US$ of land at the Biotech Park in Genome Valley 16. 7 mn Deptt. Of Biotechnology providing US$ 4. 4 mn Facility to house 7500 breeding stocks for the facility Center has received US$ 3 mn grant from US and Facility will be of international standards with US$ 4 mn from ICMR animal testing facilities, hi-tech equipment, a strong technical board and ethical committee e. Q

Government support for pre-clinical research Indian Council of Medical Research Primate Research Facility, Mumbai technical and financial assistance from NIH, USA International Animal Research Facility, Hyderabad Govt. of Andhra Pradesh has allotted 100 acres On 25 acres of land with an Investment of US$ of land at the Biotech Park in Genome Valley 16. 7 mn Deptt. Of Biotechnology providing US$ 4. 4 mn Facility to house 7500 breeding stocks for the facility Center has received US$ 3 mn grant from US and Facility will be of international standards with US$ 4 mn from ICMR animal testing facilities, hi-tech equipment, a strong technical board and ethical committee e. Q

Clinical Research – India, most significant emerging geography Success Drivers Indian clinical research industry estimated at over US$ 100 mn Cost Advantage Fast Rate of Subject Recruitments Improved Medical Infrastructure Large Pool of English Speaking Investigators Increasing compliance with ICH-GCP protocols Growing body of trained and experienced investigators India expected to capture about 10% of the global clinical research market by 2010 Big Pharma contributing patients from India multicentric global trials for FDA/EMEA submissions. Increasing Compliance with ICH –GCP 7 of the Top 10 global CROs have a presence in India e. Q for

Clinical Research – India, most significant emerging geography Success Drivers Indian clinical research industry estimated at over US$ 100 mn Cost Advantage Fast Rate of Subject Recruitments Improved Medical Infrastructure Large Pool of English Speaking Investigators Increasing compliance with ICH-GCP protocols Growing body of trained and experienced investigators India expected to capture about 10% of the global clinical research market by 2010 Big Pharma contributing patients from India multicentric global trials for FDA/EMEA submissions. Increasing Compliance with ICH –GCP 7 of the Top 10 global CROs have a presence in India e. Q for

Multinational Success Story Phase III study of Zymar gatifloxacin ophthalmic solution conducted by Quintiles in India accepted by FDA for approval to treat bacterial conjunctivitis Quintiles, India is believed to be one of the most profitable subsidiaries (by operating profit margins) of Quintiles Transnational. Pfizer, Novartis and Eli Lilly and now GSK are all understood to be making India a global hub for their clinical research activities. e. Q

Multinational Success Story Phase III study of Zymar gatifloxacin ophthalmic solution conducted by Quintiles in India accepted by FDA for approval to treat bacterial conjunctivitis Quintiles, India is believed to be one of the most profitable subsidiaries (by operating profit margins) of Quintiles Transnational. Pfizer, Novartis and Eli Lilly and now GSK are all understood to be making India a global hub for their clinical research activities. e. Q

Policy Initiatives The patent (Third amendment) Act, 2005 Revision of schedule Y to permit conduct of phase II-IV clinical trials in India Amendment of schedule M to make industry compliance to Good Manufacturing Practices Stringent measures for makers of spurious drugs Creation of pharma R&D fund with a total corpus of US$ 33. 3 million Concessional Industrial Package for pharmaceutical manufacturers in certain hilly states Constitution of India Pharmacopoeia Commission Creation of Export Promotion Council “Pharmexcil” e. Q

Policy Initiatives The patent (Third amendment) Act, 2005 Revision of schedule Y to permit conduct of phase II-IV clinical trials in India Amendment of schedule M to make industry compliance to Good Manufacturing Practices Stringent measures for makers of spurious drugs Creation of pharma R&D fund with a total corpus of US$ 33. 3 million Concessional Industrial Package for pharmaceutical manufacturers in certain hilly states Constitution of India Pharmacopoeia Commission Creation of Export Promotion Council “Pharmexcil” e. Q

Disclaimer • • • This presentation has been prepared jointly by the India Brand Equity Foundation (“IBEF”) and Ernst & Young (“Authors”) All rights reserved. All copyright in this presentation and related works is owned by IBEF and the Authors. The same may not be reproduced, wholly or in part in any material form (including photocopying or storing it in any medium by electronic means and whether or not transiently or incidentally to some other use of this presentation), modified or in any manner communicated to any third party except with the written approval of IBEF. This presentation is for information purposes only. While due care has been taken during the compilation of this presentation to ensure that the information is accurate to the best of the Author’s and IBEF’s knowledge and belief, the content is not to be construed in any manner whatsoever as a substitute for professional advice. The Author and IBEF neither recommend or endorse any specific products or services that may have been mentioned in this presentation and nor do they assume any liability or responsibility for the outcome of decisions taken as a result of any reliance placed in this presentation. Neither the Author nor IBEF shall be liable for any direct or indirect damages that may arise due to any act or omission on the part of the user due to any reliance placed or guidance taken from any portion of this presentation. e. Q

Disclaimer • • • This presentation has been prepared jointly by the India Brand Equity Foundation (“IBEF”) and Ernst & Young (“Authors”) All rights reserved. All copyright in this presentation and related works is owned by IBEF and the Authors. The same may not be reproduced, wholly or in part in any material form (including photocopying or storing it in any medium by electronic means and whether or not transiently or incidentally to some other use of this presentation), modified or in any manner communicated to any third party except with the written approval of IBEF. This presentation is for information purposes only. While due care has been taken during the compilation of this presentation to ensure that the information is accurate to the best of the Author’s and IBEF’s knowledge and belief, the content is not to be construed in any manner whatsoever as a substitute for professional advice. The Author and IBEF neither recommend or endorse any specific products or services that may have been mentioned in this presentation and nor do they assume any liability or responsibility for the outcome of decisions taken as a result of any reliance placed in this presentation. Neither the Author nor IBEF shall be liable for any direct or indirect damages that may arise due to any act or omission on the part of the user due to any reliance placed or guidance taken from any portion of this presentation. e. Q