0f16fa775815aa48397171ebeedb84a2.ppt

- Количество слайдов: 27

PHA: Hedging Transaction PHA Exposure for DW Inc. Marc Rosenthal Richard Cull James Frame Mehgan Haldane

PHA: Hedging Transaction PHA Exposure for DW Inc. Marc Rosenthal Richard Cull James Frame Mehgan Haldane

Part I: DW’s Hedging Problem n June n DW orders parts valued at JPY 200, 000 n Delivery in 2 months, payment within 30 days of delivery n July 5 th n Confirmation of delivery in October n Expected delivery is Oct. 28 th

Part I: DW’s Hedging Problem n June n DW orders parts valued at JPY 200, 000 n Delivery in 2 months, payment within 30 days of delivery n July 5 th n Confirmation of delivery in October n Expected delivery is Oct. 28 th

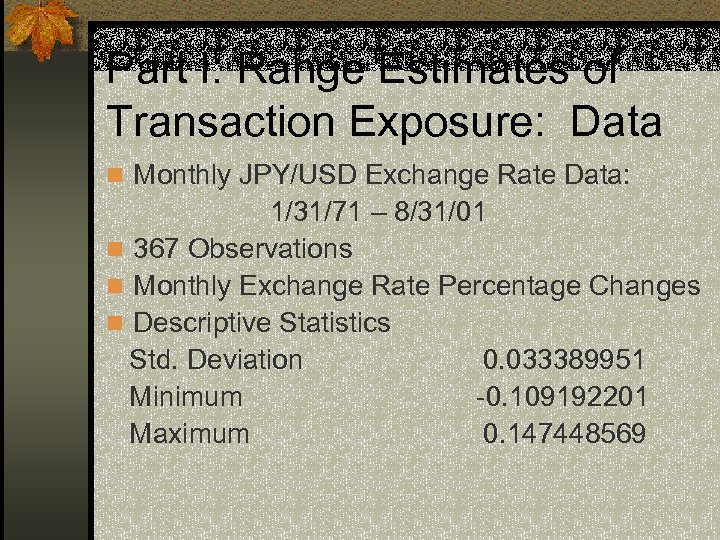

Part I: Range Estimates of Transaction Exposure: Data n Monthly JPY/USD Exchange Rate Data: 1/31/71 – 8/31/01 n 367 Observations n Monthly Exchange Rate Percentage Changes n Descriptive Statistics Std. Deviation 0. 033389951 Minimum -0. 109192201 Maximum 0. 147448569

Part I: Range Estimates of Transaction Exposure: Data n Monthly JPY/USD Exchange Rate Data: 1/31/71 – 8/31/01 n 367 Observations n Monthly Exchange Rate Percentage Changes n Descriptive Statistics Std. Deviation 0. 033389951 Minimum -0. 109192201 Maximum 0. 147448569

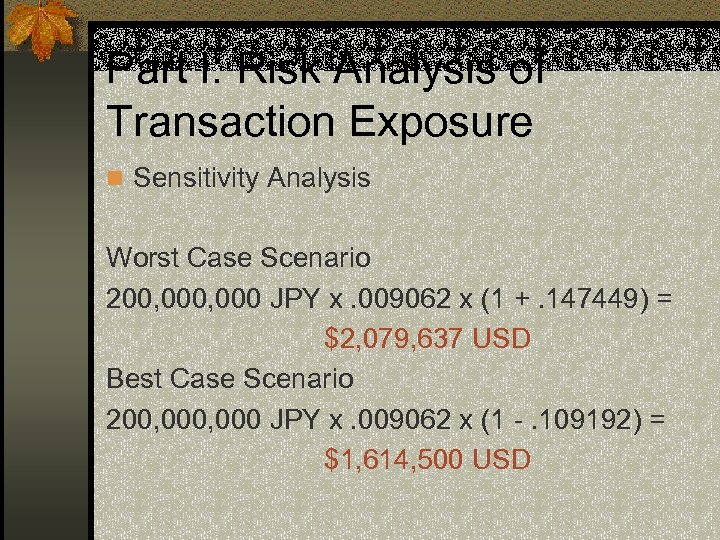

Part I: Risk Analysis of Transaction Exposure n Sensitivity Analysis Worst Case Scenario 200, 000 JPY x. 009062 x (1 +. 147449) = $2, 079, 637 USD Best Case Scenario 200, 000 JPY x. 009062 x (1 -. 109192) = $1, 614, 500 USD

Part I: Risk Analysis of Transaction Exposure n Sensitivity Analysis Worst Case Scenario 200, 000 JPY x. 009062 x (1 +. 147449) = $2, 079, 637 USD Best Case Scenario 200, 000 JPY x. 009062 x (1 -. 109192) = $1, 614, 500 USD

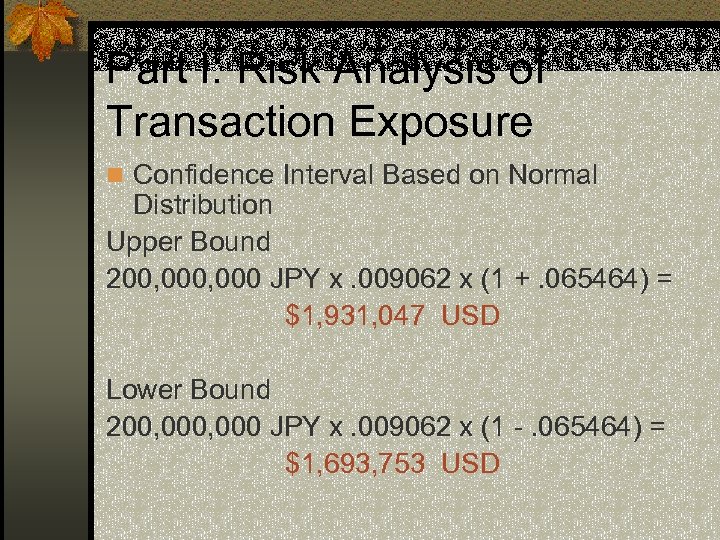

Part I: Risk Analysis of Transaction Exposure n Confidence Interval Based on Normal Distribution Upper Bound 200, 000 JPY x. 009062 x (1 +. 065464) = $1, 931, 047 USD Lower Bound 200, 000 JPY x. 009062 x (1 -. 065464) = $1, 693, 753 USD

Part I: Risk Analysis of Transaction Exposure n Confidence Interval Based on Normal Distribution Upper Bound 200, 000 JPY x. 009062 x (1 +. 065464) = $1, 931, 047 USD Lower Bound 200, 000 JPY x. 009062 x (1 -. 065464) = $1, 693, 753 USD

Part I: Hedging Strategies Proposed n. Forward Contracts n. PHLX Options n. Over-the-Counter-Options

Part I: Hedging Strategies Proposed n. Forward Contracts n. PHLX Options n. Over-the-Counter-Options

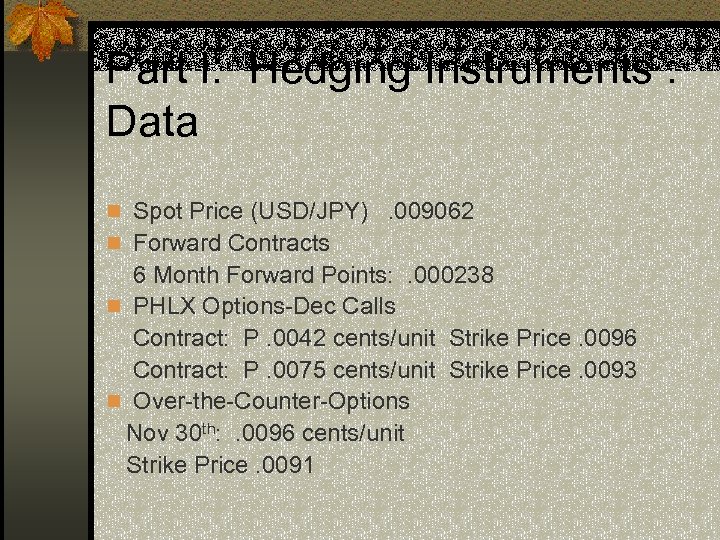

Part I: Hedging Instruments : Data n Spot Price (USD/JPY). 009062 n Forward Contracts 6 Month Forward Points: . 000238 n PHLX Options-Dec Calls Contract: P. 0042 cents/unit Strike Price. 0096 Contract: P. 0075 cents/unit Strike Price. 0093 n Over-the-Counter-Options Nov 30 th: . 0096 cents/unit Strike Price. 0091

Part I: Hedging Instruments : Data n Spot Price (USD/JPY). 009062 n Forward Contracts 6 Month Forward Points: . 000238 n PHLX Options-Dec Calls Contract: P. 0042 cents/unit Strike Price. 0096 Contract: P. 0075 cents/unit Strike Price. 0093 n Over-the-Counter-Options Nov 30 th: . 0096 cents/unit Strike Price. 0091

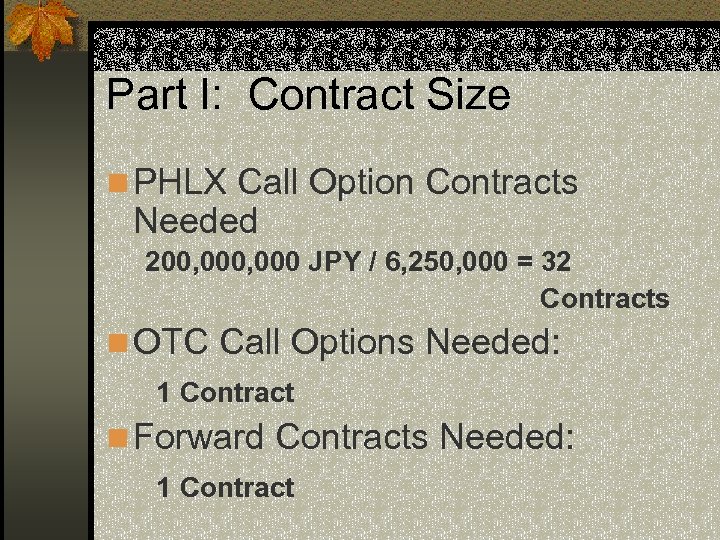

Part I: Contract Size n PHLX Call Option Contracts Needed 200, 000 JPY / 6, 250, 000 = 32 Contracts n OTC Call Options Needed: 1 Contract n Forward Contracts Needed: 1 Contract

Part I: Contract Size n PHLX Call Option Contracts Needed 200, 000 JPY / 6, 250, 000 = 32 Contracts n OTC Call Options Needed: 1 Contract n Forward Contracts Needed: 1 Contract

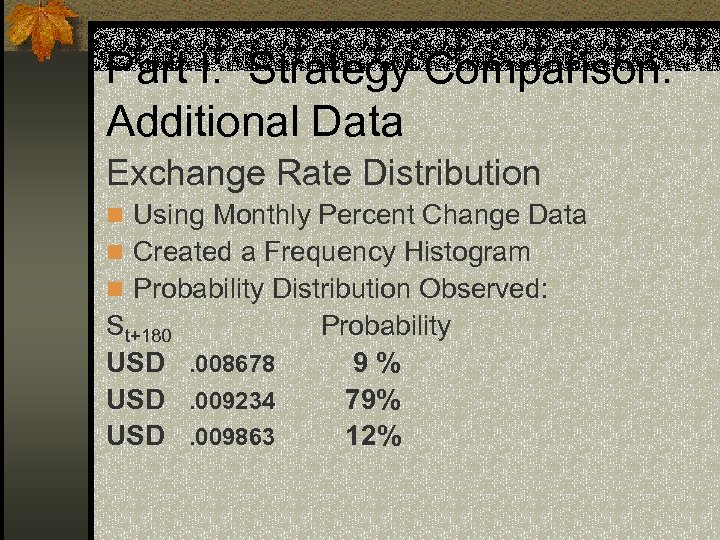

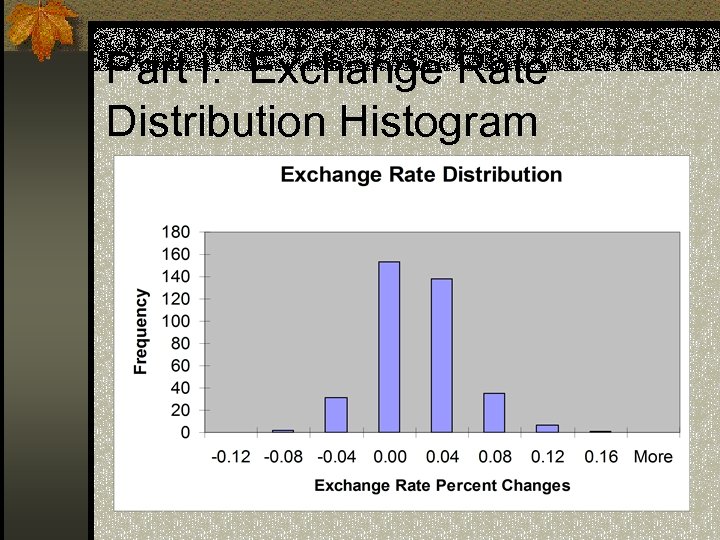

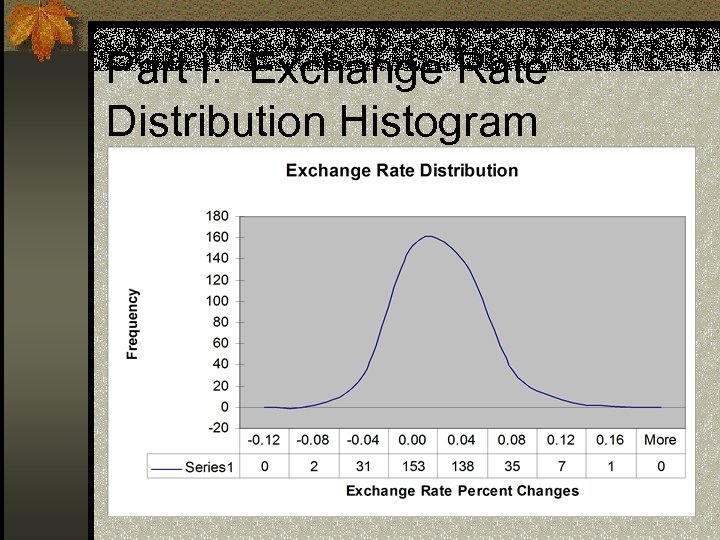

Part I: Strategy Comparison: Additional Data Exchange Rate Distribution n Using Monthly Percent Change Data n Created a Frequency Histogram n Probability Distribution Observed: St+180 USD. 008678 USD. 009234 USD. 009863 Probability 9% 79% 12%

Part I: Strategy Comparison: Additional Data Exchange Rate Distribution n Using Monthly Percent Change Data n Created a Frequency Histogram n Probability Distribution Observed: St+180 USD. 008678 USD. 009234 USD. 009863 Probability 9% 79% 12%

Part I: Exchange Rate Distribution Histogram

Part I: Exchange Rate Distribution Histogram

Part I: Exchange Rate Distribution Histogram

Part I: Exchange Rate Distribution Histogram

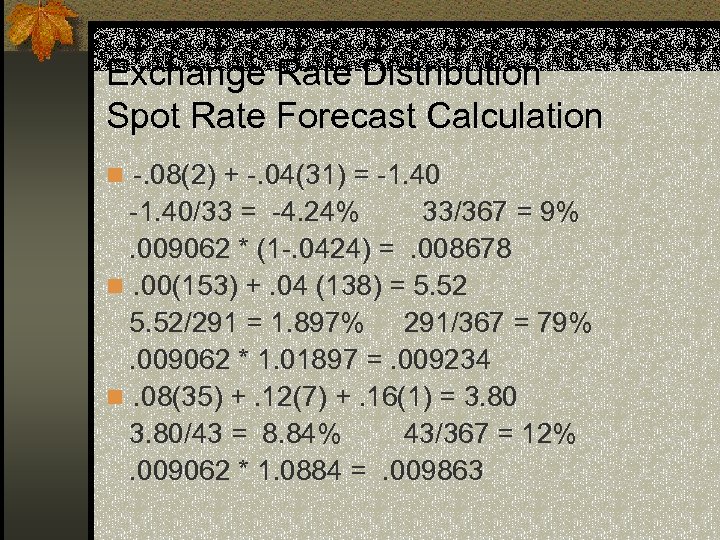

Exchange Rate Distribution Spot Rate Forecast Calculation n -. 08(2) + -. 04(31) = -1. 40/33 = -4. 24% 33/367 = 9%. 009062 * (1 -. 0424) =. 008678 n. 00(153) +. 04 (138) = 5. 52/291 = 1. 897% 291/367 = 79%. 009062 * 1. 01897 =. 009234 n. 08(35) +. 12(7) +. 16(1) = 3. 80/43 = 8. 84% 43/367 = 12%. 009062 * 1. 0884 =. 009863

Exchange Rate Distribution Spot Rate Forecast Calculation n -. 08(2) + -. 04(31) = -1. 40/33 = -4. 24% 33/367 = 9%. 009062 * (1 -. 0424) =. 008678 n. 00(153) +. 04 (138) = 5. 52/291 = 1. 897% 291/367 = 79%. 009062 * 1. 01897 =. 009234 n. 08(35) +. 12(7) +. 16(1) = 3. 80/43 = 8. 84% 43/367 = 12%. 009062 * 1. 0884 =. 009863

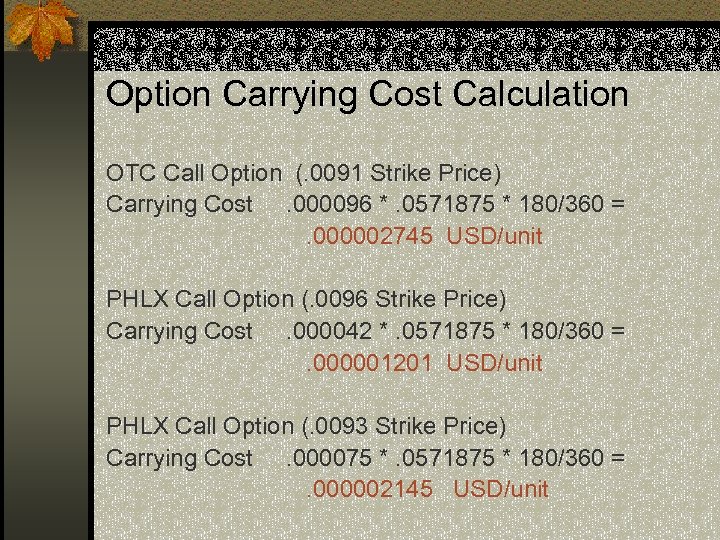

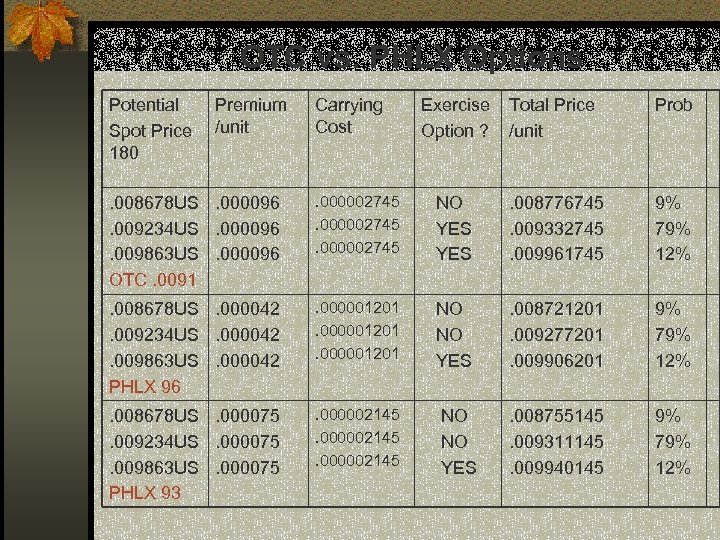

Option Carrying Cost Calculation OTC Call Option (. 0091 Strike Price) Carrying Cost. 000096 *. 0571875 * 180/360 =. 000002745 USD/unit PHLX Call Option (. 0096 Strike Price) Carrying Cost. 000042 *. 0571875 * 180/360 =. 000001201 USD/unit PHLX Call Option (. 0093 Strike Price) Carrying Cost. 000075 *. 0571875 * 180/360 =. 000002145 USD/unit

Option Carrying Cost Calculation OTC Call Option (. 0091 Strike Price) Carrying Cost. 000096 *. 0571875 * 180/360 =. 000002745 USD/unit PHLX Call Option (. 0096 Strike Price) Carrying Cost. 000042 *. 0571875 * 180/360 =. 000001201 USD/unit PHLX Call Option (. 0093 Strike Price) Carrying Cost. 000075 *. 0571875 * 180/360 =. 000002145 USD/unit

OTC vs. PHLX Options Potential Spot Price 180 Premium /unit Carrying Cost Exercise Option ? Total Price /unit Prob . 008678 US. 000096. 009234 US. 000096. 009863 US. 000096 OTC. 0091 . 000002745 NO YES . 008776745. 009332745. 009961745 9% 79% 12% . 008678 US. 000042. 009234 US. 000042. 009863 US. 000042 PHLX 96 . 000001201 NO NO YES . 008721201. 009277201. 009906201 9% 79% 12% . 008678 US. 000075. 009234 US. 000075. 009863 US. 000075 PHLX 93 . 000002145 NO NO YES . 008755145. 009311145. 009940145 9% 79% 12%

OTC vs. PHLX Options Potential Spot Price 180 Premium /unit Carrying Cost Exercise Option ? Total Price /unit Prob . 008678 US. 000096. 009234 US. 000096. 009863 US. 000096 OTC. 0091 . 000002745 NO YES . 008776745. 009332745. 009961745 9% 79% 12% . 008678 US. 000042. 009234 US. 000042. 009863 US. 000042 PHLX 96 . 000001201 NO NO YES . 008721201. 009277201. 009906201 9% 79% 12% . 008678 US. 000075. 009234 US. 000075. 009863 US. 000075 PHLX 93 . 000002145 NO NO YES . 008755145. 009311145. 009940145 9% 79% 12%

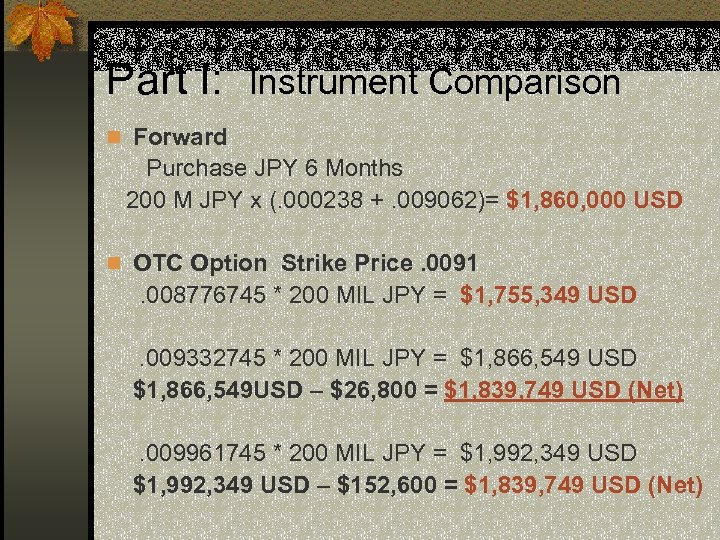

Part I: Instrument Comparison n Forward Purchase JPY 6 Months 200 M JPY x (. 000238 +. 009062)= $1, 860, 000 USD n OTC Option Strike Price. 0091 . 008776745 * 200 MIL JPY = $1, 755, 349 USD. 009332745 * 200 MIL JPY = $1, 866, 549 USD $1, 866, 549 USD – $26, 800 = $1, 839, 749 USD (Net). 009961745 * 200 MIL JPY = $1, 992, 349 USD – $152, 600 = $1, 839, 749 USD (Net)

Part I: Instrument Comparison n Forward Purchase JPY 6 Months 200 M JPY x (. 000238 +. 009062)= $1, 860, 000 USD n OTC Option Strike Price. 0091 . 008776745 * 200 MIL JPY = $1, 755, 349 USD. 009332745 * 200 MIL JPY = $1, 866, 549 USD $1, 866, 549 USD – $26, 800 = $1, 839, 749 USD (Net). 009961745 * 200 MIL JPY = $1, 992, 349 USD – $152, 600 = $1, 839, 749 USD (Net)

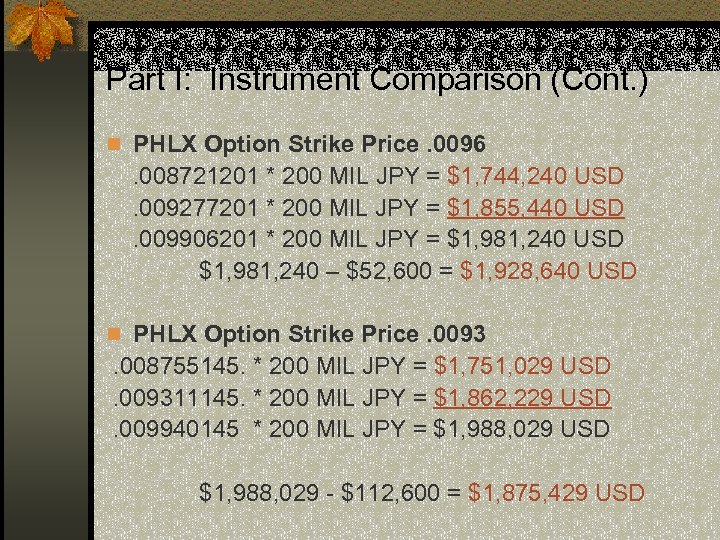

Part I: Instrument Comparison (Cont. ) n PHLX Option Strike Price. 0096 . 008721201 * 200 MIL JPY = $1, 744, 240 USD. 009277201 * 200 MIL JPY = $1, 855, 440 USD. 009906201 * 200 MIL JPY = $1, 981, 240 USD $1, 981, 240 – $52, 600 = $1, 928, 640 USD n PHLX Option Strike Price. 0093 . 008755145. * 200 MIL JPY = $1, 751, 029 USD. 009311145. * 200 MIL JPY = $1, 862, 229 USD. 009940145 * 200 MIL JPY = $1, 988, 029 USD $1, 988, 029 - $112, 600 = $1, 875, 429 USD

Part I: Instrument Comparison (Cont. ) n PHLX Option Strike Price. 0096 . 008721201 * 200 MIL JPY = $1, 744, 240 USD. 009277201 * 200 MIL JPY = $1, 855, 440 USD. 009906201 * 200 MIL JPY = $1, 981, 240 USD $1, 981, 240 – $52, 600 = $1, 928, 640 USD n PHLX Option Strike Price. 0093 . 008755145. * 200 MIL JPY = $1, 751, 029 USD. 009311145. * 200 MIL JPY = $1, 862, 229 USD. 009940145 * 200 MIL JPY = $1, 988, 029 USD $1, 988, 029 - $112, 600 = $1, 875, 429 USD

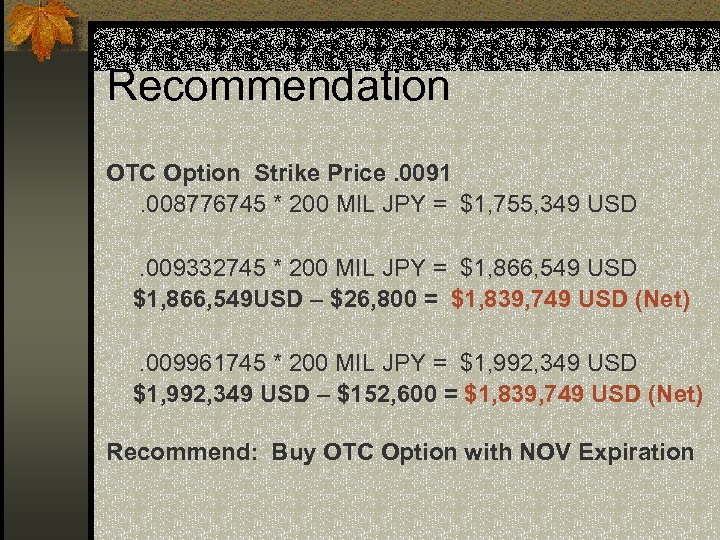

Recommendation OTC Option Strike Price. 0091. 008776745 * 200 MIL JPY = $1, 755, 349 USD. 009332745 * 200 MIL JPY = $1, 866, 549 USD $1, 866, 549 USD – $26, 800 = $1, 839, 749 USD (Net). 009961745 * 200 MIL JPY = $1, 992, 349 USD – $152, 600 = $1, 839, 749 USD (Net) Recommend: Buy OTC Option with NOV Expiration

Recommendation OTC Option Strike Price. 0091. 008776745 * 200 MIL JPY = $1, 755, 349 USD. 009332745 * 200 MIL JPY = $1, 866, 549 USD $1, 866, 549 USD – $26, 800 = $1, 839, 749 USD (Net). 009961745 * 200 MIL JPY = $1, 992, 349 USD – $152, 600 = $1, 839, 749 USD (Net) Recommend: Buy OTC Option with NOV Expiration

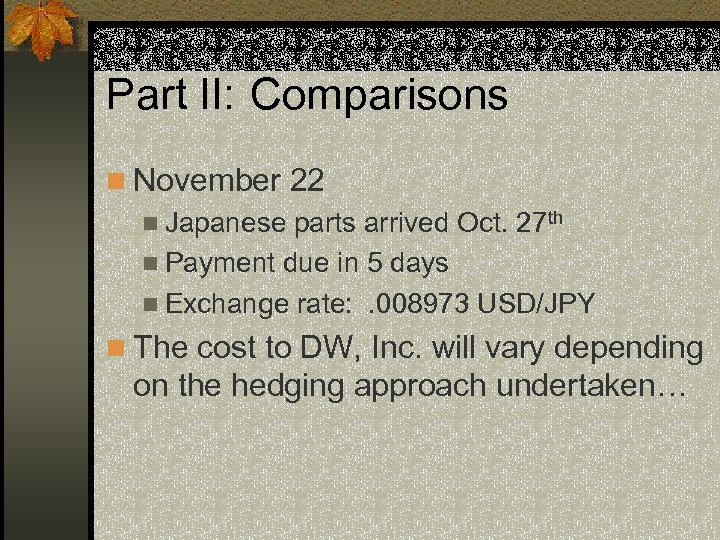

Part II: Comparisons n November 22 n Japanese parts arrived Oct. 27 th n Payment due in 5 days n Exchange rate: . 008973 USD/JPY n The cost to DW, Inc. will vary depending on the hedging approach undertaken…

Part II: Comparisons n November 22 n Japanese parts arrived Oct. 27 th n Payment due in 5 days n Exchange rate: . 008973 USD/JPY n The cost to DW, Inc. will vary depending on the hedging approach undertaken…

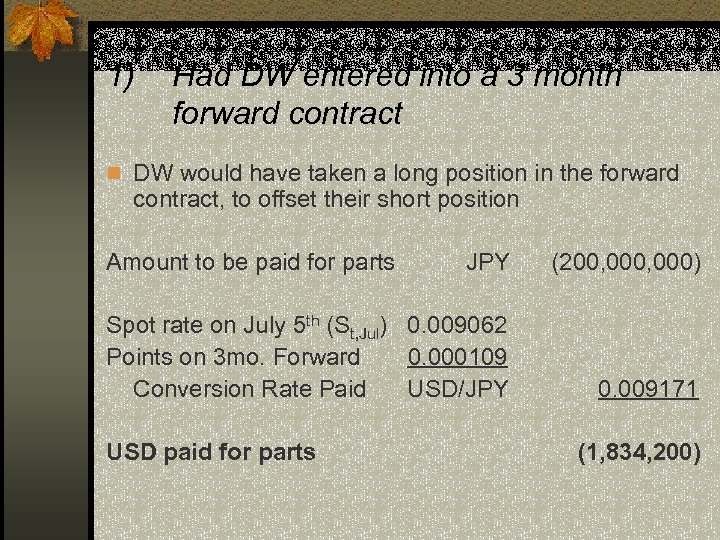

1) Had DW entered into a 3 month forward contract n DW would have taken a long position in the forward contract, to offset their short position Amount to be paid for parts JPY (200, 000) Spot rate on July 5 th (St, Jul) 0. 009062 Points on 3 mo. Forward 0. 000109 Conversion Rate Paid USD/JPY 0. 009171 USD paid for parts (1, 834, 200)

1) Had DW entered into a 3 month forward contract n DW would have taken a long position in the forward contract, to offset their short position Amount to be paid for parts JPY (200, 000) Spot rate on July 5 th (St, Jul) 0. 009062 Points on 3 mo. Forward 0. 000109 Conversion Rate Paid USD/JPY 0. 009171 USD paid for parts (1, 834, 200)

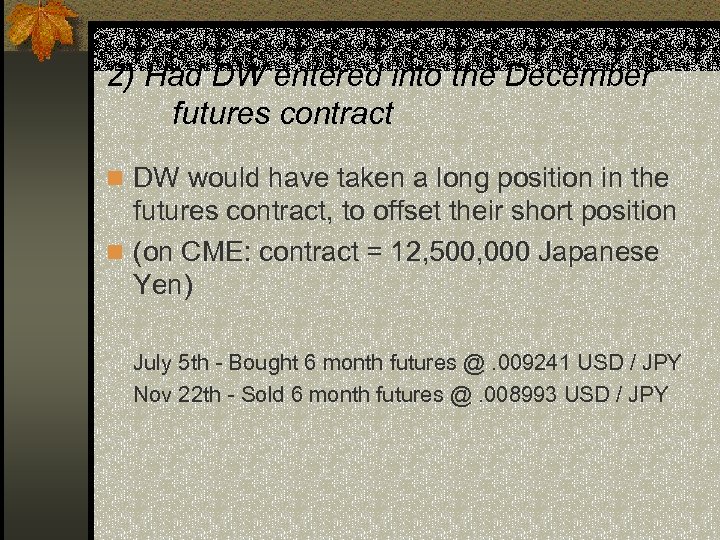

2) Had DW entered into the December futures contract n DW would have taken a long position in the futures contract, to offset their short position n (on CME: contract = 12, 500, 000 Japanese Yen) July 5 th - Bought 6 month futures @. 009241 USD / JPY Nov 22 th - Sold 6 month futures @. 008993 USD / JPY

2) Had DW entered into the December futures contract n DW would have taken a long position in the futures contract, to offset their short position n (on CME: contract = 12, 500, 000 Japanese Yen) July 5 th - Bought 6 month futures @. 009241 USD / JPY Nov 22 th - Sold 6 month futures @. 008993 USD / JPY

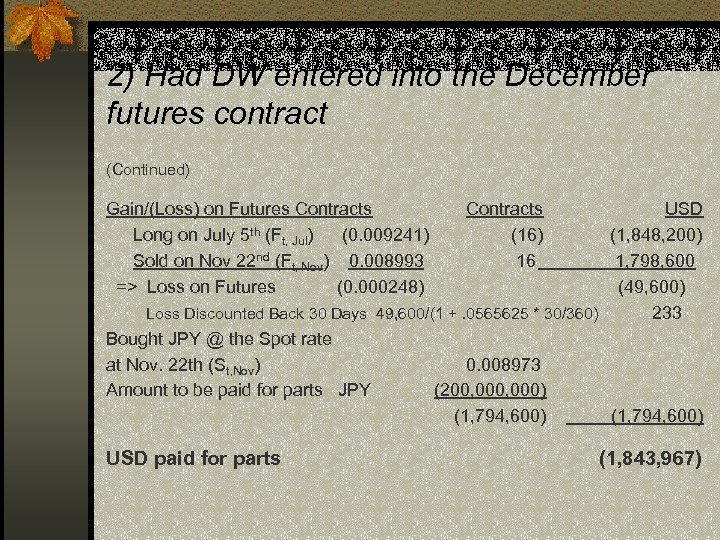

2) Had DW entered into the December futures contract (Continued) Gain/(Loss) on Futures Contracts Long on July 5 th (Ft, Jul) (0. 009241) Sold on Nov 22 nd (Ft, Nov) 0. 008993 => Loss on Futures (0. 000248) USD (1, 848, 200) 1, 798, 600 (49, 600) Loss Discounted Back 30 Days 49, 600/(1 +. 0565625 * 30/360) 233 Bought JPY @ the Spot rate at Nov. 22 th (St, Nov) 0. 008973 Amount to be paid for parts JPY (200, 000) (1, 794, 600) USD paid for parts Contracts (16) 16 (1, 843, 967)

2) Had DW entered into the December futures contract (Continued) Gain/(Loss) on Futures Contracts Long on July 5 th (Ft, Jul) (0. 009241) Sold on Nov 22 nd (Ft, Nov) 0. 008993 => Loss on Futures (0. 000248) USD (1, 848, 200) 1, 798, 600 (49, 600) Loss Discounted Back 30 Days 49, 600/(1 +. 0565625 * 30/360) 233 Bought JPY @ the Spot rate at Nov. 22 th (St, Nov) 0. 008973 Amount to be paid for parts JPY (200, 000) (1, 794, 600) USD paid for parts Contracts (16) 16 (1, 843, 967)

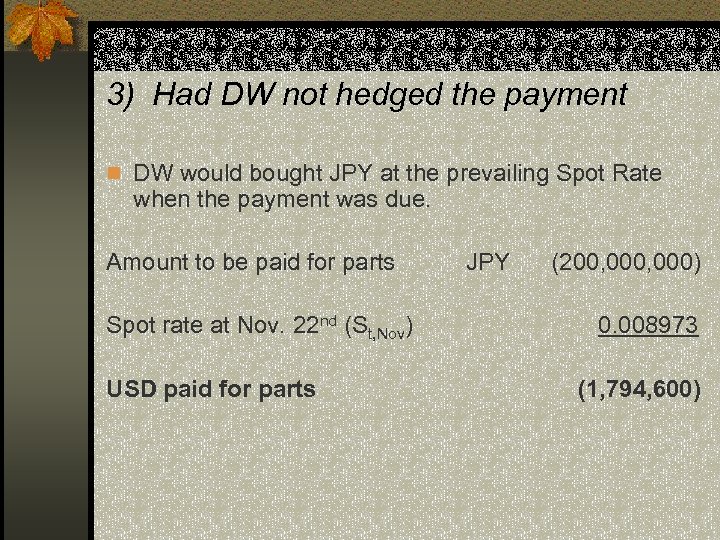

3) Had DW not hedged the payment n DW would bought JPY at the prevailing Spot Rate when the payment was due. Amount to be paid for parts Spot rate at Nov. 22 nd (St, Nov) USD paid for parts JPY (200, 000) 0. 008973 (1, 794, 600)

3) Had DW not hedged the payment n DW would bought JPY at the prevailing Spot Rate when the payment was due. Amount to be paid for parts Spot rate at Nov. 22 nd (St, Nov) USD paid for parts JPY (200, 000) 0. 008973 (1, 794, 600)

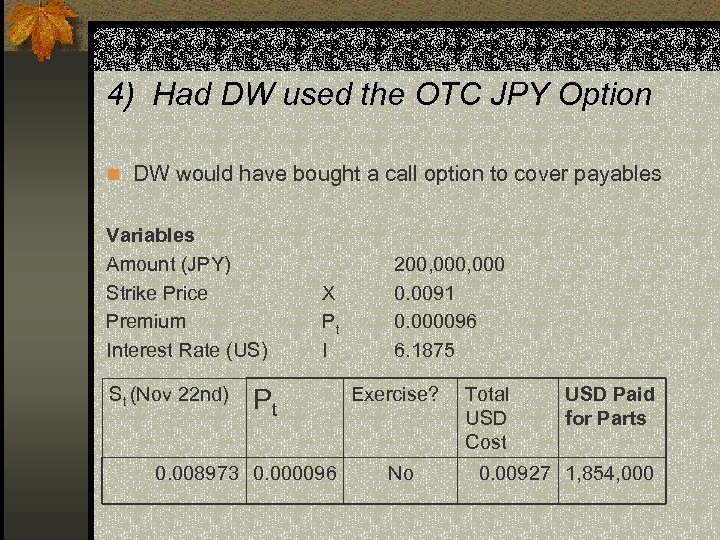

4) Had DW used the OTC JPY Option n DW would have bought a call option to cover payables Variables Amount (JPY) Strike Price Premium Interest Rate (US) St (Nov 22 nd) X Pt I Pt 0. 008973 0. 000096 200, 000 0. 0091 0. 000096 6. 1875 Exercise? No Total USD Cost USD Paid for Parts 0. 00927 1, 854, 000

4) Had DW used the OTC JPY Option n DW would have bought a call option to cover payables Variables Amount (JPY) Strike Price Premium Interest Rate (US) St (Nov 22 nd) X Pt I Pt 0. 008973 0. 000096 200, 000 0. 0091 0. 000096 6. 1875 Exercise? No Total USD Cost USD Paid for Parts 0. 00927 1, 854, 000

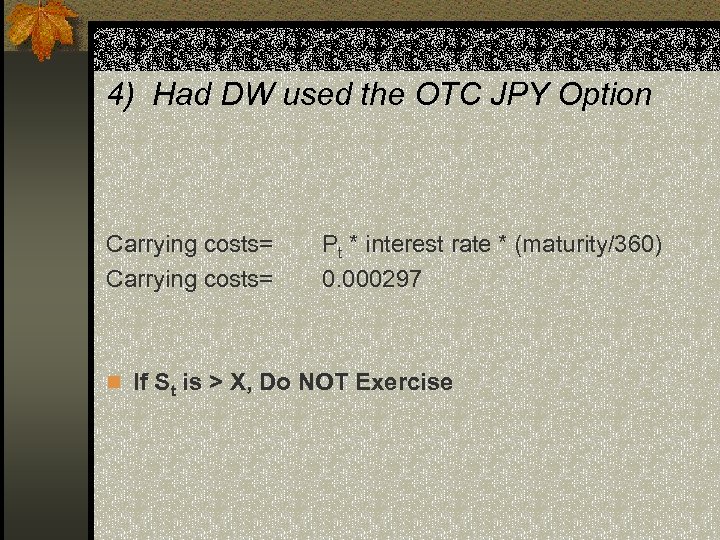

4) Had DW used the OTC JPY Option Carrying costs= Pt * interest rate * (maturity/360) 0. 000297 n If St is > X, Do NOT Exercise

4) Had DW used the OTC JPY Option Carrying costs= Pt * interest rate * (maturity/360) 0. 000297 n If St is > X, Do NOT Exercise

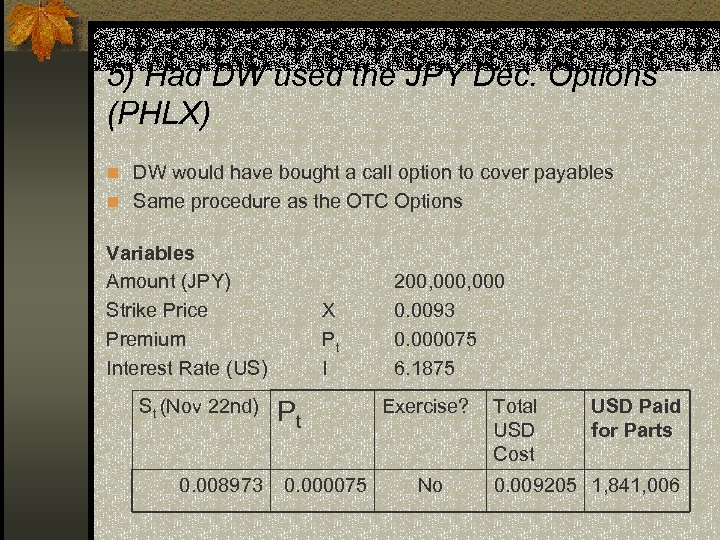

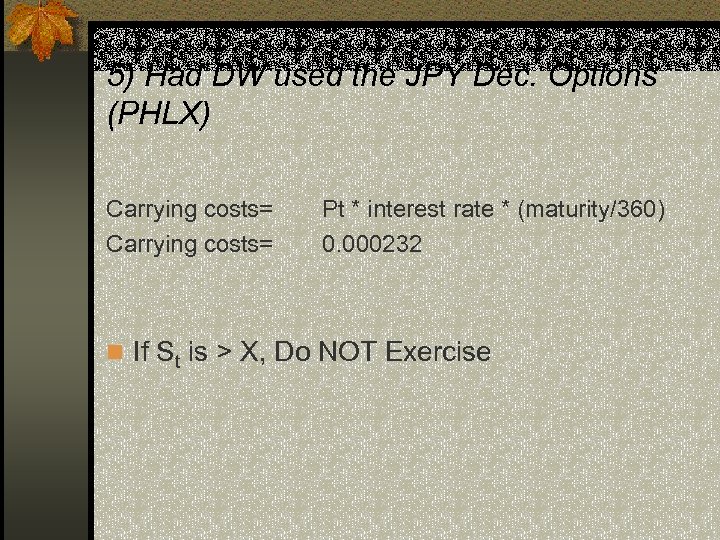

5) Had DW used the JPY Dec. Options (PHLX) n DW would have bought a call option to cover payables n Same procedure as the OTC Options Variables Amount (JPY) Strike Price Premium Interest Rate (US) St (Nov 22 nd) 0. 008973 X Pt I Pt 0. 000075 200, 000 0. 0093 0. 000075 6. 1875 Exercise? No Total USD Cost USD Paid for Parts 0. 009205 1, 841, 006

5) Had DW used the JPY Dec. Options (PHLX) n DW would have bought a call option to cover payables n Same procedure as the OTC Options Variables Amount (JPY) Strike Price Premium Interest Rate (US) St (Nov 22 nd) 0. 008973 X Pt I Pt 0. 000075 200, 000 0. 0093 0. 000075 6. 1875 Exercise? No Total USD Cost USD Paid for Parts 0. 009205 1, 841, 006

5) Had DW used the JPY Dec. Options (PHLX) Carrying costs= Pt * interest rate * (maturity/360) 0. 000232 n If St is > X, Do NOT Exercise

5) Had DW used the JPY Dec. Options (PHLX) Carrying costs= Pt * interest rate * (maturity/360) 0. 000232 n If St is > X, Do NOT Exercise

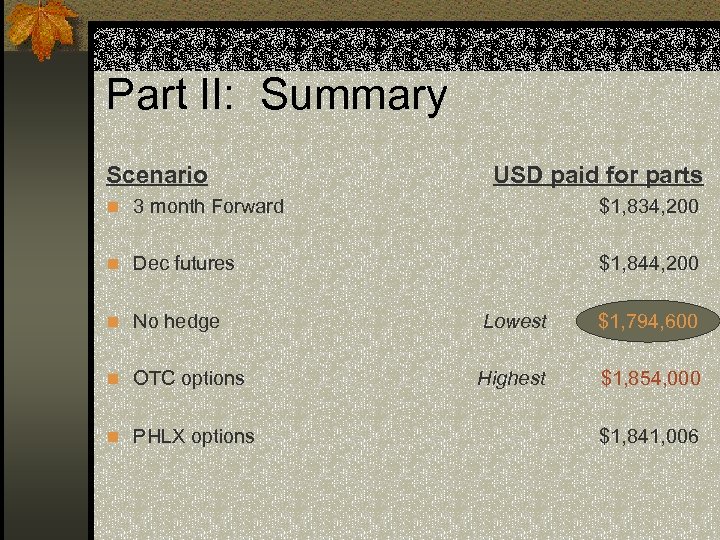

Part II: Summary Scenario USD paid for parts n 3 month Forward $1, 834, 200 n Dec futures $1, 844, 200 n No hedge n OTC options n PHLX options Lowest $1, 794, 600 Highest $1, 854, 000 $1, 841, 006

Part II: Summary Scenario USD paid for parts n 3 month Forward $1, 834, 200 n Dec futures $1, 844, 200 n No hedge n OTC options n PHLX options Lowest $1, 794, 600 Highest $1, 854, 000 $1, 841, 006