df5ae6460122e58b20290c9233689ca9.ppt

- Количество слайдов: 41

Peru Basel II implementation APEC Setiembre 2009

Experience in Basel II implementation The SBS has reinforced a regulatory framework to enable firms making an appropriate identification, evaluation, treatment and control of risks. Basel II implementation process is progressing quite well in Peru: Changes in the General Law allow the application of capital requirements to credit, market and operational risk according to Basel II. A regulatory framework for the implementation of Basel II has been made available to the public (publications and pre announcing of new rules) 2

Main changes in Banking Law DL 1028 Minimum capital requirements for credit, market and operational risks (Pillar I of Basel II) Increase of the minimum capital ratio and maintenance of suitable additional buffer, according to entities’ risk profile and the business cycle (Pillar II of Basel II) Definition of capital structure and proposal of limits on its composition (Basel) Information transparency (Pillar 3 of Basel II) Transparency: Obligation to pre announce new rules regarding capital requirement and loan loss reserves.

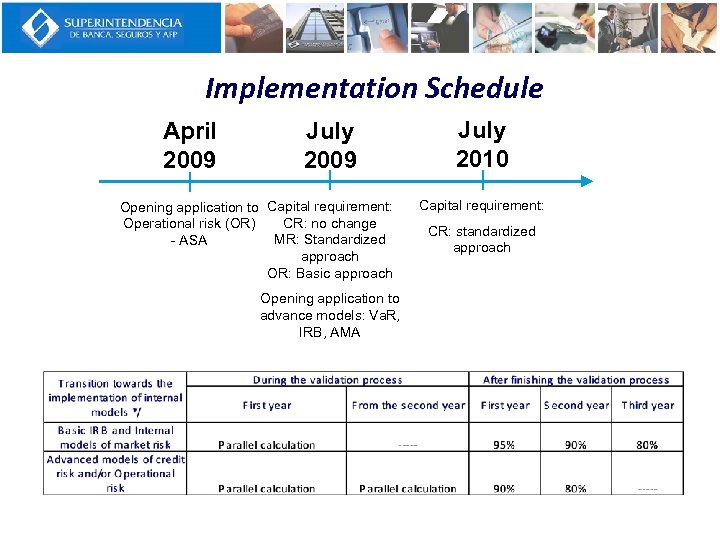

Implementation Schedule April 2009 July 2009 Opening application to Capital requirement: CR: no change Operational risk (OR) MR: Standardized - ASA approach OR: Basic approach Opening application to advance models: Va. R, IRB, AMA July 2010 Capital requirement: CR: standardized approach

Peru Basel II implementation: Pillar I: Credit risk

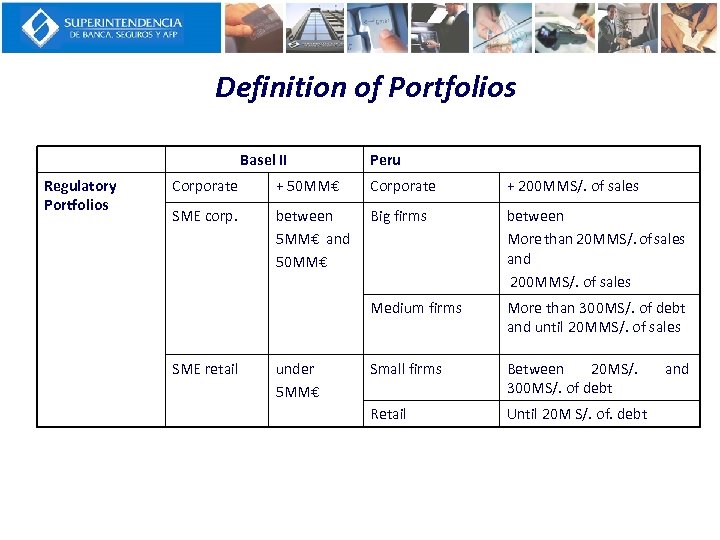

Definition of Portfolios Basel II Regulatory Portfolios Peru Corporate + 50 MM€ Corporate + 200 MMS/. of sales SME corp. between 5 MM€ and 50 MM€ Big firms between More than 20 MMS/. of sales and 200 MMS/. of sales Medium firms More than 300 MS/. of debt and until 20 MMS/. of sales Small firms Between 20 MS/. 300 MS/. of debt Retail Until 20 M S/. of. debt SME retail under 5 MM€ and

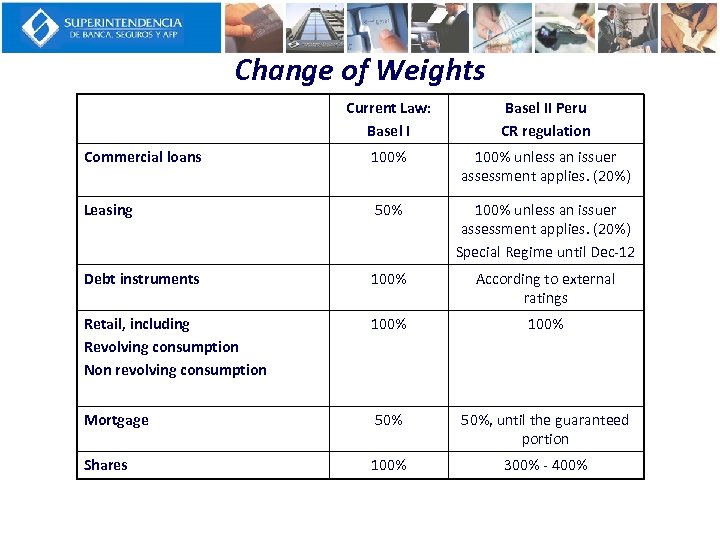

Change of Weights Current Law: Basel II Peru CR regulation Commercial loans 100% unless an issuer assessment applies. (20%) Leasing 50% 100% unless an issuer assessment applies. (20%) Special Regime until Dec-12 Debt instruments 100% According to external ratings Retail, including Revolving consumption Non revolving consumption 100% Mortgage 50%, until the guaranteed portion Shares 100% 300% - 400%

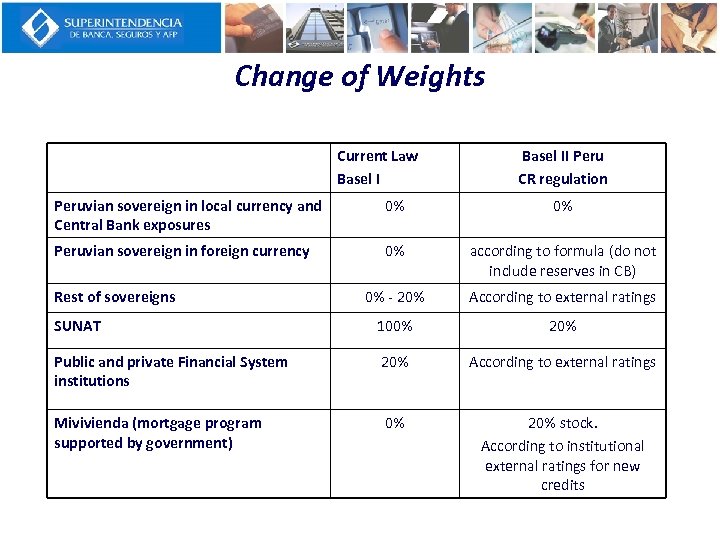

Change of Weights Current Law Basel II Peru CR regulation Peruvian sovereign in local currency and Central Bank exposures 0% 0% Peruvian sovereign in foreign currency 0% according to formula (do not include reserves in CB) 0% - 20% According to external ratings SUNAT 100% 20% Public and private Financial System institutions 20% According to external ratings Mivivienda (mortgage program supported by government) 0% 20% stock. According to institutional external ratings for new credits Rest of sovereigns

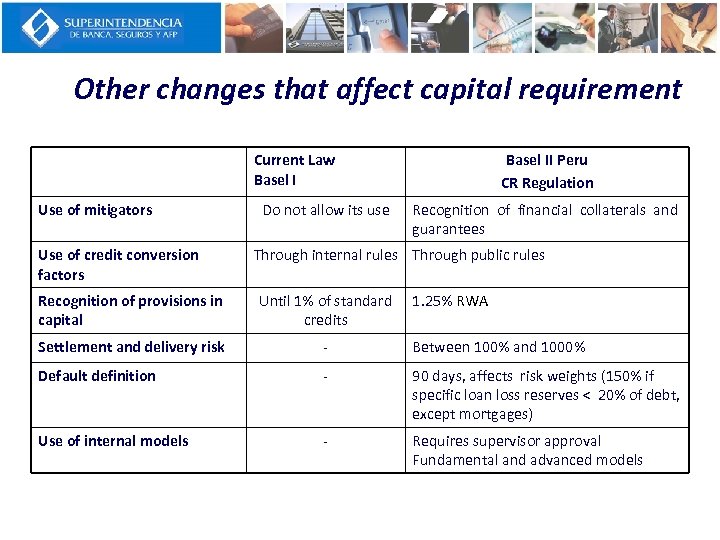

Other changes that affect capital requirement Current Law Basel I Use of mitigators Use of credit conversion factors Do not allow its use Basel II Peru CR Regulation Recognition of financial collaterals and guarantees Through internal rules Through public rules Recognition of provisions in capital Until 1% of standard credits 1. 25% RWA Settlement and delivery risk - Between 100% and 1000% Default definition - 90 days, affects risk weights (150% if specific loan loss reserves < 20% of debt, except mortgages) Use of internal models - Requires supervisor approval Fundamental and advanced models

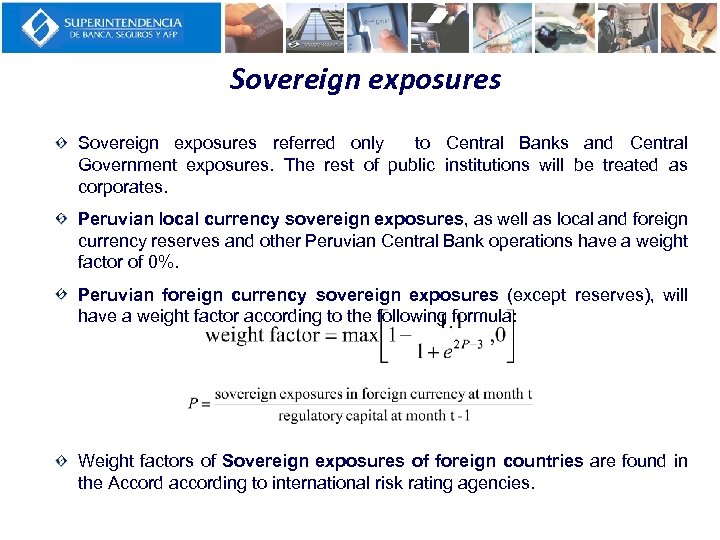

Sovereign exposures referred only to Central Banks and Central Government exposures. The rest of public institutions will be treated as corporates. Peruvian local currency sovereign exposures, as well as local and foreign currency reserves and other Peruvian Central Bank operations have a weight factor of 0%. Peruvian foreign currency sovereign exposures (except reserves), will have a weight factor according to the following formula: Weight factors of Sovereign exposures of foreign countries are found in the Accord according to international risk rating agencies.

Credit conversion factors (CCF) Basel II Peru CR Regulation Confirmations of self-liquidating irrevocable trade letters of credit up to one year, when the issuing bank is a high rating foreign financial system institution according to the CB. Not clearly defined 20% Performance bonds, bid bonds and warranties to guarantee satisfactory completion of a project Not clearly defined 50% Guarantees , bank acceptances, rest of trade letters of credit, rest of letters of guarantee Not clearly defined (100%) 100% 0% Between 0% and 50% Credit lines 11

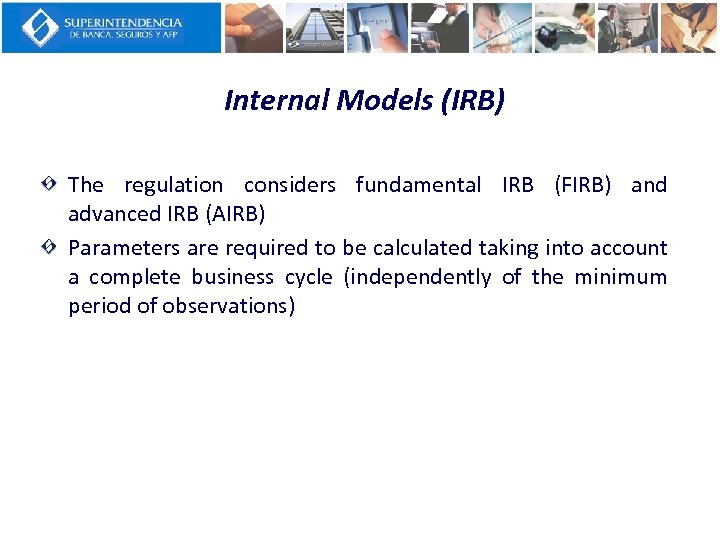

Internal Models (IRB) The regulation considers fundamental IRB (FIRB) and advanced IRB (AIRB) Parameters are required to be calculated taking into account a complete business cycle (independently of the minimum period of observations)

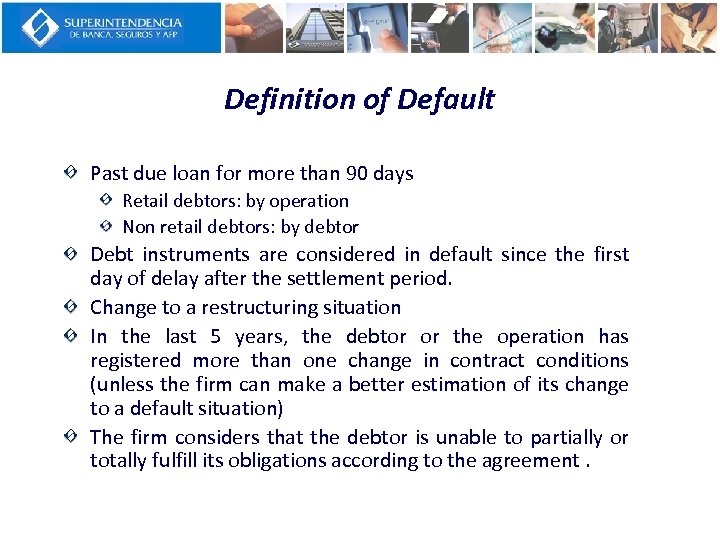

Definition of Default Past due loan for more than 90 days Retail debtors: by operation Non retail debtors: by debtor Debt instruments are considered in default since the first day of delay after the settlement period. Change to a restructuring situation In the last 5 years, the debtor or the operation has registered more than one change in contract conditions (unless the firm can make a better estimation of its change to a default situation) The firm considers that the debtor is unable to partially or totally fulfill its obligations according to the agreement.

Leaving default From the moment of non default, punctually fulfillment of liabilities for 12 consecutive months. During this period, the debtor will be able to register a maximum delay of 7 consecutive days and a maximum accumulated delay of 25 days (unless the firm can make a better estimation of the change to a non default situation) The firm considers that the debtor is able to fulfill all its obligations. This condition will be valid only when the reason of non fulfillment is due to qualitative criteria.

Peru Basel II implementation: Pillar I: Market risk

Current Methodology Firms will be able to calculate capital requirement for market risks through one of the following ways: 1. Standardized Method 2. Internal Models 3. Combination of standardized method and internal models. It must be considered that each type of risk should be evaluated using only one method. Changes in regulation Inclusion of interest rate risk measurement in trading book and commodities risk measurement, as part of the standardized method. Use of internal models with previous authorization of the SBS.

Trading book for market risk capital requirement SBS will consider the following instruments as part of trading book: a) Instruments registered in trading book b) The following instruments registered in available-for sale category: Debt CDBCRP Sovereign bonds (VAC-bonds not included) Global bonds Brady bonds Equity: IGBVL shares Mutual funds (at least 70% of the fund in shares) a) Speculative derivatives b) Derivatives that hedge a and b investments c) Commodities

Peru Basel II implementation: Pillar I: Operational risk

Capital requirement for operational risk Firms must use one of the following methods. a. Basic indicator approach – BIA (function of net income) b. Alternative Standardized approach - ASA (function of net income by business lines, except retail and commercial banking lines) c. Advanced measurement approaches – AMA (probabilistic calculations) The use of ASA or AMA requires express authorization of the SBS Basel II established methodologies are followed.

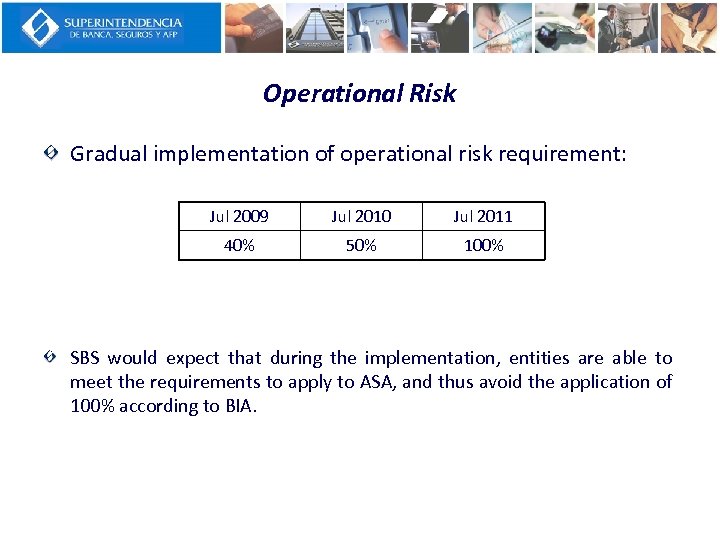

Operational Risk Gradual implementation of operational risk requirement: Jul 2009 Jul 2010 Jul 2011 40% 50% 100% SBS would expect that during the implementation, entities are able to meet the requirements to apply to ASA, and thus avoid the application of 100% according to BIA.

Peru: Implementation of pro-cyclical loan loss reserves

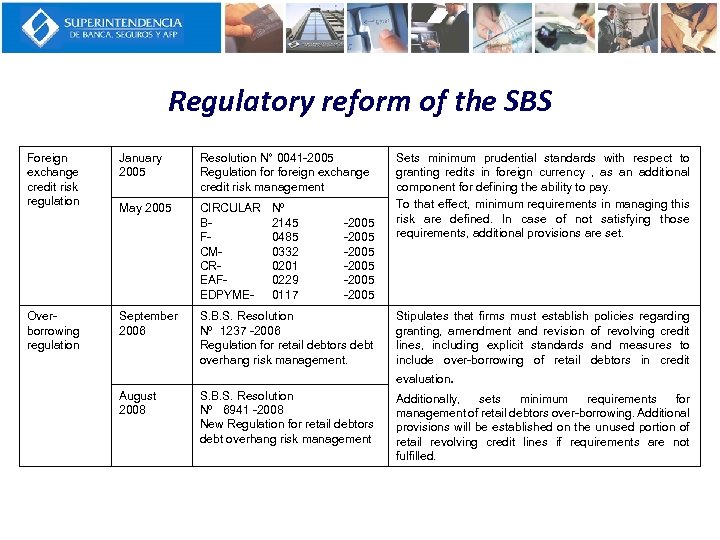

Regulatory reform of the SBS Foreign exchange credit risk regulation Overborrowing regulation January 2005 Resolution N° 0041 -2005 Regulation foreign exchange credit risk management May 2005 CIRCULAR BFCMCREAFEDPYME- September 2006 August 2008 Nº 2145 0485 0332 0201 0229 0117 -2005 -2005 Sets minimum prudential standards with respect to granting redits in foreign currency , as an additional component for defining the ability to pay. To that effect, minimum requirements in managing this risk are defined. In case of not satisfying those requirements, additional provisions are set. S. B. S. Resolution Nº 1237 -2006 Regulation for retail debtors debt overhang risk management. Stipulates that firms must establish policies regarding granting, amendment and revision of revolving credit lines, including explicit standards and measures to include over-borrowing of retail debtors in credit S. B. S. Resolution Nº 6941 -2008 New Regulation for retail debtors debt overhang risk management Additionally, sets minimum requirements for management of retail debtors over-borrowing. Additional provisions will be established on the unused portion of retail revolving credit lines if requirements are not fulfilled. evaluation.

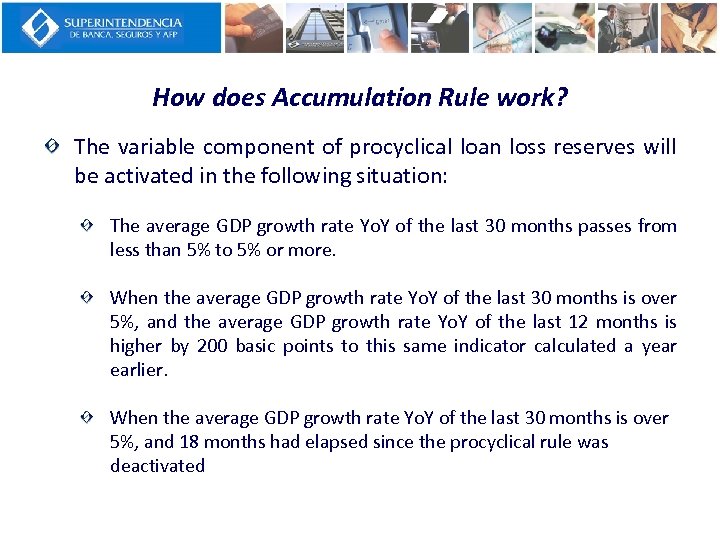

How does Accumulation Rule work? The variable component of procyclical loan loss reserves will be activated in the following situation: The average GDP growth rate Yo. Y of the last 30 months passes from less than 5% to 5% or more. When the average GDP growth rate Yo. Y of the last 30 months is over 5%, and the average GDP growth rate Yo. Y of the last 12 months is higher by 200 basic points to this same indicator calculated a year earlier. When the average GDP growth rate Yo. Y of the last 30 months is over 5%, and 18 months had elapsed since the procyclical rule was deactivated

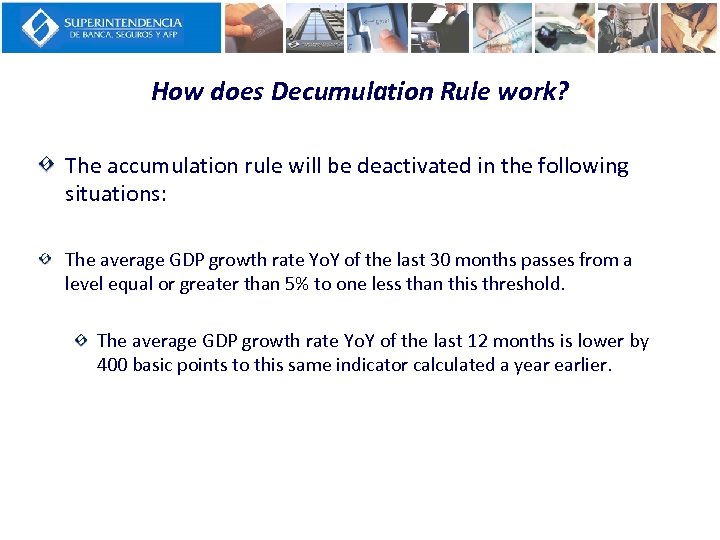

How does Decumulation Rule work? The accumulation rule will be deactivated in the following situations: The average GDP growth rate Yo. Y of the last 30 months passes from a level equal or greater than 5% to one less than this threshold. The average GDP growth rate Yo. Y of the last 12 months is lower by 400 basic points to this same indicator calculated a year earlier.

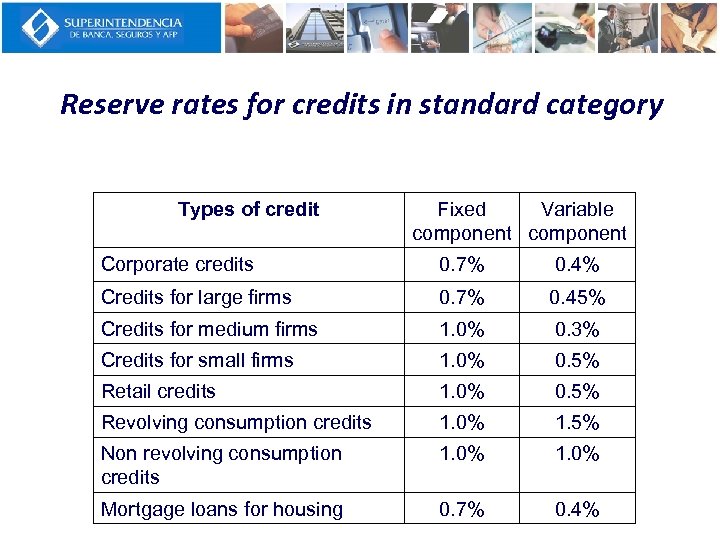

Reserve rates for credits in standard category Types of credit Fixed Variable component Corporate credits 0. 7% 0. 4% Credits for large firms 0. 7% 0. 45% Credits for medium firms 1. 0% 0. 3% Credits for small firms 1. 0% 0. 5% Retail credits 1. 0% 0. 5% Revolving consumption credits 1. 0% 1. 5% Non revolving consumption credits 1. 0% Mortgage loans for housing 0. 7% 0. 4%

Procyclical rule evolution 30 months Average GDP growth rate 30 months Threshold 5%

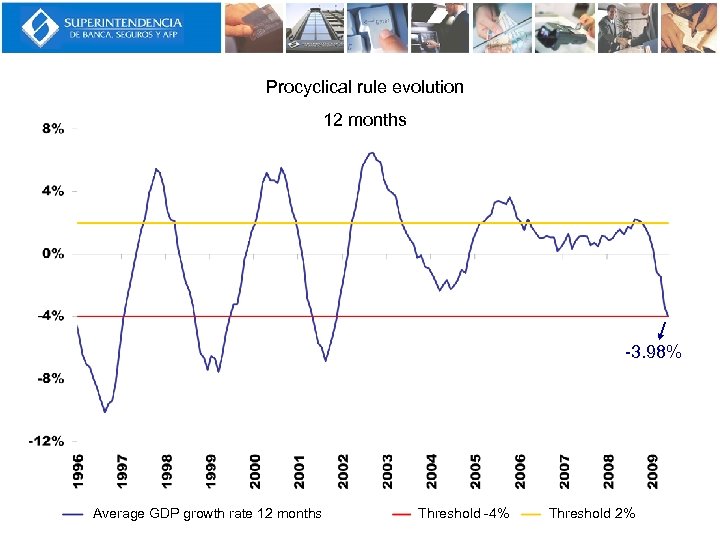

Procyclical rule evolution 12 months -3. 98% Average GDP growth rate 12 months Threshold -4% Threshold 2%

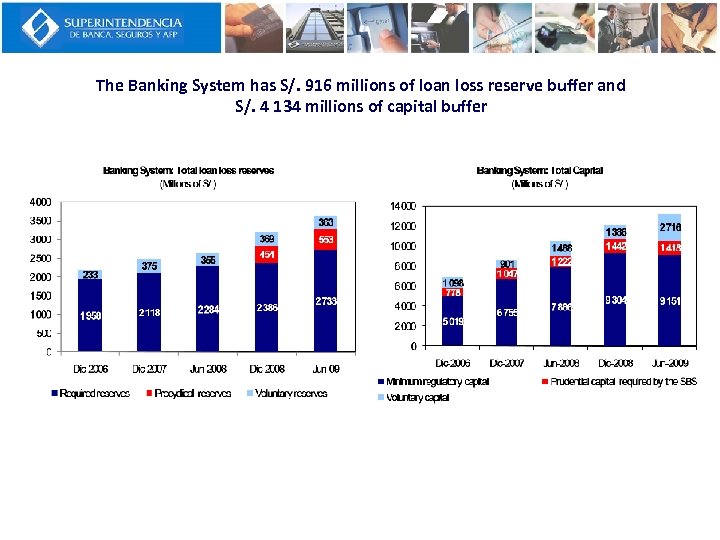

The Banking System has S/. 916 millions of loan loss reserve buffer and S/. 4 134 millions of capital buffer

Peru Basel II implementation: Pillar II

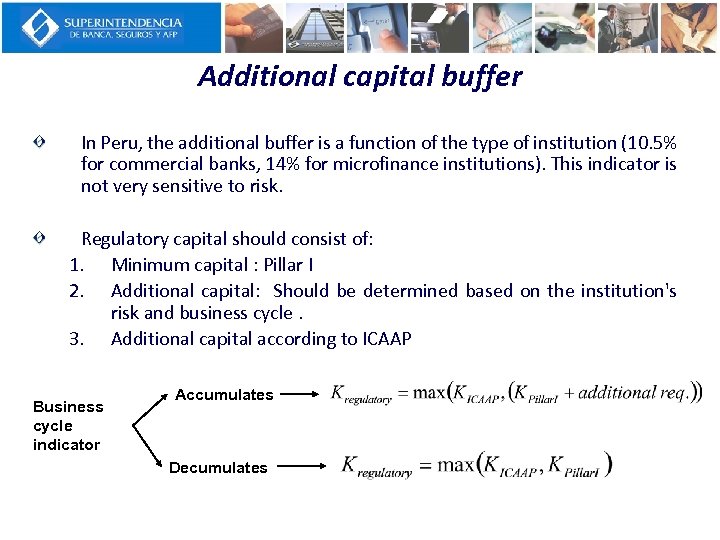

Additional capital buffer In Peru, the additional buffer is a function of the type of institution (10. 5% for commercial banks, 14% for microfinance institutions). This indicator is not very sensitive to risk. Regulatory capital should consist of: 1. Minimum capital : Pillar I 2. Additional capital: Should be determined based on the institution's risk and business cycle. 3. Additional capital according to ICAAP Business cycle indicator Accumulates Decumulates

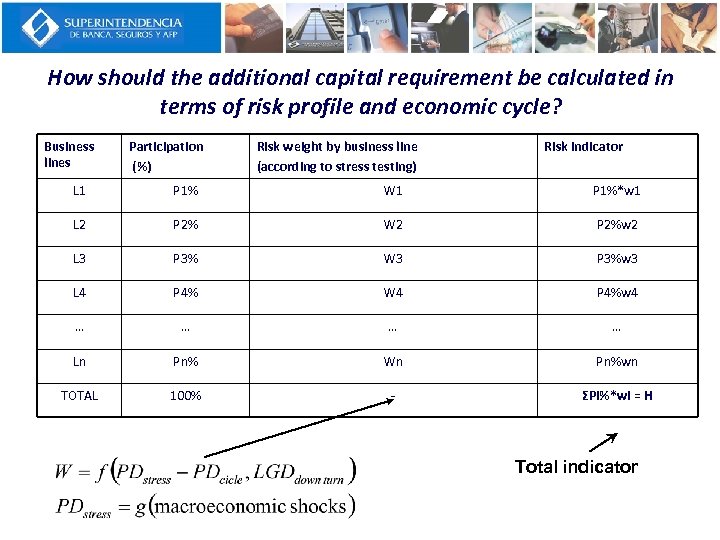

How should the additional capital requirement be calculated in terms of risk profile and economic cycle? Business lines Participation (%) Risk weight by business line (according to stress testing) Risk indicator L 1 P 1% W 1 P 1%*w 1 L 2 P 2% W 2 P 2%w 2 L 3 P 3% W 3 P 3%w 3 L 4 P 4% W 4 P 4%w 4 … … Ln Pn% Wn Pn%wn TOTAL 100% - ΣPi%*wi = H Total indicator

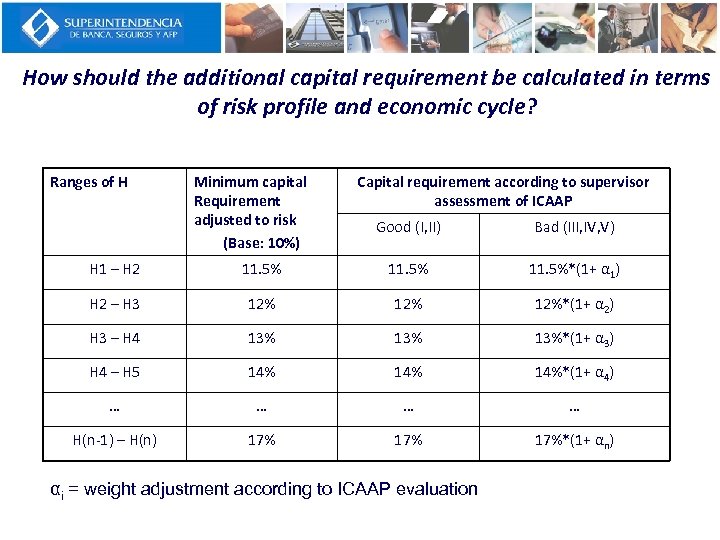

How should the additional capital requirement be calculated in terms of risk profile and economic cycle? Ranges of H Minimum capital Requirement adjusted to risk (Base: 10%) Capital requirement according to supervisor assessment of ICAAP Good (I, II) Bad (III, IV, V) H 1 – H 2 11. 5%*(1+ α 1) H 2 – H 3 12% 12%*(1+ α 2) H 3 – H 4 13% 13%*(1+ α 3) H 4 – H 5 14% 14%*(1+ α 4) … … H(n-1) – H(n) 17% 17%*(1+ αn) αi = weight adjustment according to ICAAP evaluation

Peru: Impact of Basel II implementation

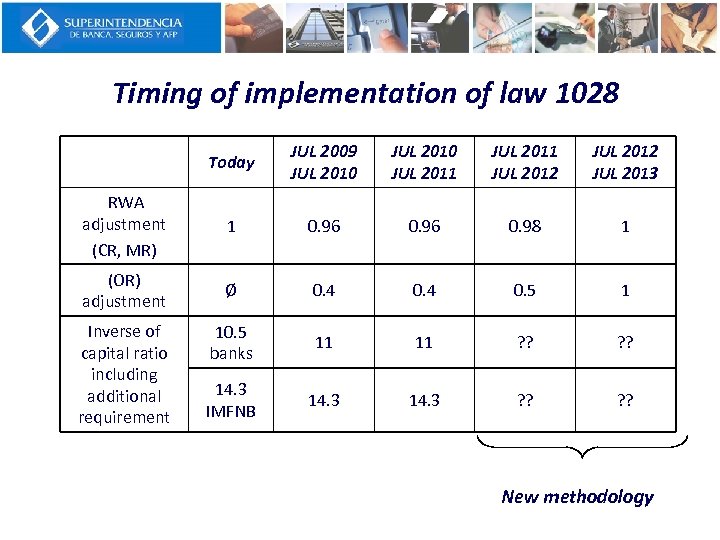

Timing of implementation of law 1028 Today JUL 2009 JUL 2010 JUL 2011 JUL 2012 JUL 2013 RWA adjustment (CR, MR) 1 0. 96 0. 98 1 (OR) adjustment Ø 0. 4 0. 5 1 10. 5 banks 11 11 ? ? 14. 3 IMFNB 14. 3 ? ? Inverse of capital ratio including additional requirement New methodology

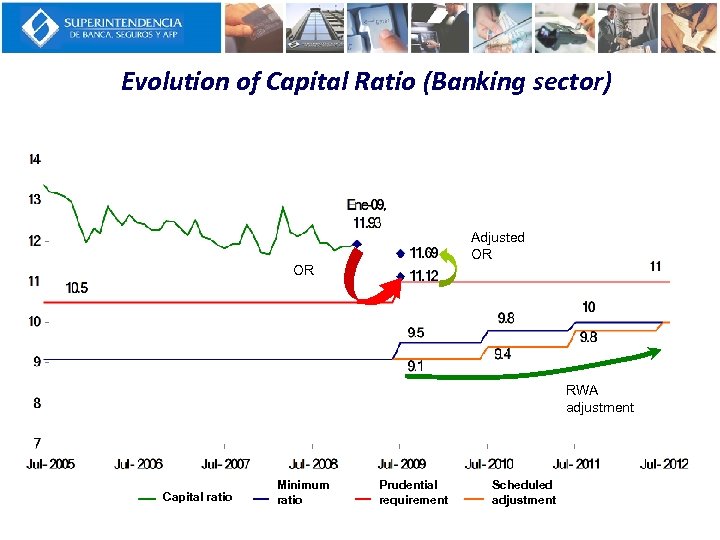

Evolution of Capital Ratio (Banking sector) Rop Adjusted OR ajustado Rop OR RWA Ajuste APR adjustment Capital ratio Minimum ratio Prudential requirement Scheduled adjustment

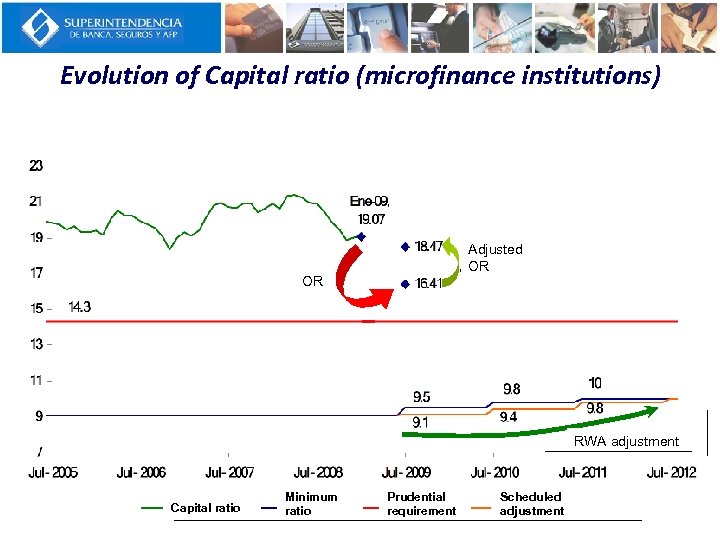

Evolution of Capital ratio (microfinance institutions) Rop Adjusted OR ajustado Rop OR Ajuste APR RWA adjustment Capital ratio Minimum ratio Prudential requirement Scheduled adjustment

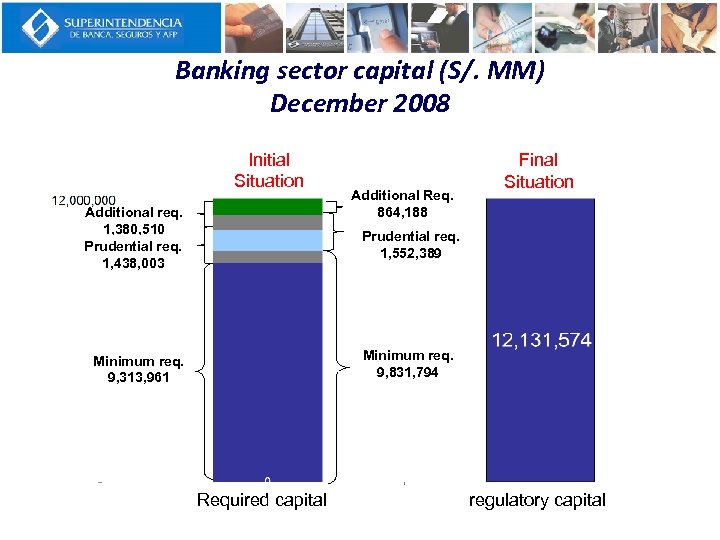

Banking sector capital (S/. MM) December 2008 Initial Situation Additional req. 1, 380, 510 Prudential req. 1, 438, 003 Additional Req. 864, 188 Final Situation Prudential req. 1, 552, 389 Minimum req. 9, 831, 794 Minimum req. 9, 313, 961 Required capital regulatory capital

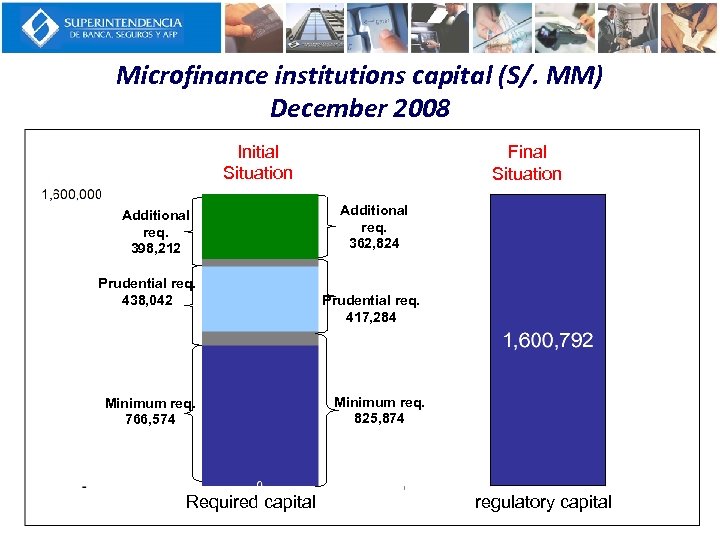

Microfinance institutions capital (S/. MM) December 2008 (December 2008) Final Initial Situation Additional req. 398, 212 Prudential req. 438, 042 Minimum req. 766, 574 Required capital Situation Additional req. 362, 824 Prudential req. 417, 284 Minimum req. 825, 874 regulatory capital

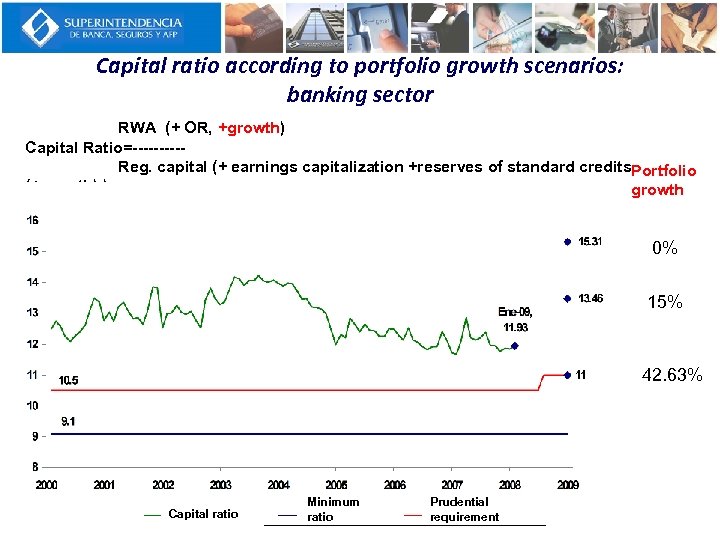

Capital ratio according to portfolio growth scenarios: banking sector RWA (+ OR, +growth) Capital Ratio=-----Reg. capital (+ earnings capitalization +reserves of standard credits. Portfolio (+growth) ) growth 0% 15% 42. 63% Capital ratio Minimum ratio Prudential requirement

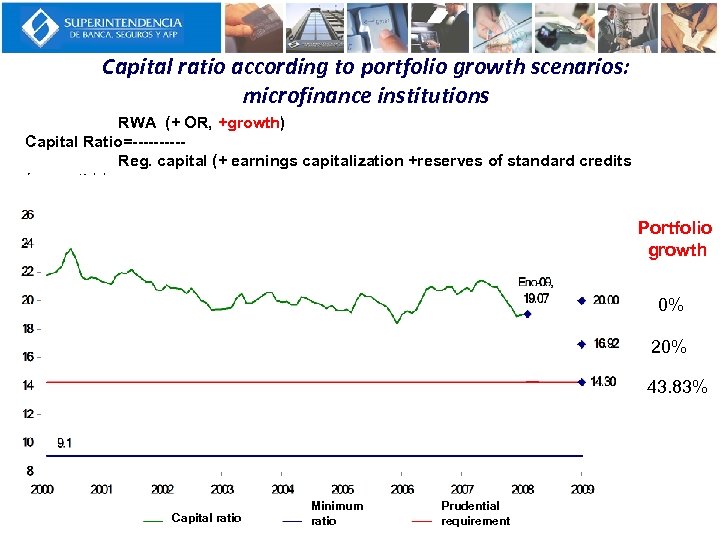

Capital ratio according to portfolio growth scenarios: microfinance institutions RWA (+ OR, +growth) Capital Ratio=-----Reg. capital (+ earnings capitalization +reserves of standard credits (+growth) ) Portfolio growth 0% 20% 43. 83% Capital ratio Minimum ratio Prudential requirement

Peru Basel II implementation APEC Setiembre 2009

df5ae6460122e58b20290c9233689ca9.ppt