12289b405260042eb9b8340a9e598c30.ppt

- Количество слайдов: 14

Perspectives on an Energy Efficiency Portfolio Institute for Regulatory Policy Studies Transforming the Electricity Market Val Jensen ICF International vjensen@icfi. com

Perspectives on an Energy Efficiency Portfolio Institute for Regulatory Policy Studies Transforming the Electricity Market Val Jensen ICF International vjensen@icfi. com

Some Structure z Theology v. Realpolitik z Context is everything z Measures, Programs and Portfolios z Measuring Goodness z What’s next ICF International 2 Icfi. com

Some Structure z Theology v. Realpolitik z Context is everything z Measures, Programs and Portfolios z Measuring Goodness z What’s next ICF International 2 Icfi. com

Theology z There is huge untapped potential for efficiency gains z Utilities have a responsibility to promote efficiency improvement as part of their charter z The presence of market barriers ensures that customers will never invest in the optimal level of energy efficiency z Societal cost effectiveness should drive decisions z Demand response is another way of saying “We don’t want to support energy efficiency” z As long as all customers have an opportunity to participate in programs, there is no crosssubsidization ICF International z Once consumers face true prices, they will select the optimal levels of consumption and efficiency z The utilities’ responsibility is to provide electricity or natural gas as efficiently as possible z Utility incentives for energy efficiency constitute subsidies/cross-subsidies z Price impacts should drive the decision z Energy efficiency does not provide the same certainty as a supply-side resource z Utility funding of energy efficiency requires crosssubsidization z These are social programs 3 Icfi. com

Theology z There is huge untapped potential for efficiency gains z Utilities have a responsibility to promote efficiency improvement as part of their charter z The presence of market barriers ensures that customers will never invest in the optimal level of energy efficiency z Societal cost effectiveness should drive decisions z Demand response is another way of saying “We don’t want to support energy efficiency” z As long as all customers have an opportunity to participate in programs, there is no crosssubsidization ICF International z Once consumers face true prices, they will select the optimal levels of consumption and efficiency z The utilities’ responsibility is to provide electricity or natural gas as efficiently as possible z Utility incentives for energy efficiency constitute subsidies/cross-subsidies z Price impacts should drive the decision z Energy efficiency does not provide the same certainty as a supply-side resource z Utility funding of energy efficiency requires crosssubsidization z These are social programs 3 Icfi. com

Realpolitik z Consumers tend to be myopic z Prices might not matter as much as costs, but information on both gets their attention z Utilities can, by their involvement have a significant and positive transformative effect on the market z Energy efficiency is the cheapest way to reduce/offset GHG emissions z Best practice involves a blend of DR and EE z There are ways to design and recover the costs of programs that minimize cross-subsidization z There are solid consumer service and customer satisfaction reasons for this z Demand-side resources can reduce the need for more expensive supply. ICF International 4 Icfi. com

Realpolitik z Consumers tend to be myopic z Prices might not matter as much as costs, but information on both gets their attention z Utilities can, by their involvement have a significant and positive transformative effect on the market z Energy efficiency is the cheapest way to reduce/offset GHG emissions z Best practice involves a blend of DR and EE z There are ways to design and recover the costs of programs that minimize cross-subsidization z There are solid consumer service and customer satisfaction reasons for this z Demand-side resources can reduce the need for more expensive supply. ICF International 4 Icfi. com

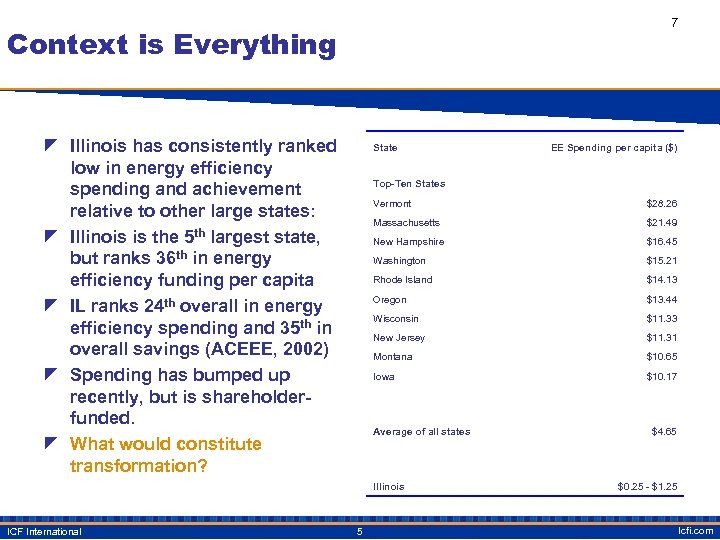

7 Context is Everything z Illinois has consistently ranked low in energy efficiency spending and achievement relative to other large states: z Illinois is the 5 th largest state, but ranks 36 th in energy efficiency funding per capita z IL ranks 24 th overall in energy efficiency spending and 35 th in overall savings (ACEEE, 2002) z Spending has bumped up recently, but is shareholderfunded. z What would constitute transformation? State Top-Ten States Vermont $28. 26 Massachusetts $21. 49 New Hampshire $16. 45 Washington $15. 21 Rhode Island $14. 13 Oregon $13. 44 Wisconsin $11. 33 New Jersey $11. 31 Montana $10. 65 Iowa $10. 17 Average of all states Illinois ICF International EE Spending per capita ($) 5 $4. 65 $0. 25 - $1. 25 Icfi. com

7 Context is Everything z Illinois has consistently ranked low in energy efficiency spending and achievement relative to other large states: z Illinois is the 5 th largest state, but ranks 36 th in energy efficiency funding per capita z IL ranks 24 th overall in energy efficiency spending and 35 th in overall savings (ACEEE, 2002) z Spending has bumped up recently, but is shareholderfunded. z What would constitute transformation? State Top-Ten States Vermont $28. 26 Massachusetts $21. 49 New Hampshire $16. 45 Washington $15. 21 Rhode Island $14. 13 Oregon $13. 44 Wisconsin $11. 33 New Jersey $11. 31 Montana $10. 65 Iowa $10. 17 Average of all states Illinois ICF International EE Spending per capita ($) 5 $4. 65 $0. 25 - $1. 25 Icfi. com

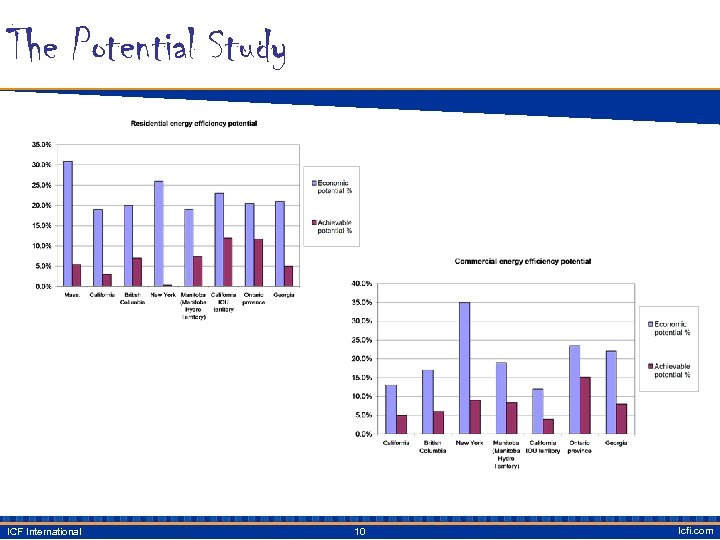

Context is Everything , Part 2 z MEEA (2006) estimates that electricity savings potential in the 20 th year of its analysis could equal about 4% of baseline Illinois sales in that year (slightly over 2 million MWh) at a cost of <= $60/MWh – Total cost to get those MWh would be roughly $71 M (from now till then) – Maybe can get there from here z MEEA estimates total achievable potential to be 8. 9% by the 20 th year at a cost of <= $150/MWh – Total cost of $480 M – Well beyond current reach? ICF International 6 Icfi. com

Context is Everything , Part 2 z MEEA (2006) estimates that electricity savings potential in the 20 th year of its analysis could equal about 4% of baseline Illinois sales in that year (slightly over 2 million MWh) at a cost of <= $60/MWh – Total cost to get those MWh would be roughly $71 M (from now till then) – Maybe can get there from here z MEEA estimates total achievable potential to be 8. 9% by the 20 th year at a cost of <= $150/MWh – Total cost of $480 M – Well beyond current reach? ICF International 6 Icfi. com

Measures, Programs and Portfolios: How this gets Done z Establish portfolio objectives z Measure Screening z Market assessment – including the POTENTIAL STUDY. z Program screening z Portfolio construction and analysis z Pass programs to the integration stage z Develop implementation plan ICF International 7 Icfi. com

Measures, Programs and Portfolios: How this gets Done z Establish portfolio objectives z Measure Screening z Market assessment – including the POTENTIAL STUDY. z Program screening z Portfolio construction and analysis z Pass programs to the integration stage z Develop implementation plan ICF International 7 Icfi. com

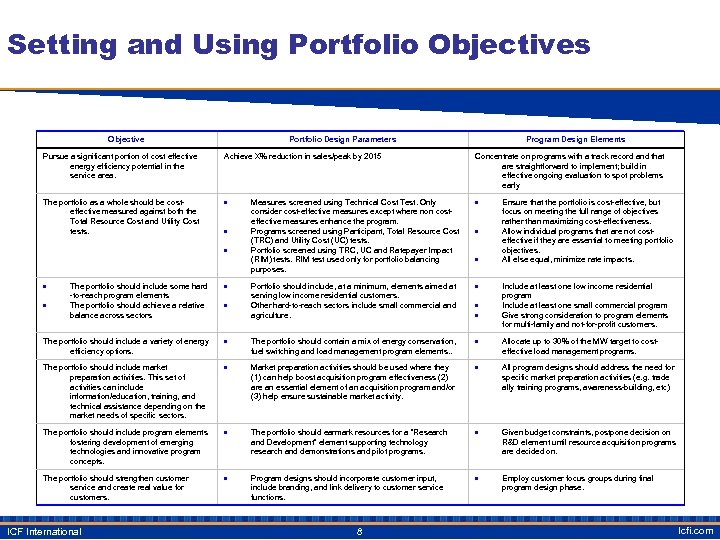

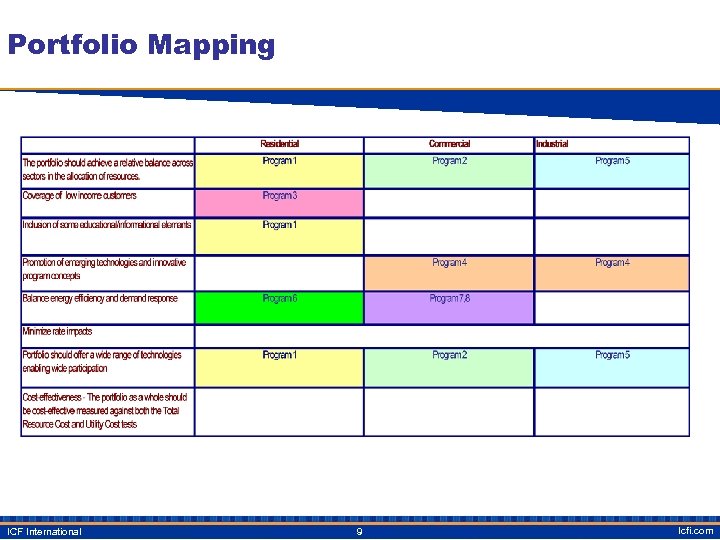

Setting and Using Portfolio Objectives Objective Portfolio Design Parameters Program Design Elements Pursue a significant portion of cost effective energy efficiency potential in the service area. Achieve X% reduction in sales/peak by 2015 Concentrate on programs with a track record and that are straightforward to implement; build in effective ongoing evaluation to spot problems early The portfolio as a whole should be costeffective measured against both the Total Resource Cost and Utility Cost tests. Measures screened using Technical Cost Test. Only consider cost-effective measures except where non costeffective measures enhance the program. Programs screened using Participant, Total Resource Cost (TRC) and Utility Cost (UC) tests. Portfolio screened using TRC, UC and Ratepayer Impact (RIM) tests. RIM test used only for portfolio balancing purposes. Portfolio should include, at a minimum, elements aimed at serving low income residential customers. Other hard-to-reach sectors include small commercial and agriculture. Ensure that the portfolio is cost-effective, but focus on meeting the full range of objectives rather than maximizing cost-effectiveness. Allow individual programs that are not costeffective if they are essential to meeting portfolio objectives. All else equal, minimize rate impacts. The portfolio should include some hard -to-reach program elements The portfolio should achieve a relative balance across sectors The portfolio should include a variety of energy efficiency options. The portfolio should contain a mix of energy conservation, fuel switching and load management program elements. . Allocate up to 30% of the MW target to costeffective load management programs. The portfolio should include market preparation activities. This set of activities can include information/education, training, and technical assistance depending on the market needs of specific sectors. Market preparation activities should be used where they (1) can help boost acquisition program effectiveness (2) are an essential element of an acquisition program and/or (3) help ensure sustainable market activity. All program designs should address the need for specific market preparation activities (e. g. trade ally training programs, awareness-building, etc) The portfolio should include program elements fostering development of emerging technologies and innovative program concepts. The portfolio should earmark resources for a “Research and Development” element supporting technology research and demonstrations and pilot programs. Given budget constraints, postpone decision on R&D element until resource acquisition programs are decided on. The portfolio should strengthen customer service and create real value for customers. Program designs should incorporate customer input, include branding, and link delivery to customer service functions. Employ customer focus groups during final program design phase. ICF International 8 Include at least one low income residential program Include at least one small commercial program Give strong consideration to program elements for multi-family and not-for-profit customers. Icfi. com

Setting and Using Portfolio Objectives Objective Portfolio Design Parameters Program Design Elements Pursue a significant portion of cost effective energy efficiency potential in the service area. Achieve X% reduction in sales/peak by 2015 Concentrate on programs with a track record and that are straightforward to implement; build in effective ongoing evaluation to spot problems early The portfolio as a whole should be costeffective measured against both the Total Resource Cost and Utility Cost tests. Measures screened using Technical Cost Test. Only consider cost-effective measures except where non costeffective measures enhance the program. Programs screened using Participant, Total Resource Cost (TRC) and Utility Cost (UC) tests. Portfolio screened using TRC, UC and Ratepayer Impact (RIM) tests. RIM test used only for portfolio balancing purposes. Portfolio should include, at a minimum, elements aimed at serving low income residential customers. Other hard-to-reach sectors include small commercial and agriculture. Ensure that the portfolio is cost-effective, but focus on meeting the full range of objectives rather than maximizing cost-effectiveness. Allow individual programs that are not costeffective if they are essential to meeting portfolio objectives. All else equal, minimize rate impacts. The portfolio should include some hard -to-reach program elements The portfolio should achieve a relative balance across sectors The portfolio should include a variety of energy efficiency options. The portfolio should contain a mix of energy conservation, fuel switching and load management program elements. . Allocate up to 30% of the MW target to costeffective load management programs. The portfolio should include market preparation activities. This set of activities can include information/education, training, and technical assistance depending on the market needs of specific sectors. Market preparation activities should be used where they (1) can help boost acquisition program effectiveness (2) are an essential element of an acquisition program and/or (3) help ensure sustainable market activity. All program designs should address the need for specific market preparation activities (e. g. trade ally training programs, awareness-building, etc) The portfolio should include program elements fostering development of emerging technologies and innovative program concepts. The portfolio should earmark resources for a “Research and Development” element supporting technology research and demonstrations and pilot programs. Given budget constraints, postpone decision on R&D element until resource acquisition programs are decided on. The portfolio should strengthen customer service and create real value for customers. Program designs should incorporate customer input, include branding, and link delivery to customer service functions. Employ customer focus groups during final program design phase. ICF International 8 Include at least one low income residential program Include at least one small commercial program Give strong consideration to program elements for multi-family and not-for-profit customers. Icfi. com

Portfolio Mapping ICF International 9 Icfi. com

Portfolio Mapping ICF International 9 Icfi. com

The Potential Study ICF International 10 Icfi. com

The Potential Study ICF International 10 Icfi. com

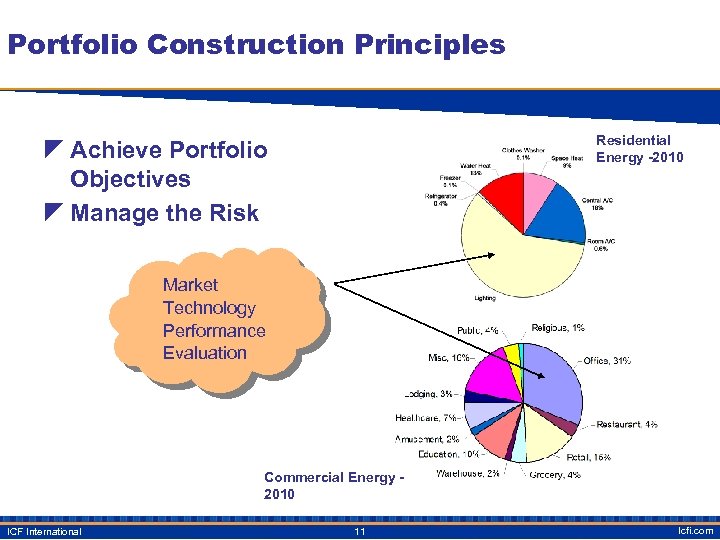

Portfolio Construction Principles Residential Energy -2010 z Achieve Portfolio Objectives z Manage the Risk Market Technology Performance Evaluation Commercial Energy 2010 ICF International 11 Icfi. com

Portfolio Construction Principles Residential Energy -2010 z Achieve Portfolio Objectives z Manage the Risk Market Technology Performance Evaluation Commercial Energy 2010 ICF International 11 Icfi. com

Measuring Goodness z The meaning of goodness is at the heart of theology z And if there is a holy war in this business it is over how one judges goodness – The Church of the Almighty TRC – The United Church of the RIM ICF International 12 Icfi. com

Measuring Goodness z The meaning of goodness is at the heart of theology z And if there is a holy war in this business it is over how one judges goodness – The Church of the Almighty TRC – The United Church of the RIM ICF International 12 Icfi. com

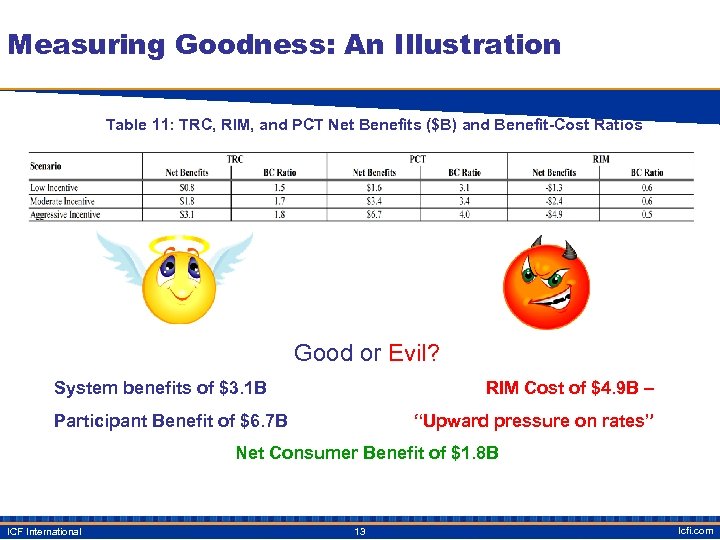

Measuring Goodness: An Illustration Table 11: TRC, RIM, and PCT Net Benefits ($B) and Benefit-Cost Ratios Good or Evil? System benefits of $3. 1 B RIM Cost of $4. 9 B – Participant Benefit of $6. 7 B “Upward pressure on rates” Net Consumer Benefit of $1. 8 B ICF International 13 Icfi. com

Measuring Goodness: An Illustration Table 11: TRC, RIM, and PCT Net Benefits ($B) and Benefit-Cost Ratios Good or Evil? System benefits of $3. 1 B RIM Cost of $4. 9 B – Participant Benefit of $6. 7 B “Upward pressure on rates” Net Consumer Benefit of $1. 8 B ICF International 13 Icfi. com

What’s Next: Emerging Best Practice z More efficient pricing is inevitable and overdue – Very positive results from pilots in terms of demand response – Disappointing participation to-date, but at some point this will be the default – This will drive very interesting combinations of controls and energyusing equipment z This will cause some wailing and gnashing of teeth – Will tend to undercut a central tenant of energy efficiency community (we need DSM to compensated for average cost pricing) – The economics of energy efficiency could change significantly • The TRC economics will change as DR cuts peak prices • The Participant economics will change – pure energy-saving devices will look less good. • Will this put a dent in the least expensive carbon strategy? z The marriage of DR and EE will take place – Who will adopt whose theology? ICF International 14 Icfi. com

What’s Next: Emerging Best Practice z More efficient pricing is inevitable and overdue – Very positive results from pilots in terms of demand response – Disappointing participation to-date, but at some point this will be the default – This will drive very interesting combinations of controls and energyusing equipment z This will cause some wailing and gnashing of teeth – Will tend to undercut a central tenant of energy efficiency community (we need DSM to compensated for average cost pricing) – The economics of energy efficiency could change significantly • The TRC economics will change as DR cuts peak prices • The Participant economics will change – pure energy-saving devices will look less good. • Will this put a dent in the least expensive carbon strategy? z The marriage of DR and EE will take place – Who will adopt whose theology? ICF International 14 Icfi. com