198be8ffcc9f1f50fa241309d8d01d73.ppt

- Количество слайдов: 34

Personal Trust Operations Standards How Competitive is Your Firm?

Personal Trust Operations Standards How Competitive is Your Firm?

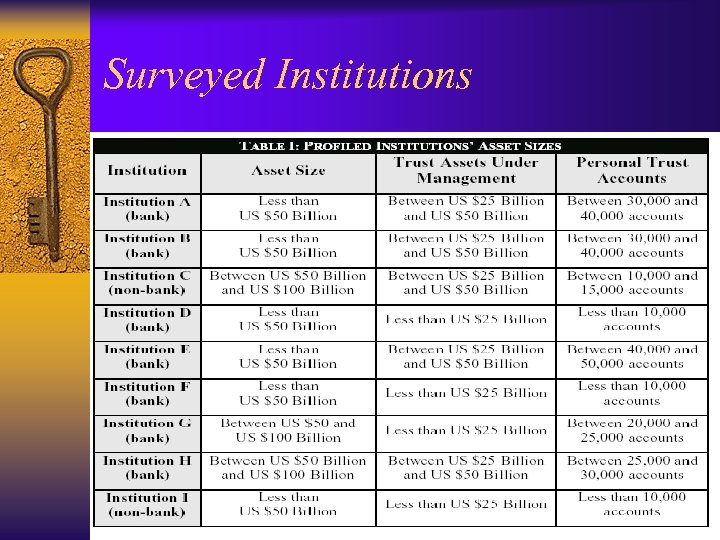

Surveyed Institutions

Surveyed Institutions

GENERAL OBSERVATIONS ¨ Increased assets per staff member. ¨ Product specialized teams. ¨ Targeted customer performance standards. ¨ Automated document preparation and storage. ¨ Centralized document preparation and storage. ¨ Temporary staff to handle peak workloads. ¨ Embracing quality improvement programs. ¨ Tracking and reporting on quality standards

GENERAL OBSERVATIONS ¨ Increased assets per staff member. ¨ Product specialized teams. ¨ Targeted customer performance standards. ¨ Automated document preparation and storage. ¨ Centralized document preparation and storage. ¨ Temporary staff to handle peak workloads. ¨ Embracing quality improvement programs. ¨ Tracking and reporting on quality standards

GENERAL OBSERVATIONS ¨ Standardized procedures. ¨ Increased training efforts. ¨ Tracking key productivity measures. ¨ Productivity based compensation. ¨ Consolidated client information database bank- wide. ¨ Contracting services to vendors. ¨ Increase use of client satisfaction/quality surveys.

GENERAL OBSERVATIONS ¨ Standardized procedures. ¨ Increased training efforts. ¨ Tracking key productivity measures. ¨ Productivity based compensation. ¨ Consolidated client information database bank- wide. ¨ Contracting services to vendors. ¨ Increase use of client satisfaction/quality surveys.

HOT BUTTONS ¨ PROXY VOTING & COMPLIANCE SOFTWARE ¨ USE OF ACATS ¨ CAPITAL CHANGES ¨ TRADE MANAGEMENT, BEST EXECUTION & SOFT DOLLARS ¨ PERFORMANCE MEASUREMENT STANDRDS (GIPS) ¨ RETIREMENT PLAN LOANS

HOT BUTTONS ¨ PROXY VOTING & COMPLIANCE SOFTWARE ¨ USE OF ACATS ¨ CAPITAL CHANGES ¨ TRADE MANAGEMENT, BEST EXECUTION & SOFT DOLLARS ¨ PERFORMANCE MEASUREMENT STANDRDS (GIPS) ¨ RETIREMENT PLAN LOANS

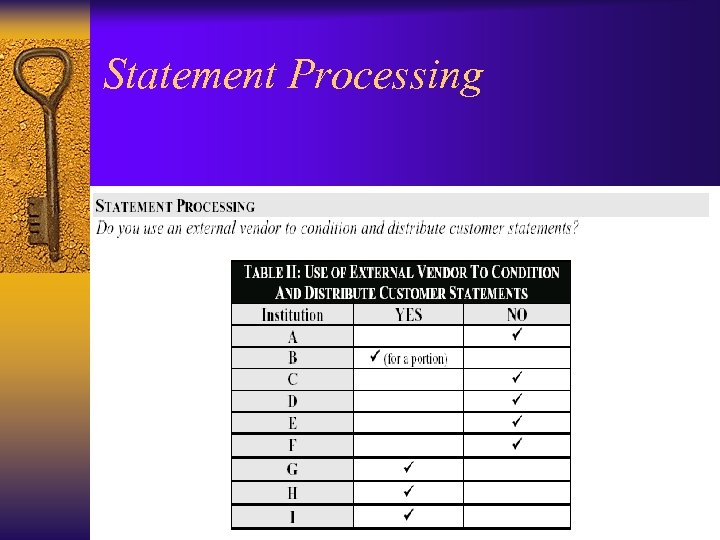

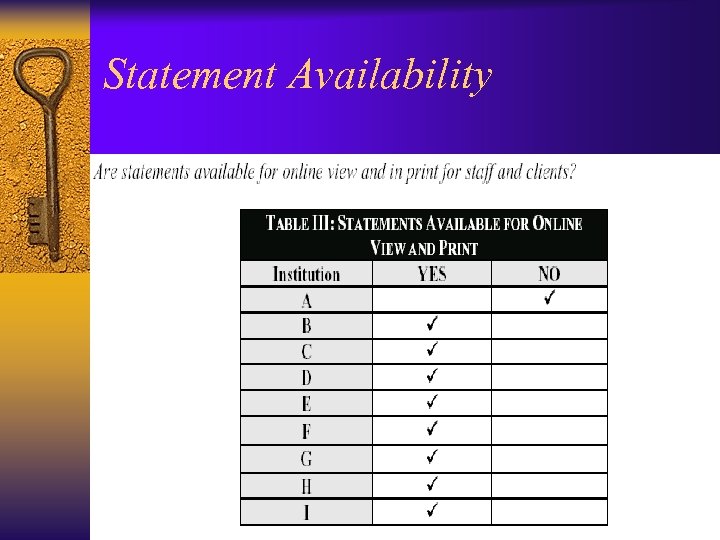

Statement Processing ! Most profiled institutions cycle customers’ trust statements at the end of the calendar month. ! Eight out of the nine profiled institutions make statements available both online and in print for staff and clients. ! Five profiled institutions do not use external vendors to condition and distribute customer statements.

Statement Processing ! Most profiled institutions cycle customers’ trust statements at the end of the calendar month. ! Eight out of the nine profiled institutions make statements available both online and in print for staff and clients. ! Five profiled institutions do not use external vendors to condition and distribute customer statements.

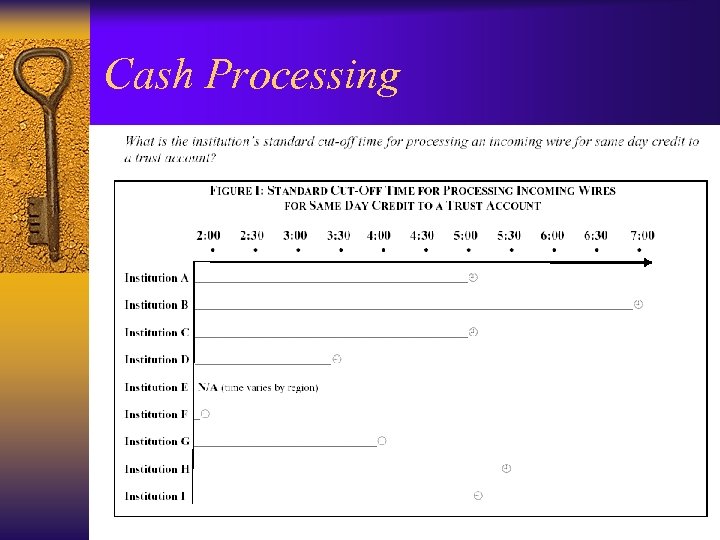

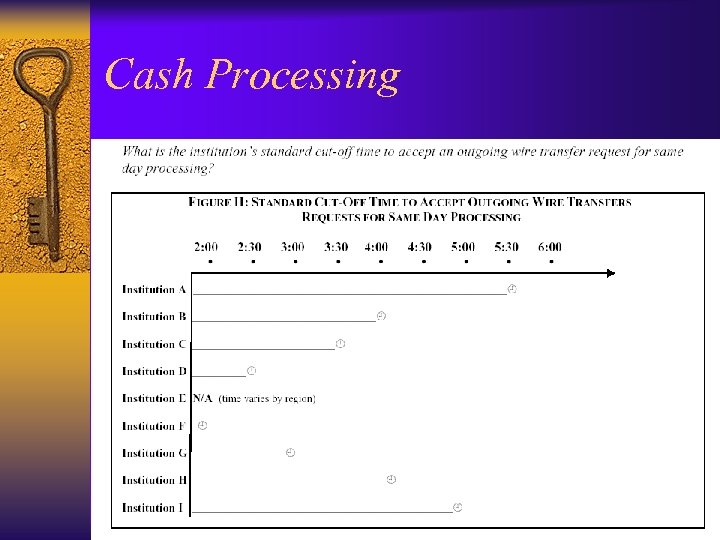

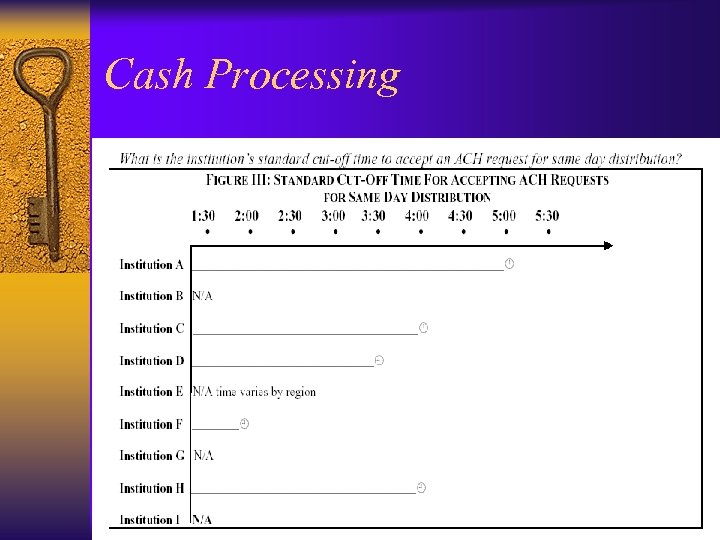

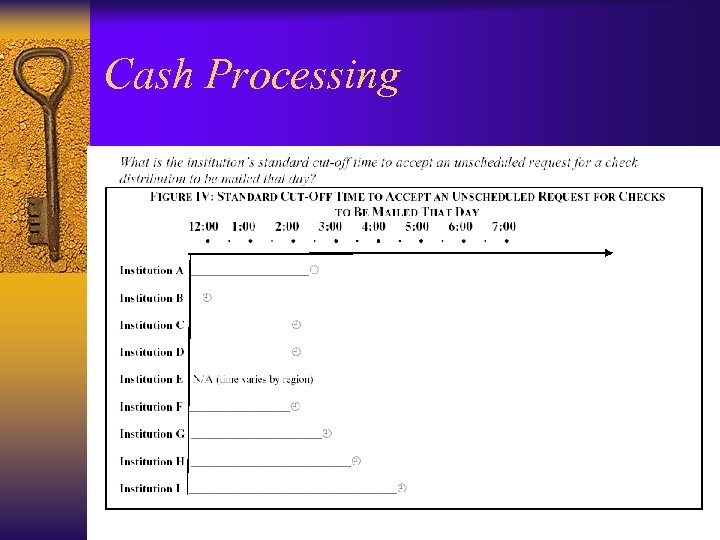

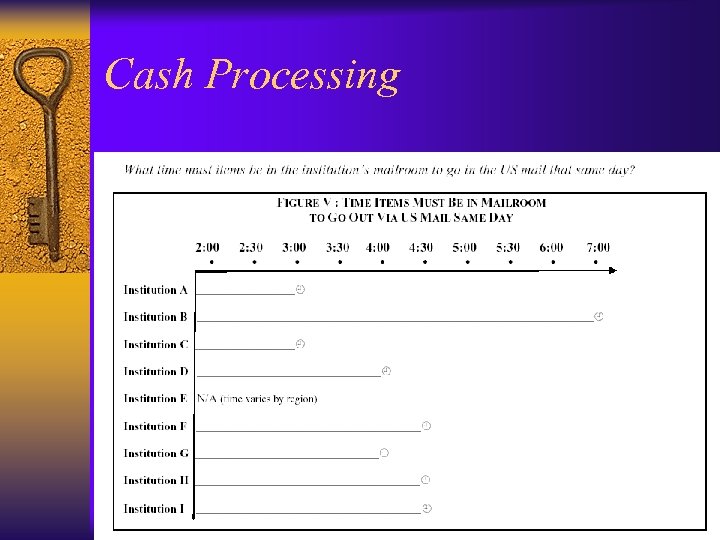

Cash Processing ! Among profiled institutions, there are notable differences in the cut-off times for accepting an outgoing wire transfer request for same-day processing. Cut-off times range from 2: 00 p. m. until 5: 30 p. m. ! Standard cut off times for accepting an ACH request for same-day distribution varied greatly by institution. Cut-off times range from 2: 00 p. m. until 5: 00 p. m. ! Five out of nine institutions report similar cut -off times to accept an unscheduled request for a check distribution to be mailed that day. These times range from 2: 00 p. m. to 3: 30 p. m.

Cash Processing ! Among profiled institutions, there are notable differences in the cut-off times for accepting an outgoing wire transfer request for same-day processing. Cut-off times range from 2: 00 p. m. until 5: 30 p. m. ! Standard cut off times for accepting an ACH request for same-day distribution varied greatly by institution. Cut-off times range from 2: 00 p. m. until 5: 00 p. m. ! Five out of nine institutions report similar cut -off times to accept an unscheduled request for a check distribution to be mailed that day. These times range from 2: 00 p. m. to 3: 30 p. m.

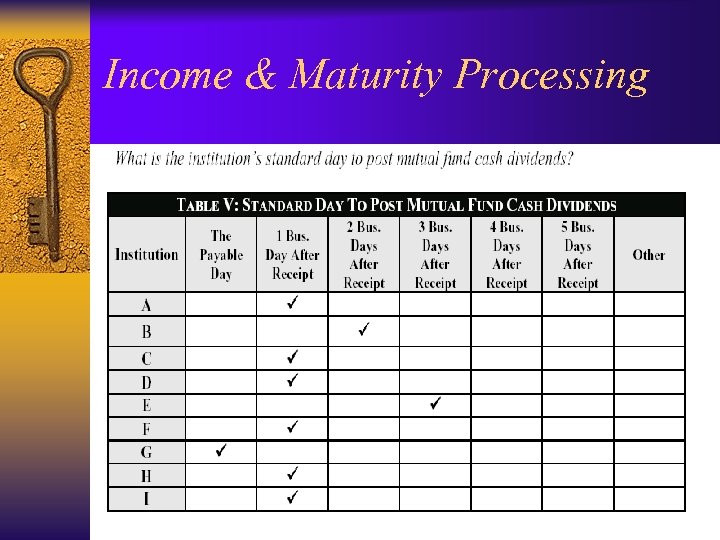

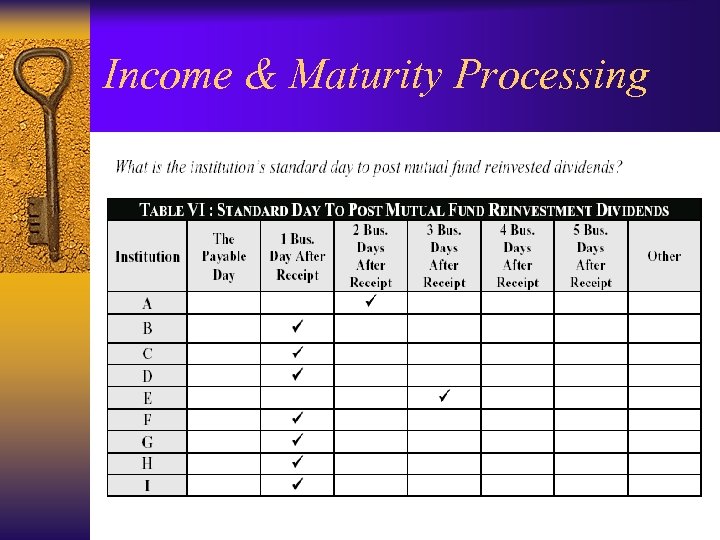

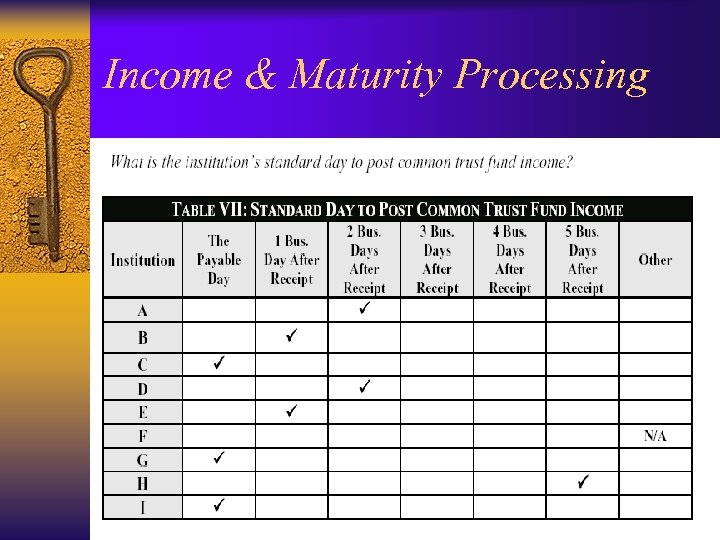

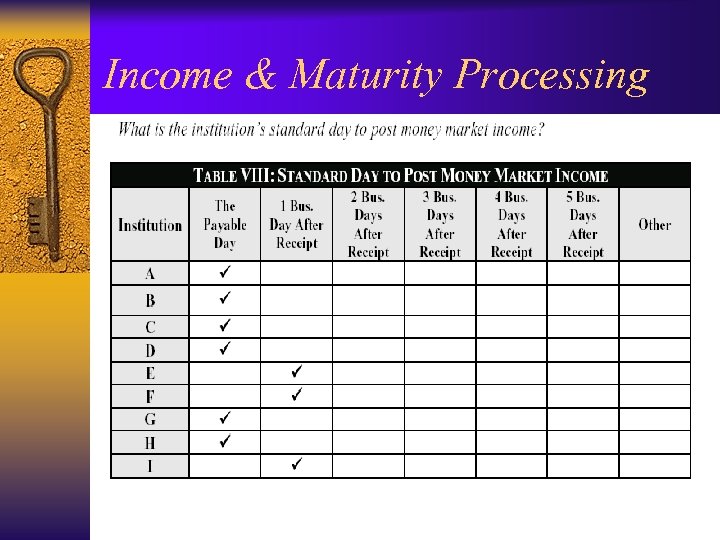

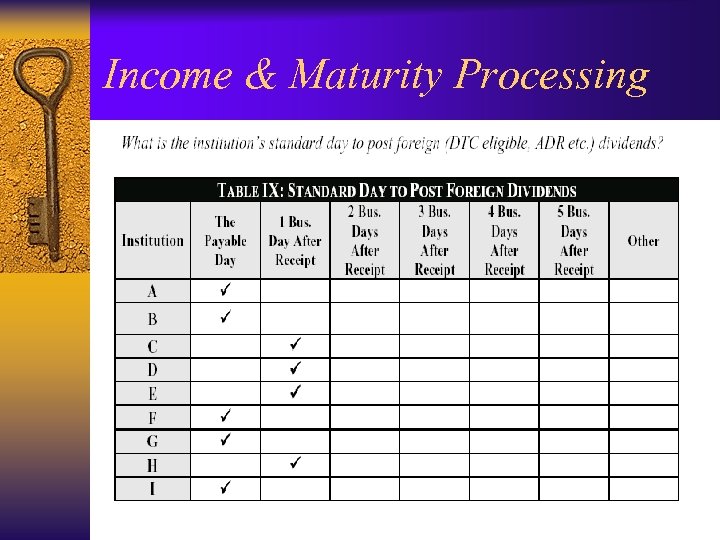

Income and Maturity Processing ! Most profiled institutions post mutual fund reinvestment dividends one business day after receipt. ! Most profiled institutions post money market income to accounts on the payable day. E, F and I post one business day after receipt. ! Only A and I have foreign denomination capability. ! Profiled institutions vary significantly in the number of days after the payable day that they post common trust fund income. C, G and I post on the payable day, B and E on the first business day after receipt, A and D on the second business day after receipt and H on the fifth business day after receipt.

Income and Maturity Processing ! Most profiled institutions post mutual fund reinvestment dividends one business day after receipt. ! Most profiled institutions post money market income to accounts on the payable day. E, F and I post one business day after receipt. ! Only A and I have foreign denomination capability. ! Profiled institutions vary significantly in the number of days after the payable day that they post common trust fund income. C, G and I post on the payable day, B and E on the first business day after receipt, A and D on the second business day after receipt and H on the fifth business day after receipt.

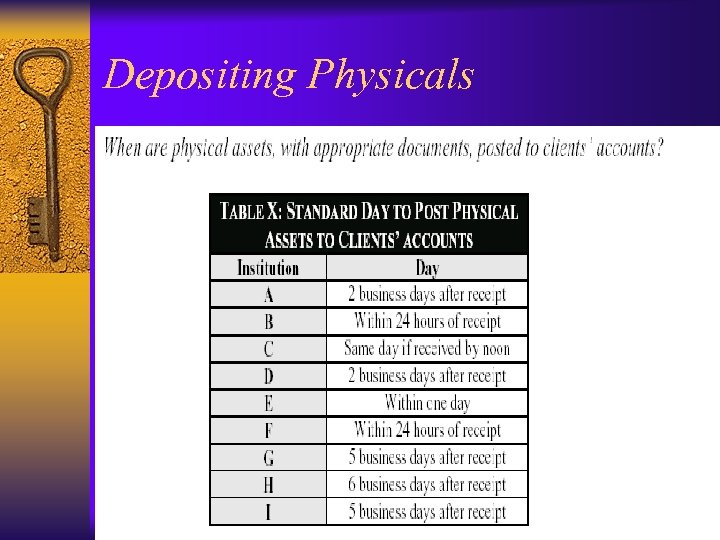

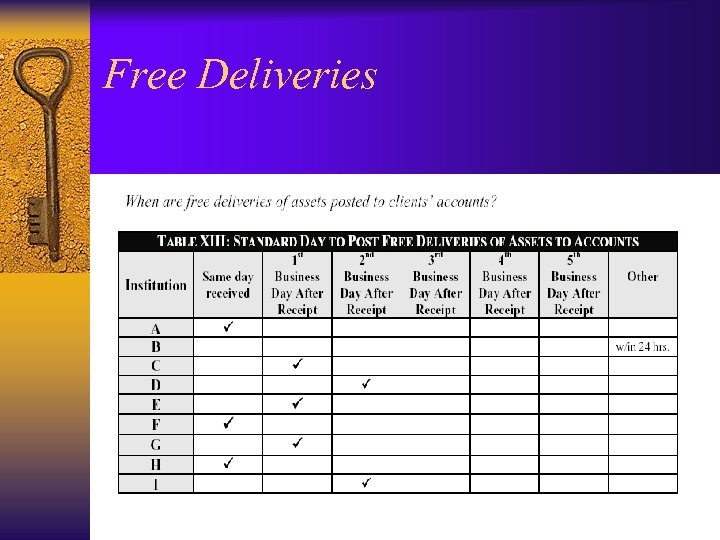

Asset Servicing ! Physical assets with appropriate documents are posted to clients’ accounts on the same day at C if received by noon. B, E and F post within a day of receipt, D post two business days after receipt, G and I post five business days after receipt and H posts six business days after receipt. ! Free receipts of assets are posted to clients’ accounts on the same day at A, C, F and H; on the first business day after receipt at B, E, G and I; and on the second day after receipt at D.

Asset Servicing ! Physical assets with appropriate documents are posted to clients’ accounts on the same day at C if received by noon. B, E and F post within a day of receipt, D post two business days after receipt, G and I post five business days after receipt and H posts six business days after receipt. ! Free receipts of assets are posted to clients’ accounts on the same day at A, C, F and H; on the first business day after receipt at B, E, G and I; and on the second day after receipt at D.

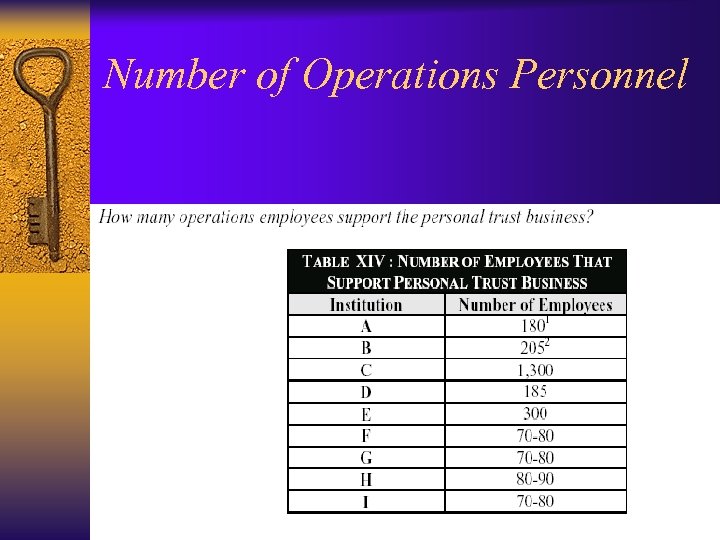

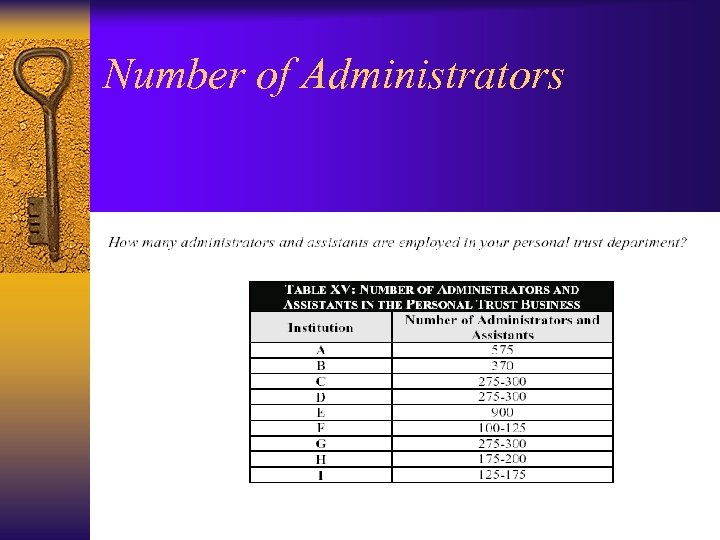

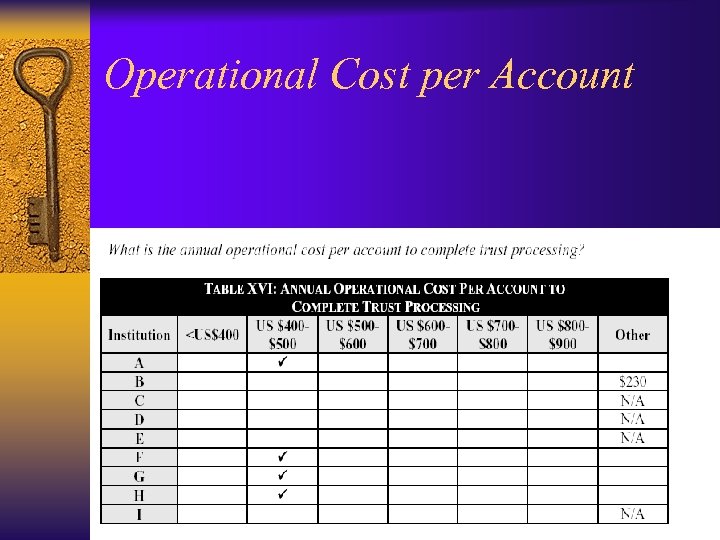

Administration ! Profiled banks employ a numerically diverse operations workforce dedicated to personal trust business. F and I maintain 70 -80 employees, H maintains 80 -90 employees, D maintains 185 employees, and E maintains 300 employees. The non-bank, Institution C has over 1300 operations employees. ! Three institutions have similar processing costs for the completion of trust accounts. Operational costs at A, F and H range US $400 to US $500.

Administration ! Profiled banks employ a numerically diverse operations workforce dedicated to personal trust business. F and I maintain 70 -80 employees, H maintains 80 -90 employees, D maintains 185 employees, and E maintains 300 employees. The non-bank, Institution C has over 1300 operations employees. ! Three institutions have similar processing costs for the completion of trust accounts. Operational costs at A, F and H range US $400 to US $500.

Statement Processing

Statement Processing

Statement Availability

Statement Availability

When are customers’ trust statements cycled? ! A, D, E, G and H cycle customers’ trust statements at the end of the calendar month. ! B cycles customers’ trust statements at the end of the month, quarterly, annually and semi-annually. ! C typically cycles statements at the end of the month and occasionally at the end of the quarter. ! F cycles either monthly or quarterly. ! I cycles on a scheduled basis throughout the month.

When are customers’ trust statements cycled? ! A, D, E, G and H cycle customers’ trust statements at the end of the calendar month. ! B cycles customers’ trust statements at the end of the month, quarterly, annually and semi-annually. ! C typically cycles statements at the end of the month and occasionally at the end of the quarter. ! F cycles either monthly or quarterly. ! I cycles on a scheduled basis throughout the month.

Statement Processing ¨ Does the institution do “special mailing requests? ” If so, what is the percentage of accounts that have special mailing requests? ! A, F and H fulfill special mailing requests. ! One to three percent of A’s accounts, four to six percent of F’s and seven to eight percent of H’s accounts are specially handled.

Statement Processing ¨ Does the institution do “special mailing requests? ” If so, what is the percentage of accounts that have special mailing requests? ! A, F and H fulfill special mailing requests. ! One to three percent of A’s accounts, four to six percent of F’s and seven to eight percent of H’s accounts are specially handled.

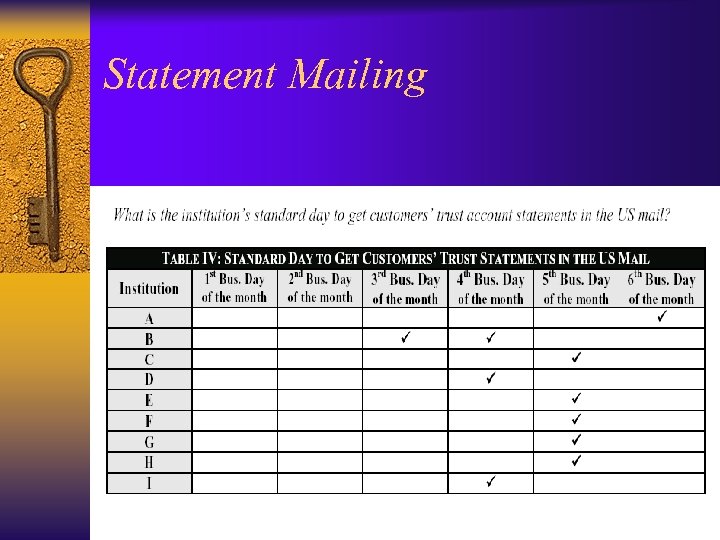

Statement Mailing

Statement Mailing

Cash Processing

Cash Processing

Cash Processing

Cash Processing

Cash Processing

Cash Processing

Cash Processing

Cash Processing

Cash Processing

Cash Processing

Income & Maturity Processing

Income & Maturity Processing

Income & Maturity Processing

Income & Maturity Processing

Income & Maturity Processing

Income & Maturity Processing

Income & Maturity Processing

Income & Maturity Processing

Income & Maturity Processing

Income & Maturity Processing

Foreign Currency ¨ Does the institution’s system have foreign denomination capability? ! A and I are the only surveyed institutions that have foreign denomination capability.

Foreign Currency ¨ Does the institution’s system have foreign denomination capability? ! A and I are the only surveyed institutions that have foreign denomination capability.

Depositing Physicals

Depositing Physicals

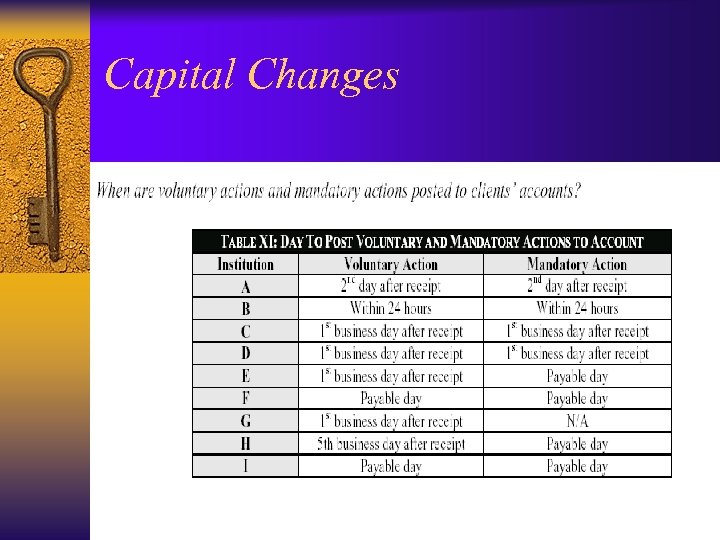

Capital Changes

Capital Changes

Free Receipts

Free Receipts

Free Deliveries

Free Deliveries

Number of Operations Personnel

Number of Operations Personnel

Number of Administrators

Number of Administrators

Operational Cost per Account

Operational Cost per Account

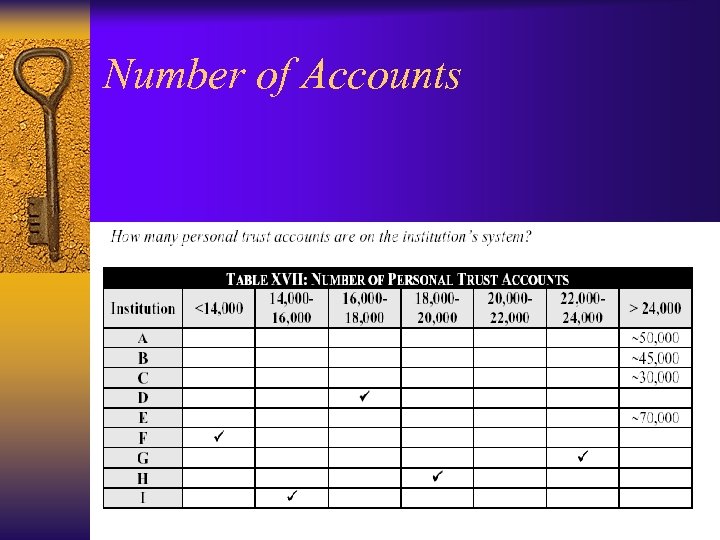

Number of Accounts

Number of Accounts