96249c7ff61a1b836e8a44c4fde80374.ppt

- Количество слайдов: 90

Personal Finance: Another Perspective The Home Decision I Updated 2012/02/06

Personal Finance: Another Perspective The Home Decision I Updated 2012/02/06

Objectives • A. Understand how a house fits into your personal financial plan and our leader’s counsel on home buying • B. Understand the advantages and disadvantages of renting, buying, building, and renovating • C. Know the process on buying a home • D. Know how to compare different types of loans with different fees • E. Understand my recommendations in obtaining a home 2

Objectives • A. Understand how a house fits into your personal financial plan and our leader’s counsel on home buying • B. Understand the advantages and disadvantages of renting, buying, building, and renovating • C. Know the process on buying a home • D. Know how to compare different types of loans with different fees • E. Understand my recommendations in obtaining a home 2

Personal Financial Plan • There are no financial plan assignments for this section • However, since you will likely be buying a home soon, you should learn this material and learn it well • If learned and followed well, it can save you thousands of dollars over your lifetime 3

Personal Financial Plan • There are no financial plan assignments for this section • However, since you will likely be buying a home soon, you should learn this material and learn it well • If learned and followed well, it can save you thousands of dollars over your lifetime 3

A. Understand how a house fits into your Personal Financial Plan ü Is a house important? ü It’s likely the largest single purchase you will ever make. ü What does it provide: ü A good location for raising children, teaching them to work, good neighbors, etc. ü A convenient location to minimize travel time ü A place to reflect your personal tastes ü What are the risks? 4

A. Understand how a house fits into your Personal Financial Plan ü Is a house important? ü It’s likely the largest single purchase you will ever make. ü What does it provide: ü A good location for raising children, teaching them to work, good neighbors, etc. ü A convenient location to minimize travel time ü A place to reflect your personal tastes ü What are the risks? 4

Risks in Home Ownership ü You buy a house you can’t afford • Your other financial goals are not attained ü You buy a fixer-upper without the necessary skills • It stays a fixer upper ü You buy the wrong type of house for your lifestyle • You must pay others to keep it up ü You buy a house without the necessary inspections • You pay dearly for your mistakes ü You are too far in debt and you lose your job • You lose the house and your self-respect 5

Risks in Home Ownership ü You buy a house you can’t afford • Your other financial goals are not attained ü You buy a fixer-upper without the necessary skills • It stays a fixer upper ü You buy the wrong type of house for your lifestyle • You must pay others to keep it up ü You buy a house without the necessary inspections • You pay dearly for your mistakes ü You are too far in debt and you lose your job • You lose the house and your self-respect 5

Our Leader’s Counsel on Buying a Home President James E. Faust stated: ü Over the years the wise counsel of our leaders has been to avoid debt except for the purchase of a home or to pay for an education. I have not heard any of the prophets change this counsel. (“Doing the Best Things in the Worst Times, ” Ensign, August 1984, 41. ) 6

Our Leader’s Counsel on Buying a Home President James E. Faust stated: ü Over the years the wise counsel of our leaders has been to avoid debt except for the purchase of a home or to pay for an education. I have not heard any of the prophets change this counsel. (“Doing the Best Things in the Worst Times, ” Ensign, August 1984, 41. ) 6

Our Leaders Counsel (continued) ü President Gordon B. Hinckley commented: • We have been counseled again and again concerning self-reliance, concerning debt, concerning thrift. When I was a young man, my father counseled me to build a modest home, sufficient for the needs of my family, and make it beautiful and attractive and pleasant and secure. He counseled me to pay off the mortgage as quickly as I could so that, come what may, there would be a roof over the heads of my wife and children. I was reared on that kind of doctrine. (Gordon B. Hinckley, “The Times in Which We Live, ” Ensign, Nov. 2001, 72. ) 7

Our Leaders Counsel (continued) ü President Gordon B. Hinckley commented: • We have been counseled again and again concerning self-reliance, concerning debt, concerning thrift. When I was a young man, my father counseled me to build a modest home, sufficient for the needs of my family, and make it beautiful and attractive and pleasant and secure. He counseled me to pay off the mortgage as quickly as I could so that, come what may, there would be a roof over the heads of my wife and children. I was reared on that kind of doctrine. (Gordon B. Hinckley, “The Times in Which We Live, ” Ensign, Nov. 2001, 72. ) 7

Our Leaders Counsel (continued) ü He further counseled: • I recognize that it may be necessary to borrow to get a home, of course. But let us buy a home that we can afford and thus ease the payments which will constantly hang over our heads without mercy or respite for as long as 30 years. … I urge you to be modest in your expenditures; discipline yourselves in your purchases to avoid debt to the extent possible. Pay off debt as quickly as you can. … That’s all I have to say about it, but I wish to say it with all the emphasis of which I am capable” (Gordon B. Hinckley, “To the Boys and to the Men, ” Ensign, Nov. 1998, 51). 8

Our Leaders Counsel (continued) ü He further counseled: • I recognize that it may be necessary to borrow to get a home, of course. But let us buy a home that we can afford and thus ease the payments which will constantly hang over our heads without mercy or respite for as long as 30 years. … I urge you to be modest in your expenditures; discipline yourselves in your purchases to avoid debt to the extent possible. Pay off debt as quickly as you can. … That’s all I have to say about it, but I wish to say it with all the emphasis of which I am capable” (Gordon B. Hinckley, “To the Boys and to the Men, ” Ensign, Nov. 1998, 51). 8

Our Leaders Counsel (continued) ü Finally, President J. Reuben Clark said: • Let every head of every household aim to own his own home, free from mortgage. Let every man who has a garden spot, garden it; every man who owns a farm, farm it (Conference Report, April 1937, p. 26). ü The challenge then becomes one to determine what is a modest home. • In the Handbook for Families, it recommends: • Avoid spending more than 25 to 40 percent of your take-home pay for the total house payment, including insurance, taxes, and maintenance costs (“Preparing for Emergencies, ” Ensign, Dec. 1990, 59). 9

Our Leaders Counsel (continued) ü Finally, President J. Reuben Clark said: • Let every head of every household aim to own his own home, free from mortgage. Let every man who has a garden spot, garden it; every man who owns a farm, farm it (Conference Report, April 1937, p. 26). ü The challenge then becomes one to determine what is a modest home. • In the Handbook for Families, it recommends: • Avoid spending more than 25 to 40 percent of your take-home pay for the total house payment, including insurance, taxes, and maintenance costs (“Preparing for Emergencies, ” Ensign, Dec. 1990, 59). 9

Questions ü Do you understand how a house fits into your financial plan and our leader’s counsel on homes? 10

Questions ü Do you understand how a house fits into your financial plan and our leader’s counsel on homes? 10

B. Understand Options in the Housing Decision ü Renting • Advantages • High mobility – can move with minimal costs • No repairs and maintenance • Minimal financial commitment • Lower initial costs • Easier budgeting 11

B. Understand Options in the Housing Decision ü Renting • Advantages • High mobility – can move with minimal costs • No repairs and maintenance • Minimal financial commitment • Lower initial costs • Easier budgeting 11

Renting (continued) ü Disadvantages • • • Lack of permanence & pride of ownership Rents may increase unexpectedly Possible restrictions No tax benefits No potential for property appreciation No equity buildup 12

Renting (continued) ü Disadvantages • • • Lack of permanence & pride of ownership Rents may increase unexpectedly Possible restrictions No tax benefits No potential for property appreciation No equity buildup 12

Buying ü Advantages • • • Permanence & pride of ownership You get what you see (usually) Tax benefits Generally a fixed monthly mortgage payment Leverage Can build equity and can borrow against it Minimal time commitment relative to building Mature landscaping & neighborhood Few surprises in terms of neighborhood, schools, shopping, etc. • Can negotiate favorable price and terms 13

Buying ü Advantages • • • Permanence & pride of ownership You get what you see (usually) Tax benefits Generally a fixed monthly mortgage payment Leverage Can build equity and can borrow against it Minimal time commitment relative to building Mature landscaping & neighborhood Few surprises in terms of neighborhood, schools, shopping, etc. • Can negotiate favorable price and terms 13

Buying (continued) ü Disadvantages • Low mobility—Low liquidity so difficult to sell if needed (must make 6 -7% just to break even after realtor fees) • Significant upfront costs • Higher living expenses • Large financial commitment • Possible decrease in value • Possible mortgage default 14

Buying (continued) ü Disadvantages • Low mobility—Low liquidity so difficult to sell if needed (must make 6 -7% just to break even after realtor fees) • Significant upfront costs • Higher living expenses • Large financial commitment • Possible decrease in value • Possible mortgage default 14

Building ü Advantages • Can build exactly what you want • Sometimes cheaper to build than buy (depending upon market conditions) • New appliances and housing systems • Can pick the location 15

Building ü Advantages • Can build exactly what you want • Sometimes cheaper to build than buy (depending upon market conditions) • New appliances and housing systems • Can pick the location 15

Building (continued) ü Disadvantages • Interpreting building plans (size of rooms, etc. ) can cause difficulty if you are unused to it • Often over budget and delays • Unanticipated additional expense for yard and fencing • Combined construction loan interest and rental expense • High monitoring costs!!! • High Stress!! • High Risk!! 16

Building (continued) ü Disadvantages • Interpreting building plans (size of rooms, etc. ) can cause difficulty if you are unused to it • Often over budget and delays • Unanticipated additional expense for yard and fencing • Combined construction loan interest and rental expense • High monitoring costs!!! • High Stress!! • High Risk!! 16

Renovating • Advantages • May get what you want faster than building • Can see what you want generally • May be cheaper to buy and renovate than build, particularly if you can do much of the work yourself (sweat equity) • There may not be available lots in a desired area 17

Renovating • Advantages • May get what you want faster than building • Can see what you want generally • May be cheaper to buy and renovate than build, particularly if you can do much of the work yourself (sweat equity) • There may not be available lots in a desired area 17

Renovating (continued) • Disadvantages • May be more expensive than to build it new • Often over budget and delays. The rule of thumb is to double you budget and then double that again • Unanticipated additional expenses for yard and fencing depending on what was renovated • Combined construction loan interest and rental expense • May have other major problems noted before • High monitoring costs!!! It will take you significant amounts of time to make decisions • High Stress and High Risk!! 18

Renovating (continued) • Disadvantages • May be more expensive than to build it new • Often over budget and delays. The rule of thumb is to double you budget and then double that again • Unanticipated additional expenses for yard and fencing depending on what was renovated • Combined construction loan interest and rental expense • May have other major problems noted before • High monitoring costs!!! It will take you significant amounts of time to make decisions • High Stress and High Risk!! 18

Questions • Any questions on your options in the housing decision? 19

Questions • Any questions on your options in the housing decision? 19

C. Understand the Home Buying Process ü Purchasing a house is a four-step process: • Step 1. Understand your limits • Know yourself, what you can afford and what you need now and in the future • Step 2. Find your home • Know what you want, and go and find it • Step 3. Negotiate your loan • Know what lenders need and want, so you can be ready to get the best loan for you, and • Step 4. Enjoy home ownership • Realize you are a steward over all God has blessed you with. Take good care of your home 20

C. Understand the Home Buying Process ü Purchasing a house is a four-step process: • Step 1. Understand your limits • Know yourself, what you can afford and what you need now and in the future • Step 2. Find your home • Know what you want, and go and find it • Step 3. Negotiate your loan • Know what lenders need and want, so you can be ready to get the best loan for you, and • Step 4. Enjoy home ownership • Realize you are a steward over all God has blessed you with. Take good care of your home 20

Step 1. Understand your Limits • Understand yourself and your limits relates to 8 areas: • a. Know your budget and how much you can afford • b. Know your credit score • c. Calculate your front and back-end bank ratios • d. Calculate your bank ratios for LDS • e. Choose your preferred loan type and term • f. Know what you need for a down payment and upfront costs • g. Have two years of copies of taxes • h. Get pre-approved 21

Step 1. Understand your Limits • Understand yourself and your limits relates to 8 areas: • a. Know your budget and how much you can afford • b. Know your credit score • c. Calculate your front and back-end bank ratios • d. Calculate your bank ratios for LDS • e. Choose your preferred loan type and term • f. Know what you need for a down payment and upfront costs • g. Have two years of copies of taxes • h. Get pre-approved 21

1. a. Know Your Budget and How Much You Can Afford ü You must have and live on a Budget • President Spencer W. Kimball said: “Every family should have a budget” (in Marvin J. Ashton, “One for the Money”, Intellectual Reserve, 1992, inside cover). • Know your lifestyle • Make sure your budget is representative of your lifestyle • Take into account likely lifestyle changes, i. e. , taxes, babies, new job, new city 22

1. a. Know Your Budget and How Much You Can Afford ü You must have and live on a Budget • President Spencer W. Kimball said: “Every family should have a budget” (in Marvin J. Ashton, “One for the Money”, Intellectual Reserve, 1992, inside cover). • Know your lifestyle • Make sure your budget is representative of your lifestyle • Take into account likely lifestyle changes, i. e. , taxes, babies, new job, new city 22

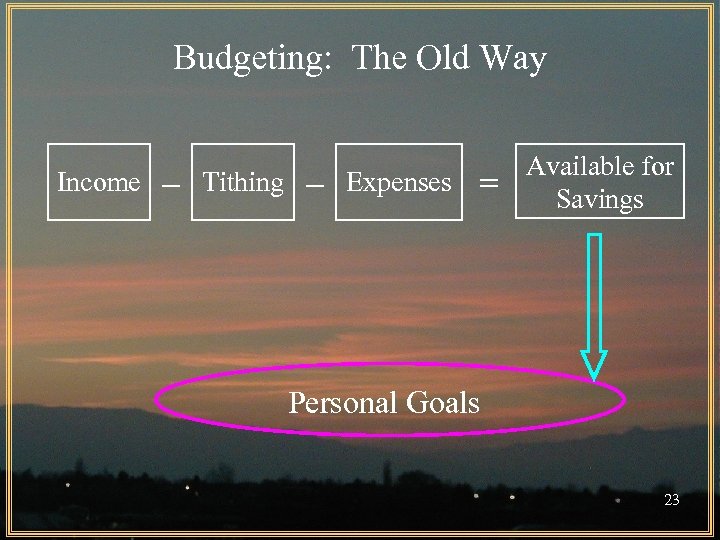

Budgeting: The Old Way Income Tithing Expenses Available for Savings Personal Goals 23

Budgeting: The Old Way Income Tithing Expenses Available for Savings Personal Goals 23

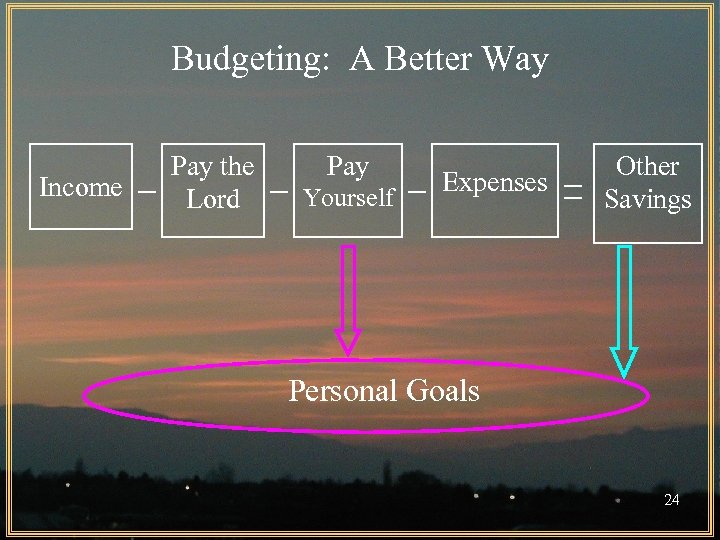

Budgeting: A Better Way Income Pay the Lord Pay Yourself Expenses Other Savings Personal Goals 24

Budgeting: A Better Way Income Pay the Lord Pay Yourself Expenses Other Savings Personal Goals 24

1 b. Know Your Credit Score ü Know your Credit History • Review your credit history every year from all three agencies • Three major credit reporting agencies • Experian (www. experian. com), Equifax (www. equifax. com), and Transunion (www. tuc. com) • You can get a free copy of your credit report from each agency each year by going to: • www. annualcreditreport. com • Fill out the info and you can get a copy online • Make sure it is correct 25

1 b. Know Your Credit Score ü Know your Credit History • Review your credit history every year from all three agencies • Three major credit reporting agencies • Experian (www. experian. com), Equifax (www. equifax. com), and Transunion (www. tuc. com) • You can get a free copy of your credit report from each agency each year by going to: • www. annualcreditreport. com • Fill out the info and you can get a copy online • Make sure it is correct 25

Your Credit Score (continued) ü Get your Credit Score • After checking your credit report for errors, order a copy of your credit score. I recommend a FICO score. You can order it directly from FICO at www. myfico. com for $15. 95 (less with coupons) ü What determines your Credit Score or lending risk? • Payment History: What is your payment record? • Amounts Owed as % of Limit: How much do you owe as a percent of your available limit? • Length of Credit: How long have you had credit? • New Credit: Are you taking on more debt? • Types of Credit Use: Is it a healthy mix? 26

Your Credit Score (continued) ü Get your Credit Score • After checking your credit report for errors, order a copy of your credit score. I recommend a FICO score. You can order it directly from FICO at www. myfico. com for $15. 95 (less with coupons) ü What determines your Credit Score or lending risk? • Payment History: What is your payment record? • Amounts Owed as % of Limit: How much do you owe as a percent of your available limit? • Length of Credit: How long have you had credit? • New Credit: Are you taking on more debt? • Types of Credit Use: Is it a healthy mix? 26

1 c. Know your Affordability Ratios: Front-end and Back-end ü Know the rules for lenders—your affordability ratios • Take into account your savings and tithing when you calculate these ratios ü Ratio 1: Housing Expenses or Front-end Ratio • This ratio calculates what percent of an your income is used to make mortgage payments. • Housing expenses should be less than 28% of your monthly gross income. The formula is: Monthly PITI* <28% Monthly Gross Income • PITI = mortgage principle, mortgage interest, property taxes, and property insurance 27

1 c. Know your Affordability Ratios: Front-end and Back-end ü Know the rules for lenders—your affordability ratios • Take into account your savings and tithing when you calculate these ratios ü Ratio 1: Housing Expenses or Front-end Ratio • This ratio calculates what percent of an your income is used to make mortgage payments. • Housing expenses should be less than 28% of your monthly gross income. The formula is: Monthly PITI* <28% Monthly Gross Income • PITI = mortgage principle, mortgage interest, property taxes, and property insurance 27

Affordability Ratios (continued) ü Ratio 2: Debt Obligations or Back-end Ratio • This ratio calculates what percent of your income is used for housing expenses plus debt obligations. • It should not exceed 36% of your monthly gross income. The formula is: Monthly PITI* and other debt obligations < 36% Monthly Gross Income • Debt obligations include mortgage payments, credit card, student loan, car, and other loan payments • *PITI = Principal, interest, property taxes, and property insurance 28

Affordability Ratios (continued) ü Ratio 2: Debt Obligations or Back-end Ratio • This ratio calculates what percent of your income is used for housing expenses plus debt obligations. • It should not exceed 36% of your monthly gross income. The formula is: Monthly PITI* and other debt obligations < 36% Monthly Gross Income • Debt obligations include mortgage payments, credit card, student loan, car, and other loan payments • *PITI = Principal, interest, property taxes, and property insurance 28

1 d. Calculate Your Ratios for LDS ü As members of the Church, we have other important obligations that we also pay, i. e. , tithing and paying ourselves, i. e. , saving • As such, should have smaller houses (at least less expensive), because we pay the Lord first and ourselves second. ü For a spreadsheet that takes into account the fact that we pay the Lord first and ourselves second within this front-end and back-end ratio framework, see: • Teaching Tool 7: Maximum Monthly Mortgage Payments for LDS Spreadsheet (from the website) 29

1 d. Calculate Your Ratios for LDS ü As members of the Church, we have other important obligations that we also pay, i. e. , tithing and paying ourselves, i. e. , saving • As such, should have smaller houses (at least less expensive), because we pay the Lord first and ourselves second. ü For a spreadsheet that takes into account the fact that we pay the Lord first and ourselves second within this front-end and back-end ratio framework, see: • Teaching Tool 7: Maximum Monthly Mortgage Payments for LDS Spreadsheet (from the website) 29

1 e. Choose your Preferred Loan Type and Loan Term ü Choose your preferred loan type. • The best type of loan takes into account your: • Goals, budget, income stream, down payment, and view on risk • There a number of different types of mortgage loans available. These include: • Fixed Rate (FRMs) - RECOMMENDED • Variable or Adjustable Rate (ARMs) • Interest Only Options: Variable or Fixed Interest • There also special loans (if you can get them) • FHA (best for students) or VA (if military) 30

1 e. Choose your Preferred Loan Type and Loan Term ü Choose your preferred loan type. • The best type of loan takes into account your: • Goals, budget, income stream, down payment, and view on risk • There a number of different types of mortgage loans available. These include: • Fixed Rate (FRMs) - RECOMMENDED • Variable or Adjustable Rate (ARMs) • Interest Only Options: Variable or Fixed Interest • There also special loans (if you can get them) • FHA (best for students) or VA (if military) 30

Recommended Loan Term (continued) ü Choose your loan term • Generally, I recommend a 30 year fixed rate loan • However, I recommend you make additional payments on principal to pay off the loan sooner if possible after you have your emergency fund 31

Recommended Loan Term (continued) ü Choose your loan term • Generally, I recommend a 30 year fixed rate loan • However, I recommend you make additional payments on principal to pay off the loan sooner if possible after you have your emergency fund 31

1 f. Determine Down Payment and Upfront Costs ü Know what you will need for a down payment and upfront costs, and begin saving for it ü Down payments: • You will need a larger down payment to get into your home now versus two years ago • Begin saving for that now • Conventional loans – 20 % recommended, but you can get in with 5% • FHA loans – 3. 5% • VA loans – 0% down payment required • Once you realize how hard it is to save, it will help you not to spend too much 32

1 f. Determine Down Payment and Upfront Costs ü Know what you will need for a down payment and upfront costs, and begin saving for it ü Down payments: • You will need a larger down payment to get into your home now versus two years ago • Begin saving for that now • Conventional loans – 20 % recommended, but you can get in with 5% • FHA loans – 3. 5% • VA loans – 0% down payment required • Once you realize how hard it is to save, it will help you not to spend too much 32

Up-front Costs (continued) ü Upfront costs include closing costs and points • Down payment (3 -20 percent of the loan amount) • Closing costs including points (3 -7 percent) ü Closing costs include: • Title insurance • Attorney’s fee • Property survey • Recording fees • Lender’s origination fee • Appraisal Credit report • Termite inspection • Prepaids (property insurance & taxes, mortgage interest) • Points • 33

Up-front Costs (continued) ü Upfront costs include closing costs and points • Down payment (3 -20 percent of the loan amount) • Closing costs including points (3 -7 percent) ü Closing costs include: • Title insurance • Attorney’s fee • Property survey • Recording fees • Lender’s origination fee • Appraisal Credit report • Termite inspection • Prepaids (property insurance & taxes, mortgage interest) • Points • 33

Up-front Costs (continued) ü Know your impound/escrow/reserve accounts • These accounts are that portion of a the monthly payments held by the lender or servicer to pay for: • Taxes • Hazard insurance • Mortgage insurance • Lease payments, and • Other items as they become due ü These are for payments for items above which are over and above your monthly mortgage payments of principle and interest. Plan for them! • These may or may not be required 34

Up-front Costs (continued) ü Know your impound/escrow/reserve accounts • These accounts are that portion of a the monthly payments held by the lender or servicer to pay for: • Taxes • Hazard insurance • Mortgage insurance • Lease payments, and • Other items as they become due ü These are for payments for items above which are over and above your monthly mortgage payments of principle and interest. Plan for them! • These may or may not be required 34

Up-front Costs (continued) ü What are points? • One percent or one hundred basis points of the loan • This money is pre-paid interest, money paid to the mortgage broker (not the lender). It is deducted from the loan proceeds (you still must pay it back), and is essentially another fee for helping you arrange the loan (minimize points) ü Why do lenders charge points? • To recover costs associated with lending, to increase their profit, and provide for negotiating flexibility ü Do I have to pay points? • Origination points (likely), buy-down points (no) 35

Up-front Costs (continued) ü What are points? • One percent or one hundred basis points of the loan • This money is pre-paid interest, money paid to the mortgage broker (not the lender). It is deducted from the loan proceeds (you still must pay it back), and is essentially another fee for helping you arrange the loan (minimize points) ü Why do lenders charge points? • To recover costs associated with lending, to increase their profit, and provide for negotiating flexibility ü Do I have to pay points? • Origination points (likely), buy-down points (no) 35

1 g. Have Copies of Two Years of Tax Returns ü Lenders want confirmation that you can pay back the loan. As such, they generally want to see two years of tax records • Have copies of your last two years of tax records, even though you were a student • If you have a confirmed job letter with salary, that may also be helpful as well 36

1 g. Have Copies of Two Years of Tax Returns ü Lenders want confirmation that you can pay back the loan. As such, they generally want to see two years of tax records • Have copies of your last two years of tax records, even though you were a student • If you have a confirmed job letter with salary, that may also be helpful as well 36

1 h. Get Pre-approved— Not Pre-qualified ü Get pre-approved for your loan by a number of lenders (with mortgage loans, you can have multiple loans requested within a 90 period and its counted as one loan request) • Pre-approved means that lenders have pulled your credit score, looked at your tax records and approved you for a specific amount of a loan • You can borrow up to this pre-approved amount without a problem • I recommend you check with multiple lenders • Remember however that you do not need to borrow that amount • I recommend you borrow less than that amount 37

1 h. Get Pre-approved— Not Pre-qualified ü Get pre-approved for your loan by a number of lenders (with mortgage loans, you can have multiple loans requested within a 90 period and its counted as one loan request) • Pre-approved means that lenders have pulled your credit score, looked at your tax records and approved you for a specific amount of a loan • You can borrow up to this pre-approved amount without a problem • I recommend you check with multiple lenders • Remember however that you do not need to borrow that amount • I recommend you borrow less than that amount 37

Step 2. Find Your Home ü There is a six step process to finding your home • a. Determine what is important to you • b. Develop a plan for finding a home • c. Once you are serious about a home, get a home inspection (you can make offers contingent on the home inspection results) • d. Determine any CCRs/fees for potential homes • e. Negotiate the home price 38

Step 2. Find Your Home ü There is a six step process to finding your home • a. Determine what is important to you • b. Develop a plan for finding a home • c. Once you are serious about a home, get a home inspection (you can make offers contingent on the home inspection results) • d. Determine any CCRs/fees for potential homes • e. Negotiate the home price 38

2 a. Determine What is Important To You ü Determine what is important to you in a home and what you will and will not do without! • This may include: • Location • Home style and layout • Number of bedrooms, garages, fireplaces, etc. • Future plans, i. e. , kids, work, schools, etc. • Realize that you will probably move within five to seven years (if you are like the average US family) 39

2 a. Determine What is Important To You ü Determine what is important to you in a home and what you will and will not do without! • This may include: • Location • Home style and layout • Number of bedrooms, garages, fireplaces, etc. • Future plans, i. e. , kids, work, schools, etc. • Realize that you will probably move within five to seven years (if you are like the average US family) 39

2 b. Develop a Plan and Build Your Team ü Establish a Plan for finding your home • Once you know your limits, what you can afford, where you want to be, and what you want (your Plan): • Start driving around • Start looking in earnest • But keep to your Plan • Use Zillow. com or other resources to find reference home values in areas you may be interested in 40

2 b. Develop a Plan and Build Your Team ü Establish a Plan for finding your home • Once you know your limits, what you can afford, where you want to be, and what you want (your Plan): • Start driving around • Start looking in earnest • But keep to your Plan • Use Zillow. com or other resources to find reference home values in areas you may be interested in 40

Develop a Plan (continued) ü Be Patient and take your time • Estimate the time you will be in the house • If it is less than 3 -5 years, look into renting • You must make 6 -7% on your house price just to break even when you sell it (realtor fees are 67%) • You will be in the house for years—don’t make the decision to quickly • It will likely be your largest financial commitment you will make for a long time • Often renting a luxury apartment for 6 months will give you time to search thoroughly 41

Develop a Plan (continued) ü Be Patient and take your time • Estimate the time you will be in the house • If it is less than 3 -5 years, look into renting • You must make 6 -7% on your house price just to break even when you sell it (realtor fees are 67%) • You will be in the house for years—don’t make the decision to quickly • It will likely be your largest financial commitment you will make for a long time • Often renting a luxury apartment for 6 months will give you time to search thoroughly 41

Develop a Plan (continued) ü Do your homework and footwork • Get a good realtor--one who knows the ins and outs of the areas you are interested in looking at • While realtors are working for sellers, it may be wise to have a buyer’s broker that works for you ü Take matters into your own hands • Be proactive—talk with friends and others • Use the internet and other tools that may help ü Stay true to your Plan and have patience • Be liquid and ready to react quickly • Be creative if necessary 42

Develop a Plan (continued) ü Do your homework and footwork • Get a good realtor--one who knows the ins and outs of the areas you are interested in looking at • While realtors are working for sellers, it may be wise to have a buyer’s broker that works for you ü Take matters into your own hands • Be proactive—talk with friends and others • Use the internet and other tools that may help ü Stay true to your Plan and have patience • Be liquid and ready to react quickly • Be creative if necessary 42

Develop a Plan (continued) ü Use a team approach—get lots of good help • Get others to help • Buyers broker • Appraiser • Attorney • Don’t become emotionally attached to a potential house • Be willing to walk away • That is often your best negotiating tactic 43

Develop a Plan (continued) ü Use a team approach—get lots of good help • Get others to help • Buyers broker • Appraiser • Attorney • Don’t become emotionally attached to a potential house • Be willing to walk away • That is often your best negotiating tactic 43

c. Have a Home Inspection ü Once you have found the home you like, can afford, and is where you want to live, have a home inspection • This may alert you to potential problems with the home • Many should be fixed by the seller prior to purchase • Don’t buy someone’s problems 44

c. Have a Home Inspection ü Once you have found the home you like, can afford, and is where you want to live, have a home inspection • This may alert you to potential problems with the home • Many should be fixed by the seller prior to purchase • Don’t buy someone’s problems 44

d. Determine any CCRs/Fees and Other Costs ü Look to potential homes and potential costs • Look through all Covenants, Conditions and Restrictions (CCRs) for a potential home • These can be quite restrictive as to what you can and cannot do with your home • If you cannot live with the CCRs, don’t buy there • There also may be lane or other monthly fees • For condos or town homes, determine the amount of the transfer/setup fees • Understand any other homeowners/association fees for potential homes and what they include 45

d. Determine any CCRs/Fees and Other Costs ü Look to potential homes and potential costs • Look through all Covenants, Conditions and Restrictions (CCRs) for a potential home • These can be quite restrictive as to what you can and cannot do with your home • If you cannot live with the CCRs, don’t buy there • There also may be lane or other monthly fees • For condos or town homes, determine the amount of the transfer/setup fees • Understand any other homeowners/association fees for potential homes and what they include 45

Fees and Other Costs (continued) ü Ask to see records of utility costs and other monthly expenses • Compare these to your current costs • Remember that these costs will vary depending on the season • Make sure these costs are consistent with your budget 46

Fees and Other Costs (continued) ü Ask to see records of utility costs and other monthly expenses • Compare these to your current costs • Remember that these costs will vary depending on the season • Make sure these costs are consistent with your budget 46

2 e. Negotiate the Price of the Home ü Use the best available resources to negotiate a price for the home • Use wisdom and judgment in determining what you can and should pay for the home • Realize your best negotiating technique is walking away • This is a negotiation process—do not be afraid to haggle • Realize that closing costs, things that need to be fixed from your home inspection report, and other things can all be part of the negotiated price • Most things are negotiable 47

2 e. Negotiate the Price of the Home ü Use the best available resources to negotiate a price for the home • Use wisdom and judgment in determining what you can and should pay for the home • Realize your best negotiating technique is walking away • This is a negotiation process—do not be afraid to haggle • Realize that closing costs, things that need to be fixed from your home inspection report, and other things can all be part of the negotiated price • Most things are negotiable 47

Step 3. Negotiate the Loan ü Negotiate the loan—this is the final part of the process. It is a three-step process • a. Understand the lending process. • b. Choose multiple lenders to compete for your business and get Good Faith Estimates from each of your lenders • c. Take the various loan offers from the lenders to calculate your lowest Effective Interest Rate • d. Negotiate with your best lender the best rate 48

Step 3. Negotiate the Loan ü Negotiate the loan—this is the final part of the process. It is a three-step process • a. Understand the lending process. • b. Choose multiple lenders to compete for your business and get Good Faith Estimates from each of your lenders • c. Take the various loan offers from the lenders to calculate your lowest Effective Interest Rate • d. Negotiate with your best lender the best rate 48

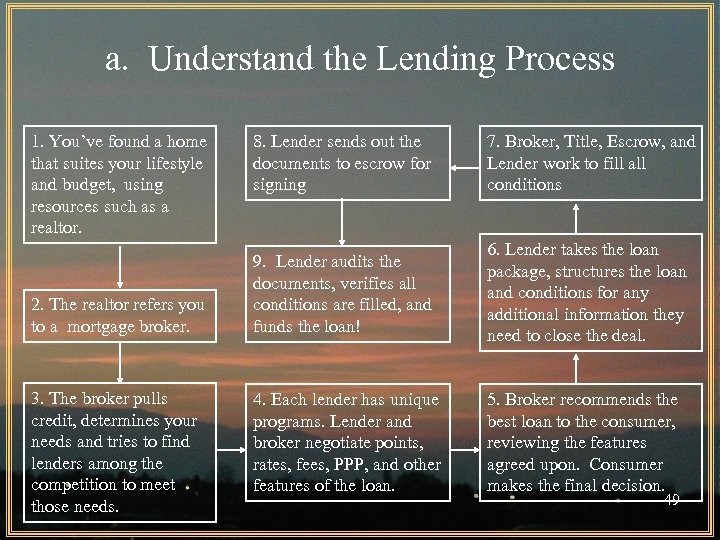

a. Understand the Lending Process 1. You’ve found a home that suites your lifestyle and budget, using resources such as a realtor. 2. The realtor refers you to a mortgage broker. 3. The broker pulls credit, determines your needs and tries to find lenders among the competition to meet those needs. 8. Lender sends out the documents to escrow for signing 7. Broker, Title, Escrow, and Lender work to fill all conditions 9. Lender audits the documents, verifies all conditions are filled, and funds the loan! 6. Lender takes the loan package, structures the loan and conditions for any additional information they need to close the deal. 4. Each lender has unique programs. Lender and broker negotiate points, rates, fees, PPP, and other features of the loan. 5. Broker recommends the best loan to the consumer, reviewing the features agreed upon. Consumer makes the final decision. 49

a. Understand the Lending Process 1. You’ve found a home that suites your lifestyle and budget, using resources such as a realtor. 2. The realtor refers you to a mortgage broker. 3. The broker pulls credit, determines your needs and tries to find lenders among the competition to meet those needs. 8. Lender sends out the documents to escrow for signing 7. Broker, Title, Escrow, and Lender work to fill all conditions 9. Lender audits the documents, verifies all conditions are filled, and funds the loan! 6. Lender takes the loan package, structures the loan and conditions for any additional information they need to close the deal. 4. Each lender has unique programs. Lender and broker negotiate points, rates, fees, PPP, and other features of the loan. 5. Broker recommends the best loan to the consumer, reviewing the features agreed upon. Consumer makes the final decision. 49

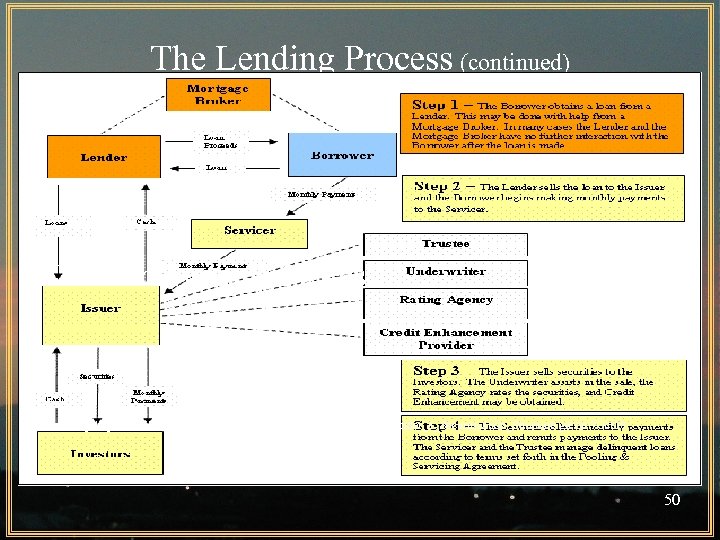

The Lending Process (continued) The Underwriting Process From http: //upload. wikimedia. org/wikipedia/commons/0/08/Borrowing_Under_a_Securitization_Structure. gif on 7 Oct 08 50

The Lending Process (continued) The Underwriting Process From http: //upload. wikimedia. org/wikipedia/commons/0/08/Borrowing_Under_a_Securitization_Structure. gif on 7 Oct 08 50

b. Choose Multiple Lenders and Get Good Faith Estimates ü You will get a lower interest rate when lenders compete for your business • Work with multiple lenders • Talk with friends and others who have gone through the process for their favorite brokers • Hold brokers accountable for what they say ü Get Good Faith Estimates (GFE) from each lender (not just a Summary) • These are the costs you will likely pay • Compare GFEs from each lender 51

b. Choose Multiple Lenders and Get Good Faith Estimates ü You will get a lower interest rate when lenders compete for your business • Work with multiple lenders • Talk with friends and others who have gone through the process for their favorite brokers • Hold brokers accountable for what they say ü Get Good Faith Estimates (GFE) from each lender (not just a Summary) • These are the costs you will likely pay • Compare GFEs from each lender 51

3 c. Calculate your Effective Interest Rate ü Estimate how long you will be in the home • This is important as it helps determine over what period you can allocate points and other costs ü Calculate your effective interest rate for each loan • Your effective interest rate is the interest rate you will pay after all your points, costs, and fees are taken into account ü Get your best rate • Your lowest effective interest rate is the best indicator that you got a good rate on your loan 52

3 c. Calculate your Effective Interest Rate ü Estimate how long you will be in the home • This is important as it helps determine over what period you can allocate points and other costs ü Calculate your effective interest rate for each loan • Your effective interest rate is the interest rate you will pay after all your points, costs, and fees are taken into account ü Get your best rate • Your lowest effective interest rate is the best indicator that you got a good rate on your loan 52

3 d. Negotiate with Your Favorite Lender for the Best Rate ü The key now is to find the lowest rate • Once you have multiple offers from multiple lenders, then you have bargaining power ü Determine your lowest rate, which includes points, fees, and the loan APR after evaluating each of the offers from the various lenders • You can take that offer if you want • Or, you can that offer to your favorite lender • Then ask them to beat it by 1/8 to 1/4 percent and you will go with them 53

3 d. Negotiate with Your Favorite Lender for the Best Rate ü The key now is to find the lowest rate • Once you have multiple offers from multiple lenders, then you have bargaining power ü Determine your lowest rate, which includes points, fees, and the loan APR after evaluating each of the offers from the various lenders • You can take that offer if you want • Or, you can that offer to your favorite lender • Then ask them to beat it by 1/8 to 1/4 percent and you will go with them 53

Step 4. Enjoy Home Ownership ü Enjoy home ownership • Maintain it well • Take care of your purchase and it will take care of you • Generally it will take roughly 1 -2% of the home’s value annually for upkeep. • Put this amount into your annual budget • A professional cleaning a few times a year can help retain a home’s value • Now keep the value of your home up! 54

Step 4. Enjoy Home Ownership ü Enjoy home ownership • Maintain it well • Take care of your purchase and it will take care of you • Generally it will take roughly 1 -2% of the home’s value annually for upkeep. • Put this amount into your annual budget • A professional cleaning a few times a year can help retain a home’s value • Now keep the value of your home up! 54

D. How to Compare Different Types of Loans with Different Rates and Fees ü The cost of a mortgage loan is based on points, up-front costs and expenses, escrow costs, and principle and interest costs • It is critical that you understand each of these areas • Understand these costs, and you can calculate a comparable rate on loans with different points, fee structures and up-front fees • It will save you lots of money overall 55

D. How to Compare Different Types of Loans with Different Rates and Fees ü The cost of a mortgage loan is based on points, up-front costs and expenses, escrow costs, and principle and interest costs • It is critical that you understand each of these areas • Understand these costs, and you can calculate a comparable rate on loans with different points, fee structures and up-front fees • It will save you lots of money overall 55

Key Points on Points ü What are points? • One percent or one hundred basis points of the loan ü Why do lenders charge points? • To recover costs associated with lending. • Origination points are not tax deductible (line 801)) • To increase the effective interest rate • Discount points are tax deductible over the life of the loan • To provide for negotiating flexibility (in a market where interest rates fluctuate), or to adjust for differences in risk between loans 56

Key Points on Points ü What are points? • One percent or one hundred basis points of the loan ü Why do lenders charge points? • To recover costs associated with lending. • Origination points are not tax deductible (line 801)) • To increase the effective interest rate • Discount points are tax deductible over the life of the loan • To provide for negotiating flexibility (in a market where interest rates fluctuate), or to adjust for differences in risk between loans 56

More Points (continued) ü What is the relationship between borrowing costs and mortgage choice? • Lenders offer many choices on interest rates and points • Your challenge is to minimize your effective cost of borrowing and get the least expensive loan ü How do you differentiate between different loans? • Remember, the lender retains the amount attributed to points when distributing the loan proceeds; however, the monthly payment will be based on the entire loan amount 57

More Points (continued) ü What is the relationship between borrowing costs and mortgage choice? • Lenders offer many choices on interest rates and points • Your challenge is to minimize your effective cost of borrowing and get the least expensive loan ü How do you differentiate between different loans? • Remember, the lender retains the amount attributed to points when distributing the loan proceeds; however, the monthly payment will be based on the entire loan amount 57

Good Faith Estimates ü What is a good faith estimate (GFE)? • It is a document provided by the mortgage lender or broker which includes an itemized list of all upfront fees and costs associated with your loan. • Fees include loan fees, fees paid in advance, reserves (escrow), title charges, government charges, and additional charges. ü Why is a GFE important? • It is used to compare different offers or quotes from different lenders and brokers ü What does a GFE look like? 58

Good Faith Estimates ü What is a good faith estimate (GFE)? • It is a document provided by the mortgage lender or broker which includes an itemized list of all upfront fees and costs associated with your loan. • Fees include loan fees, fees paid in advance, reserves (escrow), title charges, government charges, and additional charges. ü Why is a GFE important? • It is used to compare different offers or quotes from different lenders and brokers ü What does a GFE look like? 58

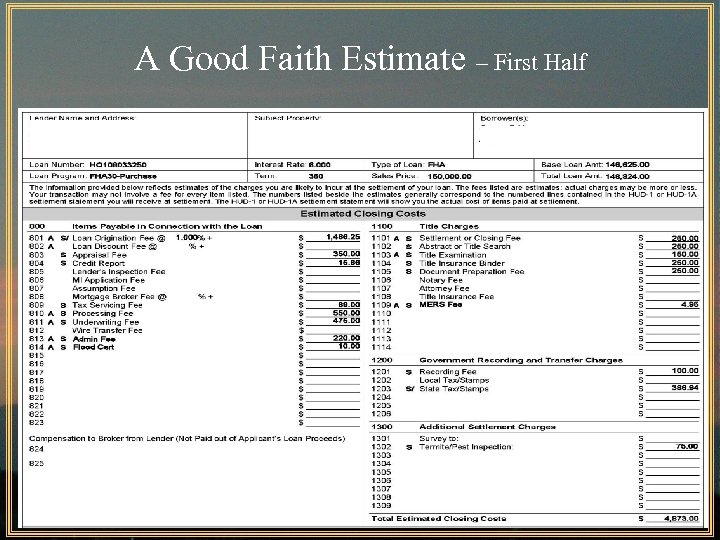

A Good Faith Estimate – First Half 59

A Good Faith Estimate – First Half 59

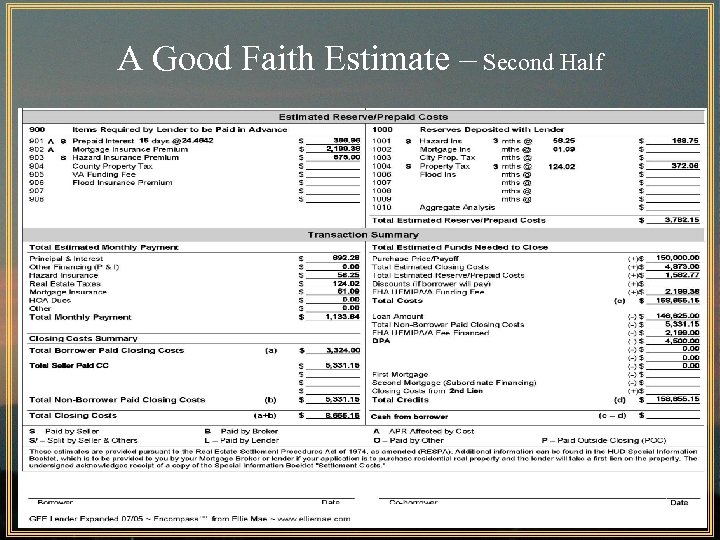

A Good Faith Estimate – Second Half 60

A Good Faith Estimate – Second Half 60

Getting the Best Loan: Calculating the Effective Interest Rate ü What is the difference between the APR and the Effective Interest Rate? (Note: this is different from the effective annual interest rate!) • The APR is a rate that is generated from a precise calculation specified in Regulation Z • The Effective Interest Rate is the precise interest rate the borrower is paying after all fees and costs are taken into account. We assume all costs come out of the loan or are paid back by the loan • If no prepayment or other costs, the EIR = APR • It is important as it will allow you to quickly compare rates from various lenders with various schedules and costs and fees 61

Getting the Best Loan: Calculating the Effective Interest Rate ü What is the difference between the APR and the Effective Interest Rate? (Note: this is different from the effective annual interest rate!) • The APR is a rate that is generated from a precise calculation specified in Regulation Z • The Effective Interest Rate is the precise interest rate the borrower is paying after all fees and costs are taken into account. We assume all costs come out of the loan or are paid back by the loan • If no prepayment or other costs, the EIR = APR • It is important as it will allow you to quickly compare rates from various lenders with various schedules and costs and fees 61

Effective Interest Rate (continued) ü This is the effective rate to the borrower after all costs and fees are taken into account • The lender retains the amount from points while the payment is based on the entire loan amount. ü Note that the borrower pays many additional fees and costs (out-of-pocket) over and above costs that are included in the loan documents • How do you account for these additional out-ofpocket costs in your calculations? 62

Effective Interest Rate (continued) ü This is the effective rate to the borrower after all costs and fees are taken into account • The lender retains the amount from points while the payment is based on the entire loan amount. ü Note that the borrower pays many additional fees and costs (out-of-pocket) over and above costs that are included in the loan documents • How do you account for these additional out-ofpocket costs in your calculations? 62

Effective Interest Rate (continued) ü The Effective Interest Rate calculation takes into account all costs, both out-of-pocket and loan costs ü How is it calculated? • 1. Calculate the payments on the total amount you will be repaying, i. e. the amount borrowed = PMT • 2. Calculate the amount of money you actually received, i. e. , the total loan less all costs = - PV • 3. Set PMT, PV = - what you actually received, N = years, and solve for your interest rate. This is the rate you are actually getting. • It takes into account all your fees, including explicit and out-of-pocket costs and fees • Where do you find your costs and fees? 63

Effective Interest Rate (continued) ü The Effective Interest Rate calculation takes into account all costs, both out-of-pocket and loan costs ü How is it calculated? • 1. Calculate the payments on the total amount you will be repaying, i. e. the amount borrowed = PMT • 2. Calculate the amount of money you actually received, i. e. , the total loan less all costs = - PV • 3. Set PMT, PV = - what you actually received, N = years, and solve for your interest rate. This is the rate you are actually getting. • It takes into account all your fees, including explicit and out-of-pocket costs and fees • Where do you find your costs and fees? 63

What about Prepayment? ü What is prepayment? • Prepayment is when you repay the loan early ü How do you calculate your effective interest rate when you plan to prepay the loan before maturity? • The process is similar, except that you must calculate your balance remaining as of the prepayment date, i. e. the balloon payment • To get your balance remaining or balloon amount, take your payment as PMT, N as the number of years remaining after your prepayment, and your interest rate as I, and solve for your Present Value. The PV is the present value of all the payments you will eliminate 64

What about Prepayment? ü What is prepayment? • Prepayment is when you repay the loan early ü How do you calculate your effective interest rate when you plan to prepay the loan before maturity? • The process is similar, except that you must calculate your balance remaining as of the prepayment date, i. e. the balloon payment • To get your balance remaining or balloon amount, take your payment as PMT, N as the number of years remaining after your prepayment, and your interest rate as I, and solve for your Present Value. The PV is the present value of all the payments you will eliminate 64

Prepayment (continued) ü With expected prepayment: • 1. Calculate your payment = PMT • 2. Calculate your amount received = -PV • 3. Calculate your balance remaining after you prepay (the balloon amount). This balance remaining will be your FV • 4. Set your number of years before prepayment as your = N, your balance remaining as your FV, amount received as your –PV, and solve for I = your effective interest rate 65

Prepayment (continued) ü With expected prepayment: • 1. Calculate your payment = PMT • 2. Calculate your amount received = -PV • 3. Calculate your balance remaining after you prepay (the balloon amount). This balance remaining will be your FV • 4. Set your number of years before prepayment as your = N, your balance remaining as your FV, amount received as your –PV, and solve for I = your effective interest rate 65

Questions ü Any questions on how to compare loans from different lenders with different APRs, points, and fees? 66

Questions ü Any questions on how to compare loans from different lenders with different APRs, points, and fees? 66

D. Final Recommendations: Buying ü Before you begin looking • Spend a significant amount of time trying to understand your needs and requirements • What is important to you, to your spouse, and to your children? • How important are schools, shopping, work? • How long are you willing to commute each day? • Generally, this will require you to rent for a period of time. Use this time wisely. • Try to rent in your preferred area first • Check into rental houses. They can be a good intermediary between renting and buying. 67

D. Final Recommendations: Buying ü Before you begin looking • Spend a significant amount of time trying to understand your needs and requirements • What is important to you, to your spouse, and to your children? • How important are schools, shopping, work? • How long are you willing to commute each day? • Generally, this will require you to rent for a period of time. Use this time wisely. • Try to rent in your preferred area first • Check into rental houses. They can be a good intermediary between renting and buying. 67

Recommendations: Buying (continued) • When planning to buy: • Calculate how much you can afford to spend on a home • Don’t spend so much on this goal that you are crimped in your other personal goals. • Calculate into your spending the fact that you will be paying tithes and offerings and saving 1020% each month for savings. • Don’t buy a “fixer-upper” unless you have the time and the inclination to do it. • Remember your first priority is to do well at work. • Having a beautiful house may not advance your career (although your spouse may love it). 68

Recommendations: Buying (continued) • When planning to buy: • Calculate how much you can afford to spend on a home • Don’t spend so much on this goal that you are crimped in your other personal goals. • Calculate into your spending the fact that you will be paying tithes and offerings and saving 1020% each month for savings. • Don’t buy a “fixer-upper” unless you have the time and the inclination to do it. • Remember your first priority is to do well at work. • Having a beautiful house may not advance your career (although your spouse may love it). 68

Recommendations: Buying (continued) • Once you have decided on a home: • Don’t scrimp on home inspections—they are good investments • Don’t let the current owners discourage you from doing inspections. • Beware of the hidden costs of home ownership. • Keep room in your budget for these. • Get pre-approved for your loan • Don’t spend your maximum amount. • Keep good records of improvements • These can increase the cost basis of your home and reduce taxes when you sell 69

Recommendations: Buying (continued) • Once you have decided on a home: • Don’t scrimp on home inspections—they are good investments • Don’t let the current owners discourage you from doing inspections. • Beware of the hidden costs of home ownership. • Keep room in your budget for these. • Get pre-approved for your loan • Don’t spend your maximum amount. • Keep good records of improvements • These can increase the cost basis of your home and reduce taxes when you sell 69

Final Recommendations: Building • If you decide to build: • The key decision is your contractor. He will either make it extremely easy or difficult for you. • Choose wisely. Interview his past clients, and check financial condition and license. • Ensure permit repairs have final inspections • Know what you want and put it on the plans. • Have friends review plans to make sure you have not forgotten anything. Changes are four times as expensive after plans are completed. • Work with the contractor (but a penalty clause for completion may be useful). • Keep back 5% of the price until all problems are fixed. 70

Final Recommendations: Building • If you decide to build: • The key decision is your contractor. He will either make it extremely easy or difficult for you. • Choose wisely. Interview his past clients, and check financial condition and license. • Ensure permit repairs have final inspections • Know what you want and put it on the plans. • Have friends review plans to make sure you have not forgotten anything. Changes are four times as expensive after plans are completed. • Work with the contractor (but a penalty clause for completion may be useful). • Keep back 5% of the price until all problems are fixed. 70

Final Recommendations: Renovating • If you decide to renovate: • Make sure you have your vision of the house, and make sure that vision is on paper. • For every change, ensure a change order is drawn. • Keep a running tally of all past, current, and estimated costs to complete the project. Review this weekly with the contractor. • You might even put in a clause that if the contractor goes over the planned amount, he makes no new money on the excess over the planned amount. • Be aware of the large time commitment necessary to renovate. 71

Final Recommendations: Renovating • If you decide to renovate: • Make sure you have your vision of the house, and make sure that vision is on paper. • For every change, ensure a change order is drawn. • Keep a running tally of all past, current, and estimated costs to complete the project. Review this weekly with the contractor. • You might even put in a clause that if the contractor goes over the planned amount, he makes no new money on the excess over the planned amount. • Be aware of the large time commitment necessary to renovate. 71

Review • A. Do you understand how a house fits into your personal financial plan? • B. Do you understand the advantages and disadvantages of renting, buying, building, and renovating? • C. Do you know the process on buying a home? • D. Can you compare different types of loans with different fees? • E. Do you understand my recommendations on getting a home? 72

Review • A. Do you understand how a house fits into your personal financial plan? • B. Do you understand the advantages and disadvantages of renting, buying, building, and renovating? • C. Do you know the process on buying a home? • D. Can you compare different types of loans with different fees? • E. Do you understand my recommendations on getting a home? 72

Case Study #1 ü Data • Bill and Brenda make $60, 000 per year. They decided that they have outgrown their small house, and found the house they wanted for $225, 000. They have agreed to a 30 -year fixed rate loan, and estimate property taxes and insurance costs will be $200 per month, and estimate they can get a fixed rate mortgage loan for 6. 5%. They have a car loan of $270 per month and student loan of $50 per month. ü Calculations • Calculate Bill and Brenda’s front-end ratio and back -end ratio (28% and 36%, respectively). ü Application • What is the amount that most banks will lend (most banks will lend to the lower of the two ratios)? 73

Case Study #1 ü Data • Bill and Brenda make $60, 000 per year. They decided that they have outgrown their small house, and found the house they wanted for $225, 000. They have agreed to a 30 -year fixed rate loan, and estimate property taxes and insurance costs will be $200 per month, and estimate they can get a fixed rate mortgage loan for 6. 5%. They have a car loan of $270 per month and student loan of $50 per month. ü Calculations • Calculate Bill and Brenda’s front-end ratio and back -end ratio (28% and 36%, respectively). ü Application • What is the amount that most banks will lend (most banks will lend to the lower of the two ratios)? 73

Salary $60, 000, $225, 000 house, 6. 5% interest rate, Property taxes and insurance $200/month, car loan of $270/month + student loan of $50 / month. Calculate the front end (28%) and back-end ratios (36%) 74

Salary $60, 000, $225, 000 house, 6. 5% interest rate, Property taxes and insurance $200/month, car loan of $270/month + student loan of $50 / month. Calculate the front end (28%) and back-end ratios (36%) 74

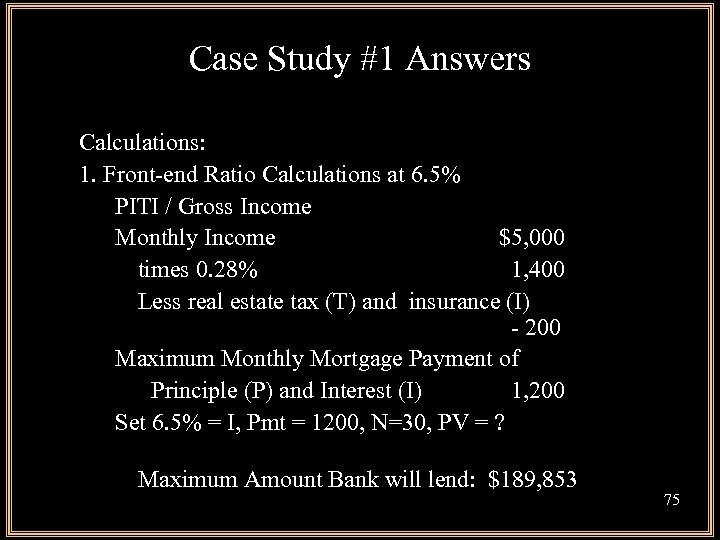

Case Study #1 Answers Calculations: 1. Front-end Ratio Calculations at 6. 5% PITI / Gross Income Monthly Income $5, 000 times 0. 28% 1, 400 Less real estate tax (T) and insurance (I) - 200 Maximum Monthly Mortgage Payment of Principle (P) and Interest (I) 1, 200 Set 6. 5% = I, Pmt = 1200, N=30, PV = ? Maximum Amount Bank will lend: $189, 853 75

Case Study #1 Answers Calculations: 1. Front-end Ratio Calculations at 6. 5% PITI / Gross Income Monthly Income $5, 000 times 0. 28% 1, 400 Less real estate tax (T) and insurance (I) - 200 Maximum Monthly Mortgage Payment of Principle (P) and Interest (I) 1, 200 Set 6. 5% = I, Pmt = 1200, N=30, PV = ? Maximum Amount Bank will lend: $189, 853 75

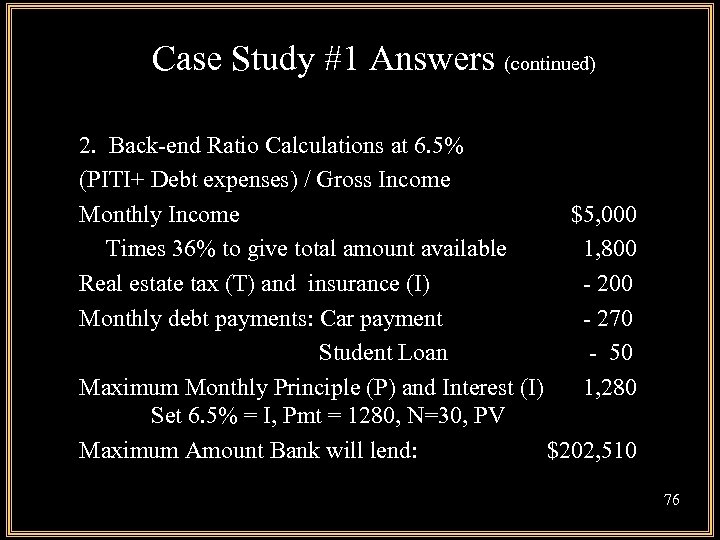

Case Study #1 Answers (continued) 2. Back-end Ratio Calculations at 6. 5% (PITI+ Debt expenses) / Gross Income Monthly Income $5, 000 Times 36% to give total amount available 1, 800 Real estate tax (T) and insurance (I) - 200 Monthly debt payments: Car payment - 270 Student Loan - 50 Maximum Monthly Principle (P) and Interest (I) 1, 280 Set 6. 5% = I, Pmt = 1280, N=30, PV Maximum Amount Bank will lend: $202, 510 76

Case Study #1 Answers (continued) 2. Back-end Ratio Calculations at 6. 5% (PITI+ Debt expenses) / Gross Income Monthly Income $5, 000 Times 36% to give total amount available 1, 800 Real estate tax (T) and insurance (I) - 200 Monthly debt payments: Car payment - 270 Student Loan - 50 Maximum Monthly Principle (P) and Interest (I) 1, 280 Set 6. 5% = I, Pmt = 1280, N=30, PV Maximum Amount Bank will lend: $202, 510 76

Case Study #1 Answers (continued) Applications: Since the bank will generally lend the lesser of the two ratios, they would likely be allowed $189, 853. 77

Case Study #1 Answers (continued) Applications: Since the bank will generally lend the lesser of the two ratios, they would likely be allowed $189, 853. 77

Case Study #2 ü Data • Trent and Jen, both 24, have decided on their dream house (well, at least their first house). In discussions with their mortgage broker, they have the choice between two $200, 000 fixed rate loans, both which are amortized over 30 years. Loan A is for 6. 0% with no points or loan origination fees, and loan B is for 5. 75% with a $1, 500 loan fee and 1 point. ü Calculations • Assuming Trent and Jen plan to stay in the house for 30 years, which loan is more advantageous based on the Effective Interest Rate (EIR) and assuming annual payments? 78

Case Study #2 ü Data • Trent and Jen, both 24, have decided on their dream house (well, at least their first house). In discussions with their mortgage broker, they have the choice between two $200, 000 fixed rate loans, both which are amortized over 30 years. Loan A is for 6. 0% with no points or loan origination fees, and loan B is for 5. 75% with a $1, 500 loan fee and 1 point. ü Calculations • Assuming Trent and Jen plan to stay in the house for 30 years, which loan is more advantageous based on the Effective Interest Rate (EIR) and assuming annual payments? 78

Loan A $200, 000 6. 0% no points, no fees, 30 years Loan B $200, 000 5. 75% 1 points, $1, 500 fees , 30 years 79

Loan A $200, 000 6. 0% no points, no fees, 30 years Loan B $200, 000 5. 75% 1 points, $1, 500 fees , 30 years 79

Case Study #2 Answers Note: Loan A has an EIR of 6% as there are no fees and costs ü 1. Calculate payment for loan B • N=30, I=5. 75%, PV = -$200, 000 PMT = ? • PMT = $14, 143. 25 ü 2. Calculate the amount you received after all fees • $200, 000 – 1 point ($2, 000 * 1) - 1, 500 = ? • $196, 500 ü 3. Calculate your effective interest rate • Set your PMT= $14, 143. 25, N = 30, PV = $196, 500, Solve for I • I = 5. 91% Loan B is the cheaper loan 80

Case Study #2 Answers Note: Loan A has an EIR of 6% as there are no fees and costs ü 1. Calculate payment for loan B • N=30, I=5. 75%, PV = -$200, 000 PMT = ? • PMT = $14, 143. 25 ü 2. Calculate the amount you received after all fees • $200, 000 – 1 point ($2, 000 * 1) - 1, 500 = ? • $196, 500 ü 3. Calculate your effective interest rate • Set your PMT= $14, 143. 25, N = 30, PV = $196, 500, Solve for I • I = 5. 91% Loan B is the cheaper loan 80

Case Study #3 ü Data • Jen reminds Trent that they will likely only be in the home for 6 years, although the job looks wonderful. Trent compromises, and estimates that they will be in the home for 12 years. Review their choice between the two $200, 000 fixed rate loans, both which are amortized over 30 years, but which will be paid back in 12 years. Loan A is for the same 6. 0% with no points or fees, and loan B is for 5. 75% with a $1, 500 loan fee and 1 point. ü Calculations • Calculate the EIR for both loans, assuming they prepay after 12 years and make annual payments. ü Application • Which loan is more advantageous with prepayment using the EIR for them? 81

Case Study #3 ü Data • Jen reminds Trent that they will likely only be in the home for 6 years, although the job looks wonderful. Trent compromises, and estimates that they will be in the home for 12 years. Review their choice between the two $200, 000 fixed rate loans, both which are amortized over 30 years, but which will be paid back in 12 years. Loan A is for the same 6. 0% with no points or fees, and loan B is for 5. 75% with a $1, 500 loan fee and 1 point. ü Calculations • Calculate the EIR for both loans, assuming they prepay after 12 years and make annual payments. ü Application • Which loan is more advantageous with prepayment using the EIR for them? 81

Prepay after 12 years: Loan A $200, 000 6. 0% no points, no fees, 30 years Loan B $200, 000 5. 75% 1 point, $1, 500 fees 82

Prepay after 12 years: Loan A $200, 000 6. 0% no points, no fees, 30 years Loan B $200, 000 5. 75% 1 point, $1, 500 fees 82

Case Study #3 Answers ü 1. Calculate payment for loan B • N=30, I=5. 75%, PV = -$200, 000 PMT = $14, 143. 25 ü 2. Set PV = to the amount you receive after all costs • $200, 000 – 1 point ($2, 000 * 1) - 1, 500 = $196, 500 ü 3. Solve for your balloon payment at year 12 • N = 18, PMT = $ 14, 143. 25, I = 5. 75, PV = $156, 054. 03 ü 4. Solve for their effective rate • PMT = $ 14, 143. 25, PV is -$196, 500, N = 12, FV = $156, 054. 03, solve for I • I = 5. 98% Loan B is still cheaper (barely) 83

Case Study #3 Answers ü 1. Calculate payment for loan B • N=30, I=5. 75%, PV = -$200, 000 PMT = $14, 143. 25 ü 2. Set PV = to the amount you receive after all costs • $200, 000 – 1 point ($2, 000 * 1) - 1, 500 = $196, 500 ü 3. Solve for your balloon payment at year 12 • N = 18, PMT = $ 14, 143. 25, I = 5. 75, PV = $156, 054. 03 ü 4. Solve for their effective rate • PMT = $ 14, 143. 25, PV is -$196, 500, N = 12, FV = $156, 054. 03, solve for I • I = 5. 98% Loan B is still cheaper (barely) 83

Case Study #4 ü Data • Jen’s broker has said that for 1 more “buy down” point (for a total of 2 points with the same $1, 500 fees), he can give her loan C with an interest rate of 5. 50%. ü Calculations • Calculate the EIR for Loan C. How much did that extra point save Jen in terms of the effective interest rate over Loan A and Loan B? ü Application • Assuming the same 12 year prepayment plan, which loan should Trent and Jen take? 84

Case Study #4 ü Data • Jen’s broker has said that for 1 more “buy down” point (for a total of 2 points with the same $1, 500 fees), he can give her loan C with an interest rate of 5. 50%. ü Calculations • Calculate the EIR for Loan C. How much did that extra point save Jen in terms of the effective interest rate over Loan A and Loan B? ü Application • Assuming the same 12 year prepayment plan, which loan should Trent and Jen take? 84

Prepay after 12 years: Loan C $200, 000 5. 5%, 2 points, $1, 500 fees , 30 years. How much did the 2 nd point save? 85

Prepay after 12 years: Loan C $200, 000 5. 5%, 2 points, $1, 500 fees , 30 years. How much did the 2 nd point save? 85

Case Study #4 Answers ü 1. Calculate payment for loan C • N=30, I=5. 5%, PV = -$200, 000 PMT = $13, 761. 08 ü 2. Calculate amount received after all fees (2 points) • $200, 000 – 2 points ($2, 000 * 2) - 1, 500 = $194, 500 ü 3. Calculate the balance owed after 12 years (18 years remaining) The PV of 18 years of the PMT is: • N=18, I=5. 5%, PMT= -$13, 761. 08, PV = $154, 758. 11 ü 4. Calculate effective interest rate to lender • Set your FV at year 12 to = $ 154, 758. 11, PMT= $ 13, 761. 08, N = 12, PV = -$194, 500, Solve for I = ? • I = 5. 85% ü Loan C saves. 15% and. 13% over Loans A and B 86

Case Study #4 Answers ü 1. Calculate payment for loan C • N=30, I=5. 5%, PV = -$200, 000 PMT = $13, 761. 08 ü 2. Calculate amount received after all fees (2 points) • $200, 000 – 2 points ($2, 000 * 2) - 1, 500 = $194, 500 ü 3. Calculate the balance owed after 12 years (18 years remaining) The PV of 18 years of the PMT is: • N=18, I=5. 5%, PMT= -$13, 761. 08, PV = $154, 758. 11 ü 4. Calculate effective interest rate to lender • Set your FV at year 12 to = $ 154, 758. 11, PMT= $ 13, 761. 08, N = 12, PV = -$194, 500, Solve for I = ? • I = 5. 85% ü Loan C saves. 15% and. 13% over Loans A and B 86

Case Study #5 ü Data • Bill has taken a job that he expects to be at for 3 -5 years until he goes back to graduate school. He and his wife are debating whether to rent or buy. She really wants to buy, and he is unsure. She has found a house in a nice neighborhood near your school that she thinks is perfect. ü Application • Are there any other tools or sources of information that may be helpful to them to help in this decision? 87

Case Study #5 ü Data • Bill has taken a job that he expects to be at for 3 -5 years until he goes back to graduate school. He and his wife are debating whether to rent or buy. She really wants to buy, and he is unsure. She has found a house in a nice neighborhood near your school that she thinks is perfect. ü Application • Are there any other tools or sources of information that may be helpful to them to help in this decision? 87

Will live there 3 -5 years until graduate school. Have found a nice house in a nice neighborhood. Any other tools to help in the decision making process? 88

Will live there 3 -5 years until graduate school. Have found a nice house in a nice neighborhood. Any other tools to help in the decision making process? 88

Case Study #5 Answers There are two additional pieces of information that may be useful as they “study it out in their mind” before they make a final decision may be: ü 1. Talk with a realtor about the neighborhood. Find the average “days on the market” (or DOM) for the area. If houses are selling quickly <30 -45 DOM, the market is currently strong. If the DOM>90 -120, it is difficult to sell homes now and may be difficult in the future. ü 2. Talk with a realtor and get the data on the average annual appreciation of the houses in that neighborhood. If they have continued to appreciate over the last few years, there may be support for continued appreciation in the future. If not, they may be more difficult to sell in the future. 89

Case Study #5 Answers There are two additional pieces of information that may be useful as they “study it out in their mind” before they make a final decision may be: ü 1. Talk with a realtor about the neighborhood. Find the average “days on the market” (or DOM) for the area. If houses are selling quickly <30 -45 DOM, the market is currently strong. If the DOM>90 -120, it is difficult to sell homes now and may be difficult in the future. ü 2. Talk with a realtor and get the data on the average annual appreciation of the houses in that neighborhood. If they have continued to appreciate over the last few years, there may be support for continued appreciation in the future. If not, they may be more difficult to sell in the future. 89

Teaching Tools ü Please note that I have prepared three teaching tools which may be helpful as you work on buying a home. They are: • TT 19 Home Loan Comparison with Prepayments (for 3 different loans), and • TT 09 Debt Amortization and Prepayments • TT 11 Maximum Mortgage Payments for LDS ü Please note that while they are helpful, they cannot be used for quizzes or exams. For another good source of information, see www. mtgprofessor. com 90

Teaching Tools ü Please note that I have prepared three teaching tools which may be helpful as you work on buying a home. They are: • TT 19 Home Loan Comparison with Prepayments (for 3 different loans), and • TT 09 Debt Amortization and Prepayments • TT 11 Maximum Mortgage Payments for LDS ü Please note that while they are helpful, they cannot be used for quizzes or exams. For another good source of information, see www. mtgprofessor. com 90