0a6184adb3e2ea526c543538c4530431.ppt

- Количество слайдов: 50

Personal Finance and Economics Chapter 20

Personal Finance and Economics Chapter 20

Managing Your Money Section 1

Managing Your Money Section 1

Consumer Rights • Consumer=Someone who buys a product or service • Your role as a consumer depends on your available income and how much of it you choose to spend.

Consumer Rights • Consumer=Someone who buys a product or service • Your role as a consumer depends on your available income and how much of it you choose to spend.

Types of Income • Disposable Income= The money that remains after all taxes on it have been paid. • Discretionary Income= The money remaining after paying for necessities – This income can be used to solve your wants

Types of Income • Disposable Income= The money that remains after all taxes on it have been paid. • Discretionary Income= The money remaining after paying for necessities – This income can be used to solve your wants

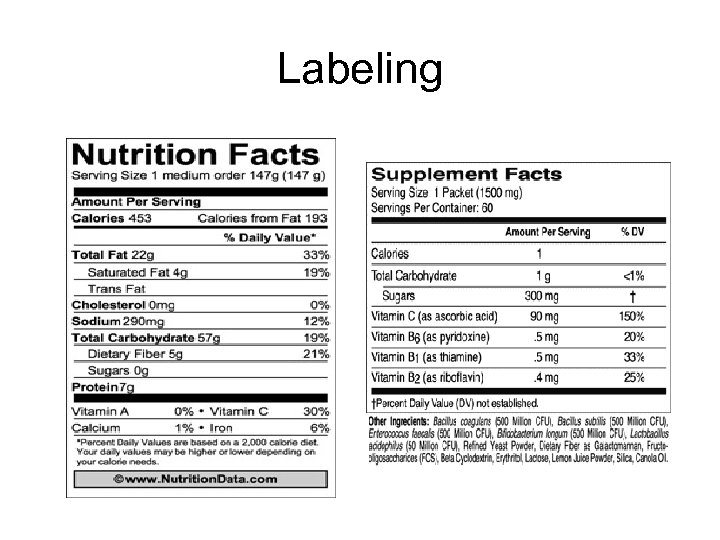

Protecting Consumer Rights • Consumerism= A movement to educate buyers about the purchases they make and to demand better and safer products from manufacturers. • Congress passed laws dealing with labeling – Food, Drug, and Cosmetic Act required packages to list their ingredients according to the amount of each.

Protecting Consumer Rights • Consumerism= A movement to educate buyers about the purchases they make and to demand better and safer products from manufacturers. • Congress passed laws dealing with labeling – Food, Drug, and Cosmetic Act required packages to list their ingredients according to the amount of each.

Labeling

Labeling

Better Business Bureau (BBB) • They provide information about local businesses and warn consumers about dishonest business practices. • They also investigate consumer complaints.

Better Business Bureau (BBB) • They provide information about local businesses and warn consumers about dishonest business practices. • They also investigate consumer complaints.

Consumer Bill of Rights • • • Right to safe product Right to be informed Right to choose Right to be heard Right to redress

Consumer Bill of Rights • • • Right to safe product Right to be informed Right to choose Right to be heard Right to redress

Consumer Responsibilities • Gather information and find out as much as you can about products so that you can recognize good quality. • Use advertising carefully to help you learn about products and services and the best places to buy them

Consumer Responsibilities • Gather information and find out as much as you can about products so that you can recognize good quality. • Use advertising carefully to help you learn about products and services and the best places to buy them

Consumer Responsibility • Decide where to buy • The process of gathering information on the types and prices of products available from different stores is called comparison shopping. – Read newspaper advertisements, make telephone class, and visit different stores.

Consumer Responsibility • Decide where to buy • The process of gathering information on the types and prices of products available from different stores is called comparison shopping. – Read newspaper advertisements, make telephone class, and visit different stores.

Reporting a Faulty Product • Report the product immediately. • Do not try to fix the product yourself (Warranty) • Contact the seller or manufacturer for a fair solution. • Keep records of your efforts to get the problem solved.

Reporting a Faulty Product • Report the product immediately. • Do not try to fix the product yourself (Warranty) • Contact the seller or manufacturer for a fair solution. • Keep records of your efforts to get the problem solved.

Reporting a Faulty Product • Allow each person responsible time to solve the problem before contacting another person. • If you need to contact in writing, type your letter. • Keep a copy of all communication. • Keep your composure.

Reporting a Faulty Product • Allow each person responsible time to solve the problem before contacting another person. • If you need to contact in writing, type your letter. • Keep a copy of all communication. • Keep your composure.

Making Fair Complaints • Exhibit ethical behavior by respecting the rights of producers and sellers. • DO NOT return a used item because it has been advertised elsewhere for a lower price or claim it is faulty if you broke it. • Provide the seller with the whole truth.

Making Fair Complaints • Exhibit ethical behavior by respecting the rights of producers and sellers. • DO NOT return a used item because it has been advertised elsewhere for a lower price or claim it is faulty if you broke it. • Provide the seller with the whole truth.

Making Buying Decisions • First, decide whether or not to buy an item. – Is it on sale? – Do you really need it? • Second, Decide what the opportunity cost would be. – Is the item worth what you must give up to buy it.

Making Buying Decisions • First, decide whether or not to buy an item. – Is it on sale? – Do you really need it? • Second, Decide what the opportunity cost would be. – Is the item worth what you must give up to buy it.

Planning and Budgeting Section 2

Planning and Budgeting Section 2

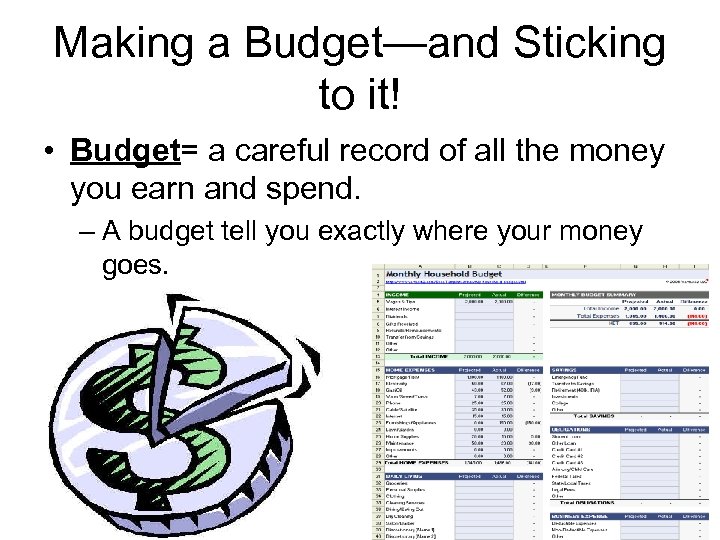

Making a Budget—and Sticking to it! • Budget= a careful record of all the money you earn and spend. – A budget tell you exactly where your money goes.

Making a Budget—and Sticking to it! • Budget= a careful record of all the money you earn and spend. – A budget tell you exactly where your money goes.

Basic Budgeting Terms • Income=the money you earn • Expenses=The money you spend on everything, including what you choose to save. • Balance= The amount of money you have left over after you subtract all of your expenses. • Surplus= means more money than expenses • Deficit= negative balance

Basic Budgeting Terms • Income=the money you earn • Expenses=The money you spend on everything, including what you choose to save. • Balance= The amount of money you have left over after you subtract all of your expenses. • Surplus= means more money than expenses • Deficit= negative balance

How to make a budget • Make a list of everything you spend for a couple of weeks. • Record everything you earn. • Analyze data – Do you need to reduce expenses? – Can you work extra hours to increase income? • Keep a surplus!! Why? • Monitor your spending

How to make a budget • Make a list of everything you spend for a couple of weeks. • Record everything you earn. • Analyze data – Do you need to reduce expenses? – Can you work extra hours to increase income? • Keep a surplus!! Why? • Monitor your spending

Credit • Credit=Barrowing money to pay for something now while promising to repay it later.

Credit • Credit=Barrowing money to pay for something now while promising to repay it later.

Recognizing your credit terms • Lender= person who loans someone the money to buy an item. (Visa or Master Card) • The Barrower receives the loaned money • Annual Percentage Rage is the annual cost of credit expressed as a percentage of the amount borrowed. • Credit Rating? • Collateral=property that a borrower pledges as security for a loan.

Recognizing your credit terms • Lender= person who loans someone the money to buy an item. (Visa or Master Card) • The Barrower receives the loaned money • Annual Percentage Rage is the annual cost of credit expressed as a percentage of the amount borrowed. • Credit Rating? • Collateral=property that a borrower pledges as security for a loan.

Sources of Credit • Home Mortgages and car loans • College loans • Banks, credit unions, and financial companies.

Sources of Credit • Home Mortgages and car loans • College loans • Banks, credit unions, and financial companies.

Credit Cards • Allow you to charge for goods and services up to the value of a present monthly limit. • When you apply for a credit card, the issuer checks your credit rating and assigns a dollar limit based on what it thinks you can afford to pay back.

Credit Cards • Allow you to charge for goods and services up to the value of a present monthly limit. • When you apply for a credit card, the issuer checks your credit rating and assigns a dollar limit based on what it thinks you can afford to pay back.

Credit Cards • To avoid interest charges, you must pay off your full credit balance each month.

Credit Cards • To avoid interest charges, you must pay off your full credit balance each month.

AVOID DOING THIS!!! • EXAMPLE – You buy a $2, 000 engagement ring with a credit card that charges 18% interest – You pay off the entire bill the next month, you pay $0 interest. – If you only make the minimum payment each month, over time it will take you 10 years to pay for the item and you will have paid $1, 142 in interest. – Thus the $2, 000 item will have cost you $3, 142

AVOID DOING THIS!!! • EXAMPLE – You buy a $2, 000 engagement ring with a credit card that charges 18% interest – You pay off the entire bill the next month, you pay $0 interest. – If you only make the minimum payment each month, over time it will take you 10 years to pay for the item and you will have paid $1, 142 in interest. – Thus the $2, 000 item will have cost you $3, 142

Benefits to having a Credit Card • Pros: It allows you to obtain something you want without waiting until you can save the entire purchase price. • Making monthly payments on time can teach you financial discipline.

Benefits to having a Credit Card • Pros: It allows you to obtain something you want without waiting until you can save the entire purchase price. • Making monthly payments on time can teach you financial discipline.

Drawbacks to Credit Cards • People buy more than they can afford. • Leads to bankruptcy, or the inability to pay back debts. – This makes it almost impossible for you to get a loan or to receive credit.

Drawbacks to Credit Cards • People buy more than they can afford. • Leads to bankruptcy, or the inability to pay back debts. – This makes it almost impossible for you to get a loan or to receive credit.

Your responsibilities as a Borrower • Have a plan to make all the payments on your loan or credit purchase in a timely manner. • Decide if you can afford to make a credit purchase before you decide to buy! • Learn about the terms of the loan or deal.

Your responsibilities as a Borrower • Have a plan to make all the payments on your loan or credit purchase in a timely manner. • Decide if you can afford to make a credit purchase before you decide to buy! • Learn about the terms of the loan or deal.

Saving and Investing Section 3

Saving and Investing Section 3

Saving for the Future • One way to reach your long term purchasing goals is to save. • Save=to set aside income for a time so you have it to use later. – The part of your income you do not spend.

Saving for the Future • One way to reach your long term purchasing goals is to save. • Save=to set aside income for a time so you have it to use later. – The part of your income you do not spend.

Why Save? • Most people cannot make major purchases without putting aside money to help pay for them. • Helps during emergencies. • Save for luxuries. • Your money that you put away in the bank makes more money available for others to invest and spend.

Why Save? • Most people cannot make major purchases without putting aside money to help pay for them. • Helps during emergencies. • Save for luxuries. • Your money that you put away in the bank makes more money available for others to invest and spend.

Saving Regularly • To make it easier for people to save, some employers will withhold a fixed amount from employees paychecks. – This money is then deposited into the employees savings account.

Saving Regularly • To make it easier for people to save, some employers will withhold a fixed amount from employees paychecks. – This money is then deposited into the employees savings account.

Easy Availability • You can withdraw funds at any time from a savings account without paying a penalty.

Easy Availability • You can withdraw funds at any time from a savings account without paying a penalty.

Earning Interest on a Savings Account • Interest=the payment people receive when they lend money, or allow someone else to use their money. • The financial institution can lend these funds to someone else, who will in turn pay interest to the financial institution for the use of the money. • You receive interest as long as funds are in the account.

Earning Interest on a Savings Account • Interest=the payment people receive when they lend money, or allow someone else to use their money. • The financial institution can lend these funds to someone else, who will in turn pay interest to the financial institution for the use of the money. • You receive interest as long as funds are in the account.

Saving and Trade-Off • The money you save today, you will have more to spend 10, 15, 20 years from now. • But today you will have less to spend.

Saving and Trade-Off • The money you save today, you will have more to spend 10, 15, 20 years from now. • But today you will have less to spend.

Savings Accounts • You can open up a savings account at a bank, savings and loan, or credit union. • You can withdraw your money at anytime, and the interest you earn is automatically added to your principal. • You can not write checks for a savings account!

Savings Accounts • You can open up a savings account at a bank, savings and loan, or credit union. • You can withdraw your money at anytime, and the interest you earn is automatically added to your principal. • You can not write checks for a savings account!

Checking Accounts • You write a check, the banking institution pays out the funds in your checking account. • “Bouncing a Check” • Debit Cards • Some institutions pay a small amount of interest on checking accounts. • Some institutions may require you to keep a minimum

Checking Accounts • You write a check, the banking institution pays out the funds in your checking account. • “Bouncing a Check” • Debit Cards • Some institutions pay a small amount of interest on checking accounts. • Some institutions may require you to keep a minimum

Money Market Funds • Money Market account allows you to write checks, usually for larger amounts, against the money you have deposited. • It pays interest, often a little higher than that on savings accounts.

Money Market Funds • Money Market account allows you to write checks, usually for larger amounts, against the money you have deposited. • It pays interest, often a little higher than that on savings accounts.

Certificates of Deposit (CDs) • Like a time deposit, in which you agree to deposit a sum of money with a financial institution for a certain amount of time. • In return, the institution guaranteed you a set rate of interest that will be added to your principal when the CD matures. • If you withdraw the money before the stated date, you pay a large penalty • CDs pay a higher rate of interest.

Certificates of Deposit (CDs) • Like a time deposit, in which you agree to deposit a sum of money with a financial institution for a certain amount of time. • In return, the institution guaranteed you a set rate of interest that will be added to your principal when the CD matures. • If you withdraw the money before the stated date, you pay a large penalty • CDs pay a higher rate of interest.

Investments • Stocks and Bonds have a much higher return over the years than savings accounts, money market accounts, and CDs.

Investments • Stocks and Bonds have a much higher return over the years than savings accounts, money market accounts, and CDs.

Stocks and Bonds • Stocks= you are buying a partial ownership in a company. – If the company does well, the value of your share will go up. – You can sell your stock at any time. • Dividends – Some companies also pay shareholders a portion of company earnings at regular intervals based on the number of shares you hold.

Stocks and Bonds • Stocks= you are buying a partial ownership in a company. – If the company does well, the value of your share will go up. – You can sell your stock at any time. • Dividends – Some companies also pay shareholders a portion of company earnings at regular intervals based on the number of shares you hold.

Bonds • A Bond is lending money to a company or government. • Company bonds – Issue bonds to raise money for new equipment or other company expenses – Companies pay bond holders interest for a certain number of years. – RISK: Company could be unable to pay you interest or make final payments to principal.

Bonds • A Bond is lending money to a company or government. • Company bonds – Issue bonds to raise money for new equipment or other company expenses – Companies pay bond holders interest for a certain number of years. – RISK: Company could be unable to pay you interest or make final payments to principal.

Government Bonds • Borrows money through bonds to pay for government expenses • The government pays interest on these bonds , but only pays when you redeem them. • A person buying a savings bond pays half the bonds face value. – $100 bond for only $50

Government Bonds • Borrows money through bonds to pay for government expenses • The government pays interest on these bonds , but only pays when you redeem them. • A person buying a savings bond pays half the bonds face value. – $100 bond for only $50

Mutual Funds • Pools of money from many people who are invested in a selection of individual stocks and/or bonds chosen by financial experts. • Spending you investment among many stocks or bonds limits the loss if one individual stock or bond performs poorly.

Mutual Funds • Pools of money from many people who are invested in a selection of individual stocks and/or bonds chosen by financial experts. • Spending you investment among many stocks or bonds limits the loss if one individual stock or bond performs poorly.

Keeping track of mutual funds • Dow Jones Industrial Average and the Standard and Poor’s (S&P) measure the stock prices over the long term.

Keeping track of mutual funds • Dow Jones Industrial Average and the Standard and Poor’s (S&P) measure the stock prices over the long term.

Achieving Your Financial Goals Section 4

Achieving Your Financial Goals Section 4

Impulse Buying • Acting on feelings or emotions without thinking about consequences. • Grocery store checkout lines! • Impulse buying can ruin an organized budget.

Impulse Buying • Acting on feelings or emotions without thinking about consequences. • Grocery store checkout lines! • Impulse buying can ruin an organized budget.

Danger Signals for Impulse buyers • You buy lots of things you don’t need or want. • Buying things makes you feel better • Always borrowing $ from friends. • Quickly lose interest in something you buy.

Danger Signals for Impulse buyers • You buy lots of things you don’t need or want. • Buying things makes you feel better • Always borrowing $ from friends. • Quickly lose interest in something you buy.

Tips for impulse buyers! • Budget out for impulse buys • Make lists when you go shopping. • Leave the store before making a big purchase. • Comparison shop

Tips for impulse buyers! • Budget out for impulse buys • Make lists when you go shopping. • Leave the store before making a big purchase. • Comparison shop

Long-Term financial goals • Working to save up for something in the future. • So do you buy stuff now and save up for your long term goal? Or do you spend more on the things you want now and eliminate the chances of obtaining your long term goal?

Long-Term financial goals • Working to save up for something in the future. • So do you buy stuff now and save up for your long term goal? Or do you spend more on the things you want now and eliminate the chances of obtaining your long term goal?