58d5661860e6ca5f3b2df69a4ee0f75f.ppt

- Количество слайдов: 10

Peritus HYLD ETF-BUY

HYLD ETF • HYLD is actively managed value oriented high yield ETF-avoids LBO originated debt • Employs risk management strategy • Less focus on credit ratings-either AAA or D • Disciplined investment process-does business provide a service, generate free cash flow, etc. • Managed by Tim Gramatovich CFA and Ron Heller

HYLD attributes • Income-buys on secondary market at discount to par providing potential capital appreciation • Coupon-investing in non-investment grade has higher coupon cash flow yield • Issuers-more focused and concentrated than industry norm • Duration/Maturity Profile-low duration (3. 2 years vs. 4. 07 index)

FUND BASICS • HYLD • NYSE Arca • Inception Date 11/30/2010 • CUSIP 00768 Y 503 • Current price $51. 25 • AUM $210, 072, 166. 70 • Premium/Discount. 02 • Net Expense Ratio 1. 35%

• YTD ETF price

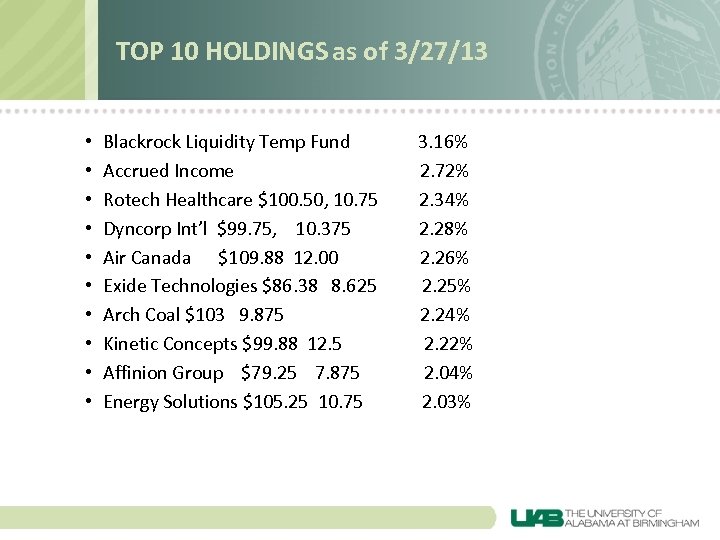

TOP 10 HOLDINGS as of 3/27/13 • • • Blackrock Liquidity Temp Fund Accrued Income Rotech Healthcare $100. 50, 10. 75 Dyncorp Int’l $99. 75, 10. 375 Air Canada $109. 88 12. 00 Exide Technologies $86. 38 8. 625 Arch Coal $103 9. 875 Kinetic Concepts $99. 88 12. 5 Affinion Group $79. 25 7. 875 Energy Solutions $105. 25 10. 75 3. 16% 2. 72% 2. 34% 2. 28% 2. 26% 2. 25% 2. 24% 2. 22% 2. 04% 2. 03%

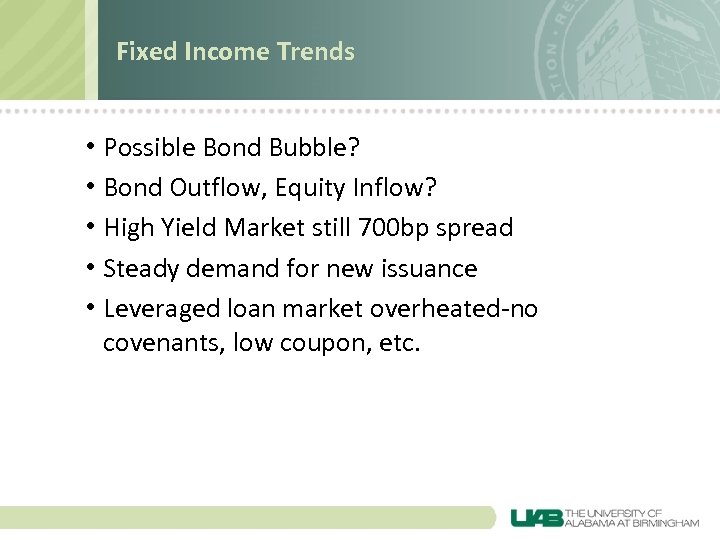

Fixed Income Trends • Possible Bond Bubble? • Bond Outflow, Equity Inflow? • High Yield Market still 700 bp spread • Steady demand for new issuance • Leveraged loan market overheated-no covenants, low coupon, etc.

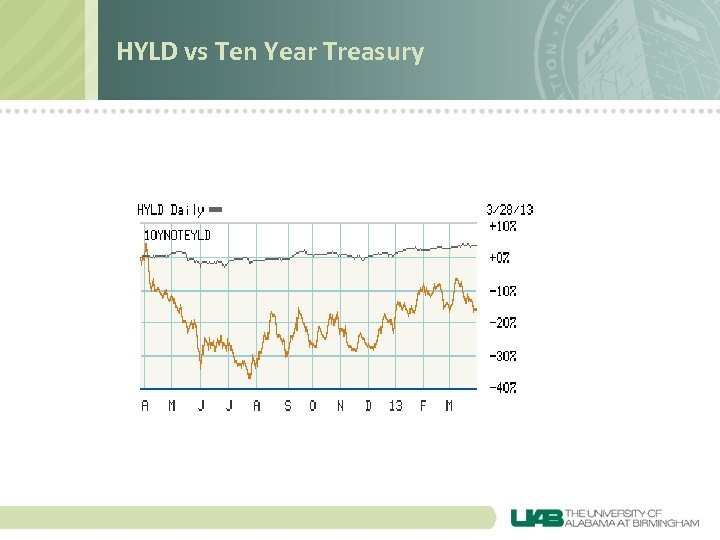

HYLD vs Ten Year Treasury

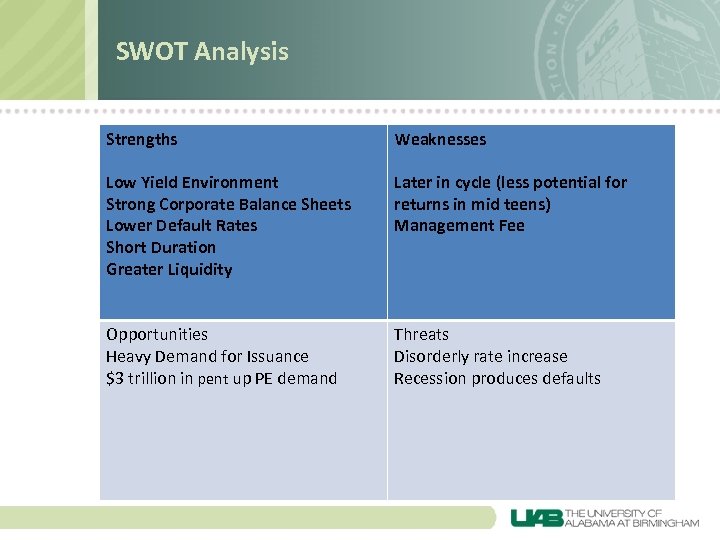

SWOT Analysis Strengths Weaknesses Low Yield Environment Strong Corporate Balance Sheets Lower Default Rates Short Duration Greater Liquidity Later in cycle (less potential for returns in mid teens) Management Fee Opportunities Heavy Demand for Issuance $3 trillion in pent up PE demand Threats Disorderly rate increase Recession produces defaults

Investment Thesis • Current low yield environment demands allocation to high yield debt. Active/value style unlocks value in the $1. 4 trillion high yield market. • Buy 200 shares at market price.

58d5661860e6ca5f3b2df69a4ee0f75f.ppt