Performance Highlights: Q 3 FY 01 25 th January, 2001

Performance Highlights: Q 3 FY 01 25 th January, 2001

Snapshot é é é PAT up 53% Yo. Y Net interest income up 148% Spread increases to 2. 75% Cost of deposit < 8% 1 mn new customer accounts added (from 0. 65 m to 1. 68 mn) é Retail deposits increase to 57% of total deposits (31%) é NRI accounts doubled to 46, 000 é ATMs cross 400 mark (175) Figures in brackets are as of 31 st March 2000

Snapshot é é é PAT up 53% Yo. Y Net interest income up 148% Spread increases to 2. 75% Cost of deposit < 8% 1 mn new customer accounts added (from 0. 65 m to 1. 68 mn) é Retail deposits increase to 57% of total deposits (31%) é NRI accounts doubled to 46, 000 é ATMs cross 400 mark (175) Figures in brackets are as of 31 st March 2000

Snapshot é é Infinity accounts reach 4, 000 (1, 10, 000) PPA relationships increase to 3000 (950) No. of credit cards reach 130, 000 (10, 656) Products launched: debit card, smart card and ATM VISA acquisition é Corporate banking relationships reach 1116 (852) é 90% of incremental exposure to clients rated A and above é B 2 B initiatives extended to 241 companies Figures in brackets are as of 31 st March 2000

Snapshot é é Infinity accounts reach 4, 000 (1, 10, 000) PPA relationships increase to 3000 (950) No. of credit cards reach 130, 000 (10, 656) Products launched: debit card, smart card and ATM VISA acquisition é Corporate banking relationships reach 1116 (852) é 90% of incremental exposure to clients rated A and above é B 2 B initiatives extended to 241 companies Figures in brackets are as of 31 st March 2000

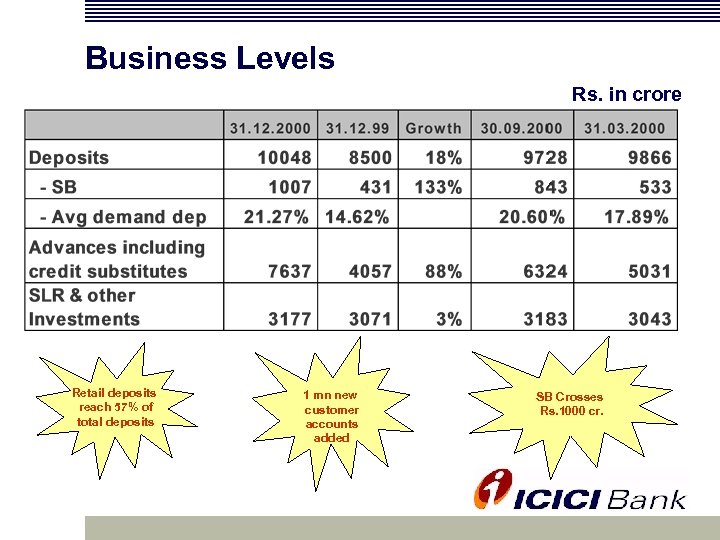

Business Levels Rs. in crore Retail deposits reach 57% of total deposits 1 mn new customer accounts added SB Crosses Rs. 1000 cr.

Business Levels Rs. in crore Retail deposits reach 57% of total deposits 1 mn new customer accounts added SB Crosses Rs. 1000 cr.

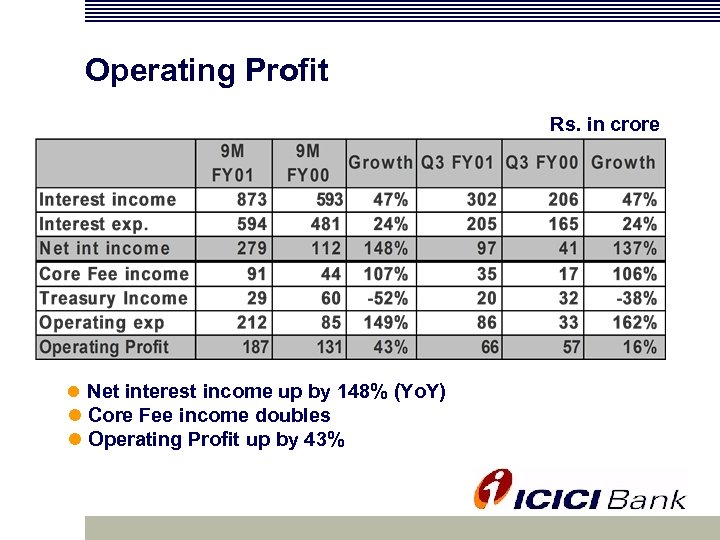

Operating Profit Rs. in crore l Net interest income up by 148% (Yo. Y) l Core Fee income doubles l Operating Profit up by 43%

Operating Profit Rs. in crore l Net interest income up by 148% (Yo. Y) l Core Fee income doubles l Operating Profit up by 43%

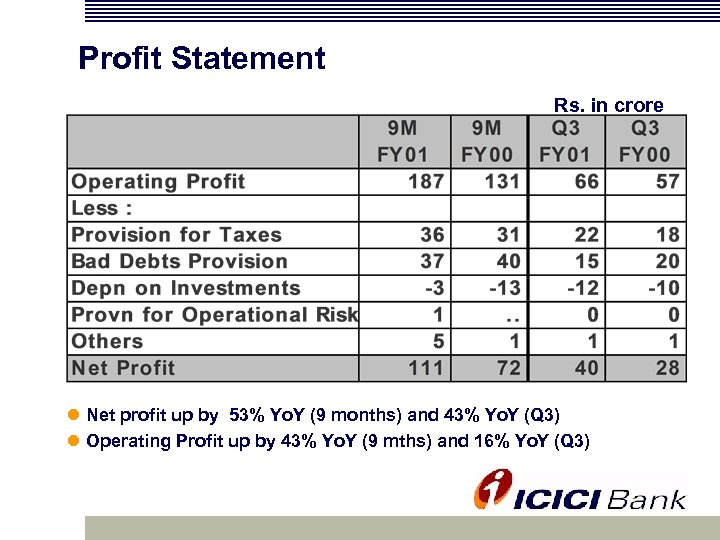

Profit Statement Rs. in crore l Net profit up by 53% Yo. Y (9 months) and 43% Yo. Y (Q 3) l Operating Profit up by 43% Yo. Y (9 mths) and 16% Yo. Y (Q 3)

Profit Statement Rs. in crore l Net profit up by 53% Yo. Y (9 months) and 43% Yo. Y (Q 3) l Operating Profit up by 43% Yo. Y (9 mths) and 16% Yo. Y (Q 3)

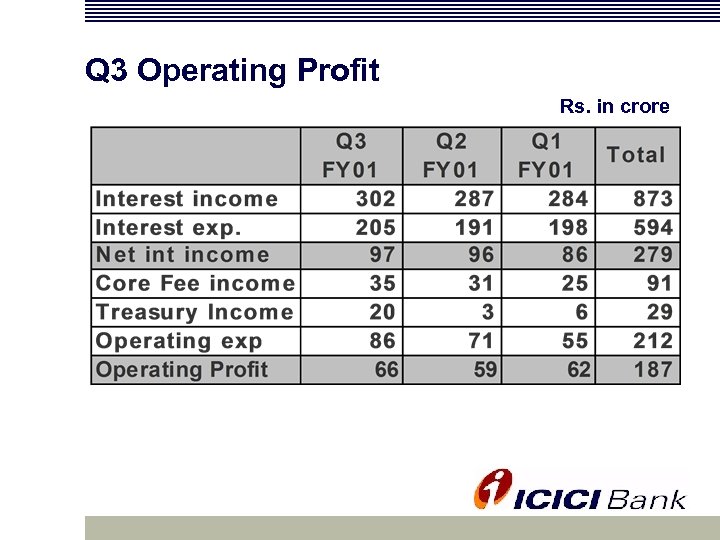

Q 3 Operating Profit Rs. in crore

Q 3 Operating Profit Rs. in crore

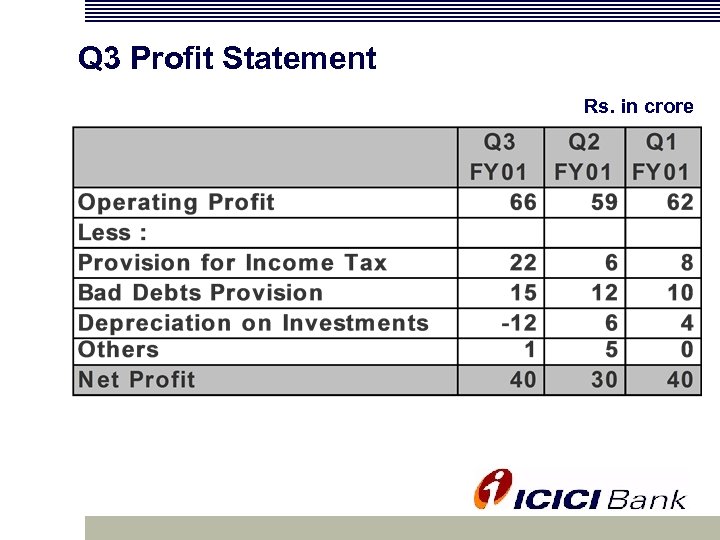

Q 3 Profit Statement Rs. in crore

Q 3 Profit Statement Rs. in crore

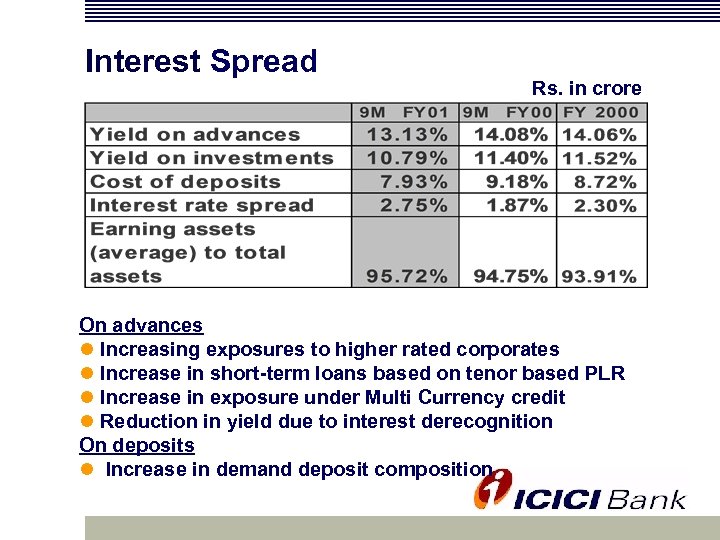

Interest Spread Rs. in crore On advances l Increasing exposures to higher rated corporates l Increase in short-term loans based on tenor based PLR l Increase in exposure under Multi Currency credit l Reduction in yield due to interest derecognition On deposits l Increase in demand deposit composition

Interest Spread Rs. in crore On advances l Increasing exposures to higher rated corporates l Increase in short-term loans based on tenor based PLR l Increase in exposure under Multi Currency credit l Reduction in yield due to interest derecognition On deposits l Increase in demand deposit composition

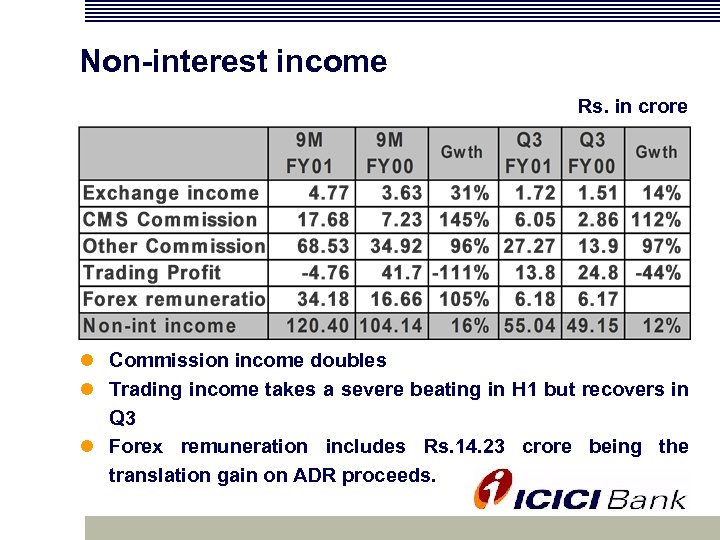

Non-interest income Rs. in crore l Commission income doubles l Trading income takes a severe beating in H 1 but recovers in Q 3 l Forex remuneration includes Rs. 14. 23 crore being the translation gain on ADR proceeds.

Non-interest income Rs. in crore l Commission income doubles l Trading income takes a severe beating in H 1 but recovers in Q 3 l Forex remuneration includes Rs. 14. 23 crore being the translation gain on ADR proceeds.

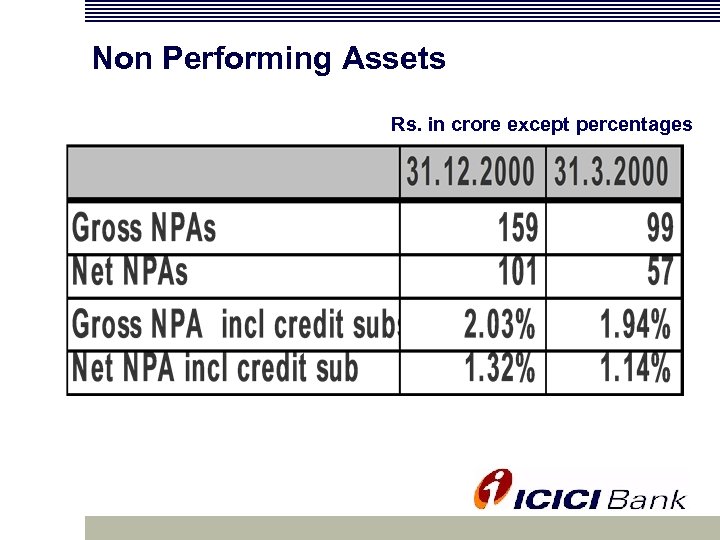

Non Performing Assets Rs. in crore except percentages

Non Performing Assets Rs. in crore except percentages

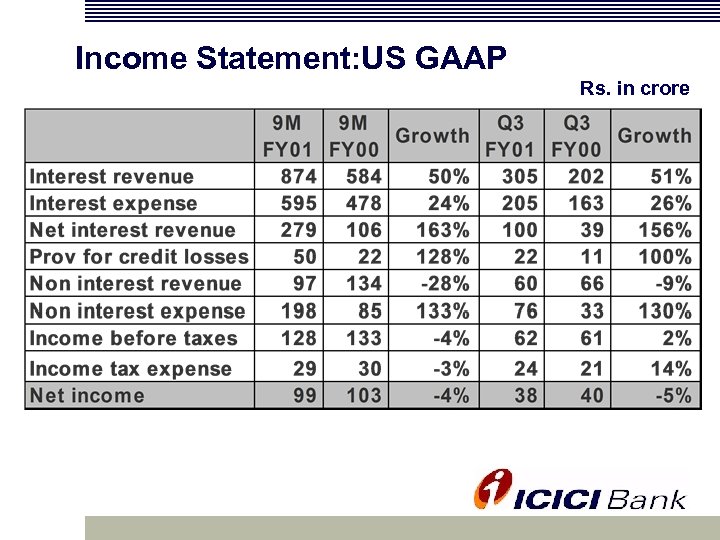

Income Statement: US GAAP Rs. in crore

Income Statement: US GAAP Rs. in crore

Thank You

Thank You