3ab158c17702094164d2931934b21404.ppt

- Количество слайдов: 65

Performance Based Contracting in the Consumer Driven Environment Presented to The National Consumer Driven Health. Care Summit September 2006

Agenda • The Big Picture • Why Medicare began Pay for Performance • Defining Performance Based Contracting • Trends driving new Performance driven organizations. • What employers are looking for • What employers are doing • New insights for physicians and hospitals. • Getting started

The Big Picture • Alan Greenspan thinks major investors who understand Global population changes will rethink their long term bond bets • “Once foreign creditors digest the extent of the population shift that is turning Medicare and Social Security into fiscal time bombs-and its negative implications for the broader US economy- they will demand higher returns for their money and be far less willing to accept the current low rates of 20 and 30 year US treasuries”. • “The cost of public pensions and health benefits is on track to double to 24% of the Gross Domestic Product by 2040. ”

Health benefits Ail as Pensions Heal • “While traditional pension plans often are contractual obligations at companies that have them, health benefits are not. Thus most companies are trimming their post retirement health care spending” • “Under funded pensions at US Auto makers have gotten a lot of ink but their health plans are in worse shape”. • “Of the 110 Billion total pension and healthcare under funding at the start of this year at GM and Ford more than 97 Billion of that amount was accounted for by retiree health care costs” according to Standard and Poor's. • Source WSJ June 6 th 2006 Tracking Numbers by Ian Mc. Donald

Eliminate Tax deductions for Health Insurance purchased by employers President Bush's federal tax advisory commission said it would recommend limits to tax deductions for employerprovided health insurance. Employers can deduct health benefits expenditures, and workers ordinarily are not taxed on the benefit. Panel spokesperson Tera Bradshaw said "the current structure creates incentives that lead to inefficiencies in the market for health care. " She added that the panel also is considering changes to the tax rules to help people purchase health insurance when their employers do not offer plans. • Used with permission from the Oct. 17, 2005, issue of MANAGED CARE WEEK.

Tax reform may not be easy • "Exactly how would one withdraw the tax preference? At the extreme, employers might be mandated to add what they now spend on health insurance premiums to the employee's taxable income on the W-2 form. But how much? • Would it be an amount averaged over all employees — young and old, healthy and sick? Young workers might deeply resent having to pay taxes for something that really benefits not them but their older and sicker colleagues. • We could, of course, risk-adjust the amount — say, add only $2, 000 to the taxable income of a young worker and $12, 000 or more to the income of an older sicker worker. • Can you imagine the litigation this would trigger? " Ewe Reinhardt James Madison Professor of Political Economy Princeton University

Preferred One to cost shift to sick • A company would sign up for the plan, then in most cases notify its workers, giving them some time and informational resources to help them shape up their health habits. • Then an independent laboratory would send nurses to the company to evaluate workers' health, placing them in appropriate deductible plans (which cover their health care expenses after the annual deductible is paid). • The plan measures five lifestyle factors: blood pressure, body-mass index, tobacco use, and cholesterol and glucose levels. • Healthy employees win lower deductibles to reward them for consistent exercise or for not smoking, for instance. In some cases, an employee's deductible could be nothing. • Employees who make unhealthy lifestyle choices (which usually account for a majority of employers' health care costs) would get higher deductibles, possibly as high as $2, 500. • All employees would be evaluated regularly, so workers faced with high deductibles could move to a cheaper plan once they improve their health, such as giving up smoking. • Workers with chronic illnesses would not be penalized

Future Medicare Spending • Medicare Parts A, B, and D (beginning in 2006) are financed differently. Payroll taxes paid by workers and employers finance the majority of Part A (the Hospital Insurance (HI) Trust Fund). The Part B Supplementary Medical Insurance (SMI) Trust Fund is financed by a combination of beneficiary premiums (24 percent) and general tax revenues (most of the remainder). • General revenue makes up roughly three-quarters of revenues for Part B and (beginning in 2006) Part D. In total, Medicare revenue in FY 2006 will come mostly from general revenue (41 percent), payroll taxes (40 percent), and beneficiary premiums (11 percent). According to the Medicare Boards of Trustees’ 2005 intermediate assumptions, total Part A spending is expected to exceed income in 2012, and the HI Trust Fund reserves are projected to be exhausted in 2020. Spending for Part B services, however, are now rising faster than spending for Part A services. • The aging of the Baby Boom generation, a reduction in the ratio of workers to beneficiaries, and other demographic and economic factors will likely play a role in the debate over additional changes in Medicare’s financing in the coming years. With the aging of the population and expected increases in overall health care costs, Medicare spending is projected to grow at a rate significantly higher than that of the overall economy. • Between 2000 and 2030, Medicare’s share of the gross domestic product (GDP) is estimated to triple from 2. 3 percent to 6. 8 percent. The addition of the prescription drug benefit in 2006 accounts for about one-third of the increase.

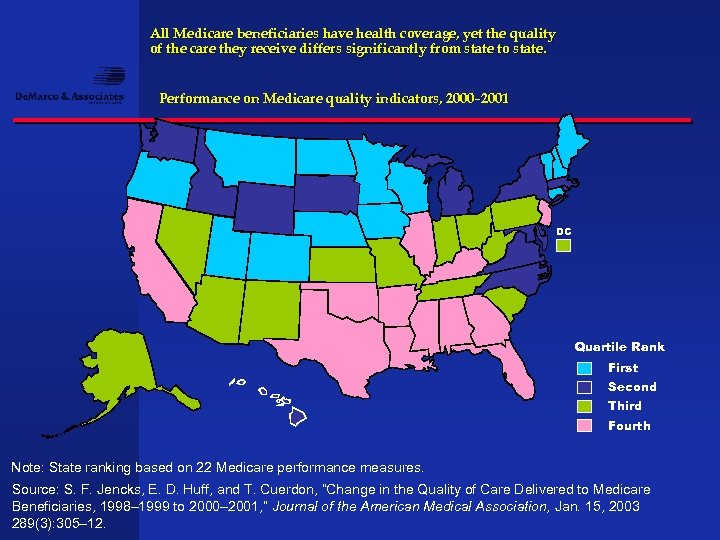

All Medicare beneficiaries have health coverage, yet the quality of the care they receive differs significantly from state to state. Performance on Medicare quality indicators, 2000– 2001 DC Quartile Rank First Second Third Fourth Note: State ranking based on 22 Medicare performance measures. Source: S. F. Jencks, E. D. Huff, and T. Cuerdon, “Change in the Quality of Care Delivered to Medicare Beneficiaries, 1998– 1999 to 2000– 2001, ” Journal of the American Medical Association, Jan. 15, 2003 289(3): 305– 12.

CMS expands quality reporting for hospitals • Hospital Compare, a quality Web site run by the CMS in collaboration with the Hospital Quality Alliance, will expand significantly between 2007 and 2009, incorporating mortality rates for the conditions it currently tracks, quality measures for additional categories of care and data on patients' experience at hospitals, the quality alliance said. • The new categories will be intensive care, pediatric asthma and surgery. • Data on patients' experience, from the Health Care Acquisition Performance System survey, will cover caregiver performance, hospital cleanliness and noise levels. The goal is to get half the measures implemented by early 2007.

Consumer Driven driving Pay for Performance but what about Providers? • Is it working in your area? Survey employers and see who is offering CDHP and P 4 P. • Cost sharing deductible in your contracts replaces old language in your managed care agreement. • Remove all barriers to balance billing or you cannot bill under current MC. • Re-pricing complicated and creates suspicion, who gets bill first? • No decision support tools, patients making up prices from hearsay. • Physicians are delaying billing to stick it to the hospital. • CDHP will change case mix of patients so can no longer cross subsidize

Pay for Performance Driving Technology • A pay-for-performance program in upstate New York hopes to tap into bonuses offered by Bridges to Excellence as well. That, however, would be icing on the cake for participating doctors who came together to get a health information technology network up and running in order, in part, to garner P 4 P bonuses from individual health plans. • "Many health plans are prepared to pay for performance, " John Blair, CEO of Taconic Health Information Network and Community, tells the New York Times. "The rub is that you have to have the technology in place to garner those incentives. You need to automate the reporting capability. " • Taconic is a collaboration of 500 physicians who don't want the technological revolution to pass them by. The program, launched with $100, 000 in seed money from the not-forprofit e. Health Initiative, is being watched by federal officials with an eye for making President Bush's goal of having all Americans' medical histories put on electronic medical records. • Taconic physicians pay a monthly subscription fee of $500 to $600. It's well worth it, says Eugene P. Heslin, MD. "The large groups can afford the software, " Heslin tells the Times. "For the onesies and twosies, small groups like ours. . " the cost is prohibitive. • As reported in MANAGED CARE October 2005. ©Media USA

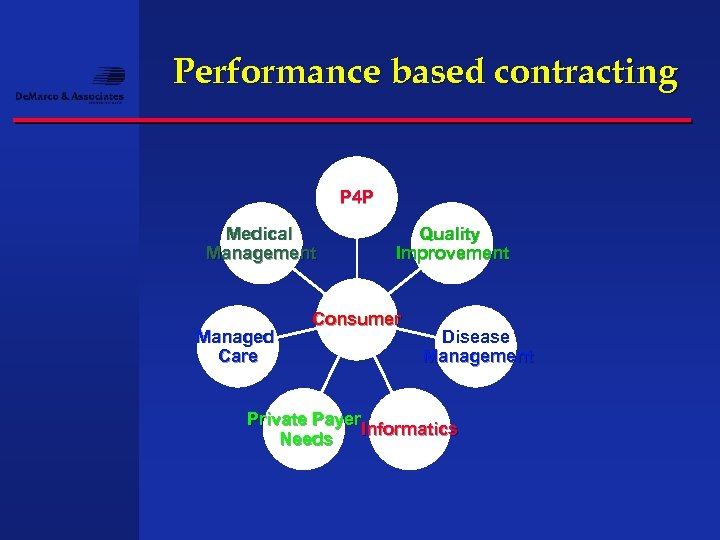

Performance based contracting P 4 P Medical Management Managed Care Quality Improvement Consumer Disease Management Private Payer Informatics Needs

Performance based contracting (PBC) • Requires multiple disciplines within a health system work together • Integrates external with environmental changes • Creates an opportunity for growth in private pay markets to balance public pay reductions • Should be a core strategy to your organization not just a agenda item in a management meeting

Product is driving industry change • Life insurance offered health insurance to get in the door • Health insurance stand alones like BCBS and Lumenos are relatively new • But consolidation is now occurring as the underwriting to control MLR is getting tighter. • The NEW health insurance which include HSA and HRA and big deductible plans are being sold to the unprofitable market segments of self funded and replace ASO business to reduce expense and bolster margins. • The new health plan is more about quality management and market differentiation than it is about size and revenue. • By linking the ability to finance large deductibles at the consumer level with high performance networks at the provider level we see an entirely new industry platform being created.

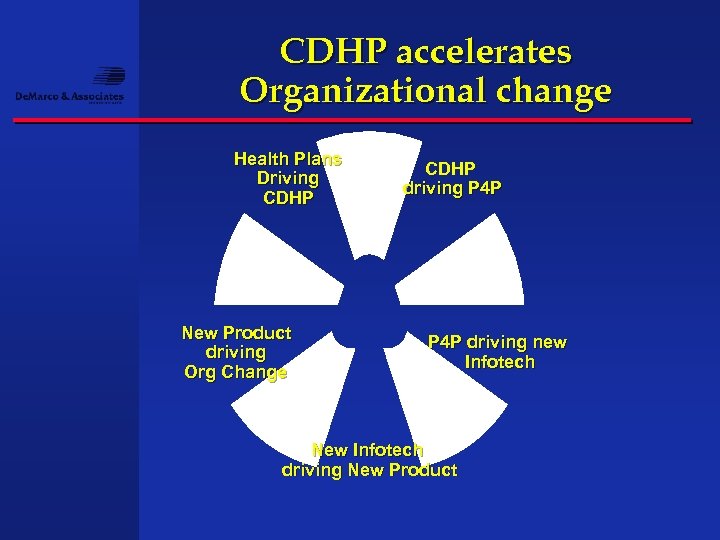

CDHP accelerates Organizational change Health Plans Driving CDHP New Product driving Org Change CDHP driving P 4 P driving new Infotech New Infotech driving New Product

Savannah Businesses to Benefit From More Competition in Health Insurance Market • SAVANNAH, Ga. , Aug. 3 /PRNewswire/ -- The Savannah Business Group (SBG) is teaming up with St. Joseph's/Candler Health System and Consumers Life Insurance Company to offer small businesses the opportunity to take advantage of high-quality, affordable health insurance. ADVERTISEMENT Consumer's Life will become SBG's endorsed plan for small businesses looking for affordable health insurance benefits. • "Under the new agreement that is effective September 1, 2006, small businesses in the six-county Greater Savannah area will have access to St. Joseph's/Candler Health System and The Care Network of physicians. • Outside the area, they will have access to 1 st Medical Network (1 st MN), the largest providersponsored PPO network in Georgia, representing 15, 000 physicians and 150 hospitals and academic medical centers and ancillary service providers. • "This partnership is going to benefit the Savannah business community, " said Michael Taddeo, vice president Network Management for Consumer's Life. "Competition is always good for the consumer. We are going to be very competitive in the marketplace as we try to help small businesses in Savannah obtain health insurance benefits for their employees. " • "This is another way in which we're working with employers in the Creative Coast to keep healthcare affordable and available, " said Paul P. Hinchey, president & CEO of St. Joseph's/Candler. "We realize that affordable healthcare is critical to both individuals and the economic development of our region. "

Hospital Sponsors new Healthplan to better differentiate itself in a crowded market • Seton Healthcare Network is going against the industry grain by wading deeper into the insurance business -- an area that hospital systems have been abandoning in droves. • The Austin, Texas-based system is teaming up with longtime partner Austin Regional Clinic to launch a new "narrow-network" health plan for selffunded employers. Called Healthy Equations, the HMO is designed to contain costs by limiting coverage to a select panel of providers, namely Seton's seven hospitals and the roughly 800 physicians affiliated with Austin Regional. Members who seek care outside the network will have to pay more out of pocket. • Seton's goal is to secure -- if not boost -- its patient volume in the increasingly competitive Austin metropolitan area, where it controls a 40% market share. • Reported in Modern Healthcare July 2006

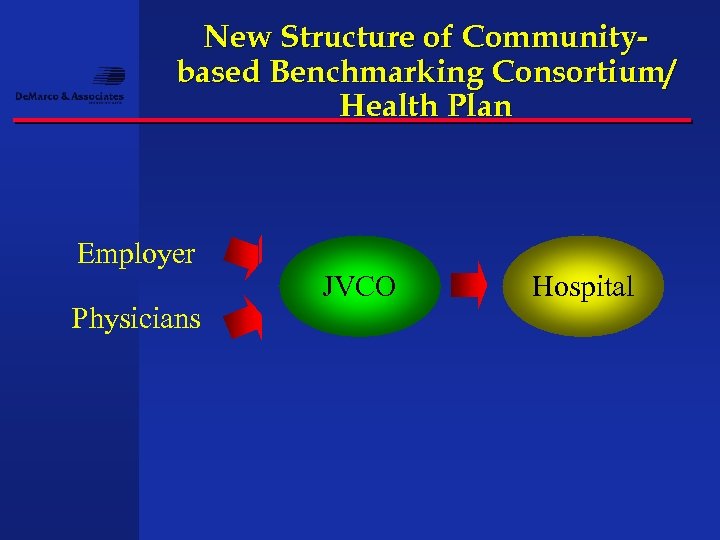

New Structure of Communitybased Benchmarking Consortium/ Health Plan Employer Physicians JVCO Hospital

Fallon Community Health Plan expands • Fallon Community health plan is a small NFP plan in Worchester Mass. • The plan recently announced it will expand into contiguous counties including Springfield Mass as well as other counties that will represent a service area of over 800, 000 residents. • Although they are going up against some large players like BCBS, Harvard/Pilgrim and Tufts, Fallon believes its favorable relationship with hospital and physicians, capabilities in terms of small town service and overall economies to scale as a provider owned plan gives it a good chance to move from 4 th in size to number 2.

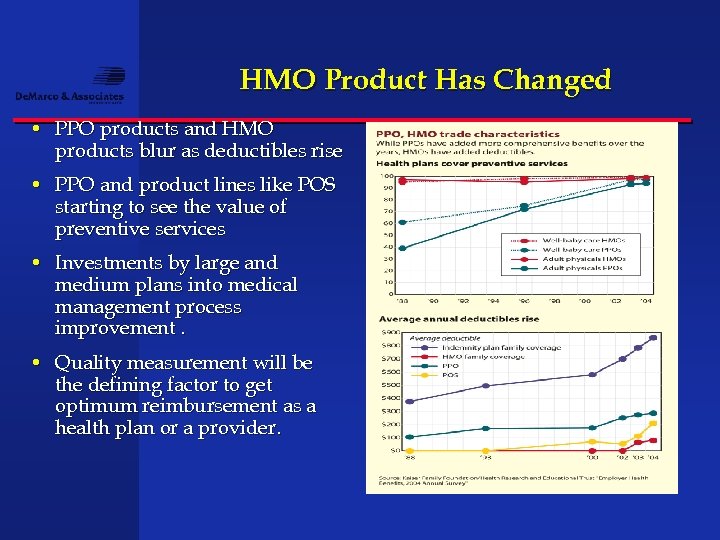

HMO Product Has Changed • PPO products and HMO products blur as deductibles rise • PPO and product lines like POS starting to see the value of preventive services • Investments by large and medium plans into medical management process improvement. • Quality measurement will be the defining factor to get optimum reimbursement as a health plan or a provider.

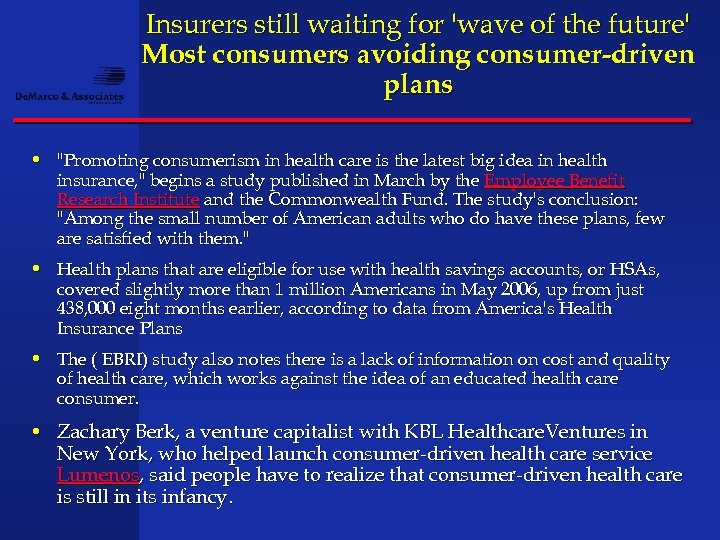

Insurers still waiting for 'wave of the future' Most consumers avoiding consumer-driven plans • "Promoting consumerism in health care is the latest big idea in health insurance, " begins a study published in March by the Employee Benefit Research Institute and the Commonwealth Fund. The study's conclusion: "Among the small number of American adults who do have these plans, few are satisfied with them. " • Health plans that are eligible for use with health savings accounts, or HSAs, covered slightly more than 1 million Americans in May 2006, up from just 438, 000 eight months earlier, according to data from America's Health Insurance Plans • The ( EBRI) study also notes there is a lack of information on cost and quality of health care, which works against the idea of an educated health care consumer. • Zachary Berk, a venture capitalist with KBL Healthcare. Ventures in New York, who helped launch consumer-driven health care service Lumenos, said people have to realize that consumer-driven health care is still in its infancy.

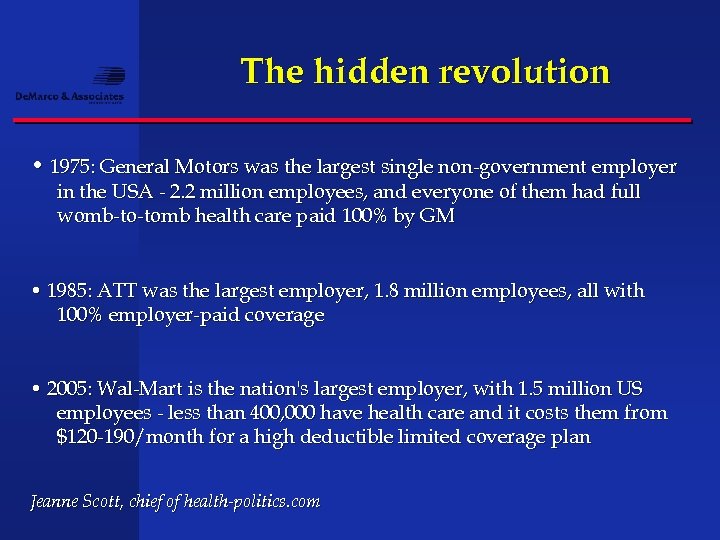

The hidden revolution • 1975: General Motors was the largest single non-government employer in the USA - 2. 2 million employees, and everyone of them had full womb-to-tomb health care paid 100% by GM • 1985: ATT was the largest employer, 1. 8 million employees, all with 100% employer-paid coverage • 2005: Wal-Mart is the nation's largest employer, with 1. 5 million US employees - less than 400, 000 have health care and it costs them from $120 -190/month for a high deductible limited coverage plan Jeanne Scott, chief of health-politics. com

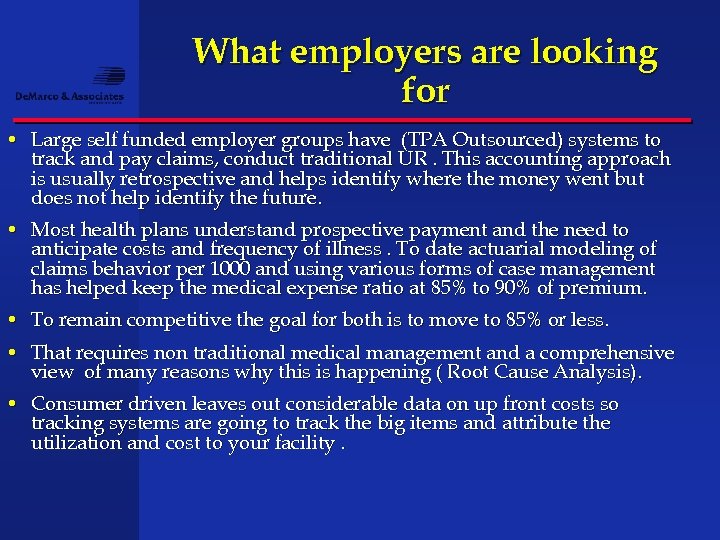

What employers are looking for • Large self funded employer groups have (TPA Outsourced) systems to track and pay claims, conduct traditional UR. This accounting approach is usually retrospective and helps identify where the money went but does not help identify the future. • Most health plans understand prospective payment and the need to anticipate costs and frequency of illness. To date actuarial modeling of claims behavior per 1000 and using various forms of case management has helped keep the medical expense ratio at 85% to 90% of premium. • To remain competitive the goal for both is to move to 85% or less. • That requires non traditional medical management and a comprehensive view of many reasons why this is happening ( Root Cause Analysis). • Consumer driven leaves out considerable data on up front costs so tracking systems are going to track the big items and attribute the utilization and cost to your facility.

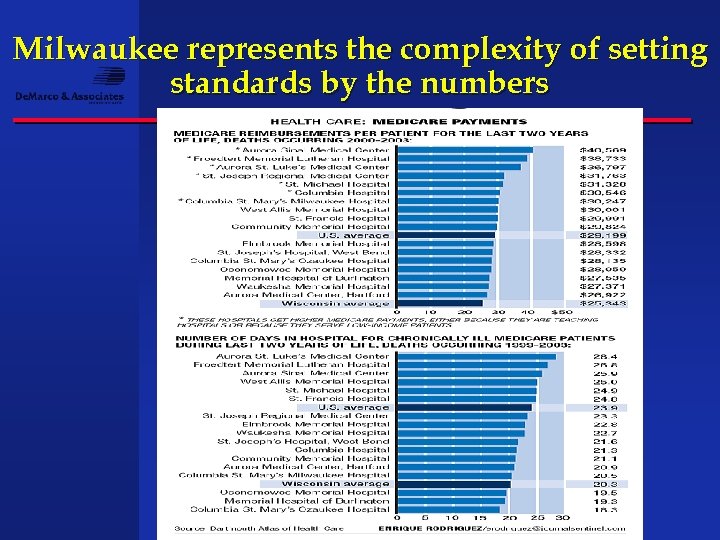

Milwaukee represents the complexity of setting standards by the numbers

Fed to move the bar on employer data use • Noting that he had 952 more days in office before the end of the Bush administration, ( CMS Secretary) Leavitt said he planned to urge corporate leaders to adopt health data sharing, data standards and pay -for-performance programs. • He will also promote the concept of transparency by encouraging companies to make price and quality information available to consumers and offer incentives for consumers to demand electronic health records Source Government health IT 6/19

Bush backs Payer Muscle to implement Infotech requirements • Executive Order signed August 22 nd 2006 requires all entities that contract with the federal employees health benefits plans, Tricare, Veterans health services, Managed Care Advantage plans that contract for Medicare beneficiaries to now report pricing, quality indicators, meet current and future interoperability requirements effective January 1 2007. • Leavitt strongly suggesting to all state governments and fortune 500 that performance measurement has working to improve nursing home quality and outcome so all employers should require this same language in there contracts with managed care payers. • If you ran a managed care company and wanted to make sure you met this requirement, what would you put in your contracts?

Beyond trends, from buying benefits to managing benchmarks • As employers move away from the defined benefit approach to buying insurance ( one benefit) to a defined contribution approach (one cost) and attempt to give employees choice of new plans, cafeteria selection and include Medical savings accounts the quest of managing benefits comes to the forefront. • Many of the techniques used by health plans in terms of medical management are now part of what employers are curious about. They see charges and utilization that points out problems of inconsistency and also see the government taking a role in standardizing quality measures for Medicare Contracting health plans. • These measure or benchmarks are key to stabilizing/projecting risk and cost.

To manage and predict benchmarks requires a return to a focus on the patient physician relationship • Discounting physician care after the fact only makes physicians angry at the insurer /employer and the patient. • In many cases we are seeing the downward pressure on physician reimbursement actually shrinking the availability of PCP s risking up to date hospital care in smaller communities. • Patients who get caught short by non covered benefits and angry docs usually do not follow treatment that’s recommended so patients sometimes only receive a small fraction of the VALUE of care employers purchase. • The Solution is to create a plan that changes behavior of the physician and patient through new incentives to re-create value. • The goal will be to swing back the Pendulum in favor of comprehensive care at affordable and predictable costs.

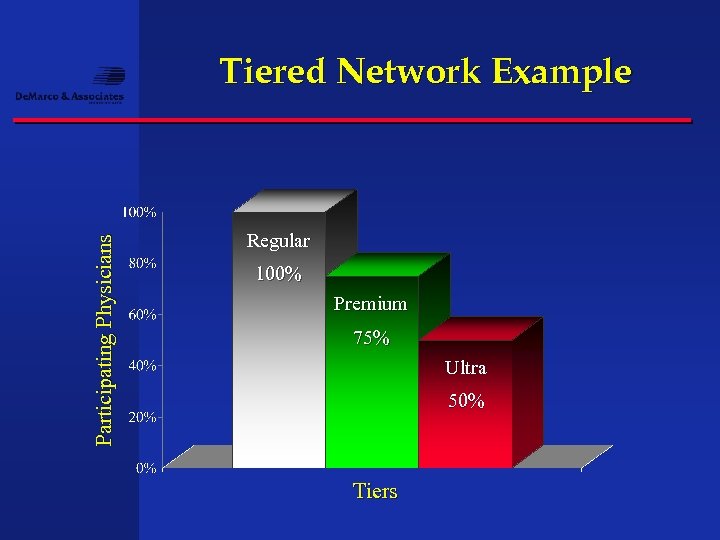

What employers are doing with this data Tiering hospital and physician services just like they did pharmacy services

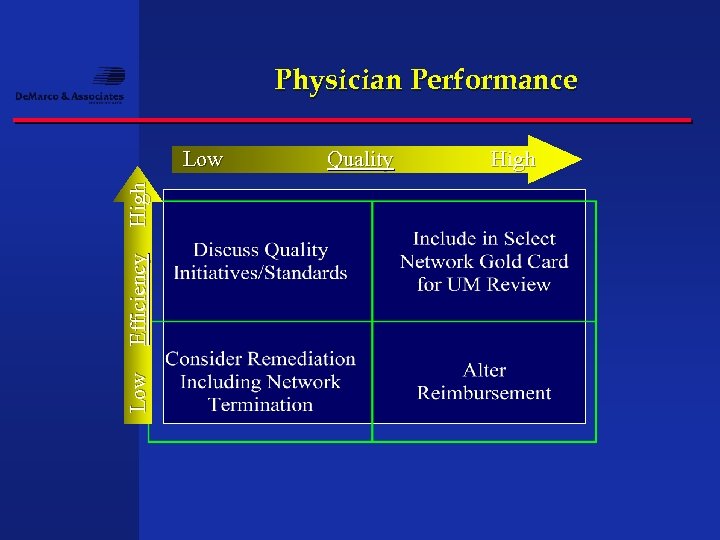

Physician Performance Low Efficiency High Low Quality High

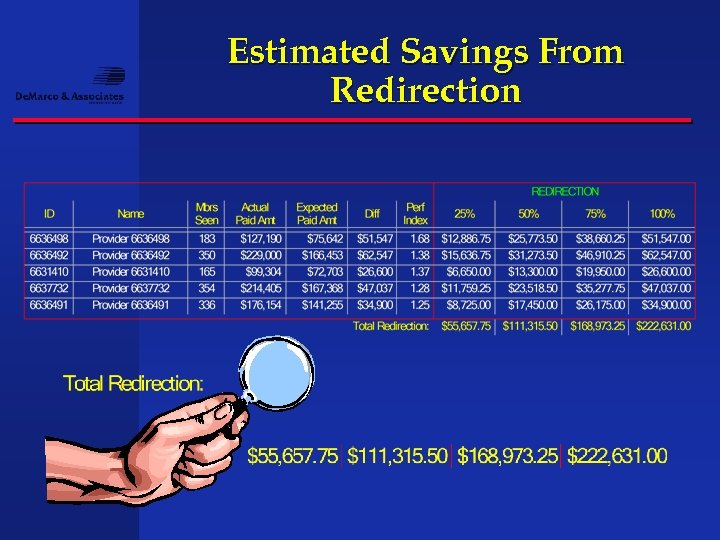

Estimated Savings From Redirection

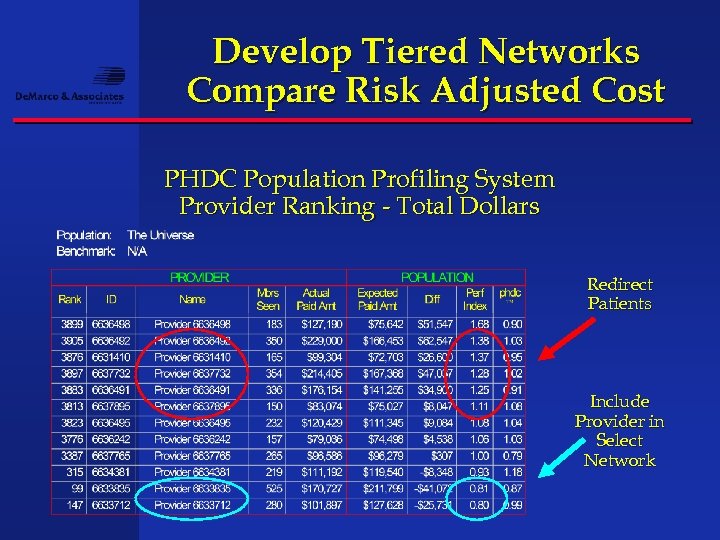

Develop Tiered Networks Compare Risk Adjusted Cost PHDC Population Profiling System Provider Ranking - Total Dollars Redirect Patients Include Provider in Select Network

Participating Physicians Tiered Network Example Regular 100% Premium 75% Ultra 50% Tiers

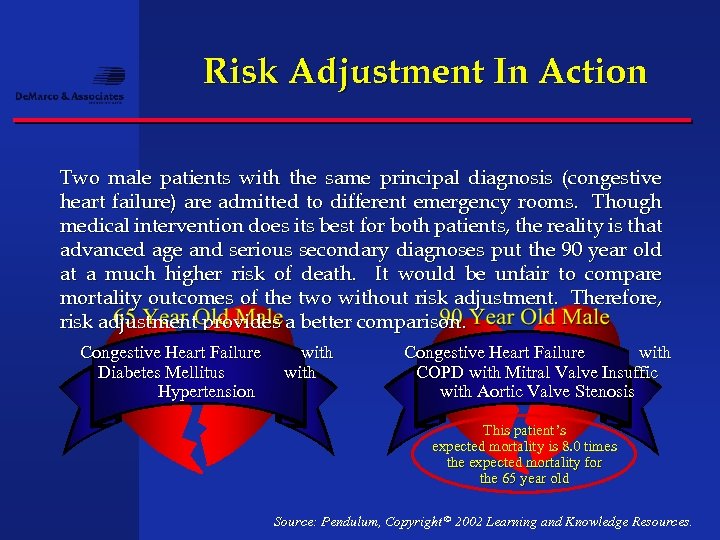

Risk Adjustment In Action Two male patients with the same principal diagnosis (congestive heart failure) are admitted to different emergency rooms. Though medical intervention does its best for both patients, the reality is that advanced age and serious secondary diagnoses put the 90 year old at a much higher risk of death. It would be unfair to compare mortality outcomes of the two without risk adjustment. Therefore, risk adjustment provides a better comparison. Congestive Heart Failure Diabetes Mellitus Hypertension with Congestive Heart Failure with COPD with Mitral Valve Insuffic with Aortic Valve Stenosis This patient’s expected mortality is 8. 0 times the expected mortality for the 65 year old Source: Pendulum, Copyright © 2002 Learning and Knowledge Resources.

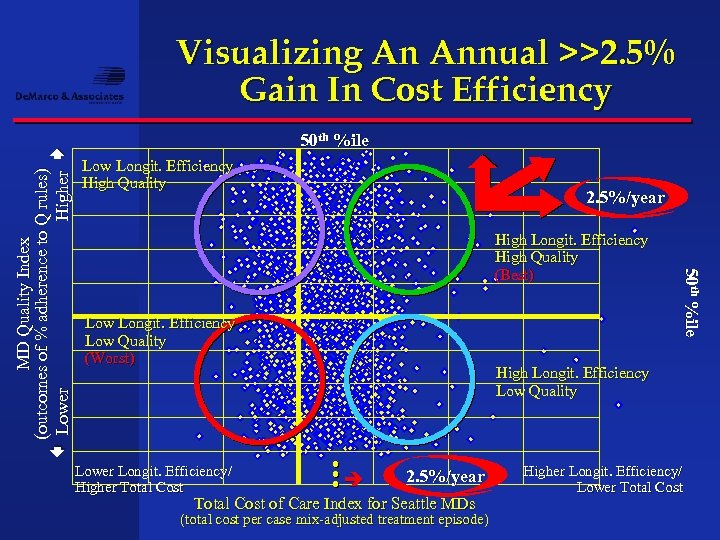

50 th %ile Low Longit. Efficiency High Quality 2. 5%/year High Longit. Efficiency High Quality (Best) Low Longit. Efficiency Low Quality (Worst) 50 th %ile 50 %ile MD Quality Index (outcomes of % adherence to Q rules) Lower Higher Visualizing An Annual >>2. 5% Gain In Cost Efficiency High Longit. Efficiency Low Quality Lower Longit. Efficiency/ Higher Total Cost 2. 5%/year Total Cost of Care Index for Seattle MDs (total cost per case mix-adjusted treatment episode) Higher Longit. Efficiency/ Lower Total Cost

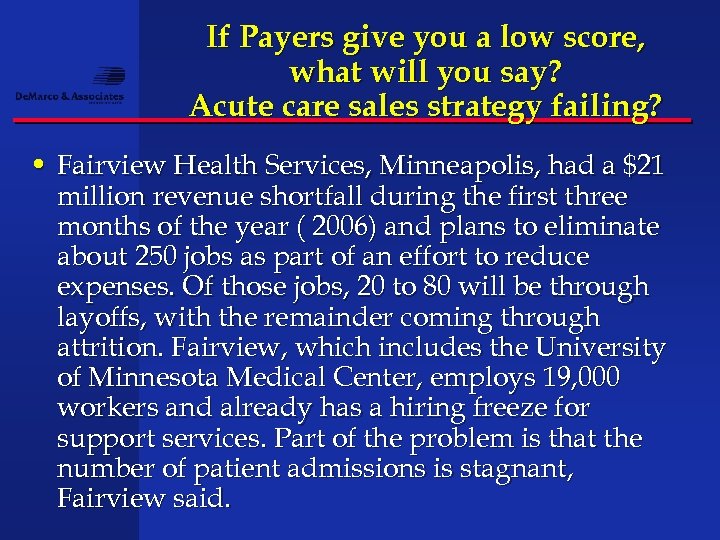

If Payers give you a low score, what will you say? Acute care sales strategy failing? • Fairview Health Services, Minneapolis, had a $21 million revenue shortfall during the first three months of the year ( 2006) and plans to eliminate about 250 jobs as part of an effort to reduce expenses. Of those jobs, 20 to 80 will be through layoffs, with the remainder coming through attrition. Fairview, which includes the University of Minnesota Medical Center, employs 19, 000 workers and already has a hiring freeze for support services. Part of the problem is that the number of patient admissions is stagnant, Fairview said.

New Insights for Physicians and Hospitals Once employers and managed care understand that they can differentiate providers on quality, product, technology and price the market, as we once knew it , shifts and providers will need to look at risk differently

The system does not behave the way employers or patients want it to behave • The system actually rewards providers who let patients get sicker. The more complex the patient the more the providers can charge. • When hospitals become more efficient and more effective they lower costs, save lives but also lower revenue projections. • Right now the more efficient and effective the hospital is , the more money the insurance company makes. • The only way to harvest these savings from improvements is to share risk in carefully constructed performance driven agreements.

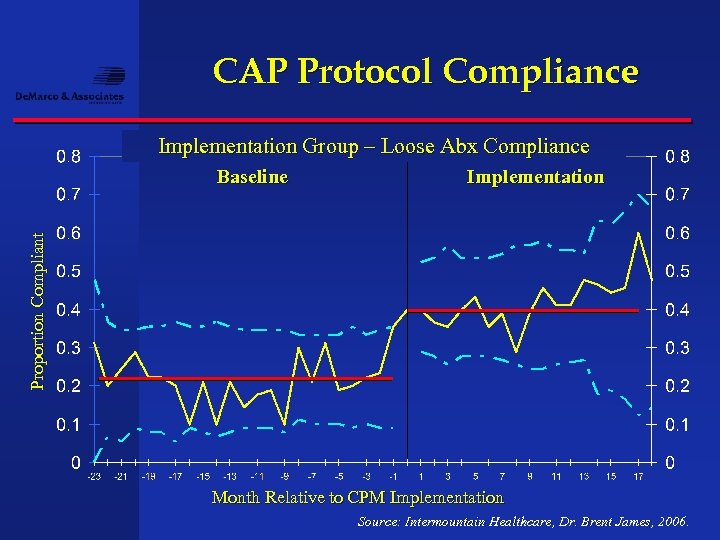

CAP Protocol Compliance Implementation Group – Loose Abx Compliance Implementation Proportion Compliant Baseline Month Relative to CPM Implementation Source: Intermountain Healthcare, Dr. Brent James, 2006.

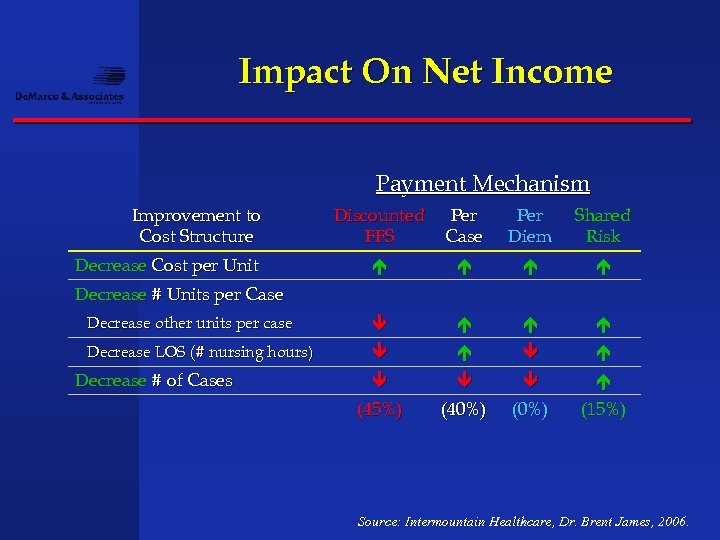

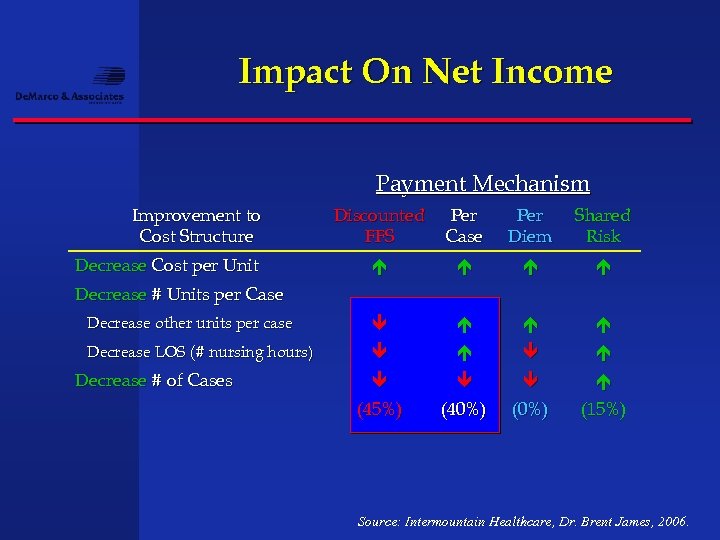

Impact On Net Income Payment Mechanism Improvement to Cost Structure Discounted FFS Per Case Per Diem Shared Risk Decrease other units per case Decrease LOS (# nursing hours) (45%) (40%) (15%) Decrease Cost per Unit Decrease # Units per Case Decrease # of Cases Source: Intermountain Healthcare, Dr. Brent James, 2006.

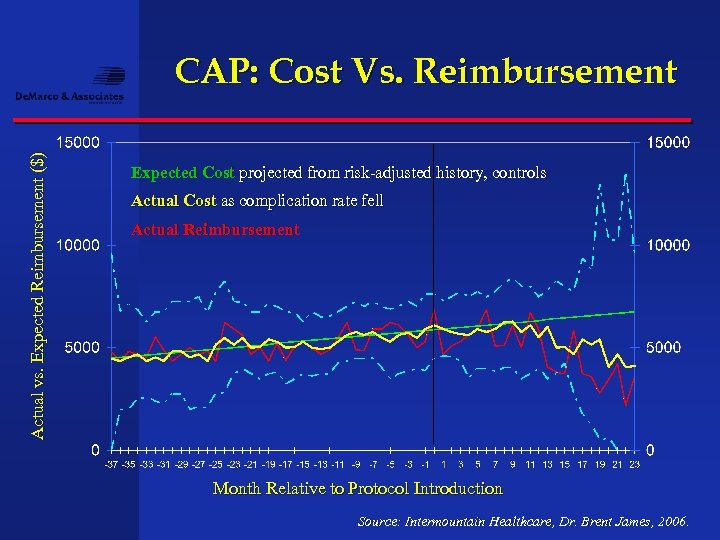

Actual vs. Expected Reimbursement ($) CAP: Cost Vs. Reimbursement Expected Cost projected from risk-adjusted history, controls Actual Cost as complication rate fell Actual Reimbursement Month Relative to Protocol Introduction Source: Intermountain Healthcare, Dr. Brent James, 2006.

Impact On Net Income Payment Mechanism Improvement to Cost Structure Discounted FFS Per Case Per Diem Shared Risk Decrease other units per case Decrease LOS (# nursing hours) (45%) (40%) (15%) Decrease Cost per Unit Decrease # Units per Case Decrease # of Cases Source: Intermountain Healthcare, Dr. Brent James, 2006.

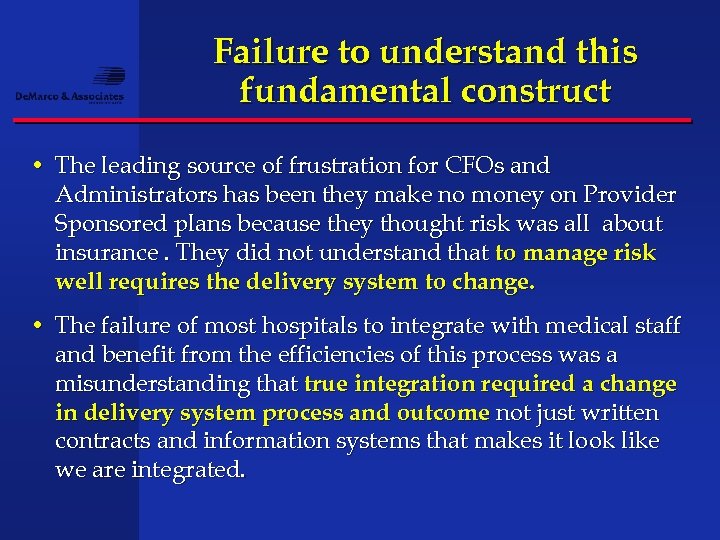

Failure to understand this fundamental construct • The leading source of frustration for CFOs and Administrators has been they make no money on Provider Sponsored plans because they thought risk was all about insurance. They did not understand that to manage risk well requires the delivery system to change. • The failure of most hospitals to integrate with medical staff and benefit from the efficiencies of this process was a misunderstanding that true integration required a change in delivery system process and outcome not just written contracts and information systems that makes it look like we are integrated.

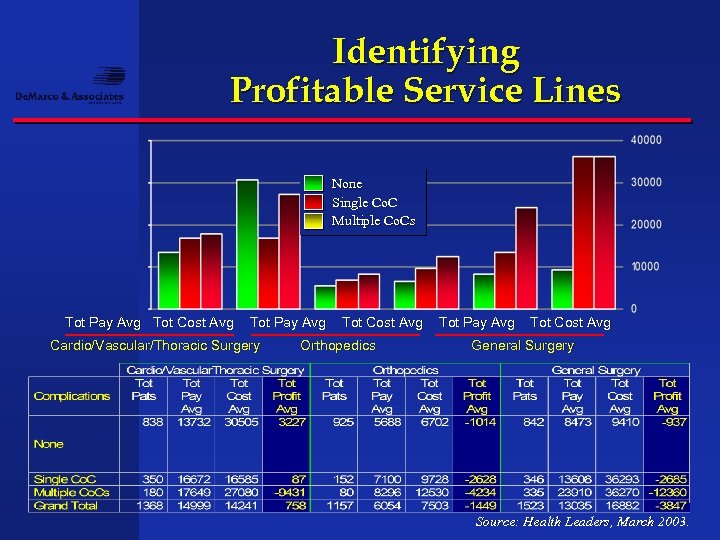

Identifying Profitable Service Lines None Single Co. C Multiple Co. Cs Tot Pay Avg Tot Cost Avg Tot Pay Avg Cardio/Vascular/Thoracic Surgery Tot Cost Avg Orthopedics Tot Pay Avg Tot Cost Avg General Surgery Source: Health Leaders, March 2003.

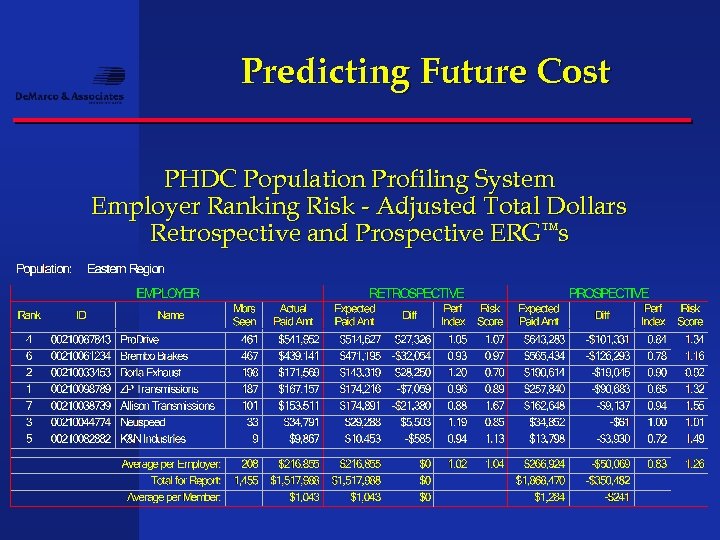

Predicting Future Cost PHDC Population Profiling System Employer Ranking Risk - Adjusted Total Dollars Retrospective and Prospective ERG™s

Wholesale to Retail Not unlike the drug companies who sold to patients and bypassed physicians to create demand for the product Insurers and bankers are doing the same thing going direct

Wholesale to retail • As consumer directed products drive new technology the consumer, not the insurer or employer is at risk for substantial out of pocket costs. • Consumers are using information more than ever before to look at disease states but also performance expectations. • Physicians and hospitals who get ahead of this curve and realize thy are in a retail environment will have an advantage. • Will your restaurant have an A or a D designation as they do in Los Angeles?

Health Care A Supermarket Service Pro. Health Physicians To Open Walk-In Clinics In Price Chopper Stores • Pro. Health Physicians, the state's largest group practice of primary-care doctors, plans to open walk-in clinics in Price Chopper supermarkets, starting next month, in the first venture of its kind in Connecticut. The clinics are designed to offer low-level, routine medical care to shoppers under the new brand name, Med. Access. Each visit would cost a flat fee of $45 for services, Pro. Health said. • "We're only doing this in stores where there is an existing pharmacy, " said Cheryl Lescarbeau, director of clinical operations for Pro. Health. Pharmacies, floral shops, banks and other services have become commonplace in supermarkets. Around the nation, some health clinics have opened, as well, as part of that trend. DAN HAAR, Courant Staff Writer July 19, 2006

Wholesale to Retail Patients Desire Improved Communication • Vendors are both frustrated with physician foot-dragging when it comes to upgrading technology, said Gary Bryant, editor of Health Industry News and a co-author of the study. "Maybe vendors should take a page from pharmaceutical firms and market benefits directly to consumers and let them educate The healthcare industry is lagging behind other industries in adopting communication technology that would benefit consumers, according to a report from Osterman Research and Health Industry News, Communications Issues in the Healthcare Industry, 2006 -2009. The report's findings indicate a major communication disconnect between patients and healthcare providers: • Among healthcare providers, e-mail is used heavily only in communications between physicians. Yet 82 percent of healthcare consumers indicated that they have never received an e-mail message from their primary healthcare provider. • Only 15 percent of survey respondents indicated that their healthcare providers give them the option of scheduling their own appointments by e-mail or through a Web site. • Nearly three-quarters of healthcare consumers would prefer to pay their medical bills through an online system, but only one in seven can currently do so. • Source: Osterman Research, August 8, 2006

Trouble to avoid • This is not a program or an isolated academic project. Do not turn this over to the revenue cycle management people alone as their goals are maximum billing not quality improvement. • This strategy has winners and losers are the ones who cannot produce reasonable evidence as to their quality and will loose market share and trust in the marketplace. • Employers and third parties including Medicare very concerned that as consumer driven exposes patients to large out of pocket risks that the care is done right the first time. Otherwise it comes out of the payers side of the bank not the consumers • Hospitals and physicians will spend more money trying to re establish themselves as a quality facility than they will taking a leadership role RIGHT NOW in positioning themselves for the future as the ally to the employer and consumer.

Measurement and perfection • Da. Vinci’s 'Vitruvian Man' proportion and ratios of human measurement revolutionized art and medicine. • A palm is the width of four fingers • A foot is the width of four palms • The length of the hand is one-tenth of a man's height • The length of a man's outspread arms is equal to his height • Imagine the perfectly executed DRG • Imagine the perfectly executed billing and recovery • What would it look like on a process chart? • What would it mean in terms of revenue improvement?

Corporate Health Department • Most health systems and physcians do not know how many patients come from which employer in their service area as insurers and TPAs control payment to providers. • Most health systems have someone selling Occupational Medicine, Wellness programs, Fitness programs, some on site screening programs etc. . Most departments cannot link volume of visits or admissions to this activity so budgets are sparse. • Combining these programs with a central core strategy of PBC offers a new dimension to partner directly with payers as they move their employees to the role of a consumer. • Employers, when asked which doctor does the best job for a particular illness , do not know the answer and will buy outside data services to get the answer. You know the answer and should charge for it.

Direct Contracting • Health system takes the lead to approach select employers with deidentified patient data to suggest problem areas where hospital and physcians can help lower cost and improve quality. • The employer has never seen all of their work comp, disability management, disease management, claims cost, network access fees, ancillary costs and productivity costs in one database. • Your strategy is looking for ways to improve productivity and holding yourself accountable to the employer and the consumer to reform the delivery system and share in the savings. • The more employers save money the more employers they will sell on the idea that your organization is a good partner

Benchmarking Consortium • Collaborative between large employers, hospitals, physicians. • Mission is to collect and share data for the purpose of improving quality and cost through understanding capabilities and limitations. • Everyone pays into the confederation to support it. • End user is the consumer and success is a combination of satisfaction, affordability and quality outcomes. • This can be a new revenue stream to pay for ongoing data initiatives • Any new health plan visits with the employer will need to use your “high performance panel” as long as you can continue to improve quality ( something the insurer cannot)

What these approaches have in common • Requires a better understanding of employers needs and makes PBC a vital payer strategy with an ROI • Requires a sincere effort to bring physcians into the future shift in the insurance and delivery system business • Builds confidence in the community as local Leadership is in charge of the process • Allows the health system or physician network to get prepared for Pay for Performance and leverage that knowledge into a new revenue stream by helping employers meet their employees needs.

Getting started Pay for Performance preparedness Inventory of current process improvement tasks Physician issues of quality measures ETGs, ERGs, AVGs, Information gaps in being able to collect and analyze (RCA) Performance Based Contracting ( PBC) feasibility Employers interest Health plan demands Internal assessment of management AND STAFF Understanding the difference between management and leadership.

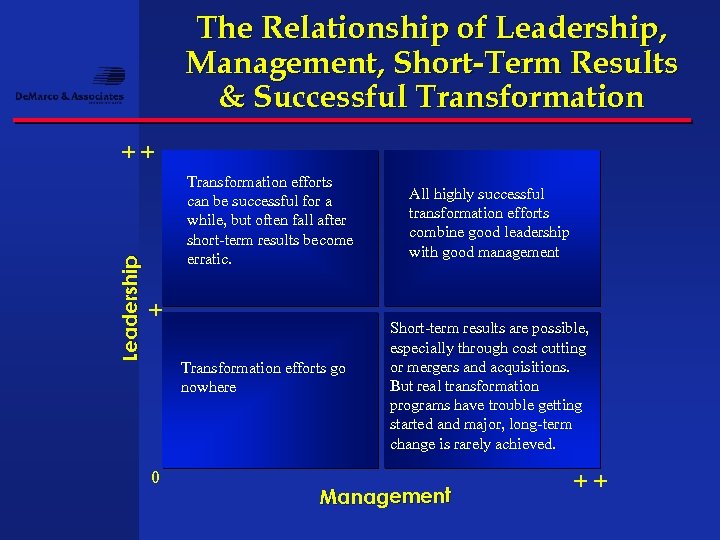

The Relationship of Leadership, Management, Short-Term Results & Successful Transformation Leadership ++ Transformation efforts can be successful for a while, but often fall after short-term results become erratic. + Transformation efforts go nowhere 0 All highly successful transformation efforts combine good leadership with good management Short-term results are possible, especially through cost cutting or mergers and acquisitions. But real transformation programs have trouble getting started and major, long-term change is rarely achieved. Management ++

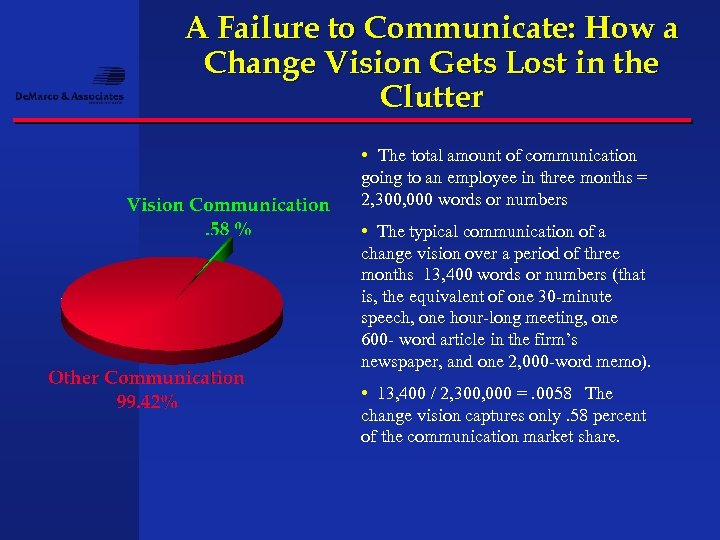

A Failure to Communicate: How a Change Vision Gets Lost in the Clutter • The total amount of communication going to an employee in three months = 2, 300, 000 words or numbers • The typical communication of a change vision over a period of three months 13, 400 words or numbers (that is, the equivalent of one 30 -minute speech, one hour-long meeting, one 600 - word article in the firm’s newspaper, and one 2, 000 -word memo). • 13, 400 / 2, 300, 000 =. 0058 The change vision captures only. 58 percent of the communication market share.

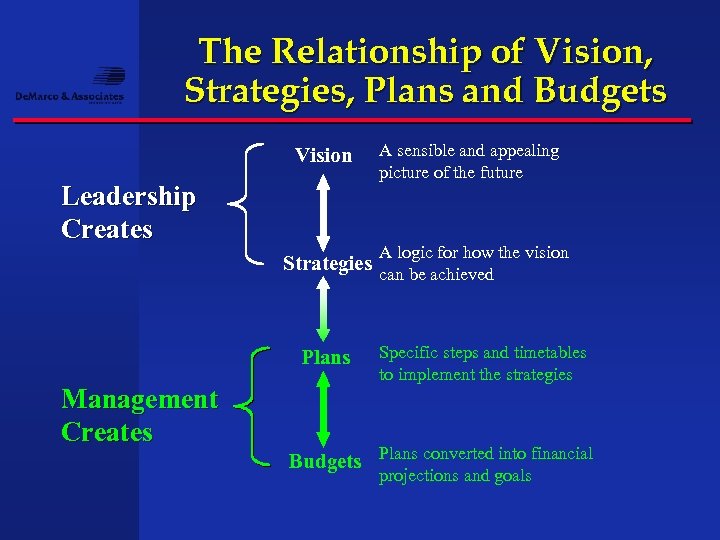

The Relationship of Vision, Strategies, Plans and Budgets Vision Leadership Creates A sensible and appealing picture of the future A logic for how the vision Strategies can be achieved Plans Management Creates Specific steps and timetables to implement the strategies Budgets Plans converted into financial projections and goals

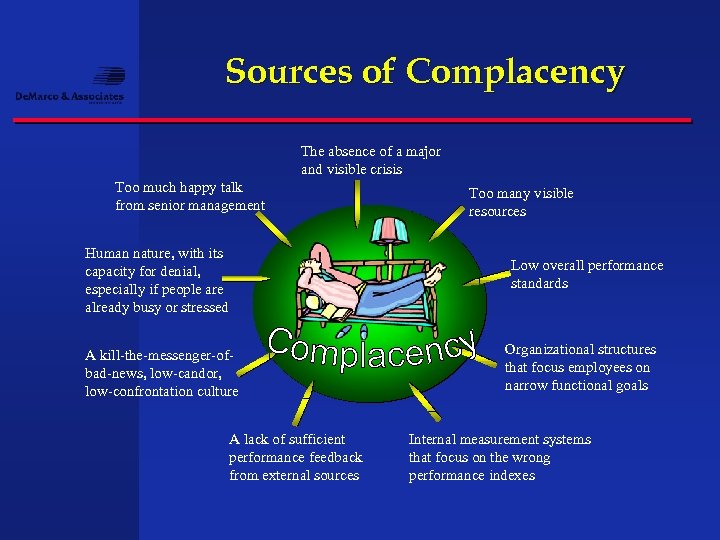

Sources of Complacency The absence of a major and visible crisis Too much happy talk from senior management Human nature, with its capacity for denial, especially if people are already busy or stressed Too many visible resources Low overall performance standards A kill-the-messenger-ofbad-news, low-candor, low-confrontation culture A lack of sufficient performance feedback from external sources Organizational structures that focus employees on narrow functional goals Internal measurement systems that focus on the wrong performance indexes

Summary • Large employers and regional health plans are in a hurry to manage benchmarks not just benefits. • Building benchmarks creates new interest in the minds of buyers to tier providers and design benefits to incent use of top providers. • The governments pay for performance demo projects and initial success with risk adjusters is a driving force that is not going away. • These changes create new opportunities for providers to collaborate and harvest savings through performance arrangements. • Technology is changing in favor of supporting these more sophisticated models of care improvement and reimbursement improvement.

Conclusion • Employers and Hospitals and Physicians have a new opportunity to not only take unnecessary costs out of the system but also improve the quality of necessary services while being paid a success fee to improve. • This is not a social engineering project but rather a business proposition that starts with making the case for quality from all stakeholder perspectives. • Do not let the complexity of informatics be the failure of your plan. Instead make data the common key to making sure you have a plan for the 80% of care that is routine. Focus on the 20% that is not routine and must be managed individually and employers and good health plans will make help you make this happen because they have a vested interest in delivery system reform. • We have just shown you a way to be paid well for being the leader of that reform as a provider in your community.

For more information Pendulum. Health. com

3ab158c17702094164d2931934b21404.ppt