a2f4af01b5fb188f38f1fe21e92b5c58.ppt

- Количество слайдов: 19

Performance Attribution • These characteristics of returns are well known. • Known “styles” of returns. – don’t give credit to a passive value manager for beating the S&P 500 – that’s too easy! • Evaluation now is relative to a “style” or benchmark portfolio – Growth -- Value – Small-Cap -- Large-Cap – Industry -- International – Momentum -- Emerging markets

Finding Alpha • Word of caution: finding historical alpha is easy! – Suppose you could sell historical alpha? – Measurement of alpha is difficult: the market is very volatile: S&P 500 = 20% per year, individual stocks 50% per year. – This has a significant effect on the reliability of estimates of alpha.

Finding Skill • High past returns: – Risk? – Return to active management: skill? – Luck? • Do returns persist? – Yes if manager always takes positions with known high returns: do a style correction. – Yes because of momentum in stock returns.

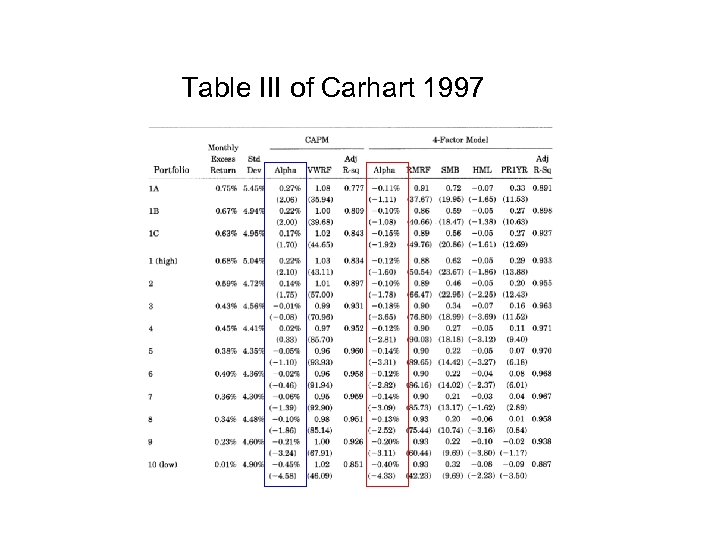

Example: Carhart (1997) • Realized returns from declared holdings or net asset value corrected for distributions • Regression of returns on – the market – small cap versus large cap factor (SMB) – value versus growth factor (HML) – momentum factor (PR 1 YR) • Similar to a style-based evaluation of performance.

Table III of Carhart 1997

Implications of these studies • Mutual funds tend to generate negative alpha when evaluated relative to sophisticated benchmarks • There is persistence in performance, but – It is driven by momentum – It is mostly due to luck – Loads and fees chew up any gains • There is persistence in poorly performing funds, – These are the funds with large expense ratios and large turnover

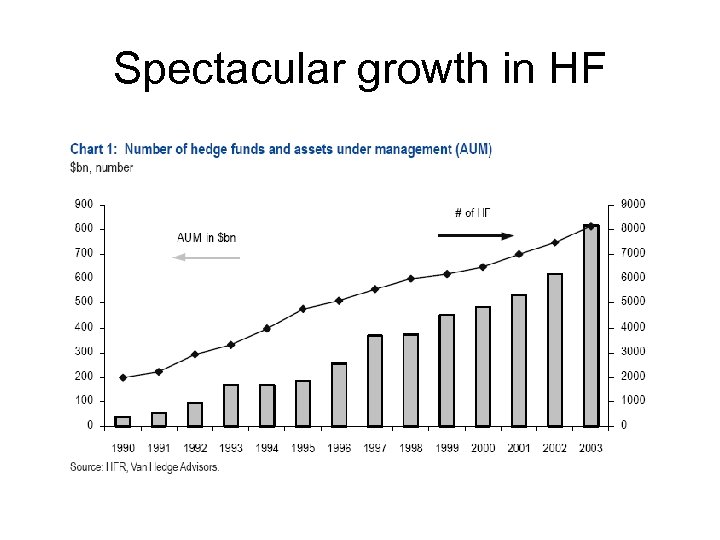

Spectacular growth in HF

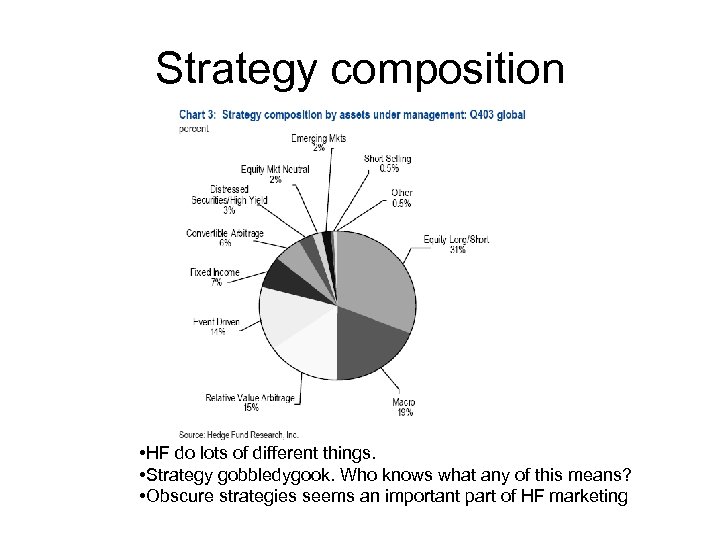

Strategy composition • HF do lots of different things. • Strategy gobbledygook. Who knows what any of this means? • Obscure strategies seems an important part of HF marketing

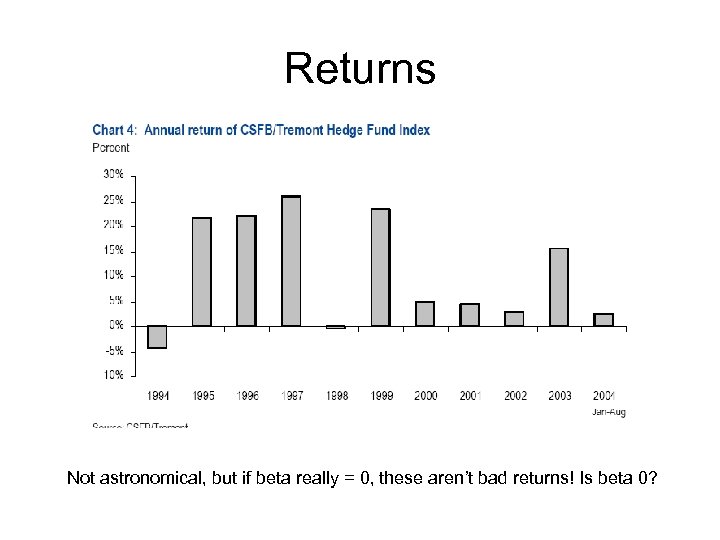

Returns Not astronomical, but if beta really = 0, these aren’t bad returns! Is beta 0?

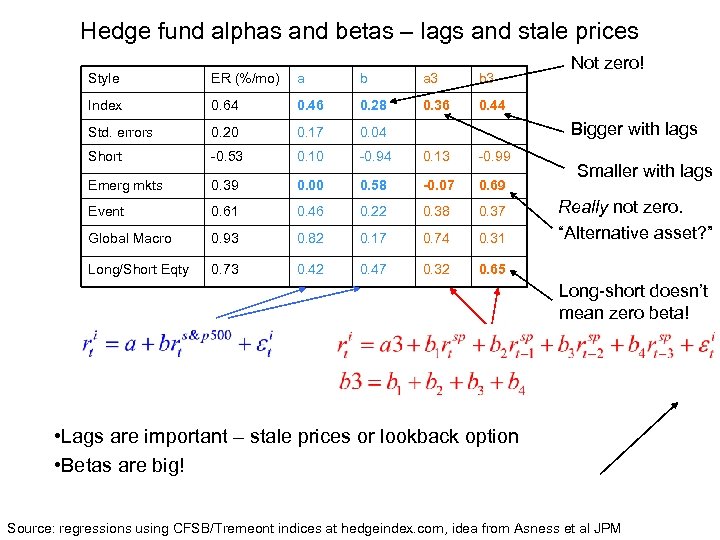

Hedge fund alphas and betas – lags and stale prices Style ER (%/mo) a b a 3 b 3 Index 0. 64 0. 46 0. 28 0. 36 0. 44 Std. errors 0. 20 0. 17 0. 04 Short -0. 53 0. 10 -0. 94 0. 13 -0. 99 Emerg mkts 0. 39 0. 00 0. 58 -0. 07 0. 69 Event 0. 61 0. 46 0. 22 0. 38 0. 37 Global Macro 0. 93 0. 82 0. 17 0. 74 0. 31 Long/Short Eqty 0. 73 0. 42 0. 47 0. 32 Not zero! 0. 65 Bigger with lags Smaller with lags Really not zero. “Alternative asset? ” Long-short doesn’t mean zero beta! • Lags are important – stale prices or lookback option • Betas are big! Source: regressions using CFSB/Tremeont indices at hedgeindex. com, idea from Asness et al JPM

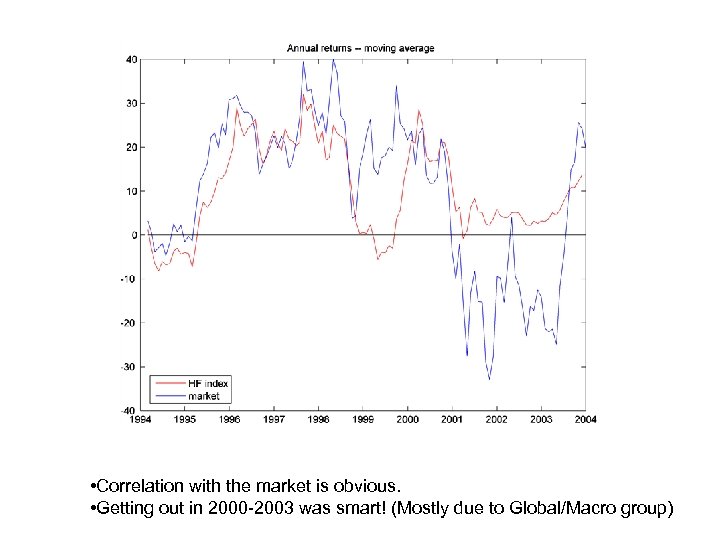

• Correlation with the market is obvious. • Getting out in 2000 -2003 was smart! (Mostly due to Global/Macro group)

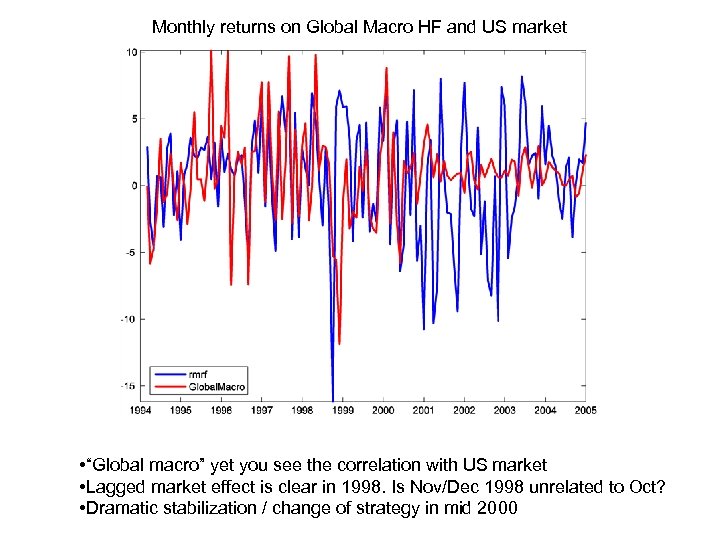

Monthly returns on Global Macro HF and US market • “Global macro” yet you see the correlation with US market • Lagged market effect is clear in 1998. Is Nov/Dec 1998 unrelated to Oct? • Dramatic stabilization / change of strategy in mid 2000

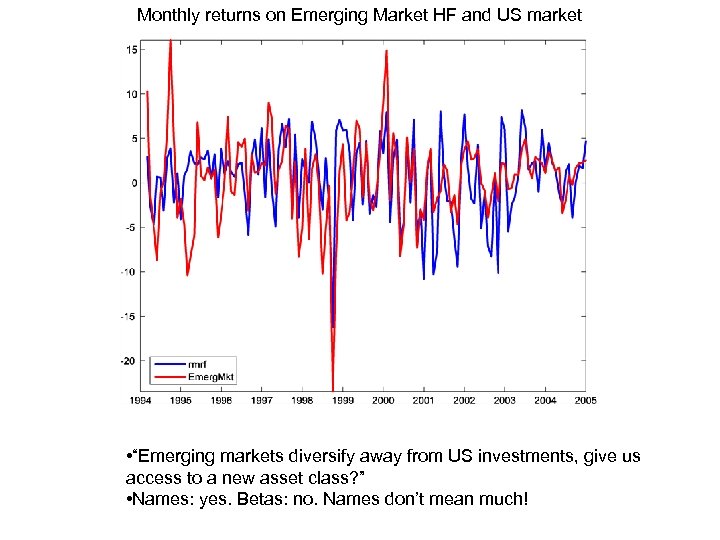

Monthly returns on Emerging Market HF and US market • “Emerging markets diversify away from US investments, give us access to a new asset class? ” • Names: yes. Betas: no. Names don’t mean much!

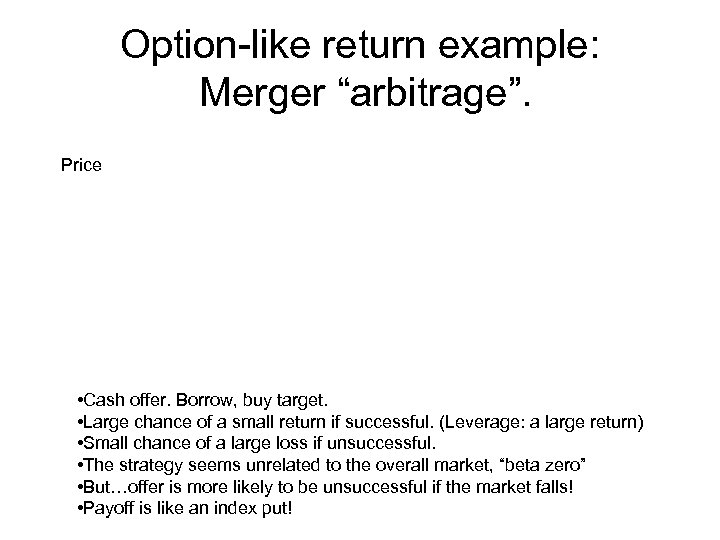

Option-like return example: Merger “arbitrage”. Price • Cash offer. Borrow, buy target. • Large chance of a small return if successful. (Leverage: a large return) • Small chance of a large loss if unsuccessful. • The strategy seems unrelated to the overall market, “beta zero” • But…offer is more likely to be unsuccessful if the market falls! • Payoff is like an index put!

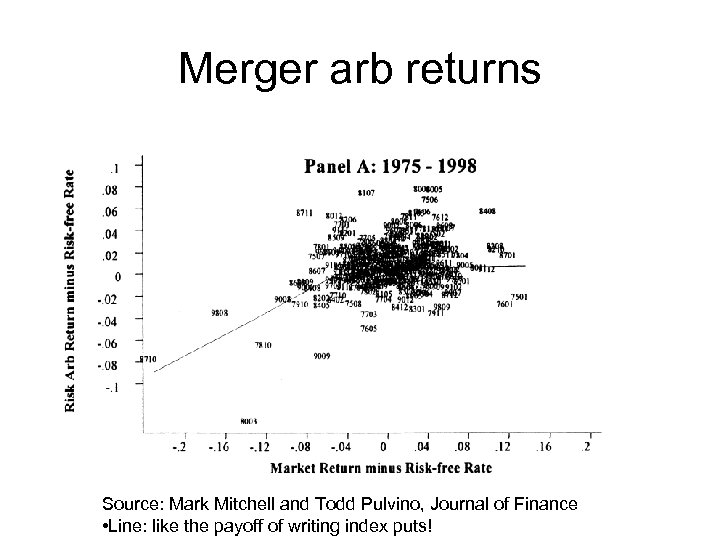

Merger arb returns Source: Mark Mitchell and Todd Pulvino, Journal of Finance • Line: like the payoff of writing index puts!

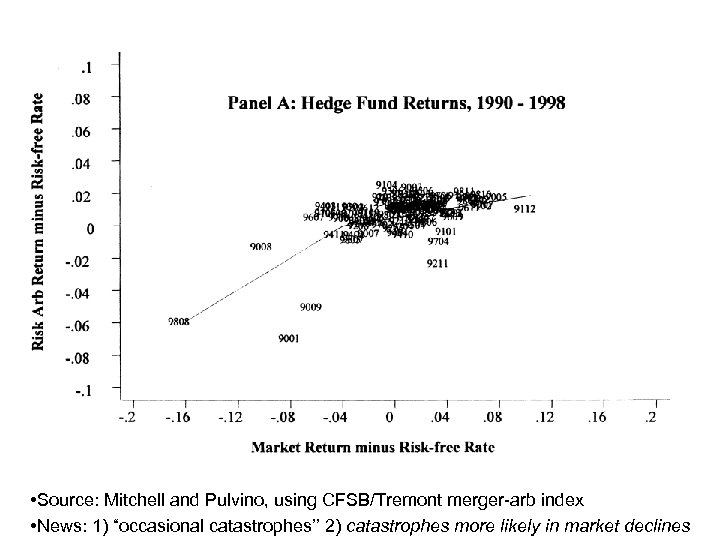

• Source: Mitchell and Pulvino, using CFSB/Tremont merger-arb index • News: 1) “occasional catastrophes’’ 2) catastrophes more likely in market declines

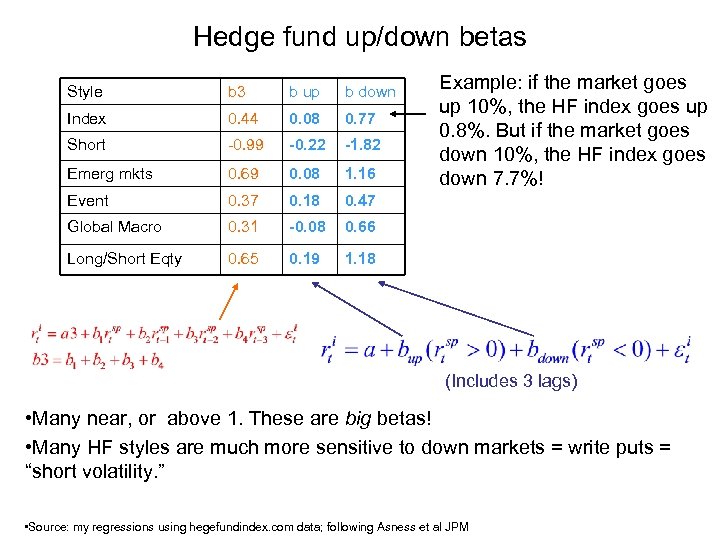

Hedge fund up/down betas Style b 3 b up b down Index 0. 44 0. 08 0. 77 Short -0. 99 -0. 22 -1. 82 Emerg mkts 0. 69 0. 08 1. 16 Event 0. 37 0. 18 0. 47 Global Macro 0. 31 -0. 08 0. 66 Long/Short Eqty 0. 65 0. 19 Example: if the market goes up 10%, the HF index goes up 0. 8%. But if the market goes down 10%, the HF index goes down 7. 7%! 1. 18 (Includes 3 lags) • Many near, or above 1. These are big betas! • Many HF styles are much more sensitive to down markets = write puts = “short volatility. ” • Source: my regressions using hegefundindex. com data; following Asness et al JPM

Implications of option-like payoffs • Need option-return benchmarks for risk management (investing in HF) and compensation benchmarks.

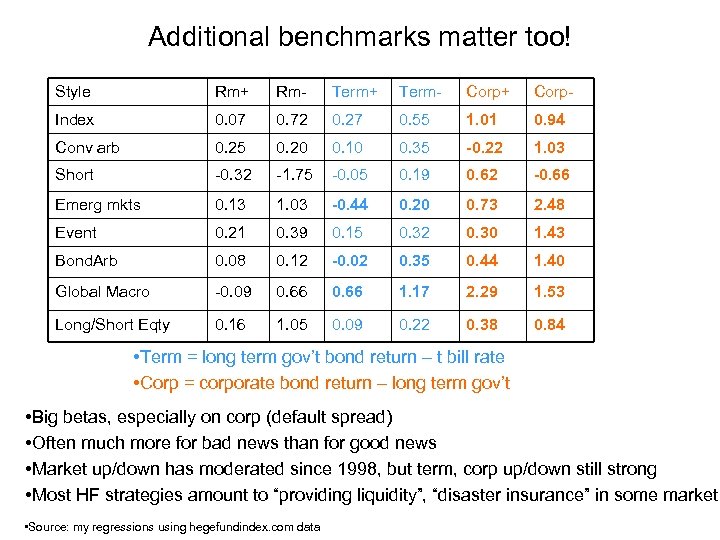

Additional benchmarks matter too! Style Rm+ Rm- Term+ Term- Corp+ Corp- Index 0. 07 0. 72 0. 27 0. 55 1. 01 0. 94 Conv arb 0. 25 0. 20 0. 10 0. 35 -0. 22 1. 03 Short -0. 32 -1. 75 -0. 05 0. 19 0. 62 -0. 66 Emerg mkts 0. 13 1. 03 -0. 44 0. 20 0. 73 2. 48 Event 0. 21 0. 39 0. 15 0. 32 0. 30 1. 43 Bond. Arb 0. 08 0. 12 -0. 02 0. 35 0. 44 1. 40 Global Macro -0. 09 0. 66 1. 17 2. 29 1. 53 Long/Short Eqty 0. 16 1. 05 0. 09 0. 22 0. 38 0. 84 • Term = long term gov’t bond return – t bill rate • Corp = corporate bond return – long term gov’t • Big betas, especially on corp (default spread) • Often much more for bad news than for good news • Market up/down has moderated since 1998, but term, corp up/down still strong • Most HF strategies amount to “providing liquidity”, “disaster insurance” in some market • Source: my regressions using hegefundindex. com data

a2f4af01b5fb188f38f1fe21e92b5c58.ppt