07a005ac3fede6e0e6597c36527be781.ppt

- Количество слайдов: 15

PERFECT COMPETITION This presentation considers the characteristics of a perfectly competitive market Perfect Competition

PERFECT COMPETITION This presentation considers the characteristics of a perfectly competitive market Perfect Competition

Assumptions Behind a Perfectly Competitive Market Many small firms each with a very small share of market Each firm is too small to influence price via a change in market supply – each individual firm is assumed to be a price taker. Identical output produced by each firm – homogeneous products that are perfect substitutes for each other Perfect knowledge among producers & consumers No barriers to entry & exit of firms in long run – market is open to competition from new suppliers – this affects the long run profits made by each firm in the industry Perfect Competition

Assumptions Behind a Perfectly Competitive Market Many small firms each with a very small share of market Each firm is too small to influence price via a change in market supply – each individual firm is assumed to be a price taker. Identical output produced by each firm – homogeneous products that are perfect substitutes for each other Perfect knowledge among producers & consumers No barriers to entry & exit of firms in long run – market is open to competition from new suppliers – this affects the long run profits made by each firm in the industry Perfect Competition

Price Taking Firms Competitive firms have no direct influence on the ruling market price In contrast, a business with a degree of monopoly (or market) power can make their own pricing decisions Examples of price-taking behaviour: Ø Local farmers selling their produce at the market. (I’m a coffee farmer- totally dependent on the “market price”). Ø You selling your local currency to buy foreign currency Ø Share prices- you have to sell your shares at the market price. Ø BITCOIN Perfect Competition

Price Taking Firms Competitive firms have no direct influence on the ruling market price In contrast, a business with a degree of monopoly (or market) power can make their own pricing decisions Examples of price-taking behaviour: Ø Local farmers selling their produce at the market. (I’m a coffee farmer- totally dependent on the “market price”). Ø You selling your local currency to buy foreign currency Ø Share prices- you have to sell your shares at the market price. Ø BITCOIN Perfect Competition

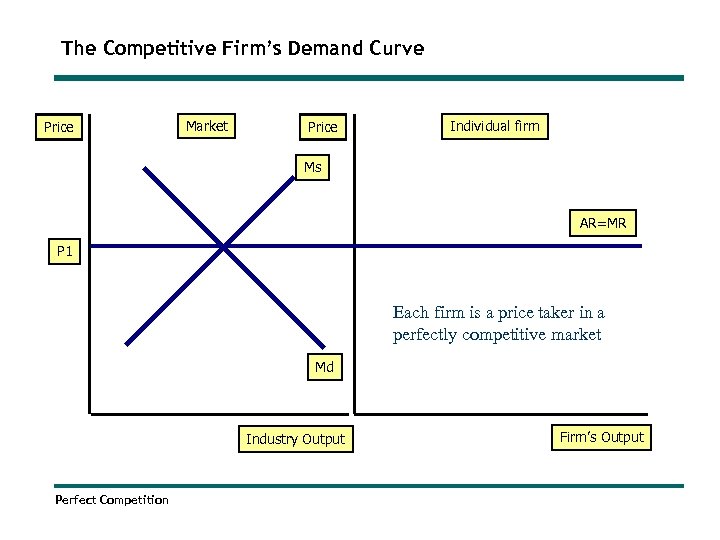

The Competitive Firm’s Demand Curve Price Market Price Individual firm Ms AR=MR P 1 Each firm is a price taker in a perfectly competitive market Md Industry Output Perfect Competition Firm’s Output

The Competitive Firm’s Demand Curve Price Market Price Individual firm Ms AR=MR P 1 Each firm is a price taker in a perfectly competitive market Md Industry Output Perfect Competition Firm’s Output

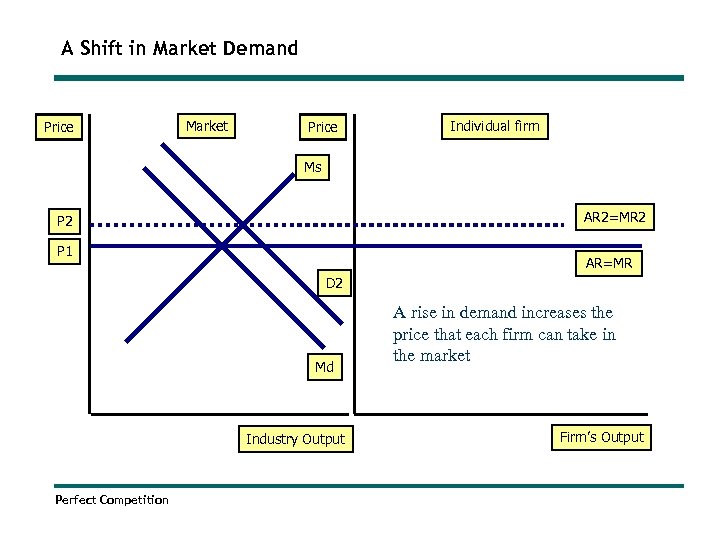

A Shift in Market Demand Price Market Price Individual firm Ms AR 2=MR 2 P 1 AR=MR D 2 Md Industry Output Perfect Competition A rise in demand increases the price that each firm can take in the market Firm’s Output

A Shift in Market Demand Price Market Price Individual firm Ms AR 2=MR 2 P 1 AR=MR D 2 Md Industry Output Perfect Competition A rise in demand increases the price that each firm can take in the market Firm’s Output

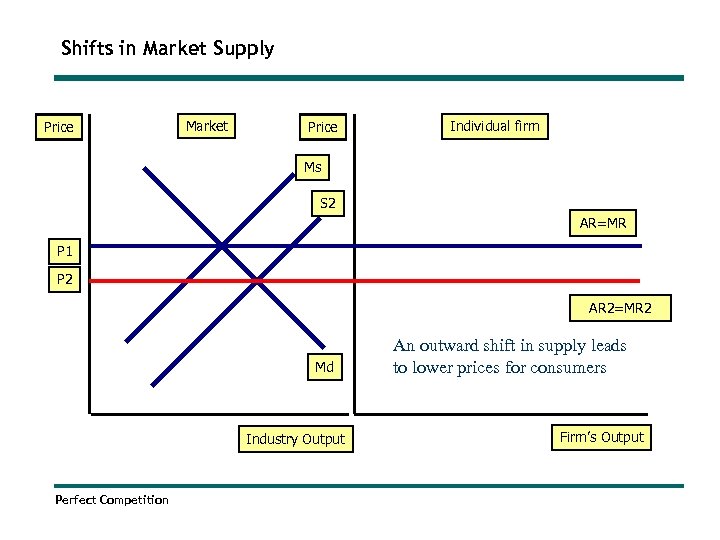

Shifts in Market Supply Price Market Price Individual firm Ms S 2 AR=MR P 1 P 2 AR 2=MR 2 Md Industry Output Perfect Competition An outward shift in supply leads to lower prices for consumers Firm’s Output

Shifts in Market Supply Price Market Price Individual firm Ms S 2 AR=MR P 1 P 2 AR 2=MR 2 Md Industry Output Perfect Competition An outward shift in supply leads to lower prices for consumers Firm’s Output

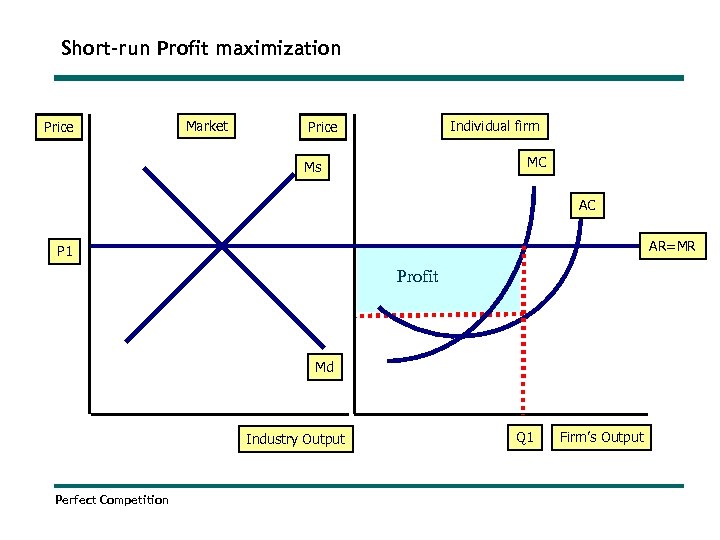

Short-run Profit maximization Price Market Individual firm Price MC Ms AC AR=MR P 1 Profit Md Industry Output Perfect Competition Q 1 Firm’s Output

Short-run Profit maximization Price Market Individual firm Price MC Ms AC AR=MR P 1 Profit Md Industry Output Perfect Competition Q 1 Firm’s Output

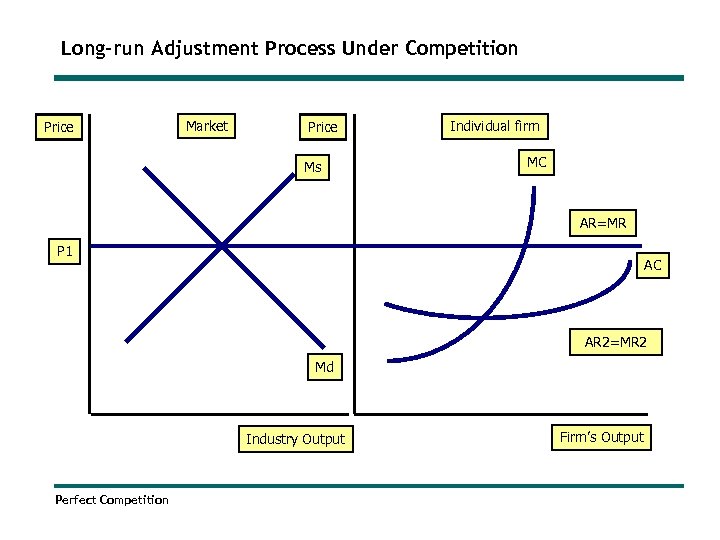

Long-run Adjustment Process Under Competition Price Market Price Ms Individual firm MC AR=MR P 1 AC AR 2=MR 2 Md Industry Output Perfect Competition Firm’s Output

Long-run Adjustment Process Under Competition Price Market Price Ms Individual firm MC AR=MR P 1 AC AR 2=MR 2 Md Industry Output Perfect Competition Firm’s Output

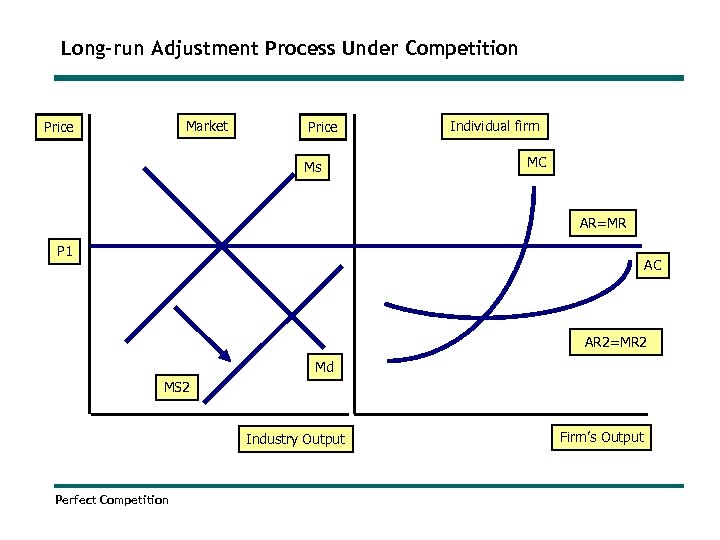

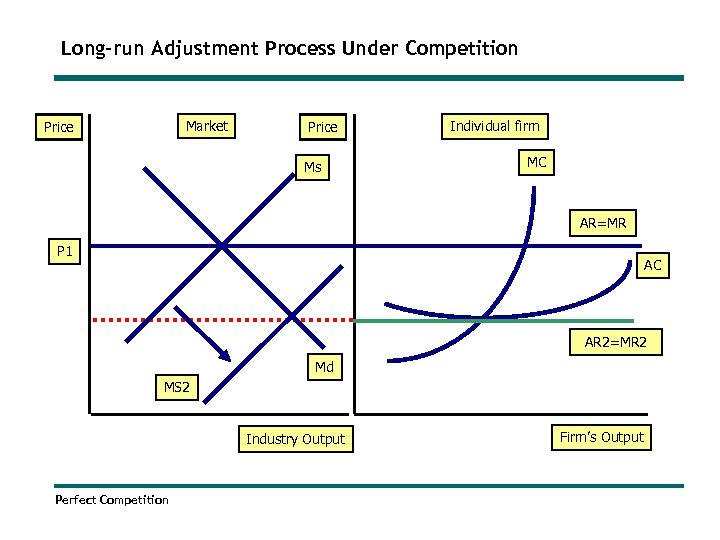

Long-run Adjustment Process Under Competition Market Price Ms Individual firm MC AR=MR P 1 AC AR 2=MR 2 Md MS 2 Industry Output Perfect Competition Firm’s Output

Long-run Adjustment Process Under Competition Market Price Ms Individual firm MC AR=MR P 1 AC AR 2=MR 2 Md MS 2 Industry Output Perfect Competition Firm’s Output

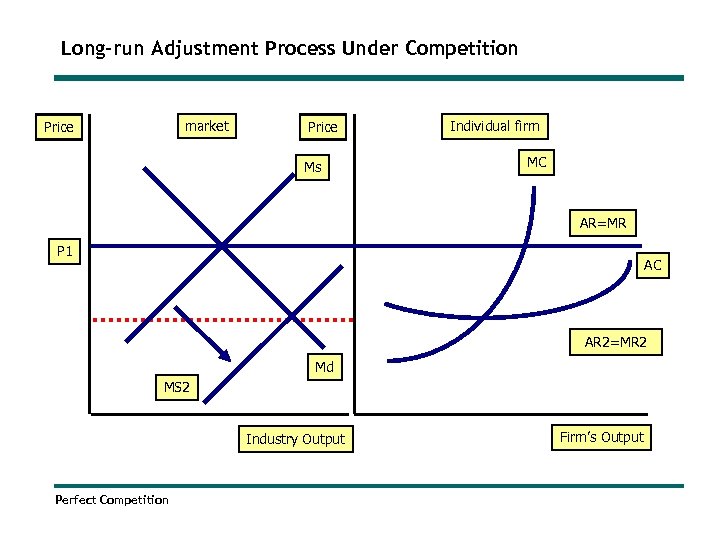

Long-run Adjustment Process Under Competition market Price Ms Individual firm MC AR=MR P 1 AC AR 2=MR 2 Md MS 2 Industry Output Perfect Competition Firm’s Output

Long-run Adjustment Process Under Competition market Price Ms Individual firm MC AR=MR P 1 AC AR 2=MR 2 Md MS 2 Industry Output Perfect Competition Firm’s Output

Long-run Adjustment Process Under Competition Market Price Ms Individual firm MC AR=MR P 1 AC AR 2=MR 2 Md MS 2 Industry Output Perfect Competition Firm’s Output

Long-run Adjustment Process Under Competition Market Price Ms Individual firm MC AR=MR P 1 AC AR 2=MR 2 Md MS 2 Industry Output Perfect Competition Firm’s Output

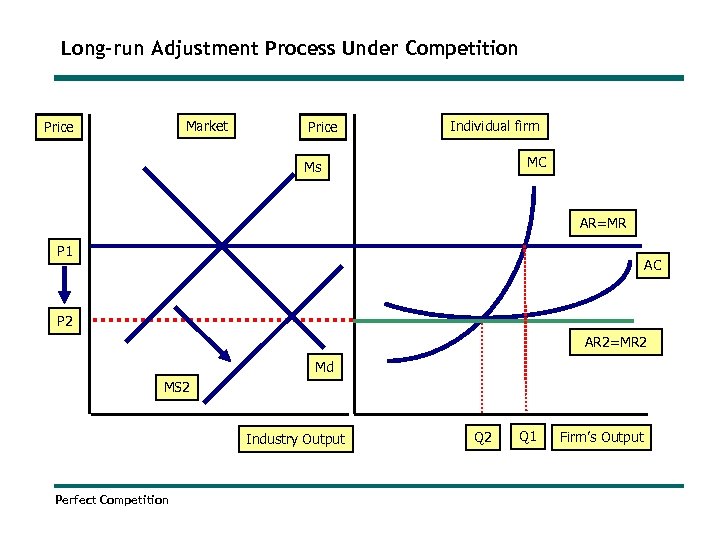

Long-run Adjustment Process Under Competition Market Price Individual firm MC Ms AR=MR P 1 AC P 2 AR 2=MR 2 Md MS 2 Industry Output Perfect Competition Q 2 Q 1 Firm’s Output

Long-run Adjustment Process Under Competition Market Price Individual firm MC Ms AR=MR P 1 AC P 2 AR 2=MR 2 Md MS 2 Industry Output Perfect Competition Q 2 Q 1 Firm’s Output

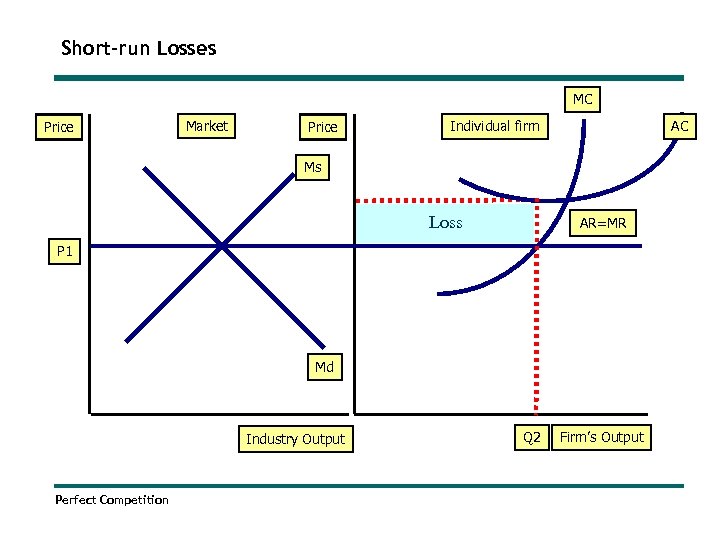

Short-run Losses MC Price Market Price AC Individual firm Ms Loss AR=MR P 1 Md Industry Output Perfect Competition Q 2 Firm’s Output

Short-run Losses MC Price Market Price AC Individual firm Ms Loss AR=MR P 1 Md Industry Output Perfect Competition Q 2 Firm’s Output

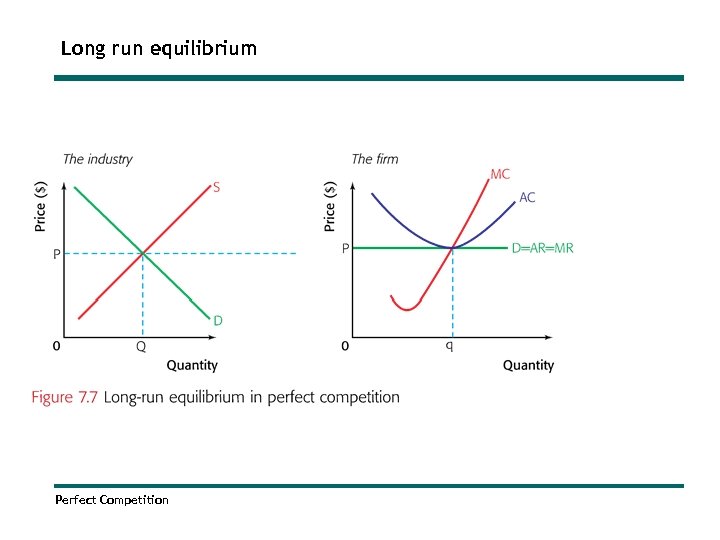

Long run equilibrium Perfect Competition

Long run equilibrium Perfect Competition

Importance of the Perfect Competition Model It is often argued that few markets exactly meet the characteristics of Perfect Competition and therefore the model is of little use. However this is wrong in that…. Some markets do meet the criteria The model is an extreme but gives us answers to what happens when a market becomes more competitive. The standard “neo-classical” view is that competition drives an improvement in economic welfare and efficiency Competition 'sorts' firms – it forces under-performing firms out of the market and shifts market share to more efficient firms in the long run Competition encourages firms to innovate and adopt bestpractise techniques. Perfect Competition

Importance of the Perfect Competition Model It is often argued that few markets exactly meet the characteristics of Perfect Competition and therefore the model is of little use. However this is wrong in that…. Some markets do meet the criteria The model is an extreme but gives us answers to what happens when a market becomes more competitive. The standard “neo-classical” view is that competition drives an improvement in economic welfare and efficiency Competition 'sorts' firms – it forces under-performing firms out of the market and shifts market share to more efficient firms in the long run Competition encourages firms to innovate and adopt bestpractise techniques. Perfect Competition