e7da8dfb49abe9ed54b43126cb352a1a.ppt

- Количество слайдов: 42

Percentages II (Tutor Version)

Overview Percentages B Key words: Percentage, Goods and Services Tax (GST), GST inclusive, GST exclusive, frequency , equivalent Purpose: To provide tutors with lesson ideas for introducing more difficult percentage calculations. By the end of the unit tutors should be able to: 1. Solve percentage problems which involve proportions 2. Develop lessons in their teaching context that help learners to solve problems with percentages

Section 1: Mathematical Background Page 1: Percentages as proportions Percentages are equivalent fractions. When we say that two fractions are equivalent that means they are different fractions for the same number. For example: ¾ = 75/100 means that three-quarters and seventy-five hundredths are the same number. So three-quarters of any amount is always 75% of that amount.

Section 1: Mathematical Background Page 2: Frequencies The most common situations where percentages occur involve frequencies. Frequencies are “out of” situations such as “Warren sinks 24 out of 40 first putts” or “ 12 out of every 100 people are left-handed. ” Frequencies can be expressed as percentages. For example, 24/40 = 6/10 = 60/100. So Warren sinks 60% of his first putts.

Section 1: Mathematical Background Page 3: Ratios as percentages Ratios are combinations of two or more quantities with the same measures. For example you might mix one shovel of cement to four shovels of sand to make mortar. That is a 1: 4 ratio. You might mix 20 m. L of Kahlua to 30 m. L of Midori to make a cocktail. That is a 20: 30 or 2: 3 ratio. Percentages are a bit harder to find in ratios than frequencies since you have to create the “out of” relationships.

Section 1: Mathematical Background Page 4: Ratios as percentages a bit harder Ratios can be expressed as part-whole fractions and as percentages. So our 2: 3 cocktail is 2/5 kahlua and 3/5 midori. 2/5 = 40/100 so the cocktail is 40% kahlua 3/5 = 60/100 so the cocktail is 60% midori.

Section 1: Mathematical Background Page 5: Ratios as percentages harder Some ratios are not parts of the same whole. In growth and reduction situations you might compare different wholes. For example you buy some shares for $400 and sell them two years later for $480. The ratio 400: 480 compares two different amounts. In this case you sell the shares for 120% of what you paid for them (480/400 = 120/100).

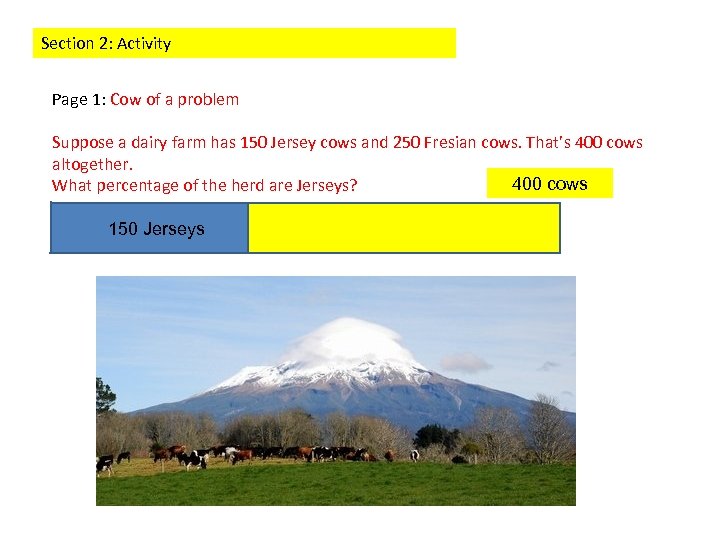

Section 2: Activity Page 1: Cow of a problem Suppose a dairy farm has 150 Jersey cows and 250 Fresian cows. That’s 400 cows altogether. 400 cows What percentage of the herd are Jerseys? 150 Jerseys

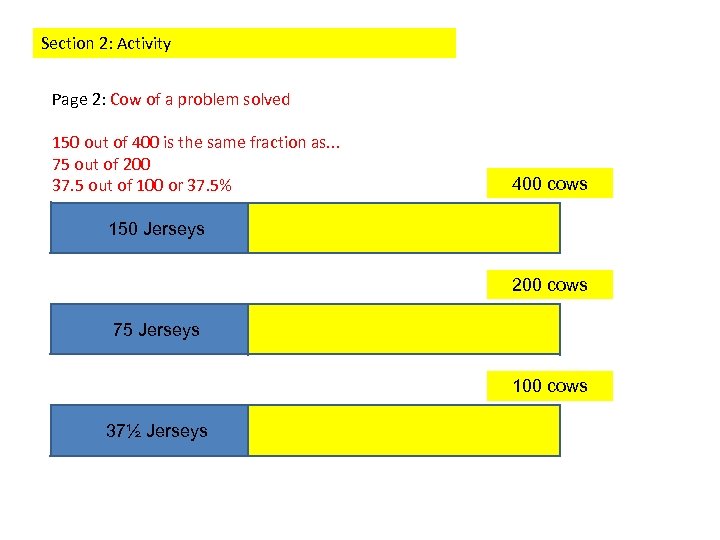

Section 2: Activity Page 2: Cow of a problem solved 150 out of 400 is the same fraction as. . . 75 out of 200 37. 5 out of 100 or 37. 5% 400 cows 150 Jerseys 200 cows 75 Jerseys 100 cows 37½ Jerseys

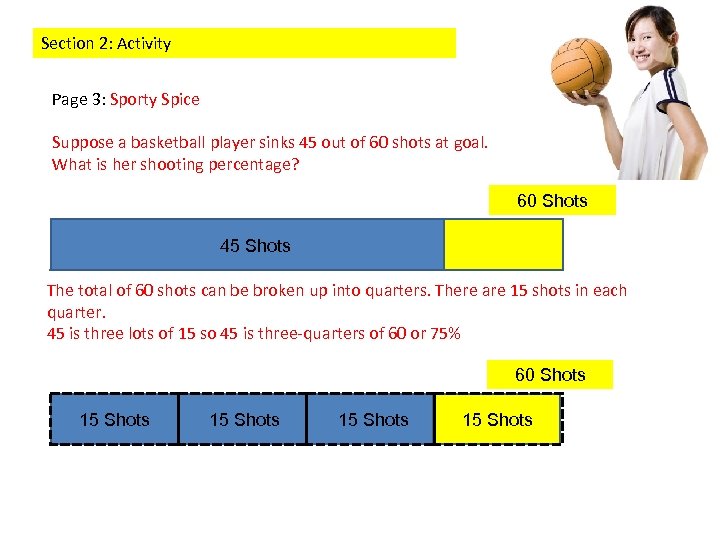

Section 2: Activity Page 3: Sporty Spice Suppose a basketball player sinks 45 out of 60 shots at goal. What is her shooting percentage? 60 Shots 45 Shots The total of 60 shots can be broken up into quarters. There are 15 shots in each quarter. 45 is three lots of 15 so 45 is three-quarters of 60 or 75% 60 Shots 15 Shots

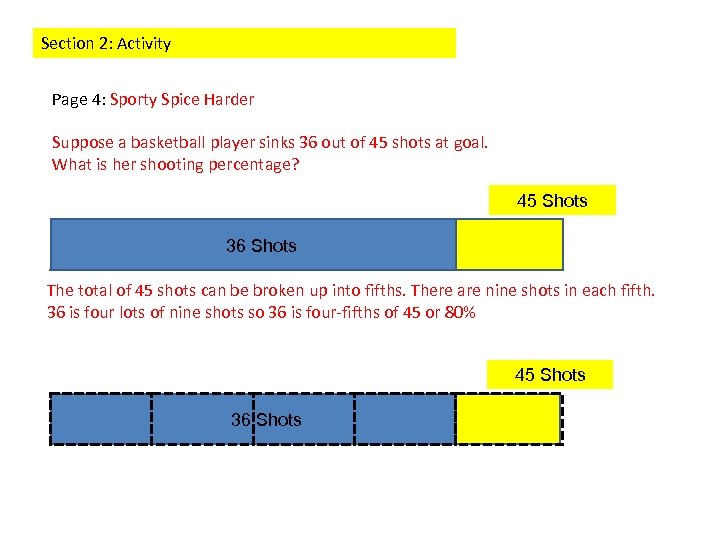

Section 2: Activity Page 4: Sporty Spice Harder Suppose a basketball player sinks 36 out of 45 shots at goal. What is her shooting percentage? 45 Shots 36 Shots The total of 45 shots can be broken up into fifths. There are nine shots in each fifth. 36 is four lots of nine shots so 36 is four-fifths of 45 or 80% 45 Shots 36 Shots

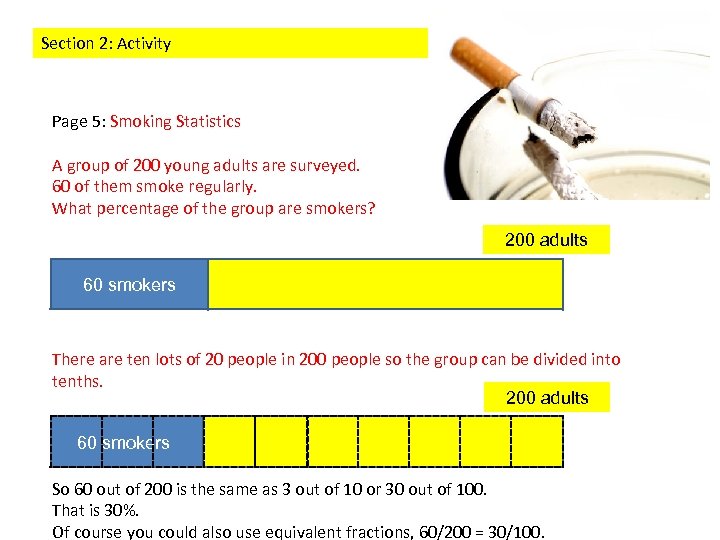

Section 2: Activity Page 5: Smoking Statistics A group of 200 young adults are surveyed. 60 of them smoke regularly. What percentage of the group are smokers? 200 adults 60 smokers There are ten lots of 20 people in 200 people so the group can be divided into tenths. 200 adults 60 smokers So 60 out of 200 is the same as 3 out of 10 or 30 out of 100. That is 30%. Of course you could also use equivalent fractions, 60/200 = 30/100.

Section 2: Activity Page 6: Try a few problems At this stage you might like to try a few percentage problems just like these? Go to slides 1 -4 of the examples section to find some problems. 60 smokers

Section 2: Activity Page 6 GST Ø GST is a government tax which is added on to the selling price of all goods we buy. Ø The letters GST stand for Goods and Services Tax. Ø GST was first applied in New Zealand on October 1, 1986 and was 10%. On July 1, 1989 it increased to 12. 5%. On October 1, 2010 it increased to 15%

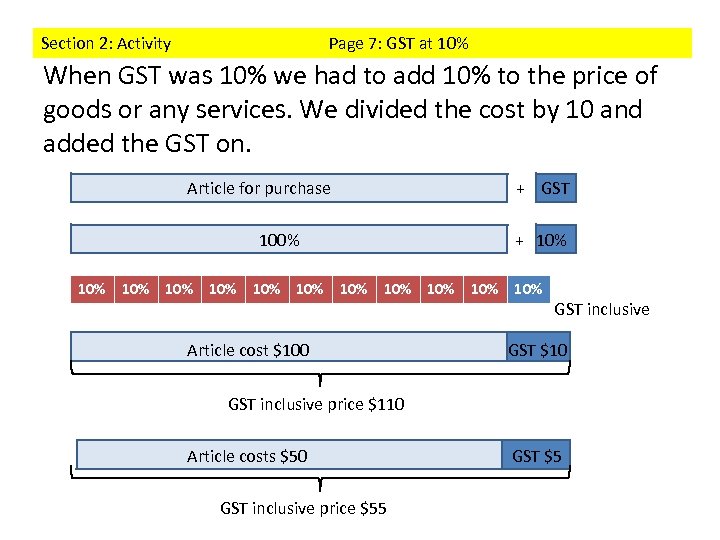

Section 2: Activity Page 7: GST at 10% When GST was 10% we had to add 10% to the price of goods or any services. We divided the cost by 10 and added the GST on. Article for purchase 100% + GST + 10% 10% 10% Article cost $100 GST inclusive GST $10 GST inclusive price $110 Article costs $50 GST inclusive price $55 GST $5

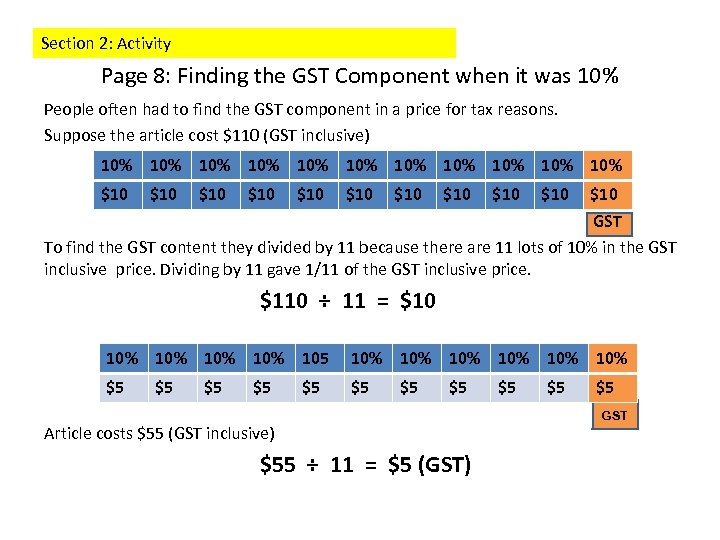

Section 2: Activity Page 8: Finding the GST Component when it was 10% People often had to find the GST component in a price for tax reasons. Suppose the article cost $110 (GST inclusive) 10% 10% 10% $10 $10 $10 GST To find the GST content they divided by 11 because there are 11 lots of 10% in the GST inclusive price. Dividing by 11 gave 1/11 of the GST inclusive price. $110 ÷ 11 = $10 10% 10% 105 10% 10% 10% $5 $5 Article costs $55 (GST inclusive) $55 ÷ 11 = $5 (GST) $5 $5 $5 GST

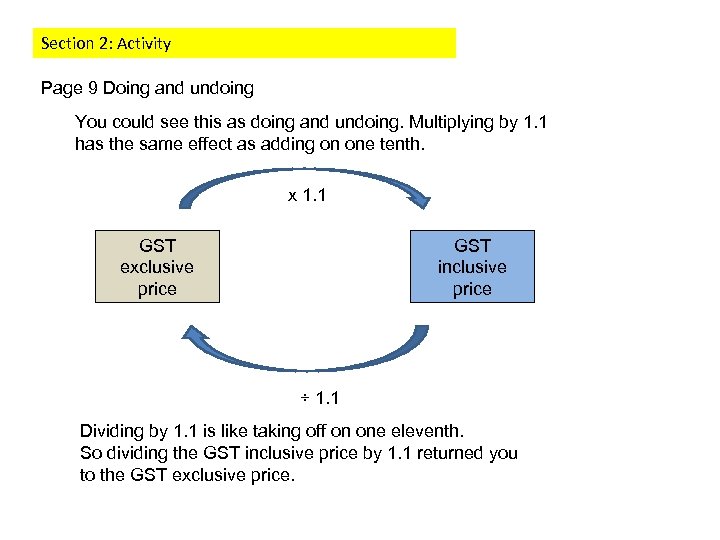

Section 2: Activity Page 9 Doing and undoing You could see this as doing and undoing. Multiplying by 1. 1 has the same effect as adding on one tenth. x 1. 1 GST exclusive price GST inclusive price ÷ 1. 1 Dividing by 1. 1 is like taking off on one eleventh. So dividing the GST inclusive price by 1. 1 returned you to the GST exclusive price.

Section 2: Activity Page 10: An historical view At 10% GST. . . The plasma television cost $660 (GST inclusive). How much of the price was GST?

Section 2: Activity Page 11: Finding the GST component when it was 12 % If you divide 100% by 12 % you get 8. So 12. 5% is another name for one-eighth. The price of goods was divided by 8 to find how much GST needed to be added on. An article cost $100. How much GST has to be added on? 12 % $12. 50 12 % 12 % + 12 % $12. 50 + $12. 50 GST The GST content on $100 was $12. 50. The total price of the article being sold was $112. 50 (GST inclusive) To find the GST component you divided by 9, because there are nine lots of 12 % in the GST inclusive price. $112. 50 ÷ 9 = $12. 50 Find the GST component on something that costs $36.

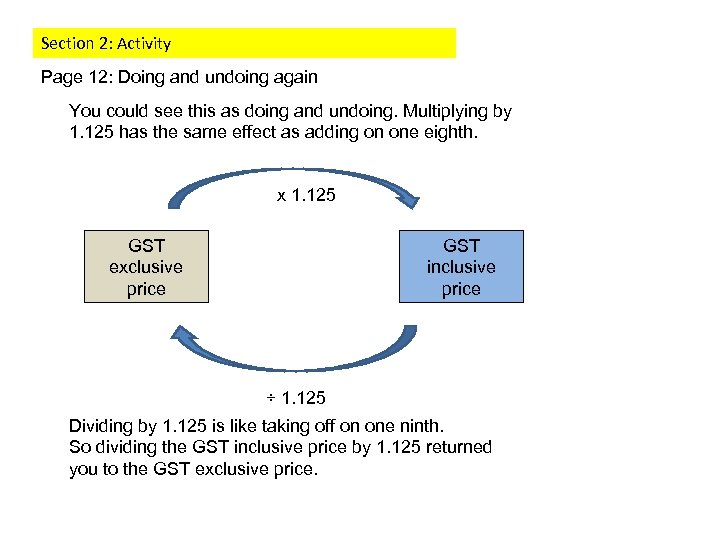

Section 2: Activity Page 12: Doing and undoing again You could see this as doing and undoing. Multiplying by 1. 125 has the same effect as adding on one eighth. x 1. 125 GST exclusive price GST inclusive price ÷ 1. 125 Dividing by 1. 125 is like taking off on one ninth. So dividing the GST inclusive price by 1. 125 returned you to the GST exclusive price.

Section 2: Activity Page 13: Another historical view At 12. 5% GST. . . The plasma television cost $1, 200 (GST inclusive). How much of the price was GST?

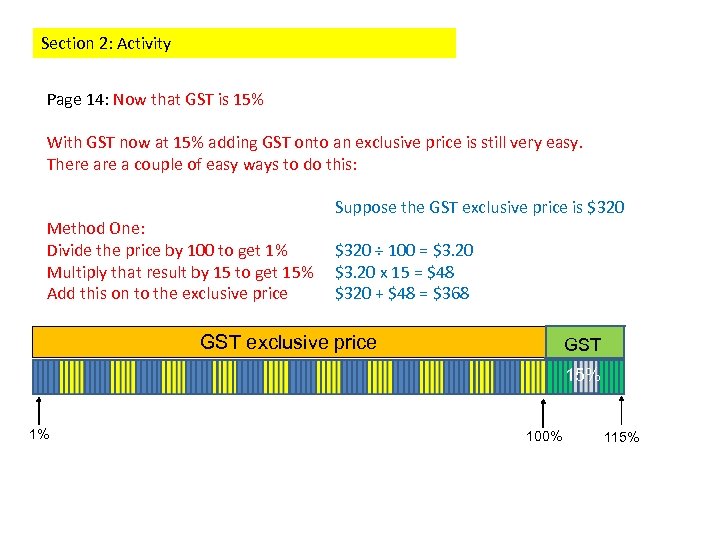

Section 2: Activity Page 14: Now that GST is 15% With GST now at 15% adding GST onto an exclusive price is still very easy. There a couple of easy ways to do this: Method One: Divide the price by 100 to get 1% Multiply that result by 15 to get 15% Add this on to the exclusive price Suppose the GST exclusive price is $320 ÷ 100 = $3. 20 x 15 = $48 $320 + $48 = $368 GST exclusive price GST 15% 1% 100% 115%

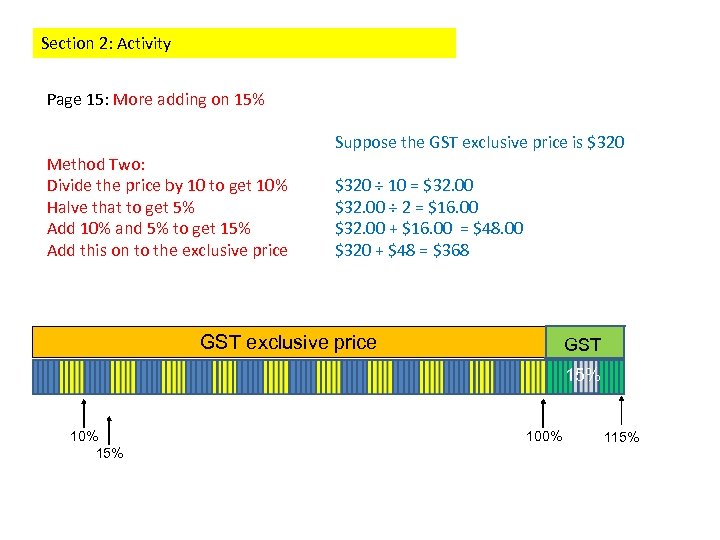

Section 2: Activity Page 15: More adding on 15% Method Two: Divide the price by 10 to get 10% Halve that to get 5% Add 10% and 5% to get 15% Add this on to the exclusive price Suppose the GST exclusive price is $320 ÷ 10 = $32. 00 ÷ 2 = $16. 00 $32. 00 + $16. 00 = $48. 00 $320 + $48 = $368 GST exclusive price GST 15% 10% 15% 100% 115%

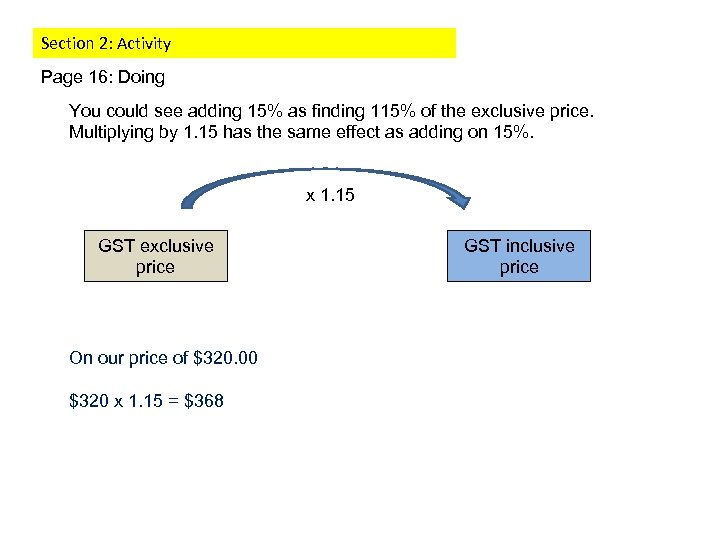

Section 2: Activity Page 16: Doing You could see adding 15% as finding 115% of the exclusive price. Multiplying by 1. 15 has the same effect as adding on 15%. x 1. 15 GST exclusive price On our price of $320. 00 $320 x 1. 15 = $368 GST inclusive price

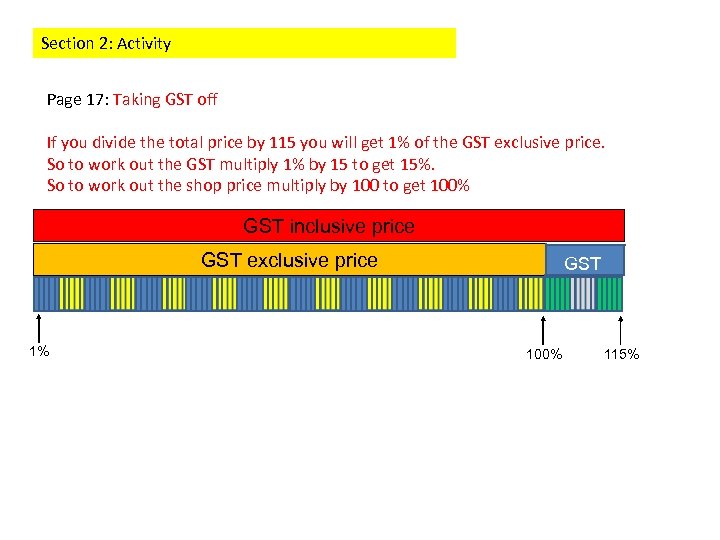

Section 2: Activity Page 17: Taking GST off If you divide the total price by 115 you will get 1% of the GST exclusive price. So to work out the GST multiply 1% by 15 to get 15%. So to work out the shop price multiply by 100 to get 100% GST inclusive price GST exclusive price 1% GST 100% 115%

Section 2: Activity Page 18: An example You are working out an expense claim for your boss. You bought a digital camera for $230. 00 (GST included). How much of the price was GST?

Section 2: Activity Page 19: Another example You put $69 of petrol in you car. How much of the price is GST and how much does the garage get?

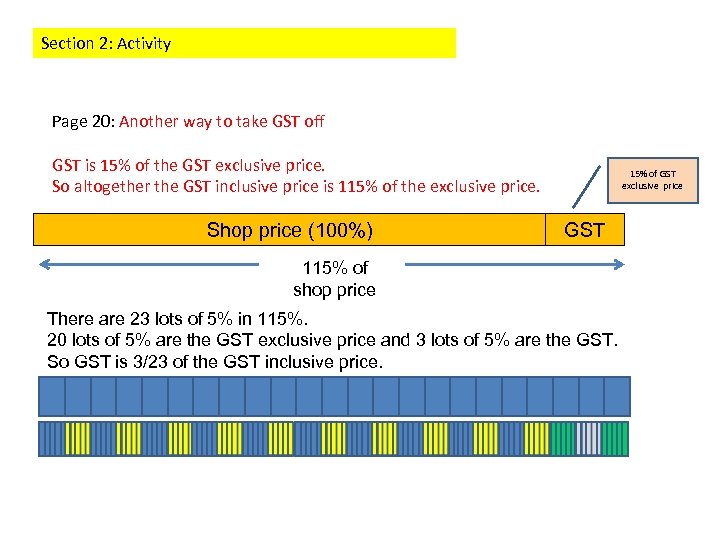

Section 2: Activity Page 20: Another way to take GST off GST is 15% of the GST exclusive price. So altogether the GST inclusive price is 115% of the exclusive price. Shop price (100%) 15% of GST exclusive price GST 115% of shop price There are 23 lots of 5% in 115%. 20 lots of 5% are the GST exclusive price and 3 lots of 5% are the GST. So GST is 3/23 of the GST inclusive price.

Section 2: Activity Page 21: Petrol Again You put $69 of petrol in you car. How much of the price is GST and how much does the garage get? Use the 3/23 method to work this out.

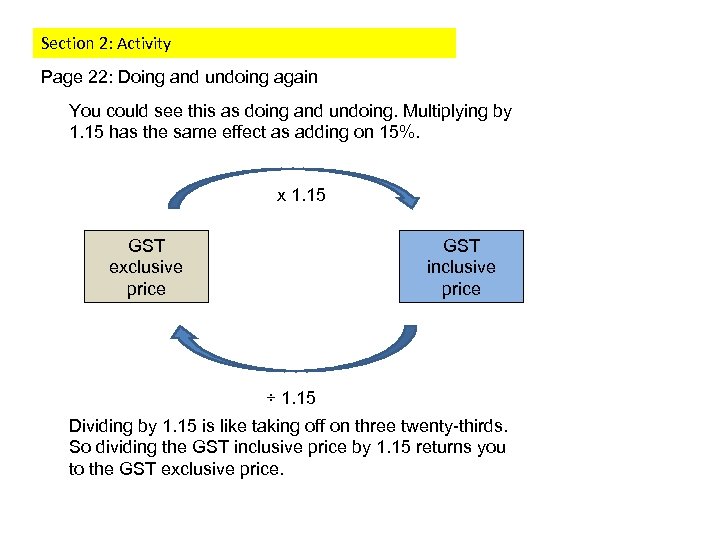

Section 2: Activity Page 22: Doing and undoing again You could see this as doing and undoing. Multiplying by 1. 15 has the same effect as adding on 15%. x 1. 15 GST exclusive price GST inclusive price ÷ 1. 15 Dividing by 1. 15 is like taking off on three twenty-thirds. So dividing the GST inclusive price by 1. 15 returns you to the GST exclusive price.

Section 2: Activity Page 23: Petrol Again and Again You put $69 of petrol in you car. How much does the garage get from the sale? Use divide by 1. 15 method to work this out.

Section 2: Activity Page 24: Try some problems Go to slides 5 -8 of the examples section to find some GST problems. 60 smokers

Section 3: Examples Page 1: Turtle Tragedy Of the 1200 baby turtles that hatch out only 384 make it to the sea. The rest are eaten by predators. What percentage of baby turtles make it?

Section 3: Examples Page 2: Crayfish Catch Last year only 25% of the crayfish you caught were under sized. This year you put back 16 of the 48 crayfish you caught. Is the percentage of undersized crayfish increasing?

Section 3: Examples Page 3: Sharp Shooting Karl got 60 of his 75 arrows on target. What percentage was that?

Section 3: Examples Page 4: Whale of a whale A baby humpback at birth measures 4. 2 metres long and weighs 2. 5 tonnes. After one month it measures 6. 0 metres long and weighs 4. 0 tonnes. By what percentages has its length and weight grown?

Section 3: Examples Page 5: Add GST The GST exclusive price of a pair of jeans as $72. 00 How much GST will be added on and how much in total will you pay for the jeans?

Section 3: Examples Page 5: Add GST is often charged on the sale of land. A small block has a GST exclusive price of $483, 000. How much GST will be charged on top of the price?

Section 3: Examples Page 7: The Hoata family bought a new Laptop for $2, 990 (incl. GST). “I use this for my business, ” said Paora, “So I can claim back the GST. ” How much GST can Paora claim back?

Section 3: Examples Page 8: Taxi Fare You pay $57. 50 for a taxi trip. How much of the cost is GST and how much does the taxi driver get?

Section 4: Assessment Page 1: New Zealand has one of the highest rates of car ownership in the world. There about 2. 5 million cars for about 4 million people. What percentage of 4 million is 2. 5 million?

Section 4: Assessment Page 2: GST Burger Please Even a hamburger and fries has GST included in the price. If the GST inclusive price is $5. 80 how much GST are you paying?

e7da8dfb49abe9ed54b43126cb352a1a.ppt