a86e7eefacc500b2f80a067f48758177.ppt

- Количество слайдов: 32

Pensions in 2016 Tom Mc. Phail Head of Retirement Policy Hargreaves Lansdown 07. 03. 2016

Pensions in 2016 Tom Mc. Phail Head of Retirement Policy Hargreaves Lansdown 07. 03. 2016

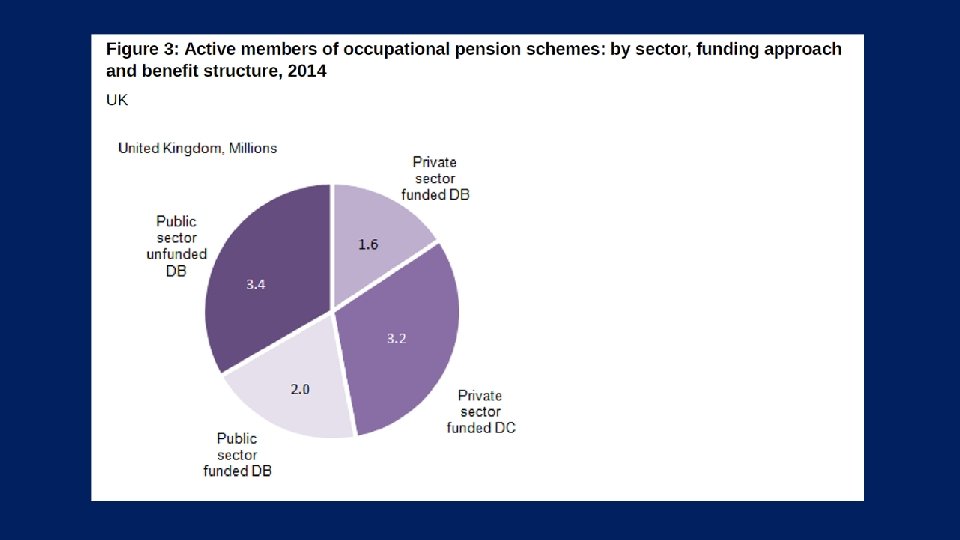

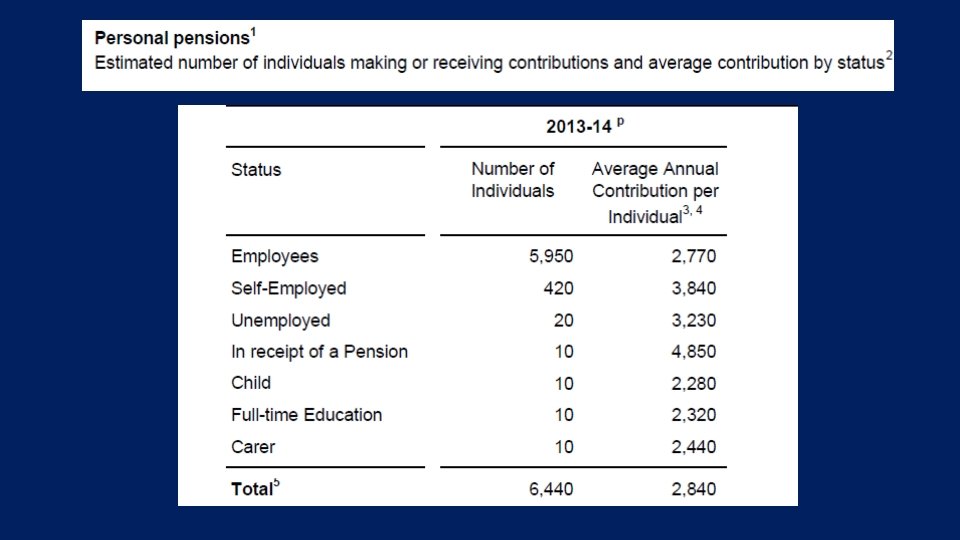

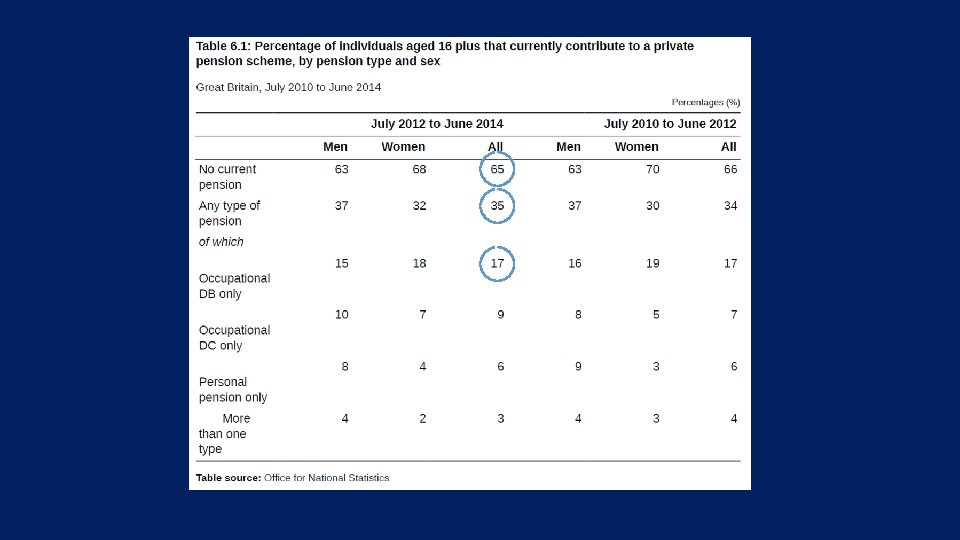

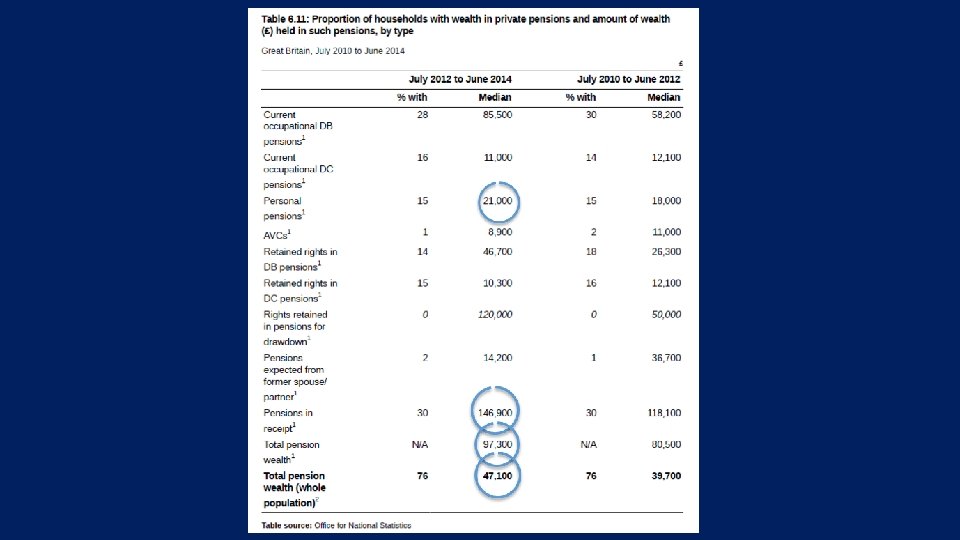

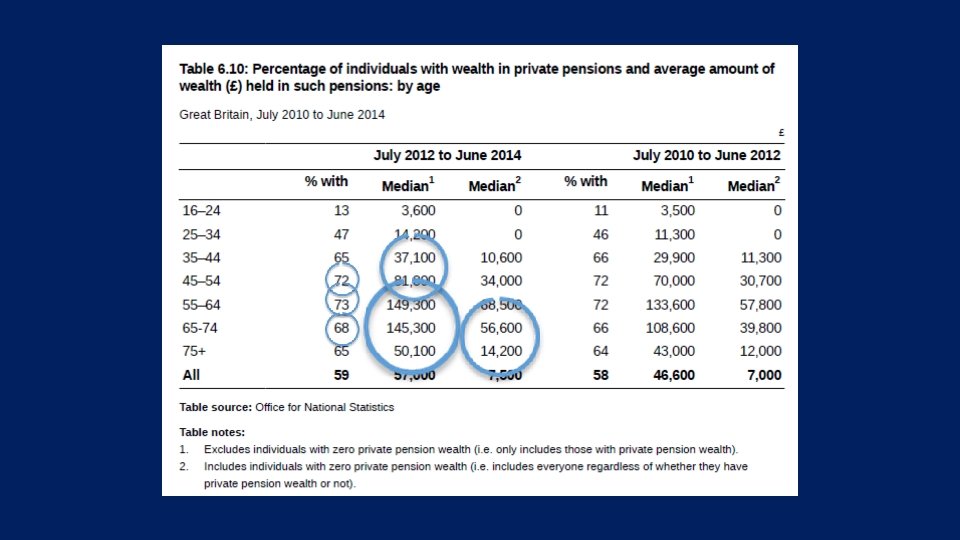

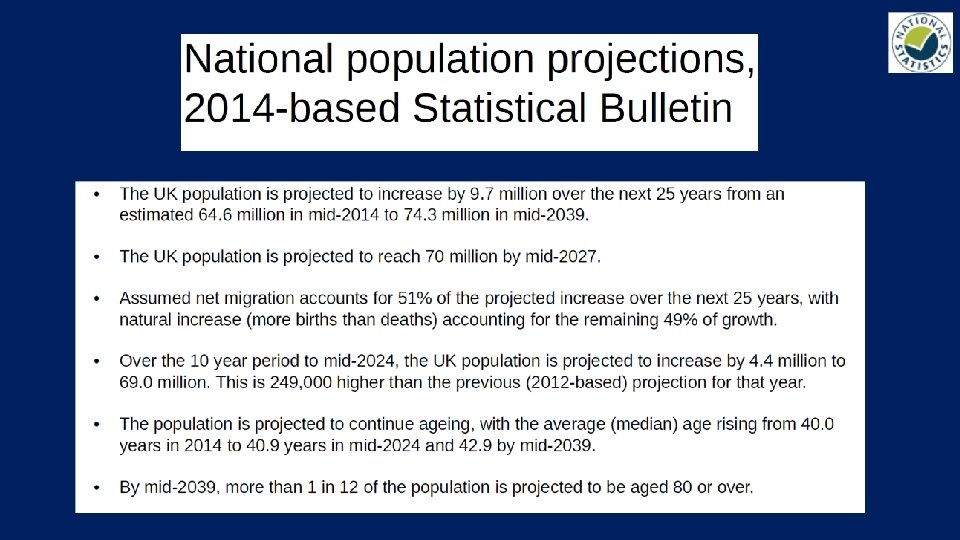

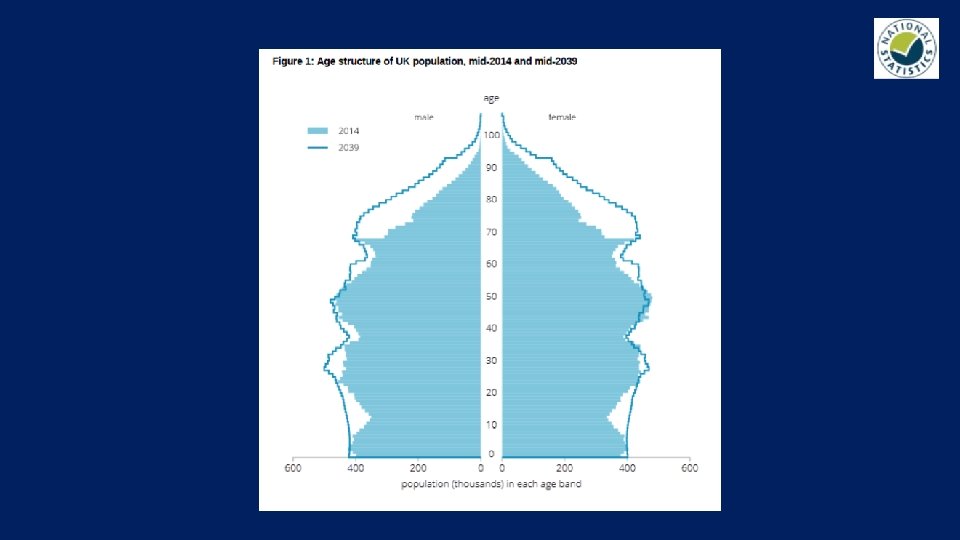

A snapshot of UK Pensions Ø Taxation Ø Current private pension provision Ø Funding rates Ø Demographics Ø Pension freedom Ø State pension 2

A snapshot of UK Pensions Ø Taxation Ø Current private pension provision Ø Funding rates Ø Demographics Ø Pension freedom Ø State pension 2

The UK pension tax system now Ø Contributions attract tax relief at highest marginal rate – 20%, 40% or 45% Ø Tax-free growth in the pension Ø 25% tax-free lump sum from age 55. Remainder taxable at marginal rate Ø Annual Allowance of £ 40, 000. Carry forward from 3 previous tax years available Ø Tapered Annual Allowance applies from 06. 04. 2016 on incomes above £ 150, 000 Ø Lifetime allowance of £ 1. 25 m, down to £ 1 m on 06. 04. 2016 Tax rules can change and benefits depend on individual circumstances. 3

The UK pension tax system now Ø Contributions attract tax relief at highest marginal rate – 20%, 40% or 45% Ø Tax-free growth in the pension Ø 25% tax-free lump sum from age 55. Remainder taxable at marginal rate Ø Annual Allowance of £ 40, 000. Carry forward from 3 previous tax years available Ø Tapered Annual Allowance applies from 06. 04. 2016 on incomes above £ 150, 000 Ø Lifetime allowance of £ 1. 25 m, down to £ 1 m on 06. 04. 2016 Tax rules can change and benefits depend on individual circumstances. 3

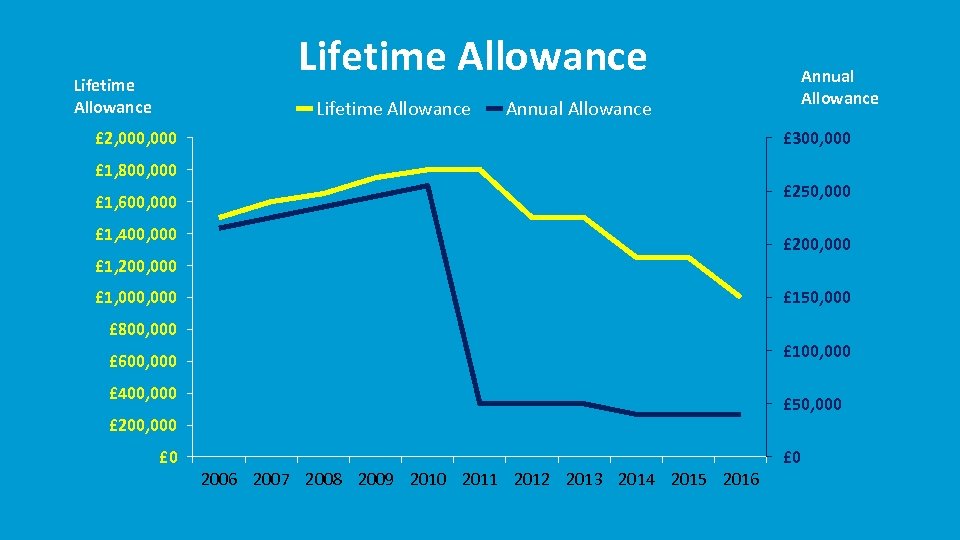

Lifetime Allowance Annual Allowance £ 2, 000 £ 300, 000 £ 1, 800, 000 £ 250, 000 £ 1, 600, 000 £ 1, 400, 000 £ 200, 000 £ 1, 000, 000 £ 150, 000 £ 800, 000 £ 100, 000 £ 600, 000 £ 400, 000 £ 50, 000 £ 200, 000 £ 0 Annual Allowance 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 £ 0

Lifetime Allowance Annual Allowance £ 2, 000 £ 300, 000 £ 1, 800, 000 £ 250, 000 £ 1, 600, 000 £ 1, 400, 000 £ 200, 000 £ 1, 000, 000 £ 150, 000 £ 800, 000 £ 100, 000 £ 600, 000 £ 400, 000 £ 50, 000 £ 200, 000 £ 0 Annual Allowance 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 £ 0

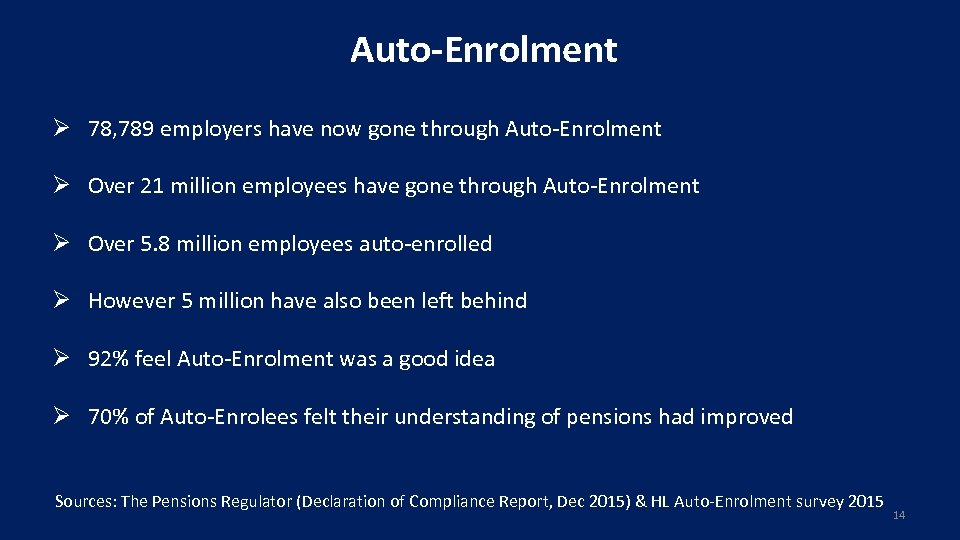

Auto-Enrolment Ø 78, 789 employers have now gone through Auto-Enrolment Ø Over 21 million employees have gone through Auto-Enrolment Ø Over 5. 8 million employees auto-enrolled Ø However 5 million have also been left behind Ø 92% feel Auto-Enrolment was a good idea Ø 70% of Auto-Enrolees felt their understanding of pensions had improved Sources: The Pensions Regulator (Declaration of Compliance Report, Dec 2015) & HL Auto-Enrolment survey 2015 14

Auto-Enrolment Ø 78, 789 employers have now gone through Auto-Enrolment Ø Over 21 million employees have gone through Auto-Enrolment Ø Over 5. 8 million employees auto-enrolled Ø However 5 million have also been left behind Ø 92% feel Auto-Enrolment was a good idea Ø 70% of Auto-Enrolees felt their understanding of pensions had improved Sources: The Pensions Regulator (Declaration of Compliance Report, Dec 2015) & HL Auto-Enrolment survey 2015 14

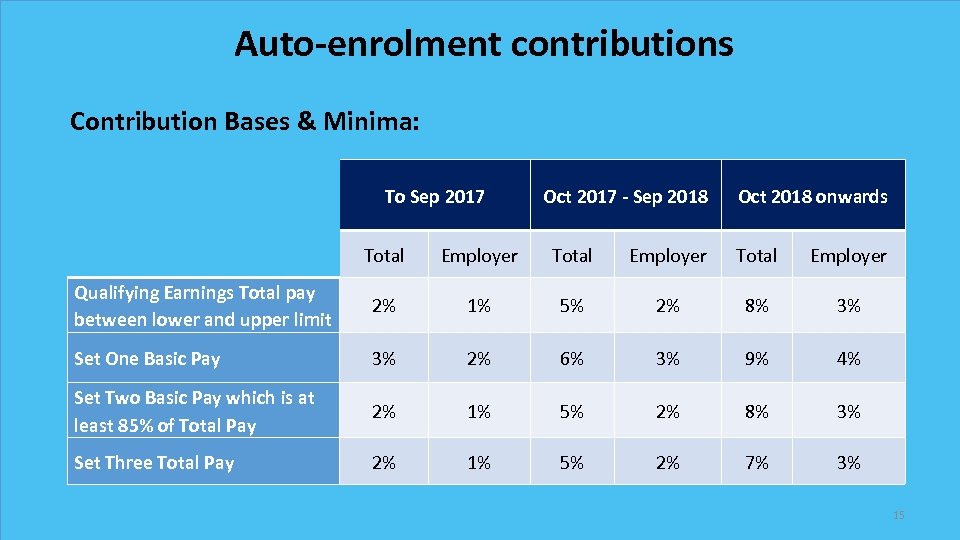

Auto-enrolment contributions Contribution Bases & Minima: To Sep 2017 Oct 2017 - Sep 2018 Oct 2018 onwards Total Employer Qualifying Earnings Total pay between lower and upper limit 2% 1% 5% 2% 8% 3% Set One Basic Pay 3% 2% 6% 3% 9% 4% Set Two Basic Pay which is at least 85% of Total Pay 2% 1% 5% 2% 8% 3% Set Three Total Pay 2% 1% 5% 2% 7% 3% 15

Auto-enrolment contributions Contribution Bases & Minima: To Sep 2017 Oct 2017 - Sep 2018 Oct 2018 onwards Total Employer Qualifying Earnings Total pay between lower and upper limit 2% 1% 5% 2% 8% 3% Set One Basic Pay 3% 2% 6% 3% 9% 4% Set Two Basic Pay which is at least 85% of Total Pay 2% 1% 5% 2% 8% 3% Set Three Total Pay 2% 1% 5% 2% 7% 3% 15

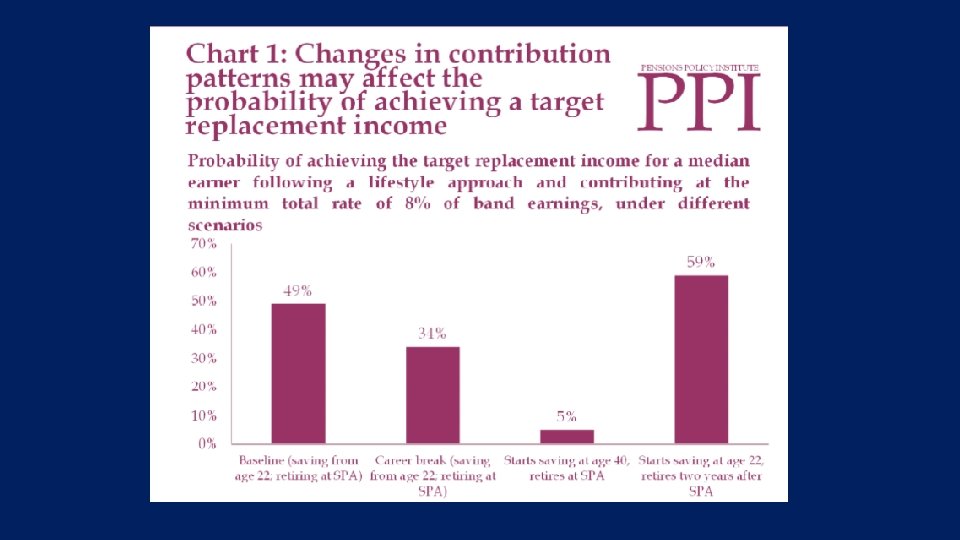

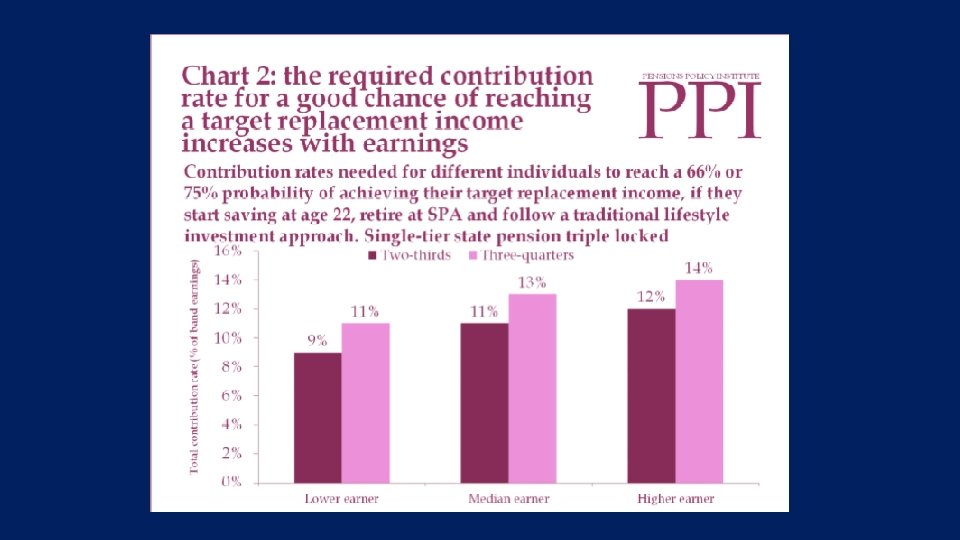

Auto-enrolment contributions 18

Auto-enrolment contributions 18

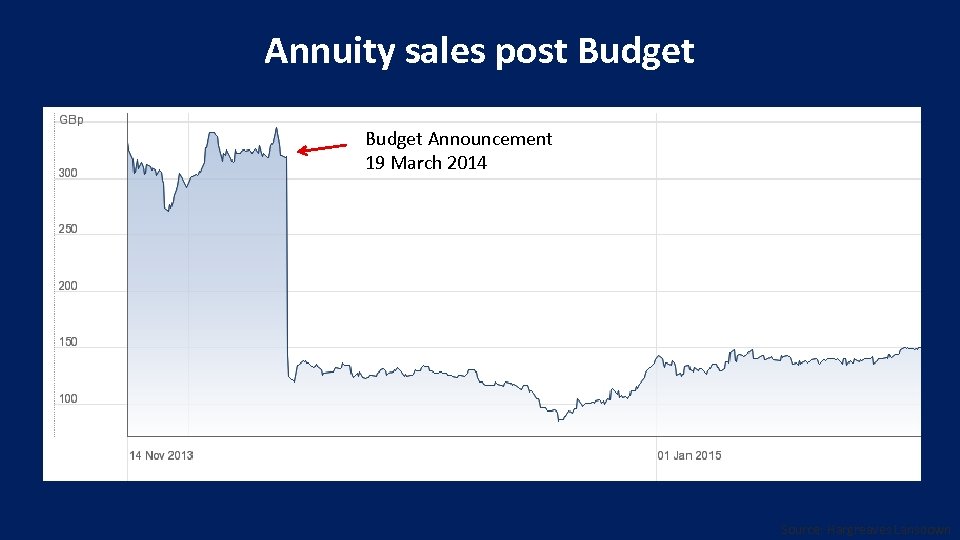

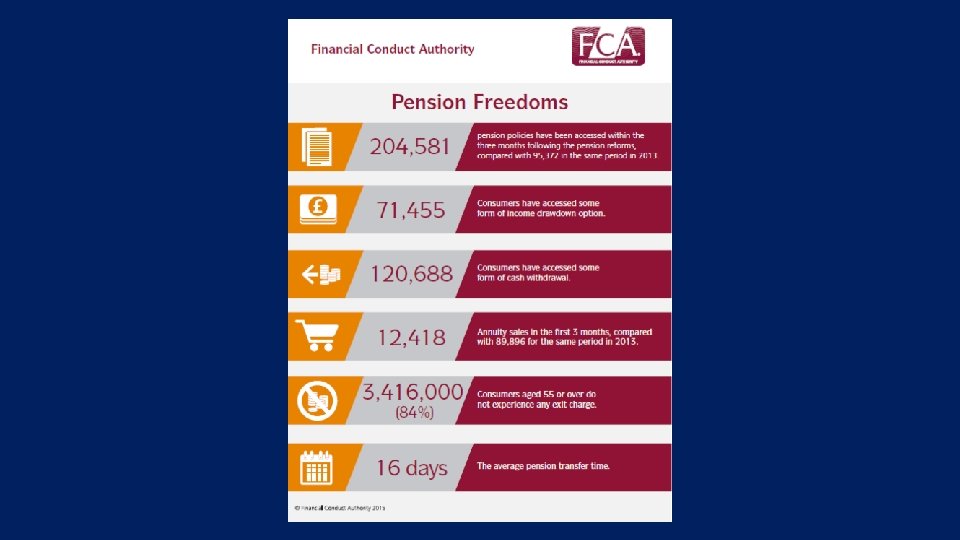

Budget reforms 2014 – Key highlights Ø No compulsion to buy an annuity Ø Free access to pension savings from age 55 Ø Inheritable pension pots Main income options: Full or partial lump sum withdrawal (UFPLS) Income drawdown Annuity purchase Blend of the above 19

Budget reforms 2014 – Key highlights Ø No compulsion to buy an annuity Ø Free access to pension savings from age 55 Ø Inheritable pension pots Main income options: Full or partial lump sum withdrawal (UFPLS) Income drawdown Annuity purchase Blend of the above 19

Annuity sales post Budget Announcement 19 March 2014 Source: Hargreaves Lansdown

Annuity sales post Budget Announcement 19 March 2014 Source: Hargreaves Lansdown

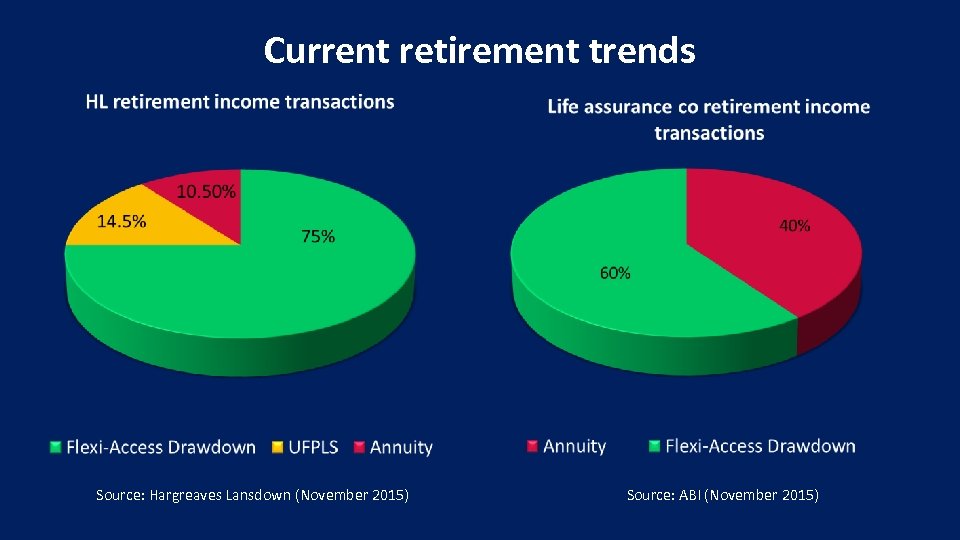

Current retirement trends Source: Hargreaves Lansdown (November 2015) Source: ABI (November 2015)

Current retirement trends Source: Hargreaves Lansdown (November 2015) Source: ABI (November 2015)

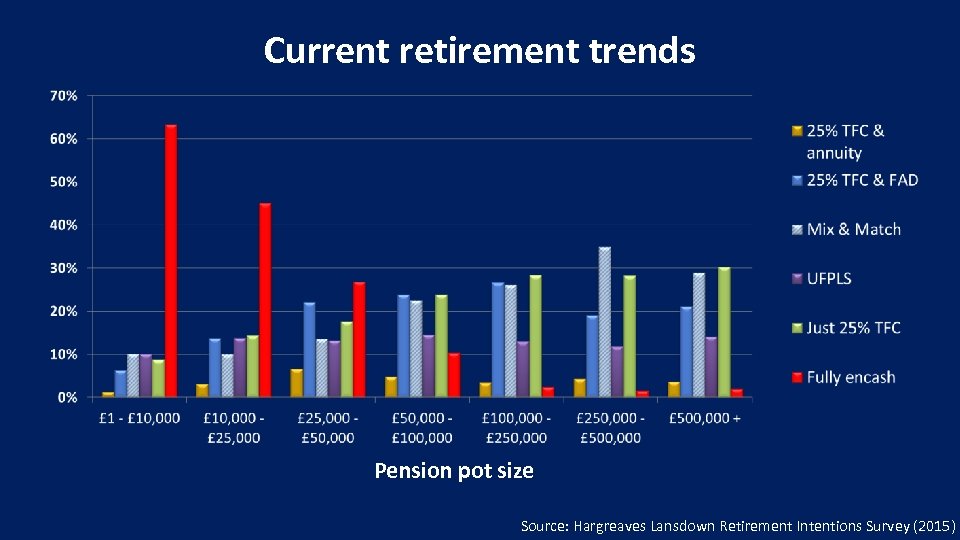

Current retirement trends Pension pot size Source: Hargreaves Lansdown Retirement Intentions Survey (2015)

Current retirement trends Pension pot size Source: Hargreaves Lansdown Retirement Intentions Survey (2015)

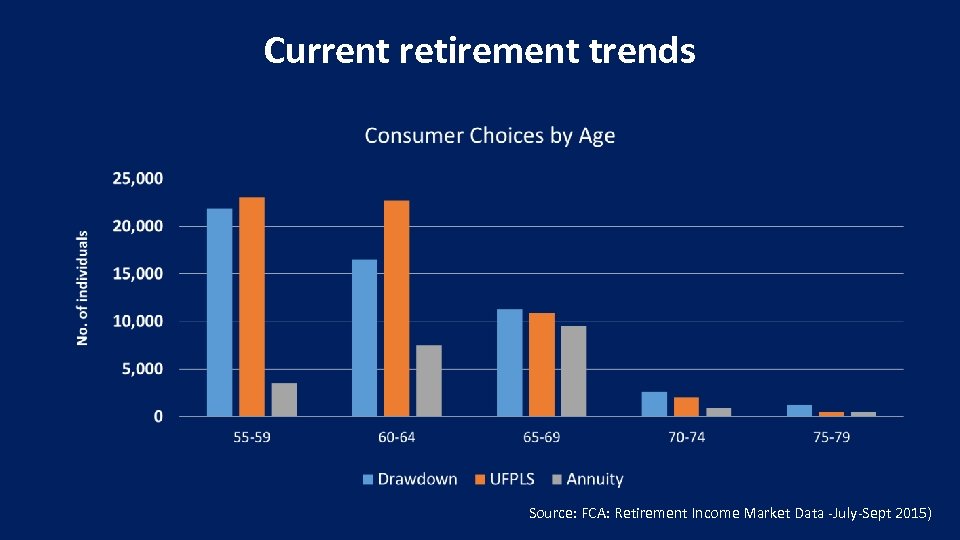

Current retirement trends Source: FCA: Retirement Income Market Data -July-Sept 2015)

Current retirement trends Source: FCA: Retirement Income Market Data -July-Sept 2015)

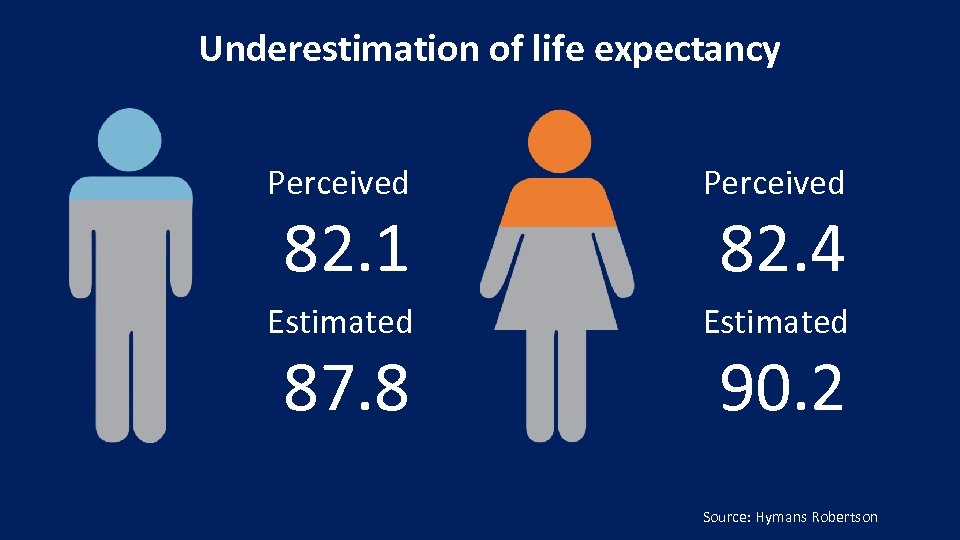

Underestimation of life expectancy Perceived Estimated 82. 1 87. 8 82. 4 90. 2 Source: Hymans Robertson

Underestimation of life expectancy Perceived Estimated 82. 1 87. 8 82. 4 90. 2 Source: Hymans Robertson

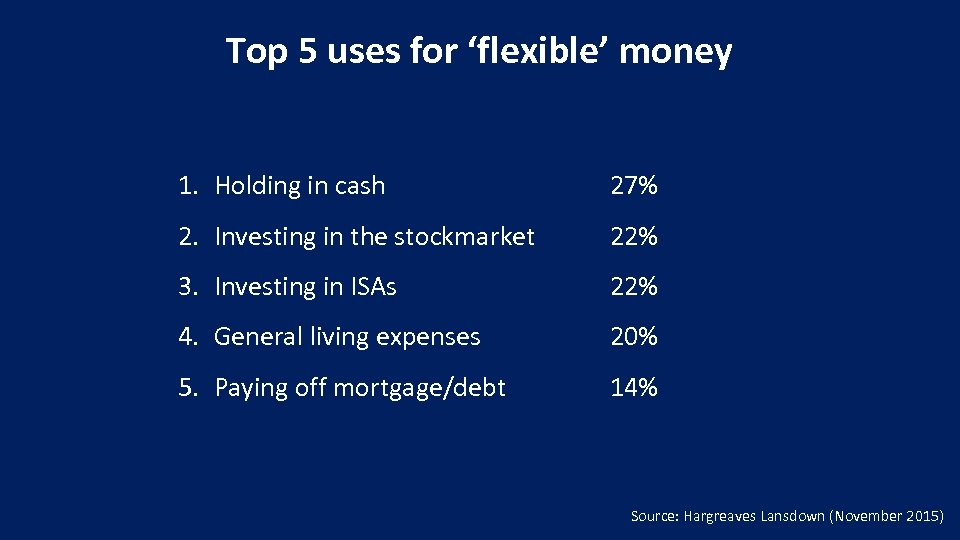

Top 5 uses for ‘flexible’ money 1. Holding in cash 27% 2. Investing in the stockmarket 22% 3. Investing in ISAs 22% 4. General living expenses 20% 5. Paying off mortgage/debt 14% Source: Hargreaves Lansdown (November 2015)

Top 5 uses for ‘flexible’ money 1. Holding in cash 27% 2. Investing in the stockmarket 22% 3. Investing in ISAs 22% 4. General living expenses 20% 5. Paying off mortgage/debt 14% Source: Hargreaves Lansdown (November 2015)

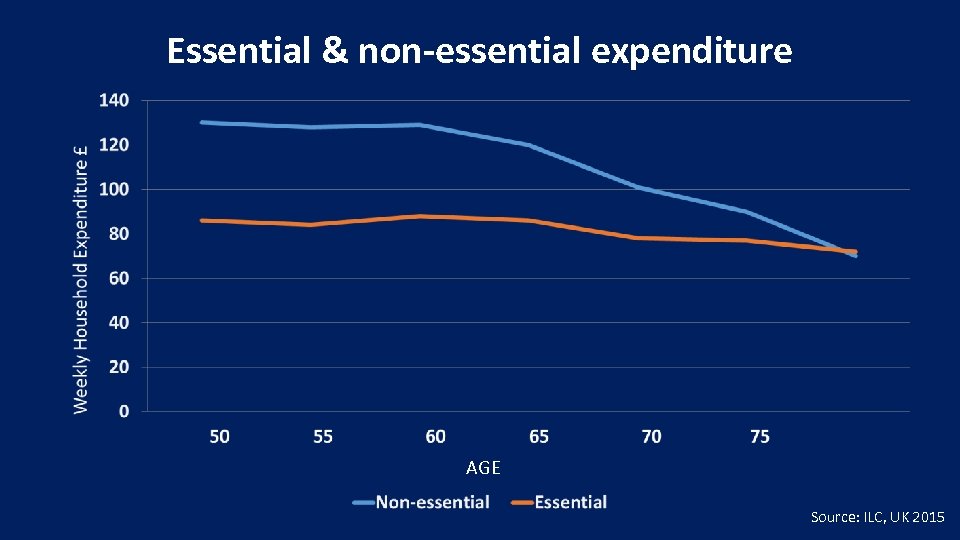

Essential & non-essential expenditure AGE Source: ILC, UK 2015

Essential & non-essential expenditure AGE Source: ILC, UK 2015

Pension Wise

Pension Wise

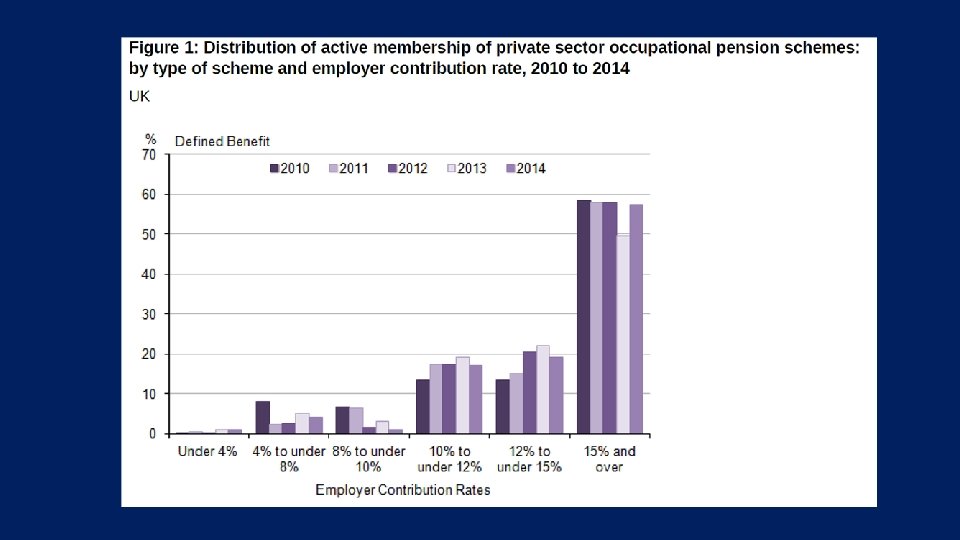

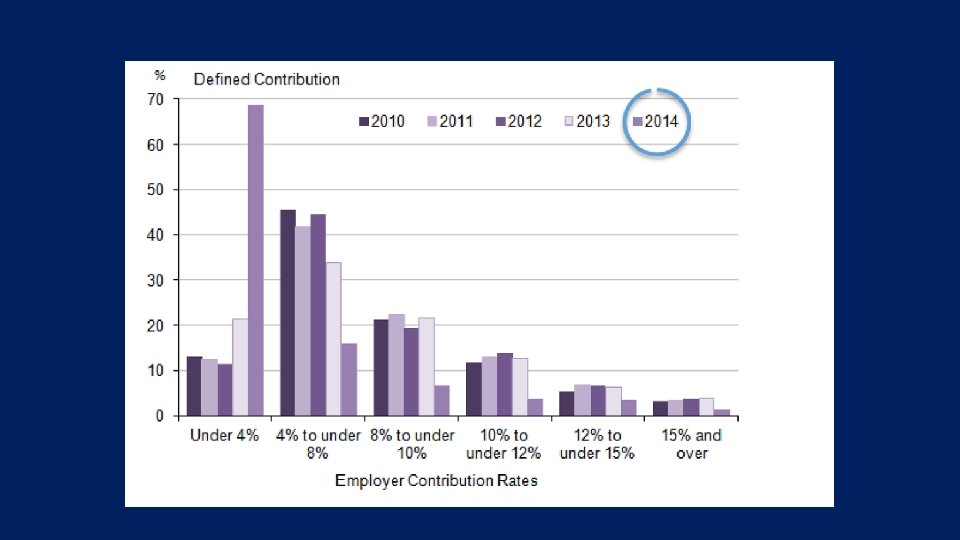

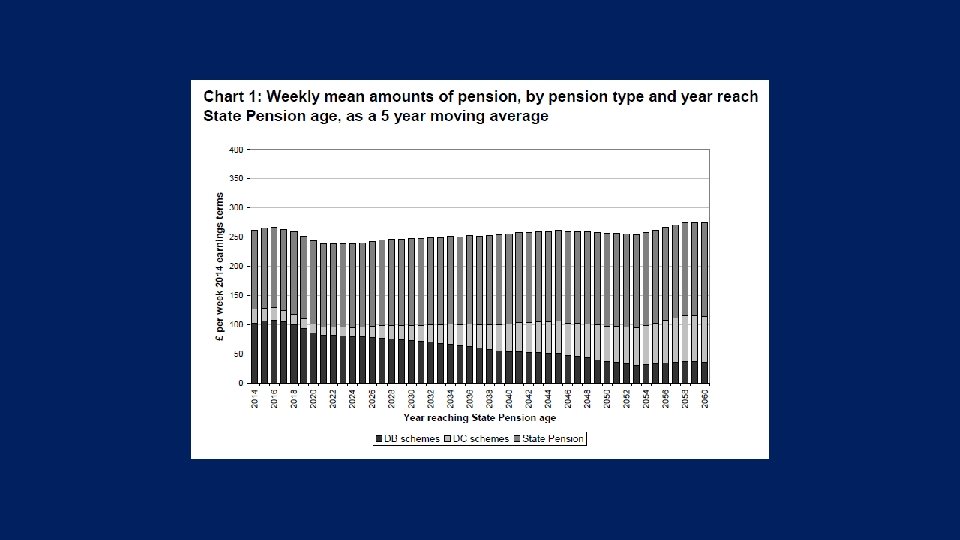

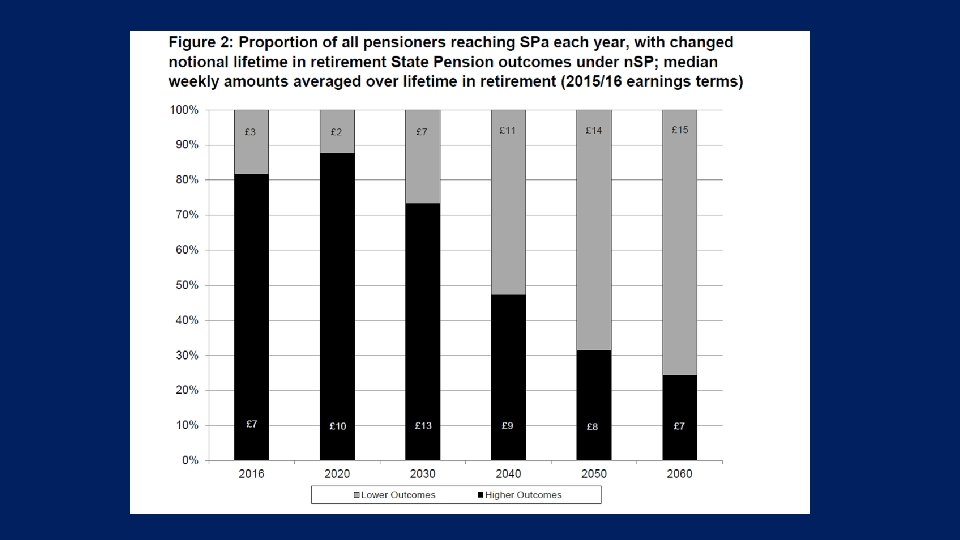

Summary Ø UK pension provision is changing very rapidly Ø Pension Freedom, Auto-enrolment, Pension Tax Review, State Pension Reform Ø Overall provision is currently declining Ø Funding rates have to imcrease substantially 32

Summary Ø UK pension provision is changing very rapidly Ø Pension Freedom, Auto-enrolment, Pension Tax Review, State Pension Reform Ø Overall provision is currently declining Ø Funding rates have to imcrease substantially 32