0db88b00693bcdf96f5c5f4ba9b5d3ab.ppt

- Количество слайдов: 11

Pension and Post Retirement Medical Benefits

Rich Heritage of OIL · Independent India’s first commercial oil discoveries were made by Assam Oil Company – Nahorkatiya, Assam – 1953 – Moran, Assam – 1956 · Incorporated as Joint Sector Company on 18 February, 1959 – 2/3 rd Owned by Assam Oil Company (Burmah Oil Company) – 1/3 rd Owned by Government of India · Became a Public Sector Undertaking, GOI on 14 October, 1981 2

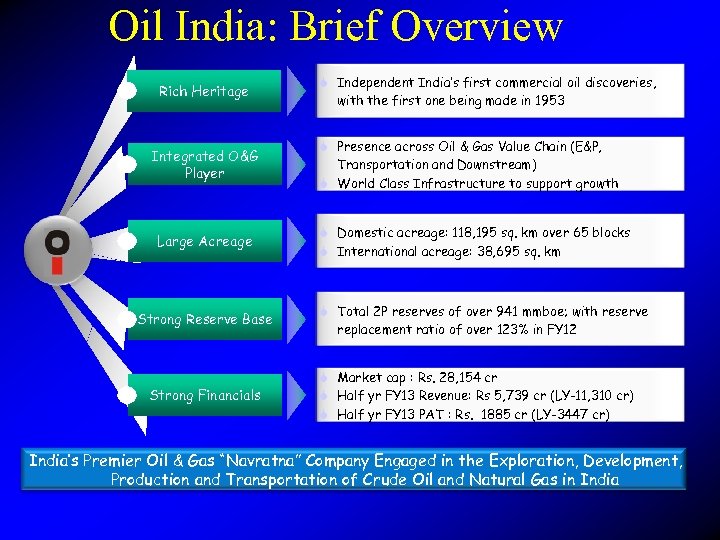

Oil India: Brief Overview Rich Heritage Integrated O&G Player Large Acreage Strong Reserve Base Strong Financials S Independent India’s first commercial oil discoveries, with the first one being made in 1953 S Presence across Oil & Gas Value Chain (E&P, Transportation and Downstream) S World Class Infrastructure to support growth S Domestic acreage: 118, 195 sq. km over 65 blocks S International acreage: 38, 695 sq. km S Total 2 P reserves of over 941 mmboe; with reserve replacement ratio of over 123% in FY 12 S Market cap : Rs. 28, 154 cr S Half yr FY 13 Revenue: Rs 5, 739 cr (LY-11, 310 cr) S Half yr FY 13 PAT : Rs. 1885 cr (LY-3447 cr) India’s Premier Oil & Gas “Navratna” Company Engaged in the Exploration, Development, Production and Transportation of Crude Oil and Natural Gas in India

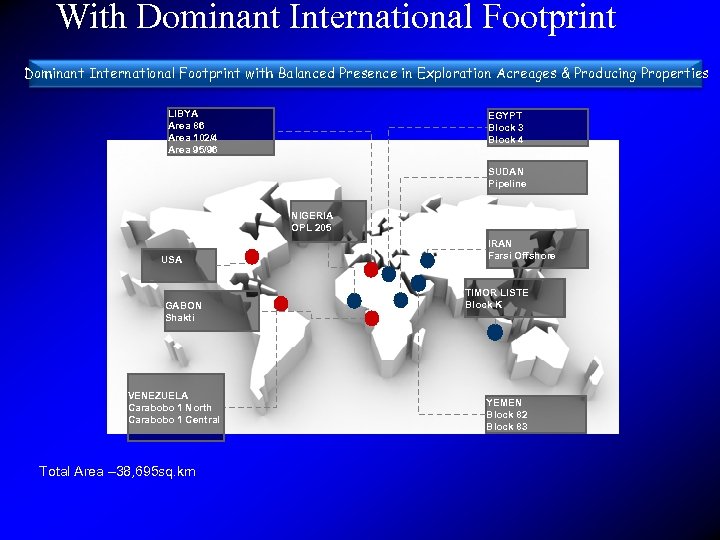

With Dominant International Footprint with Balanced Presence in Exploration Acreages & Producing Properties LIBYA Area 86 Area 102/4 Area 95/96 EGYPT Block 3 Block 4 SUDAN Pipeline NIGERIA OPL 205 USA GABON Shakti VENEZUELA Carabobo 1 North Carabobo 1 Central Total Area – 38, 695 sq. km IRAN Farsi Offshore TIMOR LISTE Block K YEMEN Block 82 Block 83

An Integrated Oil Company Drilling Seismic API (2 D&3 D) Wireline Logging In-House Expertise Transportation Outsource expertise & services as and when required (to supplement) IOR/EOR Field / Reservoir Management Field Development Production OIL is a fully self-serviced E&P company

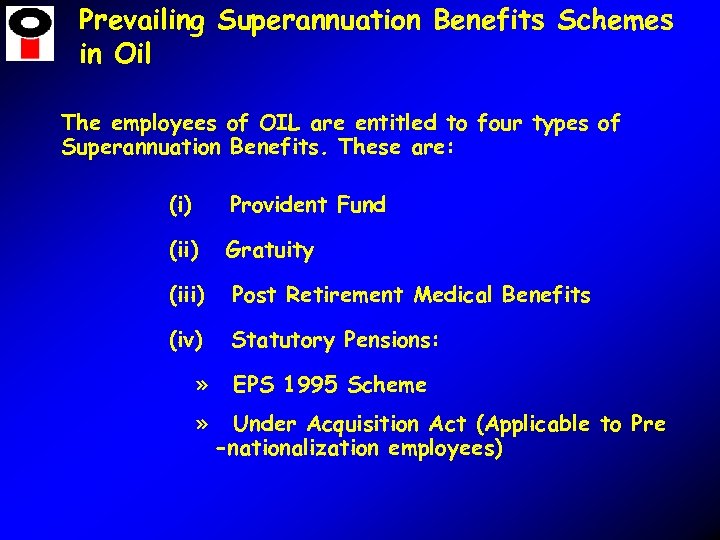

Prevailing Superannuation Benefits Schemes in Oil The employees of OIL are entitled to four types of Superannuation Benefits. These are: (i) Provident Fund (ii) Gratuity (iii) Post Retirement Medical Benefits (iv) Statutory Pensions: » » EPS 1995 Scheme Under Acquisition Act (Applicable to Pre -nationalization employees)

Scheme under EPS 95 -Oil India Employees’ Pension Scheme (OIEPS): ØEmployees Pension Scheme, 1995 (EPS-95) was introduced in OIL under EPF and MP Act 1952. Ø Applicable to all establishments to which the Employees’ Provident Fund and Miscellaneous Provisions Act 1952 apply. ØIs extended to employees of OIL through an exempted trust fund managed in house.

Scheme under the Acquisition Act- Oil India Pension Scheme: ØOn 14 th October, 1981, OIL was nationalized under the following Act (referred to as ‘the Acquisition Act”): ØThe Burmah Oil Co. [Acquisition of Shares of Oil India Limited and of the undertaking in India of Assam Oil Company Limited and the Burmah Oil Co. Ltd. (India Trading) Limited] Act, 1981. ØThe Acquisition Act stipulated as under: ØPension benefits (40% of average pensionable salary of last 10 months) for employees existing then in OIL must be continued as if there was no nationalization. ØThe rights and interests of the beneficiaries were not to be in any way prejudiced or diminished. ØThere are 1095 members as on 31. 03. 2012. ØWill cease to exist after retirement of the last eligible i. e. joined on or before 13. 10. 1981 person.

Post Retirement Medical Benefit Scheme: Ø Post retirement medical benefits is extended to retired employees and their spouse. ØThe benefits are similar to that extended to serving employees. ØThe retired employees have to subscribe by paying a nominal contribution for availing the benefits.

Proposed New Defined Contribution Pension Scheme: • New Scheme as per DPE guidelines is being formulated. • It has been found that there is gap of around 14% on an average after adjusting from 30% of basic +DA contribution towards PF, Gratuity, Post retirement medical benefit as per actuarial valuation. • The scheme will be put up to Mo. P&NG after obtaining approval from OIL Board.

0db88b00693bcdf96f5c5f4ba9b5d3ab.ppt