a9da7c9d04d79312b9fac535557cb754.ppt

- Количество слайдов: 15

PEER REVIEW Introduction, Concept & Reporting By CA Mohan Sanzgiri --- Mg. Partner: - Sanzgiri Acharya & Associates CAs

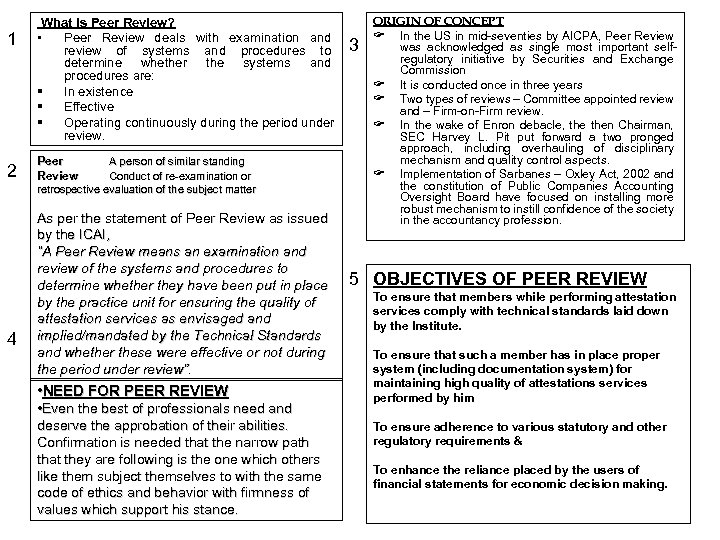

1 2 4 What is Peer Review? • Peer Review deals with examination and review of systems and procedures to determine whether the systems and procedures are: In existence Effective Operating continuously during the period under review. Peer Review A person of similar standing Conduct of re-examination or retrospective evaluation of the subject matter As per the statement of Peer Review as issued by the ICAI, “A Peer Review means an examination and review of the systems and procedures to determine whether they have been put in place by the practice unit for ensuring the quality of attestation services as envisaged and implied/mandated by the Technical Standards and whether these were effective or not during the period under review”. • NEED FOR PEER REVIEW • Even the best of professionals need and deserve the approbation of their abilities. Confirmation is needed that the narrow path that they are following is the one which others like them subject themselves to with the same code of ethics and behavior with firmness of values which support his stance. 3 ORIGIN OF CONCEPT In the US in mid-seventies by AICPA, Peer Review was acknowledged as single most important selfregulatory initiative by Securities and Exchange Commission It is conducted once in three years Two types of reviews – Committee appointed review and – Firm-on-Firm review. In the wake of Enron debacle, then Chairman, SEC Harvey L. Pit put forward a two pronged approach, including overhauling of disciplinary mechanism and quality control aspects. Implementation of Sarbanes – Oxley Act, 2002 and the constitution of Public Companies Accounting Oversight Board have focused on installing more robust mechanism to instill confidence of the society in the accountancy profession. 5 OBJECTIVES OF PEER REVIEW To ensure that members while performing attestation services comply with technical standards laid down by the Institute. To ensure that such a member has in place proper system (including documentation system) for maintaining high quality of attestations services performed by him To ensure adherence to various statutory and other regulatory requirements & To enhance the reliance placed by the users of financial statements for economic decision making.

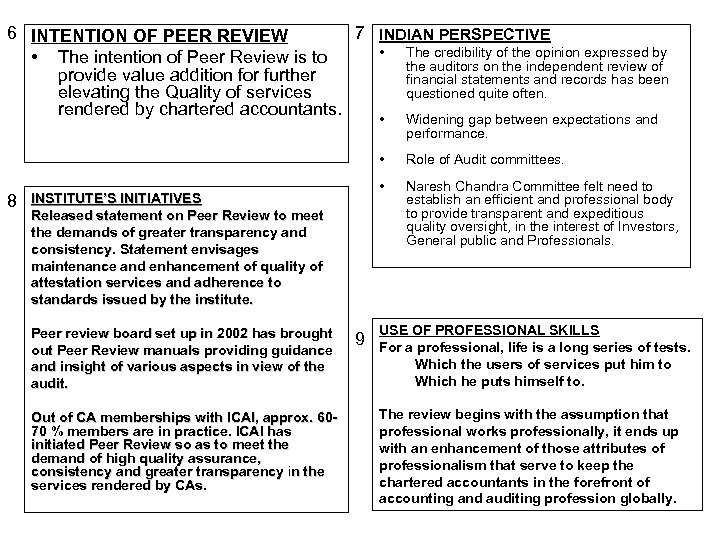

6 INTENTION OF PEER REVIEW 7 INDIAN PERSPECTIVE • The credibility of the opinion expressed by • The intention of Peer Review is to the auditors on the independent review of provide value addition for further financial statements and records has been questioned quite often. elevating the Quality of services rendered by chartered accountants. • • 8 Peer review board set up in 2002 has brought out Peer Review manuals providing guidance and insight of various aspects in view of the audit. Out of CA memberships with ICAI, approx. 6070 % members are in practice. ICAI has initiated Peer Review so as to meet the demand of high quality assurance, consistency and greater transparency in the services rendered by CAs. 9 Role of Audit committees. • INSTITUTE’S INITIATIVES Released statement on Peer Review to meet the demands of greater transparency and consistency. Statement envisages maintenance and enhancement of quality of attestation services and adherence to standards issued by the institute. Widening gap between expectations and performance. Naresh Chandra Committee felt need to establish an efficient and professional body to provide transparent and expeditious quality oversight, in the interest of Investors, General public and Professionals. USE OF PROFESSIONAL SKILLS For a professional, life is a long series of tests. Which the users of services put him to Which he puts himself to. The review begins with the assumption that professional works professionally, it ends up with an enhancement of those attributes of professionalism that serve to keep the chartered accountants in the forefront of accounting and auditing profession globally.

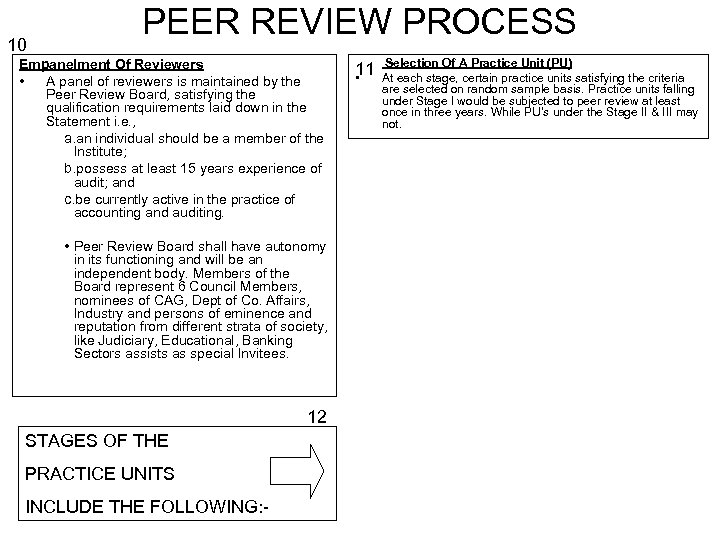

10 PEER REVIEW PROCESS Empanelment Of Reviewers • A panel of reviewers is maintained by the Peer Review Board, satisfying the qualification requirements laid down in the Statement i. e. , a. an individual should be a member of the Institute; b. possess at least 15 years experience of audit; and c. be currently active in the practice of accounting and auditing. • Peer Review Board shall have autonomy in its functioning and will be an independent body. Members of the Board represent 6 Council Members, nominees of CAG, Dept of Co. Affairs, Industry and persons of eminence and reputation from different strata of society, like Judiciary, Educational, Banking Sectors assists as special Invitees. 12 STAGES OF THE PRACTICE UNITS INCLUDE THE FOLLOWING: - 11 • Selection Of A Practice Unit (PU) At each stage, certain practice units satisfying the criteria are selected on random sample basis. Practice units falling under Stage I would be subjected to peer review at least once in three years. While PU’s under the Stage II & III may not.

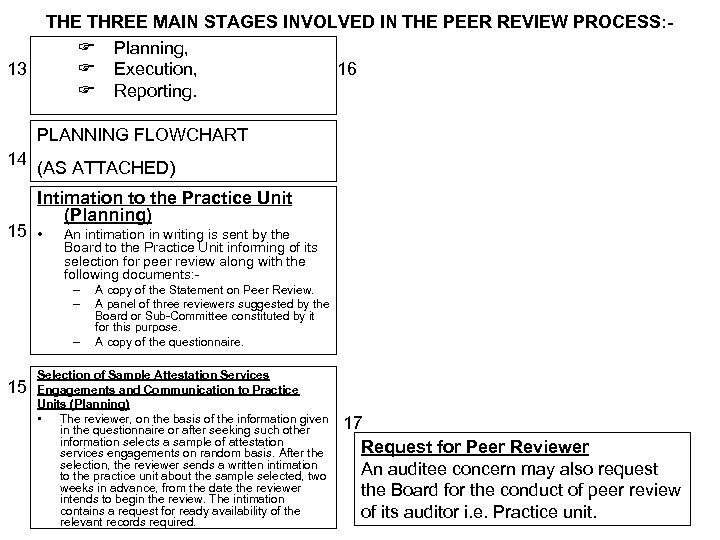

THE THREE MAIN STAGES INVOLVED IN THE PEER REVIEW PROCESS: Planning, 16 Execution, Reporting. 13 PLANNING FLOWCHART 14 (AS ATTACHED) Intimation to the Practice Unit (Planning) 15 • An intimation in writing is sent by the Board to the Practice Unit informing of its selection for peer review along with the following documents: – – – 15 A copy of the Statement on Peer Review. A panel of three reviewers suggested by the Board or Sub-Committee constituted by it for this purpose. A copy of the questionnaire. Selection of Sample Attestation Services Engagements and Communication to Practice Units (Planning) • The reviewer, on the basis of the information given in the questionnaire or after seeking such other information selects a sample of attestation services engagements on random basis. After the selection, the reviewer sends a written intimation to the practice unit about the sample selected, two weeks in advance, from the date the reviewer intends to begin the review. The intimation contains a request for ready availability of the relevant records required. 17 Request for Peer Reviewer An auditee concern may also request the Board for the conduct of peer review of its auditor i. e. Practice unit.

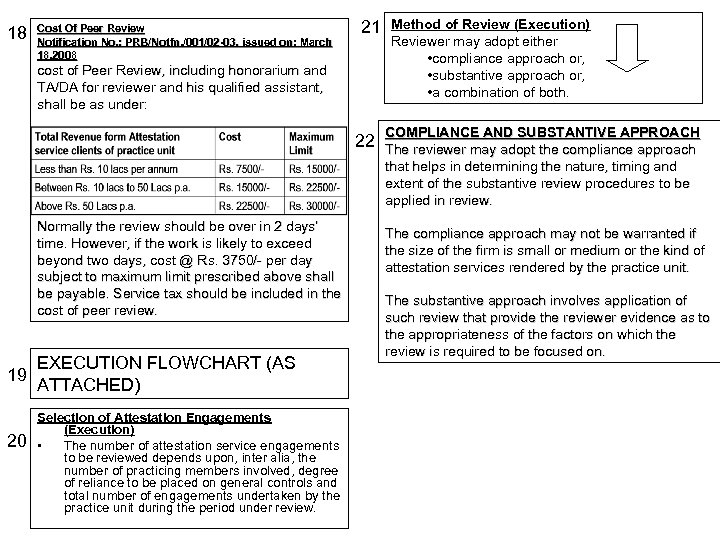

18 Cost Of Peer Review Notification No. : PRB/Notfn. /001/02 -03, issued on: March 18, 2008 21 cost of Peer Review, including honorarium and TA/DA for reviewer and his qualified assistant, shall be as under: 22 Normally the review should be over in 2 days’ time. However, if the work is likely to exceed beyond two days, cost @ Rs. 3750/- per day subject to maximum limit prescribed above shall be payable. Service tax should be included in the cost of peer review. 19 20 EXECUTION FLOWCHART (AS ATTACHED) Selection of Attestation Engagements (Execution) • The number of attestation service engagements to be reviewed depends upon, inter alia, the number of practicing members involved, degree of reliance to be placed on general controls and total number of engagements undertaken by the practice unit during the period under review. Method of Review (Execution) Reviewer may adopt either • compliance approach or, • substantive approach or, • a combination of both. COMPLIANCE AND SUBSTANTIVE APPROACH The reviewer may adopt the compliance approach that helps in determining the nature, timing and extent of the substantive review procedures to be applied in review. The compliance approach may not be warranted if the size of the firm is small or medium or the kind of attestation services rendered by the practice unit. The substantive approach involves application of such review that provide the reviewer evidence as to the appropriateness of the factors on which the review is required to be focused on.

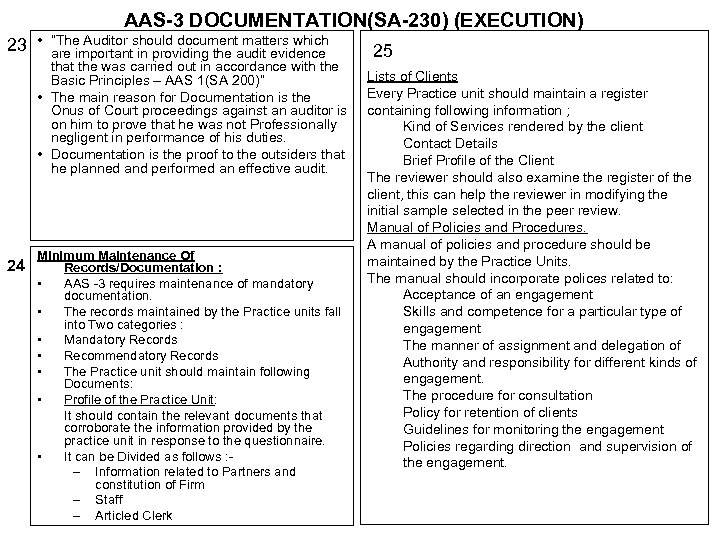

AAS-3 DOCUMENTATION(SA-230) (EXECUTION) 23 • “The Auditor should document matters which are important in providing the audit evidence that the was carried out in accordance with the Basic Principles – AAS 1(SA 200)” • The main reason for Documentation is the Onus of Court proceedings against an auditor is on him to prove that he was not Professionally negligent in performance of his duties. • Documentation is the proof to the outsiders that he planned and performed an effective audit. 24 Minimum Maintenance Of Records/Documentation : • AAS -3 requires maintenance of mandatory documentation. • The records maintained by the Practice units fall into Two categories : • Mandatory Records • Recommendatory Records • The Practice unit should maintain following Documents: • Profile of the Practice Unit: It should contain the relevant documents that corroborate the information provided by the practice unit in response to the questionnaire. • It can be Divided as follows : – Information related to Partners and constitution of Firm – Staff – Articled Clerk 25 Lists of Clients Every Practice unit should maintain a register containing following information ; Kind of Services rendered by the client Contact Details Brief Profile of the Client The reviewer should also examine the register of the client, this can help the reviewer in modifying the initial sample selected in the peer review. Manual of Policies and Procedures. A manual of policies and procedure should be maintained by the Practice Units. The manual should incorporate polices related to: Acceptance of an engagement Skills and competence for a particular type of engagement The manner of assignment and delegation of Authority and responsibility for different kinds of engagement. The procedure for consultation Policy for retention of clients Guidelines for monitoring the engagement Policies regarding direction and supervision of the engagement.

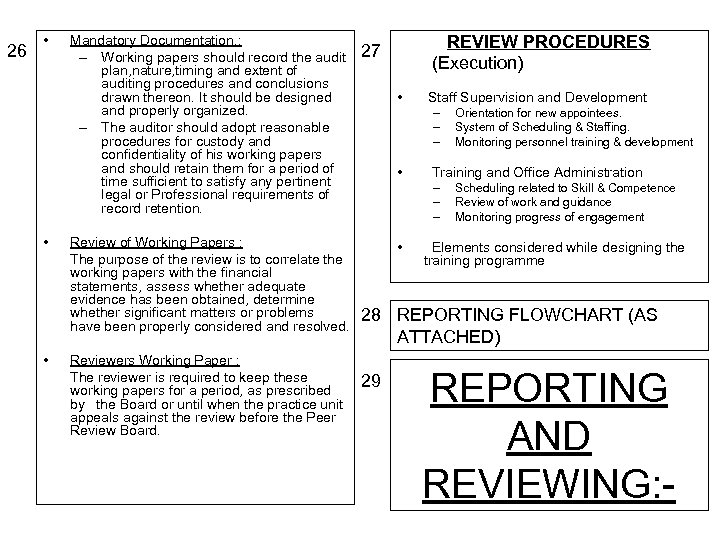

26 • • • Mandatory Documentation. : – Working papers should record the audit plan, nature, timing and extent of auditing procedures and conclusions drawn thereon. It should be designed and properly organized. – The auditor should adopt reasonable procedures for custody and confidentiality of his working papers and should retain them for a period of time sufficient to satisfy any pertinent legal or Professional requirements of record retention. Review of Working Papers : The purpose of the review is to correlate the working papers with the financial statements, assess whether adequate evidence has been obtained, determine whether significant matters or problems have been properly considered and resolved. Reviewers Working Paper : The reviewer is required to keep these working papers for a period, as prescribed by the Board or until when the practice unit appeals against the review before the Peer Review Board. REVIEW PROCEDURES (Execution) 27 • Staff Supervision and Development – – – • Training and Office Administration – – – • Orientation for new appointees. System of Scheduling & Staffing. Monitoring personnel training & development Scheduling related to Skill & Competence Review of work and guidance Monitoring progress of engagement Elements considered while designing the training programme 28 REPORTING FLOWCHART (AS ATTACHED) 29 REPORTING AND REVIEWING: -

30 31 REPORTS AT VARIOUS STAGES

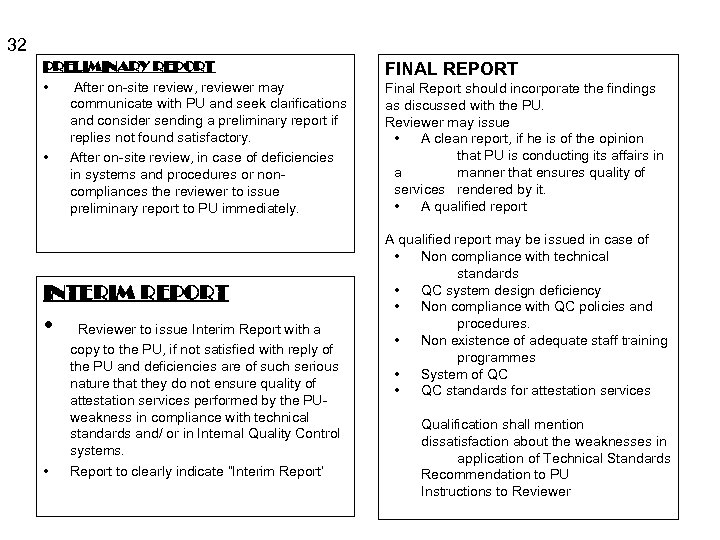

32 PRELIMINARY REPORT • After on-site review, reviewer may communicate with PU and seek clarifications and consider sending a preliminary report if replies not found satisfactory. • After on-site review, in case of deficiencies in systems and procedures or noncompliances the reviewer to issue preliminary report to PU immediately. INTERIM REPORT • • Reviewer to issue Interim Report with a copy to the PU, if not satisfied with reply of the PU and deficiencies are of such serious nature that they do not ensure quality of attestation services performed by the PUweakness in compliance with technical standards and/ or in Internal Quality Control systems. Report to clearly indicate “Interim Report’ FINAL REPORT Final Report should incorporate the findings as discussed with the PU. Reviewer may issue • A clean report, if he is of the opinion that PU is conducting its affairs in a manner that ensures quality of services rendered by it. • A qualified report may be issued in case of • Non compliance with technical standards • QC system design deficiency • Non compliance with QC policies and procedures. • Non existence of adequate staff training programmes • System of QC • QC standards for attestation services Qualification shall mention dissatisfaction about the weaknesses in application of Technical Standards Recommendation to PU Instructions to Reviewer

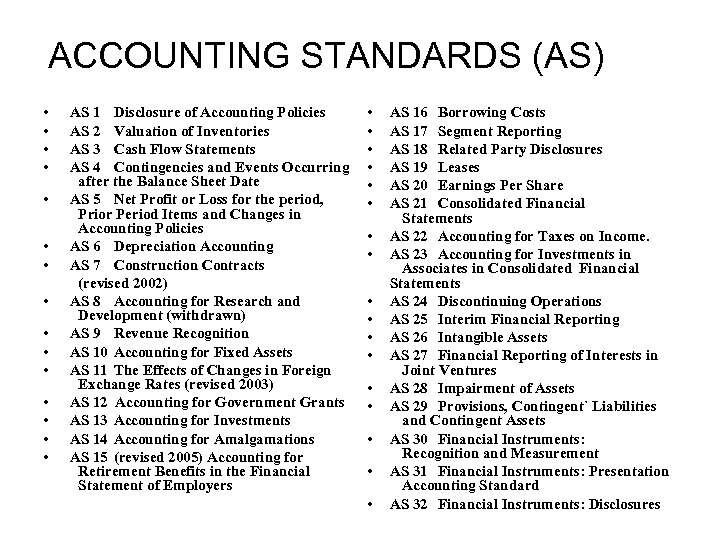

ACCOUNTING STANDARDS (AS) • • • • AS 1 Disclosure of Accounting Policies AS 2 Valuation of Inventories AS 3 Cash Flow Statements AS 4 Contingencies and Events Occurring after the Balance Sheet Date AS 5 Net Profit or Loss for the period, Prior Period Items and Changes in Accounting Policies AS 6 Depreciation Accounting AS 7 Construction Contracts (revised 2002) AS 8 Accounting for Research and Development (withdrawn) AS 9 Revenue Recognition AS 10 Accounting for Fixed Assets AS 11 The Effects of Changes in Foreign Exchange Rates (revised 2003) AS 12 Accounting for Government Grants AS 13 Accounting for Investments AS 14 Accounting for Amalgamations AS 15 (revised 2005) Accounting for Retirement Benefits in the Financial Statement of Employers • • • • • AS 16 Borrowing Costs AS 17 Segment Reporting AS 18 Related Party Disclosures AS 19 Leases AS 20 Earnings Per Share AS 21 Consolidated Financial Statements AS 22 Accounting for Taxes on Income. AS 23 Accounting for Investments in Associates in Consolidated Financial Statements AS 24 Discontinuing Operations AS 25 Interim Financial Reporting AS 26 Intangible Assets AS 27 Financial Reporting of Interests in Joint Ventures AS 28 Impairment of Assets AS 29 Provisions, Contingent` Liabilities and Contingent Assets AS 30 Financial Instruments: Recognition and Measurement AS 31 Financial Instruments: Presentation Accounting Standard AS 32 Financial Instruments: Disclosures

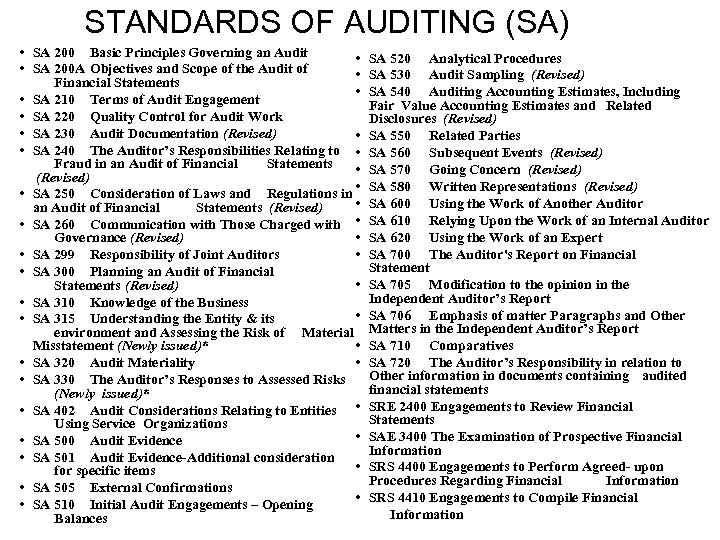

STANDARDS OF AUDITING (SA) • SA 200 Basic Principles Governing an Audit • • SA 200 A Objectives and Scope of the Audit of • Financial Statements • • SA 210 Terms of Audit Engagement • SA 220 Quality Control for Audit Work • SA 230 Audit Documentation (Revised) • • SA 240 The Auditor’s Responsibilities Relating to • Fraud in an Audit of Financial Statements • (Revised) • • SA 250 Consideration of Laws and Regulations in • an Audit of Financial Statements (Revised) • SA 260 Communication with Those Charged with • • Governance (Revised) • • SA 299 Responsibility of Joint Auditors • SA 300 Planning an Audit of Financial • Statements (Revised) • SA 310 Knowledge of the Business • • SA 315 Understanding the Entity & its environment and Assessing the Risk of Material • Misstatement (Newly issued)* • • SA 320 Audit Materiality • SA 330 The Auditor’s Responses to Assessed Risks (Newly issued)* • SA 402 Audit Considerations Relating to Entities • Using Service Organizations • • SA 500 Audit Evidence • SA 501 Audit Evidence-Additional consideration • for specific items • SA 505 External Confirmations • • SA 510 Initial Audit Engagements – Opening Balances SA 520 Analytical Procedures SA 530 Audit Sampling (Revised) SA 540 Auditing Accounting Estimates, Including Fair Value Accounting Estimates and Related Disclosures (Revised) SA 550 Related Parties SA 560 Subsequent Events (Revised) SA 570 Going Concern (Revised) SA 580 Written Representations (Revised) SA 600 Using the Work of Another Auditor SA 610 Relying Upon the Work of an Internal Auditor SA 620 Using the Work of an Expert SA 700 The Auditor's Report on Financial Statement SA 705 Modification to the opinion in the Independent Auditor’s Report SA 706 Emphasis of matter Paragraphs and Other Matters in the Independent Auditor’s Report SA 710 Comparatives SA 720 The Auditor’s Responsibility in relation to Other information in documents containing audited financial statements SRE 2400 Engagements to Review Financial Statements SAE 3400 The Examination of Prospective Financial Information SRS 4400 Engagements to Perform Agreed- upon Procedures Regarding Financial Information SRS 4410 Engagements to Compile Financial Information

35 Confidentiality • • • Reviewer is not supposed to keep any paper(s) – original or photocopy, of practice unit. He can retain only his working papers. Reviewer is bound by the code of ethics and ‘Secrecy Provision’ enshrined in the Statement of Peer Review. The Reviewer, his assistant, if any, has to sign statement of confidentiality, before commencing the review. All Board Members and officers staff assisting the Board are also subject to similar Statement of Confidentiality. 36 Certificate of Peer Review • 37 On the basis of the report submitted by the Reviewer, the Board shall issue a Certificate to the Practice Unit. TIME BUDGET • Time is of vital importance in all audit work. The partner must control it firmly, as assistants are liable to take up more time than originally scheduled. Many precious man-hours are lost if a busily occupied senior staff member fails to note that an assistant is wasting time on non-essentials. Again, a senior may lose control by failing to compare the schedule with the complete item of work. • Implementation of time management would be advisable. 38 39 Illustrative Time Schedule of Peer Review Process (As attached) PROFESSIONAL OPPORTUNITIES PROVIDED BY THE PROCESS OF PEER REVIEW • Updation of knowledge and consequently expansion of horizon. Incentive for implementation of the best professional practices by a PU since one’s internal policies and procedures are subject to an independent review. • Enhancement in the quality of members since such a process greatly increases the awareness about the implementation of technical Standards both on the part of the Reviewer and Reviewee. Facilitates networking and affiliation for small and medium PUs. • Continuously reinforce the credibility of the profession and thereby enhance the standing of individual members in the eyes of the society at large. • Certificate of Peer Review would serve as a quality assurance certificate and may invite preferences from regulatory and other authorities while assigning professional work to CAs. Develop competence in the emerging fields (DTC, IFRS, GST, etc. ) and offer value added services

40 38 CONCLUSION: The Reviewers are also advised that the job of a reviewer was not to act as a police inspector but to act as a friend, philosopher and guide and suggest ways and means to improve the quality of services rendered by a professional in his actual day to day work. Under no circumstances, the reviewer shall sit on the professional judgement of his fellow brother, but shall only review the systems and procedures prevailing in a practice unit. Feedback received says that Peer Review has been a mutually beneficial exercise.

Thank You SANZGIRI ACHARYA & ASSOCIATES

a9da7c9d04d79312b9fac535557cb754.ppt