08905c2e6544908f34b5d708de0ea965.ppt

- Количество слайдов: 11

PE INVESTMENT – DISSECTING A TERM SHEET FEBRUARY 2008 Private & Confidential

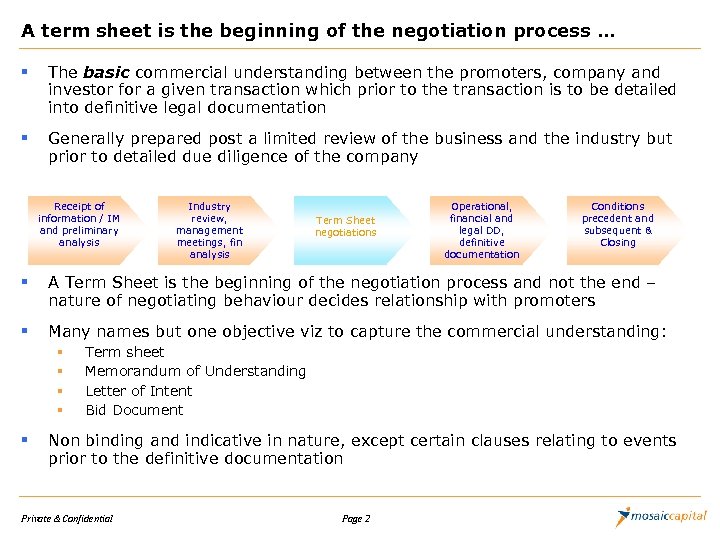

A term sheet is the beginning of the negotiation process … § The basic commercial understanding between the promoters, company and investor for a given transaction which prior to the transaction is to be detailed into definitive legal documentation § Generally prepared post a limited review of the business and the industry but prior to detailed due diligence of the company Receipt of information / IM and preliminary analysis Industry review, management meetings, fin analysis Term Sheet negotiations Operational, financial and legal DD, definitive documentation Conditions precedent and subsequent & Closing § A Term Sheet is the beginning of the negotiation process and not the end – nature of negotiating behaviour decides relationship with promoters § Many names but one objective viz to capture the commercial understanding: § § § Term sheet Memorandum of Understanding Letter of Intent Bid Document Non binding and indicative in nature, except certain clauses relating to events prior to the definitive documentation Private & Confidential Page 2

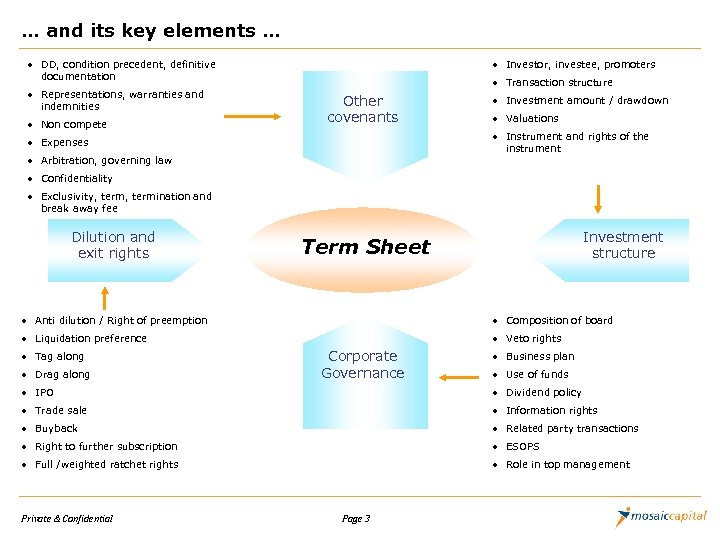

… and its key elements … • DD, condition precedent, definitive documentation • Representations, warranties and indemnities • Non compete • Investor, investee, promoters • Transaction structure Other covenants • Investment amount / drawdown • Valuations • Instrument and rights of the instrument • Expenses • Arbitration, governing law • Confidentiality • Exclusivity, termination and break away fee Dilution and exit rights Investment structure Term Sheet • Anti dilution / Right of preemption • Composition of board • Liquidation preference • Veto rights • Tag along • Drag along Corporate Governance • Business plan • Use of funds • IPO • Dividend policy • Trade sale • Information rights • Buyback • Related party transactions • Right to further subscription • ESOPS • Full /weighted ratchet rights • Role in top management Private & Confidential Page 3

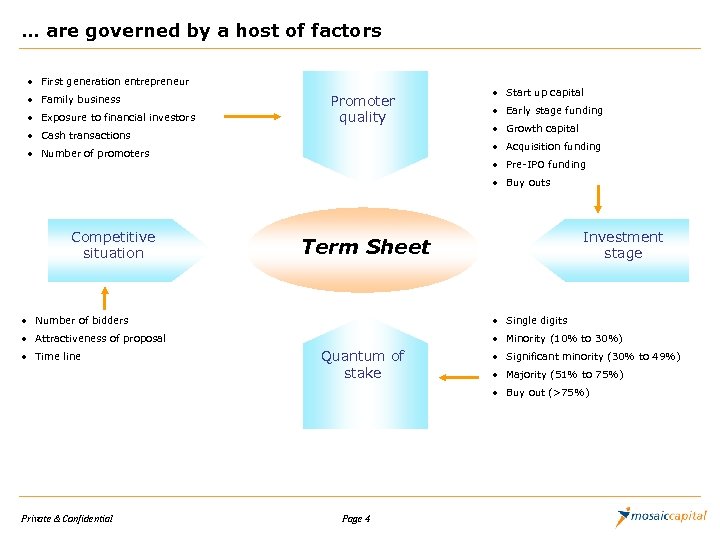

… are governed by a host of factors • First generation entrepreneur • Family business • Exposure to financial investors Promoter quality • Cash transactions • Start up capital • Early stage funding • Growth capital • Acquisition funding • Number of promoters • Pre-IPO funding • Buy outs Competitive situation Investment stage Term Sheet • Number of bidders • Single digits • Attractiveness of proposal • Minority (10% to 30%) • Time line Quantum of stake • Significant minority (30% to 49%) • Majority (51% to 75%) • Buy out (>75%) Private & Confidential Page 4

A term sheet is a tool to negotiate term sheets … § Valuations are the single biggest reason for break down in negotiations § § § Difference in the business assumptions Exit and entry multiple assumptions Size of the Company § The investment instrument significantly resolves this issue § There are multiple options available and each one has the effect of mitigating a particular fear or bringing sanity to the table § § § Straight equity Pure convertible structures Milestone based structures Clawbacks Profit sharing Mezzanine instrument Private & Confidential Page 5

… from valuations and corporate governance … § Here, the stage of the company is extremely important § Composition of board is extremely important § § § Veto rights § § § § Number of investor directors Independent directors Proportion to ownership Meeting frequency and quorum norms Generally geared towards protection of investment Strategic moves Dividend policy Start up and early stage require more operational involvement ESOPS and management hiring and firing Related party transactions Business plan and use of funds § § Investment drawdown Periodicity of reviews How to tackle significant variations Level of monitoring use of funds Private & Confidential Page 6

… to dilution and exit norms … § The investor order for an exit § § Anti dilution and right to further subscription § § Typically in start ups and early stage where the risk of failure is high Tag along and drag along – depends on the stage of funding and the quantum of stake acquired § § § Typically anti dilution is given; Right to further subscription is dependent on a case to case basis Liquidation preference § § IPO followed by a trade sale followed by a buyback Tag along is generally given but proportionately Drag along is viewed by most promoters as a draconian provision; however if the investor holds a significant majority or above this is sometimes accepted Ratchet rights – Full or weighted Private & Confidential Page 7

… and other covenants § Non compete – important clause to retain in situations of family businesses, multiple promoters, where the investor has a significant majority or more § Expenses – a tricky clause, but important that a small funds incorporates this clause (conversely where does a start up company get this money) § Exclusivity, termination and break away fee – important provisions in a competitive situation Private & Confidential Page 8

There a host of age old challenges … § Striking the right balance in detail and conciseness § You do not want the Term Sheet to look like a full fledged agreement but at the same time you need to protect yourself § Making the term sheet “investor heavy” § Use of lawyers? § Constructing the “ideal term sheet” § Consistency in negotiating stance § Do not treat term sheets as templates § § Each situation is different and the ability to spot the difference prior to submitting the Term Sheet is key to a quick resolution of the same The Term Sheet is an active tool that helps you negotiate better and to differentiate you from competition Private & Confidential Page 9

… which should be mitigated by keeping things simple § Keep the term sheet simple § Remember a term sheet can help you gain promoter trust or can make you lose his faith very quickly § Each situation is unique – do not treat a term sheet as a template § Understand the psyche of the promoter prior to submitting a term sheet § Put in some clauses which you can give away to get what you want Private & Confidential Page 10

Thank you Mosaic Capital Services Pvt Ltd § Mumbai § Bangalore § § London § Vinay Shah § vinay@mosaiccap. com § Ashutosh Ghanekar § ashutosh@mosaiccap. com § Vikram Bihani § vikram@mosaiccap. com § Sanjay Krishnan § sanjay@mosaiccap. com Private & Confidential Page 11

08905c2e6544908f34b5d708de0ea965.ppt