25055ae3bccfdd3bf8d5c55f879fb6fc.ppt

- Количество слайдов: 20

Payroll Services An Overview and Discussion with the Privatization Advisory Committee

Payroll Services An Overview and Discussion with the Privatization Advisory Committee

Payroll Mission Statement Mission: • To provide the district with efficient and effective support operations and to provide accurate and timely payments to our employees, vendors, and various reporting agencies.

Payroll Mission Statement Mission: • To provide the district with efficient and effective support operations and to provide accurate and timely payments to our employees, vendors, and various reporting agencies.

Getting to Know Payroll • Staffing: The Payroll Department consists of 11 staff members including the Director, Payroll Supervisor, five payroll processing agents, three Payroll call center agents, and one administrative assistant.

Getting to Know Payroll • Staffing: The Payroll Department consists of 11 staff members including the Director, Payroll Supervisor, five payroll processing agents, three Payroll call center agents, and one administrative assistant.

Services We Provide We provide : Full-service payroll processing to all employees of the district Monthly, quarterly, and annual reports to governmental agencies Payment requests and remittance information to non-benefit vendors Voluntary deduction and garnishment set-up for employees Assistance with reconciliation of payroll liability general ledger accounts Assistance with salary audit exceptions from the Department of Public Instruction • Continuous review and update of the payroll system set-up. • Acceptable customer service level through verbal and written communication with both internal and external customers • Resolution to employee inquiries about pay, deductions, and other requests for assistance • • •

Services We Provide We provide : Full-service payroll processing to all employees of the district Monthly, quarterly, and annual reports to governmental agencies Payment requests and remittance information to non-benefit vendors Voluntary deduction and garnishment set-up for employees Assistance with reconciliation of payroll liability general ledger accounts Assistance with salary audit exceptions from the Department of Public Instruction • Continuous review and update of the payroll system set-up. • Acceptable customer service level through verbal and written communication with both internal and external customers • Resolution to employee inquiries about pay, deductions, and other requests for assistance • • •

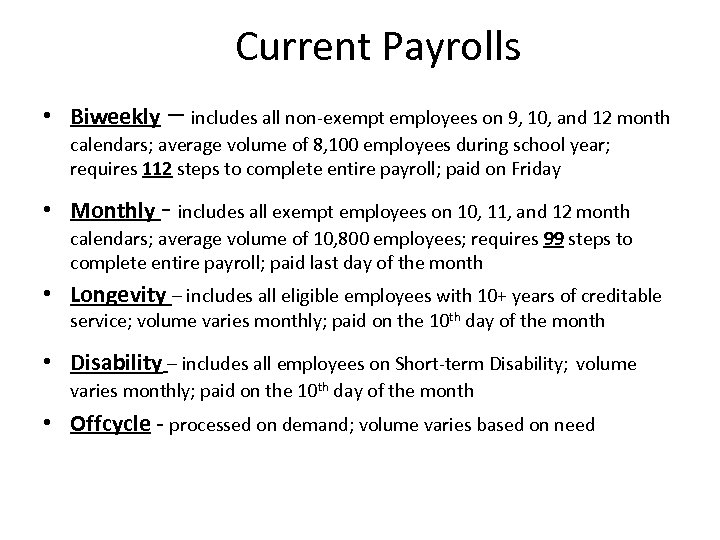

Current Payrolls • Biweekly – includes all non-exempt employees on 9, 10, and 12 month calendars; average volume of 8, 100 employees during school year; requires 112 steps to complete entire payroll; paid on Friday • Monthly - includes all exempt employees on 10, 11, and 12 month calendars; average volume of 10, 800 employees; requires 99 steps to complete entire payroll; paid last day of the month • Longevity – includes all eligible employees with 10+ years of creditable service; volume varies monthly; paid on the 10 th day of the month • Disability – includes all employees on Short-term Disability; volume varies monthly; paid on the 10 th day of the month • Offcycle - processed on demand; volume varies based on need

Current Payrolls • Biweekly – includes all non-exempt employees on 9, 10, and 12 month calendars; average volume of 8, 100 employees during school year; requires 112 steps to complete entire payroll; paid on Friday • Monthly - includes all exempt employees on 10, 11, and 12 month calendars; average volume of 10, 800 employees; requires 99 steps to complete entire payroll; paid last day of the month • Longevity – includes all eligible employees with 10+ years of creditable service; volume varies monthly; paid on the 10 th day of the month • Disability – includes all employees on Short-term Disability; volume varies monthly; paid on the 10 th day of the month • Offcycle - processed on demand; volume varies based on need

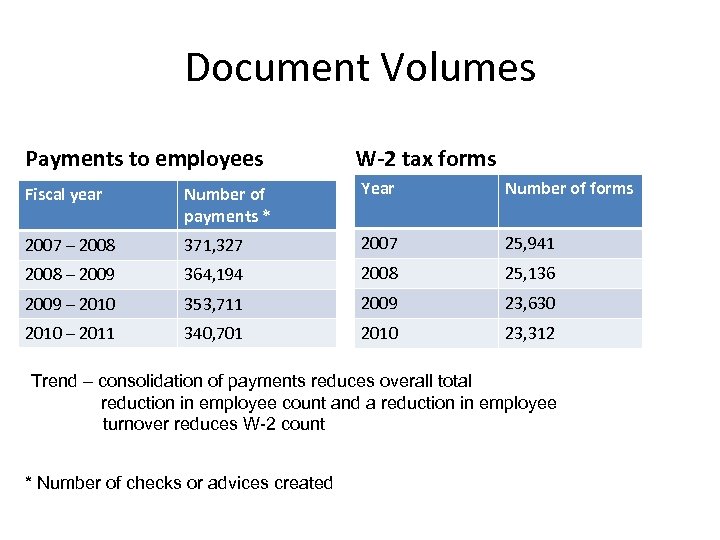

Document Volumes Payments to employees W-2 tax forms Fiscal year Number of payments * Year Number of forms 2007 – 2008 371, 327 2007 25, 941 2008 – 2009 364, 194 2008 25, 136 2009 – 2010 353, 711 2009 23, 630 2010 – 2011 340, 701 2010 23, 312 Trend – consolidation of payments reduces overall total reduction in employee count and a reduction in employee turnover reduces W-2 count * Number of checks or advices created

Document Volumes Payments to employees W-2 tax forms Fiscal year Number of payments * Year Number of forms 2007 – 2008 371, 327 2007 25, 941 2008 – 2009 364, 194 2008 25, 136 2009 – 2010 353, 711 2009 23, 630 2010 – 2011 340, 701 2010 23, 312 Trend – consolidation of payments reduces overall total reduction in employee count and a reduction in employee turnover reduces W-2 count * Number of checks or advices created

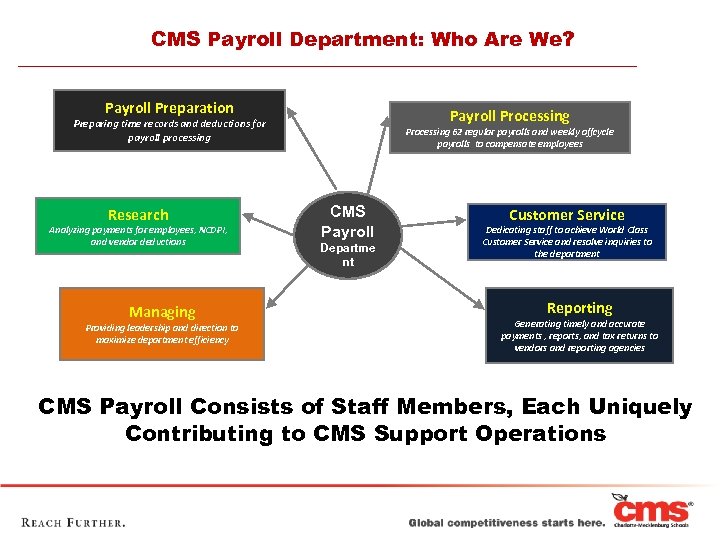

CMS Payroll Department: Who Are We? Payroll Preparation Payroll Processing Preparing time records and deductions for payroll processing Research Analyzing payments for employees, NCDPI, and vendor deductions Managing Providing leadership and direction to maximize department efficiency Processing 62 regular payrolls and weekly offcycle payrolls to compensate employees CMS Payroll Departme nt Customer Service Dedicating staff to achieve World Class Customer Service and resolve inquiries to the department Reporting Generating timely and accurate payments , reports, and tax returns to vendors and reporting agencies CMS Payroll Consists of Staff Members, Each Uniquely Contributing to CMS Support Operations

CMS Payroll Department: Who Are We? Payroll Preparation Payroll Processing Preparing time records and deductions for payroll processing Research Analyzing payments for employees, NCDPI, and vendor deductions Managing Providing leadership and direction to maximize department efficiency Processing 62 regular payrolls and weekly offcycle payrolls to compensate employees CMS Payroll Departme nt Customer Service Dedicating staff to achieve World Class Customer Service and resolve inquiries to the department Reporting Generating timely and accurate payments , reports, and tax returns to vendors and reporting agencies CMS Payroll Consists of Staff Members, Each Uniquely Contributing to CMS Support Operations

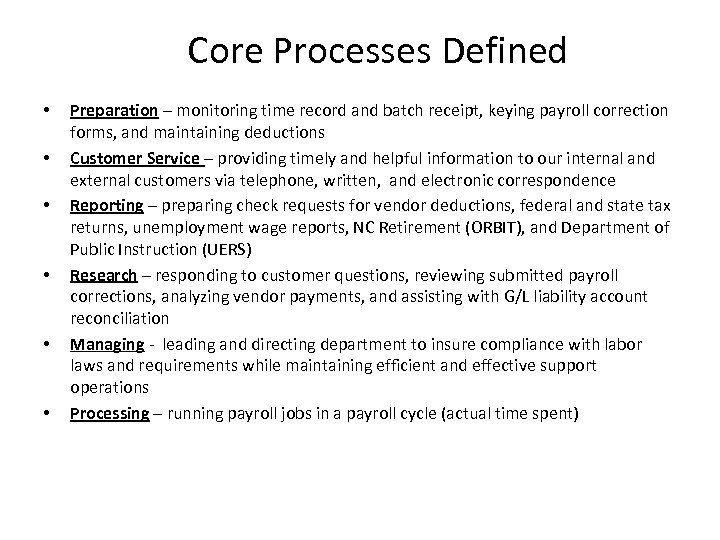

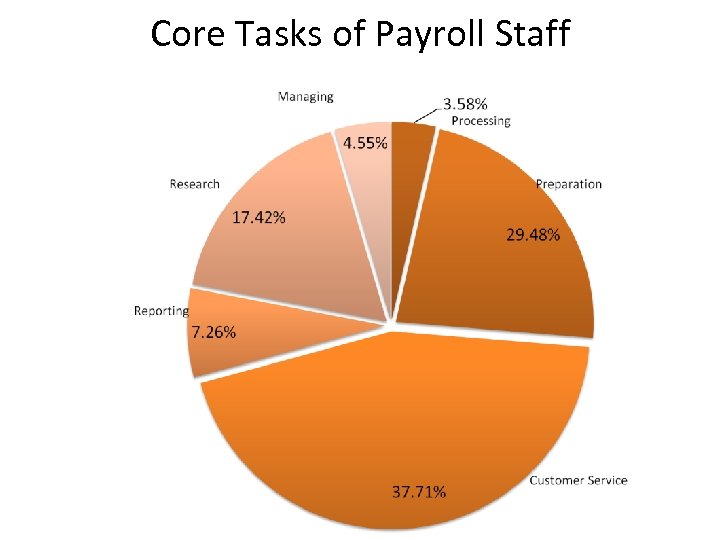

Core Processes Defined • • • Preparation – monitoring time record and batch receipt, keying payroll correction forms, and maintaining deductions Customer Service – providing timely and helpful information to our internal and external customers via telephone, written, and electronic correspondence Reporting – preparing check requests for vendor deductions, federal and state tax returns, unemployment wage reports, NC Retirement (ORBIT), and Department of Public Instruction (UERS) Research – responding to customer questions, reviewing submitted payroll corrections, analyzing vendor payments, and assisting with G/L liability account reconciliation Managing - leading and directing department to insure compliance with labor laws and requirements while maintaining efficient and effective support operations Processing – running payroll jobs in a payroll cycle (actual time spent)

Core Processes Defined • • • Preparation – monitoring time record and batch receipt, keying payroll correction forms, and maintaining deductions Customer Service – providing timely and helpful information to our internal and external customers via telephone, written, and electronic correspondence Reporting – preparing check requests for vendor deductions, federal and state tax returns, unemployment wage reports, NC Retirement (ORBIT), and Department of Public Instruction (UERS) Research – responding to customer questions, reviewing submitted payroll corrections, analyzing vendor payments, and assisting with G/L liability account reconciliation Managing - leading and directing department to insure compliance with labor laws and requirements while maintaining efficient and effective support operations Processing – running payroll jobs in a payroll cycle (actual time spent)

Core Tasks of Payroll Staff

Core Tasks of Payroll Staff

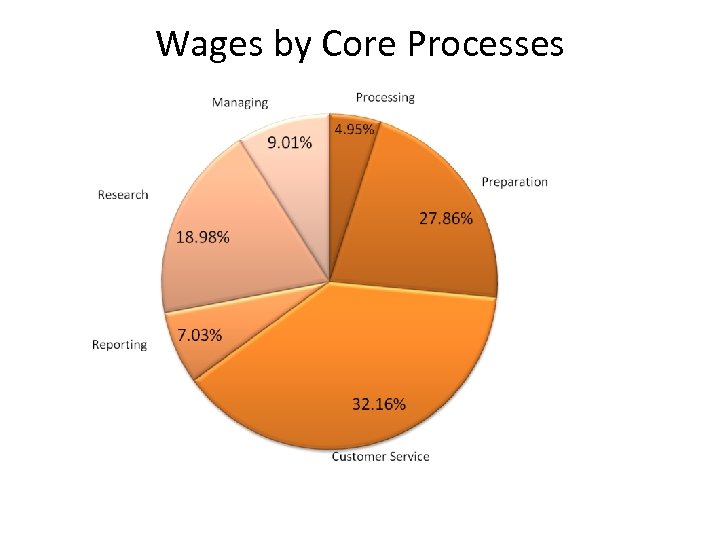

Wages by Core Processes

Wages by Core Processes

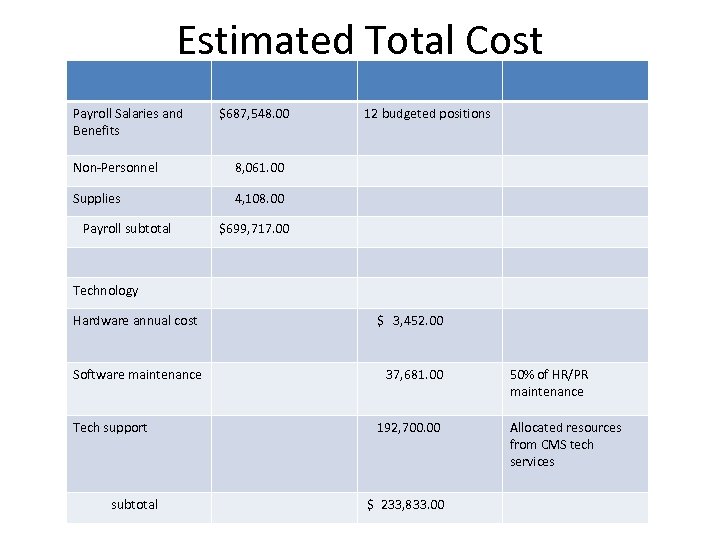

Estimated Total Cost Payroll Salaries and Benefits $687, 548. 00 Non-Personnel 8, 061. 00 Supplies 12 budgeted positions 4, 108. 00 Payroll subtotal $699, 717. 00 Technology Hardware annual cost $ 3, 452. 00 Software maintenance 37, 681. 00 Tech support subtotal 192, 700. 00 $ 233, 833. 00 50% of HR/PR maintenance Allocated resources from CMS tech services

Estimated Total Cost Payroll Salaries and Benefits $687, 548. 00 Non-Personnel 8, 061. 00 Supplies 12 budgeted positions 4, 108. 00 Payroll subtotal $699, 717. 00 Technology Hardware annual cost $ 3, 452. 00 Software maintenance 37, 681. 00 Tech support subtotal 192, 700. 00 $ 233, 833. 00 50% of HR/PR maintenance Allocated resources from CMS tech services

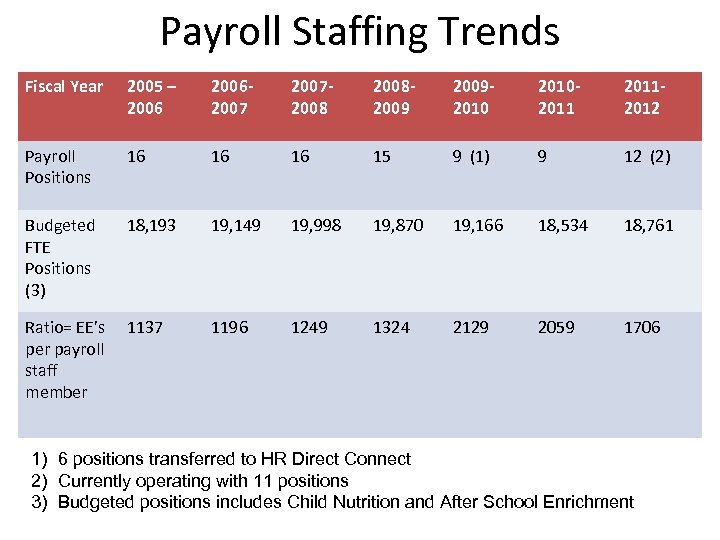

Payroll Staffing Trends Fiscal Year 2005 – 2006200720082009201020112012 Payroll Positions 16 16 16 15 9 (1) 9 12 (2) Budgeted FTE Positions (3) 18, 193 19, 149 19, 998 19, 870 19, 166 18, 534 18, 761 Ratio= EE’s per payroll staff member 1137 1196 1249 1324 2129 2059 1706 1) 6 positions transferred to HR Direct Connect 2) Currently operating with 11 positions 3) Budgeted positions includes Child Nutrition and After School Enrichment

Payroll Staffing Trends Fiscal Year 2005 – 2006200720082009201020112012 Payroll Positions 16 16 16 15 9 (1) 9 12 (2) Budgeted FTE Positions (3) 18, 193 19, 149 19, 998 19, 870 19, 166 18, 534 18, 761 Ratio= EE’s per payroll staff member 1137 1196 1249 1324 2129 2059 1706 1) 6 positions transferred to HR Direct Connect 2) Currently operating with 11 positions 3) Budgeted positions includes Child Nutrition and After School Enrichment

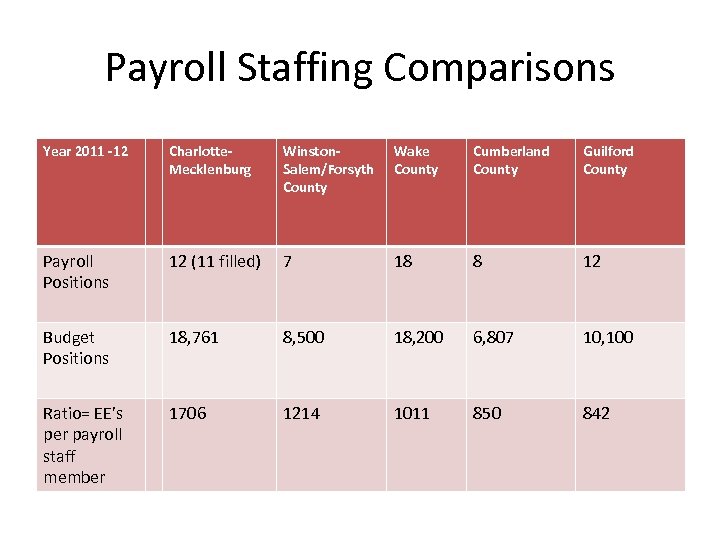

Payroll Staffing Comparisons Year 2011 -12 Charlotte. Mecklenburg Winston. Salem/Forsyth County Wake County Cumberland County Guilford County Payroll Positions 12 (11 filled) 7 18 8 12 Budget Positions 18, 761 8, 500 18, 200 6, 807 10, 100 Ratio= EE’s per payroll staff member 1706 1214 1011 850 842

Payroll Staffing Comparisons Year 2011 -12 Charlotte. Mecklenburg Winston. Salem/Forsyth County Wake County Cumberland County Guilford County Payroll Positions 12 (11 filled) 7 18 8 12 Budget Positions 18, 761 8, 500 18, 200 6, 807 10, 100 Ratio= EE’s per payroll staff member 1706 1214 1011 850 842

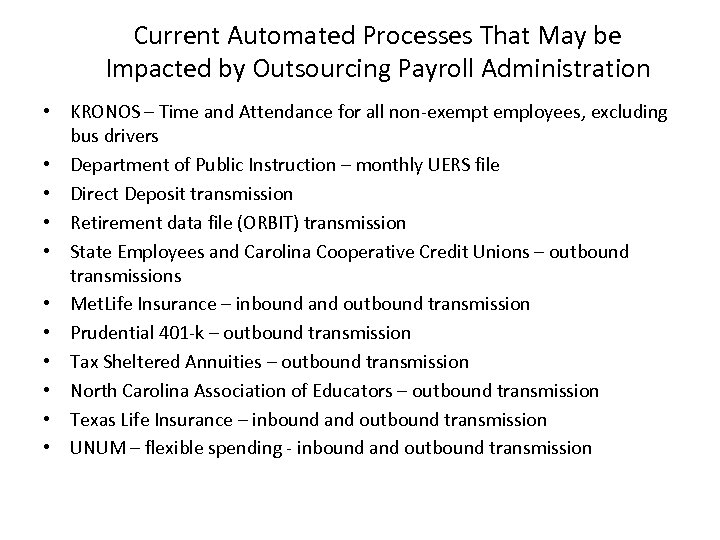

Current Automated Processes That May be Impacted by Outsourcing Payroll Administration • KRONOS – Time and Attendance for all non-exempt employees, excluding bus drivers • Department of Public Instruction – monthly UERS file • Direct Deposit transmission • Retirement data file (ORBIT) transmission • State Employees and Carolina Cooperative Credit Unions – outbound transmissions • Met. Life Insurance – inbound and outbound transmission • Prudential 401 -k – outbound transmission • Tax Sheltered Annuities – outbound transmission • North Carolina Association of Educators – outbound transmission • Texas Life Insurance – inbound and outbound transmission • UNUM – flexible spending - inbound and outbound transmission

Current Automated Processes That May be Impacted by Outsourcing Payroll Administration • KRONOS – Time and Attendance for all non-exempt employees, excluding bus drivers • Department of Public Instruction – monthly UERS file • Direct Deposit transmission • Retirement data file (ORBIT) transmission • State Employees and Carolina Cooperative Credit Unions – outbound transmissions • Met. Life Insurance – inbound and outbound transmission • Prudential 401 -k – outbound transmission • Tax Sheltered Annuities – outbound transmission • North Carolina Association of Educators – outbound transmission • Texas Life Insurance – inbound and outbound transmission • UNUM – flexible spending - inbound and outbound transmission

Challenges to Consider if Outsourcing Payroll Administration Considerations • North Carolina Department of Public Instruction system benchmark requirements • Ability to process employees with varying months of employment in the same payroll…Example: 10 month teacher and 12 month administrator, both monthly exempt employees • Ability to track multiple funding sources so CMS can reconcile funds for State/Federal/Local payments and deductions • Ability to distribute benefit expenses across multiple funding sources • Current efficiencies gained with current system integration of HR and Payroll may not be realized • Intercompany funding of deposits and deductions – State banking requirements are very specific

Challenges to Consider if Outsourcing Payroll Administration Considerations • North Carolina Department of Public Instruction system benchmark requirements • Ability to process employees with varying months of employment in the same payroll…Example: 10 month teacher and 12 month administrator, both monthly exempt employees • Ability to track multiple funding sources so CMS can reconcile funds for State/Federal/Local payments and deductions • Ability to distribute benefit expenses across multiple funding sources • Current efficiencies gained with current system integration of HR and Payroll may not be realized • Intercompany funding of deposits and deductions – State banking requirements are very specific

Challenges to Consider if Outsourcing Payroll Administration Considerations • Ability to support the use of benefit escrow accounts for employees working less than 12 months to cover the additional months • Ability to recalculate deduction amounts for benefits when employees change from 9 months to 12 months • Ability to support multiple calendars for specific groups of employees • Ability to apply unique and different leave rules to specific groups of employees • Ability to modify, enhance, or customize programs to meet requirements set forth by the North Carolina General Assembly 3/17/2018

Challenges to Consider if Outsourcing Payroll Administration Considerations • Ability to support the use of benefit escrow accounts for employees working less than 12 months to cover the additional months • Ability to recalculate deduction amounts for benefits when employees change from 9 months to 12 months • Ability to support multiple calendars for specific groups of employees • Ability to apply unique and different leave rules to specific groups of employees • Ability to modify, enhance, or customize programs to meet requirements set forth by the North Carolina General Assembly 3/17/2018

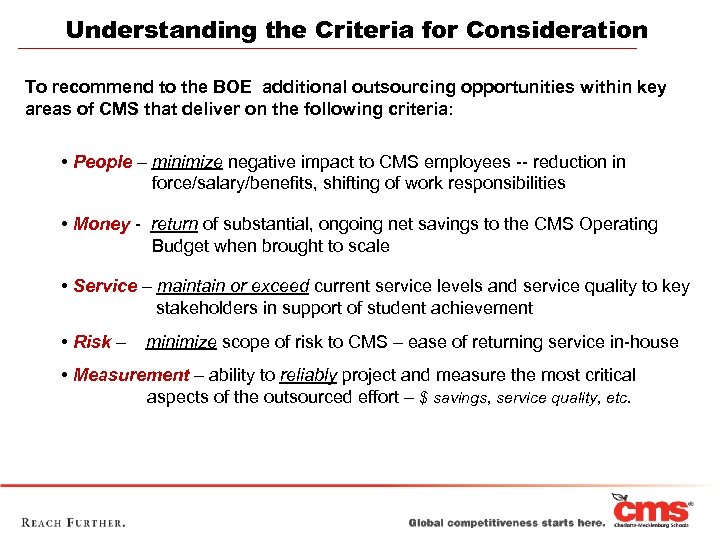

Understanding the Criteria for Consideration To recommend to the BOE additional outsourcing opportunities within key areas of CMS that deliver on the following criteria: • People – minimize negative impact to CMS employees -- reduction in force/salary/benefits, shifting of work responsibilities • Money - return of substantial, ongoing net savings to the CMS Operating Budget when brought to scale • Service – maintain or exceed current service levels and service quality to key stakeholders in support of student achievement • Risk – minimize scope of risk to CMS – ease of returning service in-house • Measurement – ability to reliably project and measure the most critical aspects of the outsourced effort – $ savings, service quality, etc.

Understanding the Criteria for Consideration To recommend to the BOE additional outsourcing opportunities within key areas of CMS that deliver on the following criteria: • People – minimize negative impact to CMS employees -- reduction in force/salary/benefits, shifting of work responsibilities • Money - return of substantial, ongoing net savings to the CMS Operating Budget when brought to scale • Service – maintain or exceed current service levels and service quality to key stakeholders in support of student achievement • Risk – minimize scope of risk to CMS – ease of returning service in-house • Measurement – ability to reliably project and measure the most critical aspects of the outsourced effort – $ savings, service quality, etc.

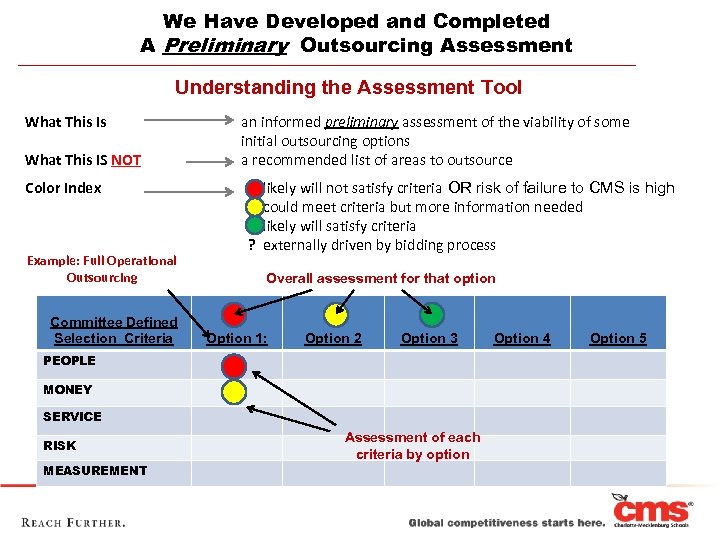

We Have Developed and Completed A Preliminary Outsourcing Assessment Understanding the Assessment Tool What This Is What This IS NOT Color Index Example: Full Operational Outsourcing Committee Defined Selection Criteria an informed preliminary assessment of the viability of some initial outsourcing options a recommended list of areas to outsource likely will not satisfy criteria OR risk of failure to CMS is high could meet criteria but more information needed likely will satisfy criteria ? externally driven by bidding process Overall assessment for that option Option 1: Option 2 Option 3 PEOPLE MONEY SERVICE RISK MEASUREMENT Assessment of each criteria by option Option 4 Option 5

We Have Developed and Completed A Preliminary Outsourcing Assessment Understanding the Assessment Tool What This Is What This IS NOT Color Index Example: Full Operational Outsourcing Committee Defined Selection Criteria an informed preliminary assessment of the viability of some initial outsourcing options a recommended list of areas to outsource likely will not satisfy criteria OR risk of failure to CMS is high could meet criteria but more information needed likely will satisfy criteria ? externally driven by bidding process Overall assessment for that option Option 1: Option 2 Option 3 PEOPLE MONEY SERVICE RISK MEASUREMENT Assessment of each criteria by option Option 4 Option 5

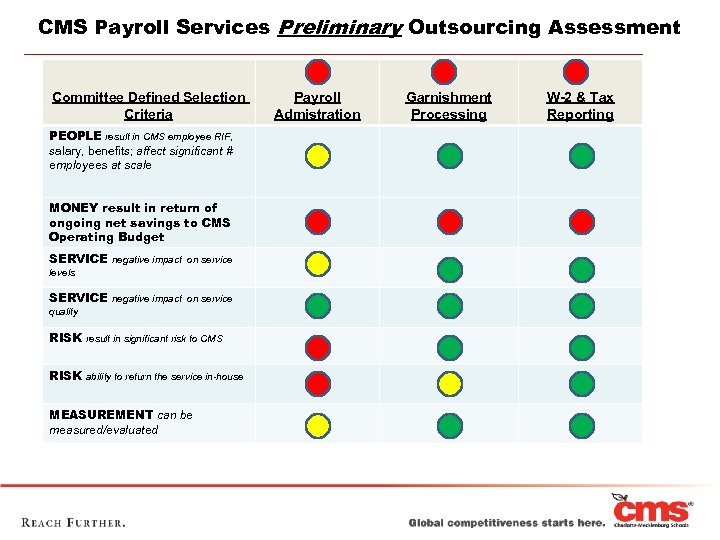

CMS Payroll Services Preliminary Outsourcing Assessment Committee Defined Selection Criteria PEOPLE result in CMS employee RIF, salary, benefits; affect significant # employees at scale MONEY result in return of ongoing net savings to CMS Operating Budget SERVICE negative impact on service levels SERVICE negative impact on service quality RISK result in significant risk to CMS RISK ability to return the service in-house MEASUREMENT can be measured/evaluated Payroll Admistration Garnishment Processing W-2 & Tax Reporting

CMS Payroll Services Preliminary Outsourcing Assessment Committee Defined Selection Criteria PEOPLE result in CMS employee RIF, salary, benefits; affect significant # employees at scale MONEY result in return of ongoing net savings to CMS Operating Budget SERVICE negative impact on service levels SERVICE negative impact on service quality RISK result in significant risk to CMS RISK ability to return the service in-house MEASUREMENT can be measured/evaluated Payroll Admistration Garnishment Processing W-2 & Tax Reporting

CMS Payroll Services & Privatization Advisory Committee Meeting Summary Discussion & Next Steps

CMS Payroll Services & Privatization Advisory Committee Meeting Summary Discussion & Next Steps