58c6cde22bf0fed9a935c13094b9280d.ppt

- Количество слайдов: 16

Payments in Americas Get connected to the future European experiences Henrik Parl Managing Director Payments in the Americas Conference 1

Payments in Americas Get connected to the future European experiences Henrik Parl Managing Director Payments in the Americas Conference 1

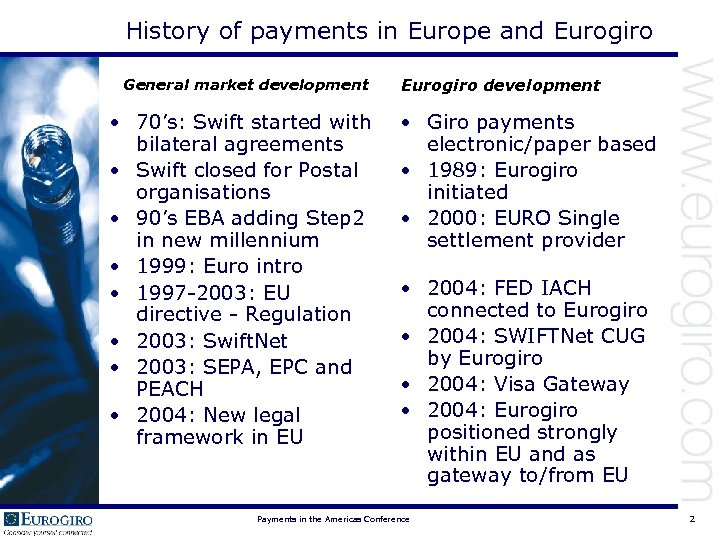

History of payments in Europe and Eurogiro General market development • 70’s: Swift started with bilateral agreements • Swift closed for Postal organisations • 90’s EBA adding Step 2 in new millennium • 1999: Euro intro • 1997 -2003: EU directive - Regulation • 2003: Swift. Net • 2003: SEPA, EPC and PEACH • 2004: New legal framework in EU Eurogiro development • Giro payments electronic/paper based • 1989: Eurogiro initiated • 2000: EURO Single settlement provider • 2004: FED IACH connected to Eurogiro • 2004: SWIFTNet CUG by Eurogiro • 2004: Visa Gateway • 2004: Eurogiro positioned strongly within EU and as gateway to/from EU Payments in the Americas Conference 2

History of payments in Europe and Eurogiro General market development • 70’s: Swift started with bilateral agreements • Swift closed for Postal organisations • 90’s EBA adding Step 2 in new millennium • 1999: Euro intro • 1997 -2003: EU directive - Regulation • 2003: Swift. Net • 2003: SEPA, EPC and PEACH • 2004: New legal framework in EU Eurogiro development • Giro payments electronic/paper based • 1989: Eurogiro initiated • 2000: EURO Single settlement provider • 2004: FED IACH connected to Eurogiro • 2004: SWIFTNet CUG by Eurogiro • 2004: Visa Gateway • 2004: Eurogiro positioned strongly within EU and as gateway to/from EU Payments in the Americas Conference 2

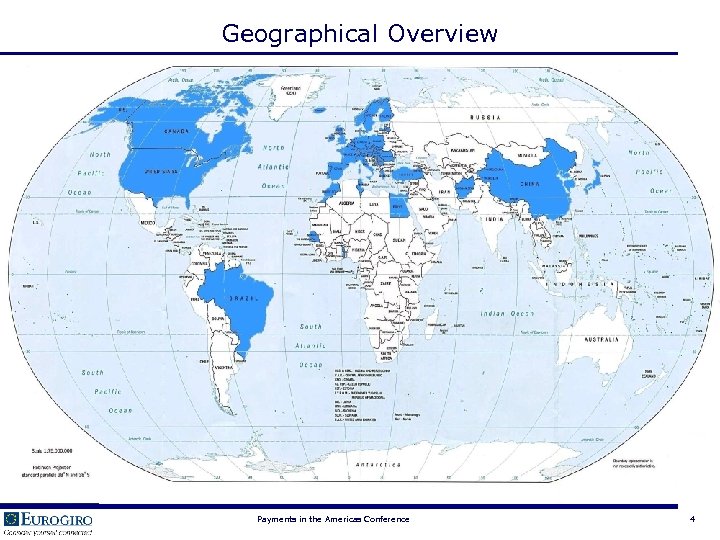

45 connections in 41 countries AF AT * BE * BR CA CH * CV CN CS CZ DE * DK EG ES ES FI FR * GB GR HR HU * Afghanistan International Bank P. S. K. /BAWAG Financial Post Empresa Brasileira de Correios e Telégrafos - ECT National Bank of Canada Post. Finance/Swiss Post Cape Verde Post China Postal Savings Bank CSOB Deutsche Postbank Sydbank CIB (Egypt) S. A. E. BBVA Correos y Telegrafos ING/Postbank (EUR transfers) La Poste Alliance & Leicester Commercial Bank plc Visa Hellenic Post Croatia Post Magyar Posta IE * IL IS * IT * JP LU * LV MA NL * NO PL PT * RO RO SE SI SK SN TG TR TN USA An Post Israel Postal Authorities Póstgíró Poste Italiane Japan Post, Postal Savings Business Headquarters P & T Luxembourg Latvia Post Barid Al Maghrib ING/Postbank (EUR & NOK transfers) ING/Bank Sląski CTT Correios de Portugal Banc Posta Romana ING/Postbank (EUR & SEK transfers) Postna Banka Slovenije Postova Banka La Poste, Senegal Societe des Postes du Togo Turkish Post La Poste Tunisienne Deutsche Bank Federal Reserve Bank Shareholder Payments in the Americas Conference 3

45 connections in 41 countries AF AT * BE * BR CA CH * CV CN CS CZ DE * DK EG ES ES FI FR * GB GR HR HU * Afghanistan International Bank P. S. K. /BAWAG Financial Post Empresa Brasileira de Correios e Telégrafos - ECT National Bank of Canada Post. Finance/Swiss Post Cape Verde Post China Postal Savings Bank CSOB Deutsche Postbank Sydbank CIB (Egypt) S. A. E. BBVA Correos y Telegrafos ING/Postbank (EUR transfers) La Poste Alliance & Leicester Commercial Bank plc Visa Hellenic Post Croatia Post Magyar Posta IE * IL IS * IT * JP LU * LV MA NL * NO PL PT * RO RO SE SI SK SN TG TR TN USA An Post Israel Postal Authorities Póstgíró Poste Italiane Japan Post, Postal Savings Business Headquarters P & T Luxembourg Latvia Post Barid Al Maghrib ING/Postbank (EUR & NOK transfers) ING/Bank Sląski CTT Correios de Portugal Banc Posta Romana ING/Postbank (EUR & SEK transfers) Postna Banka Slovenije Postova Banka La Poste, Senegal Societe des Postes du Togo Turkish Post La Poste Tunisienne Deutsche Bank Federal Reserve Bank Shareholder Payments in the Americas Conference 3

Geographical Overview Payments in the Americas Conference 4

Geographical Overview Payments in the Americas Conference 4

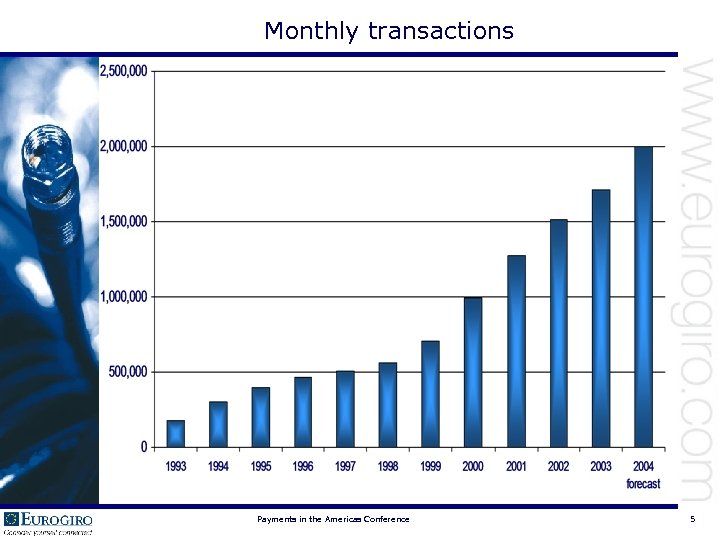

Monthly transactions Payments in the Americas Conference 5

Monthly transactions Payments in the Americas Conference 5

Eurogiro products • Payment transfers – standard (max. 3 days) and urgent • to accounts with members • to accounts with 3 rd banks • Money orders – standard – TMO, semi urgent cash – Western Union urgent cash • Bulk and pension payments • Gateways & alliances Payments in the Americas Conference 6

Eurogiro products • Payment transfers – standard (max. 3 days) and urgent • to accounts with members • to accounts with 3 rd banks • Money orders – standard – TMO, semi urgent cash – Western Union urgent cash • Bulk and pension payments • Gateways & alliances Payments in the Americas Conference 6

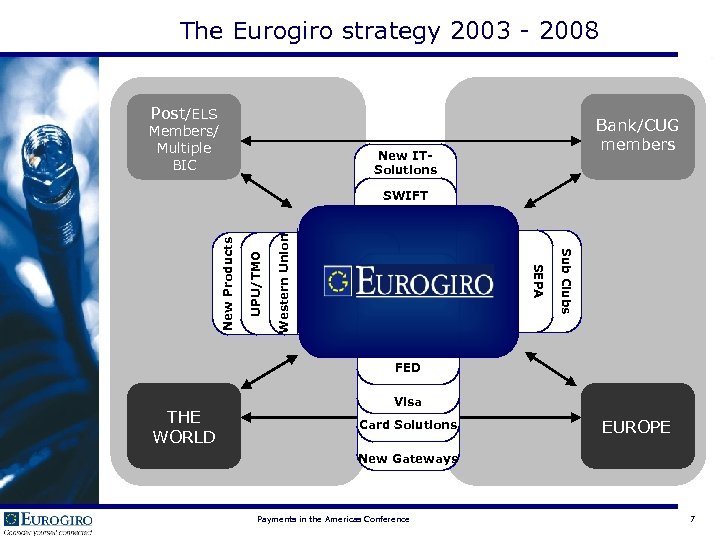

The Eurogiro strategy 2003 - 2008 Post/ELS Members/ Multiple BIC Bank/CUG members New ITSolutions Western Union UPU/TMO Sub Clubs SEPA New Products SWIFT FED THE WORLD Visa Card Solutions EUROPE New Gateways Payments in the Americas Conference 7

The Eurogiro strategy 2003 - 2008 Post/ELS Members/ Multiple BIC Bank/CUG members New ITSolutions Western Union UPU/TMO Sub Clubs SEPA New Products SWIFT FED THE WORLD Visa Card Solutions EUROPE New Gateways Payments in the Americas Conference 7

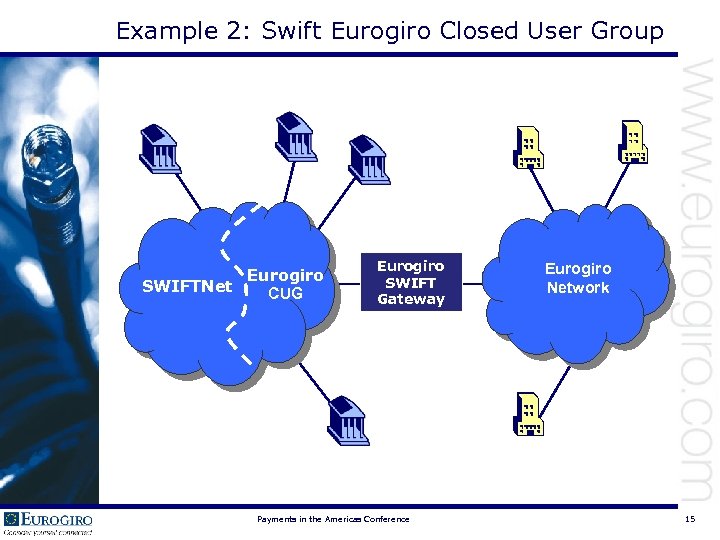

Eurogiro – providing connectivity Gateway of business opportunities for Eurogiro Members and partners: The Eurogiro SWIFTNet Closed User Group - Only one IT platform needed; - Exchange transactions in File. Act format with any SWIFTNet member and any Eurogiro member on the same system; - Access from SWIFT system to (postal) members with ELS systems and access from ELS system to (banking) members with SWIFT system The Eurogiro/Visa Direct solution - Receive payments from Visa card holders; additional volume and revenue to the Eurogiro members Payments in the Americas Conference 8

Eurogiro – providing connectivity Gateway of business opportunities for Eurogiro Members and partners: The Eurogiro SWIFTNet Closed User Group - Only one IT platform needed; - Exchange transactions in File. Act format with any SWIFTNet member and any Eurogiro member on the same system; - Access from SWIFT system to (postal) members with ELS systems and access from ELS system to (banking) members with SWIFT system The Eurogiro/Visa Direct solution - Receive payments from Visa card holders; additional volume and revenue to the Eurogiro members Payments in the Americas Conference 8

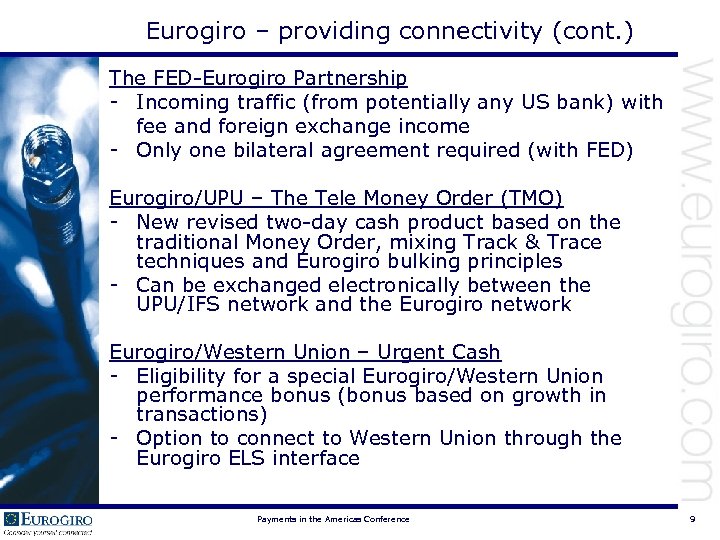

Eurogiro – providing connectivity (cont. ) The FED-Eurogiro Partnership - Incoming traffic (from potentially any US bank) with fee and foreign exchange income - Only one bilateral agreement required (with FED) Eurogiro/UPU – The Tele Money Order (TMO) - New revised two-day cash product based on the traditional Money Order, mixing Track & Trace techniques and Eurogiro bulking principles - Can be exchanged electronically between the UPU/IFS network and the Eurogiro network Eurogiro/Western Union – Urgent Cash - Eligibility for a special Eurogiro/Western Union performance bonus (bonus based on growth in transactions) - Option to connect to Western Union through the Eurogiro ELS interface Payments in the Americas Conference 9

Eurogiro – providing connectivity (cont. ) The FED-Eurogiro Partnership - Incoming traffic (from potentially any US bank) with fee and foreign exchange income - Only one bilateral agreement required (with FED) Eurogiro/UPU – The Tele Money Order (TMO) - New revised two-day cash product based on the traditional Money Order, mixing Track & Trace techniques and Eurogiro bulking principles - Can be exchanged electronically between the UPU/IFS network and the Eurogiro network Eurogiro/Western Union – Urgent Cash - Eligibility for a special Eurogiro/Western Union performance bonus (bonus based on growth in transactions) - Option to connect to Western Union through the Eurogiro ELS interface Payments in the Americas Conference 9

Why is Eurogiro relevant for you? Eurogiro was started as a pan. European (Postal) initiative to create cross border connectivity Could a similar initiative be relevant for Americas? Can something be learned from the Eurogiro ’experiment’? Payments in the Americas Conference 10

Why is Eurogiro relevant for you? Eurogiro was started as a pan. European (Postal) initiative to create cross border connectivity Could a similar initiative be relevant for Americas? Can something be learned from the Eurogiro ’experiment’? Payments in the Americas Conference 10

Some potential solutions for cross border payment solutions in Americas • A 1) Many-to-many solutions • A 2) Many-to-one solution • B 1) Own solution • B 2) Share with existing solution • C 2) Low value • C 2) High value Payments in the Americas Conference 11

Some potential solutions for cross border payment solutions in Americas • A 1) Many-to-many solutions • A 2) Many-to-one solution • B 1) Own solution • B 2) Share with existing solution • C 2) Low value • C 2) High value Payments in the Americas Conference 11

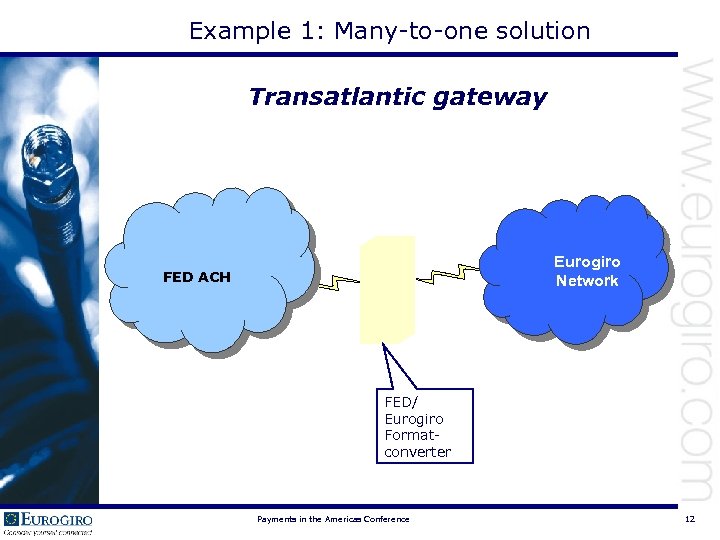

Example 1: Many-to-one solution Transatlantic gateway Eurogiro Network FED ACH FED/ Eurogiro Formatconverter Payments in the Americas Conference 12

Example 1: Many-to-one solution Transatlantic gateway Eurogiro Network FED ACH FED/ Eurogiro Formatconverter Payments in the Americas Conference 12

Value Proposition to U. S. Banks • Gateway between Europe and USA giving access to all account holders in participating countries • Enable US Banks to access US ACH with international payments as if they were domestic payments (including non-Fed customers) • Full transparency and low cost for STP transactions • Three value day transfer in USD Payments in the Americas Conference 13

Value Proposition to U. S. Banks • Gateway between Europe and USA giving access to all account holders in participating countries • Enable US Banks to access US ACH with international payments as if they were domestic payments (including non-Fed customers) • Full transparency and low cost for STP transactions • Three value day transfer in USD Payments in the Americas Conference 13

Value Proposition to U. S. Banks (cont. ) • Fixed to variable currency option • Guaranteed maximum spread on FX • Certainty of payment • Limited production covering Austria, Germany, Netherlands, Switzerland United Kingdom • Blended fee of $2. 00 to U. S. originator to send payment to any of the five countries (not including FX) Payments in the Americas Conference 14

Value Proposition to U. S. Banks (cont. ) • Fixed to variable currency option • Guaranteed maximum spread on FX • Certainty of payment • Limited production covering Austria, Germany, Netherlands, Switzerland United Kingdom • Blended fee of $2. 00 to U. S. originator to send payment to any of the five countries (not including FX) Payments in the Americas Conference 14

Example 2: Swift Eurogiro Closed User Group Eurogiro SWIFTNet CUG Eurogiro SWIFT Gateway Payments in the Americas Conference Eurogiro Network 15

Example 2: Swift Eurogiro Closed User Group Eurogiro SWIFTNet CUG Eurogiro SWIFT Gateway Payments in the Americas Conference Eurogiro Network 15

Lessons to be learned from forming payment co-operations • Do not try to solve all things for everyone • Run projects in small groups with clear decision authority • Select limited number of pilot countries preferably with largest volumes • Use standard technology, procedures and formats • Pool investment, volumes, contract to get critical mass and low costs • Secure global connectivity • Secure commitment beforehand Payments in the Americas Conference 16

Lessons to be learned from forming payment co-operations • Do not try to solve all things for everyone • Run projects in small groups with clear decision authority • Select limited number of pilot countries preferably with largest volumes • Use standard technology, procedures and formats • Pool investment, volumes, contract to get critical mass and low costs • Secure global connectivity • Secure commitment beforehand Payments in the Americas Conference 16