ac4156724e839e81380e4704a4d2ce95.ppt

- Количество слайдов: 43

Payment Terms

Payment Terms

More complicated ¡ Arrangements are international---long distance and more procedures involved ¡ Longer time ¡ Different regulations and systems of law ¡ Different monetary and financial matters and methods in different countries

More complicated ¡ Arrangements are international---long distance and more procedures involved ¡ Longer time ¡ Different regulations and systems of law ¡ Different monetary and financial matters and methods in different countries

Payment instruments ¡ Drafts (the most common one) ¡ Promissory notes ¡ Checks ¡ Money orders ¡ Credit cards ¡ Cash (rarely used)

Payment instruments ¡ Drafts (the most common one) ¡ Promissory notes ¡ Checks ¡ Money orders ¡ Credit cards ¡ Cash (rarely used)

Draft/bill of exchange---definition and contents ¡ A draft is an unconditional order in writing signed by one ¡ ü ü ü ü party(drawer) requesting a second party (drawee/payer) to make payment in lawful money immediately or at a determinable future time to a third party(payee) Basic contents The word “exchange” An unconditional order in writing Date and place of issue Time of payment Name of payee Currency and amount Name of drawee/payer Drawer’s name and signature

Draft/bill of exchange---definition and contents ¡ A draft is an unconditional order in writing signed by one ¡ ü ü ü ü party(drawer) requesting a second party (drawee/payer) to make payment in lawful money immediately or at a determinable future time to a third party(payee) Basic contents The word “exchange” An unconditional order in writing Date and place of issue Time of payment Name of payee Currency and amount Name of drawee/payer Drawer’s name and signature

Draft/bill of exchange---types ¡ Commercial draft---by a firm ¡ Banker’s draft---between banks ¡ Sight draft---payable on presentation ¡ Time/usance draft---payable in a specified number of days after its date of issue/acceptance/B/L/at a fixed future date ¡ Clean draft---no other documents attached ¡ Documentary draft---certain documents attached

Draft/bill of exchange---types ¡ Commercial draft---by a firm ¡ Banker’s draft---between banks ¡ Sight draft---payable on presentation ¡ Time/usance draft---payable in a specified number of days after its date of issue/acceptance/B/L/at a fixed future date ¡ Clean draft---no other documents attached ¡ Documentary draft---certain documents attached

Use of drafts ¡ Issuance---to order/ to bearer ¡ Presentation ¡ Acceptance ¡ Payment ¡ Endorsement ¡ Dishonour and recourse

Use of drafts ¡ Issuance---to order/ to bearer ¡ Presentation ¡ Acceptance ¡ Payment ¡ Endorsement ¡ Dishonour and recourse

Dishonored bills and protests ¡ ¡ 1. 2. 3. 4. Dishonored bill—draft that the drawee refuses or is unable to pay or accept Exercise the right of recourse Obtain a certificate of protest Present the second time Publish the certificate----give the drawee pressure —damage his commercial creditability Legal action

Dishonored bills and protests ¡ ¡ 1. 2. 3. 4. Dishonored bill—draft that the drawee refuses or is unable to pay or accept Exercise the right of recourse Obtain a certificate of protest Present the second time Publish the certificate----give the drawee pressure —damage his commercial creditability Legal action

Promissory note and check ¡ Promissory note—an unconditional promise in writing made by one person(the maker) to another(the payee/the holder) signed by the maker engaging to pay on demand or at fixed or determinable future time a sum of money to or to the order of a specified person or to bearer ¡ Check—an unconditional order in writing addressed by the customer(drawer) to a bank (drawee) signed by the customer authorizing the bank to pay on demanding a specified sum of money to or to the order of a named person or to bearer(payee)

Promissory note and check ¡ Promissory note—an unconditional promise in writing made by one person(the maker) to another(the payee/the holder) signed by the maker engaging to pay on demand or at fixed or determinable future time a sum of money to or to the order of a specified person or to bearer ¡ Check—an unconditional order in writing addressed by the customer(drawer) to a bank (drawee) signed by the customer authorizing the bank to pay on demanding a specified sum of money to or to the order of a named person or to bearer(payee)

Method of payment ¡ The importer---get the goods as ordered ¡ The exporter---the security of payment ¡ Terms of payment reflect the extent to which the seller requires a guarantee of payment before he loses control of the goods. ¡ Main methods of payment used in China include remittance, collection and letter of credit.

Method of payment ¡ The importer---get the goods as ordered ¡ The exporter---the security of payment ¡ Terms of payment reflect the extent to which the seller requires a guarantee of payment before he loses control of the goods. ¡ Main methods of payment used in China include remittance, collection and letter of credit.

Methods of payment---remittance ¡ Remittance---transfer of money from one party to another party through banks. ¡ Parties involved in remittance are: Ø Remitter Ø Payee/beneficiary Ø Remitting bank Ø Paying bank

Methods of payment---remittance ¡ Remittance---transfer of money from one party to another party through banks. ¡ Parties involved in remittance are: Ø Remitter Ø Payee/beneficiary Ø Remitting bank Ø Paying bank

Methods of payment---remittance ¡ Types of remittance Ø Mail transfer, M/T—transfer of money from the remitting Ø Ø ¡ Ø Ø bank to the paying bank by mail (relatively low cost and speed). Telegraphic transfer, T/T—transfer of funds by telecommunication system such as telex or cable (fast speed and high cost). Remittance by banker’s demand draft, D/D– cheaper but slower Difference between D/D and T/T or M/T By D/D, the remitting bank needn’t inform the payee to come to the bank and get paid. D/D can be transferred through endorsement and is negotiable provided that there is opposite stipulations of restrictions.

Methods of payment---remittance ¡ Types of remittance Ø Mail transfer, M/T—transfer of money from the remitting Ø Ø ¡ Ø Ø bank to the paying bank by mail (relatively low cost and speed). Telegraphic transfer, T/T—transfer of funds by telecommunication system such as telex or cable (fast speed and high cost). Remittance by banker’s demand draft, D/D– cheaper but slower Difference between D/D and T/T or M/T By D/D, the remitting bank needn’t inform the payee to come to the bank and get paid. D/D can be transferred through endorsement and is negotiable provided that there is opposite stipulations of restrictions.

Methods of payment---remittance ¡ Use of remittance in international trade Ø Payment after arrival of the goods—open account transaction; highly risky for exporters; based on business credit. Ø Payment in advance--highly risky for importers ü Cash with order ü Cash payment before shipment Ø The buyer shall pay the total value( partial value) to the seller in advance by T/T( M/T or D/D) not later than

Methods of payment---remittance ¡ Use of remittance in international trade Ø Payment after arrival of the goods—open account transaction; highly risky for exporters; based on business credit. Ø Payment in advance--highly risky for importers ü Cash with order ü Cash payment before shipment Ø The buyer shall pay the total value( partial value) to the seller in advance by T/T( M/T or D/D) not later than

Methods of payment---remittance ¡ Cash with order---pay when placing the order ü Attract sales ü High risk of loss to the importer as the exporter may not ship the goods ¡ Cash payment before shipment ---pay when the goods ready for shipment ü The exporter faces little risk ü Ascertain the payment has been actually received

Methods of payment---remittance ¡ Cash with order---pay when placing the order ü Attract sales ü High risk of loss to the importer as the exporter may not ship the goods ¡ Cash payment before shipment ---pay when the goods ready for shipment ü The exporter faces little risk ü Ascertain the payment has been actually received

Methods of payment—collection ¡ Collection is the process wherein a bank, in accordance with the seller’s instruction, handles documents( B/L, invoice, insurance policy, etc. ) in order to deliver them to the buyer against payment, acceptance, or on other terms and conditions.

Methods of payment—collection ¡ Collection is the process wherein a bank, in accordance with the seller’s instruction, handles documents( B/L, invoice, insurance policy, etc. ) in order to deliver them to the buyer against payment, acceptance, or on other terms and conditions.

Methods of payment—collection Parties involved in a collection ¡ Principal---drawer, usually the seller ¡ Remitting bank---in the seller’s country working as the agent of the seller ¡ Collecting bank---in buyer’s country presenting the documents to the buyer, usually the remitting bank’s overseas branch or correspondent bank ¡ Presenting bank—the bank presenting the draft and other documents to the payer; usually a bank which has current account with the payer or the collecting bank itself ¡ Payer---drawee, usually the buyer

Methods of payment—collection Parties involved in a collection ¡ Principal---drawer, usually the seller ¡ Remitting bank---in the seller’s country working as the agent of the seller ¡ Collecting bank---in buyer’s country presenting the documents to the buyer, usually the remitting bank’s overseas branch or correspondent bank ¡ Presenting bank—the bank presenting the draft and other documents to the payer; usually a bank which has current account with the payer or the collecting bank itself ¡ Payer---drawee, usually the buyer

Methods of payment—collection Types of collection ¡ Clean collection—the exporter gets paid with the draft only, ie. Without ¡ p Ø Ø p presentation of any other business documents. Documentary collection—a means that ensuring that goods( title documents) are only handed over to the buyer( by a bank) when the amount shown on a bill of exchange is paid or when the customer accepts the bill as a contract to pay by a specified date. Documents against payment, D/P-- documents can only be released to the buyer when he has paid the amount on the draft D/P Sight—documents against payment at sight---documents can only be released to the buyer when he has paid the amount on the draft as soon as the buyer is presented the draft D/P After Sight—the buyer will pay the draft amount a specified number of days after the draft is presented and accepted. Documents against acceptance, D/A---the documents representing the title to the goods will be released to the buyer once the buyer has accepted the draft.

Methods of payment—collection Types of collection ¡ Clean collection—the exporter gets paid with the draft only, ie. Without ¡ p Ø Ø p presentation of any other business documents. Documentary collection—a means that ensuring that goods( title documents) are only handed over to the buyer( by a bank) when the amount shown on a bill of exchange is paid or when the customer accepts the bill as a contract to pay by a specified date. Documents against payment, D/P-- documents can only be released to the buyer when he has paid the amount on the draft D/P Sight—documents against payment at sight---documents can only be released to the buyer when he has paid the amount on the draft as soon as the buyer is presented the draft D/P After Sight—the buyer will pay the draft amount a specified number of days after the draft is presented and accepted. Documents against acceptance, D/A---the documents representing the title to the goods will be released to the buyer once the buyer has accepted the draft.

Risks of documentary collection ¡ Buyer cannot pay ¡ When price decreases, buyer might refuse to pay or a lower price ¡ Buyer might take advantage of seller’s ignorance of the local commercial custom, regulation or law and cheat at transactions ¡ The authorities of some importing country might not be trustworthy

Risks of documentary collection ¡ Buyer cannot pay ¡ When price decreases, buyer might refuse to pay or a lower price ¡ Buyer might take advantage of seller’s ignorance of the local commercial custom, regulation or law and cheat at transactions ¡ The authorities of some importing country might not be trustworthy

Disposal of goods in case of payment default ¡ Dump the goods in the sea if the value is lost ¡ Warehouse the goods while negotiating with the buyer for payment, if the storage cost is very high ¡ Sell the goods to any taker at a lower price if shipping the goods can be costly and the value of the goods is not very high ¡ Return the goods

Disposal of goods in case of payment default ¡ Dump the goods in the sea if the value is lost ¡ Warehouse the goods while negotiating with the buyer for payment, if the storage cost is very high ¡ Sell the goods to any taker at a lower price if shipping the goods can be costly and the value of the goods is not very high ¡ Return the goods

Risks of collection for buyers ¡ Rely on seller’s reputation and ability to deliver high-quality goods ¡ The seller might have sold the documents to another buyer at a higher price ¡ Measures to avoid risks ü Pay or accept after arrival of goods and a preliminary examination ü Accept the draft with conditions authorized by the drawer

Risks of collection for buyers ¡ Rely on seller’s reputation and ability to deliver high-quality goods ¡ The seller might have sold the documents to another buyer at a higher price ¡ Measures to avoid risks ü Pay or accept after arrival of goods and a preliminary examination ü Accept the draft with conditions authorized by the drawer

Characteristics of collection ¡ Importer is the payer. The bank is not responsible for the payment. Collection is a kind of commercial credit. ¡ In D/P, before the importer actually pays the price, title to the goods still belongs to the exporter who has a right to resale the goods. ¡ In D/A, the exporter bears high risk of losses of both the goods and the money. ¡ Collection benefits the importer very much and therefore can be used to attract sales of stockpiling commodities as well as to increase the exporter’s ability of competition in the world market.

Characteristics of collection ¡ Importer is the payer. The bank is not responsible for the payment. Collection is a kind of commercial credit. ¡ In D/P, before the importer actually pays the price, title to the goods still belongs to the exporter who has a right to resale the goods. ¡ In D/A, the exporter bears high risk of losses of both the goods and the money. ¡ Collection benefits the importer very much and therefore can be used to attract sales of stockpiling commodities as well as to increase the exporter’s ability of competition in the world market.

Methods of payment---Letter of Credit ¡ Documentary credit—a written undertaking by a bank given to the seller at the request, and in accordance with the instructions, of the buyer to effect payment up to a stated sum of money, with a prescribed time limit and against stipulated documents. ¡ Characteristics of L/C Ø A kind of bank credit Ø An independent and self-sufficient document Ø A kind of documentary transaction

Methods of payment---Letter of Credit ¡ Documentary credit—a written undertaking by a bank given to the seller at the request, and in accordance with the instructions, of the buyer to effect payment up to a stated sum of money, with a prescribed time limit and against stipulated documents. ¡ Characteristics of L/C Ø A kind of bank credit Ø An independent and self-sufficient document Ø A kind of documentary transaction

Methods of payment---Letter of Credit ¡ Functions of L/C Ø For the exporter’s part, he can get paid relatively safely as long as he provides relevant documents in conformity with stipulations in the L/C. Ø For the exporter’s part, he’s guaranteed to get the title documents and receive qualified goods in time. If a time L/C is used, the exporter can be to some extent financed. Ø For the bank’s part, it can charge fees for issuing and negotiating an L/C. it can also use the deposit of the applicant to quicken its capital turnover.

Methods of payment---Letter of Credit ¡ Functions of L/C Ø For the exporter’s part, he can get paid relatively safely as long as he provides relevant documents in conformity with stipulations in the L/C. Ø For the exporter’s part, he’s guaranteed to get the title documents and receive qualified goods in time. If a time L/C is used, the exporter can be to some extent financed. Ø For the bank’s part, it can charge fees for issuing and negotiating an L/C. it can also use the deposit of the applicant to quicken its capital turnover.

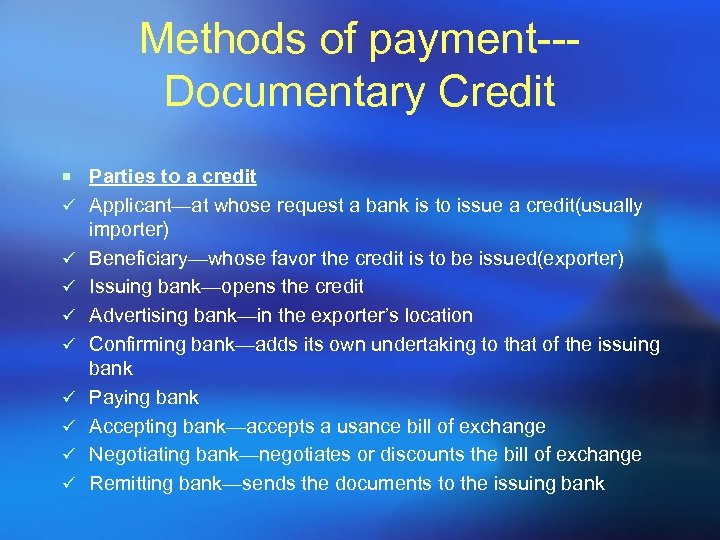

Methods of payment--Documentary Credit ¡ Parties to a credit ü Applicant—at whose request a bank is to issue a credit(usually ü ü ü ü importer) Beneficiary—whose favor the credit is to be issued(exporter) Issuing bank—opens the credit Advertising bank—in the exporter’s location Confirming bank—adds its own undertaking to that of the issuing bank Paying bank Accepting bank—accepts a usance bill of exchange Negotiating bank—negotiates or discounts the bill of exchange Remitting bank—sends the documents to the issuing bank

Methods of payment--Documentary Credit ¡ Parties to a credit ü Applicant—at whose request a bank is to issue a credit(usually ü ü ü ü importer) Beneficiary—whose favor the credit is to be issued(exporter) Issuing bank—opens the credit Advertising bank—in the exporter’s location Confirming bank—adds its own undertaking to that of the issuing bank Paying bank Accepting bank—accepts a usance bill of exchange Negotiating bank—negotiates or discounts the bill of exchange Remitting bank—sends the documents to the issuing bank

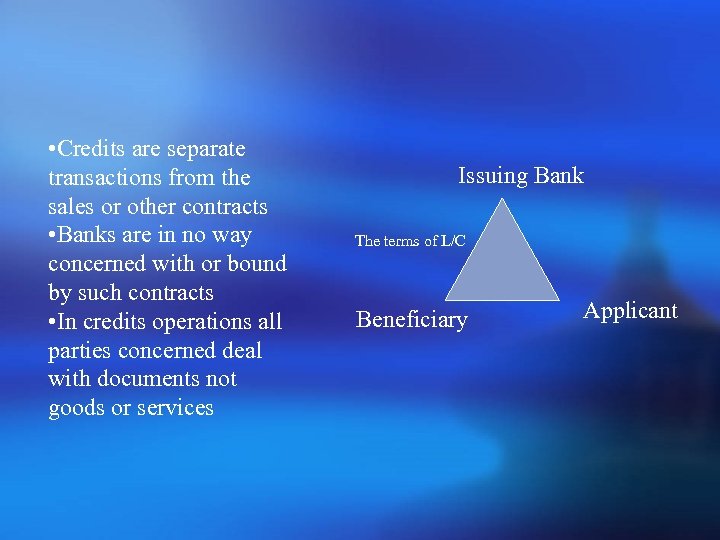

• Credits are separate transactions from the sales or other contracts • Banks are in no way concerned with or bound by such contracts • In credits operations all parties concerned deal with documents not goods or services Issuing Bank The terms of L/C Beneficiary Applicant

• Credits are separate transactions from the sales or other contracts • Banks are in no way concerned with or bound by such contracts • In credits operations all parties concerned deal with documents not goods or services Issuing Bank The terms of L/C Beneficiary Applicant

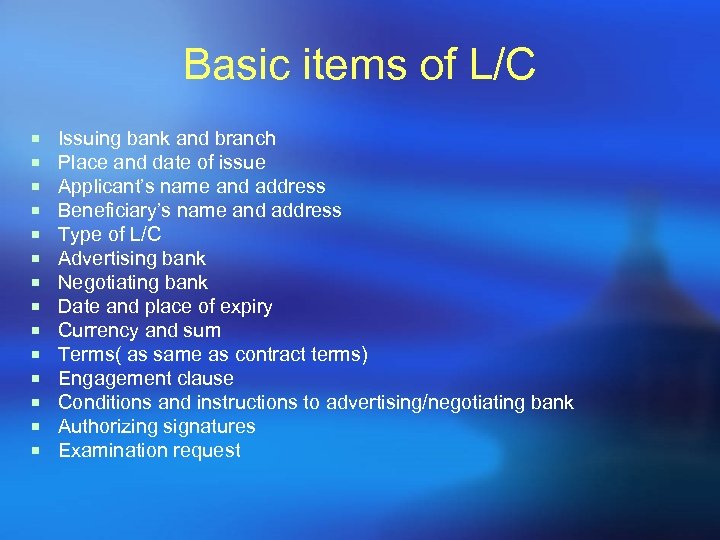

Basic items of L/C ¡ ¡ ¡ ¡ Issuing bank and branch Place and date of issue Applicant’s name and address Beneficiary’s name and address Type of L/C Advertising bank Negotiating bank Date and place of expiry Currency and sum Terms( as same as contract terms) Engagement clause Conditions and instructions to advertising/negotiating bank Authorizing signatures Examination request

Basic items of L/C ¡ ¡ ¡ ¡ Issuing bank and branch Place and date of issue Applicant’s name and address Beneficiary’s name and address Type of L/C Advertising bank Negotiating bank Date and place of expiry Currency and sum Terms( as same as contract terms) Engagement clause Conditions and instructions to advertising/negotiating bank Authorizing signatures Examination request

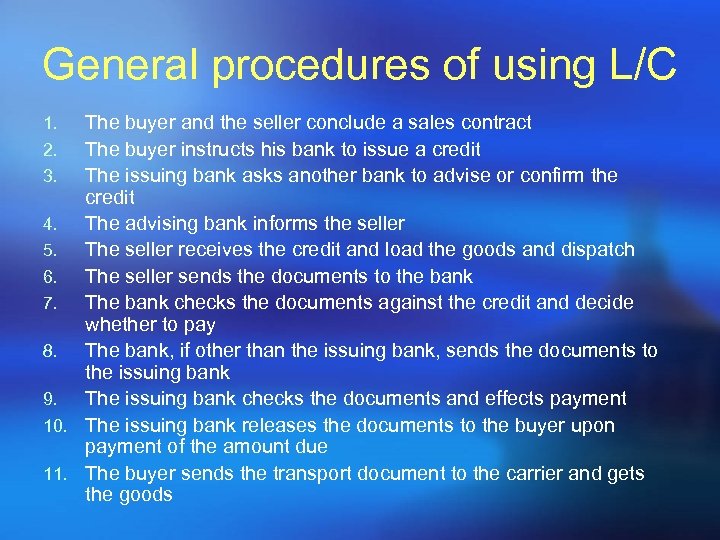

General procedures of using L/C The buyer and the seller conclude a sales contract 2. The buyer instructs his bank to issue a credit 3. The issuing bank asks another bank to advise or confirm the credit 4. The advising bank informs the seller 5. The seller receives the credit and load the goods and dispatch 6. The seller sends the documents to the bank 7. The bank checks the documents against the credit and decide whether to pay 8. The bank, if other than the issuing bank, sends the documents to the issuing bank 9. The issuing bank checks the documents and effects payment 10. The issuing bank releases the documents to the buyer upon payment of the amount due 11. The buyer sends the transport document to the carrier and gets the goods 1.

General procedures of using L/C The buyer and the seller conclude a sales contract 2. The buyer instructs his bank to issue a credit 3. The issuing bank asks another bank to advise or confirm the credit 4. The advising bank informs the seller 5. The seller receives the credit and load the goods and dispatch 6. The seller sends the documents to the bank 7. The bank checks the documents against the credit and decide whether to pay 8. The bank, if other than the issuing bank, sends the documents to the issuing bank 9. The issuing bank checks the documents and effects payment 10. The issuing bank releases the documents to the buyer upon payment of the amount due 11. The buyer sends the transport document to the carrier and gets the goods 1.

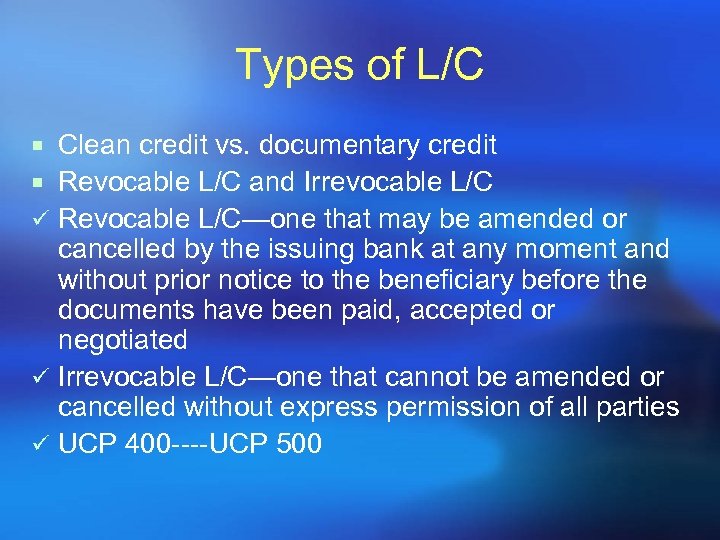

Types of L/C ¡ Clean credit vs. documentary credit ¡ Revocable L/C and Irrevocable L/C ü Revocable L/C—one that may be amended or cancelled by the issuing bank at any moment and without prior notice to the beneficiary before the documents have been paid, accepted or negotiated ü Irrevocable L/C—one that cannot be amended or cancelled without express permission of all parties ü UCP 400 ----UCP 500

Types of L/C ¡ Clean credit vs. documentary credit ¡ Revocable L/C and Irrevocable L/C ü Revocable L/C—one that may be amended or cancelled by the issuing bank at any moment and without prior notice to the beneficiary before the documents have been paid, accepted or negotiated ü Irrevocable L/C—one that cannot be amended or cancelled without express permission of all parties ü UCP 400 ----UCP 500

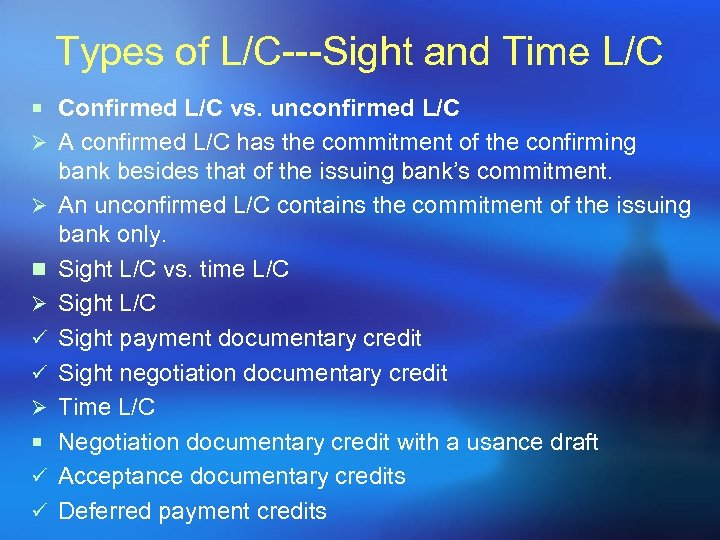

Types of L/C---Sight and Time L/C ¡ Confirmed L/C vs. unconfirmed L/C Ø A confirmed L/C has the commitment of the confirming Ø n Ø ü ü Ø ¡ ü ü bank besides that of the issuing bank’s commitment. An unconfirmed L/C contains the commitment of the issuing bank only. Sight L/C vs. time L/C Sight payment documentary credit Sight negotiation documentary credit Time L/C Negotiation documentary credit with a usance draft Acceptance documentary credits Deferred payment credits

Types of L/C---Sight and Time L/C ¡ Confirmed L/C vs. unconfirmed L/C Ø A confirmed L/C has the commitment of the confirming Ø n Ø ü ü Ø ¡ ü ü bank besides that of the issuing bank’s commitment. An unconfirmed L/C contains the commitment of the issuing bank only. Sight L/C vs. time L/C Sight payment documentary credit Sight negotiation documentary credit Time L/C Negotiation documentary credit with a usance draft Acceptance documentary credits Deferred payment credits

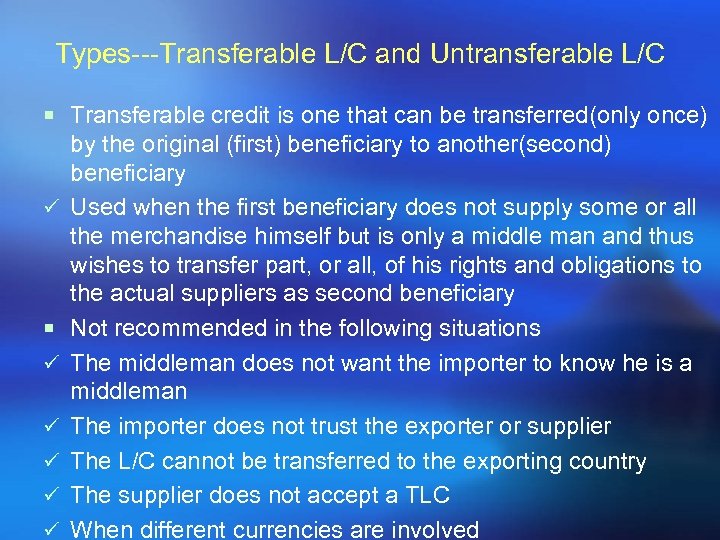

Types---Transferable L/C and Untransferable L/C ¡ Transferable credit is one that can be transferred(only once) ü ¡ ü ü ü by the original (first) beneficiary to another(second) beneficiary Used when the first beneficiary does not supply some or all the merchandise himself but is only a middle man and thus wishes to transfer part, or all, of his rights and obligations to the actual suppliers as second beneficiary Not recommended in the following situations The middleman does not want the importer to know he is a middleman The importer does not trust the exporter or supplier The L/C cannot be transferred to the exporting country The supplier does not accept a TLC When different currencies are involved

Types---Transferable L/C and Untransferable L/C ¡ Transferable credit is one that can be transferred(only once) ü ¡ ü ü ü by the original (first) beneficiary to another(second) beneficiary Used when the first beneficiary does not supply some or all the merchandise himself but is only a middle man and thus wishes to transfer part, or all, of his rights and obligations to the actual suppliers as second beneficiary Not recommended in the following situations The middleman does not want the importer to know he is a middleman The importer does not trust the exporter or supplier The L/C cannot be transferred to the exporting country The supplier does not accept a TLC When different currencies are involved

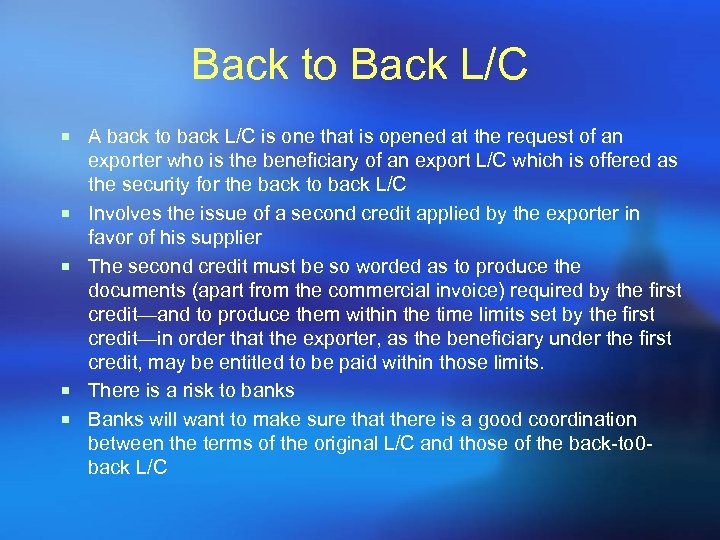

Back to Back L/C ¡ A back to back L/C is one that is opened at the request of an ¡ ¡ exporter who is the beneficiary of an export L/C which is offered as the security for the back to back L/C Involves the issue of a second credit applied by the exporter in favor of his supplier The second credit must be so worded as to produce the documents (apart from the commercial invoice) required by the first credit—and to produce them within the time limits set by the first credit—in order that the exporter, as the beneficiary under the first credit, may be entitled to be paid within those limits. There is a risk to banks Banks will want to make sure that there is a good coordination between the terms of the original L/C and those of the back-to 0 back L/C

Back to Back L/C ¡ A back to back L/C is one that is opened at the request of an ¡ ¡ exporter who is the beneficiary of an export L/C which is offered as the security for the back to back L/C Involves the issue of a second credit applied by the exporter in favor of his supplier The second credit must be so worded as to produce the documents (apart from the commercial invoice) required by the first credit—and to produce them within the time limits set by the first credit—in order that the exporter, as the beneficiary under the first credit, may be entitled to be paid within those limits. There is a risk to banks Banks will want to make sure that there is a good coordination between the terms of the original L/C and those of the back-to 0 back L/C

Revolving L/C ¡ One that is issued for a specific amount which renews itself for the same amount over a given period. ¡ Used by an importer who anticipates a regular flow of merchandise from a particular foreign supplier when there a series of shipments at regular intervals and the parties involved wish the program to proceed without interruption. ¡ The exporter will ship the goods, present documents to the bank and get paid. Then the credit become available again in the original form to the exporter and another shipment can be made.

Revolving L/C ¡ One that is issued for a specific amount which renews itself for the same amount over a given period. ¡ Used by an importer who anticipates a regular flow of merchandise from a particular foreign supplier when there a series of shipments at regular intervals and the parties involved wish the program to proceed without interruption. ¡ The exporter will ship the goods, present documents to the bank and get paid. Then the credit become available again in the original form to the exporter and another shipment can be made.

Red Clause L/C ¡ L/C with a clause (originally typed or printed in red ink to draw special attention) that authorizes the advising bank to make clean advances of a certain percentage or the total amount of the L/C to the exporter to allow the beneficiary to obtain an advance or preshipment advances from the advising or confirming bank at the responsibility of the issuing bank. ¡ Designed to finance the beneficiary’s purchase of raw materials to manufacture the goods or to make cash payments to the supplier

Red Clause L/C ¡ L/C with a clause (originally typed or printed in red ink to draw special attention) that authorizes the advising bank to make clean advances of a certain percentage or the total amount of the L/C to the exporter to allow the beneficiary to obtain an advance or preshipment advances from the advising or confirming bank at the responsibility of the issuing bank. ¡ Designed to finance the beneficiary’s purchase of raw materials to manufacture the goods or to make cash payments to the supplier

Standby L/C ¡ Intended to cover a non- performance(default) situation ¡ A sum will be paid to the beneficiary on demand in the event the beneficiary submits a signed statement(default claim) setting forth that there has been default.

Standby L/C ¡ Intended to cover a non- performance(default) situation ¡ A sum will be paid to the beneficiary on demand in the event the beneficiary submits a signed statement(default claim) setting forth that there has been default.

Disadvantages of L/C ¡ High cost ¡ The amount of time that has to be spent ü Accuracy of documentation is a must

Disadvantages of L/C ¡ High cost ¡ The amount of time that has to be spent ü Accuracy of documentation is a must

How to decide if the L/C should be used ¡ Corporate credit policy and the company’s ability ¡ ¡ ¡ to absorb risks Credit standing of the importer Political environment in the importing country Current market conditions and payment terms offered by competition Type of merchandise to be shipped and the value of the shipment Type of exchange controls in the importing country and the buyer’s ability to get foreign exchange

How to decide if the L/C should be used ¡ Corporate credit policy and the company’s ability ¡ ¡ ¡ to absorb risks Credit standing of the importer Political environment in the importing country Current market conditions and payment terms offered by competition Type of merchandise to be shipped and the value of the shipment Type of exchange controls in the importing country and the buyer’s ability to get foreign exchange

How to handle documentary discrepancies ¡ Correct the discrepancies and resubmit the documents and draft within the validity of the L/C ¡ Request the importer to waive discrepancies if they do not materially affect the shipment ¡ Provide a documentary discrepancy guarantee if, unwilling to wait for the waiver, the exporter is confident that the importer will accept the discrepancy ¡ Submit the documents on collection basis

How to handle documentary discrepancies ¡ Correct the discrepancies and resubmit the documents and draft within the validity of the L/C ¡ Request the importer to waive discrepancies if they do not materially affect the shipment ¡ Provide a documentary discrepancy guarantee if, unwilling to wait for the waiver, the exporter is confident that the importer will accept the discrepancy ¡ Submit the documents on collection basis

Open Account ¡ An arrangement in which the credit is extended to an individual, firm, corporation or other legal entity based on an estimate of the general ability to pay ¡ Procedures ü The seller dispatcher the goods ü Sends the invoice to the buyer ü When goods are dispatched, the title to the goods transfers to the buyer ¡ The seller stipulates a time period in which payment is to be made. 2/10—the buyer can take two percent off if he pays within 10 days

Open Account ¡ An arrangement in which the credit is extended to an individual, firm, corporation or other legal entity based on an estimate of the general ability to pay ¡ Procedures ü The seller dispatcher the goods ü Sends the invoice to the buyer ü When goods are dispatched, the title to the goods transfers to the buyer ¡ The seller stipulates a time period in which payment is to be made. 2/10—the buyer can take two percent off if he pays within 10 days

Advantages and disadvantages ¡ Advantages ü great flexibility and convenience ü The use of bank is reduced to minimum, less cost ¡ Disadvantages ü Total loss for the seller due to lack of real evidence of indebtedness (risks---the buyer’s insolvency and willful default) ü Delay in payment can be indefinite Insolvency--state of bankruptcy: the condition of being unable to pay debts, or an instance of this Default--failure to do something: a failure to meet an obligation, especially a financial one

Advantages and disadvantages ¡ Advantages ü great flexibility and convenience ü The use of bank is reduced to minimum, less cost ¡ Disadvantages ü Total loss for the seller due to lack of real evidence of indebtedness (risks---the buyer’s insolvency and willful default) ü Delay in payment can be indefinite Insolvency--state of bankruptcy: the condition of being unable to pay debts, or an instance of this Default--failure to do something: a failure to meet an obligation, especially a financial one

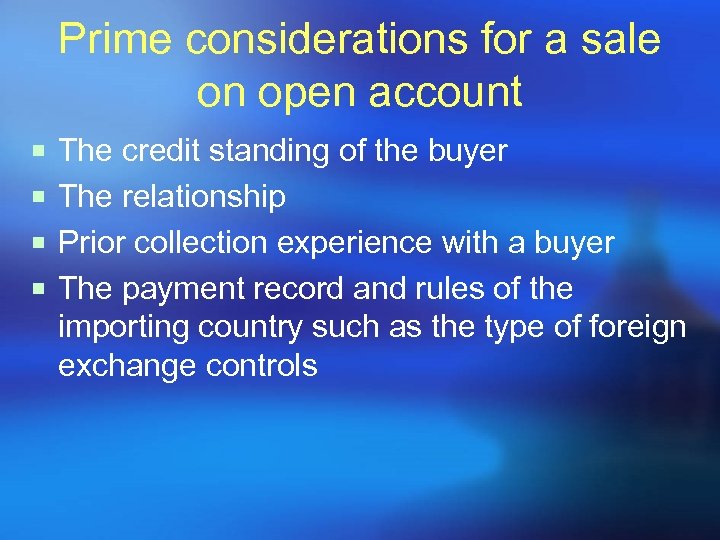

Prime considerations for a sale on open account ¡ The credit standing of the buyer ¡ The relationship ¡ Prior collection experience with a buyer ¡ The payment record and rules of the importing country such as the type of foreign exchange controls

Prime considerations for a sale on open account ¡ The credit standing of the buyer ¡ The relationship ¡ Prior collection experience with a buyer ¡ The payment record and rules of the importing country such as the type of foreign exchange controls

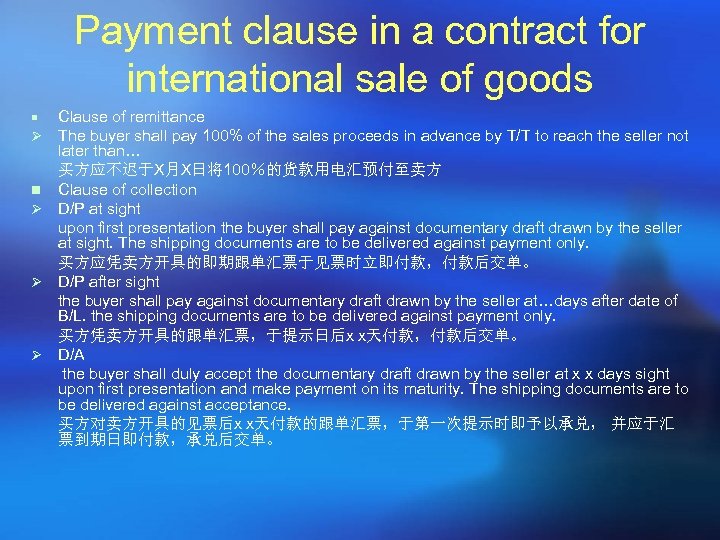

Payment clause in a contract for international sale of goods Clause of remittance The buyer shall pay 100% of the sales proceeds in advance by T/T to reach the seller not later than… 买方应不迟于X月X日将100%的货款用电汇预付至卖方 n Clause of collection Ø D/P at sight upon first presentation the buyer shall pay against documentary draft drawn by the seller at sight. The shipping documents are to be delivered against payment only. 买方应凭卖方开具的即期跟单汇票于见票时立即付款,付款后交单。 Ø D/P after sight the buyer shall pay against documentary draft drawn by the seller at…days after date of B/L. the shipping documents are to be delivered against payment only. 买方凭卖方开具的跟单汇票,于提示日后x x天付款,付款后交单。 Ø D/A the buyer shall duly accept the documentary draft drawn by the seller at x x days sight upon first presentation and make payment on its maturity. The shipping documents are to be delivered against acceptance. 买方对卖方开具的见票后x x天付款的跟单汇票,于第一次提示时即予以承兑, 并应于汇 票到期日即付款,承兑后交单。 ¡ Ø

Payment clause in a contract for international sale of goods Clause of remittance The buyer shall pay 100% of the sales proceeds in advance by T/T to reach the seller not later than… 买方应不迟于X月X日将100%的货款用电汇预付至卖方 n Clause of collection Ø D/P at sight upon first presentation the buyer shall pay against documentary draft drawn by the seller at sight. The shipping documents are to be delivered against payment only. 买方应凭卖方开具的即期跟单汇票于见票时立即付款,付款后交单。 Ø D/P after sight the buyer shall pay against documentary draft drawn by the seller at…days after date of B/L. the shipping documents are to be delivered against payment only. 买方凭卖方开具的跟单汇票,于提示日后x x天付款,付款后交单。 Ø D/A the buyer shall duly accept the documentary draft drawn by the seller at x x days sight upon first presentation and make payment on its maturity. The shipping documents are to be delivered against acceptance. 买方对卖方开具的见票后x x天付款的跟单汇票,于第一次提示时即予以承兑, 并应于汇 票到期日即付款,承兑后交单。 ¡ Ø

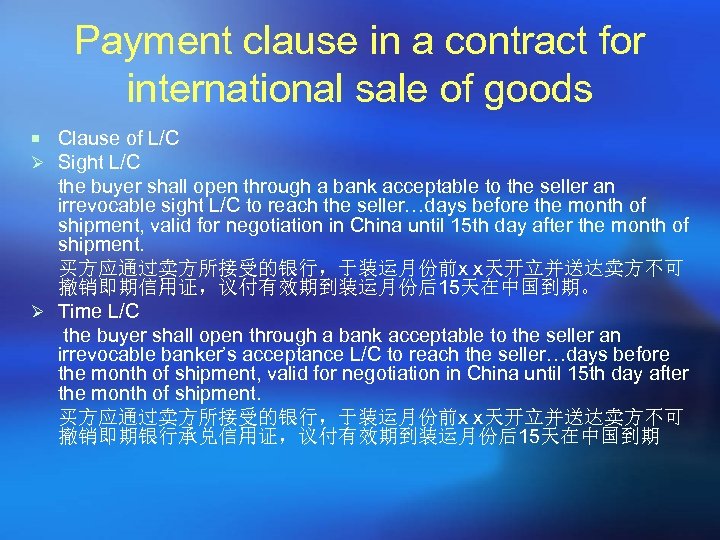

Payment clause in a contract for international sale of goods ¡ Clause of L/C Ø Sight L/C the buyer shall open through a bank acceptable to the seller an irrevocable sight L/C to reach the seller…days before the month of shipment, valid for negotiation in China until 15 th day after the month of shipment. 买方应通过卖方所接受的银行,于装运月份前x x天开立并送达卖方不可 撤销即期信用证,议付有效期到装运月份后15天在中国到期。 Ø Time L/C the buyer shall open through a bank acceptable to the seller an irrevocable banker’s acceptance L/C to reach the seller…days before the month of shipment, valid for negotiation in China until 15 th day after the month of shipment. 买方应通过卖方所接受的银行,于装运月份前x x天开立并送达卖方不可 撤销即期银行承兑信用证,议付有效期到装运月份后15天在中国到期

Payment clause in a contract for international sale of goods ¡ Clause of L/C Ø Sight L/C the buyer shall open through a bank acceptable to the seller an irrevocable sight L/C to reach the seller…days before the month of shipment, valid for negotiation in China until 15 th day after the month of shipment. 买方应通过卖方所接受的银行,于装运月份前x x天开立并送达卖方不可 撤销即期信用证,议付有效期到装运月份后15天在中国到期。 Ø Time L/C the buyer shall open through a bank acceptable to the seller an irrevocable banker’s acceptance L/C to reach the seller…days before the month of shipment, valid for negotiation in China until 15 th day after the month of shipment. 买方应通过卖方所接受的银行,于装运月份前x x天开立并送达卖方不可 撤销即期银行承兑信用证,议付有效期到装运月份后15天在中国到期

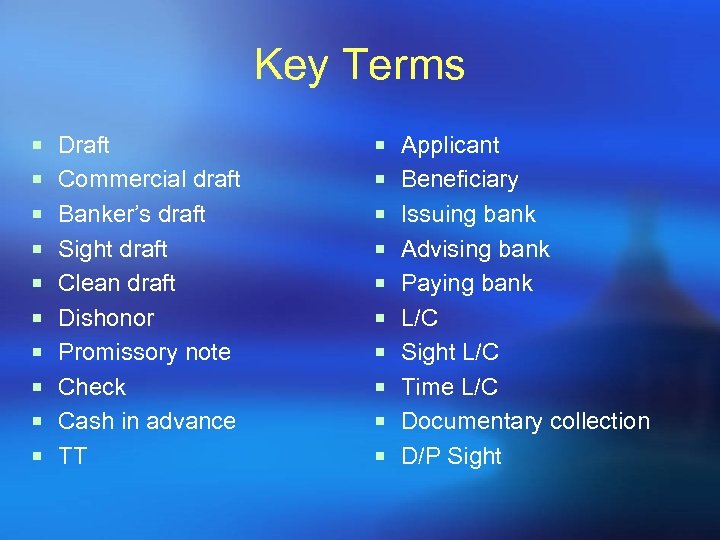

Key Terms ¡ Draft ¡ Applicant ¡ Commercial draft ¡ Beneficiary ¡ Banker’s draft ¡ Issuing bank ¡ Sight draft ¡ Advising bank ¡ Clean draft ¡ Paying bank ¡ Dishonor ¡ L/C ¡ Promissory note ¡ Sight L/C ¡ Check ¡ Time L/C ¡ Cash in advance ¡ Documentary collection ¡ TT ¡ D/P Sight

Key Terms ¡ Draft ¡ Applicant ¡ Commercial draft ¡ Beneficiary ¡ Banker’s draft ¡ Issuing bank ¡ Sight draft ¡ Advising bank ¡ Clean draft ¡ Paying bank ¡ Dishonor ¡ L/C ¡ Promissory note ¡ Sight L/C ¡ Check ¡ Time L/C ¡ Cash in advance ¡ Documentary collection ¡ TT ¡ D/P Sight

Key Terms ¡ D/P After Sight ¡ D/A ¡ Open account ¡ Insolvency ¡ Willful default

Key Terms ¡ D/P After Sight ¡ D/A ¡ Open account ¡ Insolvency ¡ Willful default