62b395ac0e294a50d245b3f3ce875a68.ppt

- Количество слайдов: 39

Payment and settlement systems - changing dynamics Reserve Bank of India Pune, 30 September – 1 October 2013 T 2 S Programme Office European Central Bank

Payment and settlement systems - changing dynamics Reserve Bank of India Pune, 30 September – 1 October 2013 T 2 S Programme Office European Central Bank

Table of Contents Payment and settlement systems – changing global dynamics 1 European context and challenges 2 Use of global standard for local systems 3 Global trends in the field of market infrastructure 1

Table of Contents Payment and settlement systems – changing global dynamics 1 European context and challenges 2 Use of global standard for local systems 3 Global trends in the field of market infrastructure 1

EU: a single market An area without internal frontiers where §goods §persons §services §capital • can circulate freely.

EU: a single market An area without internal frontiers where §goods §persons §services §capital • can circulate freely.

SEPA for retail and card payments Cashless payments in euro in the EU (EEA) should become as easy, efficient and reliable as domestic payments “One account, one card, one terminal”

SEPA for retail and card payments Cashless payments in euro in the EU (EEA) should become as easy, efficient and reliable as domestic payments “One account, one card, one terminal”

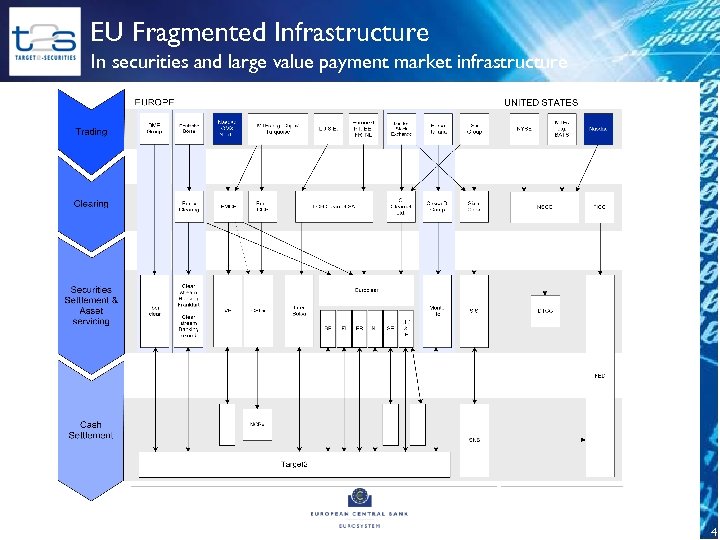

EU Fragmented Infrastructure In securities and large value payment market infrastructure 4

EU Fragmented Infrastructure In securities and large value payment market infrastructure 4

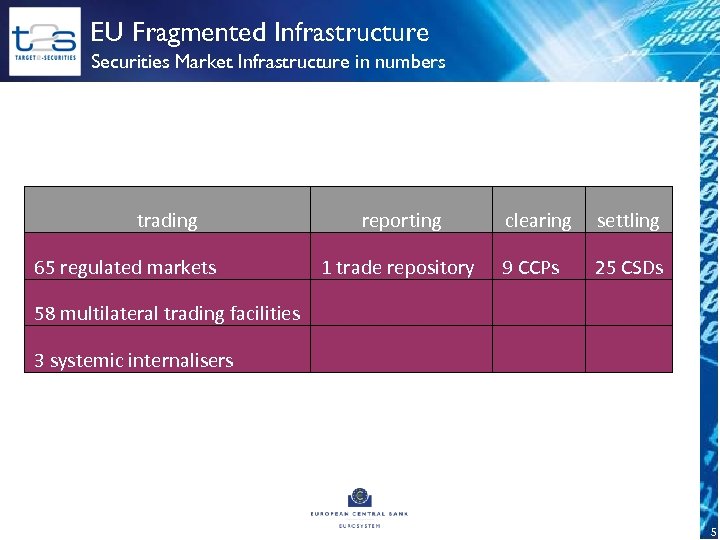

EU Fragmented Infrastructure Securities Market Infrastructure in numbers trading 65 regulated markets reporting clearing 1 trade repository 9 CCPs settling 25 CSDs 58 multilateral trading facilities 3 systemic internalisers 5

EU Fragmented Infrastructure Securities Market Infrastructure in numbers trading 65 regulated markets reporting clearing 1 trade repository 9 CCPs settling 25 CSDs 58 multilateral trading facilities 3 systemic internalisers 5

EU market infrastructure challenges § The integration of European market infrastructure is a political priority for EU governments § Major efforts are being made to facilitate integration, through harmonisation and interoperability § Usage of global standards is a must § Three actions possible for ECB/Eurosystem: regulations, catalyst for change, operator of market infrastructure 6

EU market infrastructure challenges § The integration of European market infrastructure is a political priority for EU governments § Major efforts are being made to facilitate integration, through harmonisation and interoperability § Usage of global standards is a must § Three actions possible for ECB/Eurosystem: regulations, catalyst for change, operator of market infrastructure 6

Table of Contents Payment and settlement systems – changing global dynamics 1 European context and challenges 2 Use of global standard for local systems 3 Global trends in the field of market infrastructure 7

Table of Contents Payment and settlement systems – changing global dynamics 1 European context and challenges 2 Use of global standard for local systems 3 Global trends in the field of market infrastructure 7

Use of global standards Providing an integrated market infrastructure For EU… § A common platform for payments large value: TARGET 2 ISO 20022 a common element § A common securities market infrastructure: T 2 S § Standardising retail payments for creating a single euro payment area (SEPA) 8

Use of global standards Providing an integrated market infrastructure For EU… § A common platform for payments large value: TARGET 2 ISO 20022 a common element § A common securities market infrastructure: T 2 S § Standardising retail payments for creating a single euro payment area (SEPA) 8

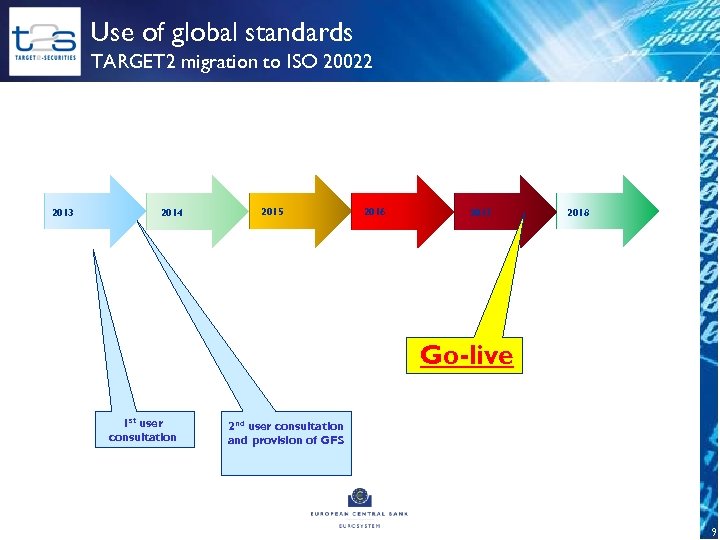

Use of global standards TARGET 2 migration to ISO 20022 2013 2014 2015 2016 2017 2018 Go-live 1 st user consultation 2 nd user consultation and provision of GFS 9

Use of global standards TARGET 2 migration to ISO 20022 2013 2014 2015 2016 2017 2018 Go-live 1 st user consultation 2 nd user consultation and provision of GFS 9

Use of global standards Maximising the reuse of investments for market participants There were a number of initiatives in Europe related to ISO 20022 already before TARGET 2 approved its migration strategy: Ø SEPA: the Single Euro Payments Area has replaced domestic retail credit transfers and direct debits with standardised European payments by using ISO 20022 messages Ø T 2 S: as announced by the T 2 S program, ISO 20022 messages will be used from the outset (new messages had to be developed for T 2 S, as no international standards previously existed) Ø EU: in the securities industry the EU is driven by the Giovannini Protocol, aiming at eliminating barriers that hamper efficient cross border activities in Europe (harmonising different standards and communication protocols is one way to achieve it) 10

Use of global standards Maximising the reuse of investments for market participants There were a number of initiatives in Europe related to ISO 20022 already before TARGET 2 approved its migration strategy: Ø SEPA: the Single Euro Payments Area has replaced domestic retail credit transfers and direct debits with standardised European payments by using ISO 20022 messages Ø T 2 S: as announced by the T 2 S program, ISO 20022 messages will be used from the outset (new messages had to be developed for T 2 S, as no international standards previously existed) Ø EU: in the securities industry the EU is driven by the Giovannini Protocol, aiming at eliminating barriers that hamper efficient cross border activities in Europe (harmonising different standards and communication protocols is one way to achieve it) 10

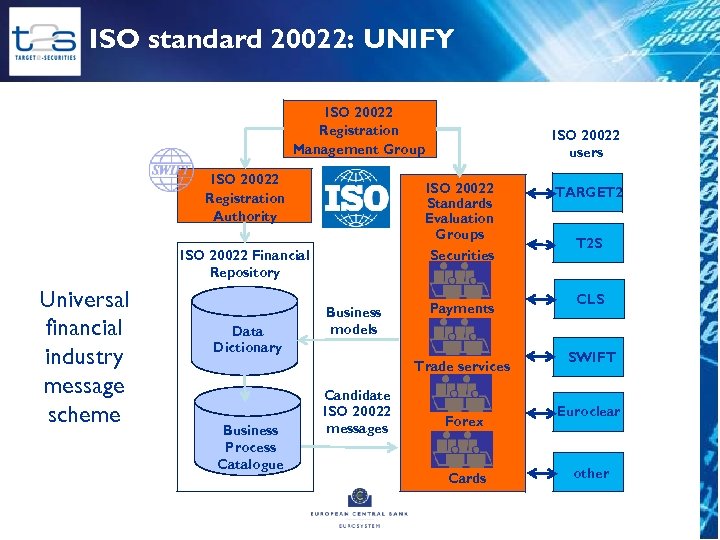

ISO standard 20022: UNIFY ISO 20022 Registration Management Group ISO 20022 Registration Authority ISO 20022 Standards Evaluation Groups Securities ISO 20022 Financial Repository Universal financial industry message scheme Data Dictionary ISO 20022 users Business models Payments Trade services Business Process Catalogue Candidate ISO 20022 messages Forex Cards TARGET 2 T 2 S CLS SWIFT Euroclear other 11

ISO standard 20022: UNIFY ISO 20022 Registration Management Group ISO 20022 Registration Authority ISO 20022 Standards Evaluation Groups Securities ISO 20022 Financial Repository Universal financial industry message scheme Data Dictionary ISO 20022 users Business models Payments Trade services Business Process Catalogue Candidate ISO 20022 messages Forex Cards TARGET 2 T 2 S CLS SWIFT Euroclear other 11

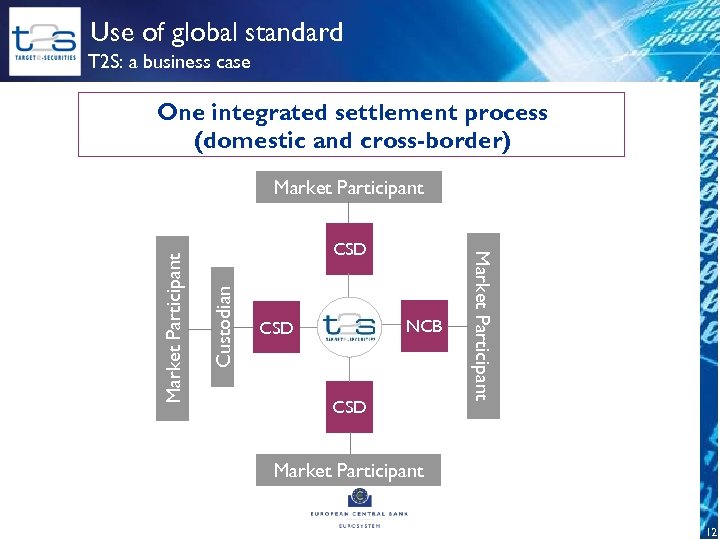

Use of global standard T 2 S: a business case One integrated settlement process (domestic and cross-border) Custodian CSD NCB CSD Market Participant 12

Use of global standard T 2 S: a business case One integrated settlement process (domestic and cross-border) Custodian CSD NCB CSD Market Participant 12

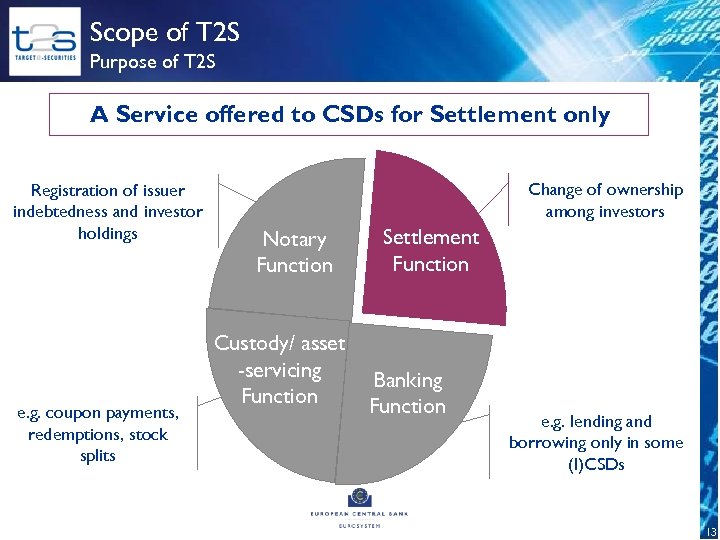

Scope of T 2 S Purpose of T 2 S A Service offered to CSDs for Settlement only Registration of issuer indebtedness and investor holdings e. g. coupon payments, redemptions, stock splits Change of ownership among investors Notary Function Custody/ asset -servicing Function Settlement Function Banking Function e. g. lending and borrowing only in some (I)CSDs 13

Scope of T 2 S Purpose of T 2 S A Service offered to CSDs for Settlement only Registration of issuer indebtedness and investor holdings e. g. coupon payments, redemptions, stock splits Change of ownership among investors Notary Function Custody/ asset -servicing Function Settlement Function Banking Function e. g. lending and borrowing only in some (I)CSDs 13

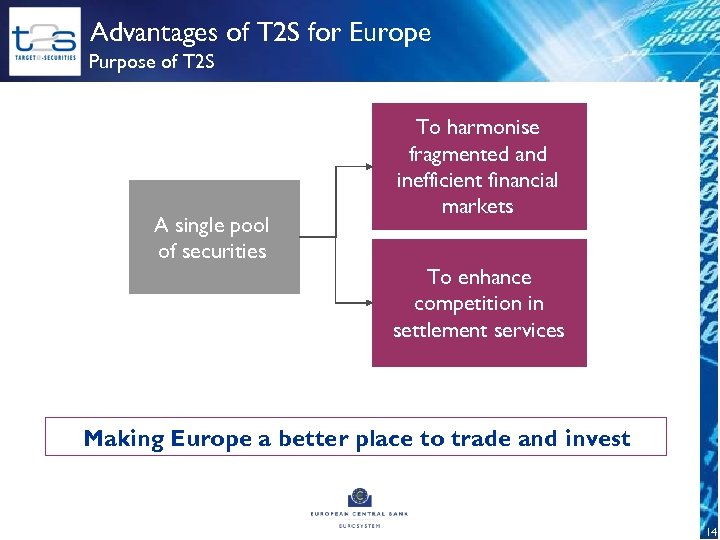

Advantages of T 2 S for Europe Purpose of T 2 S A single pool of securities To harmonise fragmented and inefficient financial markets To enhance competition in settlement services Making Europe a better place to trade and invest 14

Advantages of T 2 S for Europe Purpose of T 2 S A single pool of securities To harmonise fragmented and inefficient financial markets To enhance competition in settlement services Making Europe a better place to trade and invest 14

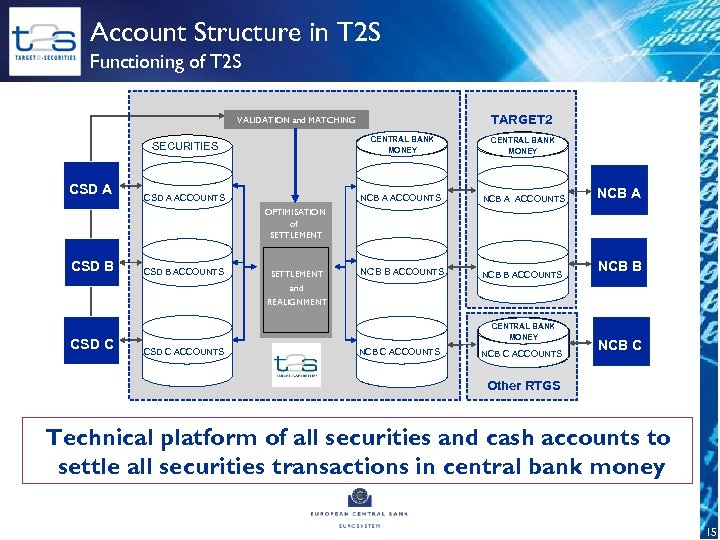

Account Structure in T 2 S Functioning of T 2 S VALIDATION and. MATCHING VALIDATION and MATCHING TARGET 2 SECURITIES CSD A CENTRAL BANK MONEY CSD A ACCOUNTS NCB A ACCOUNTS CSD NCB AAA NCB B ACCOUNTS NCB B CSD B NCB OPTIMISATION of of CENTRAL BANK MONEY SETTLEMENT CSD B ACCOUNTS SETTLEMENT and REALIGNMENT CSD C CENTRAL BANK MONEY CSD C ACCOUNTS NCB A ACCOUNTS NCB C CSD C NCB Other RTGS Technical platform of all securities and cash accounts to settle all securities transactions in central bank money 15

Account Structure in T 2 S Functioning of T 2 S VALIDATION and. MATCHING VALIDATION and MATCHING TARGET 2 SECURITIES CSD A CENTRAL BANK MONEY CSD A ACCOUNTS NCB A ACCOUNTS CSD NCB AAA NCB B ACCOUNTS NCB B CSD B NCB OPTIMISATION of of CENTRAL BANK MONEY SETTLEMENT CSD B ACCOUNTS SETTLEMENT and REALIGNMENT CSD C CENTRAL BANK MONEY CSD C ACCOUNTS NCB A ACCOUNTS NCB C CSD C NCB Other RTGS Technical platform of all securities and cash accounts to settle all securities transactions in central bank money 15

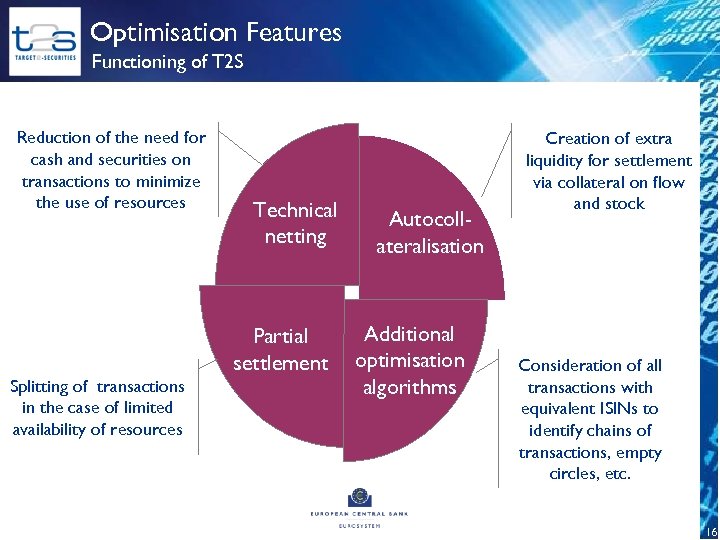

Optimisation Features Functioning of T 2 S Reduction of the need for cash and securities on transactions to minimize the use of resources Notary Function Technical Autocollnetting ateralisation Partial settlement Splitting of transactions in the case of limited availability of resources Additional optimisation algorithms Creation of extra liquidity for settlement via collateral on flow and stock Consideration of all transactions with equivalent ISINs to identify chains of transactions, empty circles, etc. 16

Optimisation Features Functioning of T 2 S Reduction of the need for cash and securities on transactions to minimize the use of resources Notary Function Technical Autocollnetting ateralisation Partial settlement Splitting of transactions in the case of limited availability of resources Additional optimisation algorithms Creation of extra liquidity for settlement via collateral on flow and stock Consideration of all transactions with equivalent ISINs to identify chains of transactions, empty circles, etc. 16

User Connectivity Functioning of T 2 S § Two T 2 S network providers to maintain competition: - Eurosystem licensing procedures led to selection of SIA/Colt and SWIFT as the two valueadded network providers § Additionally, internet access in U 2 A mode is also planned 17

User Connectivity Functioning of T 2 S § Two T 2 S network providers to maintain competition: - Eurosystem licensing procedures led to selection of SIA/Colt and SWIFT as the two valueadded network providers § Additionally, internet access in U 2 A mode is also planned 17

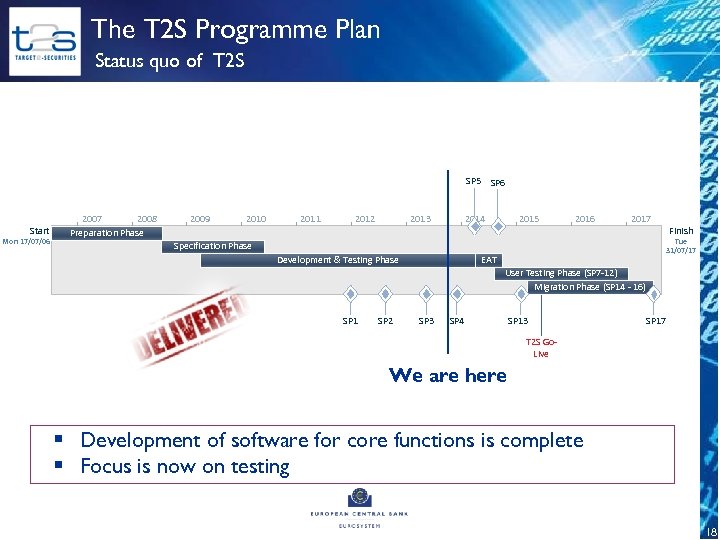

The T 2 S Programme Plan Status quo of T 2 S SP 5 SP 6 Start Mon 17/07/06 2007 2008 Preparation Phase 2009 2010 2011 2012 2013 2014 2015 2016 2017 Tue 31/07/17 Specification Phase Development & Testing Phase Finish EAT User Testing Phase (SP 7 -12) Migration Phase (SP 14 - 16) SP 1 SP 2 SP 3 SP 4 SP 13 SP 17 T 2 S Go. Live We are here § Development of software for core functions is complete § Focus is now on testing 18

The T 2 S Programme Plan Status quo of T 2 S SP 5 SP 6 Start Mon 17/07/06 2007 2008 Preparation Phase 2009 2010 2011 2012 2013 2014 2015 2016 2017 Tue 31/07/17 Specification Phase Development & Testing Phase Finish EAT User Testing Phase (SP 7 -12) Migration Phase (SP 14 - 16) SP 1 SP 2 SP 3 SP 4 SP 13 SP 17 T 2 S Go. Live We are here § Development of software for core functions is complete § Focus is now on testing 18

T 2 S Community § 23 CSDs have confirmed their participation, representing nearly 100% of settlement volume in euro § T 2 S remains an open system: other CSDs can still join, but will have to pay an entry fee § So far only the euro and DKK (as of 2018) will be settled in T 2 S, but other currencies may join later 19

T 2 S Community § 23 CSDs have confirmed their participation, representing nearly 100% of settlement volume in euro § T 2 S remains an open system: other CSDs can still join, but will have to pay an entry fee § So far only the euro and DKK (as of 2018) will be settled in T 2 S, but other currencies may join later 19

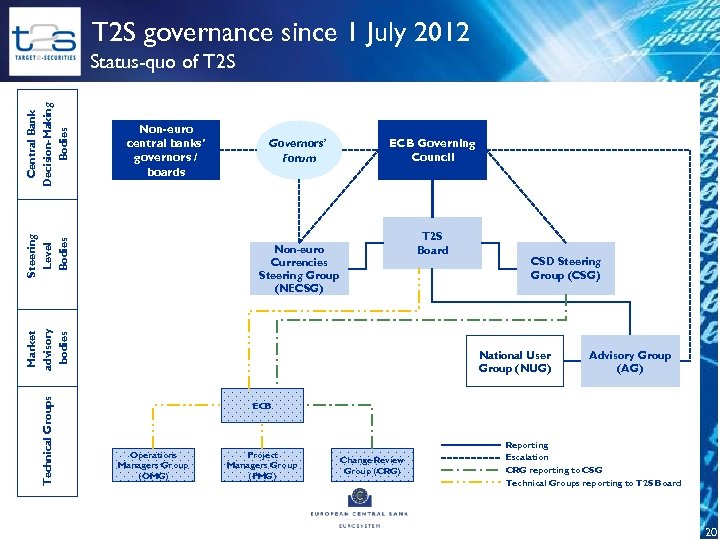

T 2 S governance since 1 July 2012 Non-euro central banks’ governors / boards Steering Level Bodies Central Bank Decision-Making Bodies Status-quo of T 2 S Governors’ Forum ECB Governing Council T 2 S Board Technical Groups Market advisory bodies Non-euro Currencies Steering Group (NECSG) CSD Steering Group (CSG) National User Group (NUG) Advisory Group (AG) ECB Operations Managers Group (OMG) Project Managers Group (PMG) Change Review Group (CRG) Reporting Escalation CRG reporting to CSG Technical Groups reporting to T 2 S Board 20

T 2 S governance since 1 July 2012 Non-euro central banks’ governors / boards Steering Level Bodies Central Bank Decision-Making Bodies Status-quo of T 2 S Governors’ Forum ECB Governing Council T 2 S Board Technical Groups Market advisory bodies Non-euro Currencies Steering Group (NECSG) CSD Steering Group (CSG) National User Group (NUG) Advisory Group (AG) ECB Operations Managers Group (OMG) Project Managers Group (PMG) Change Review Group (CRG) Reporting Escalation CRG reporting to CSG Technical Groups reporting to T 2 S Board 20

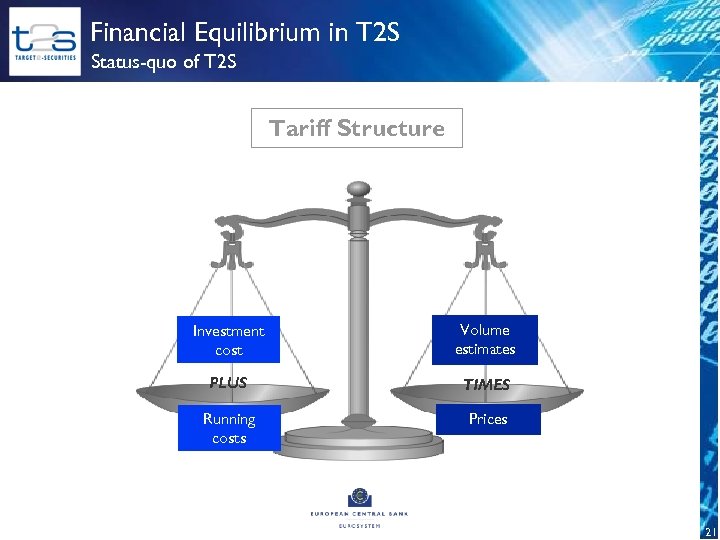

Financial Equilibrium in T 2 S Status-quo of T 2 S Tariff Structure Investment cost Volume estimates PLUS TIMES Running costs Prices 21

Financial Equilibrium in T 2 S Status-quo of T 2 S Tariff Structure Investment cost Volume estimates PLUS TIMES Running costs Prices 21

Market integration A new securities settlement landscape Three streams shaping the new European securities settlement landscape CSDR 22

Market integration A new securities settlement landscape Three streams shaping the new European securities settlement landscape CSDR 22

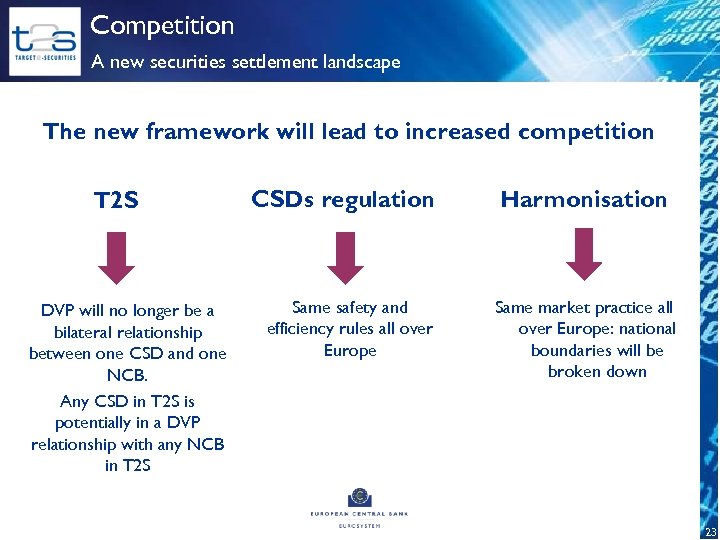

Competition A new securities settlement landscape The new framework will lead to increased competition T 2 S DVP will no longer be a bilateral relationship between one CSD and one NCB. Any CSD in T 2 S is potentially in a DVP relationship with any NCB in T 2 S CSDs regulation Same safety and efficiency rules all over Europe Harmonisation Same market practice all over Europe: national boundaries will be broken down 23

Competition A new securities settlement landscape The new framework will lead to increased competition T 2 S DVP will no longer be a bilateral relationship between one CSD and one NCB. Any CSD in T 2 S is potentially in a DVP relationship with any NCB in T 2 S CSDs regulation Same safety and efficiency rules all over Europe Harmonisation Same market practice all over Europe: national boundaries will be broken down 23

Benefits for CSDs § A technologically advanced, state-of-the-art, and robust settlement engine § Economies of scale by pooling together settlement volumes across Europe § New business opportunities through access to new markets § Long-term savings from efficient re-shaping to T 2 S 24

Benefits for CSDs § A technologically advanced, state-of-the-art, and robust settlement engine § Economies of scale by pooling together settlement volumes across Europe § New business opportunities through access to new markets § Long-term savings from efficient re-shaping to T 2 S 24

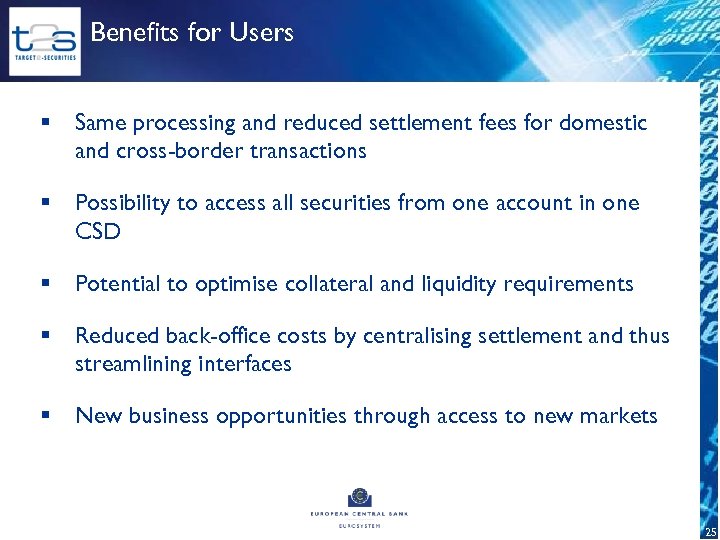

Benefits for Users § Same processing and reduced settlement fees for domestic and cross-border transactions § Possibility to access all securities from one account in one CSD § Potential to optimise collateral and liquidity requirements § Reduced back-office costs by centralising settlement and thus streamlining interfaces § New business opportunities through access to new markets 25

Benefits for Users § Same processing and reduced settlement fees for domestic and cross-border transactions § Possibility to access all securities from one account in one CSD § Potential to optimise collateral and liquidity requirements § Reduced back-office costs by centralising settlement and thus streamlining interfaces § New business opportunities through access to new markets 25

Benefits for Markets § Higher level of competition in post-trade industry § A Single Market for financial services in Europe through harmonised clearing and settlement § Reduced settlement risks on cross-border transactions to positively affect financial stability § Investors can more easily diversify their portfolios § Issuers can more easily reach European investors § Reduced costs of capital for firms lead to economic growth 26

Benefits for Markets § Higher level of competition in post-trade industry § A Single Market for financial services in Europe through harmonised clearing and settlement § Reduced settlement risks on cross-border transactions to positively affect financial stability § Investors can more easily diversify their portfolios § Issuers can more easily reach European investors § Reduced costs of capital for firms lead to economic growth 26

Use of global standards Across products… For outside EU… § Making Euro area market infrastructure more accessible for all ISO 20022 a common Element? § Preparing for answering the globalisation challenges? 27

Use of global standards Across products… For outside EU… § Making Euro area market infrastructure more accessible for all ISO 20022 a common Element? § Preparing for answering the globalisation challenges? 27

Table of Contents Payment and settlement systems – changing global dynamics 1 European context and challenges 2 Use of global standard for local systems 3 Global trends in the field of market infrastructure 28

Table of Contents Payment and settlement systems – changing global dynamics 1 European context and challenges 2 Use of global standard for local systems 3 Global trends in the field of market infrastructure 28

Global trends in the field of market infrastructure New challenges • Managing globalising markets • High volume of information from multiple sources • Reporting for multiple purposes to multiple parties Only one source of information the transactions and assets of financial institutions 29

Global trends in the field of market infrastructure New challenges • Managing globalising markets • High volume of information from multiple sources • Reporting for multiple purposes to multiple parties Only one source of information the transactions and assets of financial institutions 29

Global trends in the field of market infrastructure New challenges Reusing existing investments • Optimising existing information and systems • Increasing transparency for internal reporting • Increasing meaningful access to information for competent authorities ISO 20022 amongst other standards can help 30

Global trends in the field of market infrastructure New challenges Reusing existing investments • Optimising existing information and systems • Increasing transparency for internal reporting • Increasing meaningful access to information for competent authorities ISO 20022 amongst other standards can help 30

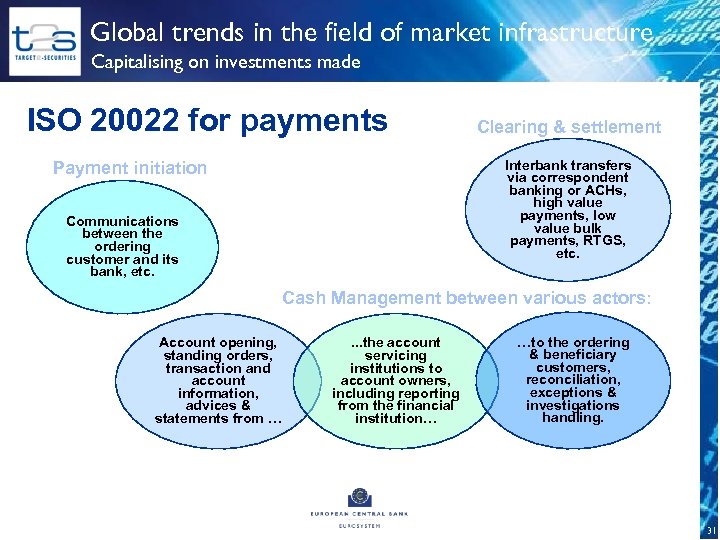

Global trends in the field of market infrastructure Capitalising on investments made ISO 20022 for payments Clearing & settlement Interbank transfers via correspondent banking or ACHs, high value payments, low value bulk payments, RTGS, etc. Payment initiation Communications between the ordering customer and its bank, etc. Cash Management between various actors: Account opening, standing orders, transaction and account information, advices & statements from … . . . the account servicing institutions to account owners, including reporting from the financial institution… …to the ordering & beneficiary customers, reconciliation, exceptions & investigations handling. 31

Global trends in the field of market infrastructure Capitalising on investments made ISO 20022 for payments Clearing & settlement Interbank transfers via correspondent banking or ACHs, high value payments, low value bulk payments, RTGS, etc. Payment initiation Communications between the ordering customer and its bank, etc. Cash Management between various actors: Account opening, standing orders, transaction and account information, advices & statements from … . . . the account servicing institutions to account owners, including reporting from the financial institution… …to the ordering & beneficiary customers, reconciliation, exceptions & investigations handling. 31

Global trends in the field of market infrastructure Capitalising on investments made ISO 20022 for securities Securities Issuance Trade Initiation, pre-trade Trade, post-trade Collateral management Account opening, standing orders, transaction and account information, advices & statements, queries & investigations Collateral, repos, securities lending & borrowing Clearing & settlement Custody Income, corporate actions, market data, proxy voting 32

Global trends in the field of market infrastructure Capitalising on investments made ISO 20022 for securities Securities Issuance Trade Initiation, pre-trade Trade, post-trade Collateral management Account opening, standing orders, transaction and account information, advices & statements, queries & investigations Collateral, repos, securities lending & borrowing Clearing & settlement Custody Income, corporate actions, market data, proxy voting 32

Global trends in the field of market infrastructure Capitalising on investments made ISO 20022 forex Pre-trade: IOI, quotes, etc. Notification of trades to third parties Trade: order, execution, allocation, affirmation, etc. Trigger events, option exercises Post-trade: confirmation, matching, assignment, novation, etc. Clearing and Settlement, including netting and related reporting 33

Global trends in the field of market infrastructure Capitalising on investments made ISO 20022 forex Pre-trade: IOI, quotes, etc. Notification of trades to third parties Trade: order, execution, allocation, affirmation, etc. Trigger events, option exercises Post-trade: confirmation, matching, assignment, novation, etc. Clearing and Settlement, including netting and related reporting 33

Global trends in the field of market infrastructure Capitalising on investments made ISO 20022 for trade services Private and corporate customers (treasurers) Risk management entities Financial Institutions Application providers Associations providing rules and master agreements (eg IFSA, ICC) Trade facilitators: chambers of commerce, insurance co, freight forwarders, carriers, customs, factoring co 34

Global trends in the field of market infrastructure Capitalising on investments made ISO 20022 for trade services Private and corporate customers (treasurers) Risk management entities Financial Institutions Application providers Associations providing rules and master agreements (eg IFSA, ICC) Trade facilitators: chambers of commerce, insurance co, freight forwarders, carriers, customs, factoring co 34

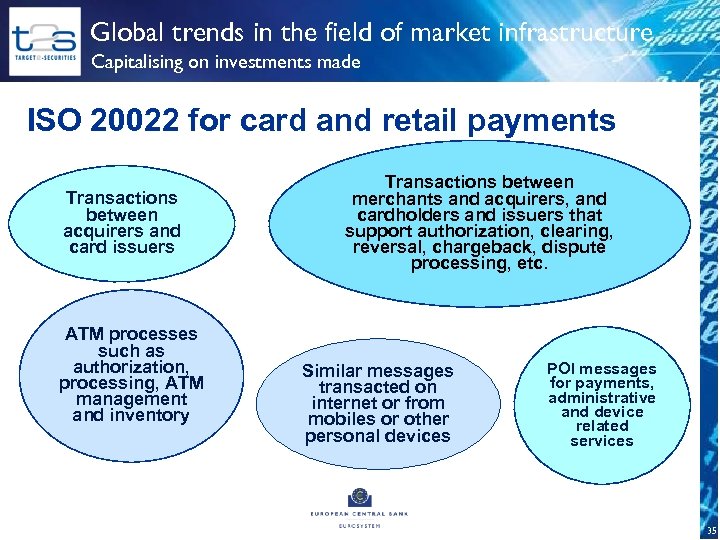

Global trends in the field of market infrastructure Capitalising on investments made ISO 20022 for card and retail payments Transactions between acquirers and card issuers ATM processes such as authorization, processing, ATM management and inventory Transactions between merchants and acquirers, and cardholders and issuers that support authorization, clearing, reversal, chargeback, dispute processing, etc. Similar messages transacted on internet or from mobiles or other personal devices POI messages for payments, administrative and device related services 35

Global trends in the field of market infrastructure Capitalising on investments made ISO 20022 for card and retail payments Transactions between acquirers and card issuers ATM processes such as authorization, processing, ATM management and inventory Transactions between merchants and acquirers, and cardholders and issuers that support authorization, clearing, reversal, chargeback, dispute processing, etc. Similar messages transacted on internet or from mobiles or other personal devices POI messages for payments, administrative and device related services 35

Global trends in the field of market infrastructure Other standards Other global initiatives are popping up • LEI - an ambitious project coming to reality • ISIN already a reality in most markets • … mapping all needs ? ISO is providing technical committee and working groups 36

Global trends in the field of market infrastructure Other standards Other global initiatives are popping up • LEI - an ambitious project coming to reality • ISIN already a reality in most markets • … mapping all needs ? ISO is providing technical committee and working groups 36

Thank you for your attention www. t 2 s. eu @T 2 SECB 37

Thank you for your attention www. t 2 s. eu @T 2 SECB 37

More information on T 2 S www. t 2 s. eu T 2 S on the web: www. t 2 s. eu - Publication of all relevant information and key documents - Access to documents of all T 2 S working groups - “Spotlight” on latest information on the project - Information on project plan, governance, pricing, harmonisation - Ad hoc sections dedicated to all the T 2 S community (CSDs, banks, NCBs, others) - Publication of newsletter “T 2 S On. Line” 38

More information on T 2 S www. t 2 s. eu T 2 S on the web: www. t 2 s. eu - Publication of all relevant information and key documents - Access to documents of all T 2 S working groups - “Spotlight” on latest information on the project - Information on project plan, governance, pricing, harmonisation - Ad hoc sections dedicated to all the T 2 S community (CSDs, banks, NCBs, others) - Publication of newsletter “T 2 S On. Line” 38