43d2d606ffd68d3152f9f2df4397547e.ppt

- Количество слайдов: 55

PAYING FOR PUBLIC EDUCATION Chapter 7 in Guthrie DR. LEN ELOVITZ

TLWDTAT; DESCRIBE THE CHARACTERISTICS OF TAXES AND DISCUSS THEIR USE TO FUND PUBLIC EDUCATION

WHERE DO SCHOOL DISTRICTS GET THE MONEY THEY NEED TO OPERATE? FEDERAL AID STATE AID WHERE DO THEY GET THE MONEY? GRANTS WHERE DO THEY GET THE MONEY? FROM WHOM? PROPERTY TAXES OTHER?

HOW DO YOU DETERMINE THE AMOUNT TO BE RAISED BY DISTRICT TAXES? A = B – OI AMOUNT TO BE RAISED = BUDGET – OTHER INCOME

POWER TO TAX FIRST PUBLIC SCHOOL LAW US CONSTITUTION Section 8 of Article 1 “The Congress shall have the power to collect and lay taxes… provide for the common defense and general welfare of the United States. ” US Supreme Court MASSACHUSETTS BAY COLONY (1642) YE OLDE DELUDER SATAN ACT (1647) Shaffer v. Carter States have taxing power “… in order to defray government expenses. ” Local Government is given power to tax by the state

Foundation of Government Taxation Ability to Pay Use of Services Primary tax bases (criteria for levying a tax) Wealth Income Consumption Privilege

WHAT IS TAXED? WEALTH – REAL PROPERTY, PERSONAL PROPERTY, ESTATE INCOME – A PORTION OF THE MONEY EARNED BY AN INDIVIDUAL OR BUSINESS OVER A PERIOD OF TIME CONSUMPTION - APPLIES TO COMMODITIES PURCHASED A. SALES TAX – GENERAL (exemptions i. e. Food) B. IF IT APPLIES TO A CLASS OF ITEMS, IT IS AN EXCISE TAX - GASOLINE , CIGARETTES C. GAMBLING PRIVILEGE – PERMIT INDIVIDUALS OR BUSINESSES TO ENGAGE IN CERTAIN ACTIVITIES OR USE PUBLIC

Criteria for Evaluating Taxes YIELD EQUITY NEUTRALITY ELASTICITY ADMINISTRATIVE BURDEN

Yield The ability of the tax to generate revenue Peabody College Series. Copyright © Allyn &

YIELD 1. EQUALS BASE TIMES RATE - Y=B X R YIELD = BASE TIMES RATE $10, 000 = $100, 000 X 10% 2. VOLUME OF BASE A. IF SMALL, HIGH RATE NEEDED TO YIELD MORE $ B. IF LARGE, HIGH RATE YIELDS MANY $ C. COMPARE - EXCISE TAX ON CIGARETTES WITH BROAD BASED INCOME TAX

EQUITY FAIRNESS ALL SHOULD CONTRIBUTE TO SOCIETY AND BE TREATED IN A UNIFORM WAY As the tax burden is imposed on all by the will of the majority, all should be treated in an equitable manner.

EQUITY - BENEFIT RECEIVED PRINCIPLE Proportional payment of tax based on benefits received or contribution to the cost of item supported by the tax GASOLINE TAXES FOR HIGHWAY REPAIRS – TOLLS? TOBACCO TAX FOR CANCER RESEARCH SHOULD ALL TAXES BE THIS WAY? TAXES BASED ON USAGE A. POLICE COST? B. EDUCATION?

ABILITY TO PAY PRINCIPLE 1. TAXPAYERS PAY IN ACCORDANCE WITH THEIR ECONOMIC CAPACITY TO SUPPORT SERVICES 2. INCOME HAS BECOME THE BEST MEASURE OF ABILITY

EQUAL-SACRIFICE PRINCIPLE 1. PEOPLE WITH HIGHER INCOME ARE EXPECTED TO NOT ONLY PAY MORE BUT A HIGHER PROPORTION OF THEIR INCOME IN TAXES 2. THE REDUCTION OF INCOME BY A GIVEN TAX CREATES A GREATER BURDEN ON PEOPLE WITH LESS MONEY

HORIZONTAL – EQUITY PRINCIPLE TREAT EQUALS EQUALLY A. SAME AMOUNT OF INCOME PAYS THE SAME - IS THIS WHAT HAPPENS? B. SAME AMOUNT OF PROPERTY PAYS THE SAME - IS THIS WHAT HAPPENS?

VERTICAL – EQUITY PRINCIPLE DIFFERING AMOUNTS OF TAXES FROM INDIVIDUALS WHO HAVE DIFFERING ABILITIES TO PAY TAXPAYERS WITH HIGHER INCOMES PAY MORE TAXES MORE IN TAXES AND A HIGHER PROPORTION OF INCOME

NEUTRALITY 1. DOES NOT ALTER AN INDIVIDUAL’S OR BUSINESS’S BEHAVIOR IN RESPONSE TO THE TAX 2. AN EXCISE TAX THAT RAISES THE COST OF PRODUCTS MAY CAUSE A SHIFT IN CONSUMER PREFERENCE. A. NY SALES TAX B. SIN TAXES C. BUSINESS LOCATIONS D. TARIFFS ON IMPORTS 3. ABANDONED PROPERTY IF TAXES GET TOO HIGH

ELASTICITY STABILITY OR FLEXABILITY OF A TAX’S YIELD IN RELATION TO MOVEMENTS IN THE ECONOMY 1. ELASTIC - A TAX WHOSE YIELD INCREASES AT A FASTER RATE THAN ECONOMIC GROWTH (Personal income) - SAY THERE IS AN EXCISE TAX ON LUXURY CARS – ECONOMY GROWTH LEADS TO AN INCREASE IN PURCHASING MORE AND MORE EXPENSIVE CARS THEREBY INCREASING THE YIELD 2. INELASTIC - - A TAX WHOSE YIELD INCREASES AT A SLOWER RATE THAN ECONOMIC GROWTH (Personal income) - SAY THERE IS AN EXCISE TAX ON SOAP – ECONOMY GROWTH DOES NOT LEAD TO AN INCREASE IN PURCHASING OF SOAP AND THERE IS NO INCREASE IN THE YIELD

ADMINISTRATIVE BURDEN THE COST OF TAX ADMINISTRATION AND COMPLIANCE 1. HOW MUCH DOES ADMINISTRATION EAT INTO YIELD? TOLLS 2. HOW MUCH DOES IT COST TO COMPLY – ACCOUNTANTS.

IMPACT v. INCIDENCE 1. IMPACT – THE ACTUAL TAXPAYER – INDIVIDUAL OR BUSINESS 2. INCIDENCE - THOSE INDIVIDUALS WHO ULTIMATELY BARE THE BRUNT 3. EXAMPLE - TAX ON MANUFACTURE OF CIGARS A. SHIFT FORWARD TO PURCHASER AS HIGHER PRICE B. SHIFT SIDEWAYS IN THE FORM OF LOWER WAGES TO EMPLOYEES, ETC. C. SHIFT BACKWARDS AS LOWER DIVIDENDS TO STOCKHOLDERS.

Regressive Taxes A family of 4 spends $200 per week on food which is taxed at 5% in their state. Tax paid is $10 per week or $520 per year. If family’s income is $100, 000 per year – tax represents 0. 52% (520/100, 000) and family has $99, 450 to spend on other things If family’s income is $50, 000 (520)/50, 000) per year – tax represents 1. 04% of income and family has $49, 450 to spend on other things This is regressive

Progressive Taxes A family of 4 spends $200 per week on food which is taxed at 10% and 5% in their state depending on income. If family’s income is $100, 000 per year and their tax rate is 10%. They pay $20 per week or $1, 040 per year. This represents 1. 04% and family still has $98, 960 to spend on other thing If family’s income is $50, 000 per year – Their tax rate is 5%. They pay $10 per week or $520 per year. Tax represents 1. 04% of income and family has $49, 450 to spend on other things This is progressive

WHICH IS THE MOST EQUAL? – MINIMUM STANDARD OF LIVING TEST

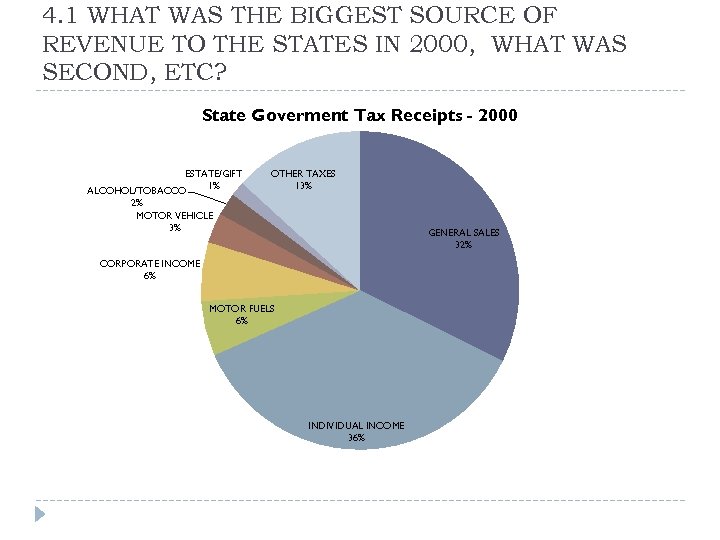

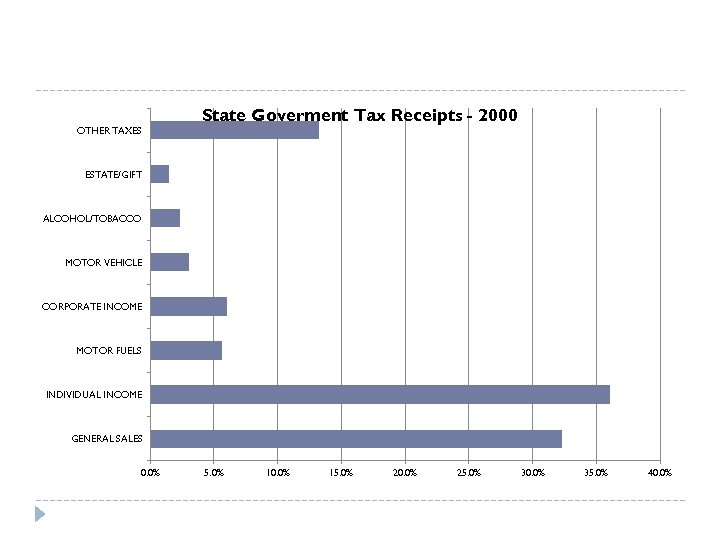

4. 1 WHAT WAS THE BIGGEST SOURCE OF REVENUE TO THE STATES IN 2000, WHAT WAS SECOND, ETC? State Goverment Tax Receipts - 2000 ESTATE/GIFT 1% ALCOHOL/TOBACCO 2% MOTOR VEHICLE 3% OTHER TAXES 13% GENERAL SALES 32% CORPORATE INCOME 6% MOTOR FUELS 6% INDIVIDUAL INCOME 36%

OTHER TAXES State Goverment Tax Receipts - 2000 ESTATE/GIFT ALCOHOL/TOBACCO MOTOR VEHICLE CORPORATE INCOME MOTOR FUELS INDIVIDUAL INCOME GENERAL SALES 0. 0% 5. 0% 10. 0% 15. 0% 20. 0% 25. 0% 30. 0% 35. 0% 40. 0%

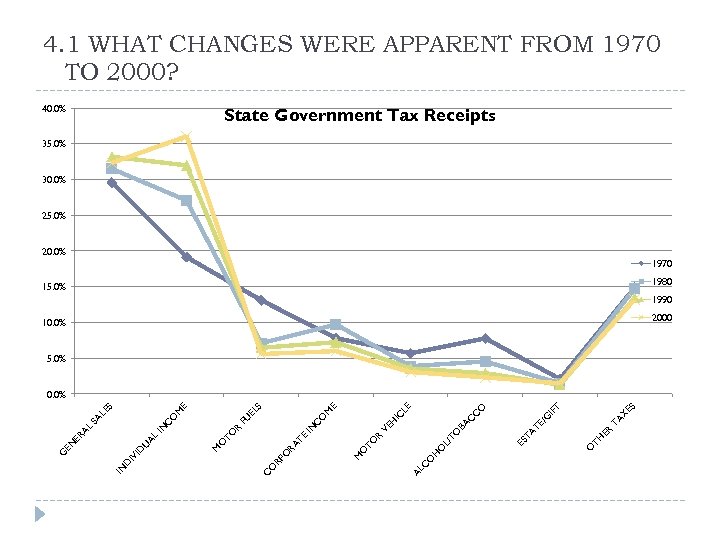

4. 1 WHAT CHANGES WERE APPARENT FROM 1970 TO 2000? 40. 0% State Government Tax Receipts 35. 0% 30. 0% 25. 0% 20. 0% 1970 1980 15. 0% 1990 2000 10. 0% 5. 0% ES T TA X IF /G C H O C AL M TH ER TE TA ES O O O L/ TO R TO VE BA H C IC M O C IN TE RA RP O O C O LE E S EL FU R TO O M AL D IV ID U IN G EN ER AL IN C SA O M LE E S 0. 0%

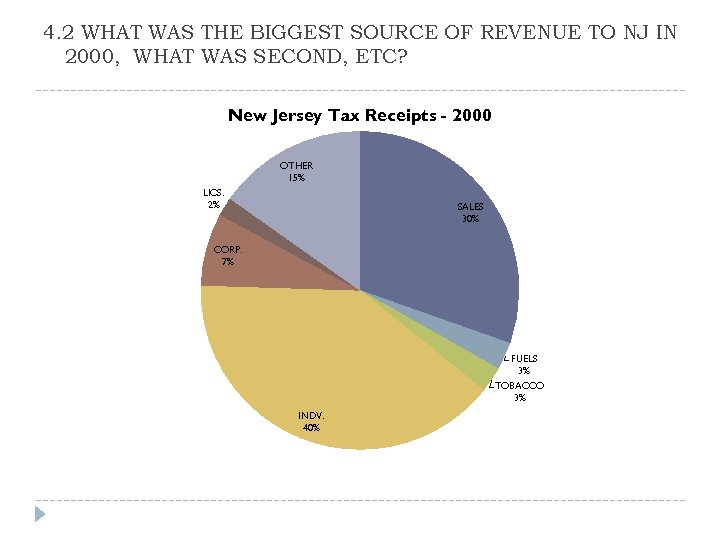

4. 2 WHAT WAS THE BIGGEST SOURCE OF REVENUE TO NJ IN 2000, WHAT WAS SECOND, ETC? New Jersey Tax Receipts - 2000 OTHER 15% LICS. 2% SALES 30% CORP. 7% FUELS 3% TOBACCO 3% INDV. 40%

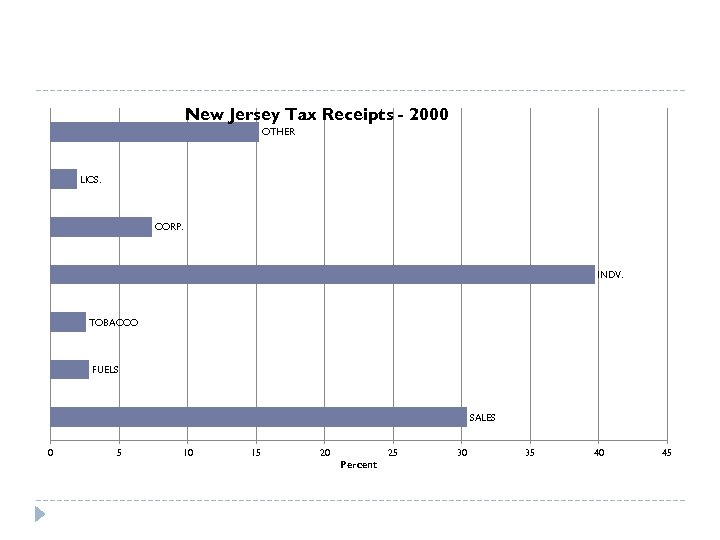

New Jersey Tax Receipts - 2000 OTHER LICS. CORP. INDV. TOBACCO FUELS SALES 0 5 10 15 20 25 Percent 30 35 40 45

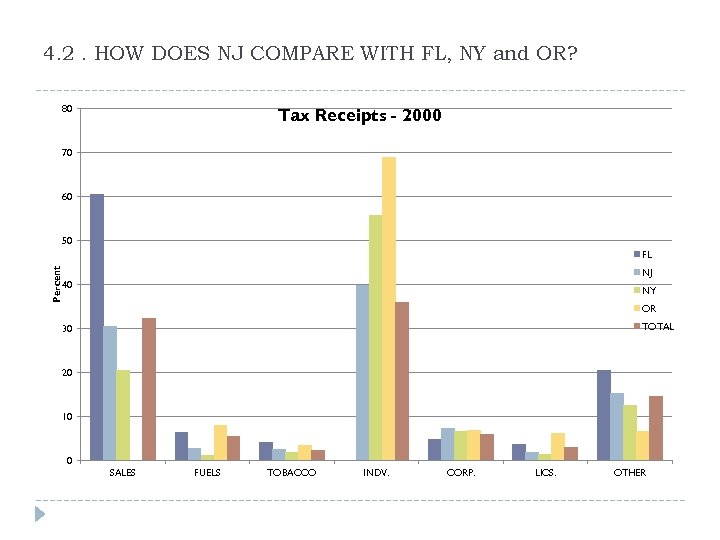

4. 2. HOW DOES NJ COMPARE WITH FL, NY and OR? 80 Tax Receipts - 2000 70 60 50 Percent FL NJ 40 NY OR TOTAL 30 20 10 0 SALES FUELS TOBACCO INDV. CORP. LICS. OTHER

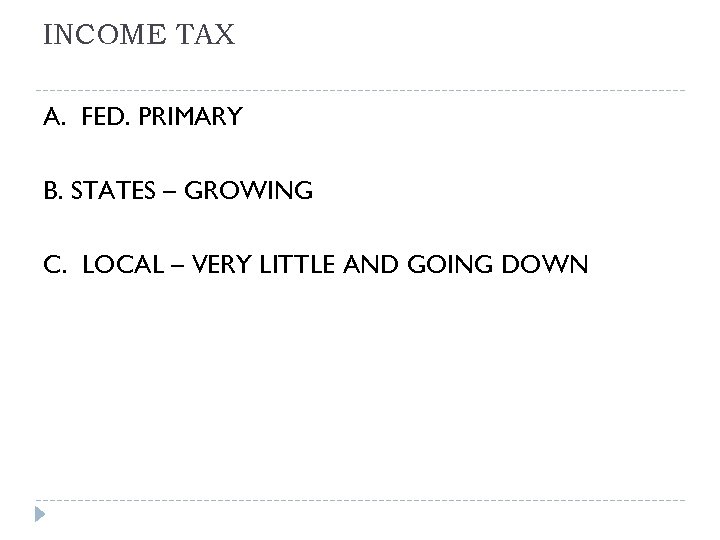

INCOME TAX A. FED. PRIMARY B. STATES – GROWING C. LOCAL – VERY LITTLE AND GOING DOWN

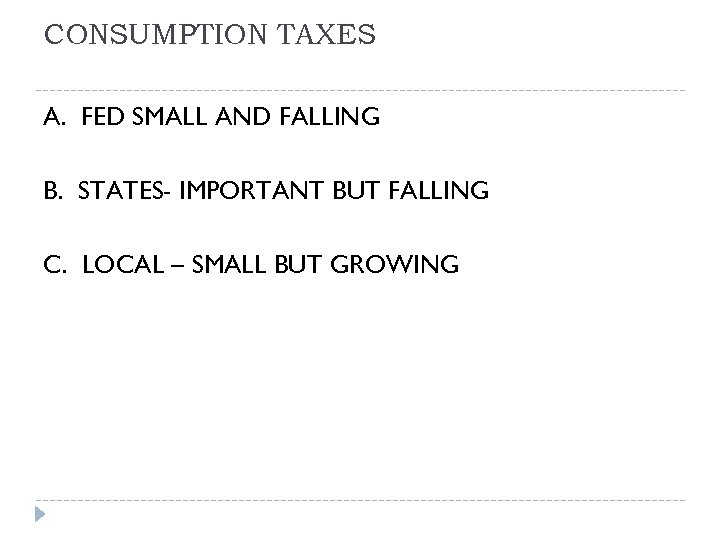

CONSUMPTION TAXES A. FED SMALL AND FALLING B. STATES- IMPORTANT BUT FALLING C. LOCAL – SMALL BUT GROWING

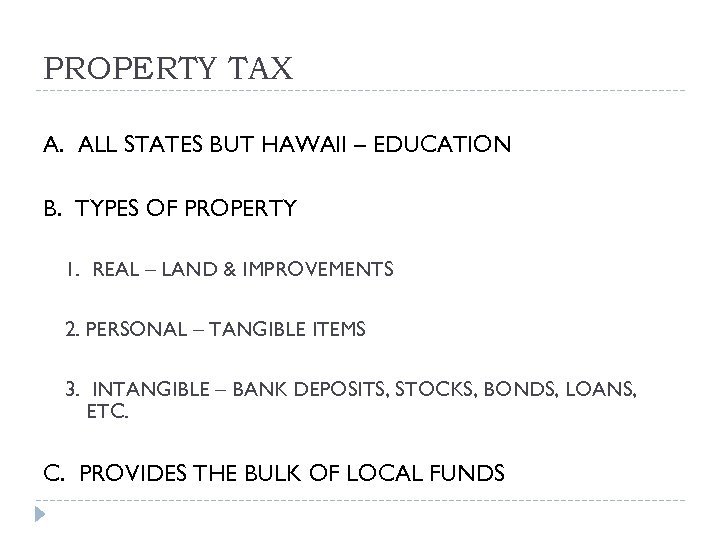

PROPERTY TAX A. ALL STATES BUT HAWAII – EDUCATION B. TYPES OF PROPERTY 1. REAL – LAND & IMPROVEMENTS 2. PERSONAL – TANGIBLE ITEMS 3. INTANGIBLE – BANK DEPOSITS, STOCKS, BONDS, LOANS, ETC. C. PROVIDES THE BULK OF LOCAL FUNDS

D. MOST VISIBLE AND LEAST POPULAR 1. TAXPAYERS SHOULD BE ABLE TO SEE DIRECT BENEFITS - SCHOOLS, POLICE FIRE 2. TAXPAYERS SHOULD BE WILLING TO PAY MORE FOR BETTER SERVICES 3. SOMETIMES TAX PAYERS DON’T LIVE IN COMMUNITY – DON’T GET BENEFITS

YIELD of Property Taxes A. HIGH B. DEPENDENCE SHOULD BE DECREASING AS STATES ASSUME MORE OF A BURDEN

ELASTICITY of Property Taxes INELASTIC A. ASSESSED VALUES DO NOT INCREASE AS RAPIDLY AS INCOME B. PROPERTY TAXES ARE NOT LINKED TO INCOME

EQUITY of Property Taxes A. VIOLATES HORIZONTAL EQUITY - INDIVIDUALS WITH THE SAME INCOME DO NOT NECESSARILY PAY THE SAME TAX B. REGRESSIVE – HIGHER PORTION OF INCOME IS SPENT BY LOW INCOME FAMILIES ON HOUSING COSTS RENTERS A. IMPACT ON OWNER B. INCIDENCE ON RENTERS

NEUTRALITY NOT NEUTRAL A. DISCOURAGE MAXIMIZATION OF POTENTIAL PROPERTY USE – CONTRIBUTES TO THE DETERIORATION OF URBAN AREAS B. INFLUENCE HOUSING DECISIONS C. CAUSE DISPARITIES IN EDUCATIONAL OFFERINGS

COMPLIANCE ADMINISTRATION & COMPLIANCE – LOW SHOULD PROPERTY TAXES BE ELIMINATED?

SOURCES OF REVENUE – PROPERTY TAX A. FED. – NONE B. STATES NEGLIGIBLE C. PRIMARY FOR SCHOOL DISTRICTS

ASSESSMENT A. PROPERTY IS IDENTIFIED AND LABELED B. OWNER IS IDENTIFIED C. VALUE IS ASSIGNED 1. FAIR MARKET VALUE – USUAL FOR RESIDENCES AND EMPTY LAND 2. BUSINESSES – INCOME EARNING POTENTIAL OR REPLACEMENT COST IS USUAL 3. DIFFICULTY – SUBJECTIVITY – TAX APPEALS 4. PROPERTY – HIGHEST AND BEST USE

FRACTIONAL ASSESSMENT 1. PUBLIC ACCEPTANCE A. PSYCHOLOGICAL – PEOPLE THINK THEY ARE GETTING A DEAL B. BUSINESSES MAY GET A LOWER ASSESSMENT TO ATTRACT OR KEEP THEM IN A MUNICIPALITY 2. VALUE INCREASES – ASSESSMENT DOES NOT CHANGE

ASSESSMENT CYCLE 1. EVERY TEN YEARS 2. ASSESSOR MUST REEVALUATE EACH PARCEL 3. MARKET VALUE X PERCENT OF VALUATION = ASSESSMENT 4. $100, 000 HOUSE X. 85 = $85, 000 5. 120, 000 HOUSE X. 75 = $90, 000

EQUALIZATION NECESSITY – COMPARISON PURPOSES A. AVERAGE EQUALIZE ASSESSED VALUATION B. EQUALIZED TAX RATE 2. ASSESSED VALUATION/ EQUALIZATION RATIO = EQUALIZED VALUE 3. Av/Er = Ev 4. $85, 000/. 85 = $100, 000

EXEMPTION LOCAL TAX BASES ARE REDUCED BY EXEMPTIONS SCHOOLS RELIGIOUS GOVERNMENT , ETC. – FOR COMMUNITY BENEFITS

TAX BREAKS A. SENIOR CITIZENS B. VETERANS C. DISABLED D. POOR E. HOMESTEAD REBATES F. CIRCUIT BREAKERS ACT AS A CREDIT AGAINST STATE INCOME TAXES

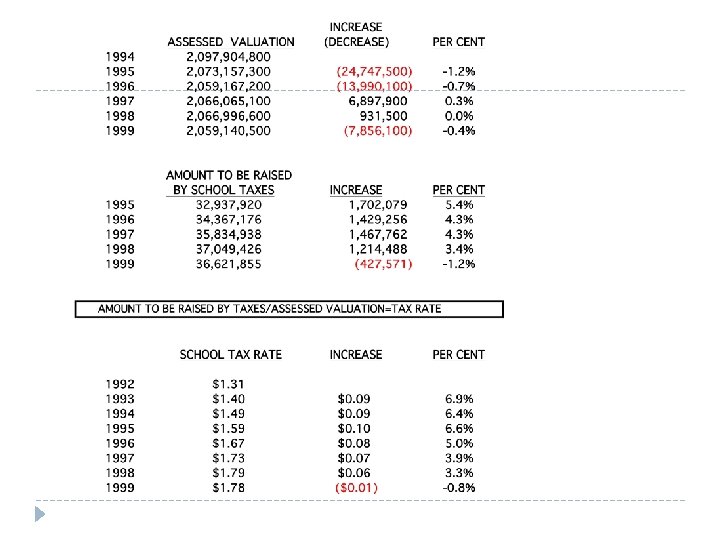

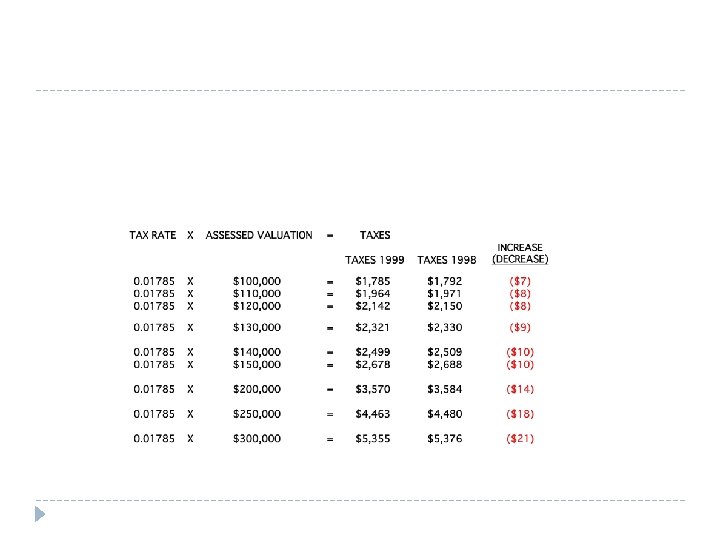

CALCULATING THE TAX RATE THE BUDGET OF A GOVERNMENTAL UNIT LESS ITS INCOME FROM OTHER SOURCES EQUALS THE AMOUNT TO BE RAISED BY TAXES. Taxes = Budget – Other income T = B-Oi B. THIS AMOUNT DIVIDED BY THE ASSESSED VALUATION GIVES YOU THE TAX RATE – Tax Rate = Budget – Other Income/ Assessed Valuation Tr = (B-Oi)/Av

EXAMPLE 1. SCHOOL DISTRICT HAS A BUDGET OF $10, 000, OTHER INCOME IS $5, 000, ASSESSED VALUATION IS $250, 000 WHAT IS THE TAX RATE BUDGET OTHER INCOME ASSESSED VALUATION 2. Tr = (10, 000 – 5, 000)/250, 000 Tr = 5, 000, 00 / 250, 000 Tr = 0. 020 3. 0. 020 X 100 = $2 per $100 of assessed valuation

CALCULATING TAXES OWED A. TAX RATE TIMES ASSESSED VALUATION B. TO = TR x AV C. EXAMPLE 1. HOUSE ASSESSED AT $100, 000 2. TAX RATE IS $2. 00 PER $100 of assessed valuation 3. TO = TR x AV TO =. 02 X 100, 000 TO = $2, 000

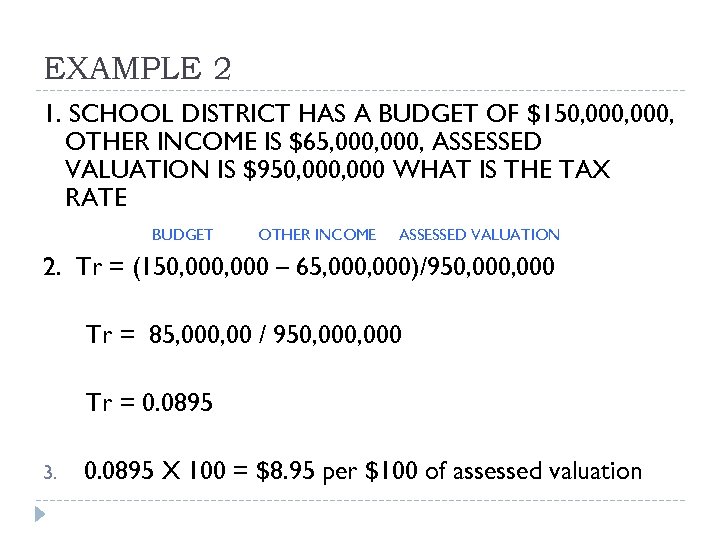

EXAMPLE 2 1. SCHOOL DISTRICT HAS A BUDGET OF $150, 000, OTHER INCOME IS $65, 000, ASSESSED VALUATION IS $950, 000 WHAT IS THE TAX RATE BUDGET OTHER INCOME ASSESSED VALUATION 2. Tr = (150, 000 – 65, 000)/950, 000 Tr = 85, 000, 00 / 950, 000 Tr = 0. 0895 3. 0. 0895 X 100 = $8. 95 per $100 of assessed valuation

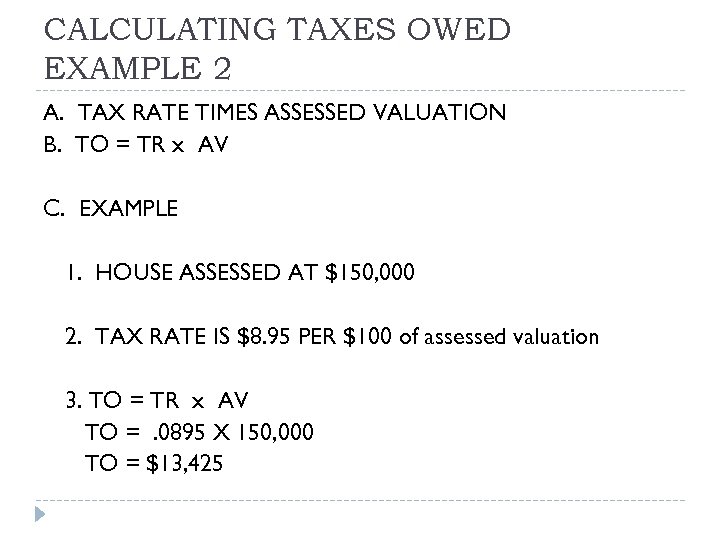

CALCULATING TAXES OWED EXAMPLE 2 A. TAX RATE TIMES ASSESSED VALUATION B. TO = TR x AV C. EXAMPLE 1. HOUSE ASSESSED AT $150, 000 2. TAX RATE IS $8. 95 PER $100 of assessed valuation 3. TO = TR x AV TO =. 0895 X 150, 000 TO = $13, 425

Name: Go to http: //www. state. nj. us/education/finance/fp/ufb/2014/01. ht ml Select district where you work or live _______ Scroll to Estimated Tax Rate Information List total school levy ___________ List Net Taxable Valuation __________ Calculate the tax rate___________ Compare to listed rate ___________

43d2d606ffd68d3152f9f2df4397547e.ppt