be4159b8ae0e4bb015ed4bc5d52c433b.ppt

- Количество слайдов: 16

Payables Efficiency Through… Access Online PAYMENT PLUS 1

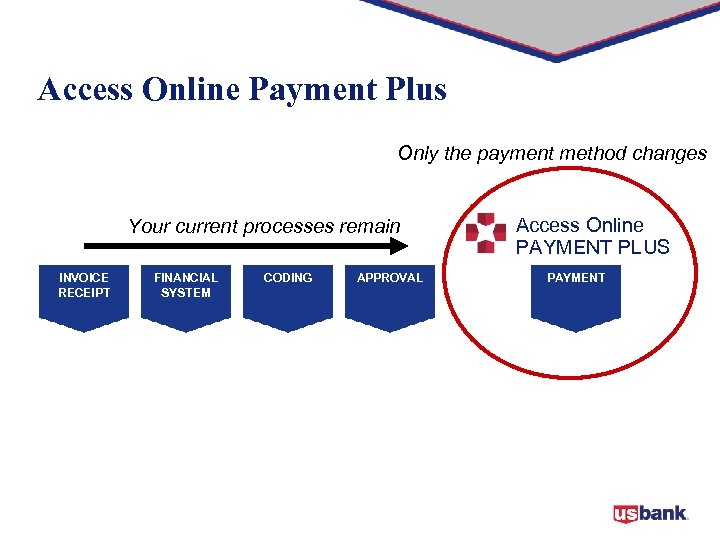

Access Online Payment Plus Only the payment method changes Your current processes remain INVOICE RECEIPT FINANCIAL SYSTEM CODING APPROVAL Access Online PAYMENT PLUS PAYMENT

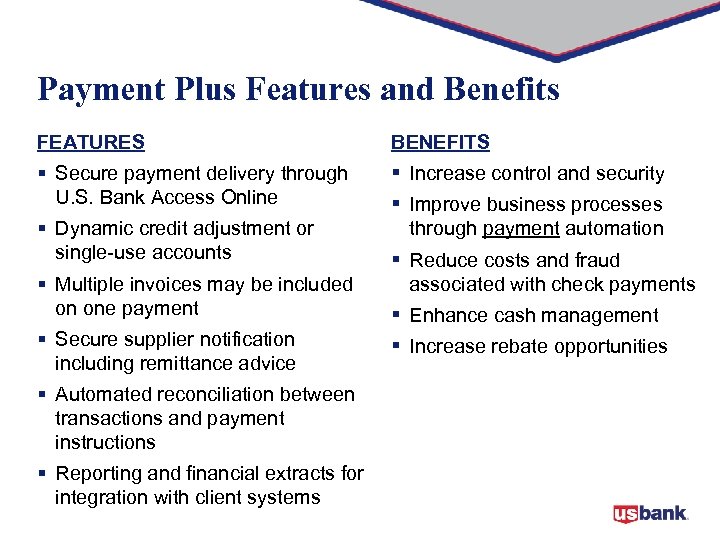

Payment Plus Features and Benefits FEATURES BENEFITS § Secure payment delivery through U. S. Bank Access Online § Increase control and security § Improve business processes § Dynamic credit adjustment or single-use accounts § Multiple invoices may be included on one payment § Secure supplier notification including remittance advice § Automated reconciliation between transactions and payment instructions § Reporting and financial extracts for integration with client systems through payment automation § Reduce costs and fraud associated with check payments § Enhance cash management § Increase rebate opportunities

Easy as 1 -2 -3 Access Online PAYMENT PLUS

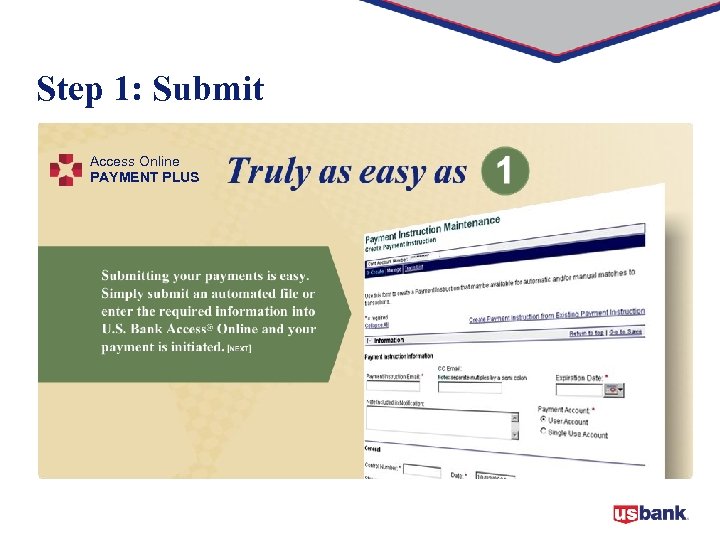

Step 1: Submit Access Online PAYMENT PLUS

Step 2: Pay Access Online PAYMENT PLUS

Step 3: Monitor Access Online

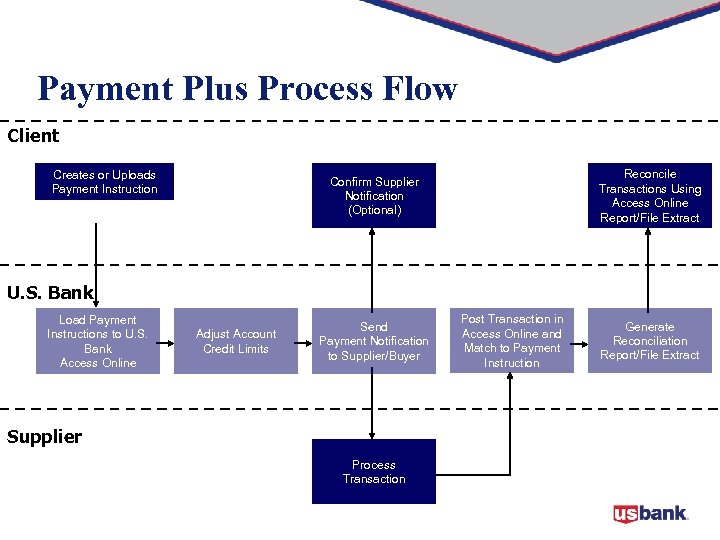

Payment Plus Process Flow Client Creates or Uploads Payment Instruction Reconcile Transactions Using Access Online Report/File Extract Confirm Supplier Notification (Optional) U. S. Bank Load Payment Instructions to U. S. Bank Access Online Adjust Account Credit Limits Send Payment Notification to Supplier/Buyer Supplier Process Transaction Post Transaction in Access Online and Match to Payment Instruction Generate Reconciliation Report/File Extract

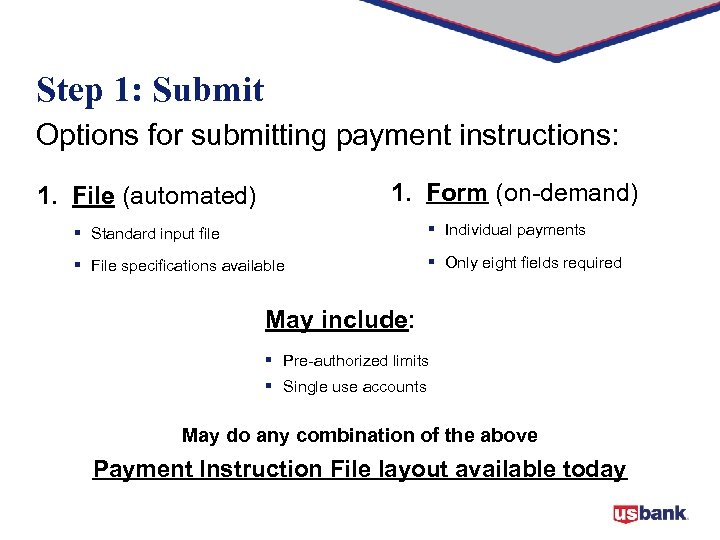

Step 1: Submit Options for submitting payment instructions: 1. Form (on-demand) 1. File (automated) § Standard input file § Individual payments § File specifications available § Only eight fields required May include: § Pre-authorized limits § Single use accounts May do any combination of the above Payment Instruction File layout available today

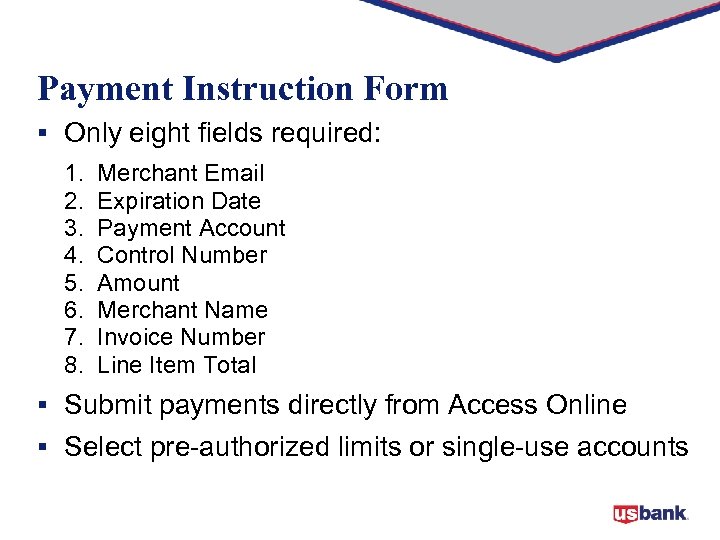

Payment Instruction Form § Only eight fields required: 1. 2. 3. 4. 5. 6. 7. 8. Merchant Email Expiration Date Payment Account Control Number Amount Merchant Name Invoice Number Line Item Total § Submit payments directly from Access Online § Select pre-authorized limits or single-use accounts

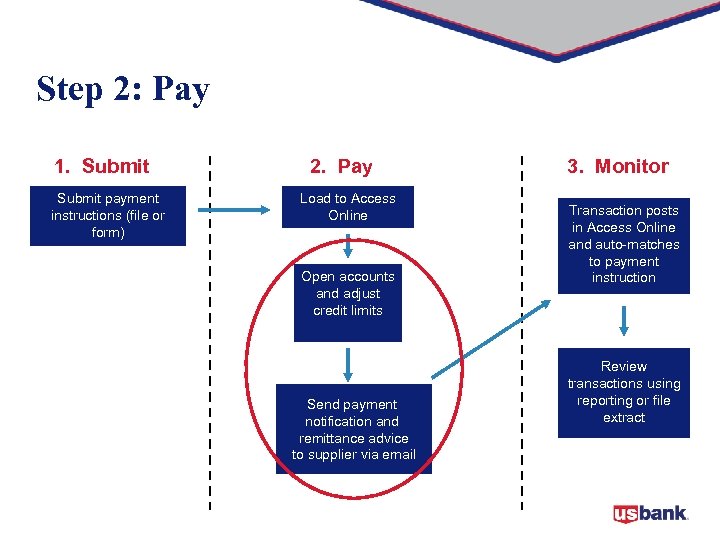

Step 2: Pay 1. Submit payment instructions (file or form) 2. Pay Load to Access Online Open accounts and adjust credit limits Send payment notification and remittance advice to supplier via email 3. Monitor Transaction posts in Access Online and auto-matches to payment instruction Review transactions using reporting or file extract

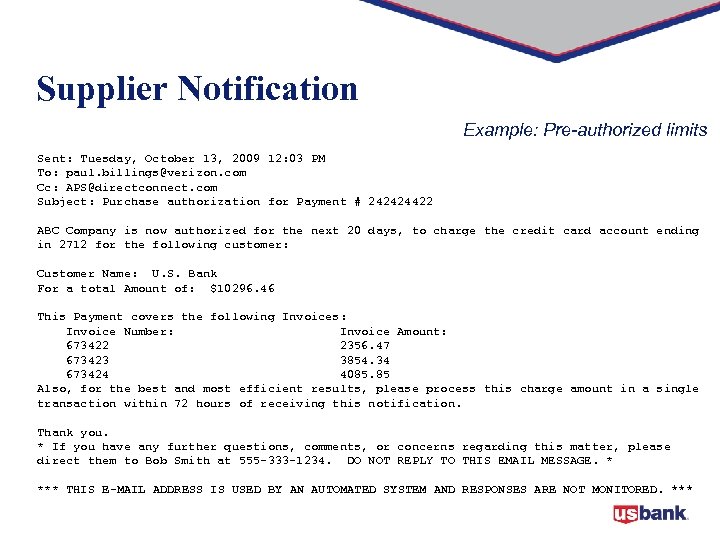

Supplier Notification Example: Pre-authorized limits Sent: Tuesday, October 13, 2009 12: 03 PM To: paul. billings@verizon. com Cc: APS@directconnect. com Subject: Purchase authorization for Payment # 242424422 ABC Company is now authorized for the next 20 days, to charge the credit card account ending in 2712 for the following customer: Customer Name: U. S. Bank For a total Amount of: $10296. 46 This Payment covers the following Invoices: Invoice Number: Invoice Amount: 673422 2356. 47 673423 3854. 34 673424 4085. 85 Also, for the best and most efficient results, please process this charge amount in a single transaction within 72 hours of receiving this notification. Thank you. * If you have any further questions, comments, or concerns regarding this matter, please direct them to Bob Smith at 555 -333 -1234. DO NOT REPLY TO THIS EMAIL MESSAGE. * *** THIS E-MAIL ADDRESS IS USED BY AN AUTOMATED SYSTEM AND RESPONSES ARE NOT MONITORED. ***

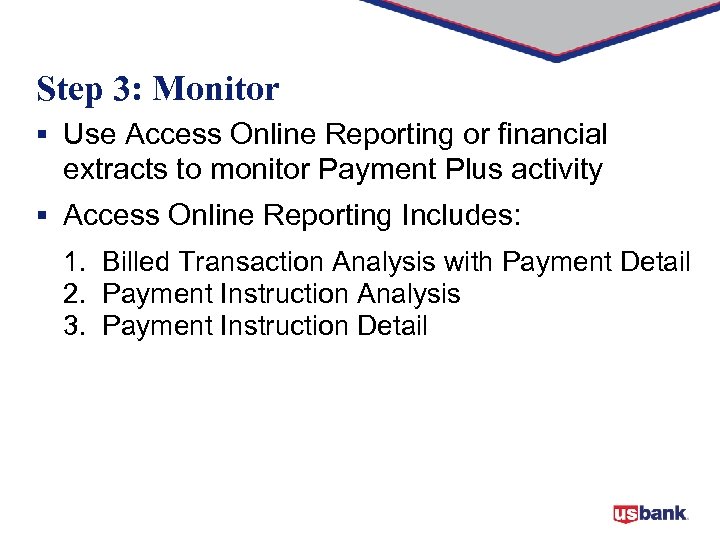

Step 3: Monitor § Use Access Online Reporting or financial extracts to monitor Payment Plus activity § Access Online Reporting Includes: 1. Billed Transaction Analysis with Payment Detail 2. Payment Instruction Analysis 3. Payment Instruction Detail

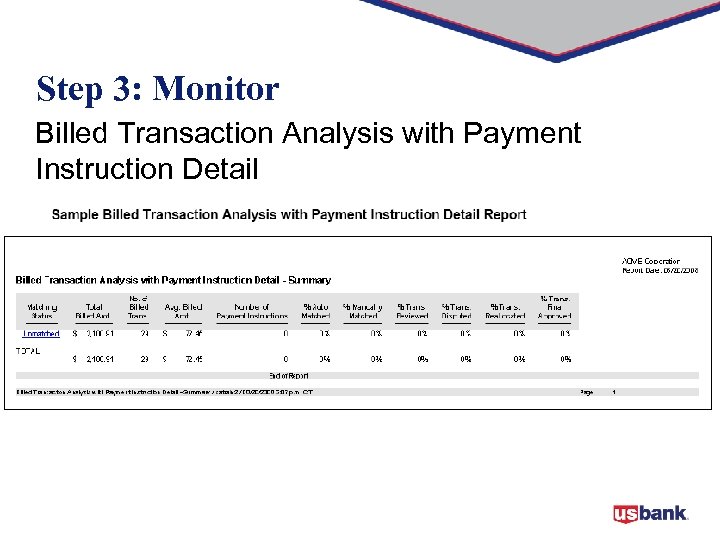

Step 3: Monitor Billed Transaction Analysis with Payment Instruction Detail

Your U. S. Bank Resources § U. S. Bank Representatives • Relationship Manager • Implementation Project Manager • Technical Integration Manager • Enablement Managers • Account Coordinator § Supplier Enablement Services • Dedicated Supplier Enablement Managers • Flexible to your needs • Take on as much or as little of supplier enablement as desired • Leverage expertise of U. S. Bank Payment Solutions to enable suppliers to accept payments, enhance data capture and review merchant fee structure § usbpayment. com

Next Steps § Prioritize suppliers and communicate expectations through Visa Perform Source tools § Try it with a few payments § Transact with Payment Plus 1. Submit 2. Pay 3. Monitor

be4159b8ae0e4bb015ed4bc5d52c433b.ppt