b4a7844522474c897a4c09af9f35114a.ppt

- Количество слайдов: 23

Path to India Market 1

Path to India Market 1

Path to India Market Agenda n n n n Why India Economic and Trade Issues Important Statistics Market Trends Opportunities & Challenges Channels and Strategies How TDC can help 2

Path to India Market Agenda n n n n Why India Economic and Trade Issues Important Statistics Market Trends Opportunities & Challenges Channels and Strategies How TDC can help 2

Path to India Market WHY INDIA n Dynamic, fast-growing economy n Sustainable growth led by services n Huge population second to China n Rise of middle & high income classes n Trade liberation & commitment to reforms n Retail revolution 3

Path to India Market WHY INDIA n Dynamic, fast-growing economy n Sustainable growth led by services n Huge population second to China n Rise of middle & high income classes n Trade liberation & commitment to reforms n Retail revolution 3

Path to India Market ECONOMIC AND TRADE ISSUES n Sustainable good economic growth. Avg. 6% GDP growth over past decade. Est. growth for this and next year is 6 -7%. Strong national reserve. n Change of Ruling Party/Prime Minister. Manmohan Singh of Congress Party replacing Vajpayee of BJ Party as Prime Minister. Mr. Singh was former financial minister pioneering many of the reform policies. n Economic reforms and liberalisation policies continued. Trade reforms and liberalization since 1991 proved to be successful. Political consensus regardless of change of leadership. Trend of globalisation and outsourcing. 4

Path to India Market ECONOMIC AND TRADE ISSUES n Sustainable good economic growth. Avg. 6% GDP growth over past decade. Est. growth for this and next year is 6 -7%. Strong national reserve. n Change of Ruling Party/Prime Minister. Manmohan Singh of Congress Party replacing Vajpayee of BJ Party as Prime Minister. Mr. Singh was former financial minister pioneering many of the reform policies. n Economic reforms and liberalisation policies continued. Trade reforms and liberalization since 1991 proved to be successful. Political consensus regardless of change of leadership. Trend of globalisation and outsourcing. 4

Path to India Market ECONOMIC AND TRADE ISSUES n “Look East” policy. Links with China, FTAs with ASEAN, Singapore, Thailand, etc. n World’s second largest market. Over 1 billion population, fast GDP growth, increasing incomes, increasing affluent households ready buyers of imported goods 5

Path to India Market ECONOMIC AND TRADE ISSUES n “Look East” policy. Links with China, FTAs with ASEAN, Singapore, Thailand, etc. n World’s second largest market. Over 1 billion population, fast GDP growth, increasing incomes, increasing affluent households ready buyers of imported goods 5

Path to India Market STATISTICS % Change India’s GDP Growth, 1991 -2004 6

Path to India Market STATISTICS % Change India’s GDP Growth, 1991 -2004 6

Path to India Market Sustainable growth led by services US$ billion India’s Exports of Services, 1997 -2003 +20% each year IT & Software 7

Path to India Market Sustainable growth led by services US$ billion India’s Exports of Services, 1997 -2003 +20% each year IT & Software 7

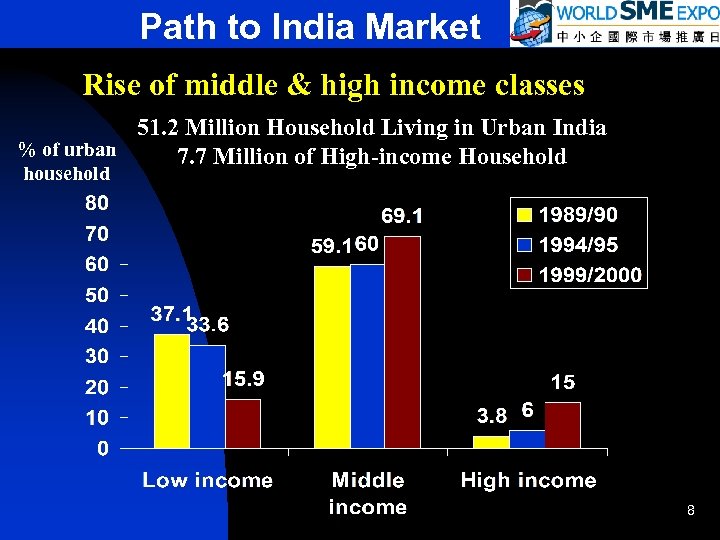

Path to India Market Rise of middle & high income classes 51. 2 Million Household Living in Urban India % of urban 7. 7 Million of High-income Household household 8

Path to India Market Rise of middle & high income classes 51. 2 Million Household Living in Urban India % of urban 7. 7 Million of High-income Household household 8

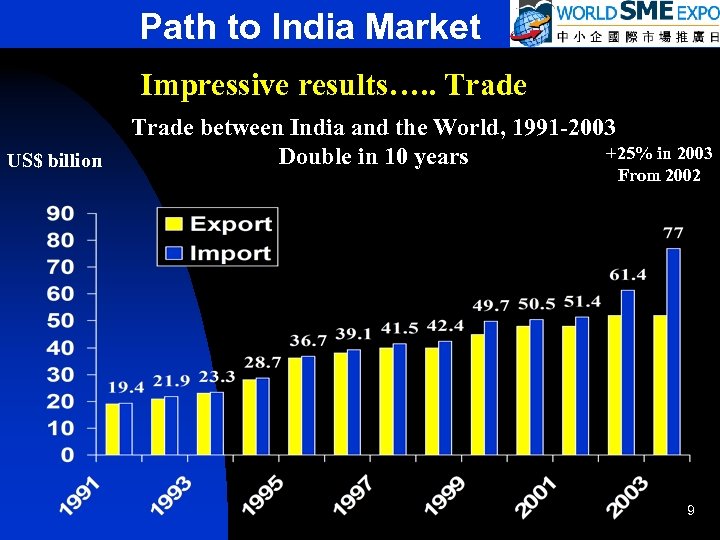

Path to India Market Impressive results…. . Trade US$ billion Trade between India and the World, 1991 -2003 +25% in 2003 Double in 10 years From 2002 9

Path to India Market Impressive results…. . Trade US$ billion Trade between India and the World, 1991 -2003 +25% in 2003 Double in 10 years From 2002 9

Path to India Market Hong Kong’s Exports to India, 1994 -2003 US$ billion Double in 5 years +32% in 2003 from 2002 10

Path to India Market Hong Kong’s Exports to India, 1994 -2003 US$ billion Double in 5 years +32% in 2003 from 2002 10

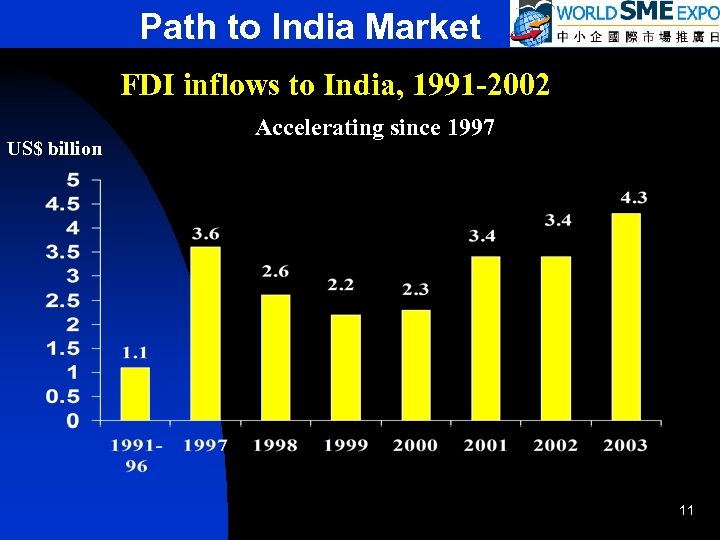

Path to India Market FDI inflows to India, 1991 -2002 US$ billion Accelerating since 1997 11

Path to India Market FDI inflows to India, 1991 -2002 US$ billion Accelerating since 1997 11

Path to India Market MARKET TRENDS n Modernising retailing. Emergence of chain stores, department stores, supermarkets, hypermarkets, shopping malls in tandem with rising living standards n Soaring demand in capital goods, machinery and parts. Serious lack of high-tech machinery – textile, injection moulding, printing, food machines, etc. n Improving trade policies and foreign investment prospects. Removal of quota system in 2001 and has since reduced import tariffs, lowered excise duty brackets to 16% and abolished additional customs duty (SAD) of 4% fr. Jan. 2004 12 total chargeable duties 40%.

Path to India Market MARKET TRENDS n Modernising retailing. Emergence of chain stores, department stores, supermarkets, hypermarkets, shopping malls in tandem with rising living standards n Soaring demand in capital goods, machinery and parts. Serious lack of high-tech machinery – textile, injection moulding, printing, food machines, etc. n Improving trade policies and foreign investment prospects. Removal of quota system in 2001 and has since reduced import tariffs, lowered excise duty brackets to 16% and abolished additional customs duty (SAD) of 4% fr. Jan. 2004 12 total chargeable duties 40%.

Path to India Market n MARKET TRENDS to foreign companies Opening up domestic market u for example, raising the ownership ceiling foreign investors in the oil/ banking sectors from 74% to 100% and 49% to 74% respectively; establishing Special Economic Zones with tax exemptions to promote export-led businesses. n Expanding two-way trade between HK and India. u n 2002 -2003, total trade grew by 12. 7% and 28. 9% respectively; while HK’s exports to India up 19. 9% and 31. 9% during the same periods. Growing middle/high classes and young generation. u Creating new demand of goods and services. 13

Path to India Market n MARKET TRENDS to foreign companies Opening up domestic market u for example, raising the ownership ceiling foreign investors in the oil/ banking sectors from 74% to 100% and 49% to 74% respectively; establishing Special Economic Zones with tax exemptions to promote export-led businesses. n Expanding two-way trade between HK and India. u n 2002 -2003, total trade grew by 12. 7% and 28. 9% respectively; while HK’s exports to India up 19. 9% and 31. 9% during the same periods. Growing middle/high classes and young generation. u Creating new demand of goods and services. 13

Path to India Market OPPORTUNITIES & CHALLENGES Opportunities for Product Sector Consumer Goods - On the rise as local offerings fail to satisfy current demand much room for imports - Consumer electronics, timepieces and, to a lesser extent, toys, gifts, house Semi-manufactures, parts and components - Except a few sectors like jewelry, India’s light manufacturing industries do not have high-tech machinery to do the processing work. badly need to procure sophisticated, high value-added semimanufactures from overseas (e. g. electronic parts) Capital goods, machinery and parts - Imports of advanced machinery, parts and accessories from overseas much needed to move up value chain. - textile, injection moulding, printing, food machines, etc. 14

Path to India Market OPPORTUNITIES & CHALLENGES Opportunities for Product Sector Consumer Goods - On the rise as local offerings fail to satisfy current demand much room for imports - Consumer electronics, timepieces and, to a lesser extent, toys, gifts, house Semi-manufactures, parts and components - Except a few sectors like jewelry, India’s light manufacturing industries do not have high-tech machinery to do the processing work. badly need to procure sophisticated, high value-added semimanufactures from overseas (e. g. electronic parts) Capital goods, machinery and parts - Imports of advanced machinery, parts and accessories from overseas much needed to move up value chain. - textile, injection moulding, printing, food machines, etc. 14

Path to India Market OPPORTUNITIES & CHALLENGES Opportunities for Services Sector n Electronics & ICT – India gained competitive advantage in providing service exports, with IT sector as the star performer. Increasing no. of IT plus electronic companies wish to expand overseas n Film & TV – India is one of the world’s largest producers of films and one of US’s outsourcing destination for animation work. Its Bollywood is gaining international attention and status. 15

Path to India Market OPPORTUNITIES & CHALLENGES Opportunities for Services Sector n Electronics & ICT – India gained competitive advantage in providing service exports, with IT sector as the star performer. Increasing no. of IT plus electronic companies wish to expand overseas n Film & TV – India is one of the world’s largest producers of films and one of US’s outsourcing destination for animation work. Its Bollywood is gaining international attention and status. 15

Path to India Market OPPORTUNITIES & CHALLENGES Opportunities for Services Sector n Infrastructure and real estate u u n Fast economic development triggers huge demand in upgrading infrastructure and real estate requirement Opportunities in roads, highways, parts/airports, commercial and residential building, township development, etc. Design u Potential consumer products like toys & gifts craving for value-add design services due to increasing keen competition 16

Path to India Market OPPORTUNITIES & CHALLENGES Opportunities for Services Sector n Infrastructure and real estate u u n Fast economic development triggers huge demand in upgrading infrastructure and real estate requirement Opportunities in roads, highways, parts/airports, commercial and residential building, township development, etc. Design u Potential consumer products like toys & gifts craving for value-add design services due to increasing keen competition 16

Path to India Market OPPORTUNITIES & CHALLENGES Challenges n n A loose and highly unorganized market. Consumers extremely price sensitive. Japanese brand Q&Q watches (@ USD 2. 5 ~ USD 35) n Very hot weather in summer (~40 C) n Insufficient flights between HK and India. n Very high airfare in India eliminates businessmen’s travel interest. 17

Path to India Market OPPORTUNITIES & CHALLENGES Challenges n n A loose and highly unorganized market. Consumers extremely price sensitive. Japanese brand Q&Q watches (@ USD 2. 5 ~ USD 35) n Very hot weather in summer (~40 C) n Insufficient flights between HK and India. n Very high airfare in India eliminates businessmen’s travel interest. 17

Path to India Market OPPORTUNITIES & CHALLENGES Challenges n n Foreign vs. Chinese goods. Foreign-made products are highly visible in India. Among them, the majority consumer goods in particular, are sourced from China. Chinese goods Chinese prices. Chinese goods mostly consolidated and shipped to India via Dubai, off record or under invoiced to avoid tax/tariffs. Prices extremely low with bad quality. Hong Kong brands/goods not visible. In the eyes of consumers, HK brands/goods are not visible; some even can’t differentiate it from China. Reliance on local manufacturers, import agents to source new products. 18

Path to India Market OPPORTUNITIES & CHALLENGES Challenges n n Foreign vs. Chinese goods. Foreign-made products are highly visible in India. Among them, the majority consumer goods in particular, are sourced from China. Chinese goods Chinese prices. Chinese goods mostly consolidated and shipped to India via Dubai, off record or under invoiced to avoid tax/tariffs. Prices extremely low with bad quality. Hong Kong brands/goods not visible. In the eyes of consumers, HK brands/goods are not visible; some even can’t differentiate it from China. Reliance on local manufacturers, import agents to source new products. 18

Path to India Market CHANNELS & STRATEGIES n Finding Indian buyers proactively n Aggressive pricing n Branding and design n Supplying semi-manufactures and capital goods n Focusing on affluent households and major cities n Seasonal sales 19

Path to India Market CHANNELS & STRATEGIES n Finding Indian buyers proactively n Aggressive pricing n Branding and design n Supplying semi-manufactures and capital goods n Focusing on affluent households and major cities n Seasonal sales 19

Path to India Market Opportunities and Challenges Watch n Market size : 50 m (now) and 75 m (by 2007) n Brands : >100 with ~50 switzerland-dominant n n Price range : 7 segments (US 5, 20, 75, 150, 300, 1, 500, >1, 500) Tax : CIF$10 $19 after tax $35 -40 market Distribution : direct (for low volume high value watches); indirect (through distributors to cover majority areas at its maximum); or a combination of both Retailing : traditional watch outlets, non-traditional watch outlets (jewelers, inflight, gift/chain/super/electronics/ fashion/lifestyle/dept. stores), franchise and showrooms. 20

Path to India Market Opportunities and Challenges Watch n Market size : 50 m (now) and 75 m (by 2007) n Brands : >100 with ~50 switzerland-dominant n n Price range : 7 segments (US 5, 20, 75, 150, 300, 1, 500, >1, 500) Tax : CIF$10 $19 after tax $35 -40 market Distribution : direct (for low volume high value watches); indirect (through distributors to cover majority areas at its maximum); or a combination of both Retailing : traditional watch outlets, non-traditional watch outlets (jewelers, inflight, gift/chain/super/electronics/ fashion/lifestyle/dept. stores), franchise and showrooms. 20

Path to India Market HOW TDC CAN HELP n tdctrade. com – market intelligence n Business matching – finding partners n n Promotional activities in India in the up and coming years (missions, exhibitions and department store promotion being planned) TDC regional office at Singapore – any queries about doing business in India 21

Path to India Market HOW TDC CAN HELP n tdctrade. com – market intelligence n Business matching – finding partners n n Promotional activities in India in the up and coming years (missions, exhibitions and department store promotion being planned) TDC regional office at Singapore – any queries about doing business in India 21

Path to India Market Loretta Wan Regional Director, Southeast Asia and India Telephone : (65) 6538 7376 Mobile : (65) 9018 1033 22

Path to India Market Loretta Wan Regional Director, Southeast Asia and India Telephone : (65) 6538 7376 Mobile : (65) 9018 1033 22

Path to India Market Thank You 23

Path to India Market Thank You 23