818fa987ae411caed1b78297292e5af0.ppt

- Количество слайдов: 59

Passive Investors and Managed Money in Commodity Futures Part 4: Price Discovery Prepared for: The CME Group Prepared by: October, 2008 1

Passive Investors and Managed Money in Commodity Futures Part 4: Price Discovery Prepared for: The CME Group Prepared by: October, 2008 1

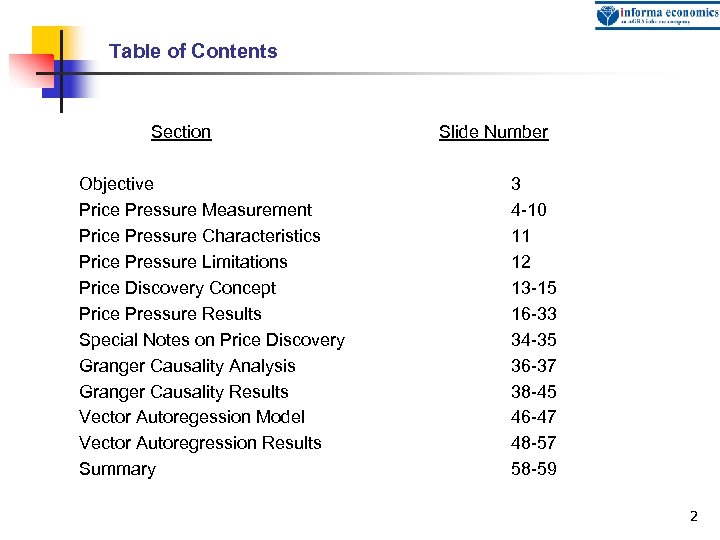

Table of Contents Section Objective Price Pressure Measurement Price Pressure Characteristics Price Pressure Limitations Price Discovery Concept Price Pressure Results Special Notes on Price Discovery Granger Causality Analysis Granger Causality Results Vector Autoregession Model Vector Autoregression Results Summary Slide Number 3 4 -10 11 12 13 -15 16 -33 34 -35 36 -37 38 -45 46 -47 48 -57 58 -59 2

Table of Contents Section Objective Price Pressure Measurement Price Pressure Characteristics Price Pressure Limitations Price Discovery Concept Price Pressure Results Special Notes on Price Discovery Granger Causality Analysis Granger Causality Results Vector Autoregession Model Vector Autoregression Results Summary Slide Number 3 4 -10 11 12 13 -15 16 -33 34 -35 36 -37 38 -45 46 -47 48 -57 58 -59 2

Objective Part 4 is an investigation into the effect that large trader groups have on the price discovery function of the studied futures markets. The specific objective is to determine if one or more trader types routinely benefits or hinders price discovery. Particular focus is placed on the index trader and money manager groups. 3

Objective Part 4 is an investigation into the effect that large trader groups have on the price discovery function of the studied futures markets. The specific objective is to determine if one or more trader types routinely benefits or hinders price discovery. Particular focus is placed on the index trader and money manager groups. 3

Price Pressure Measurement n n In order to evaluate the impact that different trader groups are having on the price discovery process, Informa utilized a method to quantify the amount of “pressure” that each trader group exerts in the market on each trading day. 1 In what follows, we illustrate the calculation of the price pressure measures for a single day in one contract. The example we use is for the March, 2006 soybean contract. We will demonstrate how price pressure is calculated for Jan 18, 2006 1 This technique was developed in: Murphy, Robert D. “The Influence of Specific Trader Groups on Price Discovery in Live Cattle Futures. ” Ph. D. Dissertation, Dept of Agricultural and Applied Economics, Virginia Tech, 1995. 4

Price Pressure Measurement n n In order to evaluate the impact that different trader groups are having on the price discovery process, Informa utilized a method to quantify the amount of “pressure” that each trader group exerts in the market on each trading day. 1 In what follows, we illustrate the calculation of the price pressure measures for a single day in one contract. The example we use is for the March, 2006 soybean contract. We will demonstrate how price pressure is calculated for Jan 18, 2006 1 This technique was developed in: Murphy, Robert D. “The Influence of Specific Trader Groups on Price Discovery in Live Cattle Futures. ” Ph. D. Dissertation, Dept of Agricultural and Applied Economics, Virginia Tech, 1995. 4

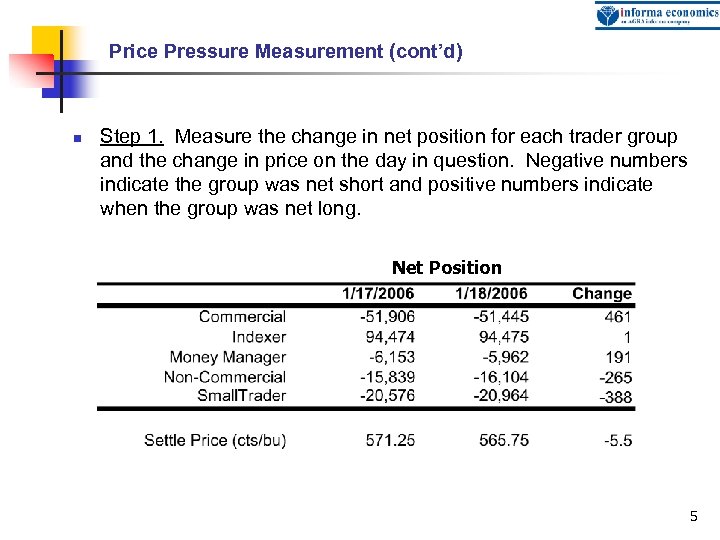

Price Pressure Measurement (cont’d) n Step 1. Measure the change in net position for each trader group and the change in price on the day in question. Negative numbers indicate the group was net short and positive numbers indicate when the group was net long. Net Position 5

Price Pressure Measurement (cont’d) n Step 1. Measure the change in net position for each trader group and the change in price on the day in question. Negative numbers indicate the group was net short and positive numbers indicate when the group was net long. Net Position 5

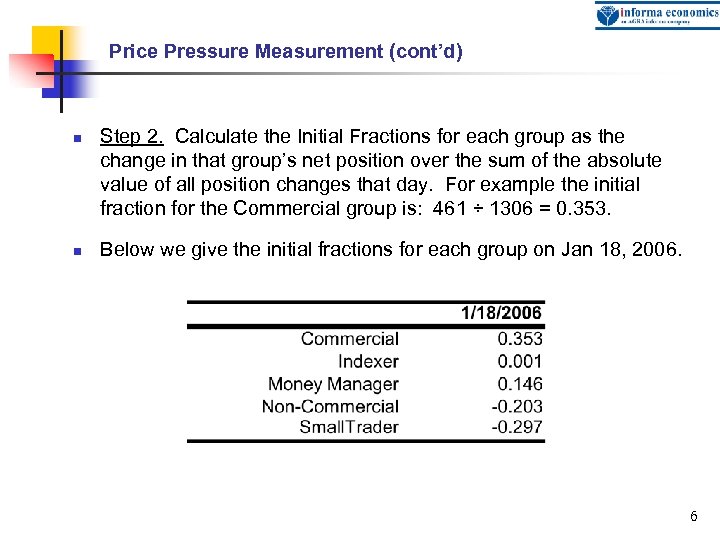

Price Pressure Measurement (cont’d) n n Step 2. Calculate the Initial Fractions for each group as the change in that group’s net position over the sum of the absolute value of all position changes that day. For example the initial fraction for the Commercial group is: 461 ÷ 1306 = 0. 353. Below we give the initial fractions for each group on Jan 18, 2006. 6

Price Pressure Measurement (cont’d) n n Step 2. Calculate the Initial Fractions for each group as the change in that group’s net position over the sum of the absolute value of all position changes that day. For example the initial fraction for the Commercial group is: 461 ÷ 1306 = 0. 353. Below we give the initial fractions for each group on Jan 18, 2006. 6

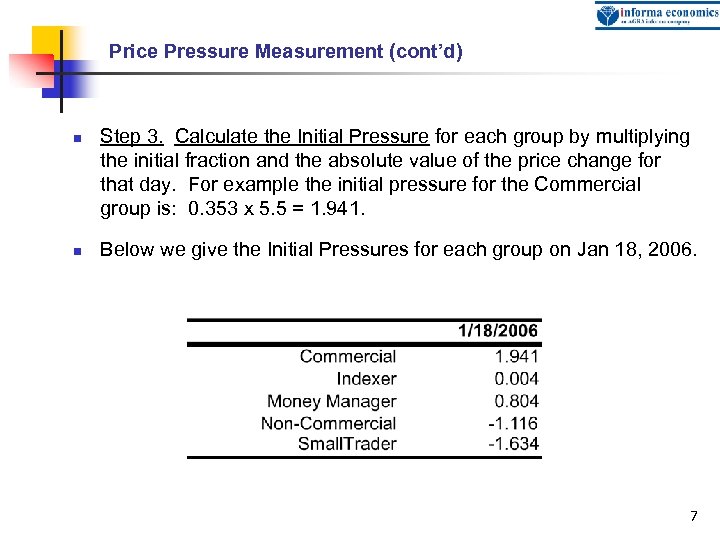

Price Pressure Measurement (cont’d) n n Step 3. Calculate the Initial Pressure for each group by multiplying the initial fraction and the absolute value of the price change for that day. For example the initial pressure for the Commercial group is: 0. 353 x 5. 5 = 1. 941. Below we give the Initial Pressures for each group on Jan 18, 2006. 7

Price Pressure Measurement (cont’d) n n Step 3. Calculate the Initial Pressure for each group by multiplying the initial fraction and the absolute value of the price change for that day. For example the initial pressure for the Commercial group is: 0. 353 x 5. 5 = 1. 941. Below we give the Initial Pressures for each group on Jan 18, 2006. 7

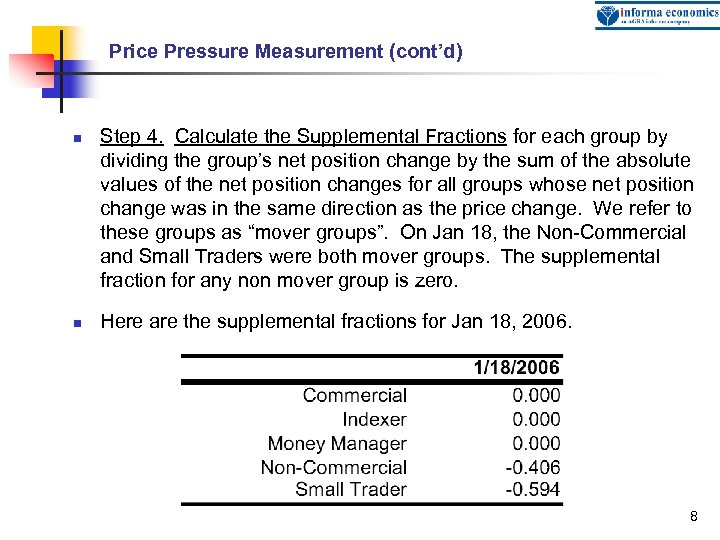

Price Pressure Measurement (cont’d) n n Step 4. Calculate the Supplemental Fractions for each group by dividing the group’s net position change by the sum of the absolute values of the net position changes for all groups whose net position change was in the same direction as the price change. We refer to these groups as “mover groups”. On Jan 18, the Non-Commercial and Small Traders were both mover groups. The supplemental fraction for any non mover group is zero. Here are the supplemental fractions for Jan 18, 2006. 8

Price Pressure Measurement (cont’d) n n Step 4. Calculate the Supplemental Fractions for each group by dividing the group’s net position change by the sum of the absolute values of the net position changes for all groups whose net position change was in the same direction as the price change. We refer to these groups as “mover groups”. On Jan 18, the Non-Commercial and Small Traders were both mover groups. The supplemental fraction for any non mover group is zero. Here are the supplemental fractions for Jan 18, 2006. 8

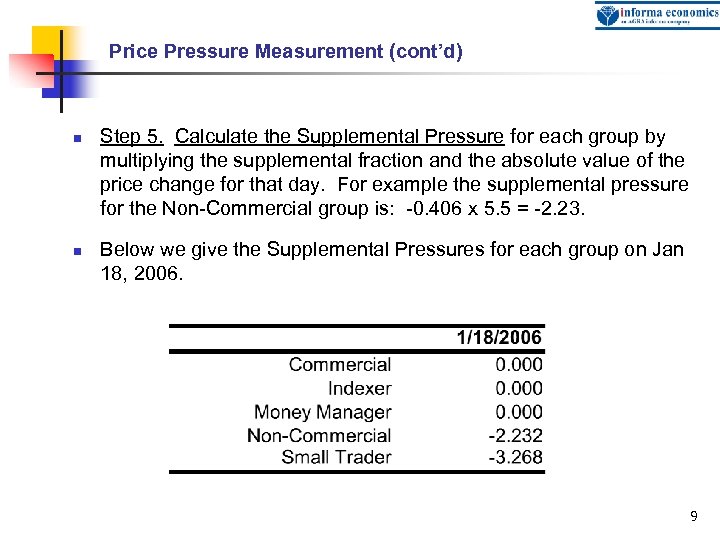

Price Pressure Measurement (cont’d) n n Step 5. Calculate the Supplemental Pressure for each group by multiplying the supplemental fraction and the absolute value of the price change for that day. For example the supplemental pressure for the Non-Commercial group is: -0. 406 x 5. 5 = -2. 23. Below we give the Supplemental Pressures for each group on Jan 18, 2006. 9

Price Pressure Measurement (cont’d) n n Step 5. Calculate the Supplemental Pressure for each group by multiplying the supplemental fraction and the absolute value of the price change for that day. For example the supplemental pressure for the Non-Commercial group is: -0. 406 x 5. 5 = -2. 23. Below we give the Supplemental Pressures for each group on Jan 18, 2006. 9

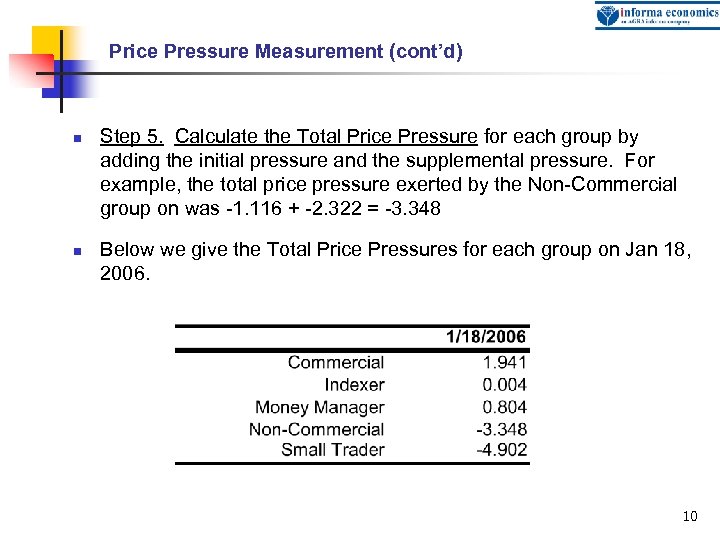

Price Pressure Measurement (cont’d) n n Step 5. Calculate the Total Price Pressure for each group by adding the initial pressure and the supplemental pressure. For example, the total price pressure exerted by the Non-Commercial group on was -1. 116 + -2. 322 = -3. 348 Below we give the Total Price Pressures for each group on Jan 18, 2006. 10

Price Pressure Measurement (cont’d) n n Step 5. Calculate the Total Price Pressure for each group by adding the initial pressure and the supplemental pressure. For example, the total price pressure exerted by the Non-Commercial group on was -1. 116 + -2. 322 = -3. 348 Below we give the Total Price Pressures for each group on Jan 18, 2006. 10

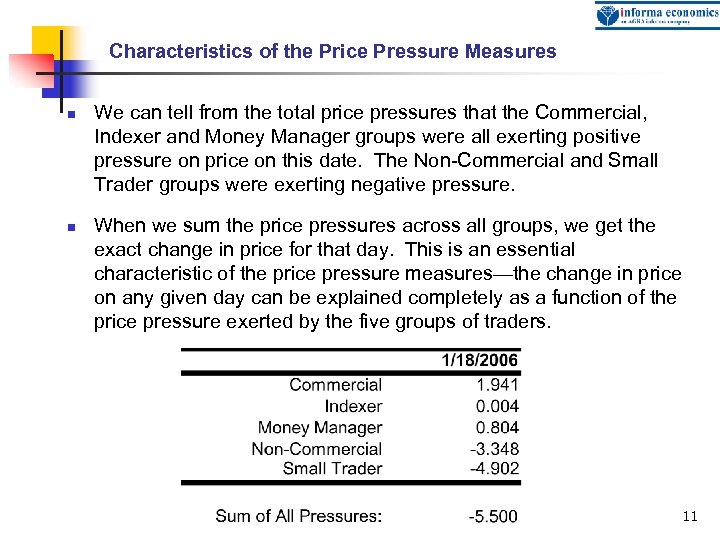

Characteristics of the Price Pressure Measures n n We can tell from the total price pressures that the Commercial, Indexer and Money Manager groups were all exerting positive pressure on price on this date. The Non-Commercial and Small Trader groups were exerting negative pressure. When we sum the price pressures across all groups, we get the exact change in price for that day. This is an essential characteristic of the price pressure measures—the change in price on any given day can be explained completely as a function of the price pressure exerted by the five groups of traders. 11

Characteristics of the Price Pressure Measures n n We can tell from the total price pressures that the Commercial, Indexer and Money Manager groups were all exerting positive pressure on price on this date. The Non-Commercial and Small Trader groups were exerting negative pressure. When we sum the price pressures across all groups, we get the exact change in price for that day. This is an essential characteristic of the price pressure measures—the change in price on any given day can be explained completely as a function of the price pressure exerted by the five groups of traders. 11

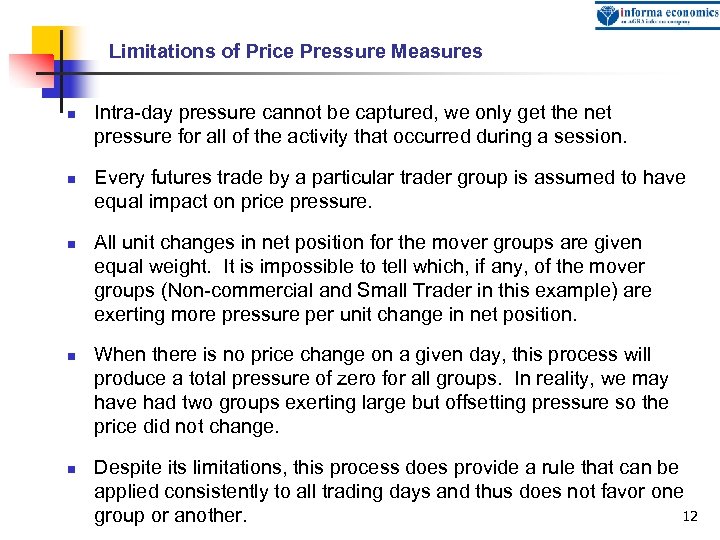

Limitations of Price Pressure Measures n n n Intra-day pressure cannot be captured, we only get the net pressure for all of the activity that occurred during a session. Every futures trade by a particular trader group is assumed to have equal impact on price pressure. All unit changes in net position for the mover groups are given equal weight. It is impossible to tell which, if any, of the mover groups (Non-commercial and Small Trader in this example) are exerting more pressure per unit change in net position. When there is no price change on a given day, this process will produce a total pressure of zero for all groups. In reality, we may have had two groups exerting large but offsetting pressure so the price did not change. Despite its limitations, this process does provide a rule that can be applied consistently to all trading days and thus does not favor one 12 group or another.

Limitations of Price Pressure Measures n n n Intra-day pressure cannot be captured, we only get the net pressure for all of the activity that occurred during a session. Every futures trade by a particular trader group is assumed to have equal impact on price pressure. All unit changes in net position for the mover groups are given equal weight. It is impossible to tell which, if any, of the mover groups (Non-commercial and Small Trader in this example) are exerting more pressure per unit change in net position. When there is no price change on a given day, this process will produce a total pressure of zero for all groups. In reality, we may have had two groups exerting large but offsetting pressure so the price did not change. Despite its limitations, this process does provide a rule that can be applied consistently to all trading days and thus does not favor one 12 group or another.

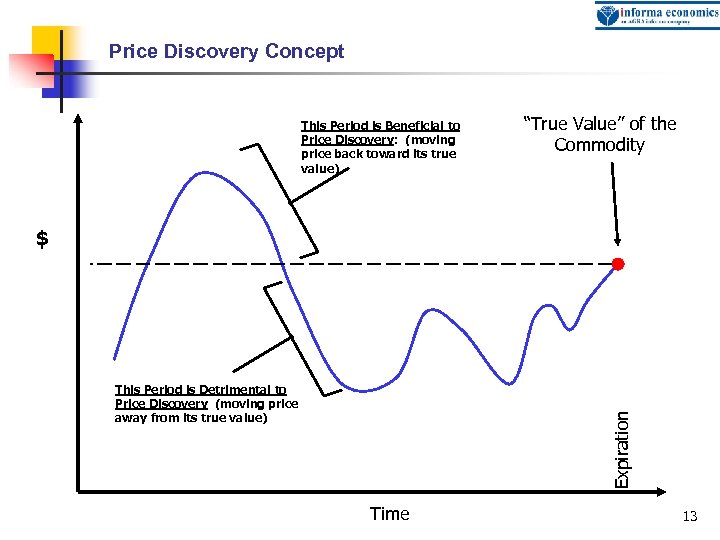

Price Discovery Concept This Period is Beneficial to Price Discovery: (moving price back toward its true value) “True Value” of the Commodity $ Expiration This Period is Detrimental to Price Discovery (moving price away from its true value) Time 13

Price Discovery Concept This Period is Beneficial to Price Discovery: (moving price back toward its true value) “True Value” of the Commodity $ Expiration This Period is Detrimental to Price Discovery (moving price away from its true value) Time 13

Price Discovery Concept n n n Price discovery in futures markets involves how well the futures price reflects the ultimate value of the commodity. For example, the March 2006 soybean contract is doing a good job of price discovery when it accurately represents the price of cash soybeans at the delivery location in March of 2006. If it spends large amounts of time away from the “true value” of cash soybeans in March of 2006 then we conclude that its price discovery performance was poor. In the section that follows, we will use the price pressure measures to identify which trader groups tend to help price discovery by exerting pressure consistent with bringing price back toward true value and which hinder price discovery by routinely pushing price away from true value. 14

Price Discovery Concept n n n Price discovery in futures markets involves how well the futures price reflects the ultimate value of the commodity. For example, the March 2006 soybean contract is doing a good job of price discovery when it accurately represents the price of cash soybeans at the delivery location in March of 2006. If it spends large amounts of time away from the “true value” of cash soybeans in March of 2006 then we conclude that its price discovery performance was poor. In the section that follows, we will use the price pressure measures to identify which trader groups tend to help price discovery by exerting pressure consistent with bringing price back toward true value and which hinder price discovery by routinely pushing price away from true value. 14

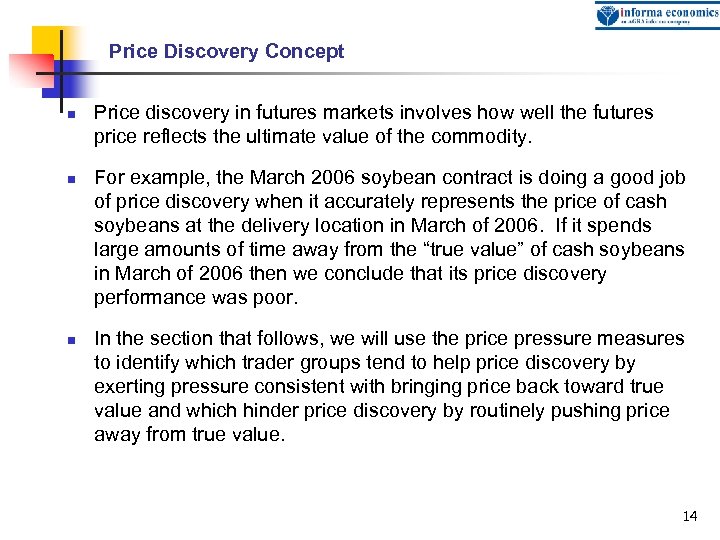

Price Series Used to Represent Fundamental Value 15

Price Series Used to Represent Fundamental Value 15

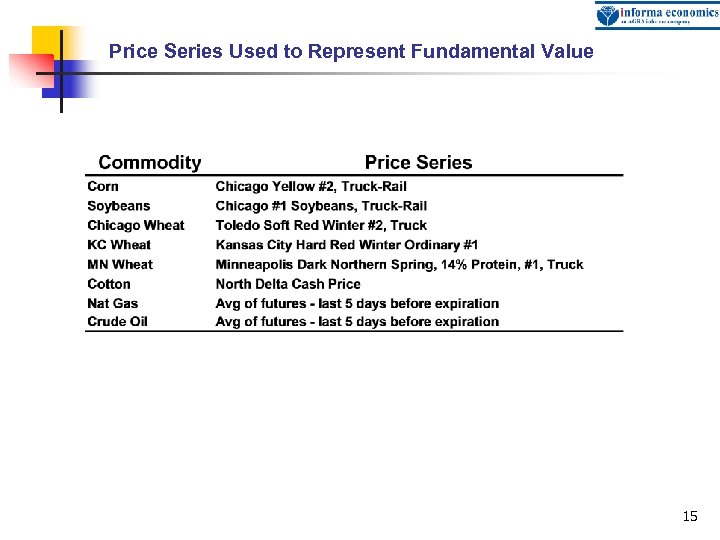

Results – CMEG Corn Futures Sum of Beneficial and Detrimental Price Pressure (absolute value in cents/bu. ) 16

Results – CMEG Corn Futures Sum of Beneficial and Detrimental Price Pressure (absolute value in cents/bu. ) 16

Comments on Corn Results n n n The Commercial and Small Trader groups are the only groups that showed more detrimental pressure than beneficial over the study period. Money managers had the highest ratio of beneficial to detrimental pressure. We hypothesize that indexers, non-commercials and money managers did well because they correctly anticipated that expiration values would be high. In other words, those that persistently pursued long positions in corn over the last few years were often on the right side of the market given where commodity prices ended up. Whether this was luck or skill is debatable, but this upward pressure was correct in the end. 17

Comments on Corn Results n n n The Commercial and Small Trader groups are the only groups that showed more detrimental pressure than beneficial over the study period. Money managers had the highest ratio of beneficial to detrimental pressure. We hypothesize that indexers, non-commercials and money managers did well because they correctly anticipated that expiration values would be high. In other words, those that persistently pursued long positions in corn over the last few years were often on the right side of the market given where commodity prices ended up. Whether this was luck or skill is debatable, but this upward pressure was correct in the end. 17

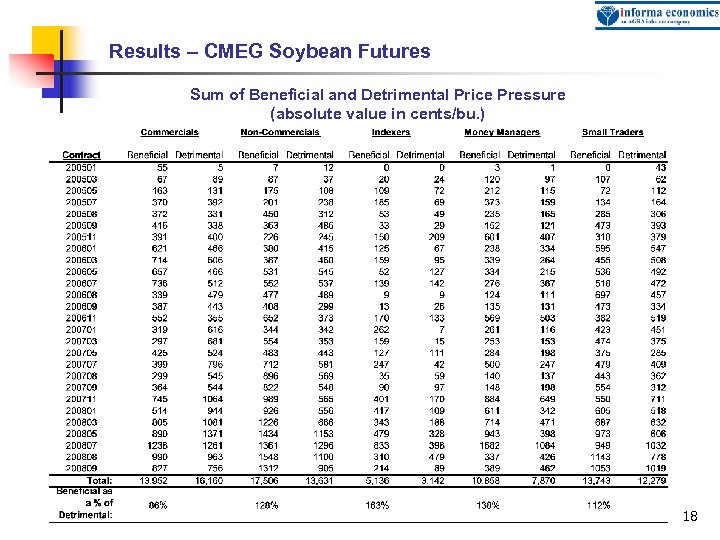

Results – CMEG Soybean Futures Sum of Beneficial and Detrimental Price Pressure (absolute value in cents/bu. ) 18

Results – CMEG Soybean Futures Sum of Beneficial and Detrimental Price Pressure (absolute value in cents/bu. ) 18

Comments on Soybean Results n n n The Commercial group is the only group that showed more detrimental pressure than beneficial over the study period Indexers had the highest ratio of beneficial to detrimental Similar to corn, we hypothesize that indexers, non-commercials and money managers did well because they correctly anticipated that expiration values would be high. In other words, those that persistently pursued long positions in soybeans over the last few years were often on the right side of the market given where commodity prices ended up. 19

Comments on Soybean Results n n n The Commercial group is the only group that showed more detrimental pressure than beneficial over the study period Indexers had the highest ratio of beneficial to detrimental Similar to corn, we hypothesize that indexers, non-commercials and money managers did well because they correctly anticipated that expiration values would be high. In other words, those that persistently pursued long positions in soybeans over the last few years were often on the right side of the market given where commodity prices ended up. 19

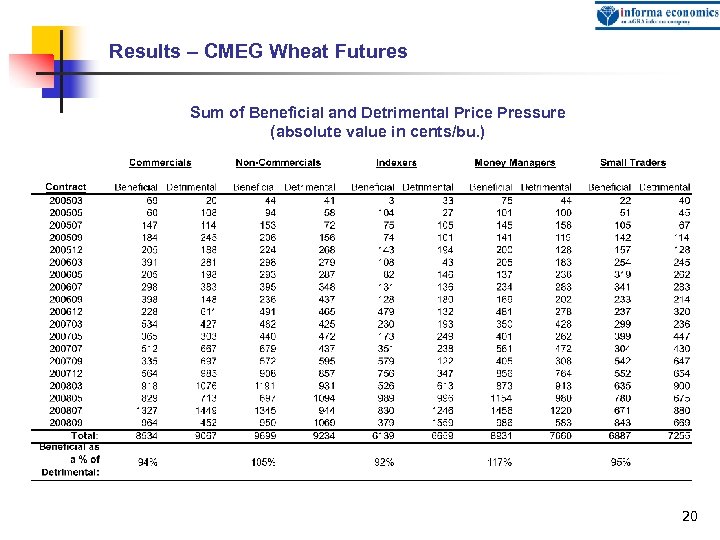

Results – CMEG Wheat Futures Sum of Beneficial and Detrimental Price Pressure (absolute value in cents/bu. ) 20

Results – CMEG Wheat Futures Sum of Beneficial and Detrimental Price Pressure (absolute value in cents/bu. ) 20

Comments on CMEG Wheat Results n n n Small Traders, Indexers and Commercials showed slightly more detrimental pressure than beneficial pressure over the study period. Money Managers had the highest ratio of beneficial to detrimental price pressure. Indexers had slightly more detrimental pressure than beneficial. Indexers were particularly detrimental in the last two contracts, July and September, 2008. In these two contracts, prices were forced way above true value a few months prior to expiration (Spring, 2008). This is the time when Indexers are most active. Small traders seem to show equal quantities of beneficial and detrimental pressure in each month. 21

Comments on CMEG Wheat Results n n n Small Traders, Indexers and Commercials showed slightly more detrimental pressure than beneficial pressure over the study period. Money Managers had the highest ratio of beneficial to detrimental price pressure. Indexers had slightly more detrimental pressure than beneficial. Indexers were particularly detrimental in the last two contracts, July and September, 2008. In these two contracts, prices were forced way above true value a few months prior to expiration (Spring, 2008). This is the time when Indexers are most active. Small traders seem to show equal quantities of beneficial and detrimental pressure in each month. 21

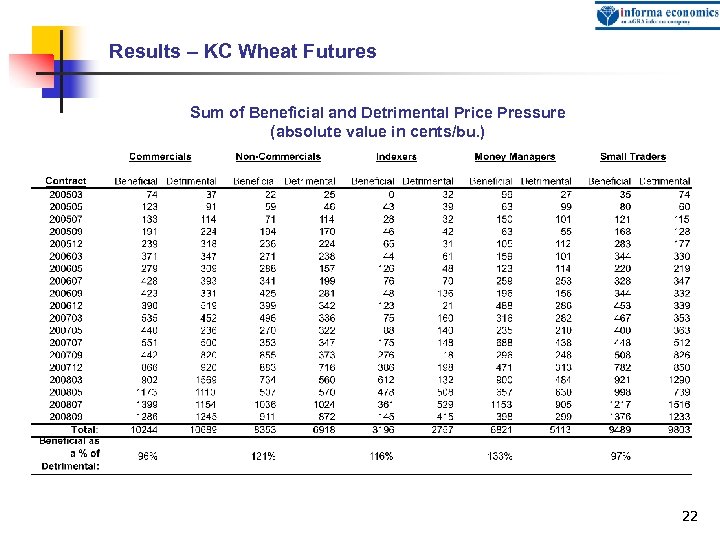

Results – KC Wheat Futures Sum of Beneficial and Detrimental Price Pressure (absolute value in cents/bu. ) 22

Results – KC Wheat Futures Sum of Beneficial and Detrimental Price Pressure (absolute value in cents/bu. ) 22

Comments on KC Wheat Results n n n Small Traders and Indexers showed slightly more detrimental pressure than beneficial pressure over the study period. Money Managers had the highest ratio of beneficial to detrimental price pressure. Indexers had slightly more detrimental pressure than beneficial. Indexers were particularly detrimental in the last three contracts, May, July and September 2008. Index traders exert less pressure overall in this market than they do in the Chicago wheat market. 23

Comments on KC Wheat Results n n n Small Traders and Indexers showed slightly more detrimental pressure than beneficial pressure over the study period. Money Managers had the highest ratio of beneficial to detrimental price pressure. Indexers had slightly more detrimental pressure than beneficial. Indexers were particularly detrimental in the last three contracts, May, July and September 2008. Index traders exert less pressure overall in this market than they do in the Chicago wheat market. 23

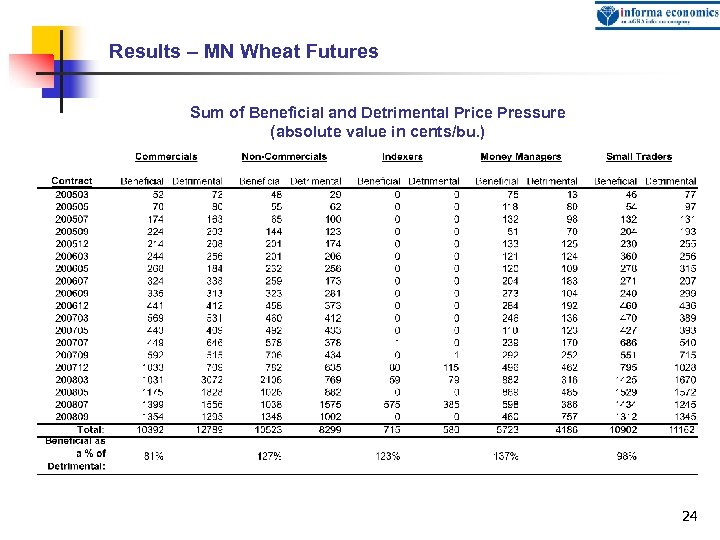

Results – MN Wheat Futures Sum of Beneficial and Detrimental Price Pressure (absolute value in cents/bu. ) 24

Results – MN Wheat Futures Sum of Beneficial and Detrimental Price Pressure (absolute value in cents/bu. ) 24

Comments on MN Wheat Results n n n Index traders have historically not been present in this market, but recently a small amount of activity has surfaced. Commercials are the only group to exhibit more detrimental price pressure than beneficial. Money managers have exhibited a greater level of beneficial price pressure in six of the last seven contracts in the study period. 25

Comments on MN Wheat Results n n n Index traders have historically not been present in this market, but recently a small amount of activity has surfaced. Commercials are the only group to exhibit more detrimental price pressure than beneficial. Money managers have exhibited a greater level of beneficial price pressure in six of the last seven contracts in the study period. 25

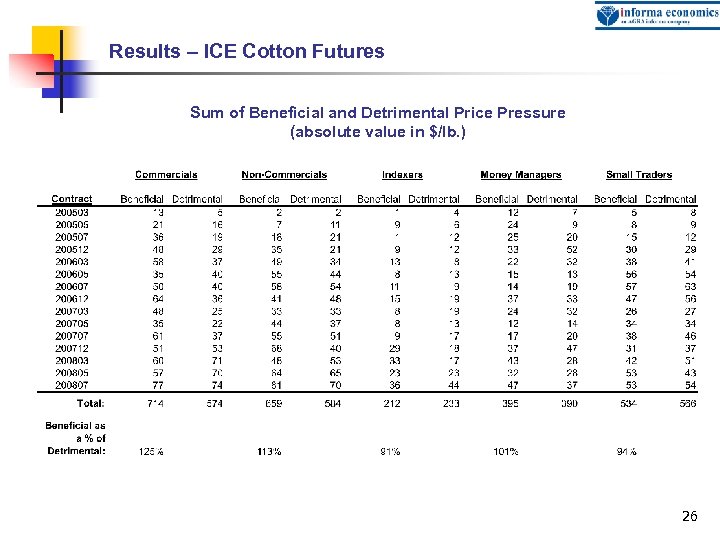

Results – ICE Cotton Futures Sum of Beneficial and Detrimental Price Pressure (absolute value in $/lb. ) 26

Results – ICE Cotton Futures Sum of Beneficial and Detrimental Price Pressure (absolute value in $/lb. ) 26

Comments on Cotton Results n n n Index and Small Traders both exerted more aggregate detrimental pressure than beneficial pressure. Index traders exerted less overall price pressure than did the Commercial, Non-commercial and Small Trader groups. Money Managers displayed a near equal split between beneficial and detrimental price pressure. 27

Comments on Cotton Results n n n Index and Small Traders both exerted more aggregate detrimental pressure than beneficial pressure. Index traders exerted less overall price pressure than did the Commercial, Non-commercial and Small Trader groups. Money Managers displayed a near equal split between beneficial and detrimental price pressure. 27

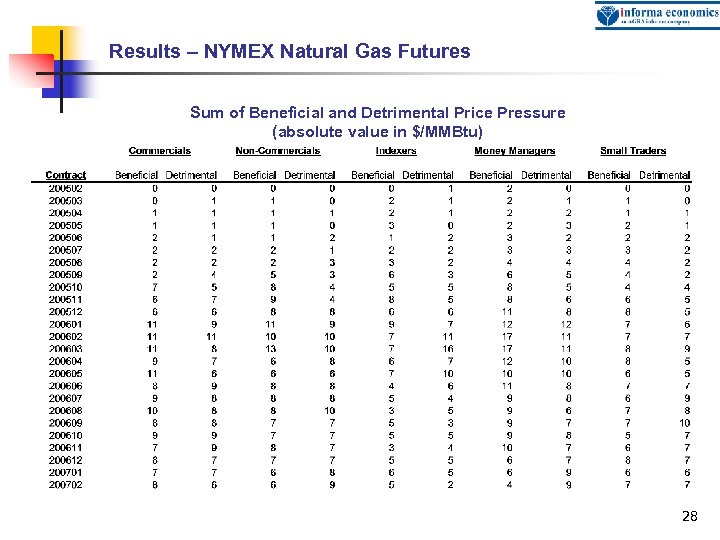

Results – NYMEX Natural Gas Futures Sum of Beneficial and Detrimental Price Pressure (absolute value in $/MMBtu) 28

Results – NYMEX Natural Gas Futures Sum of Beneficial and Detrimental Price Pressure (absolute value in $/MMBtu) 28

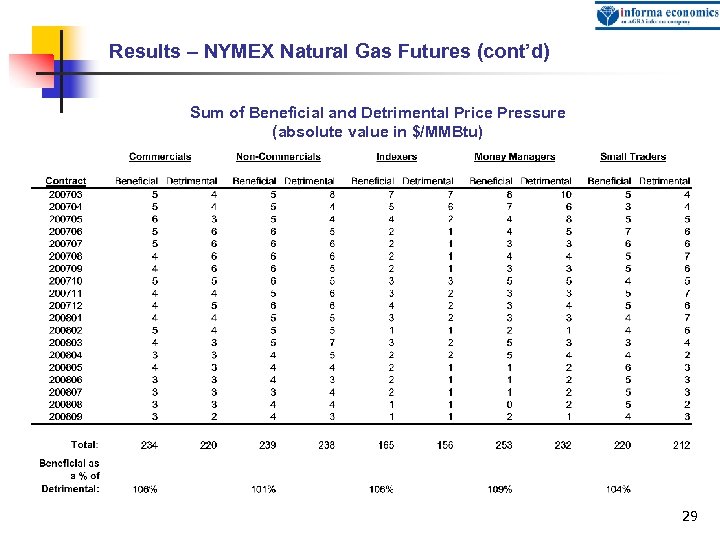

Results – NYMEX Natural Gas Futures (cont’d) Sum of Beneficial and Detrimental Price Pressure (absolute value in $/MMBtu) 29

Results – NYMEX Natural Gas Futures (cont’d) Sum of Beneficial and Detrimental Price Pressure (absolute value in $/MMBtu) 29

Comments on Natural Gas Results n n In this market, all of the groups showed a nearly equal split between beneficial and detrimental price pressure. This is indicative of a situation where no one trader group regularly percieves mis-pricing in the market. Money managers had the highest beneficial/detrimental price pressure ratio. 30

Comments on Natural Gas Results n n In this market, all of the groups showed a nearly equal split between beneficial and detrimental price pressure. This is indicative of a situation where no one trader group regularly percieves mis-pricing in the market. Money managers had the highest beneficial/detrimental price pressure ratio. 30

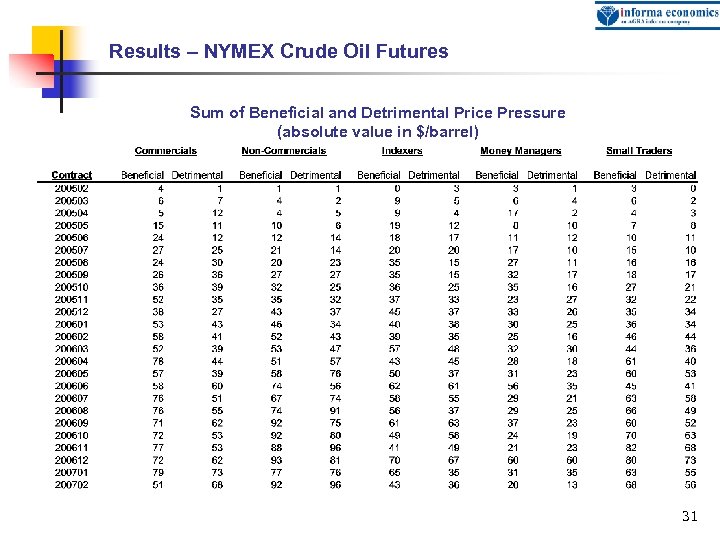

Results – NYMEX Crude Oil Futures Sum of Beneficial and Detrimental Price Pressure (absolute value in $/barrel) 31

Results – NYMEX Crude Oil Futures Sum of Beneficial and Detrimental Price Pressure (absolute value in $/barrel) 31

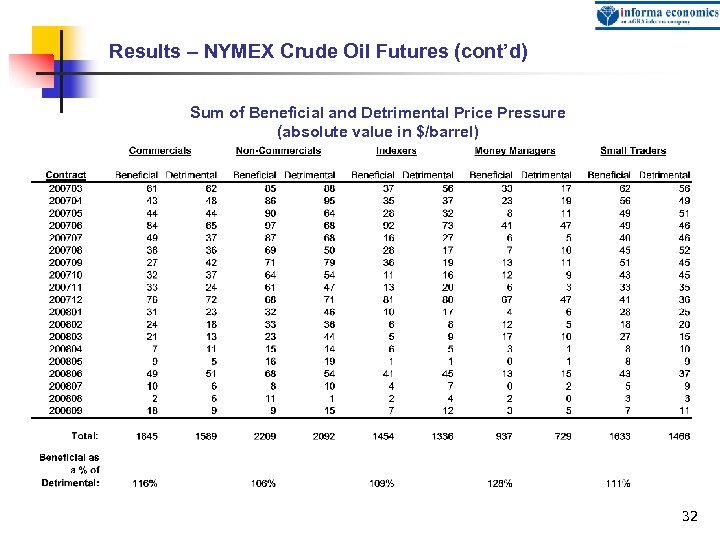

Results – NYMEX Crude Oil Futures (cont’d) Sum of Beneficial and Detrimental Price Pressure (absolute value in $/barrel) 32

Results – NYMEX Crude Oil Futures (cont’d) Sum of Beneficial and Detrimental Price Pressure (absolute value in $/barrel) 32

Comments on Crude Oil Results n n In this market, prices trended routinely higher often expiring near contract highs, this characteristic results in far more beneficial pressure than detrimental in aggregate. Money managers had the highest beneficial/detrimental price pressure ratio, but they exerted less overall pressure than the other four groups. Non-commercials had the lowest beneficial/detrimental price pressure ratio. In the most recent contract, Sep 2008, indexers showed a high degree of detrimental price pressure. This contract trended sharply lower in the last couple of months of its existence. 33

Comments on Crude Oil Results n n In this market, prices trended routinely higher often expiring near contract highs, this characteristic results in far more beneficial pressure than detrimental in aggregate. Money managers had the highest beneficial/detrimental price pressure ratio, but they exerted less overall pressure than the other four groups. Non-commercials had the lowest beneficial/detrimental price pressure ratio. In the most recent contract, Sep 2008, indexers showed a high degree of detrimental price pressure. This contract trended sharply lower in the last couple of months of its existence. 33

Special Notes on the Price Pressure Analysis It is possible that Commercial traders, if they are textbook hedging, do not care so much about the true value of the commodity as much as they do about shifting risk. Thus, Commercials often appear to exert detrimental pressure as a result of routine hedging activities. The “true value” used in these analyses was the reported cash price in the days surrounding first notice day for all commodities except natural gas and crude oil. Because of the prolonged nature of delivery in these markets (a 30 -day delivery window) spot prices were not considered to be indicative of the true value of the contract. In these instances, the average value of the futures in the final five days of trading was used as the true value. The assumption here is that these energy contracts converge correctly to the market’s estimate of their true value. 34

Special Notes on the Price Pressure Analysis It is possible that Commercial traders, if they are textbook hedging, do not care so much about the true value of the commodity as much as they do about shifting risk. Thus, Commercials often appear to exert detrimental pressure as a result of routine hedging activities. The “true value” used in these analyses was the reported cash price in the days surrounding first notice day for all commodities except natural gas and crude oil. Because of the prolonged nature of delivery in these markets (a 30 -day delivery window) spot prices were not considered to be indicative of the true value of the contract. In these instances, the average value of the futures in the final five days of trading was used as the true value. The assumption here is that these energy contracts converge correctly to the market’s estimate of their true value. 34

Special Notes on the Price Pressure Analysis Some might argue that excessive buy and hold strategies became selffulfilling prophecies in these storable commodities, forcing contracts to expire at values higher than the true cash value of the commodity. However, all of these contracts are eventually settled by physical delivery and in most instances it appears the delivery process worked well, allowing participants to turn futures paper into physicals at expiration. The exceptions are the CMEG wheat contract and, to a lesser extent, the CMEG soybean and corn contracts in the latter part of the study period. Problems with contract design in these commodities is addressed in separate phase of this project. It is difficult to argue that the futures are priced higher than the fundamental value of the commodity when market participants are actively exchanging futures for the physical commodity via the delivery process. 35

Special Notes on the Price Pressure Analysis Some might argue that excessive buy and hold strategies became selffulfilling prophecies in these storable commodities, forcing contracts to expire at values higher than the true cash value of the commodity. However, all of these contracts are eventually settled by physical delivery and in most instances it appears the delivery process worked well, allowing participants to turn futures paper into physicals at expiration. The exceptions are the CMEG wheat contract and, to a lesser extent, the CMEG soybean and corn contracts in the latter part of the study period. Problems with contract design in these commodities is addressed in separate phase of this project. It is difficult to argue that the futures are priced higher than the fundamental value of the commodity when market participants are actively exchanging futures for the physical commodity via the delivery process. 35

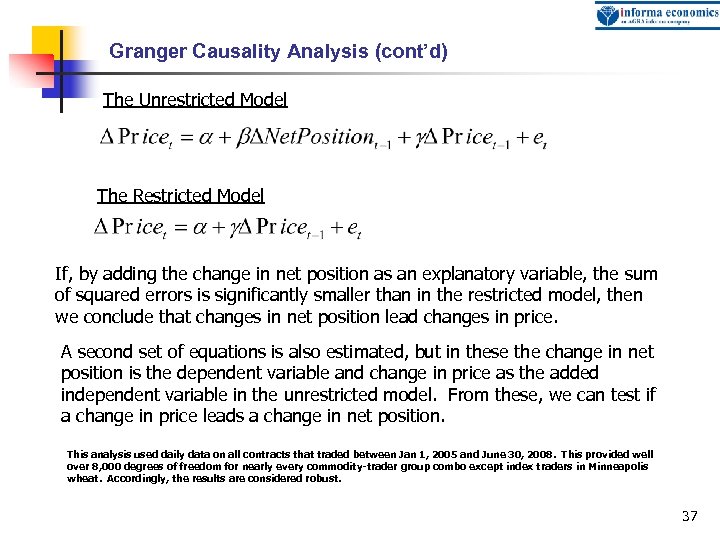

Granger Causality Analysis n n Granger Causality is an econometric technique used to determine if one variable leads (“causes”) another. In this exercise, we want to investigate: n n n Do changes in net position by trader groups cause price changes? Or Do changes in prices cause traders to alter their positions? To do this, two models are estimated, a unrestricted model and a restricted model. A simple F test is used to determine if the added variable in the unrestricted model results in significantly smaller sum of squared residuals. P-values from this F test are reported rather than the F statistic itself. 36

Granger Causality Analysis n n Granger Causality is an econometric technique used to determine if one variable leads (“causes”) another. In this exercise, we want to investigate: n n n Do changes in net position by trader groups cause price changes? Or Do changes in prices cause traders to alter their positions? To do this, two models are estimated, a unrestricted model and a restricted model. A simple F test is used to determine if the added variable in the unrestricted model results in significantly smaller sum of squared residuals. P-values from this F test are reported rather than the F statistic itself. 36

Granger Causality Analysis (cont’d) The Unrestricted Model The Restricted Model If, by adding the change in net position as an explanatory variable, the sum of squared errors is significantly smaller than in the restricted model, then we conclude that changes in net position lead changes in price. A second set of equations is also estimated, but in these the change in net position is the dependent variable and change in price as the added independent variable in the unrestricted model. From these, we can test if a change in price leads a change in net position. This analysis used daily data on all contracts that traded between Jan 1, 2005 and June 30, 2008. This provided well over 8, 000 degrees of freedom for nearly every commodity-trader group combo except index traders in Minneapolis wheat. Accordingly, the results are considered robust. 37

Granger Causality Analysis (cont’d) The Unrestricted Model The Restricted Model If, by adding the change in net position as an explanatory variable, the sum of squared errors is significantly smaller than in the restricted model, then we conclude that changes in net position lead changes in price. A second set of equations is also estimated, but in these the change in net position is the dependent variable and change in price as the added independent variable in the unrestricted model. From these, we can test if a change in price leads a change in net position. This analysis used daily data on all contracts that traded between Jan 1, 2005 and June 30, 2008. This provided well over 8, 000 degrees of freedom for nearly every commodity-trader group combo except index traders in Minneapolis wheat. Accordingly, the results are considered robust. 37

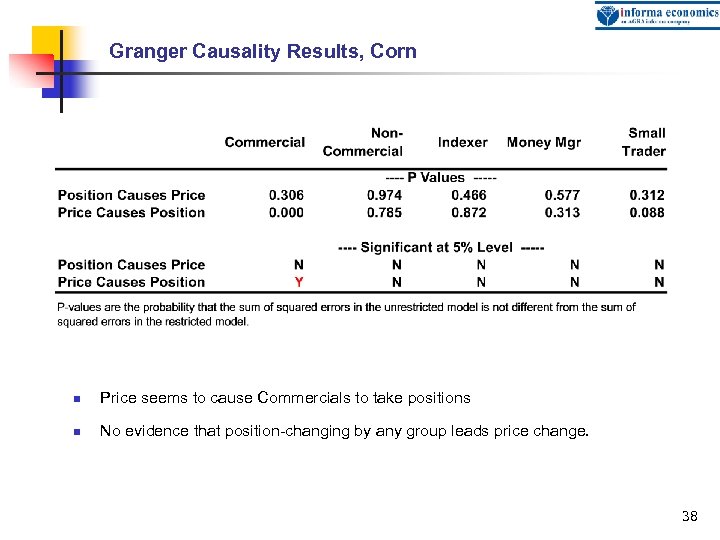

Granger Causality Results, Corn n Price seems to cause Commercials to take positions n No evidence that position-changing by any group leads price change. 38

Granger Causality Results, Corn n Price seems to cause Commercials to take positions n No evidence that position-changing by any group leads price change. 38

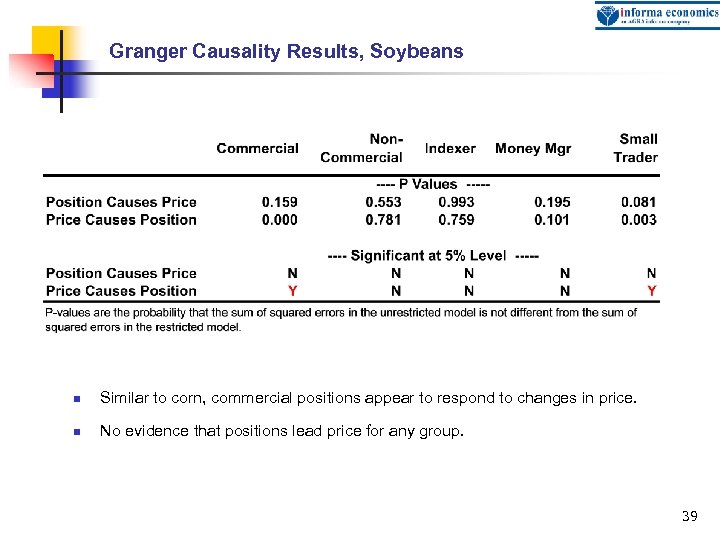

Granger Causality Results, Soybeans n Similar to corn, commercial positions appear to respond to changes in price. n No evidence that positions lead price for any group. 39

Granger Causality Results, Soybeans n Similar to corn, commercial positions appear to respond to changes in price. n No evidence that positions lead price for any group. 39

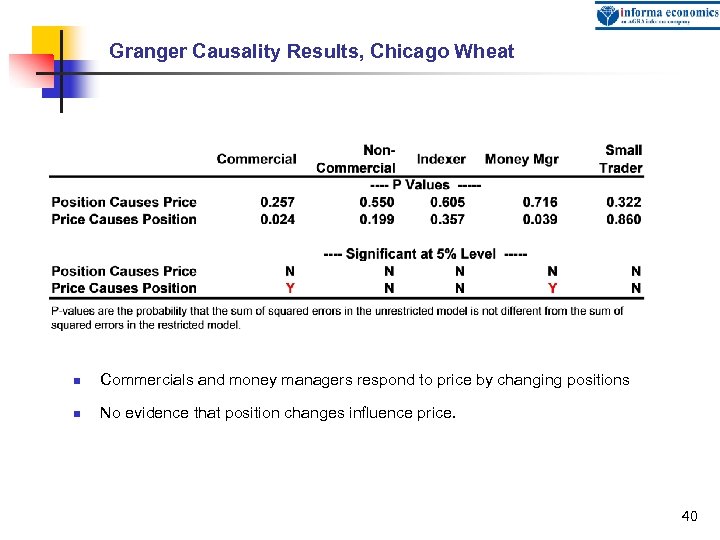

Granger Causality Results, Chicago Wheat n Commercials and money managers respond to price by changing positions n No evidence that position changes influence price. 40

Granger Causality Results, Chicago Wheat n Commercials and money managers respond to price by changing positions n No evidence that position changes influence price. 40

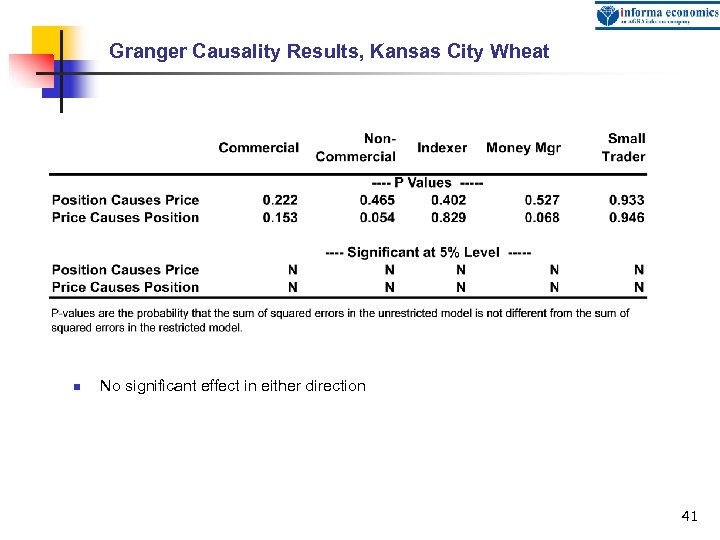

Granger Causality Results, Kansas City Wheat n No significant effect in either direction 41

Granger Causality Results, Kansas City Wheat n No significant effect in either direction 41

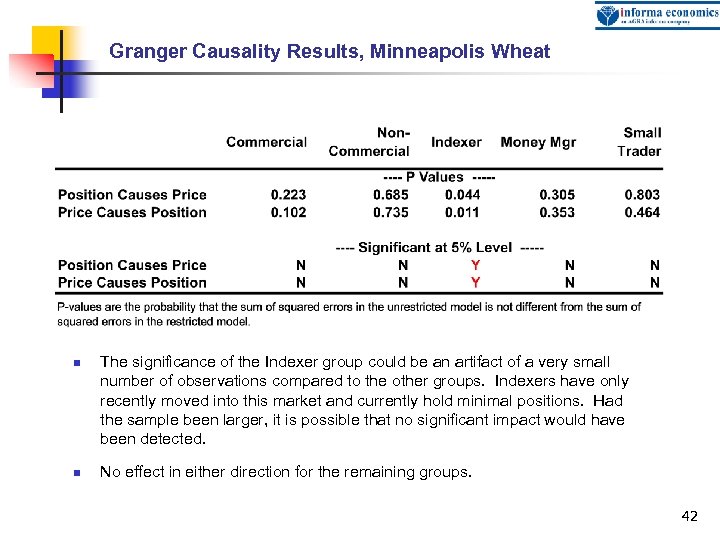

Granger Causality Results, Minneapolis Wheat n n The significance of the Indexer group could be an artifact of a very small number of observations compared to the other groups. Indexers have only recently moved into this market and currently hold minimal positions. Had the sample been larger, it is possible that no significant impact would have been detected. No effect in either direction for the remaining groups. 42

Granger Causality Results, Minneapolis Wheat n n The significance of the Indexer group could be an artifact of a very small number of observations compared to the other groups. Indexers have only recently moved into this market and currently hold minimal positions. Had the sample been larger, it is possible that no significant impact would have been detected. No effect in either direction for the remaining groups. 42

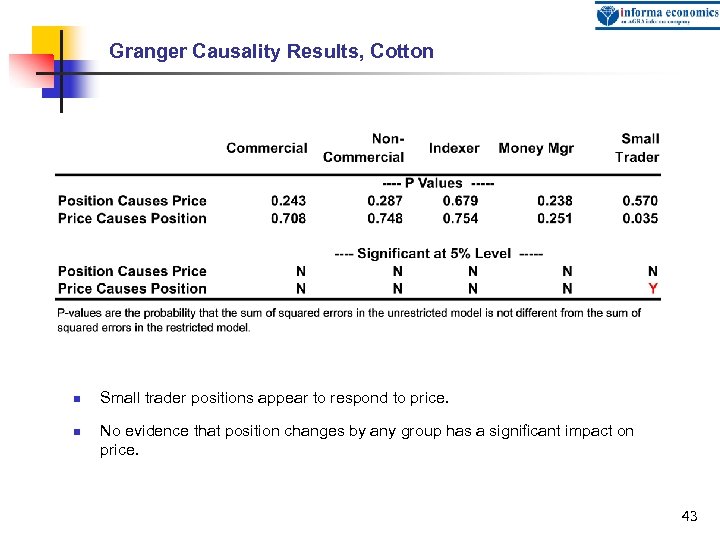

Granger Causality Results, Cotton n n Small trader positions appear to respond to price. No evidence that position changes by any group has a significant impact on price. 43

Granger Causality Results, Cotton n n Small trader positions appear to respond to price. No evidence that position changes by any group has a significant impact on price. 43

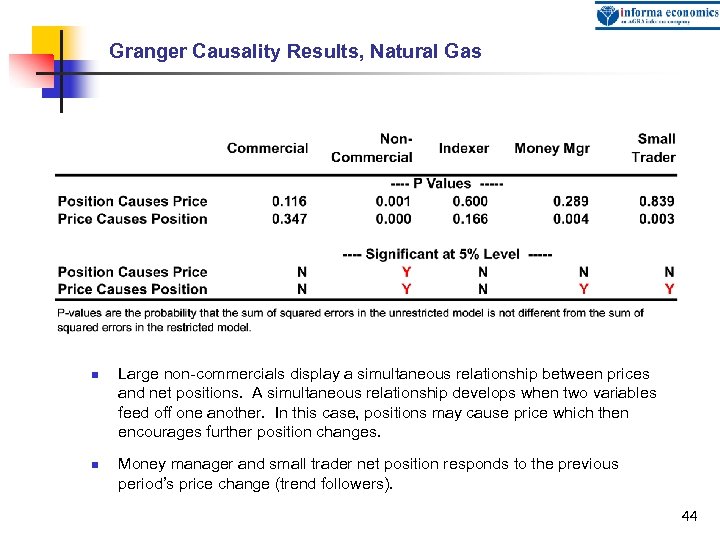

Granger Causality Results, Natural Gas n n Large non-commercials display a simultaneous relationship between prices and net positions. A simultaneous relationship develops when two variables feed off one another. In this case, positions may cause price which then encourages further position changes. Money manager and small trader net position responds to the previous period’s price change (trend followers). 44

Granger Causality Results, Natural Gas n n Large non-commercials display a simultaneous relationship between prices and net positions. A simultaneous relationship develops when two variables feed off one another. In this case, positions may cause price which then encourages further position changes. Money manager and small trader net position responds to the previous period’s price change (trend followers). 44

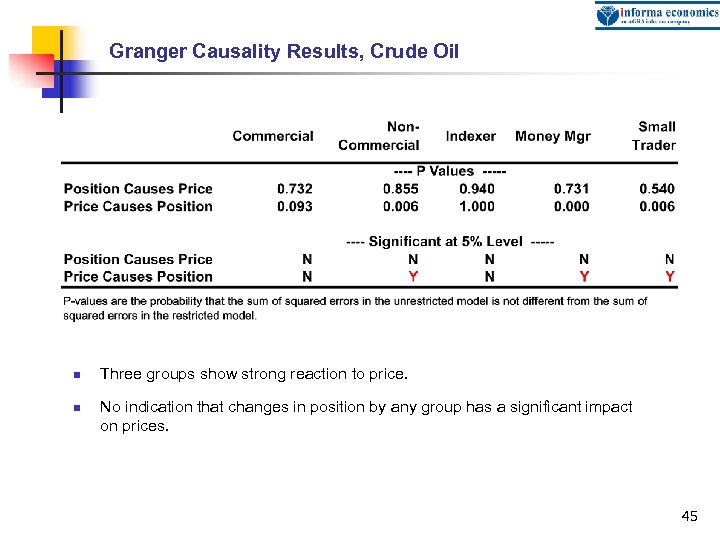

Granger Causality Results, Crude Oil n n Three groups show strong reaction to price. No indication that changes in position by any group has a significant impact on prices. 45

Granger Causality Results, Crude Oil n n Three groups show strong reaction to price. No indication that changes in position by any group has a significant impact on prices. 45

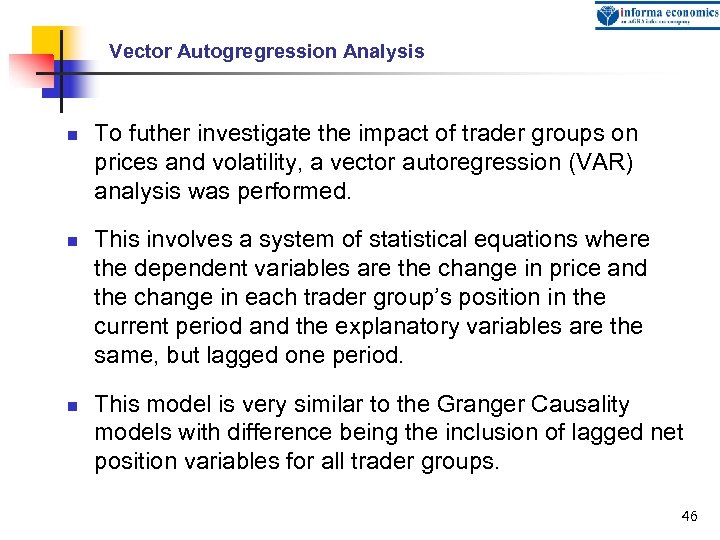

Vector Autogregression Analysis n n n To futher investigate the impact of trader groups on prices and volatility, a vector autoregression (VAR) analysis was performed. This involves a system of statistical equations where the dependent variables are the change in price and the change in each trader group’s position in the current period and the explanatory variables are the same, but lagged one period. This model is very similar to the Granger Causality models with difference being the inclusion of lagged net position variables for all trader groups. 46

Vector Autogregression Analysis n n n To futher investigate the impact of trader groups on prices and volatility, a vector autoregression (VAR) analysis was performed. This involves a system of statistical equations where the dependent variables are the change in price and the change in each trader group’s position in the current period and the explanatory variables are the same, but lagged one period. This model is very similar to the Granger Causality models with difference being the inclusion of lagged net position variables for all trader groups. 46

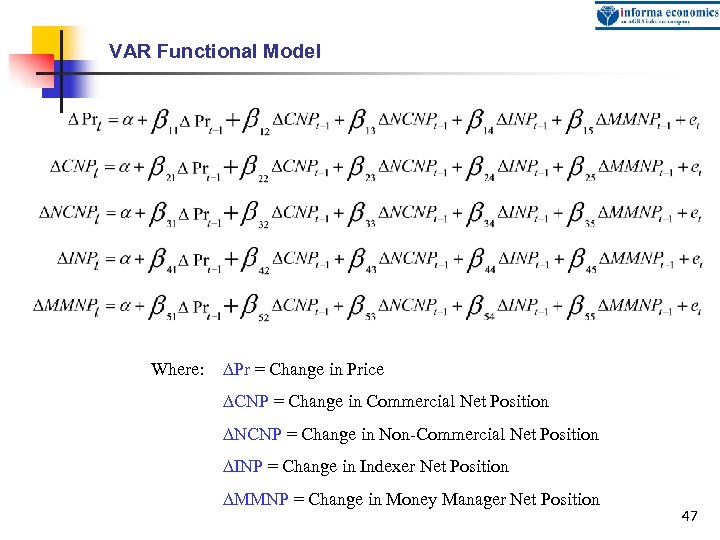

VAR Functional Model Where: DPr = Change in Price DCNP = Change in Commercial Net Position DNCNP = Change in Non-Commercial Net Position DINP = Change in Indexer Net Position DMMNP = Change in Money Manager Net Position 47

VAR Functional Model Where: DPr = Change in Price DCNP = Change in Commercial Net Position DNCNP = Change in Non-Commercial Net Position DINP = Change in Indexer Net Position DMMNP = Change in Money Manager Net Position 47

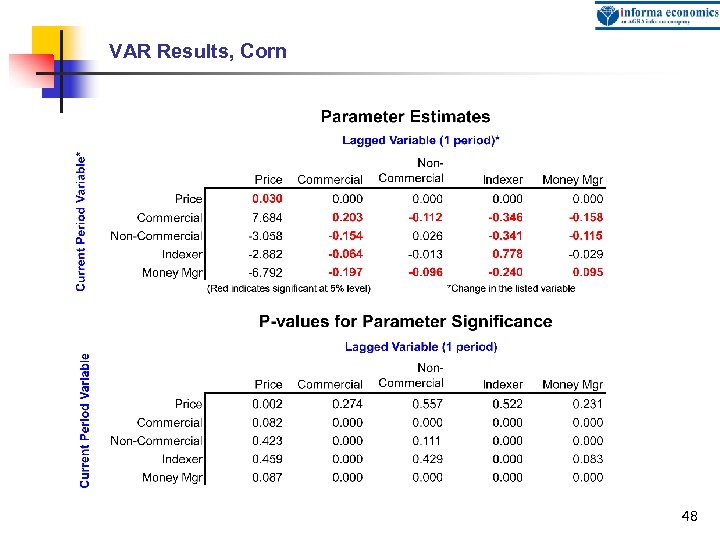

VAR Results, Corn 48

VAR Results, Corn 48

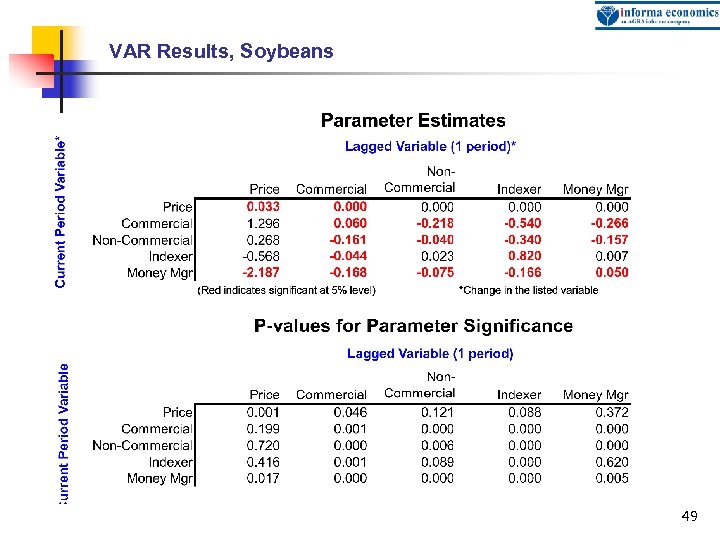

VAR Results, Soybeans 49

VAR Results, Soybeans 49

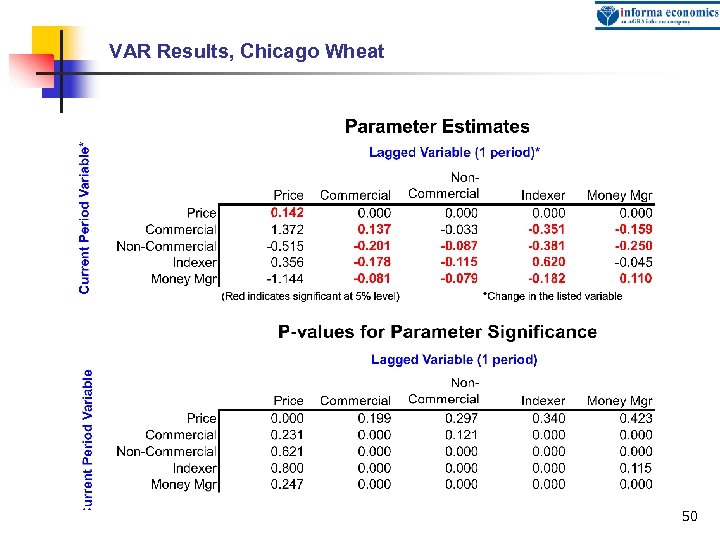

VAR Results, Chicago Wheat 50

VAR Results, Chicago Wheat 50

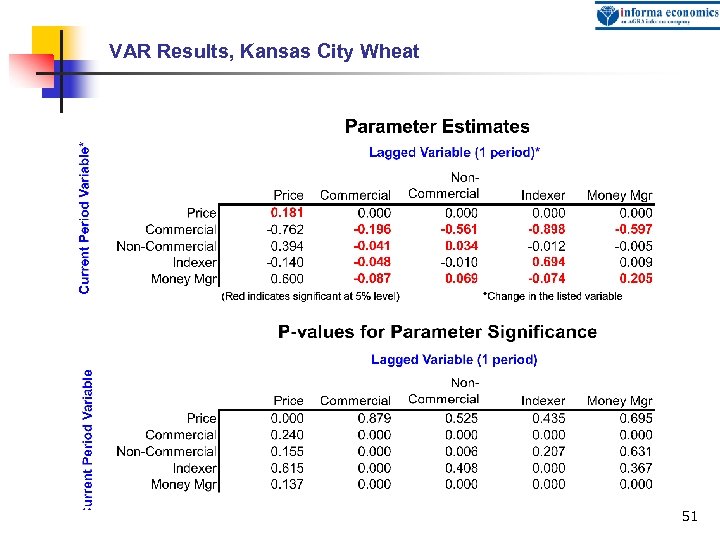

VAR Results, Kansas City Wheat 51

VAR Results, Kansas City Wheat 51

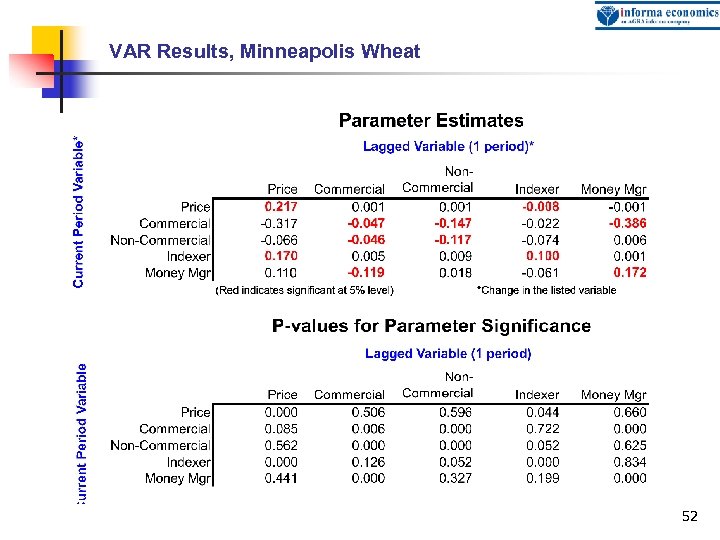

VAR Results, Minneapolis Wheat 52

VAR Results, Minneapolis Wheat 52

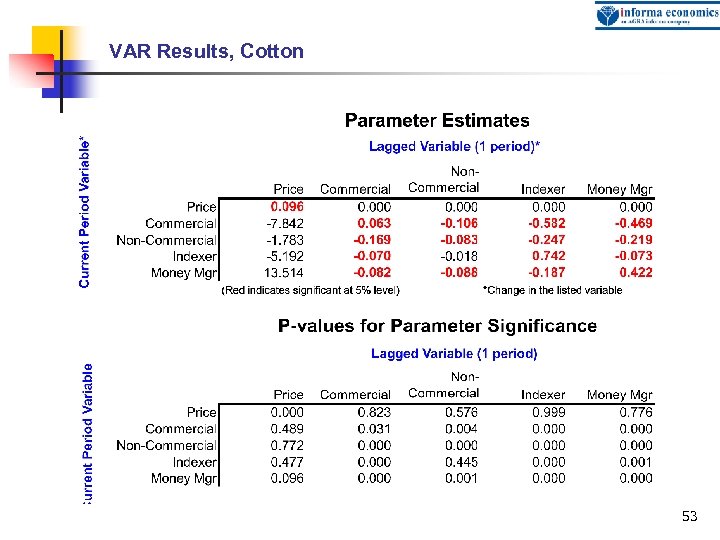

VAR Results, Cotton 53

VAR Results, Cotton 53

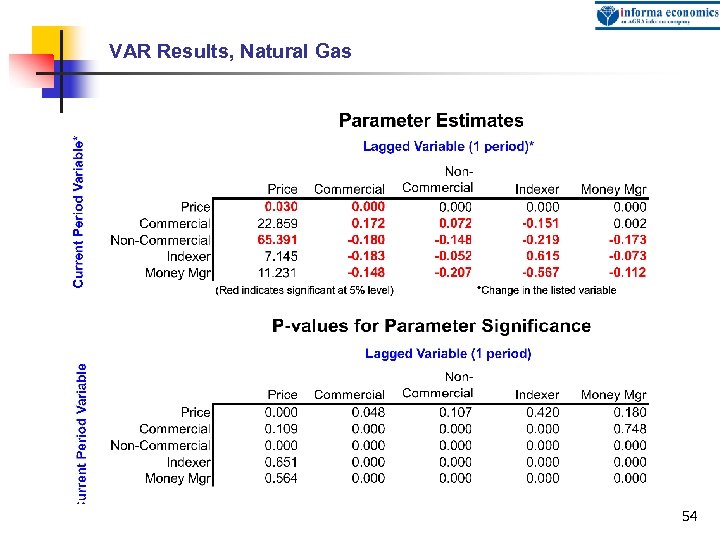

VAR Results, Natural Gas 54

VAR Results, Natural Gas 54

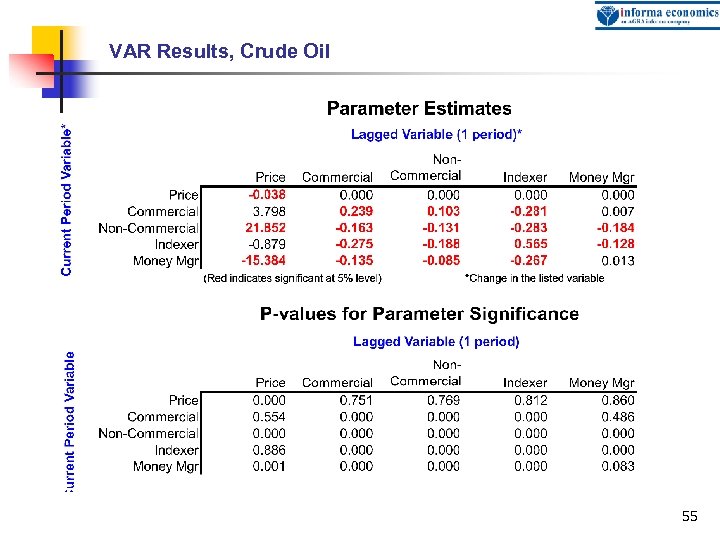

VAR Results, Crude Oil 55

VAR Results, Crude Oil 55

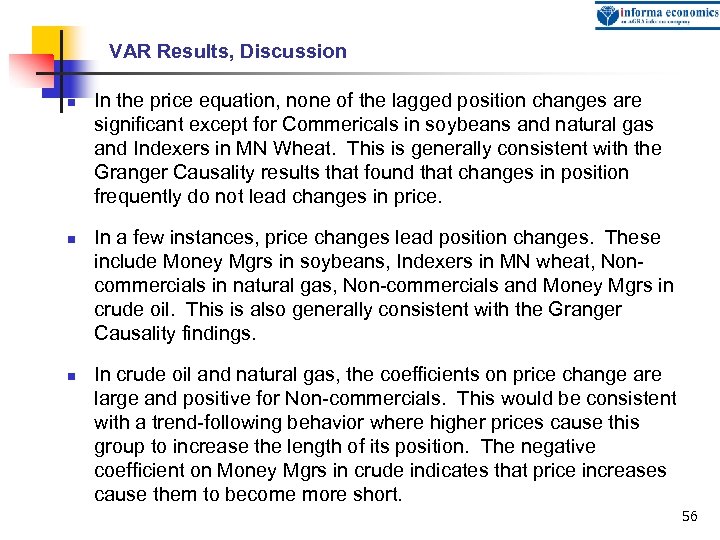

VAR Results, Discussion n In the price equation, none of the lagged position changes are significant except for Commericals in soybeans and natural gas and Indexers in MN Wheat. This is generally consistent with the Granger Causality results that found that changes in position frequently do not lead changes in price. In a few instances, price changes lead position changes. These include Money Mgrs in soybeans, Indexers in MN wheat, Noncommercials in natural gas, Non-commercials and Money Mgrs in crude oil. This is also generally consistent with the Granger Causality findings. In crude oil and natural gas, the coefficients on price change are large and positive for Non-commercials. This would be consistent with a trend-following behavior where higher prices cause this group to increase the length of its position. The negative coefficient on Money Mgrs in crude indicates that price increases cause them to become more short. 56

VAR Results, Discussion n In the price equation, none of the lagged position changes are significant except for Commericals in soybeans and natural gas and Indexers in MN Wheat. This is generally consistent with the Granger Causality results that found that changes in position frequently do not lead changes in price. In a few instances, price changes lead position changes. These include Money Mgrs in soybeans, Indexers in MN wheat, Noncommercials in natural gas, Non-commercials and Money Mgrs in crude oil. This is also generally consistent with the Granger Causality findings. In crude oil and natural gas, the coefficients on price change are large and positive for Non-commercials. This would be consistent with a trend-following behavior where higher prices cause this group to increase the length of its position. The negative coefficient on Money Mgrs in crude indicates that price increases cause them to become more short. 56

VAR Results, Discussion (continued) n n n In all other commodities beside corn, the “between group” parameters are frequently significant, indicating that there is often interaction between the positions of trader groups—thus particular trader types rarely act in isolation. There are many “own position” parameters (those on the diagonal) that are significant and positive. This indicates that an increase in a group’s long position on a particular day is often followed by a further increase the next day. This supports the idea of regular “position building” over many trading sessions. As with the Granger Causality analysis, the results from the VAR models tend to support a market process where traders change positions in reaction to price rather than the other way around. 57

VAR Results, Discussion (continued) n n n In all other commodities beside corn, the “between group” parameters are frequently significant, indicating that there is often interaction between the positions of trader groups—thus particular trader types rarely act in isolation. There are many “own position” parameters (those on the diagonal) that are significant and positive. This indicates that an increase in a group’s long position on a particular day is often followed by a further increase the next day. This supports the idea of regular “position building” over many trading sessions. As with the Granger Causality analysis, the results from the VAR models tend to support a market process where traders change positions in reaction to price rather than the other way around. 57

Part 4 Summary n n n A metric was developed to measure the pressure that trader groups put on market prices each day These pressures were categorized as beneficial if they moved price back in the direction of the final value. They were considered detrimental if they moved price away from its final value. No clear pattern emerged. All groups had periods of both types of price pressure. Index traders buy and hold strategy was strongly beneficial when contracts expired near their highs, which was often. The results are indicative of a situation where no trader group routinely “knows” the true price of a commodity and therefore does not routinely help or hinder price discovery. Passive investors and trend following speculators may have just been lucky in catching a prolonged trend in their favored direction. 58

Part 4 Summary n n n A metric was developed to measure the pressure that trader groups put on market prices each day These pressures were categorized as beneficial if they moved price back in the direction of the final value. They were considered detrimental if they moved price away from its final value. No clear pattern emerged. All groups had periods of both types of price pressure. Index traders buy and hold strategy was strongly beneficial when contracts expired near their highs, which was often. The results are indicative of a situation where no trader group routinely “knows” the true price of a commodity and therefore does not routinely help or hinder price discovery. Passive investors and trend following speculators may have just been lucky in catching a prolonged trend in their favored direction. 58

Part 4 Summary n n The Granger Causality and VAR results were consistent with previous findings using these techniques. There is little evidence that any group has a sustained and significant influence on price. There is no evidence that changes in the index trader net position has a significant price impact. Money Mangers were more likely to react to price changes than to cause them. None of the three analyses presented in this section (price pressure, Granger Causality, Vector Autoregression) supports the idea that any one trader group was routinely behaving in a manner that was detrimental to price discovery. 59

Part 4 Summary n n The Granger Causality and VAR results were consistent with previous findings using these techniques. There is little evidence that any group has a sustained and significant influence on price. There is no evidence that changes in the index trader net position has a significant price impact. Money Mangers were more likely to react to price changes than to cause them. None of the three analyses presented in this section (price pressure, Granger Causality, Vector Autoregression) supports the idea that any one trader group was routinely behaving in a manner that was detrimental to price discovery. 59