ca8726742b313f6962066a2dcee05062.ppt

- Количество слайдов: 28

PAS viability and development economics: Shropshire Council’s experience Helen Howie Principal Policy Officer helen. howie@shropshire. gov. uk 01743 252676

Shropshire is where…? A range of viability experience: Shrewsbury Growth Point Northern market towns (Oswestry, Whitchurch, Market Drayton) Green Belt Commuter towns (Bridgnorth, Shifnal) Retirement towns (Church Stretton, Albrighton) Villages (500+) of different sizes & degrees of rurality

Viability experience 2010 Core Strategy ‘dynamic viability’ approach to affordable hsg 2011 CIL Charging Schedule 2012 Infrastructure costs (s 106) additional to CIL 2013 Revised affordable housing viability study (in-house) 2014+ Proving site allocations are viable and deliverable Drawing on all the above, let me talk you through how we did it in Shropshire….

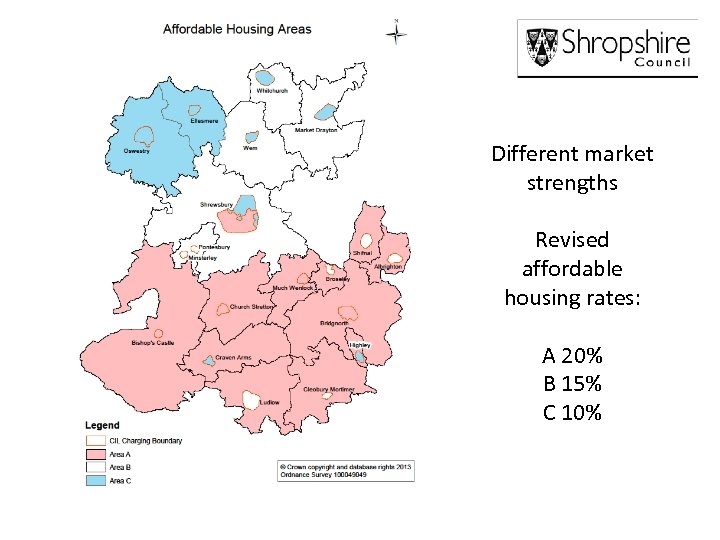

Dynamic viability 2010 viability study recommended 20% affordable housing, rising to 25% 2011 Dynamic viability approach reduced affordable housing rate to 13% (= £ 11, 700 for a 100 sqm dwelling) 2012 CIL added £ 40/sqm in urban areas, plus £ 80/sqm in rural areas (= £ 4, 000 / £ 8, 000 for a 100 sqm dwelling) 2012 Dynamic viability would reduce affordable housing rate to 3% TOO LOW FOR MEMBERS TO ACCEPT 2013 Revised affordable housing study ‘solved problem’ by creating 3 geographical areas with 3 new rates, of 10%, 15%, 20% 2014 On-going issue of demonstrating that development is deliverable

Overview of session What we found easy to do - Market strength - Costs Moderate effort (but highly worthwhile) - Developer panel - Differences between sites - HCA Area-wide viability model Difficult to crack - Land values - “Reasonable return” assumptions - Infrastructure costs Bringing different areas of expertise together

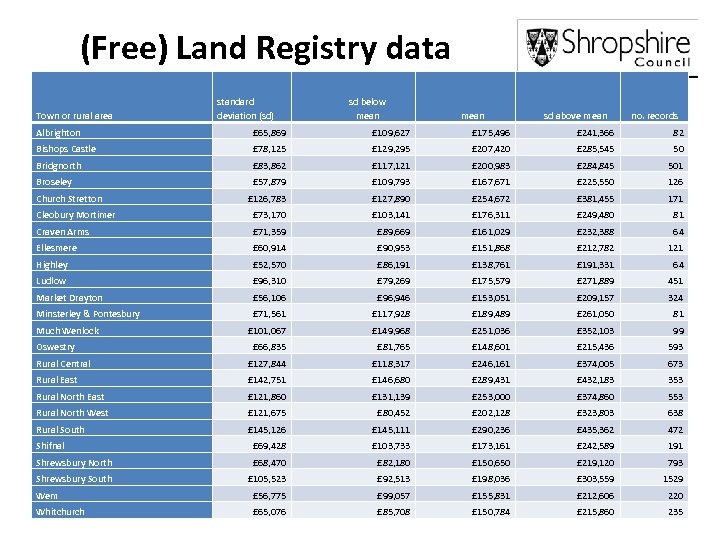

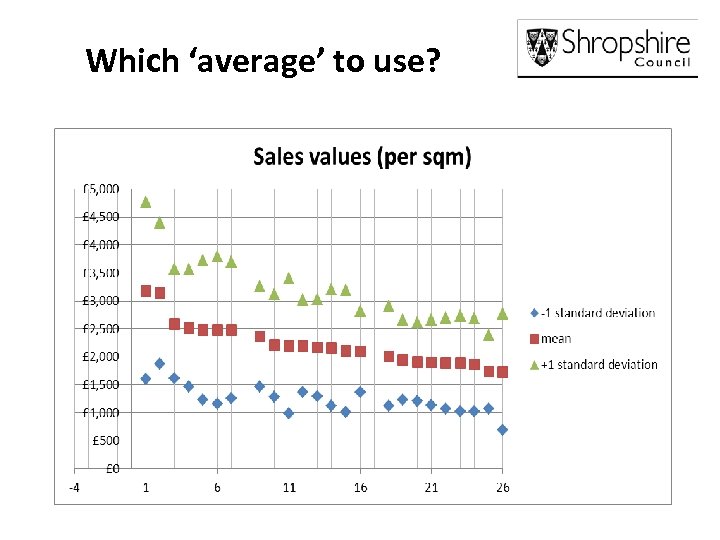

(Free) Land Registry data Town or rural area standard deviation (sd) sd below mean sd above mean no. records Albrighton £ 65, 869 £ 109, 627 £ 175, 496 £ 241, 366 82 Bishops Castle £ 78, 125 £ 129, 295 £ 207, 420 £ 285, 545 50 Bridgnorth £ 83, 862 £ 117, 121 £ 200, 983 £ 284, 845 501 Broseley £ 57, 879 £ 109, 793 £ 167, 671 £ 225, 550 126 £ 126, 783 £ 127, 890 £ 254, 672 £ 381, 455 171 Cleobury Mortimer £ 73, 170 £ 103, 141 £ 176, 311 £ 249, 480 81 Craven Arms £ 71, 359 £ 89, 669 £ 161, 029 £ 232, 388 64 Ellesmere £ 60, 914 £ 90, 953 £ 151, 868 £ 212, 782 121 Highley £ 52, 570 £ 86, 191 £ 138, 761 £ 191, 331 64 Ludlow £ 96, 310 £ 79, 269 £ 175, 579 £ 271, 889 451 Market Drayton £ 56, 106 £ 96, 946 £ 153, 051 £ 209, 157 324 Minsterley & Pontesbury £ 71, 561 £ 117, 928 £ 189, 489 £ 261, 050 81 £ 101, 067 £ 149, 968 £ 251, 036 £ 352, 103 99 £ 66, 835 £ 81, 765 £ 148, 601 £ 215, 436 593 Rural Central £ 127, 844 £ 118, 317 £ 246, 161 £ 374, 005 673 Rural East £ 142, 751 £ 146, 680 £ 289, 431 £ 432, 183 353 Rural North East £ 121, 860 £ 131, 139 £ 253, 000 £ 374, 860 553 Rural North West £ 121, 675 £ 80, 452 £ 202, 128 £ 323, 803 638 Rural South £ 145, 126 £ 145, 111 £ 290, 236 £ 435, 362 472 Shifnal £ 69, 428 £ 103, 733 £ 173, 161 £ 242, 589 191 Shrewsbury North £ 68, 470 £ 82, 180 £ 150, 650 £ 219, 120 793 Shrewsbury South £ 105, 523 £ 92, 513 £ 198, 036 £ 303, 559 1529 Wem £ 56, 775 £ 99, 057 £ 155, 831 £ 212, 606 220 Whitchurch £ 65, 076 £ 85, 708 £ 150, 784 £ 215, 860 235 Church Stretton Much Wenlock Oswestry

Which ‘average’ to use?

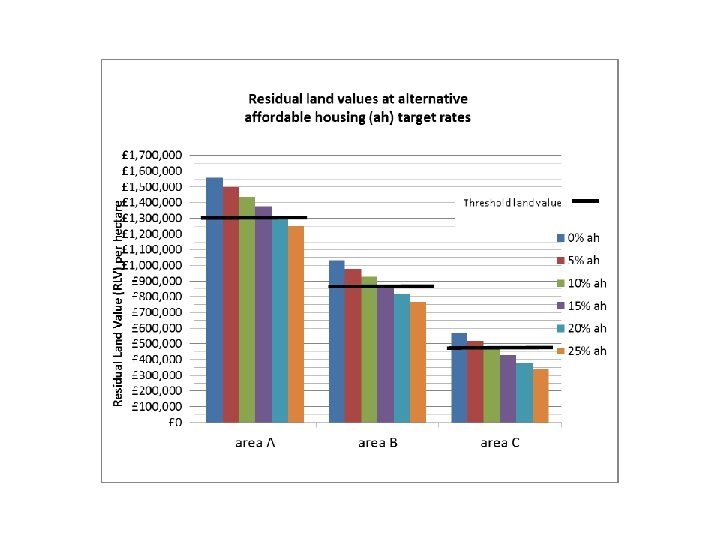

Different market strengths Revised affordable housing rates: A 20% B 15% C 10%

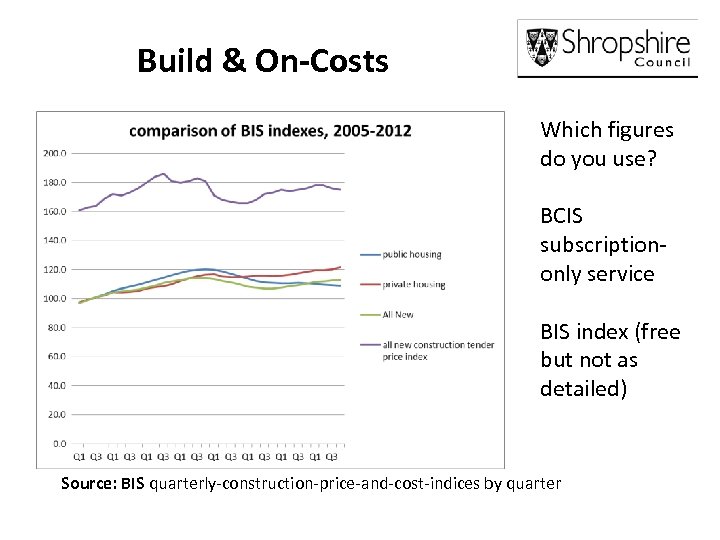

Build & On-Costs Which figures do you use? BCIS subscriptiononly service BIS index (free but not as detailed) Source: BIS quarterly-construction-price-and-cost-indices by quarter

Moderate effort (but highly worthwhile) - Developer panel - Differences between sites - HCA Area-wide viability model

Shropshire Developer Panel Meets 3 times a year & comprises: - Local developers (5 -30 homes) - Land agents specialising in small developers (1 -2 homes) - Nationals (Taylor Wimpey, Persimmon Homes, Gallaghers) - Registered Providers (so that the private sector can’t pull wool over our eyes) - Key local landowners (eg. Oswestry urban extension) ? Planning agents representing various clients (who pays? ) ? Local authority property services rep ? Split up resi from other types of development?

Differences between sites Small sites c. 60% of new dwellings in Shropshire are on sites <5 dwellings Government intends to exempt ‘self build’ from ah & CIL To what degree are small units treated differently? Redevelopment sites Are greenfield sites really more expensive?

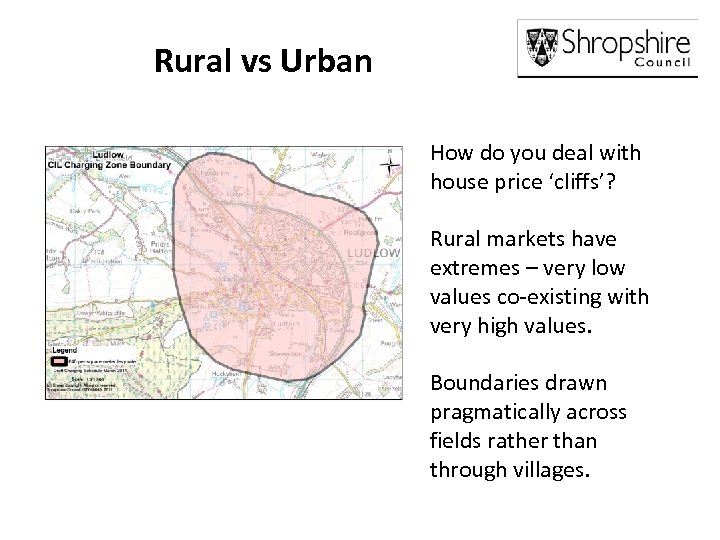

Rural vs Urban How do you deal with house price ‘cliffs’? Rural markets have extremes – very low values co-existing with very high values. Boundaries drawn pragmatically across fields rather than through villages.

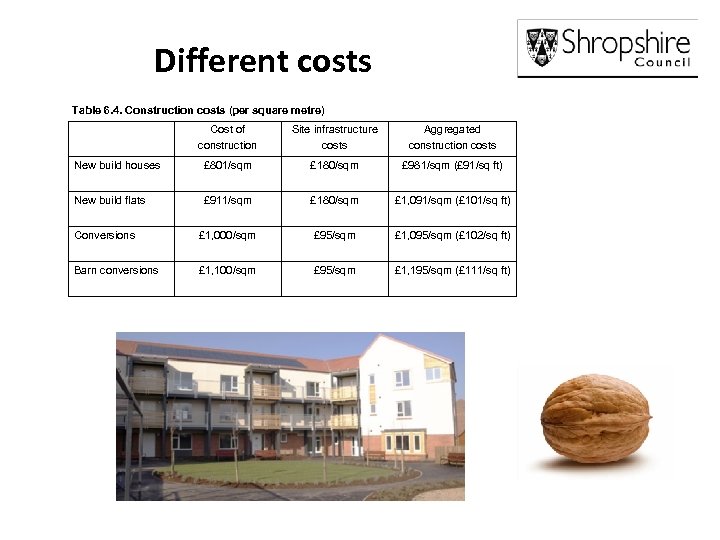

Different costs Table 6. 4. Construction costs (per square metre) Cost of construction Site infrastructure costs Aggregated construction costs New build houses £ 801/sqm £ 180/sqm £ 981/sqm (£ 91/sq ft) New build flats £ 911/sqm £ 180/sqm £ 1, 091/sqm (£ 101/sq ft) Conversions £ 1, 000/sqm £ 95/sqm £ 1, 095/sqm (£ 102/sq ft) Barn conversions £ 1, 100/sqm £ 95/sqm £ 1, 195/sqm (£ 111/sq ft)

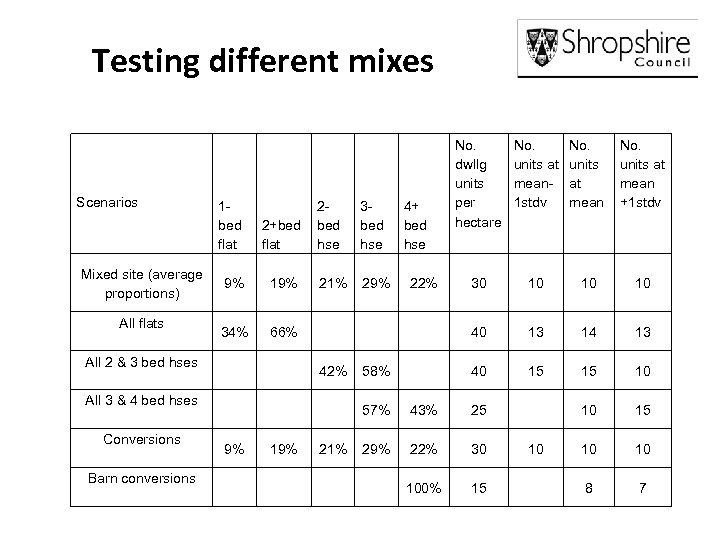

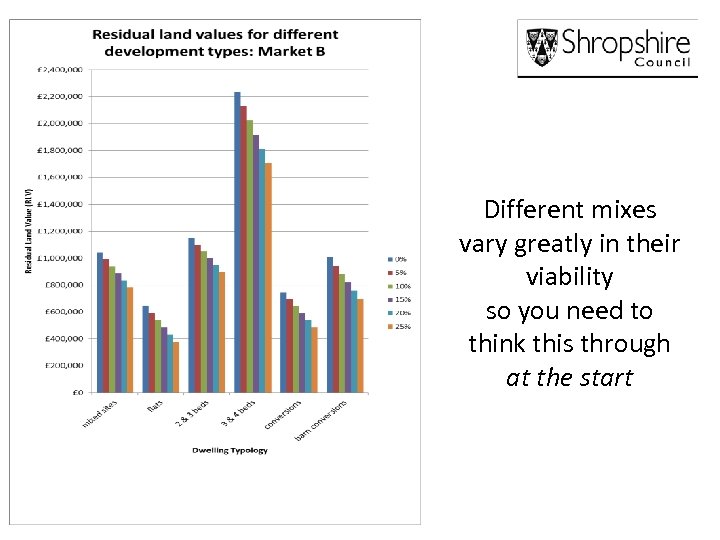

Testing different mixes Scenarios Mixed site (average proportions) All flats All 2 & 3 bed hses All 3 & 4 bed hses Conversions Barn conversions 1 bed flat 22+bed flat hse 3 bed hse 4+ bed hse No. dwllg units per hectare No. units at mean 1 stdv No. units at mean +1 stdv 9% 19% 21% 29% 22% 30 10 10 10 34% 66% 40 13 14 13 42% 58% 40 15 15 10 57% 43% 25 10 15 9% 19% 21% 29% 22% 30 10 10 10 100% 15 8 7

Different mixes vary greatly in their viability so you need to think this through at the start

HCA Area-Wide viability model A FREE and very powerful tool; works out the cash-flow aspects Results can be either a) Specify % affordable housing and it calculates RLV or b) Specify threshold LV and it calculates max % affordable housing Offers plenty of options (mixes, variable types of site, etc) But understand its limitations GIGO (Garbage In, Garbage Out)

Difficult to crack - Land values - “Reasonable return” assumptions - Infrastructure costs

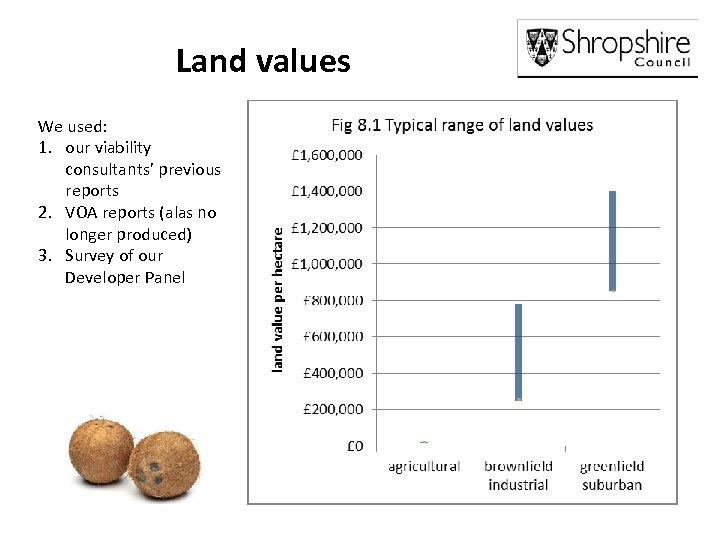

Land values We used: 1. our viability consultants’ previous reports 2. VOA reports (alas no longer produced) 3. Survey of our Developer Panel

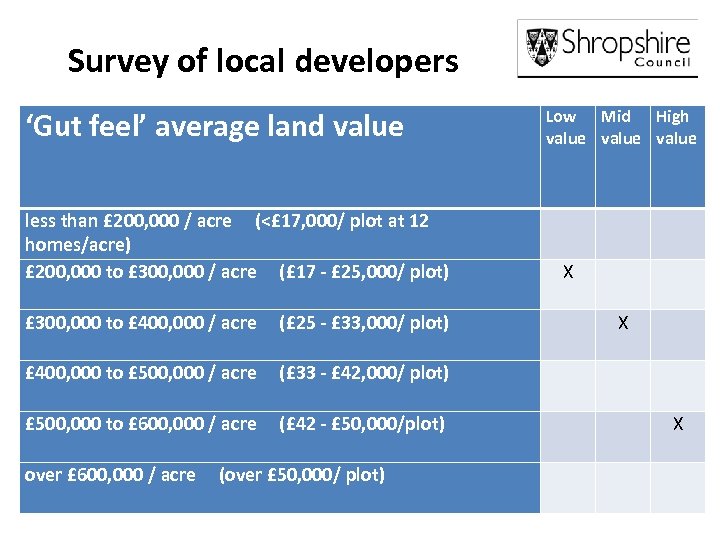

Survey of local developers ‘Gut feel’ average land value Low Mid High value less than £ 200, 000 / acre (<£ 17, 000/ plot at 12 homes/acre) £ 200, 000 to £ 300, 000 / acre (£ 17 - £ 25, 000/ plot) X £ 300, 000 to £ 400, 000 / acre (£ 25 - £ 33, 000/ plot) X £ 400, 000 to £ 500, 000 / acre (£ 33 - £ 42, 000/ plot) £ 500, 000 to £ 600, 000 / acre (£ 42 - £ 50, 000/plot) X over £ 600, 000 / acre (over £ 50, 000/ plot)

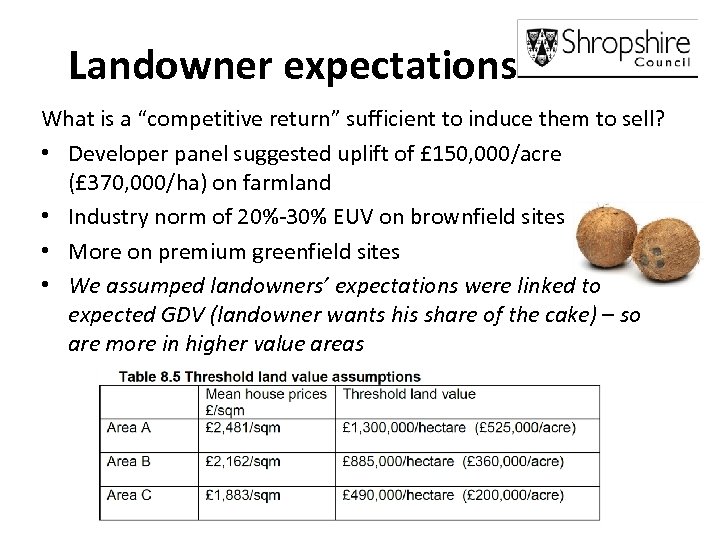

Landowner expectations What is a “competitive return” sufficient to induce them to sell? • Developer panel suggested uplift of £ 150, 000/acre (£ 370, 000/ha) on farmland • Industry norm of 20%-30% EUV on brownfield sites • More on premium greenfield sites • We assumped landowners’ expectations were linked to expected GDV (landowner wants his share of the cake) – so are more in higher value areas

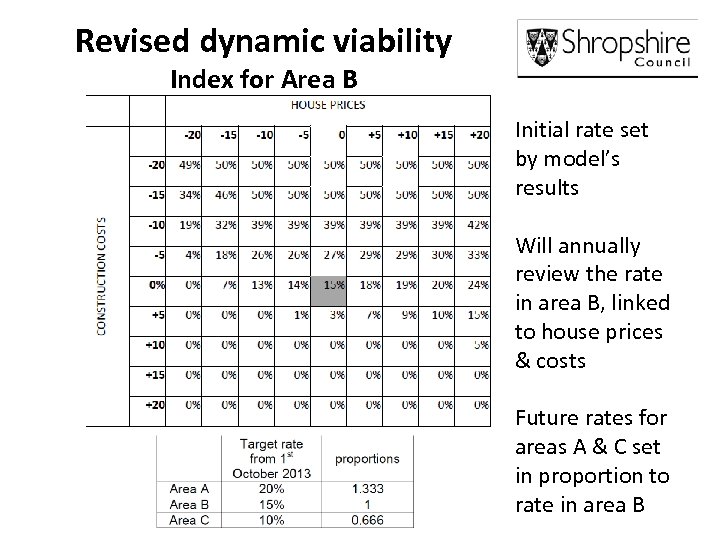

Revised dynamic viability Index for Area B Initial rate set by model’s results Will annually review the rate in area B, linked to house prices & costs Future rates for areas A & C set in proportion to rate in area B

Variability between sites: different Infrastructure Costs CIL examination: 2 Statements of Common Ground required: 1. Highways Agency & developers (Shrewsbury South Urban Extension) 2. Shropshire Council & other landowners (Shrewsbury West SUE) Shows the limitations of an area-wide CIL S 106 infrastructure & Site Allocations deliverability: v Local road improvement costs v Trunk road costs v Sustainable transport measures v Educational costs Split proportionately between developers

Conclusions – understand the limitations • Area-wide viability can only be broad-brush • Site specific viability is as slippery as soap • S 106 and site-specific requirements still needed to tailor to unique circumstances • Political and landowner expectations are as important as the figures You have more in-house information that you think: but you also need expert advice

Using consultants What we found easy to do in-house - Market strength - Costs Moderate effort – depends on staff resource - Developer panel - Differences between sites - Area-wide viability model - Obtaining build & on-costs Difficult to crack – utilise your experts - Land values - “Competitive return” for Landowners - Infrastructure provision

Conclusions – evidencing viability Viability evidence is crucial: • Technical viability study with boring costs, etc PLUS • SHLAA Market Assessment Chapter • AMR • Infrastructure costs and arrangements for its provision • Housing Implementation Strategy

Summary: Viability is a thread running through all plan -making, not a one-off study. Thanks for listening. Any Questions? Helen. howie@shropshire. gov. uk 01743 252676

ca8726742b313f6962066a2dcee05062.ppt