ec5c03815328c46584e114faf72fd683.ppt

- Количество слайдов: 31

Parts E-Commerce The Dealers’ Guide Fellowes. Research

Parts E-Commerce The Dealers’ Guide Fellowes. Research

Agenda Parts E-Commerce – Online Parts Trade Introduction Why & Why Not Dealer-as-a-Buyer Dealer-as-a-Seller ◦ ◦ ◦ Summary & Actions System Integration Special Cases Challenges What’s Next? Wrap-Up Dealer Parts Websites Wholesale Portals Retail Portals No one right solution (unlike main dealer websites) Some dealers need multiple solutions Mass Marketplaces Solutions depend on dealer’s franchises and off-line parts business Locators Fellowes. Research 2

Agenda Parts E-Commerce – Online Parts Trade Introduction Why & Why Not Dealer-as-a-Buyer Dealer-as-a-Seller ◦ ◦ ◦ Summary & Actions System Integration Special Cases Challenges What’s Next? Wrap-Up Dealer Parts Websites Wholesale Portals Retail Portals No one right solution (unlike main dealer websites) Some dealers need multiple solutions Mass Marketplaces Solutions depend on dealer’s franchises and off-line parts business Locators Fellowes. Research 2

Introduction Why listen to me? ◦ ◦ ◦ ◦ Since 1985 – Automaker/Dealer Parts Systems North America, Europe, Japan & China 1 st Electronic Parts Catalog (1986) 1 st Parts E-Commerce – Automaker Portal (1999) 1 st Wholesale Parts Portal (2000) 1 st web parts locator, order referral (2002 -2009) No Horse in the Race Structured / Actionable Fellowes. Research 3

Introduction Why listen to me? ◦ ◦ ◦ ◦ Since 1985 – Automaker/Dealer Parts Systems North America, Europe, Japan & China 1 st Electronic Parts Catalog (1986) 1 st Parts E-Commerce – Automaker Portal (1999) 1 st Wholesale Parts Portal (2000) 1 st web parts locator, order referral (2002 -2009) No Horse in the Race Structured / Actionable Fellowes. Research 3

![Introduction [Cont. ] Why Listen to Parts E-Commerce Presentation? ◦ ◦ Your Customers Your Introduction [Cont. ] Why Listen to Parts E-Commerce Presentation? ◦ ◦ Your Customers Your](https://present5.com/presentation/ec5c03815328c46584e114faf72fd683/image-4.jpg) Introduction [Cont. ] Why Listen to Parts E-Commerce Presentation? ◦ ◦ Your Customers Your Competitors Your Costs Results Sell More Parts Lower Costs Related to Sales (processing, returns, …) Lower Purchase Cost of Some Parts Without Adding Staff or Increasing Capital Invested ◦ Not Obvious: > 20 Suppliers; 6 Types (with distinct benefits, costs, buyer segments); 50 Solutions Fellowes. Research 4

Introduction [Cont. ] Why Listen to Parts E-Commerce Presentation? ◦ ◦ Your Customers Your Competitors Your Costs Results Sell More Parts Lower Costs Related to Sales (processing, returns, …) Lower Purchase Cost of Some Parts Without Adding Staff or Increasing Capital Invested ◦ Not Obvious: > 20 Suppliers; 6 Types (with distinct benefits, costs, buyer segments); 50 Solutions Fellowes. Research 4

![Introduction [Cont. ] AM crushing OE; Volumes Substantial DST reports transaction volumes same order Introduction [Cont. ] AM crushing OE; Volumes Substantial DST reports transaction volumes same order](https://present5.com/presentation/ec5c03815328c46584e114faf72fd683/image-5.jpg) Introduction [Cont. ] AM crushing OE; Volumes Substantial DST reports transaction volumes same order of magnitude as IAP & WHI Approaching $1 B/mo. >10% annual growth Fellowes. Research 5

Introduction [Cont. ] AM crushing OE; Volumes Substantial DST reports transaction volumes same order of magnitude as IAP & WHI Approaching $1 B/mo. >10% annual growth Fellowes. Research 5

![Introduction [Cont. ] Dealer-as-a-Buyer (Daa. B) Overview ◦ D 2 D – Idle & Introduction [Cont. ] Dealer-as-a-Buyer (Daa. B) Overview ◦ D 2 D – Idle &](https://present5.com/presentation/ec5c03815328c46584e114faf72fd683/image-6.jpg) Introduction [Cont. ] Dealer-as-a-Buyer (Daa. B) Overview ◦ D 2 D – Idle & Urgent ◦ AM Dealer-as-a-Seller (Daas) Overview ◦ B 2 B, B 2 C, D 2 D ◦ Portals, Dealer Websites, Locators, Mass Marketplaces ◦ Parts, Accessories, Tires, Merchandise Buyer/Seller Chaos Fellowes. Research 6

Introduction [Cont. ] Dealer-as-a-Buyer (Daa. B) Overview ◦ D 2 D – Idle & Urgent ◦ AM Dealer-as-a-Seller (Daas) Overview ◦ B 2 B, B 2 C, D 2 D ◦ Portals, Dealer Websites, Locators, Mass Marketplaces ◦ Parts, Accessories, Tires, Merchandise Buyer/Seller Chaos Fellowes. Research 6

![Introduction [Cont. ] Daa. S - Segmentation Solution Clusters §Mechanical Repair (All & Fleet Introduction [Cont. ] Daa. S - Segmentation Solution Clusters §Mechanical Repair (All & Fleet](https://present5.com/presentation/ec5c03815328c46584e114faf72fd683/image-7.jpg) Introduction [Cont. ] Daa. S - Segmentation Solution Clusters §Mechanical Repair (All & Fleet only) §Collision Repair Fellowes. Research 7

Introduction [Cont. ] Daa. S - Segmentation Solution Clusters §Mechanical Repair (All & Fleet only) §Collision Repair Fellowes. Research 7

![WHY! [Parts Buyers Prefer E-Commerce] Consumers & Semi-Pro Buyers ◦ Natural, convenient and faster WHY! [Parts Buyers Prefer E-Commerce] Consumers & Semi-Pro Buyers ◦ Natural, convenient and faster](https://present5.com/presentation/ec5c03815328c46584e114faf72fd683/image-8.jpg) WHY! [Parts Buyers Prefer E-Commerce] Consumers & Semi-Pro Buyers ◦ Natural, convenient and faster – particularly for younger and “digital” customers ◦ Searching the web is what digital buyers do Price shopping 24 x 7 to research, search and order ◦ Web educating more DIYers to do more ◦ Economy – financial pressure to DIY ◦ Wider range of OE (ex: VPI, Performance) & AM Parts Fellowes. Research 8

WHY! [Parts Buyers Prefer E-Commerce] Consumers & Semi-Pro Buyers ◦ Natural, convenient and faster – particularly for younger and “digital” customers ◦ Searching the web is what digital buyers do Price shopping 24 x 7 to research, search and order ◦ Web educating more DIYers to do more ◦ Economy – financial pressure to DIY ◦ Wider range of OE (ex: VPI, Performance) & AM Parts Fellowes. Research 8

![WHY! [Parts Buyers Prefer E-Commerce – Cont. ] Mechanical Repair Professionals ◦ Already switched WHY! [Parts Buyers Prefer E-Commerce – Cont. ] Mechanical Repair Professionals ◦ Already switched](https://present5.com/presentation/ec5c03815328c46584e114faf72fd683/image-9.jpg) WHY! [Parts Buyers Prefer E-Commerce – Cont. ] Mechanical Repair Professionals ◦ Already switched to parts e-commerce for AM parts due to discounts (most orders) ◦ 24 x 7 & Never on hold ◦ Integration to Shop’s Systems ◦ Online Access to order info/status – current/archived Collision Repair Professionals ◦ ◦ Same as for Mechanical Repair Plus: Automakers’ Parts Program (discounted parts) Access to automaker technical info Future: Compliance w/ Insurance Company programs Fellowes. Research 9

WHY! [Parts Buyers Prefer E-Commerce – Cont. ] Mechanical Repair Professionals ◦ Already switched to parts e-commerce for AM parts due to discounts (most orders) ◦ 24 x 7 & Never on hold ◦ Integration to Shop’s Systems ◦ Online Access to order info/status – current/archived Collision Repair Professionals ◦ ◦ Same as for Mechanical Repair Plus: Automakers’ Parts Program (discounted parts) Access to automaker technical info Future: Compliance w/ Insurance Company programs Fellowes. Research 9

![WHY! [Parts E-Commerce – Dealer Benefits] How Selling Via E-Commerce Benefits Dealers ◦ Some WHY! [Parts E-Commerce – Dealer Benefits] How Selling Via E-Commerce Benefits Dealers ◦ Some](https://present5.com/presentation/ec5c03815328c46584e114faf72fd683/image-10.jpg) WHY! [Parts E-Commerce – Dealer Benefits] How Selling Via E-Commerce Benefits Dealers ◦ Some parts buyers require parts e-commerce and more are shifting to e-commerce ◦ More ordered (related parts, conquest/conversion) ◦ Faster & easier to process digital than phone or fax orders (plus save the inbound toll-free charges) ◦ Potential for fewer returns (180° change) Fellowes. Research 10

WHY! [Parts E-Commerce – Dealer Benefits] How Selling Via E-Commerce Benefits Dealers ◦ Some parts buyers require parts e-commerce and more are shifting to e-commerce ◦ More ordered (related parts, conquest/conversion) ◦ Faster & easier to process digital than phone or fax orders (plus save the inbound toll-free charges) ◦ Potential for fewer returns (180° change) Fellowes. Research 10

![WHY NOT! [Not Ready for Parts E-Commerce] Costs ◦ E-Commerce is not free for WHY NOT! [Not Ready for Parts E-Commerce] Costs ◦ E-Commerce is not free for](https://present5.com/presentation/ec5c03815328c46584e114faf72fd683/image-11.jpg) WHY NOT! [Not Ready for Parts E-Commerce] Costs ◦ E-Commerce is not free for sellers ◦ Pricing – in a few cases – tricky as old cell plans ◦ Returns can be higher (though recent industry experiences are the reverse) Culture ◦ Digital buyers’ expectations are higher and heading higher – immediate accurate responses ◦ Digital Orientation required Customers ◦ Some customers not ready; others inconsistent Failure is an option Fellowes. Research 11

WHY NOT! [Not Ready for Parts E-Commerce] Costs ◦ E-Commerce is not free for sellers ◦ Pricing – in a few cases – tricky as old cell plans ◦ Returns can be higher (though recent industry experiences are the reverse) Culture ◦ Digital buyers’ expectations are higher and heading higher – immediate accurate responses ◦ Digital Orientation required Customers ◦ Some customers not ready; others inconsistent Failure is an option Fellowes. Research 11

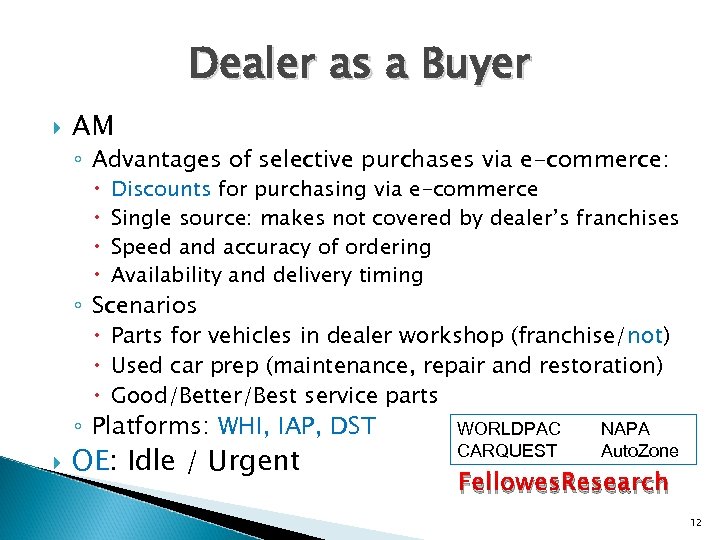

Dealer as a Buyer AM ◦ Advantages of selective purchases via e-commerce: Discounts for purchasing via e-commerce Single source: makes not covered by dealer’s franchises Speed and accuracy of ordering Availability and delivery timing ◦ Scenarios Parts for vehicles in dealer workshop (franchise/not) Used car prep (maintenance, repair and restoration) Good/Better/Best service parts ◦ Platforms: WHI, IAP, DST WORLDPAC NAPA OE: Idle / Urgent CARQUEST Auto. Zone Fellowes. Research 12

Dealer as a Buyer AM ◦ Advantages of selective purchases via e-commerce: Discounts for purchasing via e-commerce Single source: makes not covered by dealer’s franchises Speed and accuracy of ordering Availability and delivery timing ◦ Scenarios Parts for vehicles in dealer workshop (franchise/not) Used car prep (maintenance, repair and restoration) Good/Better/Best service parts ◦ Platforms: WHI, IAP, DST WORLDPAC NAPA OE: Idle / Urgent CARQUEST Auto. Zone Fellowes. Research 12

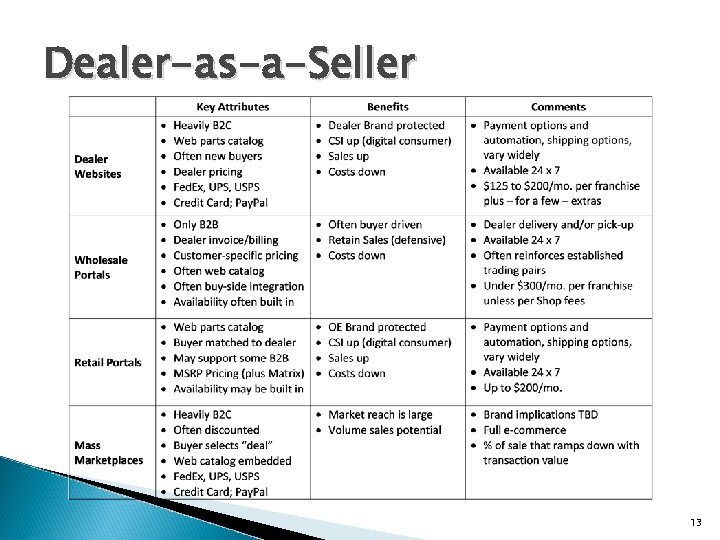

Dealer-as-a-Seller 13

Dealer-as-a-Seller 13

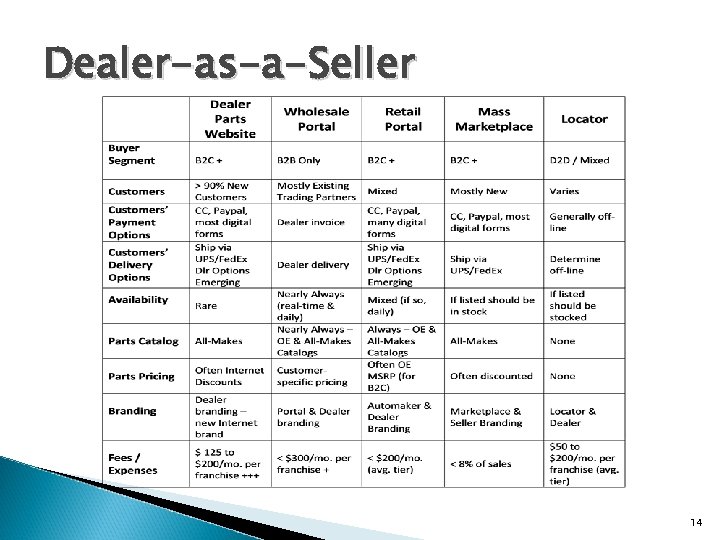

Dealer-as-a-Seller 14

Dealer-as-a-Seller 14

Dealer Parts Website dedicated to selling parts ◦ ◦ Cousin Larry Can’t Build – Catalogs & Billing Parts – Plus Accessories & Merchandise > 90% Fed. Ex, UPS or USPS shipment Issues: B 2 C now, B 2 B extensions emerging 1. Brand vs. New Brand Benefits 2. Domain Name: OE IP; Dealer IP/Subdirectory ◦ Increased sales (most incremental for dealer) ◦ Low Returns (if done right) ◦ National [International] reach – different market Easy & Quick Set-up /Maintenance Trade. Motion, Parts Website, Revolution. Parts, Sky. Parts, Reynolds & Reynolds, WHI, Others 15

Dealer Parts Website dedicated to selling parts ◦ ◦ Cousin Larry Can’t Build – Catalogs & Billing Parts – Plus Accessories & Merchandise > 90% Fed. Ex, UPS or USPS shipment Issues: B 2 C now, B 2 B extensions emerging 1. Brand vs. New Brand Benefits 2. Domain Name: OE IP; Dealer IP/Subdirectory ◦ Increased sales (most incremental for dealer) ◦ Low Returns (if done right) ◦ National [International] reach – different market Easy & Quick Set-up /Maintenance Trade. Motion, Parts Website, Revolution. Parts, Sky. Parts, Reynolds & Reynolds, WHI, Others 15

![Dealer Parts Website [Cont. ] ROI ◦ A >> Z / (X ∗ Y) Dealer Parts Website [Cont. ] ROI ◦ A >> Z / (X ∗ Y)](https://present5.com/presentation/ec5c03815328c46584e114faf72fd683/image-16.jpg) Dealer Parts Website [Cont. ] ROI ◦ A >> Z / (X ∗ Y) A = Website Sales / Month Z = Fees for Website / Month X = % Gross Margin on Retail Parts Y = % Sales that are Incremental . 1 ◦ Set S&H to cover actual costs ◦ Charge restocking fee that covers returns ◦ Upsides Retained customers that might have left w/out website Productivity gains from streamlined order processing Fellowes. Research 16

Dealer Parts Website [Cont. ] ROI ◦ A >> Z / (X ∗ Y) A = Website Sales / Month Z = Fees for Website / Month X = % Gross Margin on Retail Parts Y = % Sales that are Incremental . 1 ◦ Set S&H to cover actual costs ◦ Charge restocking fee that covers returns ◦ Upsides Retained customers that might have left w/out website Productivity gains from streamlined order processing Fellowes. Research 16

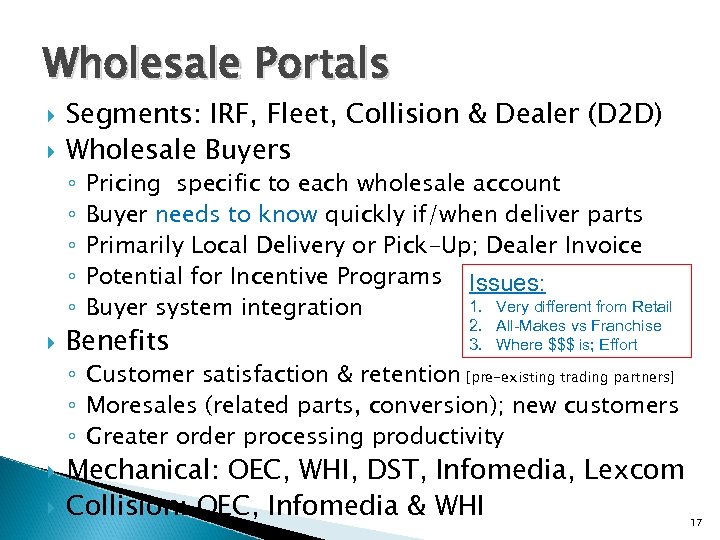

Wholesale Portals Segments: IRF, Fleet, Collision & Dealer (D 2 D) Wholesale Buyers ◦ ◦ ◦ Pricing specific to each wholesale account Buyer needs to know quickly if/when deliver parts Primarily Local Delivery or Pick-Up; Dealer Invoice Potential for Incentive Programs Issues: 1. Very different from Retail Buyer system integration Benefits 2. All-Makes vs Franchise 3. Where $$$ is; Effort ◦ Customer satisfaction & retention [pre-existing trading partners] ◦ Moresales (related parts, conversion); new customers ◦ Greater order processing productivity Mechanical: OEC, WHI, DST, Infomedia, Lexcom Collision: OEC, Infomedia & WHI 17

Wholesale Portals Segments: IRF, Fleet, Collision & Dealer (D 2 D) Wholesale Buyers ◦ ◦ ◦ Pricing specific to each wholesale account Buyer needs to know quickly if/when deliver parts Primarily Local Delivery or Pick-Up; Dealer Invoice Potential for Incentive Programs Issues: 1. Very different from Retail Buyer system integration Benefits 2. All-Makes vs Franchise 3. Where $$$ is; Effort ◦ Customer satisfaction & retention [pre-existing trading partners] ◦ Moresales (related parts, conversion); new customers ◦ Greater order processing productivity Mechanical: OEC, WHI, DST, Infomedia, Lexcom Collision: OEC, Infomedia & WHI 17

![Wholesale Portals [Cont. ] ROI ◦ (Y ∗ X) >> Z Z = Portal Wholesale Portals [Cont. ] ROI ◦ (Y ∗ X) >> Z Z = Portal](https://present5.com/presentation/ec5c03815328c46584e114faf72fd683/image-18.jpg) Wholesale Portals [Cont. ] ROI ◦ (Y ∗ X) >> Z Z = Portal Fees / Month X = % Gross Margin on Wholesale Parts Y = $ Sales that are Retained + New/Incremental ◦ Upsides Productivity gains from streamlined order processing Lower parts returns ◦ Upfront Costs / Efforts Fellowes. Research 18

Wholesale Portals [Cont. ] ROI ◦ (Y ∗ X) >> Z Z = Portal Fees / Month X = % Gross Margin on Wholesale Parts Y = $ Sales that are Retained + New/Incremental ◦ Upsides Productivity gains from streamlined order processing Lower parts returns ◦ Upfront Costs / Efforts Fellowes. Research 18

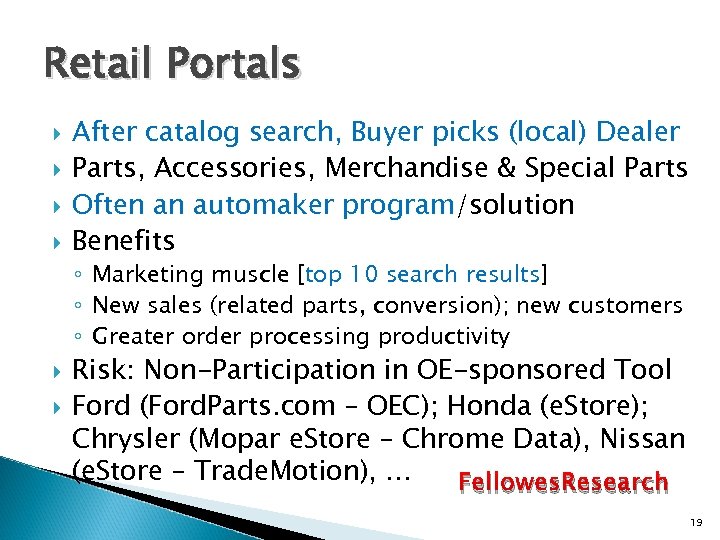

Retail Portals After catalog search, Buyer picks (local) Dealer Parts, Accessories, Merchandise & Special Parts Often an automaker program/solution Benefits ◦ Marketing muscle [top 10 search results] ◦ New sales (related parts, conversion); new customers ◦ Greater order processing productivity Risk: Non-Participation in OE-sponsored Tool Ford (Ford. Parts. com – OEC); Honda (e. Store); Chrysler (Mopar e. Store – Chrome Data), Nissan (e. Store – Trade. Motion), … Fellowes. Research 19

Retail Portals After catalog search, Buyer picks (local) Dealer Parts, Accessories, Merchandise & Special Parts Often an automaker program/solution Benefits ◦ Marketing muscle [top 10 search results] ◦ New sales (related parts, conversion); new customers ◦ Greater order processing productivity Risk: Non-Participation in OE-sponsored Tool Ford (Ford. Parts. com – OEC); Honda (e. Store); Chrysler (Mopar e. Store – Chrome Data), Nissan (e. Store – Trade. Motion), … Fellowes. Research 19

![Retail Portals [Cont. ] ROI ◦ A >> Z / (X ∗ Y) A Retail Portals [Cont. ] ROI ◦ A >> Z / (X ∗ Y) A](https://present5.com/presentation/ec5c03815328c46584e114faf72fd683/image-20.jpg) Retail Portals [Cont. ] ROI ◦ A >> Z / (X ∗ Y) A = Portal Parts Sales / Month Z = Portal Fees / Month X = % Gross Margin on Retail Parts/Accessory sales Y = % Sales that are New/Incremental + ‘Saved’ ◦ Upsides Productivity gains from streamlined order processing Lower returns Fellowes. Research 20

Retail Portals [Cont. ] ROI ◦ A >> Z / (X ∗ Y) A = Portal Parts Sales / Month Z = Portal Fees / Month X = % Gross Margin on Retail Parts/Accessory sales Y = % Sales that are New/Incremental + ‘Saved’ ◦ Upsides Productivity gains from streamlined order processing Lower returns Fellowes. Research 20

Mass Marketplaces Primarily B 2 C – AM, OE, Used Parts, Accessories, Merchandise & Special Parts Many Buyers Price Sensitive: Idle/Overstock Benefits ◦ ◦ Marketplace brand recognition & traffic HUGE - WW Marketing and advertising muscle New sales (related parts, conversion); new customers Greater order processing productivity Segments: Set Prices; Auctions; Classified Ads e. Bay; Craigslist; Amazon Fellowes. Research 21

Mass Marketplaces Primarily B 2 C – AM, OE, Used Parts, Accessories, Merchandise & Special Parts Many Buyers Price Sensitive: Idle/Overstock Benefits ◦ ◦ Marketplace brand recognition & traffic HUGE - WW Marketing and advertising muscle New sales (related parts, conversion); new customers Greater order processing productivity Segments: Set Prices; Auctions; Classified Ads e. Bay; Craigslist; Amazon Fellowes. Research 21

![Mass Marketplaces [cont. ] ROI ◦ Transaction Fees Primary Determine which parts you can Mass Marketplaces [cont. ] ROI ◦ Transaction Fees Primary Determine which parts you can](https://present5.com/presentation/ec5c03815328c46584e114faf72fd683/image-22.jpg) Mass Marketplaces [cont. ] ROI ◦ Transaction Fees Primary Determine which parts you can afford to sell For idle, if all else fails, part of a loaf is better than none Work with Marketplace Partner Non-transactional fees waived Listing & Shipping Automation tools available ◦ Upsides Productivity gains from streamlined order processing Idle reduction ◦ Upfront & Fixed Costs Fellowes. Research 22

Mass Marketplaces [cont. ] ROI ◦ Transaction Fees Primary Determine which parts you can afford to sell For idle, if all else fails, part of a loaf is better than none Work with Marketplace Partner Non-transactional fees waived Listing & Shipping Automation tools available ◦ Upsides Productivity gains from streamlined order processing Idle reduction ◦ Upfront & Fixed Costs Fellowes. Research 22

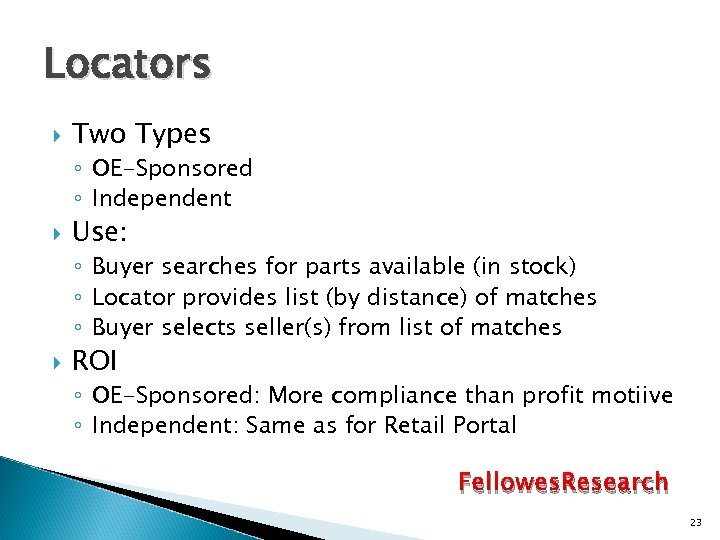

Locators Two Types ◦ OE-Sponsored ◦ Independent Use: ◦ Buyer searches for parts available (in stock) ◦ Locator provides list (by distance) of matches ◦ Buyer selects seller(s) from list of matches ROI ◦ OE-Sponsored: More compliance than profit motiive ◦ Independent: Same as for Retail Portal Fellowes. Research 23

Locators Two Types ◦ OE-Sponsored ◦ Independent Use: ◦ Buyer searches for parts available (in stock) ◦ Locator provides list (by distance) of matches ◦ Buyer selects seller(s) from list of matches ROI ◦ OE-Sponsored: More compliance than profit motiive ◦ Independent: Same as for Retail Portal Fellowes. Research 23

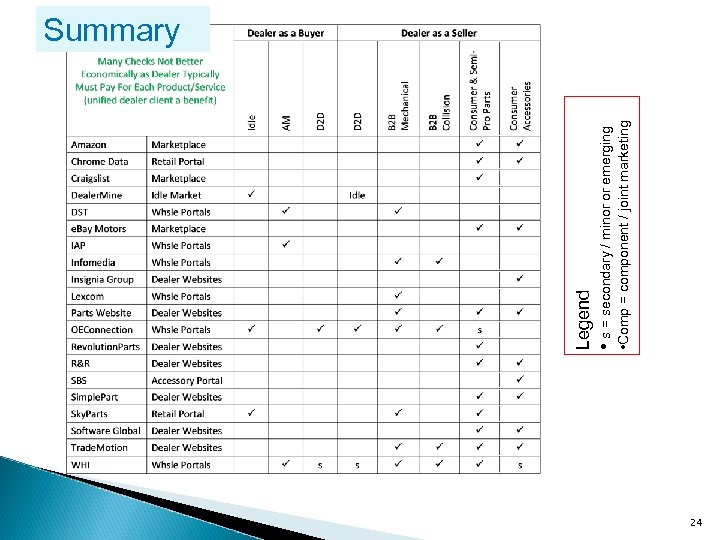

• Comp = component / joint marketing Legend • s = secondary / minor or emerging Summary 24

• Comp = component / joint marketing Legend • s = secondary / minor or emerging Summary 24

Summary Action Plan ◦ Buying Parts If in wholesale, participate in automaker D 2 D programs If service other-than-franchised: online buying discounts Investigate policy to buy idle parts (>$X if non-urgent) ◦ Selling Parts Consider and Re-Consider Automaker Programs Look for Automaker Funding of Other Programs If Idle is more than minor pursue online sales If not in wholesale, try Retail Portal or Parts Website If in wholesale, study/consider Wholesale Portals Fellowes. Research 25

Summary Action Plan ◦ Buying Parts If in wholesale, participate in automaker D 2 D programs If service other-than-franchised: online buying discounts Investigate policy to buy idle parts (>$X if non-urgent) ◦ Selling Parts Consider and Re-Consider Automaker Programs Look for Automaker Funding of Other Programs If Idle is more than minor pursue online sales If not in wholesale, try Retail Portal or Parts Website If in wholesale, study/consider Wholesale Portals Fellowes. Research 25

Dealer System Integration DMS ◦ Basic parts e-commerce is DMS independent – not so for many advanced features/capabilities ◦ DMS Integration value highest for: B 2 B, high volume ◦ Dealer-as-a-Seller Availability from DMS MSRP from DMS Customer’s Matrix Price from DMS Order Considerations: Parts / Quantity to DMS Status from DMS 1. DMS Integration Certification 2. Capabilities Vary by DMS Fellowes. Research 26

Dealer System Integration DMS ◦ Basic parts e-commerce is DMS independent – not so for many advanced features/capabilities ◦ DMS Integration value highest for: B 2 B, high volume ◦ Dealer-as-a-Seller Availability from DMS MSRP from DMS Customer’s Matrix Price from DMS Order Considerations: Parts / Quantity to DMS Status from DMS 1. DMS Integration Certification 2. Capabilities Vary by DMS Fellowes. Research 26

![Dealer System Integration [Cont. ] DMS [Cont. ] ◦ Dealer-as-a-Buyer P. O. Populated / Dealer System Integration [Cont. ] DMS [Cont. ] ◦ Dealer-as-a-Buyer P. O. Populated /](https://present5.com/presentation/ec5c03815328c46584e114faf72fd683/image-27.jpg) Dealer System Integration [Cont. ] DMS [Cont. ] ◦ Dealer-as-a-Buyer P. O. Populated / Integrated across DMS applications Improved parts receipting Shipping ◦ Fed. Ex & UPS ◦ GPS / Routing – Your Delivery Fleet [Elite EXTRA] Wholesale Buyer System ◦ Mechanical Repair Shop Systems ◦ Collision Repair Shop Systems E-Commerce to E-Commerce [Example: Portal to Marketplace] Fellowes. Research 27

Dealer System Integration [Cont. ] DMS [Cont. ] ◦ Dealer-as-a-Buyer P. O. Populated / Integrated across DMS applications Improved parts receipting Shipping ◦ Fed. Ex & UPS ◦ GPS / Routing – Your Delivery Fleet [Elite EXTRA] Wholesale Buyer System ◦ Mechanical Repair Shop Systems ◦ Collision Repair Shop Systems E-Commerce to E-Commerce [Example: Portal to Marketplace] Fellowes. Research 27

Special Cases Accessories Merchandise Niche: Vintage, Performance Tires Idle Dealer Groups ◦ Dealer Websites Branding, Referral ◦ Trade between stores Fellowes. Research 28

Special Cases Accessories Merchandise Niche: Vintage, Performance Tires Idle Dealer Groups ◦ Dealer Websites Branding, Referral ◦ Trade between stores Fellowes. Research 28

Challenges Responding to Customers (to their satisfaction) ◦ Availability ◦ Delivery day/time ◦ Accurate price (B 2 B and D 2 D – not B 2 C issue) Dealer Systems Integration Returns Part Numbers Customer adoption uneven Fellowes. Research 29

Challenges Responding to Customers (to their satisfaction) ◦ Availability ◦ Delivery day/time ◦ Accurate price (B 2 B and D 2 D – not B 2 C issue) Dealer Systems Integration Returns Part Numbers Customer adoption uneven Fellowes. Research 29

What’s Next? Continuing shift to e-commerce: ◦ Locators ◦ Idle solutions (including bulk) Parts & Service sites Parts & Accessories: In-a-Box & Installed Prices Blurring of lines ◦ Portals will add dealer parts “micro sites” ◦ Locators will add parts catalogs and/or “micro sites” ◦ Catalog Improvements: Automaker web EPCs become more useable by non-experts while All-makes OE catalogs become more accurate, complete Fellowes. Research 30

What’s Next? Continuing shift to e-commerce: ◦ Locators ◦ Idle solutions (including bulk) Parts & Service sites Parts & Accessories: In-a-Box & Installed Prices Blurring of lines ◦ Portals will add dealer parts “micro sites” ◦ Locators will add parts catalogs and/or “micro sites” ◦ Catalog Improvements: Automaker web EPCs become more useable by non-experts while All-makes OE catalogs become more accurate, complete Fellowes. Research 30

Parts E-Commerce – Dealers’ Guide Thank-You For more: www. fellowesresearch. com Fellowes. Research 31

Parts E-Commerce – Dealers’ Guide Thank-You For more: www. fellowesresearch. com Fellowes. Research 31