833b2ec869a60643f1083f86e9b13a89.ppt

- Количество слайдов: 15

PARTNERSHIP PROGRAM “Helping Communities by Helping Businesses”

Enterprise Zone Partnership Program Overview 1. 2. Introduction-Program Overview Joining the EZ Program a. Who can join b. Benefits for joining 3. Annual Certification a. Requirements for certification b. Benefits for certification

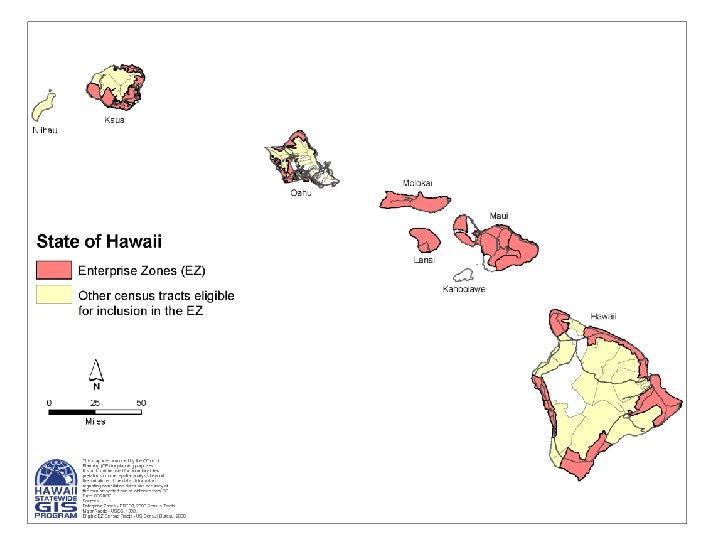

Enterprise Zone Partnership Program 1. OVERVIEW The Enterprise Zones (EZ) Partnership Program is a joint state-county government initiative: • to encourage certain types of businesses • enhance job creation in economically depressed areas (targeted areas) • reduce taxes • counties may provide additional benefits

Enterprise Zone Partnership Program 2. TO JOIN THE EZ PROGRAM 1) Must be located in an EZ designated zone 2) Earn half of annual gross receipts from one or more of the EZ eligible activities 3) Employ at least one full-time worker (Full-Time = 20 or more hours per week, can count leased employees)

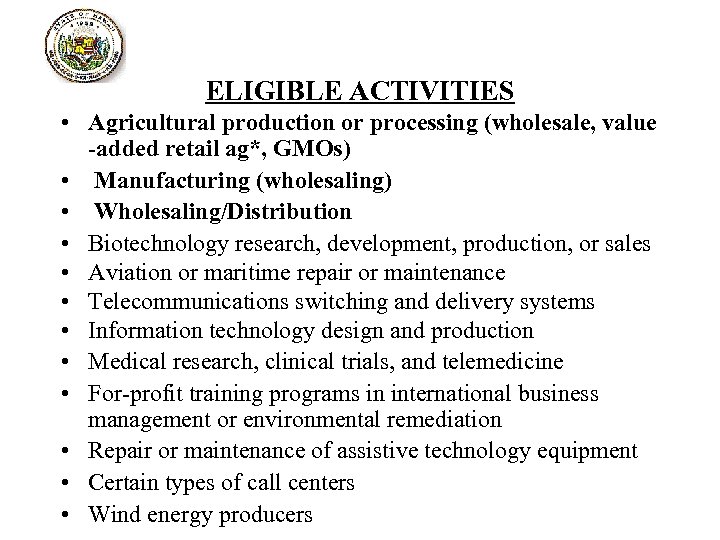

ELIGIBLE ACTIVITIES • Agricultural production or processing (wholesale, value -added retail ag*, GMOs) • Manufacturing (wholesaling) • Wholesaling/Distribution • Biotechnology research, development, production, or sales • Aviation or maritime repair or maintenance • Telecommunications switching and delivery systems • Information technology design and production • Medical research, clinical trials, and telemedicine • For-profit training programs in international business management or environmental remediation • Repair or maintenance of assistive technology equipment • Certain types of call centers • Wind energy producers

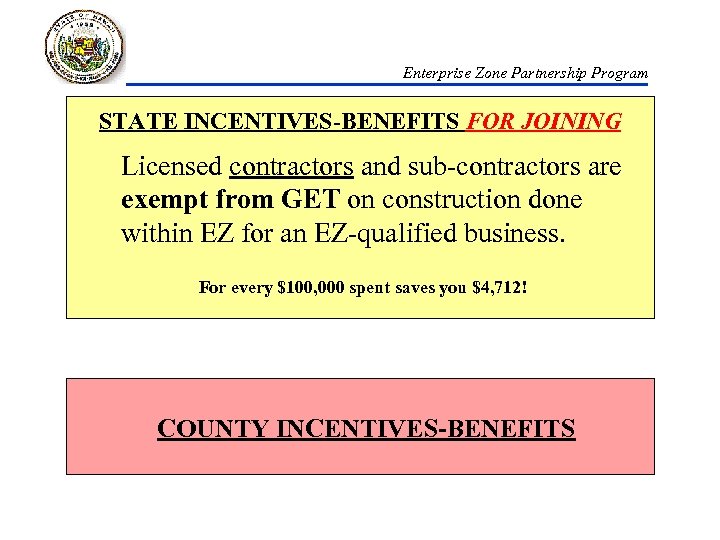

Enterprise Zone Partnership Program STATE INCENTIVES-BENEFITS FOR JOINING Licensed contractors and sub-contractors are exempt from GET on construction done within EZ for an EZ-qualified business. For every $100, 000 spent saves you $4, 712! COUNTY INCENTIVES-BENEFITS

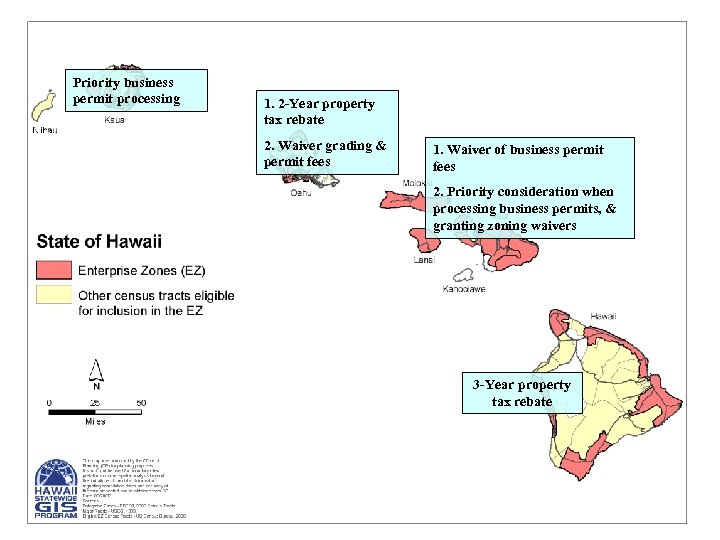

Priority business permit processing 1. 2 -Year property tax rebate 2. Waiver grading & permit fees 1. Waiver of business permit fees 2. Priority consideration when processing business permits, & granting zoning waivers 3 -Year property tax rebate

Approval Letter

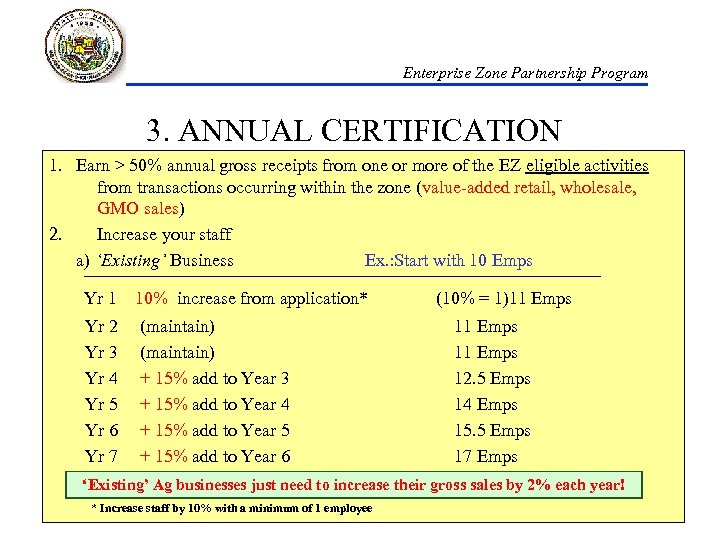

Enterprise Zone Partnership Program 3. ANNUAL CERTIFICATION 1. Earn > 50% annual gross receipts from one or more of the EZ eligible activities from transactions occurring within the zone (value-added retail, wholesale, GMO sales) 2. Increase your staff a) ‘Existing’ Business Ex. : Start with 10 Emps Yr 1 Yr 2 Yr 3 Yr 4 Yr 5 Yr 6 Yr 7 10% increase from application* (maintain) + 15% add to Year 3 + 15% add to Year 4 + 15% add to Year 5 + 15% add to Year 6 (10% = 1)11 Emps 12. 5 Emps 14 Emps 15. 5 Emps 17 Emps ‘Existing’ Ag businesses just need to increase their gross sales by 2% each year! * Increase staff by 10% with a minimum of 1 employee

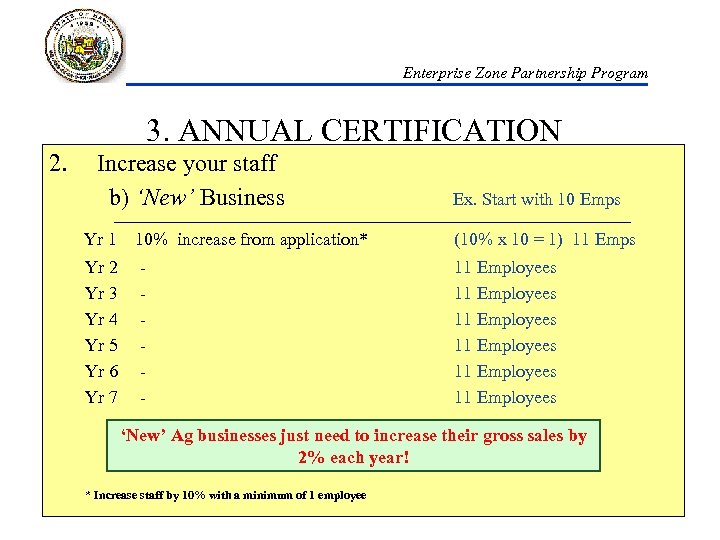

Enterprise Zone Partnership Program 3. ANNUAL CERTIFICATION 2. Increase your staff b) ‘New’ Business Yr 1 Yr 2 Yr 3 Yr 4 Yr 5 Yr 6 Yr 7 10% increase from application* - Ex. Start with 10 Emps (10% x 10 = 1) 11 Emps 11 Employees 11 Employees ‘New’ Ag businesses just need to increase their gross sales by 2% each year! * Increase staff by 10% with a minimum of 1 employee

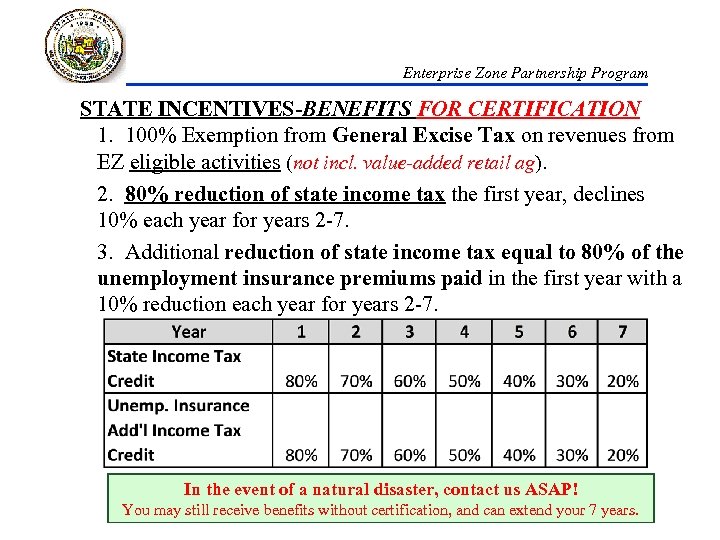

Enterprise Zone Partnership Program STATE INCENTIVES-BENEFITS FOR CERTIFICATION 1. 100% Exemption from General Excise Tax on revenues from EZ eligible activities (not incl. value-added retail ag). 2. 80% reduction of state income tax the first year, declines 10% each year for years 2 -7. 3. Additional reduction of state income tax equal to 80% of the unemployment insurance premiums paid in the first year with a 10% reduction each year for years 2 -7. In the event of a natural disaster, contact us ASAP! You may still receive benefits without certification, and can extend your 7 years.

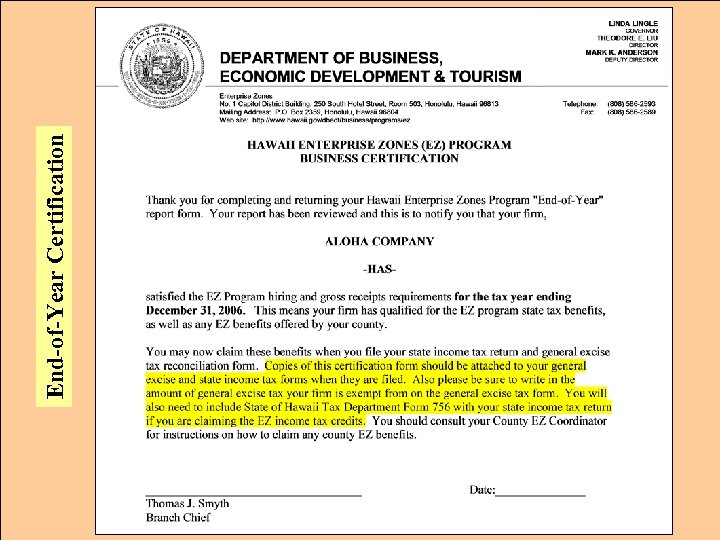

End-of-Year Certification

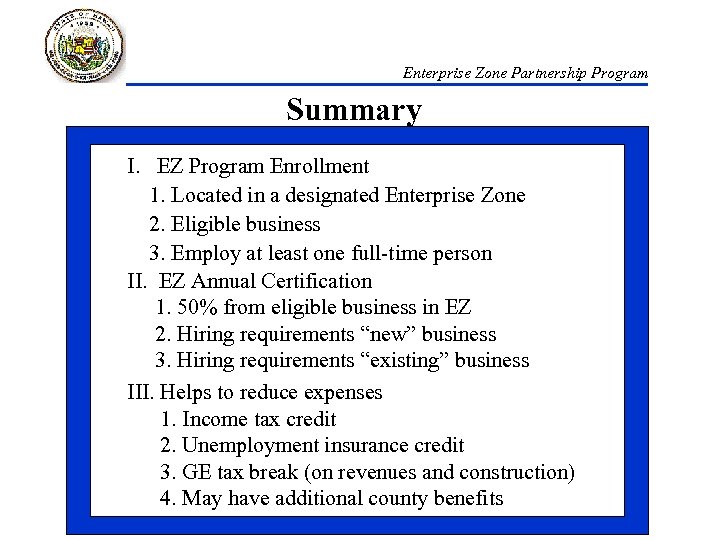

Enterprise Zone Partnership Program Summary I. EZ Program Enrollment 1. Located in a designated Enterprise Zone 2. Eligible business 3. Employ at least one full-time person II. EZ Annual Certification 1. 50% from eligible business in EZ 2. Hiring requirements “new” business 3. Hiring requirements “existing” business III. Helps to reduce expenses 1. Income tax credit 2. Unemployment insurance credit 3. GE tax break (on revenues and construction) 4. May have additional county benefits

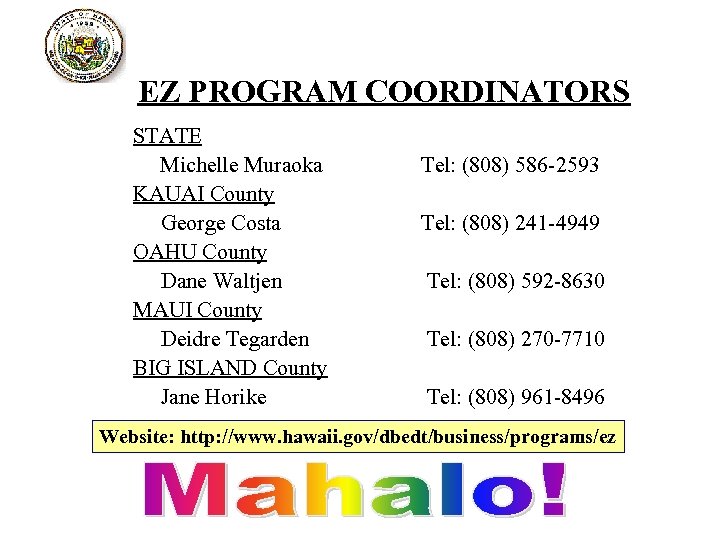

EZ PROGRAM COORDINATORS STATE Michelle Muraoka KAUAI County George Costa OAHU County Dane Waltjen MAUI County Deidre Tegarden BIG ISLAND County Jane Horike Tel: (808) 586 -2593 Tel: (808) 241 -4949 Tel: (808) 592 -8630 Tel: (808) 270 -7710 Tel: (808) 961 -8496 Website: http: //www. hawaii. gov/dbedt/business/programs/ez

833b2ec869a60643f1083f86e9b13a89.ppt