5913ee5870fce06ea9665e4997c7f4cd.ppt

- Количество слайдов: 16

Partnership has its Benefits Why Partner with ACH Direct? • A single integration enables your software to ü Process all major payment types ü Access all major payment networks ü Utilize the latest fraud protection tools • Lifetime residual revenue share on ALL profit centers • Simplify compliance and security requirements

Payments Gateway What is Payments Gateway? • Payments Gateway is ACH Direct’s portal through which your software connects to all major payment types and networks • Payment types include: ü Major Credit Cards ü Debit Cards ü Electronic Check ü Bill Pay

Payments Gateway Accepts all major credit cards • VISA/Master. Card • American Express • Discover • JCB

Payments Gateway Connect to all major Networks • 1 st Data • Chase/Paymentech • Global Payments • TSYS • Elavon (formerly NOVA)

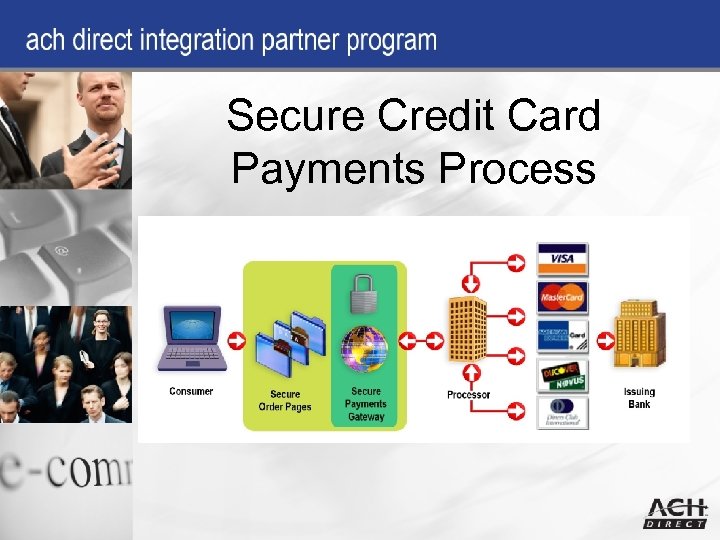

Secure Credit Card Payments Process

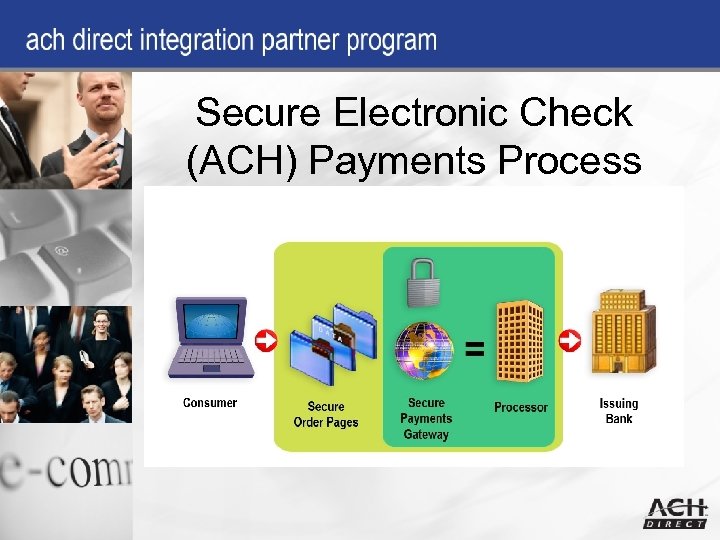

Secure Electronic Check (ACH) Payments Process

Anti-Fraud Tools How does ACH Direct protect against fraud? • Your software can take advantage of our suite of anti-fraud protection tools, including: ü IDVerify TM ü ATMVerify ü NCNVerify ®

Partner Responsibilities • Integration of software into Payments Gateway • Merchant marketing • Lead generation • Customer service for software/product offering

ACH Direct Responsibilities • Individual merchant sales/closing • Merchant application assistance • Partner training • Marketing support • Underwriting and enrollment of merchant • Merchant training • Merchant billing and collections • Customer service/support on service offering • Processing merchant transactions • Track, report and pay partner commissions

Compliance & Security How does ACH Direct reduce compliance complexity and security risk level? • Simplify the process for making your software compliant • Minimize liability by outsourcing sensitive consumer financial data • Reduce risk of ü Non-compliance ü Security breach • Eliminate the need for certain costly compliance audits • ACH Direct’s solutions are compliant with: ü NACHA Rules & Regulations ü CISP/PCI ü PABP

Integration Methodologies How does the software connect to ACH Direct? • Payment processing through Payments Gateway can occur with both real-time and batch methods: ü Advanced Gateway Interface – Traditional application program interface ü Secure Web Pay – Internet-based API ü Batch Method – Flexible format for bulk/high-volume transaction processing

Advanced Gateway Interface What is Advanced Gateway Interface (AGI)? • Secure, comprehensive electronic payments integration • Supports single and recurring transaction processing • Provides greatest flexibility for maintaining programming control • Solution for processing all payment transaction types, including: ü Face-to-face ü Web-based ü Mail/Telephone ü Electronic Checks ü Credit/Debit Cards

Secure Web Pay What is Secure Web Pay? • Turnkey solution for web-based payment processing • Internet-based Application Processing Integration (API) • Secure, comprehensive electronic payments integration • Link directly from any website to ACH Direct • Eliminates your need for secure certificate • Automatically incorporates ACH Direct’s authentication and verification capabilities • ACH Direct takes on all responsibility related to ü Processing payments ü Securing submitted data ü Rules and regulations compliance

Ways to Pay Benefits of Secure Web Pay vs. AGI Feature SWP AGI Anti-Fraud Protection X X Recurring Payments X X Single Payments X X Credit Cards X X Debit Cards X X Electronic Checks X X Web-based payments X X Face-to-Face Payments X Mail/Telephone Orders (MOTO) X SSL Certificate Required X* * Only when using Internet-based payment option.

Get Started 866. 378. 0001 ipartners@achdirect. com www. achdirect. com/partners

5913ee5870fce06ea9665e4997c7f4cd.ppt