869eb54b831713bf7d814bb693b2d26e.ppt

- Количество слайдов: 22

Partnership For Development PPP PROJECTS IN SINDH Public Private Partnership Unit Finance Department Government of Sindh May, 2011

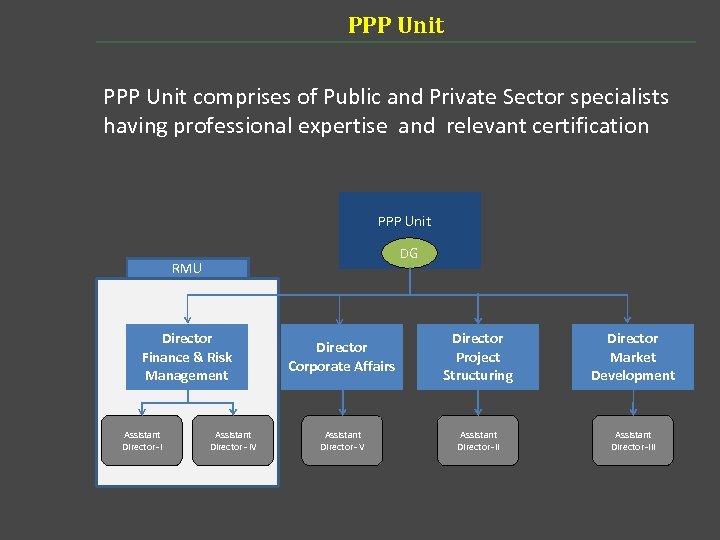

PPP Unit comprises of Public and Private Sector specialists having professional expertise and relevant certification PPP Unit DG RMU Director Finance & Risk Management Assistant Director-I Assistant Director - IV Director Corporate Affairs Director Project Structuring Director Market Development Assistant Director- V Assistant Director-III

Vision ü PPP Unit envisions that with out private sector participation, the public sector can not bring about efficiency in the Service Delivery System. üProvision of private finance is also very important and the vision is to covert abundant public sector resources into commercial assets generating constant flow of funds Vision and Objectives of PPP in Sindh ü Provision of infrastructure services ü Improve their reliability and quality for accelerating economic growth ü Achieving the social objectives of the government ü Mobilize private sector resources for infrastructure projects; ü Incorporate principles of fairness, competition and transparency in public-private partnership projects;

What do we offer to private sector? ü These contractual § obligations form part of RFP ü Well thought out plan § ü VGF Board has to decide about the project financing issue § on the pattern of TIFU *UK, *TIFIA USA and § *IIFCL India. ü The Risks of project are well defined and well quantified Administrative support Ø Licenses and clearances , Utility connections for power, gas and water, land or rights of way Asset-based support Ø leasing land infrastructure facilities Direct financial assistance Ø Viability Gap Fund Government guarantees Ø Political risks , delay of agreed user fee adjustments, (MRG), Ø Credit Enhancement, Force majeure and Demand risk etc

KEENJHAR LAKE

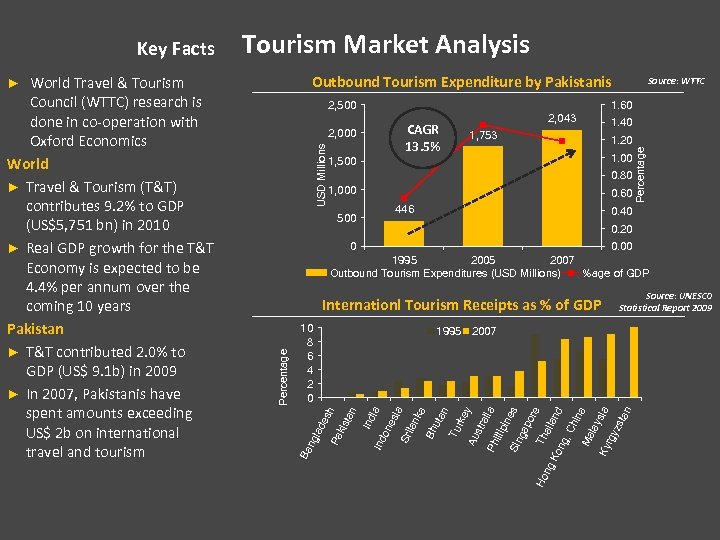

Outbound Tourism Expenditure by Pakistanis 2, 500 1. 60 2, 043 CAGR 13. 5% 2, 000 USD Millions Source: WTTC 1, 753 1. 40 1. 20 1. 00 1, 500 0. 80 1, 000 0. 60 446 500 Percentage ► 0. 40 0. 20 0 0. 00 1995 2007 Outbound Tourism Expenditures (USD Millions) %age of GDP Source: UNESCO Statistical Report 2009 nd Ch ina Ma lay sia Ky rgy zst an g, aila on Ho n g. K Th po re s Sin ga ine lia illip str a rke y 2007 Au n Tu uta ka Bh lan Sri es ia ia on Ind n kis ta Pa es h 1995 Ph 10 8 6 4 2 0 lad Percentage Internationl Tourism Receipts as % of GDP ng World Travel & Tourism Council (WTTC) research is done in co-operation with Oxford Economics World ► Travel & Tourism (T&T) contributes 9. 2% to GDP (US$5, 751 bn) in 2010 ► Real GDP growth for the T&T Economy is expected to be 4. 4% per annum over the coming 10 years Pakistan ► T&T contributed 2. 0% to GDP (US$ 9. 1 b) in 2009 ► In 2007, Pakistanis have spent amounts exceeding US$ 2 b on international travel and tourism Tourism Market Analysis Ba Key Facts

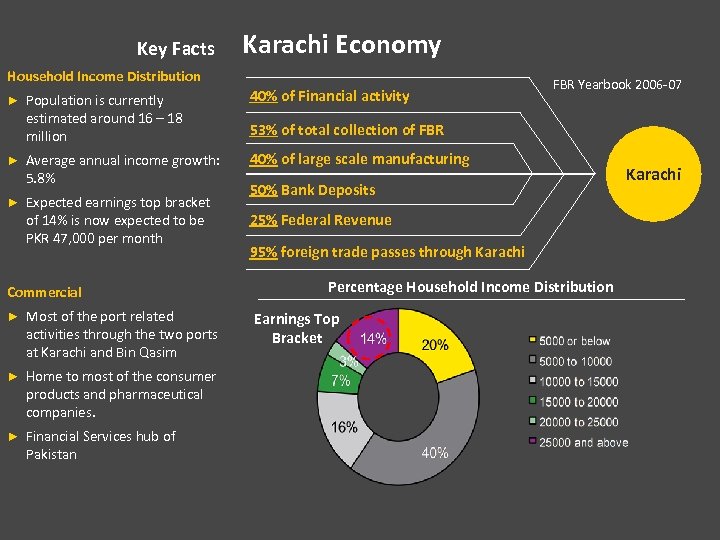

Key Facts Karachi Economy Household Income Distribution Population is currently estimated around 16 – 18 million 40% of Financial activity ► Average annual income growth: 5. 8% 40% of large scale manufacturing ► Expected earnings top bracket of 14% is now expected to be PKR 47, 000 per month FBR Yearbook 2006 -07 ► Commercial ► Most of the port related activities through the two ports at Karachi and Bin Qasim ► Home to most of the consumer products and pharmaceutical companies. ► Financial Services hub of Pakistan 53% of total collection of FBR 50% Bank Deposits 25% Federal Revenue 95% foreign trade passes through Karachi Percentage Household Income Distribution Earnings Top Bracket Karachi

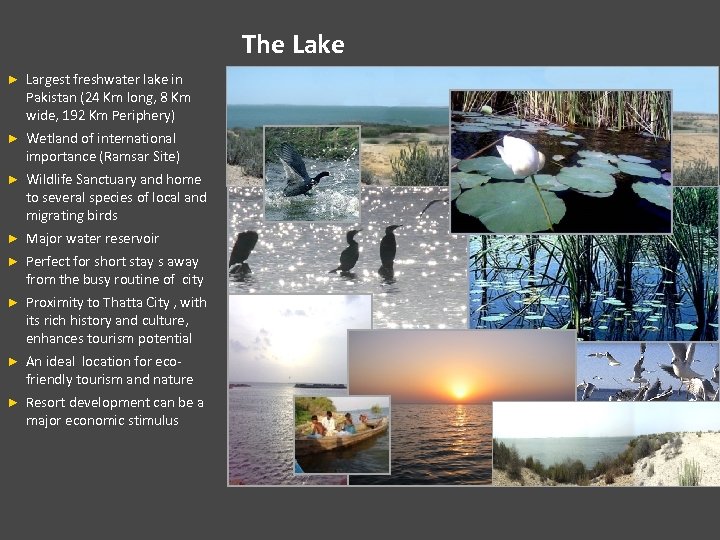

The Lake ► Largest freshwater lake in Pakistan (24 Km long, 8 Km wide, 192 Km Periphery) ► Wetland of international importance (Ramsar Site) ► Wildlife Sanctuary and home to several species of local and migrating birds ► Major water reservoir ► Perfect for short stay s away from the busy routine of city ► Proximity to Thatta City , with its rich history and culture, enhances tourism potential ► An ideal location for ecofriendly tourism and nature ► Resort development can be a major economic stimulus

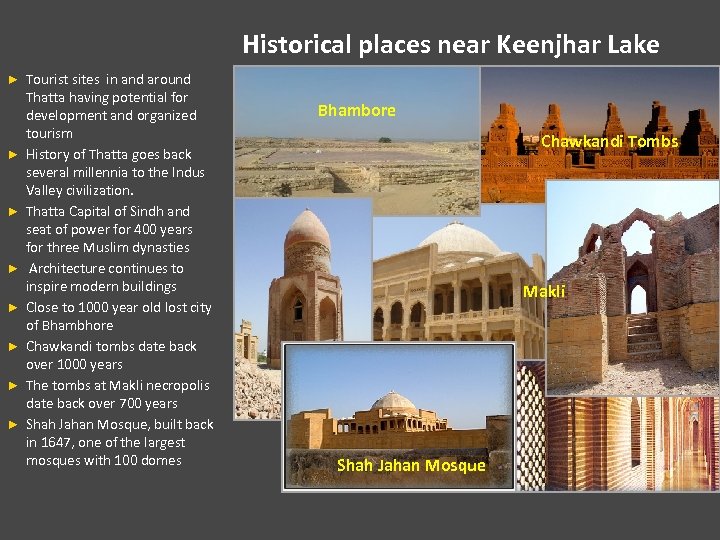

Historical places near Keenjhar Lake ► ► ► ► Tourist sites in and around Thatta having potential for development and organized tourism History of Thatta goes back several millennia to the Indus Valley civilization. Thatta Capital of Sindh and seat of power for 400 years for three Muslim dynasties Architecture continues to inspire modern buildings Close to 1000 year old lost city of Bhambhore Chawkandi tombs date back over 1000 years The tombs at Makli necropolis date back over 700 years Shah Jahan Mosque, built back in 1647, one of the largest mosques with 100 domes Bhambore Chawkandi Tombs Makli Shah Jahan Mosque

THE PROJECT

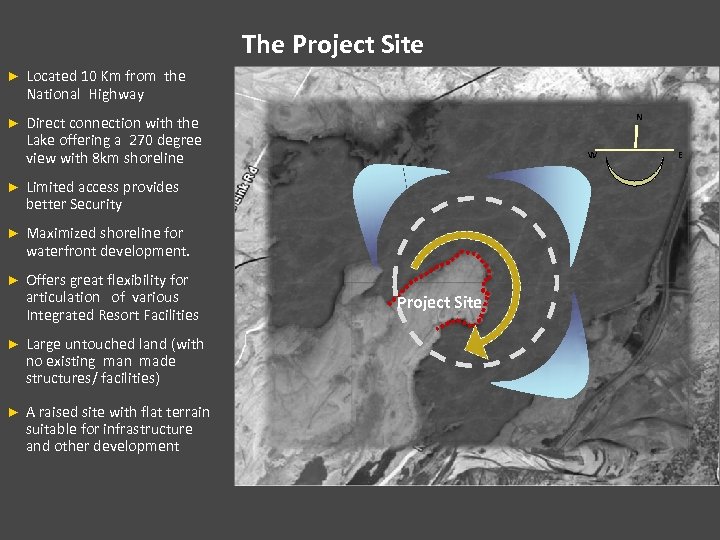

The Project Site ► Located 10 Km from the National Highway ► Direct connection with the Lake offering a 270 degree view with 8 km shoreline ► Maximized shoreline for waterfront development. ► Offers great flexibility for articulation of various Integrated Resort Facilities W Limited access provides better Security ► N ► Large untouched land (with no existing man made structures/ facilities) ► A raised site with flat terrain suitable for infrastructure and other development Project Site E

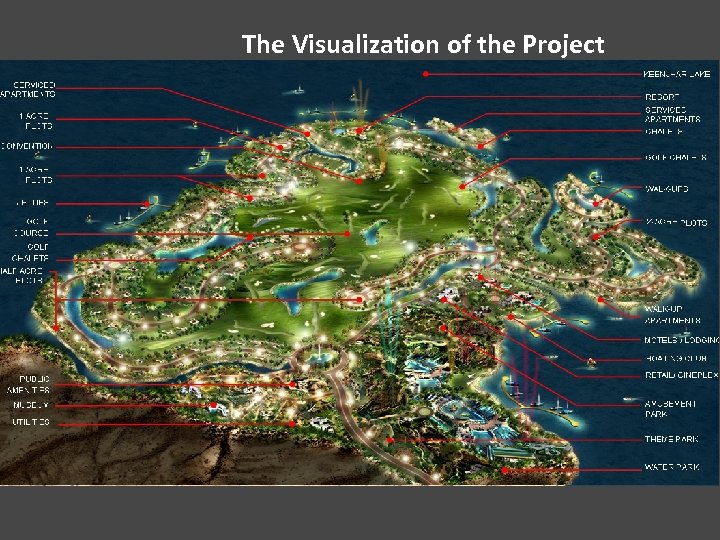

The Visualization of the Project

FINANCIAL OVERVIEW

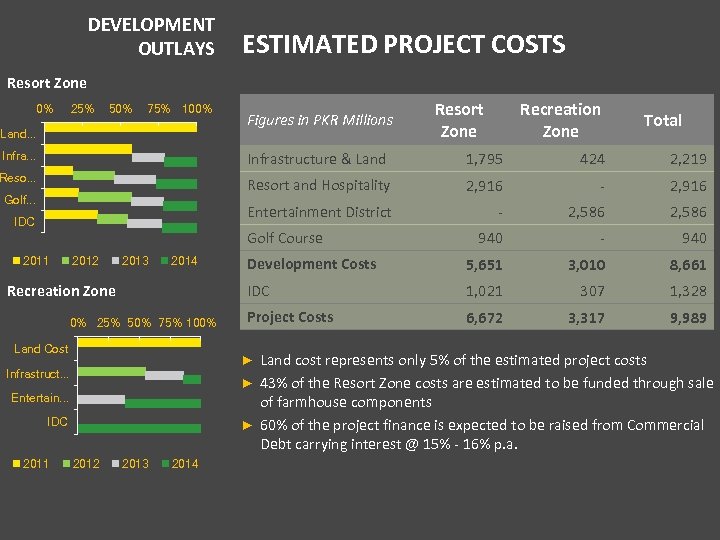

DEVELOPMENT OUTLAYS ESTIMATED PROJECT COSTS Resort Zone 0% 25% 50% 75% 100% Land. . . Figures in PKR Millions Resort Zone Recreation Zone Total Infra. . . Infrastructure & Land 1, 795 424 2, 219 Reso. . . Resort and Hospitality 2, 916 - 2, 916 Entertainment District - 2, 586 940 - 940 Development Costs 5, 651 3, 010 8, 661 IDC 1, 021 307 1, 328 Project Costs 6, 672 3, 317 9, 989 Golf. . . IDC Golf Course 2011 2012 2013 2014 Recreation Zone 0% 25% 50% 75% 100% Land Cost Land cost represents only 5% of the estimated project costs ► 43% of the Resort Zone costs are estimated to be funded through sale of farmhouse components ► 60% of the project finance is expected to be raised from Commercial Debt carrying interest @ 15% - 16% p. a. ► Infrastruct. . . Entertain. . . IDC 2011 2012 2013 2014

2, 500 1, 500 Development Period Payback: Year 9 500 -1, 500 2028 2029 2030 2027 2026 2025 2024 2023 2022 2029 Free Cash Flow - Firm 2021 2020 2019 2018 2017 2016 2015 2014 2013 Operational Period 2012 -2, 500 Free Cash Flow - Equity Recreation Zone Development Period Payback: Year 9 Free Cash Flow - Firm Free Cash Flow - Equity 2028 2027 2026 2025 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Operational Period 2013 2, 000 1, 500 1, 000 500 0 -500 -1, 000 -1, 500 -2, 000 -2, 500 2012 Qualitative Aspects ► Flexibility in terms of developing the project ► Reduced upfront investment ► Land price is payable on deferred basis ► Land is available for mortgage ► Extensive work already undertaken ► Feasibility shows bankable financial ratios Resort Zone 2011 Quantitative Aspects ► Resort Zone o Equity IRR: 23% o NPV @16%: PKR 1. 3 billion INVESTMENT ANALYSIS 2011 KEY RESULTS

TRANSACTION STRUCTURE

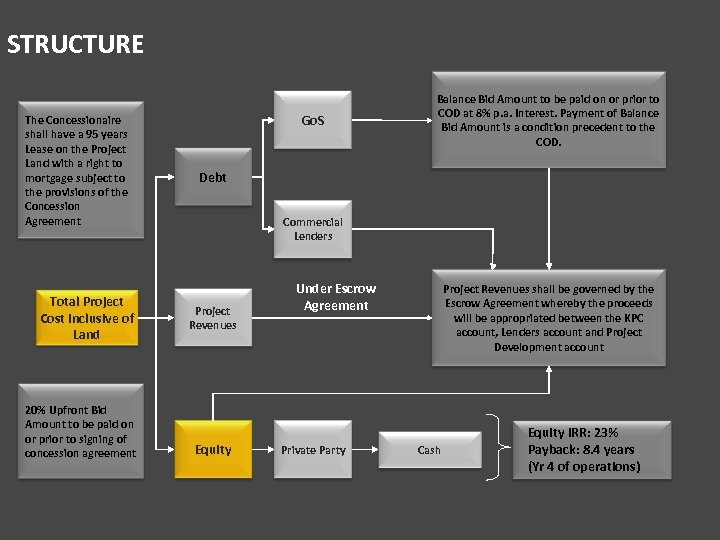

STRUCTURE The Concessionaire shall have a 95 years Lease on the Project Land with a right to mortgage subject to the provisions of the Concession Agreement Total Project Cost inclusive of Land 20% Upfront Bid Amount to be paid on or prior to signing of concession agreement Go. S Balance Bid Amount to be paid on or prior to COD at 8% p. a. Interest. Payment of Balance Bid Amount is a condition precedent to the COD. Debt Commercial Lenders Project Revenues Equity Under Escrow Agreement Private Party Project Revenues shall be governed by the Escrow Agreement whereby the proceeds will be appropriated between the KPC account, Lenders account and Project Development account Cash Equity IRR: 23% Payback: 8. 4 years (Yr 4 of operations)

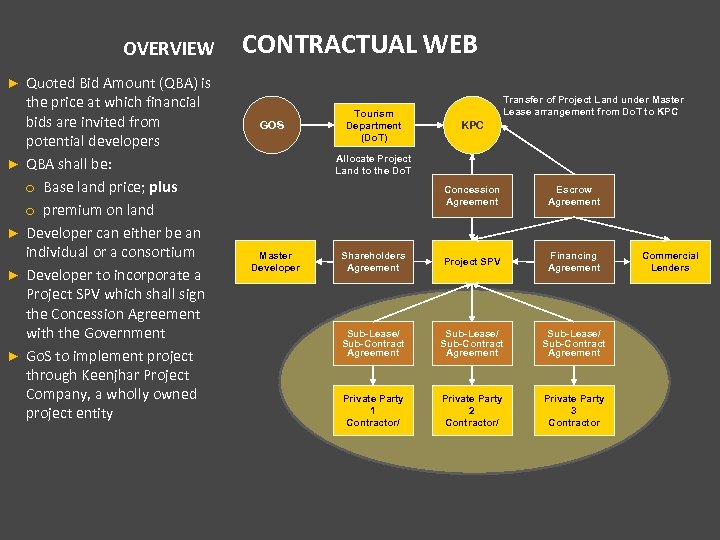

OVERVIEW Quoted Bid Amount (QBA) is the price at which financial bids are invited from potential developers ► QBA shall be: o Base land price; plus o premium on land ► Developer can either be an individual or a consortium ► Developer to incorporate a Project SPV which shall sign the Concession Agreement with the Government ► Go. S to implement project through Keenjhar Project Company, a wholly owned project entity CONTRACTUAL WEB ► GOS Tourism Department (Do. T) Transfer of Project Land under Master Lease arrangement from Do. T to KPC Allocate Project Land to the Do. T Concession Agreement Master Developer Escrow Agreement Shareholders Agreement Project SPV Financing Agreement Sub-Lease/ Sub-Contract Agreement Private Party 1 Contractor/ Private Party 2 Contractor/ Private Party 3 Contractor Commercial Lenders

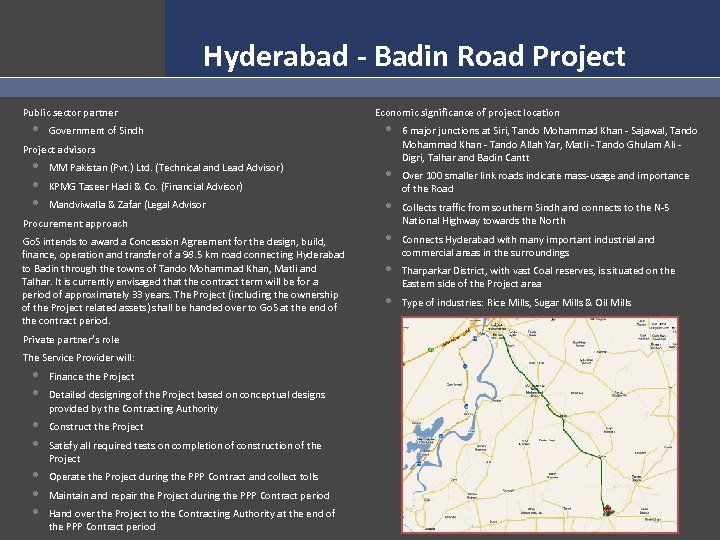

Hyderabad - Badin Road Project Public sector partner • Government of Sindh Economic significance of project location • 6 major junctions at Siri, Tando Mohammad Khan - Sajawal, Tando Mohammad Khan - Tando Allah Yar, Matli - Tando Ghulam Ali - Digri, Talhar and Badin Cantt • Over 100 smaller link roads indicate mass-usage and importance of the Road • Collects traffic from southern Sindh and connects to the N-5 National Highway towards the North • Connects Hyderabad with many important industrial and commercial areas in the surroundings • Tharparkar District, with vast Coal reserves, is situated on the Eastern side of the Project area • Type of industries: Rice Mills, Sugar Mills & Oil Mills Project advisors • • • MM Pakistan (Pvt. ) Ltd. (Technical and Lead Advisor) KPMG Taseer Hadi & Co. (Financial Advisor) Mandviwalla & Zafar (Legal Advisor Procurement approach Go. S intends to award a Concession Agreement for the design, build, finance, operation and transfer of a 98. 5 km road connecting Hyderabad to Badin through the towns of Tando Mohammad Khan, Matli and Talhar. It is currently envisaged that the contract term will be for a period of approximately 33 years. The Project (including the ownership of the Project related assets) shall be handed over to Go. S at the end of the contract period. Private partner’s role The Service Provider will: • • Finance the Project • • Construct the Project • • • Operate the Project during the PPP Contract and collect tolls Detailed designing of the Project based on conceptual designs provided by the Contracting Authority Satisfy all required tests on completion of construction of the Project Maintain and repair the Project during the PPP Contract period Hand over the Project to the Contracting Authority at the end of the PPP Contract period

Run-of-River Power Generation EOI for hiring Transaction Advisor floated on 3 rd July, 2010 Scope of work Identify the potential sites for ROR Power Generation in the province particularly at Sukkur Barrage; Conduct Feasibility Study in respect of the top four promising sites identified in the survey; Assist Government of Sindh in marketing the project to the relevant mix of investors, and administering the bidding process for the selected sites RFP issued to the 7 pre-qualified consulting consortia Transaction advisor likely to start work by June 2011

Gorakh Hill Resort Project Gorakh Hills Background Gorakh Hill Development project (GHDP) ►Gorakh Hill is located 450 km North of Karachi, 300 Kms from Hyderabad, 93 Km in Northwest of Dadu and 46 Km from Sehwan Sharif ►Gorakh Hills development was initiated in 1998, with a plan to develop Gorakh Hills as a resort on lines of hill stations in northern Pakistan. A master plan was developed by M/s Naqvi & Siddiqui Associates in collaboration with M/s Shankland & Cox for the hills covering an area of about 1, 908 Acres which included residential, recreational and hospitality components. ►PKR 198. 269 million has been spent on various development works which include road from Wahi Pandi to Gorakh Hill summit, water pumping stations and supply line to the summit, electricity supply to the summit, construction of police check posts along the road to the summit, construction of bridges, culverts etc. shades and fencing at the summit and construction of contractors cottage and residential quarters for workers. ►The road from Wahi pandi to Gorakh Hill top has been prone to damage mainly due to seasonal torrents which flow through the numerous storm water drains that pass through the road and land slides at Khanwal Luk. ►The development of Gorakh Hills fall under the Gorakh Hills Development Authority formed through an Act of Parliament in September 2008 ►It was decided by the Government of Sindh in 2010 to develop Gorakh Hills under Public Private Partnership and mandated Transaction Advisors Ernst & Young in consortium with Meinhardt (Pakistan) Private Limited and Mohsin Tayebaly & Co to evaluate options for development of Gorakh Hills under PPP. ►The initial studies suggested a need for development of better access road and development of basic facilities for tourists visiting the hill top ►Detailed design of road that follows the existing route for most part that is reengineered to provide better road access has been completed ►A conceptual design for the tourist facility at the hill top has also been completed.

Thank you

869eb54b831713bf7d814bb693b2d26e.ppt