f762e9986a2b3023c69ee108802c8283.ppt

- Количество слайдов: 13

Partner Microfinance Foundation Weathering the storm Case Study from Bosnia and Herzegovina contact@e-mfp. eu www. e-mfp. eu

Partner Microfinance Foundation Weathering the storm Case Study from Bosnia and Herzegovina contact@e-mfp. eu www. e-mfp. eu

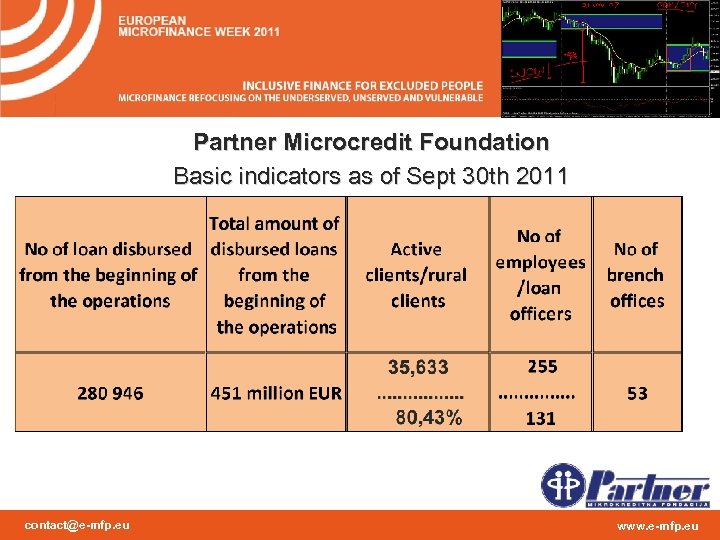

Partner Microcredit Foundation Basic indicators as of Sept 30 th 2011 contact@e-mfp. eu www. e-mfp. eu

Partner Microcredit Foundation Basic indicators as of Sept 30 th 2011 contact@e-mfp. eu www. e-mfp. eu

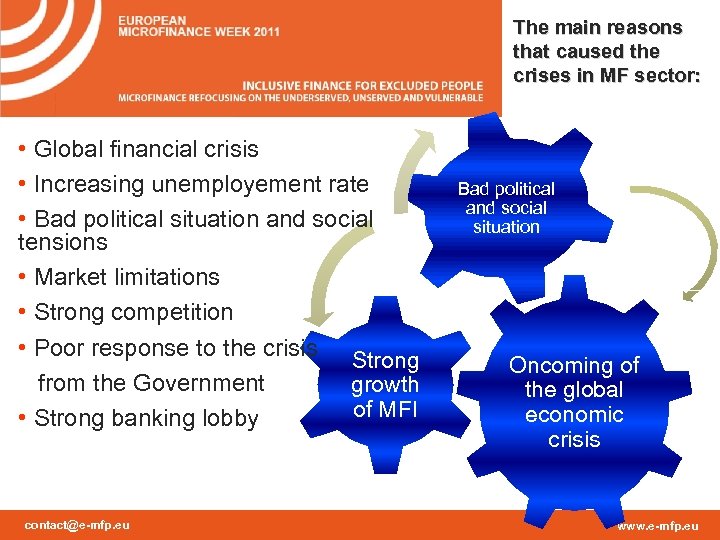

The main reasons that caused the crises in MF sector: • Global financial crisis • Increasing unemployement rate • Bad political situation and social tensions • Market limitations • Strong competition • Poor response to the crisis Strong from the Government growth of MFI • Strong banking lobby contact@e-mfp. eu Bad political and social situation Oncoming of the global economic crisis www. e-mfp. eu

The main reasons that caused the crises in MF sector: • Global financial crisis • Increasing unemployement rate • Bad political situation and social tensions • Market limitations • Strong competition • Poor response to the crisis Strong from the Government growth of MFI • Strong banking lobby contact@e-mfp. eu Bad political and social situation Oncoming of the global economic crisis www. e-mfp. eu

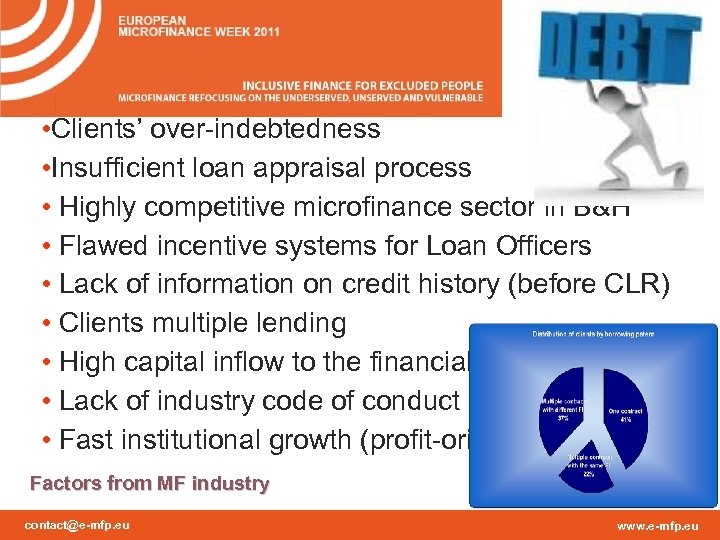

• Clients’ over-indebtedness • Insufficient loan appraisal process • Highly competitive microfinance sector in B&H • Flawed incentive systems for Loan Officers • Lack of information on credit history (before CLR) • Clients multiple lending • High capital inflow to the financial sector • Lack of industry code of conduct • Fast institutional growth (profit-oriented) Factors from MF industry contact@e-mfp. eu www. e-mfp. eu

• Clients’ over-indebtedness • Insufficient loan appraisal process • Highly competitive microfinance sector in B&H • Flawed incentive systems for Loan Officers • Lack of information on credit history (before CLR) • Clients multiple lending • High capital inflow to the financial sector • Lack of industry code of conduct • Fast institutional growth (profit-oriented) Factors from MF industry contact@e-mfp. eu www. e-mfp. eu

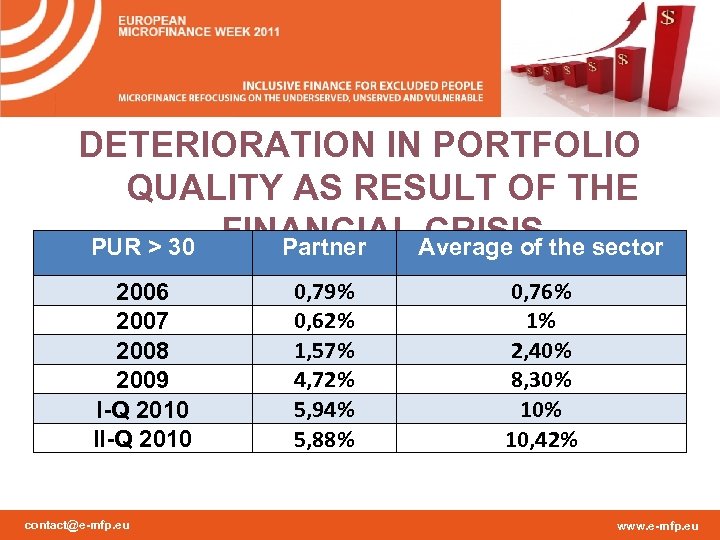

DETERIORATION IN PORTFOLIO QUALITY AS RESULT OF THE CRISIS PUR > 30 FINANCIAL Average of the sector Partner 2006 2007 2008 2009 I-Q 2010 II-Q 2010 contact@e-mfp. eu 0, 79% 0, 62% 1, 57% 4, 72% 5, 94% 5, 88% 0, 76% 1% 2, 40% 8, 30% 10, 42% www. e-mfp. eu

DETERIORATION IN PORTFOLIO QUALITY AS RESULT OF THE CRISIS PUR > 30 FINANCIAL Average of the sector Partner 2006 2007 2008 2009 I-Q 2010 II-Q 2010 contact@e-mfp. eu 0, 79% 0, 62% 1, 57% 4, 72% 5, 94% 5, 88% 0, 76% 1% 2, 40% 8, 30% 10, 42% www. e-mfp. eu

The effect of the crisis on Partner MCF: n n Compromised quality of portfolio The increase in the level of total debt write-offs The lack og demand General sense of insecurity among employees contact@e-mfp. eu www. e-mfp. eu

The effect of the crisis on Partner MCF: n n Compromised quality of portfolio The increase in the level of total debt write-offs The lack og demand General sense of insecurity among employees contact@e-mfp. eu www. e-mfp. eu

Actions taken by Partner: n n n Social responsibility Financial education of clients Inovative approach for lending (Mercy Corps projects) Innovative loan products (youth, farmers, etc). ISO standards (ISO 9001, 27001, 31000, 10000, etc) contact@e-mfp. eu www. e-mfp. eu

Actions taken by Partner: n n n Social responsibility Financial education of clients Inovative approach for lending (Mercy Corps projects) Innovative loan products (youth, farmers, etc). ISO standards (ISO 9001, 27001, 31000, 10000, etc) contact@e-mfp. eu www. e-mfp. eu

Partner’s response in client’s protection: Avoidance of overindebtedness Transparent and Responsible pricing Appropriate collections practices Ethical staff behavior Mechanisms for redress of grievances Privacy of client data The six principles contact@e-mfp. eu www. e-mfp. eu

Partner’s response in client’s protection: Avoidance of overindebtedness Transparent and Responsible pricing Appropriate collections practices Ethical staff behavior Mechanisms for redress of grievances Privacy of client data The six principles contact@e-mfp. eu www. e-mfp. eu

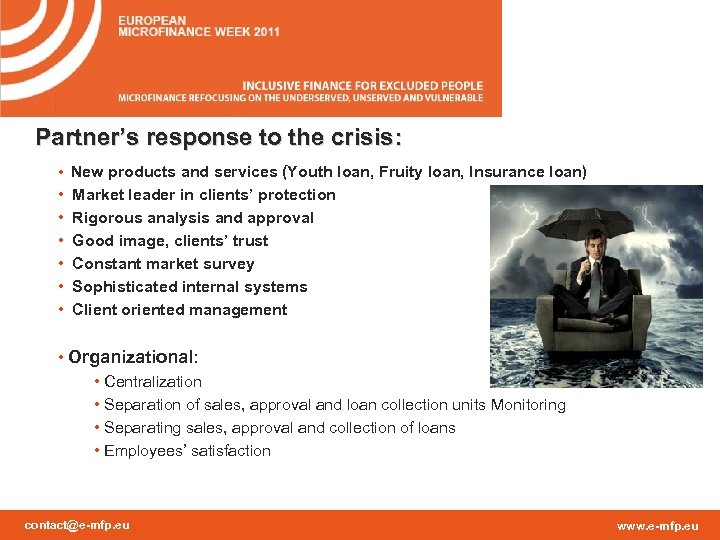

Partner’s response to the crisis: • New products and services (Youth loan, Fruity loan, Insurance loan) • • • Market leader in clients’ protection Rigorous analysis and approval Good image, clients’ trust Constant market survey Sophisticated internal systems Client oriented management • Organizational: • Centralization • Separation of sales, approval and loan collection units Monitoring • Separating sales, approval and collection of loans • Employees’ satisfaction contact@e-mfp. eu www. e-mfp. eu

Partner’s response to the crisis: • New products and services (Youth loan, Fruity loan, Insurance loan) • • • Market leader in clients’ protection Rigorous analysis and approval Good image, clients’ trust Constant market survey Sophisticated internal systems Client oriented management • Organizational: • Centralization • Separation of sales, approval and loan collection units Monitoring • Separating sales, approval and collection of loans • Employees’ satisfaction contact@e-mfp. eu www. e-mfp. eu

IMPROVEMENT IN PORTFOLIO QUALITY AS RESULT OF PURTAKEN ACTIONS Average of the sector > 30 Partner III-Q 2010 IV-Q 2010 I-Q 2011 III-Q 2011 contact@e-mfp. eu 3, 79% 3, 05% 2, 58% 1, 88% 6, 83% 5% 7, 09% 5, 91% 5% www. e-mfp. eu

IMPROVEMENT IN PORTFOLIO QUALITY AS RESULT OF PURTAKEN ACTIONS Average of the sector > 30 Partner III-Q 2010 IV-Q 2010 I-Q 2011 III-Q 2011 contact@e-mfp. eu 3, 79% 3, 05% 2, 58% 1, 88% 6, 83% 5% 7, 09% 5, 91% 5% www. e-mfp. eu

Financial or social performance objectives? Achieving social performance objectives leads to financial gain, which is necessary in order to continue providing social benefits to our clients. contact@e-mfp. eu www. e-mfp. eu

Financial or social performance objectives? Achieving social performance objectives leads to financial gain, which is necessary in order to continue providing social benefits to our clients. contact@e-mfp. eu www. e-mfp. eu

Recommendations: n Limit credit exposure per client n Reduce internaly cross-borrowing from multiple institutions n Strengthen loan appraisal and monitoring n Develop industry-wide standards of conduct n Investors should include the assessment of the compliance with the standards of the code of conduct into due diligence n Harmonize risk classification (A-E) methodology in the county n Clearly mark restructured loans n Conduct trend analysis of comprehensive CRK data contact@e-mfp. eu www. e-mfp. eu

Recommendations: n Limit credit exposure per client n Reduce internaly cross-borrowing from multiple institutions n Strengthen loan appraisal and monitoring n Develop industry-wide standards of conduct n Investors should include the assessment of the compliance with the standards of the code of conduct into due diligence n Harmonize risk classification (A-E) methodology in the county n Clearly mark restructured loans n Conduct trend analysis of comprehensive CRK data contact@e-mfp. eu www. e-mfp. eu

Selma Jahic, Assistant Director for Marketing email: selma@partner. ba contact@e-mfp. eu www. e-mfp. eu

Selma Jahic, Assistant Director for Marketing email: selma@partner. ba contact@e-mfp. eu www. e-mfp. eu