582ab2acf51087d90486127d9e261bc5.ppt

- Количество слайдов: 44

Part IX. Market Intermediation Chapter 22. Markets with intermediated goods Slides Industrial Organization: Markets and Strategies Paul Belleflamme and Martin Peitz © Cambridge University Press 2009

Part IX. Market Intermediation Chapter 22. Markets with intermediated goods Slides Industrial Organization: Markets and Strategies Paul Belleflamme and Martin Peitz © Cambridge University Press 2009

Introduction to Part IX • Most products and services are not sold directly from the producer to the final consumer but pass through intermediaries. • 4 major roles of intermediaries • Dealer. The intermediary buys goods or services from suppliers and resells them to buyers. • Platform operator. The intermediary provides a platform where buyers and sellers (or more generally various groups of agents with complementary businesses) are able to interact. • Infomediary. The intermediary acts as an information gatekeeper, or ‘infomediary’, by allowing consumers to access and process more efficiently information about prices or the match value of products and services. • Trusted third-party. The intermediary acts as a certification agent by revealing information about a product’s or seller’s reliability or quality © Cambridge University Press 2010 2

Introduction to Part IX • Most products and services are not sold directly from the producer to the final consumer but pass through intermediaries. • 4 major roles of intermediaries • Dealer. The intermediary buys goods or services from suppliers and resells them to buyers. • Platform operator. The intermediary provides a platform where buyers and sellers (or more generally various groups of agents with complementary businesses) are able to interact. • Infomediary. The intermediary acts as an information gatekeeper, or ‘infomediary’, by allowing consumers to access and process more efficiently information about prices or the match value of products and services. • Trusted third-party. The intermediary acts as a certification agent by revealing information about a product’s or seller’s reliability or quality © Cambridge University Press 2010 2

Chapter 22 – Market intermediation • Intermediaries are “visible hands” in the functioning of markets. • The digital economy has deeply affected their functioning and their importance • Especially the last 3 roles, on which we focus here • Example: • Dealer: initial business model (pioneer of ecommerce) • Platform operator: creation of Amazon Marketplace • Infomediary: users review and rate products online • Trusted third-party: reputation system © Cambridge University Press 2010 3

Chapter 22 – Market intermediation • Intermediaries are “visible hands” in the functioning of markets. • The digital economy has deeply affected their functioning and their importance • Especially the last 3 roles, on which we focus here • Example: • Dealer: initial business model (pioneer of ecommerce) • Platform operator: creation of Amazon Marketplace • Infomediary: users review and rate products online • Trusted third-party: reputation system © Cambridge University Press 2010 3

Introduction to Part IX Organization of Part IX • Chapter 22 • Intermediary buys and resells a product without adding any service to the transaction • Matching environments • ‘two-sided platforms’ • Chapter 23 • Information overload and information gatekeeper • Recommender systems • Asymmetric information problems • Intermediary as a certifier • Reputation systems © Cambridge University Press 2010 4

Introduction to Part IX Organization of Part IX • Chapter 22 • Intermediary buys and resells a product without adding any service to the transaction • Matching environments • ‘two-sided platforms’ • Chapter 23 • Information overload and information gatekeeper • Recommender systems • Asymmetric information problems • Intermediary as a certifier • Reputation systems © Cambridge University Press 2010 4

Chapter 22 - Objectives Chapter 22. Learning objectives • Understand market intermediation • Analyze different types of intermediation • Be able to examine how externalities affect the outcome in matching environments • Understand two-sided platforms and how they are affected by indirect network effects © Cambridge University Press 2010 5

Chapter 22 - Objectives Chapter 22. Learning objectives • Understand market intermediation • Analyze different types of intermediation • Be able to examine how externalities affect the outcome in matching environments • Understand two-sided platforms and how they are affected by indirect network effects © Cambridge University Press 2010 5

Chapter 22 – Market intermediation Intermediaries as dealers • Amazon. com started its business by buying books from publishers and reselling them to consumers • Business similar to the one of ‘brick-and mortar’ bookstores • Why publishers and readers use the services of such intermediaries instead of trading directly with each other? • Buyers and sellers may prefer to trade via an intermediary because its improves their matching opportunities • Alongside its dealer business, Amazon also started to operate a platform where third-party sellers can trade with Amazon customers © Cambridge University Press 2010 6

Chapter 22 – Market intermediation Intermediaries as dealers • Amazon. com started its business by buying books from publishers and reselling them to consumers • Business similar to the one of ‘brick-and mortar’ bookstores • Why publishers and readers use the services of such intermediaries instead of trading directly with each other? • Buyers and sellers may prefer to trade via an intermediary because its improves their matching opportunities • Alongside its dealer business, Amazon also started to operate a platform where third-party sellers can trade with Amazon customers © Cambridge University Press 2010 6

Chapter 22 – Intermediaries as dealers Intermediated v. nonintermediated trade • There exists a decentralized market in which buyers and sellers interact freely in the absence of an intermediary. • Buyers and sellers are not charged for joining. • They are matched randomly. • Claim: a market maker can buy and sell the product at a price difference so that he makes a profit although consumers have the possibility to participate for free in the random matching market. © Cambridge University Press 2010 7

Chapter 22 – Intermediaries as dealers Intermediated v. nonintermediated trade • There exists a decentralized market in which buyers and sellers interact freely in the absence of an intermediary. • Buyers and sellers are not charged for joining. • They are matched randomly. • Claim: a market maker can buy and sell the product at a price difference so that he makes a profit although consumers have the possibility to participate for free in the random matching market. © Cambridge University Press 2010 7

Chapter 22 – Intermediaries as dealers Intermediated v. nonintermediated trade (cont’d) • Model • Unit mass of heterogeneous buyers • 50% have high valuation v. H / 50% have low valuation v. L • Unit mass of heterogeneous sellers • 50% have high costs c. H / 50% have low costs c. L • If no trade surplus normalized to zero • Assume: v. H > c. H > v. L > c. L • Positive gains from trade for all matches, except when a low value buyer meets a high cost seller. • Gains from trade are assumed to be evenly split. © Cambridge University Press 2010 8

Chapter 22 – Intermediaries as dealers Intermediated v. nonintermediated trade (cont’d) • Model • Unit mass of heterogeneous buyers • 50% have high valuation v. H / 50% have low valuation v. L • Unit mass of heterogeneous sellers • 50% have high costs c. H / 50% have low costs c. L • If no trade surplus normalized to zero • Assume: v. H > c. H > v. L > c. L • Positive gains from trade for all matches, except when a low value buyer meets a high cost seller. • Gains from trade are assumed to be evenly split. © Cambridge University Press 2010 8

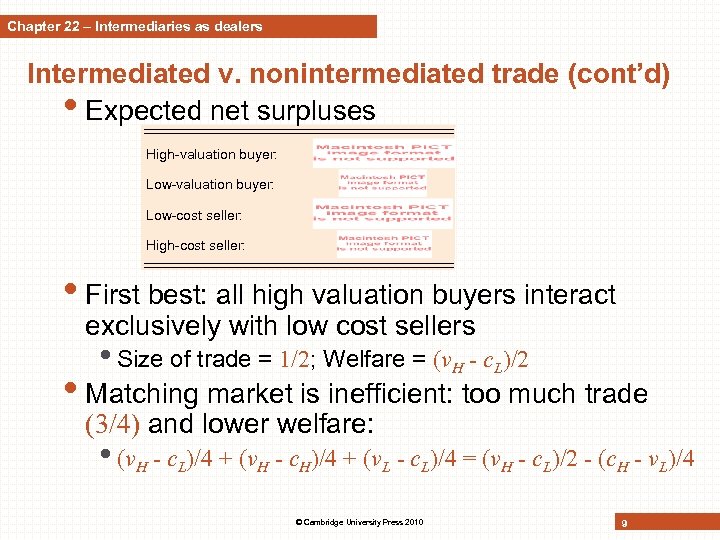

Chapter 22 – Intermediaries as dealers Intermediated v. nonintermediated trade (cont’d) • Expected net surpluses High-valuation buyer: Low-cost seller: High-cost seller: • First best: all high valuation buyers interact exclusively with low cost sellers • Size of trade = 1/2; Welfare = (v. H - c. L)/2 • Matching market is inefficient: too much trade (3/4) and lower welfare: • (v. H - c. L)/4 + (v. H - c. H)/4 + (v. L - c. L)/4 = (v. H - c. L)/2 - (c. H - v. L)/4 © Cambridge University Press 2010 9

Chapter 22 – Intermediaries as dealers Intermediated v. nonintermediated trade (cont’d) • Expected net surpluses High-valuation buyer: Low-cost seller: High-cost seller: • First best: all high valuation buyers interact exclusively with low cost sellers • Size of trade = 1/2; Welfare = (v. H - c. L)/2 • Matching market is inefficient: too much trade (3/4) and lower welfare: • (v. H - c. L)/4 + (v. H - c. H)/4 + (v. L - c. L)/4 = (v. H - c. L)/2 - (c. H - v. L)/4 © Cambridge University Press 2010 9

Chapter 22 – Intermediaries as dealers Intermediated v. nonintermediated trade (cont’d) • Introducing an intermediary may improve the allocation and even implement the first best. • Intermediary sets profit maximizing bid and ask prices, (w, p) • Prices must be such that • high value and low cost sellers prefer intermediated exchange • other buyers and sellers refrain from migrating to the intermediary. • Suppose prices satisfy these conditions • High value buyers know that they encounter only high cost sellers in the matching market indifference if: (v. H - c. H)/2 = v. H - p • Low cost sellers know that they encounter only low valuation buyers in the matching market indifference if: (v. L - c. L)/2 = w - c. L • Hence: p = (v. H + c. H)/2 & w = (v. L + c. L)/2 Profit = (p - w)/2 > 0 • Other buyers and sellers don’t join: v. L - p < 0 & w - c. H < 0 © Cambridge University Press 2010 10

Chapter 22 – Intermediaries as dealers Intermediated v. nonintermediated trade (cont’d) • Introducing an intermediary may improve the allocation and even implement the first best. • Intermediary sets profit maximizing bid and ask prices, (w, p) • Prices must be such that • high value and low cost sellers prefer intermediated exchange • other buyers and sellers refrain from migrating to the intermediary. • Suppose prices satisfy these conditions • High value buyers know that they encounter only high cost sellers in the matching market indifference if: (v. H - c. H)/2 = v. H - p • Low cost sellers know that they encounter only low valuation buyers in the matching market indifference if: (v. L - c. L)/2 = w - c. L • Hence: p = (v. H + c. H)/2 & w = (v. L + c. L)/2 Profit = (p - w)/2 > 0 • Other buyers and sellers don’t join: v. L - p < 0 & w - c. H < 0 © Cambridge University Press 2010 10

Chapter 22 – Intermediaries as dealers Intermediated v. nonintermediated trade (cont’d) Summary • Equilibrium in which high value buyers and low cost sellers self-select into the intermediated market. • The presence of a profit-maximizing dealer leads to endogenous sorting according to type. • The intermediary makes positive profit since he offers high value buyers and low cost sellers a better deal than what the matching market provides. • Intermediated trade also improves welfare by avoiding socially inefficient trade. Note • There is still room for profitable intermediation when the matching market in isolation operates efficiently (i. e. , v. L > c. H) © Cambridge University Press 2010 11

Chapter 22 – Intermediaries as dealers Intermediated v. nonintermediated trade (cont’d) Summary • Equilibrium in which high value buyers and low cost sellers self-select into the intermediated market. • The presence of a profit-maximizing dealer leads to endogenous sorting according to type. • The intermediary makes positive profit since he offers high value buyers and low cost sellers a better deal than what the matching market provides. • Intermediated trade also improves welfare by avoiding socially inefficient trade. Note • There is still room for profitable intermediation when the matching market in isolation operates efficiently (i. e. , v. L > c. H) © Cambridge University Press 2010 11

Chapter 22 – Intermediaries as dealers • Lesson: In the presence of a random-matching market, there are profitable opportunities for intermediaries to operate centralized exchanges since buyers and sellers are affected by the type of their matching partner and intermediation allow for self-selection of types. Intermediated trade may partially or even fully replace decentralized trade and lead to a more efficient allocation. © Cambridge University Press 2010 12

Chapter 22 – Intermediaries as dealers • Lesson: In the presence of a random-matching market, there are profitable opportunities for intermediaries to operate centralized exchanges since buyers and sellers are affected by the type of their matching partner and intermediation allow for self-selection of types. Intermediated trade may partially or even fully replace decentralized trade and lead to a more efficient allocation. © Cambridge University Press 2010 12

Chapter 22 – Intermediaries as dealers Intermediated v. nonintermediated trade (cont’d) • In the case that every match generates gains from trade: v. L > c. H • Under random matching there are positive gains from trade for all buyer-seller pairs and the matching market in isolation operates efficiently • Expected surpluses High-valuation buyer: Low-cost seller: High-cost seller: © Cambridge University Press 2010 13

Chapter 22 – Intermediaries as dealers Intermediated v. nonintermediated trade (cont’d) • In the case that every match generates gains from trade: v. L > c. H • Under random matching there are positive gains from trade for all buyer-seller pairs and the matching market in isolation operates efficiently • Expected surpluses High-valuation buyer: Low-cost seller: High-cost seller: © Cambridge University Press 2010 13

Chapter 22 – Intermediaries as dealers Intermediated v. nonintermediated trade (cont’d) • Suppose that all high-valuation buyers and all low-cost • • • sellers go to the intermediary If and high-valuation buyers and low-cost sellers do not have an inventive to deviate. Neither do low-valuation buyers and high-cost sellers For a low-valuation buyer the incentive constraint reads this becomes which is clearly satisfied Intermediation does not affect the number of items traded but leads to endogenous sorting © Cambridge University Press 2010 14

Chapter 22 – Intermediaries as dealers Intermediated v. nonintermediated trade (cont’d) • Suppose that all high-valuation buyers and all low-cost • • • sellers go to the intermediary If and high-valuation buyers and low-cost sellers do not have an inventive to deviate. Neither do low-valuation buyers and high-cost sellers For a low-valuation buyer the incentive constraint reads this becomes which is clearly satisfied Intermediation does not affect the number of items traded but leads to endogenous sorting © Cambridge University Press 2010 14

Chapter 22 – Intermediaries as dealers Intermediated v. nonintermediated trade (cont’d) • Lesson: In the presence of a random-matching market, intermediaries may profitably operate centralized exchanges even if the matching market in isolation operates efficiently. Intermediation then leads to market segmentation. • low-valuation buyers and high-cost sellers are necessarily worse off since the pool of possible trading partners deteriorates • High-valuation buyers and low-cost sellers are also necessarily worse off © Cambridge University Press 2010 15

Chapter 22 – Intermediaries as dealers Intermediated v. nonintermediated trade (cont’d) • Lesson: In the presence of a random-matching market, intermediaries may profitably operate centralized exchanges even if the matching market in isolation operates efficiently. Intermediation then leads to market segmentation. • low-valuation buyers and high-cost sellers are necessarily worse off since the pool of possible trading partners deteriorates • High-valuation buyers and low-cost sellers are also necessarily worse off © Cambridge University Press 2010 15

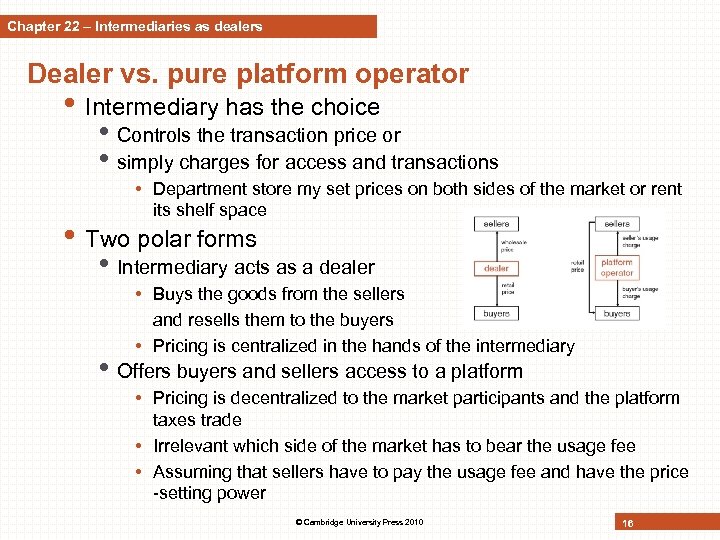

Chapter 22 – Intermediaries as dealers Dealer vs. pure platform operator • Intermediary has the choice • Controls the transaction price or • simply charges for access and transactions • Department store my set prices on both sides of the market or rent its shelf space • Two polar forms • Intermediary acts as a dealer • Buys the goods from the sellers and resells them to the buyers • Pricing is centralized in the hands of the intermediary • Offers buyers and sellers access to a platform • Pricing is decentralized to the market participants and the platform taxes trade • Irrelevant which side of the market has to bear the usage fee • Assuming that sellers have to pay the usage fee and have the price -setting power © Cambridge University Press 2010 16

Chapter 22 – Intermediaries as dealers Dealer vs. pure platform operator • Intermediary has the choice • Controls the transaction price or • simply charges for access and transactions • Department store my set prices on both sides of the market or rent its shelf space • Two polar forms • Intermediary acts as a dealer • Buys the goods from the sellers and resells them to the buyers • Pricing is centralized in the hands of the intermediary • Offers buyers and sellers access to a platform • Pricing is decentralized to the market participants and the platform taxes trade • Irrelevant which side of the market has to bear the usage fee • Assuming that sellers have to pay the usage fee and have the price -setting power © Cambridge University Press 2010 16

Chapter 22 – Intermediaries as dealers Dealer vs. pure platform operator (cont‘d) • Unit mass of sellers and a unit mass of buyers • Each seller produces a totally differentiated good at a constant marginal cost c, which is uniformly distributed over [0, 1] • Buyers have unit demand for each good • Buy if they are offered a price below or equal to their reservation price v, which is uniformly distributed over [0, 1] • Intermediary does not incur any variable cost • Assume that all sales have to go through the intermediary © Cambridge University Press 2010 17

Chapter 22 – Intermediaries as dealers Dealer vs. pure platform operator (cont‘d) • Unit mass of sellers and a unit mass of buyers • Each seller produces a totally differentiated good at a constant marginal cost c, which is uniformly distributed over [0, 1] • Buyers have unit demand for each good • Buy if they are offered a price below or equal to their reservation price v, which is uniformly distributed over [0, 1] • Intermediary does not incur any variable cost • Assume that all sales have to go through the intermediary © Cambridge University Press 2010 17

Chapter 22 – Intermediaries as dealers Dealer vs. pure platform operator (cont‘d) • Dealer intermediation • Intermediary as a dealer makes take-it-or-leave-it offers to both sides of the market • Retail price or ‘ask price’ p for the buyers • A wholesale price or ‘bid price’ (p – P), transaction fee P • Previous notation w = p – P • Stage 1: intermediary sets prices p and P • Stage 2: buyers and sellers simultaneously decide which product • • • to buy or sell Indifferent buyer v = p, indifferent seller c = p – P Dealer cannot distinguish between the different types of buyers and sellers, because types are assumed to be private information Intermediary exerts its monopoly power on both sides of the market © Cambridge University Press 2010 18

Chapter 22 – Intermediaries as dealers Dealer vs. pure platform operator (cont‘d) • Dealer intermediation • Intermediary as a dealer makes take-it-or-leave-it offers to both sides of the market • Retail price or ‘ask price’ p for the buyers • A wholesale price or ‘bid price’ (p – P), transaction fee P • Previous notation w = p – P • Stage 1: intermediary sets prices p and P • Stage 2: buyers and sellers simultaneously decide which product • • • to buy or sell Indifferent buyer v = p, indifferent seller c = p – P Dealer cannot distinguish between the different types of buyers and sellers, because types are assumed to be private information Intermediary exerts its monopoly power on both sides of the market © Cambridge University Press 2010 18

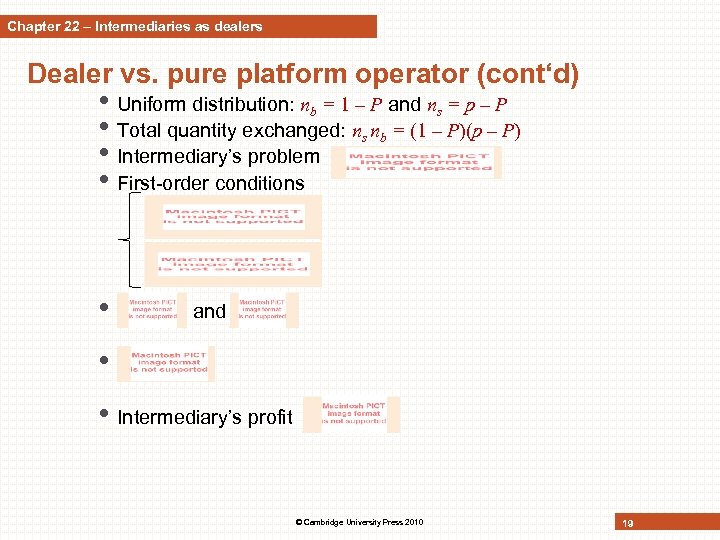

Chapter 22 – Intermediaries as dealers Dealer vs. pure platform operator (cont‘d) • Uniform distribution: nb = 1 – P and ns = p – P • Total quantity exchanged: ns nb = (1 – P)(p – P) • Intermediary’s problem • First-order conditions • and • • Intermediary’s profit © Cambridge University Press 2010 19

Chapter 22 – Intermediaries as dealers Dealer vs. pure platform operator (cont‘d) • Uniform distribution: nb = 1 – P and ns = p – P • Total quantity exchanged: ns nb = (1 – P)(p – P) • Intermediary’s problem • First-order conditions • and • • Intermediary’s profit © Cambridge University Press 2010 19

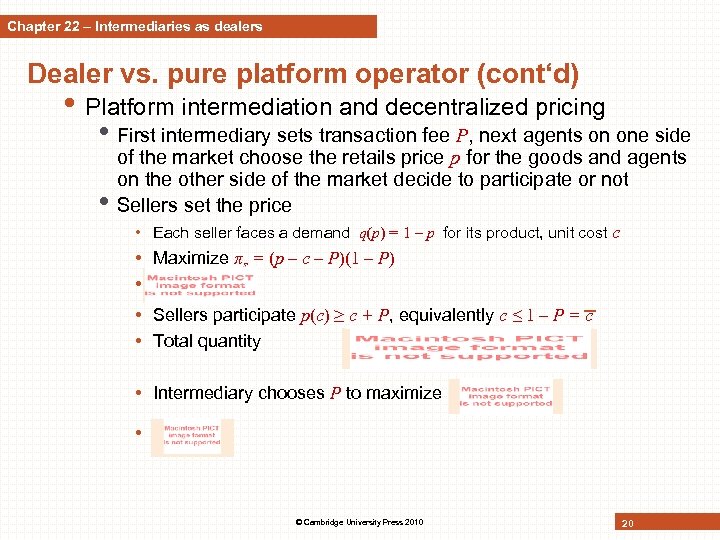

Chapter 22 – Intermediaries as dealers Dealer vs. pure platform operator (cont‘d) • Platform intermediation and decentralized pricing • First intermediary sets transaction fee P, next agents on one side • of the market choose the retails price p for the goods and agents on the other side of the market decide to participate or not Sellers set the price • Each seller faces a demand q(p) = 1 – p for its product, unit cost c • Maximize πs = (p – c – P)(1 – P) • • Sellers participate p(c) ≥ c + P, equivalently c ≤ 1 – P = c • Total quantity • Intermediary chooses P to maximize • © Cambridge University Press 2010 20

Chapter 22 – Intermediaries as dealers Dealer vs. pure platform operator (cont‘d) • Platform intermediation and decentralized pricing • First intermediary sets transaction fee P, next agents on one side • of the market choose the retails price p for the goods and agents on the other side of the market decide to participate or not Sellers set the price • Each seller faces a demand q(p) = 1 – p for its product, unit cost c • Maximize πs = (p – c – P)(1 – P) • • Sellers participate p(c) ≥ c + P, equivalently c ≤ 1 – P = c • Total quantity • Intermediary chooses P to maximize • © Cambridge University Press 2010 20

Chapter 22 – Intermediaries as dealers Dealer vs. pure platform operator (cont‘d) • Dealer vs. platform operator • In the special case of the uniform distribution, the intermediary is • • indifferent between the two forms of intermediation Dealer setting positive markup arises for inframarginal sellers since the intermediary cannot price discriminate Sellers cannot exert market power since the price is set by the intermediary Decentralized price setting such as platform intermediation allows less efficient sellers to trade and make positive profit Seller and buyer decisions do not coincide in the two environments © Cambridge University Press 2010 21

Chapter 22 – Intermediaries as dealers Dealer vs. pure platform operator (cont‘d) • Dealer vs. platform operator • In the special case of the uniform distribution, the intermediary is • • indifferent between the two forms of intermediation Dealer setting positive markup arises for inframarginal sellers since the intermediary cannot price discriminate Sellers cannot exert market power since the price is set by the intermediary Decentralized price setting such as platform intermediation allows less efficient sellers to trade and make positive profit Seller and buyer decisions do not coincide in the two environments © Cambridge University Press 2010 21

Chapter 22 – Intermediaries as dealers Dealer vs. pure platform operator (cont‘d) • Lesson: Suppose that an intermediary’s only role is to organize the exchange of goods between sellers and buyers. If the intermediary acts as a dealer (i. e. , buys and resells goods), trade is socially insufficient because the intermediary exerts monopoly power on both sides of the market. If the intermediary acts as a platform operator and only taxes trade while sellers set the retail price p, sellers condition their offer on their cost type and exert monopoly power over buyers. This tends to lead to higher prices but more sellers participating. In general, it is ambiguous under which role the intermediary makes higher profits and transaction volumes are higher. © Cambridge University Press 2010 22

Chapter 22 – Intermediaries as dealers Dealer vs. pure platform operator (cont‘d) • Lesson: Suppose that an intermediary’s only role is to organize the exchange of goods between sellers and buyers. If the intermediary acts as a dealer (i. e. , buys and resells goods), trade is socially insufficient because the intermediary exerts monopoly power on both sides of the market. If the intermediary acts as a platform operator and only taxes trade while sellers set the retail price p, sellers condition their offer on their cost type and exert monopoly power over buyers. This tends to lead to higher prices but more sellers participating. In general, it is ambiguous under which role the intermediary makes higher profits and transaction volumes are higher. © Cambridge University Press 2010 22

Chapter 22 – Intermediaries as matchmakers • Two different environments 1. Agents in one group value the matching services of an intermediary all the more when the participation of the other group is large, because a large pool is more likely to lead to a successful match • e. g. , business-to-business (B 2 B) electronic marketplaces • Generates indirect network effects leading to a winner-takes-all situation when intermediaries are homogenous 2. Users of matching services care about the characteristics of their trading partner • e. g. , job search, dating or real estate • Joining an intermediary, agent affects the welfare in the other group by changing the composition of the pool of participants in its own group • Endogenous vertical differentiation may allow multiple intermediaries to coexist at equilibrium © Cambridge University Press 2010 23

Chapter 22 – Intermediaries as matchmakers • Two different environments 1. Agents in one group value the matching services of an intermediary all the more when the participation of the other group is large, because a large pool is more likely to lead to a successful match • e. g. , business-to-business (B 2 B) electronic marketplaces • Generates indirect network effects leading to a winner-takes-all situation when intermediaries are homogenous 2. Users of matching services care about the characteristics of their trading partner • e. g. , job search, dating or real estate • Joining an intermediary, agent affects the welfare in the other group by changing the composition of the pool of participants in its own group • Endogenous vertical differentiation may allow multiple intermediaries to coexist at equilibrium © Cambridge University Press 2010 23

Chapter 22 – Intermediaries as matchmakers Divide and conquer strategies • Population of buyers and a population of sellers • Unique trading partner in the other population whom he • can find only by using the matching services of an intermediary If two matching partners registered with the same intermediary the probability of finding each other is equal to 0 < λ < 1 • If a Number of buyers register with an intermediary, probability • • for a seller to find her match is equal to λnb∊ [0, 1] Gains from trade in case of a successful match are normalized to one and equally shared between the trading partners (efficient bargaining process) Intermediaries compete à la Bertrand • Registration fees Mik • Transaction fee Pi © Cambridge University Press 2010 24

Chapter 22 – Intermediaries as matchmakers Divide and conquer strategies • Population of buyers and a population of sellers • Unique trading partner in the other population whom he • can find only by using the matching services of an intermediary If two matching partners registered with the same intermediary the probability of finding each other is equal to 0 < λ < 1 • If a Number of buyers register with an intermediary, probability • • for a seller to find her match is equal to λnb∊ [0, 1] Gains from trade in case of a successful match are normalized to one and equally shared between the trading partners (efficient bargaining process) Intermediaries compete à la Bertrand • Registration fees Mik • Transaction fee Pi © Cambridge University Press 2010 24

Chapter 22 – Intermediaries as matchmakers Divide and conquer strategies (cont‘d) • Intermediaries first simultaneously set their price structure • Then agents choose which intermediary (if any) to register with • Agents can register with at most one intermediary • Utility is zero if they do not register • Expected utilities registering with intermediary i • Cb and Cs costs an intermediary incurs when providing services to one buyer and one seller • Any equilibrium in the game involves a single active • intermediary with zero profits ‘divide and conquer strategy’ • ‘Divide’ by subsidizing one group (say buyers) to convince them to join © Cambridge University Press 2010 25

Chapter 22 – Intermediaries as matchmakers Divide and conquer strategies (cont‘d) • Intermediaries first simultaneously set their price structure • Then agents choose which intermediary (if any) to register with • Agents can register with at most one intermediary • Utility is zero if they do not register • Expected utilities registering with intermediary i • Cb and Cs costs an intermediary incurs when providing services to one buyer and one seller • Any equilibrium in the game involves a single active • intermediary with zero profits ‘divide and conquer strategy’ • ‘Divide’ by subsidizing one group (say buyers) to convince them to join © Cambridge University Press 2010 25

Chapter 22 – Intermediaries as matchmakers Divide and conquer strategies (cont‘d) • For such a divide-and-conquer strategy not to be profitable • • competitor must not be able to recoup the subsidy paid by buyers In equilibrium agents must receive the total surplus and the active intermediary cannot make a strictly positive profit Subsidize full participation, charge the maximal transaction fee (P 1 = 1) and make zero profit • Lesson: Consider a matching market with two properties: first, participants on both sides of the market care about the size of the other side, and second nondifferentiated intermediaries compete in membership and transaction fees. Then one intermediary dominates the market but makes zero profit. © Cambridge University Press 2010 26

Chapter 22 – Intermediaries as matchmakers Divide and conquer strategies (cont‘d) • For such a divide-and-conquer strategy not to be profitable • • competitor must not be able to recoup the subsidy paid by buyers In equilibrium agents must receive the total surplus and the active intermediary cannot make a strictly positive profit Subsidize full participation, charge the maximal transaction fee (P 1 = 1) and make zero profit • Lesson: Consider a matching market with two properties: first, participants on both sides of the market care about the size of the other side, and second nondifferentiated intermediaries compete in membership and transaction fees. Then one intermediary dominates the market but makes zero profit. © Cambridge University Press 2010 26

Chapter 22 – Intermediaries as matchmakers Sorting by an intermediary in a matching market • Assumption on agents • agents within each group have heterogenous types • each agent randomly matched with an agent of the other group • Agent’s valuation increases when matched with an agent of higher quality • Affiliation decisions affect the composition of the pool of participants (sorting externality) © Cambridge University Press 2010 27

Chapter 22 – Intermediaries as matchmakers Sorting by an intermediary in a matching market • Assumption on agents • agents within each group have heterogenous types • each agent randomly matched with an agent of the other group • Agent’s valuation increases when matched with an agent of higher quality • Affiliation decisions affect the composition of the pool of participants (sorting externality) © Cambridge University Press 2010 27

Chapter 22 – Intermediaries as matchmakers Two matchmakers coexist at equilibrium • • Agents have private information about their type As long as agents in both groups are heterogeneous enough • • Self-select into matching markets based on the prices and their expectations of the quality of the pool of participants from the other group If one matchmaker sets a price equal to marginal cost • the other matchmaker can charge a higher price • Earn strictly positive profits by attracting the types willing to pay more to be matched with higher types (Sorting role of prices) • Lesson: Suppose that two intermediaries offer similar random matching services to two groups of heterogeneous agents and that each agent’s valuation increases when matched with an agent of higher quality. Due to the sorting role of prices, two matchmakes competing through membership fees may coexist at the equilibrium of a sequential move game as long as the distribution of types is sufficiently diffused; the matchmaker who moves first survives with strictly positive profits. © Cambridge University Press 2010 28

Chapter 22 – Intermediaries as matchmakers Two matchmakers coexist at equilibrium • • Agents have private information about their type As long as agents in both groups are heterogeneous enough • • Self-select into matching markets based on the prices and their expectations of the quality of the pool of participants from the other group If one matchmaker sets a price equal to marginal cost • the other matchmaker can charge a higher price • Earn strictly positive profits by attracting the types willing to pay more to be matched with higher types (Sorting role of prices) • Lesson: Suppose that two intermediaries offer similar random matching services to two groups of heterogeneous agents and that each agent’s valuation increases when matched with an agent of higher quality. Due to the sorting role of prices, two matchmakes competing through membership fees may coexist at the equilibrium of a sequential move game as long as the distribution of types is sufficiently diffused; the matchmaker who moves first survives with strictly positive profits. © Cambridge University Press 2010 28

Chapter 22 – Intermediaries as two-sided platforms • Two groups of agents: sellers s and buyers b • Platform prices • Membership (or access) fees • Transaction (or usage) fees • Prices that intermediary i charges to an agent of group k∊ {s, b} © Cambridge University Press 2010 29

Chapter 22 – Intermediaries as two-sided platforms • Two groups of agents: sellers s and buyers b • Platform prices • Membership (or access) fees • Transaction (or usage) fees • Prices that intermediary i charges to an agent of group k∊ {s, b} © Cambridge University Press 2010 29

Chapter 22 – Intermediaries as two-sided platforms The price structure for intermediation services • Monopoly platform with zero marginal costs • Positive indirect network effects • Socially optimal access or membership fees involve subsidization of both sides of the market • Case that the intermediary sets only usage fees • If buyers and sellers internalize a change in the price structure in their contractual relationship • the structure of usage prices is neutral • only the total level of the usage fee P = Ps + Pb matters © Cambridge University Press 2010 30

Chapter 22 – Intermediaries as two-sided platforms The price structure for intermediation services • Monopoly platform with zero marginal costs • Positive indirect network effects • Socially optimal access or membership fees involve subsidization of both sides of the market • Case that the intermediary sets only usage fees • If buyers and sellers internalize a change in the price structure in their contractual relationship • the structure of usage prices is neutral • only the total level of the usage fee P = Ps + Pb matters © Cambridge University Press 2010 30

Chapter 22 - Intermediaries as two-sided platforms Case The ‘no surcharge rule’ in the credit card industry • Two groups of buyers • Group 1: only pay in cash • Group 2: only by credit card • Simplified representation: single credit card company that represents the intermediary • Price per transaction • No-surcharge rule: seller has to set the same retail price for cash and non-cash buyers • Not only the total price of a transaction but the structure of this usage fee matters • If, on the contrary, the seller is allowed to charge different prices for the two groups of buyers • Irrelevant whether buyers or sellers have to pay the usage fee © Cambridge University Press 2010 31

Chapter 22 - Intermediaries as two-sided platforms Case The ‘no surcharge rule’ in the credit card industry • Two groups of buyers • Group 1: only pay in cash • Group 2: only by credit card • Simplified representation: single credit card company that represents the intermediary • Price per transaction • No-surcharge rule: seller has to set the same retail price for cash and non-cash buyers • Not only the total price of a transaction but the structure of this usage fee matters • If, on the contrary, the seller is allowed to charge different prices for the two groups of buyers • Irrelevant whether buyers or sellers have to pay the usage fee © Cambridge University Press 2010 31

Chapter 22 – Intermediaries as two-sided platforms The price structure for intermediation services (cont‘d) • Price structure of membership fees (abstract from usage fees) • • Suppose that a single intermediary hosts a number of sellers that sell independent products a single platform All buyers who access the intermediary’s platform have the same demand at each seller • • • Each seller has a seller-buyer relationship with each buyer Each buyer has as seller-buyer relationship with each seller • Each buyer has downward-sloping demand q(p) for each product Suppose that seller prices are independent of the membership fees that apply to buyers and sellers Setting 1: Buyers have a demand for one unit from each seller • • Bilateral bargaining Membership fees are already paid and thus sunk • Do not affect the bargaining outcome Setting 2: Price-setting power exclusively rests with the seller, © Cambridge University Press 2010 32

Chapter 22 – Intermediaries as two-sided platforms The price structure for intermediation services (cont‘d) • Price structure of membership fees (abstract from usage fees) • • Suppose that a single intermediary hosts a number of sellers that sell independent products a single platform All buyers who access the intermediary’s platform have the same demand at each seller • • • Each seller has a seller-buyer relationship with each buyer Each buyer has as seller-buyer relationship with each seller • Each buyer has downward-sloping demand q(p) for each product Suppose that seller prices are independent of the membership fees that apply to buyers and sellers Setting 1: Buyers have a demand for one unit from each seller • • Bilateral bargaining Membership fees are already paid and thus sunk • Do not affect the bargaining outcome Setting 2: Price-setting power exclusively rests with the seller, © Cambridge University Press 2010 32

Chapter 22 – Intermediaries as two-sided platforms The price structure for intermediation services (cont‘d) • Constant marginal cost c • Seller profit per buyer • Buyer surplus per seller • Surplus of a seller vs = nbπ- Ms where nb is the number of buyers • • • on the platform Surplus of a buyer vb = nsu- Mb where ns is the number of sellers on the platform Number of buyers an sellers on the platform is determined by a free-entre condition • nb= Nb(vb) and ns= Ns(vs) Intermediary incurs constant cost per buyer Cb and a constant cost per seller Cs Profits Express membership fees as functions of surpluses • • © Cambridge University Press 2010 33

Chapter 22 – Intermediaries as two-sided platforms The price structure for intermediation services (cont‘d) • Constant marginal cost c • Seller profit per buyer • Buyer surplus per seller • Surplus of a seller vs = nbπ- Ms where nb is the number of buyers • • • on the platform Surplus of a buyer vb = nsu- Mb where ns is the number of sellers on the platform Number of buyers an sellers on the platform is determined by a free-entre condition • nb= Nb(vb) and ns= Ns(vs) Intermediary incurs constant cost per buyer Cb and a constant cost per seller Cs Profits Express membership fees as functions of surpluses • • © Cambridge University Press 2010 33

Chapter 22 – Intermediaries as two-sided platforms The price structure for intermediation services (cont‘d) • Intermediary’s profit as a function of the surpluses offered to • buyers and sellers is First-order conditions for profit maximization • Can be written as • Profit-maximizing membership fees (1) (2) Monopoly prices equal to cost of providing access adjusted downward by the external benefits exerted on the other side of the market (1) and adjusted upward by a factor related to the sensitivity of participation on the platform (2) © Cambridge University Press 2010 34

Chapter 22 – Intermediaries as two-sided platforms The price structure for intermediation services (cont‘d) • Intermediary’s profit as a function of the surpluses offered to • buyers and sellers is First-order conditions for profit maximization • Can be written as • Profit-maximizing membership fees (1) (2) Monopoly prices equal to cost of providing access adjusted downward by the external benefits exerted on the other side of the market (1) and adjusted upward by a factor related to the sensitivity of participation on the platform (2) © Cambridge University Press 2010 34

Chapter 22 – Intermediaries as two-sided platforms The price structure for intermediation services (cont‘d) • Lesson: In a market with a single intermediary who charges membership fees, the side of the market which exerts the larger external benefit on the other tends to face lower membership fees. A profit-maximizing intermediary may subsidize one side of the market so as to generate a higher volume of trade and thus, higher profits on the other side of the market. • Membership fees that implement the welfare-maximizing solution: • Ms = Cs – unb and Mb = Cb – πns • Lesson: The welfare-maximizing membership fee for an agent on one side of the platform is equal to the cost of providing access to this agent decreased by the external benefit that this agent exerts on agents on the other side of the platform. These fees are lower than the fees a monopoly intermediary would charge. © Cambridge University Press 2010 35

Chapter 22 – Intermediaries as two-sided platforms The price structure for intermediation services (cont‘d) • Lesson: In a market with a single intermediary who charges membership fees, the side of the market which exerts the larger external benefit on the other tends to face lower membership fees. A profit-maximizing intermediary may subsidize one side of the market so as to generate a higher volume of trade and thus, higher profits on the other side of the market. • Membership fees that implement the welfare-maximizing solution: • Ms = Cs – unb and Mb = Cb – πns • Lesson: The welfare-maximizing membership fee for an agent on one side of the platform is equal to the cost of providing access to this agent decreased by the external benefit that this agent exerts on agents on the other side of the platform. These fees are lower than the fees a monopoly intermediary would charge. © Cambridge University Press 2010 35

Chapter 22 – Intermediaries as two-sided platforms The price structure for intermediation services (cont‘d) • For a given number of participants on the other side of the market, demand elasticity for access • Monopoly intermediary internalizes indirect network externalities • Reflected by the downward adjustment of the cost by the • external benefit buyers exert on sellers unb in the pricing formula for the seller’s membership fees Markups are set as if there were lower costs Cs – unb and Cb – πns © Cambridge University Press 2010 36

Chapter 22 – Intermediaries as two-sided platforms The price structure for intermediation services (cont‘d) • For a given number of participants on the other side of the market, demand elasticity for access • Monopoly intermediary internalizes indirect network externalities • Reflected by the downward adjustment of the cost by the • external benefit buyers exert on sellers unb in the pricing formula for the seller’s membership fees Markups are set as if there were lower costs Cs – unb and Cb – πns © Cambridge University Press 2010 36

Chapter 22 – Intermediaries as two-sided platforms Competing intermediaries • A model of platform competition • Buyers and sellers are restricted to visit only one intermediary • • • ≙ Both sides singlehome Two platforms 1 and 2 Total number of buyers Total number of sellers • Are uniformly distributed on the unit interval • Platforms are located at the extreme point of the unit interval • Sellers and buyers face an opportunity cost of visiting a platform that increases linearly in distance at rates τb and τs © Cambridge University Press 2010 37

Chapter 22 – Intermediaries as two-sided platforms Competing intermediaries • A model of platform competition • Buyers and sellers are restricted to visit only one intermediary • • • ≙ Both sides singlehome Two platforms 1 and 2 Total number of buyers Total number of sellers • Are uniformly distributed on the unit interval • Platforms are located at the extreme point of the unit interval • Sellers and buyers face an opportunity cost of visiting a platform that increases linearly in distance at rates τb and τs © Cambridge University Press 2010 37

Chapter 22 – Intermediaries as two-sided platforms Competing intermediaries (cont‘d) • Numbers of buyers and sellers at the two platforms • For given membership fees additional buyer attracts π/τs • • additional sellers Similarly an additional seller attracts u/τb additional buyers Number of buyers and sellers © Cambridge University Press 2010 38

Chapter 22 – Intermediaries as two-sided platforms Competing intermediaries (cont‘d) • Numbers of buyers and sellers at the two platforms • For given membership fees additional buyer attracts π/τs • • additional sellers Similarly an additional seller attracts u/τb additional buyers Number of buyers and sellers © Cambridge University Press 2010 38

Chapter 22 – Intermediaries as two-sided platforms Competing intermediaries (cont‘d) • Intermediaries’ pricing game • Two intermediaries simultaneously choose membership fees on • both sides of the market in a symmetric equilibrium • Membership fee for the sellers equal to marginal costs plus the product-differentiation term as in the standard Hotelling model adjusted downward by the term = the value of an additional seller to the intermediary: • Each additional seller attracts u/τb additional buyers • These additional buyers allow the intermediary to extract π per seller without affecting the sellers‘ surplus • In addition, each of the additional buyers gives a profit of Mb – Cb to the seller © Cambridge University Press 2010 39

Chapter 22 – Intermediaries as two-sided platforms Competing intermediaries (cont‘d) • Intermediaries’ pricing game • Two intermediaries simultaneously choose membership fees on • both sides of the market in a symmetric equilibrium • Membership fee for the sellers equal to marginal costs plus the product-differentiation term as in the standard Hotelling model adjusted downward by the term = the value of an additional seller to the intermediary: • Each additional seller attracts u/τb additional buyers • These additional buyers allow the intermediary to extract π per seller without affecting the sellers‘ surplus • In addition, each of the additional buyers gives a profit of Mb – Cb to the seller © Cambridge University Press 2010 39

Chapter 22 – Intermediaries as two-sided platforms Competing intermediaries (cont‘d) • Equilibrium membership fees • • The side of the market that exerts a strong indirect network effect on the other tends to be subsidized Equilibrium membership fees can be written as • • • Compared to the formula with a single intermediary membership fee on one side is reduced twice as strongly in the size of the indirect network effect exerted by the other side Effect of a lost seller on the intermediaries profit is more pronounced under competition This lost seller joins the competitor’s platform and thus makes it more difficult to keep the same number Press 2010 of buyers © Cambridge University 40

Chapter 22 – Intermediaries as two-sided platforms Competing intermediaries (cont‘d) • Equilibrium membership fees • • The side of the market that exerts a strong indirect network effect on the other tends to be subsidized Equilibrium membership fees can be written as • • • Compared to the formula with a single intermediary membership fee on one side is reduced twice as strongly in the size of the indirect network effect exerted by the other side Effect of a lost seller on the intermediaries profit is more pronounced under competition This lost seller joins the competitor’s platform and thus makes it more difficult to keep the same number Press 2010 of buyers © Cambridge University 40

Chapter 22 – Intermediaries as two-sided platforms Competing intermediaries (cont‘d) • Lesson: In a market in which buyers and sellers join either one of two intermediaries, membership fees react more strongly on network effects than in a market with a single intermediary. © Cambridge University Press 2010 41

Chapter 22 – Intermediaries as two-sided platforms Competing intermediaries (cont‘d) • Lesson: In a market in which buyers and sellers join either one of two intermediaries, membership fees react more strongly on network effects than in a market with a single intermediary. © Cambridge University Press 2010 41

Chapter 22 – Intermediaries as two-sided platforms Competing intermediaries (cont‘d) • Effects of multihoming • Situations where sellers multihome and buyers singlehome • A seller lost to one platform is not a seller gained by the other platform • Intermediaries have to be more concerned with losing buyers • Intermediaries compete fiercely for buyers tends to lead to low and possibly even negative prices for buyers accessing the platform • Lesson: In a market with competing intermediaries in which sellers can set up shops at both intermediaries, the sellers’ surplus is ignored in the pricing decisions of the intermediary. For any given number of buyers, the intermediary maximizes the joint surplus between buyers and the intermediary itself. © Cambridge University Press 2010 42

Chapter 22 – Intermediaries as two-sided platforms Competing intermediaries (cont‘d) • Effects of multihoming • Situations where sellers multihome and buyers singlehome • A seller lost to one platform is not a seller gained by the other platform • Intermediaries have to be more concerned with losing buyers • Intermediaries compete fiercely for buyers tends to lead to low and possibly even negative prices for buyers accessing the platform • Lesson: In a market with competing intermediaries in which sellers can set up shops at both intermediaries, the sellers’ surplus is ignored in the pricing decisions of the intermediary. For any given number of buyers, the intermediary maximizes the joint surplus between buyers and the intermediary itself. © Cambridge University Press 2010 42

Chapter 22 – Intermediaries as two-sided platforms Implications for antitrust and regulation • Exercise of unilateral market power • In intermediation markets, the efficient price structure may not • • • reflect the cost structure Prices above marginal cost do not necessarily indicate market power, nor do prices below marginal cost necessarily indicate predation It is wrong to think that multi-sided platforms exhibit crosssubsidization An increase in competition in multi-sided markets does not necessarily lead to a more efficient or balanced price structure • Lesson: To be effective, regulation and antitrust assessment must be based on an accurate understanding of the way each market operates. In this respect, it is crucial to recognize the possible multi-sided aspects of a market; sticking to a one-sided logic may lead to erroneous decisions. © Cambridge University Press 2010 43

Chapter 22 – Intermediaries as two-sided platforms Implications for antitrust and regulation • Exercise of unilateral market power • In intermediation markets, the efficient price structure may not • • • reflect the cost structure Prices above marginal cost do not necessarily indicate market power, nor do prices below marginal cost necessarily indicate predation It is wrong to think that multi-sided platforms exhibit crosssubsidization An increase in competition in multi-sided markets does not necessarily lead to a more efficient or balanced price structure • Lesson: To be effective, regulation and antitrust assessment must be based on an accurate understanding of the way each market operates. In this respect, it is crucial to recognize the possible multi-sided aspects of a market; sticking to a one-sided logic may lead to erroneous decisions. © Cambridge University Press 2010 43

Chapter 22 - Review questions • Why do buyers and sellers sometimes prefer to trade via • • a dealer rather than in a decentralized way? Taking the viewpoint of an intermediary, compare two polar business models for market intermediation: the dealer model (buying and reselling goods) and the platform model (providing a marketplace where affiliated sellers can sell directly to affiliated buyers). Describe the sorting role of the prices set by intermediaries in matching markets. How do intermediaries set the price structure on twosided platforms? Why do intermediaries in two-sided industries tend to achieve high profits on the multihoming side but to dissipate these profits through competition on the singlehoming side? © Cambridge University Press 2010 44

Chapter 22 - Review questions • Why do buyers and sellers sometimes prefer to trade via • • a dealer rather than in a decentralized way? Taking the viewpoint of an intermediary, compare two polar business models for market intermediation: the dealer model (buying and reselling goods) and the platform model (providing a marketplace where affiliated sellers can sell directly to affiliated buyers). Describe the sorting role of the prices set by intermediaries in matching markets. How do intermediaries set the price structure on twosided platforms? Why do intermediaries in two-sided industries tend to achieve high profits on the multihoming side but to dissipate these profits through competition on the singlehoming side? © Cambridge University Press 2010 44